58564b45d62560685cd5b1c9425bfe34.ppt

- Количество слайдов: 75

Market Sizing Minder Chen, Ph. D. Professor of Management Information Systems Martin V. Smith School of Business and Economics California State University Channel Islands Camarillo, CA 93012 Minder. chen@csuci. edu minderchen@gmail. com © Minder Chen, 1996 -2017 Market Sizing - 1

Market Sizing Minder Chen, Ph. D. Professor of Management Information Systems Martin V. Smith School of Business and Economics California State University Channel Islands Camarillo, CA 93012 Minder. chen@csuci. edu minderchen@gmail. com © Minder Chen, 1996 -2017 Market Sizing - 1

Zappos It all started with a failed trip to the mall. In 1998, filmschool grad Nick Swinmurn was scouring the Bay Area for a pair of Airwalks, but couldn't seem to find the right size and style. Swinmurn, who was working at the Internet consumer site Autoweb. com at the time, used the model behind that site for selling shoes online. This idea would eventually become Zappos. com. © Minder Chen, 1996 -2017 Market Sizing - 2

Zappos It all started with a failed trip to the mall. In 1998, filmschool grad Nick Swinmurn was scouring the Bay Area for a pair of Airwalks, but couldn't seem to find the right size and style. Swinmurn, who was working at the Internet consumer site Autoweb. com at the time, used the model behind that site for selling shoes online. This idea would eventually become Zappos. com. © Minder Chen, 1996 -2017 Market Sizing - 2

Shoesite. com • It was the fact that 5 percent of a $40 billion (i. e. , $2 B ) shoe business was already being done through mail order. That was my big statistic (top-down estimation). People were already buying shoes without trying them on. – Total Available Market (TAM) size = $40 billion. – Served Addressable Market (SAM) size= $2 B – Share Of the Market / Target Market (SOM/TM): Reached 10% of the SAM in 2 year = $200 M • So they [ Venture Frogs ] invested $500, 000 - which at the time felt like I had just raised $100 million. • The company was a little more stable at that point, so Fred Mossler (agreed to leave Nordstrom and come on board as our “Senior VP of Merchandising” Domain Knowledge http: //about. zappos. com/press-center/media-coverage/zappos-milestone-qa-nick-swinmurn http: //www. tedxsincity. com/speakers/fred-mossler/ © Minder Chen, 1996 -2017 Market Sizing - 3

Shoesite. com • It was the fact that 5 percent of a $40 billion (i. e. , $2 B ) shoe business was already being done through mail order. That was my big statistic (top-down estimation). People were already buying shoes without trying them on. – Total Available Market (TAM) size = $40 billion. – Served Addressable Market (SAM) size= $2 B – Share Of the Market / Target Market (SOM/TM): Reached 10% of the SAM in 2 year = $200 M • So they [ Venture Frogs ] invested $500, 000 - which at the time felt like I had just raised $100 million. • The company was a little more stable at that point, so Fred Mossler (agreed to leave Nordstrom and come on board as our “Senior VP of Merchandising” Domain Knowledge http: //about. zappos. com/press-center/media-coverage/zappos-milestone-qa-nick-swinmurn http: //www. tedxsincity. com/speakers/fred-mossler/ © Minder Chen, 1996 -2017 Market Sizing - 3

Tony Hsieh and his CFO Alfred Lin • 謝家華(左)與林君叡的辦公室根本連門都不設,頂上裝 飾成熱帶雨林,還有猴子。 記者馮鳴台/攝影 • Read more: 世界新聞網 © Minder Chen, 1996 -2017 Market Sizing - 4

Tony Hsieh and his CFO Alfred Lin • 謝家華(左)與林君叡的辦公室根本連門都不設,頂上裝 飾成熱帶雨林,還有猴子。 記者馮鳴台/攝影 • Read more: 世界新聞網 © Minder Chen, 1996 -2017 Market Sizing - 4

What is the story behind a Pizza? Profit margin © Minder Chen, 1996 -2017 Market Sizing - 5

What is the story behind a Pizza? Profit margin © Minder Chen, 1996 -2017 Market Sizing - 5

Entrepreneurship New venture creation or “start-ups” vs. entrepreneurial thinking and value creation applicable to organizations of all types and sizes. • Traditionally definition: Entrepreneurship have been limited to ideas such as starting a small business, new product development, and the reduction of costs to remain competitive. • A broader definition: Entrepreneurship is the process of identifying an opportunity regardless of the resources currently available. Entrepreneurship is “A way of thinking and acting that is opportunity-obsessed, holistic in approach, and leadership-balanced. ” © Minder Chen, 1996 -2017 **http: //faculty. babson. edu/academic/eship/mappingtheterritory_babson/babson_entreprenuership. pdf Market Sizing - 6

Entrepreneurship New venture creation or “start-ups” vs. entrepreneurial thinking and value creation applicable to organizations of all types and sizes. • Traditionally definition: Entrepreneurship have been limited to ideas such as starting a small business, new product development, and the reduction of costs to remain competitive. • A broader definition: Entrepreneurship is the process of identifying an opportunity regardless of the resources currently available. Entrepreneurship is “A way of thinking and acting that is opportunity-obsessed, holistic in approach, and leadership-balanced. ” © Minder Chen, 1996 -2017 **http: //faculty. babson. edu/academic/eship/mappingtheterritory_babson/babson_entreprenuership. pdf Market Sizing - 6

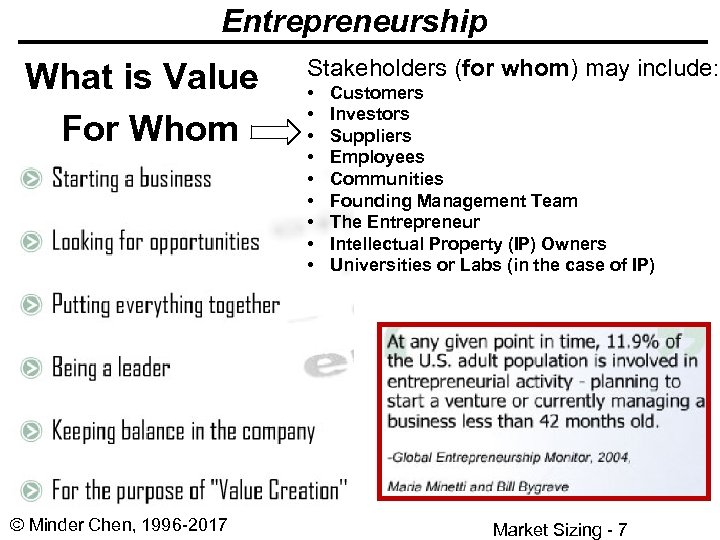

Entrepreneurship What is Value For Whom © Minder Chen, 1996 -2017 Stakeholders (for whom) may include: • • • Customers Investors Suppliers Employees Communities Founding Management Team The Entrepreneur Intellectual Property (IP) Owners Universities or Labs (in the case of IP) Market Sizing - 7

Entrepreneurship What is Value For Whom © Minder Chen, 1996 -2017 Stakeholders (for whom) may include: • • • Customers Investors Suppliers Employees Communities Founding Management Team The Entrepreneur Intellectual Property (IP) Owners Universities or Labs (in the case of IP) Market Sizing - 7

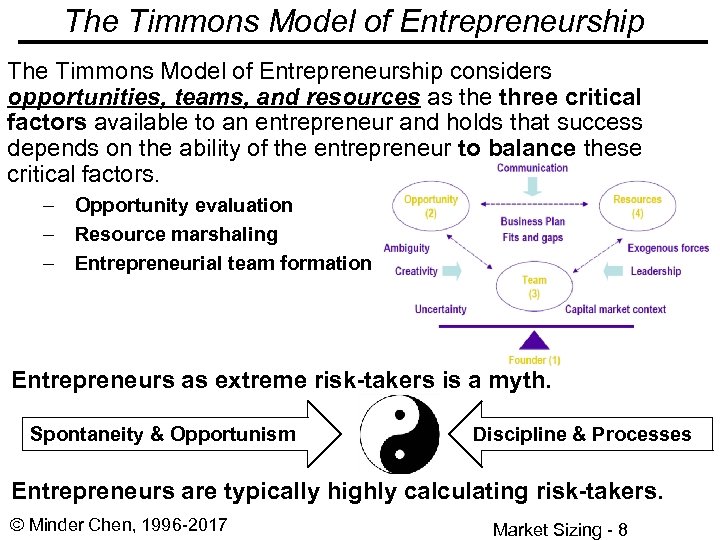

The Timmons Model of Entrepreneurship considers opportunities, teams, and resources as the three critical factors available to an entrepreneur and holds that success depends on the ability of the entrepreneur to balance these critical factors. – Opportunity evaluation – Resource marshaling – Entrepreneurial team formation Entrepreneurs as extreme risk-takers is a myth. Spontaneity & Opportunism Discipline & Processes Entrepreneurs are typically highly calculating risk-takers. © Minder Chen, 1996 -2017 Market Sizing - 8

The Timmons Model of Entrepreneurship considers opportunities, teams, and resources as the three critical factors available to an entrepreneur and holds that success depends on the ability of the entrepreneur to balance these critical factors. – Opportunity evaluation – Resource marshaling – Entrepreneurial team formation Entrepreneurs as extreme risk-takers is a myth. Spontaneity & Opportunism Discipline & Processes Entrepreneurs are typically highly calculating risk-takers. © Minder Chen, 1996 -2017 Market Sizing - 8

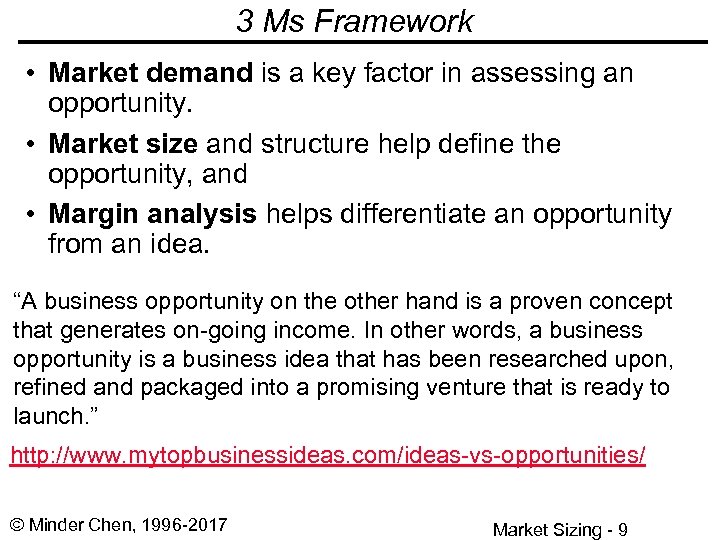

3 Ms Framework • Market demand is a key factor in assessing an opportunity. • Market size and structure help define the opportunity, and • Margin analysis helps differentiate an opportunity from an idea. “A business opportunity on the other hand is a proven concept that generates on-going income. In other words, a business opportunity is a business idea that has been researched upon, refined and packaged into a promising venture that is ready to launch. ” http: //www. mytopbusinessideas. com/ideas-vs-opportunities/ © Minder Chen, 1996 -2017 Market Sizing - 9

3 Ms Framework • Market demand is a key factor in assessing an opportunity. • Market size and structure help define the opportunity, and • Margin analysis helps differentiate an opportunity from an idea. “A business opportunity on the other hand is a proven concept that generates on-going income. In other words, a business opportunity is a business idea that has been researched upon, refined and packaged into a promising venture that is ready to launch. ” http: //www. mytopbusinessideas. com/ideas-vs-opportunities/ © Minder Chen, 1996 -2017 Market Sizing - 9

