12677ad0cfc7ccc2b282df397662f578.ppt

- Количество слайдов: 33

MBA 201 a: Entry, Exit & Equilibrium

Basic definitions & principles (I) • In the short run (SR), – for an individual firm, many costs are sunk, and – for an entire industry, the number of firms is fixed. • In the long run (LR), – everything is variable: production process within a firm and the number of firms. Professor Wolfram MBA 201 a - Fall 2009 Page 1

Basic definitions & principles (II) Profit maximization implies the following decision rules: – In the short run: • Produce at the quantity level where MR=MC*, so long as your revenues cover your variable costs. • Otherwise, exit. – In the long run: • Enter markets or expand capacity as long as your incremental revenues will cover your incremental total costs. • Stay in the market as long as you continue to cover your total costs. • Exit if you can no longer cover your total costs. * Remember that MR=P for a price-taking firm (aka a firm in a perfectly competitive industry). Professor Wolfram MBA 201 a - Fall 2009 Page 2

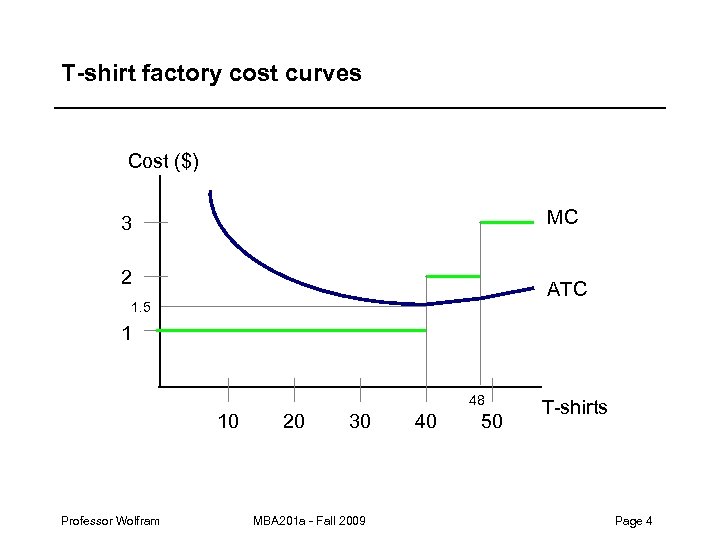

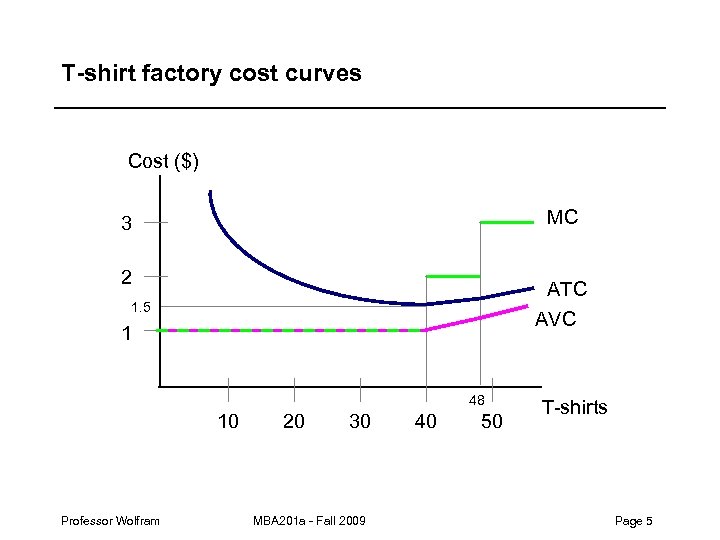

LR vs. SR example: Recall the t-shirt factory To produce T-shirts: • Lease one machine at $20 / week. • Machine requires one worker. • The machine, operated by the worker, produces one T-shirt per hour. • Worker is paid $1/hour on weekdays (up to 40 hours), $2/hour on Saturdays (up to 8 hours), $3 on Sundays (up to 8 hours). Professor Wolfram MBA 201 a - Fall 2009 Page 3

T-shirt factory cost curves Cost ($) MC 3 2 ATC 1. 5 1 48 10 Professor Wolfram 20 30 MBA 201 a - Fall 2009 40 50 T-shirts Page 4

T-shirt factory cost curves Cost ($) MC 3 2 ATC AVC 1. 5 1 48 10 Professor Wolfram 20 30 MBA 201 a - Fall 2009 40 50 T-shirts Page 5

