c84fbb9645bfdaeeb9f87a66953807e9.ppt

- Количество слайдов: 54

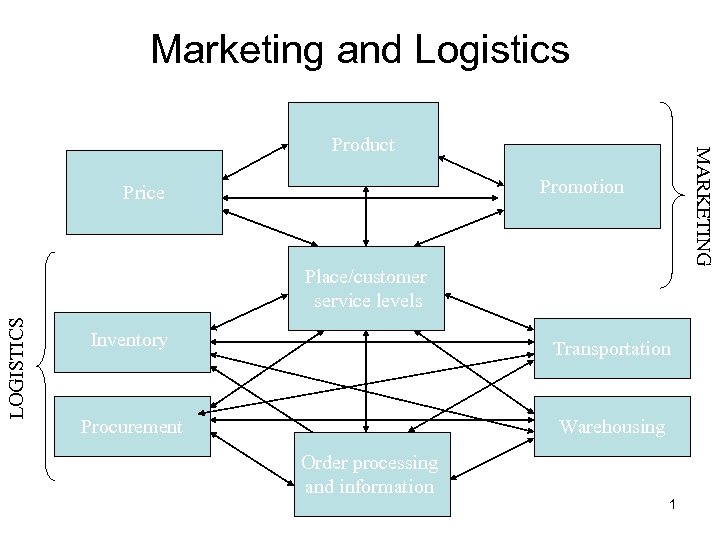

Marketing and Logistics MARKETING Product Promotion Price LOGISTICS Place/customer service levels Inventory Transportation Procurement Warehousing Order processing and information 1

Marketing and Logistics MARKETING Product Promotion Price LOGISTICS Place/customer service levels Inventory Transportation Procurement Warehousing Order processing and information 1

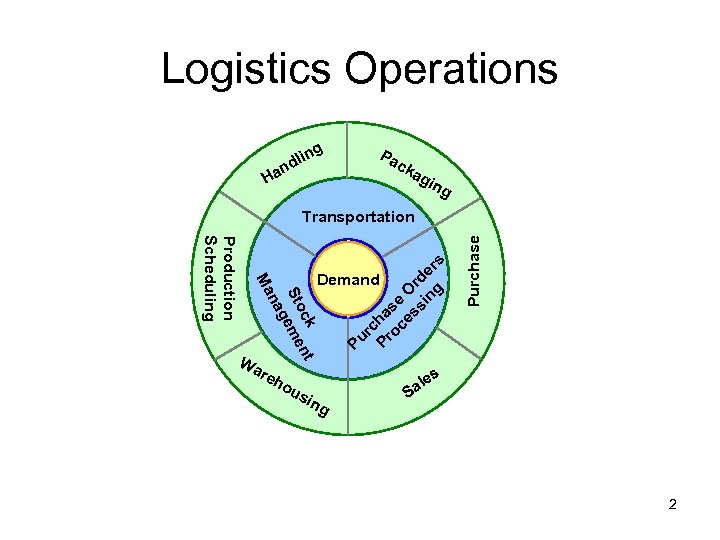

Logistics Operations g Pa c n dli ka n Ha gin g ou sin g Purchase ck nt Sto eme g na reh Pu Demand Ma Production Scheduling Wa rc Pr ha oc se es O si rde ng r s Transportation les a S 2

Logistics Operations g Pa c n dli ka n Ha gin g ou sin g Purchase ck nt Sto eme g na reh Pu Demand Ma Production Scheduling Wa rc Pr ha oc se es O si rde ng r s Transportation les a S 2

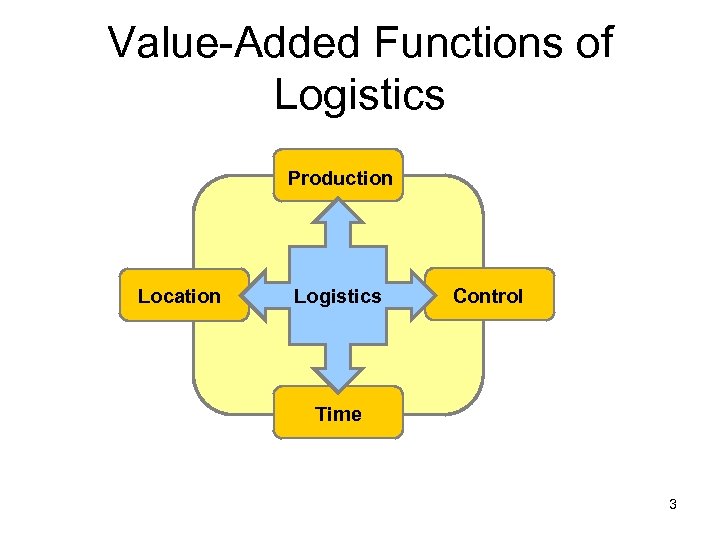

Value-Added Functions of Logistics Production Location Logistics Control Time 3

Value-Added Functions of Logistics Production Location Logistics Control Time 3

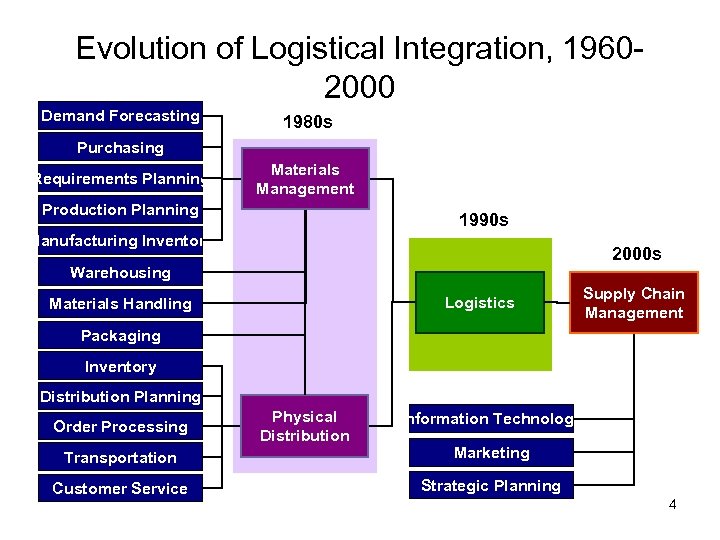

Evolution of Logistical Integration, 19602000 Demand Forecasting 1980 s Purchasing Requirements Planning Materials Management Production Planning 1990 s Manufacturing Inventory 2000 s Warehousing Logistics Materials Handling Supply Chain Management Packaging Inventory Distribution Planning Order Processing Physical Distribution Information Technology Transportation Marketing Customer Service Strategic Planning 4

Evolution of Logistical Integration, 19602000 Demand Forecasting 1980 s Purchasing Requirements Planning Materials Management Production Planning 1990 s Manufacturing Inventory 2000 s Warehousing Logistics Materials Handling Supply Chain Management Packaging Inventory Distribution Planning Order Processing Physical Distribution Information Technology Transportation Marketing Customer Service Strategic Planning 4

The goal of supply chain management “To manage upstream and downstream relationships with suppliers and customers in order to create enhanced value in the final market place at less cost to the supply chain as a whole. ” 5

The goal of supply chain management “To manage upstream and downstream relationships with suppliers and customers in order to create enhanced value in the final market place at less cost to the supply chain as a whole. ” 5

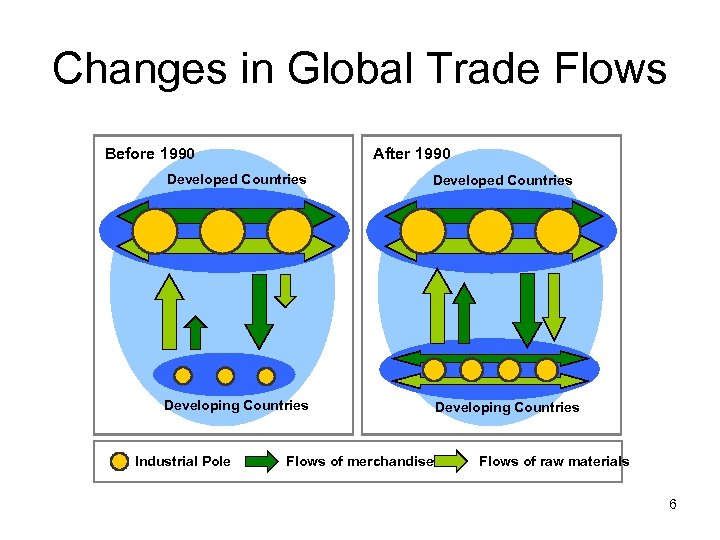

Changes in Global Trade Flows After 1990 Before 1990 Developed Countries Developing Countries Industrial Pole Flows of merchandises Flows of raw materials 6

Changes in Global Trade Flows After 1990 Before 1990 Developed Countries Developing Countries Industrial Pole Flows of merchandises Flows of raw materials 6

