e31368274255abbeadc112d093c583f4.ppt

- Количество слайдов: 19

Markets and Financing PV Power Plants 2009 - USA December 10, 2009 Global Renewable Energy Team Yujing Shu – Beijing Ivan Chiang – Shanghai Kevin Murphy – Singapore Paul de Cordova – Dubai Christian Hullmann – Berlin Dirk Michels - Palo Alto PL 31963 -v 2 James Chen – Taipei Choo Lye Tan – Hong Kong Pallavi Mehta Wahi – India Owen Waft – London Eric Freedman – Seattle Fred Greguras - Palo Alto Maria Cull - London Steve Rhyne – North Carolina James O’Hare - Boston David Brown – Austin Mark Fleisher - Miami Timothy Weston - Harrisburg Kevin Burnett - Portland Elizabeth Thomas - Seattle Fred Greguras Palo Alto Office fred. greguras@klgates. com 650. 798. 6708

Markets and Financing PV Power Plants 2009 - USA December 10, 2009 Global Renewable Energy Team Yujing Shu – Beijing Ivan Chiang – Shanghai Kevin Murphy – Singapore Paul de Cordova – Dubai Christian Hullmann – Berlin Dirk Michels - Palo Alto PL 31963 -v 2 James Chen – Taipei Choo Lye Tan – Hong Kong Pallavi Mehta Wahi – India Owen Waft – London Eric Freedman – Seattle Fred Greguras - Palo Alto Maria Cull - London Steve Rhyne – North Carolina James O’Hare - Boston David Brown – Austin Mark Fleisher - Miami Timothy Weston - Harrisburg Kevin Burnett - Portland Elizabeth Thomas - Seattle Fred Greguras Palo Alto Office fred. greguras@klgates. com 650. 798. 6708

Overview § Financing Policies in the U. S. § Financing Structures in the U. S. § RPS Policies in the U. S. § China Market and Policies § India Market and Policies § Other Markets 1

Overview § Financing Policies in the U. S. § Financing Structures in the U. S. § RPS Policies in the U. S. § China Market and Policies § India Market and Policies § Other Markets 1

U. S. Market Financing Polices and Sources of Project Revenue § No single federal or state policy is sufficient; a financing tool kit of policies is needed that are available at the same time § U. S. has a comprehensive set of financing policies but is not a homogeneous market § Feed-in-tariffs (state) § Clean Renewable Energy Bonds (CREBs) § Federal 30% cash grant in lieu of investment tax credit or ITC § Bonus depreciation for 2009 (not cash) § Loan guarantee program § Renewable Energy Certificates § Power purchase agreement payments (project revenue) § PBI rebate (California) – commercial sales only not sales to utilities § Renewable Portfolio Standards (state) 2

U. S. Market Financing Polices and Sources of Project Revenue § No single federal or state policy is sufficient; a financing tool kit of policies is needed that are available at the same time § U. S. has a comprehensive set of financing policies but is not a homogeneous market § Feed-in-tariffs (state) § Clean Renewable Energy Bonds (CREBs) § Federal 30% cash grant in lieu of investment tax credit or ITC § Bonus depreciation for 2009 (not cash) § Loan guarantee program § Renewable Energy Certificates § Power purchase agreement payments (project revenue) § PBI rebate (California) – commercial sales only not sales to utilities § Renewable Portfolio Standards (state) 2

Clean Renewable Energy Bonds § $2. 2 B in bond issuances approved in October, 2009 by U. S. Treasury for qualified issuers such as local utilities, electric coops, etc. § Could help move many public sector solar projects into construction. § Federal tax credit to the investor in lieu of payment of a portion of interest on the bonds. § 42% solar – about $900 M in allocations. Many small installations under 1 MW; largest solar project about 6 MW § Buy American provisions not applicable § Press release and list of projects authorized for issuances at http: //www. ustreas. gov/press/releases/tg 333. htm and at the links in the press release. 3

