d2ab3b10f404de9eea132f61148f0749.ppt

- Количество слайдов: 38

MEDIA PRESENTATION September 19 2007 BY MS MARIA RAMOS

AGENDA • STRATEGY REVIEW • PERFORMANCE RVIEW • CONCLUSION AND WAY FORWARD 2

TRANSNET’S VISION AND MISSION Transnet Limited is a focused freight transport company delivering: • Integrated, efficient, safe, reliable and cost effective services which help promote economic growth in South Africa INCREASED Market share IMPROVED PROVIDING Productivity and profitability Capacity for customers ahead of demand 3

TRANSNET VALUES TRANSNET’S CUSTOMERS PREFER US BECAUSE: We are: • • Reliable Trustworthy Responsive Safe service provider OUR EMPLOYEES ARE: • • Ethical Committed Safety conscious Accountable • Thinking • Disciplined • Results orientated 4

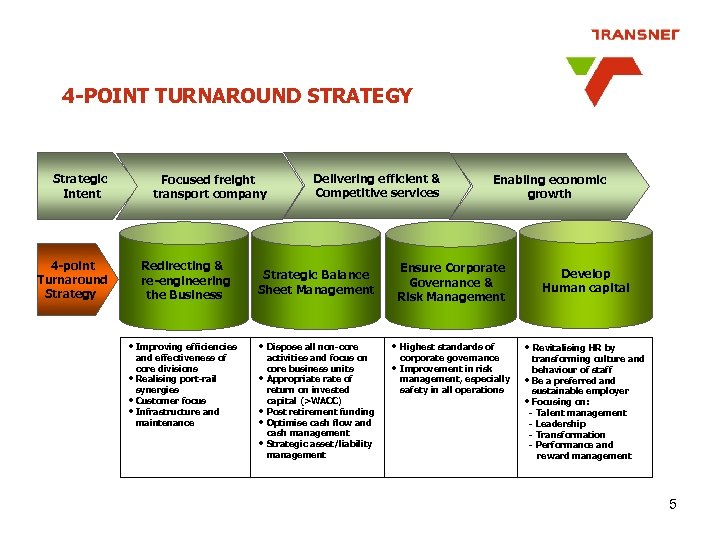

4 -POINT TURNAROUND STRATEGY Strategic Intent 4 -point Turnaround Strategy Focused freight transport company Redirecting & re-engineering the Business • Improving efficiencies and effectiveness of core divisions • Realising port-rail synergies • Customer focus • Infrastructure and maintenance Delivering efficient & Competitive services Ensure Corporate Strategic Balance Sheet Management • • • Dispose all non-core activities and focus on core business units Appropriate rate of return on invested capital (>WACC) Post retirement funding Optimise cash flow and cash management Strategic asset/liability management Enabling economic growth Governance & Risk Management • • Highest standards of corporate governance Improvement in risk management, especially safety in all operations Develop Human capital • Revitalising HR by transforming culture and behaviour of staff • Be a preferred and sustainable employer • Focusing on: - Talent management - Leadership - Transformation - Performance and reward management 5

RATIONALE FOR REBRANDING • We chose the monolithic route to mirror the new corporate strategy and structure of the Company • To communicate the integrated and customer-centric approach of the new Company • Enforcement of the consistent application of the new Transnet identity throughout the organization • To present a consistent face to customers as a platform to build and sustain momentum as Transnet gears itself for sustainable growth • To consolidate employee energies, and maximise economies of scale and brand assets in building Transnet and its unique offerings • To create a singular platform to leverage and reinforce the “One Company, One Vision” philosophy 6

FINDINGS AND RECOMMENDATIONS • The current name, Transnet, should be retained • Transnet should refresh its brand image to reflect: - Customer centeredness - Reliability - Cost-efficiency - Transparency - Competitiveness - Flexibility - Operating Division alignment - Improved communication • Preference for a monolithic or endorsed brand architecture, particularly amongst customers. In particular, customers, preferred one dominating name for Transnet with reference to its Operating Divisions to emphasize unity but distinguish between the core businesses 7

