8cfabda120ce22e592db8fddb1375afe.ppt

- Количество слайдов: 22

Medium-term Expenditure Framework - with Korea’s experience - Doyoung Min The World Bank Public Financial Management Workshop, Vientiane, Laos, May 23 -26, 2005

Medium-term Expenditure Framework - with Korea’s experience - Doyoung Min The World Bank Public Financial Management Workshop, Vientiane, Laos, May 23 -26, 2005

PE in World Bank • Objectives of PE – A critical ingredients in a country’s development – Poverty alleviation and creating an enabling environment for the private sector • PE issues in World Bank – In the WB matrix, PE covers every region and various sectors such as Public Finance and PREM – Public expenditure issues touch on virtually every aspect of the World Bank’s work 2

PE in World Bank • Objectives of PE – A critical ingredients in a country’s development – Poverty alleviation and creating an enabling environment for the private sector • PE issues in World Bank – In the WB matrix, PE covers every region and various sectors such as Public Finance and PREM – Public expenditure issues touch on virtually every aspect of the World Bank’s work 2

Public Expenditure • Public Expenditure Analysis (PEA) – “What” is to be done • Public Expenditure Management (PEM) – “How” it is to be done 3

Public Expenditure • Public Expenditure Analysis (PEA) – “What” is to be done • Public Expenditure Management (PEM) – “How” it is to be done 3

Public Expenditure Analysis (1) • The role of the state – Market failure and distributional inequity Government intervention – Improving efficiency of economy/distribution of income * Government failure vs. Market failure • Public spending and budget deficit – How is the deficit measured? – What is the composition of deficit financing? – What is the sustainable amount of fiscal deficit? 4

Public Expenditure Analysis (1) • The role of the state – Market failure and distributional inequity Government intervention – Improving efficiency of economy/distribution of income * Government failure vs. Market failure • Public spending and budget deficit – How is the deficit measured? – What is the composition of deficit financing? – What is the sustainable amount of fiscal deficit? 4

Public Expenditure Analysis (2) • Efficiency – Appropriate instrument for public intervention – Fiscal costs associated with public intervention – Impact of public intervention • Equity – What are key distributional objectives of PE? – How PE best meet these objectives? – How assess welfare impacts of PE? • Fiscal decentralization (Fiscal Federalism) 5

Public Expenditure Analysis (2) • Efficiency – Appropriate instrument for public intervention – Fiscal costs associated with public intervention – Impact of public intervention • Equity – What are key distributional objectives of PE? – How PE best meet these objectives? – How assess welfare impacts of PE? • Fiscal decentralization (Fiscal Federalism) 5

Basic Objectives of Public Expenditure Management • Level 1: Aggregate Fiscal Discipline (Budget totals as the result of explicit, enforced decisions) • Level 2: Allocative Efficiency (Expenditure according to government priorities and effectiveness of public programs) • Level 3: Operational Efficiency 6

Basic Objectives of Public Expenditure Management • Level 1: Aggregate Fiscal Discipline (Budget totals as the result of explicit, enforced decisions) • Level 2: Allocative Efficiency (Expenditure according to government priorities and effectiveness of public programs) • Level 3: Operational Efficiency 6

Key components of PEM • MTEF – Linking policy, planning and budgeting • Performance management • Integrated Financial management information system (IFMIS) • Fiscal transparency 7

Key components of PEM • MTEF – Linking policy, planning and budgeting • Performance management • Integrated Financial management information system (IFMIS) • Fiscal transparency 7

