0afa9b38e13ee4b3006a47ab37c9b9b5.ppt

- Количество слайдов: 23

“MERE CHANGE”: THE NEW FINAL SECTION 368(A)(1)(F) REGULATIONS William D. Alexander Skadden, Arps, Slate Meagher & Flom Douglas C. Bates IRS Office of the Associate Chief Counsel (Corporate) Amie Colwell Breslow General Electric Company Kenneth H. Heitner Weil, Gotshal & Manges 1

“MERE CHANGE”: THE NEW FINAL SECTION 368(A)(1)(F) REGULATIONS William D. Alexander Skadden, Arps, Slate Meagher & Flom Douglas C. Bates IRS Office of the Associate Chief Counsel (Corporate) Amie Colwell Breslow General Electric Company Kenneth H. Heitner Weil, Gotshal & Manges 1

Defining F Reorganizations • An F reorganization is a “mere change in identity, form, or place or organization of one corporation. ” § 368(a)(1)(F) • This type of reorganization is commonly used for changes in jurisdiction of incorporation or changes in corporate form. • “[The F reorganization] encompass[es] only the simplest and least significant of corporate changes. . . [The F reorganization] presumes that the surviving corporation is the same corporation as the predecessor in every respect, except for minor or technical differences. ” Berghash v. Commissioner, 43 T. C. 752 (1965). • Recent Final Regulations (and earlier Proposed Regulations) are premised on the idea that: • “. . . it is generally appropriate to treat the Resulting Corporation in an F reorganization as the functional equivalent of the Transferor Corporation and to give its corporate enterprise roughly the same freedom of action as would be accorded a corporation that remains within its original corporate shell. ” T. D. 9379. • Accordingly, an F reorganization is treated differently than other types of corporate reorganizations. • Taxable year does not close. § 381(b). • Losses can be carried back to pre-reorganization years. § 381(b); Treas. Reg. § 1. 381(b)- 1(a)(2). • The corporation continues to use the same EIN. Rev. Rul. 73 -526. 2

Defining F Reorganizations • An F reorganization is a “mere change in identity, form, or place or organization of one corporation. ” § 368(a)(1)(F) • This type of reorganization is commonly used for changes in jurisdiction of incorporation or changes in corporate form. • “[The F reorganization] encompass[es] only the simplest and least significant of corporate changes. . . [The F reorganization] presumes that the surviving corporation is the same corporation as the predecessor in every respect, except for minor or technical differences. ” Berghash v. Commissioner, 43 T. C. 752 (1965). • Recent Final Regulations (and earlier Proposed Regulations) are premised on the idea that: • “. . . it is generally appropriate to treat the Resulting Corporation in an F reorganization as the functional equivalent of the Transferor Corporation and to give its corporate enterprise roughly the same freedom of action as would be accorded a corporation that remains within its original corporate shell. ” T. D. 9379. • Accordingly, an F reorganization is treated differently than other types of corporate reorganizations. • Taxable year does not close. § 381(b). • Losses can be carried back to pre-reorganization years. § 381(b); Treas. Reg. § 1. 381(b)- 1(a)(2). • The corporation continues to use the same EIN. Rev. Rul. 73 -526. 2

Timeline of F Reorganization Guidance Historical Developments • 1921: The predecessor of 368(a)(1)(F) was enacted, defining an F reorganization as a “mere change. ” • For the next 70 years, the requirements for valid F reorganizations were generally detailed in case law, and the scope of F reorganizations expanded, and then contracted. • 1990: IRS issues Proposed and Temporary Regulations regarding outbound F reorganizations. • 2004: IRS issues Proposed Regulations detailing conditions for qualification as an F reorganization. • 2005: Final Regulations (T. D. 9182) adopt part of 2004 Proposed Regulations clarifying that continuity of business enterprise and continuity of proprietary interest are not required in an F reorganization. Recent Changes • September 18, 2015: Final Regulations (T. D. 9739) that detailed six requirements (including four from the 2004 Proposed Regulations) for a valid F reorganization and adopted the 1990 Proposed Regulations regarding outbound F reorganizations. 3

Timeline of F Reorganization Guidance Historical Developments • 1921: The predecessor of 368(a)(1)(F) was enacted, defining an F reorganization as a “mere change. ” • For the next 70 years, the requirements for valid F reorganizations were generally detailed in case law, and the scope of F reorganizations expanded, and then contracted. • 1990: IRS issues Proposed and Temporary Regulations regarding outbound F reorganizations. • 2004: IRS issues Proposed Regulations detailing conditions for qualification as an F reorganization. • 2005: Final Regulations (T. D. 9182) adopt part of 2004 Proposed Regulations clarifying that continuity of business enterprise and continuity of proprietary interest are not required in an F reorganization. Recent Changes • September 18, 2015: Final Regulations (T. D. 9739) that detailed six requirements (including four from the 2004 Proposed Regulations) for a valid F reorganization and adopted the 1990 Proposed Regulations regarding outbound F reorganizations. 3

Potential F Reorganizations • The Regulations endorse the “F in a bubble” concept and attempt to define the parameters of a Potential F Reorganization • A Potential F Reorganization “begins when the transferor corporation begins transferring its assets, directly or indirectly, to the resulting corporation, and it ends when the transferor corporation has distributed to its shareholders the consideration it receives from the resulting corporation and has completely liquidated for federal income tax purposes. ” Treas. Reg. § 1. 3682(m)(1). • There is some language in the regulations about applying the step transaction doctrine, and Example 5 of Treas. Reg. § 1. 368 -2(m)(1) allows a “drop-and-check” transaction. 4

