de08babdc0aad4b55ef5c59960e31584.ppt

- Количество слайдов: 38

MBA Technology Overview and Update Ohio Recorders Association Conference Gabe Minton, MBA Senior Director Industry Technology 7 November 2001, Columbus, Ohio

What I am and What I am not l Am – Software Engineer – “techie”, “geek” – Adjunct Professor of Computer Science – Excited about technology and standards l Am not – Mortgage banker – MERS employee – Recorder

Purpose: Why am I here? l Education: by the time you walk out of here, I want you to know what MISMO is, what XML is, what PKI is, what the excitement is about e. Mortgages l Show you that you are important and also where you fit in to the larger technological picture l The world is changing: security and virtual transactions like e. Closing are becoming increasingly popular – glimpse into the future

3 Technology Thrusts l Mortgage Industry Standards Maintenance Organization (MISMO) l Real Estate Industry Public Key Infrastructure (REFSMO) l Electronic Mortgages (e. Mortgages)

First Thrust: Data Standards for the Industry

Why are Data Standards Important? l Cost effectively collect data needed from trading partners & service providers to make informed business decisions electronically and quickly l Provide confidence in data and its integrity – Understand data definition, purpose, characteristics – Encourage consistent usage across industry l. A common language for all users

MISMO l l l Made up of members from across the industry A transactional data standard Utilizes e. Xtensible Markup Language (XML) Based on industry standard business data dictionary Meant to serve as the basis for real estate e. Commerce (which trading partners can expand upon for particular transactions by company)

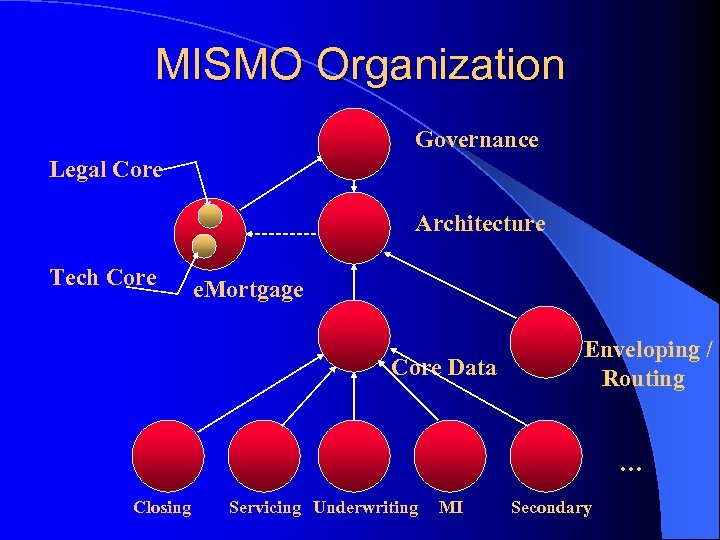

Organizational Structure l MISMO Governance Committee – Guides the policy and administrative direction of MISMO – Consists of 16 members across industry sectors l MISMO Work Groups – Process focused industry participants defining business data needs for specific business areas – Architecture WG defines technical structure, core data and process groupings and administers tool. – e. Mortgage WG defines mortgages in terms of ESIGN and UETA, and how to utilize e. Mortgages with networks and security

MISMO Organization Governance Legal Core Architecture Tech Core e. Mortgage Core Data Enveloping / Routing … Closing Servicing Underwriting MI Secondary

MISMO Subscribers l l l Nearly 90 subscribers now Over 500 people signed up on listservs Fannie, Freddie, lenders, vendors, service providers (credit, title, appraisal, flood), more… Multiple standard efforts discussion happening at this point (AARTT/REIPA, Appraisal Institute, IFX, eb. XML, XBRL, NAR/RETS, ACORD, Legal. XML, PRIJTF, etc. ) Commercial side kicked off at CREF in Feb 2001

Second Thrust: Industry Standard Security/PKI

REFSMO l l l l Stands for “Real Estate Finance Security Management Organization” Made up of members from across the industry A management infrastructure (strategic) Also, a Real Estate (PKI) and security workgroup (“hacking”, fraud, etc) Plugs together and or utilizes e. Xtensible Markup Language (XML) standards (aka MISMO) Also based on security industry standards (X. 509, etc) Meant to serve as the basis for secure e. Commerce

MBA PKI Initiative – how it all began l MBA PKI project initiated in September 1999 – Fannie Mae and Freddie Mac co-chair Security Working Group – Numerous working group meetings held – PKI documentation developed – Interest in initiative has continually grown