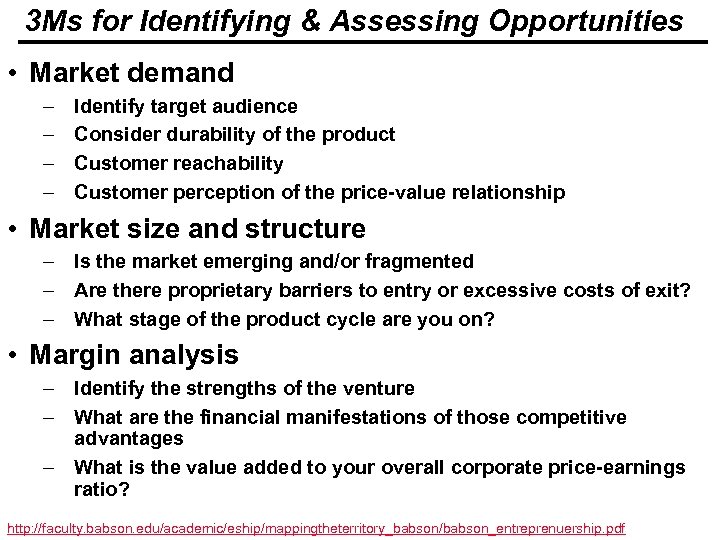

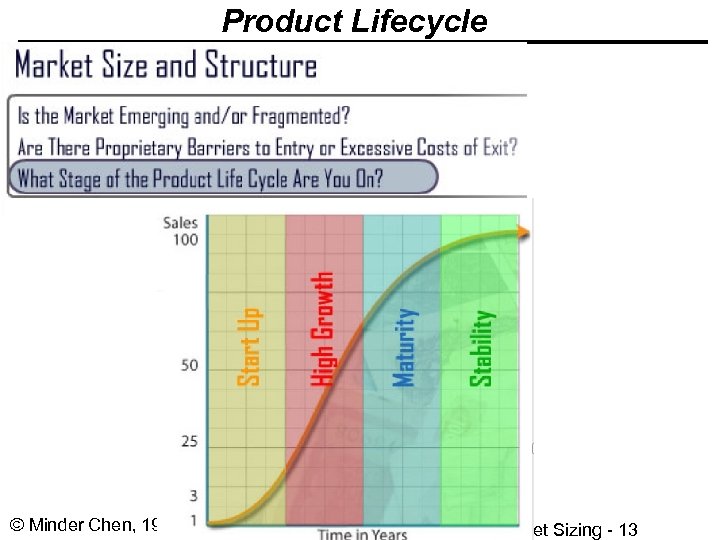

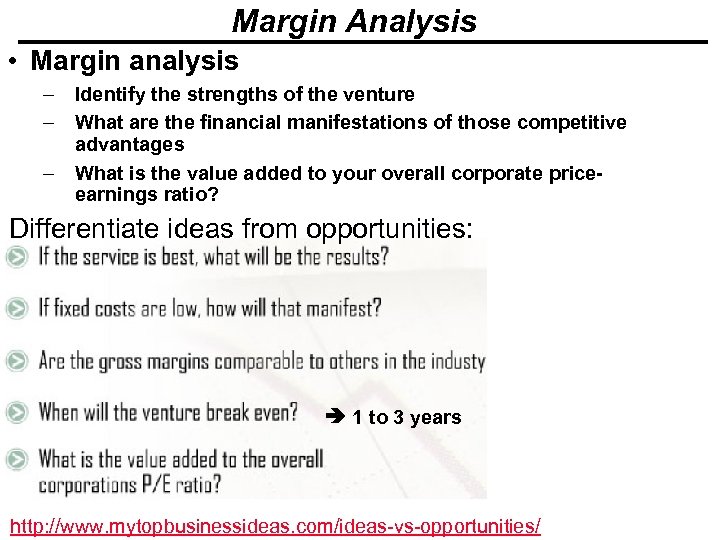

3 Ms for Identifying & Assessing Opportunities • Market demand – – Identify target audience Consider durability of the product Customer reachability Customer perception of the price-value relationship • Market size and structure – Is the market emerging and/or fragmented – Are there proprietary barriers to entry or excessive costs of exit? – What stage of the product cycle are you on? • Margin analysis – Identify the strengths of the venture – What are the financial manifestations of those competitive advantages – What is the value added to your overall corporate price-earnings ratio? © Minder Chen, 1996 -2017 http: //faculty. babson. edu/academic/eship/mappingtheterritory_babson/babson_entreprenuership. pdf Market Sizing - 10

3 Ms for Identifying & Assessing Opportunities • Market demand – – Identify target audience Consider durability of the product Customer reachability Customer perception of the price-value relationship • Market size and structure – Is the market emerging and/or fragmented – Are there proprietary barriers to entry or excessive costs of exit? – What stage of the product cycle are you on? • Margin analysis – Identify the strengths of the venture – What are the financial manifestations of those competitive advantages – What is the value added to your overall corporate price-earnings ratio? © Minder Chen, 1996 -2017 http: //faculty. babson. edu/academic/eship/mappingtheterritory_babson/babson_entreprenuership. pdf Market Sizing - 10

Gauge Market Demand • Start with market share and growth potential. • Companies that grow, succeed. – Mc. Donald’s founder Ray Kroc was fond of describing organizations as “green and growing or ripe and rotting. ” – Inside Mc. Donald's Billion Dollar Empire - Documentary Films (video) • Identifying the target audience. • Growth separates an entrepreneurial business from a small business. • Customer reachability: Channel accessibility • Expected return by investors • Customer perception of the price-value relationship: Value added of the product/service © Minder Chen, 1996 -2017 Market Sizing - 11

Gauge Market Demand • Start with market share and growth potential. • Companies that grow, succeed. – Mc. Donald’s founder Ray Kroc was fond of describing organizations as “green and growing or ripe and rotting. ” – Inside Mc. Donald's Billion Dollar Empire - Documentary Films (video) • Identifying the target audience. • Growth separates an entrepreneurial business from a small business. • Customer reachability: Channel accessibility • Expected return by investors • Customer perception of the price-value relationship: Value added of the product/service © Minder Chen, 1996 -2017 Market Sizing - 11

Importance of Market Size • Understanding your market potential/size is essential for any startup to make strategic decisions on product development, partnerships and distribution, organizational design and more. • Venture Capitalist is interested in knowing the market size • You need a scaling strategy to capture a bigger market, but you start in a more niche market using a focus strategy. Focus first then Scale! © Minder Chen, 1996 -2017 Market Sizing - 12

Importance of Market Size • Understanding your market potential/size is essential for any startup to make strategic decisions on product development, partnerships and distribution, organizational design and more. • Venture Capitalist is interested in knowing the market size • You need a scaling strategy to capture a bigger market, but you start in a more niche market using a focus strategy. Focus first then Scale! © Minder Chen, 1996 -2017 Market Sizing - 12

Product Lifecycle © Minder Chen, 1996 -2017 Market Sizing - 13

Product Lifecycle © Minder Chen, 1996 -2017 Market Sizing - 13

Margin Analysis • Margin analysis – Identify the strengths of the venture – What are the financial manifestations of those competitive advantages – What is the value added to your overall corporate priceearnings ratio? Differentiate ideas from opportunities: 1 to 3 years © Minder Chen, 1996 -2017 http: //www. mytopbusinessideas. com/ideas-vs-opportunities/ Market Sizing - 14

Margin Analysis • Margin analysis – Identify the strengths of the venture – What are the financial manifestations of those competitive advantages – What is the value added to your overall corporate priceearnings ratio? Differentiate ideas from opportunities: 1 to 3 years © Minder Chen, 1996 -2017 http: //www. mytopbusinessideas. com/ideas-vs-opportunities/ Market Sizing - 14

Market and Market Segmentation Market: The customers or potential customers who purchase specific products or services from the same providers. Market segmentation is the process of dividing a broad consumer or business market, normally consisting of existing and potential customers, into sub-groups of consumers (known as segments) based on some type of shared characteristics. © Minder Chen, 1996 -2017 Market Sizing - 15

Market and Market Segmentation Market: The customers or potential customers who purchase specific products or services from the same providers. Market segmentation is the process of dividing a broad consumer or business market, normally consisting of existing and potential customers, into sub-groups of consumers (known as segments) based on some type of shared characteristics. © Minder Chen, 1996 -2017 Market Sizing - 15

Market Segmentation helps a firm to focus efforts on the market segments in which they have competitive advantage. Market can be segmented by: • Geography • Demographics • Price • Distribution channel © Minder Chen, 1996 -2017 Market Sizing - 16

Market Segmentation helps a firm to focus efforts on the market segments in which they have competitive advantage. Market can be segmented by: • Geography • Demographics • Price • Distribution channel © Minder Chen, 1996 -2017 Market Sizing - 16

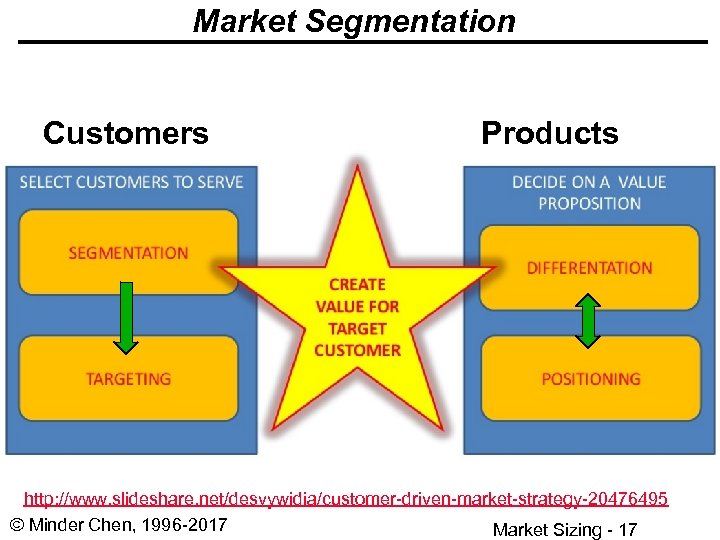

Market Segmentation Customers Products http: //www. slideshare. net/desvywidia/customer-driven-market-strategy-20476495 © Minder Chen, 1996 -2017 Market Sizing - 17

Market Segmentation Customers Products http: //www. slideshare. net/desvywidia/customer-driven-market-strategy-20476495 © Minder Chen, 1996 -2017 Market Sizing - 17

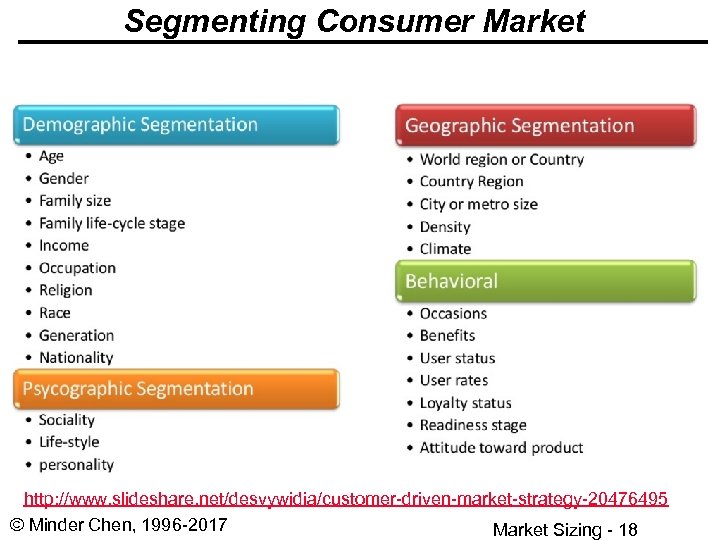

Segmenting Consumer Market http: //www. slideshare. net/desvywidia/customer-driven-market-strategy-20476495 © Minder Chen, 1996 -2017 Market Sizing - 18

Segmenting Consumer Market http: //www. slideshare. net/desvywidia/customer-driven-market-strategy-20476495 © Minder Chen, 1996 -2017 Market Sizing - 18

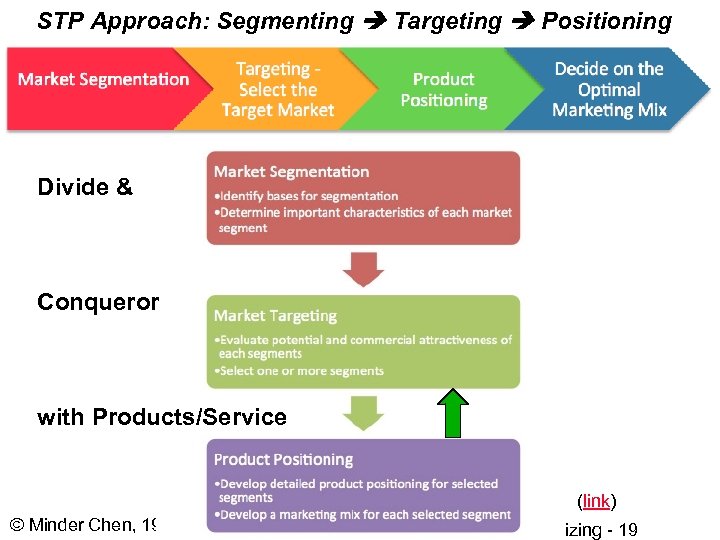

STP Approach: Segmenting Targeting Positioning Divide & Conqueror with Products/Service (link) © Minder Chen, 1996 -2017 Market Sizing - 19

STP Approach: Segmenting Targeting Positioning Divide & Conqueror with Products/Service (link) © Minder Chen, 1996 -2017 Market Sizing - 19