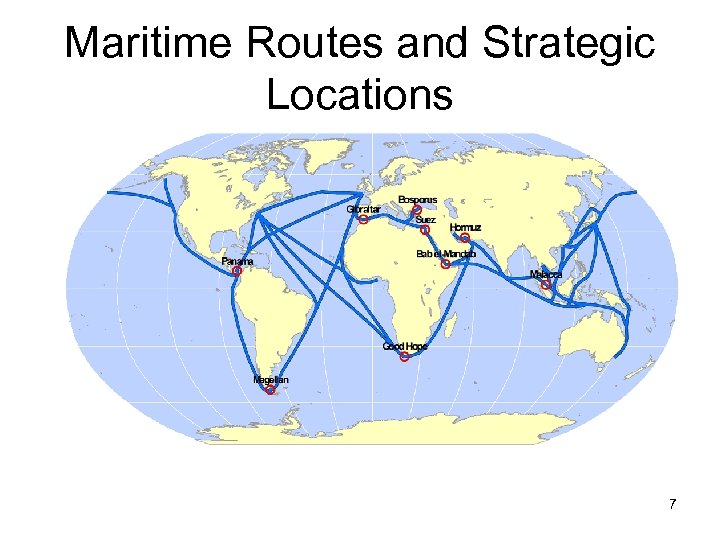

Maritime Routes and Strategic Locations 7

Maritime Routes and Strategic Locations 7

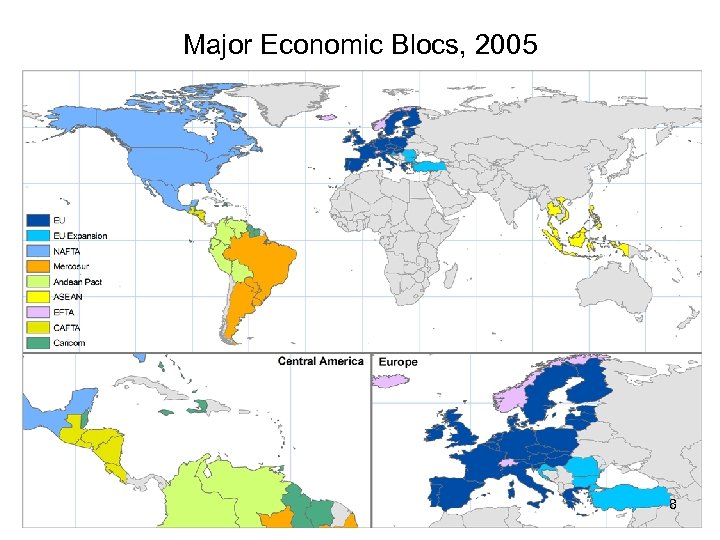

Major Economic Blocs, 2005 8

Major Economic Blocs, 2005 8

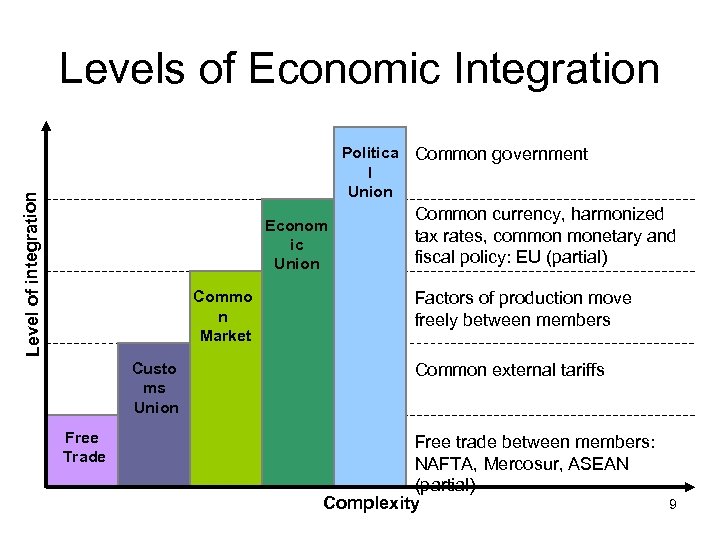

Levels of Economic Integration Level of integration Politica Common government l Union Econom ic Union Commo n Market Custo ms Union Free Trade Common currency, harmonized tax rates, common monetary and fiscal policy: EU (partial) Factors of production move freely between members Common external tariffs Free trade between members: NAFTA, Mercosur, ASEAN (partial) Complexity 9

Levels of Economic Integration Level of integration Politica Common government l Union Econom ic Union Commo n Market Custo ms Union Free Trade Common currency, harmonized tax rates, common monetary and fiscal policy: EU (partial) Factors of production move freely between members Common external tariffs Free trade between members: NAFTA, Mercosur, ASEAN (partial) Complexity 9

Global Exports of Merchandises, 1963 -2003 10

Global Exports of Merchandises, 1963 -2003 10

Trade as Share of GDP 11

Trade as Share of GDP 11

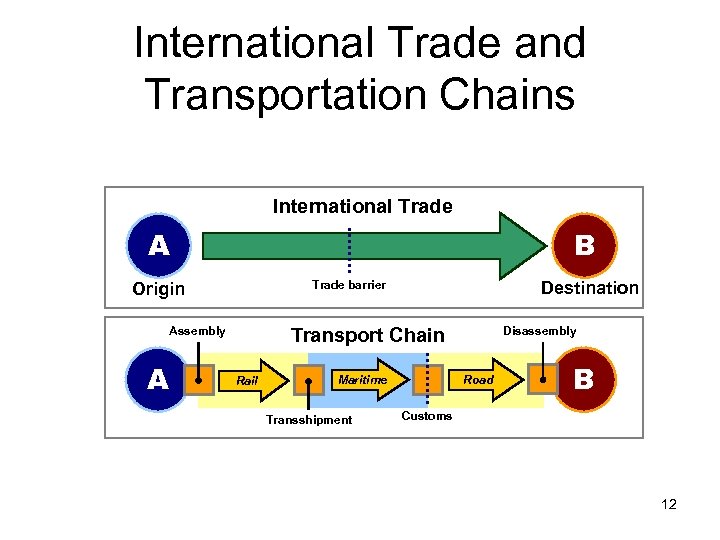

International Trade and Transportation Chains International Trade A B Transport Chain Assembly A Destination Trade barrier Origin Rail Maritime Transshipment Disassembly Road B Customs 12

International Trade and Transportation Chains International Trade A B Transport Chain Assembly A Destination Trade barrier Origin Rail Maritime Transshipment Disassembly Road B Customs 12

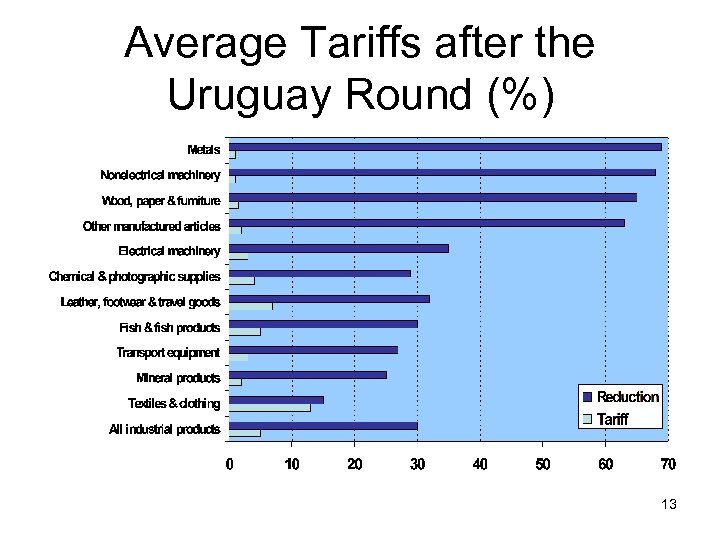

Average Tariffs after the Uruguay Round (%) 13

Average Tariffs after the Uruguay Round (%) 13

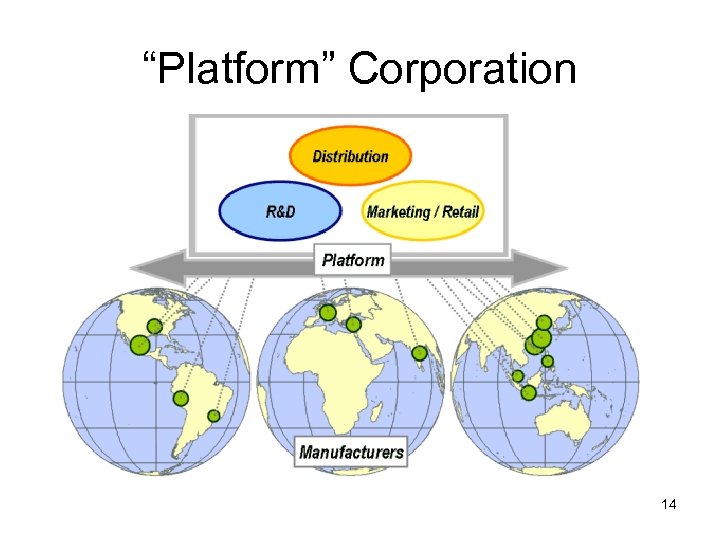

“Platform” Corporation 14

“Platform” Corporation 14

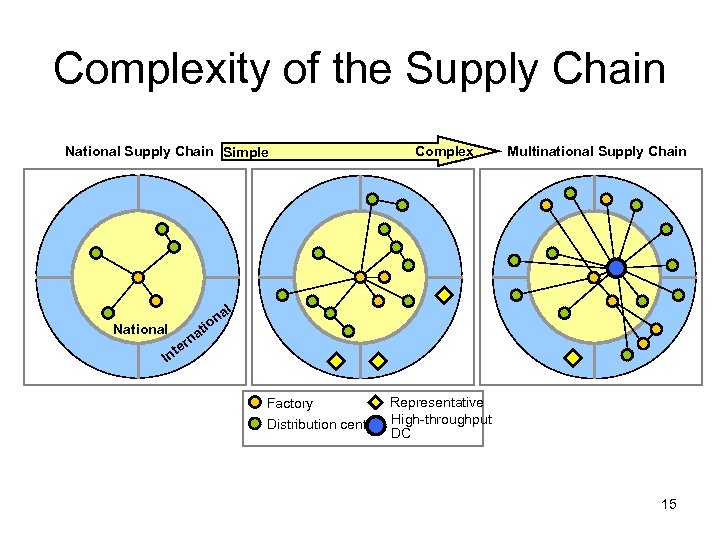

Complexity of the Supply Chain National Supply Chain Simple Complex Multinational Supply Chain l i National I a on t na r e nt Representative Distribution center High-throughput DC Factory 15

Complexity of the Supply Chain National Supply Chain Simple Complex Multinational Supply Chain l i National I a on t na r e nt Representative Distribution center High-throughput DC Factory 15

