8453734208fec539a06ac79850df7461.ppt

- Количество слайдов: 25

MEASURING YIELD FIXED INCOME MANAGEMENT

MEASURING YIELD FIXED INCOME MANAGEMENT

FIXED INCOME MANAGEMENT 2

FIXED INCOME MANAGEMENT 2

FIXED INCOME MANAGEMENT 3

FIXED INCOME MANAGEMENT 3

• CURRENT YIELD • YIELD TO MATURITY • YIELD TO CALL FIXED INCOME MANAGEMENT 4

• CURRENT YIELD • YIELD TO MATURITY • YIELD TO CALL FIXED INCOME MANAGEMENT 4

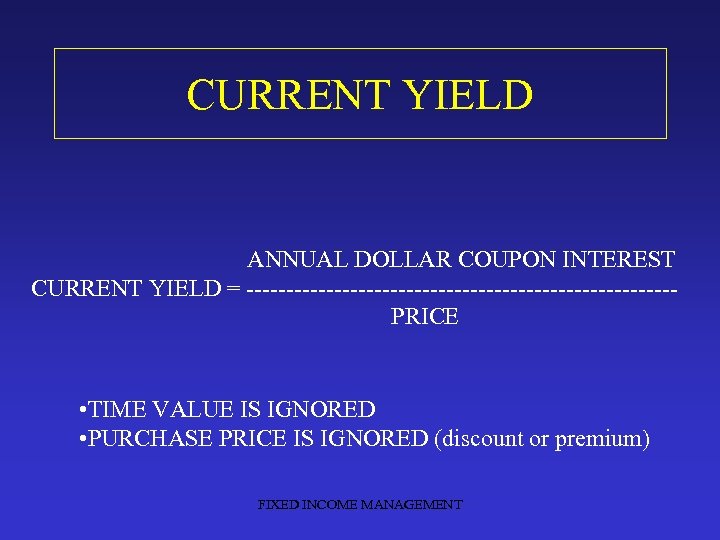

CURRENT YIELD ANNUAL DOLLAR COUPON INTEREST CURRENT YIELD = ---------------------------PRICE • TIME VALUE IS IGNORED • PURCHASE PRICE IS IGNORED (discount or premium) FIXED INCOME MANAGEMENT

CURRENT YIELD ANNUAL DOLLAR COUPON INTEREST CURRENT YIELD = ---------------------------PRICE • TIME VALUE IS IGNORED • PURCHASE PRICE IS IGNORED (discount or premium) FIXED INCOME MANAGEMENT

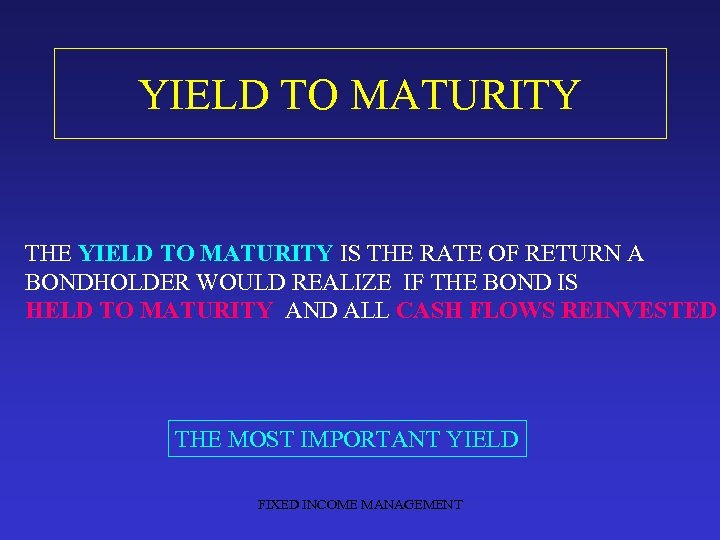

YIELD TO MATURITY THE YIELD TO MATURITY IS THE RATE OF RETURN A BONDHOLDER WOULD REALIZE IF THE BOND IS HELD TO MATURITY AND ALL CASH FLOWS REINVESTED THE MOST IMPORTANT YIELD FIXED INCOME MANAGEMENT

