be6f1b7398a7239fe38d51867fe51a83.ppt

- Количество слайдов: 35

May 2009 Environmental Industry Review 2015 Grant Ferrier Editor, Environmental Business Journal Editor, Climate Change Business Journal President, Environmental Business International, Inc. Chairman, Environmental Industry Summit XIII, March 11 -13, 2015

May 2009 Environmental Industry Review 2015 Grant Ferrier Editor, Environmental Business Journal Editor, Climate Change Business Journal President, Environmental Business International, Inc. Chairman, Environmental Industry Summit XIII, March 11 -13, 2015

Presentation Outline BIG PICTURE: 2013 -2014 data Environmental Industry: Economics & Statistics; Trends Key Growth Factors in the 2000 s and 2010 s Consulting & Engineering Segment California Perspective

Presentation Outline BIG PICTURE: 2013 -2014 data Environmental Industry: Economics & Statistics; Trends Key Growth Factors in the 2000 s and 2010 s Consulting & Engineering Segment California Perspective

Environmental Industry in Context: Growth SOURCE: EBI Inc. , San Diego CA; Annual segment-by-segment research; government shutdowns in 1995 -96 and October 2013

Environmental Industry in Context: Growth SOURCE: EBI Inc. , San Diego CA; Annual segment-by-segment research; government shutdowns in 1995 -96 and October 2013

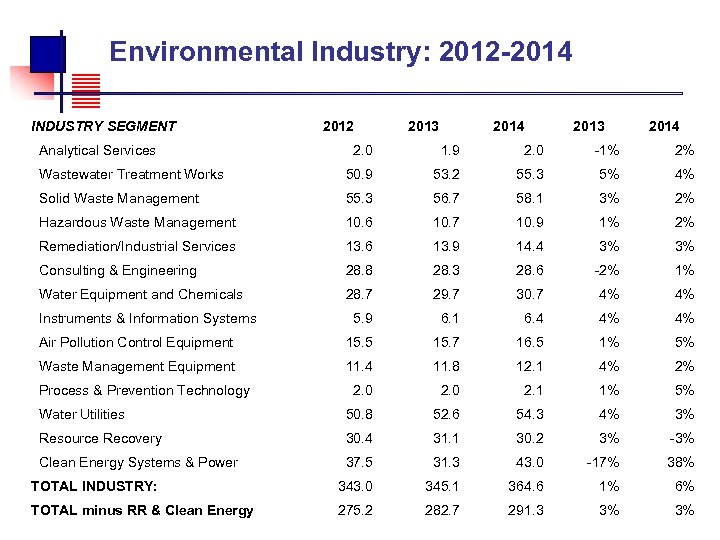

Environmental Industry: 2012 -2014 INDUSTRY SEGMENT Analytical Services 2012 2013 2014 2. 0 1. 9 2. 0 -1% 2% Wastewater Treatment Works 50. 9 53. 2 55. 3 5% 4% Solid Waste Management 55. 3 56. 7 58. 1 3% 2% Hazardous Waste Management 10. 6 10. 7 10. 9 1% 2% Remediation/Industrial Services 13. 6 13. 9 14. 4 3% 3% Consulting & Engineering 28. 8 28. 3 28. 6 -2% 1% Water Equipment and Chemicals 28. 7 29. 7 30. 7 4% 4% 5. 9 6. 1 6. 4 4% 4% Air Pollution Control Equipment 15. 5 15. 7 16. 5 1% 5% Waste Management Equipment 11. 4 11. 8 12. 1 4% 2% 2. 0 2. 1 1% 5% Water Utilities 50. 8 52. 6 54. 3 4% 3% Resource Recovery 30. 4 31. 1 30. 2 3% -3% Clean Energy Systems & Power 37. 5 31. 3 43. 0 -17% 38% TOTAL INDUSTRY: 343. 0 345. 1 364. 6 1% 6% TOTAL minus RR & Clean Energy 275. 2 282. 7 291. 3 3% 3% Instruments & Information Systems Process & Prevention Technology

Environmental Industry: 2012 -2014 INDUSTRY SEGMENT Analytical Services 2012 2013 2014 2. 0 1. 9 2. 0 -1% 2% Wastewater Treatment Works 50. 9 53. 2 55. 3 5% 4% Solid Waste Management 55. 3 56. 7 58. 1 3% 2% Hazardous Waste Management 10. 6 10. 7 10. 9 1% 2% Remediation/Industrial Services 13. 6 13. 9 14. 4 3% 3% Consulting & Engineering 28. 8 28. 3 28. 6 -2% 1% Water Equipment and Chemicals 28. 7 29. 7 30. 7 4% 4% 5. 9 6. 1 6. 4 4% 4% Air Pollution Control Equipment 15. 5 15. 7 16. 5 1% 5% Waste Management Equipment 11. 4 11. 8 12. 1 4% 2% 2. 0 2. 1 1% 5% Water Utilities 50. 8 52. 6 54. 3 4% 3% Resource Recovery 30. 4 31. 1 30. 2 3% -3% Clean Energy Systems & Power 37. 5 31. 3 43. 0 -17% 38% TOTAL INDUSTRY: 343. 0 345. 1 364. 6 1% 6% TOTAL minus RR & Clean Energy 275. 2 282. 7 291. 3 3% 3% Instruments & Information Systems Process & Prevention Technology

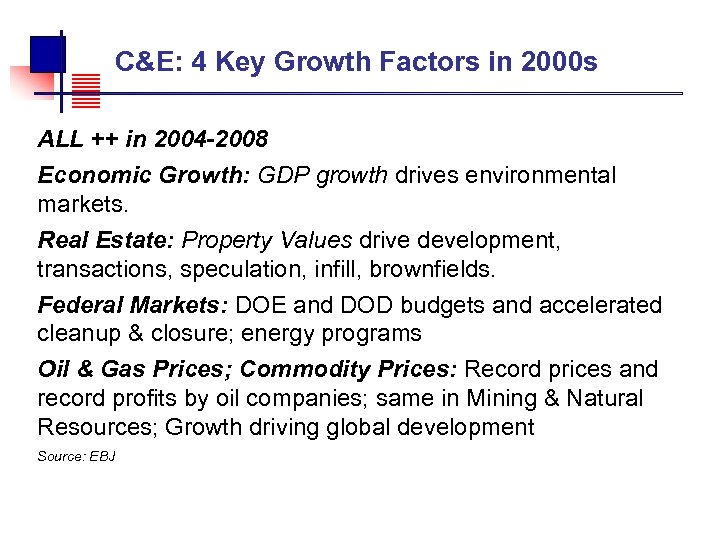

C&E: 4 Key Growth Factors in 2000 s ALL ++ in 2004 -2008 Economic Growth: GDP growth drives environmental markets. Real Estate: Property Values drive development, transactions, speculation, infill, brownfields. Federal Markets: DOE and DOD budgets and accelerated cleanup & closure; energy programs Oil & Gas Prices; Commodity Prices: Record prices and record profits by oil companies; same in Mining & Natural Resources; Growth driving global development Source: EBJ