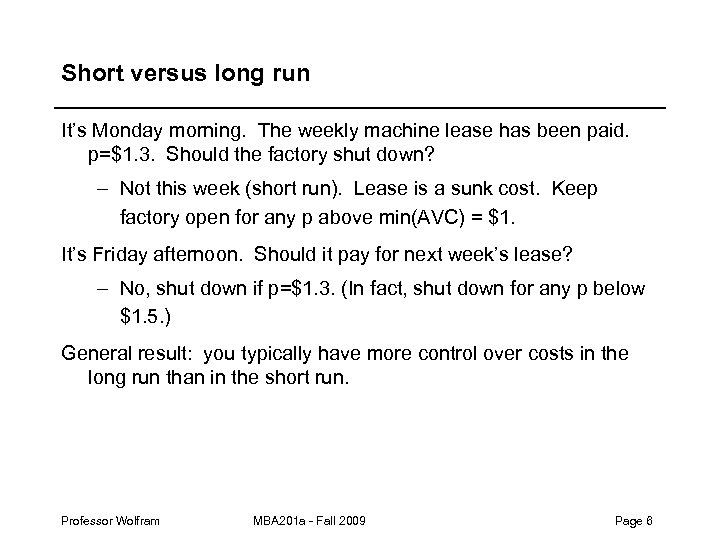

Short versus long run It’s Monday morning. The weekly machine lease has been paid. p=$1. 3. Should the factory shut down? – Not this week (short run). Lease is a sunk cost. Keep factory open for any p above min(AVC) = $1. It’s Friday afternoon. Should it pay for next week’s lease? – No, shut down if p=$1. 3. (In fact, shut down for any p below $1. 5. ) General result: you typically have more control over costs in the long run than in the short run. Professor Wolfram MBA 201 a - Fall 2009 Page 6

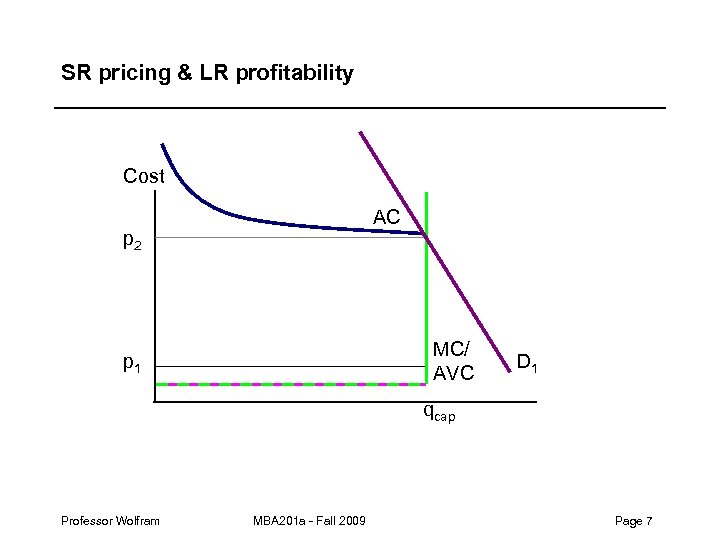

SR pricing & LR profitability Cost AC p 2 MC/ AVC p 1 D 1 qcap Professor Wolfram MBA 201 a - Fall 2009 Page 7

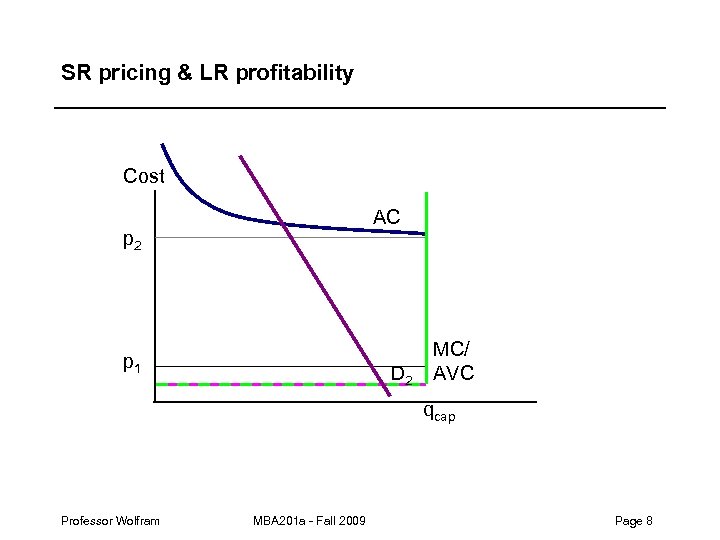

SR pricing & LR profitability Cost AC p 2 p 1 D 2 MC/ AVC qcap Professor Wolfram MBA 201 a - Fall 2009 Page 8

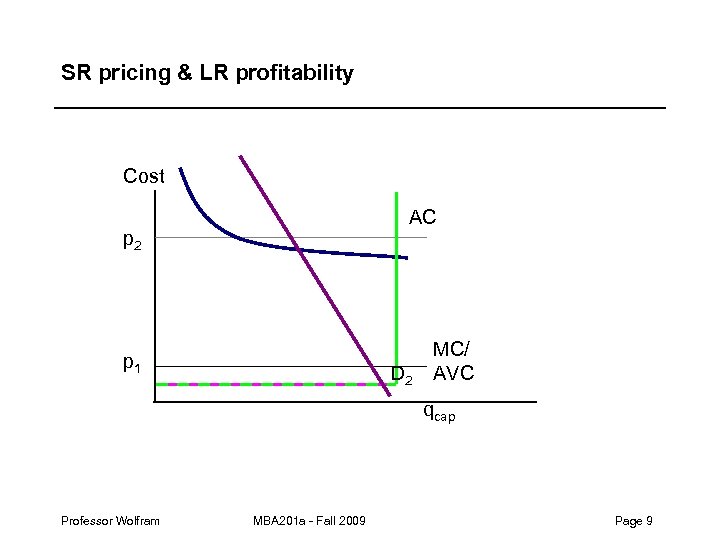

SR pricing & LR profitability Cost AC p 2 p 1 D 2 MC/ AVC qcap Professor Wolfram MBA 201 a - Fall 2009 Page 9