YIELD TO MATURITY THE YIELD TO MATURITY IS THE RATE OF RETURN A BONDHOLDER WOULD REALIZE IF THE BOND IS HELD TO MATURITY AND ALL CASH FLOWS REINVESTED THE MOST IMPORTANT YIELD FIXED INCOME MANAGEMENT

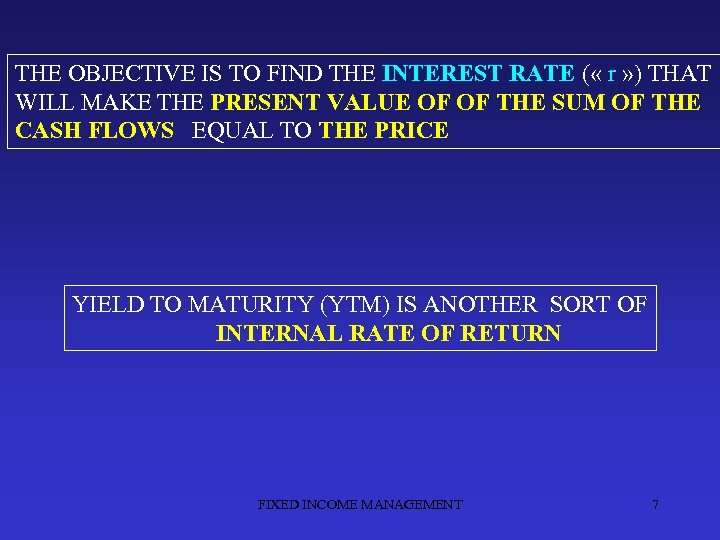

THE OBJECTIVE IS TO FIND THE INTEREST RATE ( « r » ) THAT WILL MAKE THE PRESENT VALUE OF OF THE SUM OF THE CASH FLOWS EQUAL TO THE PRICE YIELD TO MATURITY (YTM) IS ANOTHER SORT OF INTERNAL RATE OF RETURN FIXED INCOME MANAGEMENT 7

THE OBJECTIVE IS TO FIND THE INTEREST RATE ( « r » ) THAT WILL MAKE THE PRESENT VALUE OF OF THE SUM OF THE CASH FLOWS EQUAL TO THE PRICE YIELD TO MATURITY (YTM) IS ANOTHER SORT OF INTERNAL RATE OF RETURN FIXED INCOME MANAGEMENT 7

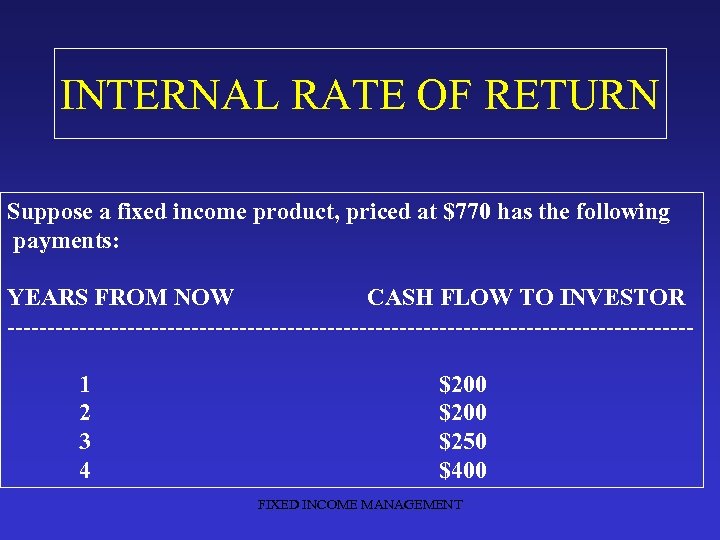

INTERNAL RATE OF RETURN Suppose a fixed income product, priced at $770 has the following payments: YEARS FROM NOW CASH FLOW TO INVESTOR -------------------------------------------1 2 3 4 $200 $250 $400 FIXED INCOME MANAGEMENT

