3d1fe7c1761d9995b81b62d79ba08e41.ppt

- Количество слайдов: 55

Medicare Part D: Critical Updates for Infusion Providers A National Home Infusion Association Audioconference Sponsored by Innovatix, LLC March 16, 2005 12: 00 noon -1: 30 pm EST

Medicare Part D: Critical Updates for Infusion Providers A National Home Infusion Association Audioconference Sponsored by Innovatix, LLC March 16, 2005 12: 00 noon -1: 30 pm EST

Presenters • Lorrie Kline Kaplan NHIA Executive Director • Bruce Rodman NHIA Director of Health Information Policy • Alan Parver Counsel to NHIA , Powell Goldstein LLP • Dan Boston Exec. VP & Partner, Health Policy Source 2

Presenters • Lorrie Kline Kaplan NHIA Executive Director • Bruce Rodman NHIA Director of Health Information Policy • Alan Parver Counsel to NHIA , Powell Goldstein LLP • Dan Boston Exec. VP & Partner, Health Policy Source 2

Medicare Part D: Two pathways of activity right now for our community • Aggressive advocacy: FIX THE PROBLEMS • Work with CMS, Congress, the Administration, Part D, and MA plans • Education and information on the benefit as written • Prepare providers to make sound business decisions regarding participation in the program • Assist Part D plans in understanding distinct issues associated with home infusion 3

Medicare Part D: Two pathways of activity right now for our community • Aggressive advocacy: FIX THE PROBLEMS • Work with CMS, Congress, the Administration, Part D, and MA plans • Education and information on the benefit as written • Prepare providers to make sound business decisions regarding participation in the program • Assist Part D plans in understanding distinct issues associated with home infusion 3

Medicare Part D: Positive Components for Home Infusion • “Only specialized infusion pharmacies can provide home infusion therapies” • Part D plans must demonstrate that they provide access to home infusion pharmacies • Part D plans can establish distinct quality standards for home infusion drugs for the protection of beneficiaries 4

Medicare Part D: Positive Components for Home Infusion • “Only specialized infusion pharmacies can provide home infusion therapies” • Part D plans must demonstrate that they provide access to home infusion pharmacies • Part D plans can establish distinct quality standards for home infusion drugs for the protection of beneficiaries 4

Medicare Part D: Positive Components for Home Infusion • Part D plans can negotiate different dispensing fees or drug reimbursement to reflect increased costs of providing infusion therapies • Significant problems remain for home infusion—no precedent for most aspects of the plan 5

Medicare Part D: Positive Components for Home Infusion • Part D plans can negotiate different dispensing fees or drug reimbursement to reflect increased costs of providing infusion therapies • Significant problems remain for home infusion—no precedent for most aspects of the plan 5

Home Infusion Under Part D 6

Home Infusion Under Part D 6

Part D Prescription Drug Plans • Two Types Of Plans Available: – Stand-Alone Coverage Of Part D Drugs • a/k/a Prescription Drug Plans (PDPs) • Standard Coverage Or Actuarial Equivalent – Most Medicare Advantage (Part C) Plans Must Offer Part D Benefit To Members • a/k/a Medicare Advantage – Prescription Drug Plans (MA-PD Plans) 7

Part D Prescription Drug Plans • Two Types Of Plans Available: – Stand-Alone Coverage Of Part D Drugs • a/k/a Prescription Drug Plans (PDPs) • Standard Coverage Or Actuarial Equivalent – Most Medicare Advantage (Part C) Plans Must Offer Part D Benefit To Members • a/k/a Medicare Advantage – Prescription Drug Plans (MA-PD Plans) 7

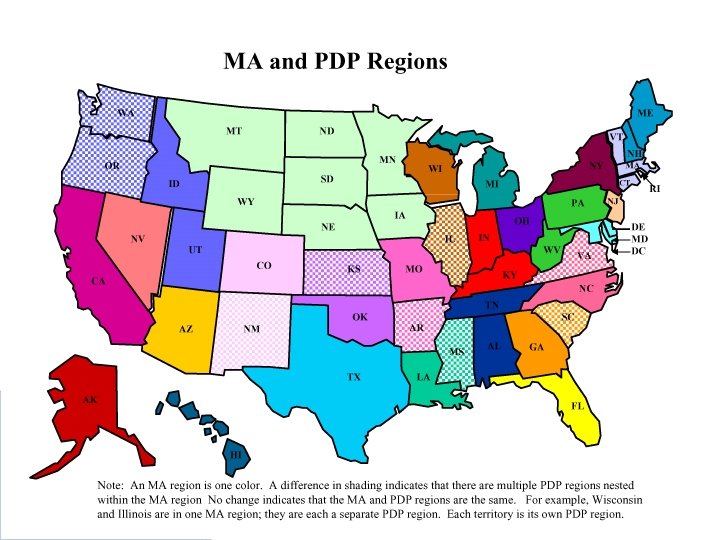

Part D Plans • Plans compete based on premiums and negotiated drug prices • At least 2 plans per region (34 regions) – At least 1 must be a stand-alone PDP • No limit on number of approved plans 8

Part D Plans • Plans compete based on premiums and negotiated drug prices • At least 2 plans per region (34 regions) – At least 1 must be a stand-alone PDP • No limit on number of approved plans 8