Clean Renewable Energy Bonds § $2. 2 B in bond issuances approved in October, 2009 by U. S. Treasury for qualified issuers such as local utilities, electric coops, etc. § Could help move many public sector solar projects into construction. § Federal tax credit to the investor in lieu of payment of a portion of interest on the bonds. § 42% solar – about $900 M in allocations. Many small installations under 1 MW; largest solar project about 6 MW § Buy American provisions not applicable § Press release and list of projects authorized for issuances at http: //www. ustreas. gov/press/releases/tg 333. htm and at the links in the press release. 3

Federal Cash Grant in Lieu of Investment Tax Credit (I) § 30% cash as opposed to investment tax credit available in 2009 -2010; thereafter reverts to ITC only unless cash grant is extended by Congress. § The simpler ITC may be acceptable to investors with tax liability § Investor owned utilities are eligible § Payments by Treasury (over $1 B) is starting to provide some predictability for financeability for project finance but not yet much pay out for solar projects § Payment is to be made by Treasury within 60 days after the later of when a complete application is received or the project is placed in service. Current processing time is more than 60 days. 4

Federal Cash Grant in Lieu of Investment Tax Credit (I) § 30% cash as opposed to investment tax credit available in 2009 -2010; thereafter reverts to ITC only unless cash grant is extended by Congress. § The simpler ITC may be acceptable to investors with tax liability § Investor owned utilities are eligible § Payments by Treasury (over $1 B) is starting to provide some predictability for financeability for project finance but not yet much pay out for solar projects § Payment is to be made by Treasury within 60 days after the later of when a complete application is received or the project is placed in service. Current processing time is more than 60 days. 4

Federal Cash Grant in Lieu of Investment Tax Credit (II) § Applications may be submitted as soon as a facility is under construction. This should be done in order to receive the fastest payment. § “Under construction” generally means that at least 5% of the total cost of the facility has been incurred. § Must be “under construction” by December 2010 5

Federal Cash Grant in Lieu of Investment Tax Credit (II) § Applications may be submitted as soon as a facility is under construction. This should be done in order to receive the fastest payment. § “Under construction” generally means that at least 5% of the total cost of the facility has been incurred. § Must be “under construction” by December 2010 5

Federal Bonus Depreciation § Bonus depreciation of 50% applies only through 12/31/2009 unless extended by Congress. This should be extended at least through 2010 so it has time to be a financing tool § Deduction reduces taxable income; not a cash rebate § Solar energy project property is in the Modified Accelerated Cost-Recovery System (MACRS) 5 year class § 85% of the basis may be depreciated § 5 MW, $25 M facility will have more than $12 M in depreciation in year one. Cash savings of about $5 M in California where combined federal and state corporate tax rate is 40. 7%. 6

Federal Bonus Depreciation § Bonus depreciation of 50% applies only through 12/31/2009 unless extended by Congress. This should be extended at least through 2010 so it has time to be a financing tool § Deduction reduces taxable income; not a cash rebate § Solar energy project property is in the Modified Accelerated Cost-Recovery System (MACRS) 5 year class § 85% of the basis may be depreciated § 5 MW, $25 M facility will have more than $12 M in depreciation in year one. Cash savings of about $5 M in California where combined federal and state corporate tax rate is 40. 7%. 6

DOE Financial Institutions Partnership Program Loan Guarantee Program § Banks are the applicants. Lending committee of banks will evaluate whether the underlying loan should be approved assuming there is no guarantee § Not all banks will participate § Guarantees not likely implemented until 3 rd quarter 2010 § Value is to reduce the cost of credit and make the financing math work better but cost of complicated application process may offset § Guarantees are generally limited to 80% of project costs. § Borrower and other principals must make a significant cash investment in the project. § DOE may determine an appropriate collateral package among creditors. 7