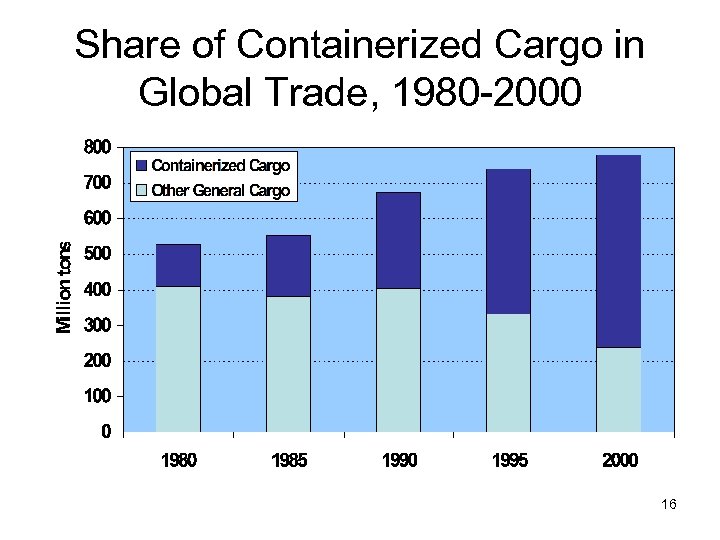

Share of Containerized Cargo in Global Trade, 1980 -2000 16

Share of Containerized Cargo in Global Trade, 1980 -2000 16

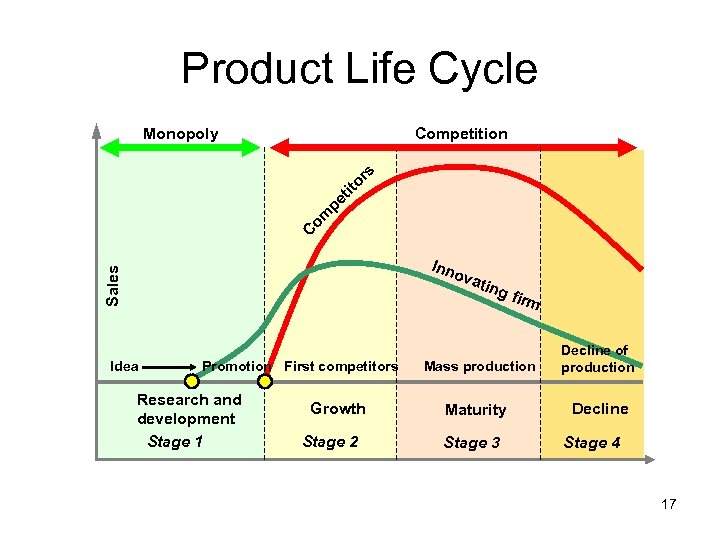

Product Life Cycle Competition C om pe t ito rs Monopoly Inn Sales ova Idea Promotion First competitors Research and development Stage 1 Growth Stage 2 ting firm Mass production Decline of production Maturity Decline Stage 3 Stage 4 17

Product Life Cycle Competition C om pe t ito rs Monopoly Inn Sales ova Idea Promotion First competitors Research and development Stage 1 Growth Stage 2 ting firm Mass production Decline of production Maturity Decline Stage 3 Stage 4 17

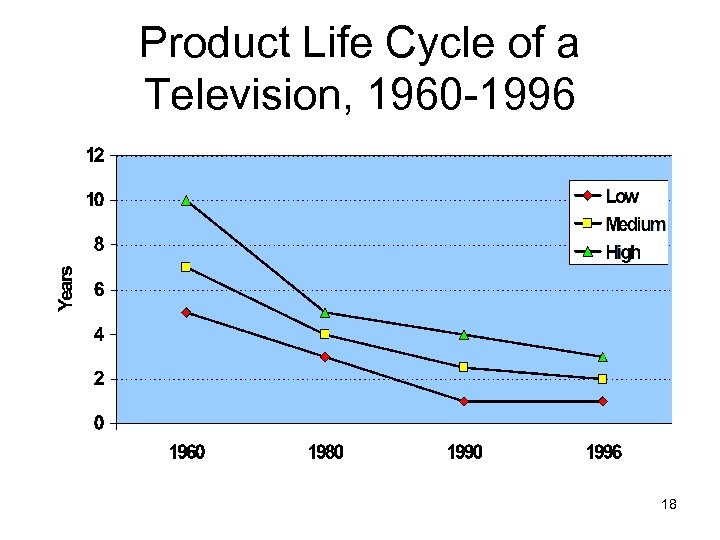

Product Life Cycle of a Television, 1960 -1996 18

Product Life Cycle of a Television, 1960 -1996 18

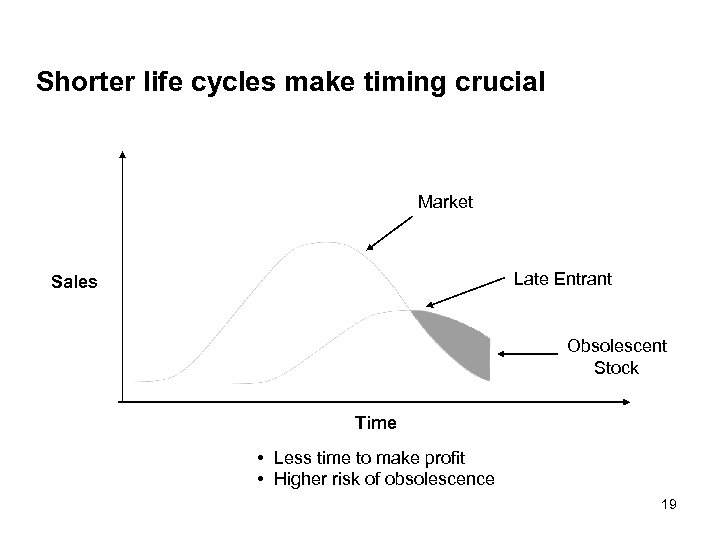

Shorter life cycles make timing crucial Market Late Entrant Sales Obsolescent Stock Time • Less time to make profit • Higher risk of obsolescence 19

Shorter life cycles make timing crucial Market Late Entrant Sales Obsolescent Stock Time • Less time to make profit • Higher risk of obsolescence 19

The role of cash in creating shareholder value “the value of a company is determined by the discounted value of the cash that can be taken out of the business during its remaining life” Warren Buffet 20

The role of cash in creating shareholder value “the value of a company is determined by the discounted value of the cash that can be taken out of the business during its remaining life” Warren Buffet 20

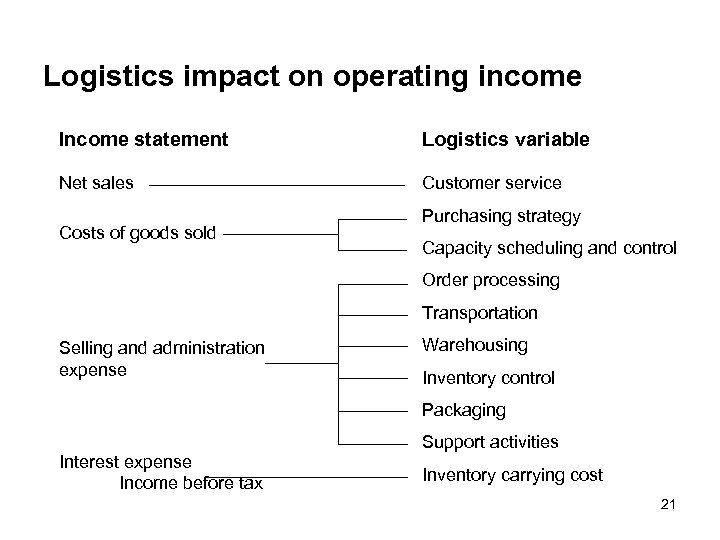

Logistics impact on operating income Income statement Logistics variable Net sales Customer service Costs of goods sold Purchasing strategy Capacity scheduling and control Order processing Transportation Selling and administration expense Warehousing Inventory control Packaging Interest expense Income before tax Support activities Inventory carrying cost 21

Logistics impact on operating income Income statement Logistics variable Net sales Customer service Costs of goods sold Purchasing strategy Capacity scheduling and control Order processing Transportation Selling and administration expense Warehousing Inventory control Packaging Interest expense Income before tax Support activities Inventory carrying cost 21

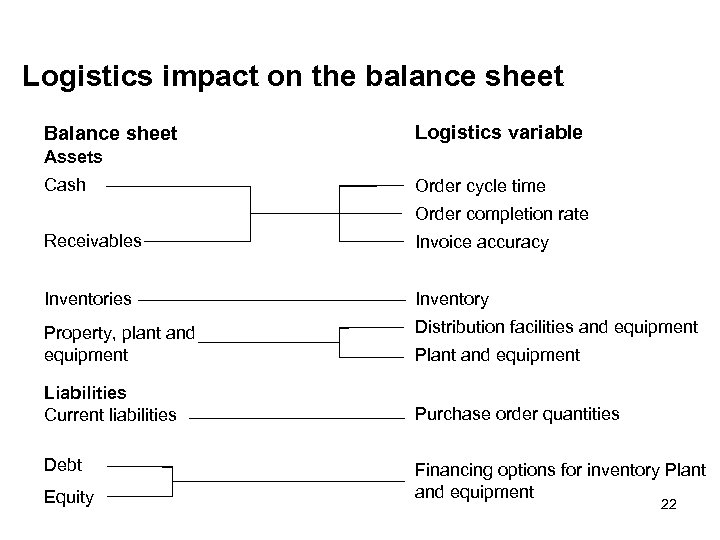

Logistics impact on the balance sheet Balance sheet Logistics variable Assets Cash Order cycle time Order completion rate Receivables Invoice accuracy Inventories Inventory Property, plant and equipment Distribution facilities and equipment Liabilities Current liabilities Debt Equity Plant and equipment Purchase order quantities Financing options for inventory Plant and equipment 22

Logistics impact on the balance sheet Balance sheet Logistics variable Assets Cash Order cycle time Order completion rate Receivables Invoice accuracy Inventories Inventory Property, plant and equipment Distribution facilities and equipment Liabilities Current liabilities Debt Equity Plant and equipment Purchase order quantities Financing options for inventory Plant and equipment 22

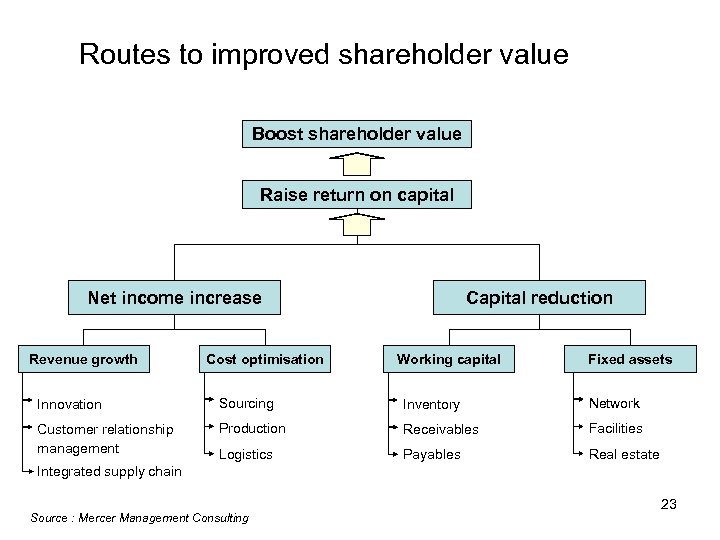

Routes to improved shareholder value Boost shareholder value Raise return on capital Net income increase Revenue growth Cost optimisation Capital reduction Working capital Fixed assets Innovation Sourcing Inventory Network Customer relationship management Production Receivables Facilities Logistics Payables Real estate Integrated supply chain Source : Mercer Management Consulting 23