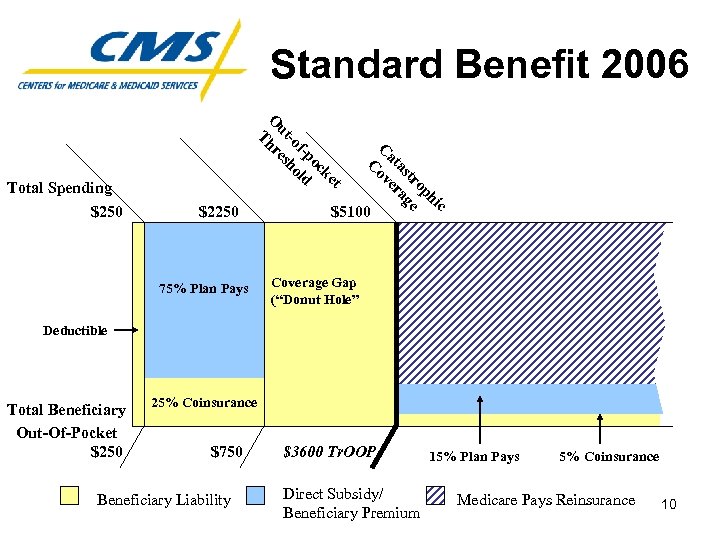

Standard Benefit 2006 $2250 75% Plan Pays c hi op tr e as ag at er C ov C t ke oc f-p ld -o ho ut es O hr T Total Spending $250 $5100 Coverage Gap (“Donut Hole” $+ Deductible ≈ 95% Total Beneficiary Out-Of-Pocket $250 25% Coinsurance $750 Beneficiary Liability $3600 Tr. OOP Direct Subsidy/ Beneficiary Premium 15% Plan Pays 5% Coinsurance Medicare Pays Reinsurance 10

Standard Benefit 2006 $2250 75% Plan Pays c hi op tr e as ag at er C ov C t ke oc f-p ld -o ho ut es O hr T Total Spending $250 $5100 Coverage Gap (“Donut Hole” $+ Deductible ≈ 95% Total Beneficiary Out-Of-Pocket $250 25% Coinsurance $750 Beneficiary Liability $3600 Tr. OOP Direct Subsidy/ Beneficiary Premium 15% Plan Pays 5% Coinsurance Medicare Pays Reinsurance 10

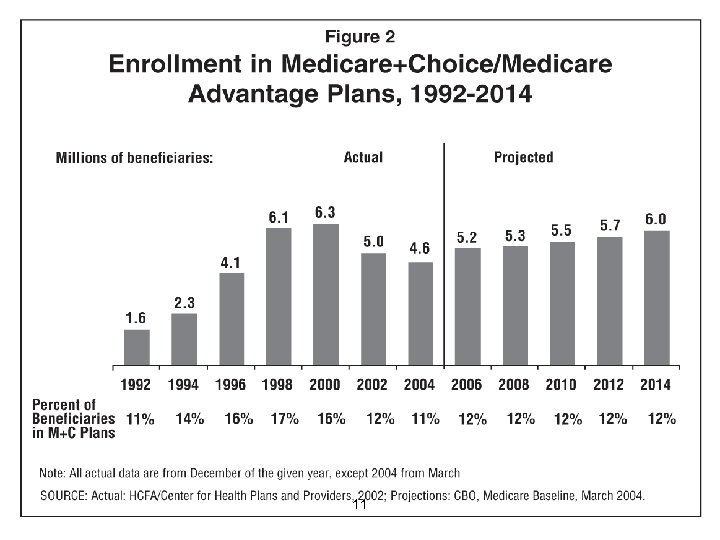

11

11

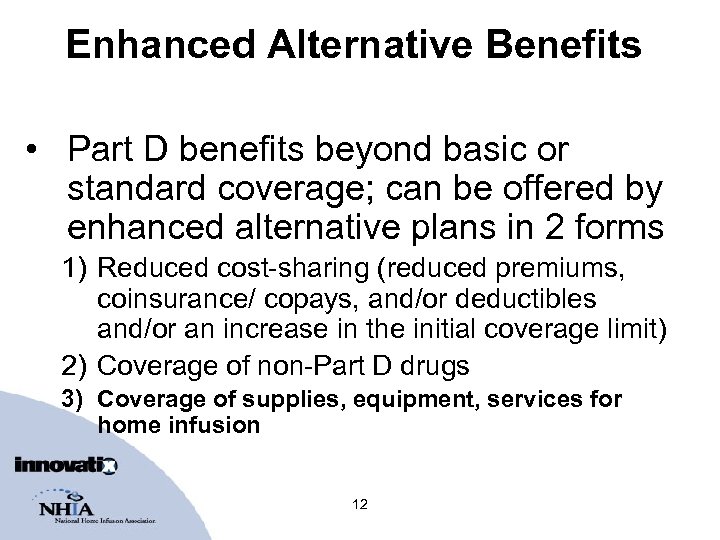

Enhanced Alternative Benefits • Part D benefits beyond basic or standard coverage; can be offered by enhanced alternative plans in 2 forms 1) Reduced cost-sharing (reduced premiums, coinsurance/ copays, and/or deductibles and/or an increase in the initial coverage limit) 2) Coverage of non-Part D drugs 3) Coverage of supplies, equipment, services for home infusion 12

