e34b9af90b1b515e5a33a1ef941b4e8f.ppt

- Количество слайдов: 32

Market Structure and Enhancing Returns October 8 th, 2015 Niall H. O’Malley Portfolio Manager niall. omalley@bluepointim. us

Disclosures Thoughts expressed are personal opinion and do not take into account the particular investment objectives, financial situations, or needs of individual clients. The presentation is based on current public information that is considered reliable, but no representation regarding accuracy is made. The information provided is not an offer to buy or sell security. Blue Point Investment Management 2

Market Structure and Societal Considerations History - Merchant’s need for additional share capital • East India Company in 1600 and Dutch East India Company 1602 • Merchant class sought trade with the East. • Balance of Estate becomes Balance Sheet and the continuous corporation is born. • Joint Stock companies enter an age of investment importance. • Trade with the East required long-term capital. Societal Considerations: • Does the society endorse entrepreneurship? • Look at stock ownership in the society? • Germans put less than 14% of their money in equity funds. Where as Americans are 52% invested in equities. Blue Point Investment Management 3

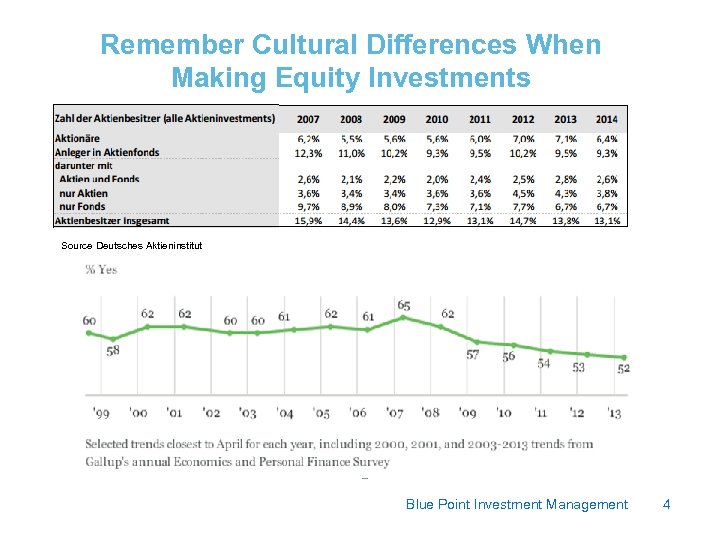

Remember Cultural Differences When Making Equity Investments Source Deutsches Aktieninstitut Blue Point Investment Management 4

Societal Considerations • Open versus Close e. g. U. S. versus China • U. S. media has many talking heads whereas China has a single party line. • A strength of the communist system is central planning and infrastructure building. There are no NIMBY issues. The gas pipeline is built. • China achieved the most rapid industrialization in human history. Communist economies often lack incentives to meet consumer wants and desires. The China of today is a hybrid economy that politically is becoming more closed while at the same time seeking a transition to a consumer economy. The U. S. is an open society with more incentives for an entrepreneurial service economy to grow. Blue Point Investment Management 5

Demand Driver Largest Urbanization and Industrialization in Human History From 1982 - 2011 China’s GDP grew from $282 billion to $9, 185 trillion – a 32. 6 x increase – while its urban population more than doubled from 20. 8% to over 50%. China’s growth resulted in dramatic year-overyear increases in commodity demand between 2003 - 2011. Blue Point Investment Management 6

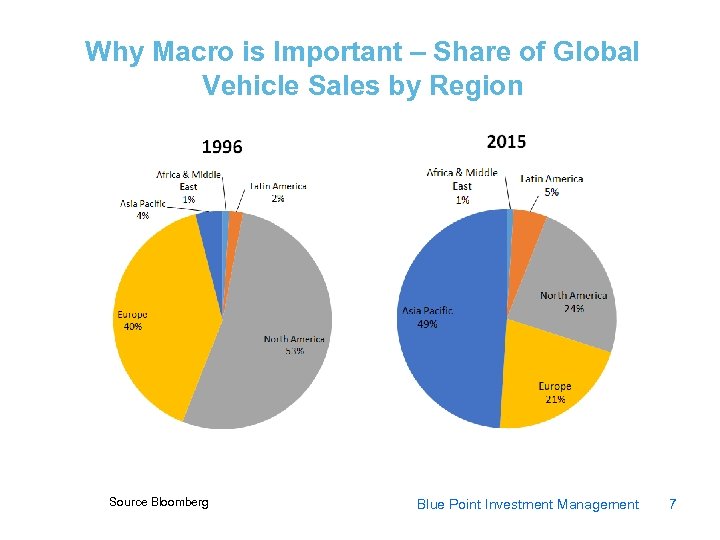

Why Macro is Important – Share of Global Vehicle Sales by Region Source Bloomberg Blue Point Investment Management 7

