c03cc33fb7fce1f778ececeaae17ca8c.ppt

- Количество слайдов: 26

Martinair Cargo Presentation ACI Cargo Subcommittee Meeting April 2006 Company Confidential

Company Confidential 2

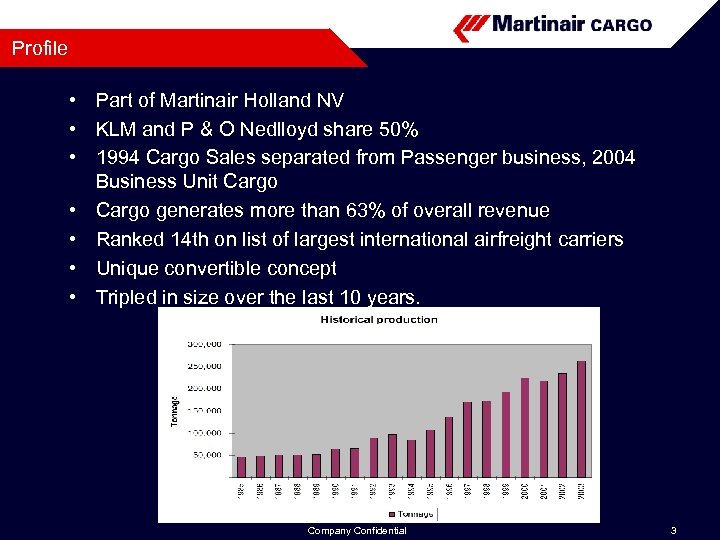

Profile • Part of Martinair Holland NV • KLM and P & O Nedlloyd share 50% • 1994 Cargo Sales separated from Passenger business, 2004 Business Unit Cargo • Cargo generates more than 63% of overall revenue • Ranked 14 th on list of largest international airfreight carriers • Unique convertible concept • Tripled in size over the last 10 years. Company Confidential 3

Fleet Company Confidential 4

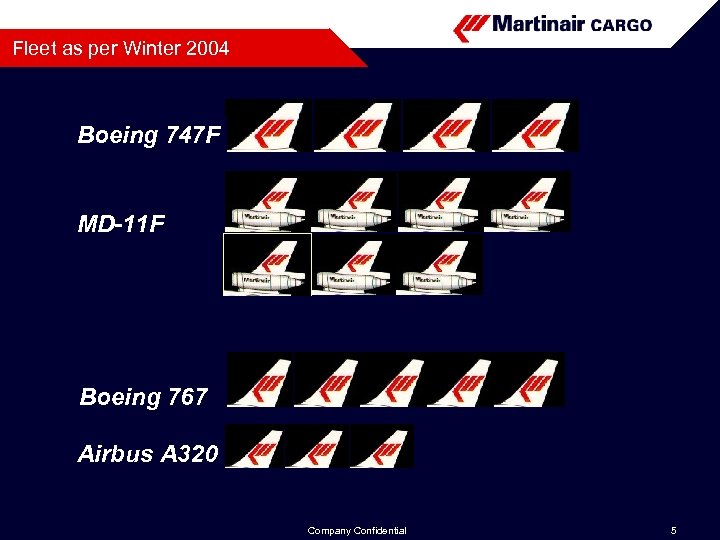

Fleet as per Winter 2004 Boeing 747 F MD-11 F Boeing 767 Airbus A 320 Company Confidential 5

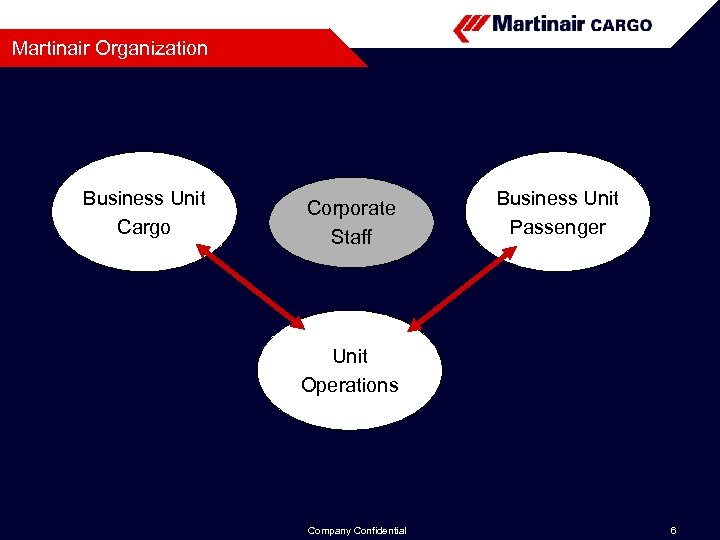

Martinair Organization Business Unit Cargo Corporate Staff Business Unit Passenger Unit Operations Company Confidential 6