DOE Financial Institutions Partnership Program Loan Guarantee Program § Banks are the applicants. Lending committee of banks will evaluate whether the underlying loan should be approved assuming there is no guarantee § Not all banks will participate § Guarantees not likely implemented until 3 rd quarter 2010 § Value is to reduce the cost of credit and make the financing math work better but cost of complicated application process may offset § Guarantees are generally limited to 80% of project costs. § Borrower and other principals must make a significant cash investment in the project. § DOE may determine an appropriate collateral package among creditors. 7

Financing Structures (I) § Utility financed and owned § Rate payer base limitations § PPA with buyout option § Purchase and sale agreement (Turn-key ownership) § Joint development § Module manufacturer financed § Financial statement limitations § PPA with or without buyout option § Purchase and sale agreement (Turn-key ownership) § Joint development 8

Financing Structures (I) § Utility financed and owned § Rate payer base limitations § PPA with buyout option § Purchase and sale agreement (Turn-key ownership) § Joint development § Module manufacturer financed § Financial statement limitations § PPA with or without buyout option § Purchase and sale agreement (Turn-key ownership) § Joint development 8

Financing Structures (II) § Project developer project finance § Working capital limitations § PPA with and without buyout option § Purchase and sale agreement (Turn-key ownership) § Joint development § NRG Energy/First Solar take out model § 21 MW solar project in Blythe, California § “Largest utility scale PV solar generation facility” in California § NRG’s first solar facility but others in the pipeline § Large energy output, late stage of development; lower risk § First Solar will operate and maintain the facility 9

Financing Structures (II) § Project developer project finance § Working capital limitations § PPA with and without buyout option § Purchase and sale agreement (Turn-key ownership) § Joint development § NRG Energy/First Solar take out model § 21 MW solar project in Blythe, California § “Largest utility scale PV solar generation facility” in California § NRG’s first solar facility but others in the pipeline § Large energy output, late stage of development; lower risk § First Solar will operate and maintain the facility 9

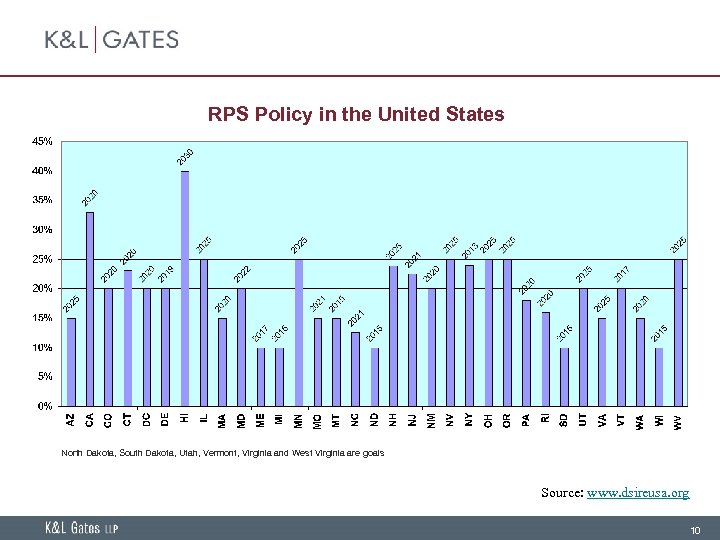

RPS Policy in the United States North Dakota, South Dakota, Utah, Vermont, Virginia and West Virginia are goals Source: www. dsireusa. org 10

RPS Policy in the United States North Dakota, South Dakota, Utah, Vermont, Virginia and West Virginia are goals Source: www. dsireusa. org 10

RPS Impact on Solar Project Financing § RPS growing at the state level; national level RPS still in discussion stage § RPS by itself will not enable financing because consequences for failure to meet RPS are not meaningful § Key factors in achieving RPS targets that states can influence § Meaningful feed-in-tariff for large projects § More financing friendly standard PPAs – What will banks finance? § Transmission line improvements § Faster and lower cost interconnect process § Expedited permitting approvals 11

