8509ed01bc98c529ba19aaf86b150149.ppt

- Количество слайдов: 101

Mergers & Acquisitions Jan 2010 Merger & Acquisitions 1

Mergers & Acquisitions Jan 2010 Merger & Acquisitions 1

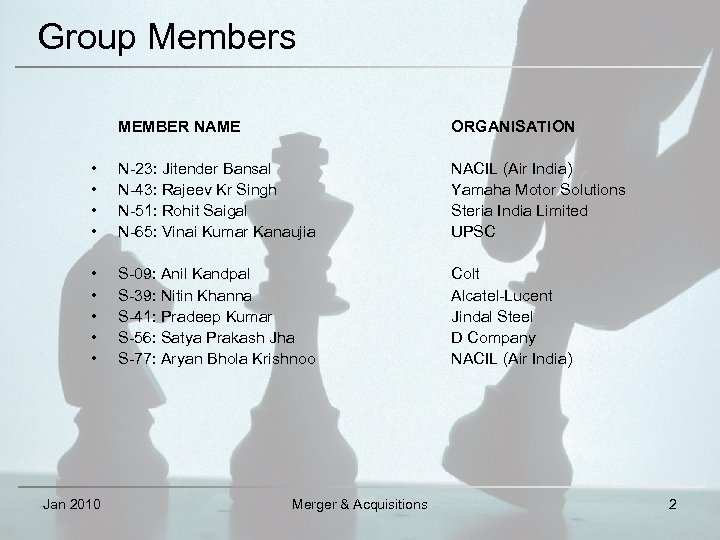

Group Members MEMBER NAME ORGANISATION • • N-23: Jitender Bansal N-43: Rajeev Kr Singh N-51: Rohit Saigal N-65: Vinai Kumar Kanaujia NACIL (Air India) Yamaha Motor Solutions Steria India Limited UPSC • • • S-09: Anil Kandpal S-39: Nitin Khanna S-41: Pradeep Kumar S-56: Satya Prakash Jha S-77: Aryan Bhola Krishnoo Colt Alcatel-Lucent Jindal Steel D Company NACIL (Air India) Jan 2010 Merger & Acquisitions 2

Group Members MEMBER NAME ORGANISATION • • N-23: Jitender Bansal N-43: Rajeev Kr Singh N-51: Rohit Saigal N-65: Vinai Kumar Kanaujia NACIL (Air India) Yamaha Motor Solutions Steria India Limited UPSC • • • S-09: Anil Kandpal S-39: Nitin Khanna S-41: Pradeep Kumar S-56: Satya Prakash Jha S-77: Aryan Bhola Krishnoo Colt Alcatel-Lucent Jindal Steel D Company NACIL (Air India) Jan 2010 Merger & Acquisitions 2

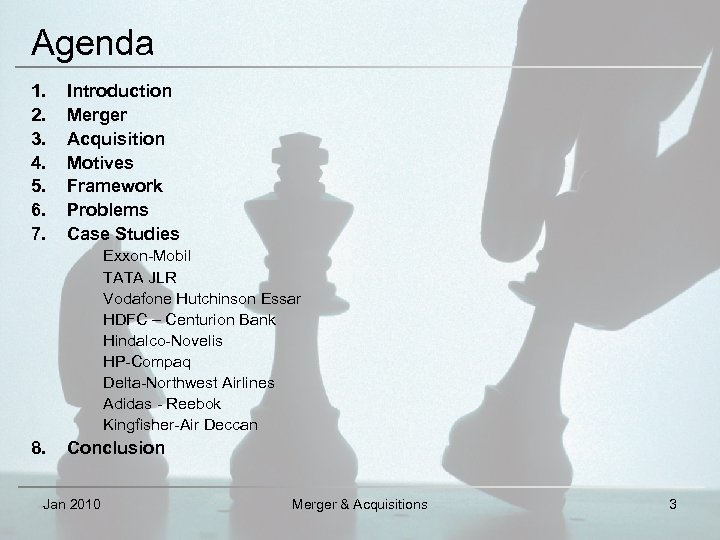

Agenda 1. 2. 3. 4. 5. 6. 7. Introduction Merger Acquisition Motives Framework Problems Case Studies Exxon-Mobil TATA JLR Vodafone Hutchinson Essar HDFC – Centurion Bank Hindalco-Novelis HP-Compaq Delta-Northwest Airlines Adidas - Reebok Kingfisher-Air Deccan 8. Conclusion Jan 2010 Merger & Acquisitions 3

Agenda 1. 2. 3. 4. 5. 6. 7. Introduction Merger Acquisition Motives Framework Problems Case Studies Exxon-Mobil TATA JLR Vodafone Hutchinson Essar HDFC – Centurion Bank Hindalco-Novelis HP-Compaq Delta-Northwest Airlines Adidas - Reebok Kingfisher-Air Deccan 8. Conclusion Jan 2010 Merger & Acquisitions 3

1 Introduction Jan 2010 Merger & Acquisitions 4

1 Introduction Jan 2010 Merger & Acquisitions 4

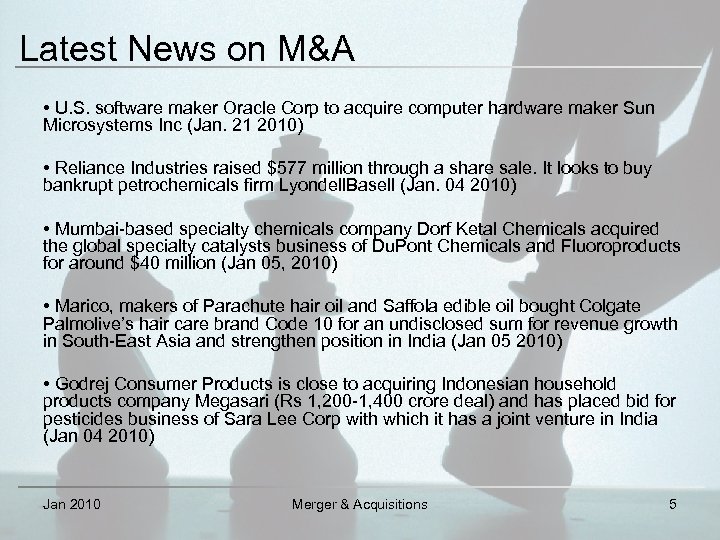

Latest News on M&A • U. S. software maker Oracle Corp to acquire computer hardware maker Sun Microsystems Inc (Jan. 21 2010) • Reliance Industries raised $577 million through a share sale. It looks to buy bankrupt petrochemicals firm Lyondell. Basell (Jan. 04 2010) • Mumbai-based specialty chemicals company Dorf Ketal Chemicals acquired the global specialty catalysts business of Du. Pont Chemicals and Fluoroproducts for around $40 million (Jan 05, 2010) • Marico, makers of Parachute hair oil and Saffola edible oil bought Colgate Palmolive’s hair care brand Code 10 for an undisclosed sum for revenue growth in South-East Asia and strengthen position in India (Jan 05 2010) • Godrej Consumer Products is close to acquiring Indonesian household products company Megasari (Rs 1, 200 -1, 400 crore deal) and has placed bid for pesticides business of Sara Lee Corp with which it has a joint venture in India (Jan 04 2010) Jan 2010 Merger & Acquisitions 5

Latest News on M&A • U. S. software maker Oracle Corp to acquire computer hardware maker Sun Microsystems Inc (Jan. 21 2010) • Reliance Industries raised $577 million through a share sale. It looks to buy bankrupt petrochemicals firm Lyondell. Basell (Jan. 04 2010) • Mumbai-based specialty chemicals company Dorf Ketal Chemicals acquired the global specialty catalysts business of Du. Pont Chemicals and Fluoroproducts for around $40 million (Jan 05, 2010) • Marico, makers of Parachute hair oil and Saffola edible oil bought Colgate Palmolive’s hair care brand Code 10 for an undisclosed sum for revenue growth in South-East Asia and strengthen position in India (Jan 05 2010) • Godrej Consumer Products is close to acquiring Indonesian household products company Megasari (Rs 1, 200 -1, 400 crore deal) and has placed bid for pesticides business of Sara Lee Corp with which it has a joint venture in India (Jan 04 2010) Jan 2010 Merger & Acquisitions 5

M & A Green field Investment Vs Mergers & Acquisitions Jan 2010 Merger & Acquisitions 6

M & A Green field Investment Vs Mergers & Acquisitions Jan 2010 Merger & Acquisitions 6

Introduction • Cross-border M&A is the growth mantra for companies aspiring to woo customers across the globe transcending the home country’s border. • An indispensable strategic tool for expanding product portfolios, entering new markets, acquiring new technologies and building new generation organization with power and resources to compete on a global basis • M&A today not only dominate FDI flows in developed countries but are an important mode of entry into developing countries & economies in transition. Jan 2010 Merger & Acquisitions 7

Introduction • Cross-border M&A is the growth mantra for companies aspiring to woo customers across the globe transcending the home country’s border. • An indispensable strategic tool for expanding product portfolios, entering new markets, acquiring new technologies and building new generation organization with power and resources to compete on a global basis • M&A today not only dominate FDI flows in developed countries but are an important mode of entry into developing countries & economies in transition. Jan 2010 Merger & Acquisitions 7

Rationale – M&A URGE to MERGE driven by “SPEED” & “ACCESS” to propriety assets Jan 2010 Merger & Acquisitions 8

Rationale – M&A URGE to MERGE driven by “SPEED” & “ACCESS” to propriety assets Jan 2010 Merger & Acquisitions 8

2 Jan 2010 Merger and Acquisition Definition, Types, Forms Merger & Acquisitions 9

2 Jan 2010 Merger and Acquisition Definition, Types, Forms Merger & Acquisitions 9

Merger A transaction where two firms agree To integrate their operations because they have resources and capabilities that together may create stronger competitive advantage Jan 2010 Merger & Acquisitions 10

Merger A transaction where two firms agree To integrate their operations because they have resources and capabilities that together may create stronger competitive advantage Jan 2010 Merger & Acquisitions 10

Types of Mergers • Horizontal • Vertical • Product Extension • Market Extension • Conglomerate Jan 2010 Merger & Acquisitions 11

Types of Mergers • Horizontal • Vertical • Product Extension • Market Extension • Conglomerate Jan 2010 Merger & Acquisitions 11

Merger Forms 1. By Purchase of Asset 2. By Exchange of Share for Asset 3. By Purchase of Common Shares 4. By Exchange of Shares for Shares Jan 2010 Merger & Acquisitions 12

Merger Forms 1. By Purchase of Asset 2. By Exchange of Share for Asset 3. By Purchase of Common Shares 4. By Exchange of Shares for Shares Jan 2010 Merger & Acquisitions 12

Acquisitions A transaction where one firm buys another firm with the intent of more effectively using a core competence by making the acquired firm its subsidiary within its portfolio of business Jan 2010 Merger & Acquisitions 13

Acquisitions A transaction where one firm buys another firm with the intent of more effectively using a core competence by making the acquired firm its subsidiary within its portfolio of business Jan 2010 Merger & Acquisitions 13

Acquisitions Strategies • Tender Offer General offer made publicly and directly to firm’s shareholders to buy at a price well above the current market price • Street Sweep Accumulate large number of stocks in target company before making open offer • Bear Hug Put pressure on management of firm by threatening to make an open offer • Strategic Alliance An acquirer offers a partnership rather than a buyout of the target firm • Brand Power Acquiring firm enters into an alliance with others to displace competitor’s brand Jan 2010 Merger & Acquisitions 14

Acquisitions Strategies • Tender Offer General offer made publicly and directly to firm’s shareholders to buy at a price well above the current market price • Street Sweep Accumulate large number of stocks in target company before making open offer • Bear Hug Put pressure on management of firm by threatening to make an open offer • Strategic Alliance An acquirer offers a partnership rather than a buyout of the target firm • Brand Power Acquiring firm enters into an alliance with others to displace competitor’s brand Jan 2010 Merger & Acquisitions 14

M&A Truth • When a deal is made between two companies in friendly terms, it is typically proclaimed as a merger, regardless of whether it is a buy out • In an unfriendly deal, where the stronger firm swallows the target firm, even when the target company is not willing to be purchased, then the process is labelled as acquisition • Target companies avoid hostile takeovers through poison pills • Although, in reality an acquisition takes place, the firms declare it as a merger to avoid any negative impression • Difference lies in how the purchase is communicated to and received by the target company's board of directors, shareholders and employees Jan 2010 Merger & Acquisitions 15

M&A Truth • When a deal is made between two companies in friendly terms, it is typically proclaimed as a merger, regardless of whether it is a buy out • In an unfriendly deal, where the stronger firm swallows the target firm, even when the target company is not willing to be purchased, then the process is labelled as acquisition • Target companies avoid hostile takeovers through poison pills • Although, in reality an acquisition takes place, the firms declare it as a merger to avoid any negative impression • Difference lies in how the purchase is communicated to and received by the target company's board of directors, shareholders and employees Jan 2010 Merger & Acquisitions 15