Potential F Reorganizations • The Regulations endorse the “F in a bubble” concept and attempt to define the parameters of a Potential F Reorganization • A Potential F Reorganization “begins when the transferor corporation begins transferring its assets, directly or indirectly, to the resulting corporation, and it ends when the transferor corporation has distributed to its shareholders the consideration it receives from the resulting corporation and has completely liquidated for federal income tax purposes. ” Treas. Reg. § 1. 3682(m)(1). • There is some language in the regulations about applying the step transaction doctrine, and Example 5 of Treas. Reg. § 1. 368 -2(m)(1) allows a “drop-and-check” transaction. 4

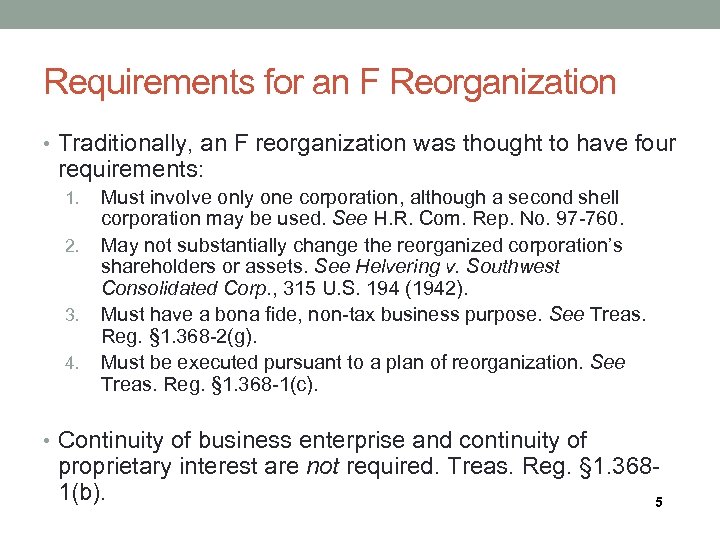

Requirements for an F Reorganization • Traditionally, an F reorganization was thought to have four requirements: 1. 2. 3. 4. Must involve only one corporation, although a second shell corporation may be used. See H. R. Com. Rep. No. 97 -760. May not substantially change the reorganized corporation’s shareholders or assets. See Helvering v. Southwest Consolidated Corp. , 315 U. S. 194 (1942). Must have a bona fide, non-tax business purpose. See Treas. Reg. § 1. 368 -2(g). Must be executed pursuant to a plan of reorganization. See Treas. Reg. § 1. 368 -1(c). • Continuity of business enterprise and continuity of proprietary interest are not required. Treas. Reg. § 1. 3681(b). 5

Requirements for an F Reorganization • Traditionally, an F reorganization was thought to have four requirements: 1. 2. 3. 4. Must involve only one corporation, although a second shell corporation may be used. See H. R. Com. Rep. No. 97 -760. May not substantially change the reorganized corporation’s shareholders or assets. See Helvering v. Southwest Consolidated Corp. , 315 U. S. 194 (1942). Must have a bona fide, non-tax business purpose. See Treas. Reg. § 1. 368 -2(g). Must be executed pursuant to a plan of reorganization. See Treas. Reg. § 1. 368 -1(c). • Continuity of business enterprise and continuity of proprietary interest are not required. Treas. Reg. § 1. 3681(b). 5

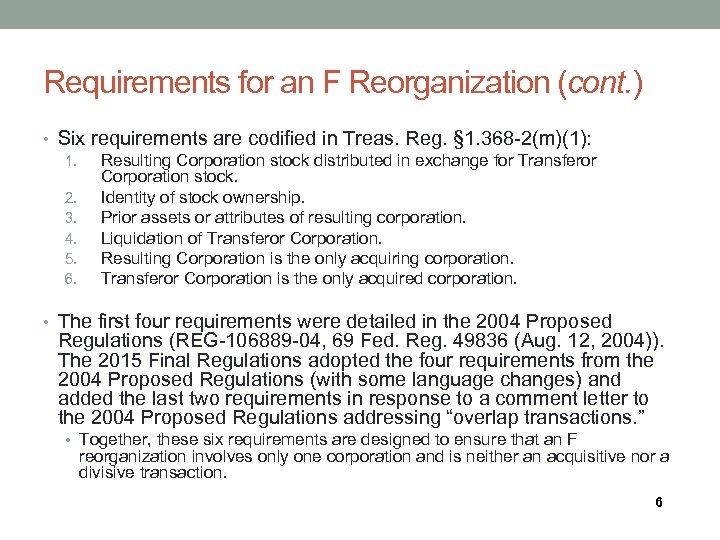

Requirements for an F Reorganization (cont. ) • Six requirements are codified in Treas. Reg. § 1. 368 -2(m)(1): 1. Resulting Corporation stock distributed in exchange for Transferor Corporation stock. 2. Identity of stock ownership. 3. Prior assets or attributes of resulting corporation. 4. Liquidation of Transferor Corporation. 5. Resulting Corporation is the only acquiring corporation. 6. Transferor Corporation is the only acquired corporation. • The first four requirements were detailed in the 2004 Proposed Regulations (REG-106889 -04, 69 Fed. Reg. 49836 (Aug. 12, 2004)). The 2015 Final Regulations adopted the four requirements from the 2004 Proposed Regulations (with some language changes) and added the last two requirements in response to a comment letter to the 2004 Proposed Regulations addressing “overlap transactions. ” • Together, these six requirements are designed to ensure that an F reorganization involves only one corporation and is neither an acquisitive nor a divisive transaction. 6

