146377d6087fb1c6148c21257ce58dd0.ppt

- Количество слайдов: 20

Measuring Income to Assess Performance Lecture 7 (Chapter 2) © 2010 Pearson Education Inc. Publishing as Prentice Hall Introduction to Financial Accounting, 10/e

Measuring Income to Assess Performance Lecture 7 (Chapter 2) © 2010 Pearson Education Inc. Publishing as Prentice Hall Introduction to Financial Accounting, 10/e

Learning Objectives (LO) After studying this chapter, you should be able to 1. Explain how accountants measure income 2. Determine when a company should record revenue from a sale 3. Use the concept of matching to record the expenses for a period 4. Prepare an income statement and show it is related to a balance sheet © 2012 Pearson Education Introduction to Financial Accounting, 10/e 2 of 35

Learning Objectives (LO) After studying this chapter, you should be able to 1. Explain how accountants measure income 2. Determine when a company should record revenue from a sale 3. Use the concept of matching to record the expenses for a period 4. Prepare an income statement and show it is related to a balance sheet © 2012 Pearson Education Introduction to Financial Accounting, 10/e 2 of 35

Learning Objectives (LO) After studying this chapter, you should be able to 5. Account for cash dividends and prepare a statement of stockholders’ equity 6. Explain how the following concepts affect financial statements: entity, reliability, going concern, materiality, cost-benefit, and stable monetary unit 7. Compute and explain earnings per share, priceearnings ratio, dividend-yield ratio, and dividendpayout ratio 8. Explain how accounting regulators trade off relevance and reliability in setting accounting standards © 2012 Pearson Education Introduction to Financial Accounting, 10/e 3 of 35

Learning Objectives (LO) After studying this chapter, you should be able to 5. Account for cash dividends and prepare a statement of stockholders’ equity 6. Explain how the following concepts affect financial statements: entity, reliability, going concern, materiality, cost-benefit, and stable monetary unit 7. Compute and explain earnings per share, priceearnings ratio, dividend-yield ratio, and dividendpayout ratio 8. Explain how accounting regulators trade off relevance and reliability in setting accounting standards © 2012 Pearson Education Introduction to Financial Accounting, 10/e 3 of 35

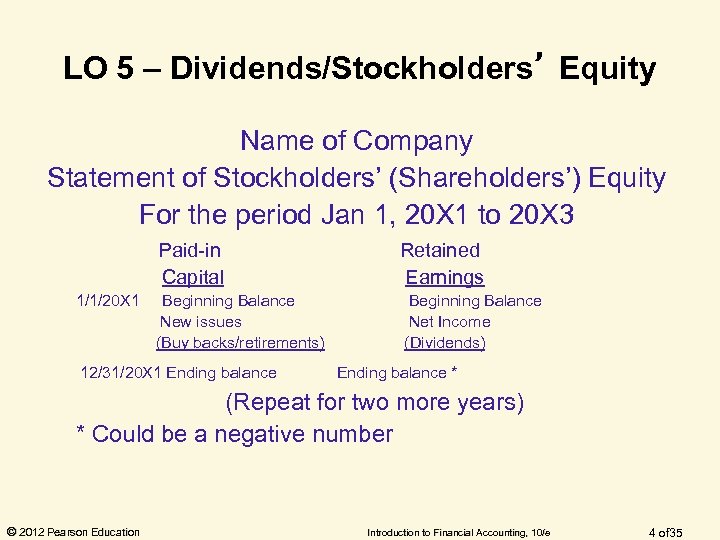

LO 5 – Dividends/Stockholders’ Equity Name of Company Statement of Stockholders’ (Shareholders’) Equity For the period Jan 1, 20 X 1 to 20 X 3 Paid-in Capital 1/1/20 X 1 Retained Earnings Beginning Balance New issues (Buy backs/retirements) Beginning Balance Net Income (Dividends) 12/31/20 X 1 Ending balance * (Repeat for two more years) * Could be a negative number © 2012 Pearson Education Introduction to Financial Accounting, 10/e 4 of 35

