1e23e88e1903640fc1f206efd64d4f79.ppt

- Количество слайдов: 50

May 19, 2001 Joe Dews Jdews@needhamco. com

May 19, 2001 Joe Dews Jdews@needhamco. com

The M&A Market in Q 1 2001 Page 1

The M&A Market in Q 1 2001 Page 1

What a great time - Q 1 2000 Only a year ago… • Large companies, with huge market caps and sky high stock multiples were bidding incredible prices for early stage companies • There was unlimited and practically free cash available in the public and private equity markets – so what did burn rates matter? • “You snooze, you lose” was the mantra Page 2

What a great time - Q 1 2000 Only a year ago… • Large companies, with huge market caps and sky high stock multiples were bidding incredible prices for early stage companies • There was unlimited and practically free cash available in the public and private equity markets – so what did burn rates matter? • “You snooze, you lose” was the mantra Page 2

M&A in Q 1 2001 Q 1 2000 • M&A came to a virtual halt: 4 Buyers don’t know what to pay 4 Buyers have seen their own stocks punished 4 Buyers are focused on figuring out their own businesses 4 Burn rates and earnings dilution are again a focus • There will be no buyers for many venture backed companies without clear business models Page 3

M&A in Q 1 2001 Q 1 2000 • M&A came to a virtual halt: 4 Buyers don’t know what to pay 4 Buyers have seen their own stocks punished 4 Buyers are focused on figuring out their own businesses 4 Burn rates and earnings dilution are again a focus • There will be no buyers for many venture backed companies without clear business models Page 3

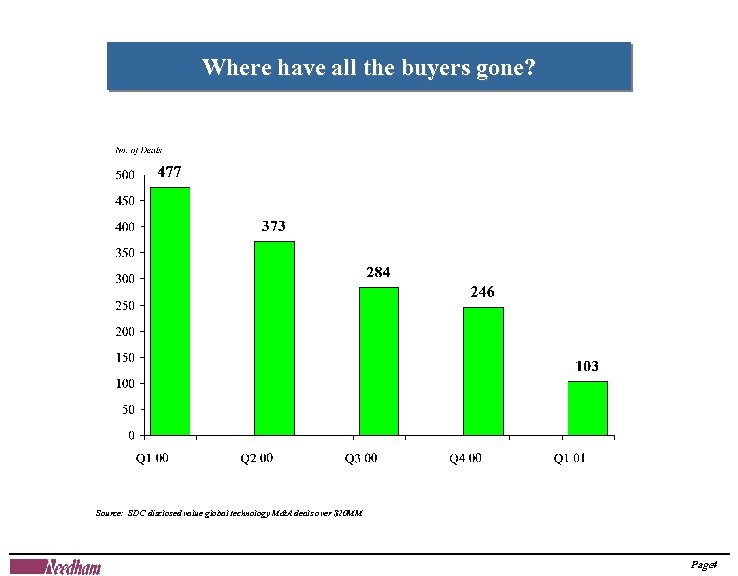

Where have all the buyers gone? Source: SDC disclosed value global technology M&A deals over $20 MM Page 4

Where have all the buyers gone? Source: SDC disclosed value global technology M&A deals over $20 MM Page 4

Where are the big deals? Tech M&A over $1 billion in value. Source: SDC. Page 5

Where are the big deals? Tech M&A over $1 billion in value. Source: SDC. Page 5

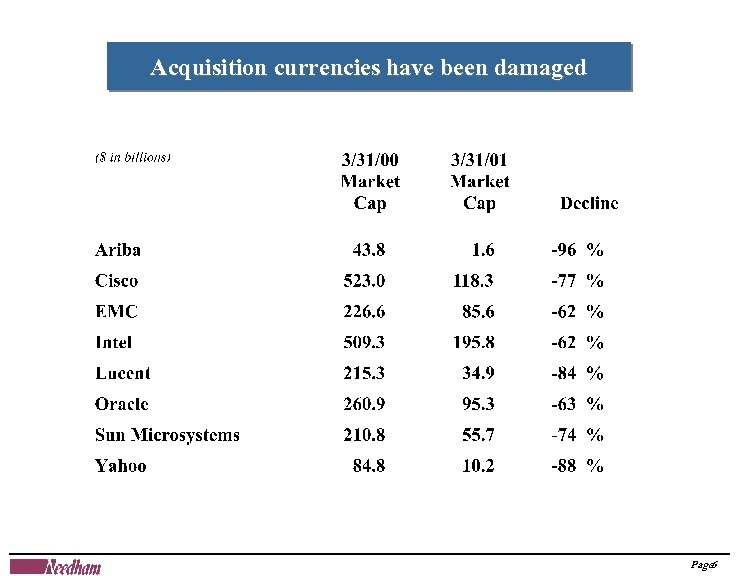

Acquisition currencies have been damaged Page 6

Acquisition currencies have been damaged Page 6

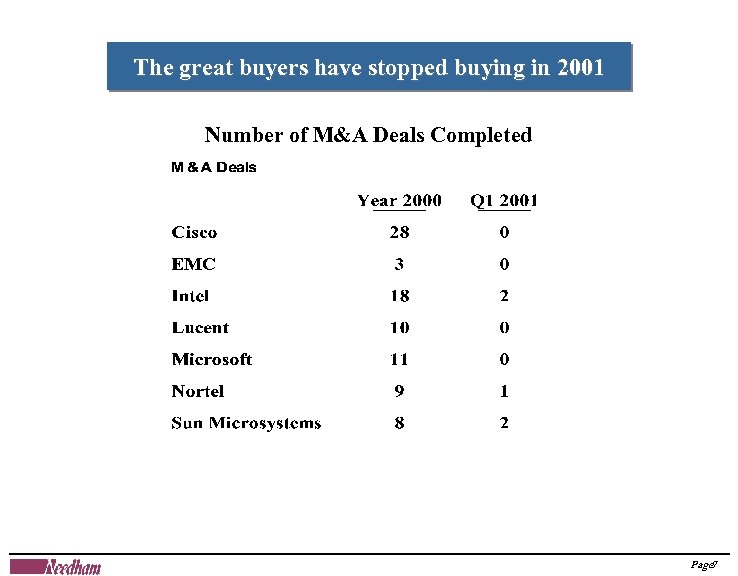

The great buyers have stopped buying in 2001 Number of M&A Deals Completed Page 7

The great buyers have stopped buying in 2001 Number of M&A Deals Completed Page 7

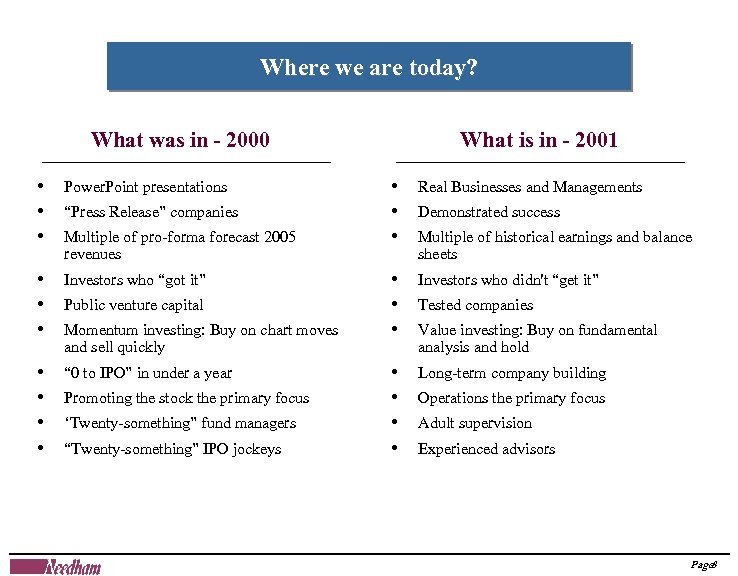

Where we are today? What was in - 2000 • • • Power. Point presentations • • • Investors who “got it” • • “ 0 to IPO” in under a year “Press Release” companies Multiple of pro-forma forecast 2005 revenues Public venture capital Momentum investing: Buy on chart moves and sell quickly Promoting the stock the primary focus ‘Twenty-something” fund managers “Twenty-something” IPO jockeys What is in - 2001 • • • Real Businesses and Managements • • • Investors who didn't “get it” • • Long-term company building Demonstrated success Multiple of historical earnings and balance sheets Tested companies Value investing: Buy on fundamental analysis and hold Operations the primary focus Adult supervision Experienced advisors Page 8