Requirements for an F Reorganization (cont. ) • Six requirements are codified in Treas. Reg. § 1. 368 -2(m)(1): 1. Resulting Corporation stock distributed in exchange for Transferor Corporation stock. 2. Identity of stock ownership. 3. Prior assets or attributes of resulting corporation. 4. Liquidation of Transferor Corporation. 5. Resulting Corporation is the only acquiring corporation. 6. Transferor Corporation is the only acquired corporation. • The first four requirements were detailed in the 2004 Proposed Regulations (REG-106889 -04, 69 Fed. Reg. 49836 (Aug. 12, 2004)). The 2015 Final Regulations adopted the four requirements from the 2004 Proposed Regulations (with some language changes) and added the last two requirements in response to a comment letter to the 2004 Proposed Regulations addressing “overlap transactions. ” • Together, these six requirements are designed to ensure that an F reorganization involves only one corporation and is neither an acquisitive nor a divisive transaction. 6

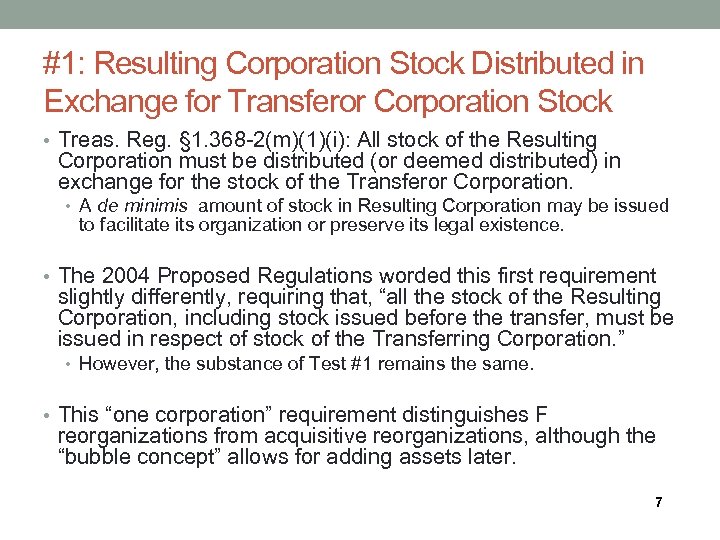

#1: Resulting Corporation Stock Distributed in Exchange for Transferor Corporation Stock • Treas. Reg. § 1. 368 -2(m)(1)(i): All stock of the Resulting Corporation must be distributed (or deemed distributed) in exchange for the stock of the Transferor Corporation. • A de minimis amount of stock in Resulting Corporation may be issued to facilitate its organization or preserve its legal existence. • The 2004 Proposed Regulations worded this first requirement slightly differently, requiring that, “all the stock of the Resulting Corporation, including stock issued before the transfer, must be issued in respect of stock of the Transferring Corporation. ” • However, the substance of Test #1 remains the same. • This “one corporation” requirement distinguishes F reorganizations from acquisitive reorganizations, although the “bubble concept” allows for adding assets later. 7

#1: Resulting Corporation Stock Distributed in Exchange for Transferor Corporation Stock • Treas. Reg. § 1. 368 -2(m)(1)(i): All stock of the Resulting Corporation must be distributed (or deemed distributed) in exchange for the stock of the Transferor Corporation. • A de minimis amount of stock in Resulting Corporation may be issued to facilitate its organization or preserve its legal existence. • The 2004 Proposed Regulations worded this first requirement slightly differently, requiring that, “all the stock of the Resulting Corporation, including stock issued before the transfer, must be issued in respect of stock of the Transferring Corporation. ” • However, the substance of Test #1 remains the same. • This “one corporation” requirement distinguishes F reorganizations from acquisitive reorganizations, although the “bubble concept” allows for adding assets later. 7

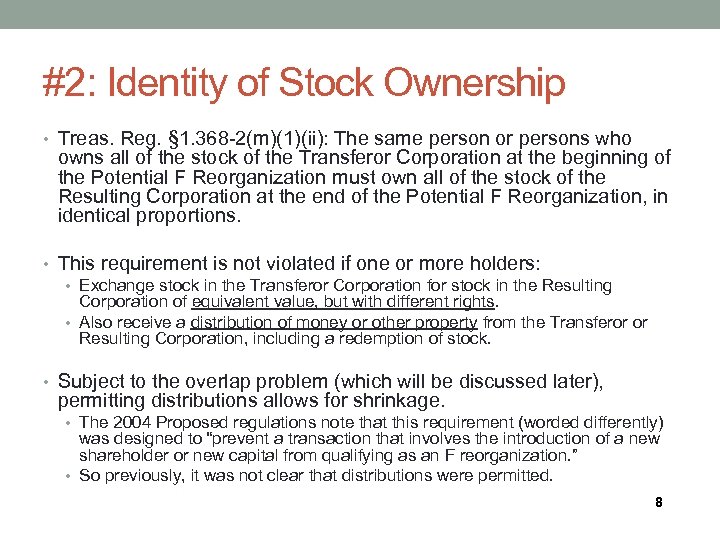

#2: Identity of Stock Ownership • Treas. Reg. § 1. 368 -2(m)(1)(ii): The same person or persons who owns all of the stock of the Transferor Corporation at the beginning of the Potential F Reorganization must own all of the stock of the Resulting Corporation at the end of the Potential F Reorganization, in identical proportions. • This requirement is not violated if one or more holders: • Exchange stock in the Transferor Corporation for stock in the Resulting Corporation of equivalent value, but with different rights. • Also receive a distribution of money or other property from the Transferor or Resulting Corporation, including a redemption of stock. • Subject to the overlap problem (which will be discussed later), permitting distributions allows for shrinkage. • The 2004 Proposed regulations note that this requirement (worded differently) was designed to “prevent a transaction that involves the introduction of a new shareholder or new capital from qualifying as an F reorganization. ” • So previously, it was not clear that distributions were permitted. 8

