16f3c2e915b65dece28bb521e2b3751c.ppt

- Количество слайдов: 19

Masaref Consulting Actual Global Limit AGL Session By Wagdy Mounir T 24 Technical Consultant

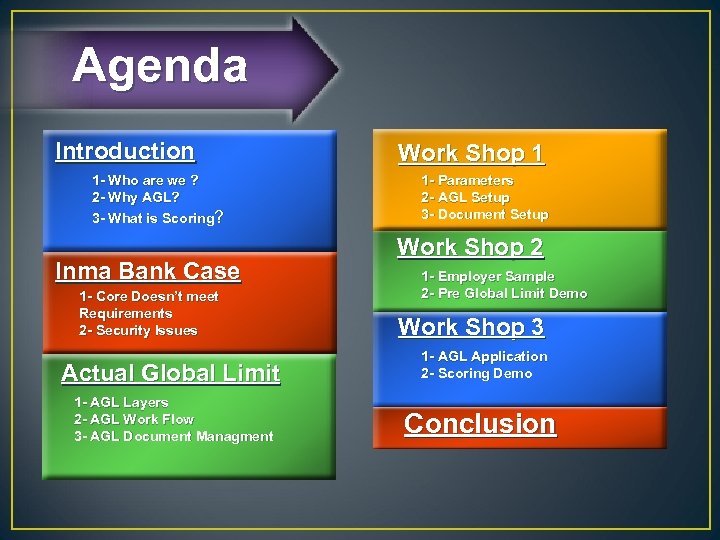

Agenda Introduction 1 - Who are we ? 2 - Why AGL? 3 - What is Scoring? Inma Bank Case 1 - Core Doesn’t meet Requirements 2 - Security Issues Work Shop 1 1 - Parameters 2 - AGL Setup 3 - Document Setup Work Shop 2 1 - Employer Sample 2 - Pre Global Limit Demo Work Shop 3 Actual Global Limit 1 - AGL Application 2 - Scoring Demo 1 - AGL Layers 2 - AGL Work Flow 3 - AGL Document Managment Conclusion

Introduction

Who Are We ? • MASAREF is a software solution and professional services company, specialized in Temenos T 24 and Islamic core banking system. • MASAREF is based in Dubai (UAE) and operating in the Middle East, our aim is to expand throughout the region.

Why AGL ? • Actual global limit is a very necessary product for any bank as based on it the bank can supply any of his products. • AGL. Make it secure for all Islamic and non-Islamic loans and products. • AGL. Keeps tracking on the customer scores. • AGL. Automated system to calculate the maximum funding for a specific customer • AGL. Calculate automatically the products that the customer is eligible for.

What Is Scoring ? • In T 24 each customer get his own scoring depends on some ready inserted parameters such as • • • Age Salary Car owner Occupation Profession Etc. Finally for each of this parameter values he get a score according to a predefined parameter table.

Inma Bank Case

Al-Inma Bank Pain Point There was two main big Pain Points : • Not satisfied by the core limit system • Security issues for the Saudi Market.

Actual Global Limit

AGL. Layers • Sector Layer • Employer sectors layer • Employer Layer • Non Saudi employer • Saudi Employer • Customer Date Filtration Layer • Based on customer provided data (Age and retirement age) • Military and non military customers handling • ESOB handeling. • Scoring Layer • As per the provided data per product.

AGL. Count. • • There are two types of Global Limit : • Actual Global Limit. • Preliminary Global Limit. Actual Global Limit (AGL) System is the T 24’s part that managed the first process of obtaining Personal Finance. The functionality supported by AGL System are: • applying for Global Limit • calculating customer’s scores • calculating Global Limit based on customer’s scores, • Applying for PF Products.

Prerequisite Configuration • • Employer Sector Approved employer Required documents and its samples Authorization person and their signatures Some parameters Rejection reasons GL types Military Rank

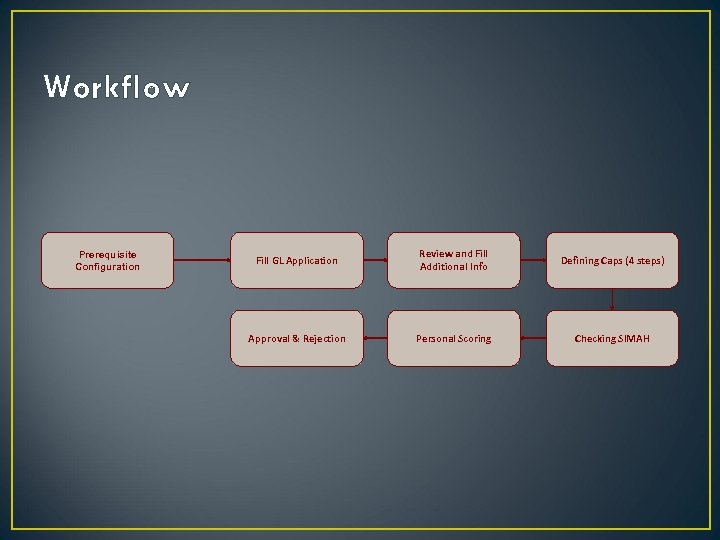

Workflow Prerequisite Configuration Fill GL Application Review and Fill Additional Info Defining Caps (4 steps) Approval & Rejection Personal Scoring Checking SIMAH

Work Shop 1

Work Shop 2

Work Shop 3

Conclusion • Masaref had designed a new Actual Global Limit module to satesfy the Saudian market needs • This Module is implemented and test in many areas • System in now live in Al inma Bank for example.

Questions And Answers

Thank You Masaref Consulting

16f3c2e915b65dece28bb521e2b3751c.ppt