Where we are today? What was in - 2000 • • • Power. Point presentations • • • Investors who “got it” • • “ 0 to IPO” in under a year “Press Release” companies Multiple of pro-forma forecast 2005 revenues Public venture capital Momentum investing: Buy on chart moves and sell quickly Promoting the stock the primary focus ‘Twenty-something” fund managers “Twenty-something” IPO jockeys What is in - 2001 • • • Real Businesses and Managements • • • Investors who didn't “get it” • • Long-term company building Demonstrated success Multiple of historical earnings and balance sheets Tested companies Value investing: Buy on fundamental analysis and hold Operations the primary focus Adult supervision Experienced advisors Page 8

M&A Banking for the Best Deal in the Current Market Page 9

M&A Banking for the Best Deal in the Current Market Page 9

Points of Discussion (a) Leading firms working with software and Internet companies, and how to identify and engage a banker, (b) Typical fee arrangements, (c) The range of services provided by bankers in the M&A process, (d) How valuation is set from the target’s perspective – and how valuations have changed over the past few months, (e) Issues in selecting the best acquisition partner, (f) Assistance, if any, that acquisition bankers might provide following completion of the deal, (g) What type of companies Needham is now working with, and (h) What kind of deals we are turning away. Page 10

Points of Discussion (a) Leading firms working with software and Internet companies, and how to identify and engage a banker, (b) Typical fee arrangements, (c) The range of services provided by bankers in the M&A process, (d) How valuation is set from the target’s perspective – and how valuations have changed over the past few months, (e) Issues in selecting the best acquisition partner, (f) Assistance, if any, that acquisition bankers might provide following completion of the deal, (g) What type of companies Needham is now working with, and (h) What kind of deals we are turning away. Page 10

Just in case I run out of time, here are the short answers I Leading firms working with software and Internet companies, and how to identify and engage a banker, In general, more important than the firm is the people you will be working with II Typical fee arrangements, Be aware that in general you will get what you pay for. The fee structure should provide incentive for the desired outcome III The range of services provided by bankers in the M&A process Various, but an overlooked point is that the M&A process is a process, a complex multi-variable process IV How valuation is set from the target’s perspective – No acquirer will pay more than they have to, so it is ALL about leverage. and how valuations have changed over the past few months, LOL V Issues in selecting the best acquisition partner Depends on a lot of things – big difference between a cash and a stock deal VI Assistance, if any, that acquisition bankers might provide following completion of the deal. If you are counting on someone who gets paid when the deal closes to help you manage the integration process, you may want to think some more about that VII What type of companies Needham is now working with (Broadly speaking) Representing buyers – Public Companies buying private or public companies that are a strategic fit and are affordable with their current currency. Representing sellers – Adequately-funded private or public companies that don’t need to be sold, but for strategic or liquidity reasons want to be sold, and which have strong market position, technology and customers VIII What kind of deals they are turning away. Fire sales; companies which we think are unlikely to be sold due to high losses or lack of significant market position, technology and customers; companies where the valuation or our ability to add value will not support our minimum fee. Page 11

Just in case I run out of time, here are the short answers I Leading firms working with software and Internet companies, and how to identify and engage a banker, In general, more important than the firm is the people you will be working with II Typical fee arrangements, Be aware that in general you will get what you pay for. The fee structure should provide incentive for the desired outcome III The range of services provided by bankers in the M&A process Various, but an overlooked point is that the M&A process is a process, a complex multi-variable process IV How valuation is set from the target’s perspective – No acquirer will pay more than they have to, so it is ALL about leverage. and how valuations have changed over the past few months, LOL V Issues in selecting the best acquisition partner Depends on a lot of things – big difference between a cash and a stock deal VI Assistance, if any, that acquisition bankers might provide following completion of the deal. If you are counting on someone who gets paid when the deal closes to help you manage the integration process, you may want to think some more about that VII What type of companies Needham is now working with (Broadly speaking) Representing buyers – Public Companies buying private or public companies that are a strategic fit and are affordable with their current currency. Representing sellers – Adequately-funded private or public companies that don’t need to be sold, but for strategic or liquidity reasons want to be sold, and which have strong market position, technology and customers VIII What kind of deals they are turning away. Fire sales; companies which we think are unlikely to be sold due to high losses or lack of significant market position, technology and customers; companies where the valuation or our ability to add value will not support our minimum fee. Page 11

Who are leading firms working with software and Internet companies, and how to identify and engage a banker • There are many investment banking firms that have both a strong effort in technology and focused M&A expertise • There a group of firms that have historically had a purely or heavily technology focus • There has been a lot of change in the industry • There has been a lot of consolidation • Recently, there have been layoffs at most investment banks • I think you should look for a firm that has expertise in your industry, expertise in M&A, with people that you feel good about working with, were you feel you will be a valued client and get the effort you want and deserve on your behalf. At the end of the day, as in anything else, you are working with a group of people. • Sources of introductions/information: professional introductions (from your lawyers, your accountants); personal references (other entrepreneurs); seminars like this; advertising. Page 12

Who are leading firms working with software and Internet companies, and how to identify and engage a banker • There are many investment banking firms that have both a strong effort in technology and focused M&A expertise • There a group of firms that have historically had a purely or heavily technology focus • There has been a lot of change in the industry • There has been a lot of consolidation • Recently, there have been layoffs at most investment banks • I think you should look for a firm that has expertise in your industry, expertise in M&A, with people that you feel good about working with, were you feel you will be a valued client and get the effort you want and deserve on your behalf. At the end of the day, as in anything else, you are working with a group of people. • Sources of introductions/information: professional introductions (from your lawyers, your accountants); personal references (other entrepreneurs); seminars like this; advertising. Page 12

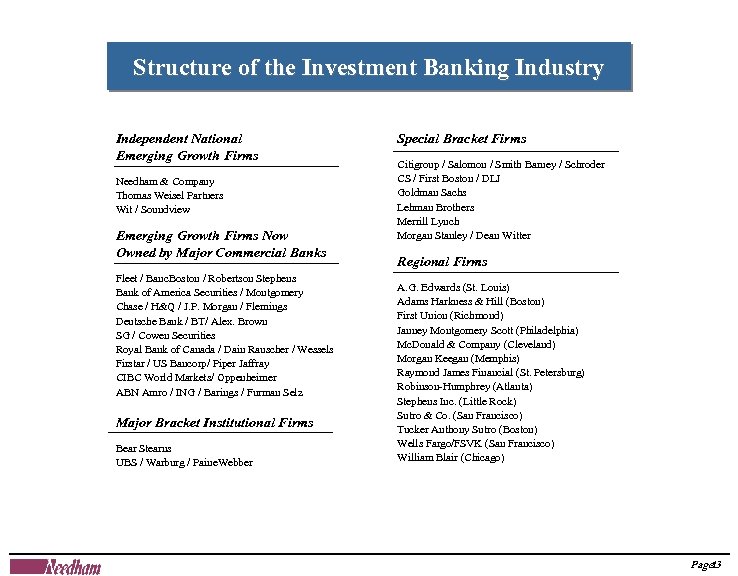

Structure of the Investment Banking Industry Independent National Emerging Growth Firms Needham & Company Thomas Weisel Partners Wit / Soundview Emerging Growth Firms Now Owned by Major Commercial Banks Fleet / Banc. Boston / Robertson Stephens Bank of America Securities / Montgomery Chase / H&Q / J. P. Morgan / Flemings Deutsche Bank / BT/ Alex. Brown SG / Cowen Securities Royal Bank of Canada / Dain Rauscher / Wessels Firstar / US Bancorp/ Piper Jaffray CIBC World Markets/ Oppenheimer ABN Amro / ING / Barings / Furman Selz Major Bracket Institutional Firms Bear Stearns UBS / Warburg / Paine. Webber Special Bracket Firms Citigroup / Salomon / Smith Barney / Schroder CS / First Boston / DLJ Goldman Sachs Lehman Brothers Merrill Lynch Morgan Stanley / Dean Witter Regional Firms A. G. Edwards (St. Louis) Adams Harkness & Hill (Boston) First Union (Richmond) Janney Montgomery Scott (Philadelphia) Mc. Donald & Company (Cleveland) Morgan Keegan (Memphis) Raymond James Financial (St. Petersburg) Robinson-Humphrey (Atlanta) Stephens Inc. (Little Rock) Sutro & Co. (San Francisco) Tucker Anthony Sutro (Boston) Wells Fargo/FSVK (San Francisco) William Blair (Chicago) Page 13

