c4bcf86f5240c5bc350b7bd3771d09ea.ppt

- Количество слайдов: 38

MERGER OF TAX EXEMPTION REGIMES For Temporary Importation CUSTOMS WING FEDERAL BOARD OF REVENUE Presented by: 0 Sheeraz Ahmed Deputy Collector, MCC Exports, PMBQ

MERGER OF TAX EXEMPTION REGIMES For Temporary Importation CUSTOMS WING FEDERAL BOARD OF REVENUE Presented by: 0 Sheeraz Ahmed Deputy Collector, MCC Exports, PMBQ

SCHEME of Presentation Introduction: Tax Relief Regimes, Rationale, Risk Areas, Preference Core Components of effective tax relief scheme Possible Scenarios for Merger Comparison of existing tax exemption regimes, Evaluation of Proposals Merging EOU & Warehousing Rules – Salient Features of proposed rules Existing Issues at Implementation Level Proposed Measures 1

SCHEME of Presentation Introduction: Tax Relief Regimes, Rationale, Risk Areas, Preference Core Components of effective tax relief scheme Possible Scenarios for Merger Comparison of existing tax exemption regimes, Evaluation of Proposals Merging EOU & Warehousing Rules – Salient Features of proposed rules Existing Issues at Implementation Level Proposed Measures 1

Tax Relief Regimes ØGrant duty/tax relief on goods ØWhich are imported or procured locally ØFor Exportation 2

Tax Relief Regimes ØGrant duty/tax relief on goods ØWhich are imported or procured locally ØFor Exportation 2

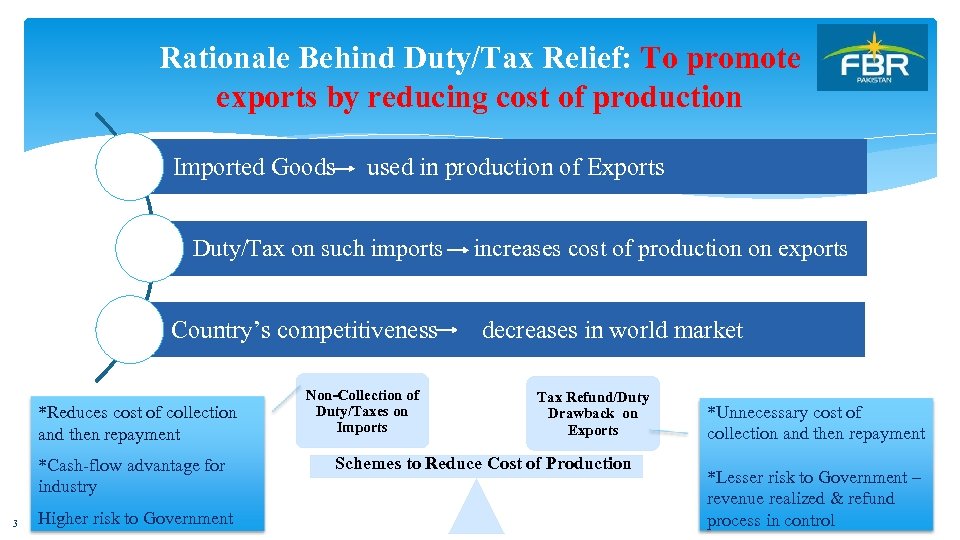

Rationale Behind Duty/Tax Relief: To promote exports by reducing cost of production Imported Goods used in production of Exports Duty/Tax on such imports Country’s competitiveness *Reduces cost of collection and then repayment *Cash-flow advantage for industry 3 Higher risk to Government Non-Collection of Duty/Taxes on Imports increases cost of production on exports decreases in world market Tax Refund/Duty Drawback on Exports Schemes to Reduce Cost of Production *Unnecessary cost of collection and then repayment *Lesser risk to Government – revenue realized & refund process in control

Rationale Behind Duty/Tax Relief: To promote exports by reducing cost of production Imported Goods used in production of Exports Duty/Tax on such imports Country’s competitiveness *Reduces cost of collection and then repayment *Cash-flow advantage for industry 3 Higher risk to Government Non-Collection of Duty/Taxes on Imports increases cost of production on exports decreases in world market Tax Refund/Duty Drawback on Exports Schemes to Reduce Cost of Production *Unnecessary cost of collection and then repayment *Lesser risk to Government – revenue realized & refund process in control

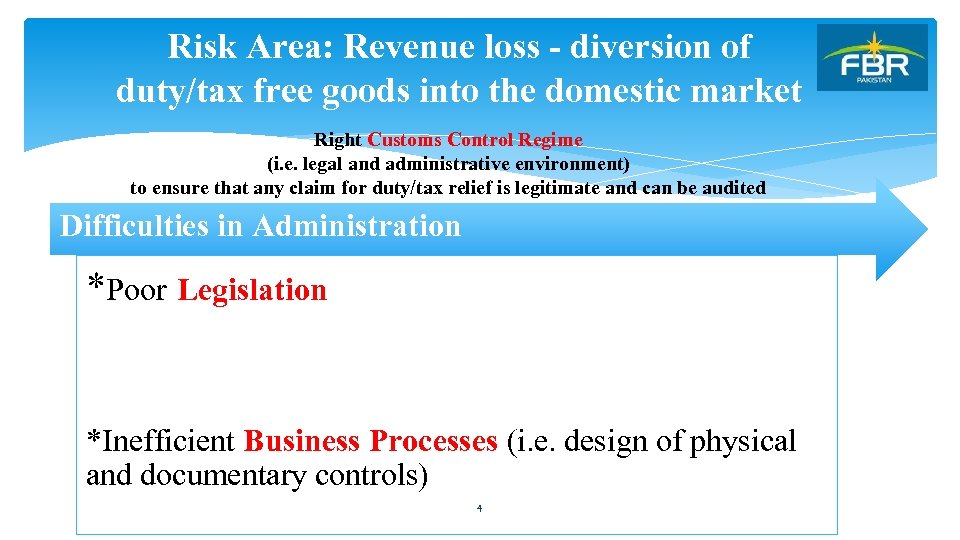

Risk Area: Revenue loss - diversion of duty/tax free goods into the domestic market Right Customs Control Regime (i. e. legal and administrative environment) to ensure that any claim for duty/tax relief is legitimate and can be audited Difficulties in Administration *Poor Legislation *Inefficient Business Processes (i. e. design of physical and documentary controls) 4

Risk Area: Revenue loss - diversion of duty/tax free goods into the domestic market Right Customs Control Regime (i. e. legal and administrative environment) to ensure that any claim for duty/tax relief is legitimate and can be audited Difficulties in Administration *Poor Legislation *Inefficient Business Processes (i. e. design of physical and documentary controls) 4

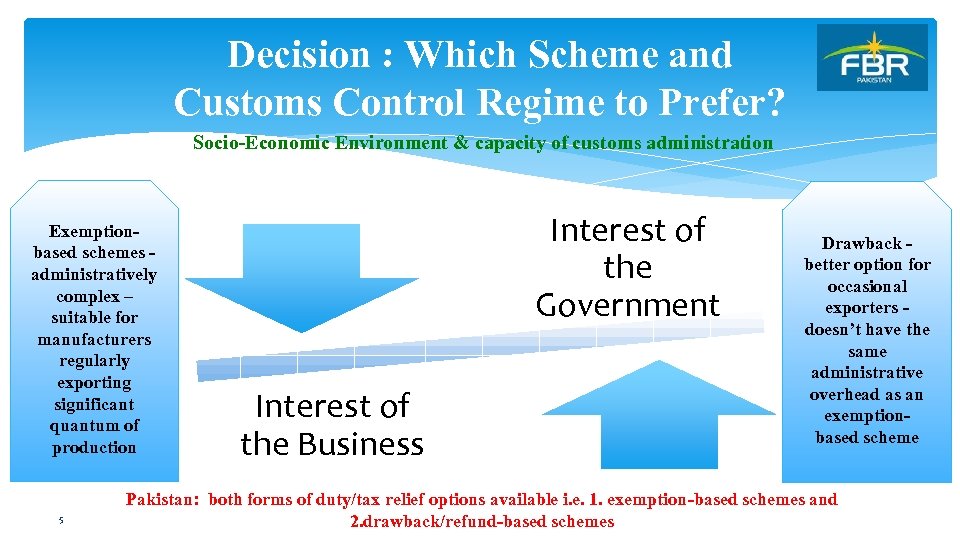

Decision : Which Scheme and Customs Control Regime to Prefer? Socio-Economic Environment & capacity of customs administration Exemptionbased schemes administratively complex – suitable for manufacturers regularly exporting significant quantum of production 5 Interest of the Government Interest of the Business Drawback better option for occasional exporters doesn’t have the same administrative overhead as an exemptionbased scheme Pakistan: both forms of duty/tax relief options available i. e. 1. exemption-based schemes and 2. drawback/refund-based schemes

Decision : Which Scheme and Customs Control Regime to Prefer? Socio-Economic Environment & capacity of customs administration Exemptionbased schemes administratively complex – suitable for manufacturers regularly exporting significant quantum of production 5 Interest of the Government Interest of the Business Drawback better option for occasional exporters doesn’t have the same administrative overhead as an exemptionbased scheme Pakistan: both forms of duty/tax relief options available i. e. 1. exemption-based schemes and 2. drawback/refund-based schemes