C&E: 4 Key Growth Factors in 2000 s ALL ++ in 2004 -2008 Economic Growth: GDP growth drives environmental markets. Real Estate: Property Values drive development, transactions, speculation, infill, brownfields. Federal Markets: DOE and DOD budgets and accelerated cleanup & closure; energy programs Oil & Gas Prices; Commodity Prices: Record prices and record profits by oil companies; same in Mining & Natural Resources; Growth driving global development Source: EBJ

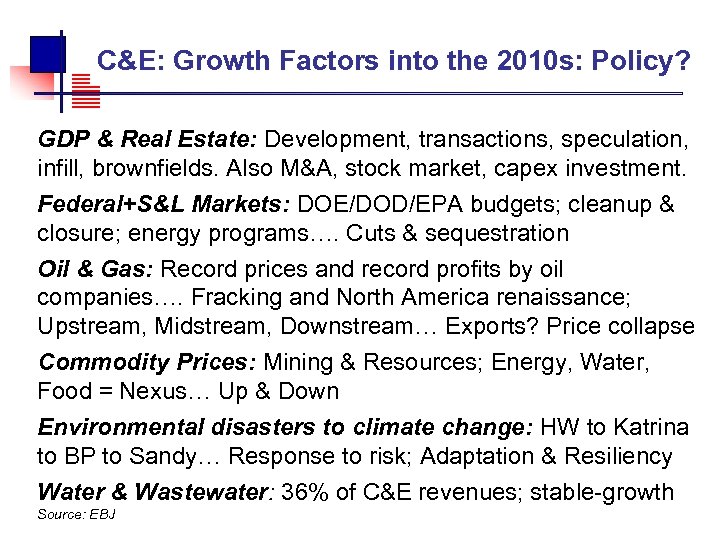

C&E: Growth Factors into the 2010 s: Policy? GDP & Real Estate: Development, transactions, speculation, infill, brownfields. Also M&A, stock market, capex investment. Federal+S&L Markets: DOE/DOD/EPA budgets; cleanup & closure; energy programs…. Cuts & sequestration Oil & Gas: Record prices and record profits by oil companies…. Fracking and North America renaissance; Upstream, Midstream, Downstream… Exports? Price collapse Commodity Prices: Mining & Resources; Energy, Water, Food = Nexus… Up & Down Environmental disasters to climate change: HW to Katrina to BP to Sandy… Response to risk; Adaptation & Resiliency Water & Wastewater: 36% of C&E revenues; stable-growth Source: EBJ

C&E: Growth Factors into the 2010 s: Policy? GDP & Real Estate: Development, transactions, speculation, infill, brownfields. Also M&A, stock market, capex investment. Federal+S&L Markets: DOE/DOD/EPA budgets; cleanup & closure; energy programs…. Cuts & sequestration Oil & Gas: Record prices and record profits by oil companies…. Fracking and North America renaissance; Upstream, Midstream, Downstream… Exports? Price collapse Commodity Prices: Mining & Resources; Energy, Water, Food = Nexus… Up & Down Environmental disasters to climate change: HW to Katrina to BP to Sandy… Response to risk; Adaptation & Resiliency Water & Wastewater: 36% of C&E revenues; stable-growth Source: EBJ

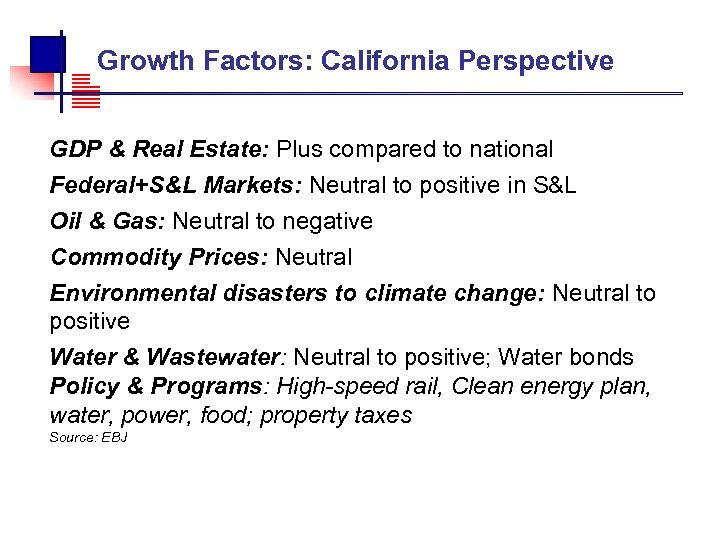

Growth Factors: California Perspective GDP & Real Estate: Plus compared to national Federal+S&L Markets: Neutral to positive in S&L Oil & Gas: Neutral to negative Commodity Prices: Neutral Environmental disasters to climate change: Neutral to positive Water & Wastewater: Neutral to positive; Water bonds Policy & Programs: High-speed rail, Clean energy plan, water, power, food; property taxes Source: EBJ

Growth Factors: California Perspective GDP & Real Estate: Plus compared to national Federal+S&L Markets: Neutral to positive in S&L Oil & Gas: Neutral to negative Commodity Prices: Neutral Environmental disasters to climate change: Neutral to positive Water & Wastewater: Neutral to positive; Water bonds Policy & Programs: High-speed rail, Clean energy plan, water, power, food; property taxes Source: EBJ

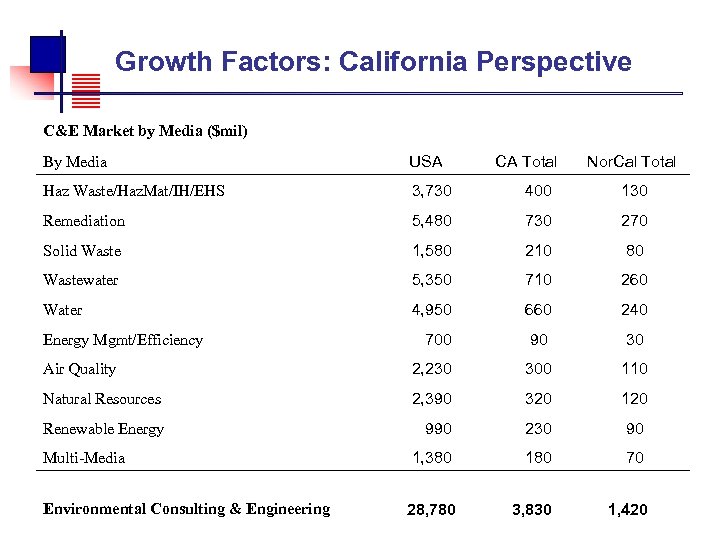

Growth Factors: California Perspective C&E Market by Media ($mil) By Media USA CA Total Nor. Cal Total Haz Waste/Haz. Mat/IH/EHS 3, 730 400 130 Remediation 5, 480 730 270 Solid Waste 1, 580 210 80 Wastewater 5, 350 710 260 Water 4, 950 660 240 Energy Mgmt/Efficiency 700 90 30 Air Quality 2, 230 300 110 Natural Resources 2, 390 320 120 Renewable Energy 990 230 90 Multi-Media 1, 380 180 70 28, 780 3, 830 1, 420 Environmental Consulting & Engineering