Structure of the Investment Banking Industry Independent National Emerging Growth Firms Needham & Company Thomas Weisel Partners Wit / Soundview Emerging Growth Firms Now Owned by Major Commercial Banks Fleet / Banc. Boston / Robertson Stephens Bank of America Securities / Montgomery Chase / H&Q / J. P. Morgan / Flemings Deutsche Bank / BT/ Alex. Brown SG / Cowen Securities Royal Bank of Canada / Dain Rauscher / Wessels Firstar / US Bancorp/ Piper Jaffray CIBC World Markets/ Oppenheimer ABN Amro / ING / Barings / Furman Selz Major Bracket Institutional Firms Bear Stearns UBS / Warburg / Paine. Webber Special Bracket Firms Citigroup / Salomon / Smith Barney / Schroder CS / First Boston / DLJ Goldman Sachs Lehman Brothers Merrill Lynch Morgan Stanley / Dean Witter Regional Firms A. G. Edwards (St. Louis) Adams Harkness & Hill (Boston) First Union (Richmond) Janney Montgomery Scott (Philadelphia) Mc. Donald & Company (Cleveland) Morgan Keegan (Memphis) Raymond James Financial (St. Petersburg) Robinson-Humphrey (Atlanta) Stephens Inc. (Little Rock) Sutro & Co. (San Francisco) Tucker Anthony Sutro (Boston) Wells Fargo/FSVK (San Francisco) William Blair (Chicago) Page 13

What are typical fee arrangements • Case by case basis • Typically a front end or retainer, and back end or success fee • Typically related to the size of the deal, as through a success fee based on a percentage or variable percentage of the transaction value • Typically subject to a minimum in the event of a completed transaction • Be aware that in general you get what you pay for. The fee structure should be designed to provide incentive for the desired outcome. Page 14

What are typical fee arrangements • Case by case basis • Typically a front end or retainer, and back end or success fee • Typically related to the size of the deal, as through a success fee based on a percentage or variable percentage of the transaction value • Typically subject to a minimum in the event of a completed transaction • Be aware that in general you get what you pay for. The fee structure should be designed to provide incentive for the desired outcome. Page 14

The range of services provided by bankers in the M&A process • “M&A” can cover a range of advisory services to clients on: 4 Mergers 4 Recapitalization 4 Acquisitions 4 Restructuring 4 Divestitures 4 Share Repurchases 4 Fairness Opinions 4 Strategic Positioning 4 Going Private 4 Takeover Defense Page 15

The range of services provided by bankers in the M&A process • “M&A” can cover a range of advisory services to clients on: 4 Mergers 4 Recapitalization 4 Acquisitions 4 Restructuring 4 Divestitures 4 Share Repurchases 4 Fairness Opinions 4 Strategic Positioning 4 Going Private 4 Takeover Defense Page 15

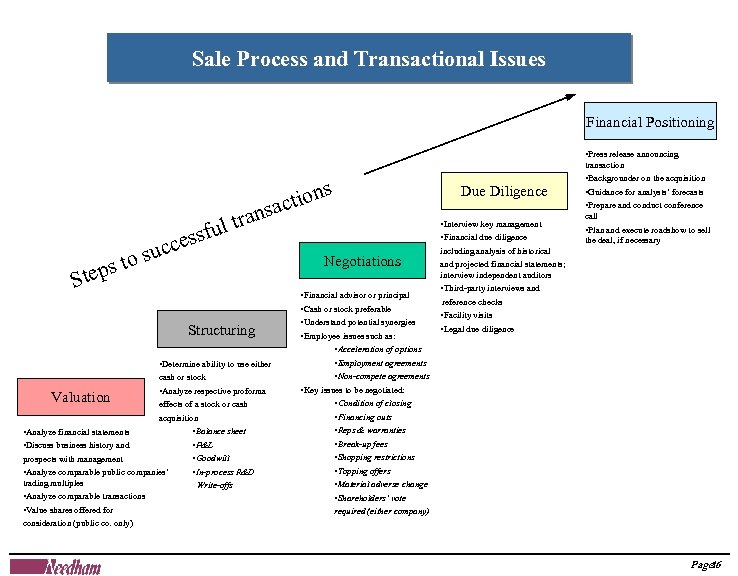

Sale Process and Transactional Issues Financial Positioning • Press release announcing transaction ns r ful t s St s ucce s s to ep Structuring • Determine ability to use either cash or stock Valuation Due Diligence actio ans • Analyze respective proforma effects of a stock or cash acquisition • Balance sheet • Analyze financial statements • P&L • Discuss business history and • Goodwill prospects with management • In-process R&D • Analyze comparable public companies’ trading multiples Write-offs • Analyze comparable transactions • Value shares offered for consideration (public co. only) • Interview key management • Financial due diligence Negotiations • Financial advisor or principal • Cash or stock preferable • Understand potential synergies • Employee issues such as: • Acceleration of options • Employment agreements • Non-compete agreements • Key issues to be negotiated: • Condition of closing • Financing outs • Reps & warranties • Break-up fees • Shopping restrictions • Topping offers • Material adverse change • Shareholders’ vote • Backgrounder on the acquisition • Guidance for analysts’ forecasts • Prepare and conduct conference call • Plan and execute roadshow to sell the deal, if necessary including analysis of historical and projected financial statements; interview independent auditors • Third-party interviews and reference checks • Facility visits • Legal due diligence required (either company) Page 16

Sale Process and Transactional Issues Financial Positioning • Press release announcing transaction ns r ful t s St s ucce s s to ep Structuring • Determine ability to use either cash or stock Valuation Due Diligence actio ans • Analyze respective proforma effects of a stock or cash acquisition • Balance sheet • Analyze financial statements • P&L • Discuss business history and • Goodwill prospects with management • In-process R&D • Analyze comparable public companies’ trading multiples Write-offs • Analyze comparable transactions • Value shares offered for consideration (public co. only) • Interview key management • Financial due diligence Negotiations • Financial advisor or principal • Cash or stock preferable • Understand potential synergies • Employee issues such as: • Acceleration of options • Employment agreements • Non-compete agreements • Key issues to be negotiated: • Condition of closing • Financing outs • Reps & warranties • Break-up fees • Shopping restrictions • Topping offers • Material adverse change • Shareholders’ vote • Backgrounder on the acquisition • Guidance for analysts’ forecasts • Prepare and conduct conference call • Plan and execute roadshow to sell the deal, if necessary including analysis of historical and projected financial statements; interview independent auditors • Third-party interviews and reference checks • Facility visits • Legal due diligence required (either company) Page 16

What is some of the value a banker can provide • Smooth orchestration of a process, saving time and energy, and increasing the likelihood of a successful deal • Convert a serial process to a parallel process, to increase leverage and get a better price • Credibility – implicit or explicit “threat of an auction”, to increase leverage and get a better price • Ability to outsource the difficult negotiations, preserving the relationship of a CEO and the Buyer, to increase leverage and get a better price and have a harmonious relationship after the deal • Experience and insight • Relationships and introductions Page 17

What is some of the value a banker can provide • Smooth orchestration of a process, saving time and energy, and increasing the likelihood of a successful deal • Convert a serial process to a parallel process, to increase leverage and get a better price • Credibility – implicit or explicit “threat of an auction”, to increase leverage and get a better price • Ability to outsource the difficult negotiations, preserving the relationship of a CEO and the Buyer, to increase leverage and get a better price and have a harmonious relationship after the deal • Experience and insight • Relationships and introductions Page 17

Resources an Investment Bank can Provide - A highly knowledgeable research analyst can be a resource, circumstance permitting - Industry bankers with a strong understanding of the industry - An M&A team experienced with the M&A process - Contacts with the “right” individuals at potential acquiring companies - Ability to leverage expertise and capabilities of various areas of the firm, including underwriting, research, mergers & acquisitions, and potentially private placements and venture capital, to produce maximum transaction value Page 18

Resources an Investment Bank can Provide - A highly knowledgeable research analyst can be a resource, circumstance permitting - Industry bankers with a strong understanding of the industry - An M&A team experienced with the M&A process - Contacts with the “right” individuals at potential acquiring companies - Ability to leverage expertise and capabilities of various areas of the firm, including underwriting, research, mergers & acquisitions, and potentially private placements and venture capital, to produce maximum transaction value Page 18

How valuation is set from the target’s perspective and how valuations have changed over the past few months • • Valuation is set by what the buyer believes they need to, and can afford to, pay to get the deal. Metrics (price/sales, price/earnings, price/book, premium to stock price) can measure valuation, can guide expectations, can at some level be constraints, but do not determine valuation. • Valuation impacted by alternatives to the seller, such as the availability of, and cost of, private or public equity capital • Valuation impacted by how the acquirer is valued, by the public or private markets • No acquirer will pay more than they believe they have to, so it is ALL about leverage. Get the leverage on your side Page 19