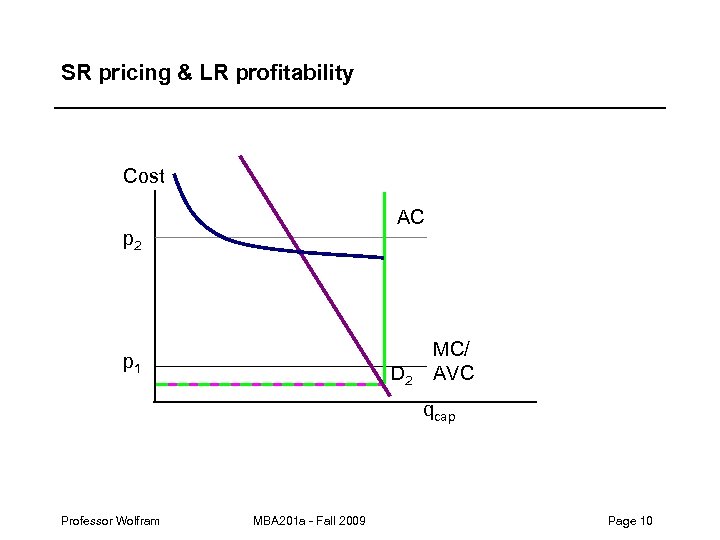

SR pricing & LR profitability Cost AC p 2 p 1 D 2 MC/ AVC qcap Professor Wolfram MBA 201 a - Fall 2009 Page 10

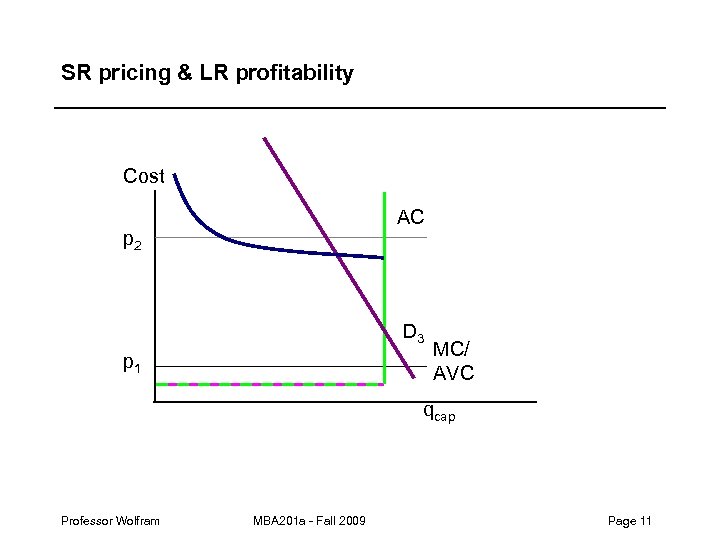

SR pricing & LR profitability Cost AC p 2 D 3 p 1 MC/ AVC qcap Professor Wolfram MBA 201 a - Fall 2009 Page 11

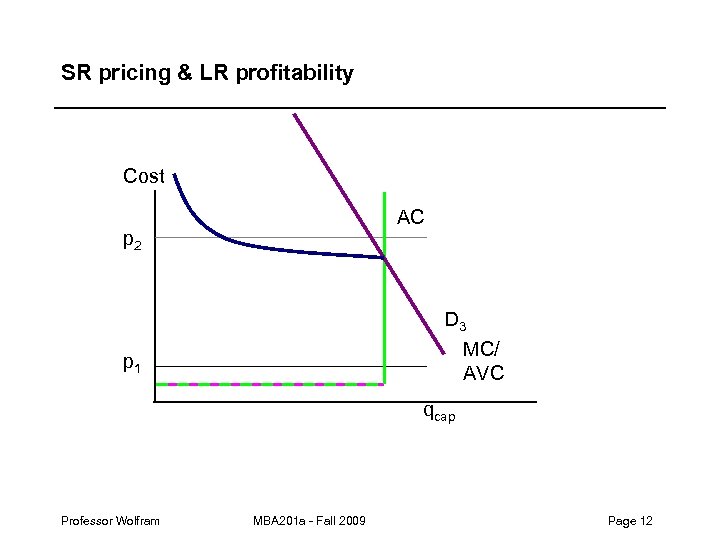

SR pricing & LR profitability Cost AC p 2 D 3 MC/ AVC p 1 qcap Professor Wolfram MBA 201 a - Fall 2009 Page 12