Core Components of an Effective Duty/Tax Relief Scheme ØPre-Authorization or Licensing ØRe-Exportation ØCross-reference: Identification of duty/tax free goods and Exported Goods ØSpecification of the use to which the goods may be put ØImportant because temporary importation procedure allows the goods to circulate quite freely ØRate of Yield/ I. O Ratio ØSecurity for Duties and Taxes 6

Core Components of an Effective Duty/Tax Relief Scheme ØPre-Authorization or Licensing ØRe-Exportation ØCross-reference: Identification of duty/tax free goods and Exported Goods ØSpecification of the use to which the goods may be put ØImportant because temporary importation procedure allows the goods to circulate quite freely ØRate of Yield/ I. O Ratio ØSecurity for Duties and Taxes 6

Core Components of an Effective Duty/Tax Relief Scheme ØTime limit for re-exportation ØShould be consistent with the intended use of the goods and risk to revenue ØCustoms Controls ØPeriodic Returns/ Documentation ØAudit & Monitoring ØTo verify the percentage of total production exported against that sold in the domestic market to ensure duty/tax relief is legitimate ØDocument Retention 7

Core Components of an Effective Duty/Tax Relief Scheme ØTime limit for re-exportation ØShould be consistent with the intended use of the goods and risk to revenue ØCustoms Controls ØPeriodic Returns/ Documentation ØAudit & Monitoring ØTo verify the percentage of total production exported against that sold in the domestic market to ensure duty/tax relief is legitimate ØDocument Retention 7

![Activities eligible for Duty/Tax Relief ØTemporary admission for re-exportation in same state [DTRE] ØTemporary Activities eligible for Duty/Tax Relief ØTemporary admission for re-exportation in same state [DTRE] ØTemporary](https://present5.com/presentation/c4bcf86f5240c5bc350b7bd3771d09ea/image-9.jpg) Activities eligible for Duty/Tax Relief ØTemporary admission for re-exportation in same state [DTRE] ØTemporary admission for inward processing [DTRE, SRO 492] ØManufacturing under bond [Manufacturing Bonds & EOUs] ØCustoms Warehousing ØExport Processing Zones 8

Activities eligible for Duty/Tax Relief ØTemporary admission for re-exportation in same state [DTRE] ØTemporary admission for inward processing [DTRE, SRO 492] ØManufacturing under bond [Manufacturing Bonds & EOUs] ØCustoms Warehousing ØExport Processing Zones 8

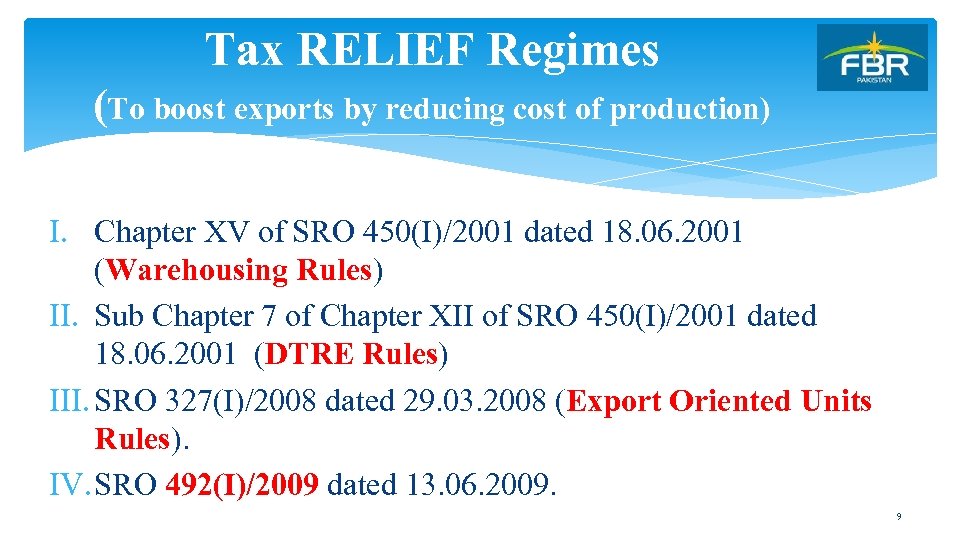

Tax RELIEF Regimes (To boost exports by reducing cost of production) I. Chapter XV of SRO 450(I)/2001 dated 18. 06. 2001 (Warehousing Rules) II. Sub Chapter 7 of Chapter XII of SRO 450(I)/2001 dated 18. 06. 2001 (DTRE Rules) III. SRO 327(I)/2008 dated 29. 03. 2008 (Export Oriented Units Rules). IV. SRO 492(I)/2009 dated 13. 06. 2009. 9

Tax RELIEF Regimes (To boost exports by reducing cost of production) I. Chapter XV of SRO 450(I)/2001 dated 18. 06. 2001 (Warehousing Rules) II. Sub Chapter 7 of Chapter XII of SRO 450(I)/2001 dated 18. 06. 2001 (DTRE Rules) III. SRO 327(I)/2008 dated 29. 03. 2008 (Export Oriented Units Rules). IV. SRO 492(I)/2009 dated 13. 06. 2009. 9

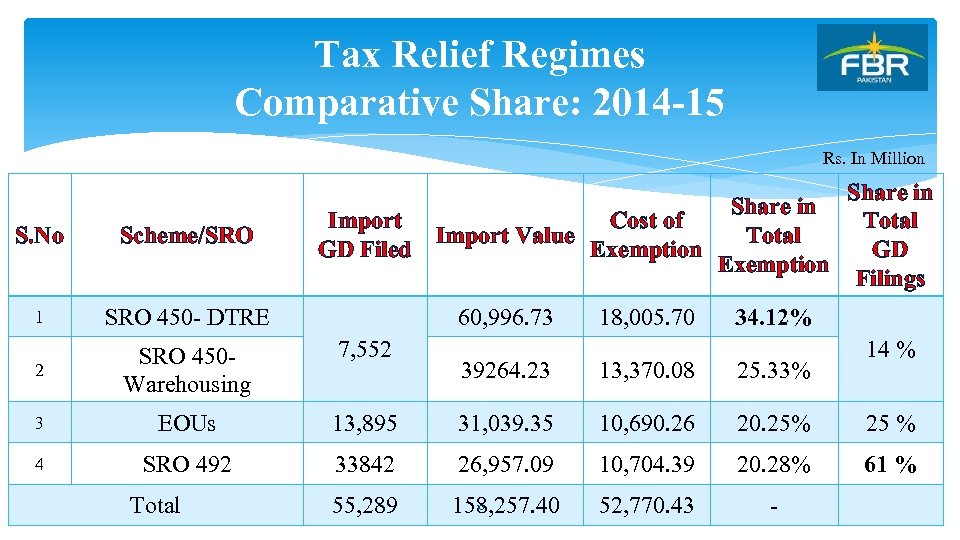

Tax Relief Regimes Comparative Share: 2014 -15 Rs. In Million Share in Import Cost of Import Value Total GD Filed Exemption S. No Scheme/SRO 1 SRO 450 - DTRE 2 SRO 450 Warehousing 7, 552 3 EOUs 4 SRO 492 Total 60, 996. 73 18, 005. 70 Share in Total GD Filings 34. 12% 14 % 39264. 23 13, 370. 08 25. 33% 13, 895 31, 039. 35 10, 690. 26 20. 25% 25 % 33842 26, 957. 09 10, 704. 39 20. 28% 61 % 55, 289 10 158, 257. 40 52, 770. 43 -

Tax Relief Regimes Comparative Share: 2014 -15 Rs. In Million Share in Import Cost of Import Value Total GD Filed Exemption S. No Scheme/SRO 1 SRO 450 - DTRE 2 SRO 450 Warehousing 7, 552 3 EOUs 4 SRO 492 Total 60, 996. 73 18, 005. 70 Share in Total GD Filings 34. 12% 14 % 39264. 23 13, 370. 08 25. 33% 13, 895 31, 039. 35 10, 690. 26 20. 25% 25 % 33842 26, 957. 09 10, 704. 39 20. 28% 61 % 55, 289 10 158, 257. 40 52, 770. 43 -

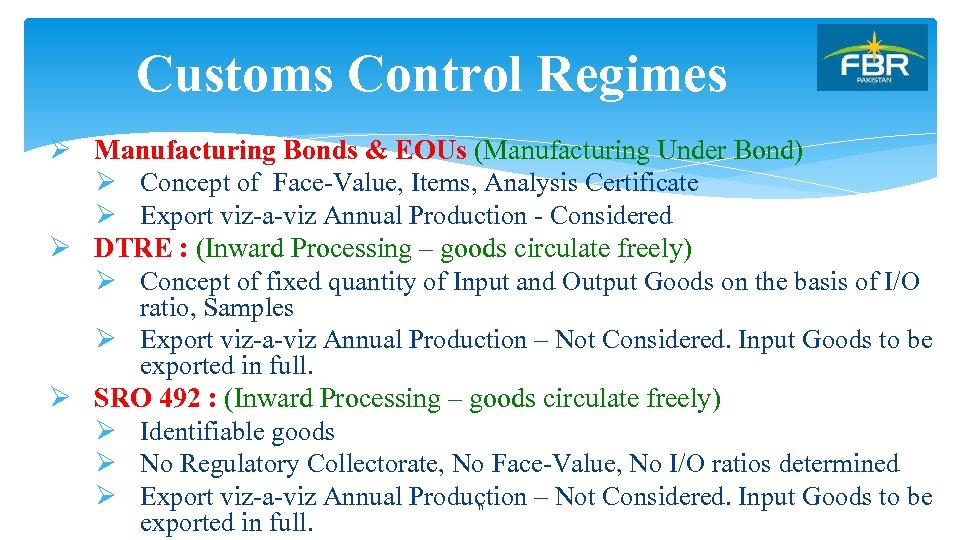

Customs Control Regimes Ø Manufacturing Bonds & EOUs (Manufacturing Under Bond) Ø Concept of Face-Value, Items, Analysis Certificate Ø Export viz-a-viz Annual Production - Considered Ø DTRE : (Inward Processing – goods circulate freely) Ø Concept of fixed quantity of Input and Output Goods on the basis of I/O ratio, Samples Ø Export viz-a-viz Annual Production – Not Considered. Input Goods to be exported in full. Ø SRO 492 : (Inward Processing – goods circulate freely) Ø Identifiable goods Ø No Regulatory Collectorate, No Face-Value, No I/O ratios determined Ø Export viz-a-viz Annual Production – Not Considered. Input Goods to be exported in full. 11