How valuation is set from the target’s perspective and how valuations have changed over the past few months • • Valuation is set by what the buyer believes they need to, and can afford to, pay to get the deal. Metrics (price/sales, price/earnings, price/book, premium to stock price) can measure valuation, can guide expectations, can at some level be constraints, but do not determine valuation. • Valuation impacted by alternatives to the seller, such as the availability of, and cost of, private or public equity capital • Valuation impacted by how the acquirer is valued, by the public or private markets • No acquirer will pay more than they believe they have to, so it is ALL about leverage. Get the leverage on your side Page 19

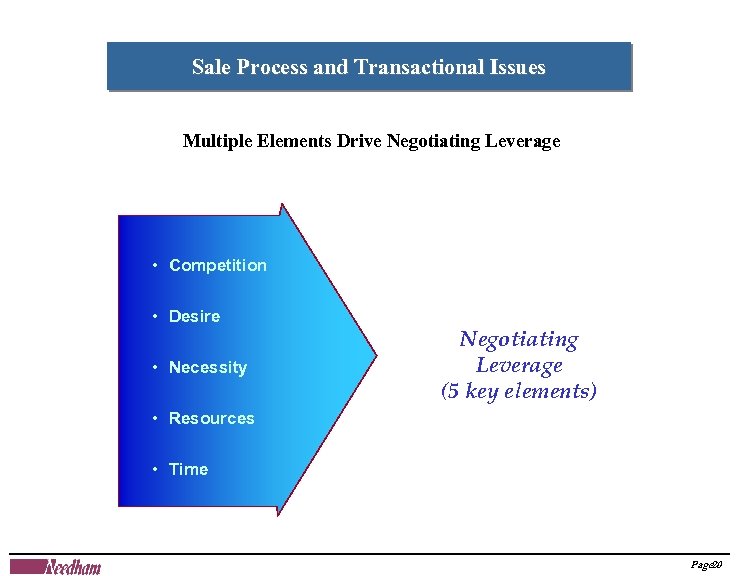

Sale Process and Transactional Issues Multiple Elements Drive Negotiating Leverage • Competition • Desire • Necessity Negotiating Leverage (5 key elements) • Resources • Time Page 20

Sale Process and Transactional Issues Multiple Elements Drive Negotiating Leverage • Competition • Desire • Necessity Negotiating Leverage (5 key elements) • Resources • Time Page 20

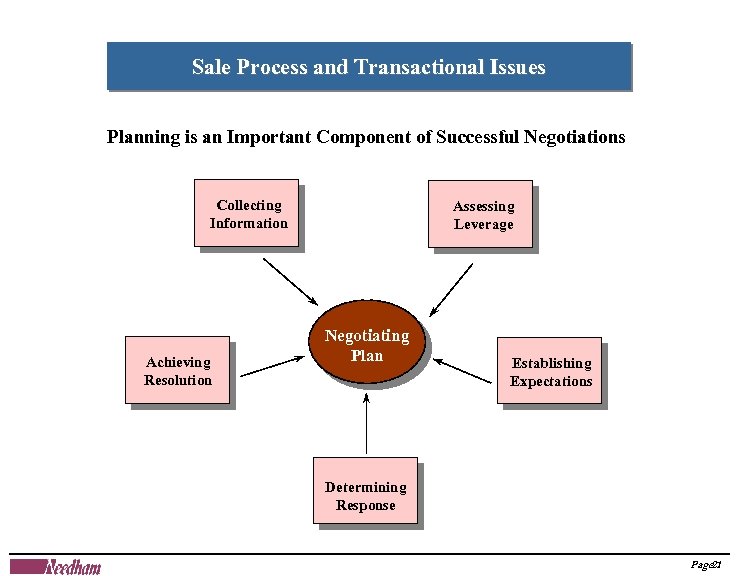

Sale Process and Transactional Issues Planning is an Important Component of Successful Negotiations Collecting Information Achieving Resolution Assessing Leverage Negotiating Plan Establishing Expectations Determining Response Page 21

Sale Process and Transactional Issues Planning is an Important Component of Successful Negotiations Collecting Information Achieving Resolution Assessing Leverage Negotiating Plan Establishing Expectations Determining Response Page 21

Issues in selecting the best acquisition partner • Think about this before you start the process, because depending on the answer the process may change • Different stake holders may have different objectives and criteria, which needs to be managed • Big difference between a cash deal and a stock deal Page 22

Issues in selecting the best acquisition partner • Think about this before you start the process, because depending on the answer the process may change • Different stake holders may have different objectives and criteria, which needs to be managed • Big difference between a cash deal and a stock deal Page 22

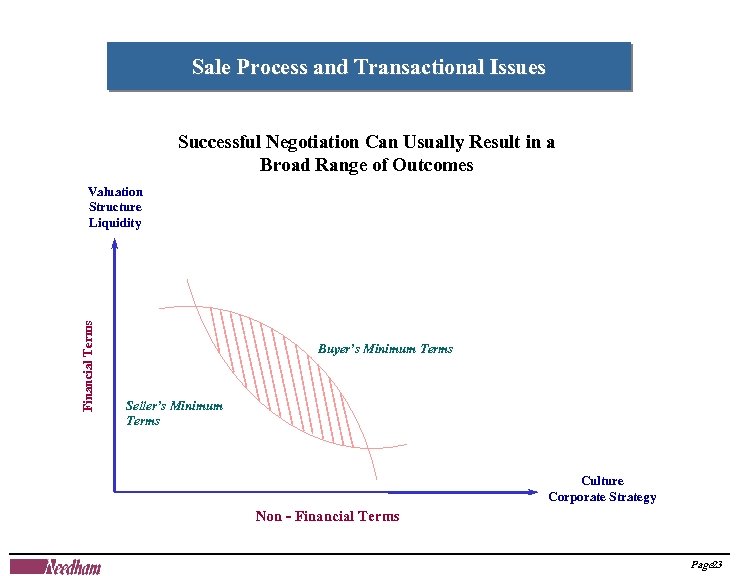

Sale Process and Transactional Issues Successful Negotiation Can Usually Result in a Broad Range of Outcomes Financial Terms Valuation Structure Liquidity Buyer’s Minimum Terms Seller’s Minimum Terms Culture Corporate Strategy Non - Financial Terms Page 23

Sale Process and Transactional Issues Successful Negotiation Can Usually Result in a Broad Range of Outcomes Financial Terms Valuation Structure Liquidity Buyer’s Minimum Terms Seller’s Minimum Terms Culture Corporate Strategy Non - Financial Terms Page 23

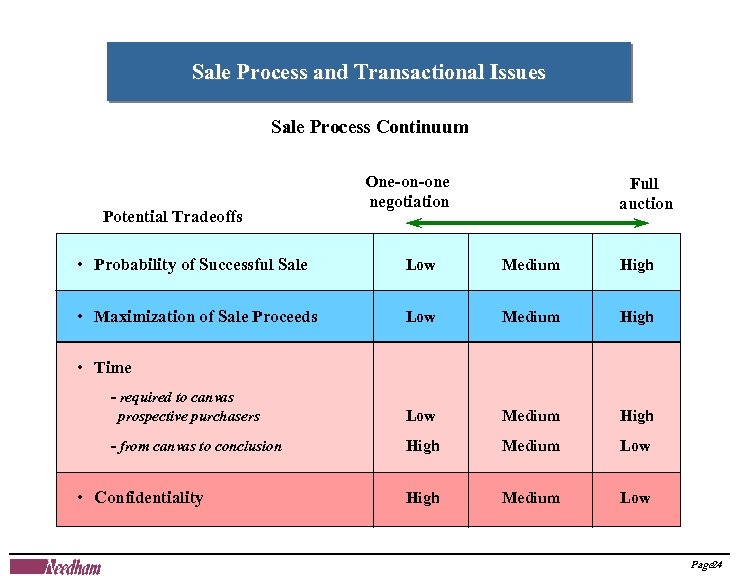

Sale Process and Transactional Issues Sale Process Continuum Potential Tradeoffs One-on-one negotiation Full auction • Probability of Successful Sale Low Medium High • Maximization of Sale Proceeds Low Medium High - required to canvas prospective purchasers Low Medium High - from canvas to conclusion High Medium Low • Time • Confidentiality Page 24