3 Jan 2010 M&A Motives Merger & Acquisitions 16

3 Jan 2010 M&A Motives Merger & Acquisitions 16

Motives for M&A • Quest for New Markets and Market Power Saturated domestic markets, foreign markets beckon • Economies of Large Scale Business Internal and external economies lead to cost reduction & more profits • Elimination of Competition Eliminates severe, intense and wasteful expenditure on competition • Adoption of Modern Technology Requires large resources which may be out of reach of a firm • Unified control and Self Sufficiency Ensure constant supply of raw materials and avoid dependence on other firms • Personal Ambition Desire of a person to increase profits and enlarge own industrial empire Jan 2010 Merger & Acquisitions 17

Motives for M&A • Quest for New Markets and Market Power Saturated domestic markets, foreign markets beckon • Economies of Large Scale Business Internal and external economies lead to cost reduction & more profits • Elimination of Competition Eliminates severe, intense and wasteful expenditure on competition • Adoption of Modern Technology Requires large resources which may be out of reach of a firm • Unified control and Self Sufficiency Ensure constant supply of raw materials and avoid dependence on other firms • Personal Ambition Desire of a person to increase profits and enlarge own industrial empire Jan 2010 Merger & Acquisitions 17

Motives for M&A • Patent Rights Exclusive right to use the invention of any new machines, method or idea. Patents give monopoly position to firms at national and international levels • Enjoy Monopoly Power Firm can easily make adjustment in the supply and price of products and also increase the profit • Lack of Talent Scarcity of entrepreneurial, managerial and technical talent in developing countries at early stages of industrialization • Government Pressure Government can pressurize for M&A through legislation if competition among firms proves harmful to the country or improvement in overall efficiency of industrial undertakings is required Jan 2010 Merger & Acquisitions 18

Motives for M&A • Patent Rights Exclusive right to use the invention of any new machines, method or idea. Patents give monopoly position to firms at national and international levels • Enjoy Monopoly Power Firm can easily make adjustment in the supply and price of products and also increase the profit • Lack of Talent Scarcity of entrepreneurial, managerial and technical talent in developing countries at early stages of industrialization • Government Pressure Government can pressurize for M&A through legislation if competition among firms proves harmful to the country or improvement in overall efficiency of industrial undertakings is required Jan 2010 Merger & Acquisitions 18

Motives for M&A • Financial Considerations – Acquirer believes Target is Undervalued – Booming Stock Market – Falling Interest Rates • Tax Considerations • Effect of Trade Cycles in Economy Ups are the periods of boom when production is on large scale, profits are more, employment is maximum and new firms crop up indiscriminately in all directions. This situations creates unhealthy competition and acts as a motivating factors for M&A Downs are the period of depression when economic activity reaches to its lowest point. Only efficient and large firms manage to survive. Inefficient firms, to reduce the risk of failures, prefer to M&A by strong firms Jan 2010 Merger & Acquisitions 19

Motives for M&A • Financial Considerations – Acquirer believes Target is Undervalued – Booming Stock Market – Falling Interest Rates • Tax Considerations • Effect of Trade Cycles in Economy Ups are the periods of boom when production is on large scale, profits are more, employment is maximum and new firms crop up indiscriminately in all directions. This situations creates unhealthy competition and acts as a motivating factors for M&A Downs are the period of depression when economic activity reaches to its lowest point. Only efficient and large firms manage to survive. Inefficient firms, to reduce the risk of failures, prefer to M&A by strong firms Jan 2010 Merger & Acquisitions 19

4 Jan 2010 M&A Framework Checklist, Regulation Merger & Acquisitions 20

4 Jan 2010 M&A Framework Checklist, Regulation Merger & Acquisitions 20

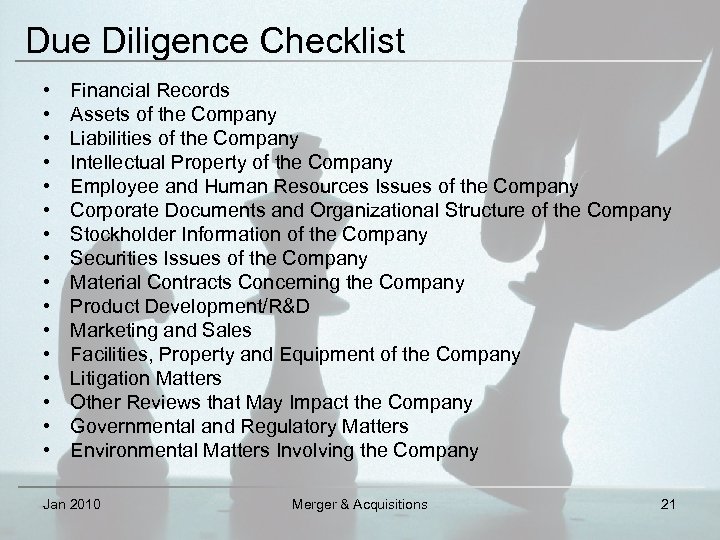

Due Diligence Checklist • • • • Financial Records Assets of the Company Liabilities of the Company Intellectual Property of the Company Employee and Human Resources Issues of the Company Corporate Documents and Organizational Structure of the Company Stockholder Information of the Company Securities Issues of the Company Material Contracts Concerning the Company Product Development/R&D Marketing and Sales Facilities, Property and Equipment of the Company Litigation Matters Other Reviews that May Impact the Company Governmental and Regulatory Matters Environmental Matters Involving the Company Jan 2010 Merger & Acquisitions 21

Due Diligence Checklist • • • • Financial Records Assets of the Company Liabilities of the Company Intellectual Property of the Company Employee and Human Resources Issues of the Company Corporate Documents and Organizational Structure of the Company Stockholder Information of the Company Securities Issues of the Company Material Contracts Concerning the Company Product Development/R&D Marketing and Sales Facilities, Property and Equipment of the Company Litigation Matters Other Reviews that May Impact the Company Governmental and Regulatory Matters Environmental Matters Involving the Company Jan 2010 Merger & Acquisitions 21

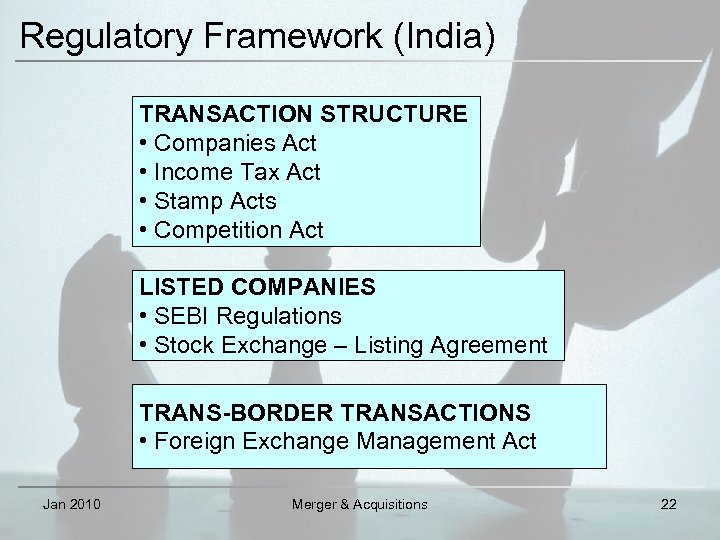

Regulatory Framework (India) TRANSACTION STRUCTURE • Companies Act • Income Tax Act • Stamp Acts • Competition Act LISTED COMPANIES • SEBI Regulations • Stock Exchange – Listing Agreement TRANS-BORDER TRANSACTIONS • Foreign Exchange Management Act Jan 2010 Merger & Acquisitions 22

Regulatory Framework (India) TRANSACTION STRUCTURE • Companies Act • Income Tax Act • Stamp Acts • Competition Act LISTED COMPANIES • SEBI Regulations • Stock Exchange – Listing Agreement TRANS-BORDER TRANSACTIONS • Foreign Exchange Management Act Jan 2010 Merger & Acquisitions 22

5 Jan 2010 M&A Problems Merger & Acquisitions 23

5 Jan 2010 M&A Problems Merger & Acquisitions 23

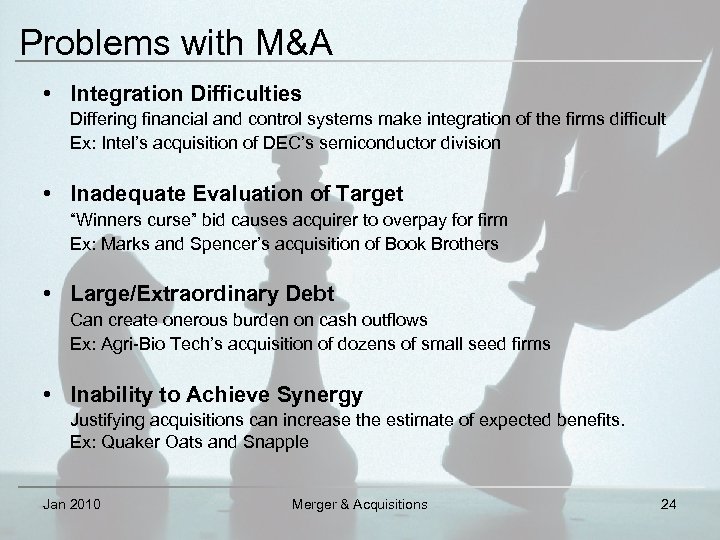

Problems with M&A • Integration Difficulties Differing financial and control systems make integration of the firms difficult Ex: Intel’s acquisition of DEC’s semiconductor division • Inadequate Evaluation of Target “Winners curse” bid causes acquirer to overpay for firm Ex: Marks and Spencer’s acquisition of Book Brothers • Large/Extraordinary Debt Can create onerous burden on cash outflows Ex: Agri-Bio Tech’s acquisition of dozens of small seed firms • Inability to Achieve Synergy Justifying acquisitions can increase the estimate of expected benefits. Ex: Quaker Oats and Snapple Jan 2010 Merger & Acquisitions 24

Problems with M&A • Integration Difficulties Differing financial and control systems make integration of the firms difficult Ex: Intel’s acquisition of DEC’s semiconductor division • Inadequate Evaluation of Target “Winners curse” bid causes acquirer to overpay for firm Ex: Marks and Spencer’s acquisition of Book Brothers • Large/Extraordinary Debt Can create onerous burden on cash outflows Ex: Agri-Bio Tech’s acquisition of dozens of small seed firms • Inability to Achieve Synergy Justifying acquisitions can increase the estimate of expected benefits. Ex: Quaker Oats and Snapple Jan 2010 Merger & Acquisitions 24

Problems with M&A • Overly Diversified Acquirer doesn’t have expertise required to manage unrelated business Ex: GE-prior to selling businesses and refocusing • Managers overly focused on Acquisitions Managers may fail to objectively access Ex: Ford and Jaguar • International Issues – Cultural Issues – Government Policy Jan 2010 Merger & Acquisitions 25

Problems with M&A • Overly Diversified Acquirer doesn’t have expertise required to manage unrelated business Ex: GE-prior to selling businesses and refocusing • Managers overly focused on Acquisitions Managers may fail to objectively access Ex: Ford and Jaguar • International Issues – Cultural Issues – Government Policy Jan 2010 Merger & Acquisitions 25

Reasons: M&A Deals Fall Through 1. Smart people are working up this deal - it must be a good one 2. There seems to be one good reason to do this deal 3. The balance sheet is not overflowing with cash, so a good deal is put off 4. The Company appears to have healthy deal flow 5. The CFO or general counsels are/ can act as M&A champions 6. The information provided by seller has not be thoroughly analysed 7. The decision becomes a strictly a left-brained process 8. There's no post-integration plan Jan 2010 Merger & Acquisitions 26

Reasons: M&A Deals Fall Through 1. Smart people are working up this deal - it must be a good one 2. There seems to be one good reason to do this deal 3. The balance sheet is not overflowing with cash, so a good deal is put off 4. The Company appears to have healthy deal flow 5. The CFO or general counsels are/ can act as M&A champions 6. The information provided by seller has not be thoroughly analysed 7. The decision becomes a strictly a left-brained process 8. There's no post-integration plan Jan 2010 Merger & Acquisitions 26

6 Jan 2010 M&A: Current Scenario Merger & Acquisitions 27

6 Jan 2010 M&A: Current Scenario Merger & Acquisitions 27

Scorecard: Top M&A deals 2000 s Year Purchased USD Mil 1 2000 Fusion: America Online Inc. (AOL) Time Warner 164, 747 2 2000 Glaxo Wellcome Plc. Smith. Kline Beecham Plc. 75, 961 3 2004 Royal Dutch Petroleum Co. Shell Transport & Trading Co 74, 559 4 2006 AT&T Inc. Bell. South Corporation 72, 671 5 2001 Comcast Corporation AT&T Broadband & Internet Svcs 72, 041 6 2004 Sanofi-Synthelabo SA Aventis SA 60, 243 7 2000 Spin-off: Nortel Networks Corporation 8 2002 Pfizer Inc. Pharmacia Corporation 59, 515 9 2004 JP Morgan Chase & Co Bank One Corp 58, 761 10 2008 Inbev Inc. Anheuser-Busch Companies, Inc 52, 000 59, 974 Source: Wikipedia, 2009 Jan 2010 Merger & Acquisitions 28