LO 5 – Dividends/Stockholders’ Equity Name of Company Statement of Stockholders’ (Shareholders’) Equity For the period Jan 1, 20 X 1 to 20 X 3 Paid-in Capital 1/1/20 X 1 Retained Earnings Beginning Balance New issues (Buy backs/retirements) Beginning Balance Net Income (Dividends) 12/31/20 X 1 Ending balance * (Repeat for two more years) * Could be a negative number © 2012 Pearson Education Introduction to Financial Accounting, 10/e 4 of 35

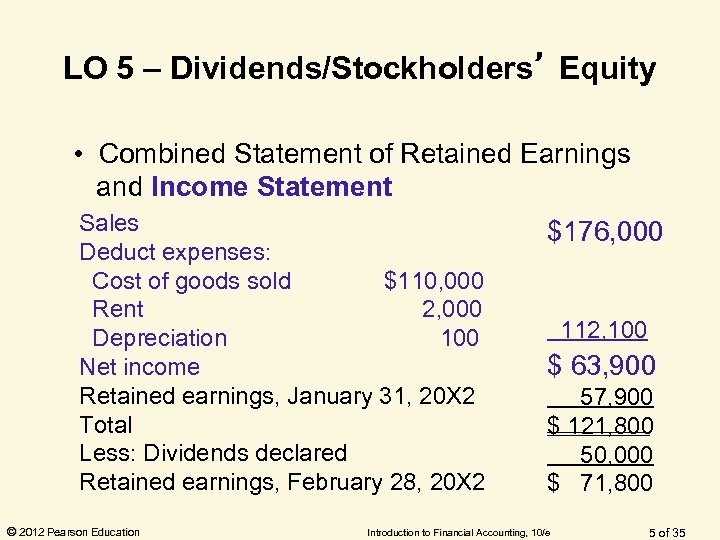

LO 5 – Dividends/Stockholders’ Equity • Combined Statement of Retained Earnings and Income Statement Sales Deduct expenses: Cost of goods sold $110, 000 Rent 2, 000 Depreciation 100 Net income Retained earnings, January 31, 20 X 2 Total Less: Dividends declared Retained earnings, February 28, 20 X 2 © 2012 Pearson Education $176, 000 112, 100 $ 63, 900 57, 900 $ 121, 800 50, 000 $ 71, 800 Introduction to Financial Accounting, 10/e 5 of 35

LO 5 – Dividends/Stockholders’ Equity • Combined Statement of Retained Earnings and Income Statement Sales Deduct expenses: Cost of goods sold $110, 000 Rent 2, 000 Depreciation 100 Net income Retained earnings, January 31, 20 X 2 Total Less: Dividends declared Retained earnings, February 28, 20 X 2 © 2012 Pearson Education $176, 000 112, 100 $ 63, 900 57, 900 $ 121, 800 50, 000 $ 71, 800 Introduction to Financial Accounting, 10/e 5 of 35