Enhanced Alternative Benefits • Part D benefits beyond basic or standard coverage; can be offered by enhanced alternative plans in 2 forms 1) Reduced cost-sharing (reduced premiums, coinsurance/ copays, and/or deductibles and/or an increase in the initial coverage limit) 2) Coverage of non-Part D drugs 3) Coverage of supplies, equipment, services for home infusion 12

MA-PD Issues/Considerations • Home infusion is part of the medical benefit for most Medicare managed care (MA) plans • How does Part D affect current programs? • Will home infusion drugs be subject to donut hole? – Standard benefit –likely – Enhanced alternative—not necessarily 13

MA-PD Issues/Considerations • Home infusion is part of the medical benefit for most Medicare managed care (MA) plans • How does Part D affect current programs? • Will home infusion drugs be subject to donut hole? – Standard benefit –likely – Enhanced alternative—not necessarily 13

14

14

Low Income Subsidies • Who is eligible? – Medicare-Medicaid dual-eligibles – Part D enrollees with income < 135% FPL • Up to $12, 569 (2004) and assets <$6, 000 for individuals – Part D enrollees with incomes 135 -150% FPL • $12, 569 -$13, 965 (2004) and assets <$10, 000 15

Low Income Subsidies • Who is eligible? – Medicare-Medicaid dual-eligibles – Part D enrollees with income < 135% FPL • Up to $12, 569 (2004) and assets <$6, 000 for individuals – Part D enrollees with incomes 135 -150% FPL • $12, 569 -$13, 965 (2004) and assets <$10, 000 15

Special Issues for Medicaid and Low-Income Enrollees • Dual-eligibles – Auto-enrollment – Medicaid will no longer cover drugs for dualeligibles • Major concerns for long-term care providers or others with high Medicaid % 16

Special Issues for Medicaid and Low-Income Enrollees • Dual-eligibles – Auto-enrollment – Medicaid will no longer cover drugs for dualeligibles • Major concerns for long-term care providers or others with high Medicaid % 16

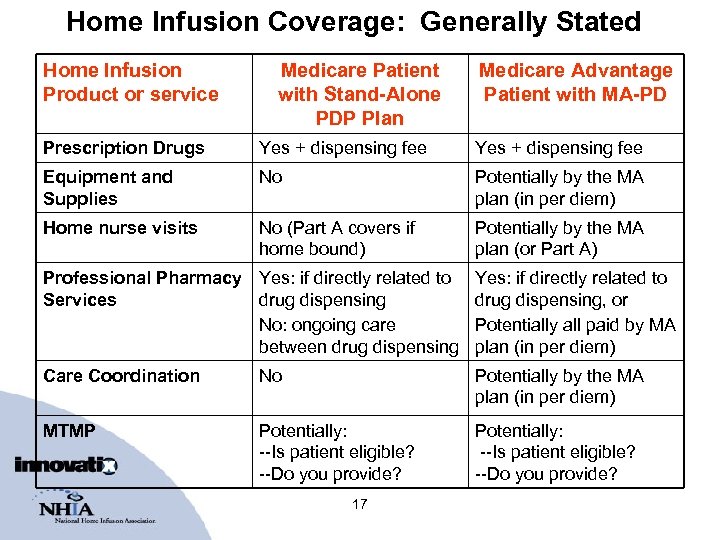

Home Infusion Coverage: Generally Stated Home Infusion Product or service Medicare Patient with Stand-Alone PDP Plan Medicare Advantage Patient with MA-PD Prescription Drugs Yes + dispensing fee Equipment and Supplies No Potentially by the MA plan (in per diem) Home nurse visits No (Part A covers if home bound) Potentially by the MA plan (or Part A) Professional Pharmacy Yes: if directly related to Services drug dispensing No: ongoing care between drug dispensing Yes: if directly related to drug dispensing, or Potentially all paid by MA plan (in per diem) Care Coordination No Potentially by the MA plan (in per diem) MTMP Potentially: --Is patient eligible? --Do you provide? 17

Home Infusion Coverage: Generally Stated Home Infusion Product or service Medicare Patient with Stand-Alone PDP Plan Medicare Advantage Patient with MA-PD Prescription Drugs Yes + dispensing fee Equipment and Supplies No Potentially by the MA plan (in per diem) Home nurse visits No (Part A covers if home bound) Potentially by the MA plan (or Part A) Professional Pharmacy Yes: if directly related to Services drug dispensing No: ongoing care between drug dispensing Yes: if directly related to drug dispensing, or Potentially all paid by MA plan (in per diem) Care Coordination No Potentially by the MA plan (in per diem) MTMP Potentially: --Is patient eligible? --Do you provide? 17

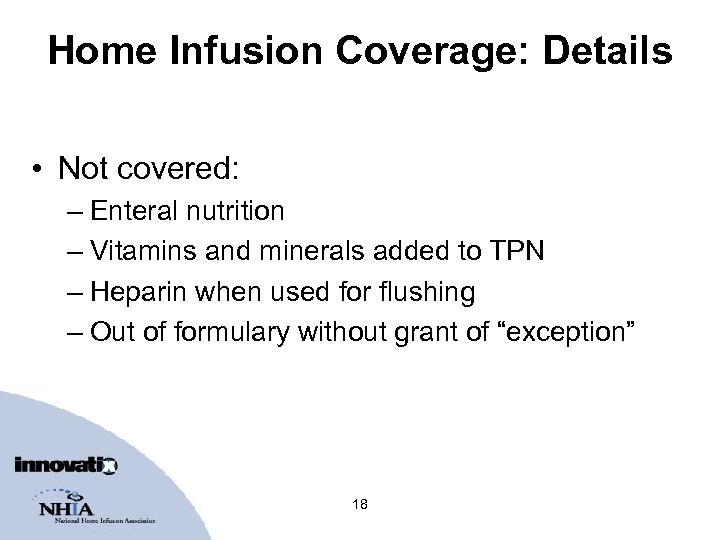

Home Infusion Coverage: Details • Not covered: – Enteral nutrition – Vitamins and minerals added to TPN – Heparin when used for flushing – Out of formulary without grant of “exception” 18