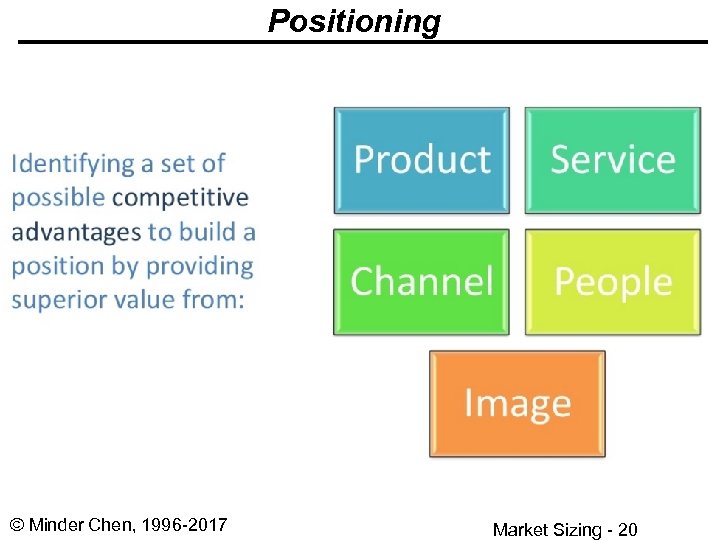

Positioning © Minder Chen, 1996 -2017 Market Sizing - 20

Positioning © Minder Chen, 1996 -2017 Market Sizing - 20

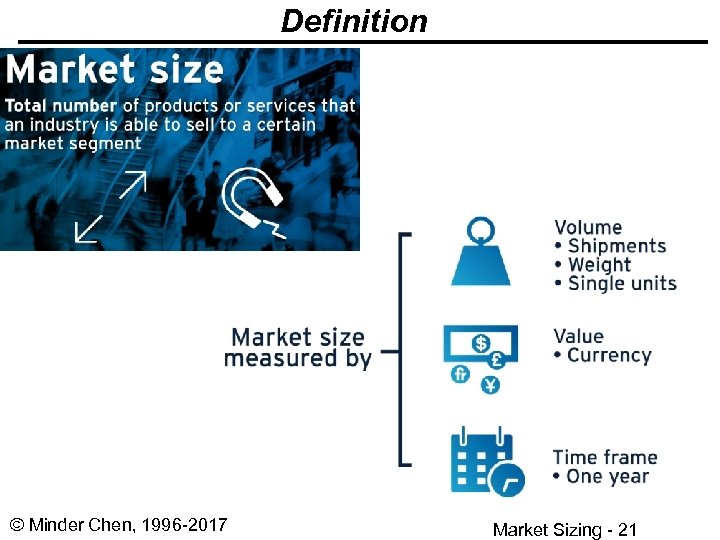

Definition © Minder Chen, 1996 -2017 Market Sizing - 21

Definition © Minder Chen, 1996 -2017 Market Sizing - 21

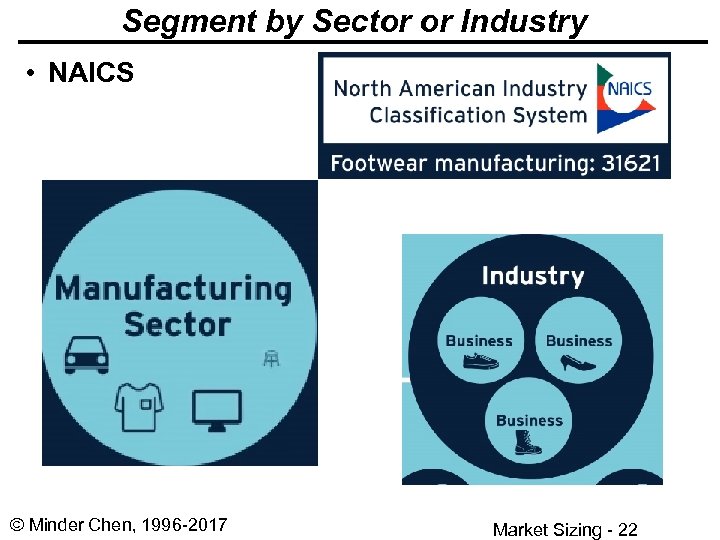

Segment by Sector or Industry • NAICS © Minder Chen, 1996 -2017 Market Sizing - 22

Segment by Sector or Industry • NAICS © Minder Chen, 1996 -2017 Market Sizing - 22

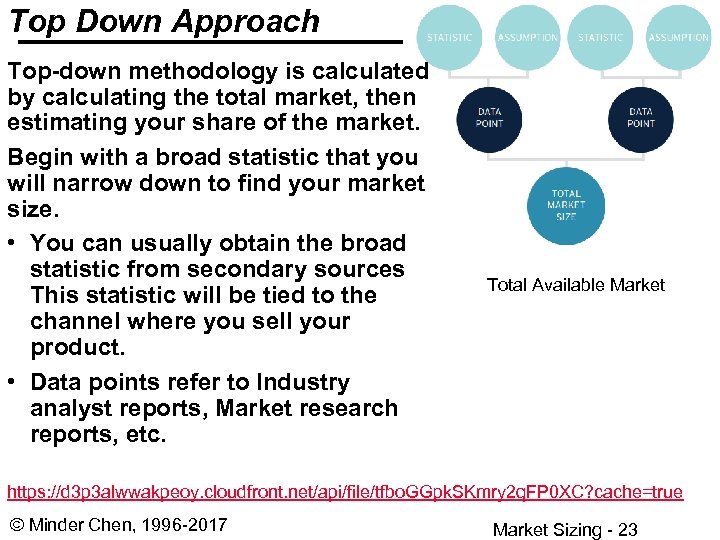

Top Down Approach Top-down methodology is calculated by calculating the total market, then estimating your share of the market. Begin with a broad statistic that you will narrow down to find your market size. • You can usually obtain the broad statistic from secondary sources This statistic will be tied to the channel where you sell your product. • Data points refer to Industry analyst reports, Market research reports, etc. Total Available Market https: //d 3 p 3 alwwakpeoy. cloudfront. net/api/file/tfbo. GGpk. SKmry 2 q. FP 0 XC? cache=true © Minder Chen, 1996 -2017 Market Sizing - 23

Top Down Approach Top-down methodology is calculated by calculating the total market, then estimating your share of the market. Begin with a broad statistic that you will narrow down to find your market size. • You can usually obtain the broad statistic from secondary sources This statistic will be tied to the channel where you sell your product. • Data points refer to Industry analyst reports, Market research reports, etc. Total Available Market https: //d 3 p 3 alwwakpeoy. cloudfront. net/api/file/tfbo. GGpk. SKmry 2 q. FP 0 XC? cache=true © Minder Chen, 1996 -2017 Market Sizing - 23

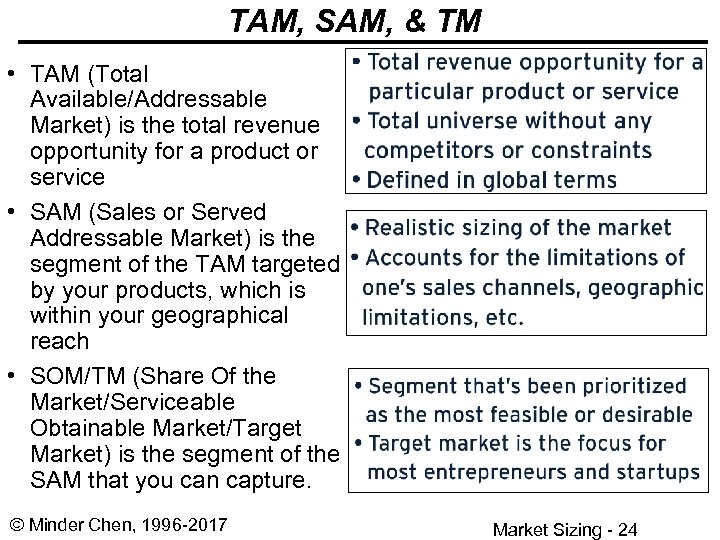

TAM, SAM, & TM • TAM (Total Available/Addressable Market) is the total revenue opportunity for a product or service • SAM (Sales or Served Addressable Market) is the segment of the TAM targeted by your products, which is within your geographical reach • SOM/TM (Share Of the Market/Serviceable Obtainable Market/Target Market) is the segment of the SAM that you can capture. © Minder Chen, 1996 -2017 Market Sizing - 24

TAM, SAM, & TM • TAM (Total Available/Addressable Market) is the total revenue opportunity for a product or service • SAM (Sales or Served Addressable Market) is the segment of the TAM targeted by your products, which is within your geographical reach • SOM/TM (Share Of the Market/Serviceable Obtainable Market/Target Market) is the segment of the SAM that you can capture. © Minder Chen, 1996 -2017 Market Sizing - 24

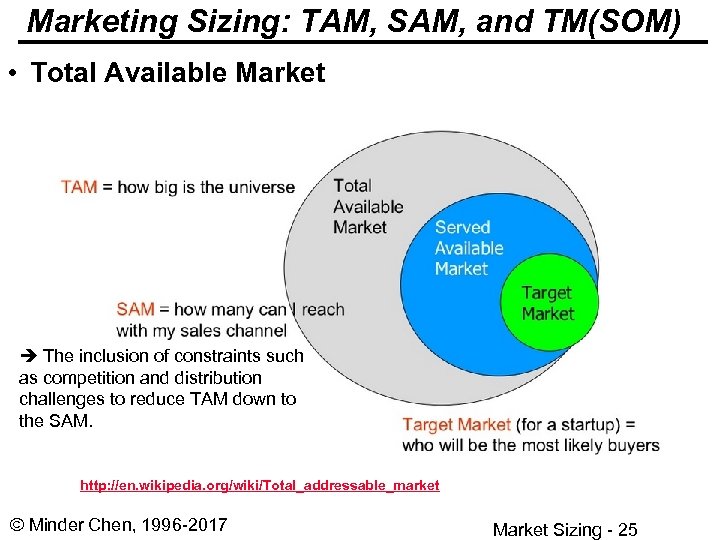

Marketing Sizing: TAM, SAM, and TM(SOM) • Total Available Market The inclusion of constraints such as competition and distribution challenges to reduce TAM down to the SAM. http: //en. wikipedia. org/wiki/Total_addressable_market © Minder Chen, 1996 -2017 Market Sizing - 25

Marketing Sizing: TAM, SAM, and TM(SOM) • Total Available Market The inclusion of constraints such as competition and distribution challenges to reduce TAM down to the SAM. http: //en. wikipedia. org/wiki/Total_addressable_market © Minder Chen, 1996 -2017 Market Sizing - 25

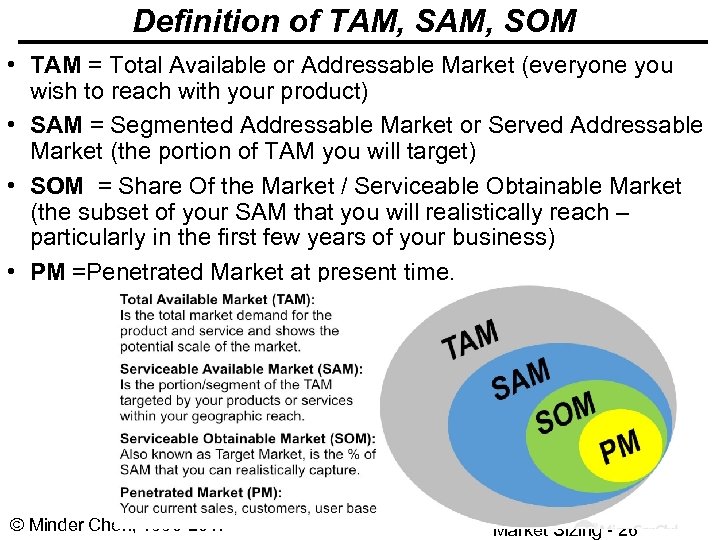

Definition of TAM, SOM • TAM = Total Available or Addressable Market (everyone you wish to reach with your product) • SAM = Segmented Addressable Market or Served Addressable Market (the portion of TAM you will target) • SOM = Share Of the Market / Serviceable Obtainable Market (the subset of your SAM that you will realistically reach – particularly in the first few years of your business) • PM =Penetrated Market at present time. © Minder Chen, 1996 -2017 Market Sizing - 26

Definition of TAM, SOM • TAM = Total Available or Addressable Market (everyone you wish to reach with your product) • SAM = Segmented Addressable Market or Served Addressable Market (the portion of TAM you will target) • SOM = Share Of the Market / Serviceable Obtainable Market (the subset of your SAM that you will realistically reach – particularly in the first few years of your business) • PM =Penetrated Market at present time. © Minder Chen, 1996 -2017 Market Sizing - 26