Customs Control Regimes Ø Manufacturing Bonds & EOUs (Manufacturing Under Bond) Ø Concept of Face-Value, Items, Analysis Certificate Ø Export viz-a-viz Annual Production - Considered Ø DTRE : (Inward Processing – goods circulate freely) Ø Concept of fixed quantity of Input and Output Goods on the basis of I/O ratio, Samples Ø Export viz-a-viz Annual Production – Not Considered. Input Goods to be exported in full. Ø SRO 492 : (Inward Processing – goods circulate freely) Ø Identifiable goods Ø No Regulatory Collectorate, No Face-Value, No I/O ratios determined Ø Export viz-a-viz Annual Production – Not Considered. Input Goods to be exported in full. 11

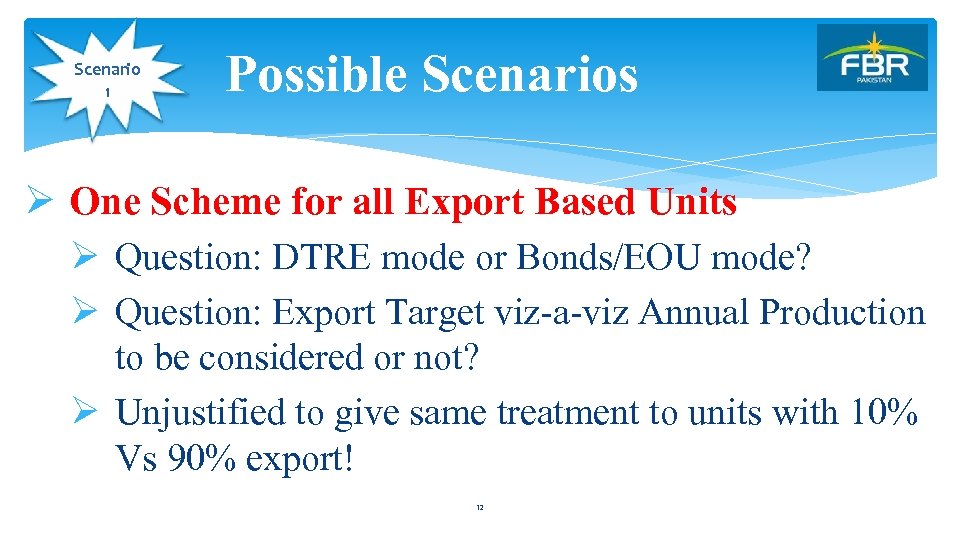

Scenario 1 Possible Scenarios Ø One Scheme for all Export Based Units Ø Question: DTRE mode or Bonds/EOU mode? Ø Question: Export Target viz-a-viz Annual Production to be considered or not? Ø Unjustified to give same treatment to units with 10% Vs 90% export! 12

Scenario 1 Possible Scenarios Ø One Scheme for all Export Based Units Ø Question: DTRE mode or Bonds/EOU mode? Ø Question: Export Target viz-a-viz Annual Production to be considered or not? Ø Unjustified to give same treatment to units with 10% Vs 90% export! 12

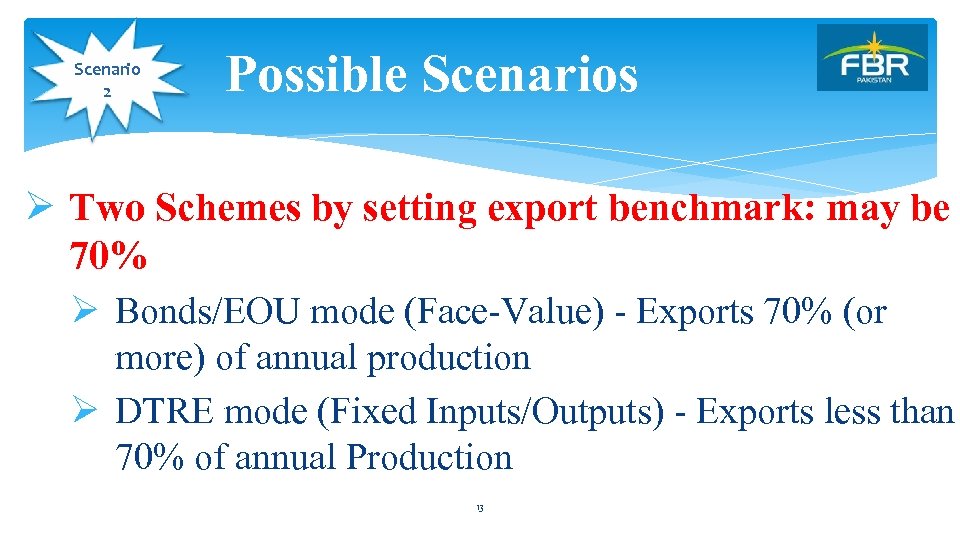

Scenario 2 Possible Scenarios Ø Two Schemes by setting export benchmark: may be 70% Ø Bonds/EOU mode (Face-Value) - Exports 70% (or more) of annual production Ø DTRE mode (Fixed Inputs/Outputs) - Exports less than 70% of annual Production 13

Scenario 2 Possible Scenarios Ø Two Schemes by setting export benchmark: may be 70% Ø Bonds/EOU mode (Face-Value) - Exports 70% (or more) of annual production Ø DTRE mode (Fixed Inputs/Outputs) - Exports less than 70% of annual Production 13

Possible Scenarios Ø Letting SRO 492 continue owing to huge quantum of GDs filed Ø Most popular and widely used scheme - GDs filing 61% share Ø 33, 842 GDs filed in 2014 -15 14

Possible Scenarios Ø Letting SRO 492 continue owing to huge quantum of GDs filed Ø Most popular and widely used scheme - GDs filing 61% share Ø 33, 842 GDs filed in 2014 -15 14

COMPARISON OF EXISTING TAX RELIEF REGIMES 15

COMPARISON OF EXISTING TAX RELIEF REGIMES 15

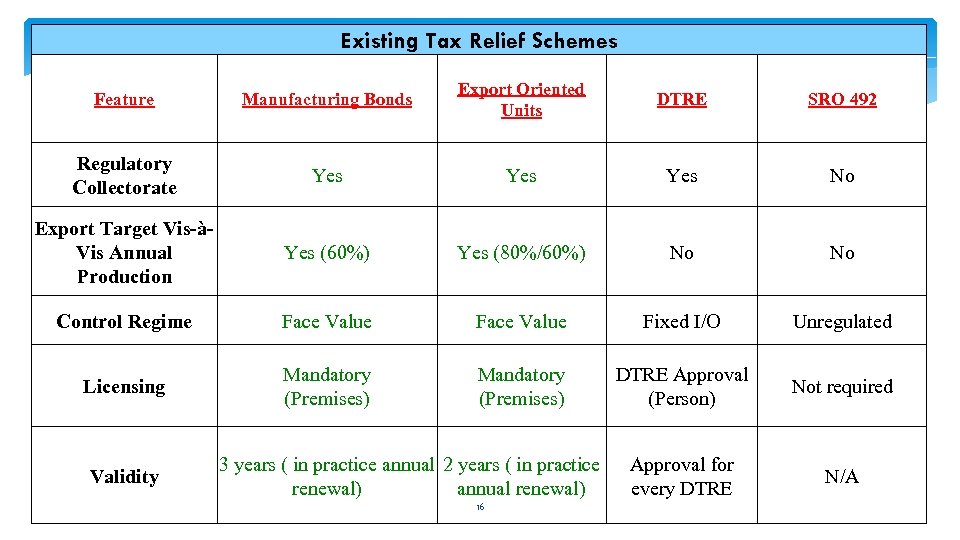

Existing Tax Relief Schemes Feature Manufacturing Bonds Export Oriented Units DTRE SRO 492 Regulatory Collectorate Yes Yes No Export Target Vis-àVis Annual Production Yes (60%) Yes (80%/60%) No No Control Regime Face Value Fixed I/O Unregulated Licensing Mandatory (Premises) DTRE Approval (Person) Not required Approval for every DTRE N/A Validity 3 years ( in practice annual 2 years ( in practice renewal) annual renewal) 16

