f80de3e198ae9ce85e466cdc056c21ff.ppt

- Количество слайдов: 38

Measuring the Cost of Public Services Through Activity-Based Cost Management u World Bank Institute u Srikant Sastry, Principal Consultant May 25, 2000 1

Presentation Overview The government has often been successful at leveraging new management practices from the private sector and applying them in public sector settings. Techniques such as process improvement, process reengineering and Activity-Based Cost Management (ABCM) are rapidly gaining ground in Federal, State and Local government agencies. However, success from these initiatives rests not in the mechanics of implementation but in the ability of government managers to solve real problems and create tangible success. This presentation will highlight the key drivers for success in the private sector and their relevance for government agencies. © Copyright 2000 Pricewaterhouse. Coopers LLP 2

Presentation Topics u ABCM: What and Why u Drivers of ABCM in the Private Sector u Private vs. Public: Similarities and Differences u Defining Success in ABCM u Lessons Learned u Government Experiences with ABCM -- Examples © Copyright 2000 Pricewaterhouse. Coopers LLP 3

Impetus for Change: From Traditional Costing to ABCM Best Practice Worldclass companies know their profitability by product, customer (market segment), and geography. Professor Larry Seldon - Columbia University © Copyright 2000 Pricewaterhouse. Coopers LLP 4

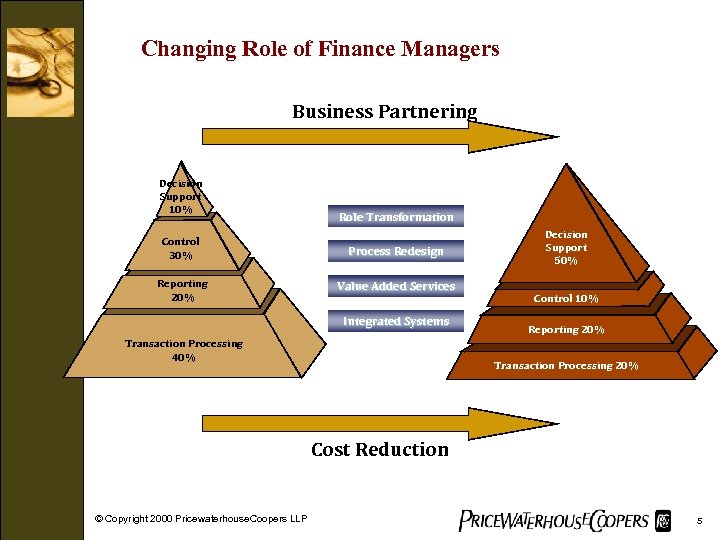

Changing Role of Finance Managers Business Partnering Decision Support 10% Role Transformation Control 30% Process Redesign Reporting 20% Value Added Services Integrated Systems Transaction Processing 40% Decision Support 50% Control 10% Reporting 20% Transaction Processing 20% Cost Reduction © Copyright 2000 Pricewaterhouse. Coopers LLP 5

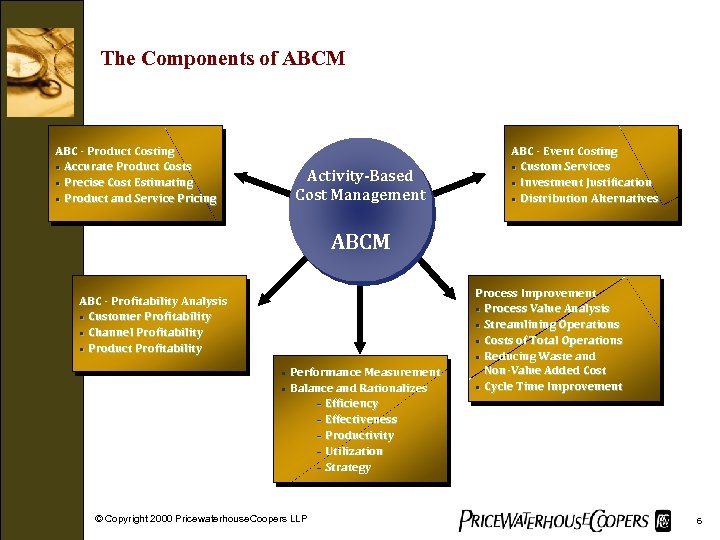

The Components of ABCM ABC - Product Costing • Accurate Product Costs • Precise Cost Estimating • Product and Service Pricing Activity-Based Cost Management ABC - Event Costing • Custom Services • Investment Justification • Distribution Alternatives ABCM ABC - Profitability Analysis • Customer Profitability • Channel Profitability • Product Profitability • • Performance Measurement Balance and Rationalizes – Efficiency – Effectiveness – Productivity – Utilization – Strategy © Copyright 2000 Pricewaterhouse. Coopers LLP Process Improvement • Process Value Analysis • Streamlining Operations • Costs of Total Operations • Reducing Waste and Non-Value Added Cost • Cycle Time Improvement 6

