5a9c89b48c90fdec7b7651b476a53c9a.ppt

- Количество слайдов: 28

MERGERS & ACQUISITIONS Leonid Sopotnitskiy

MERGERS & ACQUISITIONS Leonid Sopotnitskiy

Part 1 Restructuring a business

Part 1 Restructuring a business

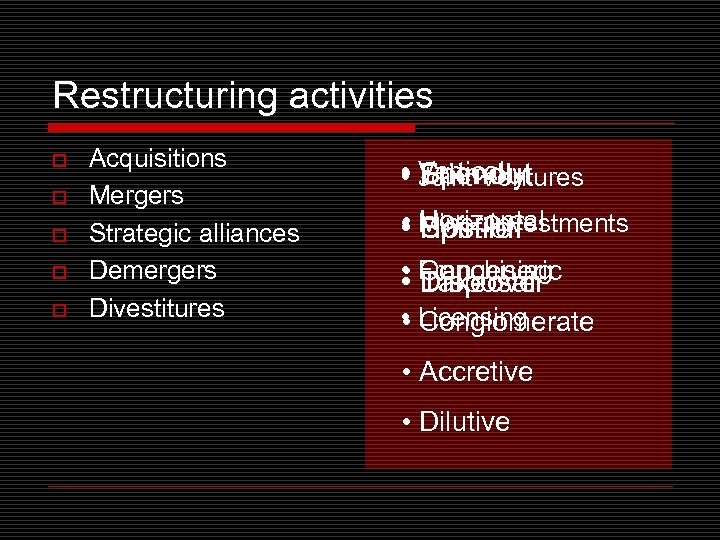

Restructuring activities o o o Acquisitions Mergers Strategic alliances Demergers Divestitures • Vertical Spin-out Friendly • Joint Ventures • Minor investments • Horizontal Spin-off Hostile • Franchising • Congeneric Disposal Takeover • Licensing Conglomerate • Accretive • Dilutive

Restructuring activities o o o Acquisitions Mergers Strategic alliances Demergers Divestitures • Vertical Spin-out Friendly • Joint Ventures • Minor investments • Horizontal Spin-off Hostile • Franchising • Congeneric Disposal Takeover • Licensing Conglomerate • Accretive • Dilutive

Holding companies in M&A + o o VS E IV Cheaper transaction Triple T C taxation E Gain control via Minority resistance FIneffective managerial F majority stake E decisions IN % to 2 66 3 o o o

Holding companies in M&A + o o VS E IV Cheaper transaction Triple T C taxation E Gain control via Minority resistance FIneffective managerial F majority stake E decisions IN % to 2 66 3 o o o

ESOP (Employee Stock Ownership Plan) ESOP-Fund t es Lo a te r In an ce 5. es Creditor Fi n ar Sh 1. 3. n 4. 2. Guarantee SPONSOR

ESOP (Employee Stock Ownership Plan) ESOP-Fund t es Lo a te r In an ce 5. es Creditor Fi n ar Sh 1. 3. n 4. 2. Guarantee SPONSOR

ESOP as an M&A-tool ce 4. Finan ESOP-Fund t res nte Sh are s Subsidiary SHARES 5. I 1. L oa n 3. “Shell” company Creditor 2. Guarantee Parent Co.

ESOP as an M&A-tool ce 4. Finan ESOP-Fund t res nte Sh are s Subsidiary SHARES 5. I 1. L oa n 3. “Shell” company Creditor 2. Guarantee Parent Co.