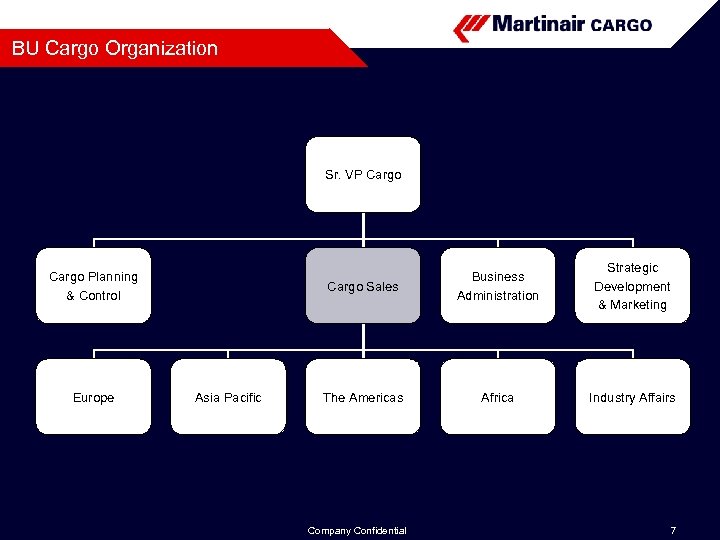

BU Cargo Organization Sr. VP Cargo Sales Cargo Planning & Control Europe Asia Pacific Business Administration Strategic Development & Marketing The Americas Africa Industry Affairs Company Confidential 7

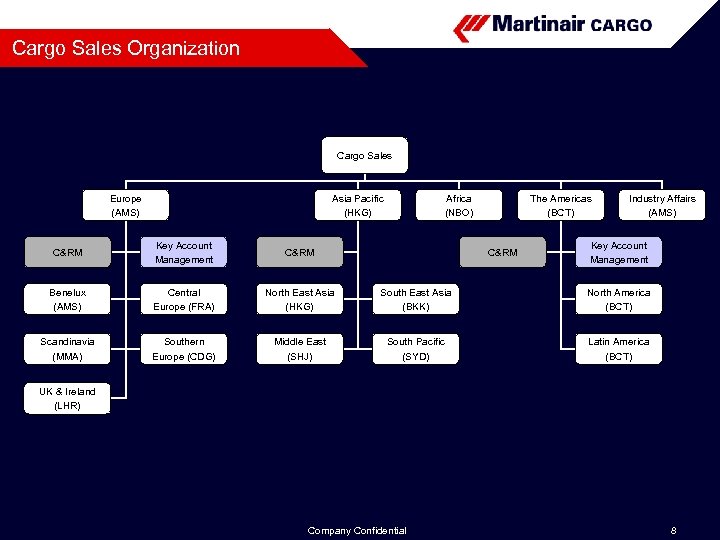

Cargo Sales Organization Cargo Sales Europe (AMS) Asia Pacific (HKG) Africa (NBO) The Americas (BCT) Industry Affairs (AMS) C&RM Key Account Management C&RM Benelux (AMS) Central Europe (FRA) North East Asia (HKG) South East Asia (BKK) North America (BCT) Scandinavia (MMA) Southern Europe (CDG) Middle East (SHJ) South Pacific (SYD) Latin America (BCT) C&RM Key Account Management UK & Ireland (LHR) Company Confidential 8

Online destinations Amsterdam Seattle Toronto Chicago Los Angeles Dallas Houston Guadalajara Mexico Guatemala Tianjin Beirut Atlanta Bahrain Sharjah Doha Muscat Miami San Juan Nanjing Hong Kong Bangkok San Jose Bogota Quito Kigali Entebbe Nairobi Lima Harare Johannesburg Santiago Sydney Buenos Aires Company Confidential 9

Hub concept Amsterdam Europe Miami Far East The Americas Hong Kong Africa Company Confidential Nairobi 10