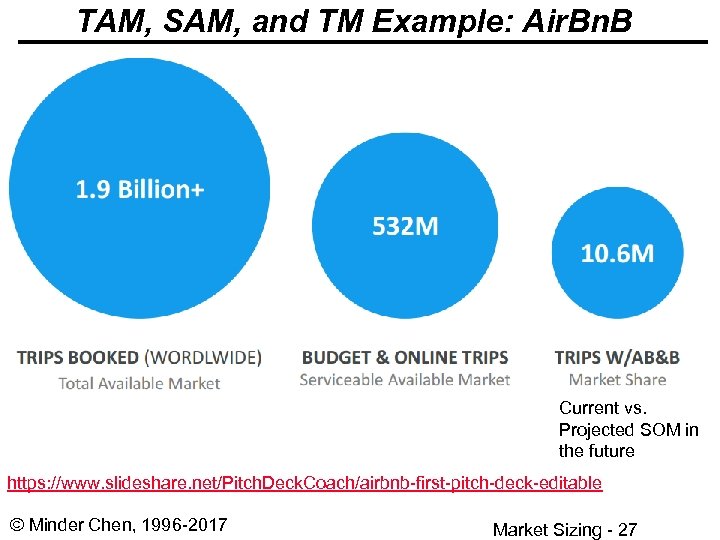

TAM, SAM, and TM Example: Air. Bn. B Current vs. Projected SOM in the future https: //www. slideshare. net/Pitch. Deck. Coach/airbnb-first-pitch-deck-editable © Minder Chen, 1996 -2017 Market Sizing - 27

TAM, SAM, and TM Example: Air. Bn. B Current vs. Projected SOM in the future https: //www. slideshare. net/Pitch. Deck. Coach/airbnb-first-pitch-deck-editable © Minder Chen, 1996 -2017 Market Sizing - 27

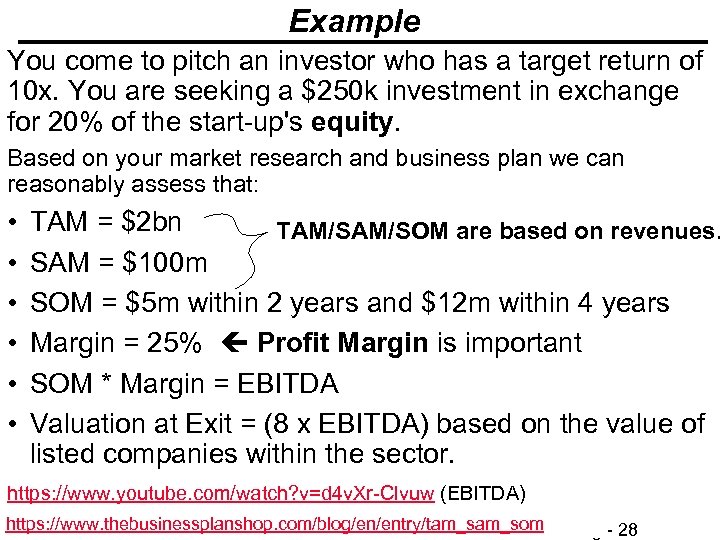

Example You come to pitch an investor who has a target return of 10 x. You are seeking a $250 k investment in exchange for 20% of the start-up's equity. Based on your market research and business plan we can reasonably assess that: • • • TAM = $2 bn TAM/SOM are based on revenues. SAM = $100 m SOM = $5 m within 2 years and $12 m within 4 years Margin = 25% Profit Margin is important SOM * Margin = EBITDA Valuation at Exit = (8 x EBITDA) based on the value of listed companies within the sector. https: //www. youtube. com/watch? v=d 4 v. Xr-Clvuw (EBITDA) https: //www. thebusinessplanshop. com/blog/en/entry/tam_som © Minder Chen, 1996 -2017 Market Sizing - 28

Example You come to pitch an investor who has a target return of 10 x. You are seeking a $250 k investment in exchange for 20% of the start-up's equity. Based on your market research and business plan we can reasonably assess that: • • • TAM = $2 bn TAM/SOM are based on revenues. SAM = $100 m SOM = $5 m within 2 years and $12 m within 4 years Margin = 25% Profit Margin is important SOM * Margin = EBITDA Valuation at Exit = (8 x EBITDA) based on the value of listed companies within the sector. https: //www. youtube. com/watch? v=d 4 v. Xr-Clvuw (EBITDA) https: //www. thebusinessplanshop. com/blog/en/entry/tam_som © Minder Chen, 1996 -2017 Market Sizing - 28

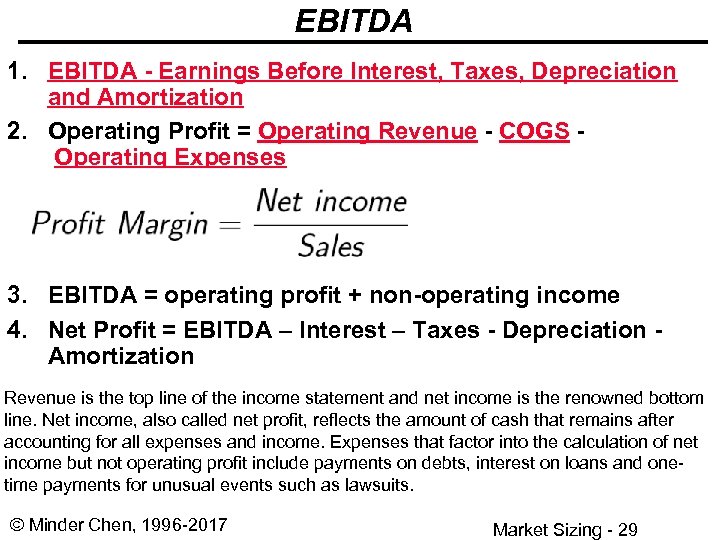

EBITDA 1. EBITDA - Earnings Before Interest, Taxes, Depreciation and Amortization 2. Operating Profit = Operating Revenue - COGS Operating Expenses 3. EBITDA = operating profit + non-operating income 4. Net Profit = EBITDA – Interest – Taxes - Depreciation - Amortization Revenue is the top line of the income statement and net income is the renowned bottom line. Net income, also called net profit, reflects the amount of cash that remains after accounting for all expenses and income. Expenses that factor into the calculation of net income but not operating profit include payments on debts, interest on loans and onetime payments for unusual events such as lawsuits. © Minder Chen, 1996 -2017 Market Sizing - 29

EBITDA 1. EBITDA - Earnings Before Interest, Taxes, Depreciation and Amortization 2. Operating Profit = Operating Revenue - COGS Operating Expenses 3. EBITDA = operating profit + non-operating income 4. Net Profit = EBITDA – Interest – Taxes - Depreciation - Amortization Revenue is the top line of the income statement and net income is the renowned bottom line. Net income, also called net profit, reflects the amount of cash that remains after accounting for all expenses and income. Expenses that factor into the calculation of net income but not operating profit include payments on debts, interest on loans and onetime payments for unusual events such as lawsuits. © Minder Chen, 1996 -2017 Market Sizing - 29

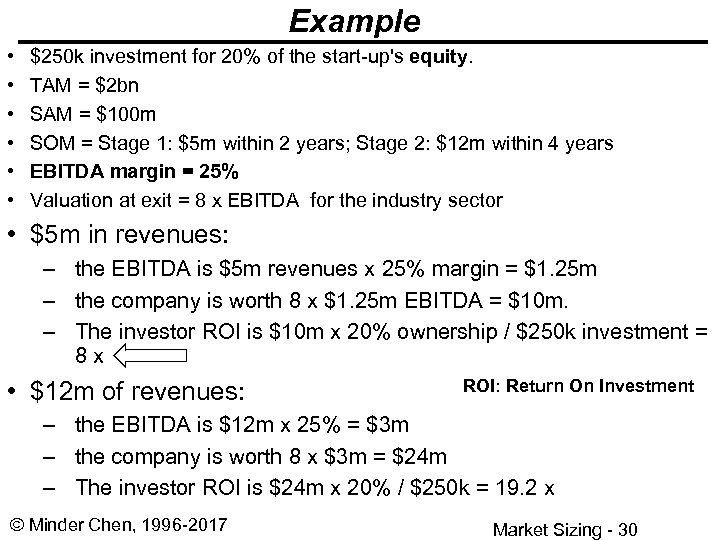

Example • • • $250 k investment for 20% of the start-up's equity. TAM = $2 bn SAM = $100 m SOM = Stage 1: $5 m within 2 years; Stage 2: $12 m within 4 years EBITDA margin = 25% Valuation at exit = 8 x EBITDA for the industry sector • $5 m in revenues: – the EBITDA is $5 m revenues x 25% margin = $1. 25 m – the company is worth 8 x $1. 25 m EBITDA = $10 m. – The investor ROI is $10 m x 20% ownership / $250 k investment = 8 x • $12 m of revenues: ROI: Return On Investment – the EBITDA is $12 m x 25% = $3 m – the company is worth 8 x $3 m = $24 m – The investor ROI is $24 m x 20% / $250 k = 19. 2 x © Minder Chen, 1996 -2017 Market Sizing - 30

Example • • • $250 k investment for 20% of the start-up's equity. TAM = $2 bn SAM = $100 m SOM = Stage 1: $5 m within 2 years; Stage 2: $12 m within 4 years EBITDA margin = 25% Valuation at exit = 8 x EBITDA for the industry sector • $5 m in revenues: – the EBITDA is $5 m revenues x 25% margin = $1. 25 m – the company is worth 8 x $1. 25 m EBITDA = $10 m. – The investor ROI is $10 m x 20% ownership / $250 k investment = 8 x • $12 m of revenues: ROI: Return On Investment – the EBITDA is $12 m x 25% = $3 m – the company is worth 8 x $3 m = $24 m – The investor ROI is $24 m x 20% / $250 k = 19. 2 x © Minder Chen, 1996 -2017 Market Sizing - 30

Bottom-Up Approach The bottom-up methodology is calculated by estimating potential sales or revenues of key players in order to determine a total market size. • Roll-up market participant sales. Add up the revenue from all the market participants for a specific time period to determine the market size. • It is often very difficult to find product sales data. Surveying customers to determine how much they spend every year on products that comprise the market. You can then extrapolate the findings from this exercise to estimate the entire market. https: //d 3 p 3 alwwakpeoy. cloudfront. net/api/file/tfbo. GGpk. SKmry 2 q. FP 0 XC? cache=true © Minder Chen, 1996 -2017 Market Sizing - 31

Bottom-Up Approach The bottom-up methodology is calculated by estimating potential sales or revenues of key players in order to determine a total market size. • Roll-up market participant sales. Add up the revenue from all the market participants for a specific time period to determine the market size. • It is often very difficult to find product sales data. Surveying customers to determine how much they spend every year on products that comprise the market. You can then extrapolate the findings from this exercise to estimate the entire market. https: //d 3 p 3 alwwakpeoy. cloudfront. net/api/file/tfbo. GGpk. SKmry 2 q. FP 0 XC? cache=true © Minder Chen, 1996 -2017 Market Sizing - 31

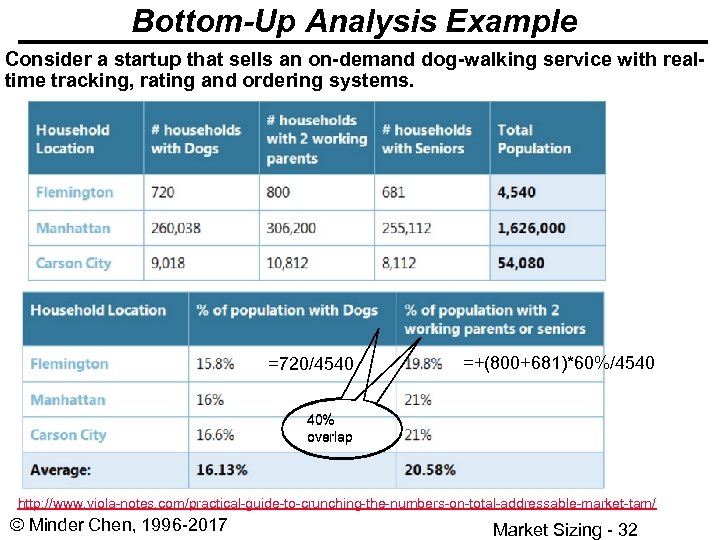

• Bottom-Up Analysis Example Consider a startup that sells an on-demand dog-walking service with realtime tracking, rating and ordering systems. =720/4540 =+(800+681)*60%/4540 40% overlap http: //www. viola-notes. com/practical-guide-to-crunching-the-numbers-on-total-addressable-market-tam/ © Minder Chen, 1996 -2017 Market Sizing - 32