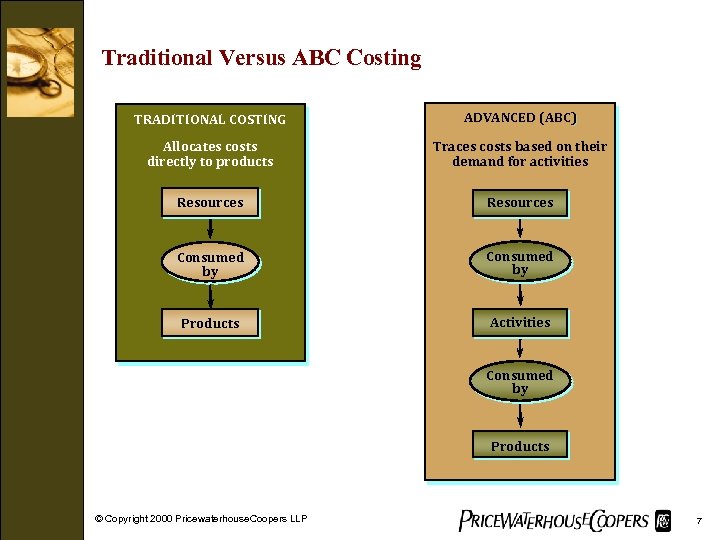

Traditional Versus ABC Costing TRADITIONAL COSTING ADVANCED (ABC) Allocates costs directly to products Traces costs based on their demand for activities Resources Consumed by Products Activities Consumed by Products © Copyright 2000 Pricewaterhouse. Coopers LLP 7

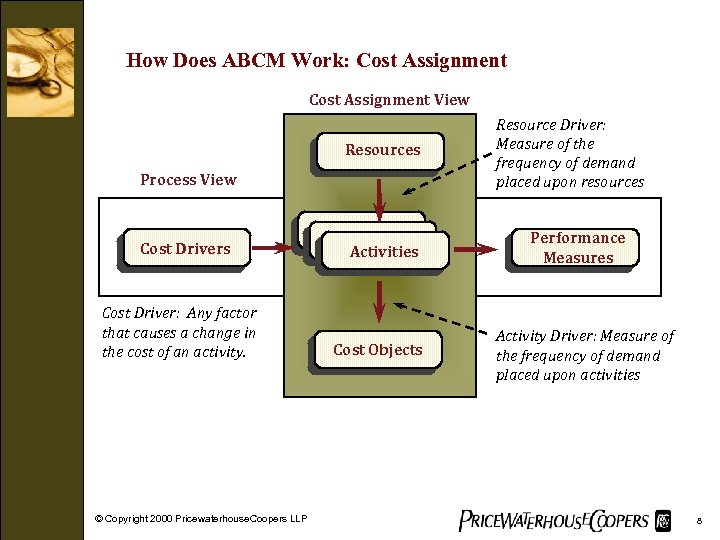

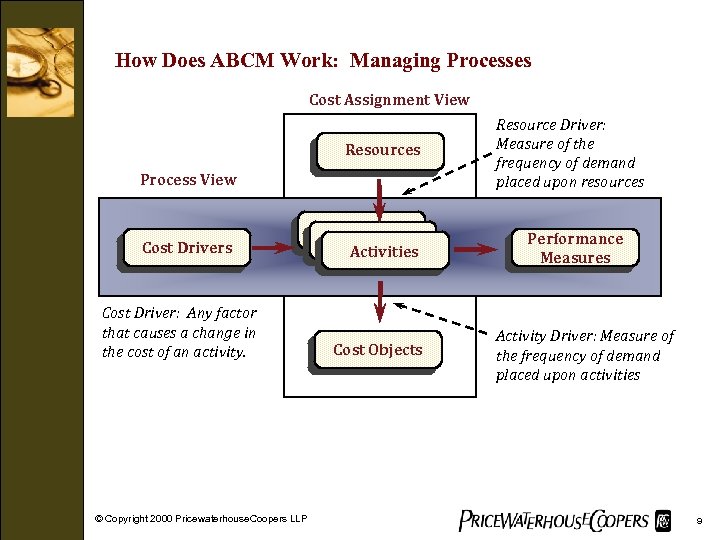

How Does ABCM Work: Cost Assignment View Resources Process View Cost Drivers Cost Driver: Any factor that causes a change in the cost of an activity. © Copyright 2000 Pricewaterhouse. Coopers LLP Activities Cost Objects Resource Driver: Measure of the frequency of demand placed upon resources Performance Measures Activity Driver: Measure of the frequency of demand placed upon activities 8

How Does ABCM Work: Managing Processes Cost Assignment View Resources Process View Cost Drivers Cost Driver: Any factor that causes a change in the cost of an activity. © Copyright 2000 Pricewaterhouse. Coopers LLP Activities Cost Objects Resource Driver: Measure of the frequency of demand placed upon resources Performance Measures Activity Driver: Measure of the frequency of demand placed upon activities 9

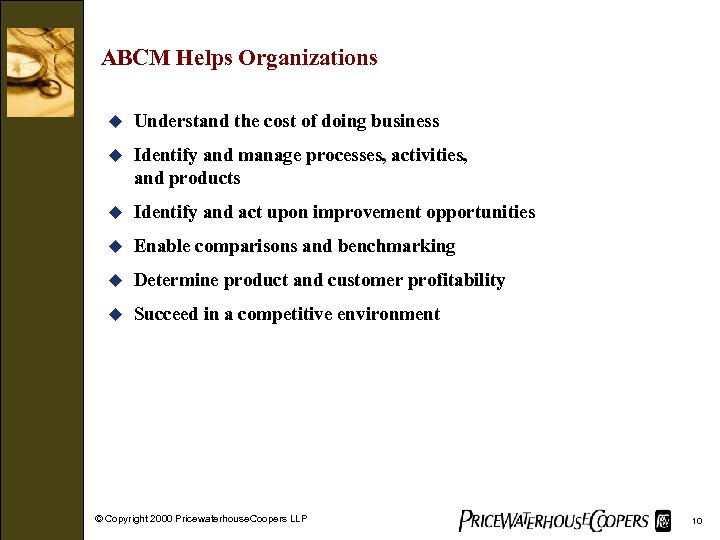

ABCM Helps Organizations u Understand the cost of doing business u Identify and manage processes, activities, and products u Identify and act upon improvement opportunities u Enable comparisons and benchmarking u Determine product and customer profitability u Succeed in a competitive environment © Copyright 2000 Pricewaterhouse. Coopers LLP 10