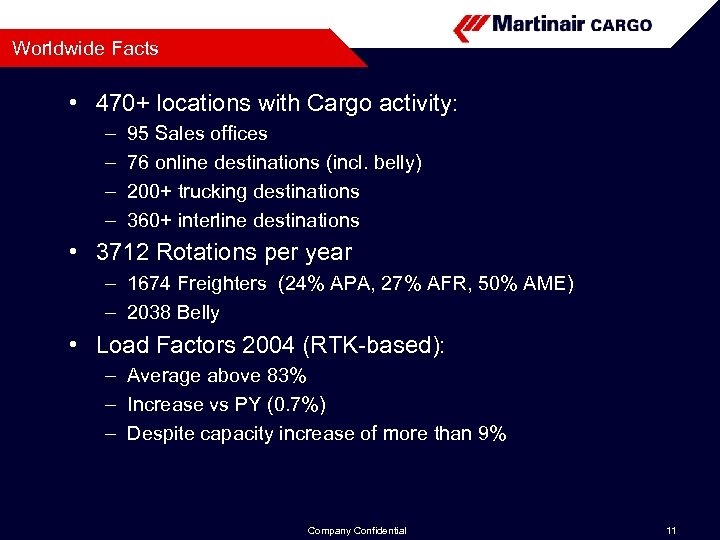

Worldwide Facts • 470+ locations with Cargo activity: – – 95 Sales offices 76 online destinations (incl. belly) 200+ trucking destinations 360+ interline destinations • 3712 Rotations per year – 1674 Freighters (24% APA, 27% AFR, 50% AME) – 2038 Belly • Load Factors 2004 (RTK-based): – Average above 83% – Increase vs PY (0. 7%) – Despite capacity increase of more than 9% Company Confidential 11

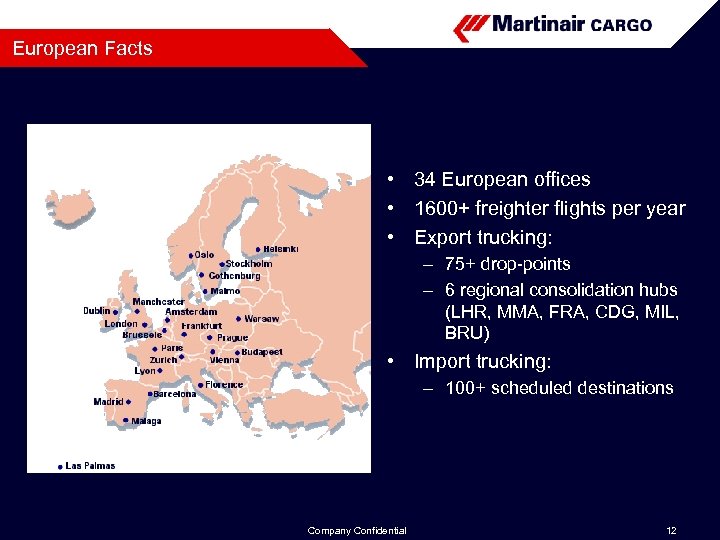

European Facts • 34 European offices • 1600+ freighter flights per year • Export trucking: – 75+ drop-points – 6 regional consolidation hubs (LHR, MMA, FRA, CDG, MIL, BRU) • Import trucking: – 100+ scheduled destinations Company Confidential 12