INTERNAL RATE OF RETURN Suppose a fixed income product, priced at $770 has the following payments: YEARS FROM NOW CASH FLOW TO INVESTOR -------------------------------------------1 2 3 4 $200 $250 $400 FIXED INCOME MANAGEMENT

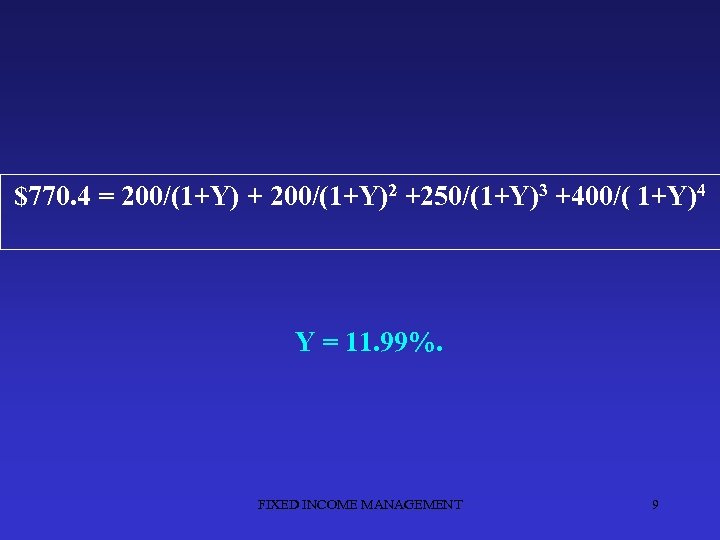

$770. 4 = 200/(1+Y) + 200/(1+Y)2 +250/(1+Y)3 +400/( 1+Y)4 Y = 11. 99%. FIXED INCOME MANAGEMENT 9

$770. 4 = 200/(1+Y) + 200/(1+Y)2 +250/(1+Y)3 +400/( 1+Y)4 Y = 11. 99%. FIXED INCOME MANAGEMENT 9

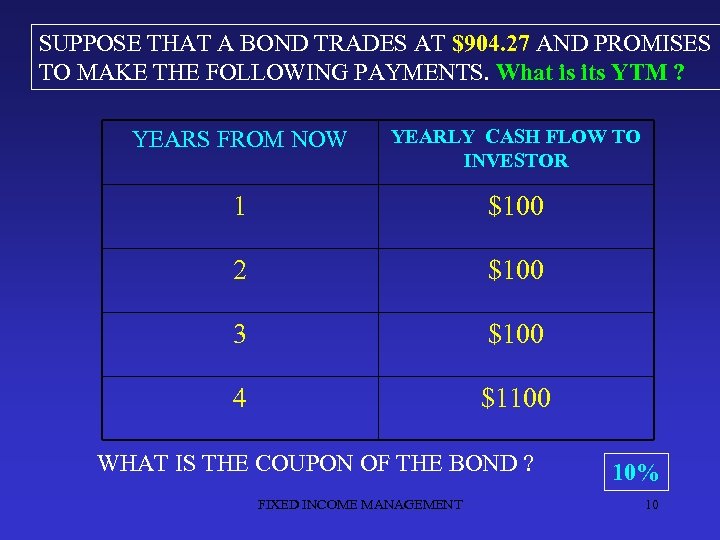

SUPPOSE THAT A BOND TRADES AT $904. 27 AND PROMISES TO MAKE THE FOLLOWING PAYMENTS. What is its YTM ? YEARS FROM NOW YEARLY CASH FLOW TO INVESTOR 1 $100 2 $100 3 $100 4 $1100 WHAT IS THE COUPON OF THE BOND ? FIXED INCOME MANAGEMENT 10% 10

SUPPOSE THAT A BOND TRADES AT $904. 27 AND PROMISES TO MAKE THE FOLLOWING PAYMENTS. What is its YTM ? YEARS FROM NOW YEARLY CASH FLOW TO INVESTOR 1 $100 2 $100 3 $100 4 $1100 WHAT IS THE COUPON OF THE BOND ? FIXED INCOME MANAGEMENT 10% 10