Routes to improved shareholder value Boost shareholder value Raise return on capital Net income increase Revenue growth Cost optimisation Capital reduction Working capital Fixed assets Innovation Sourcing Inventory Network Customer relationship management Production Receivables Facilities Logistics Payables Real estate Integrated supply chain Source : Mercer Management Consulting 23

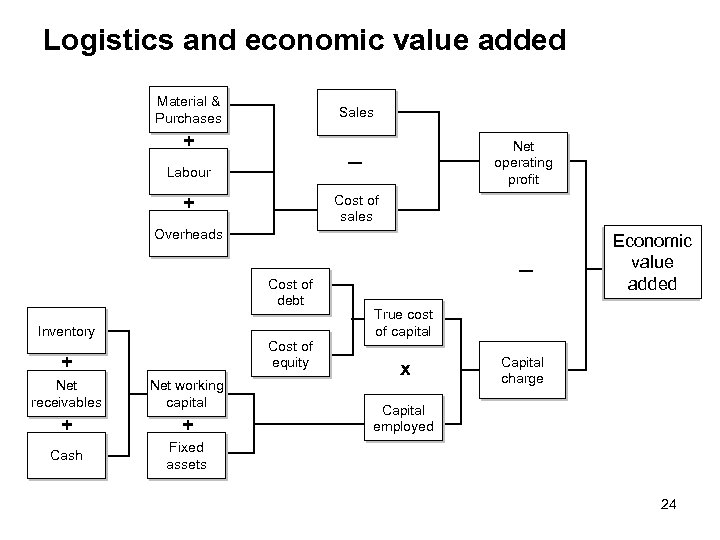

Logistics and economic value added Material & Purchases Sales + Net operating profit Labour + Cost of sales Overheads Cost of debt Inventory Cost of equity + Net receivables Net working capital + + Cash Economic value added True cost of capital x Capital charge Fixed assets Capital employed 24

Logistics and economic value added Material & Purchases Sales + Net operating profit Labour + Cost of sales Overheads Cost of debt Inventory Cost of equity + Net receivables Net working capital + + Cash Economic value added True cost of capital x Capital charge Fixed assets Capital employed 24

Total Freight Costs for Imports in World Trade (% of Total Costs) 25

Total Freight Costs for Imports in World Trade (% of Total Costs) 25

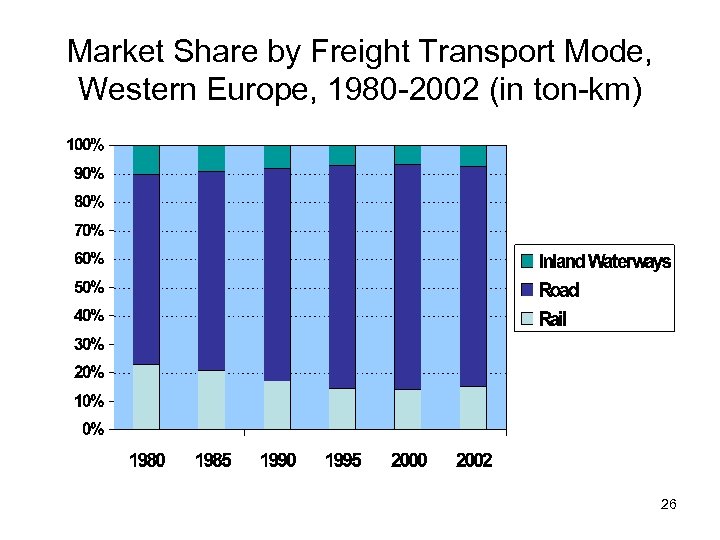

Market Share by Freight Transport Mode, Western Europe, 1980 -2002 (in ton-km) 26

Market Share by Freight Transport Mode, Western Europe, 1980 -2002 (in ton-km) 26

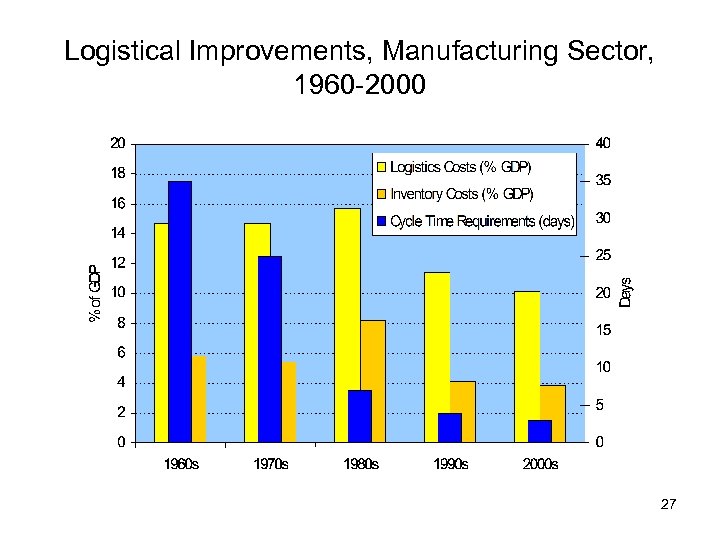

Logistical Improvements, Manufacturing Sector, 1960 -2000 27

Logistical Improvements, Manufacturing Sector, 1960 -2000 27

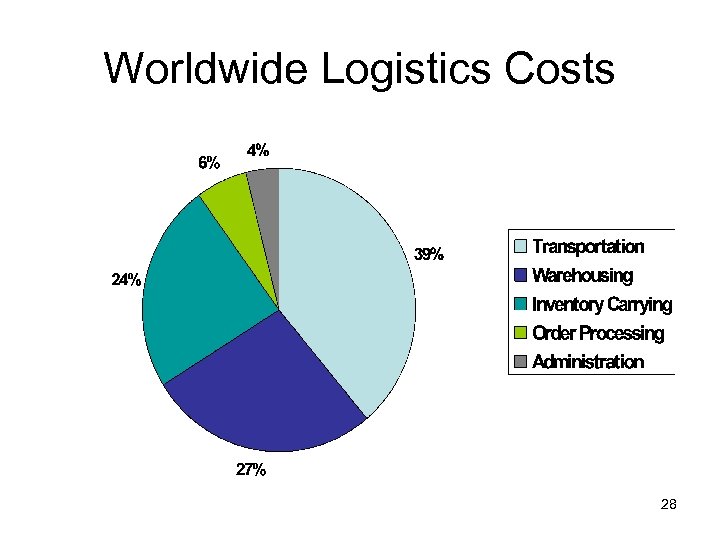

Worldwide Logistics Costs 28

Worldwide Logistics Costs 28

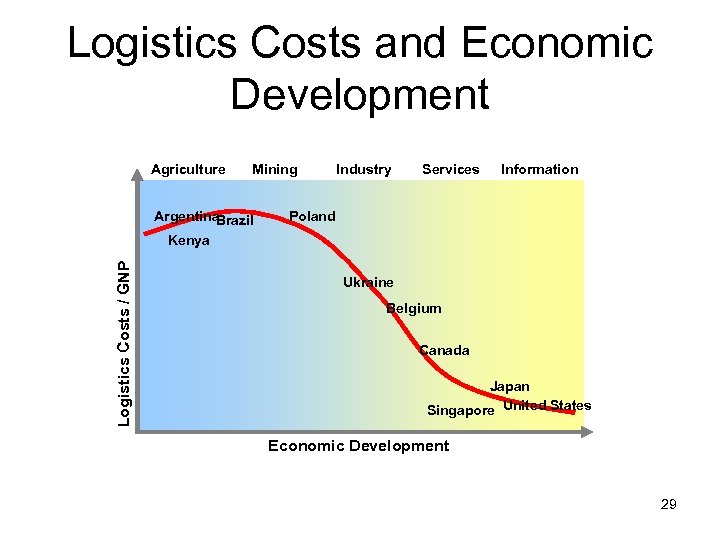

Logistics Costs and Economic Development Agriculture Mining Logistics Costs / GNP Argentina Brazil Kenya Industry Services Information Poland Ukraine Belgium Canada Japan Singapore United States Economic Development 29

Logistics Costs and Economic Development Agriculture Mining Logistics Costs / GNP Argentina Brazil Kenya Industry Services Information Poland Ukraine Belgium Canada Japan Singapore United States Economic Development 29

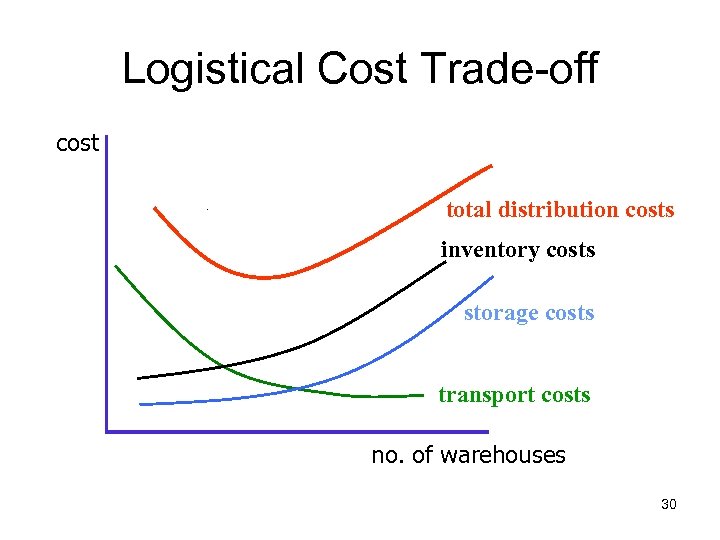

Logistical Cost Trade-off cost total distribution costs inventory costs storage costs transport costs no. of warehouses 30

Logistical Cost Trade-off cost total distribution costs inventory costs storage costs transport costs no. of warehouses 30