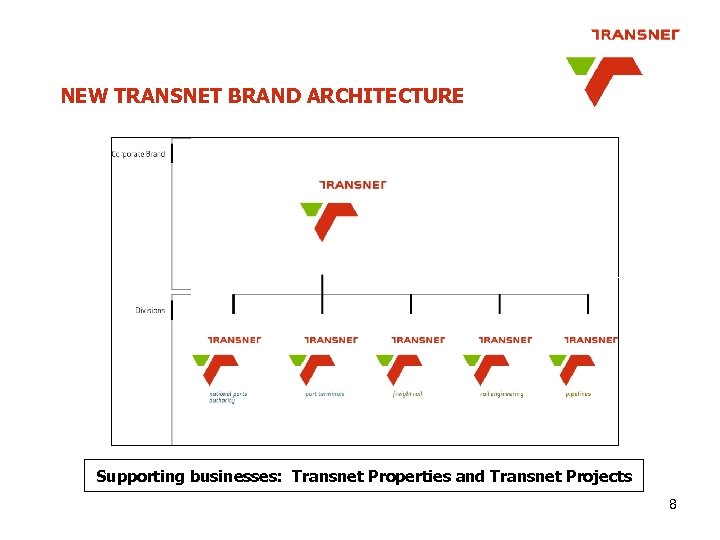

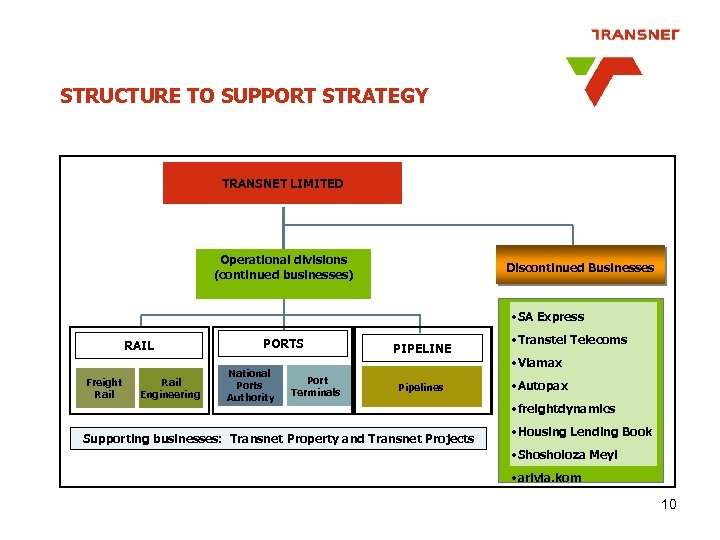

NEW TRANSNET BRAND ARCHITECTURE Discontinued Businesses Supporting businesses: Transnet Properties and Transnet Projects 8

THE WAY FORWARD: BRANDING Use the brand to: • Underpin the growth strategy • Drive integration • Support Transnet’s new culture • Establish Transnet as a leading corporate in South Africa • Enabling growth by optimising the efficiency and competitiveness of the country’s freight transport and logistics • Act as a catalyst for the growth of the economy 9

STRUCTURE TO SUPPORT STRATEGY TRANSNET LIMITED Operational divisions (continued businesses) Discontinued Businesses Discontinued businesses • SA Express RAIL Freight Rail Engineering PORTS National Ports Authority Port Terminals PIPELINE Pipelines Supporting businesses: Transnet Property and Transnet Projects • Transtel Telecoms • Viamax • Autopax • freightdynamics • Housing Lending Book • Shosholoza Meyl • arivia. kom 10

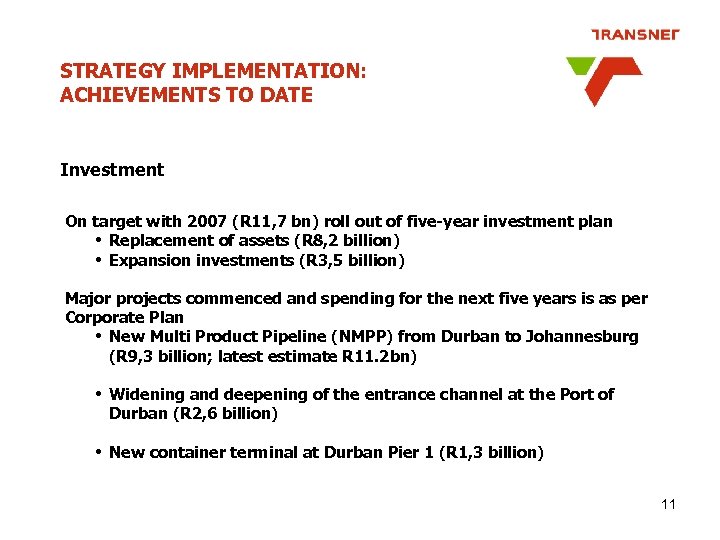

STRATEGY IMPLEMENTATION: ACHIEVEMENTS TO DATE Investment On target with 2007 (R 11, 7 bn) roll out of five-year investment plan • Replacement of assets (R 8, 2 billion) • Expansion investments (R 3, 5 billion) Major projects commenced and spending for the next five years is as per Corporate Plan • New Multi Product Pipeline (NMPP) from Durban to Johannesburg (R 9, 3 billion; latest estimate R 11. 2 bn) • Widening and deepening of the entrance channel at the Port of Durban (R 2, 6 billion) • New container terminal at Durban Pier 1 (R 1, 3 billion) 11

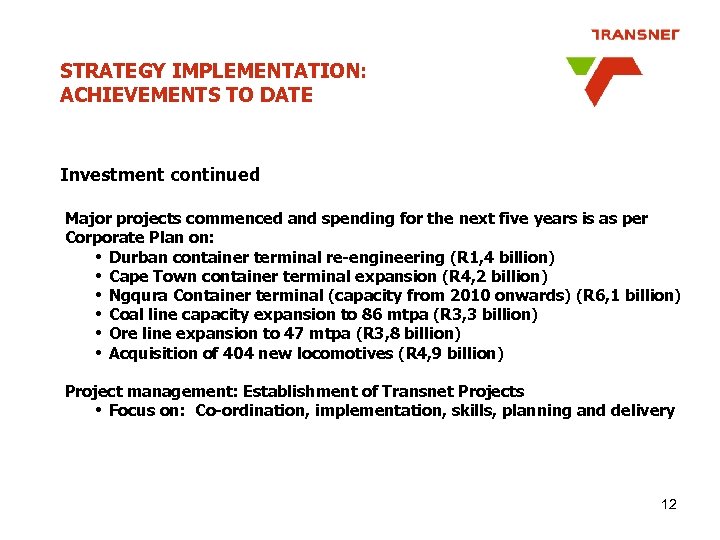

STRATEGY IMPLEMENTATION: ACHIEVEMENTS TO DATE Investment continued Major projects commenced and spending for the next five years is as per Corporate Plan on: • Durban container terminal re-engineering (R 1, 4 billion) • Cape Town container terminal expansion (R 4, 2 billion) • Ngqura Container terminal (capacity from 2010 onwards) (R 6, 1 billion) • Coal line capacity expansion to 86 mtpa (R 3, 3 billion) • Ore line expansion to 47 mtpa (R 3, 8 billion) • Acquisition of 404 new locomotives (R 4, 9 billion) Project management: Establishment of Transnet Projects • Focus on: Co-ordination, implementation, skills, planning and delivery 12