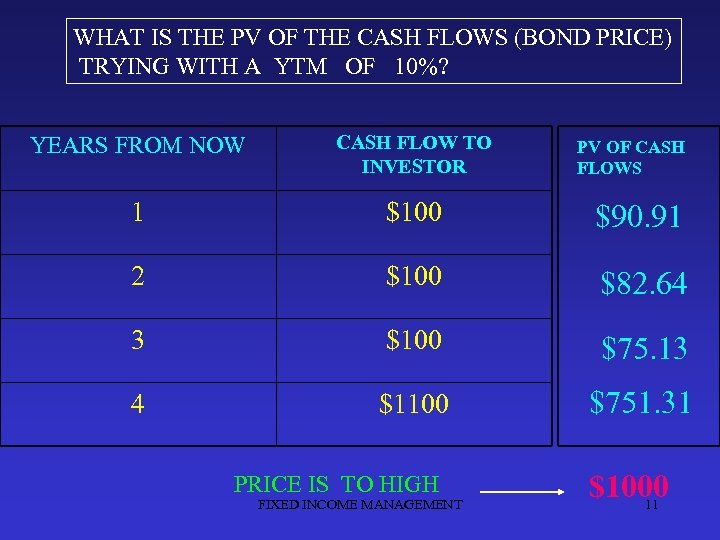

WHAT IS THE PV OF THE CASH FLOWS (BOND PRICE) TRYING WITH A YTM OF 10%? YEARS FROM NOW CASH FLOW TO INVESTOR 1 $100 $90. 91 2 $100 $82. 64 3 $100 $75. 13 4 $1100 $751. 31 PRICE IS TO HIGH FIXED INCOME MANAGEMENT PV OF CASH FLOWS $1000 11

WHAT IS THE PV OF THE CASH FLOWS (BOND PRICE) TRYING WITH A YTM OF 10%? YEARS FROM NOW CASH FLOW TO INVESTOR 1 $100 $90. 91 2 $100 $82. 64 3 $100 $75. 13 4 $1100 $751. 31 PRICE IS TO HIGH FIXED INCOME MANAGEMENT PV OF CASH FLOWS $1000 11

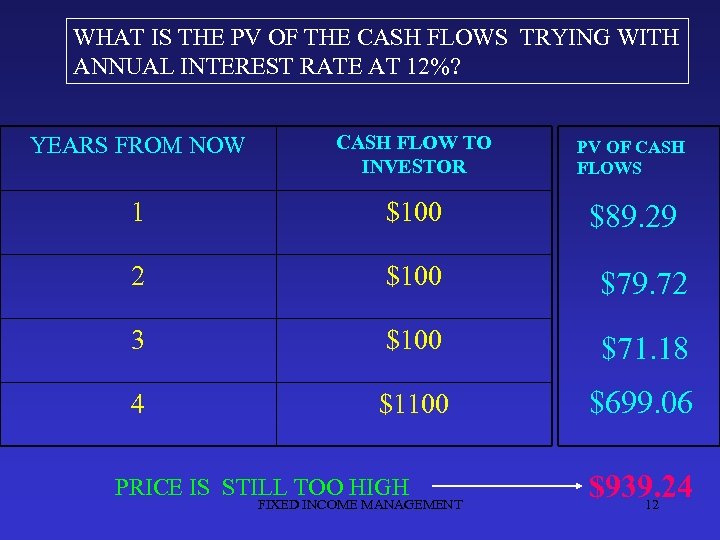

WHAT IS THE PV OF THE CASH FLOWS TRYING WITH ANNUAL INTEREST RATE AT 12%? YEARS FROM NOW CASH FLOW TO INVESTOR PV OF CASH FLOWS 1 $100 $89. 29 2 $100 $79. 72 3 $100 $71. 18 4 $1100 $699. 06 PRICE IS STILL TOO HIGH FIXED INCOME MANAGEMENT $939. 24 12

WHAT IS THE PV OF THE CASH FLOWS TRYING WITH ANNUAL INTEREST RATE AT 12%? YEARS FROM NOW CASH FLOW TO INVESTOR PV OF CASH FLOWS 1 $100 $89. 29 2 $100 $79. 72 3 $100 $71. 18 4 $1100 $699. 06 PRICE IS STILL TOO HIGH FIXED INCOME MANAGEMENT $939. 24 12