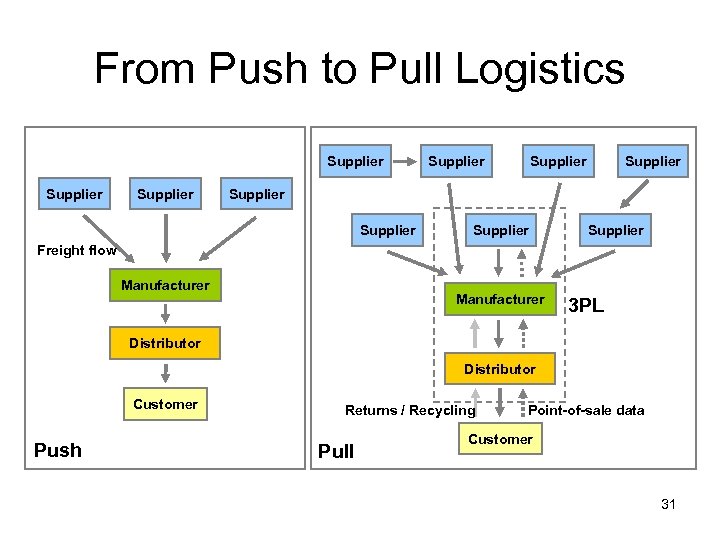

From Push to Pull Logistics Supplier Supplier Supplier Freight flow Manufacturer 3 PL Distributor Customer Push Returns / Recycling Pull Point-of-sale data Customer 31

From Push to Pull Logistics Supplier Supplier Supplier Freight flow Manufacturer 3 PL Distributor Customer Push Returns / Recycling Pull Point-of-sale data Customer 31

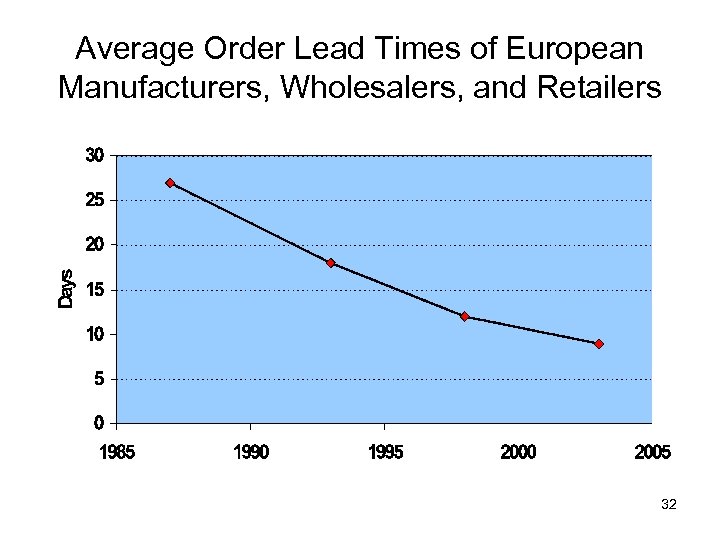

Average Order Lead Times of European Manufacturers, Wholesalers, and Retailers 32

Average Order Lead Times of European Manufacturers, Wholesalers, and Retailers 32

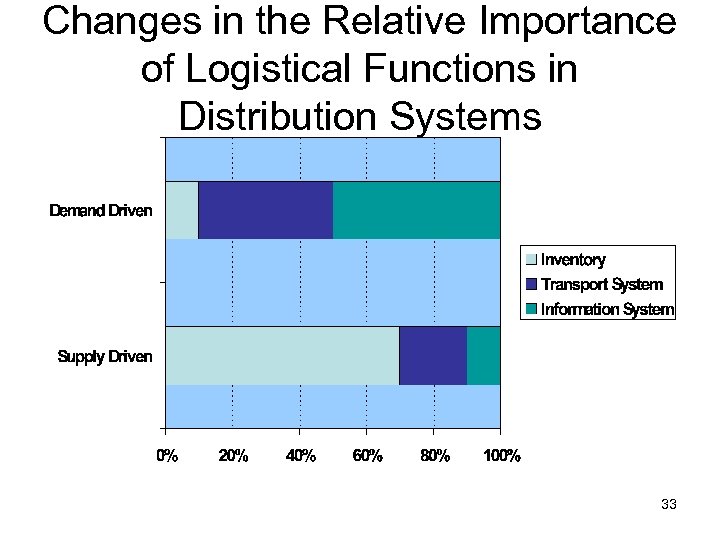

Changes in the Relative Importance of Logistical Functions in Distribution Systems 33

Changes in the Relative Importance of Logistical Functions in Distribution Systems 33

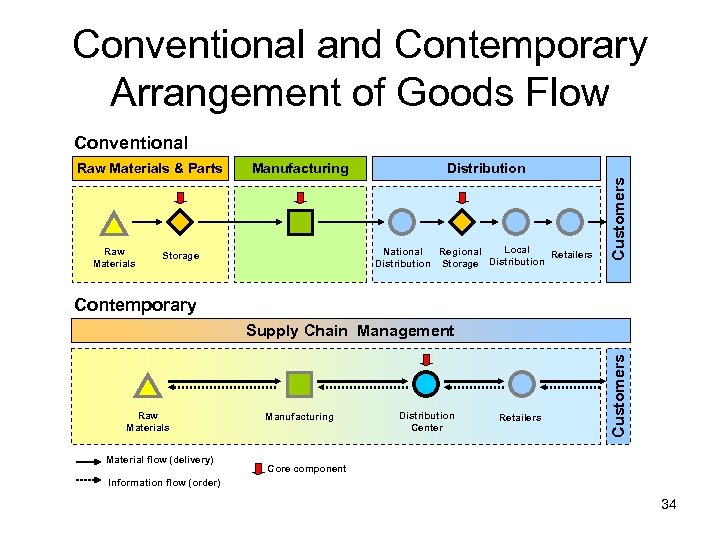

Conventional and Contemporary Arrangement of Goods Flow Conventional Raw Materials Manufacturing Distribution Local National Regional Retailers Distribution Storage Customers Raw Materials & Parts Contemporary Raw Materials Material flow (delivery) Manufacturing Distribution Center Retailers Customers Supply Chain Management Core component Information flow (order) 34

Conventional and Contemporary Arrangement of Goods Flow Conventional Raw Materials Manufacturing Distribution Local National Regional Retailers Distribution Storage Customers Raw Materials & Parts Contemporary Raw Materials Material flow (delivery) Manufacturing Distribution Center Retailers Customers Supply Chain Management Core component Information flow (order) 34

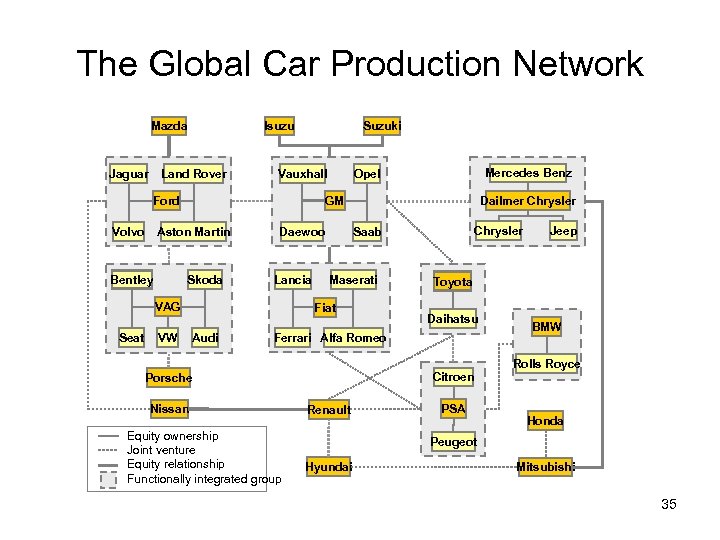

The Global Car Production Network Mazda Jaguar Isuzu Land Rover Suzuki Vauxhall Ford Volvo Skoda Daewoo Lancia VAG Seat Dailmer Chrysler GM Aston Martin Bentley Mercedes Benz Opel VW Maserati Fiat Audi Chrysler Saab Jeep Toyota Daihatsu Ferrari Alfa Romeo BMW Rolls Royce Citroen Porsche Nissan Equity ownership Joint venture Equity relationship Functionally integrated group Renault PSA Honda Peugeot Hyundai Mitsubishi 35

The Global Car Production Network Mazda Jaguar Isuzu Land Rover Suzuki Vauxhall Ford Volvo Skoda Daewoo Lancia VAG Seat Dailmer Chrysler GM Aston Martin Bentley Mercedes Benz Opel VW Maserati Fiat Audi Chrysler Saab Jeep Toyota Daihatsu Ferrari Alfa Romeo BMW Rolls Royce Citroen Porsche Nissan Equity ownership Joint venture Equity relationship Functionally integrated group Renault PSA Honda Peugeot Hyundai Mitsubishi 35

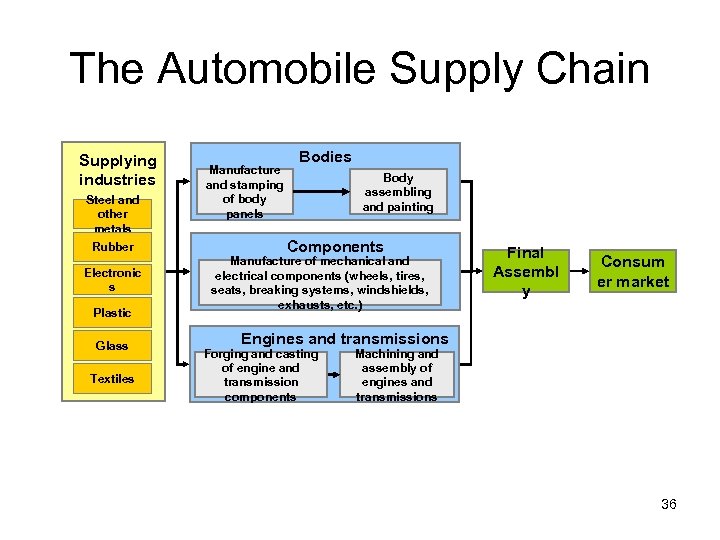

The Automobile Supply Chain Supplying industries Steel and other metals Rubber Electronic s Plastic Glass Textiles Manufacture and stamping of body panels Bodies Body assembling and painting Components Manufacture of mechanical and electrical components (wheels, tires, seats, breaking systems, windshields, exhausts, etc. ) Final Assembl y Consum er market Engines and transmissions Forging and casting of engine and transmission components Machining and assembly of engines and transmissions 36

The Automobile Supply Chain Supplying industries Steel and other metals Rubber Electronic s Plastic Glass Textiles Manufacture and stamping of body panels Bodies Body assembling and painting Components Manufacture of mechanical and electrical components (wheels, tires, seats, breaking systems, windshields, exhausts, etc. ) Final Assembl y Consum er market Engines and transmissions Forging and casting of engine and transmission components Machining and assembly of engines and transmissions 36