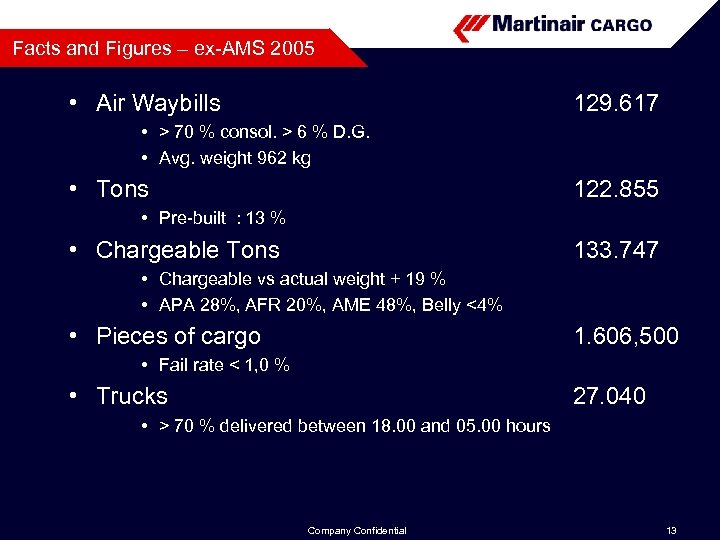

Facts and Figures – ex-AMS 2005 • Air Waybills 129. 617 • > 70 % consol. > 6 % D. G. • Avg. weight 962 kg • Tons 122. 855 • Pre-built : 13 % • Chargeable Tons 133. 747 • Chargeable vs actual weight + 19 % • APA 28%, AFR 20%, AME 48%, Belly <4% • Pieces of cargo 1. 606, 500 • Fail rate < 1, 0 % • Trucks 27. 040 • > 70 % delivered between 18. 00 and 05. 00 hours Company Confidential 13

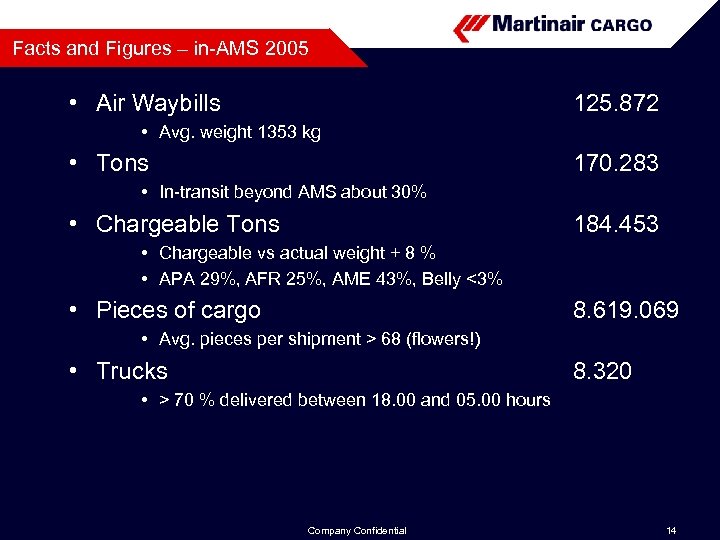

Facts and Figures – in-AMS 2005 • Air Waybills 125. 872 • Avg. weight 1353 kg • Tons 170. 283 • In-transit beyond AMS about 30% • Chargeable Tons 184. 453 • Chargeable vs actual weight + 8 % • APA 29%, AFR 25%, AME 43%, Belly <3% • Pieces of cargo 8. 619. 069 • Avg. pieces per shipment > 68 (flowers!) • Trucks 8. 320 • > 70 % delivered between 18. 00 and 05. 00 hours Company Confidential 14

Key-Competencies (external) • • Perishable traffic Dangerous goods Oversized/outside dimensions Animal traffic Pharma (part) Charters, special projects Customer specific solutions Company Confidential 15

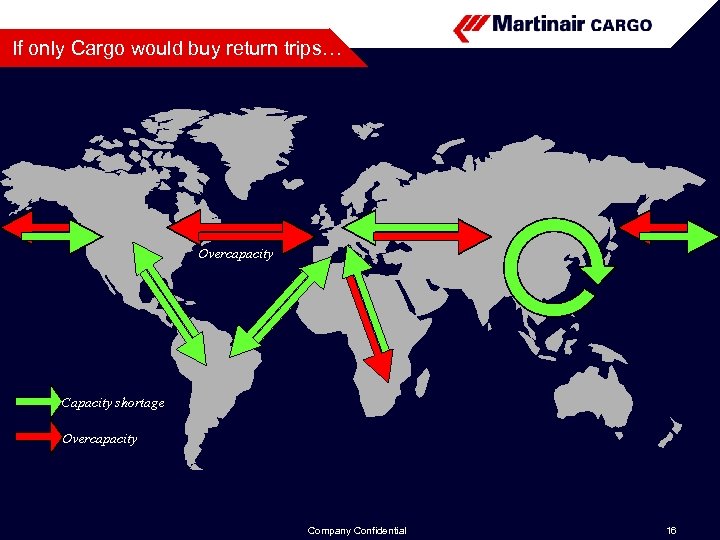

If only Cargo would buy return trips… Overcapacity Capacity shortage Overcapacity Company Confidential 16

