048525bd0a8eef5b6e79a33b25c96dbd.ppt

- Количество слайдов: 36

Mental Preparation For Stocks Investing (股票投資的心理準備)

Greed and Fear are detrimental to investor's return

After he finished college, Buffett invested $100 in a Dale Carnegie course: “… not to prevent my knees from knocking when public speaking but to do public speaking while my knees were knocking. ” --Buffett

• The purpose of this presentation: Not to prevent one from greed and fear when investing in stocks but to investing in stocks successfully while in greed and fear

股票投資的心理準備 • • • Prepare to Accept Reasonable Greed Prepare to Abandon Market Timing Prepare to Benefit from Market Volatility Prepare to Do Independent Research Prepare to KISS (Keep It Simple, Stupid) Stock Investing • Prepare to Do Performance Record & Company Story Check-up • Q&A

Prepare to Accept Reasonable Greed I've heard people say they'd be satisfied with a 25 or 30 percent annual return from the stock market! -- Lynch

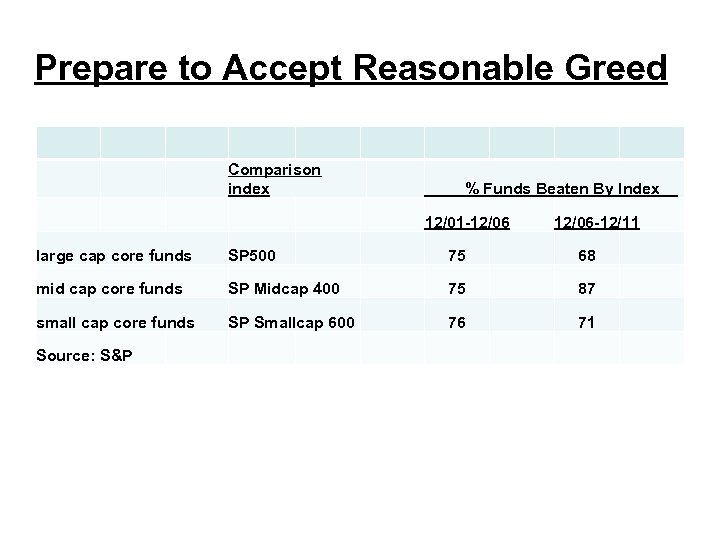

Prepare to Accept Reasonable Greed Comparison index % Funds Beaten By Index 12/01 -12/06 -12/11 large cap core funds SP 500 75 68 mid cap core funds SP Midcap 400 75 87 small cap core funds SP Smallcap 600 76 71 Source: S&P

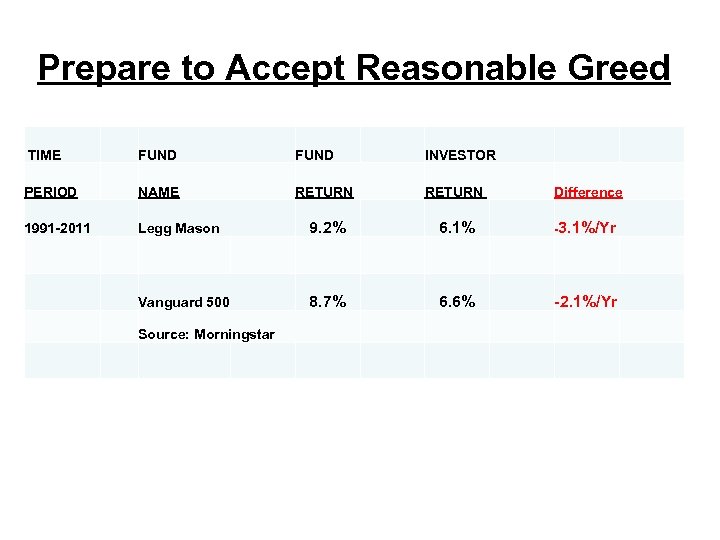

Prepare to Accept Reasonable Greed TIME FUND INVESTOR PERIOD NAME RETURN Difference 1991 -2011 Legg Mason 9. 2% 6. 1% -3. 1%/Yr Vanguard 500 8. 7% 6. 6% -2. 1%/Yr Source: Morningstar

