8dd16c1bb2b5b83225d821467ade35b1.ppt

- Количество слайдов: 46

Massachusetts Health Reform Update Lora Pellegrini Bill Graham April 2007

Massachusetts Health Reform Signed into law by Governor Romney on April 12, 2006 Chapter 58, Acts of 2006 q Legislation effective upon passage but many provisions have different effective dates. q Legislation received national attention and is viewed as potential model for other states. 2

Implementation Process 1. Chapter 58 provides a framework, but leaves it to the regulators to put the “meat on the bone”. The “meat” continues to be defined. 2. Many key regulatory decisions were made by the Romney Administration prior to leaving office. Patrick Administration under enormous pressure to change course. Many key decisions still not “final. ” 3. Battles waged on legislative front have shifted to the regulatory level and may end up back in the Legislature. 3

What’s Happened Since Law Passed? Tons!! Ø CMS approved changes to Mass. Health waiver, preserving $385 M in federal funding. Ø Connector up and running -- much more later. Ø DHCFP issued regulations on the Fair Share Assessment. Regs also issued on the Free Rider Assessment and the Health Insurance Responsibility Disclosure requirement and then pulled back. Ø Connector issued regulation on Section 125 plans Ø Two Technical Corrections Bills, changing certain effective dates, clarifying ambiguities and fixing mistakes, have been enacted. 4

The Connector A Refresher: § The law establishes 1 st in the nation aggregator of insurance. § The purpose is to connect individuals and small businesses to a wide array of insurance products – allowing more people to buy insurance with pre-tax dollars. § The Connector administers the Commonwealth Care and Commonwealth Choice programs. § The Connector is an Independent Authority. 5

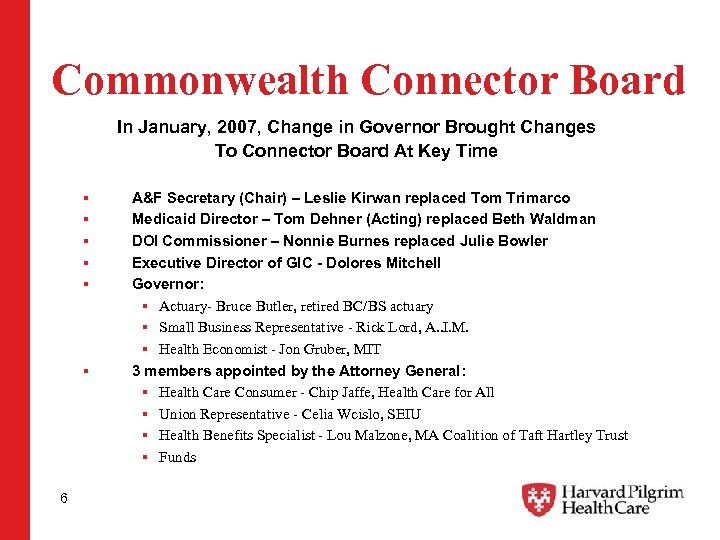

Commonwealth Connector Board In January, 2007, Change in Governor Brought Changes To Connector Board At Key Time § § § 6 A&F Secretary (Chair) – Leslie Kirwan replaced Tom Trimarco Medicaid Director – Tom Dehner (Acting) replaced Beth Waldman DOI Commissioner – Nonnie Burnes replaced Julie Bowler Executive Director of GIC - Dolores Mitchell Governor: § Actuary- Bruce Butler, retired BC/BS actuary § Small Business Representative - Rick Lord, A. . I. M. § Health Economist - Jon Gruber, MIT 3 members appointed by the Attorney General: § Health Care Consumer - Chip Jaffe, Health Care for All § Union Representative - Celia Wcislo, SEIU § Health Benefits Specialist - Lou Malzone, MA Coalition of Taft Hartley Trust § Funds