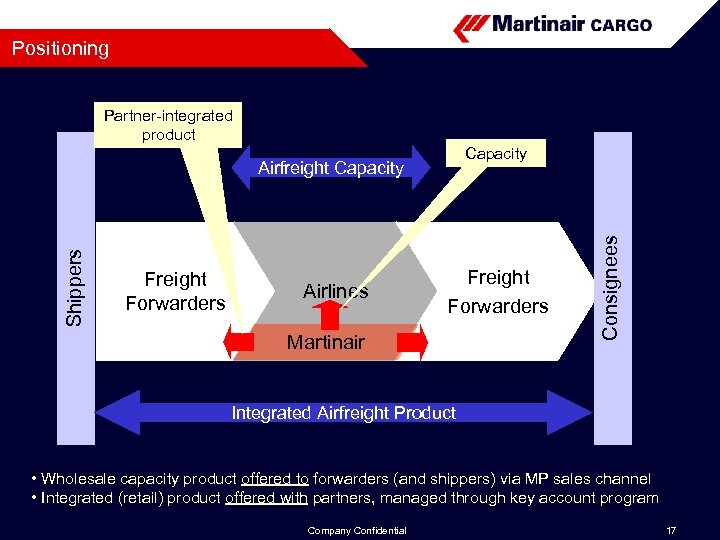

Positioning Partner-integrated product Shippers Airfreight Capacity Freight Forwarders Airlines Freight Forwarders Martinair Consignees Capacity Integrated Airfreight Product • Wholesale capacity product offered to forwarders (and shippers) via MP sales channel • Integrated (retail) product offered with partners, managed through key account program Company Confidential 17

Mission/Vision • We provide our business partners worldwide cargo services, to the benefit of all stake holders. • We want to be viewed as an independent, professional and preferred airline. • We strive for operational excellence by continuously improving our business processes. • We need to be the most efficient competitor in our markets. Company Confidential 18

Martinair Cargo Strategy • Sustained growth: To remain a serious player in the industry by: – reducing seasonal fluctuation in capacity, – expanding the network, first frequencies, then destinations, – leveraging specific areas of expertise (e. g. , perishables), – and an increased customer intimacy by being a forwarder's preferred airline, focusing on key accounts. • Based on a foundation of "Operational Excellence": An improved quality/consistency and efficiency of: – Cargo business processes (e. g. , efficiency, benchmarked performance) – the Cargo organization (e. g. , skills/training, responsibilities, accountability) – ICT capabilities (e. g. , information and electronic communication systems) Company Confidential 19

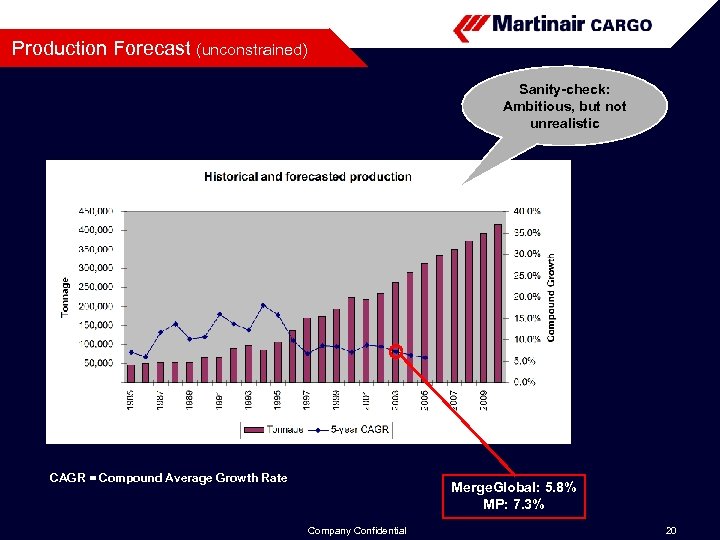

Production Forecast (unconstrained) Sanity-check: Ambitious, but not unrealistic CAGR = Compound Average Growth Rate Merge. Global: 5. 8% MP: 7. 3% Company Confidential 20