Sale Process and Transactional Issues Sale Process Continuum Potential Tradeoffs One-on-one negotiation Full auction • Probability of Successful Sale Low Medium High • Maximization of Sale Proceeds Low Medium High - required to canvas prospective purchasers Low Medium High - from canvas to conclusion High Medium Low • Time • Confidentiality Page 24

Assistance, if any, that acquisition bankers might provide following completion of the deal • If you are counting on someone who gets paid when the deal closes to help you manage the integration process, you may want to think about that some more • Strategize on positioning • A lot of issues that appear after the deal is completed, depend on the due diligence, negotiation, pricing and structure of the deal, so make sure you get those right • Liquidity • Any surprises • Integration • Long term success Page 25

Assistance, if any, that acquisition bankers might provide following completion of the deal • If you are counting on someone who gets paid when the deal closes to help you manage the integration process, you may want to think about that some more • Strategize on positioning • A lot of issues that appear after the deal is completed, depend on the due diligence, negotiation, pricing and structure of the deal, so make sure you get those right • Liquidity • Any surprises • Integration • Long term success Page 25

What type of companies Needham is now working with • Representing buyers – Public Companies buying private or public companies that are a strategic fit and affordable with their current currency. • Representing sellers – Adequately-funded private or public companies that don’t need to be sold, but for strategic or liquidity reasons want to be sold, with strong market position, technology and customers • Situations where we believe we can add a lot of value Page 26

What type of companies Needham is now working with • Representing buyers – Public Companies buying private or public companies that are a strategic fit and affordable with their current currency. • Representing sellers – Adequately-funded private or public companies that don’t need to be sold, but for strategic or liquidity reasons want to be sold, with strong market position, technology and customers • Situations where we believe we can add a lot of value Page 26

What kind of deals we are turning away. • Fire sales – don’t wait until the last minute, leave yourself plenty of runway • While deals can happen quickly, a full sale process can take 4 to 6 months or longer to close, and being almost out of cash does not help your leverage • Companies without significant market position, technology and customers • Companies where valuation or our ability to add value will not support our minimum fee Page 27

What kind of deals we are turning away. • Fire sales – don’t wait until the last minute, leave yourself plenty of runway • While deals can happen quickly, a full sale process can take 4 to 6 months or longer to close, and being almost out of cash does not help your leverage • Companies without significant market position, technology and customers • Companies where valuation or our ability to add value will not support our minimum fee Page 27

Perspective on the current tech stock market Page 28

Perspective on the current tech stock market Page 28

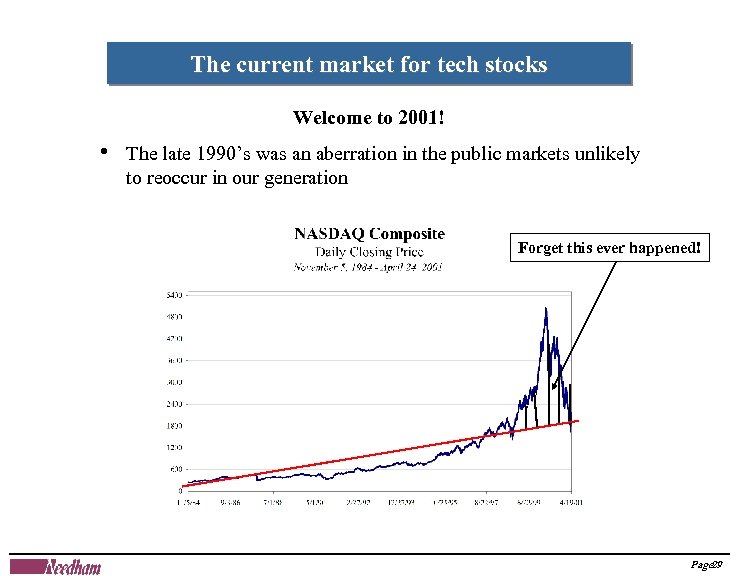

The current market for tech stocks Welcome to 2001! • The late 1990’s was an aberration in the public markets unlikely to reoccur in our generation Forget this ever happened! Page 29

The current market for tech stocks Welcome to 2001! • The late 1990’s was an aberration in the public markets unlikely to reoccur in our generation Forget this ever happened! Page 29

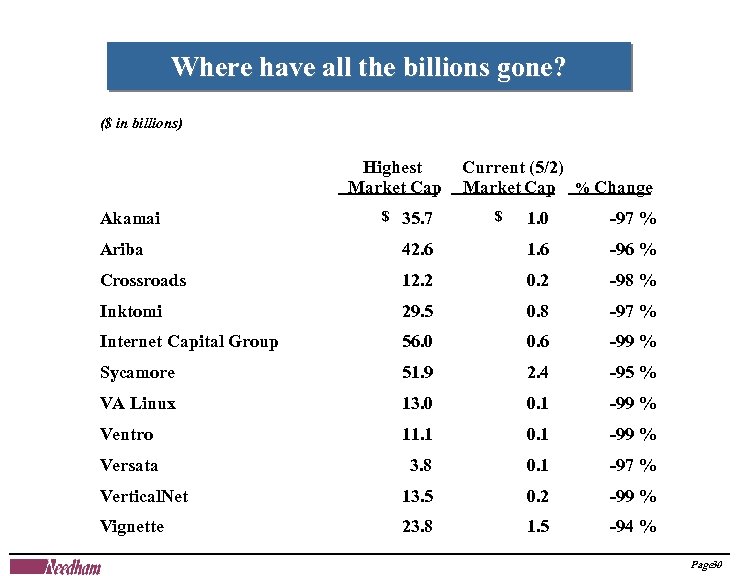

Where have all the billions gone? ($ in billions) Highest Market Cap Akamai $ 35. 7 Current (5/2) Market Cap % Change $ 1. 0 -97 % Ariba 42. 6 1. 6 -96 % Crossroads 12. 2 0. 2 -98 % Inktomi 29. 5 0. 8 -97 % Internet Capital Group 56. 0 0. 6 -99 % Sycamore 51. 9 2. 4 -95 % VA Linux 13. 0 0. 1 -99 % Ventro 11. 1 0. 1 -99 % Versata 3. 8 0. 1 -97 % Vertical. Net 13. 5 0. 2 -99 % Vignette 23. 8 1. 5 -94 % Page 30

Where have all the billions gone? ($ in billions) Highest Market Cap Akamai $ 35. 7 Current (5/2) Market Cap % Change $ 1. 0 -97 % Ariba 42. 6 1. 6 -96 % Crossroads 12. 2 0. 2 -98 % Inktomi 29. 5 0. 8 -97 % Internet Capital Group 56. 0 0. 6 -99 % Sycamore 51. 9 2. 4 -95 % VA Linux 13. 0 0. 1 -99 % Ventro 11. 1 0. 1 -99 % Versata 3. 8 0. 1 -97 % Vertical. Net 13. 5 0. 2 -99 % Vignette 23. 8 1. 5 -94 % Page 30

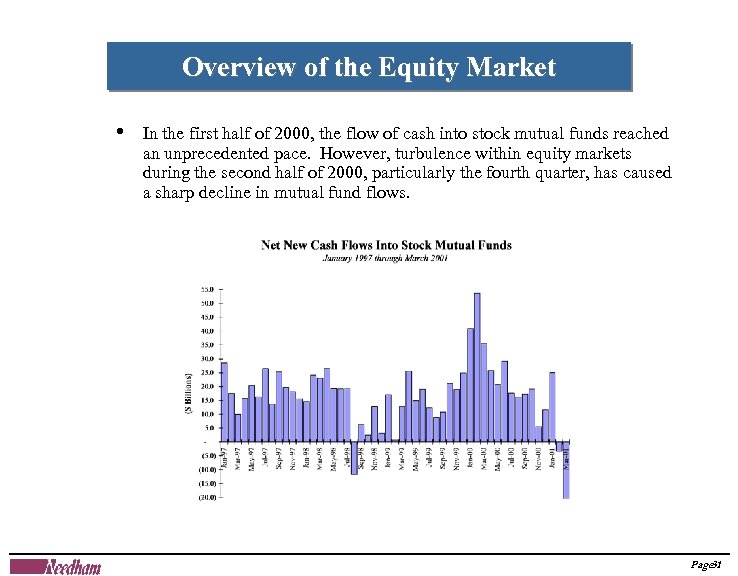

Overview of the Equity Market • In the first half of 2000, the flow of cash into stock mutual funds reached an unprecedented pace. However, turbulence within equity markets during the second half of 2000, particularly the fourth quarter, has caused a sharp decline in mutual fund flows. Page 31

