b378f451736e0636439fd790ff3dd496.ppt

- Количество слайдов: 20

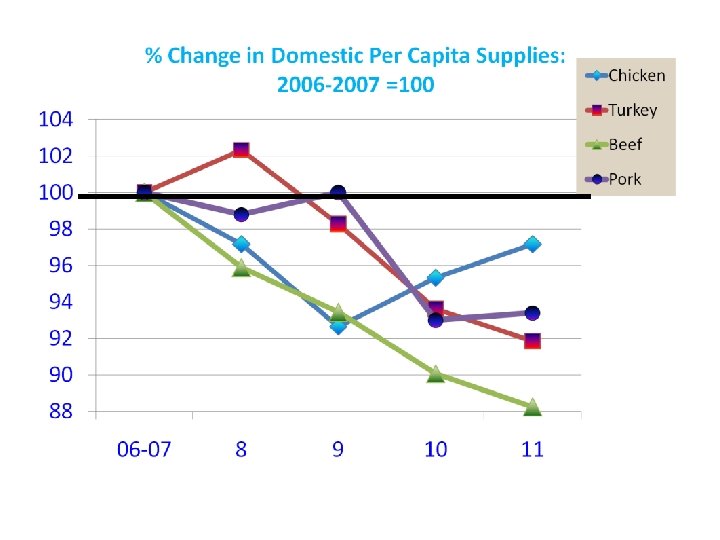

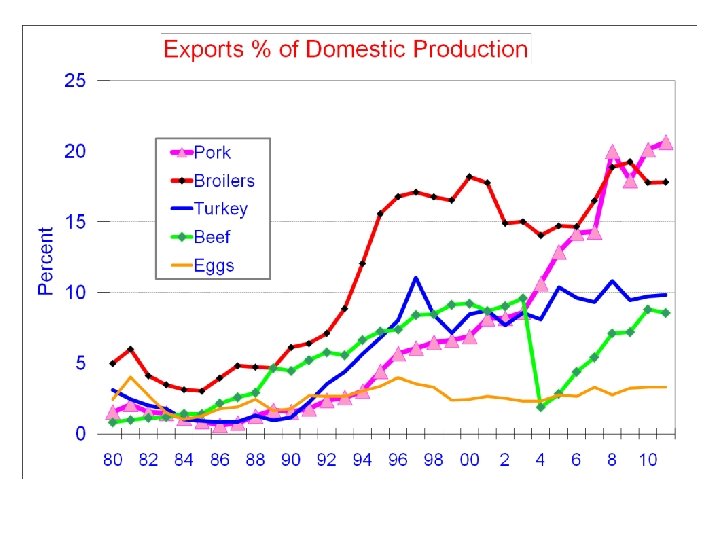

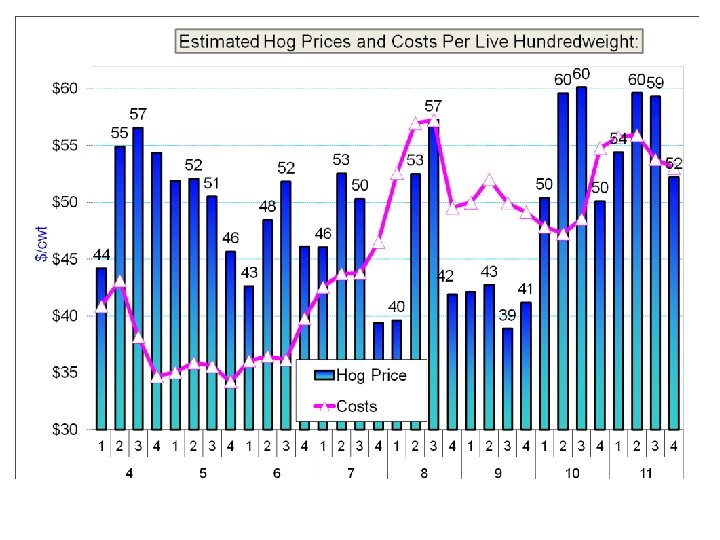

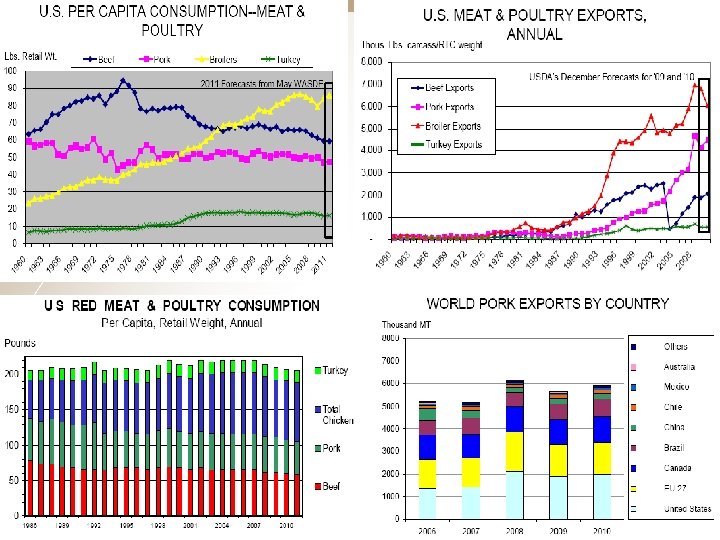

Meat Animal Outlook 2010/2011 Big Issues: 1. Adjustment to Economic Shocks 2. Exports as the Growth Market 3. Acceptance of Animal Agriculture? ? ? 4. What Corn price Means to Pork Industry 5. Biofuels: Food/Fuel Conflict Department of Agricultural Economics Purdue University