Existing Tax Relief Schemes Feature Manufacturing Bonds Export Oriented Units DTRE SRO 492 Regulatory Collectorate Yes Yes No Export Target Vis-àVis Annual Production Yes (60%) Yes (80%/60%) No No Control Regime Face Value Fixed I/O Unregulated Licensing Mandatory (Premises) DTRE Approval (Person) Not required Approval for every DTRE N/A Validity 3 years ( in practice annual 2 years ( in practice renewal) annual renewal) 16

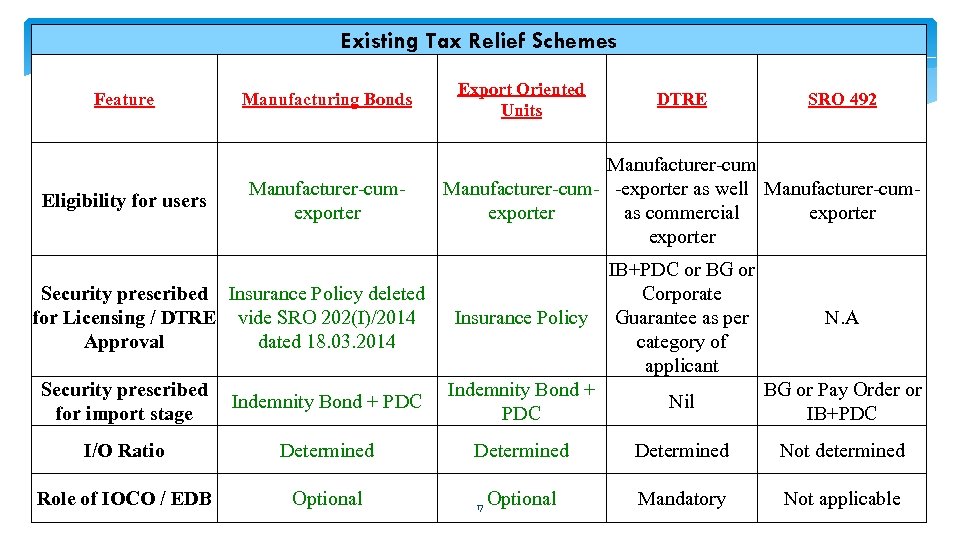

Existing Tax Relief Schemes Feature Eligibility for users Manufacturing Bonds Manufacturer-cumexporter Security prescribed Insurance Policy deleted for Licensing / DTRE vide SRO 202(I)/2014 Approval dated 18. 03. 2014 Export Oriented Units DTRE SRO 492 Manufacturer-cum- -exporter as well Manufacturer-cumexporter as commercial exporter Insurance Policy IB+PDC or BG or Corporate Guarantee as per category of applicant N. A Security prescribed for import stage Indemnity Bond + PDC Nil BG or Pay Order or IB+PDC I/O Ratio Determined Not determined Role of IOCO / EDB Optional Mandatory Not applicable 17

Existing Tax Relief Schemes Feature Eligibility for users Manufacturing Bonds Manufacturer-cumexporter Security prescribed Insurance Policy deleted for Licensing / DTRE vide SRO 202(I)/2014 Approval dated 18. 03. 2014 Export Oriented Units DTRE SRO 492 Manufacturer-cum- -exporter as well Manufacturer-cumexporter as commercial exporter Insurance Policy IB+PDC or BG or Corporate Guarantee as per category of applicant N. A Security prescribed for import stage Indemnity Bond + PDC Nil BG or Pay Order or IB+PDC I/O Ratio Determined Not determined Role of IOCO / EDB Optional Mandatory Not applicable 17

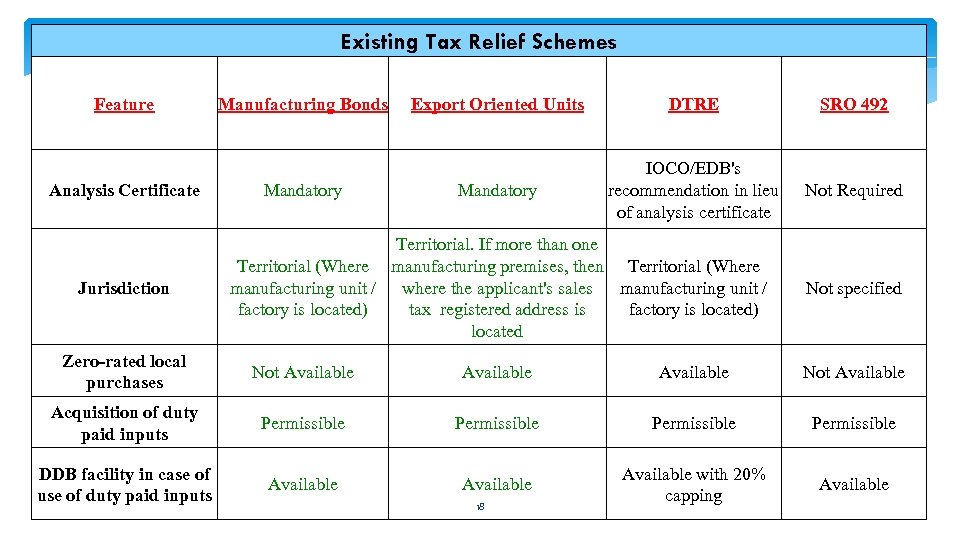

Existing Tax Relief Schemes Feature Analysis Certificate Jurisdiction Manufacturing Bonds Mandatory Export Oriented Units DTRE SRO 492 Mandatory IOCO/EDB's recommendation in lieu of analysis certificate Not Required Territorial. If more than one Territorial (Where manufacturing premises, then Territorial (Where manufacturing unit / where the applicant's sales manufacturing unit / factory is located) tax registered address is factory is located) located Not specified Zero-rated local purchases Not Available Not Available Acquisition of duty paid inputs Permissible DDB facility in case of use of duty paid inputs Available with 20% capping Available 18

Existing Tax Relief Schemes Feature Analysis Certificate Jurisdiction Manufacturing Bonds Mandatory Export Oriented Units DTRE SRO 492 Mandatory IOCO/EDB's recommendation in lieu of analysis certificate Not Required Territorial. If more than one Territorial (Where manufacturing premises, then Territorial (Where manufacturing unit / where the applicant's sales manufacturing unit / factory is located) tax registered address is factory is located) located Not specified Zero-rated local purchases Not Available Not Available Acquisition of duty paid inputs Permissible DDB facility in case of use of duty paid inputs Available with 20% capping Available 18

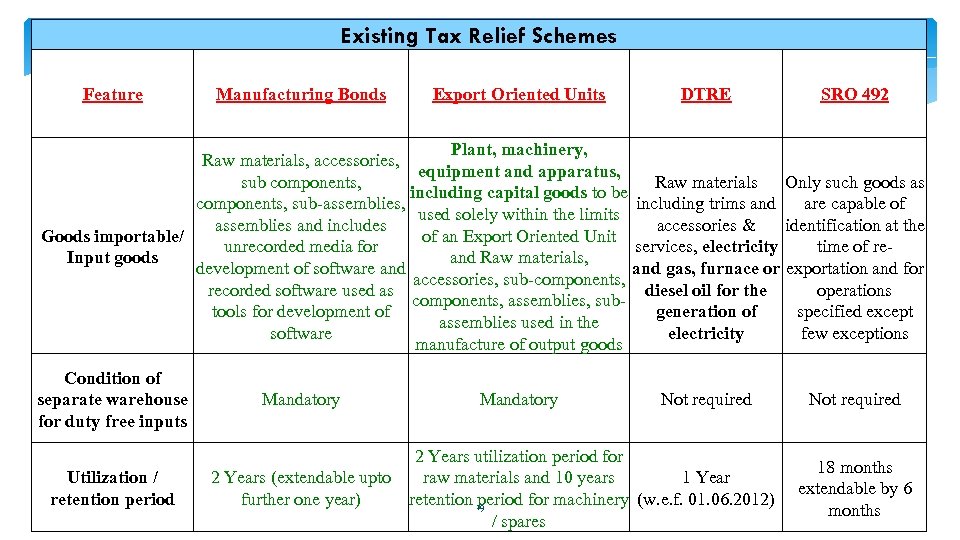

Existing Tax Relief Schemes Feature Manufacturing Bonds Export Oriented Units DTRE SRO 492 Plant, machinery, Raw materials, accessories, equipment and apparatus, sub components, Raw materials Only such goods as including capital goods to be components, sub-assemblies, including trims and are capable of used solely within the limits assemblies and includes accessories & identification at the of an Export Oriented Unit Goods importable/ unrecorded media for services, electricity time of reand Raw materials, Input goods development of software and gas, furnace or exportation and for accessories, sub-components, recorded software used as diesel oil for the operations components, assemblies, subtools for development of generation of specified except assemblies used in the software electricity few exceptions manufacture of output goods Condition of separate warehouse for duty free inputs Utilization / retention period Mandatory Not required 2 Years utilization period for 2 Years (extendable upto raw materials and 10 years 1 Year further one year) retention 19 period for machinery (w. e. f. 01. 06. 2012) / spares Not required 18 months extendable by 6 months

