4cd0300afb69c86de0083e135f82ab4a.ppt

- Количество слайдов: 38

Marketing Tactics in Volatile Times Matthew Diersen, Ph. D. Department of Economics South Dakota State University May 6 & 8, 2008

Marketing Tactics in Volatile Times Matthew Diersen, Ph. D. Department of Economics South Dakota State University May 6 & 8, 2008

Outline § General observations § Volatility discussion § Wheat strategies § Synthetic puts § Cattle strategies § Timing price & risk 2

Outline § General observations § Volatility discussion § Wheat strategies § Synthetic puts § Cattle strategies § Timing price & risk 2

What Has Changed § Disruptions have occurred § Question rural legends about marketing § Ability to price like never before § Fundamental drivers § Speculative forces § Need to deal with credible partners 3

What Has Changed § Disruptions have occurred § Question rural legends about marketing § Ability to price like never before § Fundamental drivers § Speculative forces § Need to deal with credible partners 3

Marketing Plans § One plan per enterprise § Get a handle on the big picture § High stakes mean: § more to keep track of § more room for error § Evaluation more important than ever § Understand what did not work § Contingency plans important 4

Marketing Plans § One plan per enterprise § Get a handle on the big picture § High stakes mean: § more to keep track of § more room for error § Evaluation more important than ever § Understand what did not work § Contingency plans important 4

Pricing § § § Know what you are trying to “beat” Lock in “high enough” up-front profit Pull trigger after prices move favorably Reduce transaction costs Done with: 1. Handshakes to forward contracts 2. Futures contracts 5

Pricing § § § Know what you are trying to “beat” Lock in “high enough” up-front profit Pull trigger after prices move favorably Reduce transaction costs Done with: 1. Handshakes to forward contracts 2. Futures contracts 5

Protection § § § Already realize profits Want to get higher returns Want to guard against wrecks Cover yourself prudently Done with: 1. Options contracts 2. Insurance contracts 6

Protection § § § Already realize profits Want to get higher returns Want to guard against wrecks Cover yourself prudently Done with: 1. Options contracts 2. Insurance contracts 6

7

7

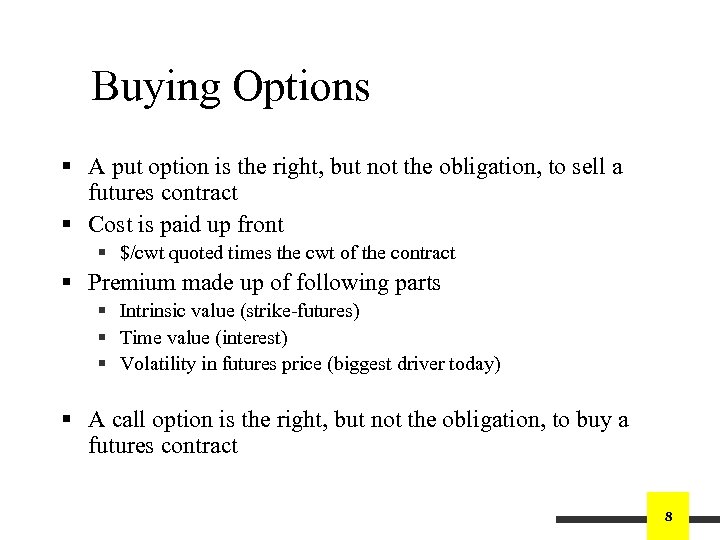

Buying Options § A put option is the right, but not the obligation, to sell a futures contract § Cost is paid up front § $/cwt quoted times the cwt of the contract § Premium made up of following parts § Intrinsic value (strike-futures) § Time value (interest) § Volatility in futures price (biggest driver today) § A call option is the right, but not the obligation, to buy a futures contract 8

Buying Options § A put option is the right, but not the obligation, to sell a futures contract § Cost is paid up front § $/cwt quoted times the cwt of the contract § Premium made up of following parts § Intrinsic value (strike-futures) § Time value (interest) § Volatility in futures price (biggest driver today) § A call option is the right, but not the obligation, to buy a futures contract 8