RPS Impact on Solar Project Financing § RPS growing at the state level; national level RPS still in discussion stage § RPS by itself will not enable financing because consequences for failure to meet RPS are not meaningful § Key factors in achieving RPS targets that states can influence § Meaningful feed-in-tariff for large projects § More financing friendly standard PPAs – What will banks finance? § Transmission line improvements § Faster and lower cost interconnect process § Expedited permitting approvals 11

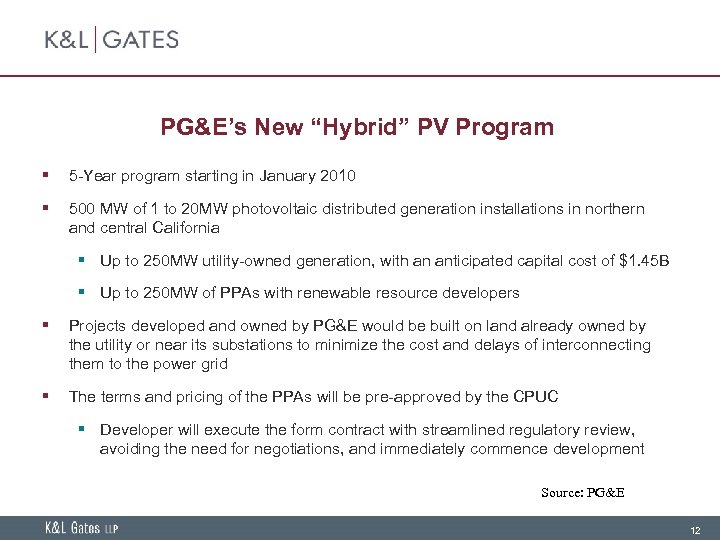

PG&E’s New “Hybrid” PV Program § 5 -Year program starting in January 2010 § 500 MW of 1 to 20 MW photovoltaic distributed generation installations in northern and central California § Up to 250 MW utility-owned generation, with an anticipated capital cost of $1. 45 B § Up to 250 MW of PPAs with renewable resource developers § Projects developed and owned by PG&E would be built on land already owned by the utility or near its substations to minimize the cost and delays of interconnecting them to the power grid § The terms and pricing of the PPAs will be pre-approved by the CPUC § Developer will execute the form contract with streamlined regulatory review, avoiding the need for negotiations, and immediately commence development Source: PG&E 12

PG&E’s New “Hybrid” PV Program § 5 -Year program starting in January 2010 § 500 MW of 1 to 20 MW photovoltaic distributed generation installations in northern and central California § Up to 250 MW utility-owned generation, with an anticipated capital cost of $1. 45 B § Up to 250 MW of PPAs with renewable resource developers § Projects developed and owned by PG&E would be built on land already owned by the utility or near its substations to minimize the cost and delays of interconnecting them to the power grid § The terms and pricing of the PPAs will be pre-approved by the CPUC § Developer will execute the form contract with streamlined regulatory review, avoiding the need for negotiations, and immediately commence development Source: PG&E 12