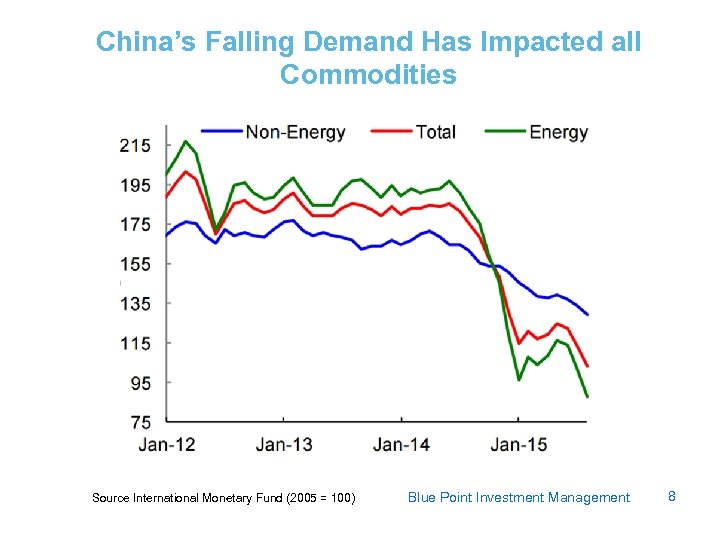

China’s Falling Demand Has Impacted all Commodities Source International Monetary Fund (2005 = 100) Blue Point Investment Management 8

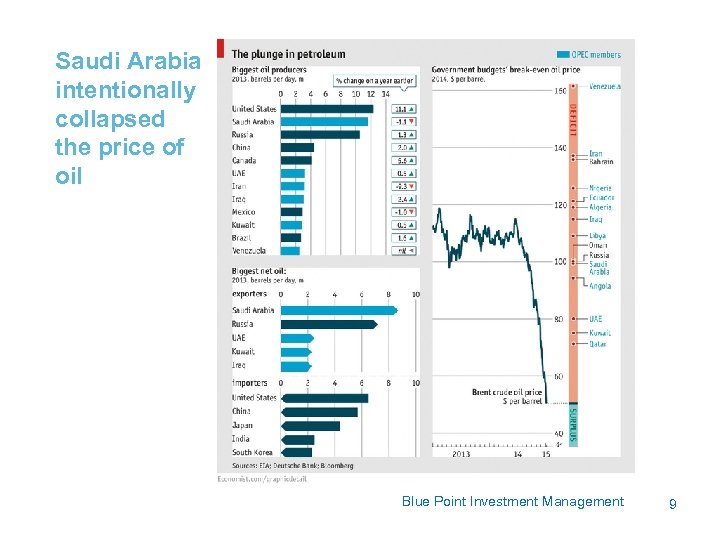

Saudi Arabia intentionally collapsed the price of oil Blue Point Investment Management 9

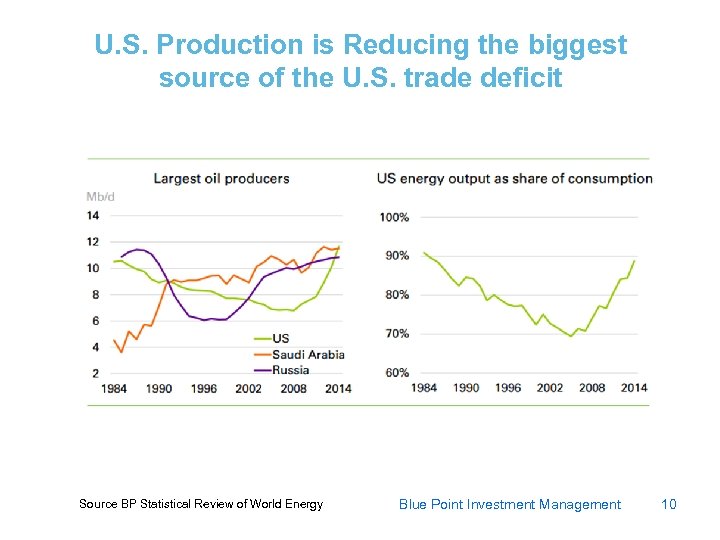

U. S. Production is Reducing the biggest source of the U. S. trade deficit Source BP Statistical Review of World Energy Blue Point Investment Management 10