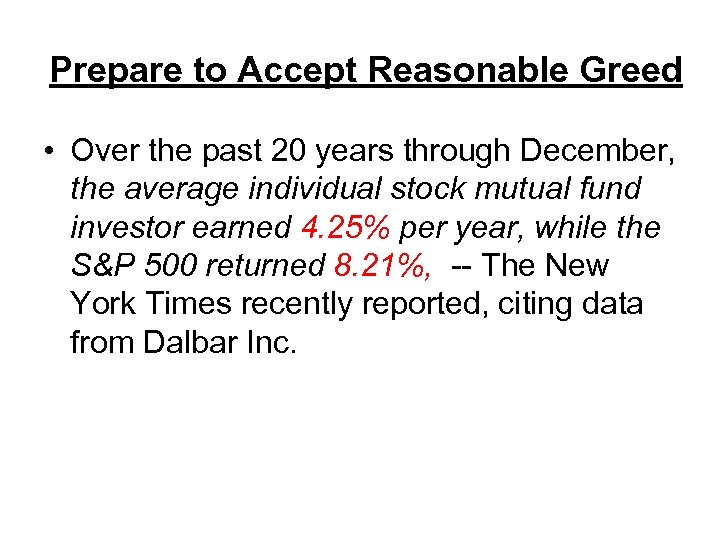

Prepare to Accept Reasonable Greed • Over the past 20 years through December, the average individual stock mutual fund investor earned 4. 25% per year, while the S&P 500 returned 8. 21%, -- The New York Times recently reported, citing data from Dalbar Inc.

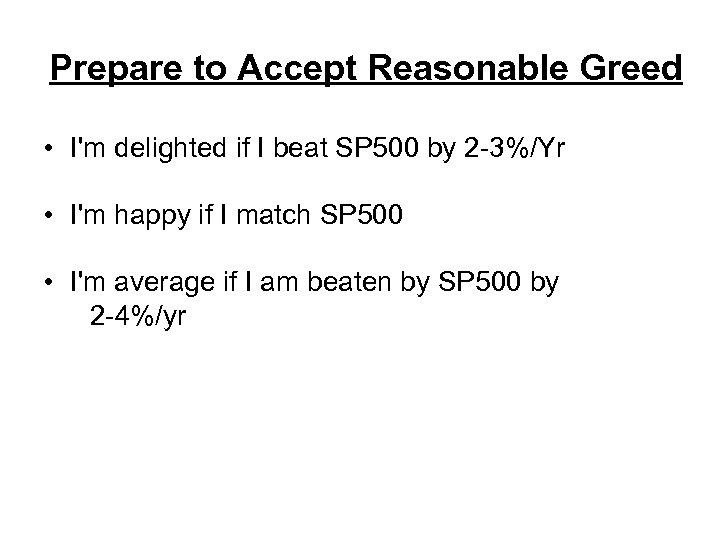

Prepare to Accept Reasonable Greed • I'm delighted if I beat SP 500 by 2 -3%/Yr • I'm happy if I match SP 500 • I'm average if I am beaten by SP 500 by 2 -4%/yr

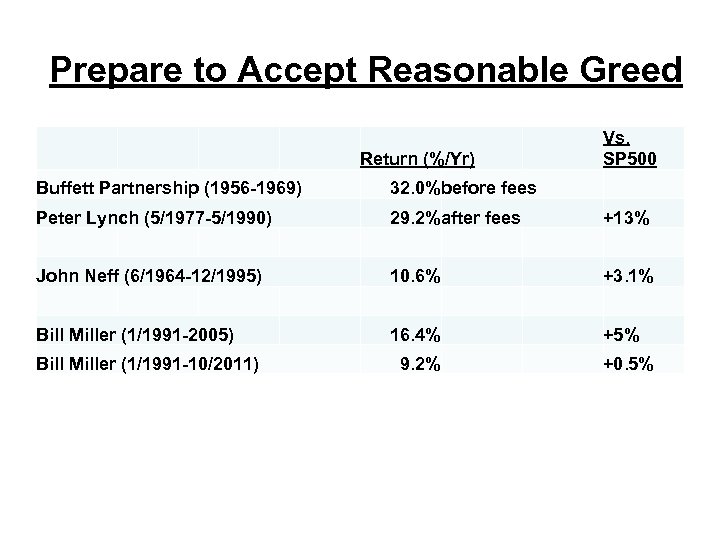

Prepare to Accept Reasonable Greed Return (%/Yr) Vs. SP 500 Buffett Partnership (1956 -1969) 32. 0%before fees Peter Lynch (5/1977 -5/1990) 29. 2%after fees +13% John Neff (6/1964 -12/1995) 10. 6% +3. 1% Bill Miller (1/1991 -2005) 16. 4% +5% Bill Miller (1/1991 -10/2011) 9. 2% +0. 5%