• Bottom-Up Analysis Example Consider a startup that sells an on-demand dog-walking service with realtime tracking, rating and ordering systems. =720/4540 =+(800+681)*60%/4540 40% overlap http: //www. viola-notes. com/practical-guide-to-crunching-the-numbers-on-total-addressable-market-tam/ © Minder Chen, 1996 -2017 Market Sizing - 32

Calculation Based on market research, they determined that the number of dogs per household is independent of the number of working parents or the age of the homeowner, so they multiplied the densities to find the overall percentage: 16. 13%*20. 58% = 3. 3% US population 318 M 318 m*. 3. 3% = 10 million With an estimated cost per customer per dog of $100 per month, the TAM is approximated at 10 m*100 = $1 billion © Minder Chen, 1996 -2017 Market Sizing - 33

Calculation Based on market research, they determined that the number of dogs per household is independent of the number of working parents or the age of the homeowner, so they multiplied the densities to find the overall percentage: 16. 13%*20. 58% = 3. 3% US population 318 M 318 m*. 3. 3% = 10 million With an estimated cost per customer per dog of $100 per month, the TAM is approximated at 10 m*100 = $1 billion © Minder Chen, 1996 -2017 Market Sizing - 33

Bottom-Up Analysis: Market Growth • No market remains the same; markets grow or shrink. • Assuming that you are targeting a growing market, it would be important at the final stage of each analysis to come up with a reasonable assumption for the growth rate of the overall market year over year (Yo. Y). • Once you have the growth figure you can project the size of the market for the next few years and in turn your revenue as a function of the market growth (assuming all other variables remain constant). • For example, $1 b * 10% growth Yo. Y will lead to a market size of ~$1. 6 B in five years. • • https: //www. inc. com/jeff-haden/bottom-up-or-top-down-market-analysis-which-should-you-use. html http: //www. armorysv. com/wp-content/uploads/2015/04/Understanding-Bottom-Up-Market-Sizing. pdf © Minder Chen, 1996 -2017 Market Sizing - 34

Bottom-Up Analysis: Market Growth • No market remains the same; markets grow or shrink. • Assuming that you are targeting a growing market, it would be important at the final stage of each analysis to come up with a reasonable assumption for the growth rate of the overall market year over year (Yo. Y). • Once you have the growth figure you can project the size of the market for the next few years and in turn your revenue as a function of the market growth (assuming all other variables remain constant). • For example, $1 b * 10% growth Yo. Y will lead to a market size of ~$1. 6 B in five years. • • https: //www. inc. com/jeff-haden/bottom-up-or-top-down-market-analysis-which-should-you-use. html http: //www. armorysv. com/wp-content/uploads/2015/04/Understanding-Bottom-Up-Market-Sizing. pdf © Minder Chen, 1996 -2017 Market Sizing - 34

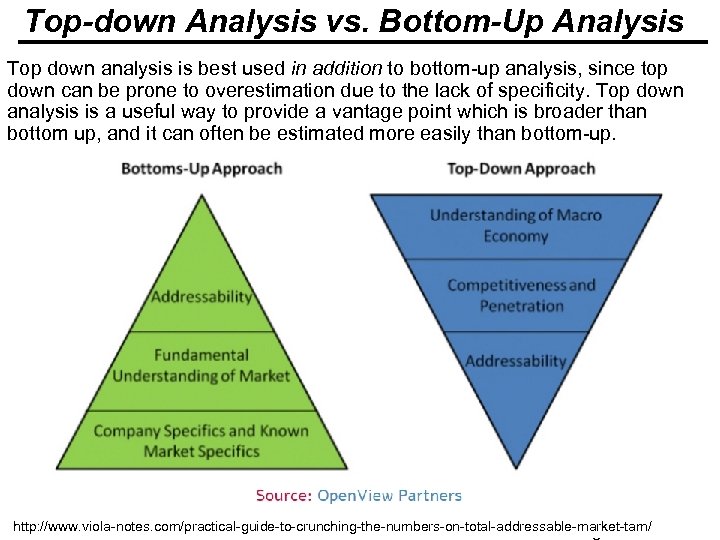

Top-down Analysis vs. Bottom-Up Analysis Top down analysis is best used in addition to bottom-up analysis, since top down can be prone to overestimation due to the lack of specificity. Top down analysis is a useful way to provide a vantage point which is broader than bottom up, and it can often be estimated more easily than bottom-up. http: //www. viola-notes. com/practical-guide-to-crunching-the-numbers-on-total-addressable-market-tam/ © Minder Chen, 1996 -2017 Market Sizing - 35

Top-down Analysis vs. Bottom-Up Analysis Top down analysis is best used in addition to bottom-up analysis, since top down can be prone to overestimation due to the lack of specificity. Top down analysis is a useful way to provide a vantage point which is broader than bottom up, and it can often be estimated more easily than bottom-up. http: //www. viola-notes. com/practical-guide-to-crunching-the-numbers-on-total-addressable-market-tam/ © Minder Chen, 1996 -2017 Market Sizing - 35

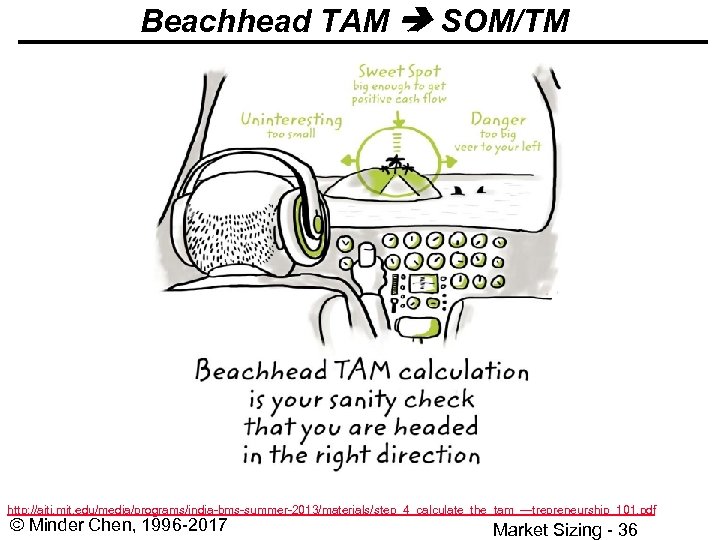

Beachhead TAM SOM/TM http: //aiti. mit. edu/media/programs/india-bms-summer-2013/materials/step_4_calculate_the_tam_---trepreneurship_101. pdf © Minder Chen, 1996 -2017 Market Sizing - 36

Beachhead TAM SOM/TM http: //aiti. mit. edu/media/programs/india-bms-summer-2013/materials/step_4_calculate_the_tam_---trepreneurship_101. pdf © Minder Chen, 1996 -2017 Market Sizing - 36

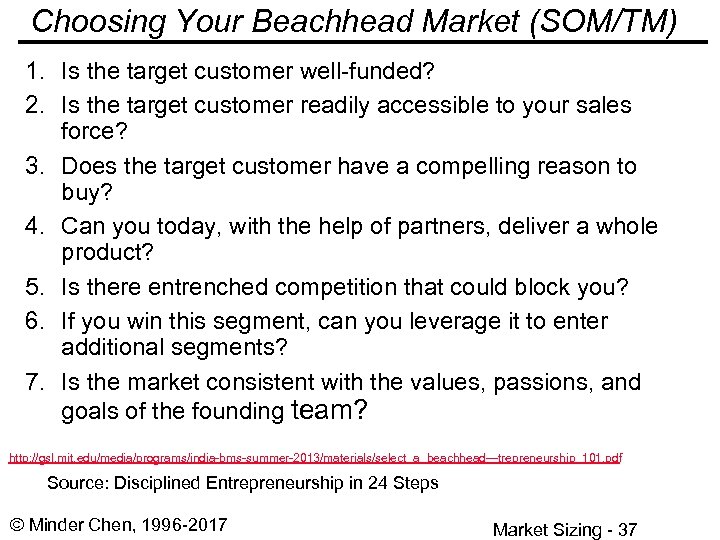

Choosing Your Beachhead Market (SOM/TM) 1. Is the target customer well-funded? 2. Is the target customer readily accessible to your sales force? 3. Does the target customer have a compelling reason to buy? 4. Can you today, with the help of partners, deliver a whole product? 5. Is there entrenched competition that could block you? 6. If you win this segment, can you leverage it to enter additional segments? 7. Is the market consistent with the values, passions, and goals of the founding team? http: //gsl. mit. edu/media/programs/india-bms-summer-2013/materials/select_a_beachhead---trepreneurship_101. pdf Source: Disciplined Entrepreneurship in 24 Steps © Minder Chen, 1996 -2017 Market Sizing - 37

Choosing Your Beachhead Market (SOM/TM) 1. Is the target customer well-funded? 2. Is the target customer readily accessible to your sales force? 3. Does the target customer have a compelling reason to buy? 4. Can you today, with the help of partners, deliver a whole product? 5. Is there entrenched competition that could block you? 6. If you win this segment, can you leverage it to enter additional segments? 7. Is the market consistent with the values, passions, and goals of the founding team? http: //gsl. mit. edu/media/programs/india-bms-summer-2013/materials/select_a_beachhead---trepreneurship_101. pdf Source: Disciplined Entrepreneurship in 24 Steps © Minder Chen, 1996 -2017 Market Sizing - 37

Resources 1. 3 Ms Frameowrk in Entrepreneurship – http: //faculty. babson. edu/academic/eship/mappingtheterritory_babson/ba bson_entreprenuership. pdf 2. Selecting a beachhead market – – http: //gsl. mit. edu/media/programs/india-bms-summer 2013/materials/select_a_beachhead---trepreneurship_101. pdf http: //gsl. mit. edu/media/programs/india-bms-summer 2013/materials/step_4_calculate_the_tam_---trepreneurship_101. pdf 3. Disciplined-Entrepreneurship by Bill Aulet – – http: //home. aubg. edu/students/GMB 150/Disciplined-Entrepreneurship-Bill. Aulet. pdf http: //gsl. mit. edu/materials/india-bms-summer-2013/ 4. Video Tutorial on Market Size – – https: //entrepreneurs-toolkit. schoolkeep. com/catalog/bsr 0 hzd/introduction -to-market-sizing https: //entrepreneurs-toolkit. schoolkeep. com/catalog © Minder Chen, 1996 -2017 Market Sizing - 38

Resources 1. 3 Ms Frameowrk in Entrepreneurship – http: //faculty. babson. edu/academic/eship/mappingtheterritory_babson/ba bson_entreprenuership. pdf 2. Selecting a beachhead market – – http: //gsl. mit. edu/media/programs/india-bms-summer 2013/materials/select_a_beachhead---trepreneurship_101. pdf http: //gsl. mit. edu/media/programs/india-bms-summer 2013/materials/step_4_calculate_the_tam_---trepreneurship_101. pdf 3. Disciplined-Entrepreneurship by Bill Aulet – – http: //home. aubg. edu/students/GMB 150/Disciplined-Entrepreneurship-Bill. Aulet. pdf http: //gsl. mit. edu/materials/india-bms-summer-2013/ 4. Video Tutorial on Market Size – – https: //entrepreneurs-toolkit. schoolkeep. com/catalog/bsr 0 hzd/introduction -to-market-sizing https: //entrepreneurs-toolkit. schoolkeep. com/catalog © Minder Chen, 1996 -2017 Market Sizing - 38

© Minder Chen, 1996 -2017 Market Sizing - 39

© Minder Chen, 1996 -2017 Market Sizing - 39

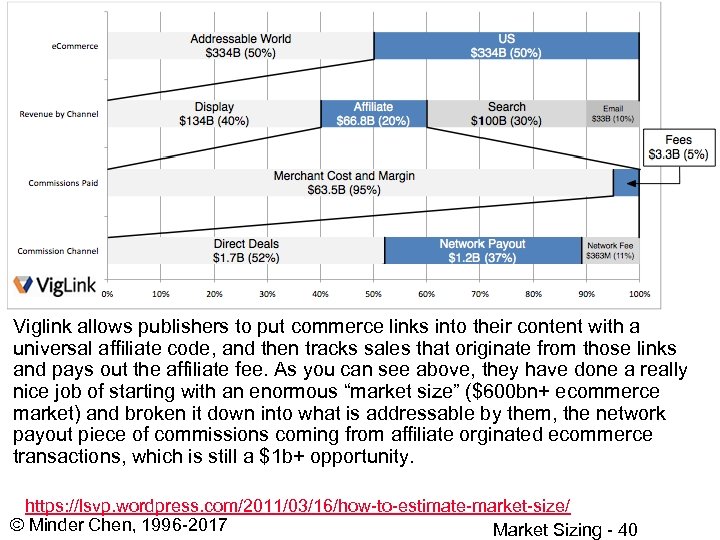

Example of Viglink allows publishers to put commerce links into their content with a universal affiliate code, and then tracks sales that originate from those links and pays out the affiliate fee. As you can see above, they have done a really nice job of starting with an enormous “market size” ($600 bn+ ecommerce market) and broken it down into what is addressable by them, the network payout piece of commissions coming from affiliate orginated ecommerce transactions, which is still a $1 b+ opportunity. https: //lsvp. wordpress. com/2011/03/16/how-to-estimate-market-size/ © Minder Chen, 1996 -2017 Market Sizing - 40