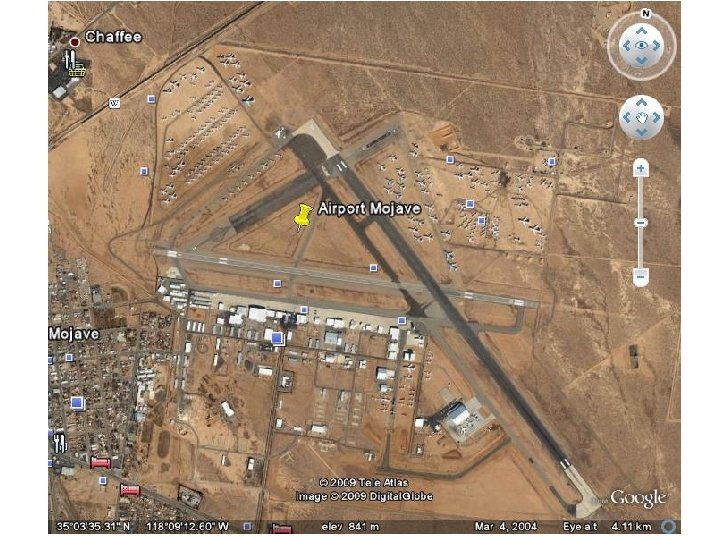

Mojave, California Professor Wolfram MBA 201 a - Fall 2009 Page 13

Professor Wolfram MBA 201 a - Fall 2009 Page 14

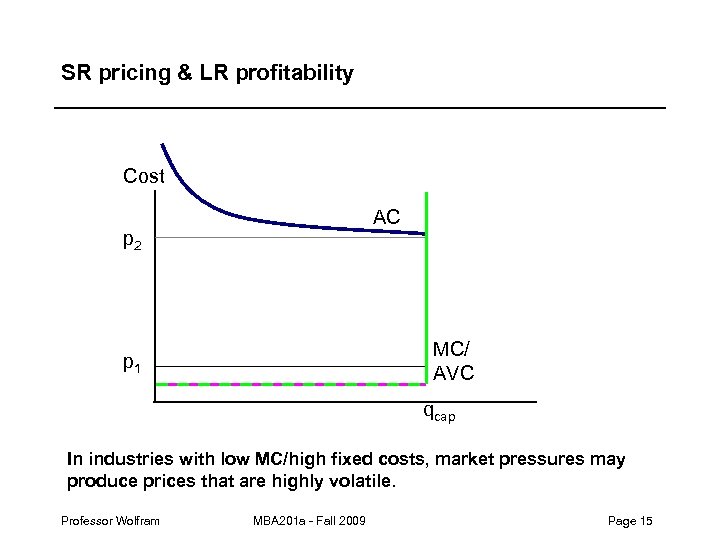

SR pricing & LR profitability Cost AC p 2 MC/ AVC p 1 qcap In industries with low MC/high fixed costs, market pressures may produce prices that are highly volatile. Professor Wolfram MBA 201 a - Fall 2009 Page 15

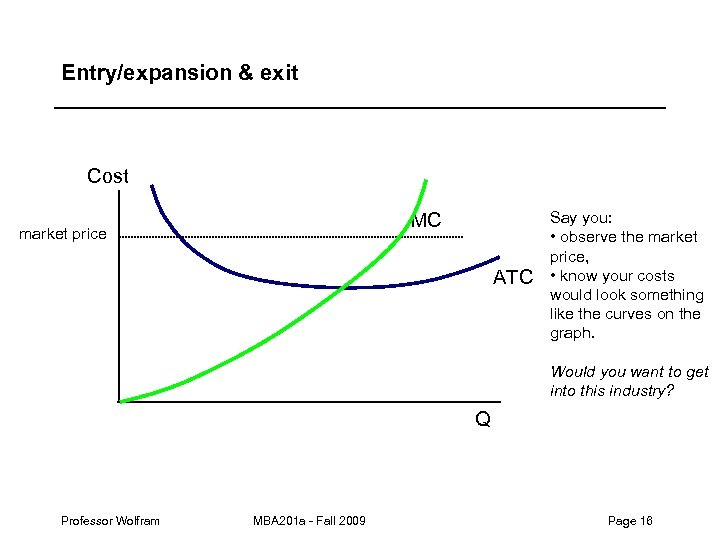

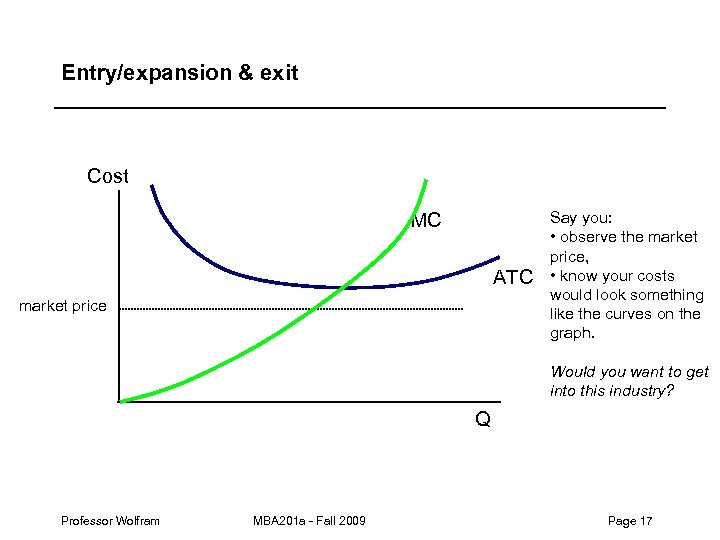

Entry/expansion & exit Cost MC market price ATC Say you: • observe the market price, • know your costs would look something like the curves on the graph. Would you want to get into this industry? Q Professor Wolfram MBA 201 a - Fall 2009 Page 16

