38ff5e40150ea3e7e328825f5fc8d7a4.ppt

- Количество слайдов: 48

MATH 3286 Mathematics of Finance Instructor: Dr. Alexandre Karassev

MATH 3286 Mathematics of Finance Instructor: Dr. Alexandre Karassev

COURSE OUTLINE • Theory of Interest 1. 2. 3. 4. 5. • Interest: the basic theory Interest: basic applications Annuities Amortization and sinking funds Bonds Life Insurance 6. 7. 8. 9. Preparation for life contingencies Life tables and population problems Life annuities Life insurance

COURSE OUTLINE • Theory of Interest 1. 2. 3. 4. 5. • Interest: the basic theory Interest: basic applications Annuities Amortization and sinking funds Bonds Life Insurance 6. 7. 8. 9. Preparation for life contingencies Life tables and population problems Life annuities Life insurance

Chapter 1 INTEREST: THE BASIC THEORY • • • Accumulation Function Simple Interest Compound Interest Present Value and Discount Nominal Rate of Interest Force of Interest

Chapter 1 INTEREST: THE BASIC THEORY • • • Accumulation Function Simple Interest Compound Interest Present Value and Discount Nominal Rate of Interest Force of Interest

1. 1 ACCUMULATION FUNCTION Definitions • The amount of money initially invested is called the principal. • The amount of money principal has grown to after the time period is called the accumulated value and is denoted by A(t) – amount function. § t ≥ 0 is measured in years (for the moment) • Define Accumulation function a(t)=A(t)/A(0) • A(0)=principal • a(0)=1 • A(t)=A(0)∙a(t)

1. 1 ACCUMULATION FUNCTION Definitions • The amount of money initially invested is called the principal. • The amount of money principal has grown to after the time period is called the accumulated value and is denoted by A(t) – amount function. § t ≥ 0 is measured in years (for the moment) • Define Accumulation function a(t)=A(t)/A(0) • A(0)=principal • a(0)=1 • A(t)=A(0)∙a(t)

Natural assumptions on a(t) • increasing • (piece-wise) continuous a(t) (0, 1) t (0, 1) Note: a(0)=1 a(t) t (0, 1) t

Natural assumptions on a(t) • increasing • (piece-wise) continuous a(t) (0, 1) t (0, 1) Note: a(0)=1 a(t) t (0, 1) t

Definition of Interest and Rate of Interest • Interest = Accumulated Value – Principal: Interest = A(t) – A(0) • Effective rate of interest i (per year): • Effective rate of interest in nth year in:

Definition of Interest and Rate of Interest • Interest = Accumulated Value – Principal: Interest = A(t) – A(0) • Effective rate of interest i (per year): • Effective rate of interest in nth year in:

Example (p. 5) a(t)=t 2+t+1 • • • Verify that a(0)=1 Show that a(t) is increasing for all t ≥ 0 Is a(t) continuous? Find the effective rate of interest i for a(t) Find in

Example (p. 5) a(t)=t 2+t+1 • • • Verify that a(0)=1 Show that a(t) is increasing for all t ≥ 0 Is a(t) continuous? Find the effective rate of interest i for a(t) Find in

Two Types of Interest ( ≡ Two Types of Accumulation Functions) • Simple interest: – only principal earns interest – beneficial for short term (1 year) – easy to describe • Compound interest: – interest earns interest – beneficial for long term – the most important type of accumulation function

Two Types of Interest ( ≡ Two Types of Accumulation Functions) • Simple interest: – only principal earns interest – beneficial for short term (1 year) – easy to describe • Compound interest: – interest earns interest – beneficial for long term – the most important type of accumulation function

1. 2 SIMPLE INTEREST a(t)=1+it, t ≥ 0 a(t) =1+it 1+i (0, 1) t 1 • Amount function: A(t)=A(0) ∙a(t)=A(0)(1+it) • Effective rate is i • Effective rate in nth year:

1. 2 SIMPLE INTEREST a(t)=1+it, t ≥ 0 a(t) =1+it 1+i (0, 1) t 1 • Amount function: A(t)=A(0) ∙a(t)=A(0)(1+it) • Effective rate is i • Effective rate in nth year:

a(t)=1+it Example (p. 5) Jack borrows 1000 from the bank on January 1, 1996 at a rate of 15% simple interest per year. How much does he owe on January 17, 1996? Solution A(0)=1000 i=0. 15 A(t)=A(0)(1+it)=1000(1+0. 15 t) t=?

a(t)=1+it Example (p. 5) Jack borrows 1000 from the bank on January 1, 1996 at a rate of 15% simple interest per year. How much does he owe on January 17, 1996? Solution A(0)=1000 i=0. 15 A(t)=A(0)(1+it)=1000(1+0. 15 t) t=?