Overview of the Equity Market • In the first half of 2000, the flow of cash into stock mutual funds reached an unprecedented pace. However, turbulence within equity markets during the second half of 2000, particularly the fourth quarter, has caused a sharp decline in mutual fund flows. Page 31

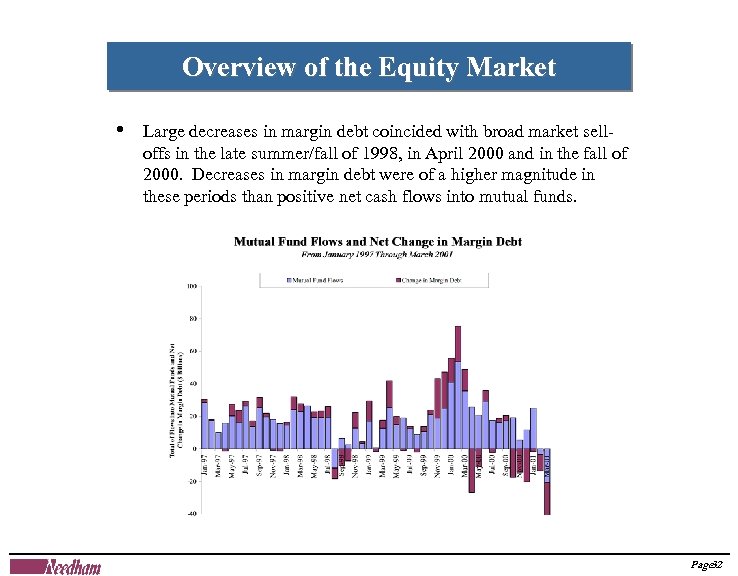

Overview of the Equity Markets Overview of the Equity Market • Large decreases in margin debt coincided with broad market selloffs in the late summer/fall of 1998, in April 2000 and in the fall of 2000. Decreases in margin debt were of a higher magnitude in these periods than positive net cash flows into mutual funds. Page 32

Overview of the Equity Markets Overview of the Equity Market • Large decreases in margin debt coincided with broad market selloffs in the late summer/fall of 1998, in April 2000 and in the fall of 2000. Decreases in margin debt were of a higher magnitude in these periods than positive net cash flows into mutual funds. Page 32

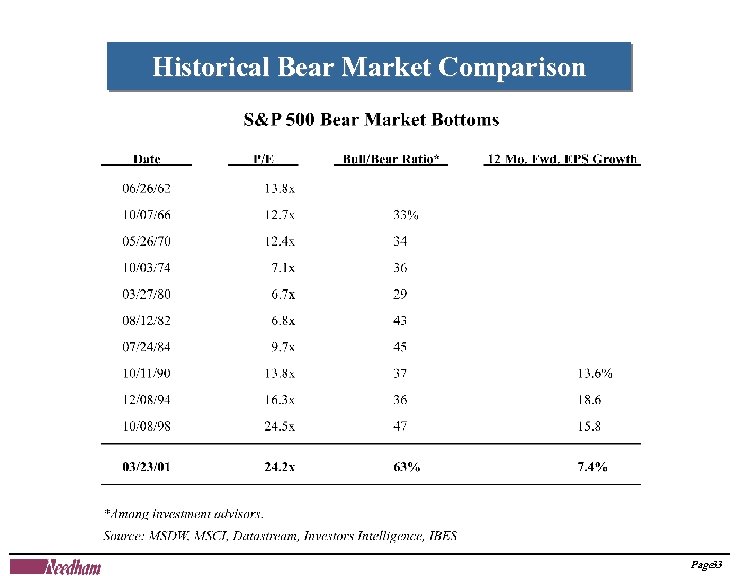

Historical Bear Market Comparison Page 33

Historical Bear Market Comparison Page 33

Will history repeat itself? • • This crash was the “big one” for tech stocks • A frightening thought - The recovery time from the two prior tech stock crashes was each 8 years The market crash of 2000 - 2001 makes the earlier post WW II tech stock crashes looks like mere fender benders Page 34

Will history repeat itself? • • This crash was the “big one” for tech stocks • A frightening thought - The recovery time from the two prior tech stock crashes was each 8 years The market crash of 2000 - 2001 makes the earlier post WW II tech stock crashes looks like mere fender benders Page 34

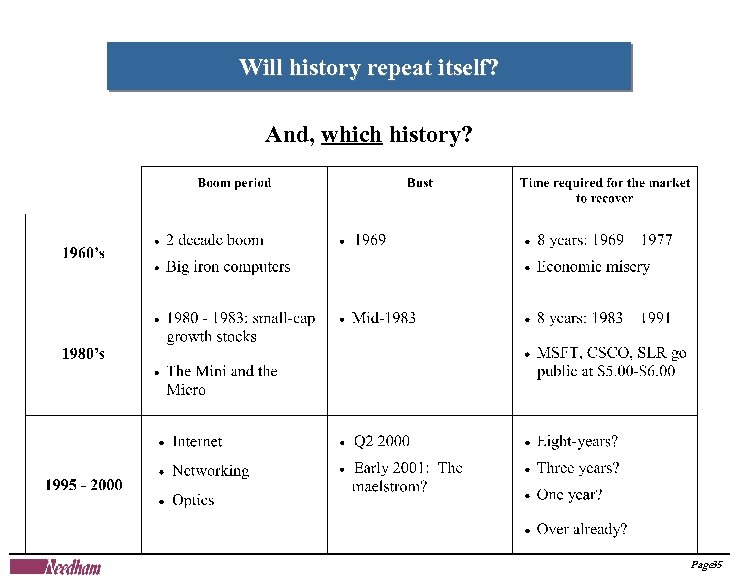

Will history repeat itself? And, which history? Page 35

Will history repeat itself? And, which history? Page 35

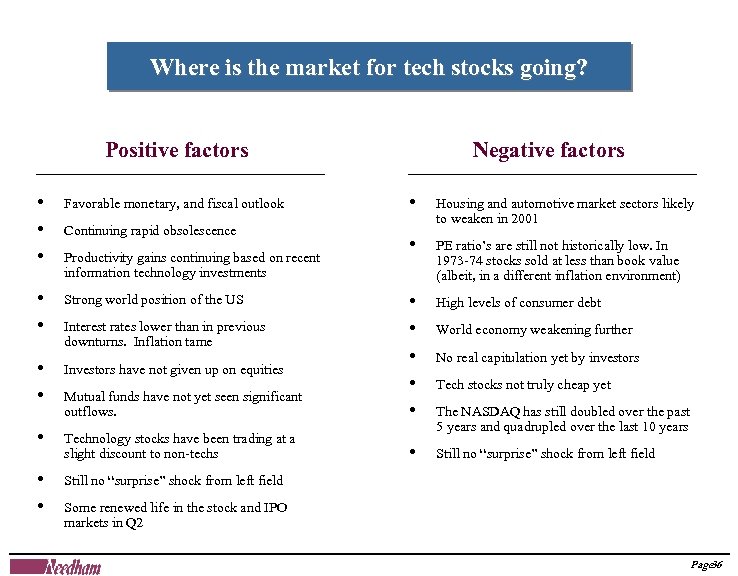

Where is the market for tech stocks going? Positive factors • • • Favorable monetary, and fiscal outlook • • Strong world position of the US • • Investors have not given up on equities Negative factors • Housing and automotive market sectors likely to weaken in 2001 • PE ratio’s are still not historically low. In 1973 -74 stocks sold at less than book value (albeit, in a different inflation environment) High levels of consumer debt Mutual funds have not yet seen significant outflows. • • • Technology stocks have been trading at a slight discount to non-techs • Still no “surprise” shock from left field • • Still no “surprise” shock from left field Continuing rapid obsolescence Productivity gains continuing based on recent information technology investments Interest rates lower than in previous downturns. Inflation tame World economy weakening further No real capitulation yet by investors Tech stocks not truly cheap yet The NASDAQ has still doubled over the past 5 years and quadrupled over the last 10 years Some renewed life in the stock and IPO markets in Q 2 Page 36

Where is the market for tech stocks going? Positive factors • • • Favorable monetary, and fiscal outlook • • Strong world position of the US • • Investors have not given up on equities Negative factors • Housing and automotive market sectors likely to weaken in 2001 • PE ratio’s are still not historically low. In 1973 -74 stocks sold at less than book value (albeit, in a different inflation environment) High levels of consumer debt Mutual funds have not yet seen significant outflows. • • • Technology stocks have been trading at a slight discount to non-techs • Still no “surprise” shock from left field • • Still no “surprise” shock from left field Continuing rapid obsolescence Productivity gains continuing based on recent information technology investments Interest rates lower than in previous downturns. Inflation tame World economy weakening further No real capitulation yet by investors Tech stocks not truly cheap yet The NASDAQ has still doubled over the past 5 years and quadrupled over the last 10 years Some renewed life in the stock and IPO markets in Q 2 Page 36