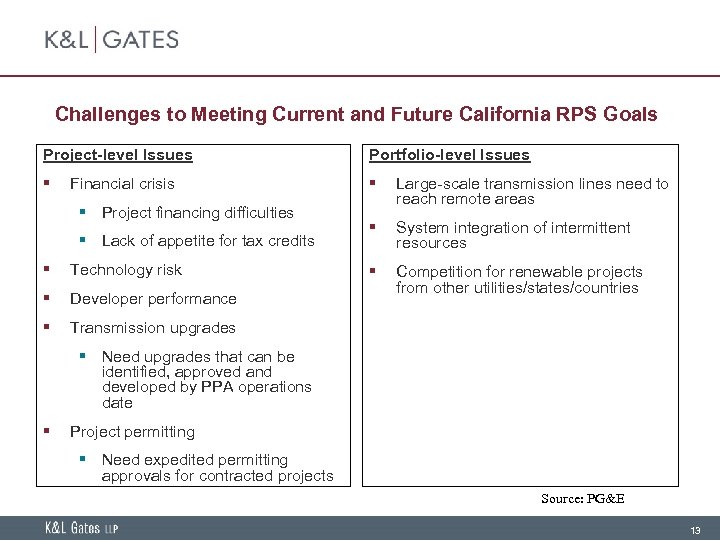

Challenges to Meeting Current and Future California RPS Goals Project-level Issues Portfolio-level Issues § § Large-scale transmission lines need to reach remote areas § System integration of intermittent resources § Competition for renewable projects from other utilities/states/countries Financial crisis § Project financing difficulties § Lack of appetite for tax credits § Technology risk § Developer performance § Transmission upgrades § Need upgrades that can be identified, approved and developed by PPA operations date § Project permitting § Need expedited permitting approvals for contracted projects Source: PG&E 13

Challenges to Meeting Current and Future California RPS Goals Project-level Issues Portfolio-level Issues § § Large-scale transmission lines need to reach remote areas § System integration of intermittent resources § Competition for renewable projects from other utilities/states/countries Financial crisis § Project financing difficulties § Lack of appetite for tax credits § Technology risk § Developer performance § Transmission upgrades § Need upgrades that can be identified, approved and developed by PPA operations date § Project permitting § Need expedited permitting approvals for contracted projects Source: PG&E 13

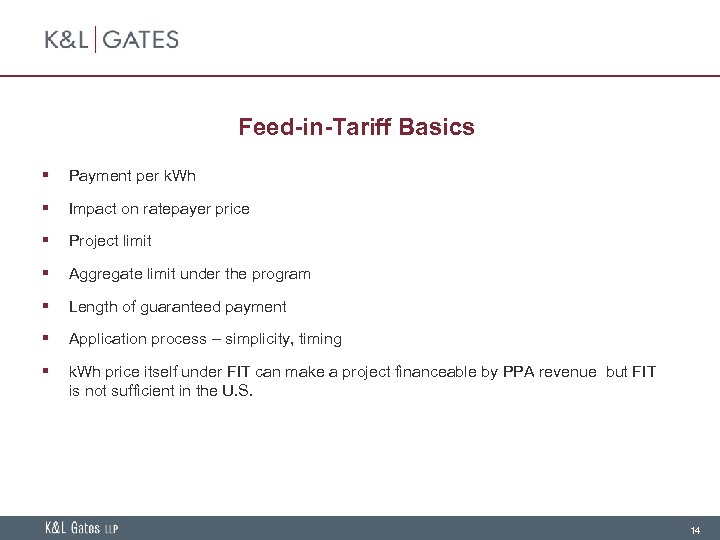

Feed-in-Tariff Basics § Payment per k. Wh § Impact on ratepayer price § Project limit § Aggregate limit under the program § Length of guaranteed payment § Application process – simplicity, timing § k. Wh price itself under FIT can make a project financeable by PPA revenue but FIT is not sufficient in the U. S. 14

Feed-in-Tariff Basics § Payment per k. Wh § Impact on ratepayer price § Project limit § Aggregate limit under the program § Length of guaranteed payment § Application process – simplicity, timing § k. Wh price itself under FIT can make a project financeable by PPA revenue but FIT is not sufficient in the U. S. 14