Activities leading to 2001: l l l l Developed Project Plan and associated documentation for a community of interest PKI Co-Hosted PKI Working Group, 14 -15 June 2000 – 20 companies represented Drafted and circulated Certificate Authority requirements (Vendor RFP) Validated and presented draft CA requirements at Security WG meeting in September 2000 Released requirements to selected vendors for response. Vendor presentations-Washington DC Mid Oct Selected recommended Vendor – Digital Signature Trust Met with MBA leadership to discuss vendor selection in Jan 2001

REFSMO During 2001 DST supports a policy maintained by the ABA l MBA partnered with ABA on standard digital certificates (Trust. ID™)!!! l MBA nominated 4 members to the ABA PAB l – MBAA has nominated itself, First American, Capital Thinking, and Taylor Bean and Whitaker to the PAB – MBAA has drawn from both from commercial and residential real estate companies MBA will support the ABA PAB through help and participation going forward l MBA signed contract with DST as a preferred provider l

REFSMO Short Term Vision REFMO becomes the project/moniker that is used for the MBAA PKI initiative l REFSMO is staffed by Industry Technology and reports into the MBA Bo. DTech steering committee (peering with MISMO) l It is recommended for the short term, the 7 real estate companies on the ABA PAB will become the “REFSMO board” for year 1 (plus a couple more) l

REFSMO Short Term cont’d The REFSMO Board will report the different versions of the Trust. ID® CP as being acceptable to the real estate community l Their recommendation is carried to the Bo. DTech, which then “signs off” on the CP for MBAA l The Bo. DTech is jointly made up of commercial and residential real estate companies l

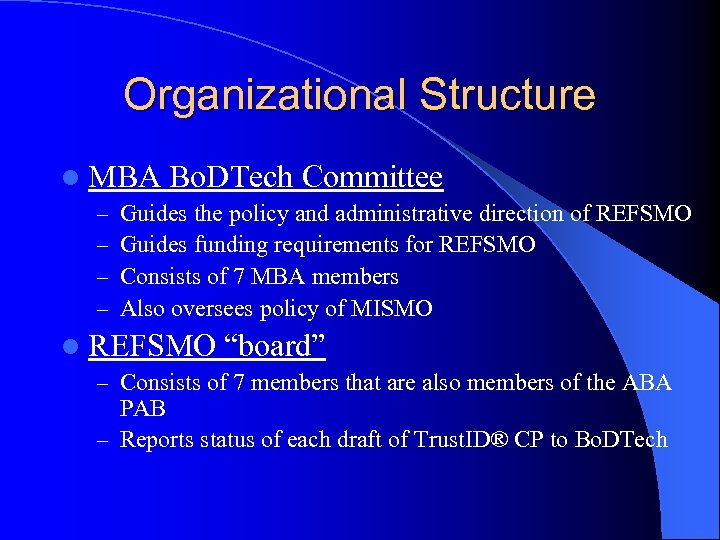

Organizational Structure l MBA – – Bo. DTech Committee Guides the policy and administrative direction of REFSMO Guides funding requirements for REFSMO Consists of 7 MBA members Also oversees policy of MISMO l REFSMO “board” – Consists of 7 members that are also members of the ABA PAB – Reports status of each draft of Trust. ID® CP to Bo. DTech

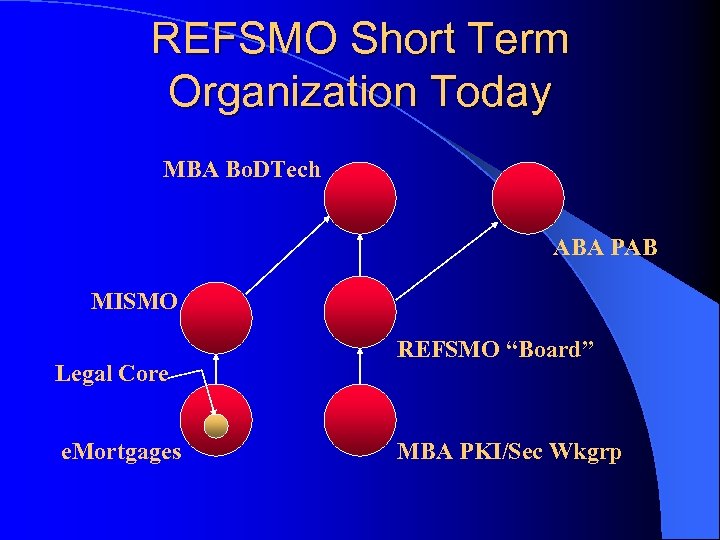

REFSMO Short Term Organization Today MBA Bo. DTech ABA PAB MISMO Legal Core e. Mortgages REFSMO “Board” MBA PKI/Sec Wkgrp