Connector (cont’d) Tasks Accomplished: ü Commonwealth Care -- Over 70, 000 are enrolled in this new program through the 4 Medicaid MCOs; ü Commonwealth Choice – 6 carriers (Harvard Pilgrim, Blue Cross, Tufts, Fallon, Neighborhood, Health New England) granted “Seal of Approval. ” Plans set to begin enrollment on May 1 st for Coverage on July 1 st. ü Sub. Connector Selected- SBSB will serve as Subconnector in conjunction with NBT. ü MCC and Affordability standards established. ü Section 125 emergency regulations issued ü Broker commissions set Tasks Delayed: ü Commonwealth Choice will not be available to contributing employers for 7/1. Now targeting 9/1. 7

Connector Broker Commissions will be set as follows: Ø $10. 00 per subscriber, per month. Ø Applies to group coverage regardless of whether employer is making a contribution. Ø Does not apply to “true” nongroup coverage (including young adults sold exclusively through Connector). 8

Connector Charged with Two Policy Key Decisions in 2007 (1) Setting Minimum Creditable Coverage; and ( 2 ) Setting the Affordability Standard—who, if anyone, will be exempt from the individual mandate? 9

Minimum Creditable Coverage Ø a/k/a/ “MCC” –This is the minimum level of coverage that a person needs in order to be in compliance with the individual mandate set to take effect on July 1, 2007. Ø There is NO obligation on an employer to offer MCC coverage -- the obligation rests with the individual to obtain MCC coverage. 10

When Setting MCC- the Connector Board Wanted: Ø No lifetime benefit maximum; Ø Deductibles capped at $2, 000 for individuals and $4, 000 for families annually; Ø Out-of-Pocket maximums capped at $5000 for an individual and $10, 000 for families annually; Ø Preventive care covered pre-deductible (3 visits for individuals and 6 for families); Ø RX coverage mandated with generics not subject to deductible despite there being no state RX mandate. Ø Ban or Grandfather HSAs despite their specific reference in the law. 11

But soon it was learned…… q If MCC went forward as previously outlined, over 500, 000 currently insured people would need to buy up! q Approximately 200, 000 do not have RX coverage or have coverage with generics subject to the deductible. q Approximately 360, 000 Massachusetts residents would not meet MCC because they work for companies that self insure and use lifetime maximums. q Approximately 19, 000 with HSAs would need to change coverage because HSAs would not meet MCC. And, finally, no other state has ever adopted such stringent standards. q 12

Minimum Creditable Coverage (cont’d) It was also learned that NO other state in the Nation has set: - a limit on out of pocket maximums; - a maximum annual deductible; - a prohibition on lifetime or annual caps; and NO other State has mandated RX coverage. … and remember - we are setting the floor for coverage here in Massachusetts. 13

So…. Where did they land? v After intense lobbying from Harvard Pilgrim, Tufts, Fallon, HNE and NHP along with key business groups such as A. I. M. , MTF, Boston Chamber, NFIB, Mass. AHU and the Retailers, the Connector decided that: v As of 7/1/2007 -Any health plan qualifies as MCC, but… 14

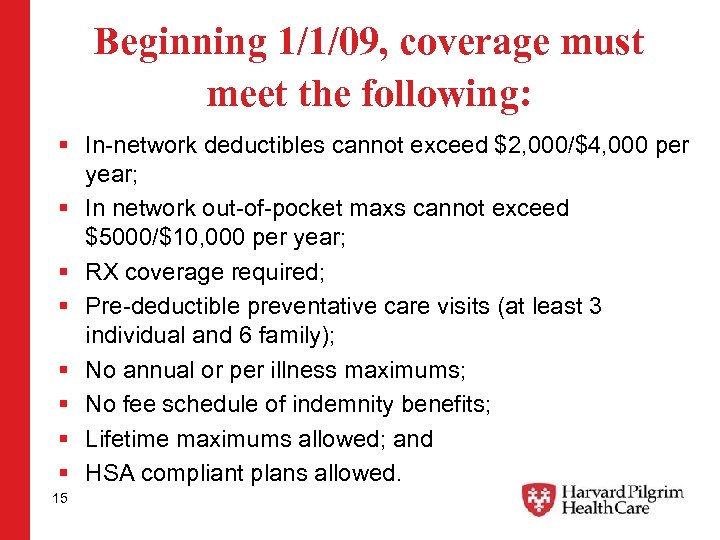

Beginning 1/1/09, coverage must meet the following: § In-network deductibles cannot exceed $2, 000/$4, 000 per year; § In network out-of-pocket maxs cannot exceed $5000/$10, 000 per year; § RX coverage required; § Pre-deductible preventative care visits (at least 3 individual and 6 family); § No annual or per illness maximums; § No fee schedule of indemnity benefits; § Lifetime maximums allowed; and § HSA compliant plans allowed. 15