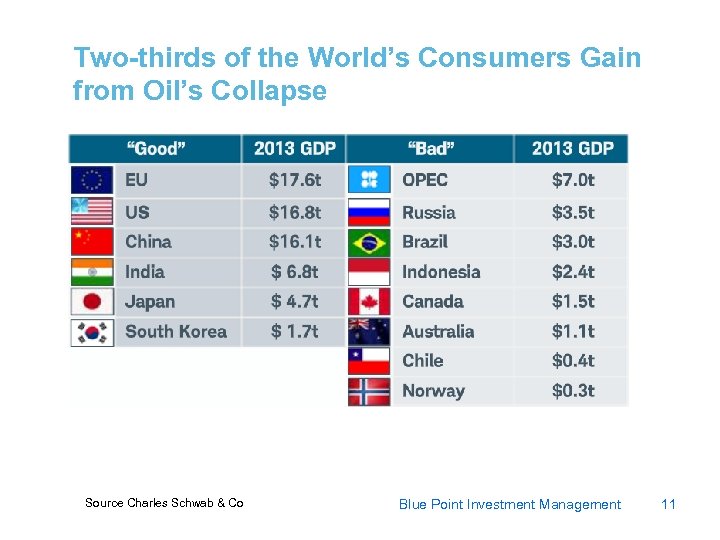

Two-thirds of the World’s Consumers Gain from Oil’s Collapse Source Charles Schwab & Co Blue Point Investment Management 11

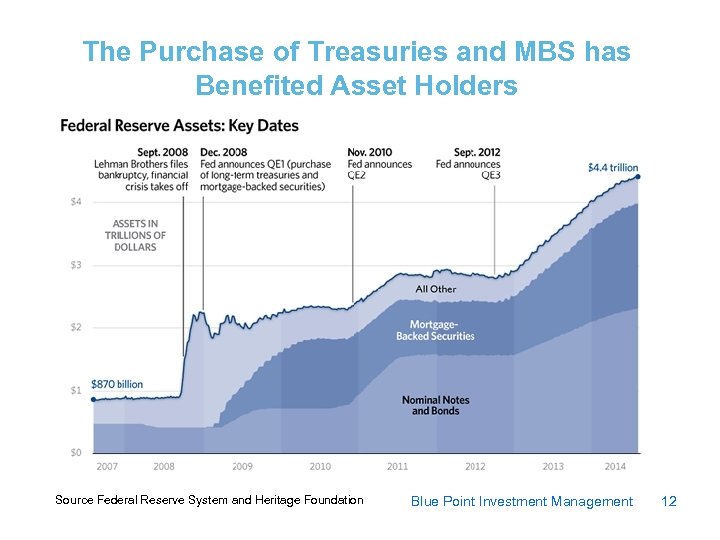

The Purchase of Treasuries and MBS has Benefited Asset Holders Source Federal Reserve System and Heritage Foundation Blue Point Investment Management 12

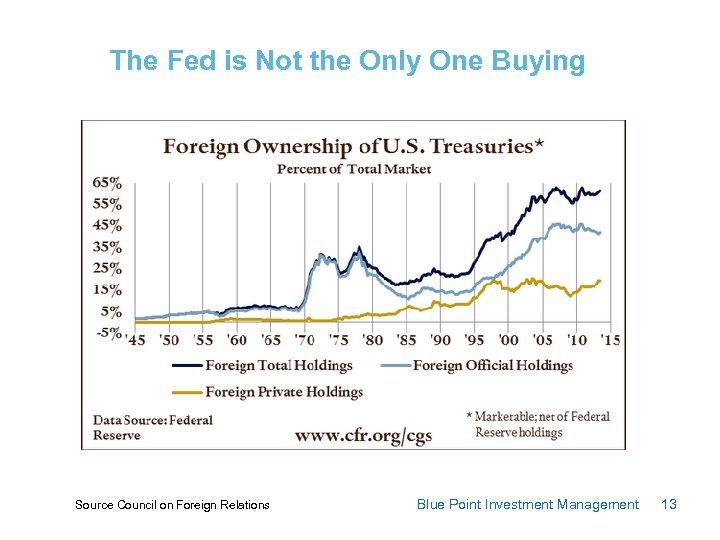

The Fed is Not the Only One Buying Source Council on Foreign Relations Blue Point Investment Management 13