Existing Tax Relief Schemes Feature Manufacturing Bonds Export Oriented Units DTRE SRO 492 Plant, machinery, Raw materials, accessories, equipment and apparatus, sub components, Raw materials Only such goods as including capital goods to be components, sub-assemblies, including trims and are capable of used solely within the limits assemblies and includes accessories & identification at the of an Export Oriented Unit Goods importable/ unrecorded media for services, electricity time of reand Raw materials, Input goods development of software and gas, furnace or exportation and for accessories, sub-components, recorded software used as diesel oil for the operations components, assemblies, subtools for development of generation of specified except assemblies used in the software electricity few exceptions manufacture of output goods Condition of separate warehouse for duty free inputs Utilization / retention period Mandatory Not required 2 Years utilization period for 2 Years (extendable upto raw materials and 10 years 1 Year further one year) retention 19 period for machinery (w. e. f. 01. 06. 2012) / spares Not required 18 months extendable by 6 months

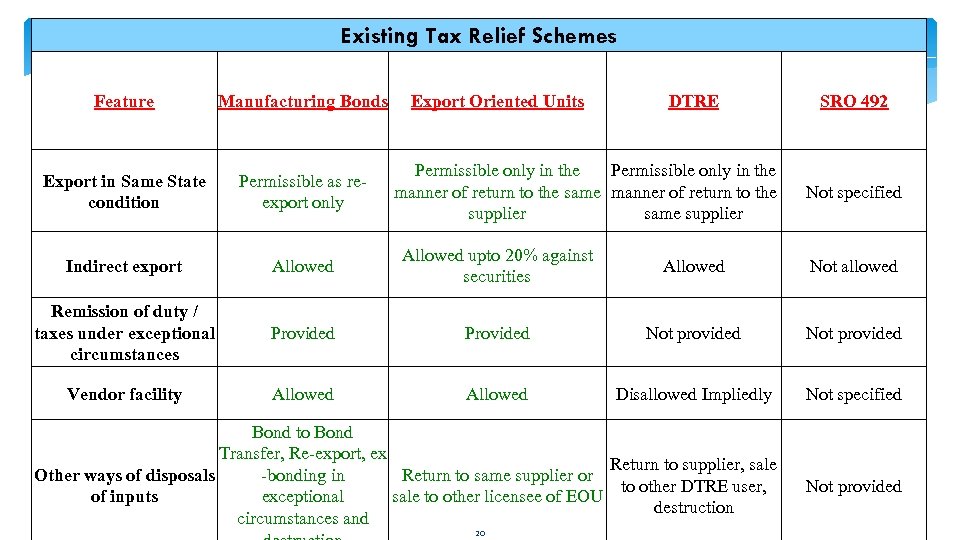

Existing Tax Relief Schemes Feature Manufacturing Bonds Export Oriented Units DTRE Export in Same State condition Permissible as reexport only Indirect export Allowed upto 20% against securities Allowed Not allowed Remission of duty / taxes under exceptional circumstances Provided Not provided Vendor facility Allowed Disallowed Impliedly Not specified Permissible only in the manner of return to the same manner of return to the supplier same supplier Bond to Bond Transfer, Re-export, ex Return to supplier, sale Other ways of disposals -bonding in Return to same supplier or to other DTRE user, of inputs exceptional sale to other licensee of EOU destruction circumstances and 20 SRO 492 Not specified Not provided

Existing Tax Relief Schemes Feature Manufacturing Bonds Export Oriented Units DTRE Export in Same State condition Permissible as reexport only Indirect export Allowed upto 20% against securities Allowed Not allowed Remission of duty / taxes under exceptional circumstances Provided Not provided Vendor facility Allowed Disallowed Impliedly Not specified Permissible only in the manner of return to the same manner of return to the supplier same supplier Bond to Bond Transfer, Re-export, ex Return to supplier, sale Other ways of disposals -bonding in Return to same supplier or to other DTRE user, of inputs exceptional sale to other licensee of EOU destruction circumstances and 20 SRO 492 Not specified Not provided

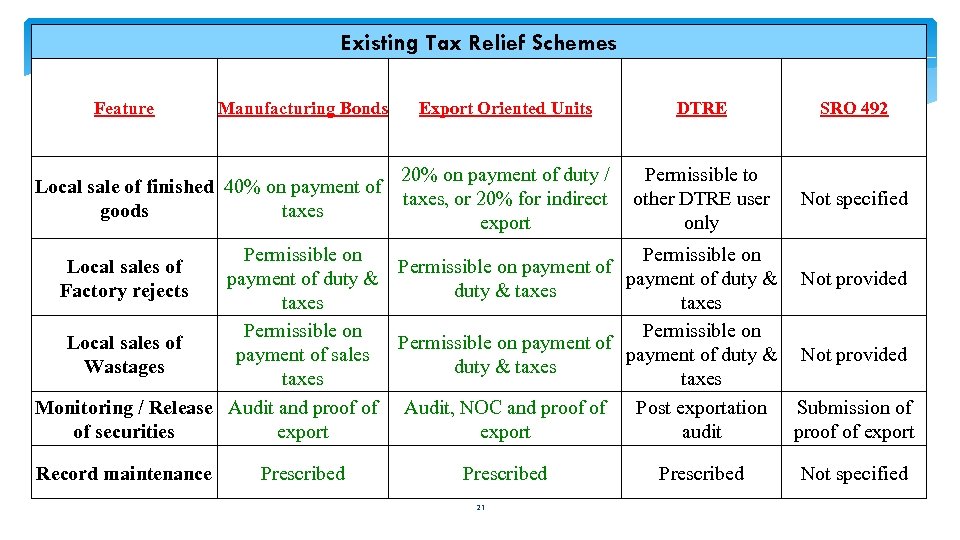

Existing Tax Relief Schemes Feature Manufacturing Bonds Local sale of finished 40% on payment of goods taxes Export Oriented Units DTRE SRO 492 20% on payment of duty / taxes, or 20% for indirect export Permissible to other DTRE user only Not specified Permissible on payment of duty & Not provided duty & taxes Permissible on Local sales of Permissible on payment of sales payment of duty & Not provided Wastages duty & taxes Monitoring / Release Audit and proof of Audit, NOC and proof of Post exportation Submission of of securities export audit proof of export Local sales of Factory rejects Record maintenance Prescribed 21 Prescribed Not specified

Existing Tax Relief Schemes Feature Manufacturing Bonds Local sale of finished 40% on payment of goods taxes Export Oriented Units DTRE SRO 492 20% on payment of duty / taxes, or 20% for indirect export Permissible to other DTRE user only Not specified Permissible on payment of duty & Not provided duty & taxes Permissible on Local sales of Permissible on payment of sales payment of duty & Not provided Wastages duty & taxes Monitoring / Release Audit and proof of Audit, NOC and proof of Post exportation Submission of of securities export audit proof of export Local sales of Factory rejects Record maintenance Prescribed 21 Prescribed Not specified

Evaluation of Proposals From Trade “Exports Facilitation Rules, 2014” “Apparel Export (Special) Rules, 2014” 22

Evaluation of Proposals From Trade “Exports Facilitation Rules, 2014” “Apparel Export (Special) Rules, 2014” 22

Critical Analysis on Proposed Schemes by Trade “Exports Facilitation Rules, 2014” Too Liberal e. g. No need of physical verification due to We. BOC Replacement of DTRE scheme with SRO 492 Single DTRE scheme based controls for all Export Based Unit Unnecessary change of language & addition of new terms/ definitions “Foreign origin imported goods”, “Chief Executive Officer”, “single yield report”, “standard yield report” Faulty and impractical Monthly Statement Format Useful Suggestions: Concept of Self-Audit Department's Audit Selection on the basis of Self Audit Report 23

Critical Analysis on Proposed Schemes by Trade “Exports Facilitation Rules, 2014” Too Liberal e. g. No need of physical verification due to We. BOC Replacement of DTRE scheme with SRO 492 Single DTRE scheme based controls for all Export Based Unit Unnecessary change of language & addition of new terms/ definitions “Foreign origin imported goods”, “Chief Executive Officer”, “single yield report”, “standard yield report” Faulty and impractical Monthly Statement Format Useful Suggestions: Concept of Self-Audit Department's Audit Selection on the basis of Self Audit Report 23

Critical Analysis on Proposed Schemes “Apparel Export (Special) Rules, 2014” Undue role to ADRC to avoid legal action, e. g. 90% export target but in case of violation, matter goes to ADRC instead of cancellation of license Faulty and impractical Monthly Statement Format Insurance policy condition present Useful suggestion: Electricity , natural gas, oil and lubricants may be included in the definition of input goods 24

Critical Analysis on Proposed Schemes “Apparel Export (Special) Rules, 2014” Undue role to ADRC to avoid legal action, e. g. 90% export target but in case of violation, matter goes to ADRC instead of cancellation of license Faulty and impractical Monthly Statement Format Insurance policy condition present Useful suggestion: Electricity , natural gas, oil and lubricants may be included in the definition of input goods 24

Boosting Merging Warehousing and EOU Rules Rescinding SRO 327(I)/2008 dated 29. 03. 2008, Replacing Chapter XV of SRO 450(I)/2001 dated 18. 06. 2001 with Proposed Rules “Warehousing and Export” 25

Boosting Merging Warehousing and EOU Rules Rescinding SRO 327(I)/2008 dated 29. 03. 2008, Replacing Chapter XV of SRO 450(I)/2001 dated 18. 06. 2001 with Proposed Rules “Warehousing and Export” 25

Benefits SRO Reduction Single We. BOC Module Rectification of issues in existing rules and procedures Introduction of more facilitatory measures Self Audit Duty/tax free import of capital goods Reduction is retention period for technology transfer etc 26