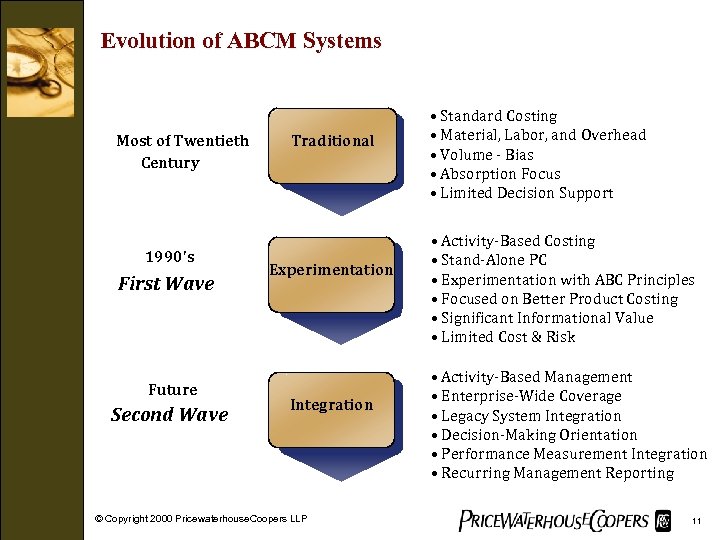

Evolution of ABCM Systems Most of Twentieth Century 1990's First Wave Future Second Wave Traditional Experimentation Integration © Copyright 2000 Pricewaterhouse. Coopers LLP • Standard Costing • Material, Labor, and Overhead • Volume - Bias • Absorption Focus • Limited Decision Support • Activity-Based Costing • Stand-Alone PC • Experimentation with ABC Principles • Focused on Better Product Costing • Significant Informational Value • Limited Cost & Risk • Activity-Based Management • Enterprise-Wide Coverage • Legacy System Integration • Decision-Making Orientation • Performance Measurement Integration • Recurring Management Reporting 11

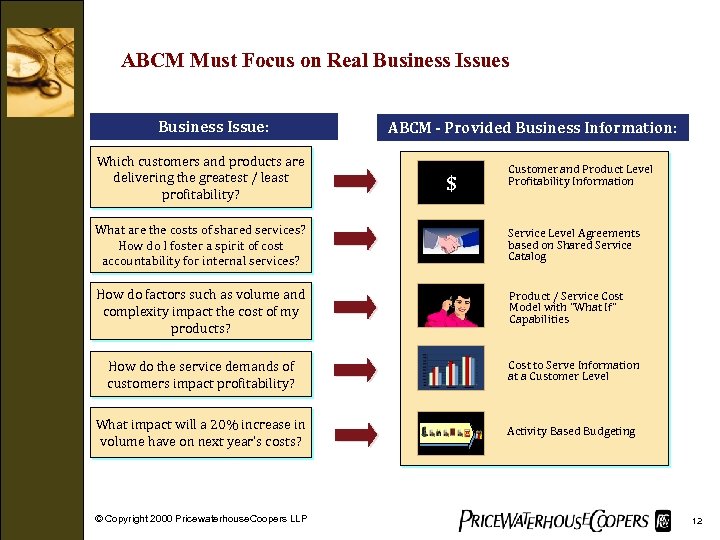

ABCM Must Focus on Real Business Issues Business Issue: Which customers and products are delivering the greatest / least profitability? ABCM - Provided Business Information: $ Customer and Product Level Profitability Information What are the costs of shared services? How do I foster a spirit of cost accountability for internal services? Service Level Agreements based on Shared Service Catalog How do factors such as volume and complexity impact the cost of my products? Product / Service Cost Model with “What If” Capabilities How do the service demands of customers impact profitability? Cost to Serve Information at a Customer Level What impact will a 20% increase in volume have on next year’s costs? Activity Based Budgeting © Copyright 2000 Pricewaterhouse. Coopers LLP 12

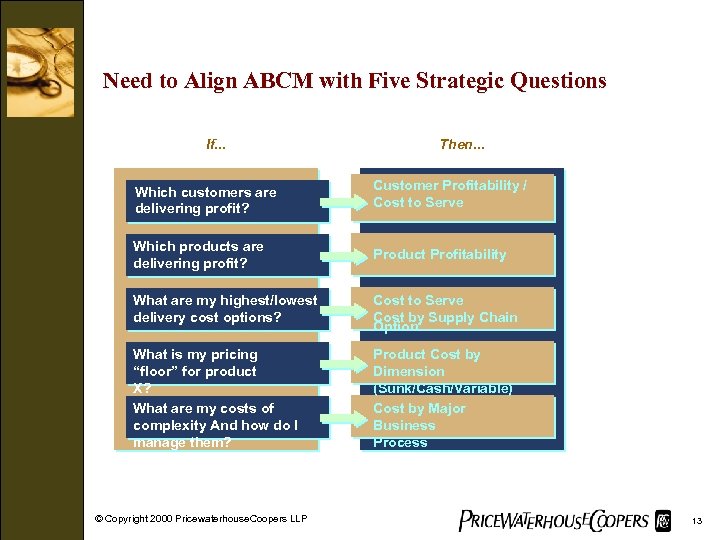

Need to Align ABCM with Five Strategic Questions If. . . Then. . . Which customers are delivering profit? Customer Profitability / Cost to Serve Which products are delivering profit? Product Profitability What are my highest/lowest delivery cost options? Cost to Serve Cost by Supply Chain Option What is my pricing “floor” for product X? What are my costs of complexity And how do I manage them? Product Cost by Dimension (Sunk/Cash/Variable) Cost by Major Business Process © Copyright 2000 Pricewaterhouse. Coopers LLP 13