#2: Identity of Stock Ownership • Treas. Reg. § 1. 368 -2(m)(1)(ii): The same person or persons who owns all of the stock of the Transferor Corporation at the beginning of the Potential F Reorganization must own all of the stock of the Resulting Corporation at the end of the Potential F Reorganization, in identical proportions. • This requirement is not violated if one or more holders: • Exchange stock in the Transferor Corporation for stock in the Resulting Corporation of equivalent value, but with different rights. • Also receive a distribution of money or other property from the Transferor or Resulting Corporation, including a redemption of stock. • Subject to the overlap problem (which will be discussed later), permitting distributions allows for shrinkage. • The 2004 Proposed regulations note that this requirement (worded differently) was designed to “prevent a transaction that involves the introduction of a new shareholder or new capital from qualifying as an F reorganization. ” • So previously, it was not clear that distributions were permitted. 8

#3: Prior Assets or Attributes of Resulting Corporation • Treas. Reg. § 1. 368 -2(m)(1)(iii): The Resulting Corporation may not hold any property or have any tax attributes immediately before the Potential F Reorganization. • However, the Resulting Corporation may hold: • A de minimis amount of assets to facilitate its organization or maintain its legal existence. • The proceeds of borrowings undertaken in connection with the Potential F Reorganization. 9

#3: Prior Assets or Attributes of Resulting Corporation • Treas. Reg. § 1. 368 -2(m)(1)(iii): The Resulting Corporation may not hold any property or have any tax attributes immediately before the Potential F Reorganization. • However, the Resulting Corporation may hold: • A de minimis amount of assets to facilitate its organization or maintain its legal existence. • The proceeds of borrowings undertaken in connection with the Potential F Reorganization. 9

#4: Liquidation of Transferor Corporation • Treas. Reg. § 1. 368 -2(m)(1)(iv): The Transferor Corporation must completely liquidate in the Potential F Reorganization. • The Transferor Corporation is not required to dissolve for legal purposes. • The Transferor Corporation may retain a de minimis amount of assets for the sole purpose of preserving its legal existence. 10

#4: Liquidation of Transferor Corporation • Treas. Reg. § 1. 368 -2(m)(1)(iv): The Transferor Corporation must completely liquidate in the Potential F Reorganization. • The Transferor Corporation is not required to dissolve for legal purposes. • The Transferor Corporation may retain a de minimis amount of assets for the sole purpose of preserving its legal existence. 10

#5: Resulting Corporation is the Only Acquiring Corporation: The Overlap Rule • Treas. Reg. § 1. 368 -2(m)(1)(v): Immediately after the F reorganization, no corporation other than the Resulting Corporation may hold property previously held by the Transferor Corporation immediately before the Potential F Reorganization if the other corporation would, as a result, succeed to and take into account the items of the Transferor Corporation described in § 381(c). 11

#5: Resulting Corporation is the Only Acquiring Corporation: The Overlap Rule • Treas. Reg. § 1. 368 -2(m)(1)(v): Immediately after the F reorganization, no corporation other than the Resulting Corporation may hold property previously held by the Transferor Corporation immediately before the Potential F Reorganization if the other corporation would, as a result, succeed to and take into account the items of the Transferor Corporation described in § 381(c). 11

#6: Transferor Corporation is the Only Acquired Corporation • Treas. Reg. § 1. 368 -2(m)(1)(i): Immediately after the F reorganization, the Resulting Corporation may not hold property acquired from a corporation other than the Transferor Corporation if the Resulting Corporation would, as a result, succeed to and take into account the items of such other corporation described in § 381(c). • Simultaneous acquisitions of property and tax attributes from multiple transferor organizations will not qualify as an F reorganization. • This requirement is designed to ensure that acquisitive transactions will not qualify as an F reorganization. 12

#6: Transferor Corporation is the Only Acquired Corporation • Treas. Reg. § 1. 368 -2(m)(1)(i): Immediately after the F reorganization, the Resulting Corporation may not hold property acquired from a corporation other than the Transferor Corporation if the Resulting Corporation would, as a result, succeed to and take into account the items of such other corporation described in § 381(c). • Simultaneous acquisitions of property and tax attributes from multiple transferor organizations will not qualify as an F reorganization. • This requirement is designed to ensure that acquisitive transactions will not qualify as an F reorganization. 12

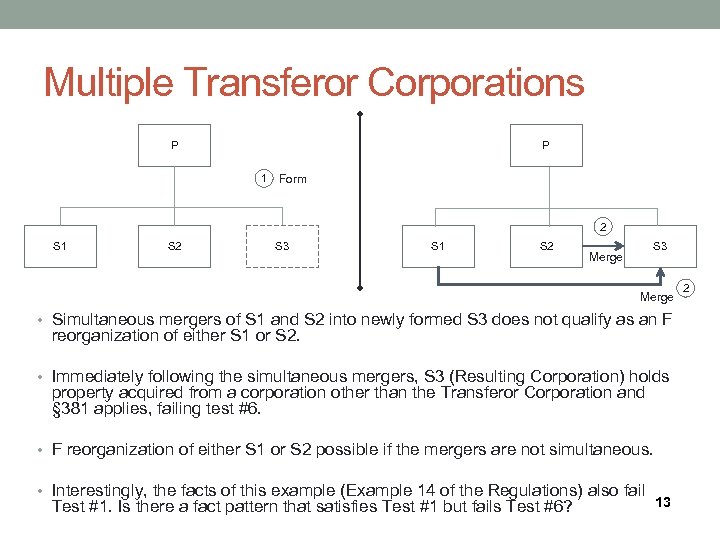

Multiple Transferor Corporations P P 1 Form 2 S 1 S 2 S 3 Merge • Simultaneous mergers of S 1 and S 2 into newly formed S 3 does not qualify as an F reorganization of either S 1 or S 2. • Immediately following the simultaneous mergers, S 3 (Resulting Corporation) holds property acquired from a corporation other than the Transferor Corporation and § 381 applies, failing test #6. • F reorganization of either S 1 or S 2 possible if the mergers are not simultaneous. • Interestingly, the facts of this example (Example 14 of the Regulations) also fail Test #1. Is there a fact pattern that satisfies Test #1 but fails Test #6? 13 2