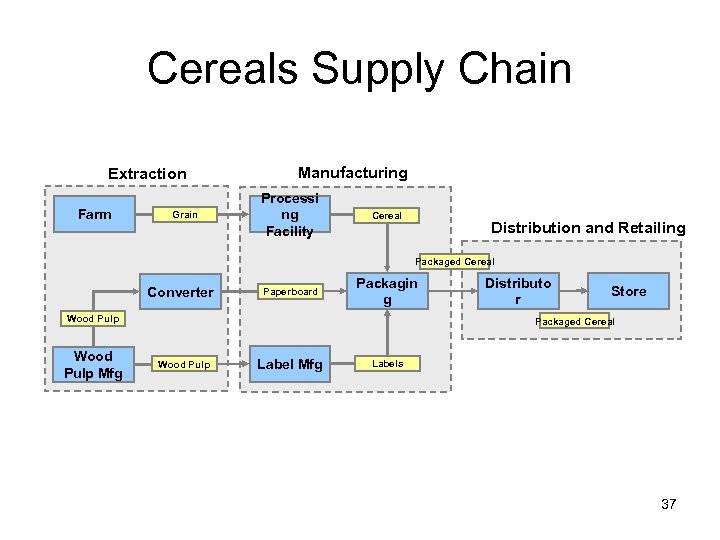

Cereals Supply Chain Extraction Farm Grain Manufacturing Processi ng Facility Cereal Distribution and Retailing Packaged Cereal Converter Paperboard Packagin g Wood Pulp Mfg Distributo r Store Packaged Cereal Wood Pulp Label Mfg Labels 37

Cereals Supply Chain Extraction Farm Grain Manufacturing Processi ng Facility Cereal Distribution and Retailing Packaged Cereal Converter Paperboard Packagin g Wood Pulp Mfg Distributo r Store Packaged Cereal Wood Pulp Label Mfg Labels 37

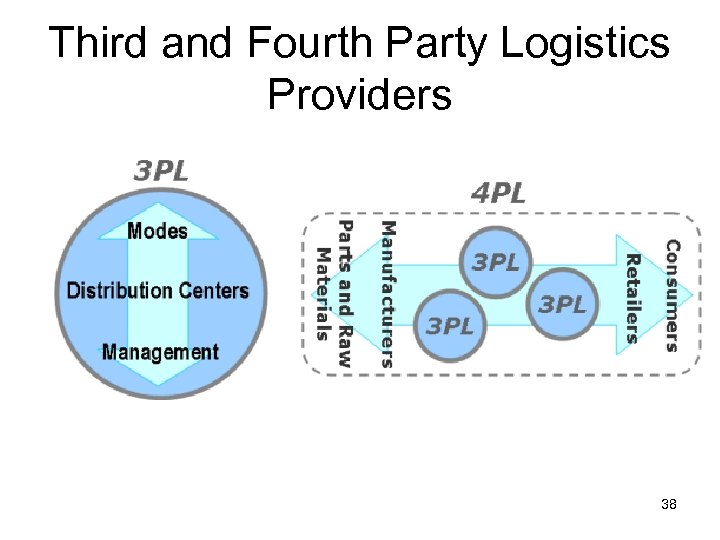

Third and Fourth Party Logistics Providers 38

Third and Fourth Party Logistics Providers 38

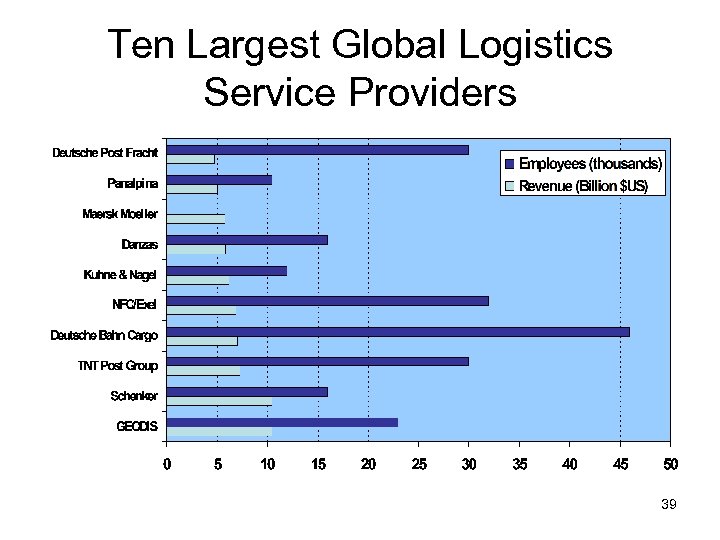

Ten Largest Global Logistics Service Providers 39

Ten Largest Global Logistics Service Providers 39

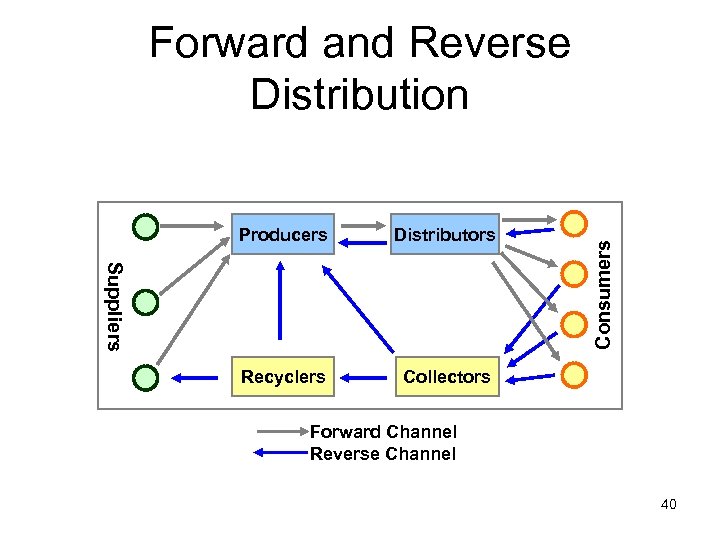

Forward and Reverse Distribution Recyclers Collectors Consumers Distributors Suppliers Producers Forward Channel Reverse Channel 40

Forward and Reverse Distribution Recyclers Collectors Consumers Distributors Suppliers Producers Forward Channel Reverse Channel 40

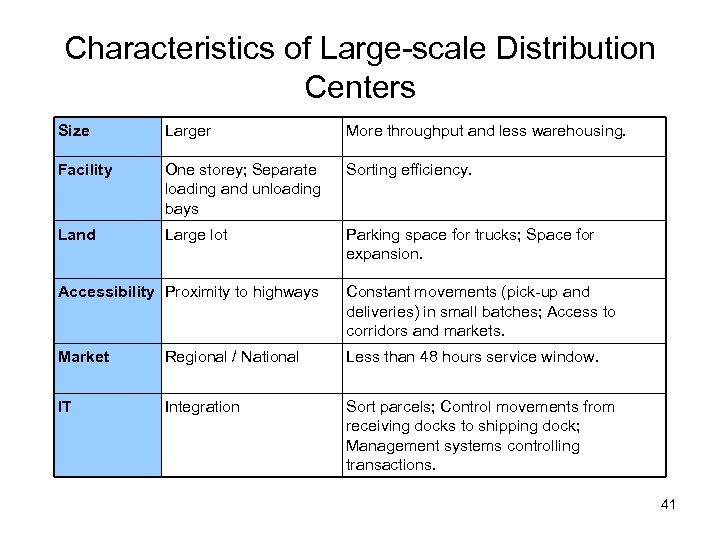

Characteristics of Large-scale Distribution Centers Size Larger More throughput and less warehousing. Facility One storey; Separate loading and unloading bays Sorting efficiency. Land Large lot Parking space for trucks; Space for expansion. Accessibility Proximity to highways Constant movements (pick-up and deliveries) in small batches; Access to corridors and markets. Market Regional / National Less than 48 hours service window. IT Integration Sort parcels; Control movements from receiving docks to shipping dock; Management systems controlling transactions. 41

Characteristics of Large-scale Distribution Centers Size Larger More throughput and less warehousing. Facility One storey; Separate loading and unloading bays Sorting efficiency. Land Large lot Parking space for trucks; Space for expansion. Accessibility Proximity to highways Constant movements (pick-up and deliveries) in small batches; Access to corridors and markets. Market Regional / National Less than 48 hours service window. IT Integration Sort parcels; Control movements from receiving docks to shipping dock; Management systems controlling transactions. 41

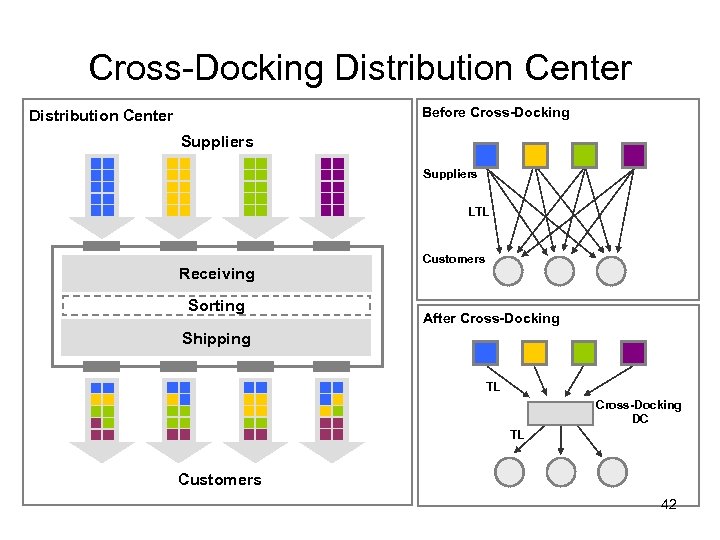

Cross-Docking Distribution Center Before Cross-Docking Distribution Center Suppliers LTL Receiving Sorting Customers After Cross-Docking Shipping TL Cross-Docking DC TL Customers 42

Cross-Docking Distribution Center Before Cross-Docking Distribution Center Suppliers LTL Receiving Sorting Customers After Cross-Docking Shipping TL Cross-Docking DC TL Customers 42