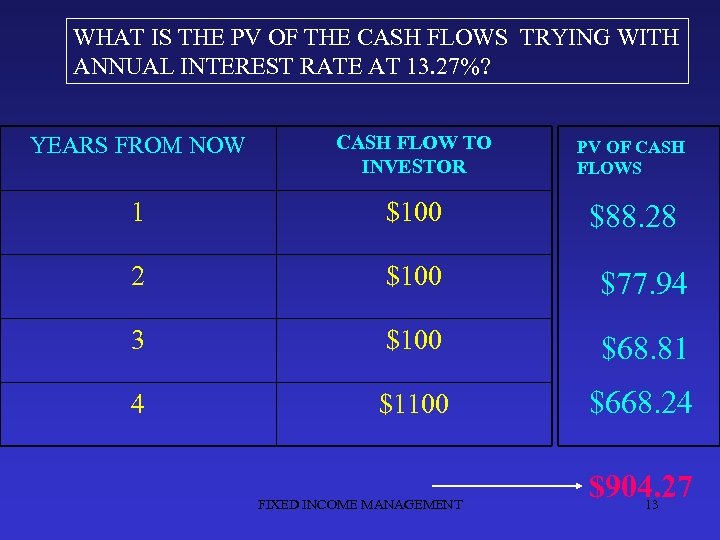

WHAT IS THE PV OF THE CASH FLOWS TRYING WITH ANNUAL INTEREST RATE AT 13. 27%? YEARS FROM NOW CASH FLOW TO INVESTOR PV OF CASH FLOWS 1 $100 $88. 28 2 $100 $77. 94 3 $100 $68. 81 4 $1100 $668. 24 FIXED INCOME MANAGEMENT $904. 27 13

WHAT IS THE PV OF THE CASH FLOWS TRYING WITH ANNUAL INTEREST RATE AT 13. 27%? YEARS FROM NOW CASH FLOW TO INVESTOR PV OF CASH FLOWS 1 $100 $88. 28 2 $100 $77. 94 3 $100 $68. 81 4 $1100 $668. 24 FIXED INCOME MANAGEMENT $904. 27 13

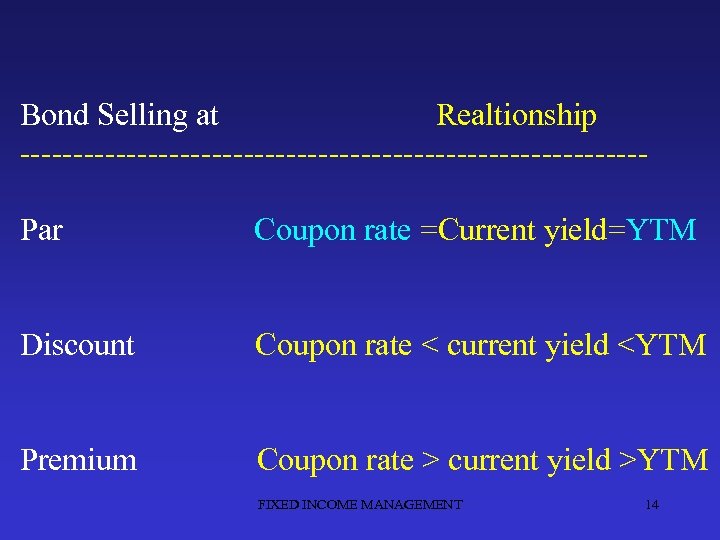

Bond Selling at Realtionship -----------------------------Par Coupon rate =Current yield=YTM Discount Coupon rate < current yield

Bond Selling at Realtionship -----------------------------Par Coupon rate =Current yield=YTM Discount Coupon rate < current yield