The IPO Market in Q 1 2001 Page 37

The IPO Market in Q 1 2001 Page 37

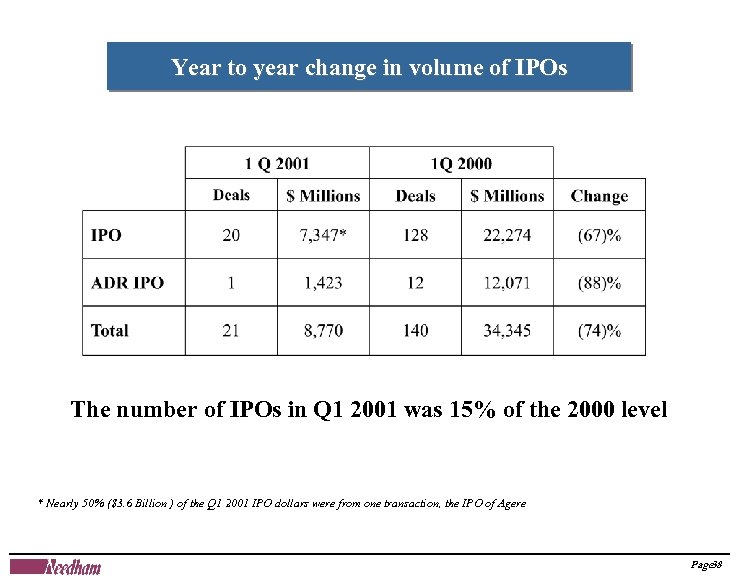

Year to year change in volume of IPOs The number of IPOs in Q 1 2001 was 15% of the 2000 level * Nearly 50% ($3. 6 Billion ) of the Q 1 2001 IPO dollars were from one transaction, the IPO of Agere Page 38

Year to year change in volume of IPOs The number of IPOs in Q 1 2001 was 15% of the 2000 level * Nearly 50% ($3. 6 Billion ) of the Q 1 2001 IPO dollars were from one transaction, the IPO of Agere Page 38

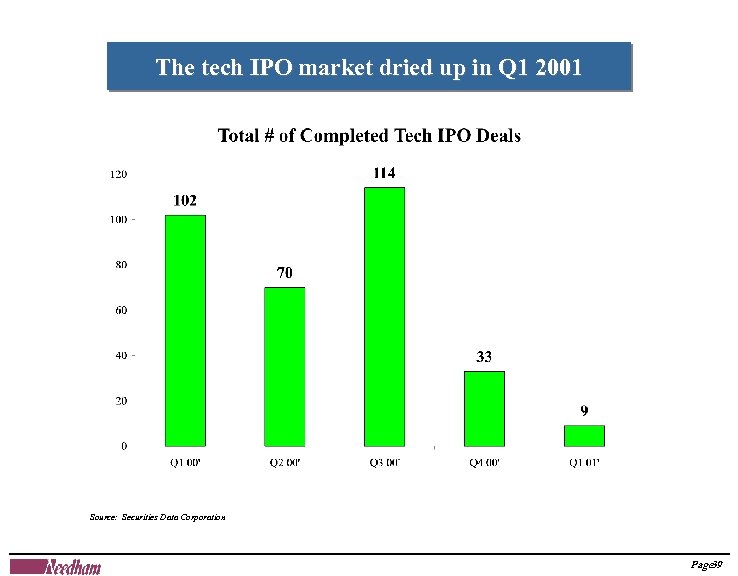

The tech IPO market dried up in Q 1 2001 Source: Securities Data Corporation Page 39

The tech IPO market dried up in Q 1 2001 Source: Securities Data Corporation Page 39