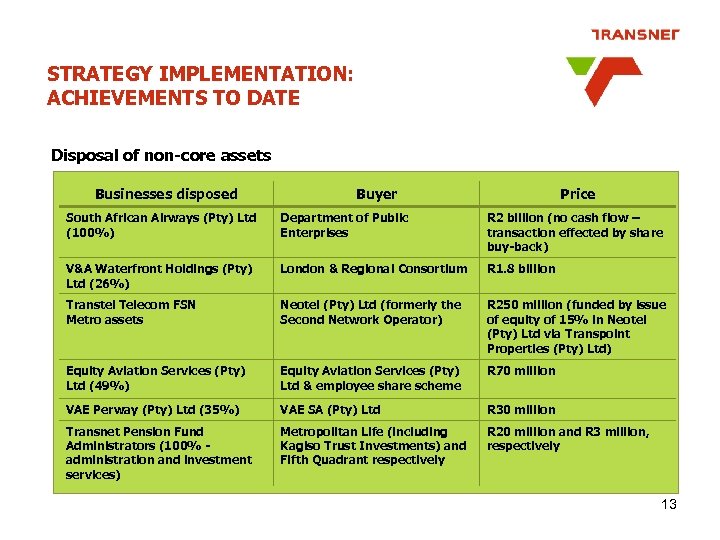

STRATEGY IMPLEMENTATION: ACHIEVEMENTS TO DATE Disposal of non-core assets Businesses disposed Buyer Price South African Airways (Pty) Ltd (100%) Department of Public Enterprises R 2 billion (no cash flow – transaction effected by share buy-back) V&A Waterfront Holdings (Pty) Ltd (26%) London & Regional Consortium R 1. 8 billion Transtel Telecom FSN Metro assets Neotel (Pty) Ltd (formerly the Second Network Operator) R 250 million (funded by issue of equity of 15% in Neotel (Pty) Ltd via Transpoint Properties (Pty) Ltd) Equity Aviation Services (Pty) Ltd (49%) Equity Aviation Services (Pty) Ltd & employee share scheme R 70 million VAE Perway (Pty) Ltd (35%) VAE SA (Pty) Ltd R 30 million Transnet Pension Fund Administrators (100% - administration and investment services) Metropolitan Life (including Kagiso Trust Investments) and Fifth Quadrant respectively R 20 million and R 3 million, respectively 13

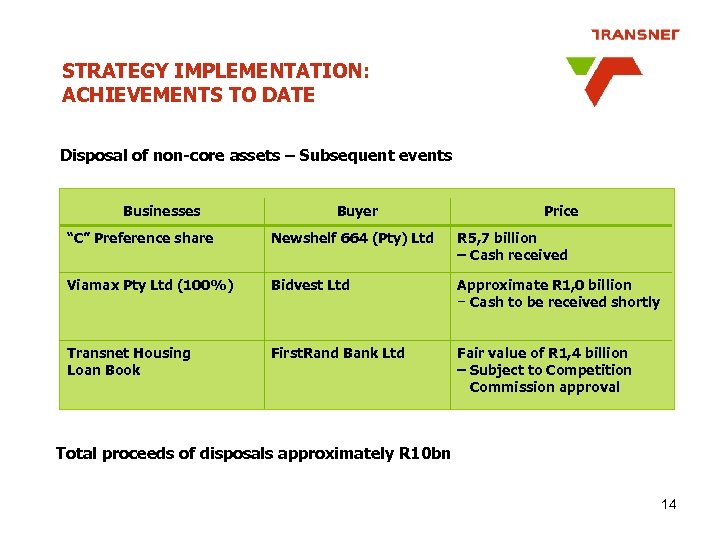

STRATEGY IMPLEMENTATION: ACHIEVEMENTS TO DATE Disposal of non-core assets – Subsequent events Businesses Buyer Price “C” Preference share Newshelf 664 (Pty) Ltd R 5, 7 billion – Cash received Viamax Pty Ltd (100%) Bidvest Ltd Approximate R 1, 0 billion − Cash to be received shortly Transnet Housing Loan Book First. Rand Bank Ltd Fair value of R 1, 4 billion – Subject to Competition Commission approval Total proceeds of disposals approximately R 10 bn 14

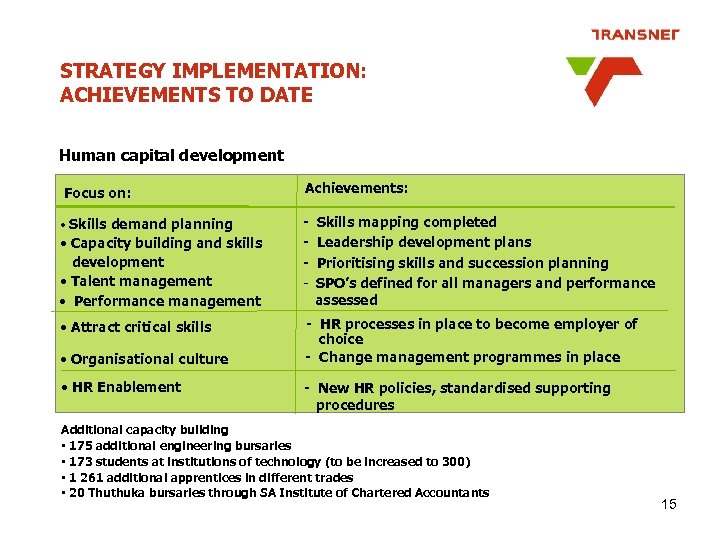

STRATEGY IMPLEMENTATION: ACHIEVEMENTS TO DATE Human capital development Focus on: Achievements: • Capacity building and skills development • Talent management • Performance management - Skills mapping completed - Leadership development plans - Prioritising skills and succession planning - SPO’s defined for all managers and performance assessed • Attract critical skills - HR processes in place to become employer of • Skills demand planning • Organisational culture • HR Enablement choice - Change management programmes in place - New HR policies, standardised supporting procedures Additional capacity building • 175 additional engineering bursaries • 173 students at institutions of technology (to be increased to 300) • 1 261 additional apprentices in different trades • 20 Thuthuka bursaries through SA Institute of Chartered Accountants 15