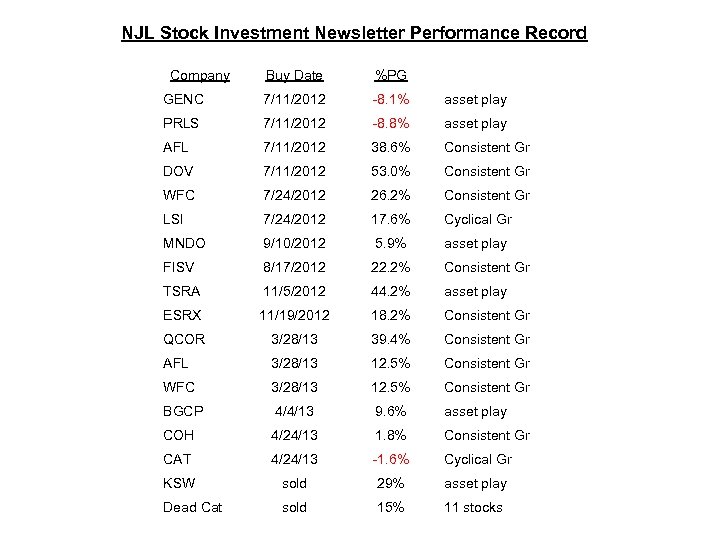

NJL Stock Investment Newsletter Performance Record Company Buy Date %PG GENC 7/11/2012 -8. 1% asset play PRLS 7/11/2012 -8. 8% asset play AFL 7/11/2012 38. 6% Consistent Gr DOV 7/11/2012 53. 0% Consistent Gr WFC 7/24/2012 26. 2% Consistent Gr LSI 7/24/2012 17. 6% Cyclical Gr MNDO 9/10/2012 5. 9% asset play FISV 8/17/2012 22. 2% Consistent Gr TSRA 11/5/2012 44. 2% asset play ESRX 11/19/2012 18. 2% Consistent Gr QCOR 3/28/13 39. 4% Consistent Gr AFL 3/28/13 12. 5% Consistent Gr WFC 3/28/13 12. 5% Consistent Gr BGCP 4/4/13 9. 6% asset play COH 4/24/13 1. 8% Consistent Gr CAT 4/24/13 -1. 6% Cyclical Gr KSW sold 29% asset play Dead Cat sold 15% 11 stocks

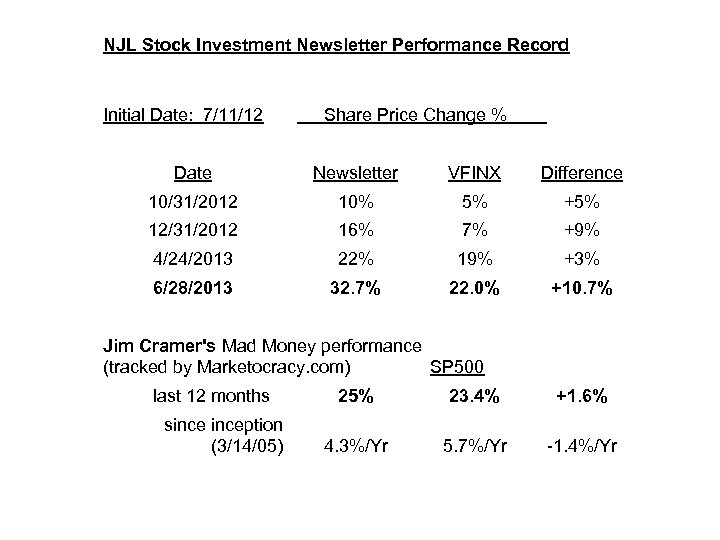

NJL Stock Investment Newsletter Performance Record Initial Date: 7/11/12 Share Price Change % Date Newsletter VFINX Difference 10/31/2012 10% 5% +5% 12/31/2012 16% 7% +9% 4/24/2013 22% 19% +3% 6/28/2013 32. 7% 22. 0% +10. 7% Jim Cramer's Mad Money performance (tracked by Marketocracy. com) SP 500 last 12 months sinception (3/14/05) 25% 23. 4% +1. 6% 4. 3%/Yr 5. 7%/Yr -1. 4%/Yr