Scorecard: Top M&A deals 2000 s Year Purchased USD Mil 1 2000 Fusion: America Online Inc. (AOL) Time Warner 164, 747 2 2000 Glaxo Wellcome Plc. Smith. Kline Beecham Plc. 75, 961 3 2004 Royal Dutch Petroleum Co. Shell Transport & Trading Co 74, 559 4 2006 AT&T Inc. Bell. South Corporation 72, 671 5 2001 Comcast Corporation AT&T Broadband & Internet Svcs 72, 041 6 2004 Sanofi-Synthelabo SA Aventis SA 60, 243 7 2000 Spin-off: Nortel Networks Corporation 8 2002 Pfizer Inc. Pharmacia Corporation 59, 515 9 2004 JP Morgan Chase & Co Bank One Corp 58, 761 10 2008 Inbev Inc. Anheuser-Busch Companies, Inc 52, 000 59, 974 Source: Wikipedia, 2009 Jan 2010 Merger & Acquisitions 28

Scorecard: Top M&A deals India Rank Partners Date US$m 1 Tata Steel - Corus Jan '07 $12, 200 2 Vodafone-Hutchison Essar Feb '07 $11, 100 3 Hindalco - Novelis Feb '07 $6, 000 4 Ranbaxy-Daiichi Sankyo Jun '08 $4, 500 5 ONGC-Imperial Energy Jan '09 $2, 800 6 NTT Do. Co. Mo-Tata Tele Nov '08 $2, 700 7 HDFC Bank -Centurion Bank of Punjab Feb '08 $2, 400 8 Tata Motors-Jaguar Land Rover Mar '08 $2, 300 9 Sterlite-Asarco Mar '09 $1, 800 10 Suzlon-Re. Power May '07 $1, 700 11 RIL-RPL merger Mar '09 $1, 680 Source: ET, 2009 Expected Merger of Bharti Airtel and South Africa's MTN US $23 Billion Jan 2010 Merger & Acquisitions 29

Scorecard: Top M&A deals India Rank Partners Date US$m 1 Tata Steel - Corus Jan '07 $12, 200 2 Vodafone-Hutchison Essar Feb '07 $11, 100 3 Hindalco - Novelis Feb '07 $6, 000 4 Ranbaxy-Daiichi Sankyo Jun '08 $4, 500 5 ONGC-Imperial Energy Jan '09 $2, 800 6 NTT Do. Co. Mo-Tata Tele Nov '08 $2, 700 7 HDFC Bank -Centurion Bank of Punjab Feb '08 $2, 400 8 Tata Motors-Jaguar Land Rover Mar '08 $2, 300 9 Sterlite-Asarco Mar '09 $1, 800 10 Suzlon-Re. Power May '07 $1, 700 11 RIL-RPL merger Mar '09 $1, 680 Source: ET, 2009 Expected Merger of Bharti Airtel and South Africa's MTN US $23 Billion Jan 2010 Merger & Acquisitions 29

M&A in India: Growth in recent years • The Indian industry has been steadily moving towards building competitive enterprises globally. • Increase in both inbound and outbound M&A. • Not only the number & the size of the deals, but also the quality of the deals and range of participants has improved. • A rise in cross border M&A activity has the backing of healthy performance at home, strong management capabilities and access to competitive financing. • India Inc. is spreading its wings beyond border and acquiring foreign assets to serve global markets– with M&A fast becoming the most preferred route. • The easy availability of funds, speed of execution and the growing confidence of the India Inc. are some of the contributory factors, giving momentum to the growth. Table I reveals largest M&A deals by Indian companies. Jan 2010 Merger & Acquisitions 30

M&A in India: Growth in recent years • The Indian industry has been steadily moving towards building competitive enterprises globally. • Increase in both inbound and outbound M&A. • Not only the number & the size of the deals, but also the quality of the deals and range of participants has improved. • A rise in cross border M&A activity has the backing of healthy performance at home, strong management capabilities and access to competitive financing. • India Inc. is spreading its wings beyond border and acquiring foreign assets to serve global markets– with M&A fast becoming the most preferred route. • The easy availability of funds, speed of execution and the growing confidence of the India Inc. are some of the contributory factors, giving momentum to the growth. Table I reveals largest M&A deals by Indian companies. Jan 2010 Merger & Acquisitions 30

India Scenario At the close of 2009, where are we? • In the wake of the global financial meltdown, a number of policy changes have been undertaken by Government and SEBI aimed at boosting investments and M&A • In 2008, introduction of the Companies Bill, proposes a few positive changes in context of M&A, as compared to the Companies Act, 1956 • Among the recent noteworthy amendments brought in by the SEBI are: – Relaxation of registration requirements pertaining to the FIIs – Pricing guidelines set out in DIP (Disclosure & Investor Protection) – Permitting majority shareholders to further consolidate shareholding under the Takeover Regulations – Disclosure of pledged shares by promoters and additional restrictions on company directors under the Insider Trading Regulations • On the FDI front, there is better clarity available around rules governing sectoral caps foreign shareholding Jan 2010 Merger & Acquisitions 31

India Scenario At the close of 2009, where are we? • In the wake of the global financial meltdown, a number of policy changes have been undertaken by Government and SEBI aimed at boosting investments and M&A • In 2008, introduction of the Companies Bill, proposes a few positive changes in context of M&A, as compared to the Companies Act, 1956 • Among the recent noteworthy amendments brought in by the SEBI are: – Relaxation of registration requirements pertaining to the FIIs – Pricing guidelines set out in DIP (Disclosure & Investor Protection) – Permitting majority shareholders to further consolidate shareholding under the Takeover Regulations – Disclosure of pledged shares by promoters and additional restrictions on company directors under the Insider Trading Regulations • On the FDI front, there is better clarity available around rules governing sectoral caps foreign shareholding Jan 2010 Merger & Acquisitions 31

M&A in India: Opportunities & Challenges • Indian companies are pursuing a rapid growth strategy by expanding in the global markets through M&A - a quick path to pursue competitive business globally. • With turmoil in global financial markets & slowdown in the domestic markets, time is appropriate for outbound acquisitions by Indian companies because of attractive valuations at which global companies are available currently. • The Indian corporate industry has made investments for expansion, increased its capacity & has successfully countered competition. • Indian companies have been harboring global ambitions & are taking steps to increase their footprints in the global markets. • Spate of M&A activities is all set to accelerate in the near future. Jan 2010 Merger & Acquisitions 32

M&A in India: Opportunities & Challenges • Indian companies are pursuing a rapid growth strategy by expanding in the global markets through M&A - a quick path to pursue competitive business globally. • With turmoil in global financial markets & slowdown in the domestic markets, time is appropriate for outbound acquisitions by Indian companies because of attractive valuations at which global companies are available currently. • The Indian corporate industry has made investments for expansion, increased its capacity & has successfully countered competition. • Indian companies have been harboring global ambitions & are taking steps to increase their footprints in the global markets. • Spate of M&A activities is all set to accelerate in the near future. Jan 2010 Merger & Acquisitions 32

India Scenario For 2010, what should be the Agenda? • Statistically, M&A activity and economic growth have shown a strong correlation, forming a vortex around each other at the peak of financial market activity. As India gears up for the next big M&A rally, the role of the policymaker and the regulator will continue to become even more important in the coming times • It will be interesting to see how they deal with issues such as – – – the FDI in retail, as 100 per cent is already allowed through wholesale further streamlining of the FIPB approvals process practical issues that still surround M&A in listed companies double taxation of cross-border deals guidelines relating to leveraged buyouts for domestic M&A Jan 2010 Merger & Acquisitions 33

India Scenario For 2010, what should be the Agenda? • Statistically, M&A activity and economic growth have shown a strong correlation, forming a vortex around each other at the peak of financial market activity. As India gears up for the next big M&A rally, the role of the policymaker and the regulator will continue to become even more important in the coming times • It will be interesting to see how they deal with issues such as – – – the FDI in retail, as 100 per cent is already allowed through wholesale further streamlining of the FIPB approvals process practical issues that still surround M&A in listed companies double taxation of cross-border deals guidelines relating to leveraged buyouts for domestic M&A Jan 2010 Merger & Acquisitions 33

7 Jan 2010 M&A Case Studies Success or Failure Merger & Acquisitions 34

7 Jan 2010 M&A Case Studies Success or Failure Merger & Acquisitions 34

Exxon - Mobil Jan 2010 Merger & Acquisitions 35

Exxon - Mobil Jan 2010 Merger & Acquisitions 35

Exxon-Mobil Merger History • Exxon and Mobil was one company called Standard Oil Company of Ohio in 1870 • In 1911, broken up into Exxon and Mobil until 1999 • In December 1998 Exxon agreed to buy Mobil for about $75 billion Motives • • • Improved Earnings Stability Falling Oil Prices Long-term Capital Productivity Increased Exploration and Production Costs Enhanced Competitive Advantage in Technology Mobil's strong point was liquefied natural gas and Exxon had a strong hold on pipeline gas thus completing the oil circle Jan 2010 Merger & Acquisitions 36

Exxon-Mobil Merger History • Exxon and Mobil was one company called Standard Oil Company of Ohio in 1870 • In 1911, broken up into Exxon and Mobil until 1999 • In December 1998 Exxon agreed to buy Mobil for about $75 billion Motives • • • Improved Earnings Stability Falling Oil Prices Long-term Capital Productivity Increased Exploration and Production Costs Enhanced Competitive Advantage in Technology Mobil's strong point was liquefied natural gas and Exxon had a strong hold on pipeline gas thus completing the oil circle Jan 2010 Merger & Acquisitions 36

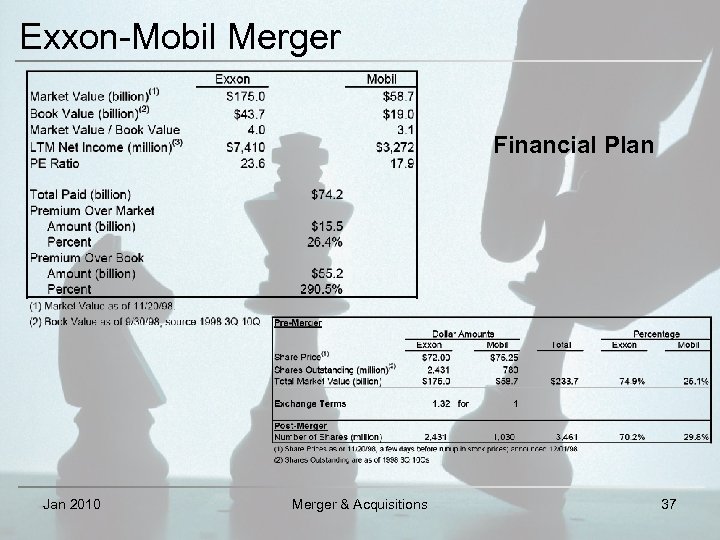

Exxon-Mobil Merger Financial Plan Jan 2010 Merger & Acquisitions 37

Exxon-Mobil Merger Financial Plan Jan 2010 Merger & Acquisitions 37

Exxon-Mobil Merger Post-Merger Strategy • Operational Efficiency, Margin Improvement Initiatives and Prudent Capital Management • Attract customers willing to pay additional premiums for their products and at the same time improve efficiency in supply chain in order to reduce cost • Focus on core business R&D to e-business and venture capital activities Results • • Strong cash flows at the operating level Operating profit three times that required for operational activity 30 -40% of net earnings is normally paid out as dividend Huge investments in non-gasoline products Jan 2010 Merger & Acquisitions 38

Exxon-Mobil Merger Post-Merger Strategy • Operational Efficiency, Margin Improvement Initiatives and Prudent Capital Management • Attract customers willing to pay additional premiums for their products and at the same time improve efficiency in supply chain in order to reduce cost • Focus on core business R&D to e-business and venture capital activities Results • • Strong cash flows at the operating level Operating profit three times that required for operational activity 30 -40% of net earnings is normally paid out as dividend Huge investments in non-gasoline products Jan 2010 Merger & Acquisitions 38

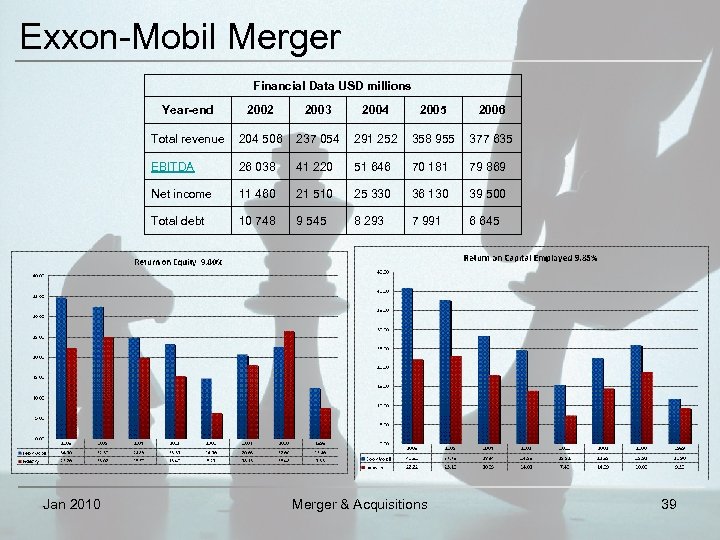

Exxon-Mobil Merger Financial Data USD millions Year-end 2003 2004 2005 2006 Total revenue 204 506 237 054 291 252 358 955 377 635 EBITDA 26 038 41 220 51 646 70 181 79 869 Net income 11 460 21 510 25 330 36 130 39 500 Total debt Jan 2010 2002 10 748 9 545 8 293 7 991 6 645 Merger & Acquisitions 39