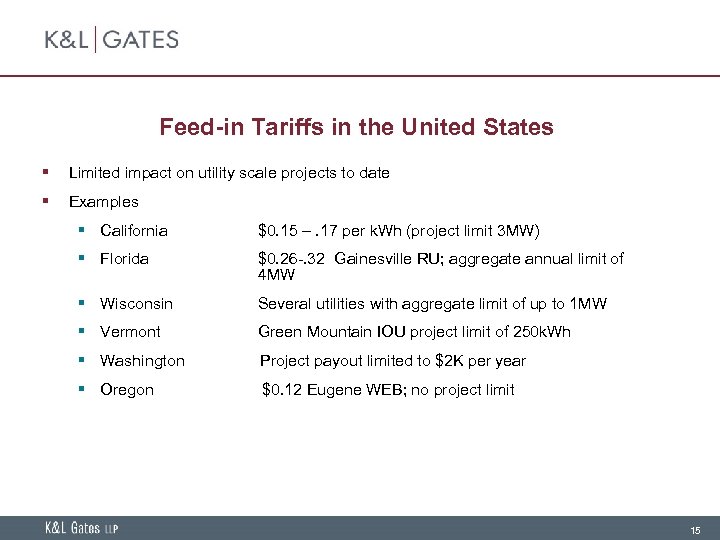

Feed-in Tariffs in the United States § Limited impact on utility scale projects to date § Examples § California $0. 15 –. 17 per k. Wh (project limit 3 MW) § Florida $0. 26 -. 32 Gainesville RU; aggregate annual limit of 4 MW § Wisconsin Several utilities with aggregate limit of up to 1 MW § Vermont Green Mountain IOU project limit of 250 k. Wh § Washington Project payout limited to $2 K per year § Oregon $0. 12 Eugene WEB; no project limit 15

Feed-in Tariffs in the United States § Limited impact on utility scale projects to date § Examples § California $0. 15 –. 17 per k. Wh (project limit 3 MW) § Florida $0. 26 -. 32 Gainesville RU; aggregate annual limit of 4 MW § Wisconsin Several utilities with aggregate limit of up to 1 MW § Vermont Green Mountain IOU project limit of 250 k. Wh § Washington Project payout limited to $2 K per year § Oregon $0. 12 Eugene WEB; no project limit 15

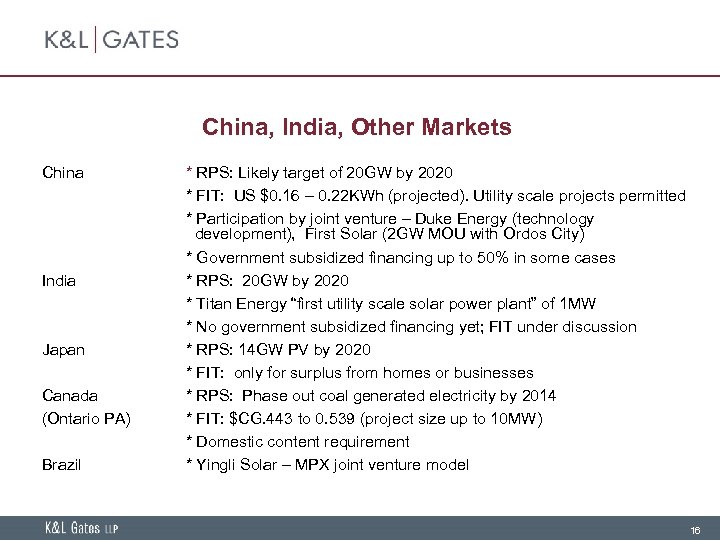

China, India, Other Markets China India Japan Canada (Ontario PA) Brazil * RPS: Likely target of 20 GW by 2020 * FIT: US $0. 16 – 0. 22 KWh (projected). Utility scale projects permitted * Participation by joint venture – Duke Energy (technology development), First Solar (2 GW MOU with Ordos City) * Government subsidized financing up to 50% in some cases * RPS: 20 GW by 2020 * Titan Energy “first utility scale solar power plant” of 1 MW * No government subsidized financing yet; FIT under discussion * RPS: 14 GW PV by 2020 * FIT: only for surplus from homes or businesses * RPS: Phase out coal generated electricity by 2014 * FIT: $CG. 443 to 0. 539 (project size up to 10 MW) * Domestic content requirement * Yingli Solar – MPX joint venture model 16