Money Talk § In-the-money put § Strike price is above the futures price § Implies a positive intrinsic value § Will cost the most § At-the-money put § Strike price is near the futures price § May be closest-to the futures price § Out-of-the-money put § Strike price is below the futures price 9

Money Talk § In-the-money put § Strike price is above the futures price § Implies a positive intrinsic value § Will cost the most § At-the-money put § Strike price is near the futures price § May be closest-to the futures price § Out-of-the-money put § Strike price is below the futures price 9

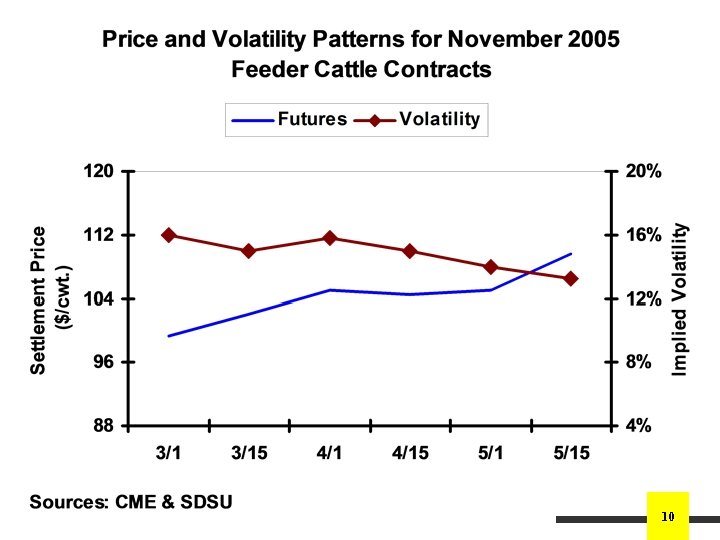

10

10

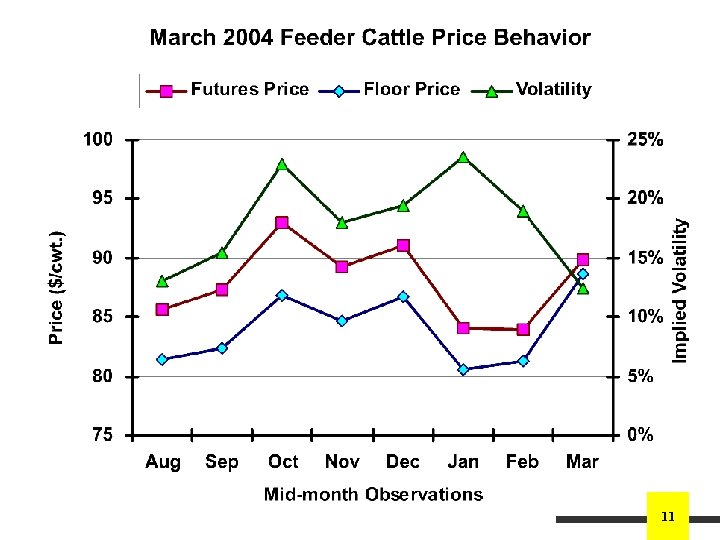

11

11

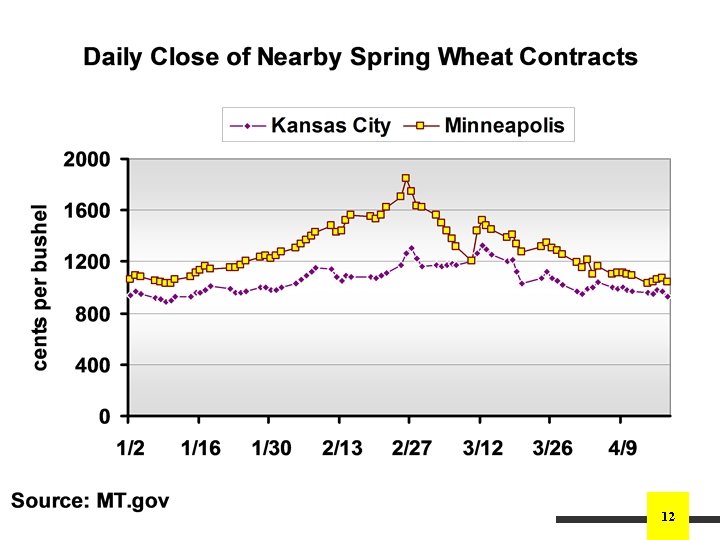

12

12

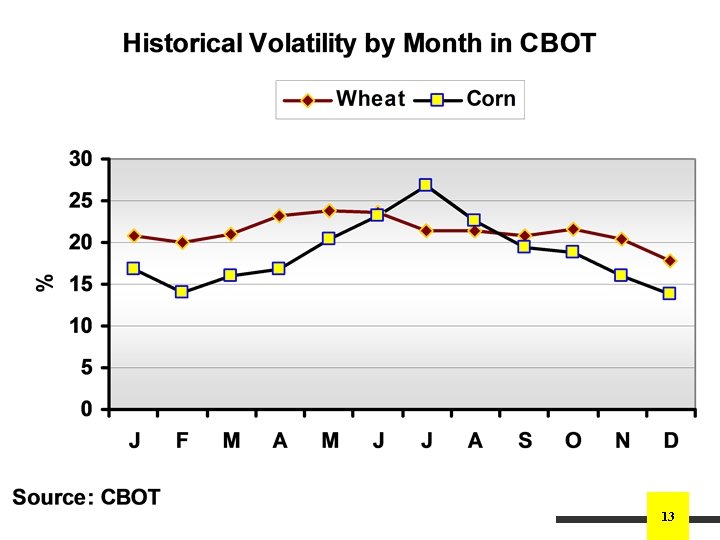

13

13

Wheat Tactics 14

Wheat Tactics 14

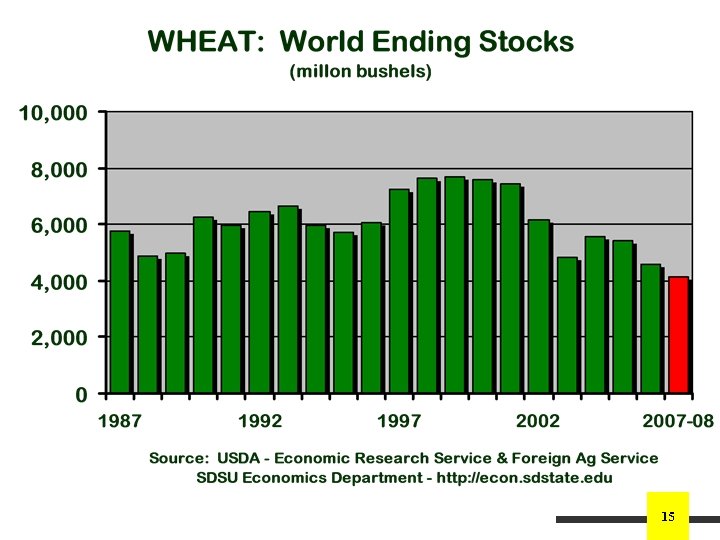

15

15

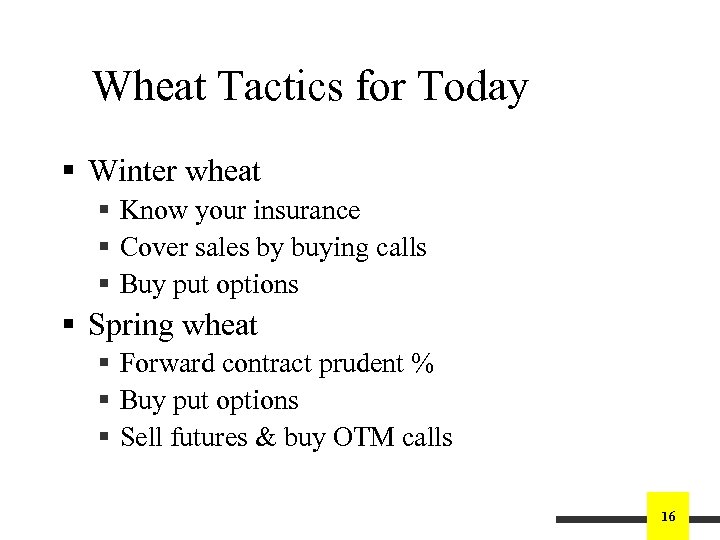

Wheat Tactics for Today § Winter wheat § Know your insurance § Cover sales by buying calls § Buy put options § Spring wheat § Forward contract prudent % § Buy put options § Sell futures & buy OTM calls 16