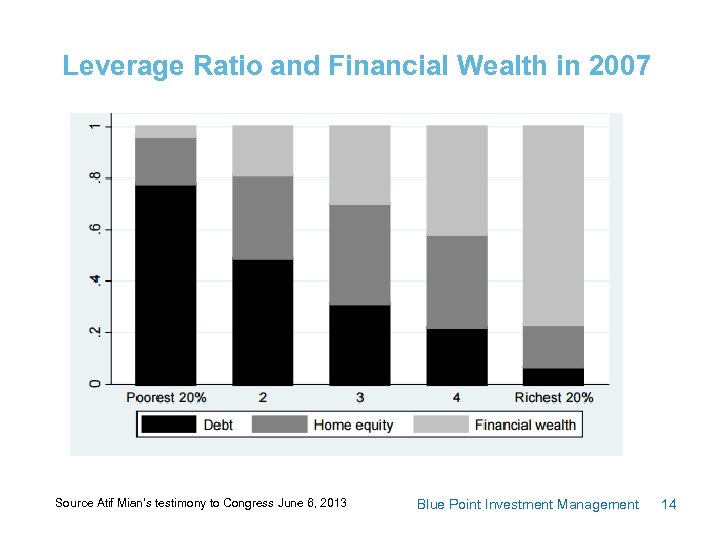

Leverage Ratio and Financial Wealth in 2007 Source Atif Mian’s testimony to Congress June 6, 2013 Blue Point Investment Management 14

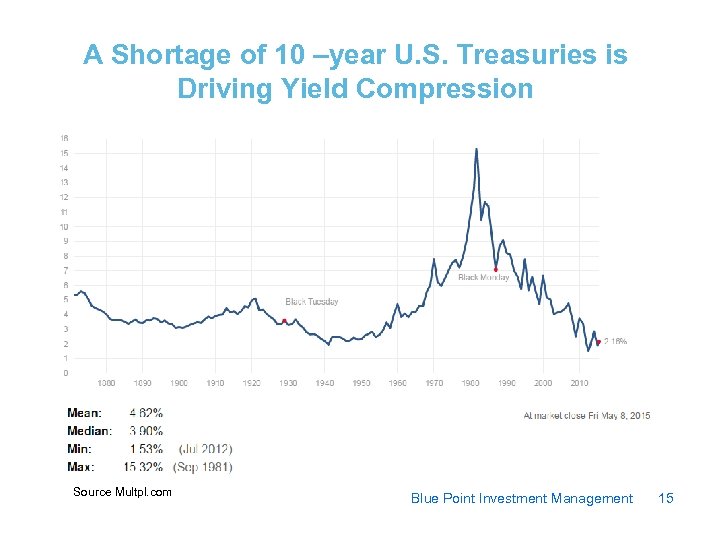

A Shortage of 10 –year U. S. Treasuries is Driving Yield Compression Source Multpl. com Blue Point Investment Management 15

A Turning Point for Europe. ECB Receives a Legal Endorsement for QE in January Source REUTERS/ Kai Pfaffenba Blue Point Investment Management 16

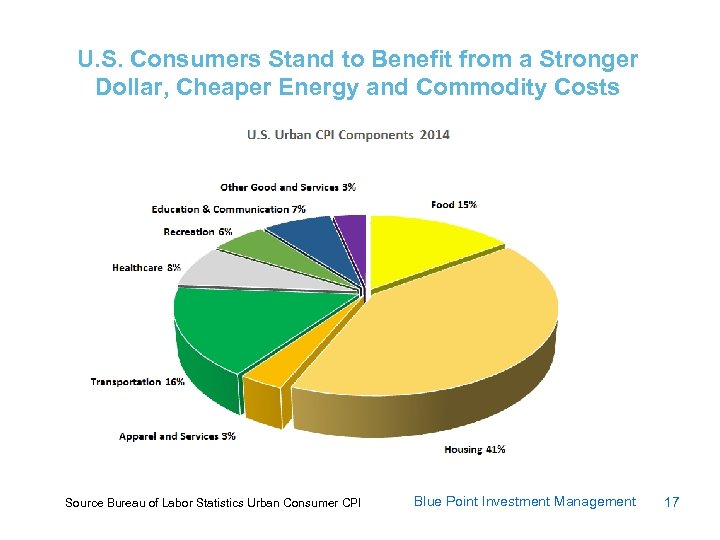

U. S. Consumers Stand to Benefit from a Stronger Dollar, Cheaper Energy and Commodity Costs Source Bureau of Labor Statistics Urban Consumer CPI Blue Point Investment Management 17

