0cea0b505a1cb5e45cc9e39ba7ed86c4.ppt

- Количество слайдов: 16

MATERI XI ASPEK KEUANGAN

Basic Financial Statement of Operational (Income Statement – Laporan Rugi Laba) o Balance Sheet (Neraca) o Statement of Cash Flows

Income Statement l Operating Revenues (The actual and or expected cash inflows resulting from activities that central to the on going operation) l Expenses (The actual and or expected cash outflows resulting from the sale delivery of goods or service) l Profit (loss) (The difference between revenues and expenses)

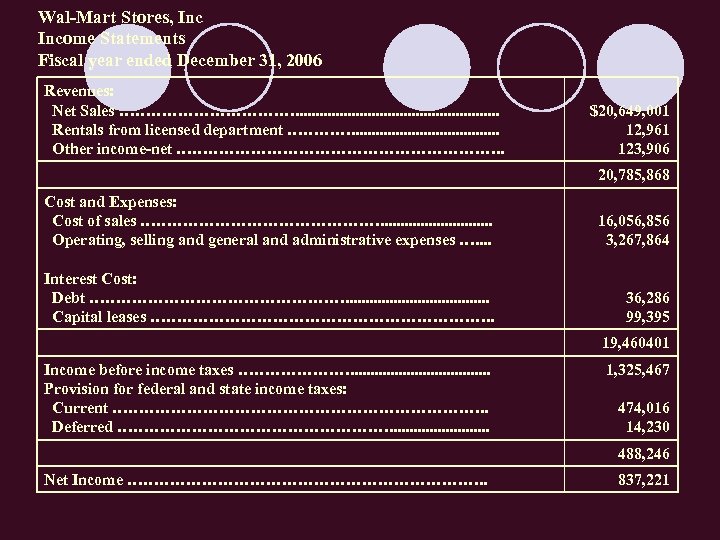

Wal-Mart Stores, Income Statements Fiscal year ended December 31, 2006 Revenues: Net Sales ………………. . . . Rentals from licensed department …………. . . . . Other income-net …………………………. . $20, 649, 001 12, 961 123, 906 20, 785, 868 Cost and Expenses: Cost of sales ……………………. . . . Operating, selling and general and administrative expenses …. . 16, 056, 856 3, 267, 864 Interest Cost: Debt ……………………. . . . . Capital leases ……………………………. . 36, 286 99, 395 19, 460401 Income before income taxes …………………. . . . . Provision for federal and state income taxes: Current ………………………………. . Deferred ………………………. . . 1, 325, 467 474, 016 14, 230 488, 246 Net Income ……………………………. . 837, 221

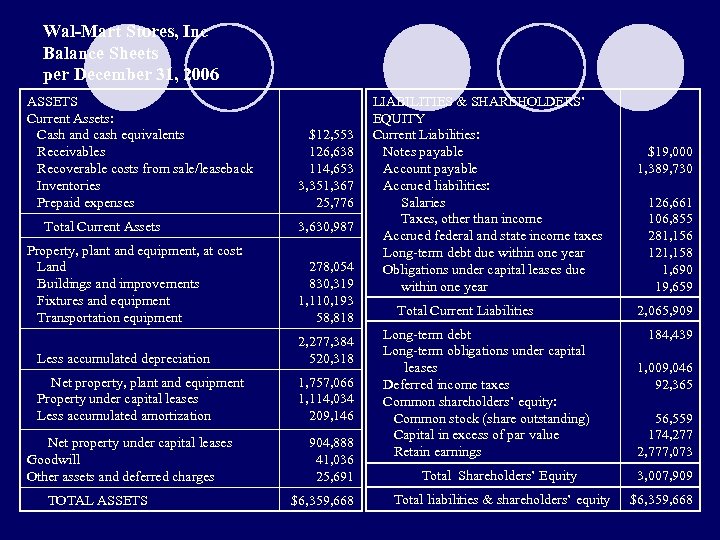

Wal-Mart Stores, Inc Balance Sheets per December 31, 2006 ASSETS Current Assets: Cash and cash equivalents Receivables Recoverable costs from sale/leaseback Inventories Prepaid expenses Total Current Assets Property, plant and equipment, at cost: Land Buildings and improvements Fixtures and equipment Transportation equipment $12, 553 126, 638 114, 653 3, 351, 367 25, 776 3, 630, 987 278, 054 830, 319 1, 110, 193 58, 818 Less accumulated depreciation 2, 277, 384 520, 318 Net property, plant and equipment Property under capital leases Less accumulated amortization 1, 757, 066 1, 114, 034 209, 146 Net property under capital leases Goodwill Other assets and deferred charges TOTAL ASSETS 904, 888 41, 036 25, 691 $6, 359, 668 LIABILITIES & SHAREHOLDERS’ EQUITY Current Liabilities: Notes payable Account payable Accrued liabilities: Salaries Taxes, other than income Accrued federal and state income taxes Long-term debt due within one year Obligations under capital leases due within one year Total Current Liabilities Long-term debt Long-term obligations under capital leases Deferred income taxes Common shareholders’ equity: Common stock (share outstanding) Capital in excess of par value Retain earnings $19, 000 1, 389, 730 126, 661 106, 855 281, 156 121, 158 1, 690 19, 659 2, 065, 909 184, 439 1, 009, 046 92, 365 56, 559 174, 277 2, 777, 073 Total Shareholders’ Equity 3, 007, 909 Total liabilities & shareholders’ equity $6, 359, 668

Financial Management How a company funds itself and maximizes the return on money raised from its share holder or debt holder Two major functions: Business Investment Decisions What assets should the firm own? In what project should the business invest? Financing Decisions How should the investment to buy paid for?

Three Basic Decision Categories Accept or Reject a Single Investment Proposal Chose One Competing Investment over Another Capital Rationing With a limited investment pool capital rationing tells which projects among many should be chosen Major tools: Payback Period Net Present Value

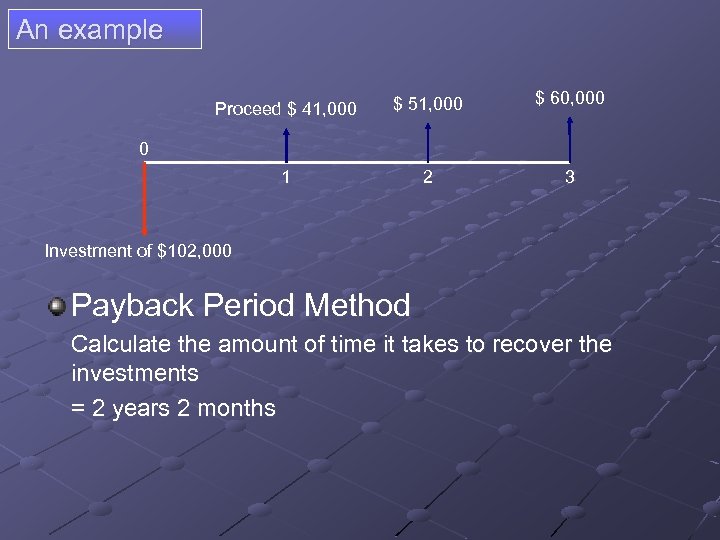

An example Proceed $ 41, 000 $ 51, 000 $ 60, 000 1 2 3 0 Investment of $102, 000 Payback Period Method Calculate the amount of time it takes to recover the investments = 2 years 2 months

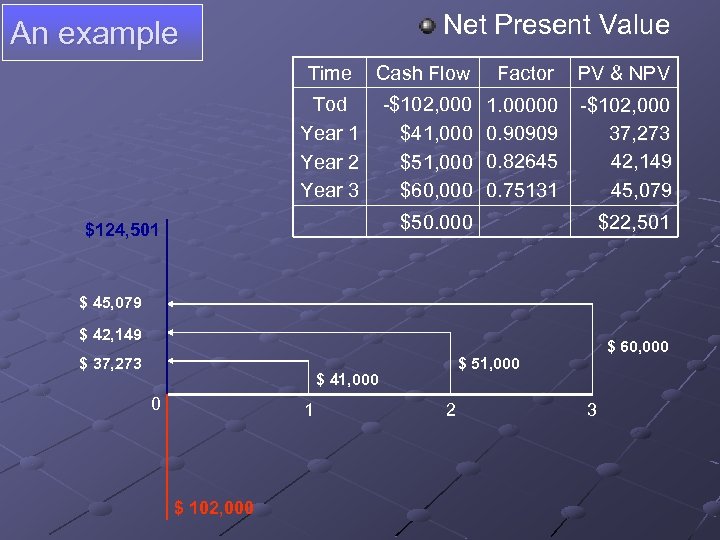

Net Present Value An example Time Cash Flow Factor PV & NPV Tod Year 1 Year 2 Year 3 -$102, 000 $41, 000 $51, 000 $60, 000 1. 00000 0. 90909 0. 82645 0. 75131 -$102, 000 37, 273 42, 149 45, 079 $50. 000 $124, 501 $22, 501 $ 45, 079 $ 42, 149 $ 37, 273 $ 51, 000 $ 41, 000 0 1 $ 102, 000 $ 60, 000 2 3

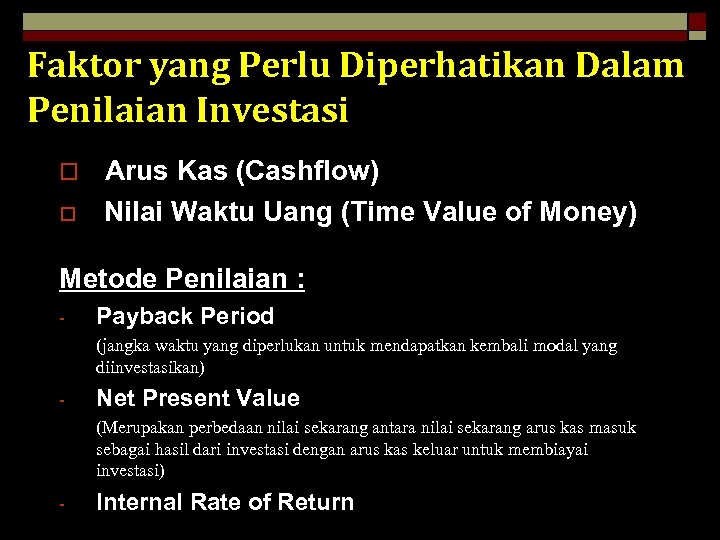

Faktor yang Perlu Diperhatikan Dalam Penilaian Investasi o o Arus Kas (Cashflow) Nilai Waktu Uang (Time Value of Money) Metode Penilaian : - Payback Period (jangka waktu yang diperlukan untuk mendapatkan kembali modal yang diinvestasikan) - Net Present Value (Merupakan perbedaan nilai sekarang antara nilai sekarang arus kas masuk sebagai hasil dari investasi dengan arus kas keluar untuk membiayai investasi) - Internal Rate of Return

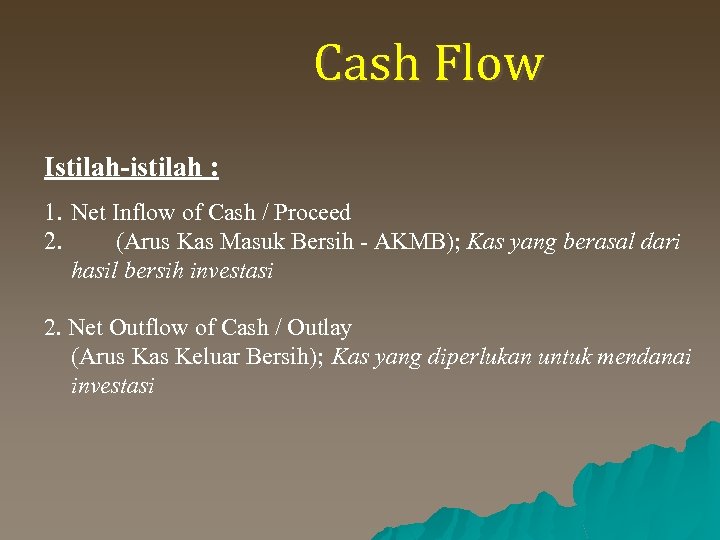

Cash Flow Istilah-istilah : 1. Net Inflow of Cash / Proceed 2. (Arus Kas Masuk Bersih - AKMB); Kas yang berasal dari hasil bersih investasi 2. Net Outflow of Cash / Outlay (Arus Kas Keluar Bersih); Kas yang diperlukan untuk mendanai investasi

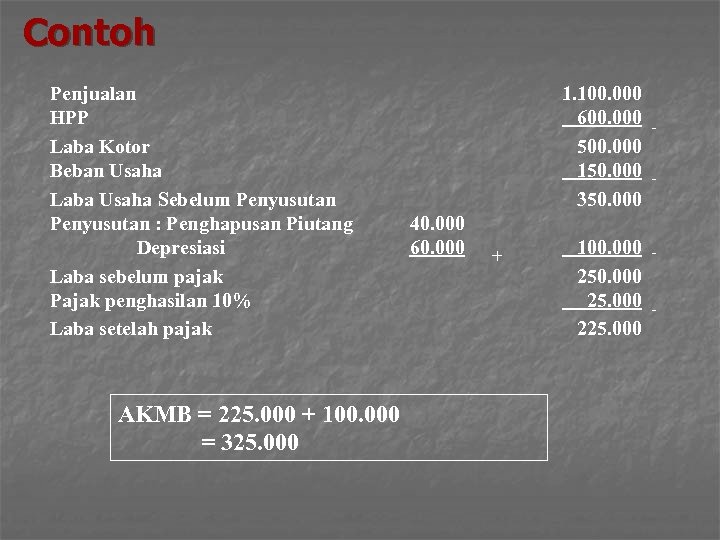

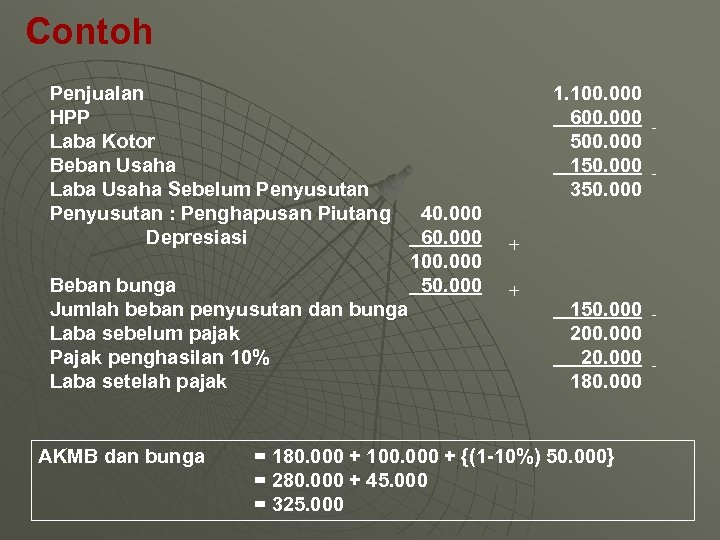

Contoh Penjualan HPP Laba Kotor Beban Usaha Laba Usaha Sebelum Penyusutan : Penghapusan Piutang Depresiasi Laba sebelum pajak Pajak penghasilan 10% Laba setelah pajak AKMB = 225. 000 + 100. 000 = 325. 000 1. 100. 000 600. 000 500. 000 150. 000 350. 000 40. 000 60. 000 + 100. 000 25. 000 225. 000

Contoh Penjualan HPP Laba Kotor Beban Usaha Laba Usaha Sebelum Penyusutan : Penghapusan Piutang Depresiasi Beban bunga Jumlah beban penyusutan dan bunga Laba sebelum pajak Pajak penghasilan 10% Laba setelah pajak AKMB dan bunga 1. 100. 000 600. 000 500. 000 150. 000 350. 000 40. 000 60. 000 100. 000 50. 000 + + 150. 000 20. 000 180. 000 = 180. 000 + 100. 000 + {(1 -10%) 50. 000} = 280. 000 + 45. 000 = 325. 000