Exxon-Mobil Merger Financial Data USD millions Year-end 2003 2004 2005 2006 Total revenue 204 506 237 054 291 252 358 955 377 635 EBITDA 26 038 41 220 51 646 70 181 79 869 Net income 11 460 21 510 25 330 36 130 39 500 Total debt Jan 2010 2002 10 748 9 545 8 293 7 991 6 645 Merger & Acquisitions 39

Tata Motors acquisition of Jaguar and Land Rover (JLR) Jan 2010 Merger & Acquisitions 40

Tata Motors acquisition of Jaguar and Land Rover (JLR) Jan 2010 Merger & Acquisitions 40

Tata Motors acquisition of JLR Tata Group • One of the largest business Conglomerate in India (7 diverse sector) • Presence in over 80 countries • Workforce of around 3. 5 Lakh people Tata Motors • • Largest Automobile Company in India Second largest Bus manufacturer in the world Fourth largest truck manufacturer in the world Dual listed company: Indian & New York Stock Exchange Long term strategy includes consolidating its position in the domestic Indian market and expanding its international footprint by leveraging on in-house capabilities & products and also through acquisitions and strategic collaborations Jan 2010 Merger & Acquisitions 41

Tata Motors acquisition of JLR Tata Group • One of the largest business Conglomerate in India (7 diverse sector) • Presence in over 80 countries • Workforce of around 3. 5 Lakh people Tata Motors • • Largest Automobile Company in India Second largest Bus manufacturer in the world Fourth largest truck manufacturer in the world Dual listed company: Indian & New York Stock Exchange Long term strategy includes consolidating its position in the domestic Indian market and expanding its international footprint by leveraging on in-house capabilities & products and also through acquisitions and strategic collaborations Jan 2010 Merger & Acquisitions 41

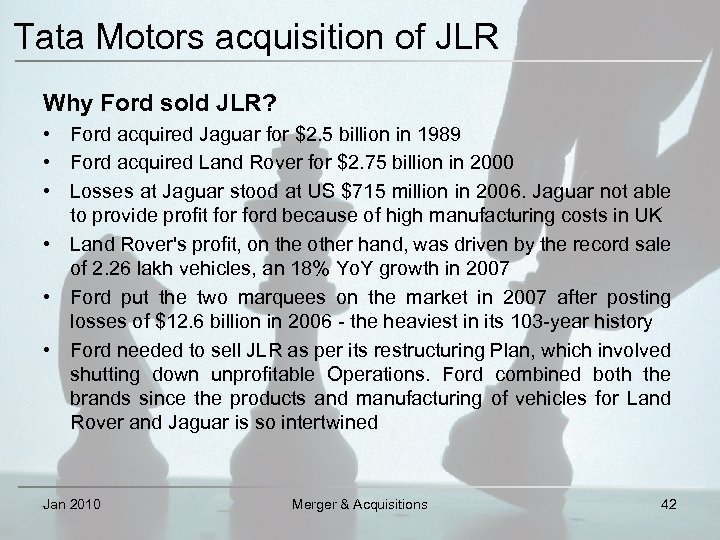

Tata Motors acquisition of JLR Why Ford sold JLR? • Ford acquired Jaguar for $2. 5 billion in 1989 • Ford acquired Land Rover for $2. 75 billion in 2000 • Losses at Jaguar stood at US $715 million in 2006. Jaguar not able to provide profit ford because of high manufacturing costs in UK • Land Rover's profit, on the other hand, was driven by the record sale of 2. 26 lakh vehicles, an 18% Yo. Y growth in 2007 • Ford put the two marquees on the market in 2007 after posting losses of $12. 6 billion in 2006 - the heaviest in its 103 -year history • Ford needed to sell JLR as per its restructuring Plan, which involved shutting down unprofitable Operations. Ford combined both the brands since the products and manufacturing of vehicles for Land Rover and Jaguar is so intertwined Jan 2010 Merger & Acquisitions 42

Tata Motors acquisition of JLR Why Ford sold JLR? • Ford acquired Jaguar for $2. 5 billion in 1989 • Ford acquired Land Rover for $2. 75 billion in 2000 • Losses at Jaguar stood at US $715 million in 2006. Jaguar not able to provide profit ford because of high manufacturing costs in UK • Land Rover's profit, on the other hand, was driven by the record sale of 2. 26 lakh vehicles, an 18% Yo. Y growth in 2007 • Ford put the two marquees on the market in 2007 after posting losses of $12. 6 billion in 2006 - the heaviest in its 103 -year history • Ford needed to sell JLR as per its restructuring Plan, which involved shutting down unprofitable Operations. Ford combined both the brands since the products and manufacturing of vehicles for Land Rover and Jaguar is so intertwined Jan 2010 Merger & Acquisitions 42

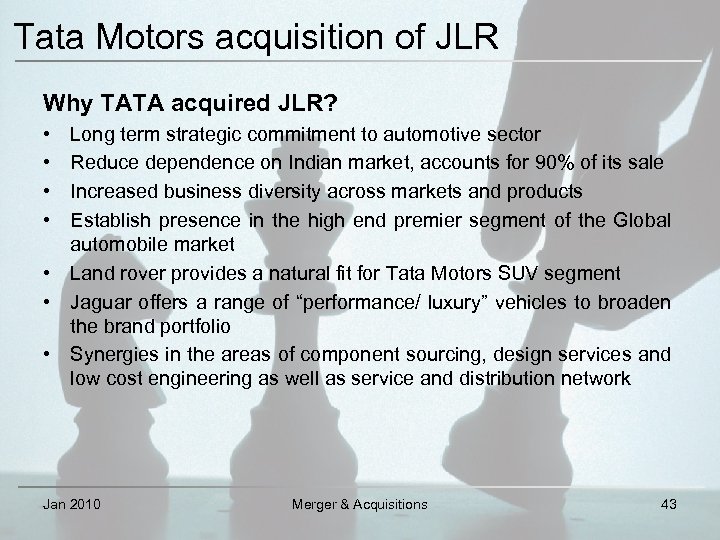

Tata Motors acquisition of JLR Why TATA acquired JLR? • • Long term strategic commitment to automotive sector Reduce dependence on Indian market, accounts for 90% of its sale Increased business diversity across markets and products Establish presence in the high end premier segment of the Global automobile market • Land rover provides a natural fit for Tata Motors SUV segment • Jaguar offers a range of “performance/ luxury” vehicles to broaden the brand portfolio • Synergies in the areas of component sourcing, design services and low cost engineering as well as service and distribution network Jan 2010 Merger & Acquisitions 43

Tata Motors acquisition of JLR Why TATA acquired JLR? • • Long term strategic commitment to automotive sector Reduce dependence on Indian market, accounts for 90% of its sale Increased business diversity across markets and products Establish presence in the high end premier segment of the Global automobile market • Land rover provides a natural fit for Tata Motors SUV segment • Jaguar offers a range of “performance/ luxury” vehicles to broaden the brand portfolio • Synergies in the areas of component sourcing, design services and low cost engineering as well as service and distribution network Jan 2010 Merger & Acquisitions 43

Tata Motors acquisition of JLR Need For Growth • Tata group has led the growing appetite among Indian companies to acquire businesses overseas in Europe, the US, Australia and Africa • With revenues of $7. 2 billion in 2006 -07. With over 4 million Tata vehicles plying in India, it is the leader in commercial vehicles and second largest in passenger vehicles Competitive Advantage • Tata Motors is vulnerable to greater competition at home. Foreign vehicle makers including Daimler, Nissan Motor, Volvo and MAN AG have struck local alliances for a bigger presence • Tata Motors, has a joint venture with Fiat for cars, engines and transmissions in India, is also facing heat from top car maker Maruti, Hyundai Motor, Renault and Volkswagen Jan 2010 Merger & Acquisitions 44

Tata Motors acquisition of JLR Need For Growth • Tata group has led the growing appetite among Indian companies to acquire businesses overseas in Europe, the US, Australia and Africa • With revenues of $7. 2 billion in 2006 -07. With over 4 million Tata vehicles plying in India, it is the leader in commercial vehicles and second largest in passenger vehicles Competitive Advantage • Tata Motors is vulnerable to greater competition at home. Foreign vehicle makers including Daimler, Nissan Motor, Volvo and MAN AG have struck local alliances for a bigger presence • Tata Motors, has a joint venture with Fiat for cars, engines and transmissions in India, is also facing heat from top car maker Maruti, Hyundai Motor, Renault and Volkswagen Jan 2010 Merger & Acquisitions 44

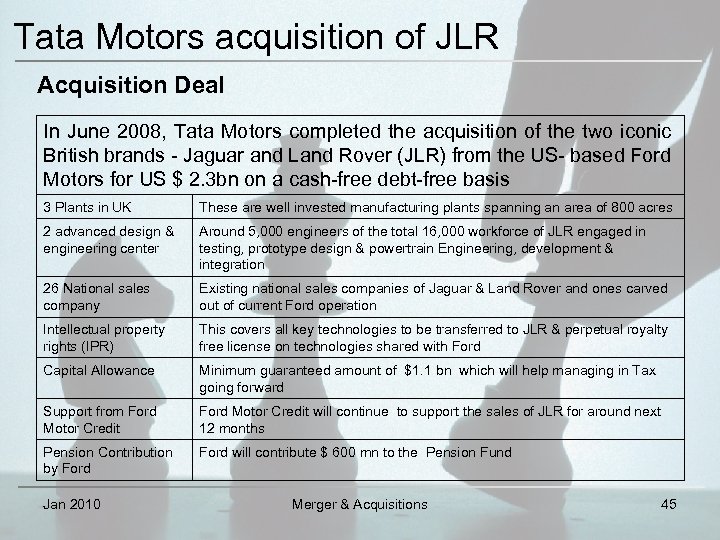

Tata Motors acquisition of JLR Acquisition Deal In June 2008, Tata Motors completed the acquisition of the two iconic British brands - Jaguar and Land Rover (JLR) from the US- based Ford Motors for US $ 2. 3 bn on a cash-free debt-free basis 3 Plants in UK These are well invested manufacturing plants spanning an area of 800 acres 2 advanced design & engineering center Around 5, 000 engineers of the total 16, 000 workforce of JLR engaged in testing, prototype design & powertrain Engineering, development & integration 26 National sales company Existing national sales companies of Jaguar & Land Rover and ones carved out of current Ford operation Intellectual property rights (IPR) This covers all key technologies to be transferred to JLR & perpetual royalty free license on technologies shared with Ford Capital Allowance Minimum guaranteed amount of $1. 1 bn which will help managing in Tax going forward Support from Ford Motor Credit will continue to support the sales of JLR for around next 12 months Pension Contribution by Ford will contribute $ 600 mn to the Pension Fund Jan 2010 Merger & Acquisitions 45

Tata Motors acquisition of JLR Acquisition Deal In June 2008, Tata Motors completed the acquisition of the two iconic British brands - Jaguar and Land Rover (JLR) from the US- based Ford Motors for US $ 2. 3 bn on a cash-free debt-free basis 3 Plants in UK These are well invested manufacturing plants spanning an area of 800 acres 2 advanced design & engineering center Around 5, 000 engineers of the total 16, 000 workforce of JLR engaged in testing, prototype design & powertrain Engineering, development & integration 26 National sales company Existing national sales companies of Jaguar & Land Rover and ones carved out of current Ford operation Intellectual property rights (IPR) This covers all key technologies to be transferred to JLR & perpetual royalty free license on technologies shared with Ford Capital Allowance Minimum guaranteed amount of $1. 1 bn which will help managing in Tax going forward Support from Ford Motor Credit will continue to support the sales of JLR for around next 12 months Pension Contribution by Ford will contribute $ 600 mn to the Pension Fund Jan 2010 Merger & Acquisitions 45