Wheat Tactics for Today § Winter wheat § Know your insurance § Cover sales by buying calls § Buy put options § Spring wheat § Forward contract prudent % § Buy put options § Sell futures & buy OTM calls 16

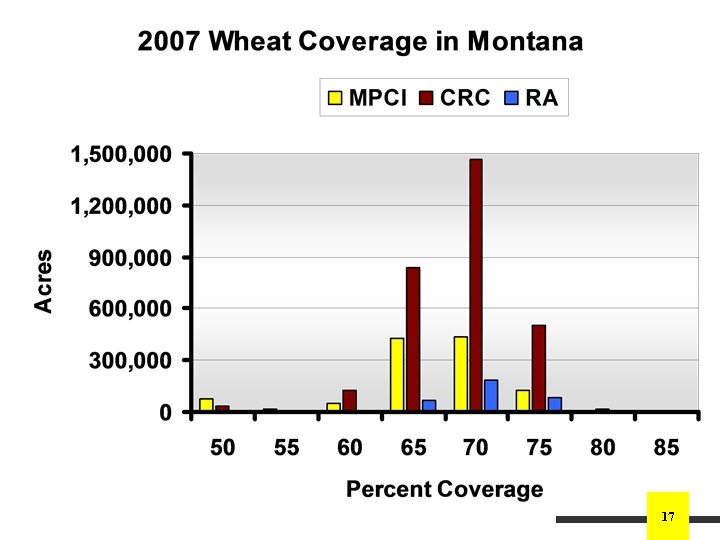

17

17

Crop Insurance § Often buy Crop Revenue Coverage (CRC) § Futures have exceeded upper limit § Hedge losses could greatly exceed indemnity § Can be managed with call options § Risk Calculator § Available at http: //econ. sdstate. edu/ § What level can be prudently hedged? 18

Crop Insurance § Often buy Crop Revenue Coverage (CRC) § Futures have exceeded upper limit § Hedge losses could greatly exceed indemnity § Can be managed with call options § Risk Calculator § Available at http: //econ. sdstate. edu/ § What level can be prudently hedged? 18

Pricing and Protecting Wheat § Rely heavily on KC, MPLS markets § Better hedging performance § Work with lender on margin account § Margin costs are higher § Worst-case returns likely low given: § Low loan rate § Increased production costs § Inadequate insurance § Prices have some support from corn (feed) 19

Pricing and Protecting Wheat § Rely heavily on KC, MPLS markets § Better hedging performance § Work with lender on margin account § Margin costs are higher § Worst-case returns likely low given: § Low loan rate § Increased production costs § Inadequate insurance § Prices have some support from corn (feed) 19

Basis Risk & Storage § Highlights local conditions § Transportation concerns § Price convergence still probable § Crop insurance of no help § Weigh basis improvement against carry § Tough to store with inverted markets § Monitor interest opportunity cost § Some research supports some “speculative” storage behavior 20

Basis Risk & Storage § Highlights local conditions § Transportation concerns § Price convergence still probable § Crop insurance of no help § Weigh basis improvement against carry § Tough to store with inverted markets § Monitor interest opportunity cost § Some research supports some “speculative” storage behavior 20