How to calculate t in practice? • Exact simple interest t = number of days 365 • Ordinary simple interest (Banker’s Rule) number of days t= 360 Number of days: count the last day but not the first

How to calculate t in practice? • Exact simple interest t = number of days 365 • Ordinary simple interest (Banker’s Rule) number of days t= 360 Number of days: count the last day but not the first

A(t)=1000(1+0. 15 t) Number of days (from Jan 1 to Jan 17) = 16 • Exact simple interest § t=16/365 § A(t)=1000(1+0. 15 ∙ 16/365) = 1006. 58 • Ordinary simple interest (Banker’s Rule) § t=16/360 § A(t)=1000(1+0. 15 ∙ 16/360) = 1006. 67

A(t)=1000(1+0. 15 t) Number of days (from Jan 1 to Jan 17) = 16 • Exact simple interest § t=16/365 § A(t)=1000(1+0. 15 ∙ 16/365) = 1006. 58 • Ordinary simple interest (Banker’s Rule) § t=16/360 § A(t)=1000(1+0. 15 ∙ 16/360) = 1006. 67

1. 3 COMPOUND INTEREST Interest earns interest • After one year: a(1) = 1+i • After two years: a(2) = 1+i+i(1+i) = (1+i)=(1+i)2 • Similarly after n years: a(n) = (1+i)n

1. 3 COMPOUND INTEREST Interest earns interest • After one year: a(1) = 1+i • After two years: a(2) = 1+i+i(1+i) = (1+i)=(1+i)2 • Similarly after n years: a(n) = (1+i)n

COMPOUND INTEREST Accumulation Function t a(t)=(1+i)t 1+i (0, 1) t 1 • Amount function: A(t)=A(0) ∙a(t)=A(0) (1+i)t • Effective rate is i • Moreover effective rate in nth year is i (effective rate is constant):

COMPOUND INTEREST Accumulation Function t a(t)=(1+i)t 1+i (0, 1) t 1 • Amount function: A(t)=A(0) ∙a(t)=A(0) (1+i)t • Effective rate is i • Moreover effective rate in nth year is i (effective rate is constant):

How to evaluate a(t)? • If t is not an integer, first find the value for the integral values immediately before and after • Use linear interpolation • Thus, compound interest is used for integral values of t and simple interest is used between integral values a(t)=(1+i)t (1+i)2 1+i 1 1 t 2

How to evaluate a(t)? • If t is not an integer, first find the value for the integral values immediately before and after • Use linear interpolation • Thus, compound interest is used for integral values of t and simple interest is used between integral values a(t)=(1+i)t (1+i)2 1+i 1 1 t 2

Example (p. 8) Jack borrows 1000 at 15% compound interest. a) How much does he owe after 2 years? b) How much does he owe after 57 days, assuming compound interest between integral durations? c) How much does he owe after 1 year and 57 days, under the same assumptions as in (b)? d) How much does he owe after 1 year and 57 days, assuming linear interpolation between integral durations e) In how many years will his principal have accumulated to 2000? a(t)=(1+i)t A(t)=A(0)(1+i)t A(0)=1000, i=0. 15 A(t)=1000(1+0. 15)t

Example (p. 8) Jack borrows 1000 at 15% compound interest. a) How much does he owe after 2 years? b) How much does he owe after 57 days, assuming compound interest between integral durations? c) How much does he owe after 1 year and 57 days, under the same assumptions as in (b)? d) How much does he owe after 1 year and 57 days, assuming linear interpolation between integral durations e) In how many years will his principal have accumulated to 2000? a(t)=(1+i)t A(t)=A(0)(1+i)t A(0)=1000, i=0. 15 A(t)=1000(1+0. 15)t

1. 4 PRESENT VALUE AND DISCOUNT Definition The amount of money that will accumulate to the principal over t years is called the present value t years in the past. PRESENT VALUE PRINCIPAL ACCUMULATED VALUE