Growth Factors: California Perspective C&E Market by Media ($mil) By Media USA CA Total Nor. Cal Total Haz Waste/Haz. Mat/IH/EHS 3, 730 400 130 Remediation 5, 480 730 270 Solid Waste 1, 580 210 80 Wastewater 5, 350 710 260 Water 4, 950 660 240 Energy Mgmt/Efficiency 700 90 30 Air Quality 2, 230 300 110 Natural Resources 2, 390 320 120 Renewable Energy 990 230 90 Multi-Media 1, 380 180 70 28, 780 3, 830 1, 420 Environmental Consulting & Engineering

Growth Factors: California GHGs/Climate 4 bills in the California Senate 2015 package: SB 32: State GHG reduction target of 80% below 1990 levels by 2050. The current target, adopted by the legislature in 2006, requires statewide emissions to decline to 1990 levels by 2020. SB 350: 50% of our electricity from emissions-free renewables, doubling energy efficiency, and reducing petroleum in cars and trucks by 50% - all by 2030. SB 189: Committee on economic growth and job creation. SB 185 Cal. PERS and Cal. STRS to divest coal companies. IL: RE 35% by 2030; increase EE by 20%; CO 2 e auctions; 100 k jobs

Growth Factors: California GHGs/Climate 4 bills in the California Senate 2015 package: SB 32: State GHG reduction target of 80% below 1990 levels by 2050. The current target, adopted by the legislature in 2006, requires statewide emissions to decline to 1990 levels by 2020. SB 350: 50% of our electricity from emissions-free renewables, doubling energy efficiency, and reducing petroleum in cars and trucks by 50% - all by 2030. SB 189: Committee on economic growth and job creation. SB 185 Cal. PERS and Cal. STRS to divest coal companies. IL: RE 35% by 2030; increase EE by 20%; CO 2 e auctions; 100 k jobs

Growth Factors: California Water Bond Aug. 2014: Legislature approved water bond ballot measure aimed at increasing the supply of water and habitat. November 4, 2014, voters approved Proposition 1 with $7. 5 billion: $2. 7 billion for water storage projects and $1. 5 billion for watershed protection and restoration projects. Also groundwater sustainability, regional water management, water recycling and desalination, water treatment, and flood protection. Governor’s Budget Proposals. $533 million from Proposition 1 in 2015 -16. This includes $178 million for various watershed protection and restoration activities, $137 million for water recycling and desalination projects, and $69 million for projects to improve drinking water in disadvantaged communities.

Growth Factors: California Water Bond Aug. 2014: Legislature approved water bond ballot measure aimed at increasing the supply of water and habitat. November 4, 2014, voters approved Proposition 1 with $7. 5 billion: $2. 7 billion for water storage projects and $1. 5 billion for watershed protection and restoration projects. Also groundwater sustainability, regional water management, water recycling and desalination, water treatment, and flood protection. Governor’s Budget Proposals. $533 million from Proposition 1 in 2015 -16. This includes $178 million for various watershed protection and restoration activities, $137 million for water recycling and desalination projects, and $69 million for projects to improve drinking water in disadvantaged communities.

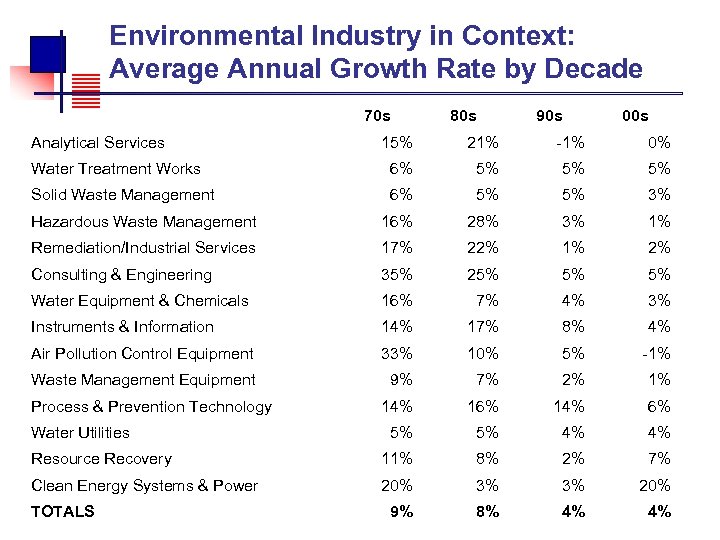

Environmental Industry in Context: Average Annual Growth Rate by Decade 70 s Analytical Services 80 s 90 s 00 s 15% 21% -1% 0% Water Treatment Works 6% 5% 5% 5% Solid Waste Management 6% 5% 5% 3% Hazardous Waste Management 16% 28% 3% 1% Remediation/Industrial Services 17% 22% 1% 2% Consulting & Engineering 35% 25% 5% 5% Water Equipment & Chemicals 16% 7% 4% 3% Instruments & Information 14% 17% 8% 4% Air Pollution Control Equipment 33% 10% 5% -1% Waste Management Equipment 9% 7% 2% 1% 14% 16% 14% 6% 5% 5% 4% 4% Resource Recovery 11% 8% 2% 7% Clean Energy Systems & Power 20% 3% 3% 20% 9% 8% 4% 4% Process & Prevention Technology Water Utilities TOTALS

Environmental Industry in Context: Average Annual Growth Rate by Decade 70 s Analytical Services 80 s 90 s 00 s 15% 21% -1% 0% Water Treatment Works 6% 5% 5% 5% Solid Waste Management 6% 5% 5% 3% Hazardous Waste Management 16% 28% 3% 1% Remediation/Industrial Services 17% 22% 1% 2% Consulting & Engineering 35% 25% 5% 5% Water Equipment & Chemicals 16% 7% 4% 3% Instruments & Information 14% 17% 8% 4% Air Pollution Control Equipment 33% 10% 5% -1% Waste Management Equipment 9% 7% 2% 1% 14% 16% 14% 6% 5% 5% 4% 4% Resource Recovery 11% 8% 2% 7% Clean Energy Systems & Power 20% 3% 3% 20% 9% 8% 4% 4% Process & Prevention Technology Water Utilities TOTALS