Multiple Transferor Corporations P P 1 Form 2 S 1 S 2 S 3 Merge • Simultaneous mergers of S 1 and S 2 into newly formed S 3 does not qualify as an F reorganization of either S 1 or S 2. • Immediately following the simultaneous mergers, S 3 (Resulting Corporation) holds property acquired from a corporation other than the Transferor Corporation and § 381 applies, failing test #6. • F reorganization of either S 1 or S 2 possible if the mergers are not simultaneous. • Interestingly, the facts of this example (Example 14 of the Regulations) also fail Test #1. Is there a fact pattern that satisfies Test #1 but fails Test #6? 13 2

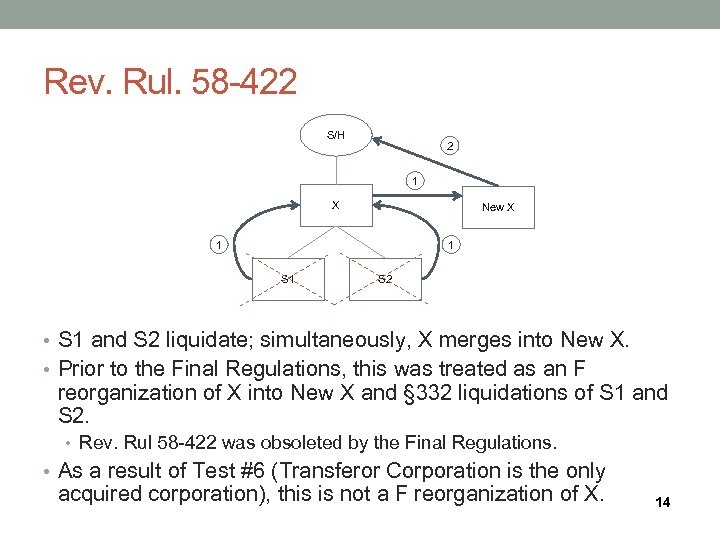

Rev. Rul. 58 -422 S/H 2 1 X New X 1 1 S 2 • S 1 and S 2 liquidate; simultaneously, X merges into New X. • Prior to the Final Regulations, this was treated as an F reorganization of X into New X and § 332 liquidations of S 1 and S 2. • Rev. Rul 58 -422 was obsoleted by the Final Regulations. • As a result of Test #6 (Transferor Corporation is the only acquired corporation), this is not a F reorganization of X. 14

Rev. Rul. 58 -422 S/H 2 1 X New X 1 1 S 2 • S 1 and S 2 liquidate; simultaneously, X merges into New X. • Prior to the Final Regulations, this was treated as an F reorganization of X into New X and § 332 liquidations of S 1 and S 2. • Rev. Rul 58 -422 was obsoleted by the Final Regulations. • As a result of Test #6 (Transferor Corporation is the only acquired corporation), this is not a F reorganization of X. 14

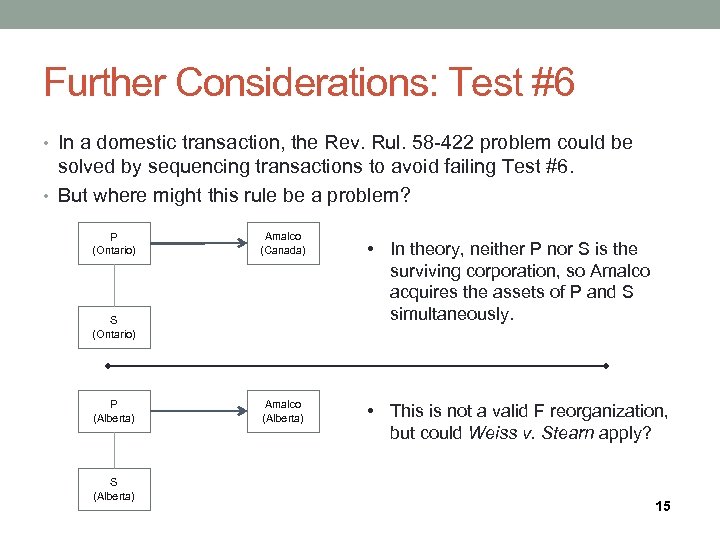

Further Considerations: Test #6 • In a domestic transaction, the Rev. Rul. 58 -422 problem could be solved by sequencing transactions to avoid failing Test #6. • But where might this rule be a problem? P (Ontario) Amalco (Canada) S (Ontario) P (Alberta) S (Alberta) Amalco (Alberta) • In theory, neither P nor S is the surviving corporation, so Amalco acquires the assets of P and S simultaneously. • This is not a valid F reorganization, but could Weiss v. Stearn apply? 15

Further Considerations: Test #6 • In a domestic transaction, the Rev. Rul. 58 -422 problem could be solved by sequencing transactions to avoid failing Test #6. • But where might this rule be a problem? P (Ontario) Amalco (Canada) S (Ontario) P (Alberta) S (Alberta) Amalco (Alberta) • In theory, neither P nor S is the surviving corporation, so Amalco acquires the assets of P and S simultaneously. • This is not a valid F reorganization, but could Weiss v. Stearn apply? 15