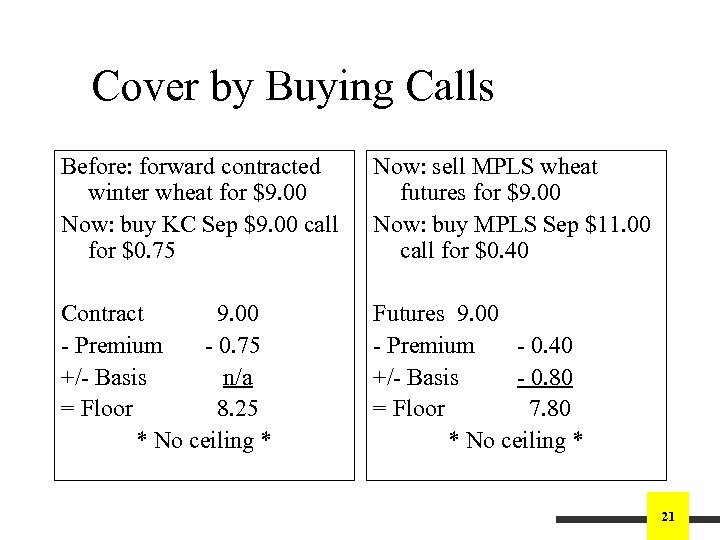

Cover by Buying Calls Before: forward contracted winter wheat for $9. 00 Now: buy KC Sep $9. 00 call for $0. 75 Now: sell MPLS wheat futures for $9. 00 Now: buy MPLS Sep $11. 00 call for $0. 40 Contract 9. 00 - Premium - 0. 75 +/- Basis n/a = Floor 8. 25 * No ceiling * Futures 9. 00 - Premium - 0. 40 +/- Basis - 0. 80 = Floor 7. 80 * No ceiling * 21

Cover by Buying Calls Before: forward contracted winter wheat for $9. 00 Now: buy KC Sep $9. 00 call for $0. 75 Now: sell MPLS wheat futures for $9. 00 Now: buy MPLS Sep $11. 00 call for $0. 40 Contract 9. 00 - Premium - 0. 75 +/- Basis n/a = Floor 8. 25 * No ceiling * Futures 9. 00 - Premium - 0. 40 +/- Basis - 0. 80 = Floor 7. 80 * No ceiling * 21

Current Prices 22

Current Prices 22

Feeder Cattle Tactics 23

Feeder Cattle Tactics 23

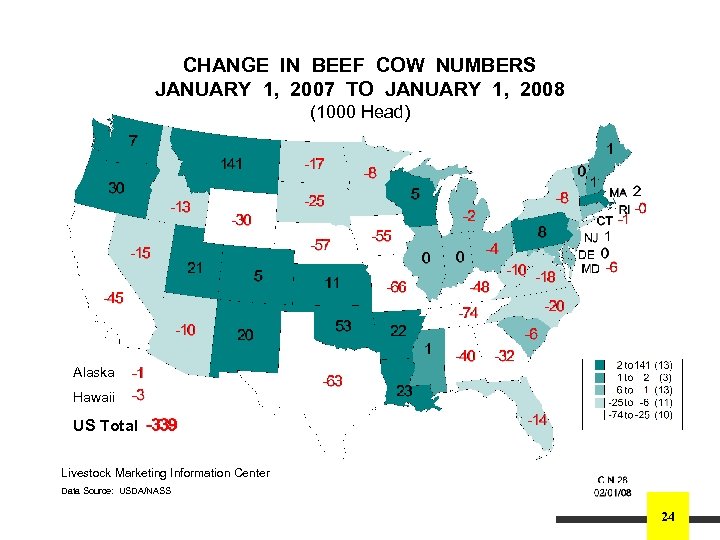

CHANGE IN BEEF COW NUMBERS JANUARY 1, 2007 TO JANUARY 1, 2008 (1000 Head) Alaska Hawaii US Total Livestock Marketing Information Center Data Source: USDA/NASS 24

CHANGE IN BEEF COW NUMBERS JANUARY 1, 2007 TO JANUARY 1, 2008 (1000 Head) Alaska Hawaii US Total Livestock Marketing Information Center Data Source: USDA/NASS 24