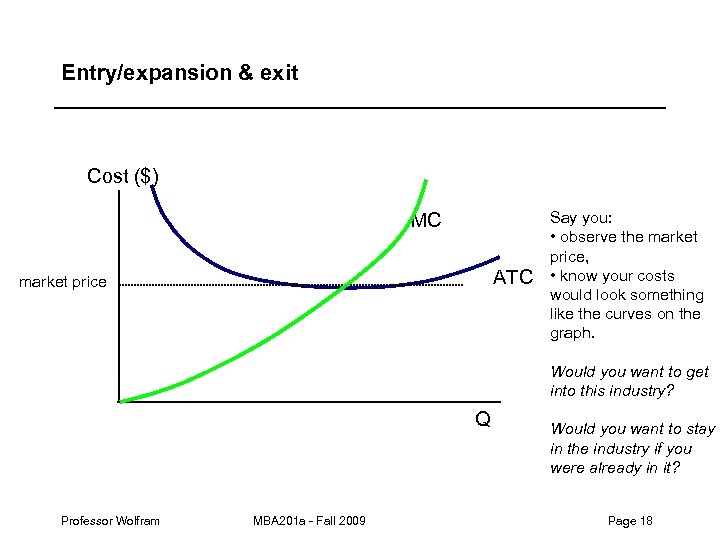

Entry/expansion & exit Cost MC ATC market price Say you: • observe the market price, • know your costs would look something like the curves on the graph. Would you want to get into this industry? Q Professor Wolfram MBA 201 a - Fall 2009 Page 17

Entry/expansion & exit Cost ($) MC ATC market price Say you: • observe the market price, • know your costs would look something like the curves on the graph. Would you want to get into this industry? Q Professor Wolfram MBA 201 a - Fall 2009 Would you want to stay in the industry if you were already in it? Page 18

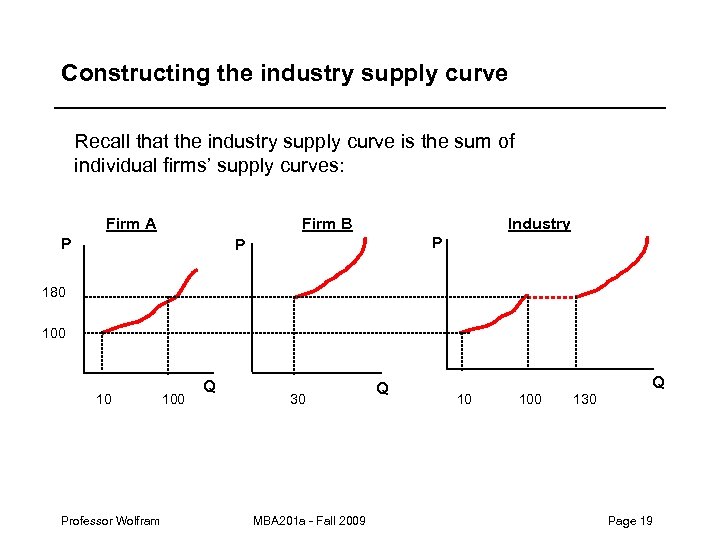

Constructing the industry supply curve Recall that the industry supply curve is the sum of individual firms’ supply curves: Firm A Firm B P Industry P P 180 10 Professor Wolfram 100 Q 30 MBA 201 a - Fall 2009 Q Q 10 100 130 Page 19

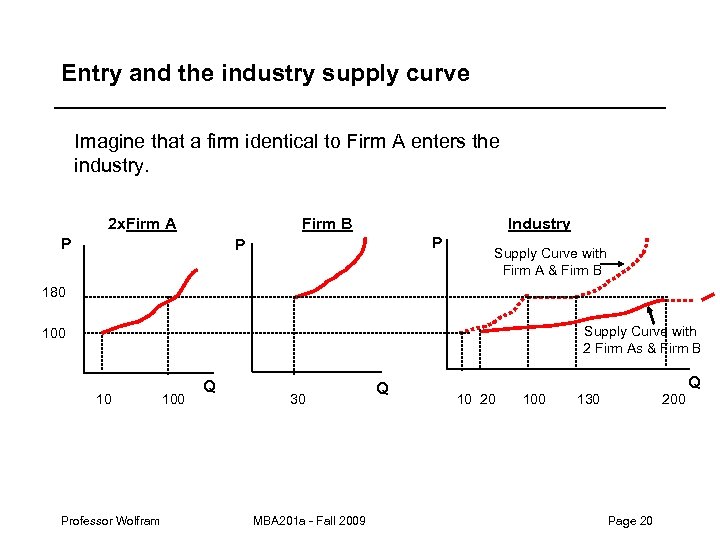

Entry and the industry supply curve Imagine that a firm identical to Firm A enters the industry. 2 x. Firm A Firm B P Industry P P Supply Curve with Firm A & Firm B 180 Supply Curve with 2 Firm As & Firm B 100 10 Professor Wolfram 100 Q 30 MBA 201 a - Fall 2009 Q Q 10 20 100 130 200 Page 20

