d4cefc62a06e284e5978057b573e4207.ppt

- Количество слайдов: 11

Markets for Electric Power Produced in Bulgaria Sofia – March 12, 2007 Krassimir Nenov, Commercial Operations Director Enel Maritza East 3 AD

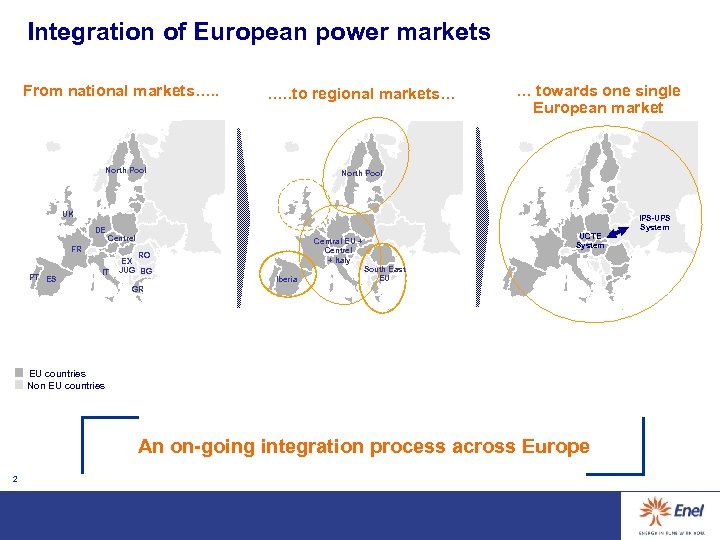

Integration of European power markets From national markets…. . to regional markets… North Pool … towards one single European market North Pool UK DE Centrel FR PT ES IT RO EX JUG BG Central EU + Centrel + Italy Iberia UCTE System South East EU GR EU countries Non EU countries An on-going integration process across Europe 2 IPS-UPS System

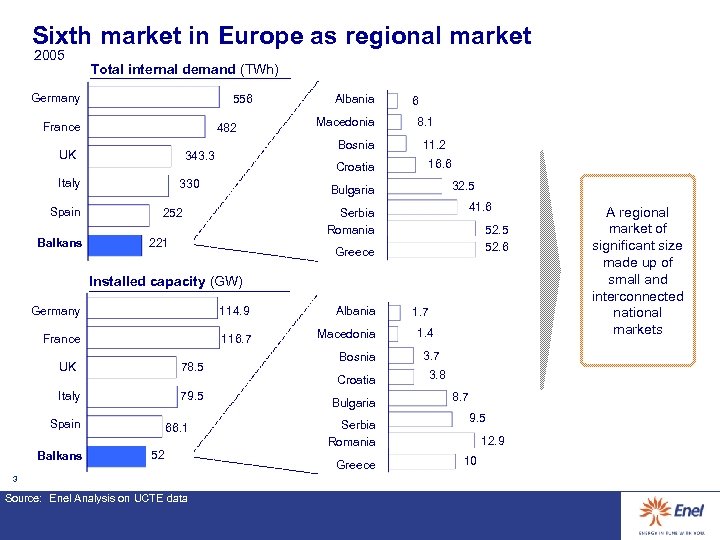

Sixth market in Europe as regional market 2005 Total internal demand (TWh) Germany 556 France 482 UK Spain Balkans Macedonia Bosnia 343. 3 Italy Albania Croatia 330 6 8. 1 11. 2 16. 6 32. 5 Bulgaria 252 41. 6 Serbia Romania 221 52. 5 52. 6 Greece Installed capacity (GW) Germany 114. 9 Albania France 116. 7 Macedonia UK 78. 5 Italy 79. 5 Spain Balkans 66. 1 52 3 Source: Enel Analysis on UCTE data Bosnia Croatia Bulgaria Serbia Romania Greece 1. 7 1. 4 3. 7 3. 8 8. 7 9. 5 12. 9 10 A regional market of significant size made up of small and interconnected national markets