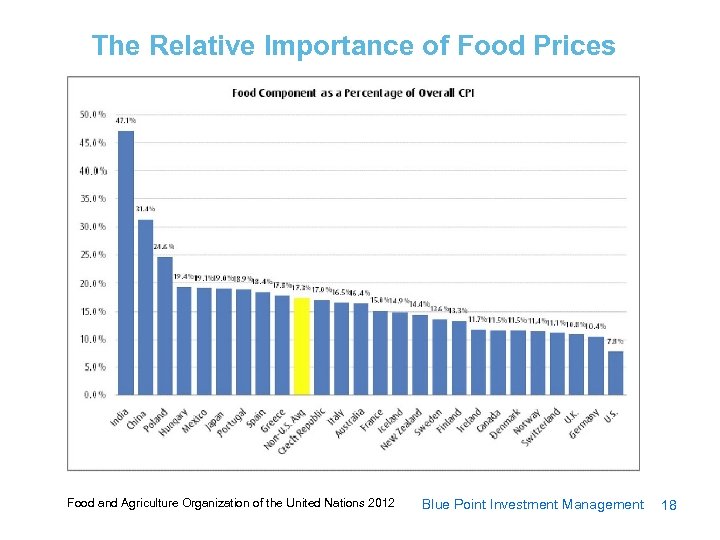

The Relative Importance of Food Prices Food and Agriculture Organization of the United Nations 2012 Blue Point Investment Management 18

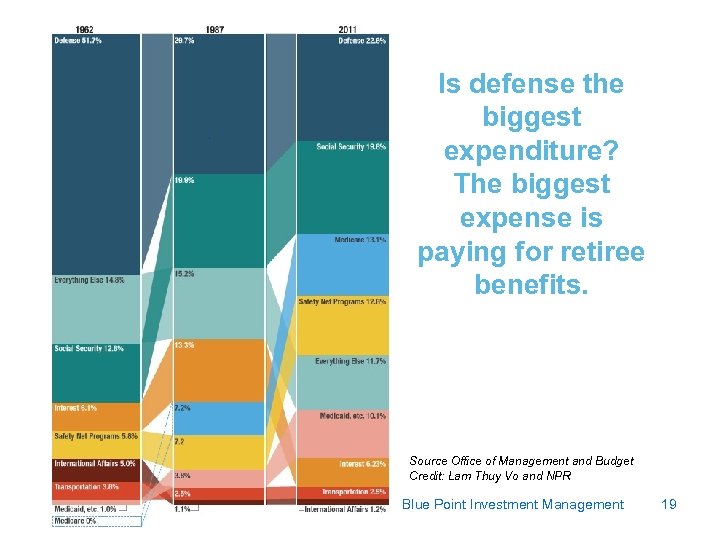

Is defense the biggest expenditure? The biggest expense is paying for retiree benefits. Source Office of Management and Budget Credit: Lam Thuy Vo and NPR Blue Point Investment Management 19

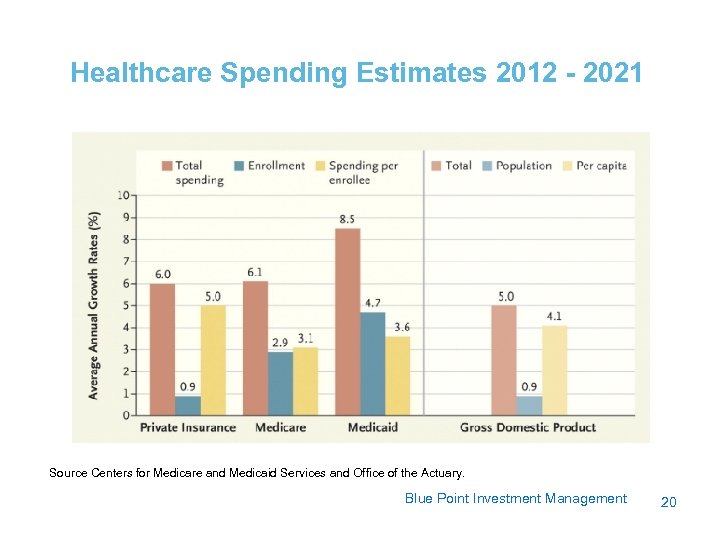

Healthcare Spending Estimates 2012 - 2021 Source Centers for Medicare and Medicaid Services and Office of the Actuary. Blue Point Investment Management 20