Home Infusion Coverage: Details • Not covered: – Enteral nutrition – Vitamins and minerals added to TPN – Heparin when used for flushing – Out of formulary without grant of “exception” 18

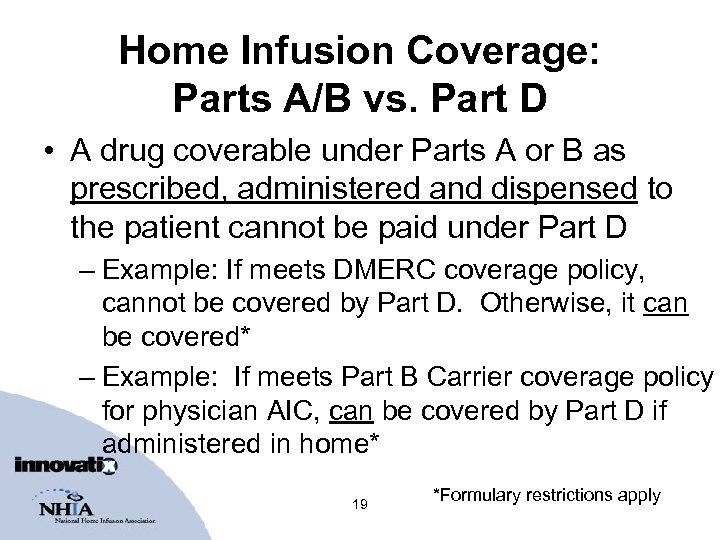

Home Infusion Coverage: Parts A/B vs. Part D • A drug coverable under Parts A or B as prescribed, administered and dispensed to the patient cannot be paid under Part D – Example: If meets DMERC coverage policy, cannot be covered by Part D. Otherwise, it can be covered* – Example: If meets Part B Carrier coverage policy for physician AIC, can be covered by Part D if administered in home* 19 *Formulary restrictions apply

Home Infusion Coverage: Parts A/B vs. Part D • A drug coverable under Parts A or B as prescribed, administered and dispensed to the patient cannot be paid under Part D – Example: If meets DMERC coverage policy, cannot be covered by Part D. Otherwise, it can be covered* – Example: If meets Part B Carrier coverage policy for physician AIC, can be covered by Part D if administered in home* 19 *Formulary restrictions apply

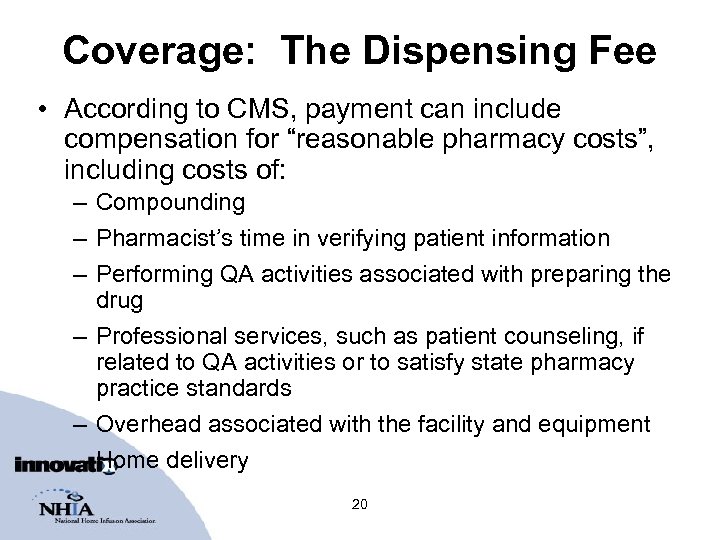

Coverage: The Dispensing Fee • According to CMS, payment can include compensation for “reasonable pharmacy costs”, including costs of: – Compounding – Pharmacist’s time in verifying patient information – Performing QA activities associated with preparing the drug – Professional services, such as patient counseling, if related to QA activities or to satisfy state pharmacy practice standards – Overhead associated with the facility and equipment – Home delivery 20

Coverage: The Dispensing Fee • According to CMS, payment can include compensation for “reasonable pharmacy costs”, including costs of: – Compounding – Pharmacist’s time in verifying patient information – Performing QA activities associated with preparing the drug – Professional services, such as patient counseling, if related to QA activities or to satisfy state pharmacy practice standards – Overhead associated with the facility and equipment – Home delivery 20

Coverage: Dispensing Fee (2) • Different dispensing fee could be established for home infusion pharmacies vs. retail pharmacies • PDPs and MA-PDs not supposed to reimburse in the dispensing fee for: – Equipment and supplies – Care coordination – Professional pharmacy services unrelated to dispensing nor compensated through MTMP – Nursing visits • However… 21