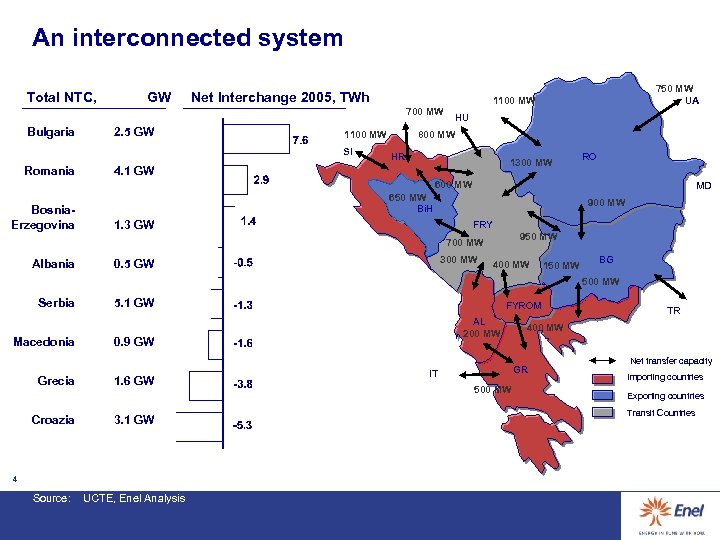

An interconnected system Total NTC, GW Net Interchange 2005, TWh 700 MW Bulgaria 2. 5 GW 1100 MW SI Romania 750 MW UA 1100 MW HU 800 MW HR 1300 MW 4. 1 GW RO 600 MW Bosnia. Erzegovina MD 650 MW Bi. H 1. 3 GW 900 MW FRY 950 MW 700 MW Albania 300 MW 0. 5 GW 400 MW 150 MW BG 500 MW Serbia Macedonia Grecia 5. 1 GW FYROM AL 200 MW 0. 9 GW 1. 6 GW Croazia 3. 1 GW Source: UCTE, Enel Analysis 4 400 MW GR IT 500 MW TR Net transfer capacity Importing countries Exporting countries Transit Countries

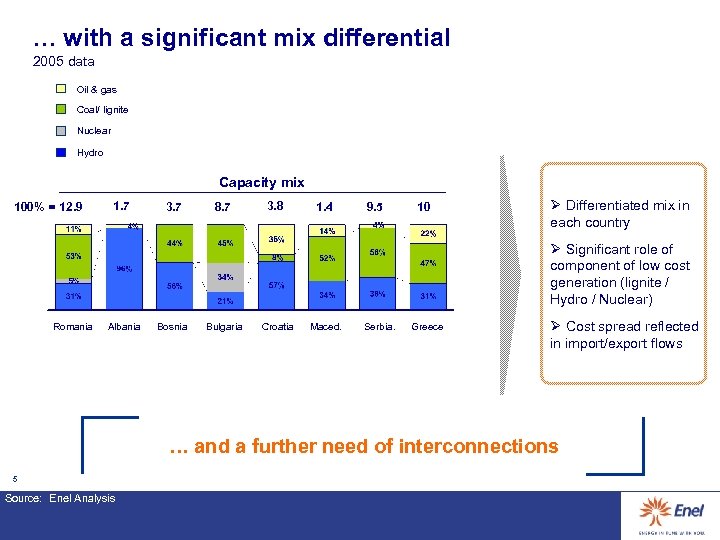

… with a significant mix differential 2005 data Oil & gas Coal/ lignite Nuclear Hydro Capacity mix 100% = 12. 9 1. 7 3. 7 8. 7 3. 8 1. 4 9. 5 10 Ø Differentiated mix in each country Ø Significant role of component of low cost generation (lignite / Hydro / Nuclear) Romania Albania Bosnia Bulgaria Croatia Maced. Serbia. Greece Ø Cost spread reflected in import/export flows … and a further need of interconnections 5 Source: Enel Analysis

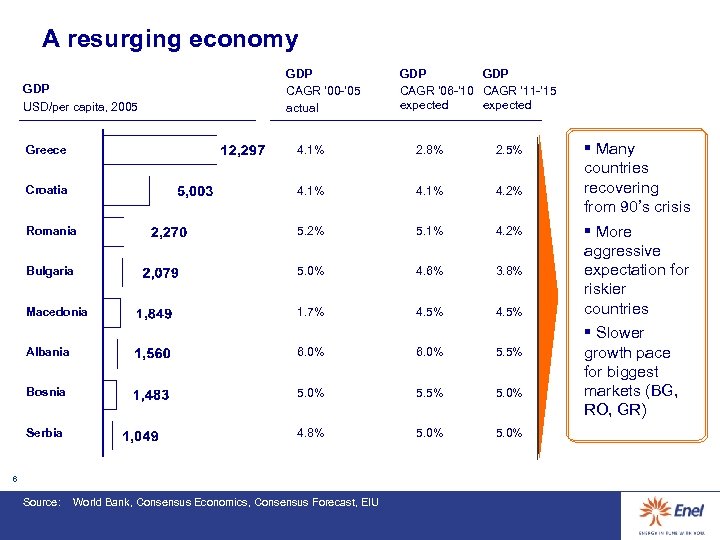

A resurging economy GDP USD/per capita, 2005 GDP CAGR ’ 00 -’ 05 actual GDP CAGR ’ 06 -’ 10 CAGR ’ 11 -’ 15 expected Greece 4. 1% 2. 8% 2. 5% Croatia 4. 1% 4. 2% Romania 5. 2% 5. 1% 4. 2% Bulgaria 5. 0% 4. 6% 3. 8% Macedonia 1. 7% 4. 5% Albania 6. 0% 5. 5% Bosnia 5. 0% 5. 5% 5. 0% Serbia 4. 8% 5. 0% 6 Source: World Bank, Consensus Economics, Consensus Forecast, EIU § Many countries recovering from 90’s crisis § More aggressive expectation for riskier countries § Slower growth pace for biggest markets (BG, RO, GR)