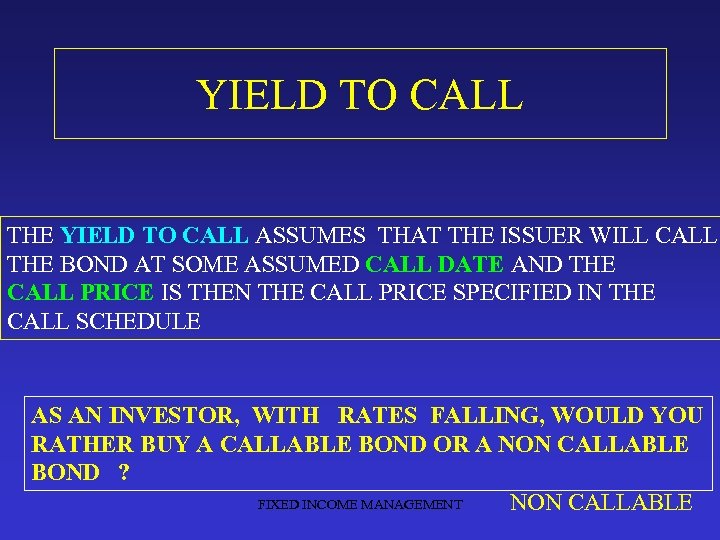

YIELD TO CALL THE YIELD TO CALL ASSUMES THAT THE ISSUER WILL CALL THE BOND AT SOME ASSUMED CALL DATE AND THE CALL PRICE IS THEN THE CALL PRICE SPECIFIED IN THE CALL SCHEDULE AS AN INVESTOR, WITH RATES FALLING, WOULD YOU RATHER BUY A CALLABLE BOND OR A NON CALLABLE BOND ? FIXED INCOME MANAGEMENT NON CALLABLE

YIELD TO CALL THE YIELD TO CALL ASSUMES THAT THE ISSUER WILL CALL THE BOND AT SOME ASSUMED CALL DATE AND THE CALL PRICE IS THEN THE CALL PRICE SPECIFIED IN THE CALL SCHEDULE AS AN INVESTOR, WITH RATES FALLING, WOULD YOU RATHER BUY A CALLABLE BOND OR A NON CALLABLE BOND ? FIXED INCOME MANAGEMENT NON CALLABLE

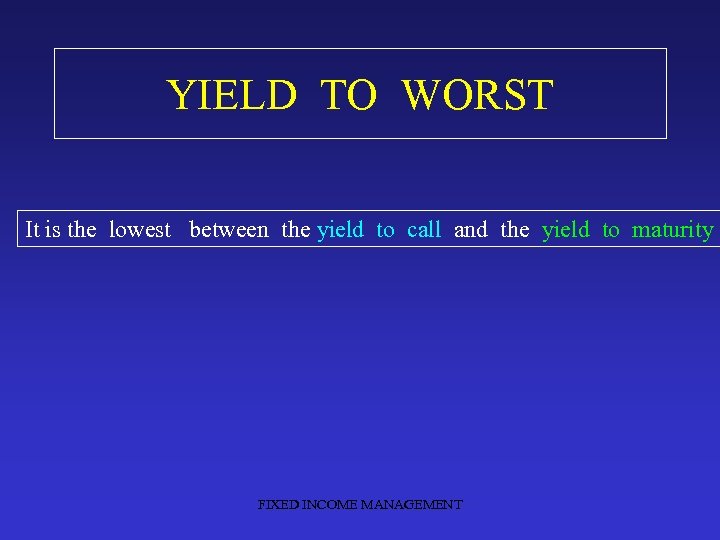

YIELD TO WORST It is the lowest between the yield to call and the yield to maturity FIXED INCOME MANAGEMENT

YIELD TO WORST It is the lowest between the yield to call and the yield to maturity FIXED INCOME MANAGEMENT

BOND’S TOTAL RETURN: 3 COMPONENTS 1. TOTAL COUPONS INTEREST 2. CAPITAL GAIN 3. INTEREST ON INTEREST FIXED INCOME MANAGEMENT

BOND’S TOTAL RETURN: 3 COMPONENTS 1. TOTAL COUPONS INTEREST 2. CAPITAL GAIN 3. INTEREST ON INTEREST FIXED INCOME MANAGEMENT