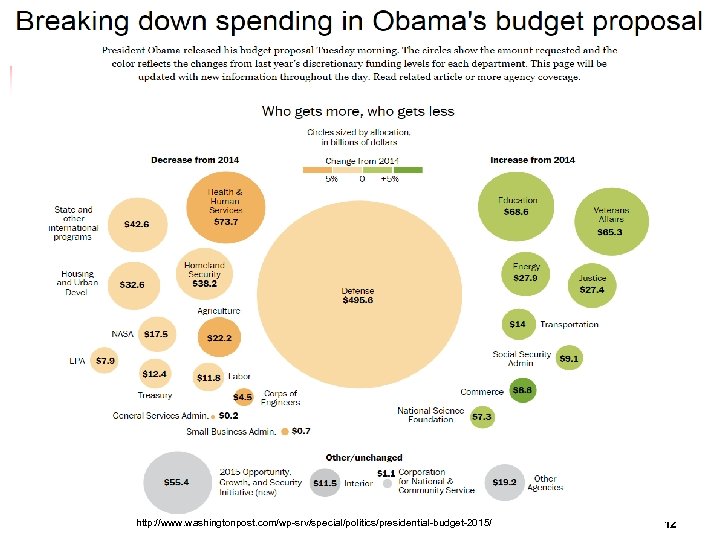

http: //www. washingtonpost. com/wp-srv/special/politics/presidential-budget-2015/ 12

http: //www. washingtonpost. com/wp-srv/special/politics/presidential-budget-2015/ 12

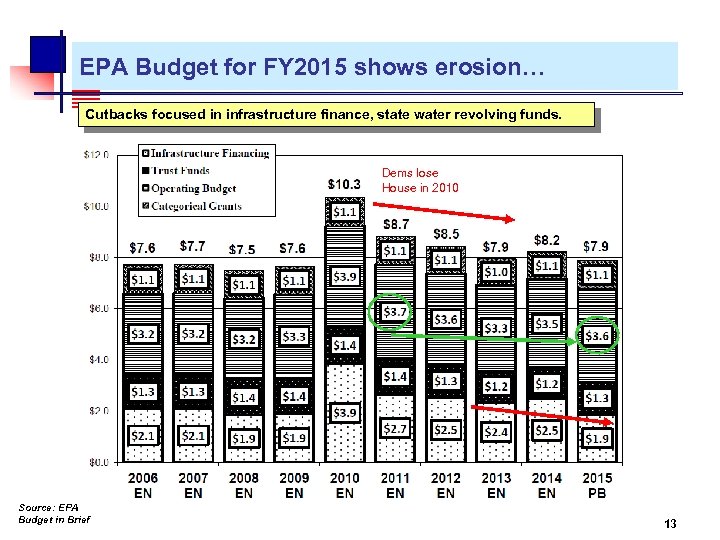

EPA Budget for FY 2015 shows erosion… Cutbacks focused in infrastructure finance, state water revolving funds. Dems lose House in 2010 Source: EPA Budget in Brief 13

EPA Budget for FY 2015 shows erosion… Cutbacks focused in infrastructure finance, state water revolving funds. Dems lose House in 2010 Source: EPA Budget in Brief 13

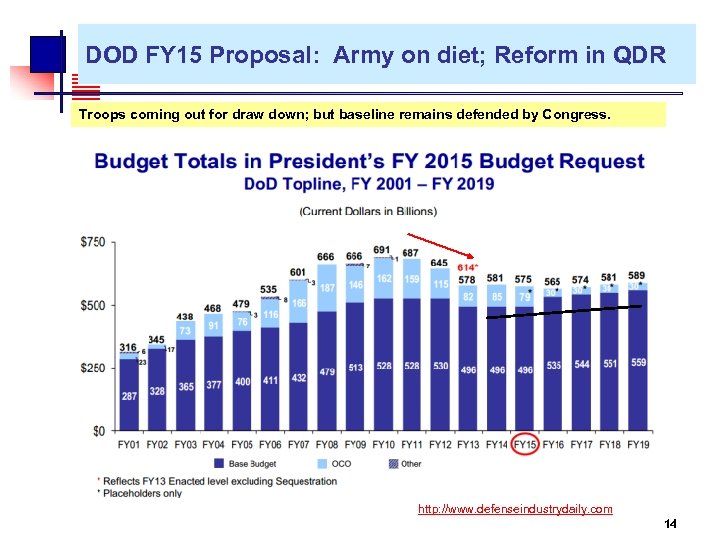

DOD FY 15 Proposal: Army on diet; Reform in QDR Troops coming out for draw down; but baseline remains defended by Congress. http: //www. defenseindustrydaily. com 14

DOD FY 15 Proposal: Army on diet; Reform in QDR Troops coming out for draw down; but baseline remains defended by Congress. http: //www. defenseindustrydaily. com 14

Industry Context The Green Economy Environmental Industry Climate Change Industry

Industry Context The Green Economy Environmental Industry Climate Change Industry

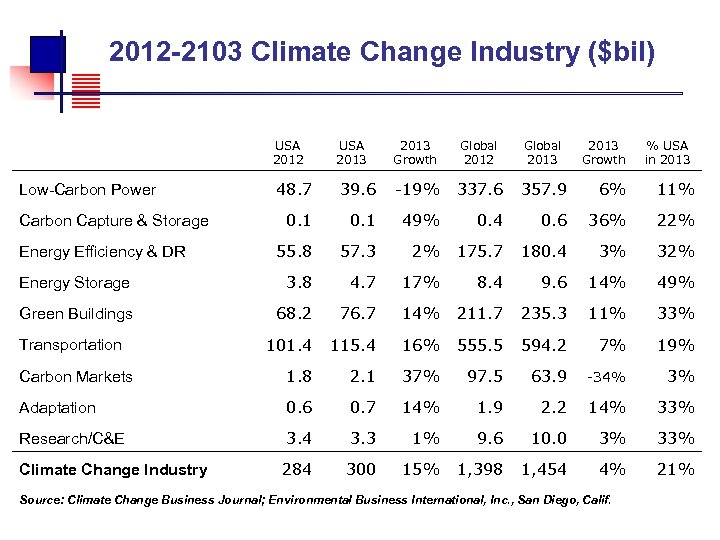

2012 -2103 Climate Change Industry ($bil) USA 2012 USA 2013 Growth Global 2012 Global 2013 Low-Carbon Power 48. 7 39. 6 -19% 337. 6 357. 9 6% 11% 0. 1 49% 0. 4 0. 6 36% 22% 55. 8 57. 3 2% 175. 7 180. 4 3% 32% Energy Storage 3. 8 4. 7 17% 8. 4 9. 6 14% 49% Green Buildings 68. 2 76. 7 14% 211. 7 235. 3 11% 33% 101. 4 115. 4 16% 555. 5 594. 2 7% 19% Carbon Markets 1. 8 2. 1 37% 97. 5 63. 9 -34% 3% Adaptation 0. 6 0. 7 14% 1. 9 2. 2 14% 33% Research/C&E 3. 4 3. 3 1% 9. 6 10. 0 3% 33% Climate Change Industry 284 300 15% 1, 398 1, 454 4% 21% Carbon Capture & Storage Energy Efficiency & DR Transportation 2013 Growth Source: Climate Change Business Journal; Environmental Business International, Inc. , San Diego, Calif. % USA in 2013