Medium-Term Expenditure Framework

Medium-Term Expenditure Framework

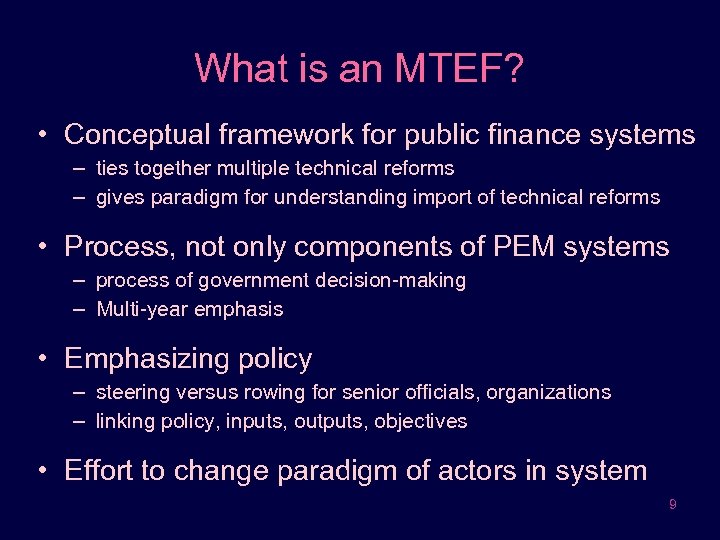

What is an MTEF? • Conceptual framework for public finance systems – ties together multiple technical reforms – gives paradigm for understanding import of technical reforms • Process, not only components of PEM systems – process of government decision-making – Multi-year emphasis • Emphasizing policy – steering versus rowing for senior officials, organizations – linking policy, inputs, outputs, objectives • Effort to change paradigm of actors in system 9

What is an MTEF? • Conceptual framework for public finance systems – ties together multiple technical reforms – gives paradigm for understanding import of technical reforms • Process, not only components of PEM systems – process of government decision-making – Multi-year emphasis • Emphasizing policy – steering versus rowing for senior officials, organizations – linking policy, inputs, outputs, objectives • Effort to change paradigm of actors in system 9

Objectives of MTEF • Improve macrofiscal situation – lower deficits, improved economic growth – more rational approach to retrenchment and economic stabilization • Improve impact of Government policy – link between government priorities/policies and government programs • Improve program performance/impact – Shift bureaucracy from administrative to managerial culture • Managerial flexibility & innovation: lower cost/output; greater effectiveness of programs/policies – Improved resource predictability 10

Objectives of MTEF • Improve macrofiscal situation – lower deficits, improved economic growth – more rational approach to retrenchment and economic stabilization • Improve impact of Government policy – link between government priorities/policies and government programs • Improve program performance/impact – Shift bureaucracy from administrative to managerial culture • Managerial flexibility & innovation: lower cost/output; greater effectiveness of programs/policies – Improved resource predictability 10

MTEF: New Budget Process • Stage 1. Macroeconomic and public sector envelopes • Stage 2. High-level policy: aligning policies & objectives under resource constraints • Stage 3. Linking policy, resources, and means by sector • Stage 4. Reconciling resources with means • Stage 5. Reconciling strategic policy and means 11

MTEF: New Budget Process • Stage 1. Macroeconomic and public sector envelopes • Stage 2. High-level policy: aligning policies & objectives under resource constraints • Stage 3. Linking policy, resources, and means by sector • Stage 4. Reconciling resources with means • Stage 5. Reconciling strategic policy and means 11

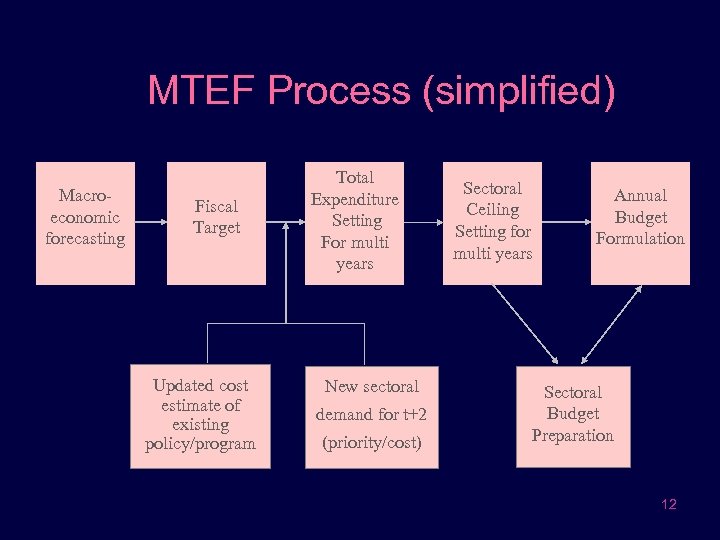

MTEF Process (simplified) Macroeconomic forecasting Fiscal Target Updated cost estimate of existing policy/program Total Expenditure Setting For multi years New sectoral demand for t+2 (priority/cost) Sectoral Ceiling Setting for multi years Annual Budget Formulation Sectoral Budget Preparation 12