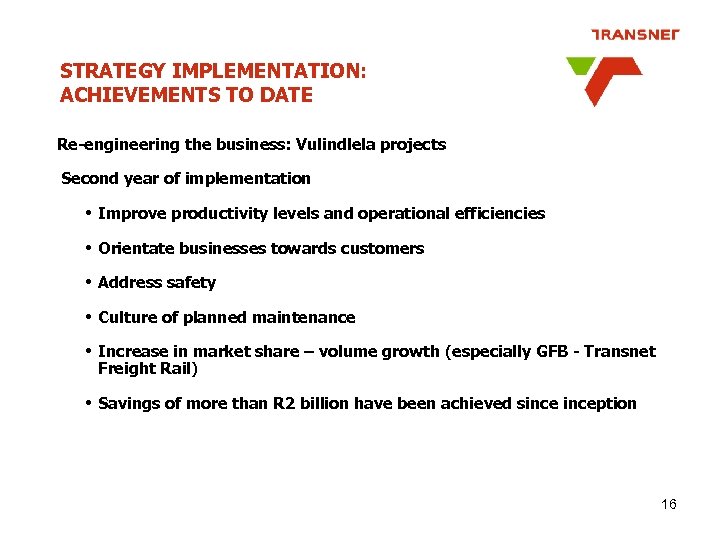

STRATEGY IMPLEMENTATION: ACHIEVEMENTS TO DATE Re-engineering the business: Vulindlela projects Second year of implementation • Improve productivity levels and operational efficiencies • Orientate businesses towards customers • Address safety • Culture of planned maintenance • Increase in market share – volume growth (especially GFB - Transnet Freight Rail) • Savings of more than R 2 billion have been achieved sinception 16

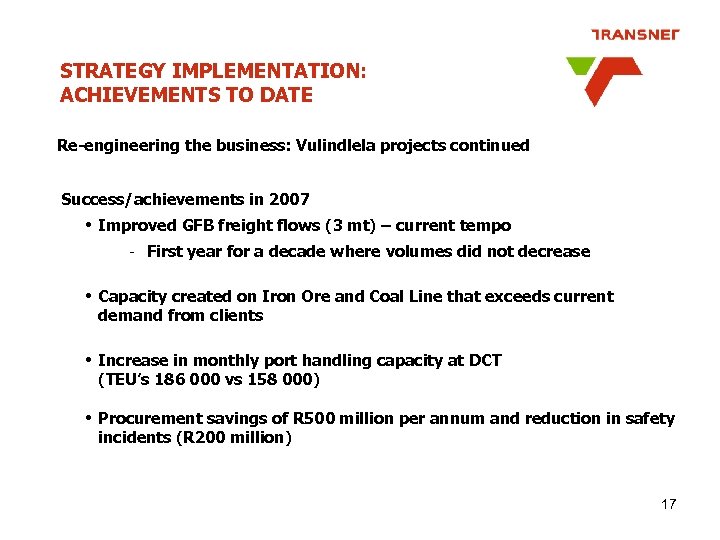

STRATEGY IMPLEMENTATION: ACHIEVEMENTS TO DATE Re-engineering the business: Vulindlela projects continued Success/achievements in 2007 • Improved GFB freight flows (3 mt) – current tempo First year for a decade where volumes did not decrease • Capacity created on Iron Ore and Coal Line that exceeds current demand from clients • Increase in monthly port handling capacity at DCT (TEU’s 186 000 vs 158 000) • Procurement savings of R 500 million per annum and reduction in safety incidents (R 200 million) 17

STRATEGY IMPLEMENTATION: ACHIEVEMENTS TO DATE Efficiency improvement: Transnet Business Intelligence projects (“TBI”) • Implementation of TBI projects - Effective use of technology, world class systems and processes - Financial management and reporting - Improving processes and systems that enable information management • Identified KPI’s across businesses to measure key value drivers • Benchmarking against international companies to ensure world class performance • Implemented KPI project to measure: - Key volume drivers - KPI performance weekly/monthly - Performance vs benchmarks – all areas of business 18

STRATEGY IMPLEMENTATION: ACHIEVEMENTS TO DATE Transnet Second Defined Benefit Fund • Active management and leadership from Transnet • Currently in surplus of R 1, 9 billion as opposed to being in deficit in 2006 of R 1, 6 billion (aided by the sale of MTN shares-M Cell and V&A Waterfront) • Rule amendments approved by the Ministers of Finance and Public Enterprises - Generally to enable bonus amounts to be paid to pensioners to exceed 2% pension increase (subject to affordability) • Transnet paid ex-gratia bonuses of R 125 million to pensioners - All received an additional 1% - Previously disadvantaged widows and members with >15 years service who receive low pensions and/or also over 65 years old received additional amounts 19

STRATEGY IMPLEMENTATION: ACHIEVEMENTS TO DATE Transnet Pension Fund • Act changes have received presidential approval to enable non-Transnet employees of businesses transferred to Government to remain members • Rule amendments approved by the Ministers of Finance and Public Enterprises • Fund will become multi-employer with new employers guaranteeing the obligations of its employees and pensioners • Fund now in substantial surplus of R 1. 6 billion 20