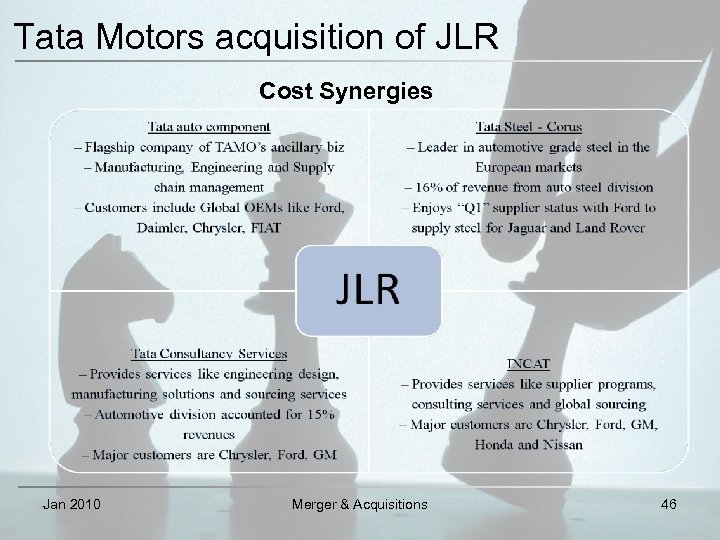

Tata Motors acquisition of JLR Cost Synergies Jan 2010 Merger & Acquisitions 46

Tata Motors acquisition of JLR Cost Synergies Jan 2010 Merger & Acquisitions 46

Tata Motors acquisition of JLR Failure/ Results • Tata Motors suffered a net loss of about Rs 2, 500 Crore in 2008 -09 mainly on account of JLR that it acquired in June 2008. The expensive JLR marquee suffered on account of the economic meltdown • Deal mean a lot from business point of view as it is a major step of India corporate sector to really become Global as well as on emotional point of view as it brought pride to India. May be the deal is not sounding convincing in the first year of its operation but of course the technological knowledge and advancement it will bring to Tata Motors with its world class R & D, it will surely benefit Tata Motor in long run and will establish it as a major player in global auto market Jan 2010 Merger & Acquisitions 47

Tata Motors acquisition of JLR Failure/ Results • Tata Motors suffered a net loss of about Rs 2, 500 Crore in 2008 -09 mainly on account of JLR that it acquired in June 2008. The expensive JLR marquee suffered on account of the economic meltdown • Deal mean a lot from business point of view as it is a major step of India corporate sector to really become Global as well as on emotional point of view as it brought pride to India. May be the deal is not sounding convincing in the first year of its operation but of course the technological knowledge and advancement it will bring to Tata Motors with its world class R & D, it will surely benefit Tata Motor in long run and will establish it as a major player in global auto market Jan 2010 Merger & Acquisitions 47

Vodafone - Hutch Jan 2010 Merger & Acquisitions 48

Vodafone - Hutch Jan 2010 Merger & Acquisitions 48

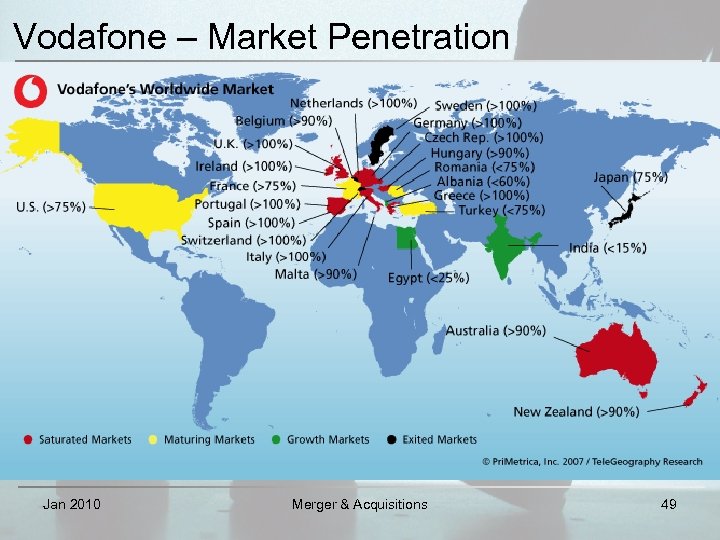

Vodafone – Market Penetration Jan 2010 Merger & Acquisitions 49

Vodafone – Market Penetration Jan 2010 Merger & Acquisitions 49

Vodafone Acquisition of Hutchinson History • • • Biggest deal in the Indian telecom market in Feb ‘ 07 Vodafone acquired 52% interest in Hutch Essar for US$11. 1 billion Vodafone has 10% share in Bharti Primary Motives • • Increase Vodafone’s presence in higher growth emerging markets Hutch Essar delivered a strong existing platform in India – – • Nationwide presence with 22 out of 23 licence areas (“circles”) 23. 3 million customers as on 31 December 2006 (16. 4% market share) Revenue growth of 51%, EBITDA margin of 33% in 6 months (Jun 06) Experienced and highly respected management team HTIL exited India because – – Jan 2010 urban markets in the country had become saturated Future expansion would have had to be only in the rural areas, which would lead to falling average revenue per user (ARPU) consequently lower returns on its investments HTIL also wanted to use the money earned through this deal to fund its businesses in Europe. Merger & Acquisitions 50

Vodafone Acquisition of Hutchinson History • • • Biggest deal in the Indian telecom market in Feb ‘ 07 Vodafone acquired 52% interest in Hutch Essar for US$11. 1 billion Vodafone has 10% share in Bharti Primary Motives • • Increase Vodafone’s presence in higher growth emerging markets Hutch Essar delivered a strong existing platform in India – – • Nationwide presence with 22 out of 23 licence areas (“circles”) 23. 3 million customers as on 31 December 2006 (16. 4% market share) Revenue growth of 51%, EBITDA margin of 33% in 6 months (Jun 06) Experienced and highly respected management team HTIL exited India because – – Jan 2010 urban markets in the country had become saturated Future expansion would have had to be only in the rural areas, which would lead to falling average revenue per user (ARPU) consequently lower returns on its investments HTIL also wanted to use the money earned through this deal to fund its businesses in Europe. Merger & Acquisitions 50

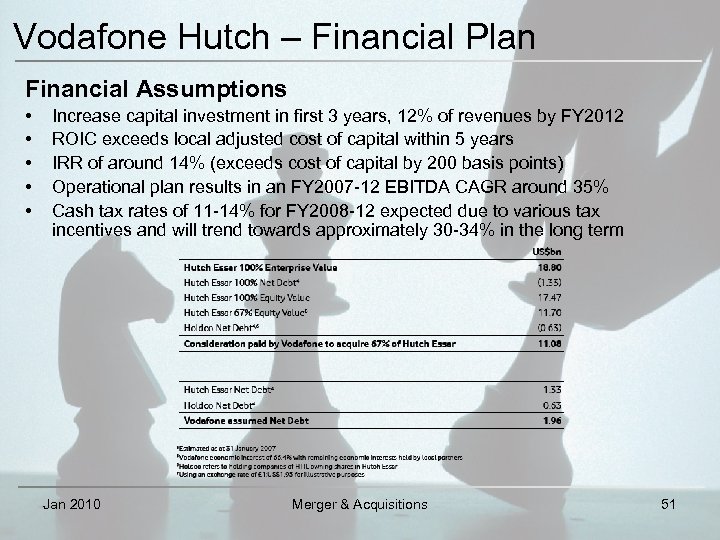

Vodafone Hutch – Financial Plan Financial Assumptions • • • Increase capital investment in first 3 years, 12% of revenues by FY 2012 ROIC exceeds local adjusted cost of capital within 5 years IRR of around 14% (exceeds cost of capital by 200 basis points) Operational plan results in an FY 2007 -12 EBITDA CAGR around 35% Cash tax rates of 11 -14% for FY 2008 -12 expected due to various tax incentives and will trend towards approximately 30 -34% in the long term Jan 2010 Merger & Acquisitions 51

Vodafone Hutch – Financial Plan Financial Assumptions • • • Increase capital investment in first 3 years, 12% of revenues by FY 2012 ROIC exceeds local adjusted cost of capital within 5 years IRR of around 14% (exceeds cost of capital by 200 basis points) Operational plan results in an FY 2007 -12 EBITDA CAGR around 35% Cash tax rates of 11 -14% for FY 2008 -12 expected due to various tax incentives and will trend towards approximately 30 -34% in the long term Jan 2010 Merger & Acquisitions 51

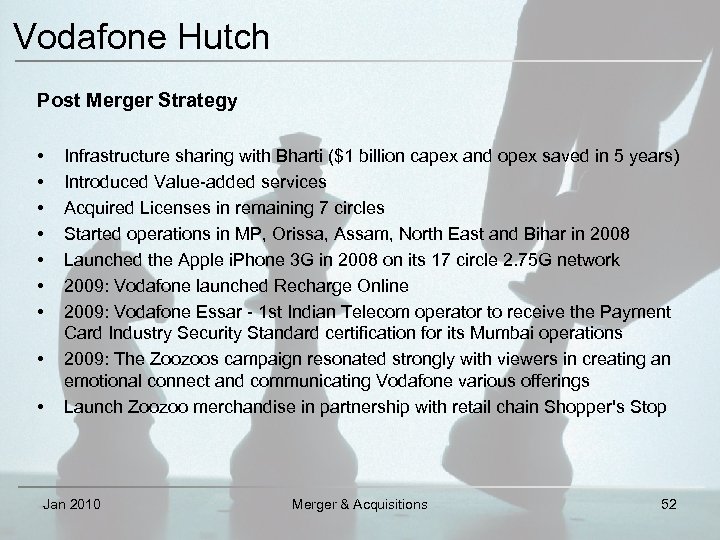

Vodafone Hutch Post Merger Strategy • • • Infrastructure sharing with Bharti ($1 billion capex and opex saved in 5 years) Introduced Value-added services Acquired Licenses in remaining 7 circles Started operations in MP, Orissa, Assam, North East and Bihar in 2008 Launched the Apple i. Phone 3 G in 2008 on its 17 circle 2. 75 G network 2009: Vodafone launched Recharge Online 2009: Vodafone Essar - 1 st Indian Telecom operator to receive the Payment Card Industry Security Standard certification for its Mumbai operations 2009: The Zoozoos campaign resonated strongly with viewers in creating an emotional connect and communicating Vodafone various offerings Launch Zoozoo merchandise in partnership with retail chain Shopper's Stop Jan 2010 Merger & Acquisitions 52

Vodafone Hutch Post Merger Strategy • • • Infrastructure sharing with Bharti ($1 billion capex and opex saved in 5 years) Introduced Value-added services Acquired Licenses in remaining 7 circles Started operations in MP, Orissa, Assam, North East and Bihar in 2008 Launched the Apple i. Phone 3 G in 2008 on its 17 circle 2. 75 G network 2009: Vodafone launched Recharge Online 2009: Vodafone Essar - 1 st Indian Telecom operator to receive the Payment Card Industry Security Standard certification for its Mumbai operations 2009: The Zoozoos campaign resonated strongly with viewers in creating an emotional connect and communicating Vodafone various offerings Launch Zoozoo merchandise in partnership with retail chain Shopper's Stop Jan 2010 Merger & Acquisitions 52

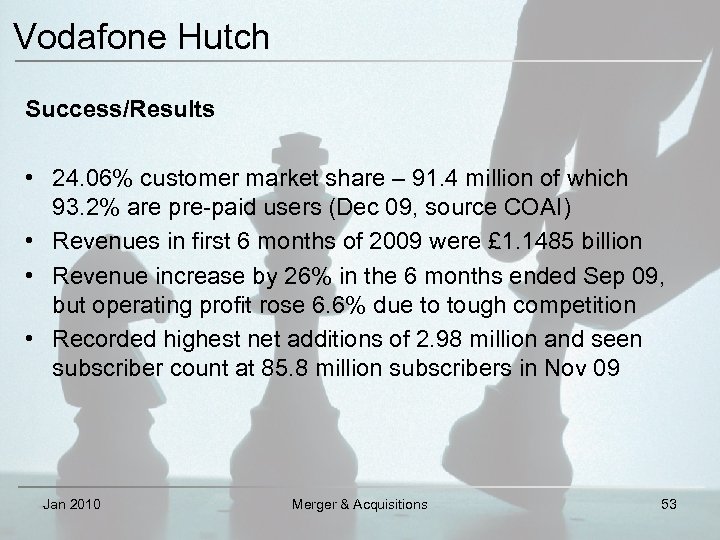

Vodafone Hutch Success/Results • 24. 06% customer market share – 91. 4 million of which 93. 2% are pre-paid users (Dec 09, source COAI) • Revenues in first 6 months of 2009 were £ 1. 1485 billion • Revenue increase by 26% in the 6 months ended Sep 09, but operating profit rose 6. 6% due to tough competition • Recorded highest net additions of 2. 98 million and seen subscriber count at 85. 8 million subscribers in Nov 09 Jan 2010 Merger & Acquisitions 53

Vodafone Hutch Success/Results • 24. 06% customer market share – 91. 4 million of which 93. 2% are pre-paid users (Dec 09, source COAI) • Revenues in first 6 months of 2009 were £ 1. 1485 billion • Revenue increase by 26% in the 6 months ended Sep 09, but operating profit rose 6. 6% due to tough competition • Recorded highest net additions of 2. 98 million and seen subscriber count at 85. 8 million subscribers in Nov 09 Jan 2010 Merger & Acquisitions 53