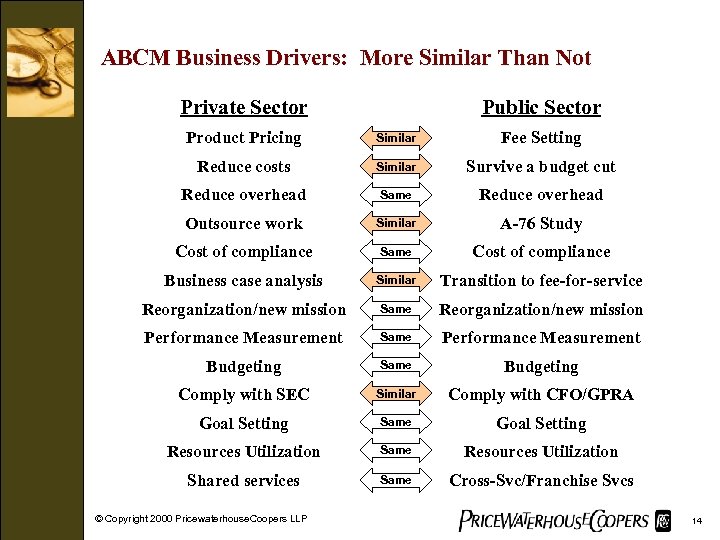

ABCM Business Drivers: More Similar Than Not Private Sector Public Sector Product Pricing Similar Fee Setting Reduce costs Similar Survive a budget cut Reduce overhead Same Reduce overhead Outsource work Similar A-76 Study Cost of compliance Same Cost of compliance Business case analysis Similar Transition to fee-for-service Reorganization/new mission Same Reorganization/new mission Performance Measurement Same Performance Measurement Budgeting Same Budgeting Comply with SEC Similar Comply with CFO/GPRA Goal Setting Same Goal Setting Resources Utilization Same Resources Utilization Shared services Same Cross-Svc/Franchise Svcs © Copyright 2000 Pricewaterhouse. Coopers LLP 14

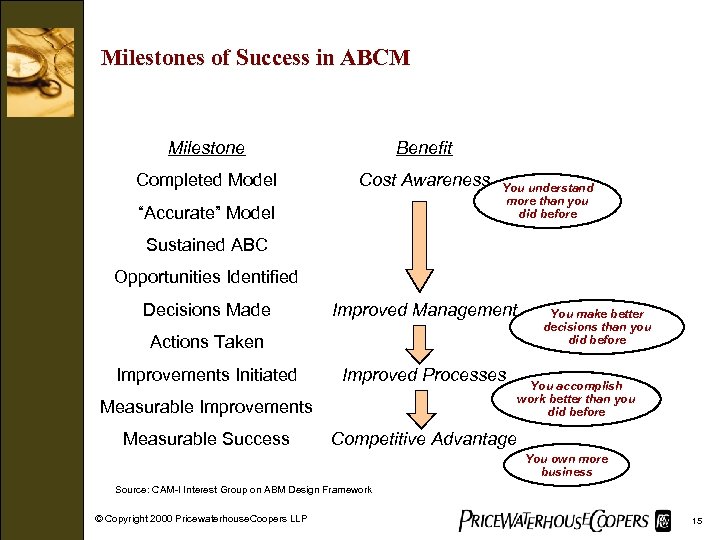

Milestones of Success in ABCM Milestone Benefit Completed Model Cost Awareness “Accurate” Model You understand more than you did before Sustained ABC Opportunities Identified Decisions Made Improved Management Actions Taken Improvements Initiated Improved Processes Measurable Improvements Measurable Success You make better decisions than you did before You accomplish work better than you did before Competitive Advantage You own more business Source: CAM-I Interest Group on ABM Design Framework © Copyright 2000 Pricewaterhouse. Coopers LLP 15

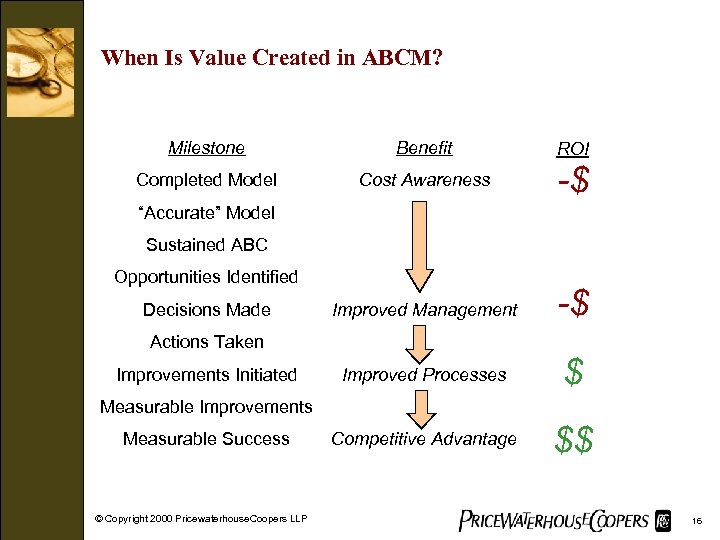

When Is Value Created in ABCM? Milestone Benefit ROI Completed Model Cost Awareness -$ Improved Management -$ Improved Processes $ Competitive Advantage $$ “Accurate” Model Sustained ABC Opportunities Identified Decisions Made Actions Taken Improvements Initiated Measurable Improvements Measurable Success © Copyright 2000 Pricewaterhouse. Coopers LLP 16