Coverage: Dispensing Fee (2) • Different dispensing fee could be established for home infusion pharmacies vs. retail pharmacies • PDPs and MA-PDs not supposed to reimburse in the dispensing fee for: – Equipment and supplies – Care coordination – Professional pharmacy services unrelated to dispensing nor compensated through MTMP – Nursing visits • However… 21

Coverage: What About Rates? • Concept of Part D: market forces set rates – No Medicare fee schedules or allowances • Drug payment is negotiable – Does not have to be ASP-based • Dispensing fee is negotiable • Both rates must be sufficient to ensure access 22

Coverage: What About Rates? • Concept of Part D: market forces set rates – No Medicare fee schedules or allowances • Drug payment is negotiable – Does not have to be ASP-based • Dispensing fee is negotiable • Both rates must be sufficient to ensure access 22

No Secondary Coverage? • CMS: “Enrollees will have access to home infusion services, though they may have to pay for supplies, equipment, and professional services out-of-pocket particularly if they are enrolled in a Part D plan – especially a standalone PDP—and have no source of supplemental coverage” • If you participate, must you accept all patients? – Probably a contractual issue • Are these patients “appropriate for home infusion”? 23

No Secondary Coverage? • CMS: “Enrollees will have access to home infusion services, though they may have to pay for supplies, equipment, and professional services out-of-pocket particularly if they are enrolled in a Part D plan – especially a standalone PDP—and have no source of supplemental coverage” • If you participate, must you accept all patients? – Probably a contractual issue • Are these patients “appropriate for home infusion”? 23

Your Costs for Coordination of Benefits (COB) • Patients may have secondary coverage for the drug and Part D plans must coordinate with: – – – – – State Pharmaceutical Assistance Programs (SPAPs) Medicaid programs (including 1115 waiver programs) Group health plans FEHBP plans TRICARE and VA Indian Health Service (IHS) Rural Health Centers Federally Qualified Health Centers Other entities as CMS determines 24

Your Costs for Coordination of Benefits (COB) • Patients may have secondary coverage for the drug and Part D plans must coordinate with: – – – – – State Pharmaceutical Assistance Programs (SPAPs) Medicaid programs (including 1115 waiver programs) Group health plans FEHBP plans TRICARE and VA Indian Health Service (IHS) Rural Health Centers Federally Qualified Health Centers Other entities as CMS determines 24

Your Costs for COB (2) • Patients may have secondary coverage for non-drug products and services: – Medicare Advantage plan – Medicaid programs – Group health plans (retiree) – FEHBP plans – TRICARE and VA – IHS – Etc. 25

Your Costs for COB (2) • Patients may have secondary coverage for non-drug products and services: – Medicare Advantage plan – Medicaid programs – Group health plans (retiree) – FEHBP plans – TRICARE and VA – IHS – Etc. 25

Your Costs for COB (3) • All Medicare secondary payer rules apply • The Tr. OOP – True-Out-Of-Pocket costs = $3, 600/yr. – Part of the statute • After 2006, increases by annual % increase in per capita Part D drug expenditure 26

Your Costs for COB (3) • All Medicare secondary payer rules apply • The Tr. OOP – True-Out-Of-Pocket costs = $3, 600/yr. – Part of the statute • After 2006, increases by annual % increase in per capita Part D drug expenditure 26

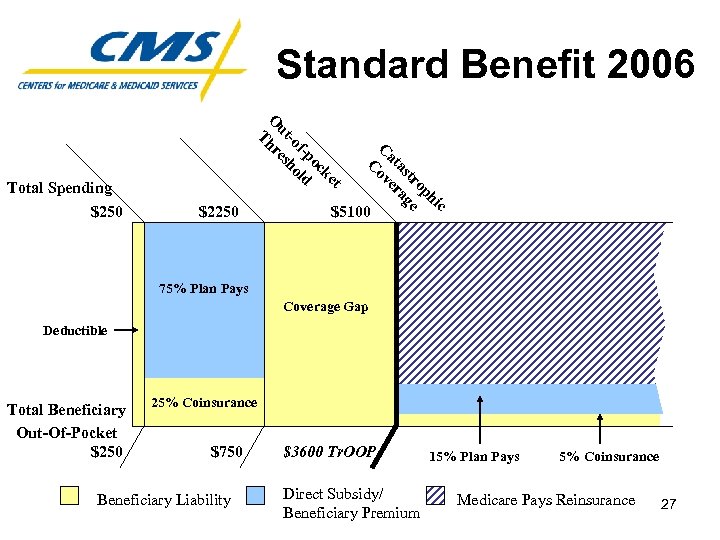

Standard Benefit 2006 $2250 c hi op tr e as ag at er C ov C t ke oc f-p ld -o ho ut es O hr T Total Spending $250 $5100 75% Plan Pays Coverage Gap $+ Deductible ≈ 95% Total Beneficiary Out-Of-Pocket $250 25% Coinsurance $750 Beneficiary Liability $3600 Tr. OOP Direct Subsidy/ Beneficiary Premium 15% Plan Pays 5% Coinsurance Medicare Pays Reinsurance 27

Standard Benefit 2006 $2250 c hi op tr e as ag at er C ov C t ke oc f-p ld -o ho ut es O hr T Total Spending $250 $5100 75% Plan Pays Coverage Gap $+ Deductible ≈ 95% Total Beneficiary Out-Of-Pocket $250 25% Coinsurance $750 Beneficiary Liability $3600 Tr. OOP Direct Subsidy/ Beneficiary Premium 15% Plan Pays 5% Coinsurance Medicare Pays Reinsurance 27