It is worth noting here that: Ø Under the bill filed by former Governor Romney, MCC was defined as “Any health insurance policy that includes at least $100, 000 in hospitalization expenses. ” Ø The final bill that was signed into law left it to the Connector to determine the MCC standard. Ø This story may not be over…. draft regs in place, hearings to be held across the state and final regs to be adopted in June. This still could change! 16

The Bottom Line on MCC Because the more stringent standards apply starting in January 2009, employers need to adopt MCC compliant plans starting with February 2008 renewals to ensure that employees are not subject to penalties on their 2009 tax returns. 17

Affordability Standard/Individual Mandate § § § 18 Soon after the MCC battle, the Connector Board started working on an even thornier issue…. setting the “affordability standard” for the individual mandate. Under the individual mandate, effective 7/1/2007, all adults must have health insurance that meets the MCC standard, obtain an affordability waiver from the Connector or pay a tax penalty. Chapter 58 requires the Connector Board to annually set a schedule for how much individuals can afford to pay for insurance based on income. In conjunction with the affordability schedule, Connector will consider each individual’s circumstances, including the availability of employer sponsored coverage and/or coverage through a Section 125 plan. If an individual chooses to file an appeal, the penalty is held in abeyance until the appeal process is completed.

Affordability Standard Critical to set a narrow standard because: 1. Potential impact on the Market Merger—Will small groups be harmed disproportionately if we don’t get healthy, young lives into the risk pool? 2. Selection issues in the subsidized program evident in Commonwealth Care already. Connector Staff predict a 18% increase in trend if folks up to 300% of poverty are waived from the mandate; 3. Notion of Shared Responsibility and Universal Participation were cornerstones of Legislation—what happens if large classes of individuals are exempted from mandate—does broad based coalition begin to erode? 4. What happens to Uncompensated Care Pool? Key business issue. 5. Do Federal and State financing fall apart if everyone isn’t participating? 19

Where did the Players line up? Ø Jon Gruber- MIT Economist, Connector Board Member. Helped the House and Romney develop their bills. Claims to have most robust national data. Says folks generally under-report income. Based on his modeling, he says all Massachusetts uninsured can afford Commonwealth Care or Commonwealth Choice products. Ø GBIO-Surveyed approximately 635 people. Their initial position was that everyone under 500% FPL (approx. $50 K individual, $100 K family of 4) should be exempt from mandate. Ø Coalition of Business (AIM, Chamber, MTF, Mass. AHU and the health plans – Harvard Pilgrim, Tufts, NHP, Fallon) argued for a narrow standard. 20