Benefits SRO Reduction Single We. BOC Module Rectification of issues in existing rules and procedures Introduction of more facilitatory measures Self Audit Duty/tax free import of capital goods Reduction is retention period for technology transfer etc 26

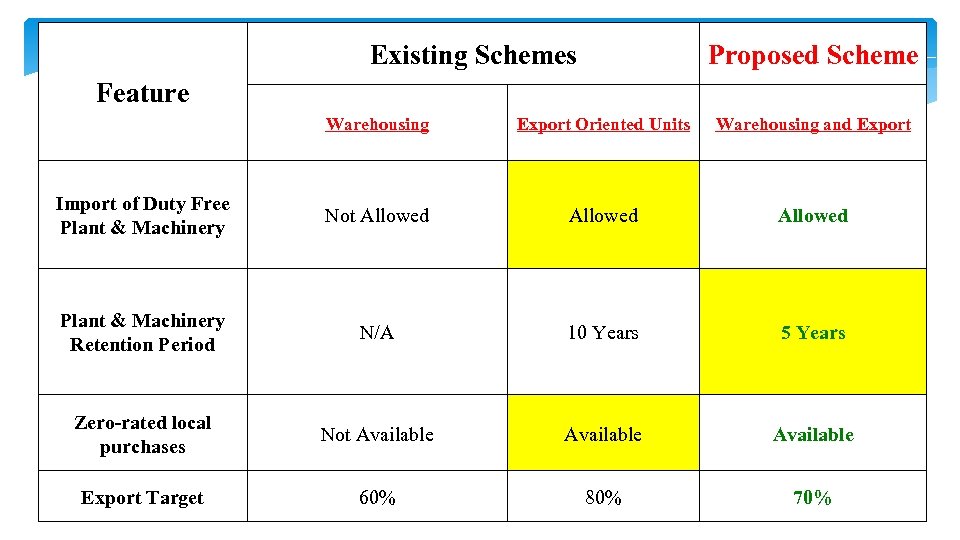

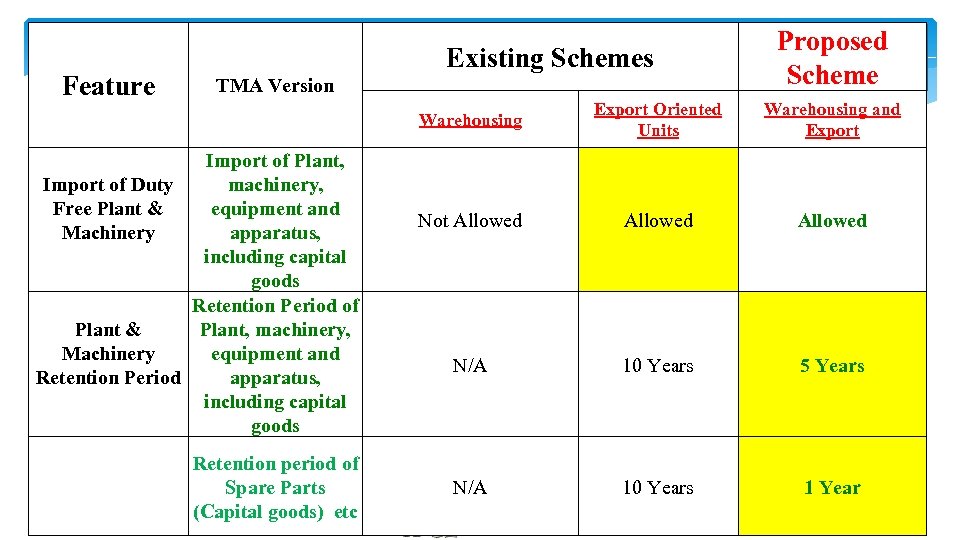

Existing Schemes Proposed Scheme Feature Warehousing Export Oriented Units Warehousing and Export Import of Duty Free Plant & Machinery Not Allowed Plant & Machinery Retention Period N/A 10 Years 5 Years Zero-rated local purchases Not Available Export Target 60% 80% 70% 27

Existing Schemes Proposed Scheme Feature Warehousing Export Oriented Units Warehousing and Export Import of Duty Free Plant & Machinery Not Allowed Plant & Machinery Retention Period N/A 10 Years 5 Years Zero-rated local purchases Not Available Export Target 60% 80% 70% 27

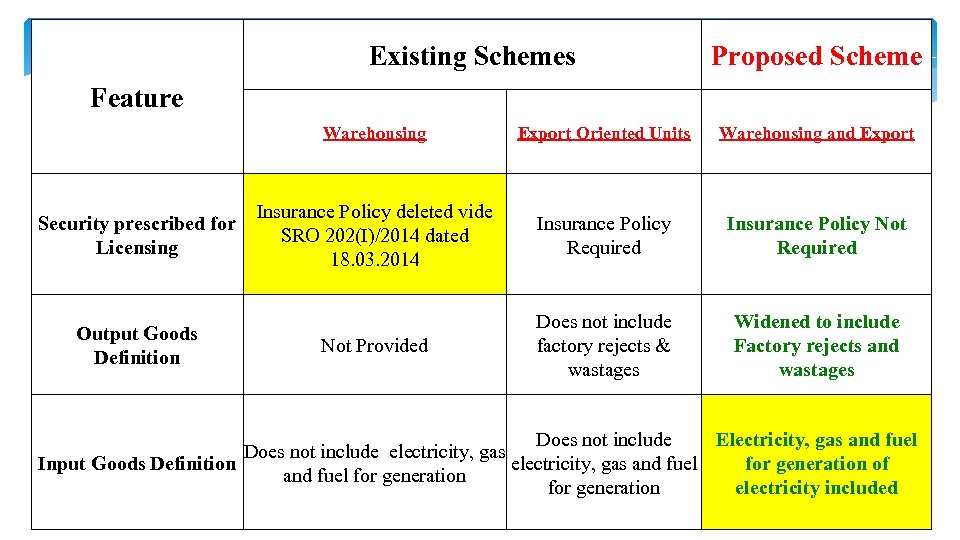

Existing Schemes Proposed Scheme Feature Warehousing Security prescribed for Licensing Output Goods Definition Export Oriented Units Warehousing and Export Insurance Policy deleted vide SRO 202(I)/2014 dated 18. 03. 2014 Insurance Policy Required Insurance Policy Not Required Not Provided Does not include factory rejects & wastages Widened to include Factory rejects and wastages Does not include Electricity, gas and fuel Does not include electricity, gas Input Goods Definition for generation of electricity, gas and fuel for generation electricity included 28

Existing Schemes Proposed Scheme Feature Warehousing Security prescribed for Licensing Output Goods Definition Export Oriented Units Warehousing and Export Insurance Policy deleted vide SRO 202(I)/2014 dated 18. 03. 2014 Insurance Policy Required Insurance Policy Not Required Not Provided Does not include factory rejects & wastages Widened to include Factory rejects and wastages Does not include Electricity, gas and fuel Does not include electricity, gas Input Goods Definition for generation of electricity, gas and fuel for generation electricity included 28

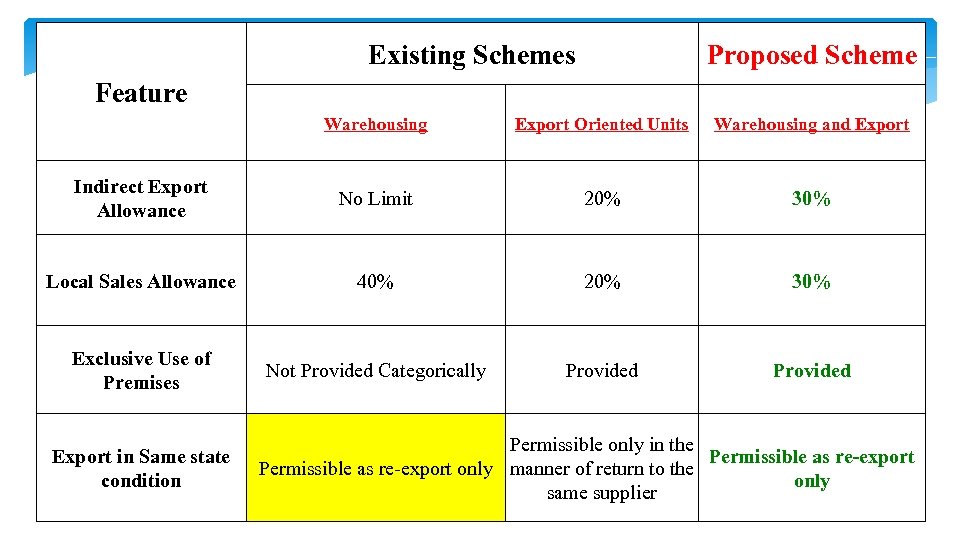

Existing Schemes Proposed Scheme Feature Warehousing Export Oriented Units Warehousing and Export Indirect Export Allowance No Limit 20% 30% Local Sales Allowance 40% 20% 30% Exclusive Use of Premises Not Provided Categorically Provided Export in Same state condition Permissible only in the Permissible as re-export only manner of return to the only same supplier

Existing Schemes Proposed Scheme Feature Warehousing Export Oriented Units Warehousing and Export Indirect Export Allowance No Limit 20% 30% Local Sales Allowance 40% 20% 30% Exclusive Use of Premises Not Provided Categorically Provided Export in Same state condition Permissible only in the Permissible as re-export only manner of return to the only same supplier