Feeder Cattle Tactics for Today § Sell futures or forward contract § Know the relevant basis § Buy put options § Buy Livestock Risk Protection § Build wide fences 25

Feeder Cattle Tactics for Today § Sell futures or forward contract § Know the relevant basis § Buy put options § Buy Livestock Risk Protection § Build wide fences 25

Feeder Cattle Contracts § Contract is for 50, 000 pounds of steers § Contract months: January, March, April, May, August, September, October, and November § Futures settle on the last Thursday of the contract month (except November) § Cash settled to the CME Feeder Cattle Index § 650 -849 lbs Medium and Large #1, #1 -2 26

Feeder Cattle Contracts § Contract is for 50, 000 pounds of steers § Contract months: January, March, April, May, August, September, October, and November § Futures settle on the last Thursday of the contract month (except November) § Cash settled to the CME Feeder Cattle Index § 650 -849 lbs Medium and Large #1, #1 -2 26

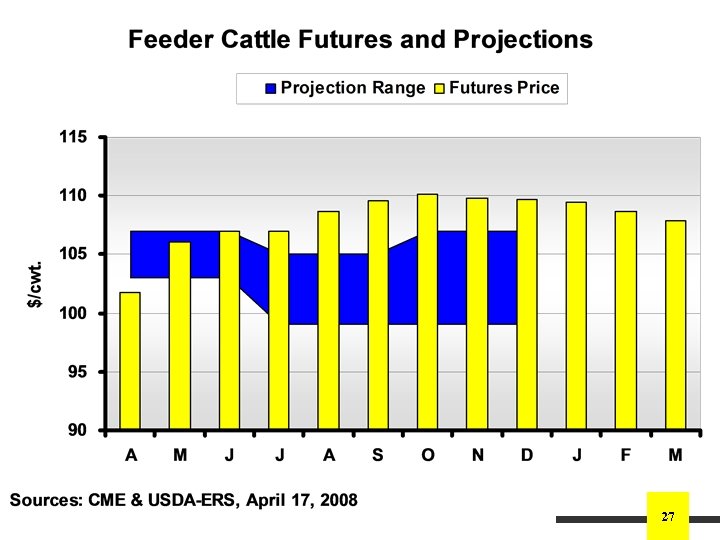

27

27

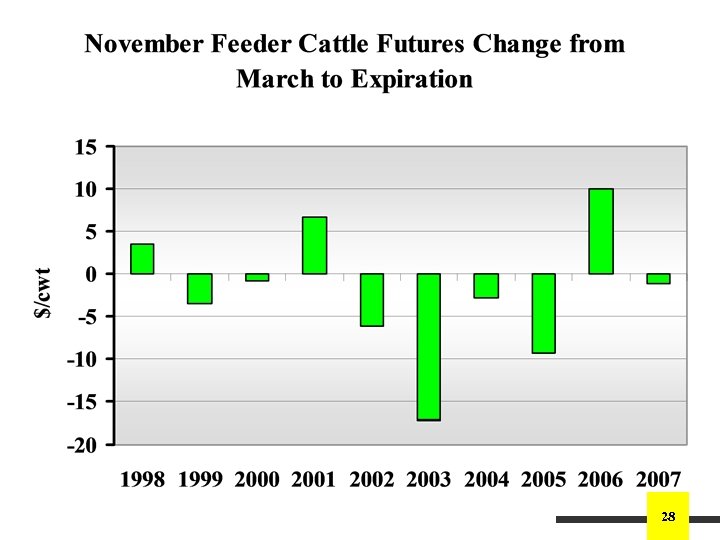

28

28

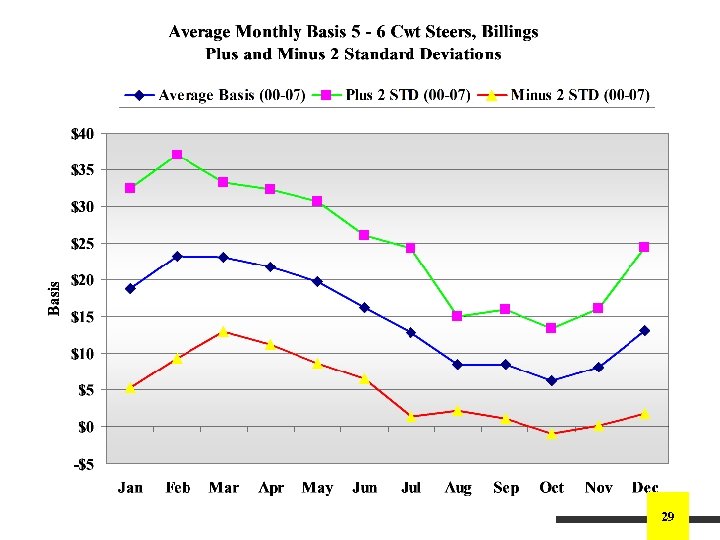

29

29

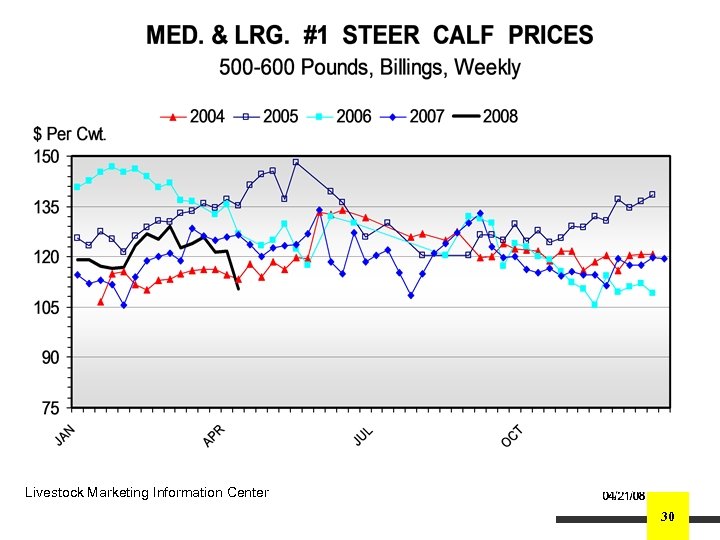

Livestock Marketing Information Center 30

Livestock Marketing Information Center 30

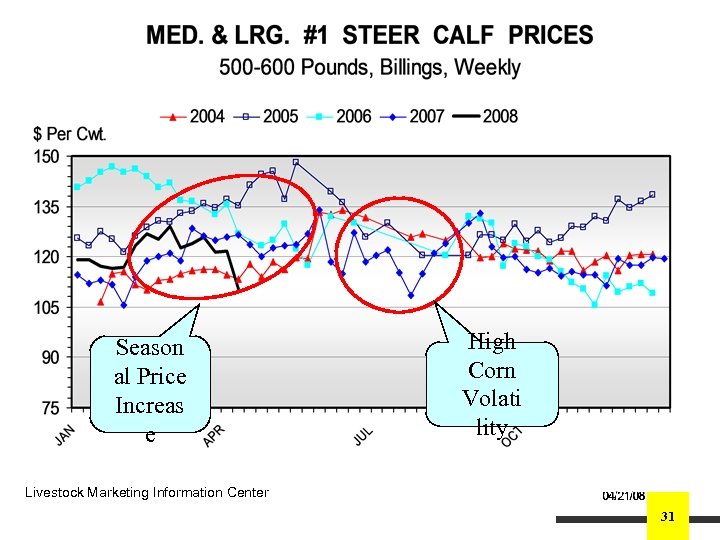

Season al Price Increas e High Corn Volati lity Livestock Marketing Information Center 31

Season al Price Increas e High Corn Volati lity Livestock Marketing Information Center 31