Example of Viglink allows publishers to put commerce links into their content with a universal affiliate code, and then tracks sales that originate from those links and pays out the affiliate fee. As you can see above, they have done a really nice job of starting with an enormous “market size” ($600 bn+ ecommerce market) and broken it down into what is addressable by them, the network payout piece of commissions coming from affiliate orginated ecommerce transactions, which is still a $1 b+ opportunity. https: //lsvp. wordpress. com/2011/03/16/how-to-estimate-market-size/ © Minder Chen, 1996 -2017 Market Sizing - 40

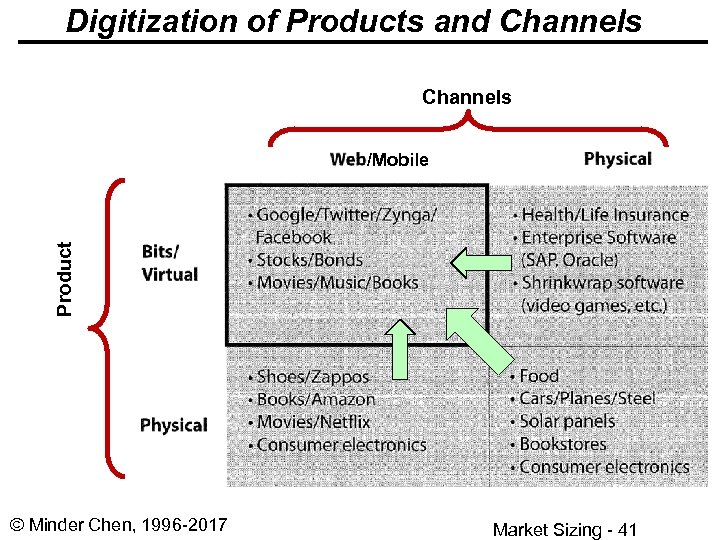

Digitization of Products and Channels Product /Mobile © Minder Chen, 1996 -2017 Market Sizing - 41

Digitization of Products and Channels Product /Mobile © Minder Chen, 1996 -2017 Market Sizing - 41

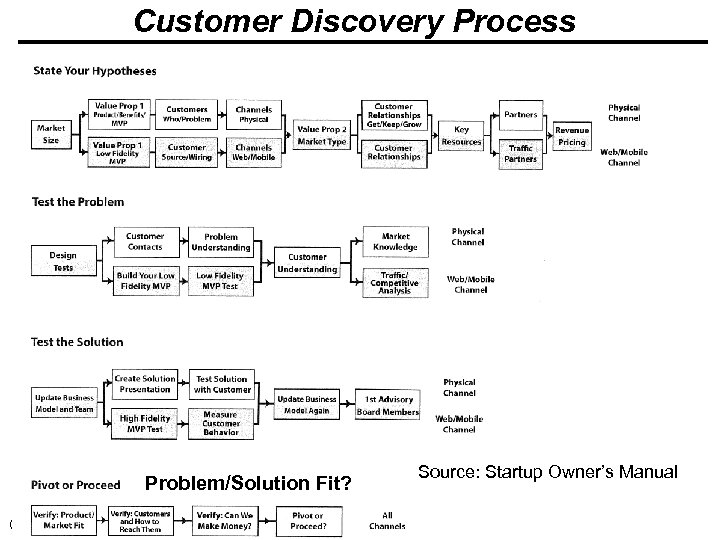

Customer Discovery Process Problem/Solution Fit? © Minder Chen, 1996 -2017 Source: Startup Owner’s Manual Market Sizing - 42

Customer Discovery Process Problem/Solution Fit? © Minder Chen, 1996 -2017 Source: Startup Owner’s Manual Market Sizing - 42

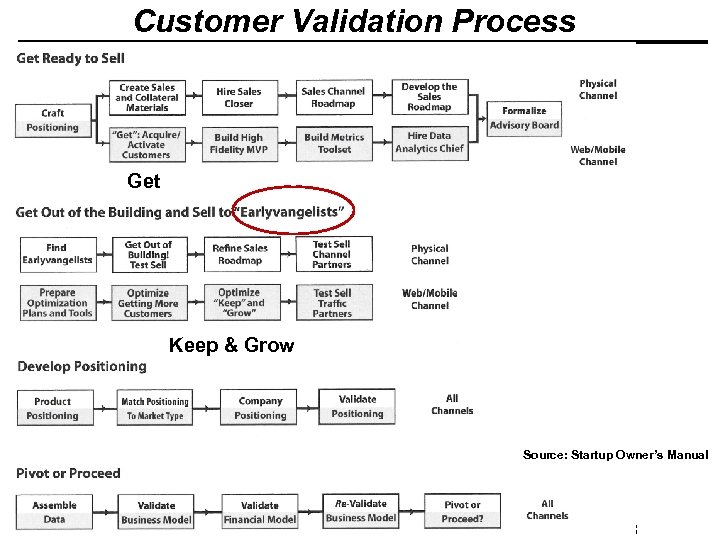

Customer Validation Process Get Keep & Grow Source: Startup Owner’s Manual © Minder Chen, 1996 -2017 Market Sizing - 43

Customer Validation Process Get Keep & Grow Source: Startup Owner’s Manual © Minder Chen, 1996 -2017 Market Sizing - 43

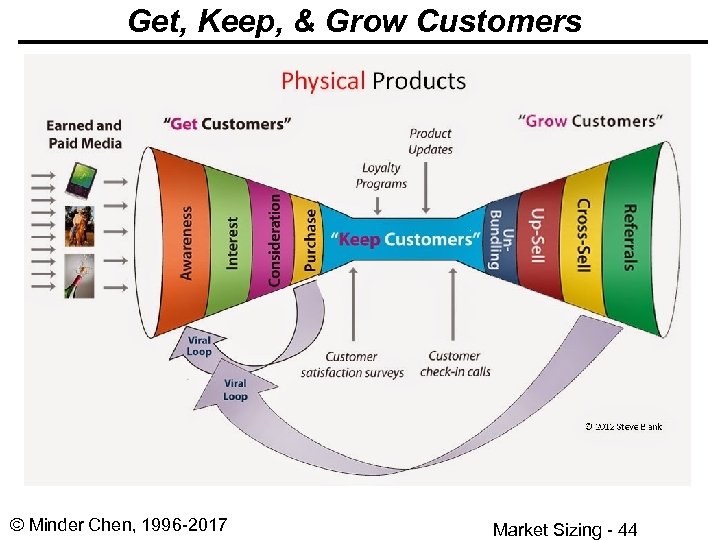

Get, Keep, & Grow Customers © Minder Chen, 1996 -2017 Market Sizing - 44

Get, Keep, & Grow Customers © Minder Chen, 1996 -2017 Market Sizing - 44

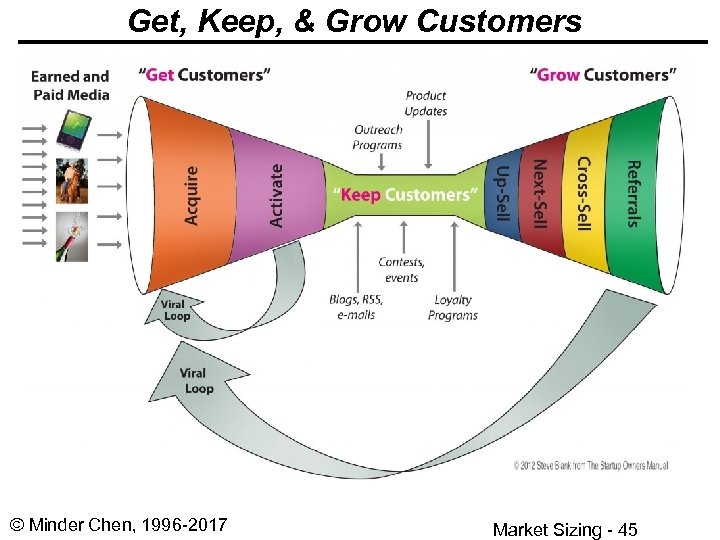

Get, Keep, & Grow Customers © Minder Chen, 1996 -2017 Market Sizing - 45

Get, Keep, & Grow Customers © Minder Chen, 1996 -2017 Market Sizing - 45

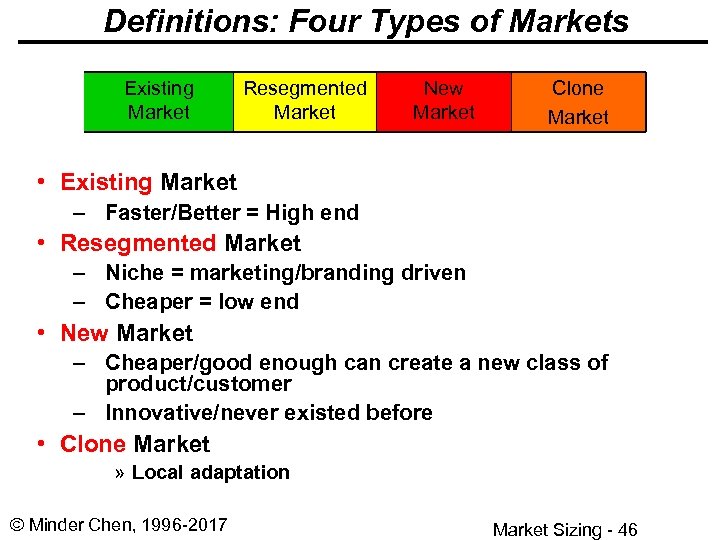

Definitions: Four Types of Markets Existing Market Resegmented Market New Market Clone Market • Existing Market – Faster/Better = High end • Resegmented Market – Niche = marketing/branding driven – Cheaper = low end • New Market – Cheaper/good enough can create a new class of product/customer – Innovative/never existed before • Clone Market » Local adaptation © Minder Chen, 1996 -2017 Market Sizing - 46

Definitions: Four Types of Markets Existing Market Resegmented Market New Market Clone Market • Existing Market – Faster/Better = High end • Resegmented Market – Niche = marketing/branding driven – Cheaper = low end • New Market – Cheaper/good enough can create a new class of product/customer – Innovative/never existed before • Clone Market » Local adaptation © Minder Chen, 1996 -2017 Market Sizing - 46

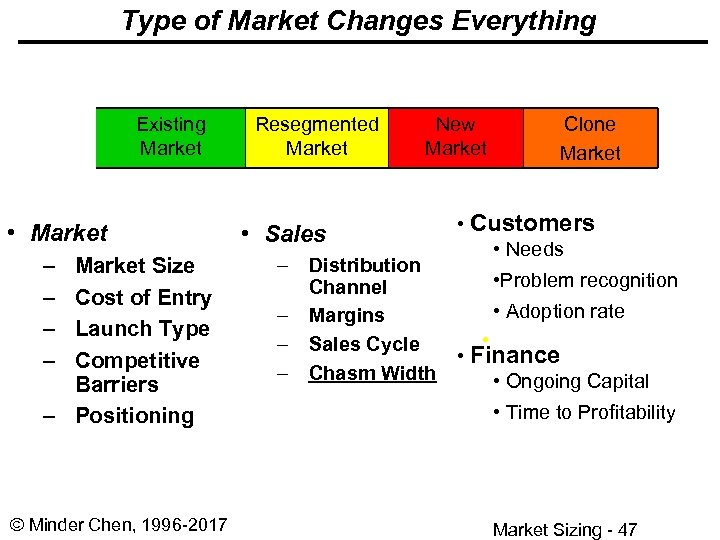

Type of Market Changes Everything Existing Market • Market – – Market Size Cost of Entry Launch Type Competitive Barriers – Positioning © Minder Chen, 1996 -2017 Resegmented Market New Market • Sales – Distribution Channel – Margins – Sales Cycle – Chasm Width Clone Market • Customers • Needs • Adoption • Problem recognition • Adoption rate • Finance • Ongoing Capital • Time to Profitability Market Sizing - 47