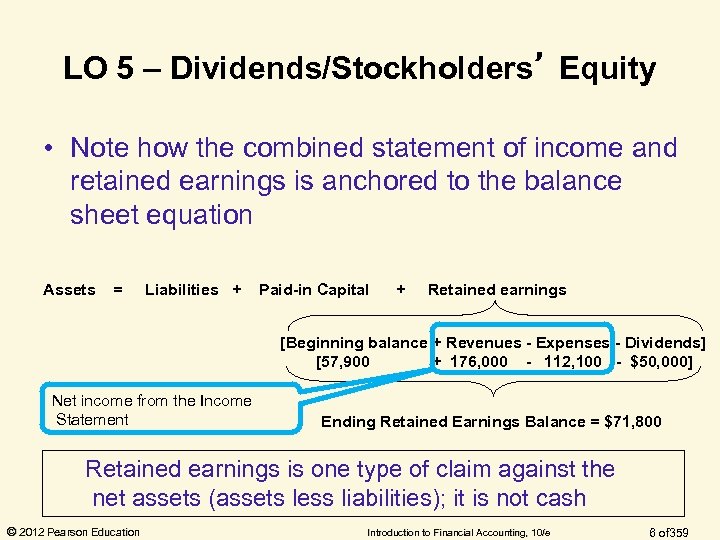

LO 5 – Dividends/Stockholders’ Equity • Note how the combined statement of income and retained earnings is anchored to the balance sheet equation Assets = Liabilities + Paid-in Capital + Retained earnings [Beginning balance + Revenues - Expenses - Dividends] [57, 900 + 176, 000 - 112, 100 - $50, 000] Net income from the Income Statement Ending Retained Earnings Balance = $71, 800 Retained earnings is one type of claim against the net assets (assets less liabilities); it is not cash © 2012 Pearson Education Introduction to Financial Accounting, 10/e 6 of 359

LO 5 – Dividends/Stockholders’ Equity • Note how the combined statement of income and retained earnings is anchored to the balance sheet equation Assets = Liabilities + Paid-in Capital + Retained earnings [Beginning balance + Revenues - Expenses - Dividends] [57, 900 + 176, 000 - 112, 100 - $50, 000] Net income from the Income Statement Ending Retained Earnings Balance = $71, 800 Retained earnings is one type of claim against the net assets (assets less liabilities); it is not cash © 2012 Pearson Education Introduction to Financial Accounting, 10/e 6 of 359

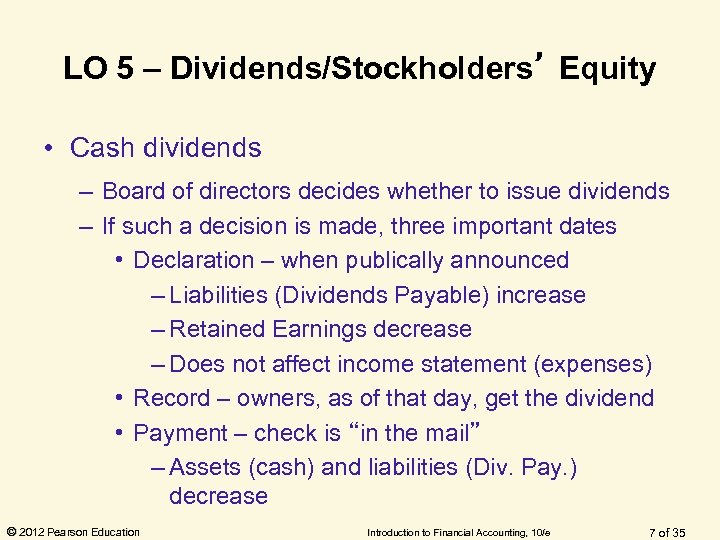

LO 5 – Dividends/Stockholders’ Equity • Cash dividends – Board of directors decides whether to issue dividends – If such a decision is made, three important dates • Declaration – when publically announced – Liabilities (Dividends Payable) increase – Retained Earnings decrease – Does not affect income statement (expenses) • Record – owners, as of that day, get the dividend • Payment – check is “in the mail” – Assets (cash) and liabilities (Div. Pay. ) decrease © 2012 Pearson Education Introduction to Financial Accounting, 10/e 7 of 35

LO 5 – Dividends/Stockholders’ Equity • Cash dividends – Board of directors decides whether to issue dividends – If such a decision is made, three important dates • Declaration – when publically announced – Liabilities (Dividends Payable) increase – Retained Earnings decrease – Does not affect income statement (expenses) • Record – owners, as of that day, get the dividend • Payment – check is “in the mail” – Assets (cash) and liabilities (Div. Pay. ) decrease © 2012 Pearson Education Introduction to Financial Accounting, 10/e 7 of 35

LO 6 – BASIC CONCEPTS • (Economic) Entity - an organization that stands apart from other organizations and individuals as a separate economic unit – The first line in the statements’ headings – Personal transactions are not recorded by a business entity • Stable Monetary Unit – Currency is used to measure events – Its purchasing power is assumed to be stable (low inflation) over time © 2012 Pearson Education Introduction to Financial Accounting, 10/e 8 of 35