HDFC - Centurion Jan 2010 Merger & Acquisitions 54

HDFC - Centurion Jan 2010 Merger & Acquisitions 54

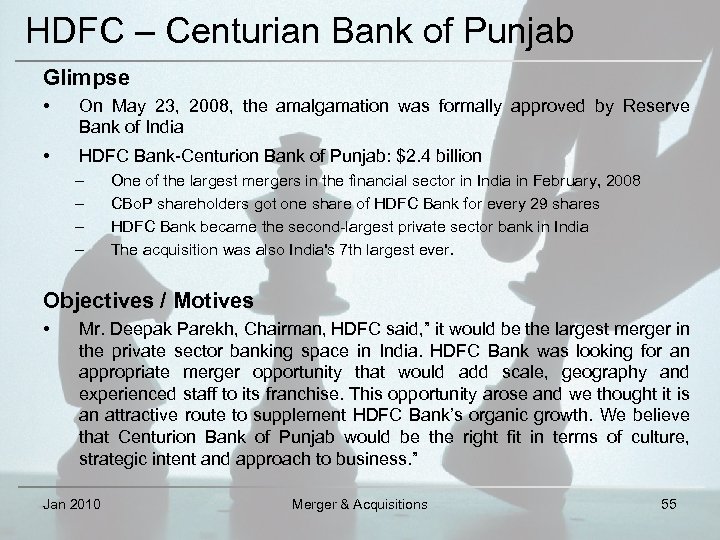

HDFC – Centurian Bank of Punjab Glimpse • On May 23, 2008, the amalgamation was formally approved by Reserve Bank of India • HDFC Bank-Centurion Bank of Punjab: $2. 4 billion – – One of the largest mergers in the financial sector in India in February, 2008 CBo. P shareholders got one share of HDFC Bank for every 29 shares HDFC Bank became the second-largest private sector bank in India The acquisition was also India's 7 th largest ever. Objectives / Motives • Mr. Deepak Parekh, Chairman, HDFC said, ” it would be the largest merger in the private sector banking space in India. HDFC Bank was looking for an appropriate merger opportunity that would add scale, geography and experienced staff to its franchise. This opportunity arose and we thought it is an attractive route to supplement HDFC Bank’s organic growth. We believe that Centurion Bank of Punjab would be the right fit in terms of culture, strategic intent and approach to business. ” Jan 2010 Merger & Acquisitions 55

HDFC – Centurian Bank of Punjab Glimpse • On May 23, 2008, the amalgamation was formally approved by Reserve Bank of India • HDFC Bank-Centurion Bank of Punjab: $2. 4 billion – – One of the largest mergers in the financial sector in India in February, 2008 CBo. P shareholders got one share of HDFC Bank for every 29 shares HDFC Bank became the second-largest private sector bank in India The acquisition was also India's 7 th largest ever. Objectives / Motives • Mr. Deepak Parekh, Chairman, HDFC said, ” it would be the largest merger in the private sector banking space in India. HDFC Bank was looking for an appropriate merger opportunity that would add scale, geography and experienced staff to its franchise. This opportunity arose and we thought it is an attractive route to supplement HDFC Bank’s organic growth. We believe that Centurion Bank of Punjab would be the right fit in terms of culture, strategic intent and approach to business. ” Jan 2010 Merger & Acquisitions 55

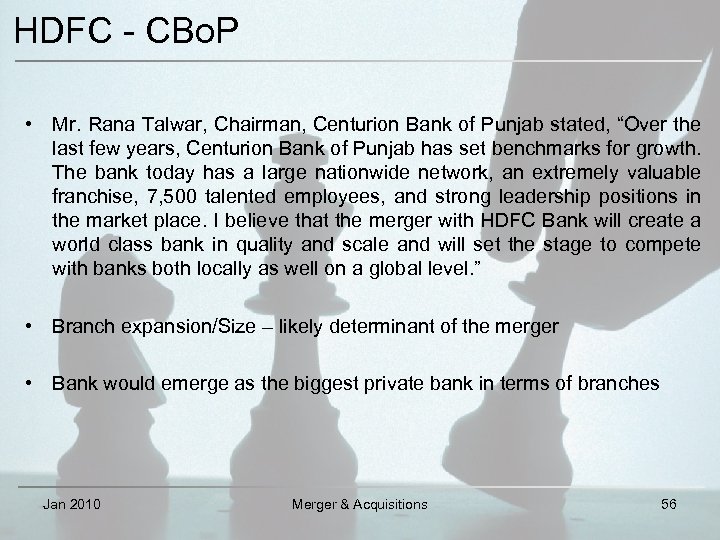

HDFC - CBo. P • Mr. Rana Talwar, Chairman, Centurion Bank of Punjab stated, “Over the last few years, Centurion Bank of Punjab has set benchmarks for growth. The bank today has a large nationwide network, an extremely valuable franchise, 7, 500 talented employees, and strong leadership positions in the market place. I believe that the merger with HDFC Bank will create a world class bank in quality and scale and will set the stage to compete with banks both locally as well on a global level. ” • Branch expansion/Size – likely determinant of the merger • Bank would emerge as the biggest private bank in terms of branches Jan 2010 Merger & Acquisitions 56

HDFC - CBo. P • Mr. Rana Talwar, Chairman, Centurion Bank of Punjab stated, “Over the last few years, Centurion Bank of Punjab has set benchmarks for growth. The bank today has a large nationwide network, an extremely valuable franchise, 7, 500 talented employees, and strong leadership positions in the market place. I believe that the merger with HDFC Bank will create a world class bank in quality and scale and will set the stage to compete with banks both locally as well on a global level. ” • Branch expansion/Size – likely determinant of the merger • Bank would emerge as the biggest private bank in terms of branches Jan 2010 Merger & Acquisitions 56

HDFC - CBo. P • For HDFC – Opportunity to add scale, geography (northern and southern states) and management bandwidth – Potential of business synergy and cultural fit between the two organizations • For CBo. P – HDFC bank would exploit its underutilized branch network that had the requisite expertise in retail liabilities, transaction banking and third party distribution – The combined entity would improve productivity levels of CBo. P branches by leveraging HDFC Bank's brand name. Jan 2010 Merger & Acquisitions 57

HDFC - CBo. P • For HDFC – Opportunity to add scale, geography (northern and southern states) and management bandwidth – Potential of business synergy and cultural fit between the two organizations • For CBo. P – HDFC bank would exploit its underutilized branch network that had the requisite expertise in retail liabilities, transaction banking and third party distribution – The combined entity would improve productivity levels of CBo. P branches by leveraging HDFC Bank's brand name. Jan 2010 Merger & Acquisitions 57

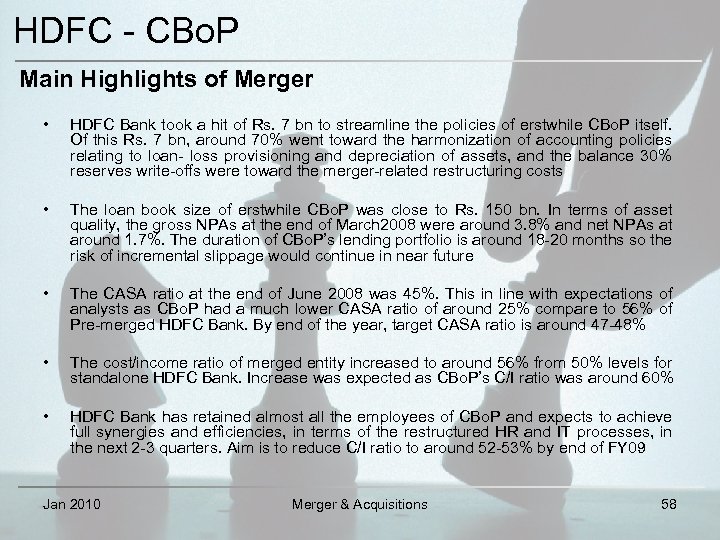

HDFC - CBo. P Main Highlights of Merger • HDFC Bank took a hit of Rs. 7 bn to streamline the policies of erstwhile CBo. P itself. Of this Rs. 7 bn, around 70% went toward the harmonization of accounting policies relating to loan- loss provisioning and depreciation of assets, and the balance 30% reserves write-offs were toward the merger-related restructuring costs • The loan book size of erstwhile CBo. P was close to Rs. 150 bn. In terms of asset quality, the gross NPAs at the end of March 2008 were around 3. 8% and net NPAs at around 1. 7%. The duration of CBo. P’s lending portfolio is around 18 -20 months so the risk of incremental slippage would continue in near future • The CASA ratio at the end of June 2008 was 45%. This in line with expectations of analysts as CBo. P had a much lower CASA ratio of around 25% compare to 56% of Pre-merged HDFC Bank. By end of the year, target CASA ratio is around 47 -48% • The cost/income ratio of merged entity increased to around 56% from 50% levels for standalone HDFC Bank. Increase was expected as CBo. P’s C/I ratio was around 60% • HDFC Bank has retained almost all the employees of CBo. P and expects to achieve full synergies and efficiencies, in terms of the restructured HR and IT processes, in the next 2 -3 quarters. Aim is to reduce C/I ratio to around 52 -53% by end of FY 09 Jan 2010 Merger & Acquisitions 58

HDFC - CBo. P Main Highlights of Merger • HDFC Bank took a hit of Rs. 7 bn to streamline the policies of erstwhile CBo. P itself. Of this Rs. 7 bn, around 70% went toward the harmonization of accounting policies relating to loan- loss provisioning and depreciation of assets, and the balance 30% reserves write-offs were toward the merger-related restructuring costs • The loan book size of erstwhile CBo. P was close to Rs. 150 bn. In terms of asset quality, the gross NPAs at the end of March 2008 were around 3. 8% and net NPAs at around 1. 7%. The duration of CBo. P’s lending portfolio is around 18 -20 months so the risk of incremental slippage would continue in near future • The CASA ratio at the end of June 2008 was 45%. This in line with expectations of analysts as CBo. P had a much lower CASA ratio of around 25% compare to 56% of Pre-merged HDFC Bank. By end of the year, target CASA ratio is around 47 -48% • The cost/income ratio of merged entity increased to around 56% from 50% levels for standalone HDFC Bank. Increase was expected as CBo. P’s C/I ratio was around 60% • HDFC Bank has retained almost all the employees of CBo. P and expects to achieve full synergies and efficiencies, in terms of the restructured HR and IT processes, in the next 2 -3 quarters. Aim is to reduce C/I ratio to around 52 -53% by end of FY 09 Jan 2010 Merger & Acquisitions 58

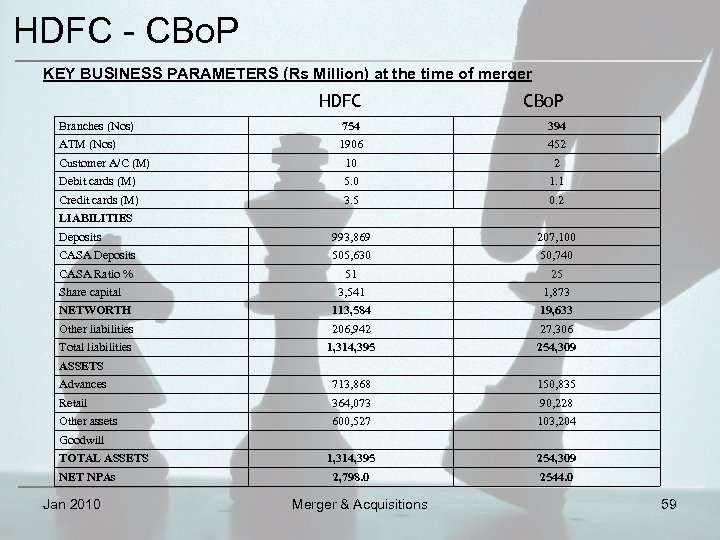

HDFC - CBo. P KEY BUSINESS PARAMETERS (Rs Million) at the time of merger HDFC CBo. P Branches (Nos) 754 394 ATM (Nos) 1906 452 Customer A/C (M) 10 2 Debit cards (M) 5. 0 1. 1 Credit cards (M) 3. 5 0. 2 Deposits 993, 869 207, 100 CASA Deposits 505, 630 50, 740 CASA Ratio % 51 25 3, 541 1, 873 NETWORTH 113, 584 19, 633 Other liabilities 206, 942 27, 306 Total liabilities 1, 314, 395 254, 309 Advances 713, 868 150, 835 Retail 364, 073 90, 228 Other assets 600, 527 103, 204 1, 314, 395 254, 309 2, 798. 0 2544. 0 LIABILITIES Share capital ASSETS Goodwill TOTAL ASSETS NET NPAs Jan 2010 Merger & Acquisitions 59

HDFC - CBo. P KEY BUSINESS PARAMETERS (Rs Million) at the time of merger HDFC CBo. P Branches (Nos) 754 394 ATM (Nos) 1906 452 Customer A/C (M) 10 2 Debit cards (M) 5. 0 1. 1 Credit cards (M) 3. 5 0. 2 Deposits 993, 869 207, 100 CASA Deposits 505, 630 50, 740 CASA Ratio % 51 25 3, 541 1, 873 NETWORTH 113, 584 19, 633 Other liabilities 206, 942 27, 306 Total liabilities 1, 314, 395 254, 309 Advances 713, 868 150, 835 Retail 364, 073 90, 228 Other assets 600, 527 103, 204 1, 314, 395 254, 309 2, 798. 0 2544. 0 LIABILITIES Share capital ASSETS Goodwill TOTAL ASSETS NET NPAs Jan 2010 Merger & Acquisitions 59