Your Costs for COB (4) • Adding to complexity even for retail: – Secondary and MSP coverage – Co-pay % and donut hole depends on Tr. OOP – CMS to online automate/adjudicate secondary payments at point-of-sale & report to Part D plan – How much secondary online adjudication occurs now in retail? 28

Your Costs for COB (4) • Adding to complexity even for retail: – Secondary and MSP coverage – Co-pay % and donut hole depends on Tr. OOP – CMS to online automate/adjudicate secondary payments at point-of-sale & report to Part D plan – How much secondary online adjudication occurs now in retail? 28

Your Costs for COB (5) • Adjustments/recoups given updated status to Part D plan of beneficiary status within Tr. OOP • $3, 600 to collect if patient is over indigent thresholds • Demonstrating to secondary that you did not get complete Part D payment because: – Deductible, co-pay (25%, 5% or whatever), or donut hole – Necessary drugs/vitamins not paid for, e. g. heparin for flush – Equipment, supplies, nurse visits, professional pharmacy services, care coordination not covered and unlikely you can bill them to demonstrate a denial EOB • Likely to be even worse than current DMERC denial situation! • How will secondary payers understand all of this to correctly pay your claims? 29

Your Costs for COB (5) • Adjustments/recoups given updated status to Part D plan of beneficiary status within Tr. OOP • $3, 600 to collect if patient is over indigent thresholds • Demonstrating to secondary that you did not get complete Part D payment because: – Deductible, co-pay (25%, 5% or whatever), or donut hole – Necessary drugs/vitamins not paid for, e. g. heparin for flush – Equipment, supplies, nurse visits, professional pharmacy services, care coordination not covered and unlikely you can bill them to demonstrate a denial EOB • Likely to be even worse than current DMERC denial situation! • How will secondary payers understand all of this to correctly pay your claims? 29

Insurance Verification Becomes Even More Critical and Complex • You must check for Part D coverage (standard or otherwise), wrap-around, and other coverage • You must be experts at what is coverable under Part B vs. Part D vs. other secondary • You must know what is fully or nearly covered for Medicaid and indigent patients • ALERT: On 1/1/06, dual-eligibles switch to Part D – No drug coverage if you aren’t in the dual eligibles Part D plan network – Transfer them or sign up for Part D is your choice 30

Insurance Verification Becomes Even More Critical and Complex • You must check for Part D coverage (standard or otherwise), wrap-around, and other coverage • You must be experts at what is coverable under Part B vs. Part D vs. other secondary • You must know what is fully or nearly covered for Medicaid and indigent patients • ALERT: On 1/1/06, dual-eligibles switch to Part D – No drug coverage if you aren’t in the dual eligibles Part D plan network – Transfer them or sign up for Part D is your choice 30

Claiming and Coding: NHIA Advocacy • NHIA has fought long and hard for home IV claiming simplification via: – Standardized coding of charge lines on claims – Single consolidated claims include charges for services, supplies, equip and drugs to single primary payer NOT “SPLIT BILLING” – Electronic claiming as path to faster adjudication – X 12 N 837 professional claiming for your professional medical practice of home infusion – Coverage by medical benefit as has been predominant in private/Medicare for 15+ yrs (drugs and all else) 31

Claiming and Coding: NHIA Advocacy • NHIA has fought long and hard for home IV claiming simplification via: – Standardized coding of charge lines on claims – Single consolidated claims include charges for services, supplies, equip and drugs to single primary payer NOT “SPLIT BILLING” – Electronic claiming as path to faster adjudication – X 12 N 837 professional claiming for your professional medical practice of home infusion – Coverage by medical benefit as has been predominant in private/Medicare for 15+ yrs (drugs and all else) 31

Claiming and Coding: Achievements • HCPCS per diem S-codes now the standard for submitting claims to private payers • Infusion providers are lowering DSOs through X 12 N 837 electronic claiming • CMS recognized since early 2003 that home infusion isn’t retail pharmacy: – Retail NCPDP claim doesn’t meet home IV claiming requirements – X 12 N 837 required per HIPAA for home IV • 1/14/05: HHS Secretary letter affirms 837 for home IV (posted on www. nhianet. org) 32

Claiming and Coding: Achievements • HCPCS per diem S-codes now the standard for submitting claims to private payers • Infusion providers are lowering DSOs through X 12 N 837 electronic claiming • CMS recognized since early 2003 that home infusion isn’t retail pharmacy: – Retail NCPDP claim doesn’t meet home IV claiming requirements – X 12 N 837 required per HIPAA for home IV • 1/14/05: HHS Secretary letter affirms 837 for home IV (posted on www. nhianet. org) 32

Claiming and Coding: Part D Rule • CMS again recognizes differences and distinguishes between retail vs. home infusion pharmacies in Part D final rule • CMS requires Part D plans to comply with HIPAA regulations (Part D Rule: 423. 50) – This means home IV claims to PDPs and MA-PDs should be submitted via X 12 N 837 33

Claiming and Coding: Part D Rule • CMS again recognizes differences and distinguishes between retail vs. home infusion pharmacies in Part D final rule • CMS requires Part D plans to comply with HIPAA regulations (Part D Rule: 423. 50) – This means home IV claims to PDPs and MA-PDs should be submitted via X 12 N 837 33