LO 6 – BASIC CONCEPTS • (Economic) Entity - an organization that stands apart from other organizations and individuals as a separate economic unit – The first line in the statements’ headings – Personal transactions are not recorded by a business entity • Stable Monetary Unit – Currency is used to measure events – Its purchasing power is assumed to be stable (low inflation) over time © 2012 Pearson Education Introduction to Financial Accounting, 10/e 8 of 35

LO 6 – BASIC CONCEPTS • Going concern (continuity) – Reporting entity will continue to exist indefinitely, i. e. can use historical costs to measure long-lived assets – If liquidation is in sight, assets should be revalued to their current market value • Materiality – If it makes a difference to a decision maker, information should be separately identifiable – Immaterial – combine with other information © 2012 Pearson Education Introduction to Financial Accounting, 10/e 9 of 35

LO 6 – BASIC CONCEPTS • Going concern (continuity) – Reporting entity will continue to exist indefinitely, i. e. can use historical costs to measure long-lived assets – If liquidation is in sight, assets should be revalued to their current market value • Materiality – If it makes a difference to a decision maker, information should be separately identifiable – Immaterial – combine with other information © 2012 Pearson Education Introduction to Financial Accounting, 10/e 9 of 35

LO 6 – BASIC CONCEPTS • Cost-benefit – Apply established criteria, (like GAAP or IFRS) – If the costs to comply with that criteria exceed the benefits of doing so, deviations are permissible • Difficult to measure benefits – judgment which can easily lead to disagreements • GAAP may contain deviations justified by costbenefit considerations © 2012 Pearson Education Introduction to Financial Accounting, 10/e 10 of 35

LO 6 – BASIC CONCEPTS • Cost-benefit – Apply established criteria, (like GAAP or IFRS) – If the costs to comply with that criteria exceed the benefits of doing so, deviations are permissible • Difficult to measure benefits – judgment which can easily lead to disagreements • GAAP may contain deviations justified by costbenefit considerations © 2012 Pearson Education Introduction to Financial Accounting, 10/e 10 of 35

LO 6 – BASIC CONCEPTS • Reliability – Management prepares and is rewarded by the content of financial statements (possible bias) – Independent auditors, in theory, add quality to those statements by offering three opinions • “Fair” presentation (unqualified) • Prepared according to the relevant accounting standards • Adequacy of internal controls – Higher quality statements makes them more reliable (useful) in decision making © 2012 Pearson Education Introduction to Financial Accounting, 10/e 11 of 35

LO 6 – BASIC CONCEPTS • Reliability – Management prepares and is rewarded by the content of financial statements (possible bias) – Independent auditors, in theory, add quality to those statements by offering three opinions • “Fair” presentation (unqualified) • Prepared according to the relevant accounting standards • Adequacy of internal controls – Higher quality statements makes them more reliable (useful) in decision making © 2012 Pearson Education Introduction to Financial Accounting, 10/e 11 of 35

LO 7 – FINANCIAL RATIOS • Calculated results mean nothing unless – Same accounting principals are used – Totals are reported similarly – There are other numbers to make comparisons (budget, historical, competitors) • Comparisons mean nothing unless other data – Has underlying comparable quality – Covers comparable periods – Uses the same formulas © 2012 Pearson Education Introduction to Financial Accounting, 10/e 12 of 35

LO 7 – FINANCIAL RATIOS • Calculated results mean nothing unless – Same accounting principals are used – Totals are reported similarly – There are other numbers to make comparisons (budget, historical, competitors) • Comparisons mean nothing unless other data – Has underlying comparable quality – Covers comparable periods – Uses the same formulas © 2012 Pearson Education Introduction to Financial Accounting, 10/e 12 of 35

LO 7 – FINANCIAL RATIOS • Assuming one has high quality comparative data, the investor, when using ratio analysis must still keep in mind – Will historical relationships continue to exist in their same proportions? – Is the past a good predictor of the future? – Will unforeseen events occur that will alter the future? © 2012 Pearson Education Introduction to Financial Accounting, 10/e 13 of 35