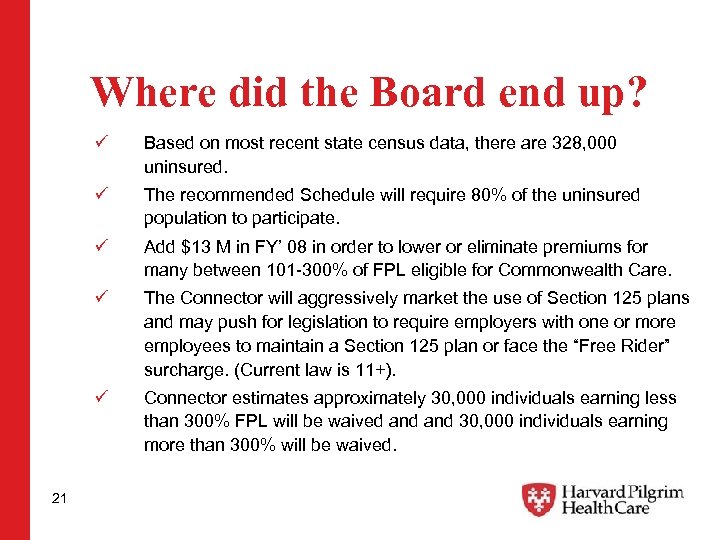

Where did the Board end up? ü ü The recommended Schedule will require 80% of the uninsured population to participate. ü Add $13 M in FY’ 08 in order to lower or eliminate premiums for many between 101 -300% of FPL eligible for Commonwealth Care. ü The Connector will aggressively market the use of Section 125 plans and may push for legislation to require employers with one or more employees to maintain a Section 125 plan or face the “Free Rider” surcharge. (Current law is 11+). ü 21 Based on most recent state census data, there are 328, 000 uninsured. Connector estimates approximately 30, 000 individuals earning less than 300% FPL will be waived and 30, 000 individuals earning more than 300% will be waived.

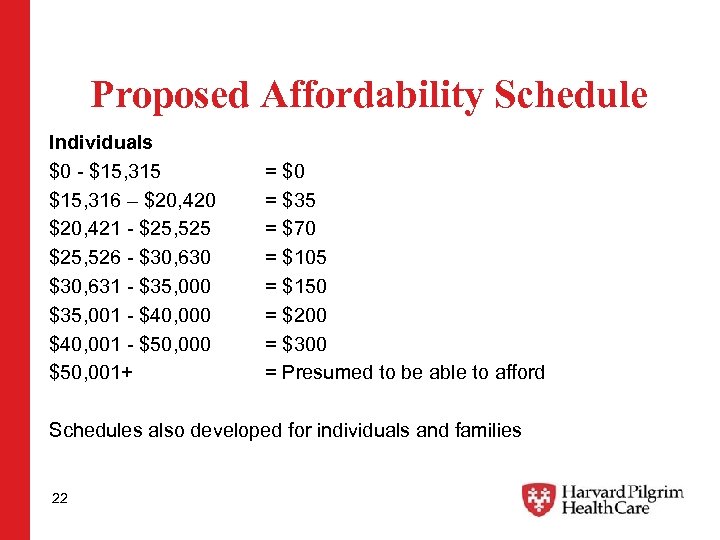

Proposed Affordability Schedule Individuals $0 - $15, 315 $15, 316 – $20, 420 $20, 421 - $25, 525 $25, 526 - $30, 630 $30, 631 - $35, 000 $35, 001 - $40, 000 $40, 001 - $50, 000 $50, 001+ = $0 = $35 = $70 = $105 = $150 = $200 = $300 = Presumed to be able to afford Schedules also developed for individuals and families 22

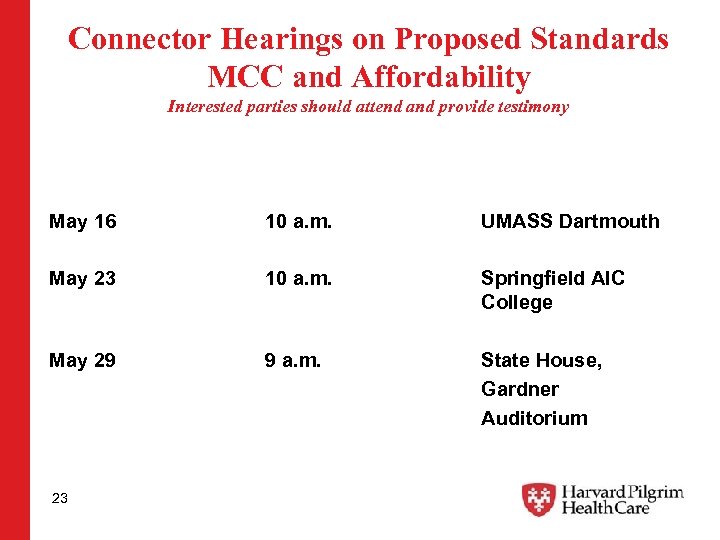

Connector Hearings on Proposed Standards MCC and Affordability Interested parties should attend and provide testimony May 16 10 a. m. UMASS Dartmouth May 23 10 a. m. Springfield AIC College May 29 9 a. m. State House, Gardner Auditorium 23