1. 4 PRESENT VALUE AND DISCOUNT Definition The amount of money that will accumulate to the principal over t years is called the present value t years in the past. PRESENT VALUE PRINCIPAL ACCUMULATED VALUE

Calculation of present value • • t=1, principal = 1 Let v denote the present value v (1+i)=1 v=1/(1+i)

Calculation of present value • • t=1, principal = 1 Let v denote the present value v (1+i)=1 v=1/(1+i)

v=1/(1+i) In general: • t is arbitrary • a(t)=(1+i)t • [the present value of 1 (t years in the past)]∙ (1+i)t = 1 • the present value of 1 (t years in the past) = 1/ (1+i)t = vt

v=1/(1+i) In general: • t is arbitrary • a(t)=(1+i)t • [the present value of 1 (t years in the past)]∙ (1+i)t = 1 • the present value of 1 (t years in the past) = 1/ (1+i)t = vt

a(t)=(1+i)t gives the value of one unit (at time 0) at any time t, past or future a(t)=(1+i)t (0, 1) t

a(t)=(1+i)t gives the value of one unit (at time 0) at any time t, past or future a(t)=(1+i)t (0, 1) t

If principal is not equal to 1… present value = A(0) (1+i)t t<0 t=0 t>0 PRESENT VALUE PRINCIPAL A (0) ACCUMULATED VALUE A(0) (1+i)t

If principal is not equal to 1… present value = A(0) (1+i)t t<0 t=0 t>0 PRESENT VALUE PRINCIPAL A (0) ACCUMULATED VALUE A(0) (1+i)t

Example (p. 11) The Kelly family buys a new house for 93, 500 on May 1, 1996. How much was this house worth on May 1, 1992 if real estate prices have risen at a compound rate for 8 % per year during that period? Solution a(t)=(1+i)t • Find present value of A(0) = 93, 500 996 - 1992 = 4 years in the past • t = - 4, i = 0. 08 • Present value = A(0) (1+i)t = 93, 500 (1+0. 8) = 68, 725. 29 -4

Example (p. 11) The Kelly family buys a new house for 93, 500 on May 1, 1996. How much was this house worth on May 1, 1992 if real estate prices have risen at a compound rate for 8 % per year during that period? Solution a(t)=(1+i)t • Find present value of A(0) = 93, 500 996 - 1992 = 4 years in the past • t = - 4, i = 0. 08 • Present value = A(0) (1+i)t = 93, 500 (1+0. 8) = 68, 725. 29 -4

If simple interest is assumed… • a (t) = 1 + it • Let x denote the present value of one unit t years in the past • x ∙a (t) = x (1 + it) =1 • x = 1 / (1 + it) NOTE: In the last formula, t is positive t>0

If simple interest is assumed… • a (t) = 1 + it • Let x denote the present value of one unit t years in the past • x ∙a (t) = x (1 + it) =1 • x = 1 / (1 + it) NOTE: In the last formula, t is positive t>0

Thus, unlikely to the case of compound interest, we cannot use the same formula for present value and accumulated value in the case of simple interest a(t) =1+it 1 1 / (1 + it) t a(t) =1+it 1 / (1 - it) 1 t

Thus, unlikely to the case of compound interest, we cannot use the same formula for present value and accumulated value in the case of simple interest a(t) =1+it 1 1 / (1 + it) t a(t) =1+it 1 / (1 - it) 1 t

Discount Alternatively: • We invest 100 • After one year it accumulates to 112 • The interest 12 was added at the end of the term • Look at 112 as a basic amount • Imagine that 12 were deducted from 112 at the beginning of the year • Then 12 is amount of discount

Discount Alternatively: • We invest 100 • After one year it accumulates to 112 • The interest 12 was added at the end of the term • Look at 112 as a basic amount • Imagine that 12 were deducted from 112 at the beginning of the year • Then 12 is amount of discount