MTEF Process (simplified) Macroeconomic forecasting Fiscal Target Updated cost estimate of existing policy/program Total Expenditure Setting For multi years New sectoral demand for t+2 (priority/cost) Sectoral Ceiling Setting for multi years Annual Budget Formulation Sectoral Budget Preparation 12

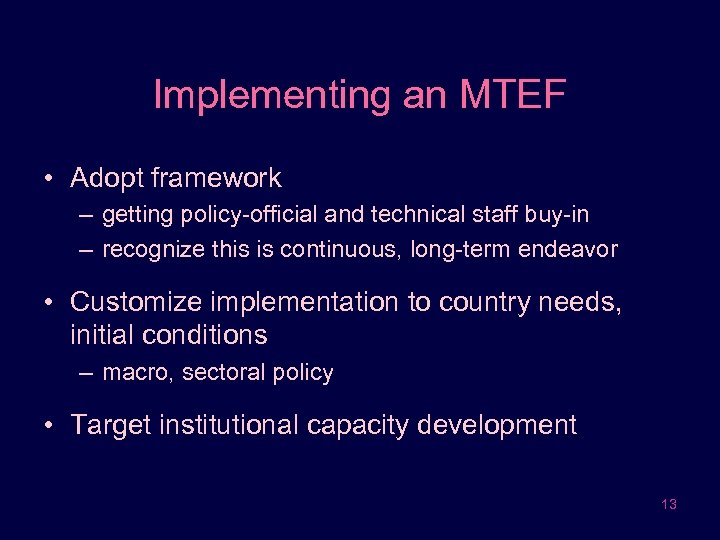

Implementing an MTEF • Adopt framework – getting policy-official and technical staff buy-in – recognize this is continuous, long-term endeavor • Customize implementation to country needs, initial conditions – macro, sectoral policy • Target institutional capacity development 13

Implementing an MTEF • Adopt framework – getting policy-official and technical staff buy-in – recognize this is continuous, long-term endeavor • Customize implementation to country needs, initial conditions – macro, sectoral policy • Target institutional capacity development 13

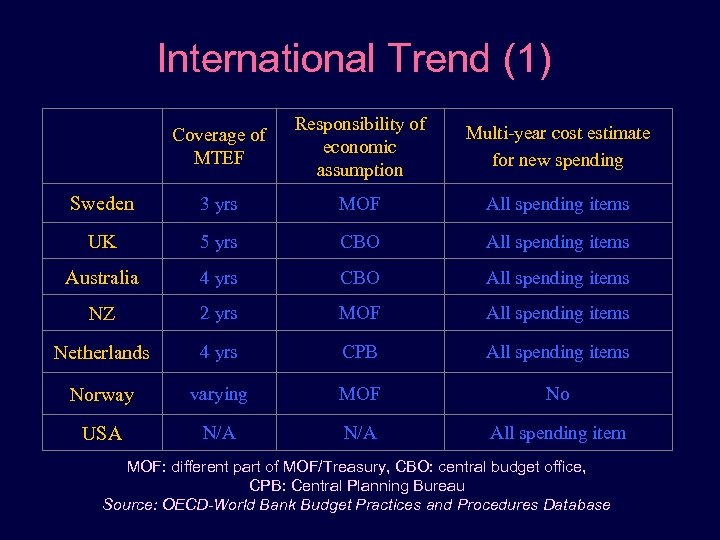

International Trend (1) Coverage of MTEF Responsibility of economic assumption Multi-year cost estimate for new spending Sweden 3 yrs MOF All spending items UK 5 yrs CBO All spending items Australia 4 yrs CBO All spending items NZ 2 yrs MOF All spending items Netherlands 4 yrs CPB All spending items Norway varying MOF No USA N/A All spending item MOF: different part of MOF/Treasury, CBO: central budget office, CPB: Central Planning Bureau Source: OECD-World Bank Budget Practices and Procedures Database