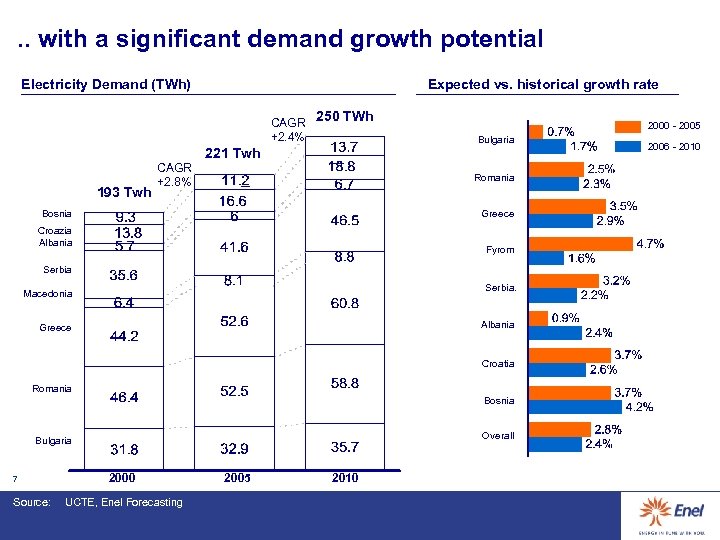

. . with a significant demand growth potential Electricity Demand (TWh) Expected vs. historical growth rate CAGR 250 TWh +2. 4% 193 Twh CAGR +2. 8% 2000 - 2005 Bulgaria 221 Twh Romania Bosnia Greece Croazia Albania Fyrom Serbia. Macedonia Albania Greece Croatia Romania Bosnia Overall Bulgaria 7 Source: 2000 UCTE, Enel Forecasting 2005 2010 2006 - 2010

Project opportunities UA HU Romania: Ø Conversion from oil to coal of Braila Plant (350 MW) Ø Cernavoda Nuclear power plant, unit 3 and 4 construction (2 x 700 MW) Ø Rehabilitation of Lignite Complexes (Craiova 800 MW, Rovinari 1100 MW, Turceni 1500 MW) SI RO HR Bi. H FRY BG FYROM AL Bulgaria: Ø Extension of Martiza East 3 lignite plant (700 -800 MW) Ø Belene Nuclear power plant construction (2 x 1000 MW) IT TR GR Greece: Ø New CCGT (400 MW) 8 New opportunities account for 7000 MW of additional capacity

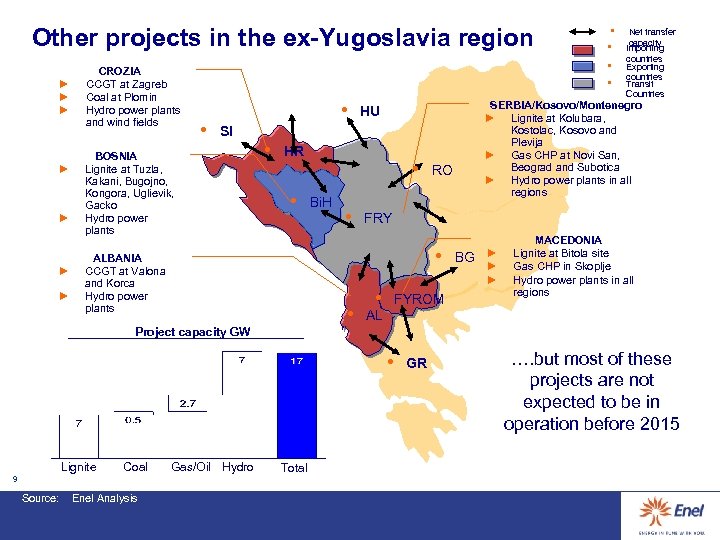

Other projects in the ex-Yugoslavia region ► ► ► ► CROZIA CCGT at Zagreb Coal at Plomin Hydro power plants and wind fields • • SI BOSNIA Lignite at Tuzla, Kakani, Bugojno, Kongora, Uglievik, Gacko Hydro power plants • • • Bi. H • RO FRY • ALBANIA CCGT at Valona and Korca Hydro power plants • Net transfer capacity Importing countries Exporting countries Transit Countries SERBIA/Kosovo/Montenegro ► Lignite at Kolubara, Kostolac, Kosovo and Plevija ► Gas CHP at Novi San, Beograd and Subotica ► Hydro power plants in all regions HU HR • • • FYROM BG ► ► ► MACEDONIA Lignite at Bitola site Gas CHP in Skoplje Hydro power plants in all regions AL Project capacity GW • Lignite Coal 9 Source: Enel Analysis Gas/Oil Hydro Total GR …. but most of these projects are not expected to be in operation before 2015

Regional market: new assets market position (2015) Belene and Maritza East 3 Extension are extremely competitive on a Regional basis where they would serve as a base-load generators Greek CCGTs Romanian Lignite Bulgarian/Serbian Lignite Maritza East 3 Ext. Belene 8232 Hydro+CHP 10 15294 Nuclear 18258 30064 Lignite Coal 37958 46414 Gas Oil

Drivers of an expanding energy market for SEE q Significant demand growth potential q Strong need for investment in new capacity q Additional connection grids with neighbouring countries q Early stages of market liberalization and privatization q Favorable environment for new entrants thanks to EU rules A growing and liberalizing macro-regional market 11

d4cefc62a06e284e5978057b573e4207.ppt