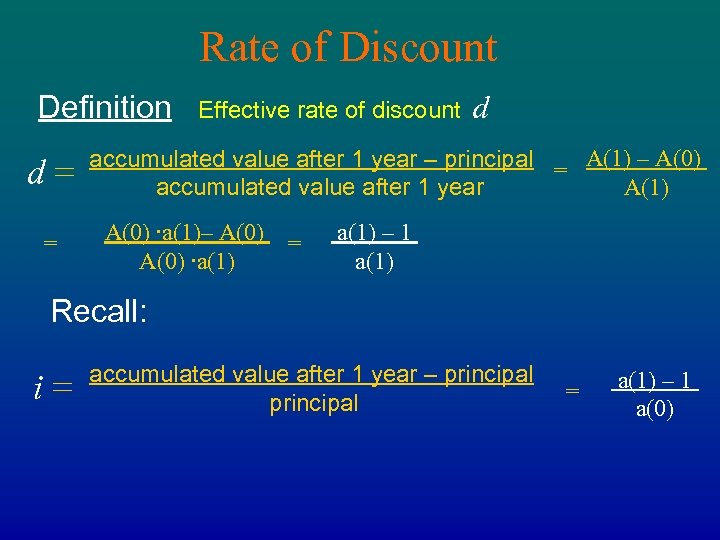

Rate of Discount Definition d= = Effective rate of discount d accumulated value after 1 year – principal = A(1) – A(0) A(1) accumulated value after 1 year A(0) ∙a(1)– A(0) = A(0) ∙a(1) – 1 a(1) Recall: i= accumulated value after 1 year – principal = a(1) – 1 a(0)

Rate of Discount Definition d= = Effective rate of discount d accumulated value after 1 year – principal = A(1) – A(0) A(1) accumulated value after 1 year A(0) ∙a(1)– A(0) = A(0) ∙a(1) – 1 a(1) Recall: i= accumulated value after 1 year – principal = a(1) – 1 a(0)

In th n year…

In th n year…

Identities relating d to i and v Note: d < i

Identities relating d to i and v Note: d < i

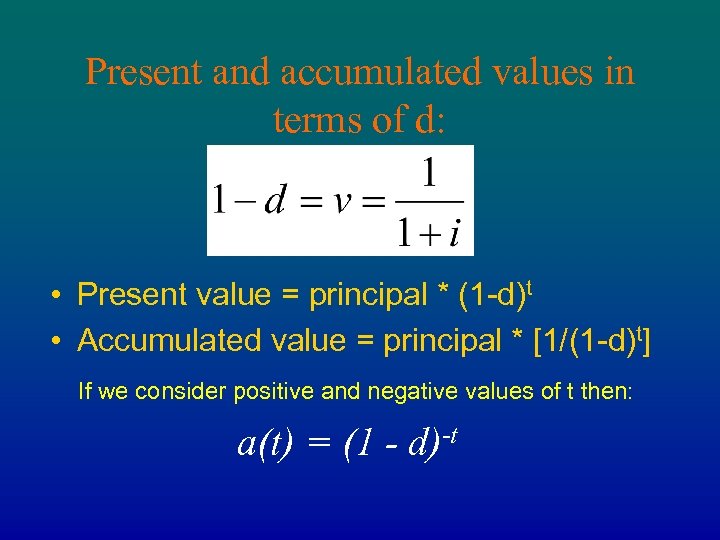

Present and accumulated values in terms of d: • Present value = principal * (1 -d)t • Accumulated value = principal * [1/(1 -d)t] If we consider positive and negative values of t then: a(t) = (1 - d)-t

Present and accumulated values in terms of d: • Present value = principal * (1 -d)t • Accumulated value = principal * [1/(1 -d)t] If we consider positive and negative values of t then: a(t) = (1 - d)-t

Examples (p. 13) 1. 1000 is to be accumulated by January 1, 1995 at a compound rate of discount of 9% per year. a) Find the present value on January 1, 1992 b) Find the value of i corresponding to d 2. Jane deposits 1000 in a bank account on August 1, 1996. If the rate of compound interest is 7% per year, find the value of this deposit on August 1, 1994.

Examples (p. 13) 1. 1000 is to be accumulated by January 1, 1995 at a compound rate of discount of 9% per year. a) Find the present value on January 1, 1992 b) Find the value of i corresponding to d 2. Jane deposits 1000 in a bank account on August 1, 1996. If the rate of compound interest is 7% per year, find the value of this deposit on August 1, 1994.