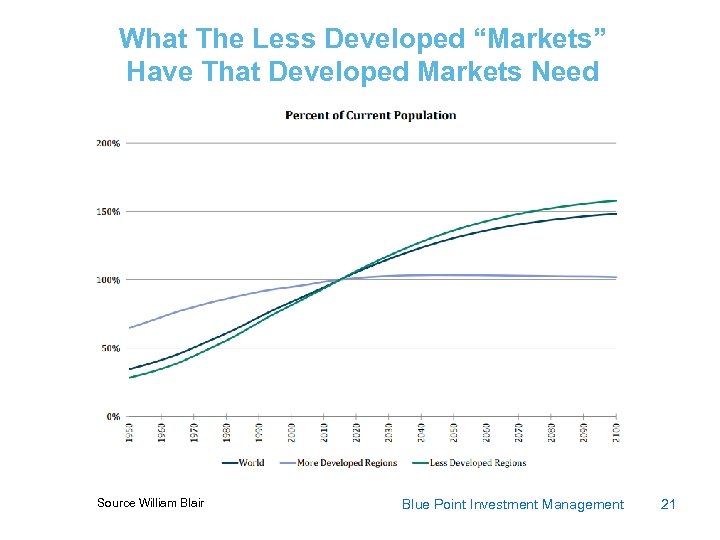

What The Less Developed “Markets” Have That Developed Markets Need Source William Blair Blue Point Investment Management 21

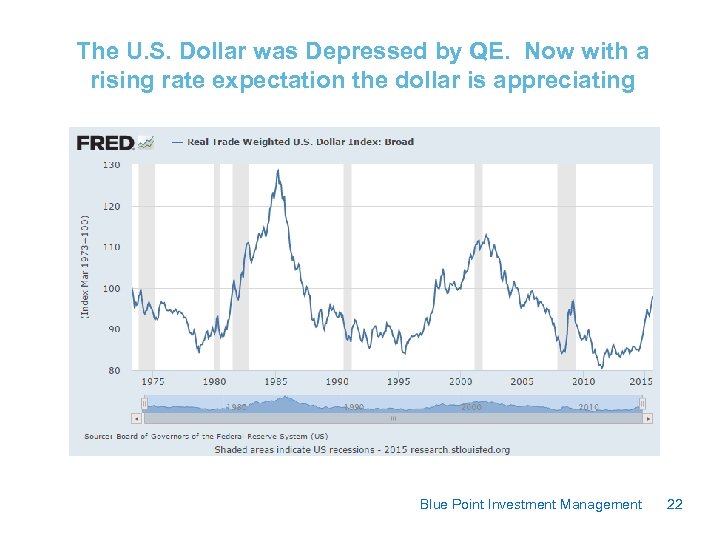

The U. S. Dollar was Depressed by QE. Now with a rising rate expectation the dollar is appreciating Blue Point Investment Management 22

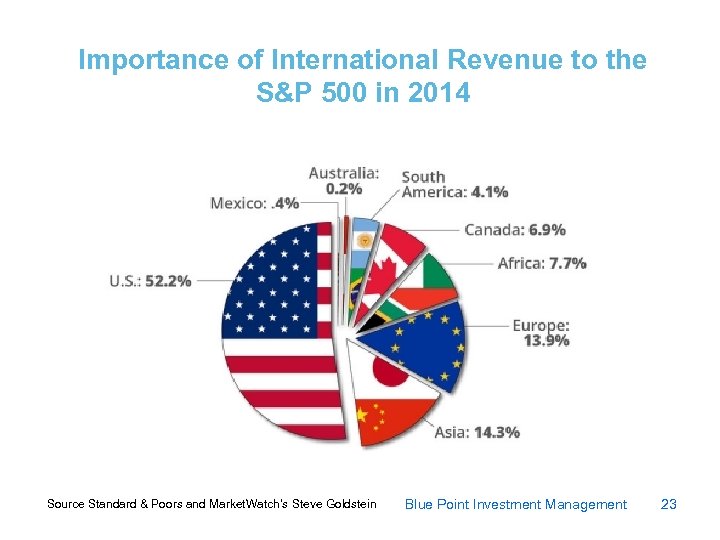

Importance of International Revenue to the S&P 500 in 2014 Source Standard & Poors and Market. Watch’s Steve Goldstein Blue Point Investment Management 23