REFSMO Long Term l The long term view is very important to MBA l MBA has significant resources and budget allocated over the next year to working on this issue l MBA is excited to enter into a cooperative agreement with the ABA to work together and execute this long-term vision

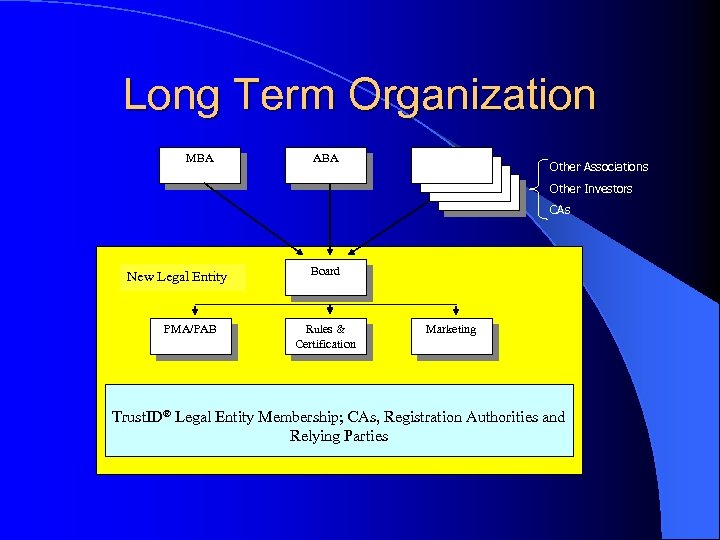

Long Term Organization MBA ABA ABA Other Associations Other Investors CAs New Legal Entity PMA/PAB Board Rules & Certification Marketing Trust. ID® Legal Entity Membership; CAs, Registration Authorities and Relying Parties

Long Term Organization l Responsibilities – Management of Certificate Policy – Management of Trust. ID® Rules including enforcement – – and network fees Annual Certification of Trust. ID® CAs Advocacy for Trust. ID® Marketing Trust. ID® Management of the guidelines for the operation of the entity

MBA/REFSMO Direction MBAA fully supports the Trust. ID® CP and plans to market the Trust. ID® service to its membership (provided it stays open) l MBAA’s PKI/Security workgroup will continue to meet about PKI and security issues in the real estate community l – The work-product of the group will feed back into the ABA PAB for the short term – The workgroup will become participants in the new successor entity

Digital Certificates A digital certificate identifies you on the Internet l A digital certificate is issues by a trusted third party referred to as a Certificate Authority l A CA will offer a range of certificates, graded to the level of inquiry used to confirm the identity of an individual l – Certificates can be issued in response to an email address – Certificates can be issued after receiving third party proofing of name, address, and other personal information in the on-line registration process – Certificates can be issued once a person appears in person and presents registered credentials and /or after a person has been thoroughly investigated

Digital Signatures l A digital signature is: – An electronic fingerprint of a message “signed” by a private key (using a hashing algorithm and digital cert) l A digital signature is not: – A scan of a handwritten signature – An electronic “penned” signature l Unlike “wet” signature: – Signature differs for each document – Document contents and origin can be verified (integrity and verification)

Certificate Authority l l l Accepts applications for certificates Verifies the identity of the person or company applying for the certificate (out of bands procedures may be incorporated into the process) Issues certificates Revokes certificates (Certificate Revocation Lists) Provides information about the certificates that it has issued in a Repository (ldap accessible)

Participant Analogies Between Credit Cards and e. Commerce l Credit Card Model l e. Commerce – Card Issuer – Certificate Issuer – Card Holder – Certificate Holder – Merchant – Relying Party

Here’s Where PKI Can Help l PKI can enable applications to be deployed securely and efficiently on the Internet – – – Loan origination/underwriting Loan delivery to investors Secondary market deal making Servicing transactions Mortgage-related document transfers Secure electronic recording

Third Thrust: Industry Standard e. Mortgages

e. Mortgage Mission Statement “…standardizing functional, technical & operational requirements associated with creating, maintaining, transmitting, distributing, securing, processing, referencing and storing documents and data for electronic mortgages over the Internet. Research, decisions, and work products of the e. Mortgage work group are meant to support the electronic commerce data needs of any and all MISMO work groups. ”