2012 -2103 Climate Change Industry ($bil) USA 2012 USA 2013 Growth Global 2012 Global 2013 Low-Carbon Power 48. 7 39. 6 -19% 337. 6 357. 9 6% 11% 0. 1 49% 0. 4 0. 6 36% 22% 55. 8 57. 3 2% 175. 7 180. 4 3% 32% Energy Storage 3. 8 4. 7 17% 8. 4 9. 6 14% 49% Green Buildings 68. 2 76. 7 14% 211. 7 235. 3 11% 33% 101. 4 115. 4 16% 555. 5 594. 2 7% 19% Carbon Markets 1. 8 2. 1 37% 97. 5 63. 9 -34% 3% Adaptation 0. 6 0. 7 14% 1. 9 2. 2 14% 33% Research/C&E 3. 4 3. 3 1% 9. 6 10. 0 3% 33% Climate Change Industry 284 300 15% 1, 398 1, 454 4% 21% Carbon Capture & Storage Energy Efficiency & DR Transportation 2013 Growth Source: Climate Change Business Journal; Environmental Business International, Inc. , San Diego, Calif. % USA in 2013

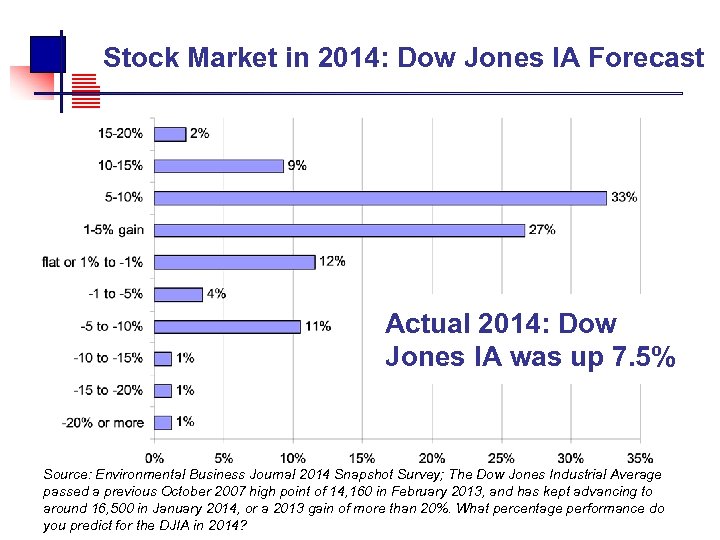

Stock Market in 2014: Dow Jones IA Forecast Actual 2014: Dow Jones IA was up 7. 5% Source: Environmental Business Journal 2014 Snapshot Survey; The Dow Jones Industrial Average passed a previous October 2007 high point of 14, 160 in February 2013, and has kept advancing to around 16, 500 in January 2014, or a 2013 gain of more than 20%. What percentage performance do you predict for the DJIA in 2014?

Stock Market in 2014: Dow Jones IA Forecast Actual 2014: Dow Jones IA was up 7. 5% Source: Environmental Business Journal 2014 Snapshot Survey; The Dow Jones Industrial Average passed a previous October 2007 high point of 14, 160 in February 2013, and has kept advancing to around 16, 500 in January 2014, or a 2013 gain of more than 20%. What percentage performance do you predict for the DJIA in 2014?

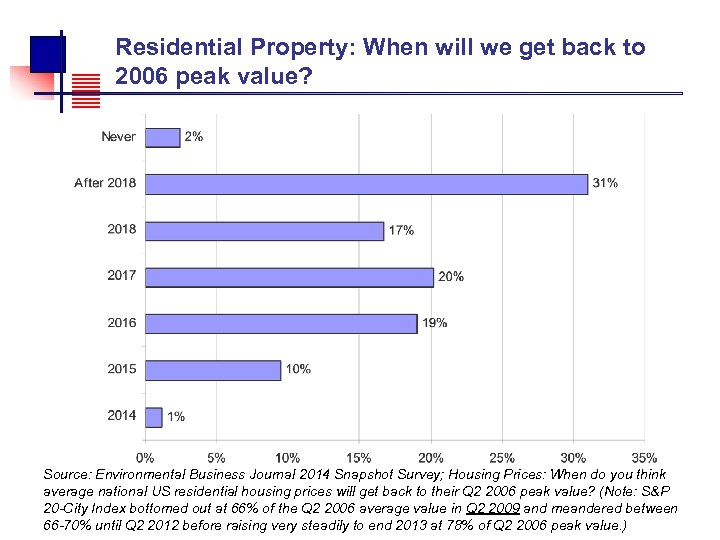

Residential Property: When will we get back to 2006 peak value? Source: Environmental Business Journal 2014 Snapshot Survey; Housing Prices: When do you think average national US residential housing prices will get back to their Q 2 2006 peak value? (Note: S&P 20 -City Index bottomed out at 66% of the Q 2 2006 average value in Q 2 2009 and meandered between 66 -70% until Q 2 2012 before raising very steadily to end 2013 at 78% of Q 2 2006 peak value. )

Residential Property: When will we get back to 2006 peak value? Source: Environmental Business Journal 2014 Snapshot Survey; Housing Prices: When do you think average national US residential housing prices will get back to their Q 2 2006 peak value? (Note: S&P 20 -City Index bottomed out at 66% of the Q 2 2006 average value in Q 2 2009 and meandered between 66 -70% until Q 2 2012 before raising very steadily to end 2013 at 78% of Q 2 2006 peak value. )

