Merger and Acquisition Strategies.pptx

- Количество слайдов: 7

Merger and Acquisition Strategies Presented by: Alina Yakovlieva

OUTLINE 1. Model description 2. 5 Strategic Objectives 3. Advantages & Disadvantages 4. Example FUIB (ПУМБ) & Dongor. Bank

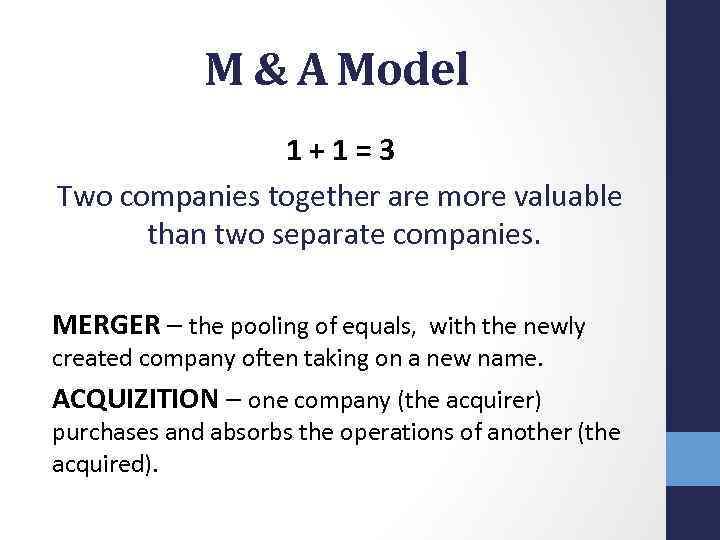

M & A Model 1+1=3 Two companies together are more valuable than two separate companies. MERGER – the pooling of equals, with the newly created company often taking on a new name. ACQUIZITION – one company (the acquirer) purchases and absorbs the operations of another (the acquired).

(Advantages) 5 Strategic Objectives • Create a more cost-efficient operation out of combined companies. • Expand a company’s geographic coverage • Extend the company’s business into new product categories • Gain quick access to new technologies and other resources or competitive capabilities • Try to invent a new industry and lead the intersection of industries

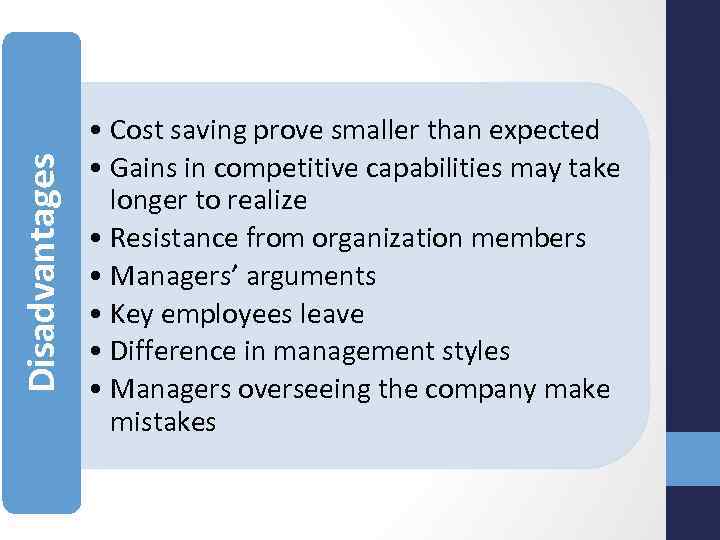

Disadvantages • Cost saving prove smaller than expected • Gains in competitive capabilities may take longer to realize • Resistance from organization members • Managers’ arguments • Key employees leave • Difference in management styles • Managers overseeing the company make mistakes

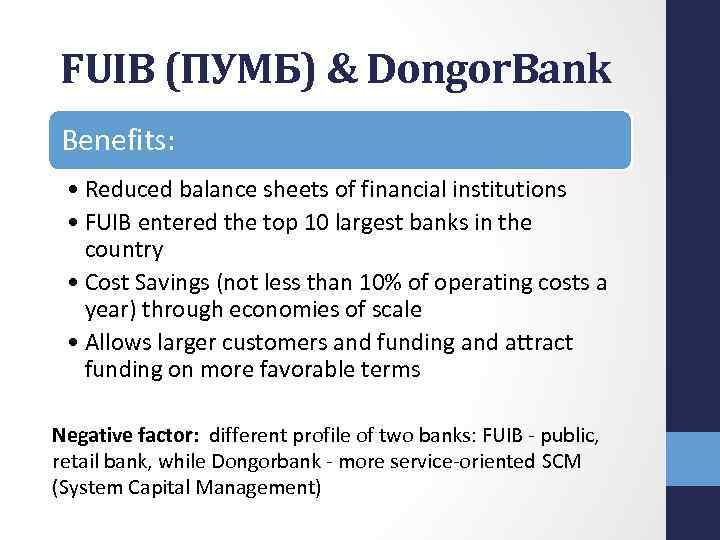

FUIB (ПУМБ) & Dongor. Bank Benefits: • Reduced balance sheets of financial institutions • FUIB entered the top 10 largest banks in the country • Cost Savings (not less than 10% of operating costs a year) through economies of scale • Allows larger customers and funding and attract funding on more favorable terms Negative factor: different profile of two banks: FUIB - public, retail bank, while Dongorbank - more service-oriented SCM (System Capital Management)

Resources: • http: //www. fixygen. ua/news/20110719/pumb-razdalsya. html • http: //www. investopedia. com/university/mergers 1. asp#axzz 29 j. OJr. Lsq • Main Book (on servert)

Merger and Acquisition Strategies.pptx