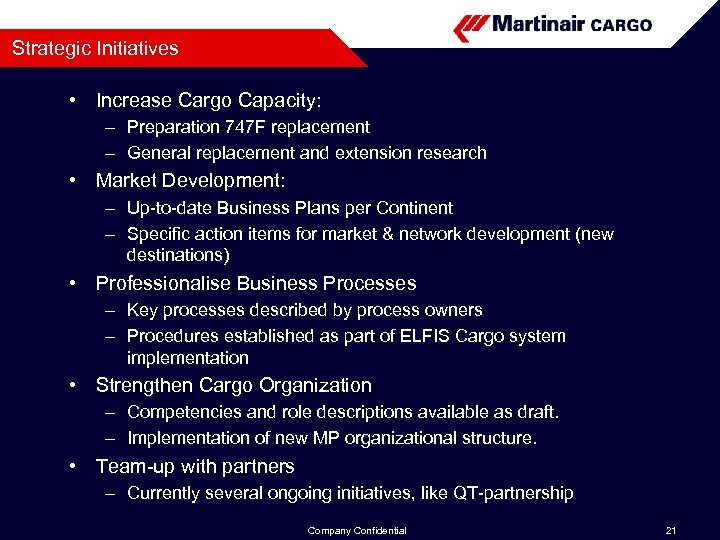

Strategic Initiatives • Increase Cargo Capacity: – Preparation 747 F replacement – General replacement and extension research • Market Development: – Up-to-date Business Plans per Continent – Specific action items for market & network development (new destinations) • Professionalise Business Processes – Key processes described by process owners – Procedures established as part of ELFIS Cargo system implementation • Strengthen Cargo Organization – Competencies and role descriptions available as draft. – Implementation of new MP organizational structure. • Team-up with partners – Currently several ongoing initiatives, like QT-partnership Company Confidential 21

MP 747 cargo fleet • • • Boeing 747 -200/300 PH-BUH Oct 1975 PH-MCE Feb 1987 PH-MCF Sep 1988 PH-MCN Oct 1991 phase out 15 Dec 2006 phase out 18 Feb 2007 phase out 05 Nov 2007 phase out after Feb 2008 • • • Boeing 747 -400 BCF PH-MPP PH-MPQ PH-MPR PH-MPS phase in 16 Nov 2006 phase in 14 Feb 2007 phase in 29 Oct 2007 phase in 27 Feb 2008 Company Confidential 22

Market information • MIDDLE/FAR-EAST • Eastbound: relief goods, hard cargo, vegetables, cattle • Westbound: electronics, wearing apparel, consumer goods • AFRICA • Southbound: relief goods, hard cargo, machinery, car parts • Northbound: mainly perishables • USA/NORTH- and MIDDLE AMERICA • Westbound: hard cargo, livestock, cars • Eastbound: electronics, hard cargo, perishables • SOUTH AMERICA • Southbound: hard cargo, livestock, “half products” • Northbound: some “finished goods”, perishables Company Confidential 23

Aircraft type comparison • AMS-shj-sin-SYD-HKG-bkk-shj-AMS. Carrying 93 tons eb and 100 tons wb 747 -200 appears to be > 10 % more costly than a MD-11 with 80 tons both ways, but appears be be heavily VOLUME restricted • AMS-tip-nbo-JNB-HRE-NBO-ben-AMS. Carrying 92 tons sb and 95 tons nb 747 -200 appears to be > 10 % more costly than a MD-11 with 80 ton both ways, but FREQUENTIE (peaks) is here more important than payload Company Confidential 24

Aircraft type comparison • AMS-sju-SCL-LIM-BOG-sju-AMS carrying 71 tons sb and 72 tons nb 747 -200 appears to be approx. 25 % more costly than a MD-11 with 67 tons sb and 69 tons nb, but payload difference is not that significant so clear choice: MD-11. • AMS-atl-MEX-LAX-atl-AMS carrying 76 tons wb and 87 tons eb 747 -200 appears to be approx. 30 % more costly than a MD-11 with 69 tons wb and 78 tons eb, here same as above payload difference not that significant so clear choice: MD-11 Company Confidential 25

747 -400/747 -200 freighter comparison • Due to its volume the Boeing 747 is the most suitable aircraft to fly to and from the Asia-Pacific region. • A Boeing 747 -400 BCF operates 12. 6 % more economical (mainly fuel consumtion) than a Boeing 747 -200. • Newer aircraft, newer engines, less crew, better aerodynamics: LESS COSTS • An ongoing development Company Confidential 26

c03cc33fb7fce1f778ececeaae17ca8c.ppt