Commonwealth Connector Now let’s Remember what they were established to do…. . They are in the Business of Selling Insurance: § Sell Commonwealth Choice (Commercial market) § Sell Exclusively Subsidized Commonwealth Care (Low Income between 0 -300% FPL) § Sell Exclusively Young Adults Plan to Individuals age 19 -26. 24

Commonwealth Connector -Commercial Plans § Connector will begin to offer “Commonwealth Choice” as of 5/1/2007 with an effective date of coverage of 7/1/2007. § “Commonwealth Choice” is available to individuals and small businesses. Larger employers can offer it to non-benefit eligible employees. § Allows contributing small employers to implement an employee choice model. Employees can select within a suite of products – Remember, the earliest this will be available is September. § “Commonwealth Choice” plans have received the “Seal of Approval” from the Connector Board. “Seal” was awarded to plans that provide “high quality and good value”. 25

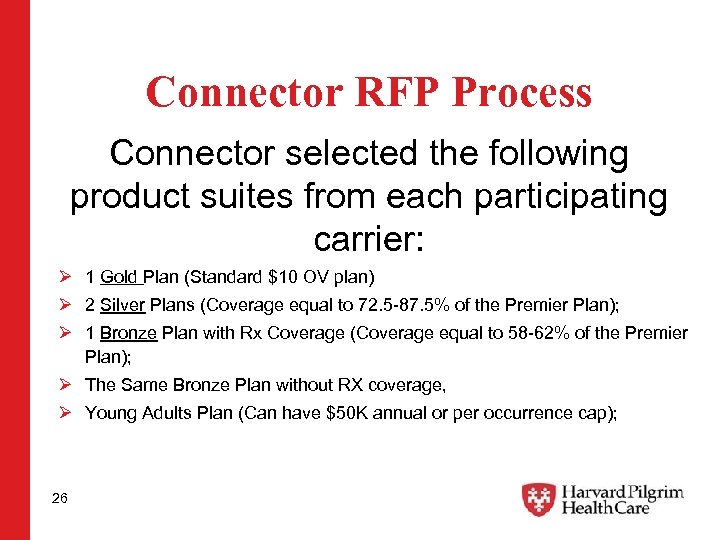

Connector RFP Process Connector selected the following product suites from each participating carrier: Ø 1 Gold Plan (Standard $10 OV plan) Ø 2 Silver Plans (Coverage equal to 72. 5 -87. 5% of the Premier Plan); Ø 1 Bronze Plan with Rx Coverage (Coverage equal to 58 -62% of the Premier Plan); Ø The Same Bronze Plan without RX coverage, Ø Young Adults Plan (Can have $50 K annual or per occurrence cap); 26