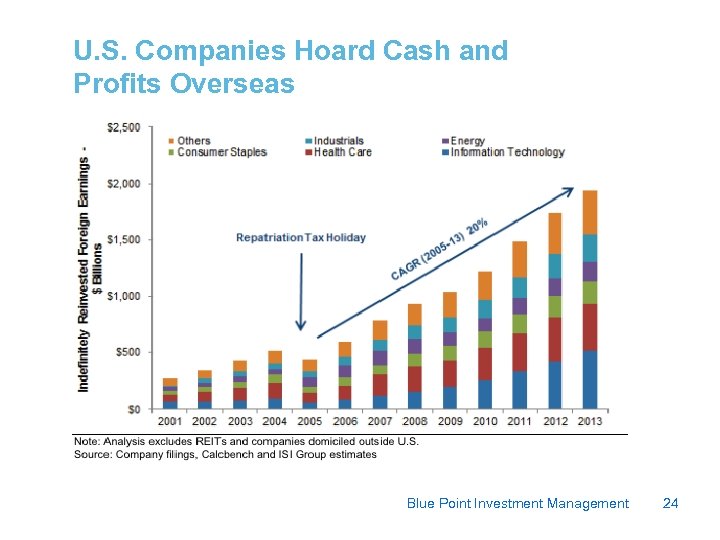

U. S. Companies Hoard Cash and Profits Overseas Blue Point Investment Management 24

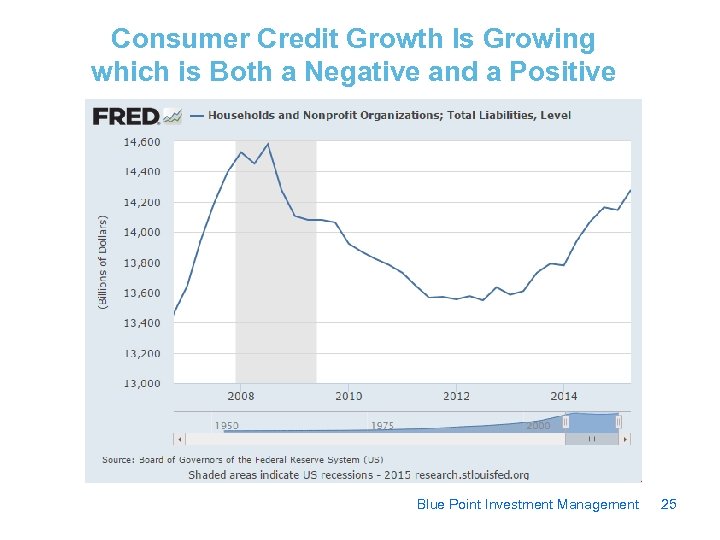

Consumer Credit Growth Is Growing which is Both a Negative and a Positive Blue Point Investment Management 25

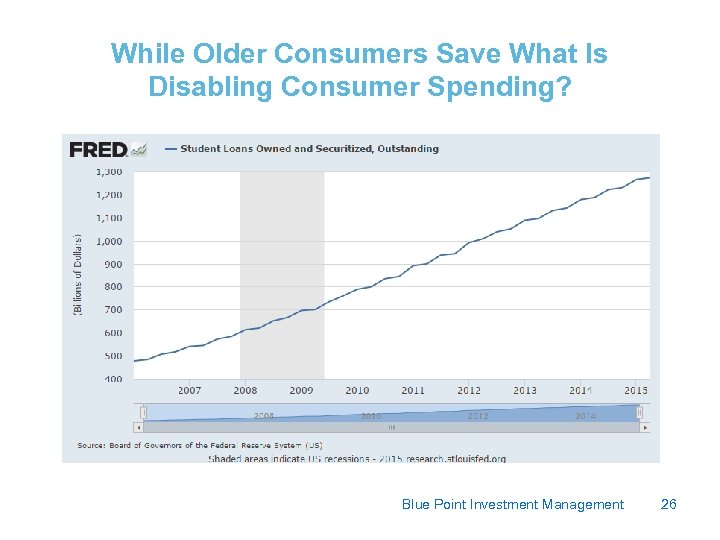

While Older Consumers Save What Is Disabling Consumer Spending? Blue Point Investment Management 26

Is Today’s Computer and Information driven Market Efficient? Source Douglas Healey/Bloomberg Blue Point Investment Management 27