Prepare to Abandon Market Timing Peter Lynch’s Cocktail Theory

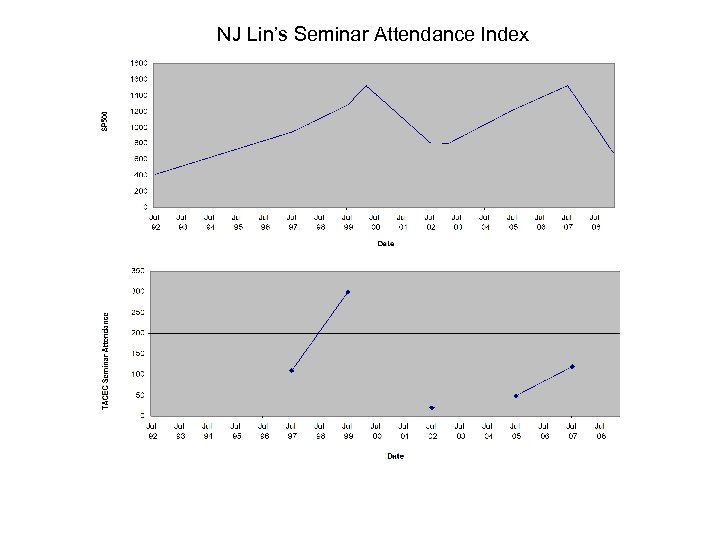

NJ Lin’s Seminar Attendance Index

Prepare to Abandon Market Timing *The small investors tend to be pessimistic and optimistic at precisely the wrong times, so it's self-defeating to try to invest in good markets and get out of bad ones. –Lynch *The only buy signal I need is to find a company I like. In that case, it's never too soon nor too late to buy shares -- Lynch

Prepare to Abandon Market Timing • As Stock market close to top, less companies meet the buy criteria, and as market close to bottom, more companies meet the buy criteria

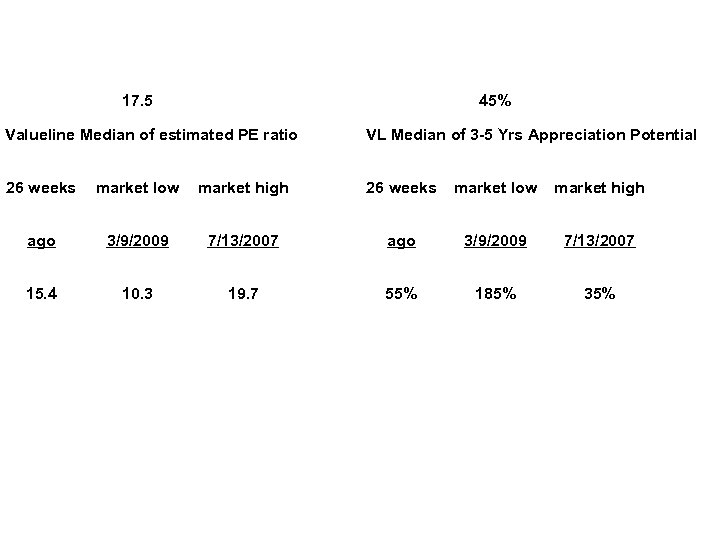

17. 5 45% Valueline Median of estimated PE ratio VL Median of 3 -5 Yrs Appreciation Potential 26 weeks market low market high ago 3/9/2009 7/13/2007 15. 4 10. 3 19. 7 55% 185% 35%