Type of Market Changes Everything Existing Market • Market – – Market Size Cost of Entry Launch Type Competitive Barriers – Positioning © Minder Chen, 1996 -2017 Resegmented Market New Market • Sales – Distribution Channel – Margins – Sales Cycle – Chasm Width Clone Market • Customers • Needs • Adoption • Problem recognition • Adoption rate • Finance • Ongoing Capital • Time to Profitability Market Sizing - 47

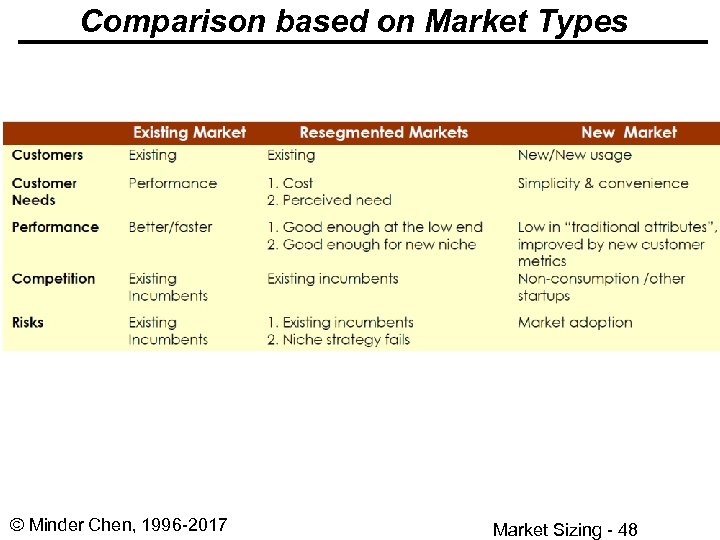

Comparison based on Market Types © Minder Chen, 1996 -2017 Market Sizing - 48

Comparison based on Market Types © Minder Chen, 1996 -2017 Market Sizing - 48

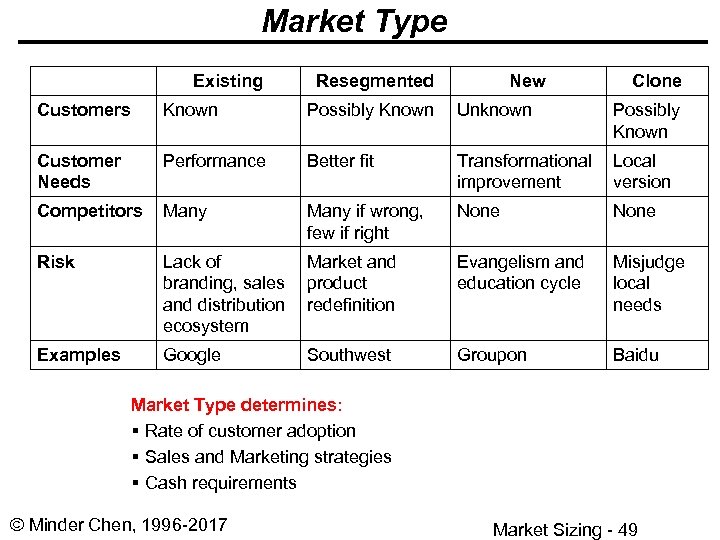

Market Type Existing Resegmented New Clone Customers Known Possibly Known Unknown Customer Needs Performance Better fit Transformational Local improvement version Competitors Many if wrong, few if right None Risk Lack of Market and branding, sales product and distribution redefinition ecosystem Evangelism and education cycle Misjudge local needs Examples Google Groupon Baidu Southwest Possibly Known Market Type determines: § Rate of customer adoption § Sales and Marketing strategies § Cash requirements © Minder Chen, 1996 -2017 Market Sizing - 49

Market Type Existing Resegmented New Clone Customers Known Possibly Known Unknown Customer Needs Performance Better fit Transformational Local improvement version Competitors Many if wrong, few if right None Risk Lack of Market and branding, sales product and distribution redefinition ecosystem Evangelism and education cycle Misjudge local needs Examples Google Groupon Baidu Southwest Possibly Known Market Type determines: § Rate of customer adoption § Sales and Marketing strategies § Cash requirements © Minder Chen, 1996 -2017 Market Sizing - 49

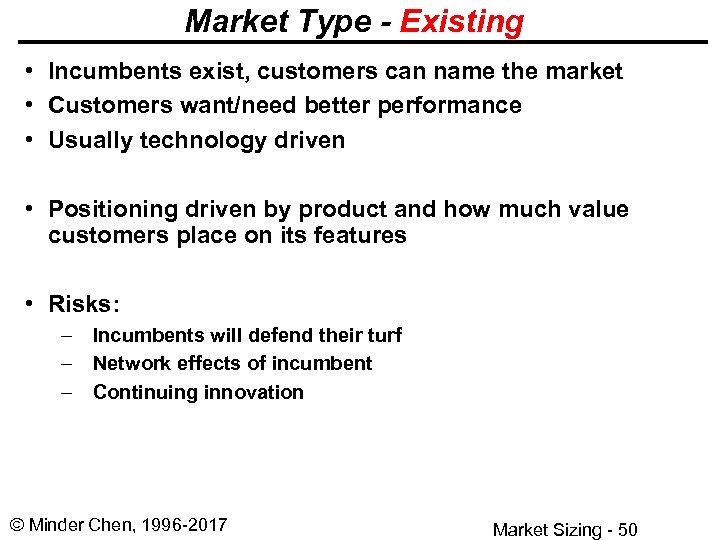

Market Type - Existing • Incumbents exist, customers can name the market • Customers want/need better performance • Usually technology driven • Positioning driven by product and how much value customers place on its features • Risks: – Incumbents will defend their turf – Network effects of incumbent – Continuing innovation © Minder Chen, 1996 -2017 Market Sizing - 50

Market Type - Existing • Incumbents exist, customers can name the market • Customers want/need better performance • Usually technology driven • Positioning driven by product and how much value customers place on its features • Risks: – Incumbents will defend their turf – Network effects of incumbent – Continuing innovation © Minder Chen, 1996 -2017 Market Sizing - 50

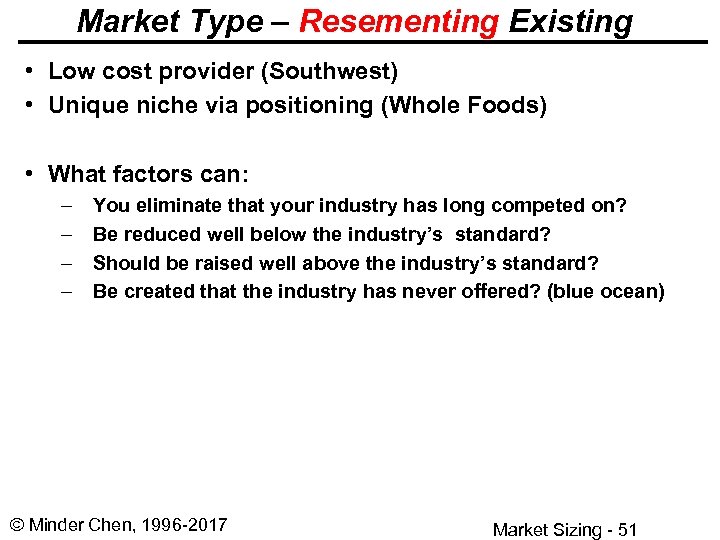

Market Type – Resementing Existing • Low cost provider (Southwest) • Unique niche via positioning (Whole Foods) • What factors can: – – You eliminate that your industry has long competed on? Be reduced well below the industry’s standard? Should be raised well above the industry’s standard? Be created that the industry has never offered? (blue ocean) © Minder Chen, 1996 -2017 Market Sizing - 51

Market Type – Resementing Existing • Low cost provider (Southwest) • Unique niche via positioning (Whole Foods) • What factors can: – – You eliminate that your industry has long competed on? Be reduced well below the industry’s standard? Should be raised well above the industry’s standard? Be created that the industry has never offered? (blue ocean) © Minder Chen, 1996 -2017 Market Sizing - 51

Market Type – New • • Customers don’t exist today How will they find out about you? How will they become aware of their need? How do you know the market size is compelling? • Which factors should be created that the industry has never offered? (blue ocean) © Minder Chen, 1996 -2017 Market Sizing - 52

Market Type – New • • Customers don’t exist today How will they find out about you? How will they become aware of their need? How do you know the market size is compelling? • Which factors should be created that the industry has never offered? (blue ocean) © Minder Chen, 1996 -2017 Market Sizing - 52

Market Type – Clone • Takes foreign business model and adapts it to local conditions – – Language Culture Import restrictions Local control/ownership • Need market large enough >100 million © Minder Chen, 1996 -2017 Market Sizing - 53

Market Type – Clone • Takes foreign business model and adapts it to local conditions – – Language Culture Import restrictions Local control/ownership • Need market large enough >100 million © Minder Chen, 1996 -2017 Market Sizing - 53

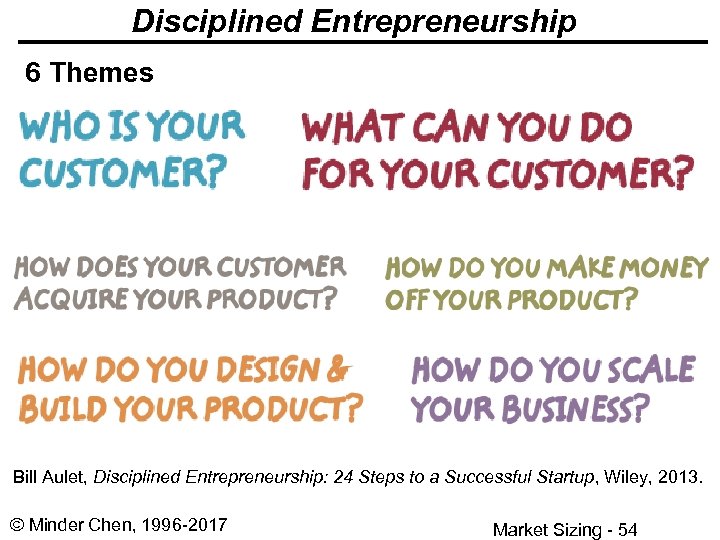

Disciplined Entrepreneurship 6 Themes Bill Aulet, Disciplined Entrepreneurship: 24 Steps to a Successful Startup, Wiley, 2013. © Minder Chen, 1996 -2017 Market Sizing - 54

Disciplined Entrepreneurship 6 Themes Bill Aulet, Disciplined Entrepreneurship: 24 Steps to a Successful Startup, Wiley, 2013. © Minder Chen, 1996 -2017 Market Sizing - 54

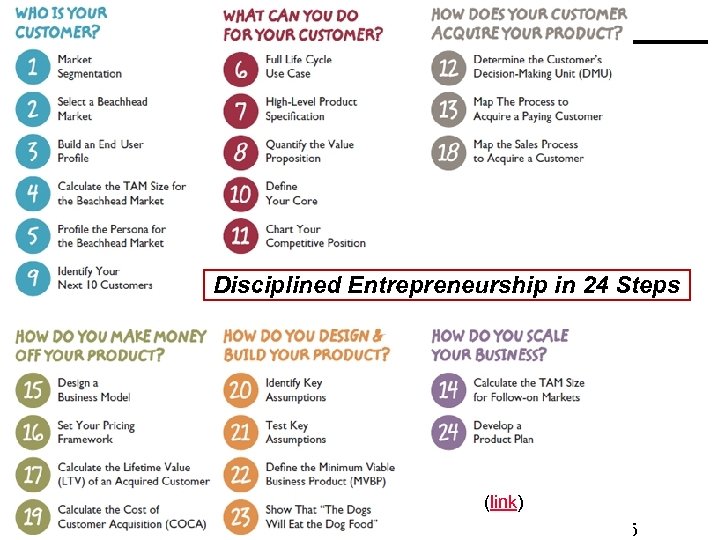

Disciplined Entrepreneurship in 24 Steps (link) © Minder Chen, 1996 -2017 Market Sizing - 55

Disciplined Entrepreneurship in 24 Steps (link) © Minder Chen, 1996 -2017 Market Sizing - 55