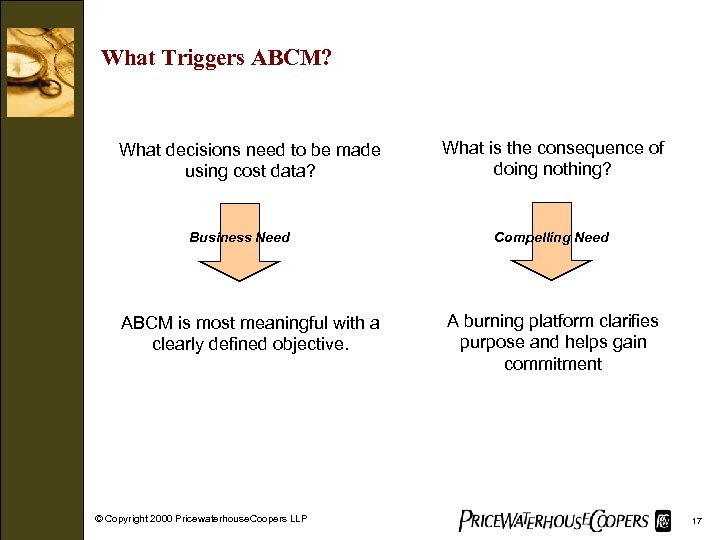

What Triggers ABCM? What decisions need to be made using cost data? Business Need ABCM is most meaningful with a clearly defined objective. © Copyright 2000 Pricewaterhouse. Coopers LLP What is the consequence of doing nothing? Compelling Need A burning platform clarifies purpose and helps gain commitment 17

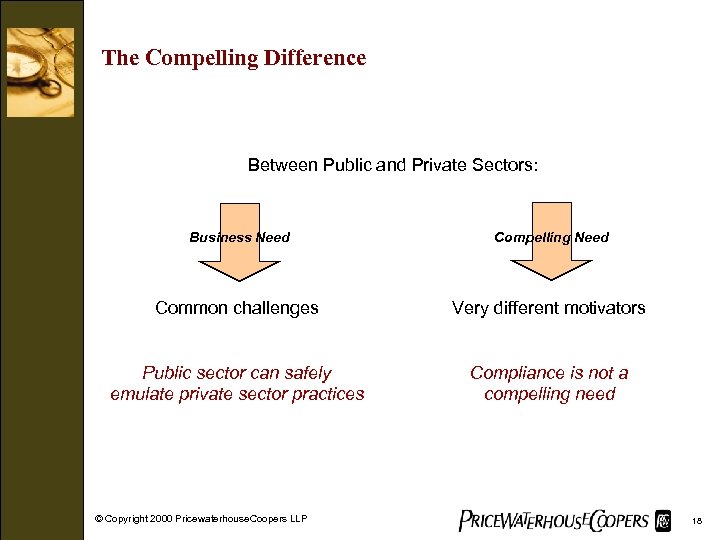

The Compelling Difference Between Public and Private Sectors: Business Need Compelling Need Common challenges Very different motivators Public sector can safely emulate private sector practices Compliance is not a compelling need © Copyright 2000 Pricewaterhouse. Coopers LLP 18

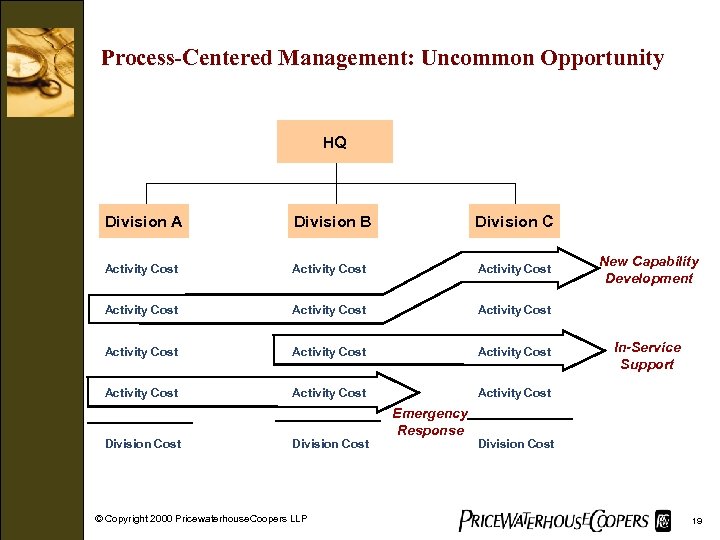

Process-Centered Management: Uncommon Opportunity HQ Division A Division B Division C Activity Cost Activity Cost Activity Cost Division Cost © Copyright 2000 Pricewaterhouse. Coopers LLP Emergency Response New Capability Development In-Service Support Division Cost 19