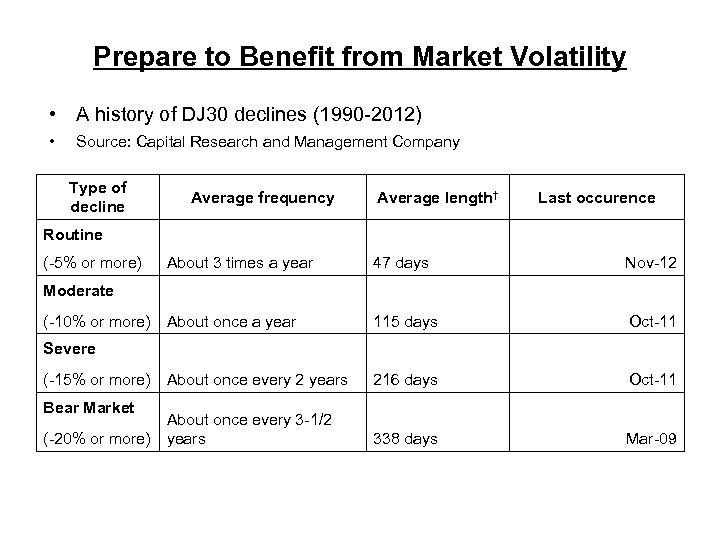

Prepare to Benefit from Market Volatility • A history of DJ 30 declines (1990 -2012) • Source: Capital Research and Management Company Type of decline Average frequency Average length† Last occurence Routine (-5% or more) About 3 times a year 47 days Nov-12 115 days Oct-11 216 days Oct-11 338 days Mar-09 Moderate (-10% or more) About once a year Severe (-15% or more) About once every 2 years Bear Market About once every 3 -1/2 (-20% or more) years

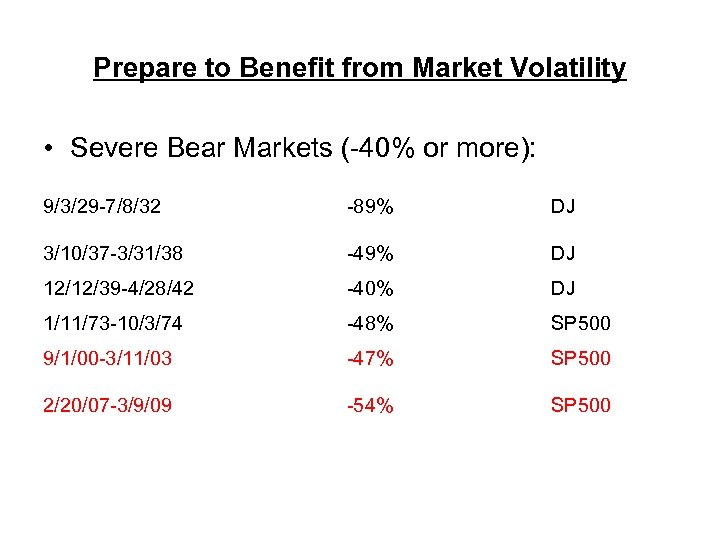

Prepare to Benefit from Market Volatility • Severe Bear Markets (-40% or more): 9/3/29 -7/8/32 -89% DJ 3/10/37 -3/31/38 -49% DJ 12/12/39 -4/28/42 -40% DJ 1/11/73 -10/3/74 -48% SP 500 9/1/00 -3/11/03 -47% SP 500 2/20/07 -3/9/09 -54% SP 500

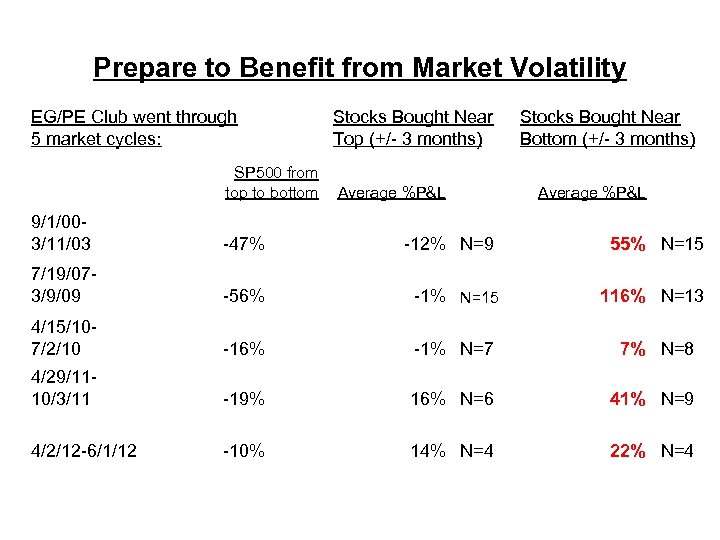

Prepare to Benefit from Market Volatility EG/PE Club went through 5 market cycles: Stocks Bought Near Top (+/- 3 months) SP 500 from top to bottom Average %P&L Stocks Bought Near Bottom (+/- 3 months) Average %P&L 9/1/003/11/03 -47% -12% N=9 55% N=15 7/19/073/9/09 -56% -1% N=15 116% N=13 4/15/107/2/10 -16% -1% N=7 7% N=8 4/29/1110/3/11 -19% 16% N=6 41% N=9 4/2/12 -6/1/12 -10% 14% N=4 22% N=4