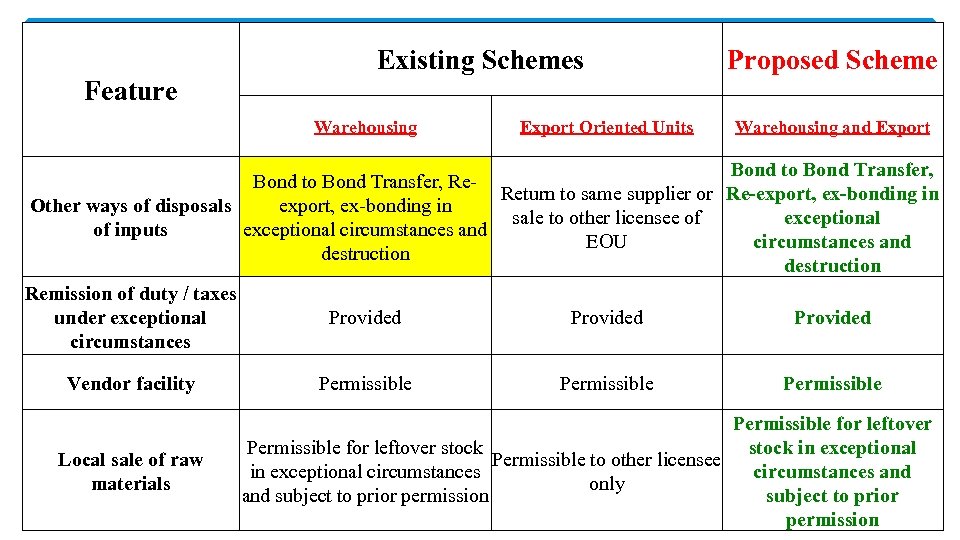

Feature Existing Schemes Warehousing Export Oriented Units Proposed Scheme Warehousing and Export Bond to Bond Transfer, Re. Return to same supplier or Re-export, ex-bonding in Other ways of disposals export, ex-bonding in sale to other licensee of exceptional of inputs exceptional circumstances and EOU circumstances and destruction Remission of duty / taxes Provided under exceptional circumstances Vendor facility Local sale of raw materials Permissible for leftover Permissible for leftover stock in exceptional Permissible to other licensee in exceptional circumstances and only and subject to prior permission subject to prior 30 permission

Feature Existing Schemes Warehousing Export Oriented Units Proposed Scheme Warehousing and Export Bond to Bond Transfer, Re. Return to same supplier or Re-export, ex-bonding in Other ways of disposals export, ex-bonding in sale to other licensee of exceptional of inputs exceptional circumstances and EOU circumstances and destruction Remission of duty / taxes Provided under exceptional circumstances Vendor facility Local sale of raw materials Permissible for leftover Permissible for leftover stock in exceptional Permissible to other licensee in exceptional circumstances and only and subject to prior permission subject to prior 30 permission

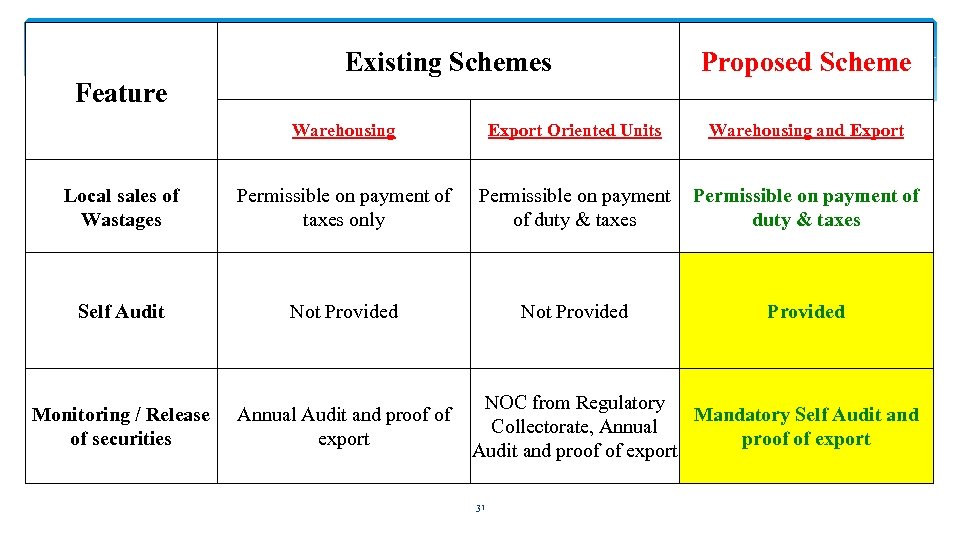

Feature Existing Schemes Proposed Scheme Warehousing Export Oriented Units Warehousing and Export Local sales of Wastages Permissible on payment of taxes only Permissible on payment of duty & taxes Self Audit Not Provided Monitoring / Release of securities Annual Audit and proof of export NOC from Regulatory Mandatory Self Audit and Collectorate, Annual proof of export Audit and proof of export 31

Feature Existing Schemes Proposed Scheme Warehousing Export Oriented Units Warehousing and Export Local sales of Wastages Permissible on payment of taxes only Permissible on payment of duty & taxes Self Audit Not Provided Monitoring / Release of securities Annual Audit and proof of export NOC from Regulatory Mandatory Self Audit and Collectorate, Annual proof of export Audit and proof of export 31

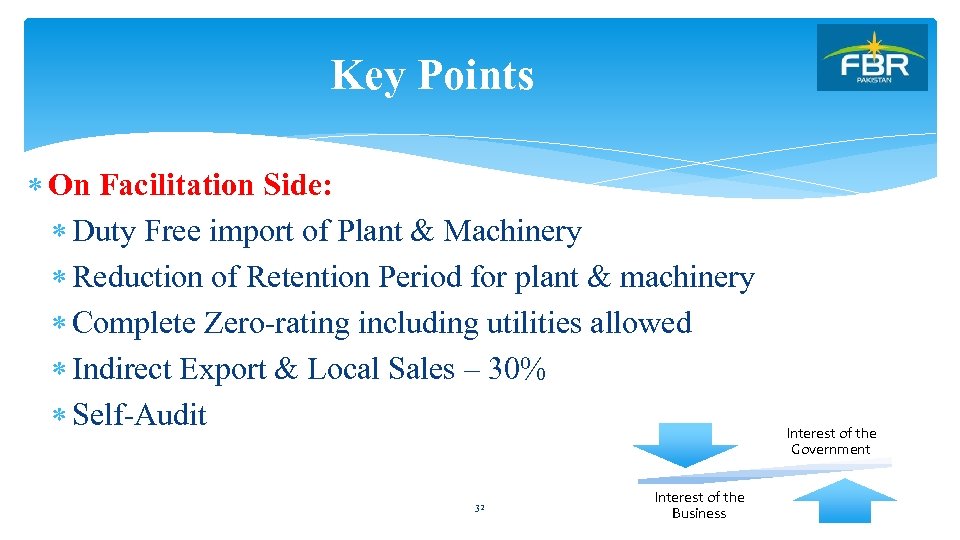

Key Points On Facilitation Side: Duty Free import of Plant & Machinery Reduction of Retention Period for plant & machinery Complete Zero-rating including utilities allowed Indirect Export & Local Sales – 30% Self-Audit 32 Interest of the Business Interest of the Government

Key Points On Facilitation Side: Duty Free import of Plant & Machinery Reduction of Retention Period for plant & machinery Complete Zero-rating including utilities allowed Indirect Export & Local Sales – 30% Self-Audit 32 Interest of the Business Interest of the Government

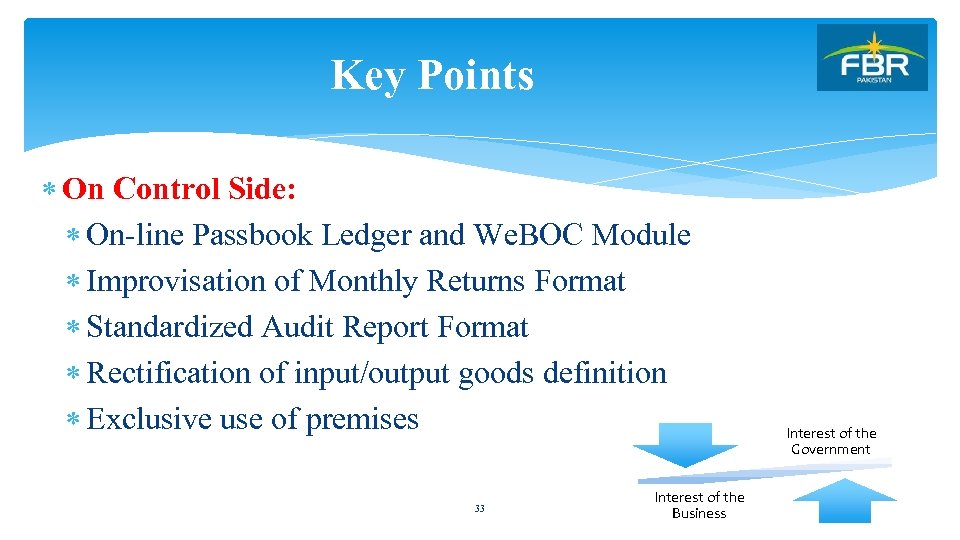

Key Points On Control Side: On-line Passbook Ledger and We. BOC Module Improvisation of Monthly Returns Format Standardized Audit Report Format Rectification of input/output goods definition Exclusive use of premises 33 Interest of the Business Interest of the Government