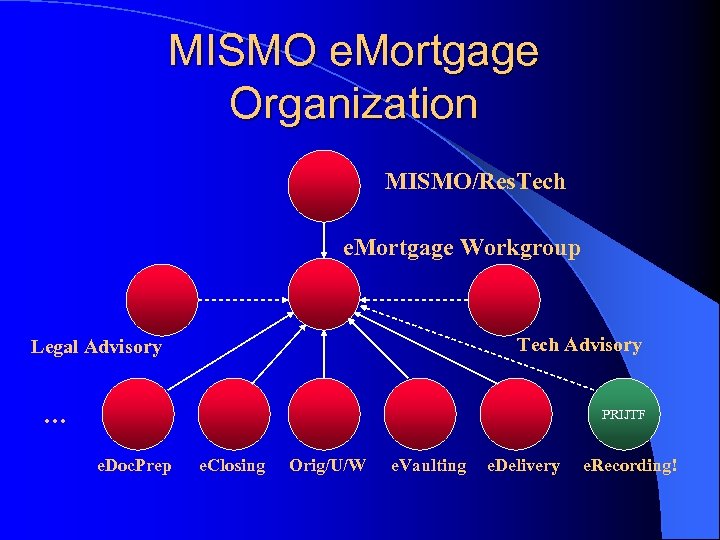

MISMO e. Mortgage Organization MISMO/Res. Tech e. Mortgage Workgroup Tech Advisory Legal Advisory … PRIJTF e. Doc. Prep e. Closing Orig/U/W e. Vaulting e. Delivery e. Recording!

PRIJTF l l l A task force created by NACRC and IACREOT Committee is co-chaired by Carmelo Bramante and Helen Purcell Industry Liaison is Mark Monacelli Kicked off an XML ER Workgroup in Sept Works on: use case, DTD/Schema, workflow, glossary, and requirements for e. Recording ER Workgroup plugs into MISMO

e. Mortgage Structure l Main group is at about 170 members l Advisory Panels (2) – Legal Core & Technology – Review issues of broad interest – Provide consensus opinions back to workgroup l Focus Groups (7) – Working on specific functional areas – 3 – 25 members each

e. Mortgage Highlights l l l Kicked off in January, regular conf calls Averaging 20 -30 people per call Adopted mission statement & scope and mapped to existing MISMO processes Created industry guidelines for technical, functional, and operational requirements Tackled technology infrastructure issues (e. g. XHTML, transferable record, archival) Delivered 1. 0 draft recommendations & guidelines in October 2001 at MBA annual conference!

e. Mortgage Workgroup Deliverables l From each Focus Group: – Requirements / Scope Definition – Common Language: Use Case(s) / Sequence Diagrams – Best Practices / Workflows l Overall: – MISMO e. Mortgage Standards l l Industry glossary Requirements – Functional, Technical, Operational l Resulting Guidelines and Recommendations

e. Mortgage Use Case Areas l Three categories: – Closing (including identification & authentication, through to execution and funds dispersal, including recording) – Pre-Closing (including: origination and underwriting, document preparation) – Post-Closing (including: loan delivery, and vaulting/archival)

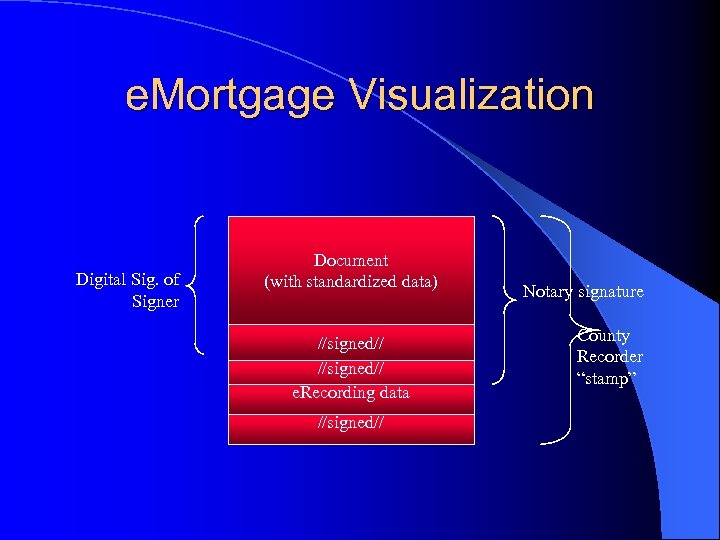

e. Mortgage Visualization Digital Sig. of Signer Document (with standardized data) //signed// e. Recording data //signed// Notary signature County Recorder “stamp”

Questions?

de08babdc0aad4b55ef5c59960e31584.ppt