Prepare to Benefit from Market Volatility Prepare your courage to buy more stocks when everyone has extreme fear about the market

Prepare to Do Independent Research • Ultimately, it is not the stock market nor even the companies that determine an investor's fate. It is the investor -- Lynch • The same couple that spends the weekend searching for the best deal on airfares to London buy 500 shares of KLM without having spent five minutes --Lynch • The only thing anyone wants to know is, ‘what are you buying today? ’ -- Buffett

Prepare to Do Independent Research • If you turn over 10 rocks, you may get 1 gem • You probably will spend about 1 hour to research 1 company

Prepare to KISS (Keep It Simple, Stupid) Stock Investing • Investing is not a game where the guy with the 160 IQ beats the guy with a 130 IQ. – Buffett • IQ fall somewhere above the bottom ten percent but also below the top three percent -- Lynch

Prepare to KISS (Keep It Simple, Stupid) Stock Investing • KISS Stock Investing: *Buy Growth Companies (high EGp) (Consistent Growth, Cyclical Growth, Turnaround Growth) at Reasonable Price (low PE) * Buy Asset Play Companies: Stock Price <Net Cash + Positive FCF (free cash flow)

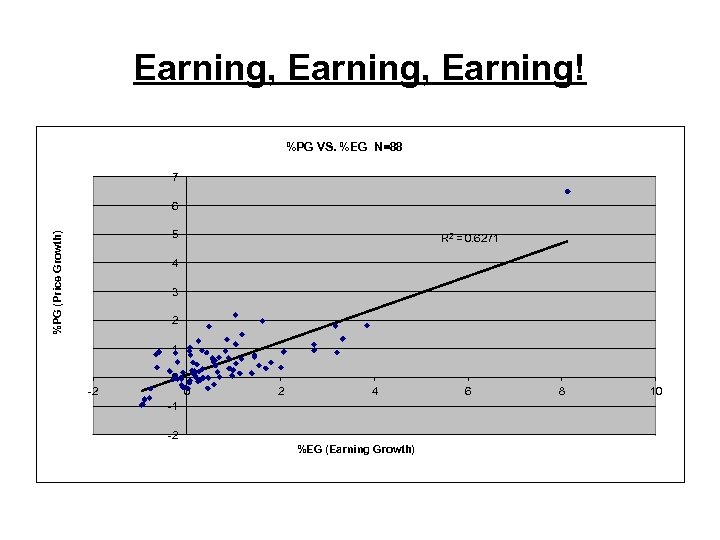

Earning, Earning! %PG VS. %EG N=88 7 6 %PG (Price Growth) 5 R 2 = 0. 6271 4 3 2 1 0 -2 0 2 4 -1 -2 %EG (Earning Growth) 6 8 10