HDFC - CBo. P Results – Success / Failure • HDFC Bank’s NIM at 4. 5% is much higher than CBo. P’s 3. 6%, hence NIM of the merged entity declined in the medium term to 4. 3% • HDFC Bank’s productivity and profitability ratios are among the best in the industry, which declined in case of merged entity • HDFC Bank has strong distributional reach — 1, 412 branches across 528 cities at March ‘ 09(up from 761 branches in 327 cities in ‘ 08) • It has capital strength, with capital adequacy of 15%, 6% above the regulatory floor • It will get stronger when Rs 4, 000 crore of warrants issued to parent HDFC are exercised in Nov (parent has to hold 22% in the bank) • HDFC overtook ICICI to become 2 nd largest bank by market capitalization after SBI • HDFC Bank’s deposit base is built on a very stable retail base: current, savings and retail term deposits make up about 80% • It has a strong technology platform that supports client servicing capabilities. All of this gives HDFC the foundation for shift from a hitherto conservative stance to one of qualified aggression Jan 2010 Merger & Acquisitions 60

HDFC - CBo. P Results – Success / Failure • HDFC Bank’s NIM at 4. 5% is much higher than CBo. P’s 3. 6%, hence NIM of the merged entity declined in the medium term to 4. 3% • HDFC Bank’s productivity and profitability ratios are among the best in the industry, which declined in case of merged entity • HDFC Bank has strong distributional reach — 1, 412 branches across 528 cities at March ‘ 09(up from 761 branches in 327 cities in ‘ 08) • It has capital strength, with capital adequacy of 15%, 6% above the regulatory floor • It will get stronger when Rs 4, 000 crore of warrants issued to parent HDFC are exercised in Nov (parent has to hold 22% in the bank) • HDFC overtook ICICI to become 2 nd largest bank by market capitalization after SBI • HDFC Bank’s deposit base is built on a very stable retail base: current, savings and retail term deposits make up about 80% • It has a strong technology platform that supports client servicing capabilities. All of this gives HDFC the foundation for shift from a hitherto conservative stance to one of qualified aggression Jan 2010 Merger & Acquisitions 60

HDFC - CBo. P • Today, HDFC Bank hawks the full retail suite — credit cards, auto, personal and gold loans, and advances against shares. • The number of savings accounts has increased by over 70 per cent and the total customer base has increased to about 19 million (of which 2 million were added through CBo. P) from about 11. 6 million in FY 08. • Citi, with 40 branches, posted a net profit of Rs 2, 100 crore for 2008 -09. HDFC Bank’s profit after tax for FY 09 was Rs 2, 245 crore, despite its larger footprint. • Growth through acquisition also has adverse effects on operational cost and efficiency structures. HDFC Bank’s cost to income ratio at 53. 6 per cent was one of the highest amongst private banks in FY 09. • HDFC Bank’s employee base of 52, 000+ is 52% higher than ICICI Bank’s (while total assets are 52 % lower) • CBo. P merger only added 20 per cent to the balance sheet. “It’s the distribution that has made the big difference. Jan 2010 Merger & Acquisitions 61

HDFC - CBo. P • Today, HDFC Bank hawks the full retail suite — credit cards, auto, personal and gold loans, and advances against shares. • The number of savings accounts has increased by over 70 per cent and the total customer base has increased to about 19 million (of which 2 million were added through CBo. P) from about 11. 6 million in FY 08. • Citi, with 40 branches, posted a net profit of Rs 2, 100 crore for 2008 -09. HDFC Bank’s profit after tax for FY 09 was Rs 2, 245 crore, despite its larger footprint. • Growth through acquisition also has adverse effects on operational cost and efficiency structures. HDFC Bank’s cost to income ratio at 53. 6 per cent was one of the highest amongst private banks in FY 09. • HDFC Bank’s employee base of 52, 000+ is 52% higher than ICICI Bank’s (while total assets are 52 % lower) • CBo. P merger only added 20 per cent to the balance sheet. “It’s the distribution that has made the big difference. Jan 2010 Merger & Acquisitions 61

HDFC - CBo. P • The other headache is dud loans. During the fourth quarter, the bank’s stock of NPAs shot up by 119 per cent to Rs 1, 988 crore. But, 42 per cent of this was from CBo. P’s books. • But the bank’s net non-performing loans are still just 0. 6 per cent. • HDFC Bank, managing HR will remain an important challenge. • At present, out of the Bank’s total Gross NPAs of Rs 1, 988 cr, 42% (Rs 835 cr) are attributable to CBo. P, indicating a high rate of slippage in the CBo. P loan portfolio postacquisition as well. • One big factor in HDFC Bank’s favour is that it has all along been pretty good at garnering current and savings accounts (CASA). • In the CBo. P merger, HDFC Bank managed a quick integration despite being on different platforms — i-flex’s ‘Flexcube’ and Infosys’s ‘Finacle’. HDFC Bank is now powered by ‘Flexcube’. Jan 2010 Merger & Acquisitions 62

HDFC - CBo. P • The other headache is dud loans. During the fourth quarter, the bank’s stock of NPAs shot up by 119 per cent to Rs 1, 988 crore. But, 42 per cent of this was from CBo. P’s books. • But the bank’s net non-performing loans are still just 0. 6 per cent. • HDFC Bank, managing HR will remain an important challenge. • At present, out of the Bank’s total Gross NPAs of Rs 1, 988 cr, 42% (Rs 835 cr) are attributable to CBo. P, indicating a high rate of slippage in the CBo. P loan portfolio postacquisition as well. • One big factor in HDFC Bank’s favour is that it has all along been pretty good at garnering current and savings accounts (CASA). • In the CBo. P merger, HDFC Bank managed a quick integration despite being on different platforms — i-flex’s ‘Flexcube’ and Infosys’s ‘Finacle’. HDFC Bank is now powered by ‘Flexcube’. Jan 2010 Merger & Acquisitions 62

Hindalco - Novelis Jan 2010 Merger & Acquisitions 63

Hindalco - Novelis Jan 2010 Merger & Acquisitions 63

Hindalco : Company profile • Hindalco a Flagship Company of $28 billion Aditya Birla Group ( set up in 1857 ) • Largest integrated aluminum producer : 40% market share in India. • Ranks among top quartile of low cost producers in the world. Jan 2010 Merger & Acquisitions 64

Hindalco : Company profile • Hindalco a Flagship Company of $28 billion Aditya Birla Group ( set up in 1857 ) • Largest integrated aluminum producer : 40% market share in India. • Ranks among top quartile of low cost producers in the world. Jan 2010 Merger & Acquisitions 64

Novelis: Company Profile • Novelis - World’s leading producer of aluminium-rolled products with a 19 per cent global market share. • World leader in the recycling of used aluminium beverage cans. • No. 1 in rolled products producer in Europe, South America and Asia. • Facilities to produces metal cans for Pepsi and Coke. Jan 2010 Merger & Acquisitions 65

Novelis: Company Profile • Novelis - World’s leading producer of aluminium-rolled products with a 19 per cent global market share. • World leader in the recycling of used aluminium beverage cans. • No. 1 in rolled products producer in Europe, South America and Asia. • Facilities to produces metal cans for Pepsi and Coke. Jan 2010 Merger & Acquisitions 65

Introduction • The series of acquisitions in metal industry was initiated by acquisition of Arcelor by Mittal followed by Corus by Tata’s. • Indian aluminium giant Hindalco extended this process by acquiring Atlanta based company Novelis Inc, a world leader in aluminium rolling and flat-rolled aluminium products. Jan 2010 Merger & Acquisitions 66

Introduction • The series of acquisitions in metal industry was initiated by acquisition of Arcelor by Mittal followed by Corus by Tata’s. • Indian aluminium giant Hindalco extended this process by acquiring Atlanta based company Novelis Inc, a world leader in aluminium rolling and flat-rolled aluminium products. Jan 2010 Merger & Acquisitions 66

Reasons for Acquisition The fundamental reason for which we acquired Novelis – global market leadership, cutting edge technology, going up the value chain in the largest segment of value added products and a highly competent team. “Kumar M Birla” , Letter to Shareholder 08 -09. • • • Increased market power Learning and Developing new capabilities Overcoming the new entrants into the industry. Cost of new product development To avoid excessive competition Jan 2010 Merger & Acquisitions 67

Reasons for Acquisition The fundamental reason for which we acquired Novelis – global market leadership, cutting edge technology, going up the value chain in the largest segment of value added products and a highly competent team. “Kumar M Birla” , Letter to Shareholder 08 -09. • • • Increased market power Learning and Developing new capabilities Overcoming the new entrants into the industry. Cost of new product development To avoid excessive competition Jan 2010 Merger & Acquisitions 67

Facts about the Deal • All-cash transaction, US $6. 0 billion, including approximately US $2. 4 billion of debt. • Global integrated aluminium producer with low-cost alumina and aluminium production facilities. • Biggest rolled aluminium products maker and fifth -largest integrated aluminium manufacturer in the world. • Globally positioned organization Jan 2010 Merger & Acquisitions 68

Facts about the Deal • All-cash transaction, US $6. 0 billion, including approximately US $2. 4 billion of debt. • Global integrated aluminium producer with low-cost alumina and aluminium production facilities. • Biggest rolled aluminium products maker and fifth -largest integrated aluminium manufacturer in the world. • Globally positioned organization Jan 2010 Merger & Acquisitions 68

Funding Structure • Hindalco acquired novelis: 6$ billion • To buy the $3. 6 billion worth of Novelis’s equity, Hindalco borrowed almost $2. 85 billion of the balance, $300 million is being raised as debt from group companies and $450 million is being mobilized from its cash reserves. Jan 2010 Merger & Acquisitions 69

Funding Structure • Hindalco acquired novelis: 6$ billion • To buy the $3. 6 billion worth of Novelis’s equity, Hindalco borrowed almost $2. 85 billion of the balance, $300 million is being raised as debt from group companies and $450 million is being mobilized from its cash reserves. Jan 2010 Merger & Acquisitions 69

Strategic Rationale for Acquisition • Hindalco will be able to ship primary aluminium from India and make value-added products. • Hindalco metal is accepted under the high-grade aluminium contract on the LME as a registered brand. • Hindalco’s rationale for the acquisition is increasing scale of operation, entry into high—end downstream market and enhancing global presence(11 countries). Jan 2010 Merger & Acquisitions 70

Strategic Rationale for Acquisition • Hindalco will be able to ship primary aluminium from India and make value-added products. • Hindalco metal is accepted under the high-grade aluminium contract on the LME as a registered brand. • Hindalco’s rationale for the acquisition is increasing scale of operation, entry into high—end downstream market and enhancing global presence(11 countries). Jan 2010 Merger & Acquisitions 70

Benefits • Post acquisition, the company got a strong global footprint • The deal gave Hindalco a strong presence in recycling of aluminium business • Novelis has a very strong technology for value added products • As per company details, the replacement value of the Novelis is US $12 billion, so considering the time required and replacement value; the deal is worth for Hindalco Jan 2010 Merger & Acquisitions 71

Benefits • Post acquisition, the company got a strong global footprint • The deal gave Hindalco a strong presence in recycling of aluminium business • Novelis has a very strong technology for value added products • As per company details, the replacement value of the Novelis is US $12 billion, so considering the time required and replacement value; the deal is worth for Hindalco Jan 2010 Merger & Acquisitions 71

Conclusion • To conclude the achievements in the financial year, the company recorded a commendable performance in an extremely difficult year that witnessed unprecedented events in the financial and commodity markets • This performance is because of the underlying strength of business operations & project management capabilities. Jan 2010 Merger & Acquisitions 72

Conclusion • To conclude the achievements in the financial year, the company recorded a commendable performance in an extremely difficult year that witnessed unprecedented events in the financial and commodity markets • This performance is because of the underlying strength of business operations & project management capabilities. Jan 2010 Merger & Acquisitions 72

HP - Compaq Jan 2010 Merger & Acquisitions 73

HP - Compaq Jan 2010 Merger & Acquisitions 73

HP-Compaq Merger Pre Merger Issues HP • Not adapting to technological innovation fast • Margins going down • IPG - leader in market segment but not among top 3 in servers, storage or services • Printing line facing competition from Lexmark and Epson • Needed to build strong complementary business lines COMPAQ • Weakening performance made Compaq directors impatient • Dell became strong competitor through cost efficiency • Compaq missed the online bus and its made-to-order system through its retail outlets failed to take off due to bad inventory management • Bad investments • Got caught in a cycle of cost cutting and layoffs • Too small and poorly run to maintain its wide array of products and services Jan 2010 Merger & Acquisitions 74

HP-Compaq Merger Pre Merger Issues HP • Not adapting to technological innovation fast • Margins going down • IPG - leader in market segment but not among top 3 in servers, storage or services • Printing line facing competition from Lexmark and Epson • Needed to build strong complementary business lines COMPAQ • Weakening performance made Compaq directors impatient • Dell became strong competitor through cost efficiency • Compaq missed the online bus and its made-to-order system through its retail outlets failed to take off due to bad inventory management • Bad investments • Got caught in a cycle of cost cutting and layoffs • Too small and poorly run to maintain its wide array of products and services Jan 2010 Merger & Acquisitions 74