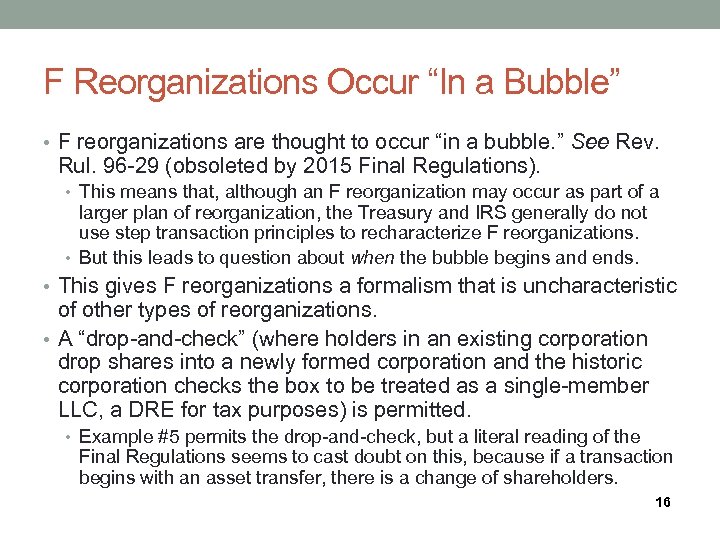

F Reorganizations Occur “In a Bubble” • F reorganizations are thought to occur “in a bubble. ” See Rev. Rul. 96 -29 (obsoleted by 2015 Final Regulations). • This means that, although an F reorganization may occur as part of a larger plan of reorganization, the Treasury and IRS generally do not use step transaction principles to recharacterize F reorganizations. • But this leads to question about when the bubble begins and ends. • This gives F reorganizations a formalism that is uncharacteristic of other types of reorganizations. • A “drop-and-check” (where holders in an existing corporation drop shares into a newly formed corporation and the historic corporation checks the box to be treated as a single-member LLC, a DRE for tax purposes) is permitted. • Example #5 permits the drop-and-check, but a literal reading of the Final Regulations seems to cast doubt on this, because if a transaction begins with an asset transfer, there is a change of shareholders. 16

F Reorganizations Occur “In a Bubble” • F reorganizations are thought to occur “in a bubble. ” See Rev. Rul. 96 -29 (obsoleted by 2015 Final Regulations). • This means that, although an F reorganization may occur as part of a larger plan of reorganization, the Treasury and IRS generally do not use step transaction principles to recharacterize F reorganizations. • But this leads to question about when the bubble begins and ends. • This gives F reorganizations a formalism that is uncharacteristic of other types of reorganizations. • A “drop-and-check” (where holders in an existing corporation drop shares into a newly formed corporation and the historic corporation checks the box to be treated as a single-member LLC, a DRE for tax purposes) is permitted. • Example #5 permits the drop-and-check, but a literal reading of the Final Regulations seems to cast doubt on this, because if a transaction begins with an asset transfer, there is a change of shareholders. 16

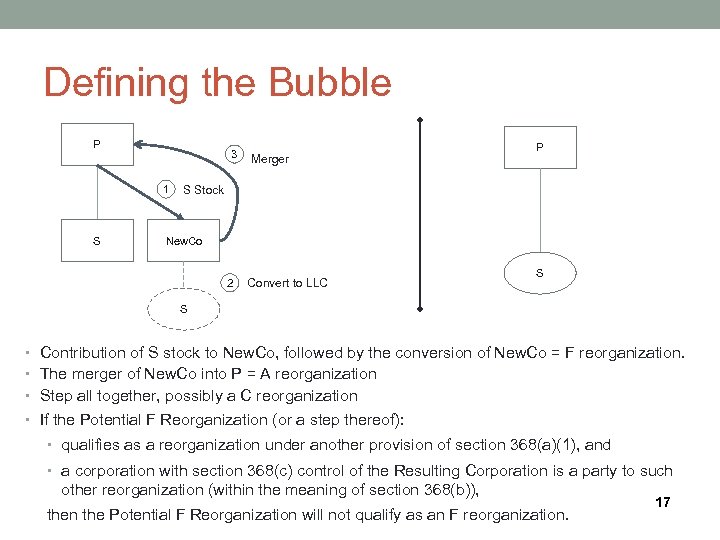

Defining the Bubble P 3 1 S Merger P S Stock New. Co 2 Convert to LLC S S • Contribution of S stock to New. Co, followed by the conversion of New. Co = F reorganization. • The merger of New. Co into P = A reorganization • Step all together, possibly a C reorganization • If the Potential F Reorganization (or a step thereof): • qualifies as a reorganization under another provision of section 368(a)(1), and • a corporation with section 368(c) control of the Resulting Corporation is a party to such other reorganization (within the meaning of section 368(b)), then the Potential F Reorganization will not qualify as an F reorganization. 17

Defining the Bubble P 3 1 S Merger P S Stock New. Co 2 Convert to LLC S S • Contribution of S stock to New. Co, followed by the conversion of New. Co = F reorganization. • The merger of New. Co into P = A reorganization • Step all together, possibly a C reorganization • If the Potential F Reorganization (or a step thereof): • qualifies as a reorganization under another provision of section 368(a)(1), and • a corporation with section 368(c) control of the Resulting Corporation is a party to such other reorganization (within the meaning of section 368(b)), then the Potential F Reorganization will not qualify as an F reorganization. 17