TOTAL COUPONS INTEREST NUMBER OF PAYMENTS X COUPON DOLLAR AMOUNT FIXED INCOME MANAGEMENT 18

TOTAL COUPONS INTEREST NUMBER OF PAYMENTS X COUPON DOLLAR AMOUNT FIXED INCOME MANAGEMENT 18

CAPITAL GAIN FACE VALUE - PURCHASE PRICE FIXED INCOME MANAGEMENT 19

CAPITAL GAIN FACE VALUE - PURCHASE PRICE FIXED INCOME MANAGEMENT 19

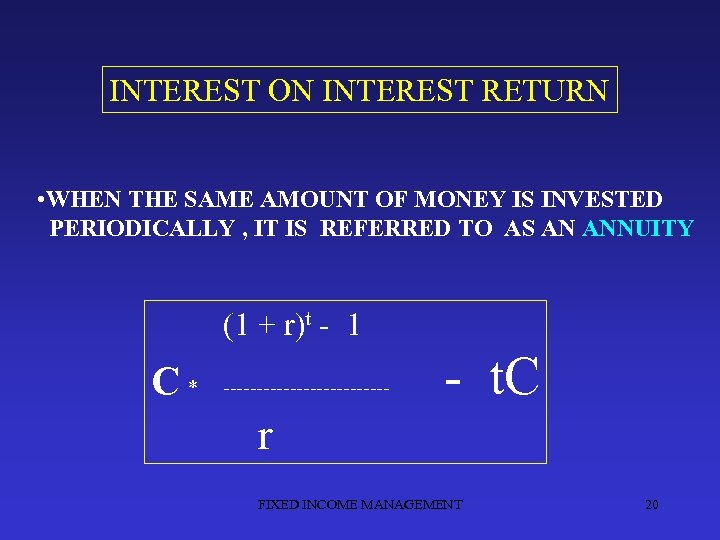

INTEREST ON INTEREST RETURN • WHEN THE SAME AMOUNT OF MONEY IS INVESTED PERIODICALLY , IT IS REFERRED TO AS AN ANNUITY (1 + r)t - 1 C * ------------- - t. C r FIXED INCOME MANAGEMENT 20

INTEREST ON INTEREST RETURN • WHEN THE SAME AMOUNT OF MONEY IS INVESTED PERIODICALLY , IT IS REFERRED TO AS AN ANNUITY (1 + r)t - 1 C * ------------- - t. C r FIXED INCOME MANAGEMENT 20

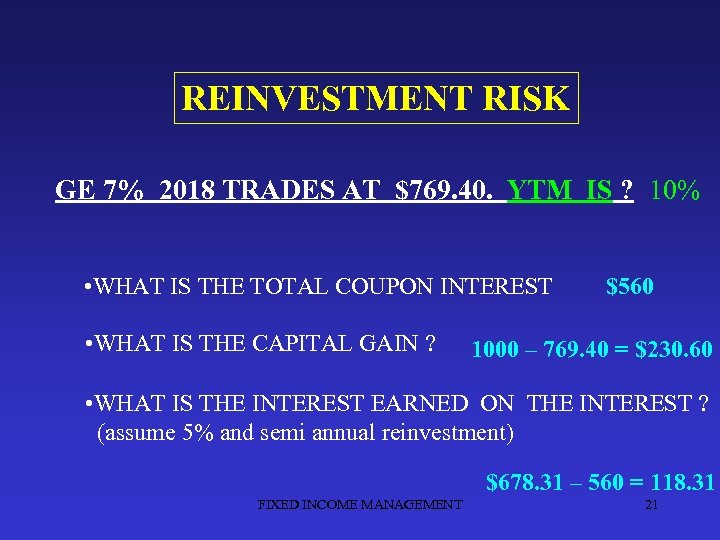

REINVESTMENT RISK GE 7% 2018 TRADES AT $769. 40. YTM IS ? 10% • WHAT IS THE TOTAL COUPON INTEREST • WHAT IS THE CAPITAL GAIN ? $560 1000 – 769. 40 = $230. 60 • WHAT IS THE INTEREST EARNED ON THE INTEREST ? (assume 5% and semi annual reinvestment) $678. 31 – 560 = 118. 31 FIXED INCOME MANAGEMENT 21