LO 7 – FINANCIAL RATIOS • Assuming one has high quality comparative data, the investor, when using ratio analysis must still keep in mind – Will historical relationships continue to exist in their same proportions? – Is the past a good predictor of the future? – Will unforeseen events occur that will alter the future? © 2012 Pearson Education Introduction to Financial Accounting, 10/e 13 of 35

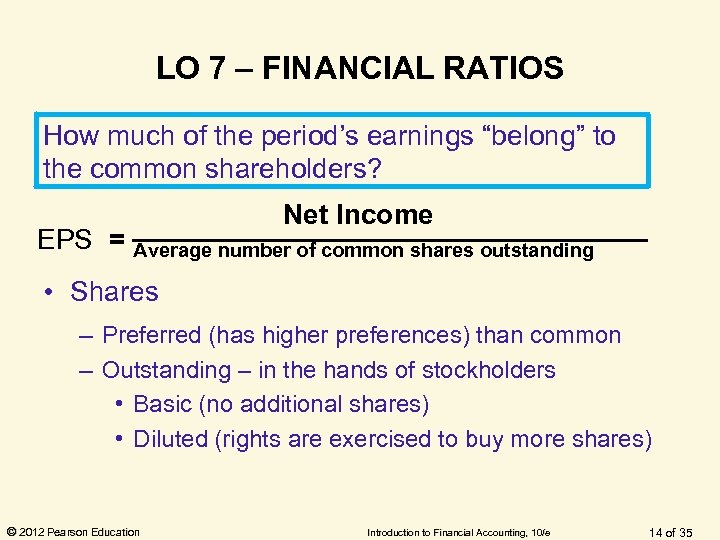

LO 7 – FINANCIAL RATIOS How much of the period’s earnings “belong” to the common shareholders? Net Income EPS = Average number of common shares outstanding • Shares – Preferred (has higher preferences) than common – Outstanding – in the hands of stockholders • Basic (no additional shares) • Diluted (rights are exercised to buy more shares) © 2012 Pearson Education Introduction to Financial Accounting, 10/e 14 of 35

LO 7 – FINANCIAL RATIOS How much of the period’s earnings “belong” to the common shareholders? Net Income EPS = Average number of common shares outstanding • Shares – Preferred (has higher preferences) than common – Outstanding – in the hands of stockholders • Basic (no additional shares) • Diluted (rights are exercised to buy more shares) © 2012 Pearson Education Introduction to Financial Accounting, 10/e 14 of 35

LO 7 – FINANCIAL RATIOS How much more is an investor willing to pay for one share of stock than it is earning? P-E Ratio = Market price per share of common stock Earnings per share of common stock • Conceptually, a higher than normal ratio suggests investors predict the company’s net income will grow • Factually, a higher ratio has proven to be good and bad news (and vice versa) © 2012 Pearson Education Introduction to Financial Accounting, 10/e 15 of 35

LO 7 – FINANCIAL RATIOS How much more is an investor willing to pay for one share of stock than it is earning? P-E Ratio = Market price per share of common stock Earnings per share of common stock • Conceptually, a higher than normal ratio suggests investors predict the company’s net income will grow • Factually, a higher ratio has proven to be good and bad news (and vice versa) © 2012 Pearson Education Introduction to Financial Accounting, 10/e 15 of 35

LO 7 – FINANCIAL RATIOS • The return to investors when they invest in stocks is twofold: – Appreciation in Value – Receipt of dividends How much is one share of stock returning to its owners in the form of dividends from the past year? Common dividends per share Dividend-Yield Ratio = Current market price per share © 2012 Pearson Education Introduction to Financial Accounting, 10/e 16 of 35

LO 7 – FINANCIAL RATIOS • The return to investors when they invest in stocks is twofold: – Appreciation in Value – Receipt of dividends How much is one share of stock returning to its owners in the form of dividends from the past year? Common dividends per share Dividend-Yield Ratio = Current market price per share © 2012 Pearson Education Introduction to Financial Accounting, 10/e 16 of 35