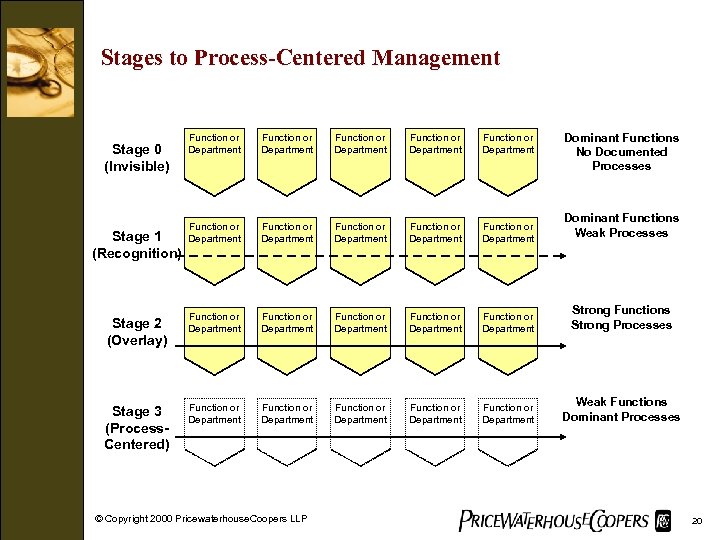

Stages to Process-Centered Management Dominant Functions No Documented Processes Function or Department Function or Department Function or Department Stage 2 (Overlay) Function or Department Function or Department Strong Functions Strong Processes Stage 3 (Process. Centered) Function or Department Function or Department Weak Functions Dominant Processes Stage 0 (Invisible) Stage 1 (Recognition) © Copyright 2000 Pricewaterhouse. Coopers LLP Dominant Functions Weak Processes 20

Key Success Factors for ABCM u Plan long-term, but implement in stages u Integrate with other business processes, not stand-alone u Understand why, how, and by whom cost information will be used u Identify “champions” who will visibly lead the effort u Develop early “pull” or demand through a successful pilot u Strive for relevance, not necessarily precision u Don’t lead with technology; prove value first u Develop working consensus between key internal stakeholders: finance, programs, and IT © Copyright 2000 Pricewaterhouse. Coopers LLP 21

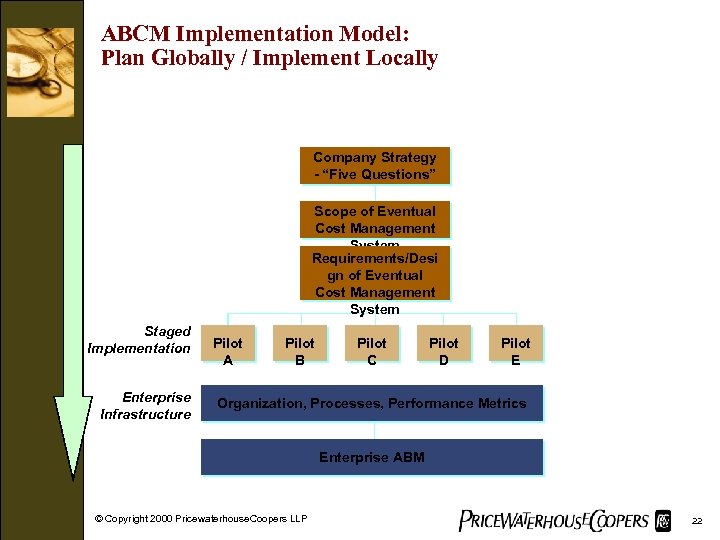

ABCM Implementation Model: Plan Globally / Implement Locally Company Strategy - “Five Questions” Scope of Eventual Cost Management System Requirements/Desi gn of Eventual Cost Management System Staged Implementation Enterprise Infrastructure Pilot A Pilot B Pilot C Pilot D Pilot E Organization, Processes, Performance Metrics Enterprise ABM © Copyright 2000 Pricewaterhouse. Coopers LLP 22

Federal Agency Experiences u Compliance with Federal regulations u Fee-setting u Shared services u Resource allocation u Process improvement © Copyright 2000 Pricewaterhouse. Coopers LLP 23

Compliance with Federal Regulations Case Example u The National Science Foundation ä ä u Assessed Managerial Cost Accounting capabilities for compliance with federal accounting standards, reporting requirements and GPRA initiatives Evaluated data collection methods to support linkages between strategic planning, budget formulation, financial reporting and managerial accountability Social Security Administration (SSA) ä ä u Reviewed the SSA’s cost allocation methodology and made recommendations for improving the process. Obtained buy-in of key stakeholders, including GAO and OMB Department of Labor ä Identifying gaps between “as-is” cost accounting processes and best practices per FASAB and JFMIP ä Develop costing pilots with program offices to use as a benchmark and as a tool to evaluate their programs by connecting cost data to program performance. © Copyright 2000 Pricewaterhouse. Coopers LLP

Fee-Setting Case Example u Immigration and Naturalization Service (INS), Executive Office of Immigration Review (EOIR) ä ä Identified the cost to process each immigration appeal and motion ä u Developed a fee schedule for Examination and User Fee applications and services using Activity-Based Costing principles Developed the total cost to perform each EOIR activity and the total unit cost to process each INSfunded appeal and motion Drug Enforcement Agency ä Determined full cost of Diversion Control Program services ä Recommended appropriate registrant fees © Copyright 2000 Pricewaterhouse. Coopers LLP