REINVESTMENT RISK GE 7% 2018 TRADES AT $769. 40. YTM IS ? 10% • WHAT IS THE TOTAL COUPON INTEREST • WHAT IS THE CAPITAL GAIN ? $560 1000 – 769. 40 = $230. 60 • WHAT IS THE INTEREST EARNED ON THE INTEREST ? (assume 5% and semi annual reinvestment) $678. 31 – 560 = 118. 31 FIXED INCOME MANAGEMENT 21

![Interest on interest calculation…. [ 1. 0528 - 1 ] 35 --------- - (28 Interest on interest calculation…. [ 1. 0528 - 1 ] 35 --------- - (28](https://present5.com/presentation/8453734208fec539a06ac79850df7461/image-22.jpg) Interest on interest calculation…. [ 1. 0528 - 1 ] 35 --------- - (28 )(35) = $1064 0. 05 FIXED INCOME MANAGEMENT

Interest on interest calculation…. [ 1. 0528 - 1 ] 35 --------- - (28 )(35) = $1064 0. 05 FIXED INCOME MANAGEMENT

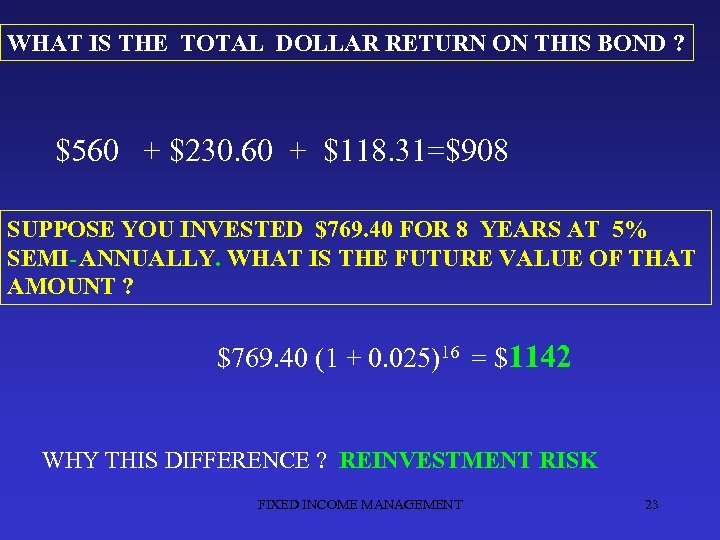

WHAT IS THE TOTAL DOLLAR RETURN ON THIS BOND ? $560 + $230. 60 + $118. 31=$908 SUPPOSE YOU INVESTED $769. 40 FOR 8 YEARS AT 5% SEMI- ANNUALLY. WHAT IS THE FUTURE VALUE OF THAT AMOUNT ? $769. 40 (1 + 0. 025)16 = $1142 WHY THIS DIFFERENCE ? REINVESTMENT RISK FIXED INCOME MANAGEMENT 23

WHAT IS THE TOTAL DOLLAR RETURN ON THIS BOND ? $560 + $230. 60 + $118. 31=$908 SUPPOSE YOU INVESTED $769. 40 FOR 8 YEARS AT 5% SEMI- ANNUALLY. WHAT IS THE FUTURE VALUE OF THAT AMOUNT ? $769. 40 (1 + 0. 025)16 = $1142 WHY THIS DIFFERENCE ? REINVESTMENT RISK FIXED INCOME MANAGEMENT 23

QUESTIONS 1. IS THE REINVESTMENT RISK HIGHER OR LOWER WITH A LOW COUPON ? LOWER FIXED INCOME MANAGEMENT

QUESTIONS 1. IS THE REINVESTMENT RISK HIGHER OR LOWER WITH A LOW COUPON ? LOWER FIXED INCOME MANAGEMENT

TAKE A BREAK ! FIXED INCOME MANAGEMENT

TAKE A BREAK ! FIXED INCOME MANAGEMENT