1. 5 NOMINAL RATE OF INTEREST Example (p. 13) A man borrows 1000 at an effective rate of interest of 2% per month. How much does he owe after 3 years? Note: t is the number of effective interest periods in any particular problem

1. 5 NOMINAL RATE OF INTEREST Example (p. 13) A man borrows 1000 at an effective rate of interest of 2% per month. How much does he owe after 3 years? Note: t is the number of effective interest periods in any particular problem

More examples… (p. 14) • You want to take out a mortgage on a house Note: in both that a rate of interest is 12% per examples the given rates and discover of interest (12% and 18%) wererate is year. However, you find out that this nominal “convertible semi-annually”. Is 12% the rates of interest effective rate of interest per year? • Credit card charges 18% per year convertible monthly. Is 18% the effective rate of interest per year?

More examples… (p. 14) • You want to take out a mortgage on a house Note: in both that a rate of interest is 12% per examples the given rates and discover of interest (12% and 18%) wererate is year. However, you find out that this nominal “convertible semi-annually”. Is 12% the rates of interest effective rate of interest per year? • Credit card charges 18% per year convertible monthly. Is 18% the effective rate of interest per year?

Definition • Suppose we have interest convertible m times per year • The nominal rate of interest i(m) is defined so that i(m) / m is an effective rate of interest in 1/m part of a year

Definition • Suppose we have interest convertible m times per year • The nominal rate of interest i(m) is defined so that i(m) / m is an effective rate of interest in 1/m part of a year

Note: If i is the effective rate of interest per year, it follows that Equivalently: In other words, i is the effective rate of interest convertible annually which is equivalent to the effective rate of interest i(m) /m convertible mthly.

Note: If i is the effective rate of interest per year, it follows that Equivalently: In other words, i is the effective rate of interest convertible annually which is equivalent to the effective rate of interest i(m) /m convertible mthly.

Examples (p. 15) 1. Find the accumulated value of 1000 after three years at a rate of interest of 24 % per year convertible monthly 2. If i(6)=15% find the equivalent nominal rate of interest convertible semi-annually

Examples (p. 15) 1. Find the accumulated value of 1000 after three years at a rate of interest of 24 % per year convertible monthly 2. If i(6)=15% find the equivalent nominal rate of interest convertible semi-annually

Nominal rate of discount • The nominal rate of discount d(m) is defined so that d(m) / m is an effective rate of interest in 1/m part of a year • Formula:

Nominal rate of discount • The nominal rate of discount d(m) is defined so that d(m) / m is an effective rate of interest in 1/m part of a year • Formula:

Formula relating nominal rates of interest and discount

Formula relating nominal rates of interest and discount

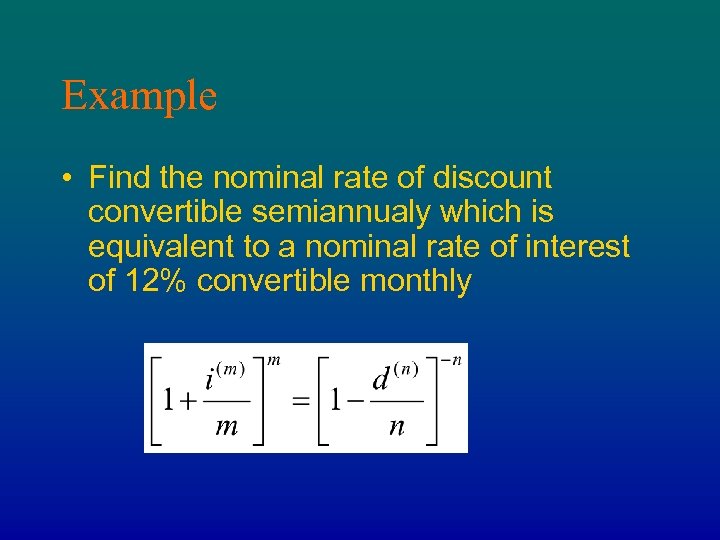

Example • Find the nominal rate of discount convertible semiannualy which is equivalent to a nominal rate of interest of 12% convertible monthly

Example • Find the nominal rate of discount convertible semiannualy which is equivalent to a nominal rate of interest of 12% convertible monthly

1. 6 FORCE OF INTEREST • What happens if the number m of periods is very large? • One can consider mathematical model of interest which is convertible continuously • Then the force of interest is the nominal rate of interest, convertible continuously