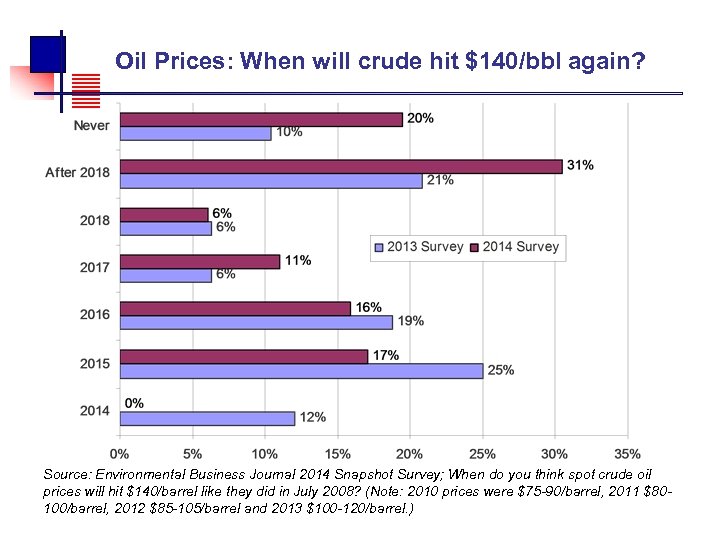

Oil Prices: When will crude hit $140/bbl again? Source: Environmental Business Journal 2014 Snapshot Survey; When do you think spot crude oil prices will hit $140/barrel like they did in July 2008? (Note: 2010 prices were $75 -90/barrel, 2011 $80100/barrel, 2012 $85 -105/barrel and 2013 $100 -120/barrel. )

Oil Prices: When will crude hit $140/bbl again? Source: Environmental Business Journal 2014 Snapshot Survey; When do you think spot crude oil prices will hit $140/barrel like they did in July 2008? (Note: 2010 prices were $75 -90/barrel, 2011 $80100/barrel, 2012 $85 -105/barrel and 2013 $100 -120/barrel. )

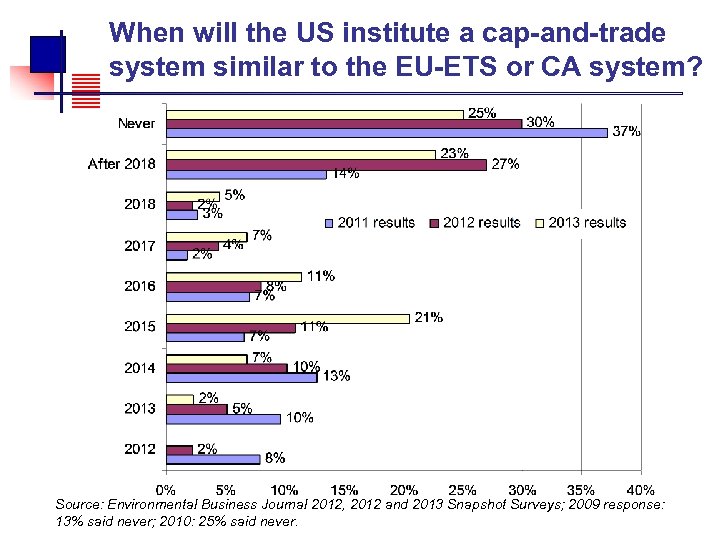

When will the US institute a cap-and-trade system similar to the EU-ETS or CA system? Source: Environmental Business Journal 2012, 2012 and 2013 Snapshot Surveys; 2009 response: 13% said never; 2010: 25% said never.

When will the US institute a cap-and-trade system similar to the EU-ETS or CA system? Source: Environmental Business Journal 2012, 2012 and 2013 Snapshot Surveys; 2009 response: 13% said never; 2010: 25% said never.

US Carbon Policy Forecast When do you think the United States will institute a carbon cap-and-trade system similar to the EU-ETS system in Europe, or that being tested in California; and/or when do you think the U. S. will institute a carbon tax or fee-for-emissions based system to restrict GHG emissions?

US Carbon Policy Forecast When do you think the United States will institute a carbon cap-and-trade system similar to the EU-ETS system in Europe, or that being tested in California; and/or when do you think the U. S. will institute a carbon tax or fee-for-emissions based system to restrict GHG emissions?

Coal: % of US Electricity Generation Source: Environmental Business Journal 2014 Snapshot Survey; Coal: U. S. DOE's Energy Information Administration says coal was 51% of U. S. electricity generation in 2003, and was down to 37 -38% in 2012 and 2013, largely on the growth of generation from renewables and natural gas. What percentage of U. S. electricity generation do you believe coal will represent in 2020 -2050?

Coal: % of US Electricity Generation Source: Environmental Business Journal 2014 Snapshot Survey; Coal: U. S. DOE's Energy Information Administration says coal was 51% of U. S. electricity generation in 2003, and was down to 37 -38% in 2012 and 2013, largely on the growth of generation from renewables and natural gas. What percentage of U. S. electricity generation do you believe coal will represent in 2020 -2050?

Coal: % of China Electricity Generation Source: Environmental Business Journal 2014 Snapshot Survey; Coal: International Energy Agency says coal was 81% of China's electricity generation in 2007, and was down marginally to 78% in 2012. What percentage of Chinese electricity generation do you believe coal will represent in 2020 -2050?

Coal: % of China Electricity Generation Source: Environmental Business Journal 2014 Snapshot Survey; Coal: International Energy Agency says coal was 81% of China's electricity generation in 2007, and was down marginally to 78% in 2012. What percentage of Chinese electricity generation do you believe coal will represent in 2020 -2050?

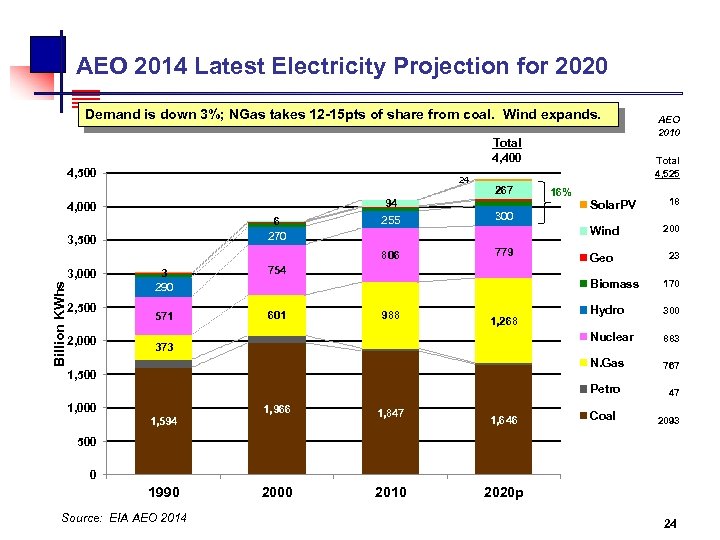

AEO 2014 Latest Electricity Projection for 2020 Demand is down 3%; NGas takes 12 -15 pts of share from coal. Wind expands. Total 4, 400 4, 500 24 267 6 270 3, 500 3, 000 3 290 601 779 Total 4, 525 16% Solar. PV 18 Wind 754 571 300 806 4, 000 94 255 AEO 2010 200 Geo 23 Billion KWhs 2, 000 373 1, 500 1, 000 1, 966 1, 847 2000 2010 1, 594 1, 646 300 883 N. Gas 1, 268 Hydro Nuclear 988 170 767 Petro 2, 500 Biomass 47 Coal 2093 500 0 1990 Source: EIA AEO 2014 2020 p 24