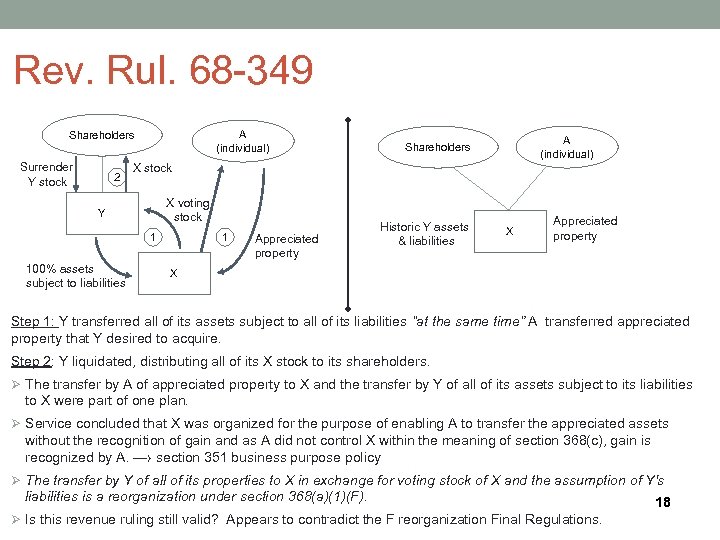

Rev. Rul. 68 -349 A (individual) Shareholders Surrender Y stock 2 X stock X voting stock Y 1 100% assets subject to liabilities A (individual) Shareholders 1 Appreciated property Historic Y assets & liabilities X Appreciated property X Step 1: Y transferred all of its assets subject to all of its liabilities “at the same time” A transferred appreciated property that Y desired to acquire. Step 2: Y liquidated, distributing all of its X stock to its shareholders. Ø The transfer by A of appreciated property to X and the transfer by Y of all of its assets subject to its liabilities to X were part of one plan. Ø Service concluded that X was organized for the purpose of enabling A to transfer the appreciated assets without the recognition of gain and as A did not control X within the meaning of section 368(c), gain is recognized by A. —› section 351 business purpose policy Ø The transfer by Y of all of its properties to X in exchange for voting stock of X and the assumption of Y's liabilities is a reorganization under section 368(a)(1)(F). Ø Is this revenue ruling still valid? Appears to contradict the F reorganization Final Regulations. 18

Rev. Rul. 68 -349 A (individual) Shareholders Surrender Y stock 2 X stock X voting stock Y 1 100% assets subject to liabilities A (individual) Shareholders 1 Appreciated property Historic Y assets & liabilities X Appreciated property X Step 1: Y transferred all of its assets subject to all of its liabilities “at the same time” A transferred appreciated property that Y desired to acquire. Step 2: Y liquidated, distributing all of its X stock to its shareholders. Ø The transfer by A of appreciated property to X and the transfer by Y of all of its assets subject to its liabilities to X were part of one plan. Ø Service concluded that X was organized for the purpose of enabling A to transfer the appreciated assets without the recognition of gain and as A did not control X within the meaning of section 368(c), gain is recognized by A. —› section 351 business purpose policy Ø The transfer by Y of all of its properties to X in exchange for voting stock of X and the assumption of Y's liabilities is a reorganization under section 368(a)(1)(F). Ø Is this revenue ruling still valid? Appears to contradict the F reorganization Final Regulations. 18

Distributions • Concurrent distributions are treated as separate from the F reorganization. • Treas. Reg. § 1. 368 -2(m)(3)(iii): “[A] potential F reorganization may qualify as a mere change even though a holder of stock in the transferor corporation receives a distribution of money or property from the transferor corporation or the resulting corporation. If a shareholder receives money or property (including in exchange for its shares) from the transferor corporation or the resulting corporation in a potential F reorganization that qualifies as [an F reorganization], then the receipt of money or other property (including any exchanged for shares), is treated as an unrelated, separate transaction, whether or not connected in the formal sense. ” 19

Distributions • Concurrent distributions are treated as separate from the F reorganization. • Treas. Reg. § 1. 368 -2(m)(3)(iii): “[A] potential F reorganization may qualify as a mere change even though a holder of stock in the transferor corporation receives a distribution of money or property from the transferor corporation or the resulting corporation. If a shareholder receives money or property (including in exchange for its shares) from the transferor corporation or the resulting corporation in a potential F reorganization that qualifies as [an F reorganization], then the receipt of money or other property (including any exchanged for shares), is treated as an unrelated, separate transaction, whether or not connected in the formal sense. ” 19

Distributions (cont. ) • The 2004 Proposed Regulations treated distributions as occurring immediately before the F reorganization. • Preamble to the 2015 Final Regulations: • “[T]he 2004 Proposed Regulations provided that, if a shareholder received money or other property (including in exchange for its shares) from the transferor Corporation or the Resulting Corporation in a transaction that constituted an F reorganization, the money or other property would be treated as distributed by the Transferor Corporation immediately before the transaction, not as additional consideration under 356(a). The preamble to the 2004 Proposed Regulations indicated that this treatment would also be appropriate for distributions of money or other property in E reorganizations. . Although the 2004 Proposed Regulations would have treated a distribution as occurring immediately before the transaction qualifying as an F reorganization, the Treasury Department and the IRS believe it is sufficient to treat the distribution as a separate transaction that occurs at the same time as the F reorganization. ” 20