1. 6 FORCE OF INTEREST • What happens if the number m of periods is very large? • One can consider mathematical model of interest which is convertible continuously • Then the force of interest is the nominal rate of interest, convertible continuously

Definition Nominal rate of interest equivalent to i: Let m approach infinity: We define the force of interest δ equal to this limit:

Definition Nominal rate of interest equivalent to i: Let m approach infinity: We define the force of interest δ equal to this limit:

Formula • Force of interest δ = ln (1+i) eδ = 1+i t =eδt a (t) = (1+i) • Therefore • and • Practical use of δ: the previous formula gives good approximation to a(t) when m is very large

Formula • Force of interest δ = ln (1+i) eδ = 1+i t =eδt a (t) = (1+i) • Therefore • and • Practical use of δ: the previous formula gives good approximation to a(t) when m is very large

Example • A loan of 3000 is taken out on June 23, 1997. If the force of interest is 14%, find each of the following: – The value of the loan on June 23, 2002 – The value of i(12)

Example • A loan of 3000 is taken out on June 23, 1997. If the force of interest is 14%, find each of the following: – The value of the loan on June 23, 2002 – The value of i(12)

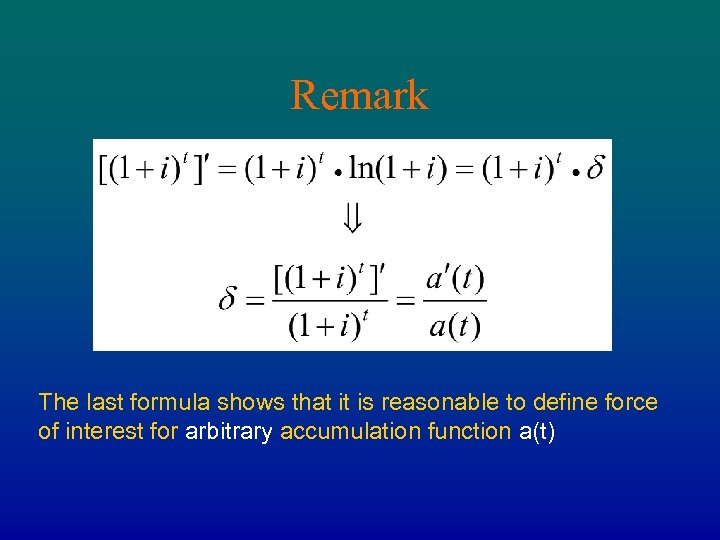

Remark The last formula shows that it is reasonable to define force of interest for arbitrary accumulation function a(t)

Remark The last formula shows that it is reasonable to define force of interest for arbitrary accumulation function a(t)

Definition The force of interest corresponding to a(t): Note: 1) in general case, force of interest depends on t 2) it does not depend on t ↔ a(t)= (1+i)t !

Definition The force of interest corresponding to a(t): Note: 1) in general case, force of interest depends on t 2) it does not depend on t ↔ a(t)= (1+i)t !

Example (p. 19) • Find in δt the case of simple interest • Solution

Example (p. 19) • Find in δt the case of simple interest • Solution

How to find a(t) if we are given by δt ? We have: Consider differential equation in which a is unknown function: Since a(0) = 1 its solution is given by = a(t)

How to find a(t) if we are given by δt ? We have: Consider differential equation in which a is unknown function: Since a(0) = 1 its solution is given by = a(t)

Applications • Prove that if δt = δ is a constant then a(t) = (1+i)t for some i • Prove that for any amount function A(t) we have: • Note: δt dt represents the effective rate of interest over the infinitesimal “period of time” dt. Hence A(t)δt dt is the amount of interest earned in this period and the integral is the total amount

Applications • Prove that if δt = δ is a constant then a(t) = (1+i)t for some i • Prove that for any amount function A(t) we have: • Note: δt dt represents the effective rate of interest over the infinitesimal “period of time” dt. Hence A(t)δt dt is the amount of interest earned in this period and the integral is the total amount

Remarks • Do we need to define the force of discount? • It turns out that the force of discount coincides with the force of interest! (Exercise: PROVE IT) • Moreover, we have the following inequalities: • and formulas:

Remarks • Do we need to define the force of discount? • It turns out that the force of discount coincides with the force of interest! (Exercise: PROVE IT) • Moreover, we have the following inequalities: • and formulas: