a92e1b18b4a2e011ba3682f110d83dd3.ppt

- Количество слайдов: 96

Master. Card Money Transfer Solutions Card Based Solutions to Enable Global Funds Transfer Department Name Presentation Date

Master. Card P 2 P Money Transfer Solutions Main Menu P 2 P: What are the Opportunities? …and Challenges? Master. Card Payment Transaction Solutions Master. Card P 2 P Prepaid Cards The Master. Card Family Account Supporting Bank Business Models Next Steps

Master. Card P 2 P Money Transfer Solutions Main Menu P 2 P: What are the Opportunities? …and Challenges? Master. Card Payment Transaction Solutions Master. Card P 2 P Prepaid Cards The Master. Card Family Account Supporting Bank Business Models Next Steps

Master. Card P 2 P Money Transfer Solutions Main Menu P 2 P: What are the Opportunities? …and Challenges? Master. Card Payment Transaction Solutions Master. Card P 2 P Prepaid Cards The Master. Card Family Account Supporting Bank Business Models Next Steps

Master. Card P 2 P Money Transfer Solutions Main Menu P 2 P: What are the Opportunities? …and Challenges? Master. Card Payment Transaction Solutions Master. Card P 2 P Prepaid Cards The Master. Card Family Account Supporting Bank Business Models Next Steps

Master. Card P 2 P Money Transfer Solutions Main Menu P 2 P: What are the Opportunities? …and Challenges? Master. Card Payment Transaction Solutions Master. Card P 2 P Prepaid Cards The Master. Card Family Account Supporting Bank Business Models Next Steps

Master. Card P 2 P Money Transfer Solutions Main Menu P 2 P: What are the Opportunities? …and Challenges? Master. Card Payment Transaction Solutions Master. Card P 2 P Prepaid Cards The Master. Card Family Account Supporting Bank Business Models Next Steps

Master. Card P 2 P Money Transfer Solutions Main Menu P 2 P: What are the Opportunities? …and Challenges? Master. Card Payment Transaction Solutions Master. Card P 2 P Prepaid Cards The Master. Card Family Account Supporting Bank Business Models Next Steps

Master. Card P 2 P Money Transfer Solutions P 2 P: What are the Opportunities? …and Challenges? P 2 P: A Significant Opportunity Key Corridors and Countries Who Sends the Funds? What are the Challenges? To Main Menu To Next Section

P 2 P: What are the Opportunities and Challenges? P 2 P: A Significant Opportunity To Main Menu To Next Section

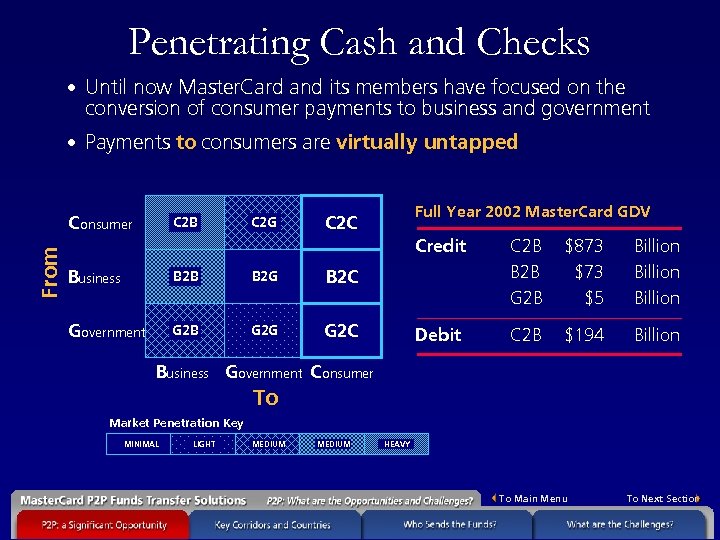

Penetrating Cash and Checks • Until now Master. Card and its members have focused on the conversion of consumer payments to business and government • Payments to consumers are virtually untapped From C onsumer C 2 B C 2 G Full Year 2002 Master. Card GDV C 2 C Credit Business B 2 B B 2 G G 2 B G 2 G Billion Debit G 2 C $873 $5 C 2 B $194 Billion B 2 C Government C 2 B B 2 B G 2 B Business Government C onsumer To Market Penetration Key MINIMAL LIGHT MEDIUM HEAVY To Main Menu To Next Section

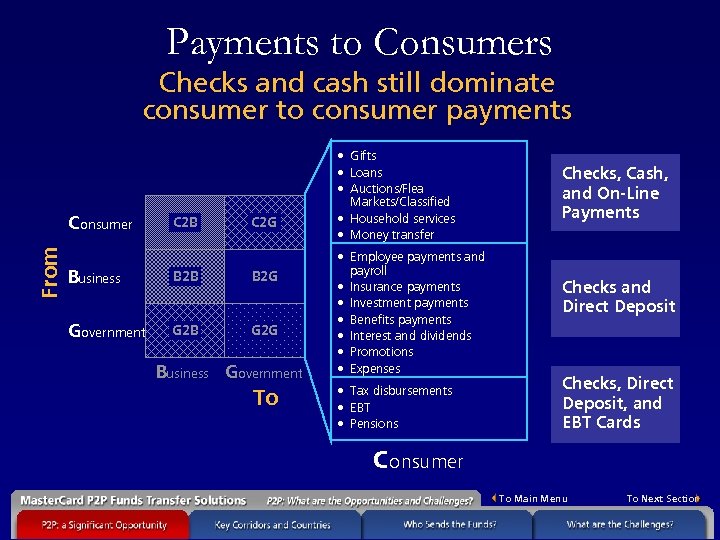

Payments to Consumers Checks and cash still dominate consumer to consumer payments From C onsumer C 2 B C 2 G Business B 2 B B 2 G Government G 2 B G 2 G Business Government To • Gifts • Loans • Auctions/Flea Markets/Classified • Household services • Money transfer • Employee payments and payroll • Insurance payments • Investment payments • Benefits payments • Interest and dividends • Promotions • Expenses • Tax disbursements • EBT • Pensions Checks, Cash, and On-Line Payments Checks and Direct Deposit Checks, Direct Deposit, and EBT Cards C onsumer To Main Menu To Next Section

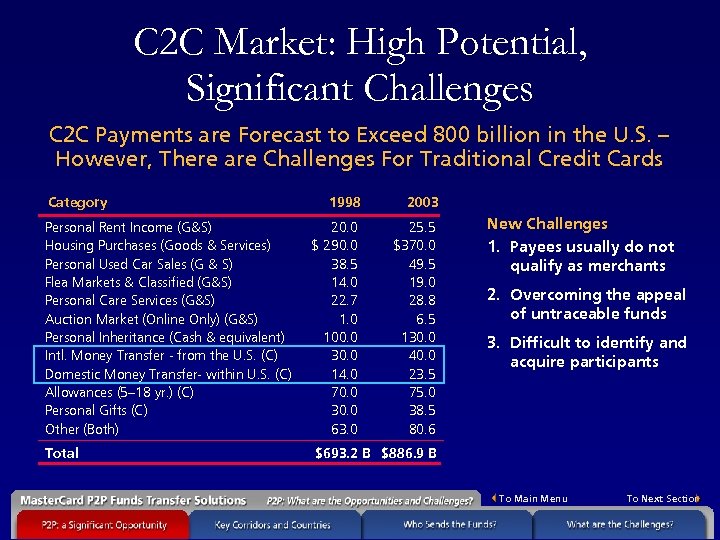

C 2 C Market: High Potential, Significant Challenges C 2 C Payments are Forecast to Exceed 800 billion in the U. S. – However, There are Challenges For Traditional Credit Cards Category 1998 2003 Personal Rent Income (G&S) Housing Purchases (Goods & Services) Personal Used Car Sales (G & S) Flea Markets & Classified (G&S) Personal Care Services (G&S) Auction Market (Online Only) (G&S) Personal Inheritance (Cash & equivalent) Intl. Money Transfer - from the U. S. (C) Domestic Money Transfer- within U. S. (C) Allowances (5– 18 yr. ) (C) Personal Gifts (C) Other (Both) 20. 0 $ 290. 0 38. 5 14. 0 22. 7 1. 0 100. 0 30. 0 14. 0 70. 0 30. 0 63. 0 25. 5 $370. 0 49. 5 19. 0 28. 8 6. 5 130. 0 40. 0 23. 5 75. 0 38. 5 80. 6 Total $693. 2 B $886. 9 B New Challenges 1. Payees usually do not qualify as merchants 2. Overcoming the appeal of untraceable funds 3. Difficult to identify and acquire participants To Main Menu To Next Section

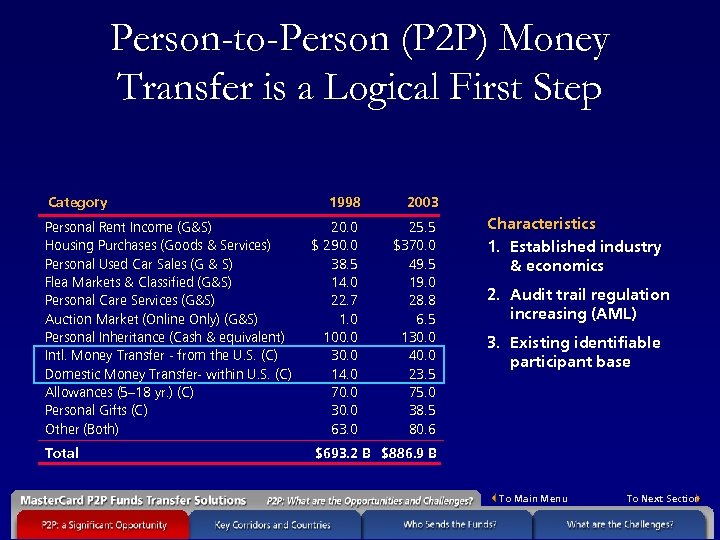

Person-to-Person (P 2 P) Money Transfer is a Logical First Step Category 1998 2003 Personal Rent Income (G&S) Housing Purchases (Goods & Services) Personal Used Car Sales (G & S) Flea Markets & Classified (G&S) Personal Care Services (G&S) Auction Market (Online Only) (G&S) Personal Inheritance (Cash & equivalent) Intl. Money Transfer - from the U. S. (C) Domestic Money Transfer- within U. S. (C) Allowances (5– 18 yr. ) (C) Personal Gifts (C) Other (Both) 20. 0 $ 290. 0 38. 5 14. 0 22. 7 1. 0 100. 0 30. 0 14. 0 70. 0 30. 0 63. 0 25. 5 $370. 0 49. 5 19. 0 28. 8 6. 5 130. 0 40. 0 23. 5 75. 0 38. 5 80. 6 Total $693. 2 B $886. 9 B Characteristics 1. Established industry & economics 2. Audit trail regulation increasing (AML) 3. Existing identifiable participant base To Main Menu To Next Section

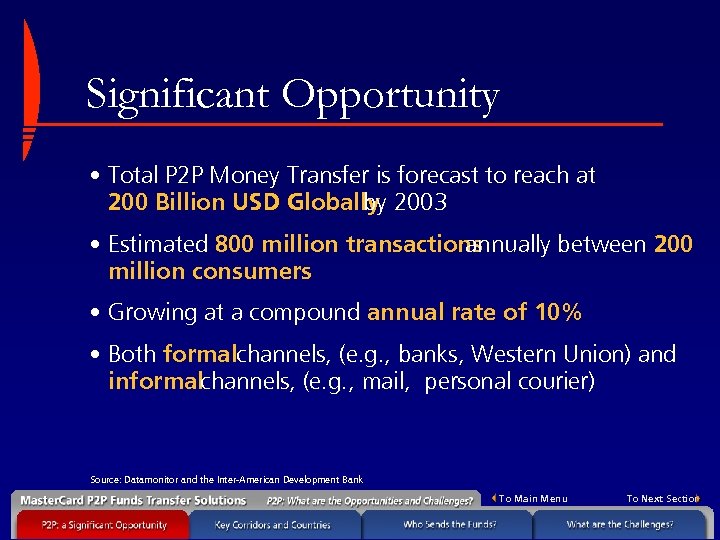

Significant Opportunity • Total P 2 P Money Transfer is forecast to reach at 200 Billion USD Globally 2003 by • Estimated 800 million transactions annually between 200 million consumers • Growing at a compound annual rate of 10% • Both formalchannels, (e. g. , banks, Western Union) and informalchannels, (e. g. , mail, personal courier) Source: Datamonitor and the Inter-American Development Bank To Main Menu To Next Section

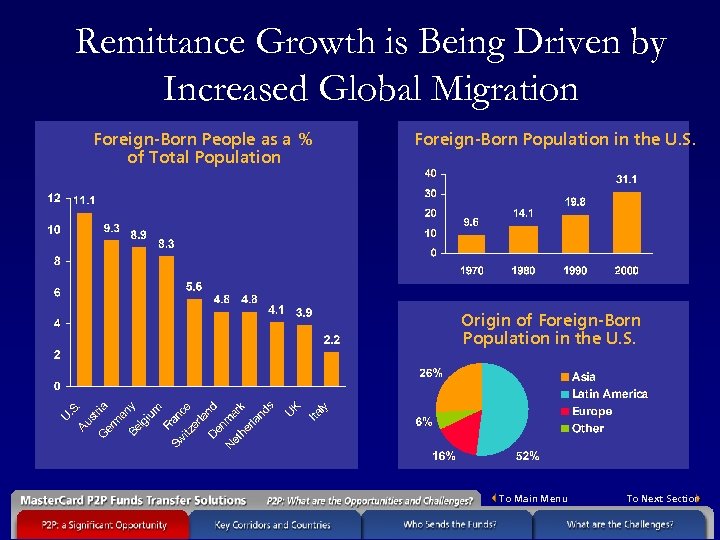

Remittance Growth is Being Driven by Increased Global Migration Foreign-Born People as a % of Total Population Foreign-Born Population in the U. S. Origin of Foreign-Born Population in the U. S. To Main Menu To Next Section

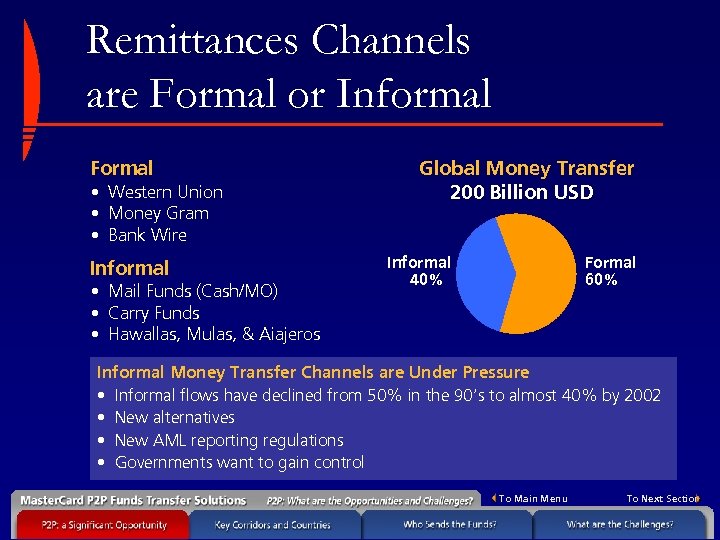

Remittances Channels are Formal or Informal Formal • Western Union • Money Gram • Bank Wire Informal • Mail Funds (Cash/MO) • Carry Funds • Hawallas, Mulas, & Aiajeros Global Money Transfer 200 Billion USD Informal 40% Formal 60% Informal Money Transfer Channels are Under Pressure • Informal flows have declined from 50% in the 90’s to almost 40% by 2002 • New alternatives • New AML reporting regulations • Governments want to gain control To Main Menu To Next Section

P 2 P: What are the Opportunities and Challenges? Key Corridors and Countries To Main Menu To Next Section

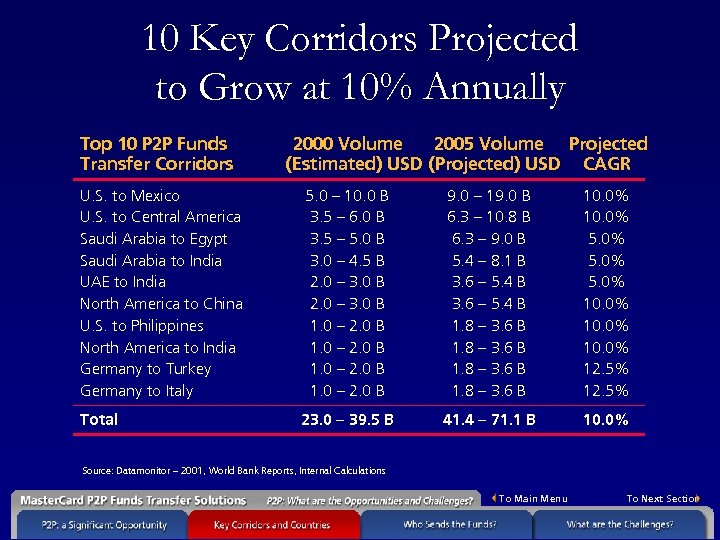

10 Key Corridors Projected to Grow at 10% Annually Top 10 P 2 P Funds Transfer Corridors 2000 Volume 2005 Volume Projected (Estimated) USD (Projected) USD CAGR U. S. to Mexico U. S. to Central America Saudi Arabia to Egypt Saudi Arabia to India UAE to India North America to China U. S. to Philippines North America to India Germany to Turkey Germany to Italy 5. 0 – 10. 0 B 3. 5 – 6. 0 B 3. 5 – 5. 0 B 3. 0 – 4. 5 B 2. 0 – 3. 0 B 1. 0 – 2. 0 B 9. 0 – 19. 0 B 6. 3 – 10. 8 B 6. 3 – 9. 0 B 5. 4 – 8. 1 B 3. 6 – 5. 4 B 1. 8 – 3. 6 B 10. 0% 5. 0% 10. 0% 12. 5% Total 23. 0 – 39. 5 B 41. 4 – 71. 1 B 10. 0% Source: Datamonitor – 2001, World Bank Reports, Internal Calculations To Main Menu To Next Section

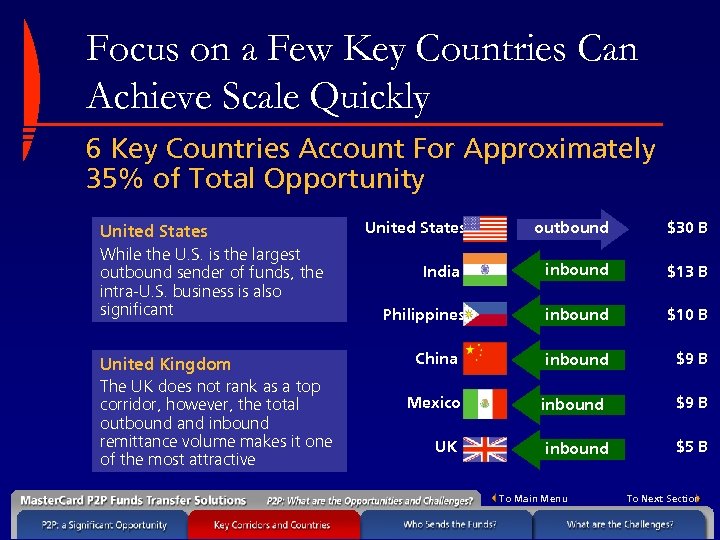

Focus on a Few Key Countries Can Achieve Scale Quickly 6 Key Countries Account For Approximately 35% of Total Opportunity United States While the U. S. is the largest outbound sender of funds, the intra-U. S. business is also significant United Kingdom The UK does not rank as a top corridor, however, the total outbound and inbound remittance volume makes it one of the most attractive United States outbound $30 B inbound $13 B inbound $10 B China inbound $9 B Mexico inbound $9 B UK inbound $5 B India Philippines To Main Menu To Next Section

P 2 P: What are the Opportunities and Challenges? Who Sends the Funds? To Main Menu To Next Section

Profile of the Remittance Consumer • Participants in cross-border remittances vary by remittance corridor • Overall, senders are characterized as: – – – Male Younger Employed Having minimal bank relationships Using technology less • Sending money cross border 8 to 12 times per year • An average of 2, 800 USD per remitter is sent annually To Main Menu To Next Section

P 2 P: What are the Opportunities and Challenges? What are the Challenges? To Main Menu To Next Section

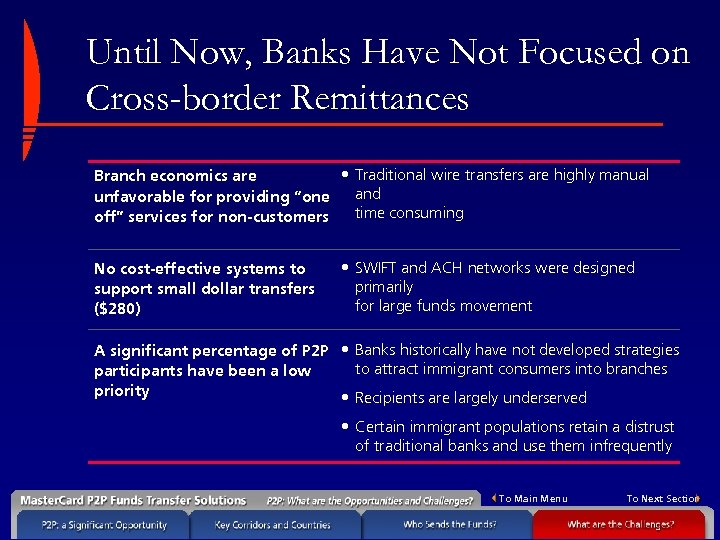

Until Now, Banks Have Not Focused on Cross-border Remittances • Traditional wire transfers are highly manual Branch economics are and unfavorable for providing “one time consuming off” services for non-customers No cost-effective systems to support small dollar transfers ($280) • SWIFT and ACH networks were designed primarily for large funds movement A significant percentage of P 2 P • Banks historically have not developed strategies to attract immigrant consumers into branches participants have been a low priority • Recipients are largely underserved • Certain immigrant populations retain a distrust of traditional banks and use them infrequently To Main Menu To Next Section

Banks are Well Positioned to Offer Cross-border Services Core competencies and assets include: • Transaction risk management • AML compliance methodologies • Technology platforms and networks • Card program capabilities • Retail merchant relationships To Main Menu To Next Section

Master. Card P 2 P Money Transfer Solutions Master. Card Payment Transaction Solutions Leveraging Card-Based Technology Master. Card Payment Transactions Money Transfer Service: Online and Agent-Based To Main Menu To Next Section

Master. Card Payment Transaction Solutions Leveraging Card-Based Technology To Main Menu To Next Section

Banks Can Leverage Card-based Technology to Capitalize on P 2 P Money Transfer • 67% of recipients indicate their desire to receive funds on a money transfer card instead of going to an agent to get cash • 58% of recipients indicate interest in adding their own fundsto a card • Penetrating the global money transfer opportunity requires the global processing and connectivity of today’s modern electronic payments industry • Card-based capabilities and economics offer improved security, convenience, and value To Main Menu To Next Section

Different Customer Segments Require Different Business Models. . . To Main Menu To Next Section

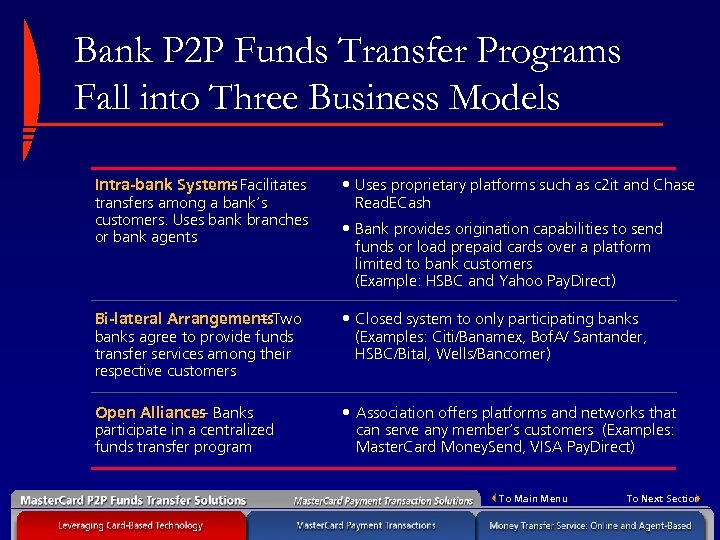

Bank P 2 P Funds Transfer Programs Fall into Three Business Models Intra-bank Systems Facilitates – transfers among a bank’s customers. Uses bank branches or bank agents • Uses proprietary platforms such as c 2 it and Chase Read. ECash Bi-lateral Arrangements. Two – banks agree to provide funds transfer services among their respective customers • Closed system to only participating banks (Examples: Citi/Banamex, Bof. A/ Santander, HSBC/Bital, Wells/Bancomer) Open Alliances Banks – participate in a centralized funds transfer program • Association offers platforms and networks that can serve any member’s customers (Examples: Master. Card Money. Send, VISA Pay. Direct) • Bank provides origination capabilities to send funds or load prepaid cards over a platform limited to bank customers (Example: HSBC and Yahoo Pay. Direct) To Main Menu To Next Section

How Do We Tap Into the Billions in Cash That are Sent Globally Between Family and Friends? To Main Menu To Next Section

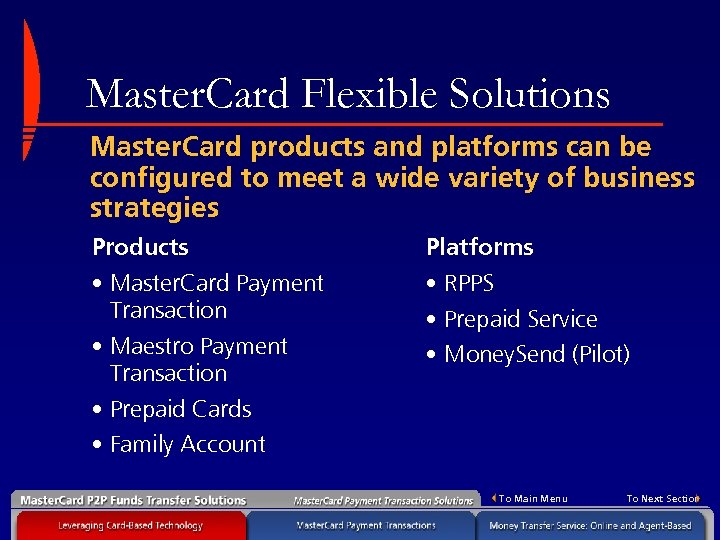

Master. Card Flexible Solutions Master. Card products and platforms can be configured to meet a wide variety of business strategies Products • Master. Card Payment Transaction • Maestro Payment Transaction • Prepaid Cards • Family Account Platforms • RPPS • Prepaid Service • Money. Send (Pilot) To Main Menu To Next Section

Master. Card Payment Transaction Solutions Master. Card Payment Transactions To Main Menu To Next Section

Master. Card Payment Transactions Master. Card has created the payment transaction to support a variety of off-line and online P 2 P Money Transfer Models • What is the “payment transactions” • How does it work? • What P 2 P Money Transfer Models does it support? • What does a member have to do to use the new payment transaction? To Main Menu To Next Section

What is the Payment Transaction? • The payment transaction is “a credit to an account without an off-setting debit” • The payment transaction brings positive interchange for the issuing member posting the credit • Payment transactions have been created for both Master. Card and Maestro branded products • The current interchange on both the Master. Card and Maestro account is $. 53 USD plus 19 BP To Main Menu To Next Section

How Does it Work? • Master. Card/Maestro payment transactions are used in end-to -end P 2 P Money Transfer solutions that rely on a Payment Service Provider to accept value, create the payment transaction, and enter it into the Master. Card system • The payment service provider acts as a merchant and pays the reverse interchange • The payment service provider interacts with the sender and receiver and charges a service fee • Originating value can be from cash, bank accounts, or credit cards To Main Menu To Next Section

What P 2 P Money Transfer Solutions Do They Support? The Master. Card/Maestro payment transactions were designed to enable P 2 P Money Transfer services that provide both online and offline service, domestically or globally. Models include, but are not limited to: • Internet P 2 P Money Transfer services accessed by PCs, kiosks, or other internet devices • Agent based services that can accept cash • Bank to bank services that move money onto credit or debit accounts To Main Menu To Next Section

What Does a Bank Have to Do to Use the New Payment Transactions? Member banks can use the new Master. Card/Maestro payments transactions in two ways: • Recipient Banks: complete the maintenance required to become certified to accept the payment transactions and complete the AML* compliance review • Sending Banks: develop in-house capability or partner an outside payment service provider platform to generate the payment transaction, (e. g. , Yahoo, Certi. Pay). Complete an AML compliance review • *AML = Anti-money laundering – See U. S. Patriot Act and FATFA To Main Menu To Next Section

Benefits of the Payment Transaction Enabling the Master. Card/Maestro payment transaction provides instant access to P 2 P Money Transfer • Banks can accept transactions from any participating funds transfer service • Banks can receive P 2 P Money Transfer transactions from any domestic or global originating point • Banks require no special development after becoming certified to create or accept the payment transaction • Banks can rely on the Master. Card global systems for P 2 P Money Transfer settlement and connectivity • Banks can use the payment transaction in a wide range of service designs To Main Menu To Next Section

Consumer Benefits Using the Master. Card/Maestro Payment Transactions wi provide a P 2 P Money Transfer Service that is: • Usually less expensive than agent-to-agent funds transfer services • Easier and safer than receiving and keeping cash • Easily accessed a hundreds of thousands of ATMs • Used immediately in millions of merchants worldwide To Main Menu To Next Section

The Role of the Payment Service Provider Money Transfer Services: Online and Agent-Based To Main Menu To Next Section

What is a Payment Service Provider? A payment service provider stands between the sender and the receiver Business Model Qualified merchant or Acquirer – Target Consumer Segment. Fully banked or underserved – Channels– Online or Face-to-Face Economics– Transaction-based fees, interchange, and FX Key Challenges – Ensure banks in the receiving markets are prepared to accept the payment transaction To Main Menu To Next Section

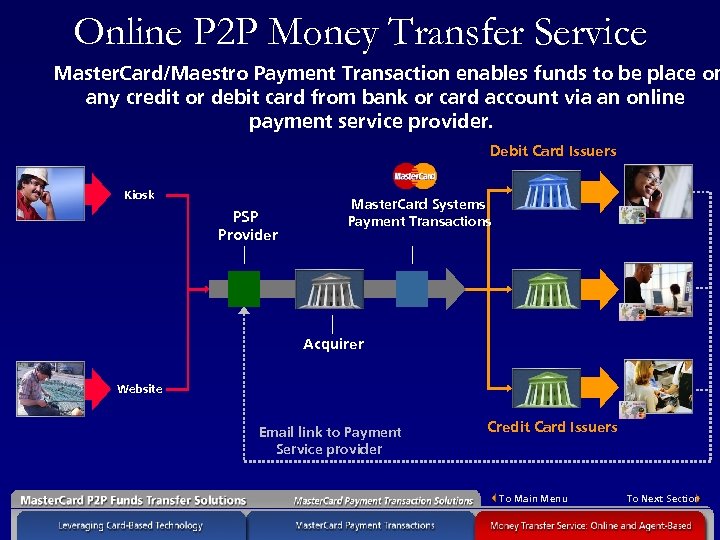

Payment Service Provider in an Online P 2 P Service Banks leverage online payment service provider to support money transfer Master. Card Solution Master. Card/Maestro Payment Transaction – Target Consumer Segment. Fully banked and technology aware – Channels– Online or kiosk Economics– Transaction-based fees, interchange, and FX Key Challenges – Ensure banks in the receiving markets are prepared to accept the payment transaction To Main Menu To Next Section

Online P 2 P Money Transfer Service • A member or co-brand partner offers the ability to send money to family and friends over their online website • Sender and recipient register to be a part of the service • The sender selects the account that will be used to fund the transfer and identifies the sender and a pass code • The sender reviews and accepts the fees and foreign exchange rates if applicable • The recipient receives an email message with a link to the P 2 P Money Transfer Service • The recipient enters their name, the pass code, and the Master. Card account to which the money will be transferred To Main Menu To Next Section

Online P 2 P Money Transfer Service Master. Card/Maestro Payment Transaction enables funds to be place on any credit or debit card from bank or card account via an online payment service provider. Debit Card Issuers Kiosk PSP Provider Master. Card Systems Payment Transactions Acquirer Website Email link to Payment Service provider Credit Card Issuers To Main Menu To Next Section

Online P 2 P Money Transfer Service How a Member Makes Money Service Provider • Service fees • Foreign exchange Acquirer Bank • Discount Rate Receiving Bank • Account fees • Interchange (Payment Transaction and Usage) To Main Menu To Next Section

Online P 2 P Money Transfer Service How the Member Will Sell It Online Promotion • Pop-up ads • Portal ads • Email ads To Main Menu To Next Section

Payment Service Provider in an Agent-Based P 2 P Service Banks leverage retail agents and a payment service provider to support money transfer Master. Card Solution Master. Card/Maestro Payment Transaction – Target Consumer Segment. Underserved – Channels– Retail agent Economics– Transaction-based fees, interchange, and FX Key Challenges – Establishing a retail relationship that appeals to the under served market—developing internal or outsourcing payment service provider capability To Main Menu To Next Section

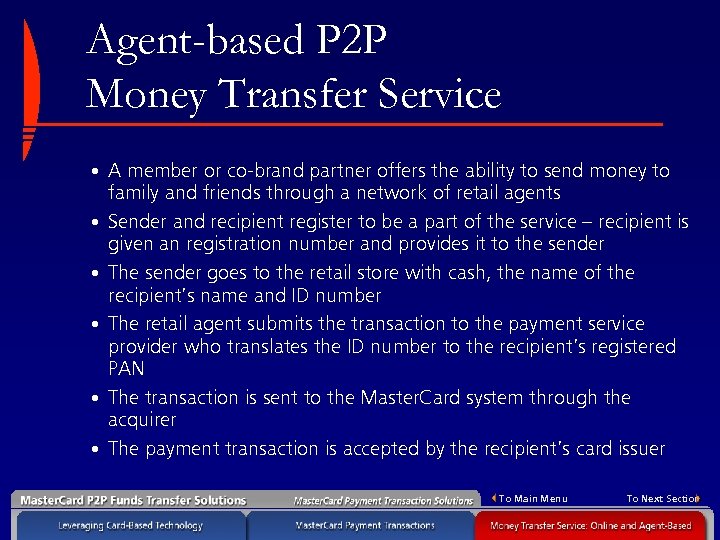

Agent-based P 2 P Money Transfer Service • A member or co-brand partner offers the ability to send money to • • • family and friends through a network of retail agents Sender and recipient register to be a part of the service – recipient is given an registration number and provides it to the sender The sender goes to the retail store with cash, the name of the recipient’s name and ID number The retail agent submits the transaction to the payment service provider who translates the ID number to the recipient’s registered PAN The transaction is sent to the Master. Card system through the acquirer The payment transaction is accepted by the recipient’s card issuer To Main Menu To Next Section

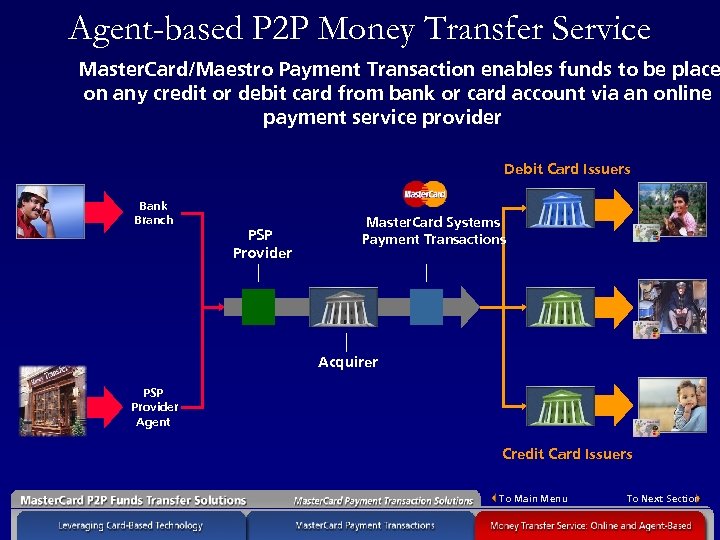

Agent-based P 2 P Money Transfer Service Master. Card/Maestro Payment Transaction enables funds to be place on any credit or debit card from bank or card account via an online payment service provider Debit Card Issuers Bank Branch PSP Provider Master. Card Systems Payment Transactions Acquirer PSP Provider Agent Credit Card Issuers To Main Menu To Next Section

Agent-based P 2 P Money Transfer Service How a Member Makes Money Agent • Commission • Foreign Exchange Acquirer Bank • Discount Rate Recipient Bank • Account fees • Interchange (Payment Transaction and Usage) To Main Menu To Next Section

Agent-based P 2 P Money Transfer Service How the Member Will Sell It • Targeted Local Market Promotion • Local print • Community Promotion (Ethnic associations, church groups) • Selected branch advertising To Main Menu To Next Section

Master. Card P 2 P Money Transfer Solutions Master. Card P 2 P Prepaid Cards Introduction: The Master. Card Prepaid Card Opportunity The Sender Centric Model The Recipient Centric Model Master. Card Prepaid Services To Main Menu To Next Section

Master. Card P 2 P Prepaid Cards Introduction: The Master. Card Prepaid Card Opportunity To Main Menu To Next Section

Master. Card P 2 P Prepaid Cards Prepaid cards can play a role in a number of P 2 P Solutions • Effective for targeting underserved/unbanked segments • A solution Master. Card members can support now using existing infrastructure • Low cost of entry • Sender-centric and/or receiver-centric programs To Main Menu To Next Section

Consumer Benefits of Using Prepaid Cards for P 2 P • Research indicates recurring money transfer consumers find prepaid cards an attractive proposition • Provides greater security and privacy than traditional transfers • Offers greater convenience for both sender and recipient • Can be less expensive for the consumer than current funds transfer options • Improves the personal self-worth of the underserved remittance customer To Main Menu To Next Section

Opportunities for Members at Either End of Funds Flow Supports Issuers in “Sending” and “Receiving" Countries Sending model Issuer offers a prepaid card account to sender with an additional access card for the recipient Receiving model Issuer offers recipient a card account to which funds are transferred by a participating sender To Main Menu To Next Section

Master. Card P 2 P Prepaid Cards The Sender Centric Model To Main Menu To Next Section

P 2 P Prepaid Card Sender Centric Model • A single prepaid account with two cards at a bank in the sending country • Sender and recipient name, address, and ID captured for AML compliance • Secondary card is delivered to recipient • Recipient uses cards at ATMs or POS • Sender can reload at designated locations using the primary card and photo ID for authentication • Sender has equal access to funds To Main Menu To Next Section

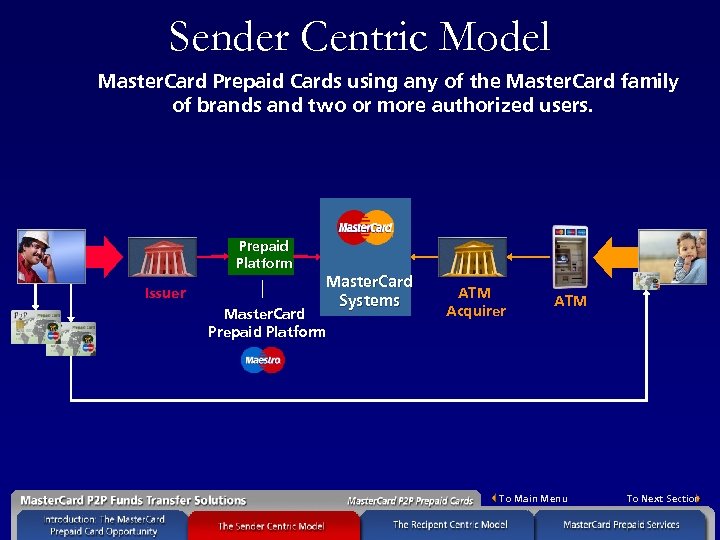

Sender Centric Model Master. Card Prepaid Cards using any of the Master. Card family of brands and two or more authorized users. Prepaid Platform Issuer Master. Card Systems Master. Card Prepaid Platform ATM Acquirer ATM To Main Menu To Next Section

P 2 P Prepaid Card Programs How a Member Makes Money Fees and float • Annual fees • Loading fees • Interchange (when used at POS or with the “payment” transaction) • Servicing fees • FX on sender centric model • Float To Main Menu To Next Section

P 2 P Prepaid Card Programs How the Member Will Sell It Targeted Local Market Promotion • Local print • Community Promotion (Ethnic associations, church groups) • Selected branch advertising To Main Menu To Next Section

Master. Card P 2 P Prepaid Cards The Recipient Centric Model To Main Menu To Next Section

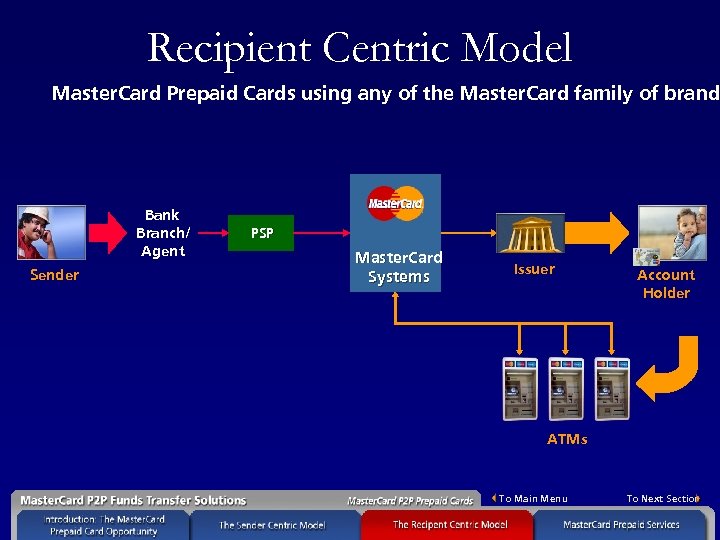

P 2 P Prepaid Card Recipient Centric Model • A single prepaid account at a bank in the receiving country • Recipient is the primary account holder – name, address, and ID captured for AML compliance • Recipient uses cards at ATMs or POS • Sender can send funds at designated branches or retail locations that are certified to send a payment transaction To Main Menu To Next Section

Recipient Centric Model Master. Card Prepaid Cards using any of the Master. Card family of brand Bank Branch/ Agent Sender PSP Master. Card Systems Issuer Account Holder ATMs To Main Menu To Next Section

P 2 P Recipient Centric Prepaid Card Programs How a Member Makes Money Fees and float • Annual fees • Loading fees • Interchange (when used at POS or with the “payment” transaction) • Servicing fees • Float To Main Menu To Next Section

P 2 P Recipient Centric Prepaid Card Programs How the Member Will Sell It Targeted Local Market Promotion • Local print • Community Promotion (Ethnic associations, church groups) • Selected branch advertising To Main Menu To Next Section

Master. Card P 2 P Prepaid Cards Master. Card Prepaid Services To Main Menu To Next Section

Master. Card Prepaid Services • Master. Card Prepaid Cards can be used with any proprietary or third party prepaid platform • Members are free to use a prepaid platform of their choice However, Master. Card Prepaid Services has features that makes it ideal for global funds transfer To Main Menu To Next Section

Master. Card Prepaid Services What is Master. Card Prepaid Services? • Prepaid is one of the processing services Master. Card delivers today using its core processing infrastructure – – Credit (Banknet) Debit (Banknet/MDS) Prepaid (PDC) Gateway Services To Main Menu To Next Section

Master. Card Prepaid Services • Master. Card processing services support prepaid programs using any of the Master. Card family of brands – Maestro/Cirrus – online, PIN – Master. Card/MCE – signature • Master. Card authorizes, clears and settles prepaid transactions, and manages balance information on behalf of issuing members To Main Menu To Next Section

Master. Card P 2 P Money Transfer Solutions Master. Card Family Account The Master. Card Family Account To Main Menu To Next Section

The Master. Card Family Account • A convenient "passive" recurring transfer solution – No need for either party to take action unless parent wants to change limit • A low risk way to give a Master. Card card to teens and young adults – Parent is accountholder • Can also be used for extended families or household employees To Main Menu To Next Section

Family Card Uses traditional bank card platform with card level controls Master. Card Solution Master. Card Family Card – Target Consumer Segment. Fully banks consumers – Channels– Bank branches or website Economics– Account fees, interchange, and interest income Key Challenges Limited to issuer customers – To Main Menu To Next Section

Family Card Components and Customer Experience Components • Bank card management platform • Bank branch or website • Master. Card branded cards with card level controls Customer. Experience 1. Primary account holder designates an authorized user 2. Primary account holder sets spending and credit limits 3. Authorized user uses card at POS or to access cash at ATMs or bank branches To Main Menu To Next Section

Family Card How a Member Makes Money Interest and Interchange • Interest on larger outstanding balances • Interchange from multiple users To Main Menu To Next Section

Family Card How the Member Will Sell It Targeted Direct Response • Direct Mail • Out Bound Calls • Targeted Take-one Applications To Main Menu To Next Section

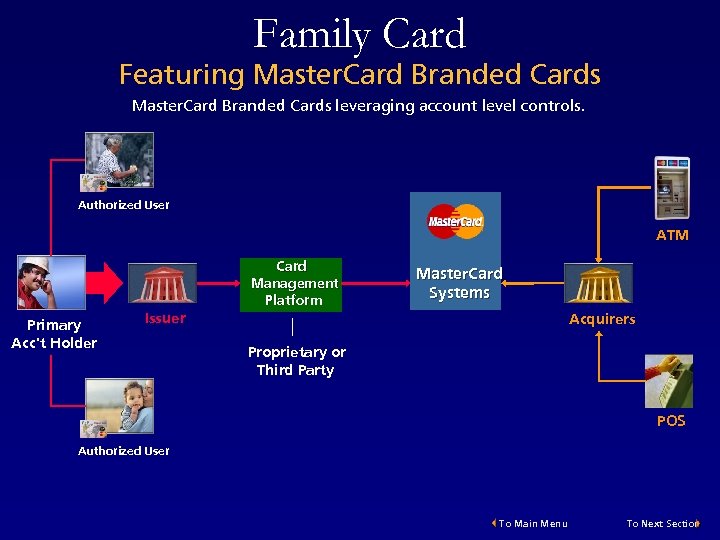

Family Card Featuring Master. Card Branded Cards leveraging account level controls. Authorized User ATM Card Management Platform Primary Acc’t Holder Master. Card Systems Issuer Acquirers Proprietary or Third Party POS Authorized User To Main Menu To Next Section

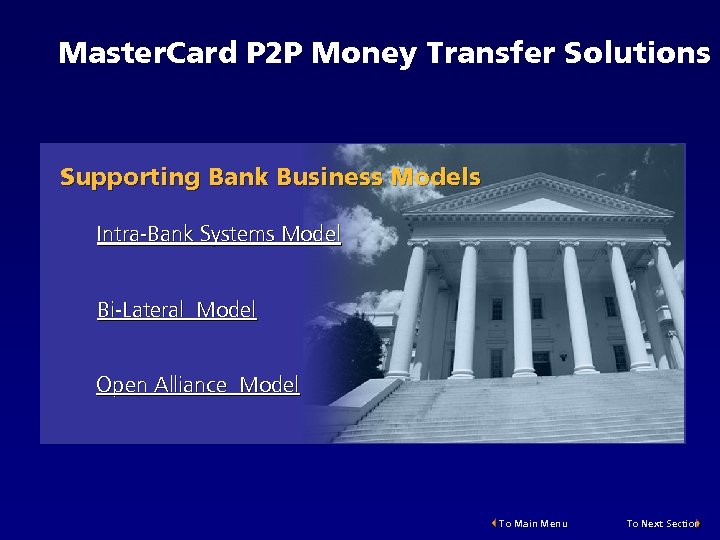

Master. Card P 2 P Money Transfer Solutions Supporting Bank Business Models Intra-Bank Systems Model Bi-Lateral Model Open Alliance Model To Main Menu To Next Section

Master. Card P 2 PPayment Money Transfer Solutions Intra-Bank Systems Model To Main Menu To Next Section

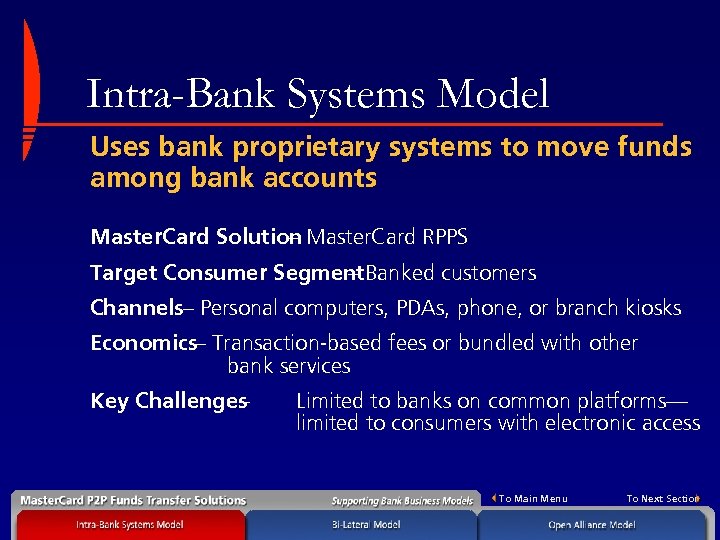

Intra-Bank Systems Model Uses bank proprietary systems to move funds among bank accounts Master. Card Solution Master. Card RPPS – Target Consumer Segment. Banked customers – Channels– Personal computers, PDAs, phone, or branch kiosks Economics– Transaction-based fees or bundled with other bank services Key Challenges – Limited to banks on common platforms— limited to consumers with electronic access To Main Menu To Next Section

Intra-Bank Systems Model Components and Customer Experience Components • • Electronic terminal (PC, phone, PDA, or kiosk) Bank branded Internet portal Electronic transaction processor (e. g. , Check. Free) Global network and transaction manager (Master. Card RPPS) Customer Experience 1. 2. 3. 4. 5. 6. Customer signs up for electronic banking service Accesses funds transfer option Enters recipient name and bank account information Selects source of funds from accounts with the bank Approves the transaction for delivery Recipient receives the funds automatically in DDA or credit card account To Main Menu To Next Section

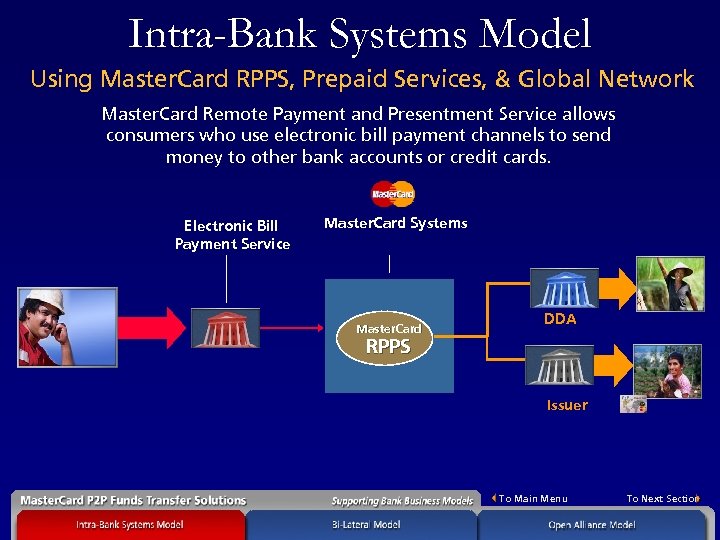

Intra-Bank Systems Model Using Master. Card RPPS, Prepaid Services, & Global Network Master. Card Remote Payment and Presentment Service allows consumers who use electronic bill payment channels to send money to other bank accounts or credit cards. Electronic Bill Payment Service Master. Card Systems Master. Card DDA RPPS Issuer To Main Menu To Next Section

Master. Card P 2 PPayment Money Transfer Solutions Bi-Lateral Model To Main Menu To Next Section

Bi-Lateral Model Banks develop a funds transfer among their customers using an agreed upon system Master. Card Solution Master. Card/Maestro Payment Transaction – Target Consumer Segment. Banked customers & underserved – Channels– Bank branches or electronic channels Economics– Transaction-based fees along with float Key Challenges Not a global solution – To Main Menu To Next Section

Bi-Lateral Model Components and Customer Experience Components • • Payment Service Provider platform. (Acquirer or merchant) One or more bank account(s). (DDA or Credit) Bank branch, bank kiosks, or bank agent retail locations Master. Card “payment transaction” Customer Experience 1. 2. 3. 4. 5. Sending customer signs up for bank branded funds transfer service Bank captures user profile and performs authentication Sender selects service from a terminal or is supported by a branch teller Sender identifies the recipient in the partner bank via a program ID Funds are sent to partner bank via PSP platform using the Master. Card/ Maestro “payment transaction” to credit card account or debit account To Main Menu To Next Section

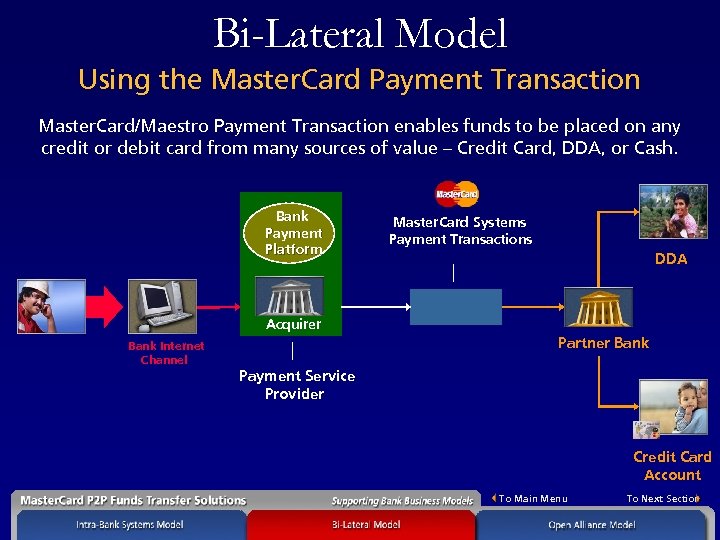

Bi-Lateral Model Using the Master. Card Payment Transaction Master. Card/Maestro Payment Transaction enables funds to be placed on any credit or debit card from many sources of value – Credit Card, DDA, or Cash. Bank Payment Platform Master. Card Systems Payment Transactions DDA Acquirer Partner Bank Internet Channel Payment Service Provider Credit Card Account To Main Menu To Next Section

Master. Card P 2 P Money Transfer Solutions Open Alliance Model To Main Menu To Next Section

Open Alliance Model Banks leverage an open alliance to provide their customers with global funds transfer capability Master. Card Solution Master. Card/Maestro Payment Transaction – Target Consumer Segment. Underserved – Channels– Participating retail agents Economics– Transaction-based fees, interchange, and FX Key Challenges Engage underserved consumer segment – To Main Menu To Next Section

Open Alliance Model Components and Customer Experience Components • • Payment Service Provider platform (Acquirer or Merchant) One or more bank account(s). (DDA or Credit) Bank branch, bank kiosks, or bank sponsored agent retail locations Master. Card/Maestro “payment transaction” Customer Experience 1. Sending customer signs up for bank branded funds transfer service at participating retail agent 2. Retail agent captures user profile and performs authentication 3. Sender identifies the recipient in the partner bank via a program ID 4. Funds are sent to any qualified Master. Card branded card using the Master. Card/Maestro “payment transaction” To Main Menu To Next Section

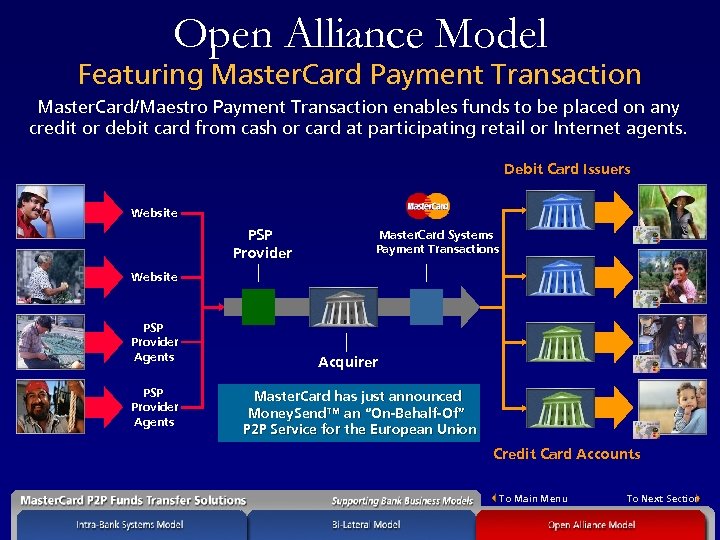

Open Alliance Model Featuring Master. Card Payment Transaction Master. Card/Maestro Payment Transaction enables funds to be placed on any credit or debit card from cash or card at participating retail or Internet agents. Debit Card Issuers Website PSP Provider Master. Card Systems Payment Transactions Website PSP Provider Agents Acquirer Master. Card has just announced Money. Send™ an “On-Behalf-Of” P 2 P Service for the European Union Credit Card Accounts To Main Menu To Next Section

Master. Card P 2 P Money Transfer Solutions Conclusion: Next Steps To Main Menu

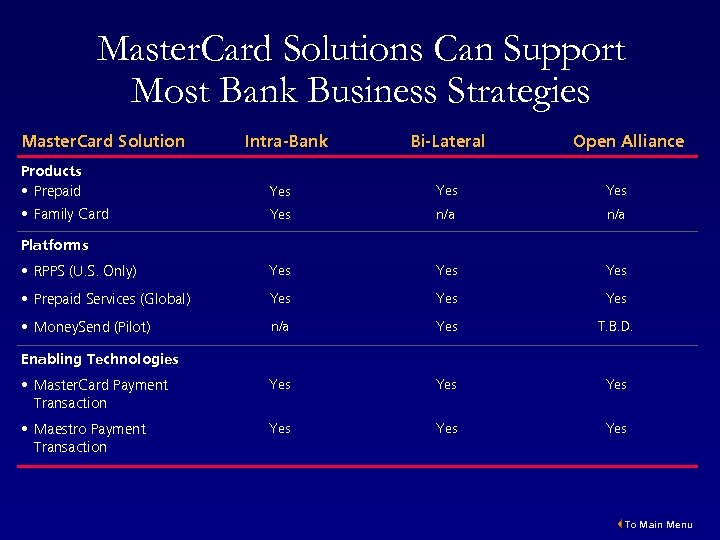

Master. Card Solutions Can Support Most Bank Business Strategies Master. Card Solution Products • Prepaid • Family Card Intra-Bank Bi-Lateral Open Alliance Yes Yes n/a • RPPS (U. S. Only) Yes Yes • Prepaid Services (Global) Yes Yes • Money. Send (Pilot) n/a Yes T. B. D. • Master. Card Payment Transaction Yes Yes • Maestro Payment Transaction Yes Yes Platforms Enabling Technologies To Main Menu

Master. Card Funds Transfer Card Next Steps. . . • Select customer segment • Select business model • Develop product and plan and requirements • Identify technology platform The team is ready to support you! To Main Menu

Master. Card Funds Transfer Solutions Consumers transferring money to other consumers represents a new opportunity for card issuers. Master. Card envisions a not too distant future when value is exchanged over a myriad of personal terminals. However, the business case today for person-toperson funds transfer is cross-border remittances. The Master. Card provides cross border solutions you can implement Today! To Main Menu

a92e1b18b4a2e011ba3682f110d83dd3.ppt