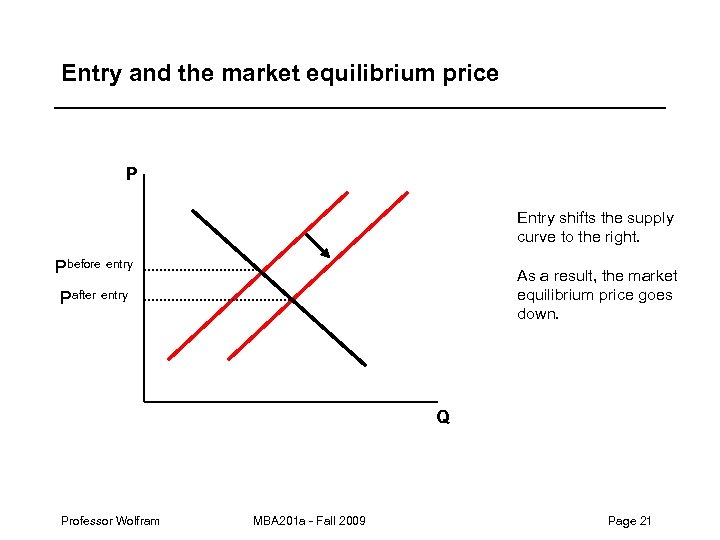

Entry and the market equilibrium price P Entry shifts the supply curve to the right. Pbefore entry As a result, the market equilibrium price goes down. Pafter entry Q Professor Wolfram MBA 201 a - Fall 2009 Page 21

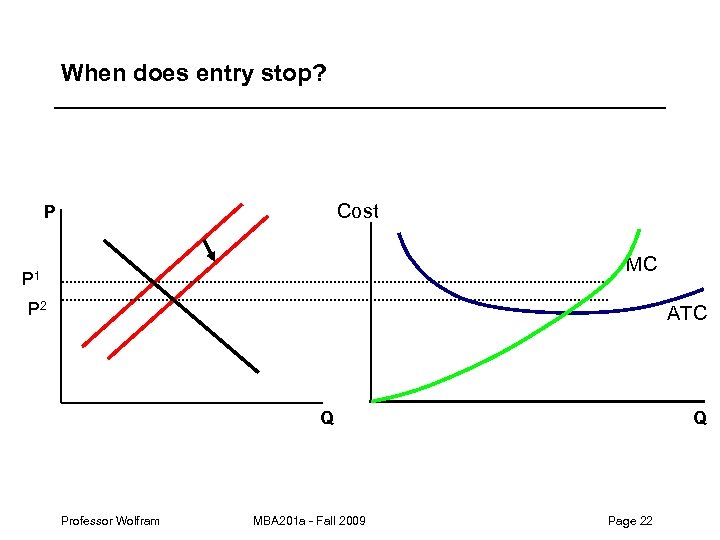

When does entry stop? Cost P MC P 1 P 2 ATC Q Professor Wolfram MBA 201 a - Fall 2009 Q Page 22

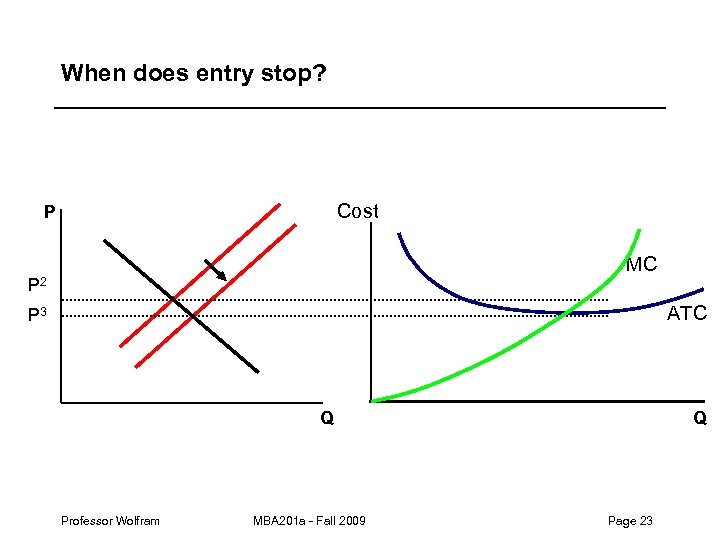

When does entry stop? Cost P MC P 2 ATC P 3 Q Professor Wolfram MBA 201 a - Fall 2009 Q Page 23