HP-Compaq Merger Market Benefits • • • Create a full-service technology firm capable of doing everything from selling PCs and printers to setting up complex networks Create immediate end to end leadership Compaq was a clear #2 in the PC business and stronger on the commercial side than HP, but HP was stronger on the consumer side. Together they would be #1 in market share Expand the numbers of the company’s service professionals. As a result, HP would have largest market share in all hardware market segments and become the number three in market share in services Improves access to the market with Compaq’s direct capability and low cost structure Bigger company could have scale advantages: gaining bargaining power with suppliers; and scope advantage: gaining share of wallet in major accounts Jan 2010 Merger & Acquisitions 75

HP-Compaq Merger Market Benefits • • • Create a full-service technology firm capable of doing everything from selling PCs and printers to setting up complex networks Create immediate end to end leadership Compaq was a clear #2 in the PC business and stronger on the commercial side than HP, but HP was stronger on the consumer side. Together they would be #1 in market share Expand the numbers of the company’s service professionals. As a result, HP would have largest market share in all hardware market segments and become the number three in market share in services Improves access to the market with Compaq’s direct capability and low cost structure Bigger company could have scale advantages: gaining bargaining power with suppliers; and scope advantage: gaining share of wallet in major accounts Jan 2010 Merger & Acquisitions 75

HP-Compaq Merger Operational Benefits • HP and Compaq had highly complimentary R&D capabilities – HP was strong in mid and high-end UNIX servers, a weakness for Compaq; while Compaq was strong in low-end industry standard (Intel) servers, a weakness for HP • Top management experienced with complex organizational changes • Merger would result in work force reduction by around 15, 000 employees saving around $1. 5 billion per year Financial Benefits • Merger could result in substantial increase in profit margin and liquidity • $ 2. 5 billion: the estimated value of annual synergies • Provides the combined entity with better ability to reinvest Jan 2010 Merger & Acquisitions 76

HP-Compaq Merger Operational Benefits • HP and Compaq had highly complimentary R&D capabilities – HP was strong in mid and high-end UNIX servers, a weakness for Compaq; while Compaq was strong in low-end industry standard (Intel) servers, a weakness for HP • Top management experienced with complex organizational changes • Merger would result in work force reduction by around 15, 000 employees saving around $1. 5 billion per year Financial Benefits • Merger could result in substantial increase in profit margin and liquidity • $ 2. 5 billion: the estimated value of annual synergies • Provides the combined entity with better ability to reinvest Jan 2010 Merger & Acquisitions 76

HP-Compaq Merger Challenges • HP’s strategy was to move to higher margin less commodity like business, hence merging with Compaq was a strategic misfit • Lower growth prospects on invested capital • Market position in key attractive segments remain same • Services remain highly weighed to lower margin segment • No precedent for success in big technology transactions • Market reaction for the merger was negative • Revenue risk might offset synergies • HP and Compaq have different cultures Jan 2010 Merger & Acquisitions 77

HP-Compaq Merger Challenges • HP’s strategy was to move to higher margin less commodity like business, hence merging with Compaq was a strategic misfit • Lower growth prospects on invested capital • Market position in key attractive segments remain same • Services remain highly weighed to lower margin segment • No precedent for success in big technology transactions • Market reaction for the merger was negative • Revenue risk might offset synergies • HP and Compaq have different cultures Jan 2010 Merger & Acquisitions 77

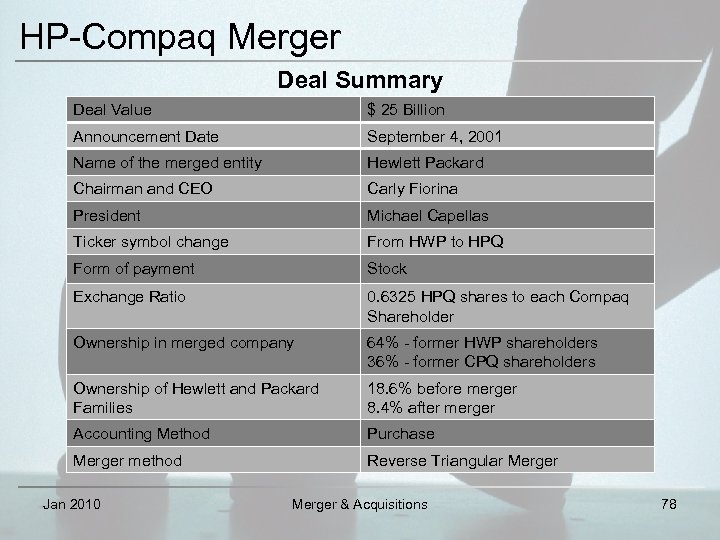

HP-Compaq Merger Deal Summary Deal Value $ 25 Billion Announcement Date September 4, 2001 Name of the merged entity Hewlett Packard Chairman and CEO Carly Fiorina President Michael Capellas Ticker symbol change From HWP to HPQ Form of payment Stock Exchange Ratio 0. 6325 HPQ shares to each Compaq Shareholder Ownership in merged company 64% - former HWP shareholders 36% - former CPQ shareholders Ownership of Hewlett and Packard Families 18. 6% before merger 8. 4% after merger Accounting Method Purchase Merger method Reverse Triangular Merger Jan 2010 Merger & Acquisitions 78

HP-Compaq Merger Deal Summary Deal Value $ 25 Billion Announcement Date September 4, 2001 Name of the merged entity Hewlett Packard Chairman and CEO Carly Fiorina President Michael Capellas Ticker symbol change From HWP to HPQ Form of payment Stock Exchange Ratio 0. 6325 HPQ shares to each Compaq Shareholder Ownership in merged company 64% - former HWP shareholders 36% - former CPQ shareholders Ownership of Hewlett and Packard Families 18. 6% before merger 8. 4% after merger Accounting Method Purchase Merger method Reverse Triangular Merger Jan 2010 Merger & Acquisitions 78

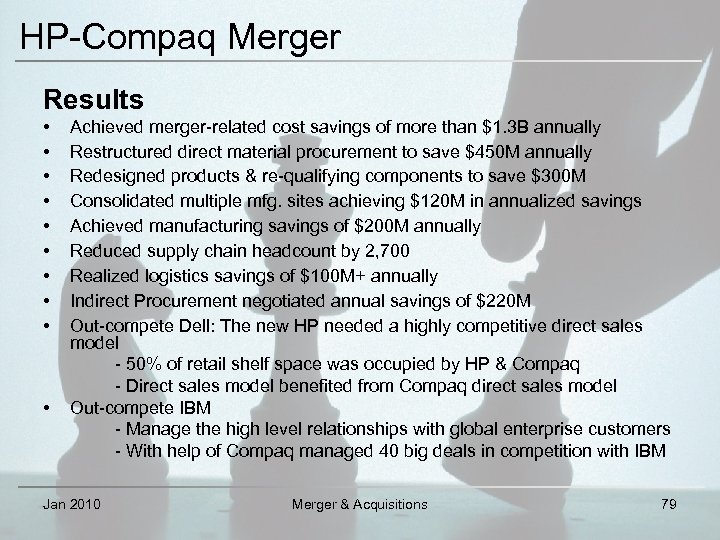

HP-Compaq Merger Results • • • Achieved merger-related cost savings of more than $1. 3 B annually Restructured direct material procurement to save $450 M annually Redesigned products & re-qualifying components to save $300 M Consolidated multiple mfg. sites achieving $120 M in annualized savings Achieved manufacturing savings of $200 M annually Reduced supply chain headcount by 2, 700 Realized logistics savings of $100 M+ annually Indirect Procurement negotiated annual savings of $220 M Out-compete Dell: The new HP needed a highly competitive direct sales model - 50% of retail shelf space was occupied by HP & Compaq - Direct sales model benefited from Compaq direct sales model Out-compete IBM - Manage the high level relationships with global enterprise customers - With help of Compaq managed 40 big deals in competition with IBM Jan 2010 Merger & Acquisitions 79

HP-Compaq Merger Results • • • Achieved merger-related cost savings of more than $1. 3 B annually Restructured direct material procurement to save $450 M annually Redesigned products & re-qualifying components to save $300 M Consolidated multiple mfg. sites achieving $120 M in annualized savings Achieved manufacturing savings of $200 M annually Reduced supply chain headcount by 2, 700 Realized logistics savings of $100 M+ annually Indirect Procurement negotiated annual savings of $220 M Out-compete Dell: The new HP needed a highly competitive direct sales model - 50% of retail shelf space was occupied by HP & Compaq - Direct sales model benefited from Compaq direct sales model Out-compete IBM - Manage the high level relationships with global enterprise customers - With help of Compaq managed 40 big deals in competition with IBM Jan 2010 Merger & Acquisitions 79

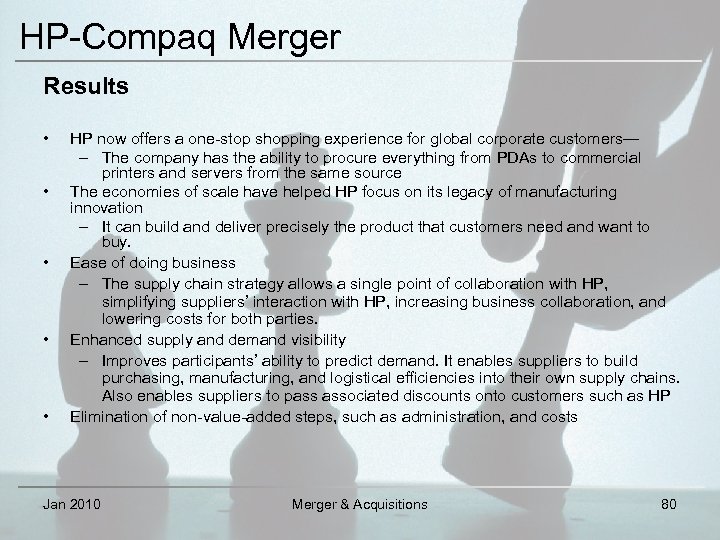

HP-Compaq Merger Results • • • HP now offers a one-stop shopping experience for global corporate customers— – The company has the ability to procure everything from PDAs to commercial printers and servers from the same source The economies of scale have helped HP focus on its legacy of manufacturing innovation – It can build and deliver precisely the product that customers need and want to buy. Ease of doing business – The supply chain strategy allows a single point of collaboration with HP, simplifying suppliers’ interaction with HP, increasing business collaboration, and lowering costs for both parties. Enhanced supply and demand visibility – Improves participants’ ability to predict demand. It enables suppliers to build purchasing, manufacturing, and logistical efficiencies into their own supply chains. Also enables suppliers to pass associated discounts onto customers such as HP Elimination of non-value-added steps, such as administration, and costs Jan 2010 Merger & Acquisitions 80

HP-Compaq Merger Results • • • HP now offers a one-stop shopping experience for global corporate customers— – The company has the ability to procure everything from PDAs to commercial printers and servers from the same source The economies of scale have helped HP focus on its legacy of manufacturing innovation – It can build and deliver precisely the product that customers need and want to buy. Ease of doing business – The supply chain strategy allows a single point of collaboration with HP, simplifying suppliers’ interaction with HP, increasing business collaboration, and lowering costs for both parties. Enhanced supply and demand visibility – Improves participants’ ability to predict demand. It enables suppliers to build purchasing, manufacturing, and logistical efficiencies into their own supply chains. Also enables suppliers to pass associated discounts onto customers such as HP Elimination of non-value-added steps, such as administration, and costs Jan 2010 Merger & Acquisitions 80

Delta – Northwest Airlines Jan 2010 Merger & Acquisitions 81

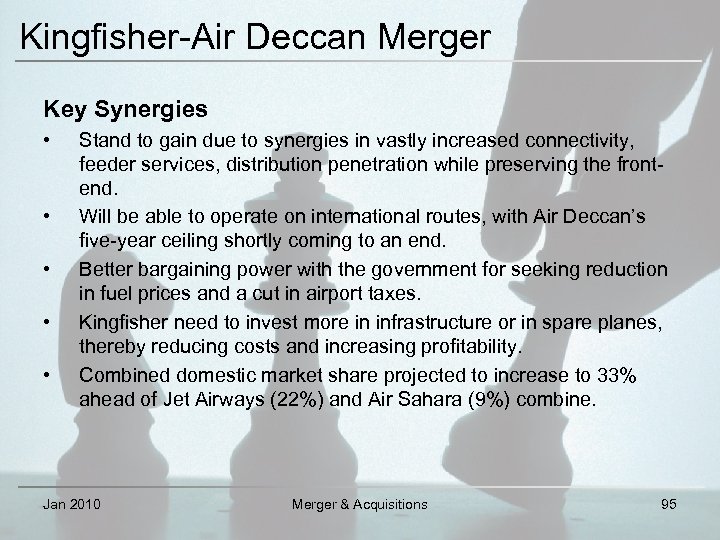

Delta – Northwest Airlines Jan 2010 Merger & Acquisitions 81