Claiming and Coding: Issues • The benefit is structured by CMS as primarily a retail prescription drug benefit • Accurate calculation of co-pays at point of sale (Tr. OOP) requires on-line adjudication • Online adjudication is fundamental and NCPDP is assumed 34

Claiming and Coding: Issues • The benefit is structured by CMS as primarily a retail prescription drug benefit • Accurate calculation of co-pays at point of sale (Tr. OOP) requires on-line adjudication • Online adjudication is fundamental and NCPDP is assumed 34

Part D Networks Must Include Home Infusion Pharmacies • Part D plans must “provide adequate access to home infusion pharmacies” • No requirement for specialty pharmacies that do not provide home infusion services 35

Part D Networks Must Include Home Infusion Pharmacies • Part D plans must “provide adequate access to home infusion pharmacies” • No requirement for specialty pharmacies that do not provide home infusion services 35

Part D Pharmacy Networks • CMS deadline to Part D plans to demonstrate they have home infusion networks in place: August 1 • PDPs and MA-PDs can negotiate separate contractual terms for infusion pharmacies 36

Part D Pharmacy Networks • CMS deadline to Part D plans to demonstrate they have home infusion networks in place: August 1 • PDPs and MA-PDs can negotiate separate contractual terms for infusion pharmacies 36

Any Willing Pharmacy • Any willing pharmacy requirements apply to home infusion • BUT: MA-PD plans that own and operate their own pharmacies can apply to waive any willing provider if they can meet access standards 37

Any Willing Pharmacy • Any willing pharmacy requirements apply to home infusion • BUT: MA-PD plans that own and operate their own pharmacies can apply to waive any willing provider if they can meet access standards 37

Formularies • Part D plans may submit their own classification system for CMS review, or… • Use USP model guidelines (146 classes) • CMS will evaluate to ensure access to medically necessary drugs and no discrimination against any beneficiary groups 38

Formularies • Part D plans may submit their own classification system for CMS review, or… • Use USP model guidelines (146 classes) • CMS will evaluate to ensure access to medically necessary drugs and no discrimination against any beneficiary groups 38

Formularies (2) • At least 2 drugs per class • Some classes broad 2 covered drugs will be inadequate • Example: USP category 118, “immunologic agents” includes – immune suppressants – Immune stimulants – Immunomodulators 39

Formularies (2) • At least 2 drugs per class • Some classes broad 2 covered drugs will be inadequate • Example: USP category 118, “immunologic agents” includes – immune suppressants – Immune stimulants – Immunomodulators 39

Formularies: Considerations for Part D Plans • NHIA recommends open formulary for home infusion – Rarely if ever used in private sector • Pharmacists and other home infusion professionals should be on the P&T cmttee • Decisions should reflect other clinical and cost factors – Patient factors, supplies, drug delivery device, VAD, dosing schedule, nursing considerations 40

Formularies: Considerations for Part D Plans • NHIA recommends open formulary for home infusion – Rarely if ever used in private sector • Pharmacists and other home infusion professionals should be on the P&T cmttee • Decisions should reflect other clinical and cost factors – Patient factors, supplies, drug delivery device, VAD, dosing schedule, nursing considerations 40

Formularies: Considerations for Part D Plans (2) • Home infusion patients require additional protections • Patients often need to continue the drug initiated in inpatient (or other) stay • Need an efficient exceptions process 41

Formularies: Considerations for Part D Plans (2) • Home infusion patients require additional protections • Patients often need to continue the drug initiated in inpatient (or other) stay • Need an efficient exceptions process 41

Part D Plan Use of Mail-Order • Part D plans can “encourage” enrollees to use mail-order—but can’t require it • Differential co-pays for preferred vs. nonpreferred pharmacies • CMS cannot intervene 42

Part D Plan Use of Mail-Order • Part D plans can “encourage” enrollees to use mail-order—but can’t require it • Differential co-pays for preferred vs. nonpreferred pharmacies • CMS cannot intervene 42

Quality Standards • Primarily based on state pharmacy practice act • Part D plans can establish additional quality standards for home infusion pharmacies – Many state laws are not adequate • CMS “encourages plans and their network pharmacy providers to establish and agree upon additional QA standards as necessary, including those required for accreditation. ” 43

Quality Standards • Primarily based on state pharmacy practice act • Part D plans can establish additional quality standards for home infusion pharmacies – Many state laws are not adequate • CMS “encourages plans and their network pharmacy providers to establish and agree upon additional QA standards as necessary, including those required for accreditation. ” 43

Quality Standards • Private plans use accreditation to credential providers (limited exceptions to ensure access) – JCAHO, ACHC, CHAP – An assessment of the entire patient care process • Quality standards coming for Part B home IV suppliers, to be implemented by accreditors • Accredited providers cannot provide a lower standard of care for Part D patients 44

Quality Standards • Private plans use accreditation to credential providers (limited exceptions to ensure access) – JCAHO, ACHC, CHAP – An assessment of the entire patient care process • Quality standards coming for Part B home IV suppliers, to be implemented by accreditors • Accredited providers cannot provide a lower standard of care for Part D patients 44

Medication Therapy Management • Designed to optimize therapeutic outcomes for “targeted beneficiaries” by improving medication use, reducing adverse drug events • Furnished by pharmacist or other qualified provider (i. e. , physician, PBM, etc. ) • Fees must reflect time and resources required to implement program 45