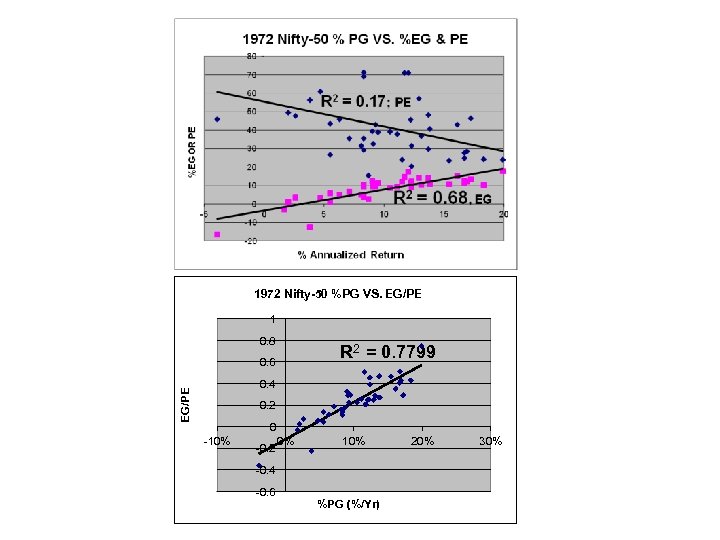

1972 Nifty-50 %PG VS. EG/PE 1 0. 8 R 2 = 0. 7799 0. 6 EG/PE 0. 4 0. 2 0 -10% -0. 2 0% 10% -0. 4 -0. 6 %PG (%/Yr) 20% 30%

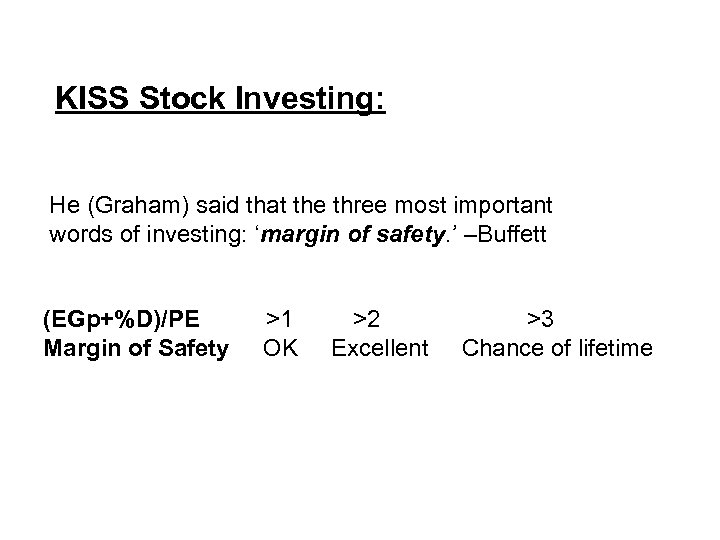

KISS Stock Investing: He (Graham) said that the three most important words of investing: ‘margin of safety. ’ –Buffett (EGp+%D)/PE >1 >2 >3 Margin of Safety OK Excellent Chance of lifetime

KISS Stock Investing: (EGp+%D)/PE < 0. 5 May consider to sell

More on EGp: (projected earning growth rate, %/Yr) *Like Wayne Gretzky says, go where the puck is going, not where it is. -- Buffett *Of course, the investor of today does not profit from yesterday’s growth -- Buffett *Earnings, or a promise of future earnings, give stocks their value -- Buffett

More on EGp: EGp is hard to predict, because Stocks Information Include: You Know You Don’t Know You Should Know You Don't Know GIGO (Garbage In Garbage Out)

Prepare to Do Performance Record & Company Story Check-up • Are you cutting the flowers and watering the weed? • The point is that fortunes change, there's no assurance that major companies won't become minor, and there's no such thing as a can't miss blue chip -- Lynch • If a stock is down but the fundamentals are positive, it's best to hold on and even better to buy more -- Lynch

Prepare to Do Performance Record & Company Story Check-up • WFC (Wells Fargo): This US 4 th largest bank made money during the 2008 financial crisis; it rank No. 1 among 10 large and regional bank peers for 5 -yr compounding annual earning growth rate (CAGR) • (1) It has the lowest cost of deposit and the lowest residential mortgage foreclosure rate. • (2) It achieves the highest return on asset. • (3) Warren Buffett's company owns 6. 5% of WFC. • (4) WFC is expected to grow EPS at 10%/Yr, and with its dividend yield of 2. 7%, • (5) the (EG+%D)/PE ratio of 1. 2 is respectable.

股市有時升有時落 升起免太歡喜 是賣Hot Stocks的好時機 May Sell When (EGp+%D)/PE < 0. 5 落下免太驚懍 是買Quality Stocks的好時刻 買Consistent Growth, Cyclical Growth & Turnaround Growth (EGp+%D)/PE >1 (OK) >2 (Excellent) >3 (Chance of Lifetime) 買Asset Play 不理股市升股市落 繼續投資 兩三個Market Cycles看輸贏

股票投資的心理準備 * To receive the content of the presentation or the Complimentary NJ Lin's Stock Investment Newsletter, please send your request to: nanjae@yahoo. com

048525bd0a8eef5b6e79a33b25c96dbd.ppt