AEO 2014 Latest Electricity Projection for 2020 Demand is down 3%; NGas takes 12 -15 pts of share from coal. Wind expands. Total 4, 400 4, 500 24 267 6 270 3, 500 3, 000 3 290 601 779 Total 4, 525 16% Solar. PV 18 Wind 754 571 300 806 4, 000 94 255 AEO 2010 200 Geo 23 Billion KWhs 2, 000 373 1, 500 1, 000 1, 966 1, 847 2000 2010 1, 594 1, 646 300 883 N. Gas 1, 268 Hydro Nuclear 988 170 767 Petro 2, 500 Biomass 47 Coal 2093 500 0 1990 Source: EIA AEO 2014 2020 p 24

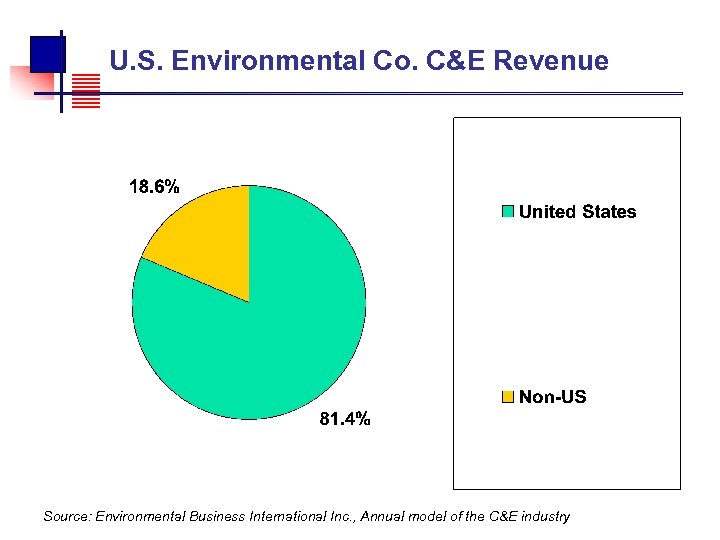

U. S. Environmental Co. C&E Revenue Source: Environmental Business International Inc. , Annual model of the C&E industry

U. S. Environmental Co. C&E Revenue Source: Environmental Business International Inc. , Annual model of the C&E industry

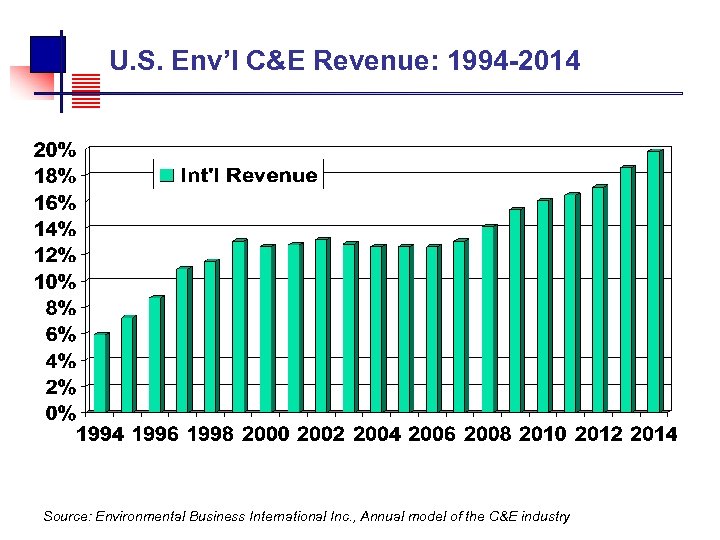

U. S. Env’l C&E Revenue: 1994 -2014 Source: Environmental Business International Inc. , Annual model of the C&E industry

U. S. Env’l C&E Revenue: 1994 -2014 Source: Environmental Business International Inc. , Annual model of the C&E industry

U. S. Env’l C&E Revenue: 2004 -2014 Source: Environmental Business International Inc. , Annual model of the C&E industry

U. S. Env’l C&E Revenue: 2004 -2014 Source: Environmental Business International Inc. , Annual model of the C&E industry

Distribution of Environmental Consulting & Engineering Firms in 2012 -2013 ($mil) Source: Environmental Business Journal's annual model of the U. S. environmental consulting & engineering industry based on annual surveys of C&E firms by EBJ, EBJ interviews, compiled revenue data derived from various sources including ENR, EFCG, Zweig. White and public company data.

Distribution of Environmental Consulting & Engineering Firms in 2012 -2013 ($mil) Source: Environmental Business Journal's annual model of the U. S. environmental consulting & engineering industry based on annual surveys of C&E firms by EBJ, EBJ interviews, compiled revenue data derived from various sources including ENR, EFCG, Zweig. White and public company data.

Volume XXVI: EBJ in 2013 EBJ Vol XXVI No 12: The U. S. Water Industry EBJ Vol XXVI No 10 & 11: Environmental C&E Industry Review EBJ Vol XXVI No 9: M&A 2013 EBJ Vol XXVI No 7/8: Environmental Industry Overview 2013 EBJ Vol XXVI No 5/6: Corp. Sustainability and Sustainability Consulting EBJ Vol XXVI No 4: Remediation 2013 EBJ Vol XXVI No 3: Outlook 2013: EBJ Snapshot Survey 2013 EBJ Vol XXVI No 2: Future of Fracking: Unconventional Oil & Gas E&P EBJ Vol XXVI No 1: Executive Q&As and 2012 EBJ Awards

Volume XXVI: EBJ in 2013 EBJ Vol XXVI No 12: The U. S. Water Industry EBJ Vol XXVI No 10 & 11: Environmental C&E Industry Review EBJ Vol XXVI No 9: M&A 2013 EBJ Vol XXVI No 7/8: Environmental Industry Overview 2013 EBJ Vol XXVI No 5/6: Corp. Sustainability and Sustainability Consulting EBJ Vol XXVI No 4: Remediation 2013 EBJ Vol XXVI No 3: Outlook 2013: EBJ Snapshot Survey 2013 EBJ Vol XXVI No 2: Future of Fracking: Unconventional Oil & Gas E&P EBJ Vol XXVI No 1: Executive Q&As and 2012 EBJ Awards

Volume XXVI: EBJ in 2014 EBJ Vol XXVII No 12: Executive Q&As and 2014 EBJ Awards EBJ Vol XXVII No 11: Consulting & Engineering 2014 EBJ Vol XXVII No 10: Environmental Contracting Services 2014 EBJ Vol XXVII No 8/9: Environmental Industry Overview 2014 EBJ Vol XXVII No 6/7: Global Environmental Markets 2014 EBJ Vol XXVII No 4/5: Natural Resource Management Markets 2014 EBJ Vol XXVII No 3: Outlook 2014: EBJ Snapshot Survey EBJ Vol XXVII No 2: Air Pollution Control