Medication Therapy Management • Designed to optimize therapeutic outcomes for “targeted beneficiaries” by improving medication use, reducing adverse drug events • Furnished by pharmacist or other qualified provider (i. e. , physician, PBM, etc. ) • Fees must reflect time and resources required to implement program 45

MTM (2) • Targeted beneficiaries: – Multiple diseases + – Multiple drugs + – Cost threshold (Likely to incur) 46

MTM (2) • Targeted beneficiaries: – Multiple diseases + – Multiple drugs + – Cost threshold (Likely to incur) 46

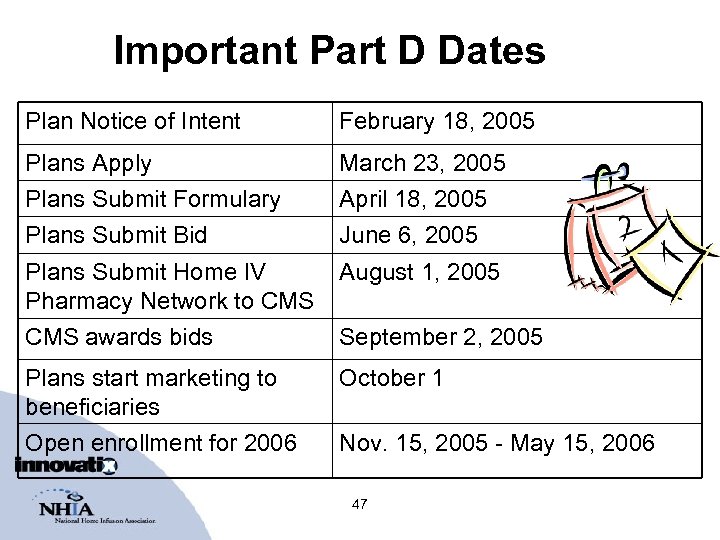

Important Part D Dates Plan Notice of Intent February 18, 2005 Plans Apply March 23, 2005 Plans Submit Formulary Plans Submit Bid April 18, 2005 June 6, 2005 Plans Submit Home IV Pharmacy Network to CMS August 1, 2005 CMS awards bids September 2, 2005 Plans start marketing to beneficiaries Open enrollment for 2006 October 1 Nov. 15, 2005 - May 15, 2006 47

Important Part D Dates Plan Notice of Intent February 18, 2005 Plans Apply March 23, 2005 Plans Submit Formulary Plans Submit Bid April 18, 2005 June 6, 2005 Plans Submit Home IV Pharmacy Network to CMS August 1, 2005 CMS awards bids September 2, 2005 Plans start marketing to beneficiaries Open enrollment for 2006 October 1 Nov. 15, 2005 - May 15, 2006 47

NHIA Advocacy Areas • A lost opportunity for Medicare cost-savings • Fix Part D or find a more appropriate benefit • Cover the required services, supplies, equipment – Drug-only coverage not meaningful! – New home IVIG benefit is a perfect example • Adopt prevailing quality standards • Educate plans on home infusion under Part D 48

NHIA Advocacy Areas • A lost opportunity for Medicare cost-savings • Fix Part D or find a more appropriate benefit • Cover the required services, supplies, equipment – Drug-only coverage not meaningful! – New home IVIG benefit is a perfect example • Adopt prevailing quality standards • Educate plans on home infusion under Part D 48

NHIA Advocacy Activities • Grassroots campaign – Letter writing, key member contacts, fly-ins • NHIA Legislative Defense Fund ensures vigorous representation for NHIA members (legislative and regulatory) • Per Diem Cost Study with Abt Associates – July 2005 completion date – Contact us for more information 49

NHIA Advocacy Activities • Grassroots campaign – Letter writing, key member contacts, fly-ins • NHIA Legislative Defense Fund ensures vigorous representation for NHIA members (legislative and regulatory) • Per Diem Cost Study with Abt Associates – July 2005 completion date – Contact us for more information 49

50

50

Legislative Outlook 51

Legislative Outlook 51

Summary and Wrap-up • Plans submit infusion networks to CMS Aug. 1 • Providers must each make an individual business decision whether to participate – – Impact on Medicare managed care, Medicaid, retirees Accreditation issues Complex coordination of benefits Services, supplies, and equipment for those w/no secondary – Risk and liability—professional and financial 52

Summary and Wrap-up • Plans submit infusion networks to CMS Aug. 1 • Providers must each make an individual business decision whether to participate – – Impact on Medicare managed care, Medicaid, retirees Accreditation issues Complex coordination of benefits Services, supplies, and equipment for those w/no secondary – Risk and liability—professional and financial 52

An Ongoing Process for All of Us • Stay Up-to-Date!! – NHIA members-only Part D resource page • Join NHIA if you haven’t already—we need your support! • Support the NHIA LDF 53

An Ongoing Process for All of Us • Stay Up-to-Date!! – NHIA members-only Part D resource page • Join NHIA if you haven’t already—we need your support! • Support the NHIA LDF 53

• Send questions to info@nhianet. org • Join: www. nhianet. org • Support Legislative Defense Fund: www. nhianet. org 54

• Send questions to info@nhianet. org • Join: www. nhianet. org • Support Legislative Defense Fund: www. nhianet. org 54

Thank you 55

Thank you 55