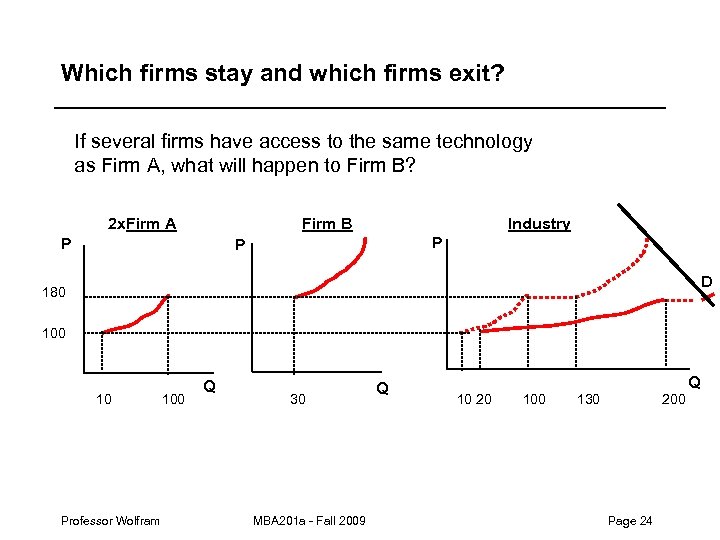

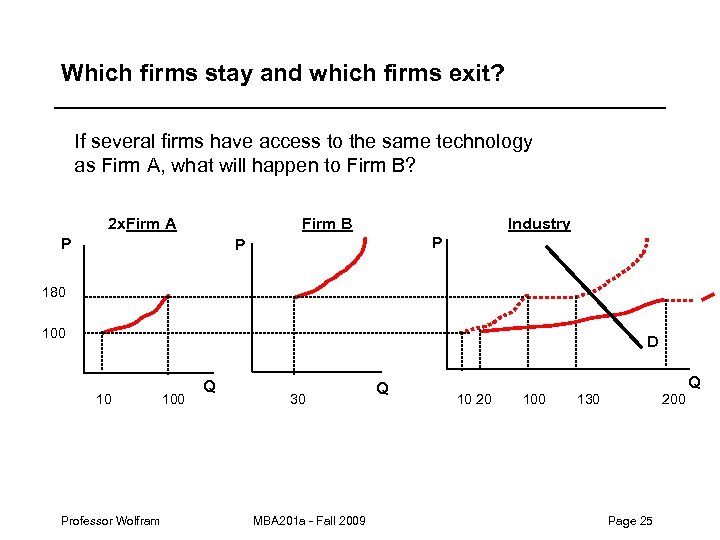

Which firms stay and which firms exit? If several firms have access to the same technology as Firm A, what will happen to Firm B? 2 x. Firm A Firm B P Industry P P D 180 10 Professor Wolfram 100 Q 30 MBA 201 a - Fall 2009 Q Q 10 20 100 130 200 Page 24

Which firms stay and which firms exit? If several firms have access to the same technology as Firm A, what will happen to Firm B? 2 x. Firm A Firm B P Industry P P 180 100 D 10 Professor Wolfram 100 Q 30 MBA 201 a - Fall 2009 Q Q 10 20 100 130 200 Page 25

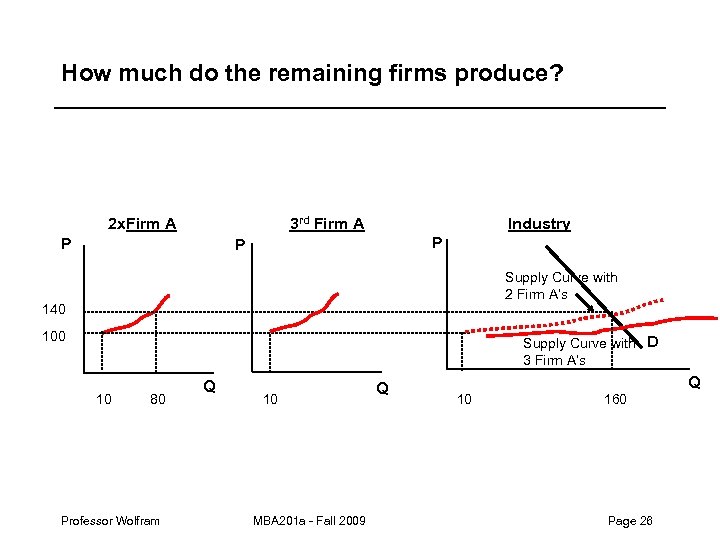

How much do the remaining firms produce? 2 x. Firm A 3 rd Firm A P Industry P P Supply Curve with 2 Firm A’s 140 100 Supply Curve with D 3 Firm A’s 10 80 Professor Wolfram Q 10 MBA 201 a - Fall 2009 Q Q 10 160 Page 26

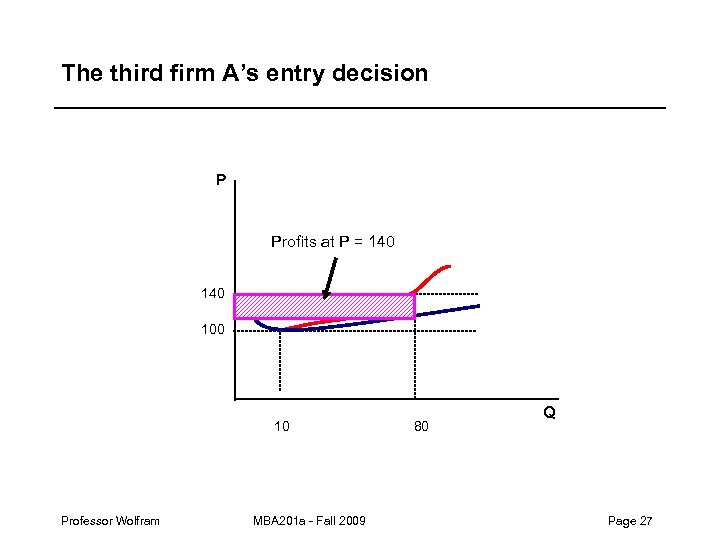

The third firm A’s entry decision P Profits at P = 140 100 10 Professor Wolfram MBA 201 a - Fall 2009 80 Q Page 27