LO 7 – FINANCIAL RATIOS What proportion of net income does a company elect to pay in cash dividends? Dividend-Payout Ratio = Common dividends per share Earnings per share Dividend policy is set by the Board of Directors • Younger companies tend to pay no dividends • More mature companies often pay dividends – Irregular amounts each year – Recurring or increasing amounts each year © 2012 Pearson Education Introduction to Financial Accounting, 10/e 17 of 35

LO 7 – FINANCIAL RATIOS What proportion of net income does a company elect to pay in cash dividends? Dividend-Payout Ratio = Common dividends per share Earnings per share Dividend policy is set by the Board of Directors • Younger companies tend to pay no dividends • More mature companies often pay dividends – Irregular amounts each year – Recurring or increasing amounts each year © 2012 Pearson Education Introduction to Financial Accounting, 10/e 17 of 35

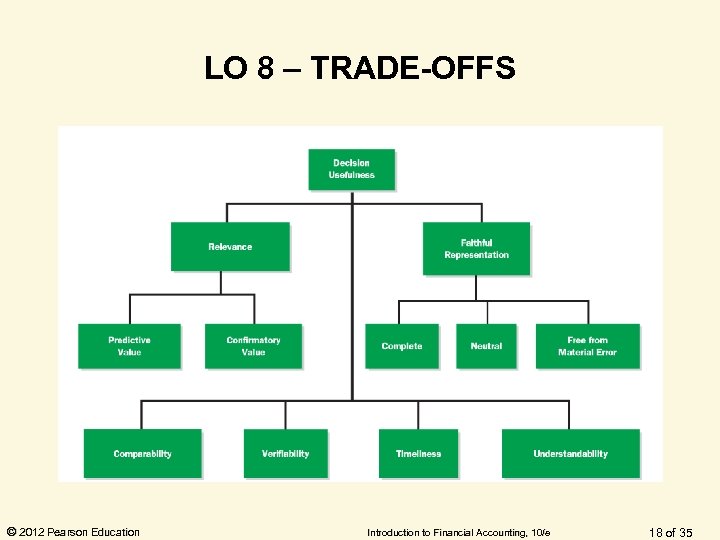

LO 8 – TRADE-OFFS © 2012 Pearson Education Introduction to Financial Accounting, 10/e 18 of 35

LO 8 – TRADE-OFFS © 2012 Pearson Education Introduction to Financial Accounting, 10/e 18 of 35

LO 8 – TRADE-OFFS • Trying to make the information provided to Decision Makers (DM) useful • Relevance – Will it make a difference to the DM? – Predictive Value (helps predict the future) – Confirmatory value (confirms/refutes expectations) – E. g. Present value of an asset - Land • Faithful Representation - is what happened – Free of bias, material errors and is neutral – E. g. Historical cost of an asset – land • Trade-off – Land at what value? Cost or value © 2012 Pearson Education Introduction to Financial Accounting, 10/e 19 of 35

LO 8 – TRADE-OFFS • Trying to make the information provided to Decision Makers (DM) useful • Relevance – Will it make a difference to the DM? – Predictive Value (helps predict the future) – Confirmatory value (confirms/refutes expectations) – E. g. Present value of an asset - Land • Faithful Representation - is what happened – Free of bias, material errors and is neutral – E. g. Historical cost of an asset – land • Trade-off – Land at what value? Cost or value © 2012 Pearson Education Introduction to Financial Accounting, 10/e 19 of 35

LO 8 – TRADE-OFFS • Characteristics that enhance relevance and faithful representation – – Comparability – consistent use of same measures Verifiability – able to be checked for accuracy Timelines – reach DM in time to be useful Understandability – clear and consistent information that avoids undo complexity © 2012 Pearson Education Introduction to Financial Accounting, 10/e 20 of 35

LO 8 – TRADE-OFFS • Characteristics that enhance relevance and faithful representation – – Comparability – consistent use of same measures Verifiability – able to be checked for accuracy Timelines – reach DM in time to be useful Understandability – clear and consistent information that avoids undo complexity © 2012 Pearson Education Introduction to Financial Accounting, 10/e 20 of 35