International Trend (1) Coverage of MTEF Responsibility of economic assumption Multi-year cost estimate for new spending Sweden 3 yrs MOF All spending items UK 5 yrs CBO All spending items Australia 4 yrs CBO All spending items NZ 2 yrs MOF All spending items Netherlands 4 yrs CPB All spending items Norway varying MOF No USA N/A All spending item MOF: different part of MOF/Treasury, CBO: central budget office, CPB: Central Planning Bureau Source: OECD-World Bank Budget Practices and Procedures Database

International Trend (2) Basis of setting spending limit for ministries Final decision on ministries’ spending Arrangement in congress to establish total budget before individual item Sweden MTEF Prime Minister Yes UK MTEF MOF No Australia MTEF Cabinet No NZ MTEF Cabinet No Netherlands MTEF Cabinet Yes Norway N/A Cabinet Yes USA Suggestion only President Yes Source: OECD-World Bank Budget Practices and Procedures Database

International Trend (2) Basis of setting spending limit for ministries Final decision on ministries’ spending Arrangement in congress to establish total budget before individual item Sweden MTEF Prime Minister Yes UK MTEF MOF No Australia MTEF Cabinet No NZ MTEF Cabinet No Netherlands MTEF Cabinet Yes Norway N/A Cabinet Yes USA Suggestion only President Yes Source: OECD-World Bank Budget Practices and Procedures Database

Lessons from International Experiences • Integration of multi-year planning with annual budget – MTEF and annual budgeting is ‘one’ process • Honest/realistic macroeconomic forecasting • Separation of total budget from detailed program • Clarification of new roles of MOF/line ministries • Capacity building and incentives for MOF/LMs • Development of feedback mechanism 16

Lessons from International Experiences • Integration of multi-year planning with annual budget – MTEF and annual budgeting is ‘one’ process • Honest/realistic macroeconomic forecasting • Separation of total budget from detailed program • Clarification of new roles of MOF/line ministries • Capacity building and incentives for MOF/LMs • Development of feedback mechanism 16

Korea’s Experience and Lessons

Korea’s Experience and Lessons

Why MTEF? • Short-term Perspective with Bottom-up Approach – Yearly based revenues and expenditures – Weak linkage between national policy priorities and budgeting • Future Fiscal Risk – Social welfare expenditure demands/rapidly aging population • Inefficiency from Managerial Inflexibility – Limited autonomy to plan policy and implement budget 18

Why MTEF? • Short-term Perspective with Bottom-up Approach – Yearly based revenues and expenditures – Weak linkage between national policy priorities and budgeting • Future Fiscal Risk – Social welfare expenditure demands/rapidly aging population • Inefficiency from Managerial Inflexibility – Limited autonomy to plan policy and implement budget 18

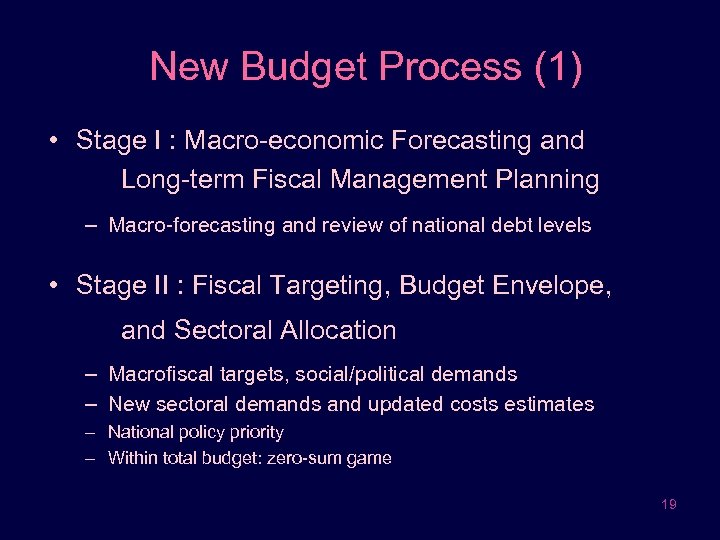

New Budget Process (1) • Stage I : Macro-economic Forecasting and Long-term Fiscal Management Planning – Macro-forecasting and review of national debt levels • Stage II : Fiscal Targeting, Budget Envelope, and Sectoral Allocation – Macrofiscal targets, social/political demands – New sectoral demands and updated costs estimates – National policy priority – Within total budget: zero-sum game 19