Key Points On Control Side: On-line Passbook Ledger and We. BOC Module Improvisation of Monthly Returns Format Standardized Audit Report Format Rectification of input/output goods definition Exclusive use of premises 33 Interest of the Business Interest of the Government

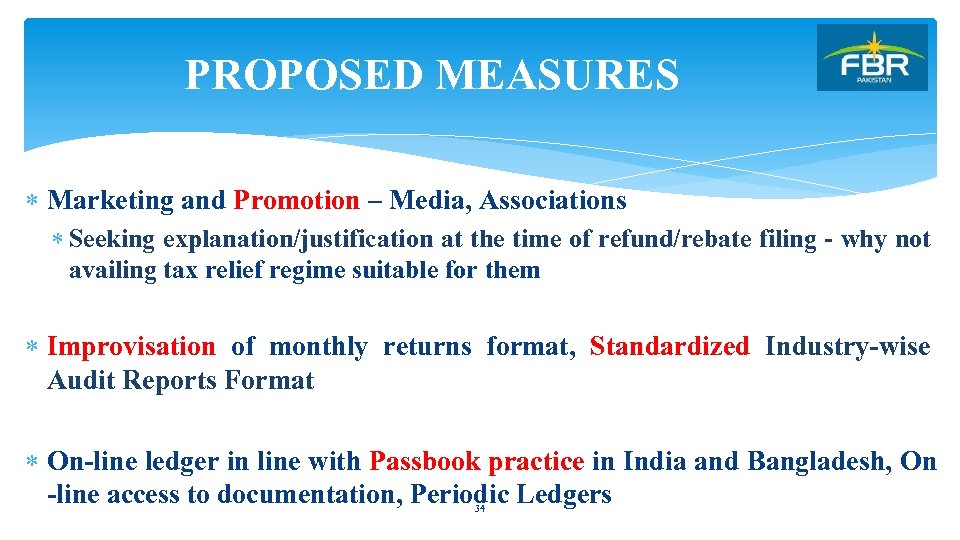

PROPOSED MEASURES Marketing and Promotion – Media, Associations Seeking explanation/justification at the time of refund/rebate filing - why not availing tax relief regime suitable for them Improvisation of monthly returns format, Standardized Industry-wise Audit Reports Format On-line ledger in line with Passbook practice in India and Bangladesh, On -line access to documentation, Periodic Ledgers 34

PROPOSED MEASURES Marketing and Promotion – Media, Associations Seeking explanation/justification at the time of refund/rebate filing - why not availing tax relief regime suitable for them Improvisation of monthly returns format, Standardized Industry-wise Audit Reports Format On-line ledger in line with Passbook practice in India and Bangladesh, On -line access to documentation, Periodic Ledgers 34

Feature Existing Schemes TMA Version Proposed Scheme Warehousing Import of Plant, machinery, Import of Duty equipment and Free Plant & Machinery apparatus, including capital goods Retention Period of Plant, machinery, Plant & equipment and Machinery Retention Period apparatus, including capital goods Export Oriented Units Warehousing and Export Not Allowed N/A 10 Years 5 Years N/A 10 Years 1 Year THANKS Retention period of Spare Parts (Capital goods) etc 35

Feature Existing Schemes TMA Version Proposed Scheme Warehousing Import of Plant, machinery, Import of Duty equipment and Free Plant & Machinery apparatus, including capital goods Retention Period of Plant, machinery, Plant & equipment and Machinery Retention Period apparatus, including capital goods Export Oriented Units Warehousing and Export Not Allowed N/A 10 Years 5 Years N/A 10 Years 1 Year THANKS Retention period of Spare Parts (Capital goods) etc 35

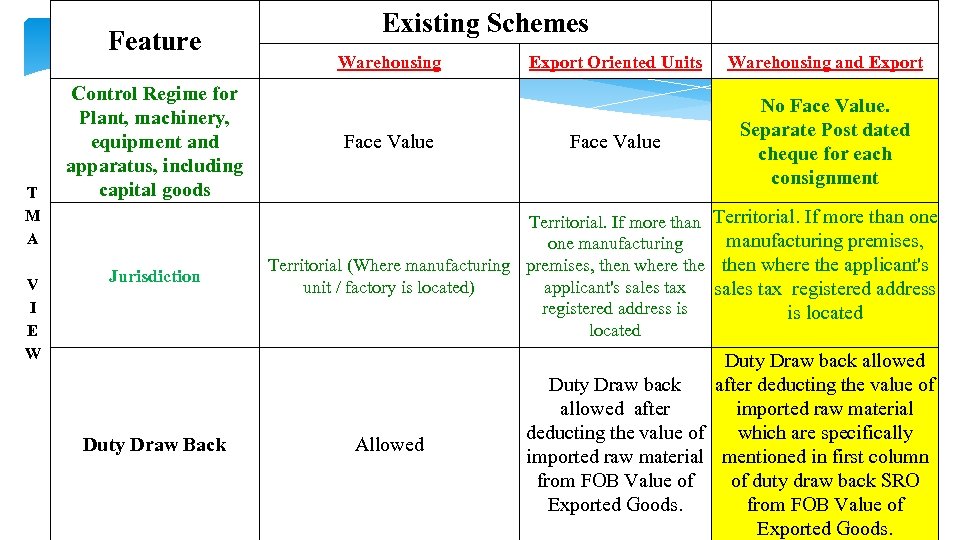

Feature T M A V I E W Control Regime for Plant, machinery, equipment and apparatus, including capital goods Jurisdiction Duty Draw Back Existing Schemes Warehousing Export Oriented Units Face Value Warehousing and Export No Face Value. Separate Post dated cheque for each consignment Territorial. If more than one manufacturing premises, one manufacturing Territorial (Where manufacturing premises, then where the applicant's unit / factory is located) applicant's sales tax registered address is is located Allowed 36 Duty Draw back allowed Duty Draw back after deducting the value of allowed after imported raw material deducting the value of which are specifically imported raw material mentioned in first column from FOB Value of of duty draw back SRO Exported Goods. from FOB Value of Exported Goods.

Feature T M A V I E W Control Regime for Plant, machinery, equipment and apparatus, including capital goods Jurisdiction Duty Draw Back Existing Schemes Warehousing Export Oriented Units Face Value Warehousing and Export No Face Value. Separate Post dated cheque for each consignment Territorial. If more than one manufacturing premises, one manufacturing Territorial (Where manufacturing premises, then where the applicant's unit / factory is located) applicant's sales tax registered address is is located Allowed 36 Duty Draw back allowed Duty Draw back after deducting the value of allowed after imported raw material deducting the value of which are specifically imported raw material mentioned in first column from FOB Value of of duty draw back SRO Exported Goods. from FOB Value of Exported Goods.

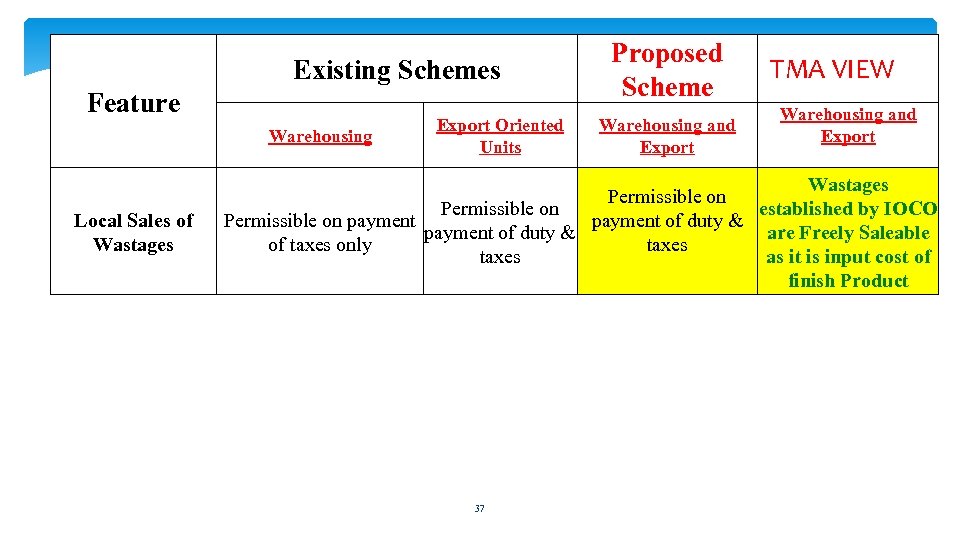

Existing Schemes Feature Warehousing Local Sales of Wastages Export Oriented Units Proposed Scheme Warehousing and Export TMA VIEW Warehousing and Export Wastages Permissible on established by IOCO Permissible on payment of duty & are Freely Saleable payment of duty & of taxes only taxes as it is input cost of finish Product 37

Existing Schemes Feature Warehousing Local Sales of Wastages Export Oriented Units Proposed Scheme Warehousing and Export TMA VIEW Warehousing and Export Wastages Permissible on established by IOCO Permissible on payment of duty & are Freely Saleable payment of duty & of taxes only taxes as it is input cost of finish Product 37