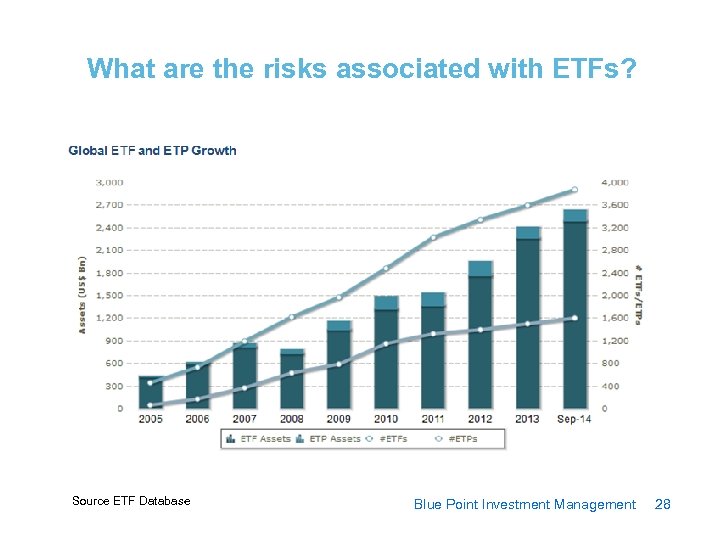

What are the risks associated with ETFs? Source ETF Database Blue Point Investment Management 28

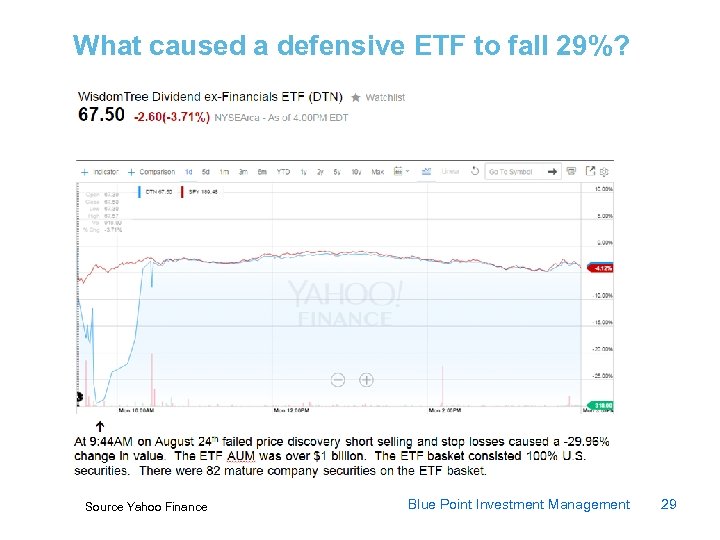

What caused a defensive ETF to fall 29%? Source Yahoo Finance Blue Point Investment Management 29

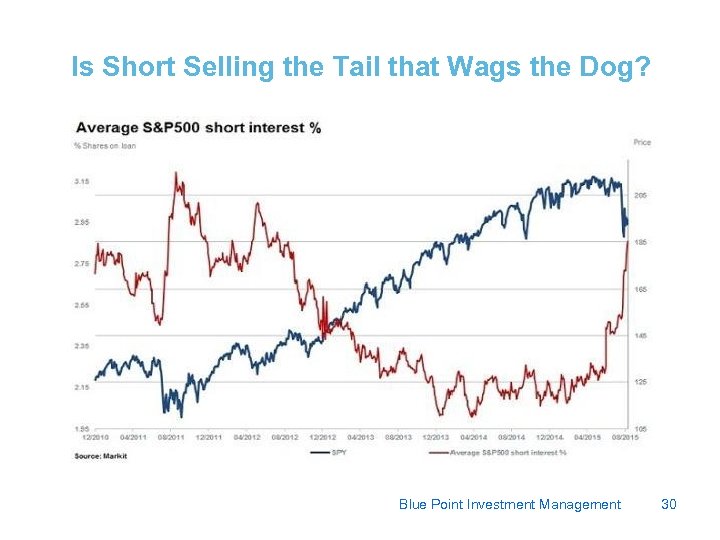

Is Short Selling the Tail that Wags the Dog? Blue Point Investment Management 30

The U. S. is Favored in a Growth Challenged World • A strong dollar increases U. S. consumers purchasing power. Imports, energy and commodities are cheaper. Three quarters of the U. S. economy is consumption. • Consumer credit is more readily available • Job growth is supporting stronger consumer confidence. • Unusually high retirement savings and student debt continue to reduce consumer demand. Blue Point Investment Management 31

Keeping You Posted Blue Point Investment Management 32

e34b9af90b1b515e5a33a1ef941b4e8f.ppt