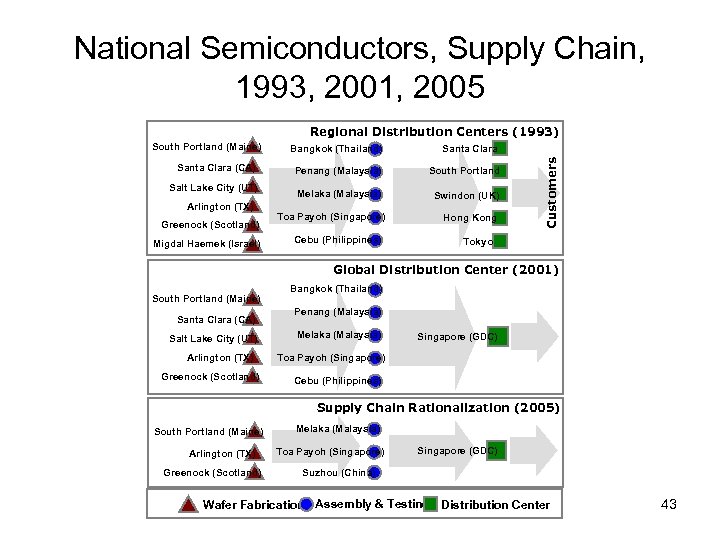

National Semiconductors, Supply Chain, 1993, 2001, 2005 Regional Distribution Centers (1993) Santa Clara (CA) Salt Lake City (UT) Arlington (TX) Greenock (Scotland) Migdal Haemek (Israel) Bangkok (Thailand) Santa Clara Penang (Malaysia) South Portland Melaka (Malaysia) Swindon (UK) Toa Payoh (Singapore) Cebu (Philippines) Hong Kong Customers South Portland (Maine) Tokyo Global Distribution Center (2001) South Portland (Maine) Santa Clara (CA) Salt Lake City (UT) Arlington (TX) Greenock (Scotland) Bangkok (Thailand) Penang (Malaysia) Melaka (Malaysia) Singapore (GDC) Toa Payoh (Singapore) Cebu (Philippines) Supply Chain Rationalization (2005) South Portland (Maine) Arlington (TX) Greenock (Scotland) Melaka (Malaysia) Toa Payoh (Singapore) Singapore (GDC) Suzhou (China) Wafer Fabrication Assembly & Testing Distribution Center 43

National Semiconductors, Supply Chain, 1993, 2001, 2005 Regional Distribution Centers (1993) Santa Clara (CA) Salt Lake City (UT) Arlington (TX) Greenock (Scotland) Migdal Haemek (Israel) Bangkok (Thailand) Santa Clara Penang (Malaysia) South Portland Melaka (Malaysia) Swindon (UK) Toa Payoh (Singapore) Cebu (Philippines) Hong Kong Customers South Portland (Maine) Tokyo Global Distribution Center (2001) South Portland (Maine) Santa Clara (CA) Salt Lake City (UT) Arlington (TX) Greenock (Scotland) Bangkok (Thailand) Penang (Malaysia) Melaka (Malaysia) Singapore (GDC) Toa Payoh (Singapore) Cebu (Philippines) Supply Chain Rationalization (2005) South Portland (Maine) Arlington (TX) Greenock (Scotland) Melaka (Malaysia) Toa Payoh (Singapore) Singapore (GDC) Suzhou (China) Wafer Fabrication Assembly & Testing Distribution Center 43

Gaining competitive advantage “A business is profitable if the value it creates exceeds the cost of performing the value activities. To gain competitive advantage over its rivals, a company must either perform these activities at a lower cost or perform them in a way that leads to differentiation and a premium price (more value). ” Michael Porter 44

Gaining competitive advantage “A business is profitable if the value it creates exceeds the cost of performing the value activities. To gain competitive advantage over its rivals, a company must either perform these activities at a lower cost or perform them in a way that leads to differentiation and a premium price (more value). ” Michael Porter 44

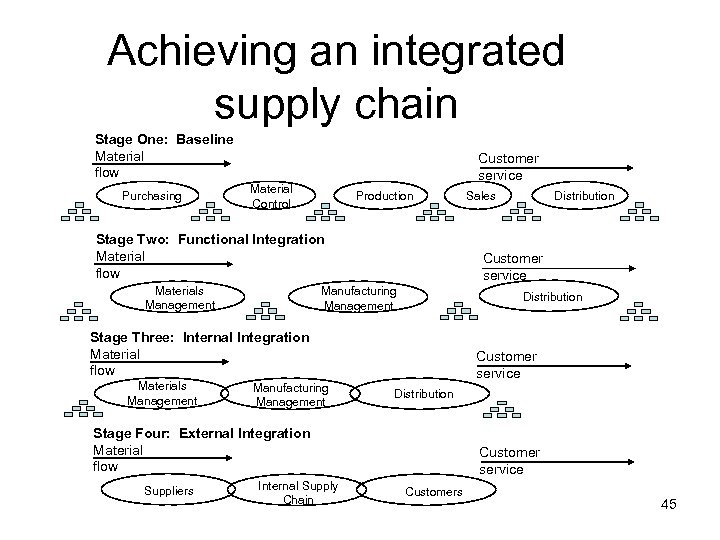

Achieving an integrated supply chain Stage One: Baseline Material flow Purchasing Customer service Material Control Production Stage Two: Functional Integration Material flow Materials Management Manufacturing Management Distribution Customer service Distribution Stage Four: External Integration Material flow Suppliers Internal Supply Chain Distribution Customer service Stage Three: Internal Integration Material flow Materials Management Sales Customer service Customers 45

Achieving an integrated supply chain Stage One: Baseline Material flow Purchasing Customer service Material Control Production Stage Two: Functional Integration Material flow Materials Management Manufacturing Management Distribution Customer service Distribution Stage Four: External Integration Material flow Suppliers Internal Supply Chain Distribution Customer service Stage Three: Internal Integration Material flow Materials Management Sales Customer service Customers 45

The two dimensions of supply chain excellence • Cost advantage : Lower end-to-end delivered cost • Value advantage : Creating superior customer value through enhanced service 46

The two dimensions of supply chain excellence • Cost advantage : Lower end-to-end delivered cost • Value advantage : Creating superior customer value through enhanced service 46

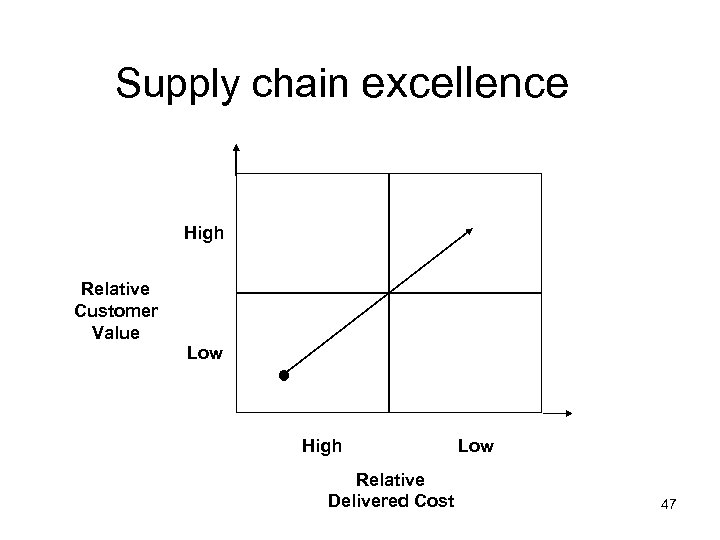

Supply chain excellence High Relative Customer Value Low High Relative Delivered Cost Low 47

Supply chain excellence High Relative Customer Value Low High Relative Delivered Cost Low 47

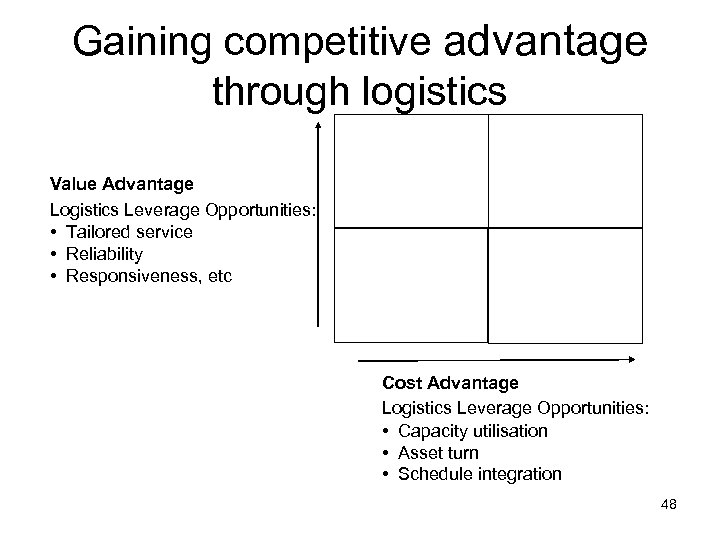

Gaining competitive advantage through logistics Value Advantage Logistics Leverage Opportunities: • Tailored service • Reliability • Responsiveness, etc Cost Advantage Logistics Leverage Opportunities: • Capacity utilisation • Asset turn • Schedule integration 48

Gaining competitive advantage through logistics Value Advantage Logistics Leverage Opportunities: • Tailored service • Reliability • Responsiveness, etc Cost Advantage Logistics Leverage Opportunities: • Capacity utilisation • Asset turn • Schedule integration 48

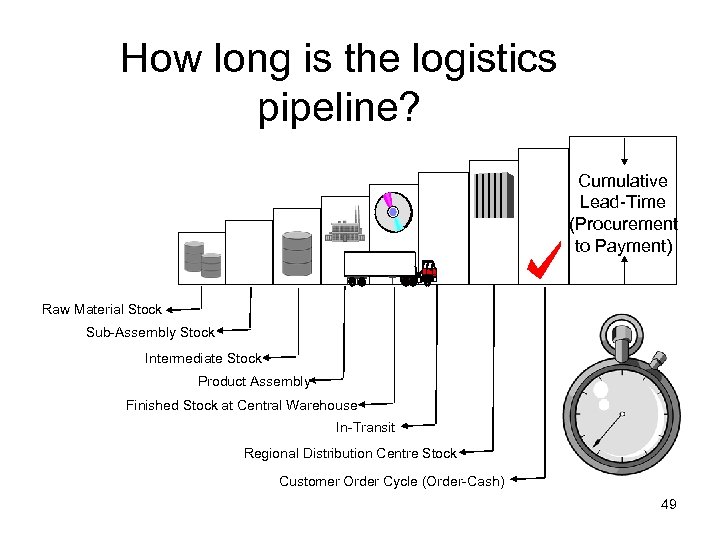

How long is the logistics pipeline? Cumulative Lead-Time (Procurement to Payment) Raw Material Stock Sub-Assembly Stock Intermediate Stock Product Assembly Finished Stock at Central Warehouse In-Transit Regional Distribution Centre Stock Customer Order Cycle (Order-Cash) 49