STRATEGY IMPLEMENTATION: ACHIEVEMENTS TO DATE Transnet Retirement Fund • Act changes have received presidential approval to enable non-Transnet employees of businesses transferred to Government to remain members • Rule amendments approved by the Ministers of Finance and Public Enterprises 21

STRATEGY IMPLEMENTATION: ACHIEVEMENTS TO DATE Economic Regulation National Ports Act • Act in place from November 2006 • Places responsibility on Transnet National Ports Authority to ensure safe, efficient and effective functioning of ports system • Independent Regulator oversees Transnet National Ports Authority’s functions, approves tariffs, hears complaints and appeals from port users • Transnet is investing in systems and capacities to perform additional functions prescribed by legislation • Interacting with shareholder in certain aspects of Act 22

STRATEGY IMPLEMENTATION: ACHIEVEMENTS TO DATE Economic Regulation continued Transnet Pipelines • NERSA (energy regulator), declined Transnet Pipelines’ application for 5, 6% increase • Regulations for, amongst other issues, determining tariff increases not yet finalised • Transnet engaging with relevant authorities; important that tariff methodology enables Transnet to earn a fair return on invested capital (> WACC) Have formed a public policy and regulatory unit to lead Transnet’s strategy and interactions with the Regulators 23

STRATEGY IMPLEMENTATION: ACHIEVEMENTS TO DATE Risk Management Operational Risk • Established a Risk Committee of the Board and appointed a Chief Risk Officer that serves on the Executive Committee • Appointed Group Executive Human Resources and HR Sub-Committee dealing with human capital in sustaining the turnaround • Improved safety measures and roll out safety awareness and training programmes • Reviewed safety procedures and strengthened capacity in problematic areas • Improved controls and campaign against fraud 24

STRATEGY IMPLEMENTATION: ACHIEVEMENTS TO DATE Risk Management continued Financial Risk • Financial Risk Framework in place covering all risks (interest, currency, market) • Asset and Liability Committee ensures that financial risks are effectively managed • Stringent financial objectives are set to ensure that targeted financial ratios are achieved/maintained • Improved internal financial and system controls 25

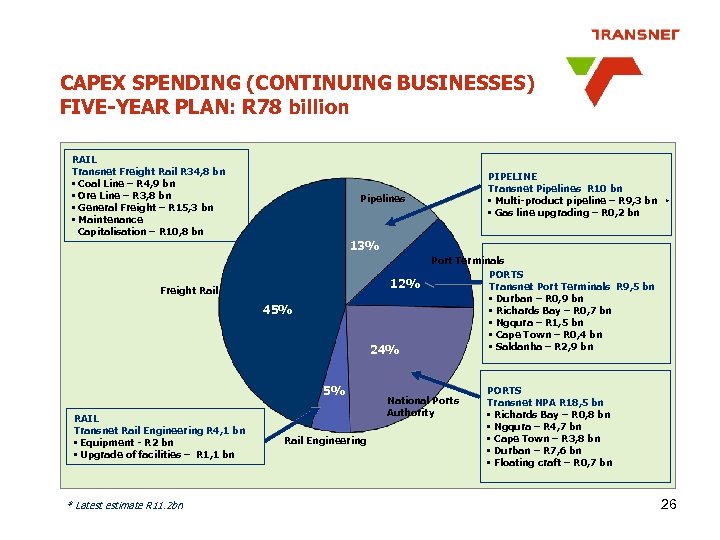

CAPEX SPENDING (CONTINUING BUSINESSES) FIVE-YEAR PLAN: R 78 billion RAIL Transnet Freight Rail R 34, 8 bn • Coal Line – R 4, 9 bn • Ore Line – R 3, 8 bn • General Freight – R 15, 3 bn • Maintenance Capitalisation – R 10, 8 bn Pipelines PIPELINE Transnet Pipelines R 10 bn • Multi-product pipeline – R 9, 3 bn * • Gas line upgrading – R 0, 2 bn 13% Port Terminals PORTS 12% Transnet Port Terminals R 9, 5 bn • Durban – R 0, 9 bn • Richards Bay – R 0, 7 bn • Ngqura – R 1, 5 bn • Cape Town – R 0, 4 bn • Saldanha – R 2, 9 bn 24% Freight Rail 45% 5% RAIL Transnet Rail Engineering R 4, 1 bn • Equipment - R 2 bn • Upgrade of facilities – R 1, 1 bn * Latest estimate R 11. 2 bn Rail Engineering National Ports Authority PORTS Transnet NPA R 18, 5 bn • Richards Bay – R 0, 8 bn • Ngqura – R 4, 7 bn • Cape Town – R 3, 8 bn • Durban – R 7, 6 bn • Floating craft – R 0, 7 bn 26

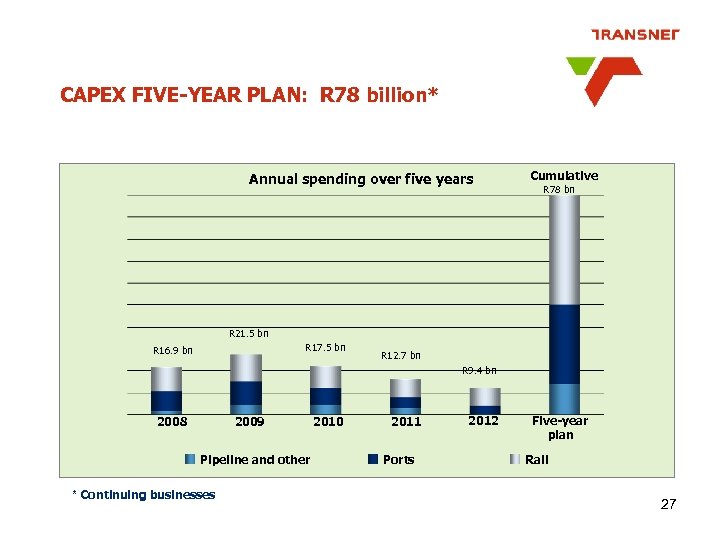

CAPEX FIVE-YEAR PLAN: R 78 billion* Annual spending over five years Cumulative R 78 bn R 21. 5 bn R 17. 5 bn R 16. 9 bn R 12. 7 bn R 9. 4 bn 2008 2009 Pipeline and other * Continuing businesses 2010 2011 Ports 2012 Five-year plan Rail 27

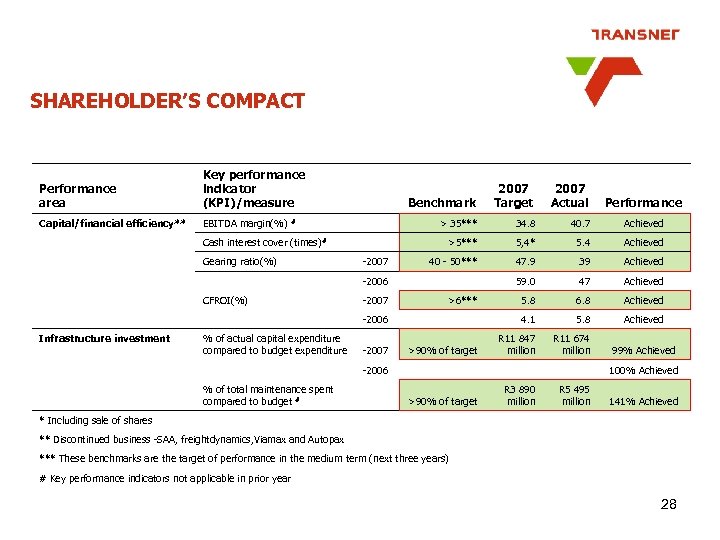

SHAREHOLDER’S COMPACT Key performance indicator Performance area (KPI)/measure Benchmark Capital/financial efficiency** 2007 Target 2007 Actual Performance EBITDA margin(%) # > 35*** 34. 8 40. 7 Achieved Cash interest cover (times) # >5*** 5, 4* 5. 4 Achieved Gearing ratio(%) -2007 40 - 50*** 47. 9 39 Achieved 59. 0 47 Achieved 5. 8 6. 8 Achieved 4. 1 5. 8 Achieved R 11 847 million R 11 674 million -2006 CFROI(%) -2007 -2006 Infrastructure investment % of actual capital expenditure compared to budget expenditure -2007 >6*** >90% of target -2006 % of total maintenance spent compared to budget # 99% Achieved 100% Achieved >90% of target R 3 890 million R 5 495 million 141% Achieved * Including sale of shares ** Discontinued business -SAA, freightdynamics, Viamax and Autopax *** These benchmarks are the target of performance in the medium term (next three years) # Key performance indicators not applicable in prior year 28

BROAD-BASED BLACK ECONOMIC EMPOWERMENT Policy: • Transnet fully endorses and supports the Government’s Broad-based Black Economic Empowerment (“BBBEE”) Programme and has aligned its policies with the DTI’s Codes of Good Practice which were gazetted on 9 February 2007. (Some alignments need to take place between the DTI Codes and the Department of Transport’s new draft Rail Transport Charter) • Transnet encourages join ventures with and sub-contracting to BBBEE companies Achievements: • During the 2006/07 financial year, the Operating Divisions spent R 10. 6 billion externally with suppliers, of which R 3. 9 billion went to broad based BEE companies, up R 600 million from 2006 29

BROAD-BASED BLACK ECONOMIC EMPOWERMENT Strategy – BBBEE going forward: • Transnet will participate in the Rail Transport Charter workgroup to ensure alignment between the DTI and Department of Transport scorecards • Transnet has had most of its high-value suppliers accredited against the DTI scorecard and will continue to encourage all its tenderers/suppliers to do so • Having had itself accredited, Transnet scored 56. 8 on BBBEE, equating to a “Level 5”, recognition level of 80%. A BBBEE Task team has subsequently been created at Transnet Corporate office to improve this score by driving strategy and coordinating all elements of the DTI Scorecard • Over and above Transnet’s BBBEE and Supplier Development strategies, we will implement a plan for Competitive Supplier Development (“CSDP”) in alignment with our support of Asgi. SA. This plan will consider opportunities to develop globally competitive local suppliers (especially from the BBBEE ranks) through various strategic initiatives 30

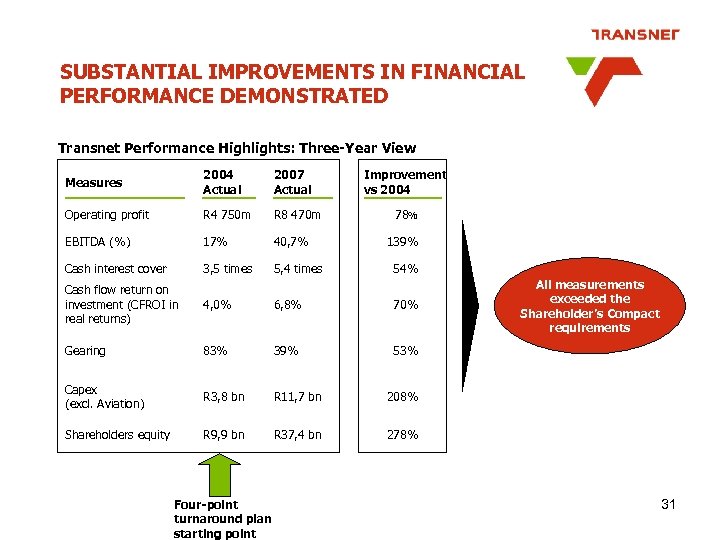

SUBSTANTIAL IMPROVEMENTS IN FINANCIAL PERFORMANCE DEMONSTRATED Transnet Performance Highlights: Three-Year View Measures 2004 Actual 2007 Actual Improvement vs 2004 Operating profit R 4 750 m R 8 470 m 78% EBITDA (%) 17% 40, 7% Cash interest cover 3, 5 times 5, 4 times 139% 54% Cash flow return on investment (CFROI in real returns) 4, 0% 6, 8% 70% Gearing 83% 39% 53% Capex (excl. Aviation) R 3, 8 bn R 11, 7 bn 208% Shareholders equity R 9, 9 bn R 37, 4 bn All measurements exceeded the Shareholder’s Compact requirements 278% Four-point turnaround plan starting point 31

THE WAY FORWARD

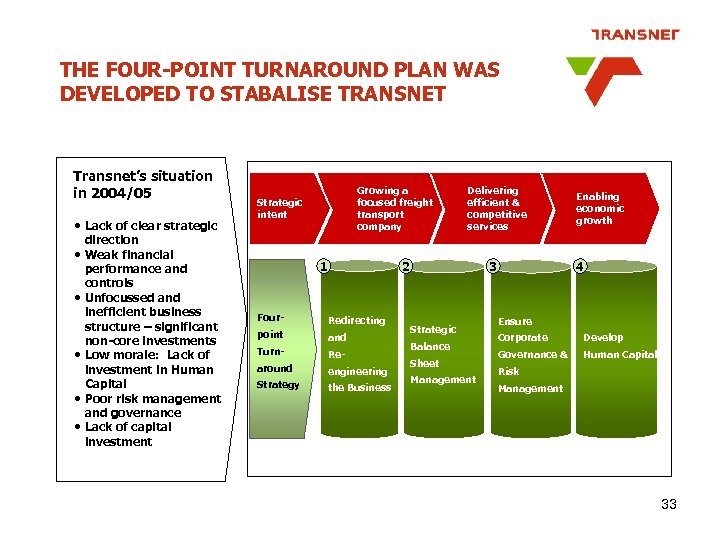

THE FOUR-POINT TURNAROUND PLAN WAS DEVELOPED TO STABALISE TRANSNET Transnet’s situation in 2004/05 • Lack of clear strategic Strategic intent direction • Weak financial • • performance and controls Unfocussed and inefficient business structure – significant non-core investments Low morale: Lack of investment in Human Capital Poor risk management and governance Lack of capital investment Growing a focused freight transport company 1 Delivering efficient & competitive services 2 Four- Redirecting point and Turn- Re- around engineering Strategy the Business 3 Strategic Balance Sheet Management Enabling economic growth 4 Ensure Corporate Develop Governance & Human Capital Risk Management 33

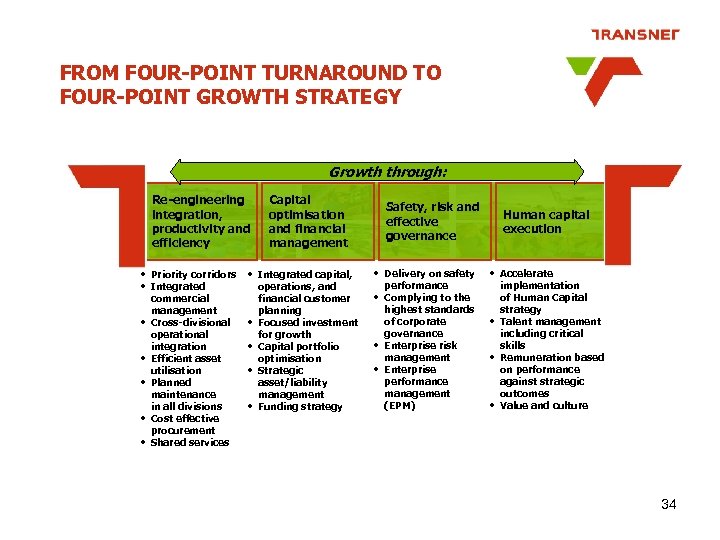

FROM FOUR-POINT TURNAROUND TO FOUR-POINT GROWTH STRATEGY Growth through: Re-engineering integration, productivity and efficiency • • Priority corridors Integrated commercial management Cross-divisional operational integration Efficient asset utilisation Planned maintenance in all divisions Cost effective procurement Shared services • • • Capital optimisation and financial management Integrated capital, operations, and financial customer planning Focused investment for growth Capital portfolio optimisation Strategic asset/liability management Funding strategy Safety, risk and effective governance • • Delivery on safety performance Complying to the highest standards of corporate governance Enterprise risk management Enterprise performance management (EPM) Human capital execution • • Accelerate implementation of Human Capital strategy Talent management including critical skills Remuneration based on performance against strategic outcomes Value and culture 34