Volume XXVI: EBJ in 2014 EBJ Vol XXVII No 12: Executive Q&As and 2014 EBJ Awards EBJ Vol XXVII No 11: Consulting & Engineering 2014 EBJ Vol XXVII No 10: Environmental Contracting Services 2014 EBJ Vol XXVII No 8/9: Environmental Industry Overview 2014 EBJ Vol XXVII No 6/7: Global Environmental Markets 2014 EBJ Vol XXVII No 4/5: Natural Resource Management Markets 2014 EBJ Vol XXVII No 3: Outlook 2014: EBJ Snapshot Survey EBJ Vol XXVII No 2: Air Pollution Control

EBJ Subscriptions EBJ corporate electronic subscription: includes PDF file of editions, excel files of industry, segment and survey data for internal use. Special data sets and presentation files. up to 5 readers one year $1, 250 up to 10 readers one year $1, 500 up to 20 readers one year $1, 750 up to 30 readers one year $2, 000 up to 50 readers one year $2, 500 over 50 readers one year $3, 000 Discounts available for individuals and companies <50 people

EBJ Subscriptions EBJ corporate electronic subscription: includes PDF file of editions, excel files of industry, segment and survey data for internal use. Special data sets and presentation files. up to 5 readers one year $1, 250 up to 10 readers one year $1, 500 up to 20 readers one year $1, 750 up to 30 readers one year $2, 000 up to 50 readers one year $2, 500 over 50 readers one year $3, 000 Discounts available for individuals and companies <50 people

CCBJ: Volume VI in 2013 • 2014 Executive Review & 2013 CCBJ Awards (December 2013) • Markets in Combined Heat & Power (November 2013) • Climate Change Industry and the Mining Industry (October 2013) • Carbon Markets 2013 (August/Sept 2013) • GHG Mitigation in the Oil and Gas Industry (June/July 2013) • Finance and the Climate Change Industry (May 2013) • Transportation: Alternative Fuels & Vehicles (March/April 2013) • Conventional Power: 2013 Outlook for Fossil & Nuclear (January/February 2013)

CCBJ: Volume VI in 2013 • 2014 Executive Review & 2013 CCBJ Awards (December 2013) • Markets in Combined Heat & Power (November 2013) • Climate Change Industry and the Mining Industry (October 2013) • Carbon Markets 2013 (August/Sept 2013) • GHG Mitigation in the Oil and Gas Industry (June/July 2013) • Finance and the Climate Change Industry (May 2013) • Transportation: Alternative Fuels & Vehicles (March/April 2013) • Conventional Power: 2013 Outlook for Fossil & Nuclear (January/February 2013)

CCBJ: Volume VII in 2014 • 2015 Executive Review & 2014 CCBJ Awards (December 2014) • Climate Change Industry Drivers (Q 4 2014) • Renewable Energy: Key Issues and Service Market (Q 3 2014) • Energy Efficiency & Green Building (Q 2 2014) • Climate Risk Assessment and Adaptation Markets (Q 1 2014)

CCBJ: Volume VII in 2014 • 2015 Executive Review & 2014 CCBJ Awards (December 2014) • Climate Change Industry Drivers (Q 4 2014) • Renewable Energy: Key Issues and Service Market (Q 3 2014) • Energy Efficiency & Green Building (Q 2 2014) • Climate Risk Assessment and Adaptation Markets (Q 1 2014)

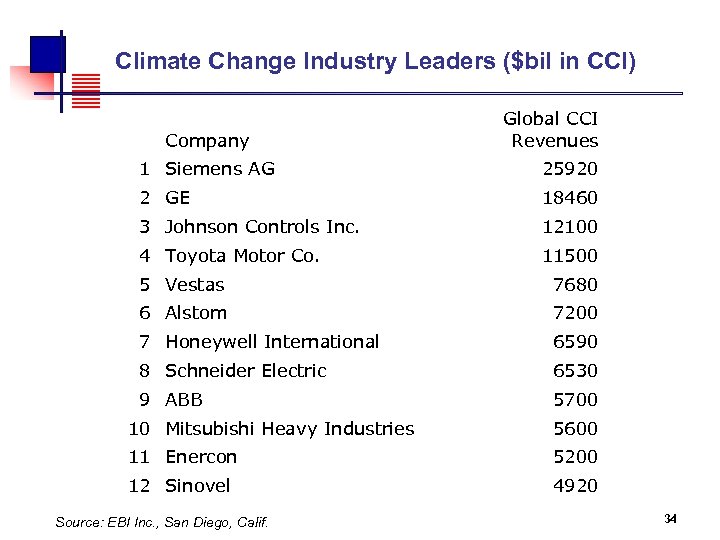

Climate Change Industry Leaders ($bil in CCI) Company Global CCI Revenues 1 Siemens AG 25920 2 GE 18460 3 Johnson Controls Inc. 12100 4 Toyota Motor Co. 11500 5 Vestas 7680 6 Alstom 7200 7 Honeywell International 6590 8 Schneider Electric 6530 9 ABB 5700 10 Mitsubishi Heavy Industries 5600 11 Enercon 5200 12 Sinovel 4920 Source: EBI Inc. , San Diego, Calif. 34

Climate Change Industry Leaders ($bil in CCI) Company Global CCI Revenues 1 Siemens AG 25920 2 GE 18460 3 Johnson Controls Inc. 12100 4 Toyota Motor Co. 11500 5 Vestas 7680 6 Alstom 7200 7 Honeywell International 6590 8 Schneider Electric 6530 9 ABB 5700 10 Mitsubishi Heavy Industries 5600 11 Enercon 5200 12 Sinovel 4920 Source: EBI Inc. , San Diego, Calif. 34

March 11 -13, 2015 - 13 th Anniversary Solamar Hotel, Gaslamp District, San Diego Grant Ferrier President, Environmental Business International, Inc. Chairman, Environmental Industry Summit Editor, Environmental Business Journal Editor, Climate Change Business Journal 4452 Park Blvd. #306, San Diego CA 92116, 619 -295 -7685 ext. 15 grant@ebimailbox. com; gf@climatechangebusiness. com Sign up for free EBJ & CCBJ weekly news at www. climatechangebusiness. com www. ebionline. org

March 11 -13, 2015 - 13 th Anniversary Solamar Hotel, Gaslamp District, San Diego Grant Ferrier President, Environmental Business International, Inc. Chairman, Environmental Industry Summit Editor, Environmental Business Journal Editor, Climate Change Business Journal 4452 Park Blvd. #306, San Diego CA 92116, 619 -295 -7685 ext. 15 grant@ebimailbox. com; gf@climatechangebusiness. com Sign up for free EBJ & CCBJ weekly news at www. climatechangebusiness. com www. ebionline. org