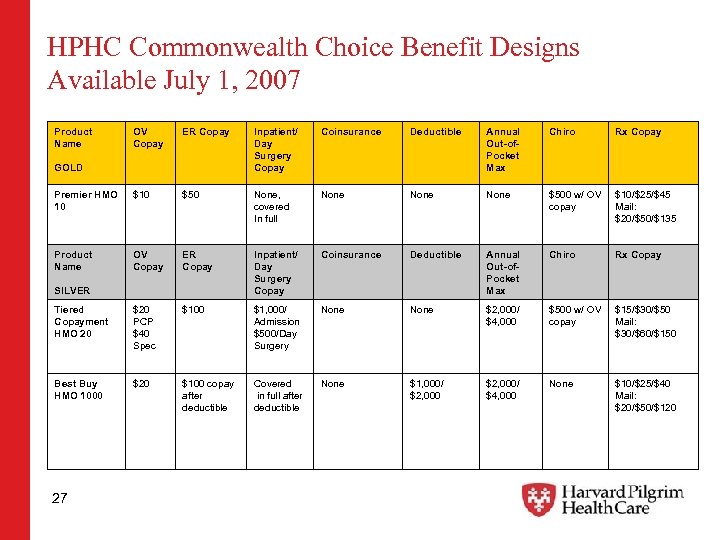

HPHC Commonwealth Choice Benefit Designs Available July 1, 2007 Product Name OV Copay ER Copay Inpatient/ Day Surgery Copay Coinsurance Deductible Annual Out-of. Pocket Max Chiro Rx Copay Premier HMO 10 $50 None, covered In full None $500 w/ OV copay $10/$25/$45 Mail: $20/$50/$135 Product Name OV Copay ER Copay Inpatient/ Day Surgery Copay Coinsurance Deductible Annual Out-of. Pocket Max Chiro Rx Copay Tiered Copayment HMO 20 $20 PCP $40 Spec $100 $1, 000/ Admission $500/Day Surgery None $2, 000/ $4, 000 $500 w/ OV copay $15/$30/$50 Mail: $30/$60/$150 Best Buy HMO 1000 $20 $100 copay after deductible Covered in full after deductible None $1, 000/ $2, 000/ $4, 000 None $10/$25/$40 Mail: $20/$50/$120 GOLD SILVER 27

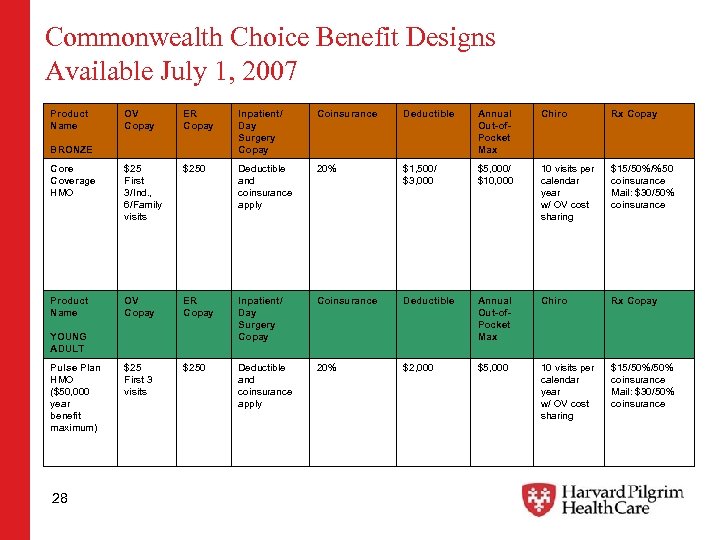

Commonwealth Choice Benefit Designs Available July 1, 2007 Product Name OV Copay ER Copay Inpatient/ Day Surgery Copay Coinsurance Deductible Annual Out-of. Pocket Max Chiro Rx Copay Core Coverage HMO $25 First 3/Ind. , 6/Family visits $250 Deductible and coinsurance apply 20% $1, 500/ $3, 000 $5, 000/ $10, 000 10 visits per calendar year w/ OV cost sharing $15/50%/%50 coinsurance Mail: $30/50% coinsurance Product Name OV Copay ER Copay Inpatient/ Day Surgery Copay Coinsurance Deductible Annual Out-of. Pocket Max Chiro Rx Copay $25 First 3 visits $250 Deductible and coinsurance apply 20% $2, 000 $5, 000 10 visits per calendar year w/ OV cost sharing $15/50% coinsurance Mail: $30/50% coinsurance BRONZE YOUNG ADULT Pulse Plan HMO ($50, 000 year benefit maximum) 28

Commonwealth Care 1. Sliding-scaled subsidy program established to help those low-wage earners (300% FPL or less) who do not qualify for Medicaid. 2. To be eligible, individual must be uninsured and must NOT have been eligible for employer-sponsored coverage in the past 6 months. 3. But, the Connector can allow those with access to employer-sponsored coverage to enroll if the employer is willing to pay premium contribution directly to the Connector. More to come from Connector on this in the coming months. 29

Commonwealth Care (cont’d) Ø Medicaid MCOs (Fallon, NHP, BMC, Cambridge) have “exclusivity” from July, 2006 -June 20, 2009 to sell Commonwealth Care and to receive subsidy payments. Ø Exclusivity abolished if Medicaid MCOs do not reach a combined enrollment of 40, 000 by 6/30/07 or 12 months after implementation. Ø If enrollment doesn’t meet 80, 000 target by 6/30/08 or 24 months after the program, non Medicaid MCOs may participate. 30