Shared Services Case Example u USPS Corporate Call Management ä ä u Determined full cost of Call Center service offerings Implementing internal charge-back fee-setting structure for call center services US Department of Agriculture, National Finance Center ä Determining full cost of NFC processes, activities, and products ä Seeking to improve customer service and accuracy of shared service fees ä Defining customer products and services, soliciting customer perspectives of the delivery of those services, mapping high level processes used in accounting product delivery, and developing as-is process maps based on the evaluation of existing accounting systems and activities ä Providing recommendations on the financial management model, optimal structure and organizational placement to improve accounting operations © Copyright 2000 Pricewaterhouse. Coopers LLP 26

Resource Allocation u US Customs Resource Allocation Model ä ä Linked Customs performance measures to occupations performing specific activities ä Developed what-if capability to analyze different workload scenarios ä u Developed a “service-wide” staffing allocation model to support staffing decision-making and budgeting using ABC Praised by GAO before Congress Federal Deposit Insurance Corporation ä Implementing ABC in Receivership Management Program ä Objectives include accurate billings, benchmarking and cost management ä Realigning FDIC budget along activities and processes to support better integration with planning and promote process ownership © Copyright 2000 Pricewaterhouse. Coopers LLP

Process Improvement Case Example u Department of Veterans Affairs ä ä Board Of Veterans’ Appeals - Full Cost of Operations ä u Veterans Health Administration - Medical Care Cost Recovery Veterans Benefits Administration - Entity-wide ABC Implementation Fleet Technical Support Center Atlantic (FTSCLANT) ä Naval Station Norfolk has embarked on an ABC project to provide insight into the activities performed by both the Civilian and Military employees and the contractors who support them. ä The Command has special interest in understanding the work performed by Headquarters back-office personnel, the numerous contractors employed, and the personnel at the four detachments ä Project motivation is to better understand the cost and performance of the work that is due to many external forces which includes: pending Commercial Activity (A-76) studies, commercial contractor competition, and pressure from CINCLANTFLT (their parent command). ä Ultimate goal is to identify "areas for improvement" and reengineer them so as to be able to better support the Fleet and warfighter. © Copyright 2000 Pricewaterhouse. Coopers LLP 28

Process Improvement (con’t) Case Example u Defense Finance and Accounting Service ä Service organization of 20, 000 employees at 24 sites with separate divisions serving separate customer groups and all doing work differently ä Different “Stage II” systems, no common means of measuring cost performance other than budget variance ä Objective: Determine the total cost of providing key services to different customers and identify process inefficiencies ä Capture costs for a selected Division (5, 000 employees) at all sites ä Develop separate site costing models, all with the same structure -- easy to aggregate, compare across the organization ä A Web-based survey application was developed to facilitate identifying the activities individuals perform (labor resource driver data). Specific features included the following: ä Employees need only Internet access and a PC-based Web browser, thus avoiding problems associated with disparate IT infrastructures. ä Employee time allocation information is passed directly to a centralized database. ä Built-in data integrity and validation checks ä Receipts are returned to each employee providing a record of their transaction. © Copyright 2000 Pricewaterhouse. Coopers LLP 29

Process Improvement (con’t) u Case Example U. S. Coast Guard ä Approximately 450 employees deployed across 40 field sites with all sites perform similar work, although certain mission specific activities performed at selected site ä Objective: Develop cost information to assist HQ in budgeting and fee setting; Integrate with GPRA/performance measurement efforts; and, Provide visibility to field units over work activities on a frequent (daily) basis ä Cost Model Design: Prototype cost models, aggregate labor and costs from all sites ä Capture workload data daily -- report cost results quarterly ä A Web-based survey application was developed to facilitate identifying the activities individuals perform (labor resource driver data). Specific features included the following: ä Employees need only Internet access and a PC-based Web browser, thus avoiding problems associated with disparate IT infrastructures. ä Employee time allocation information is passed directly to a centralized database. ä Built-in data integrity and validation checks ä Receipts are returned to each employee providing a record of their transaction. ä The project team can perform administrative adjustments to the application from any site location © Copyright 2000 Pricewaterhouse. Coopers LLP 30

Process Improvement (con’t) Case Example u U. S. Postal Service ä Mail Processing and Distribution Center - developing and implementing cost management and standard costing system ä Corporate Treasury - developed ABC model to determine cost of various means of receiving payment for domestic Postal products and services © Copyright 2000 Pricewaterhouse. Coopers LLP 31

USPS - Business Environment Case Example u Uncertainty of regulatory environment u Preparation for competition u Pressure to cut costs u The need for a “lifestyle change” u Process Standardization and Control u The Information Platform u Transition of Finance to role of “Business Enabler” © Copyright 2000 Pricewaterhouse. Coopers LLP 32