China, India, Other Markets China India Japan Canada (Ontario PA) Brazil * RPS: Likely target of 20 GW by 2020 * FIT: US $0. 16 – 0. 22 KWh (projected). Utility scale projects permitted * Participation by joint venture – Duke Energy (technology development), First Solar (2 GW MOU with Ordos City) * Government subsidized financing up to 50% in some cases * RPS: 20 GW by 2020 * Titan Energy “first utility scale solar power plant” of 1 MW * No government subsidized financing yet; FIT under discussion * RPS: 14 GW PV by 2020 * FIT: only for surplus from homes or businesses * RPS: Phase out coal generated electricity by 2014 * FIT: $CG. 443 to 0. 539 (project size up to 10 MW) * Domestic content requirement * Yingli Solar – MPX joint venture model 16

Summary § No single U. S government policy is sufficient; a financing tool kit of policies is needed that can be applied at the same time § The federal 30% cash grant is the single most important policy incentive in the U. S. but is not sufficient by itself § Utility scale project FITs in the U. S. will develop cautiously because of the concern over the pricing impact on ratepayers § There will be more utility financed and owned projects as well as projects financed by module manufacturers but ratepayer and financial statement impacts will require other financing structures § Solar projects need to be larger in order for RPS requirements to be met and to attract a buyer like NRG Energy § Independent project developers need some equity investment in order to make the project math work § Consequences of failing to meet RPS need to be more severe in order to have a meaningful impact on financing 17

Summary § No single U. S government policy is sufficient; a financing tool kit of policies is needed that can be applied at the same time § The federal 30% cash grant is the single most important policy incentive in the U. S. but is not sufficient by itself § Utility scale project FITs in the U. S. will develop cautiously because of the concern over the pricing impact on ratepayers § There will be more utility financed and owned projects as well as projects financed by module manufacturers but ratepayer and financial statement impacts will require other financing structures § Solar projects need to be larger in order for RPS requirements to be met and to attract a buyer like NRG Energy § Independent project developers need some equity investment in order to make the project math work § Consequences of failing to meet RPS need to be more severe in order to have a meaningful impact on financing 17

Sources § Database of State Incentives for Renewables and Efficiency (www. dsireusa. org) § DB Climate Change Advisors, Global Climate Change Policy Tracker: An Investors Assessment (October 2009) § Ontario Power Authority web site (fit. powerauthority. on. ca) § Volume 2, Renewable Power, A Blueprint for Green Energy in the Americas, 2009 (prepared by Garten Rothkopf) gartenrothkopf. com/publications, asp § Couture and Cary, State Renewable Energy Policies, Analysis Project: An Analysis of Renewable Energy Tariffs in the U. S. (June 2009) (sti. gov/bridge) § Doris, Mc. Laren, Healey and Hockett, State of the States 2009: Renewable Energy Development and the Role of Policy, NREL Technical Report, October 2009 (nrel. gov/features/20091120_states. html) 18

Sources § Database of State Incentives for Renewables and Efficiency (www. dsireusa. org) § DB Climate Change Advisors, Global Climate Change Policy Tracker: An Investors Assessment (October 2009) § Ontario Power Authority web site (fit. powerauthority. on. ca) § Volume 2, Renewable Power, A Blueprint for Green Energy in the Americas, 2009 (prepared by Garten Rothkopf) gartenrothkopf. com/publications, asp § Couture and Cary, State Renewable Energy Policies, Analysis Project: An Analysis of Renewable Energy Tariffs in the U. S. (June 2009) (sti. gov/bridge) § Doris, Mc. Laren, Healey and Hockett, State of the States 2009: Renewable Energy Development and the Role of Policy, NREL Technical Report, October 2009 (nrel. gov/features/20091120_states. html) 18