Commonwealth Care (cont’d) Ø Less than 100% FPL ($9, 700 individual / $16, 000 family of 3)– no premium, no deductibles, co-payments no greater than Medicaid. Products were available 10/1/06. Ø 101 -300% FPL ($29, 000 individual / $48, 000 for a family of 3)— sliding scale premium with no deductibles. Products were available on January 1, 2007. Ø Income standard for zero premium coverage is being increased to 150% FPL. Individuals earning between 100. 1% - 150% will have higher copays than those earning less than 100% FPL. Ø 70, 000 people enrolled as of today with some paying premium. 31

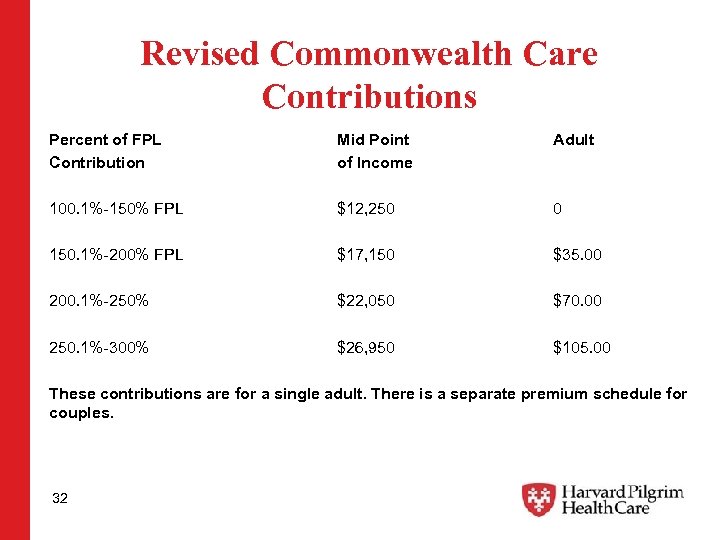

Revised Commonwealth Care Contributions Percent of FPL Contribution Mid Point of Income Adult 100. 1%-150% FPL $12, 250 0 150. 1%-200% FPL $17, 150 $35. 00 200. 1%-250% $22, 050 $70. 00 250. 1%-300% $26, 950 $105. 00 These contributions are for a single adult. There is a separate premium schedule for couples. 32

Merger of Small Group and Non-group ØMerger is central to both Romney and House visions for Health Reform. Ø Romney anticipated “individuals” rather than “groups” coming through the Connector – you must make insurance affordable at the “individual” level. Ø House saw individuals needing premium relief. Ø Merger estimated to drop rates for individuals by 15%. 33

Merger of Small Group and Non-group What about small business? Ø Special Commission found that merger would cause small group rates to increase by 1 -4% in year 1. Ø In subsequent years, rates may decrease by as much as 3. 2% or increase by as much as 6. 2% from what they would have been without the merger; Ø Impact will vary based on how many and what segments of the uninsured purchase coverage. MCC and Affordability will impact this Ø Some on Commission would like to revisit impact of merger in 2009 -2010. 34

Merger of Small Group and Non-group Small groups must continue to meet carrier participation and contribution requirements. Otherwise, carriers can require enrollment through the Connector. 2. All coverage sold through the Connector will be list billed and the “nongroup” group size adjustment will apply. 1. 35

Employer Responsibilities An update on: q Fair Share q Section 125 q Free Rider q Health Insurance Responsibility Disclosure (HIRD) q Dependent Coverage q Nondiscrimination 36

Employer Responsibility § “Fair Share Assessment: ” § Employers with 11+ FTEs must make a “fair and reasonable contribution” to health coverage. § Employers who do not make a “fair and reasonable contribution” will be assessed an amount not to exceed $295/employee/year § “Fair and reasonable” was not defined in the law, but was left to the regulators. § Effective 10/1/2006, but first payments not due until sometime after 9/30/2007. 37

“Fair Share Assessment” Final DHCFP regulations state that employers are making a “fair and reasonable contribution” if: Ø At least 25% of the business’s full-time (35+ hrs/wk) employees are enrolled in the business’s group health plan; or Ø The employer offers to pay at least 33% of the individual premium for its full-time employees. No minimum level of coverage is specified. 38