Part 2 Participants

Part 2 Participants

Investment Bankers o o o Deal clarification Consulting services IPO

Investment Bankers o o o Deal clarification Consulting services IPO

Lawyers o o o o Corporate law Antimonopoly law M&A code Tax law Pension planning Real-estate law Securities Court experts

Lawyers o o o o Corporate law Antimonopoly law M&A code Tax law Pension planning Real-estate law Securities Court experts

Other participants o o Accountants Proxy-hunters PR-agents Institutional investors (pension funds, insurance companies, etc. ) o Arbitrage traders (a. k. a. “Arbs”)

Other participants o o Accountants Proxy-hunters PR-agents Institutional investors (pension funds, insurance companies, etc. ) o Arbitrage traders (a. k. a. “Arbs”)

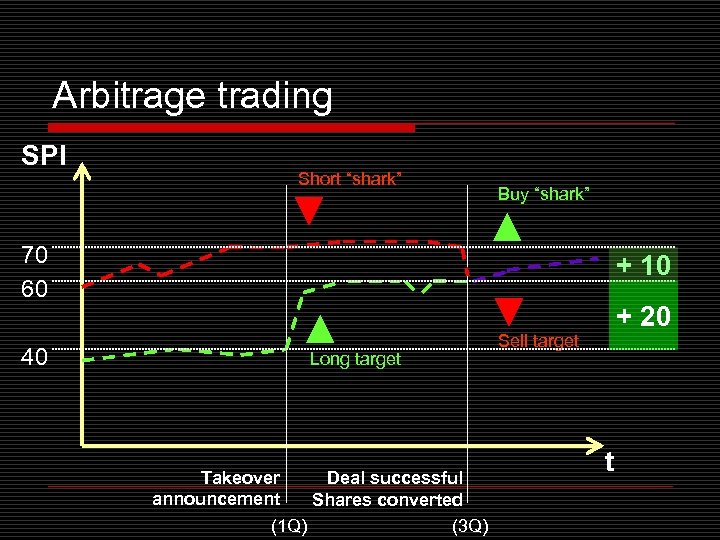

Arbitrage trading SPI Short “shark” Buy “shark” 70 60 40 + 10 Long target Takeover Deal successful announcement Shares converted (1 Q) (3 Q) + 20 Sell target t

Arbitrage trading SPI Short “shark” Buy “shark” 70 60 40 + 10 Long target Takeover Deal successful announcement Shares converted (1 Q) (3 Q) + 20 Sell target t

Part 3 HQ behind the scenes

Part 3 HQ behind the scenes

Synergy 1 + 1 = 3 o o Operational effect Financial effect

Synergy 1 + 1 = 3 o o Operational effect Financial effect

Common stimuli o o Market leadership Strategy realignment Taxes Cross-selling o o Empire building Managers’ hubris Diversification Undervalued assets (q -ratio)

Common stimuli o o Market leadership Strategy realignment Taxes Cross-selling o o Empire building Managers’ hubris Diversification Undervalued assets (q -ratio)

Why do M&A deals fail? o o o o Overestimated synergy Low integration tempo Bad strategy Cultural conflicts Core-business conflicts Oversized targets Careless deal clearance (by investment bankers) Financing errors

Why do M&A deals fail? o o o o Overestimated synergy Low integration tempo Bad strategy Cultural conflicts Core-business conflicts Oversized targets Careless deal clearance (by investment bankers) Financing errors

Part 4 Acquisitions & takeovers

Part 4 Acquisitions & takeovers

Friendly acquisitions o o o Voluntary General Offering (VGO) Deal through board negotiations Willfulness of both parties Late announcements Lack of surprise Preliminary SPI-growth risk + -

Friendly acquisitions o o o Voluntary General Offering (VGO) Deal through board negotiations Willfulness of both parties Late announcements Lack of surprise Preliminary SPI-growth risk + -