Economic SHOCK Department of Agricultural Economics Purdue University

Bio. Fuels Production Department of Agricultural Economics Purdue University

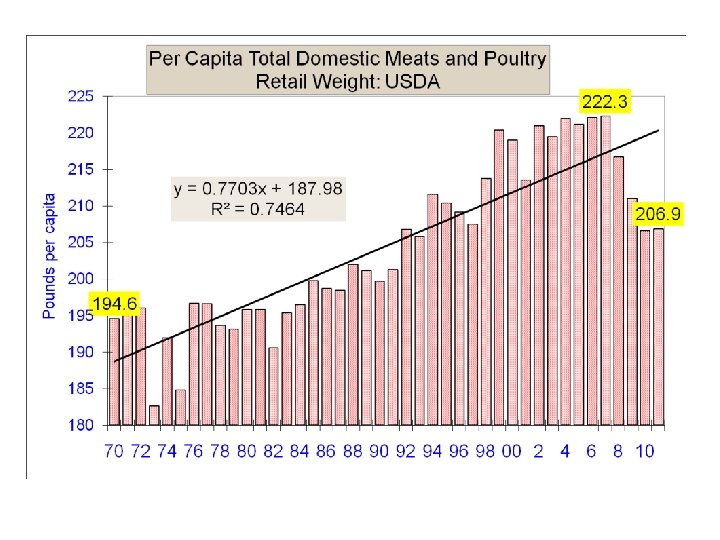

The Economy Department of Agricultural Economics Purdue University

Department of Agricultural Economics Purdue University

Department of Agricultural Economics Purdue University

Department of Agricultural Economics Purdue University

Department of Agricultural Economics Purdue University

Department of Agricultural Economics Purdue University

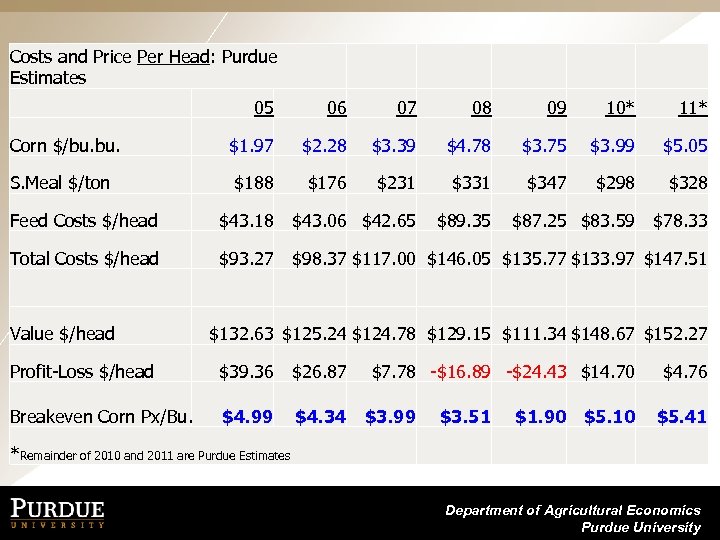

Costs and Price Per Head: Purdue Estimates 05 06 07 08 09 10* 11* Corn $/bu. $1. 97 $2. 28 $3. 39 $4. 78 $3. 75 $3. 99 $5. 05 S. Meal $/ton $188 $176 $231 $347 $298 $328 $89. 35 $87. 25 $83. 59 $78. 33 Feed Costs $/head $43. 18 $43. 06 $42. 65 Total Costs $/head $93. 27 $98. 37 $117. 00 $146. 05 $135. 77 $133. 97 $147. 51 Value $/head $132. 63 $125. 24 $124. 78 $129. 15 $111. 34 $148. 67 $152. 27 Profit-Loss $/head $39. 36 $26. 87 Breakeven Corn Px/Bu. $4. 99 $4. 34 *Remainder of 2010 and 2011 are Purdue Estimates $7. 78 -$16. 89 -$24. 43 $14. 70 $3. 99 $3. 51 $4. 76 $1. 90 $5. 10 $5. 41 Department of Agricultural Economics Purdue University