“Fair Share Assessment” Ø Under the DHCFP regs, part-time, seasonal and temporary workers are not counted when determining the 25% enrollment test or 33% contribution test. Ø However, if an employer does not make a “fair and reasonable” contribution for its full-time employees, the assessment will be calculated based on all employees who worked at least one month during the year, with a pro-rated contribution required for part-time, seasonal and temp workers. 39

“Fair Share Assessment” Political Fallout Ø Business groups say DHCFP regulations mirror legislative agreement. This is NOT A MANDATE. The $295 per head assessment was calculated based on Pool usage for employees of companies that do not offer insurance and do not pay into the pool. They argue that this is what legislative leaders agreed to! Ø Health Care for All and some key House and Senate leaders disagree. They say DHCFP standards are too low and that employers should make a 50% contribution towards employee health insurance. A contribution for part-time, temporary and seasonal workers also needs to be added to the equation and they argue that this was the legislative intent! Threats of legislation mandating 50% and a ballot initiative are on the table. Ø The Patrick Administration may need to address these arguments— the noise seems to be dying done on this one or is it? ? Possible funding source for more subsidies? 40

More Employer Responsibility: Section 125 Requirements Ø All Employers with 11+ employees must establish a Section 125 Plan that complies with Connector regulations. Ø Section 125 Plans, as defined by federal law, allow employees to purchase coverage with pre-tax dollars. Employer must process payroll deductions for premium payments. Ø Employers do not need to make a contribution towards the cost of coverage. Ø This requirement applies to both full-time and part-time employees. Ø Emergency regulations exempt: employees under age 18, temporary employees hired for less than 12 weeks, part-time employees working less than 64 hours per month, restaurant/bar staff earning less than $400/month, seasonal workers from other countries with travel insurance and interns/coop students. Ø Waiting periods for new employees cannot exceed 2 months. Ø Effective July 1, 2007 41

More Employer Responsibility: Free Rider Assessment ØEmployers with 11 or more employees who do not establish a Section 125 plan in accordance with regulations to be issued by the Connector may be assessed a surcharge if: • Their employees access free care a total of 5 x per year in the aggregate, or • One employee accesses free care 3 x in one year, and • Claims total at least $50 K in the aggregate. Ø Effective July 1, 2007 42

Free Rider Assessment cont’d… DHPFP regulation sets the penalty at 10 -55% of the cost of the care based on a number of factors, including: Ø the size of the employer, Ø the cost of the services Ø the number of visits or admissions paid for by the Pool, Ø compliance with the Health Insurance Responsibility Disclosure requirements, and Ø whether the employer was subject to the assessment during the prior year NOTE: Due to the Legislature's delay of the effective date of the Free Rider Assessment, DHCFP has repealed these regs and will reissue them with the correct date in the spring. 43

Health Insurance Responsibility Disclosure (HIRD) Ø Employers with 11 or more employees are required to annually report to the state whether they are in compliance with the Section 125 mandate. (Effective 7/1/2007) Ø Employers with 11 or more employees are required to collect signed statements from employees who decline coverage. The employer must retain the form for 3 years and provide it to the state upon request. (Effective 7/1/2007) Ø Employers (or their carrier acting on behalf of the employer) are required to issue employees “Health Insurance 1099 s” on an annual basis. Social Security Numbers cannot be included on the form. (Effective 1/1/2008) Ø Regs and Forms expected soon!. 44

Dependent Eligibility Ø Employers must cover dependents until age 26 or up to 2 years after loss of dependent status, per IRS code, whichever comes first. Ø Applies to fully-insured coverage only. Ø Effective January 1, 2007, irrespective of renewal date. 45

Nondiscrimination 1. Employers must offer same coverage to all full-time employees. 2. Employers cannot make a lower premium contribution to a low-wage employee than they do for a high-wage employee for the same product. 3. Applies to fully-insured coverage only. 4. Does not apply to employees covered by union contracts. 5. DOI Bulletin states the “full-time” is defined in the same manner as the DHCPF Fair Share regulations. 6. Effective July 1, 2007, delayed from January 1, 2007. 46

8dd16c1bb2b5b83225d821467ade35b1.ppt