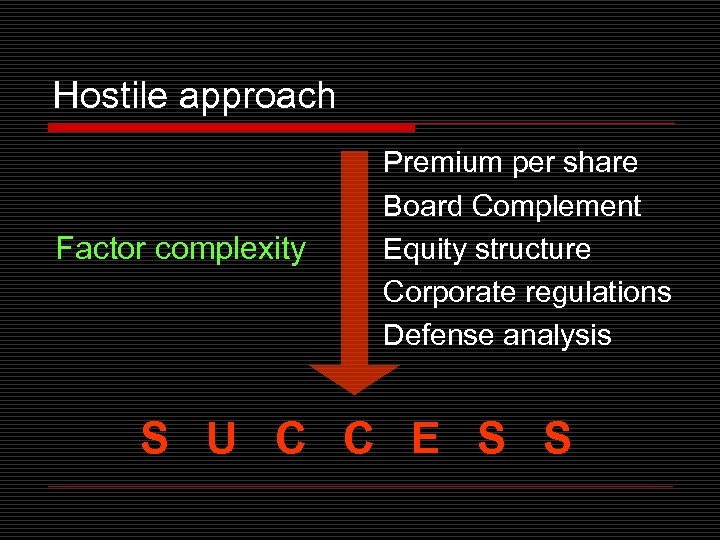

Hostile approach Factor complexity Premium per share Board Complement Equity structure Corporate regulations Defense analysis S U C C E S S

Hostile approach Factor complexity Premium per share Board Complement Equity structure Corporate regulations Defense analysis S U C C E S S

Black Knight in action o o o Dodging board negotiations Direct shareholder contact Proxy-fighting (becoming a trustee) Preliminary press-release Psychological pressure on the board directors Various takeover strategies & tactics

Black Knight in action o o o Dodging board negotiations Direct shareholder contact Proxy-fighting (becoming a trustee) Preliminary press-release Psychological pressure on the board directors Various takeover strategies & tactics

Takeover strategies o o o “Bear hug” Proxy battles Pre-tender concealed buying spree Tender offer Toehold strategy

Takeover strategies o o o “Bear hug” Proxy battles Pre-tender concealed buying spree Tender offer Toehold strategy

Takeover decision tree Friendly LOI Y Aggressive actions N Negotiations Refusal Bear hug Y Negotiations N Proxy battle Renegotiate Fulfill offer Y N Tender offer Complex Open market Court

Takeover decision tree Friendly LOI Y Aggressive actions N Negotiations Refusal Bear hug Y Negotiations N Proxy battle Renegotiate Fulfill offer Y N Tender offer Complex Open market Court

Reverse takeovers (APO) o o Avoid IPO expenses 12 -months’ procedure (i. e. time-saving tool) Fundamental changes in business Search for an effective floating mechanism

Reverse takeovers (APO) o o Avoid IPO expenses 12 -months’ procedure (i. e. time-saving tool) Fundamental changes in business Search for an effective floating mechanism

PIPE deals (Private Investment in Public Equity) PRIVATE M INVESTOR PLC A R K E T

PIPE deals (Private Investment in Public Equity) PRIVATE M INVESTOR PLC A R K E T

Part 5 Defense mechanism

Part 5 Defense mechanism

Possible measures o o o Poison pills Shark repellents Golden & silver parachutes o o o Green mail Pac-man defense White knight ESOP Leveraged recapitalization

Possible measures o o o Poison pills Shark repellents Golden & silver parachutes o o o Green mail Pac-man defense White knight ESOP Leveraged recapitalization

“Poison pills” o o o Preferred stock plan Flip-over rights plan (discount option) Ownership flip-in plan (1: 1 exchange option) Back-end rights plan Poison put

“Poison pills” o o o Preferred stock plan Flip-over rights plan (discount option) Ownership flip-in plan (1: 1 exchange option) Back-end rights plan Poison put

Preferred stock plan 18, 5% 25% MARKET BLACK KNIGHT S 18, 5% 25% DEAL 1: 1, 06 S S P 18, 5% 25% 8, 3% 33% S P 8, 3% 33% 1943 396 shares + 500 000 P 000000 1 943396 shares 000000 74 % TARGET VS 26 %

Preferred stock plan 18, 5% 25% MARKET BLACK KNIGHT S 18, 5% 25% DEAL 1: 1, 06 S S P 18, 5% 25% 8, 3% 33% S P 8, 3% 33% 1943 396 shares + 500 000 P 000000 1 943396 shares 000000 74 % TARGET VS 26 %

To be continued… Thank you!

To be continued… Thank you!