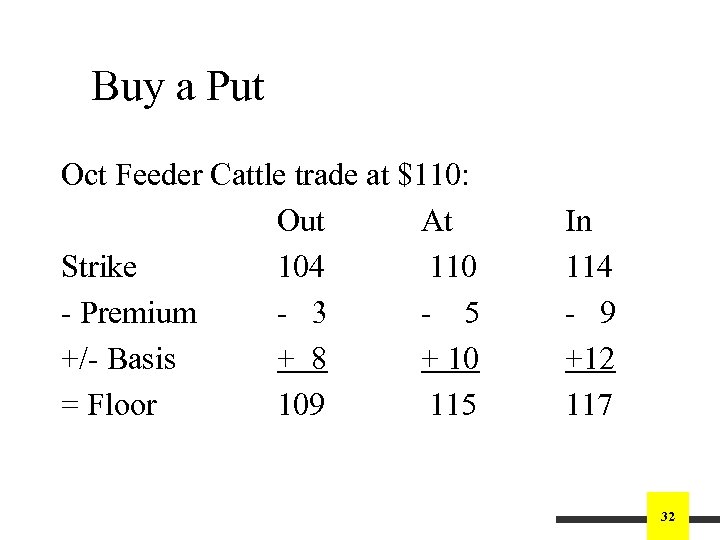

Buy a Put Oct Feeder Cattle trade at $110: Out At Strike 104 110 - Premium - 3 - 5 +/- Basis + 8 + 10 = Floor 109 115 In 114 - 9 +12 117 32

Buy a Put Oct Feeder Cattle trade at $110: Out At Strike 104 110 - Premium - 3 - 5 +/- Basis + 8 + 10 = Floor 109 115 In 114 - 9 +12 117 32

Current Prices 33

Current Prices 33

LRP vs. Other Tools § LRP has Price Adjustment Factors § Fixed percent up front and at settlement § For Steer calves: 110% § Forward contracts likely give the best basis § Synthetic put strategies need broker’s help § LPR designed for spot sales in final 30 days of coverage (transferable on earlier sales) 34

LRP vs. Other Tools § LRP has Price Adjustment Factors § Fixed percent up front and at settlement § For Steer calves: 110% § Forward contracts likely give the best basis § Synthetic put strategies need broker’s help § LPR designed for spot sales in final 30 days of coverage (transferable on earlier sales) 34

Typical Marketing Plan Cow-calf producer with 140 steers & 100 heifers to sell on October 15, 2008 § Buy 2 Oct puts (200 head), 108 strike, for $3. 00 per cwt. or better § Buy LRP on 40 steers if floor exceeds $115 and cost is $4. 00 per cwt. or better § Sell 1 Oct futures (100 head) if $115 or better (assume $10 cwt. basis) 35

Typical Marketing Plan Cow-calf producer with 140 steers & 100 heifers to sell on October 15, 2008 § Buy 2 Oct puts (200 head), 108 strike, for $3. 00 per cwt. or better § Buy LRP on 40 steers if floor exceeds $115 and cost is $4. 00 per cwt. or better § Sell 1 Oct futures (100 head) if $115 or better (assume $10 cwt. basis) 35

For More Information § Commodity Exchanges § CME, MGEX, KCBOT § USDA’s Risk Management Agency § http: //www. rma. usda. gov/ § SDSU Department of Economics § § http: //econ. sdstate. edu/ Extension / Current Market Analysis FS 929 – Writing a Commodity Marketing Plan Ex. Ex 5055 – How to Capture High Calf Prices 36

For More Information § Commodity Exchanges § CME, MGEX, KCBOT § USDA’s Risk Management Agency § http: //www. rma. usda. gov/ § SDSU Department of Economics § § http: //econ. sdstate. edu/ Extension / Current Market Analysis FS 929 – Writing a Commodity Marketing Plan Ex. Ex 5055 – How to Capture High Calf Prices 36

Some Thoughts § “Put all your eggs in one basket, then watch that basket. ” – Mark Twain § Active risk management means doing things 1) when prices are high, 2) when volatility is low, and 3) before its too late 37

Some Thoughts § “Put all your eggs in one basket, then watch that basket. ” – Mark Twain § Active risk management means doing things 1) when prices are high, 2) when volatility is low, and 3) before its too late 37

Any Questions?

Any Questions?