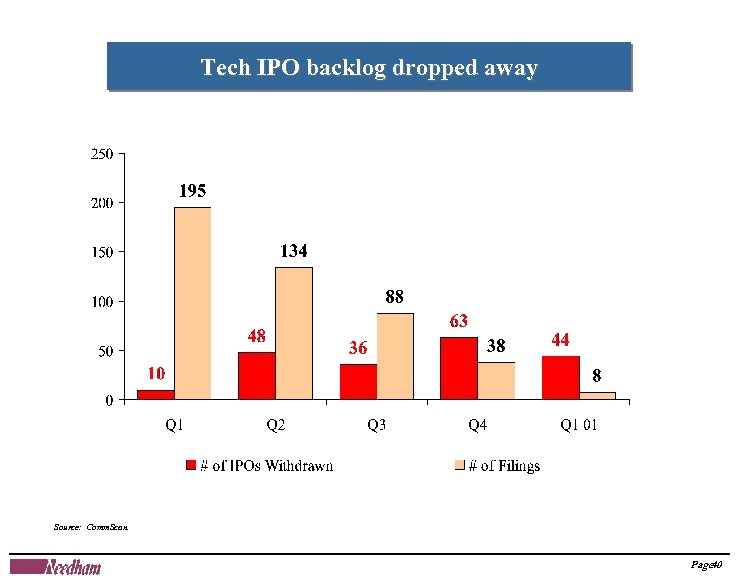

Tech IPO backlog dropped away Source: Comm. Scan. Page 40

Tech IPO backlog dropped away Source: Comm. Scan. Page 40

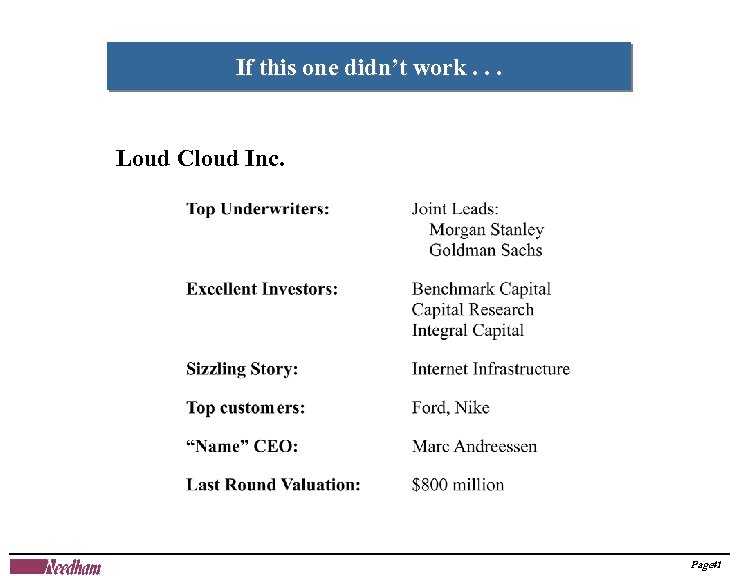

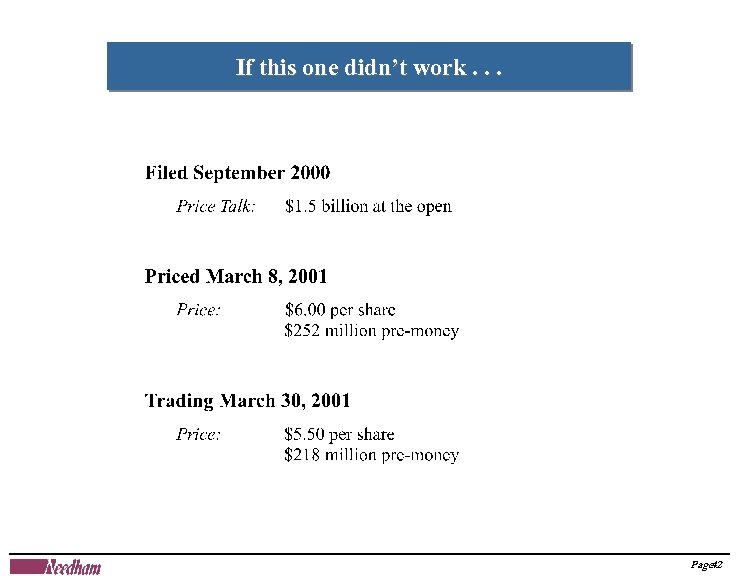

If this one didn’t work. . . Loud Cloud Inc. Page 41

If this one didn’t work. . . Loud Cloud Inc. Page 41

If this one didn’t work. . . Page 42

If this one didn’t work. . . Page 42

The private equity market in Q 1 2001 Page 43

The private equity market in Q 1 2001 Page 43

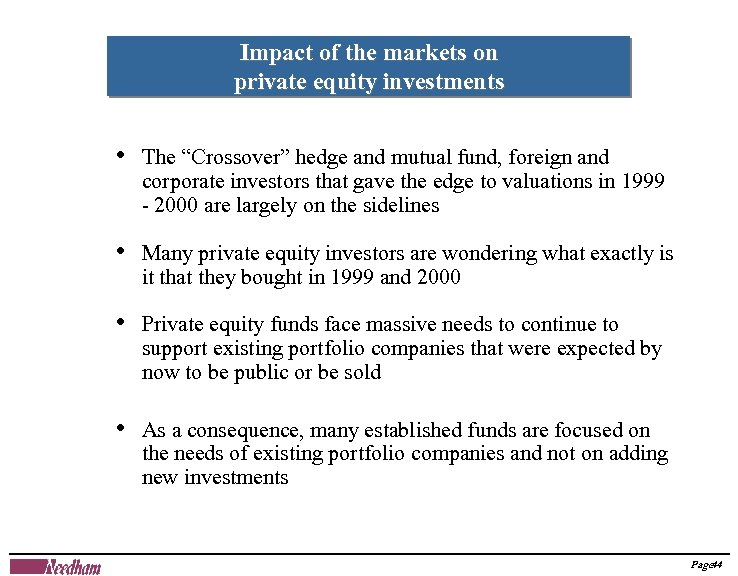

Impact of the markets on private equity investments • The “Crossover” hedge and mutual fund, foreign and corporate investors that gave the edge to valuations in 1999 - 2000 are largely on the sidelines • Many private equity investors are wondering what exactly is it that they bought in 1999 and 2000 • Private equity funds face massive needs to continue to support existing portfolio companies that were expected by now to be public or be sold • As a consequence, many established funds are focused on the needs of existing portfolio companies and not on adding new investments Page 44

Impact of the markets on private equity investments • The “Crossover” hedge and mutual fund, foreign and corporate investors that gave the edge to valuations in 1999 - 2000 are largely on the sidelines • Many private equity investors are wondering what exactly is it that they bought in 1999 and 2000 • Private equity funds face massive needs to continue to support existing portfolio companies that were expected by now to be public or be sold • As a consequence, many established funds are focused on the needs of existing portfolio companies and not on adding new investments Page 44

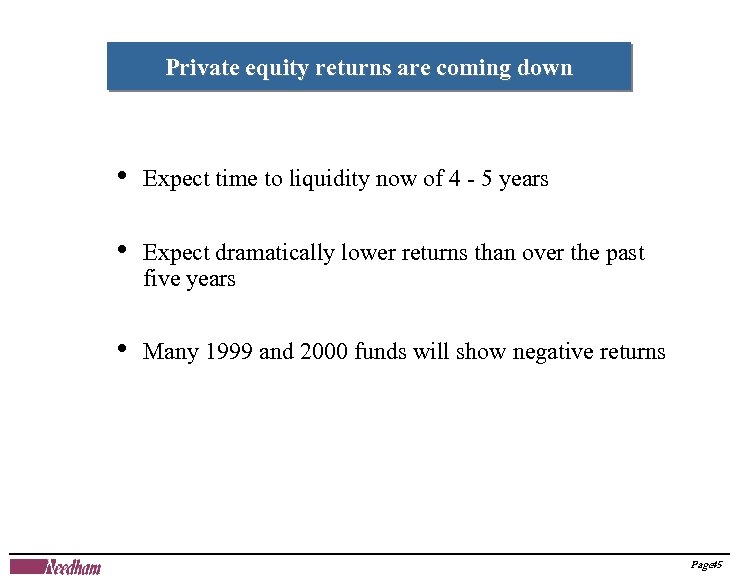

Private equity returns are coming down • Expect time to liquidity now of 4 - 5 years • Expect dramatically lower returns than over the past five years • Many 1999 and 2000 funds will show negative returns Page 45

Private equity returns are coming down • Expect time to liquidity now of 4 - 5 years • Expect dramatically lower returns than over the past five years • Many 1999 and 2000 funds will show negative returns Page 45

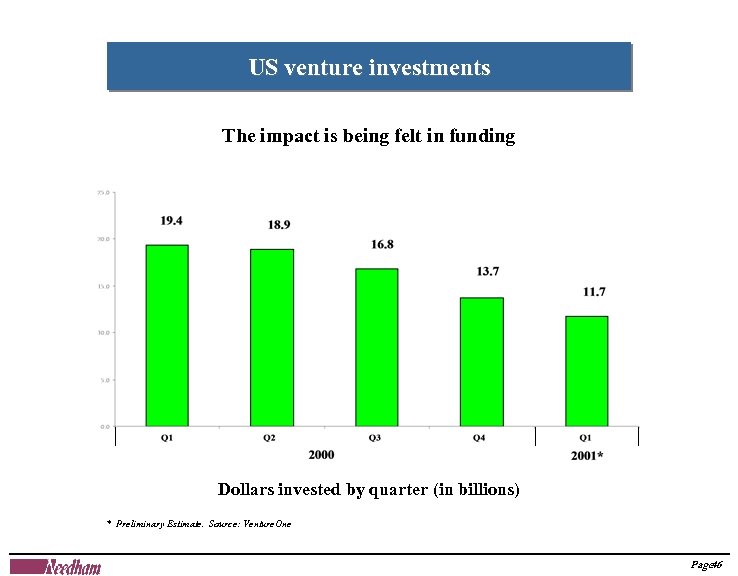

US venture investments The impact is being felt in funding Dollars invested by quarter (in billions) * Preliminary Estimate. Source: Venture. One Page 46

US venture investments The impact is being felt in funding Dollars invested by quarter (in billions) * Preliminary Estimate. Source: Venture. One Page 46

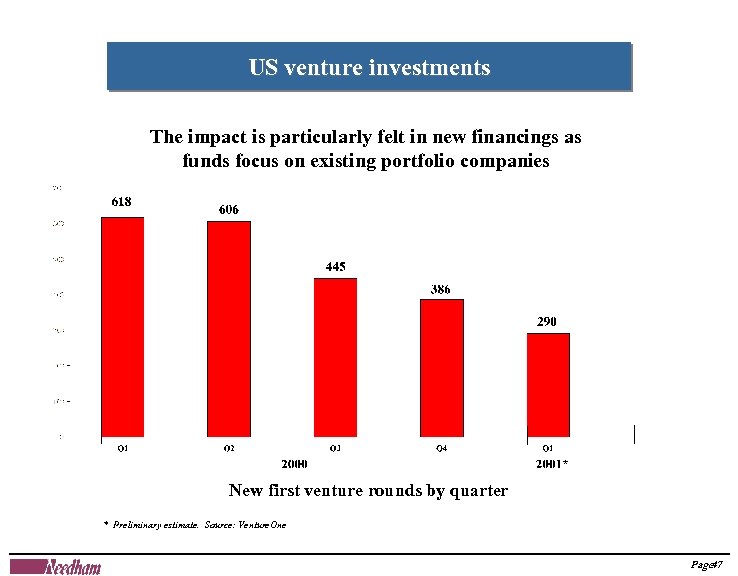

US venture investments The impact is particularly felt in new financings as funds focus on existing portfolio companies New first venture rounds by quarter * Preliminary estimate. Source: Venture. One Page 47

US venture investments The impact is particularly felt in new financings as funds focus on existing portfolio companies New first venture rounds by quarter * Preliminary estimate. Source: Venture. One Page 47

Valuations are coming down in many sectors • New rounds are difficult to raise at last round or, in many cases, at any valuation • Desperate efforts to avoid write-downs on new rounds (e. g. 3 x or more preferences on new rounds, large warrant packages) serve to reduce the effective valuation while still keeping the last round nominal price • Pre-money valuations are dropping dramatically when new investors are needed Page 48

Valuations are coming down in many sectors • New rounds are difficult to raise at last round or, in many cases, at any valuation • Desperate efforts to avoid write-downs on new rounds (e. g. 3 x or more preferences on new rounds, large warrant packages) serve to reduce the effective valuation while still keeping the last round nominal price • Pre-money valuations are dropping dramatically when new investors are needed Page 48

It is a good time to be a private equity investor • It is a much better time to invest in new investments than for the past three years (if you have any money and time left after caring for your investments of the past two years) Page 49

It is a good time to be a private equity investor • It is a much better time to invest in new investments than for the past three years (if you have any money and time left after caring for your investments of the past two years) Page 49