New Budget Process (1) • Stage I : Macro-economic Forecasting and Long-term Fiscal Management Planning – Macro-forecasting and review of national debt levels • Stage II : Fiscal Targeting, Budget Envelope, and Sectoral Allocation – Macrofiscal targets, social/political demands – New sectoral demands and updated costs estimates – National policy priority – Within total budget: zero-sum game 19

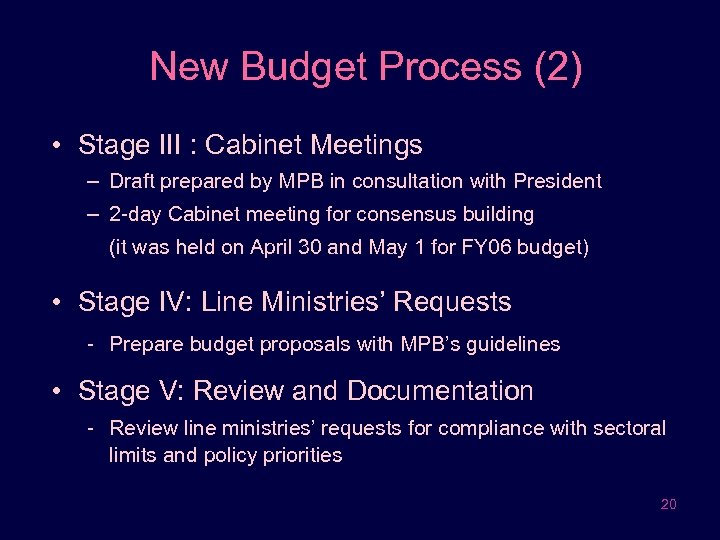

New Budget Process (2) • Stage III : Cabinet Meetings – Draft prepared by MPB in consultation with President – 2 -day Cabinet meeting for consensus building (it was held on April 30 and May 1 for FY 06 budget) • Stage IV: Line Ministries’ Requests - Prepare budget proposals with MPB’s guidelines • Stage V: Review and Documentation - Review line ministries’ requests for compliance with sectoral limits and policy priorities 20

New Budget Process (2) • Stage III : Cabinet Meetings – Draft prepared by MPB in consultation with President – 2 -day Cabinet meeting for consensus building (it was held on April 30 and May 1 for FY 06 budget) • Stage IV: Line Ministries’ Requests - Prepare budget proposals with MPB’s guidelines • Stage V: Review and Documentation - Review line ministries’ requests for compliance with sectoral limits and policy priorities 20

Conclusion • Generally, on the right track – MTEF along with other fiscal reforms: Performance management, Program budgeting, and IFIMS • Track Record of Linking Budgeting to Planning – Economic Planning Board (EPB), 1961 -1994 • Strong Leadership: President and MPB – promote the National Reforms • Well-trained technocrats 21

Conclusion • Generally, on the right track – MTEF along with other fiscal reforms: Performance management, Program budgeting, and IFIMS • Track Record of Linking Budgeting to Planning – Economic Planning Board (EPB), 1961 -1994 • Strong Leadership: President and MPB – promote the National Reforms • Well-trained technocrats 21

Challenges remained • Integrate NFMP with Annual budget • Establish Performance management system – MTEF and Performance management • Strengthen Macro-forecasting capacity – MPB and MOFE • Capacity building: MPB and LMs • Autonomy and Accountability – New role of MPB and LMs 22

Challenges remained • Integrate NFMP with Annual budget • Establish Performance management system – MTEF and Performance management • Strengthen Macro-forecasting capacity – MPB and MOFE • Capacity building: MPB and LMs • Autonomy and Accountability – New role of MPB and LMs 22