Distributions (cont. ) • The 2004 Proposed Regulations treated distributions as occurring immediately before the F reorganization. • Preamble to the 2015 Final Regulations: • “[T]he 2004 Proposed Regulations provided that, if a shareholder received money or other property (including in exchange for its shares) from the transferor Corporation or the Resulting Corporation in a transaction that constituted an F reorganization, the money or other property would be treated as distributed by the Transferor Corporation immediately before the transaction, not as additional consideration under 356(a). The preamble to the 2004 Proposed Regulations indicated that this treatment would also be appropriate for distributions of money or other property in E reorganizations. . Although the 2004 Proposed Regulations would have treated a distribution as occurring immediately before the transaction qualifying as an F reorganization, the Treasury Department and the IRS believe it is sufficient to treat the distribution as a separate transaction that occurs at the same time as the F reorganization. ” 20

Reconsidering Distributions • But could the separate transaction be a recapitalization with boot? See, e. g. , Rev. Rul 84 -114. • The 2015 Final Regulations explain: “[I]f a Potential F Reorganization qualifies as an [F reorganization] and would also qualify as an [A, C, or D reorganization], then for all federal income tax purposes the Potential F Reorganization qualifies only as a reorganization under section 368(a)(1)(F) This rule does not apply to a reorganization within the meaning of 368(a)(1)(E). ” 21

Reconsidering Distributions • But could the separate transaction be a recapitalization with boot? See, e. g. , Rev. Rul 84 -114. • The 2015 Final Regulations explain: “[I]f a Potential F Reorganization qualifies as an [F reorganization] and would also qualify as an [A, C, or D reorganization], then for all federal income tax purposes the Potential F Reorganization qualifies only as a reorganization under section 368(a)(1)(F) This rule does not apply to a reorganization within the meaning of 368(a)(1)(E). ” 21

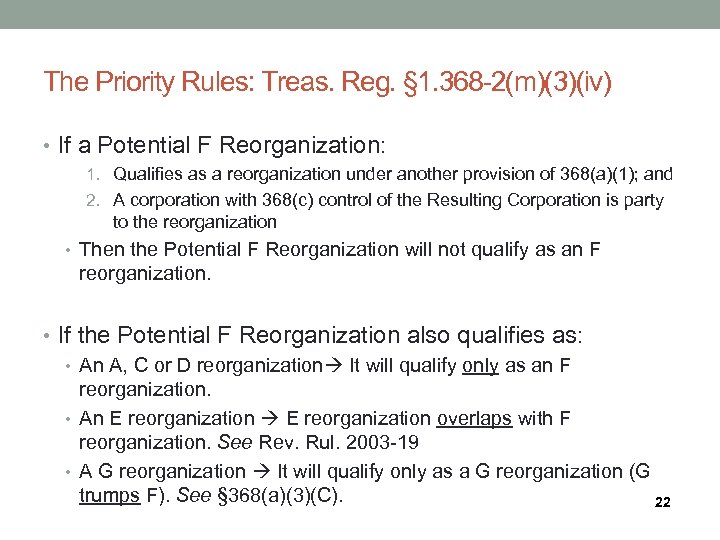

The Priority Rules: Treas. Reg. § 1. 368 -2(m)(3)(iv) • If a Potential F Reorganization: 1. Qualifies as a reorganization under another provision of 368(a)(1); and 2. A corporation with 368(c) control of the Resulting Corporation is party to the reorganization • Then the Potential F Reorganization will not qualify as an F reorganization. • If the Potential F Reorganization also qualifies as: • An A, C or D reorganization It will qualify only as an F reorganization. • An E reorganization overlaps with F reorganization. See Rev. Rul. 2003 -19 • A G reorganization It will qualify only as a G reorganization (G trumps F). See § 368(a)(3)(C). 22

The Priority Rules: Treas. Reg. § 1. 368 -2(m)(3)(iv) • If a Potential F Reorganization: 1. Qualifies as a reorganization under another provision of 368(a)(1); and 2. A corporation with 368(c) control of the Resulting Corporation is party to the reorganization • Then the Potential F Reorganization will not qualify as an F reorganization. • If the Potential F Reorganization also qualifies as: • An A, C or D reorganization It will qualify only as an F reorganization. • An E reorganization overlaps with F reorganization. See Rev. Rul. 2003 -19 • A G reorganization It will qualify only as a G reorganization (G trumps F). See § 368(a)(3)(C). 22

Outbound F Reorganizations • The 1990 Proposed Regulations were finalized without substantive change. • In an F reorganization where the Transferor Corporation is a domestic corporation and the Acquiring Corporation is a foreign corporation, there is deemed to be: • A § 361(a) transfer of assets by the transferor Corporation to the Acquiring Corporation in exchange for stock of the acquiring Corporation and the assumption of transferor Corporation liabilities; • A distribution of stock of the Acquiring Corporation by the transferor Corporation to its shareholders; and • A § 354(a) exchange by the Transferor Corporation’s shareholders of their Transferor Corporation stock for acquiring Corporation stock. Treas. Reg. § 1. 367(a)-1(e). • The taxable year of the domestic Transferor Corporation closes in an outbound F reorganization. Treas. Reg. § 1. 367(a)-1(e). 23

Outbound F Reorganizations • The 1990 Proposed Regulations were finalized without substantive change. • In an F reorganization where the Transferor Corporation is a domestic corporation and the Acquiring Corporation is a foreign corporation, there is deemed to be: • A § 361(a) transfer of assets by the transferor Corporation to the Acquiring Corporation in exchange for stock of the acquiring Corporation and the assumption of transferor Corporation liabilities; • A distribution of stock of the Acquiring Corporation by the transferor Corporation to its shareholders; and • A § 354(a) exchange by the Transferor Corporation’s shareholders of their Transferor Corporation stock for acquiring Corporation stock. Treas. Reg. § 1. 367(a)-1(e). • The taxable year of the domestic Transferor Corporation closes in an outbound F reorganization. Treas. Reg. § 1. 367(a)-1(e). 23