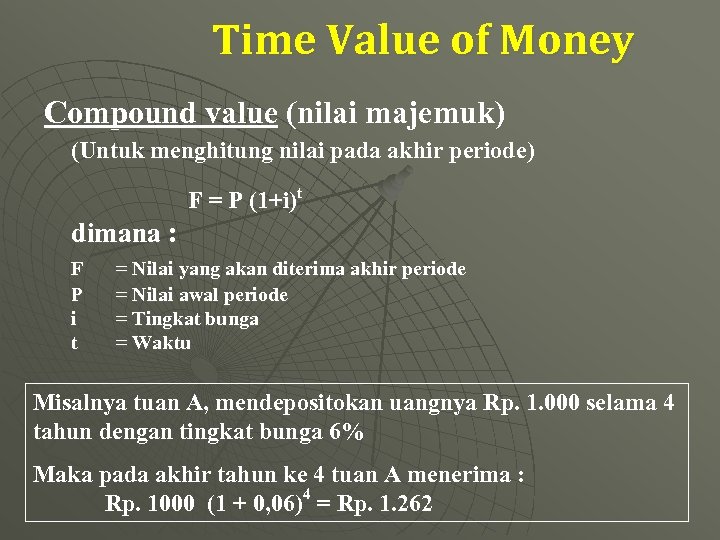

Time Value of Money Compound value (nilai majemuk) (Untuk menghitung nilai pada akhir periode) F = P (1+i)t dimana : F P i t = Nilai yang akan diterima akhir periode = Nilai awal periode = Tingkat bunga = Waktu Misalnya tuan A, mendepositokan uangnya Rp. 1. 000 selama 4 tahun dengan tingkat bunga 6% Maka pada akhir tahun ke 4 tuan A menerima : Rp. 1000 (1 + 0, 06)4 = Rp. 1. 262

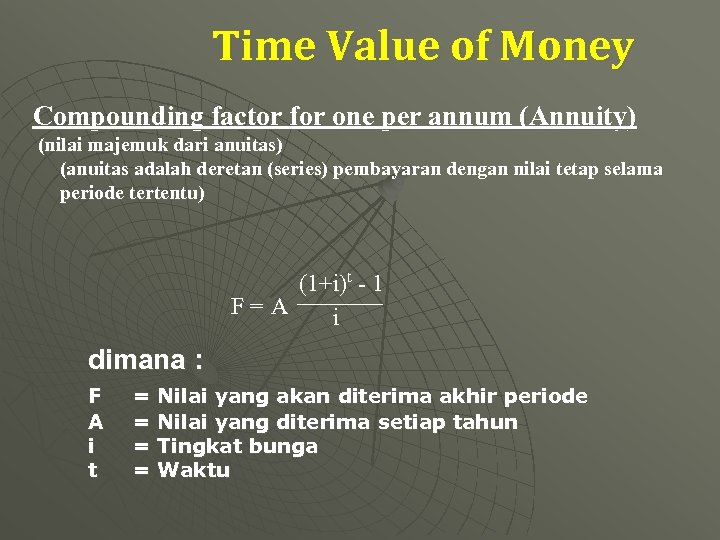

Time Value of Money Compounding factor for one per annum (Annuity) (nilai majemuk dari anuitas) (anuitas adalah deretan (series) pembayaran dengan nilai tetap selama periode tertentu) (1+i)t - 1 F=A i dimana : F A i t = Nilai yang akan diterima akhir periode = Nilai yang diterima setiap tahun = Tingkat bunga = Waktu

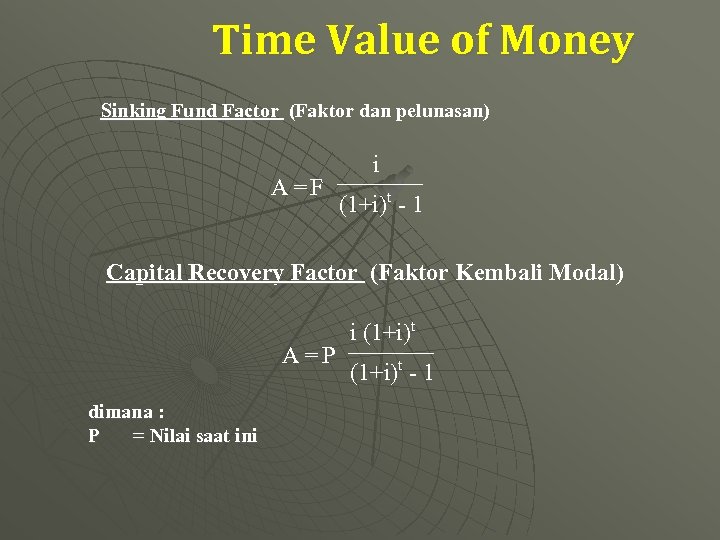

Time Value of Money Sinking Fund Factor (Faktor dan pelunasan) A =F i (1+i)t - 1 Capital Recovery Factor (Faktor Kembali Modal) A =P dimana : P = Nilai saat ini i (1+i)t - 1

0cea0b505a1cb5e45cc9e39ba7ed86c4.ppt