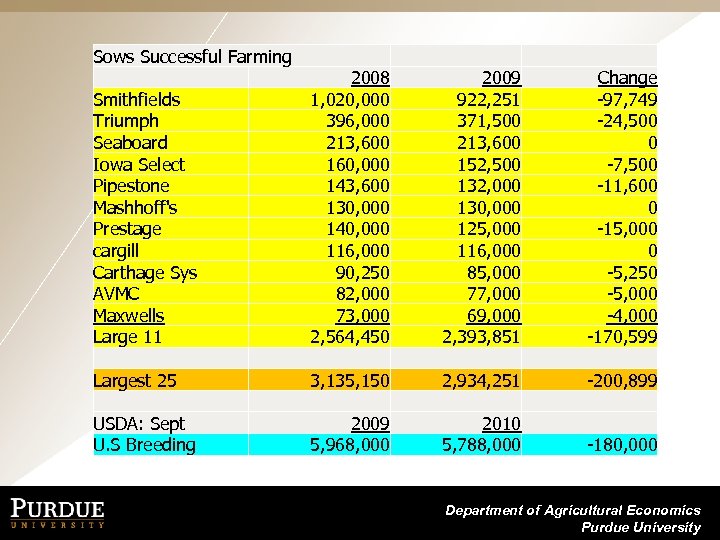

Sows Successful Farming Smithfields Triumph Seaboard Iowa Select Pipestone Mashhoff's Prestage cargill Carthage Sys AVMC Maxwells Large 11 Largest 25 USDA: Sept U. S Breeding 2008 1, 020, 000 396, 000 213, 600 160, 000 143, 600 130, 000 140, 000 116, 000 90, 250 82, 000 73, 000 2, 564, 450 3, 135, 150 2009 5, 968, 000 2009 922, 251 371, 500 213, 600 152, 500 132, 000 130, 000 125, 000 116, 000 85, 000 77, 000 69, 000 2, 393, 851 2, 934, 251 2010 5, 788, 000 Change -97, 749 -24, 500 0 -7, 500 -11, 600 0 -15, 000 0 -5, 250 -5, 000 -4, 000 -170, 599 -200, 899 -180, 000 Department of Agricultural Economics Purdue University

2009 2010 Change 1, 020, 000 1, 010, 000 -10, 000 N. Carolina 990, 000 880, 000 -110, 000 Minnesota 580, 000 550, 000 -30, 000 Illinois 480, 000 490, 000 10, 000 Oklahoma 400, 000 410, 000 Nebraska 390000 370000 -20, 000 Missouri 345, 000 350, 000 5, 000 Indiana 270, 000 290, 000 20, 000 Kansas 170, 000 185, 000 15, 000 Ohio 170, 000 165, 000 -5, 000 Iowa U. S. 5, 968, 000 5, 788, 000 -180, 000 Department of Agricultural Economics Purdue University

Bio. Fuels Production Department of Agricultural Economics Purdue University

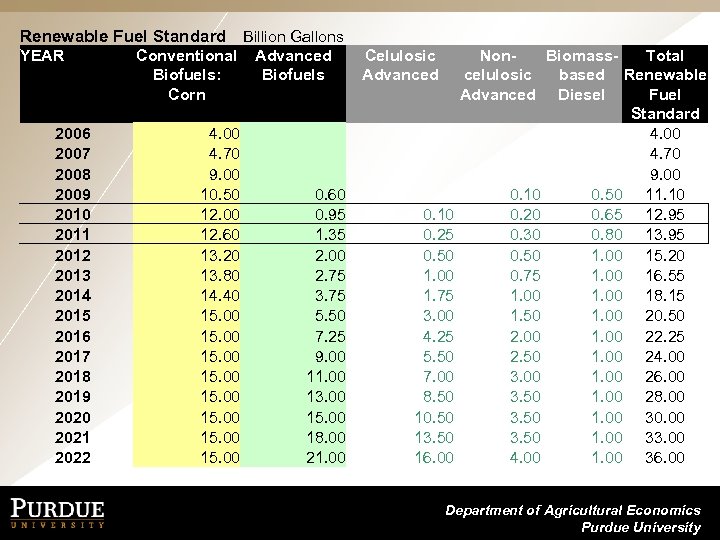

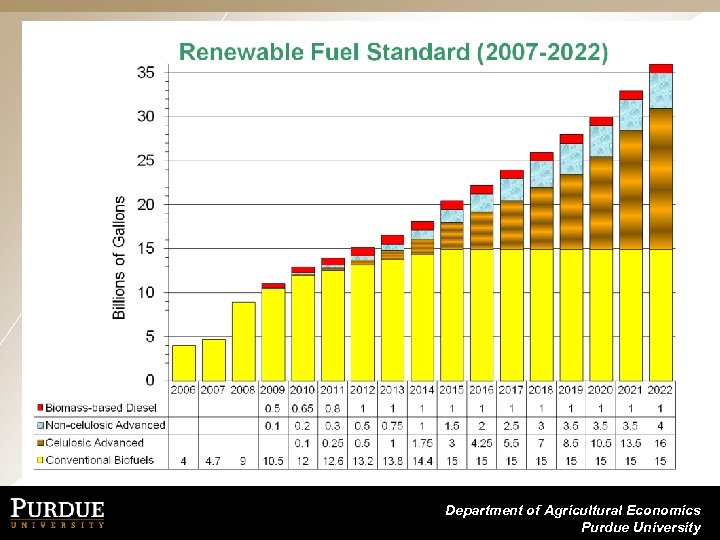

Renewable Fuel Standard Billion Gallons YEAR 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 Conventional Biofuels: Corn 4. 00 4. 70 9. 00 10. 50 12. 00 12. 60 13. 20 13. 80 14. 40 15. 00 15. 00 Advanced Biofuels 0. 60 0. 95 1. 35 2. 00 2. 75 3. 75 5. 50 7. 25 9. 00 11. 00 13. 00 15. 00 18. 00 21. 00 Celulosic Advanced 0. 10 0. 25 0. 50 1. 00 1. 75 3. 00 4. 25 5. 50 7. 00 8. 50 10. 50 13. 50 16. 00 Non. Biomass. Total celulosic based Renewable Advanced Diesel Fuel Standard 4. 00 4. 70 9. 00 0. 10 0. 50 11. 10 0. 20 0. 65 12. 95 0. 30 0. 80 13. 95 0. 50 1. 00 15. 20 0. 75 1. 00 16. 55 1. 00 18. 15 1. 50 1. 00 20. 50 2. 00 1. 00 22. 25 2. 50 1. 00 24. 00 3. 00 1. 00 26. 00 3. 50 1. 00 28. 00 3. 50 1. 00 30. 00 3. 50 1. 00 33. 00 4. 00 1. 00 36. 00 Department of Agricultural Economics Purdue University

Department of Agricultural Economics Purdue University

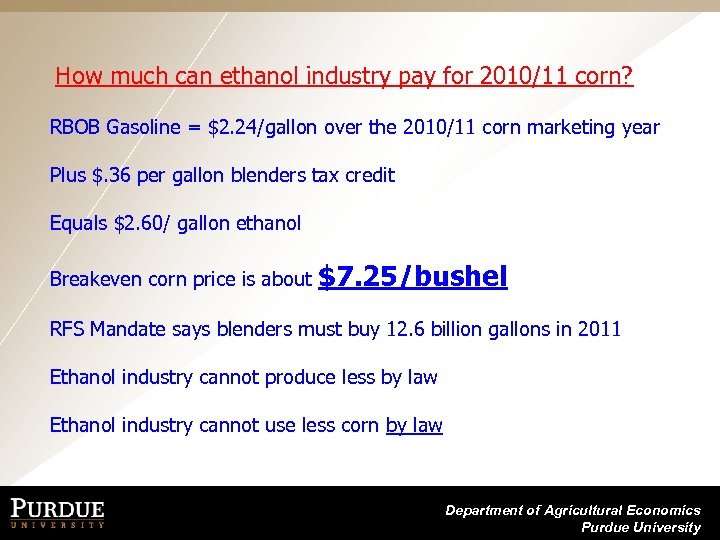

How much can ethanol industry pay for 2010/11 corn? RBOB Gasoline = $2. 24/gallon over the 2010/11 corn marketing year Plus $. 36 per gallon blenders tax credit Equals $2. 60/ gallon ethanol Breakeven corn price is about $7. 25/bushel RFS Mandate says blenders must buy 12. 6 billion gallons in 2011 Ethanol industry cannot produce less by law Ethanol industry cannot use less corn by law Department of Agricultural Economics Purdue University

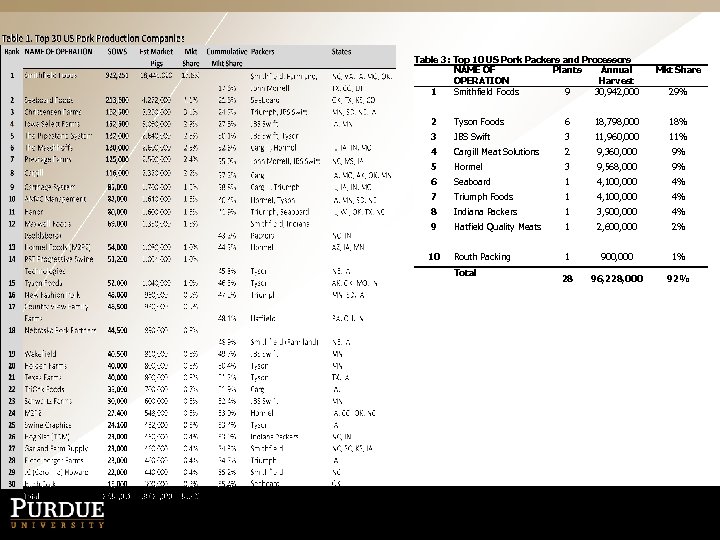

Table 3: Top 10 US Pork Packers and Processors NAME OF Plants Annual OPERATION Harvest 1 Smithfield Foods 9 30, 942, 000 Mkt Share 29% 2 Tyson Foods 6 18, 798, 000 18% 3 JBS Swift 3 11, 960, 000 11% 4 Cargill Meat Solutions 2 9, 360, 000 9% 5 Hormel 3 9, 568, 000 9% 6 Seaboard 1 4, 100, 000 4% 7 Triumph Foods 1 4, 100, 000 4% 8 Indiana Packers 1 3, 900, 000 4% 9 Hatfield Quality Meats 1 2, 600, 000 2% Routh Packing 1 900, 000 1% 28 96, 228, 000 92% 10 Total

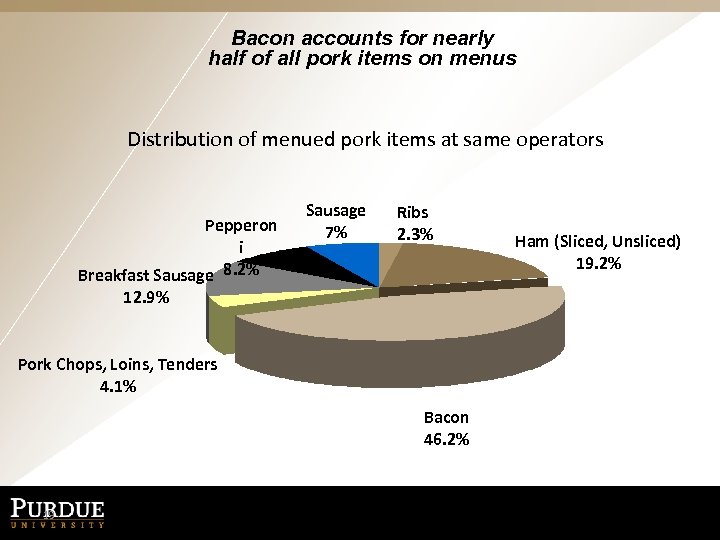

Bacon accounts for nearly half of all pork items on menus Distribution of menued pork items at same operators Pepperon i Breakfast Sausage 8. 2% Sausage 7% Ribs 2. 3% 12. 9% Pork Chops, Loins, Tenders 4. 1% Bacon 46. 2% 19 Source: Menu. Mine 2005 Ham (Sliced, Unsliced) 19. 2%

Department of Agricultural Economics Purdue University

b378f451736e0636439fd790ff3dd496.ppt