How long is the logistics pipeline? Cumulative Lead-Time (Procurement to Payment) Raw Material Stock Sub-Assembly Stock Intermediate Stock Product Assembly Finished Stock at Central Warehouse In-Transit Regional Distribution Centre Stock Customer Order Cycle (Order-Cash) 49

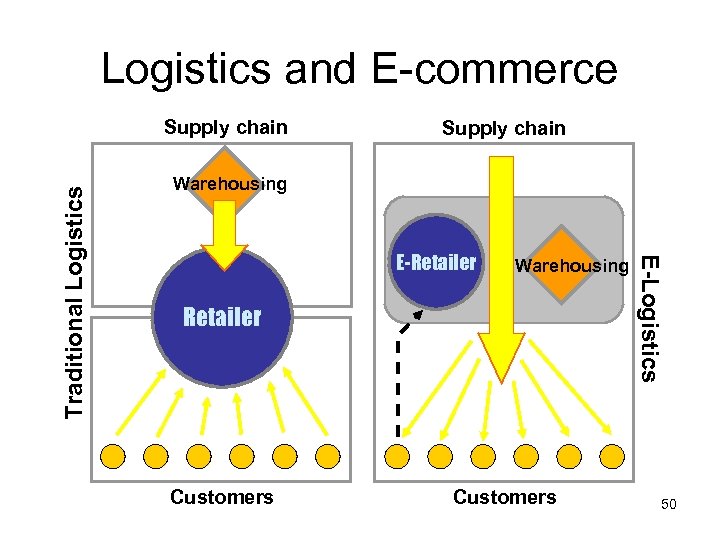

Logistics and E-commerce Supply chain Warehousing E-Retailer Warehousing Retailer Customers E-Logistics Traditional Logistics Supply chain 50

Logistics and E-commerce Supply chain Warehousing E-Retailer Warehousing Retailer Customers E-Logistics Traditional Logistics Supply chain 50

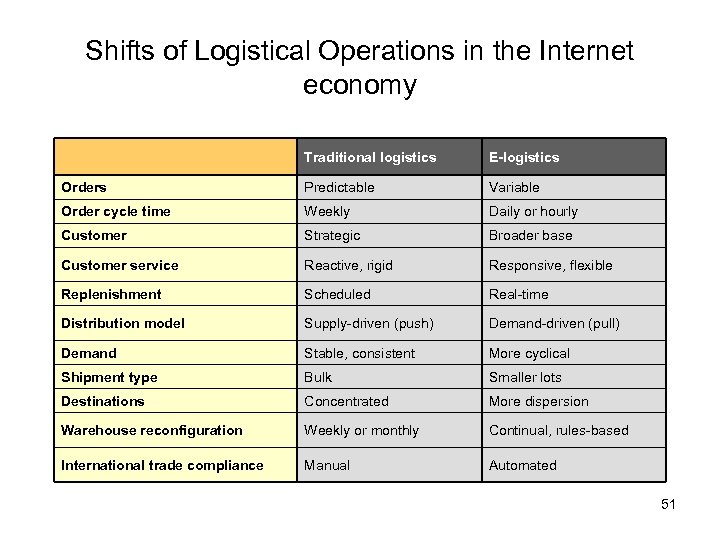

Shifts of Logistical Operations in the Internet economy Traditional logistics E-logistics Orders Predictable Variable Order cycle time Weekly Daily or hourly Customer Strategic Broader base Customer service Reactive, rigid Responsive, flexible Replenishment Scheduled Real-time Distribution model Supply-driven (push) Demand-driven (pull) Demand Stable, consistent More cyclical Shipment type Bulk Smaller lots Destinations Concentrated More dispersion Warehouse reconfiguration Weekly or monthly Continual, rules-based International trade compliance Manual Automated 51

Shifts of Logistical Operations in the Internet economy Traditional logistics E-logistics Orders Predictable Variable Order cycle time Weekly Daily or hourly Customer Strategic Broader base Customer service Reactive, rigid Responsive, flexible Replenishment Scheduled Real-time Distribution model Supply-driven (push) Demand-driven (pull) Demand Stable, consistent More cyclical Shipment type Bulk Smaller lots Destinations Concentrated More dispersion Warehouse reconfiguration Weekly or monthly Continual, rules-based International trade compliance Manual Automated 51

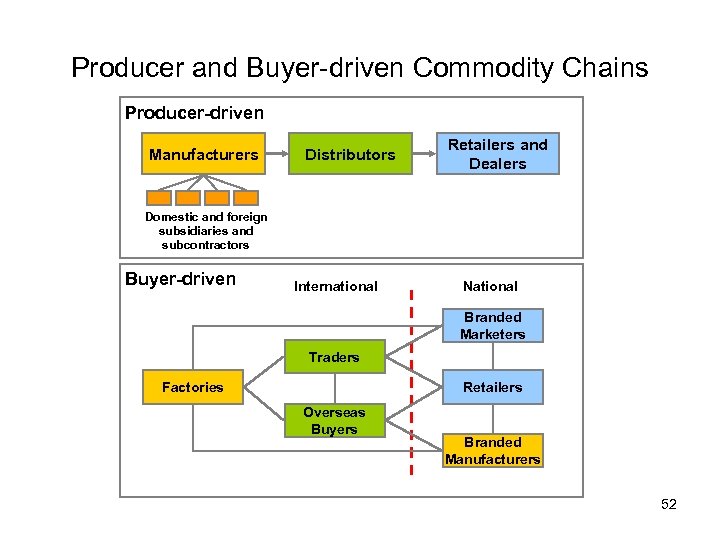

Producer and Buyer-driven Commodity Chains Producer-driven Manufacturers Distributors Retailers and Dealers Domestic and foreign subsidiaries and subcontractors Buyer-driven International National Branded Marketers Traders Factories Retailers Overseas Buyers Branded Manufacturers 52

Producer and Buyer-driven Commodity Chains Producer-driven Manufacturers Distributors Retailers and Dealers Domestic and foreign subsidiaries and subcontractors Buyer-driven International National Branded Marketers Traders Factories Retailers Overseas Buyers Branded Manufacturers 52

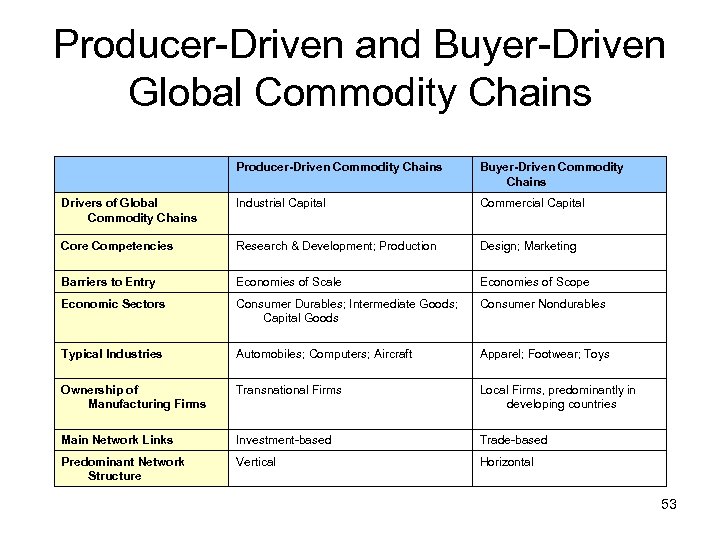

Producer-Driven and Buyer-Driven Global Commodity Chains Producer-Driven Commodity Chains Buyer-Driven Commodity Chains Drivers of Global Commodity Chains Industrial Capital Commercial Capital Core Competencies Research & Development; Production Design; Marketing Barriers to Entry Economies of Scale Economies of Scope Economic Sectors Consumer Durables; Intermediate Goods; Capital Goods Consumer Nondurables Typical Industries Automobiles; Computers; Aircraft Apparel; Footwear; Toys Ownership of Manufacturing Firms Transnational Firms Local Firms, predominantly in developing countries Main Network Links Investment-based Trade-based Predominant Network Structure Vertical Horizontal 53

Producer-Driven and Buyer-Driven Global Commodity Chains Producer-Driven Commodity Chains Buyer-Driven Commodity Chains Drivers of Global Commodity Chains Industrial Capital Commercial Capital Core Competencies Research & Development; Production Design; Marketing Barriers to Entry Economies of Scale Economies of Scope Economic Sectors Consumer Durables; Intermediate Goods; Capital Goods Consumer Nondurables Typical Industries Automobiles; Computers; Aircraft Apparel; Footwear; Toys Ownership of Manufacturing Firms Transnational Firms Local Firms, predominantly in developing countries Main Network Links Investment-based Trade-based Predominant Network Structure Vertical Horizontal 53

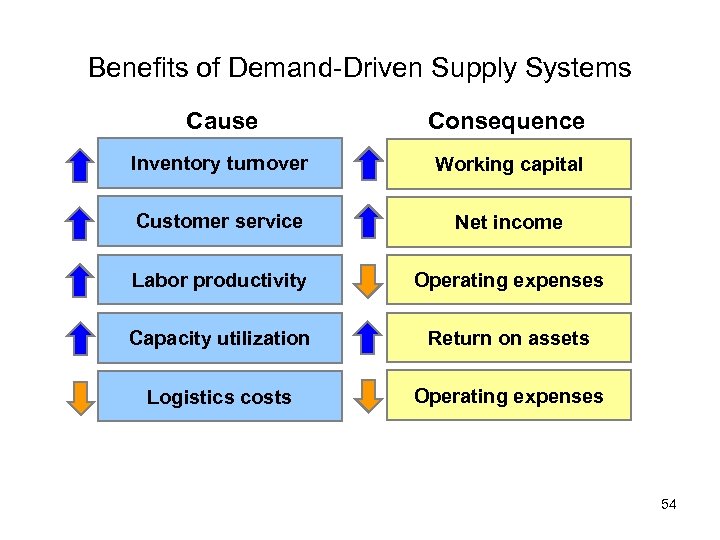

Benefits of Demand-Driven Supply Systems Cause Consequence Inventory turnover Working capital Customer service Net income Labor productivity Operating expenses Capacity utilization Return on assets Logistics costs Operating expenses 54

Benefits of Demand-Driven Supply Systems Cause Consequence Inventory turnover Working capital Customer service Net income Labor productivity Operating expenses Capacity utilization Return on assets Logistics costs Operating expenses 54