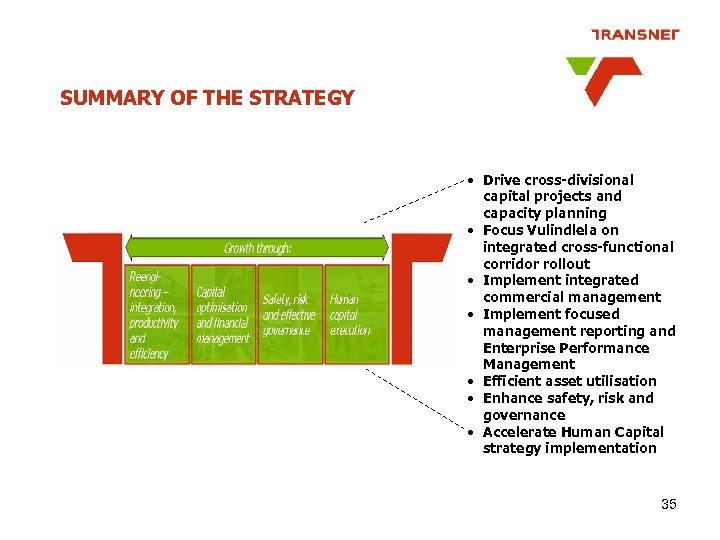

SUMMARY OF THE STRATEGY • Drive cross-divisional capital projects and capacity planning • Focus Vulindlela on integrated cross-functional corridor rollout • Implement integrated commercial management • Implement focused management reporting and Enterprise Performance Management • Efficient asset utilisation • Enhance safety, risk and governance • Accelerate Human Capital strategy implementation 35

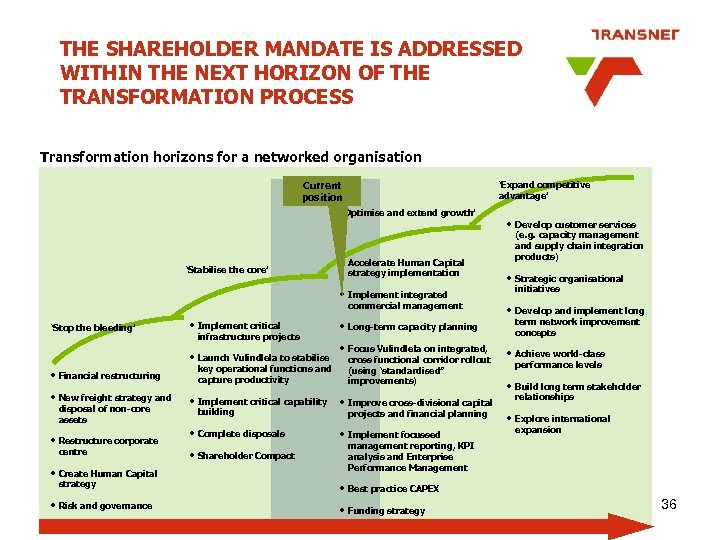

THE SHAREHOLDER MANDATE IS ADDRESSED WITHIN THE NEXT HORIZON OF THE TRANSFORMATION PROCESS Transformation horizons for a networked organisation ‘Expand competitive advantage’ Current position ‘Optimise and extend growth’ ‘Stabilise the core’ • • • New freight strategy and disposal of non-core assets Implement critical infrastructure projects Launch Vulindlela to stabilise key operational functions and capture productivity Financial restructuring • • • ‘Stop the bleeding’ • • • Restructure corporate centre Create Human Capital strategy Risk and governance • Accelerate Human Capital strategy implementation Implement integrated commercial management • Focus Vulindlela on integrated, cross functional corridor rollout (using ‘standardised” improvements) Develop customer services (e. g. capacity management and supply chain integration products) • Strategic organisational initiatives • Develop and implement long term network improvement concepts • Achieve world-class performance levels • Build long term stakeholder relationships • Explore international expansion Long-term capacity planning • • Implement critical capability building • • Complete disposals • • Shareholder Compact Implement focussed management reporting, KPI analysis and Enterprise Performance Management • Best practice CAPEX • Funding strategy Improve cross-divisional capital projects and financial planning 36

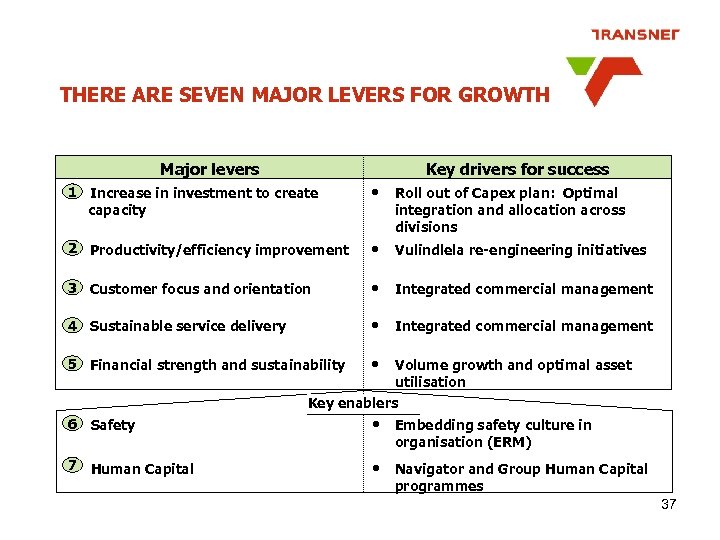

THERE ARE SEVEN MAJOR LEVERS FOR GROWTH Major levers Key drivers for success • 1 Increase in investment to create • Roll out of Capex plan: Optimal • 2 Productivity/efficiency improvement • Vulindlela re-engineering initiatives • 3 Customer focus and orientation • Integrated commercial management • 4 Sustainable service delivery • Integrated commercial management • 5 Financial strength and sustainability • Volume growth and optimal asset capacity integration and allocation across divisions utilisation Key enablers • 6 Safety • Embedding safety culture in • 7 Human Capital • Navigator and Group Human Capital organisation (ERM) programmes 37

THE END THANK YOU

d2ab3b10f404de9eea132f61148f0749.ppt