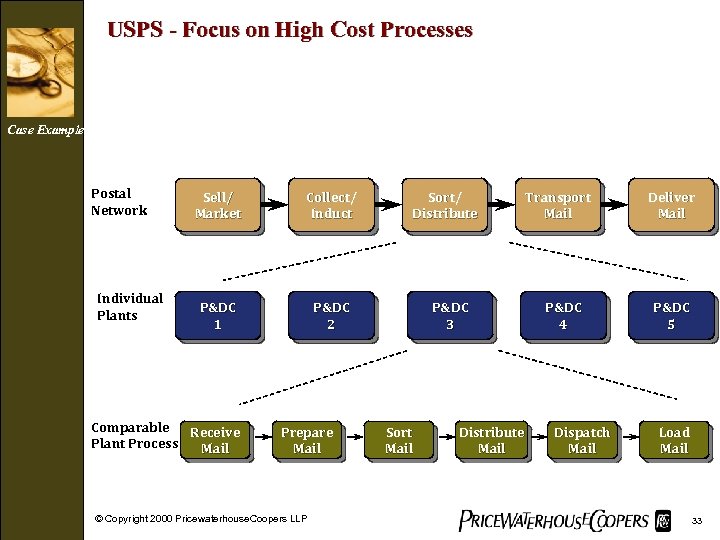

USPS - Focus on High Cost Processes Case Example Postal Network Individual Plants Sell/ Market Collect/ Induct P&DC 1 P&DC 2 Comparable Receive Plant Process Mail Prepare Mail © Copyright 2000 Pricewaterhouse. Coopers LLP Sort/ Distribute P&DC 3 Sort Mail Distribute Mail Transport Mail P&DC 4 Dispatch Mail Deliver Mail P&DC 5 Load Mail 33

USPS - ABM in Mail Processing - Objectives Case Example u To realize ongoing and measurable benefits through implementation of automated ABM system prototype u To focus on process improvement in operations u To develop improved workload measures for automated and manual activities u To identify improvement opportunities and take action © Copyright 2000 Pricewaterhouse. Coopers LLP 34

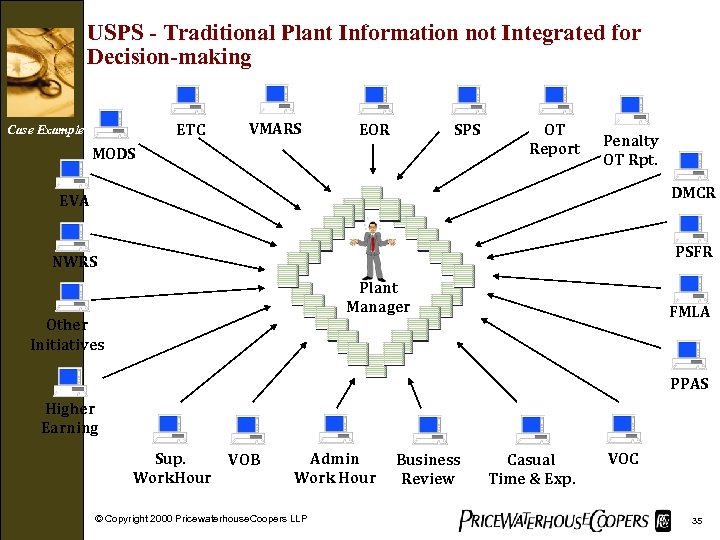

USPS - Traditional Plant Information not Integrated for Decision-making ETC Case Example VMARS EOR SPS MODS OT Report Penalty OT Rpt. DMCR EVA PSFR NWRS Plant Manager Other Initiatives FMLA PPAS Higher Earning Sup. Work. Hour VOB Admin Work Hour © Copyright 2000 Pricewaterhouse. Coopers LLP Business Review Casual Time & Exp. VOC 35

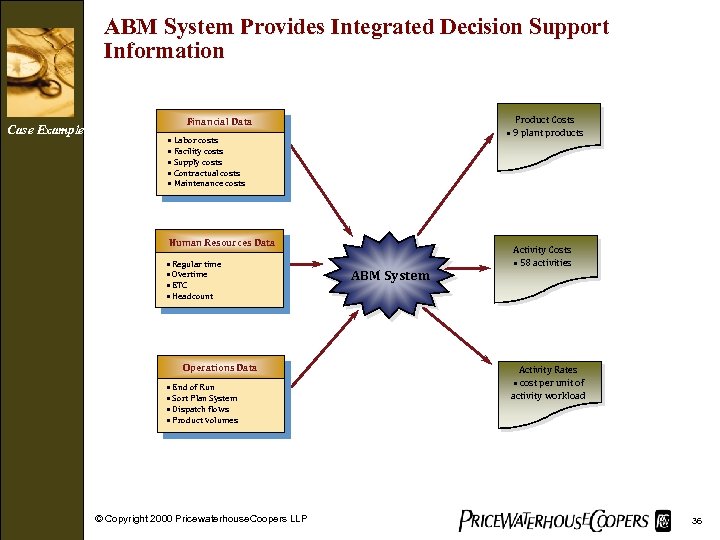

ABM System Provides Integrated Decision Support Information Case Example Product Costs • 9 plant products Financial Data • Labor costs • Facility costs • Supply costs • Contractual costs • Maintenance costs Human Resources Data • Regular time • Overtime • ETC • Headcount Operations Data • End of Run • Sort Plan System • Dispatch flows • Product volumes © Copyright 2000 Pricewaterhouse. Coopers LLP ABM System Activity Costs • 58 activities Activity Rates • cost per unit of activity workload 36

USPS - Accomplishments To Date Case Example u Developed AP-based activity costs, product costs, and activity rates u Developed more accurate, cost-effective approach to measuring workload u Ensuring knowledge transfer to HQ, District and Plant management u Taking action through series of process improvement workshops u Identified significant cost reduction opportunities u Rolling out system to additional Plants © Copyright 2000 Pricewaterhouse. Coopers LLP 37

Summary u Need compelling business reasons to drive ABCM u Clearly communicate the compelling need for change u Several similarities between public and private sector drivers u Bottom line is the same: Need to demonstrate tangible value! © Copyright 2000 Pricewaterhouse. Coopers LLP 38

f80de3e198ae9ce85e466cdc056c21ff.ppt