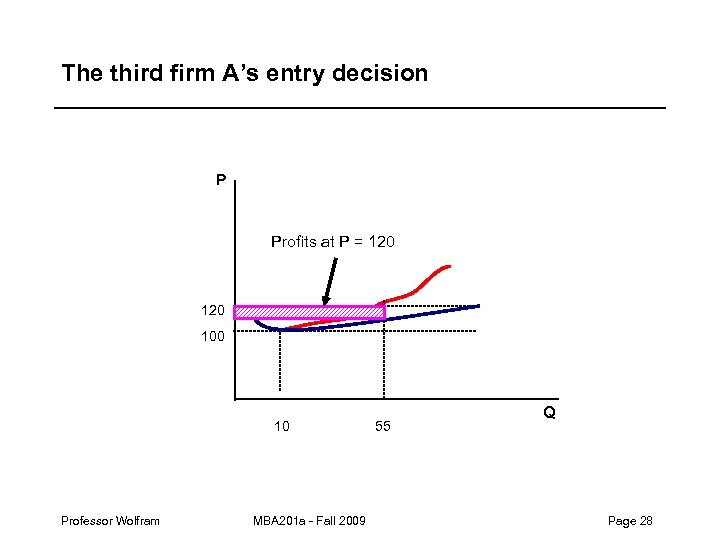

The third firm A’s entry decision P Profits at P = 120 100 10 Professor Wolfram MBA 201 a - Fall 2009 55 Q Page 28

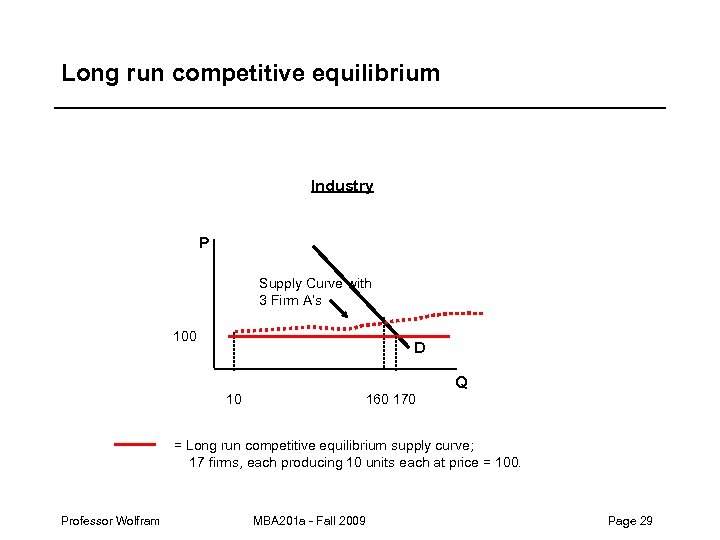

Long run competitive equilibrium Industry P Supply Curve with 3 Firm A’s 100 D Q 10 160 170 = Long run competitive equilibrium supply curve; 17 firms, each producing 10 units each at price = 100. Professor Wolfram MBA 201 a - Fall 2009 Page 29

Long run competitive equilibrium In a long-run competitive equilibrium: – All of the existing firms are maximizing their short-run profits. – None of the existing firms want to either exit or expand output. – No new firms want to enter. – All existing firms earn zero economic profits. – The market price equals the minimum of the long-run average cost curve (P=min(LRAC)). – All consumers who want to buy the product at this price are able to. Professor Wolfram MBA 201 a - Fall 2009 Page 30

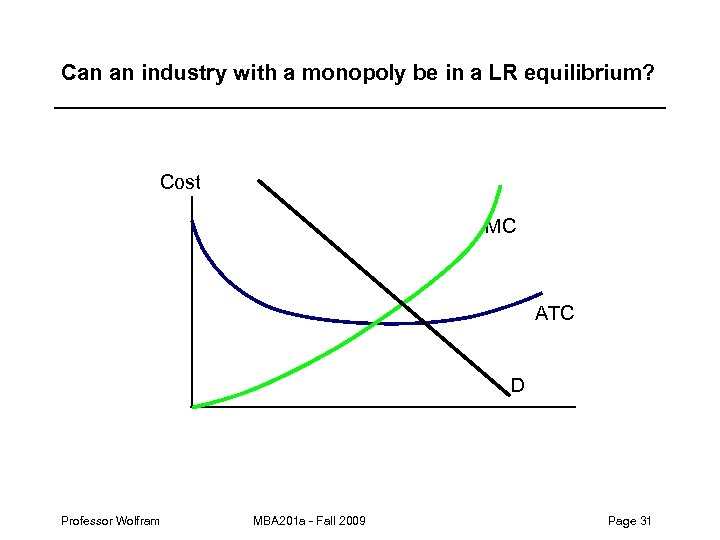

Can an industry with a monopoly be in a LR equilibrium? Cost MC ATC D Professor Wolfram MBA 201 a - Fall 2009 Page 31

Takeaways – Firms have more control over their costs in the long run. – A firm should stay in business in the short run as long as it is making some contribution towards its fixed costs (i. e. P>AVC). – The following dynamics contribute to the long-run competitive equilibrium: • Firms entering markets where there are opportunities to make profits. • Firms exiting markets where they can no longer cover their total costs, even if they’re making profit maximizing price/output decisions. – In a long-run competitive equilibrium: p=min(LRAC), all firms earn zero economic profits. Professor Wolfram MBA 201 a - Fall 2009 Page 32

12677ad0cfc7ccc2b282df397662f578.ppt