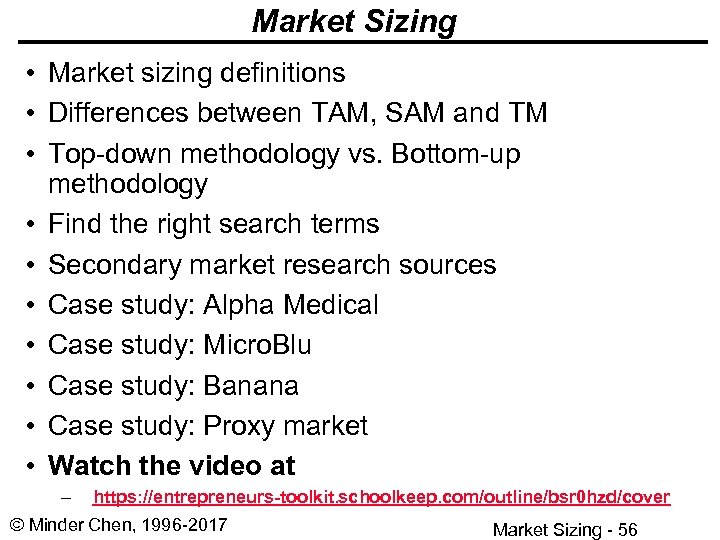

Market Sizing • Market sizing definitions • Differences between TAM, SAM and TM • Top-down methodology vs. Bottom-up methodology • Find the right search terms • Secondary market research sources • Case study: Alpha Medical • Case study: Micro. Blu • Case study: Banana • Case study: Proxy market • Watch the video at – https: //entrepreneurs-toolkit. schoolkeep. com/outline/bsr 0 hzd/cover © Minder Chen, 1996 -2017 Market Sizing - 56

Market Sizing • Market sizing definitions • Differences between TAM, SAM and TM • Top-down methodology vs. Bottom-up methodology • Find the right search terms • Secondary market research sources • Case study: Alpha Medical • Case study: Micro. Blu • Case study: Banana • Case study: Proxy market • Watch the video at – https: //entrepreneurs-toolkit. schoolkeep. com/outline/bsr 0 hzd/cover © Minder Chen, 1996 -2017 Market Sizing - 56

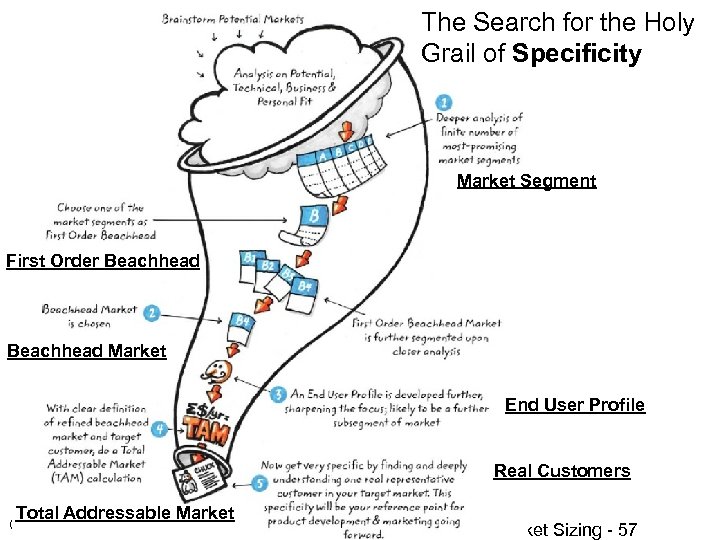

The Search for the Holy Grail of Specificity Market Segment First Order Beachhead Market End User Profile Real Customers Total Addressable Market © Minder Chen, 1996 -2017 Market Sizing - 57

The Search for the Holy Grail of Specificity Market Segment First Order Beachhead Market End User Profile Real Customers Total Addressable Market © Minder Chen, 1996 -2017 Market Sizing - 57

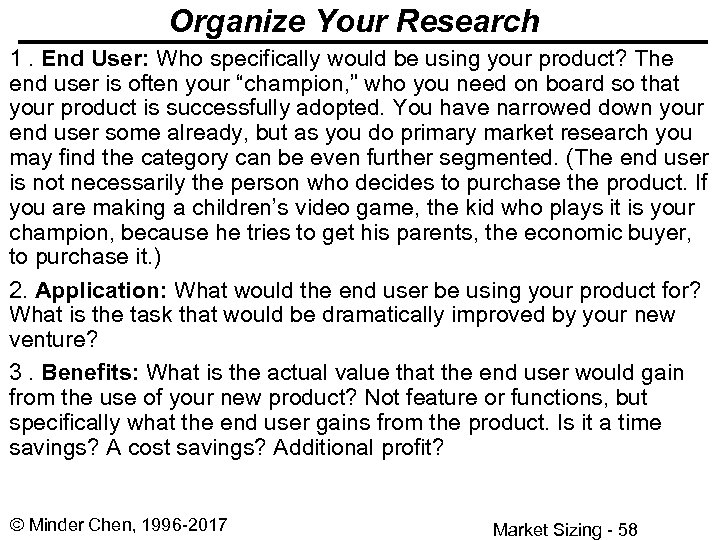

Organize Your Research 1. End User: Who specifically would be using your product? The end user is often your “champion, ” who you need on board so that your product is successfully adopted. You have narrowed down your end user some already, but as you do primary market research you may find the category can be even further segmented. (The end user is not necessarily the person who decides to purchase the product. If you are making a children’s video game, the kid who plays it is your champion, because he tries to get his parents, the economic buyer, to purchase it. ) 2. Application: What would the end user be using your product for? What is the task that would be dramatically improved by your new venture? 3. Benefits: What is the actual value that the end user would gain from the use of your new product? Not feature or functions, but specifically what the end user gains from the product. Is it a time savings? A cost savings? Additional profit? © Minder Chen, 1996 -2017 Market Sizing - 58

Organize Your Research 1. End User: Who specifically would be using your product? The end user is often your “champion, ” who you need on board so that your product is successfully adopted. You have narrowed down your end user some already, but as you do primary market research you may find the category can be even further segmented. (The end user is not necessarily the person who decides to purchase the product. If you are making a children’s video game, the kid who plays it is your champion, because he tries to get his parents, the economic buyer, to purchase it. ) 2. Application: What would the end user be using your product for? What is the task that would be dramatically improved by your new venture? 3. Benefits: What is the actual value that the end user would gain from the use of your new product? Not feature or functions, but specifically what the end user gains from the product. Is it a time savings? A cost savings? Additional profit? © Minder Chen, 1996 -2017 Market Sizing - 58

Organize Your Research 4. Lead Customers: Who are the most influential customers that others look to for thought leadership and adoption of new technology? These are sometimes referred to as “lighthouse customers” because they are so respected that when they buy, others look to them and follow their lead, gaining you instant credibility. Some people call these customers “early adopters, ” but lead customers are not technological enthusiasts. They must be respected by others as innovative and successful customers who purchase because the product provides them with real value and not simply bragging rights. 5. Market Characteristics: What about this market would help or hinder the adoption of new technology? 6. Partners/Players: Which companies will you need to work with to provide a solution that integrates into the customer’s workflow? Sometimes, this category will tie into the “Complementary Assets Required” category below. © Minder Chen, 1996 -2017 Market Sizing - 59

Organize Your Research 4. Lead Customers: Who are the most influential customers that others look to for thought leadership and adoption of new technology? These are sometimes referred to as “lighthouse customers” because they are so respected that when they buy, others look to them and follow their lead, gaining you instant credibility. Some people call these customers “early adopters, ” but lead customers are not technological enthusiasts. They must be respected by others as innovative and successful customers who purchase because the product provides them with real value and not simply bragging rights. 5. Market Characteristics: What about this market would help or hinder the adoption of new technology? 6. Partners/Players: Which companies will you need to work with to provide a solution that integrates into the customer’s workflow? Sometimes, this category will tie into the “Complementary Assets Required” category below. © Minder Chen, 1996 -2017 Market Sizing - 59

Organize Your Research 7. Size of the Market: Roughly, how many potential customers exist if you achieve 100 percent market penetration? 8. Competition: Who, if anyone, is making similar products—real or perceived? Remember, this is from the customer’s perspective and not just yours. 9. Complementary Assets Required: What else does your customer need in order to get the “full solution, ” that is, to get full functionality from your product? You will likely need to bundle your product with products from other manufacturers so that customers can easily buy your product and have full functionality. At the very least, you will need to identify which other products your customer will need to buy to use your product. For instance, if you are developing a game for the Sega Dreamcast video-game console, your customers will need to be able to purchase the console as well. Since the console is not sold anymore, this need will limit your customer’s ability to purchase your product. © Minder Chen, 1996 -2017 Market Sizing - 60

Organize Your Research 7. Size of the Market: Roughly, how many potential customers exist if you achieve 100 percent market penetration? 8. Competition: Who, if anyone, is making similar products—real or perceived? Remember, this is from the customer’s perspective and not just yours. 9. Complementary Assets Required: What else does your customer need in order to get the “full solution, ” that is, to get full functionality from your product? You will likely need to bundle your product with products from other manufacturers so that customers can easily buy your product and have full functionality. At the very least, you will need to identify which other products your customer will need to buy to use your product. For instance, if you are developing a game for the Sega Dreamcast video-game console, your customers will need to be able to purchase the console as well. Since the console is not sold anymore, this need will limit your customer’s ability to purchase your product. © Minder Chen, 1996 -2017 Market Sizing - 60

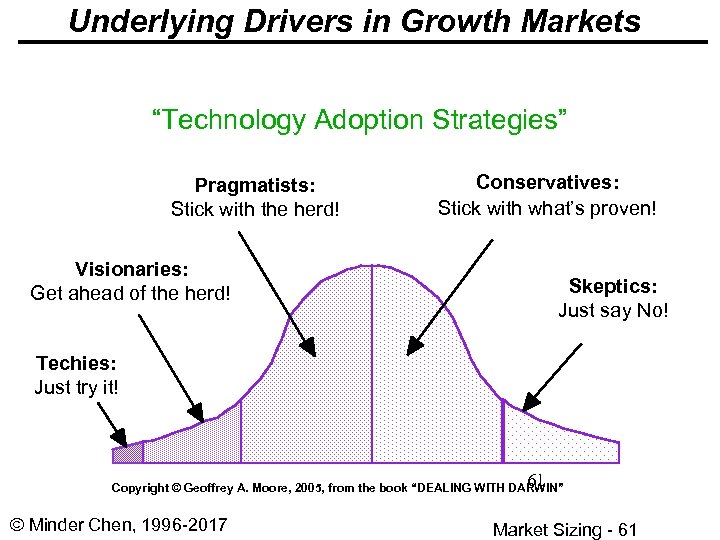

Underlying Drivers in Growth Markets “Technology Adoption Strategies” Pragmatists: Stick with the herd! Conservatives: Stick with what’s proven! Visionaries: Get ahead of the herd! Skeptics: Just say No! Techies: Just try it! 61 Copyright © Geoffrey A. Moore, 2005, from the book “DEALING WITH DARWIN” © Minder Chen, 1996 -2017 Market Sizing - 61

Underlying Drivers in Growth Markets “Technology Adoption Strategies” Pragmatists: Stick with the herd! Conservatives: Stick with what’s proven! Visionaries: Get ahead of the herd! Skeptics: Just say No! Techies: Just try it! 61 Copyright © Geoffrey A. Moore, 2005, from the book “DEALING WITH DARWIN” © Minder Chen, 1996 -2017 Market Sizing - 61

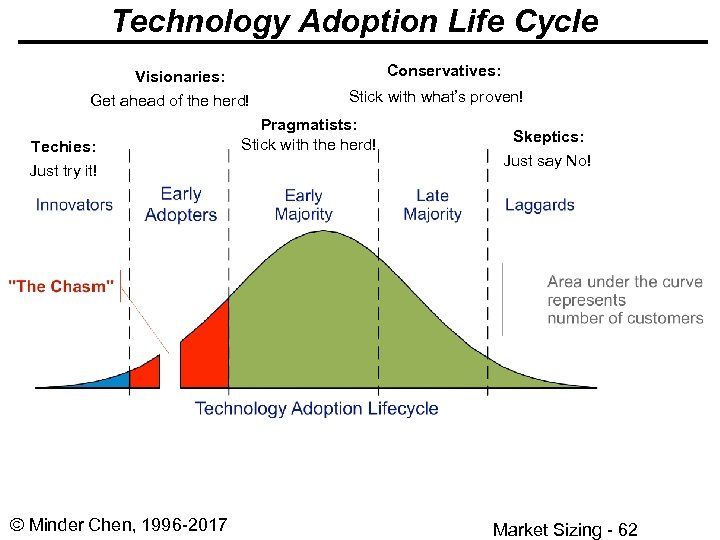

Technology Adoption Life Cycle Visionaries: Get ahead of the herd! Techies: Just try it! © Minder Chen, 1996 -2017 Conservatives: Stick with what’s proven! Pragmatists: Stick with the herd! Skeptics: Just say No! Market Sizing - 62

Technology Adoption Life Cycle Visionaries: Get ahead of the herd! Techies: Just try it! © Minder Chen, 1996 -2017 Conservatives: Stick with what’s proven! Pragmatists: Stick with the herd! Skeptics: Just say No! Market Sizing - 62

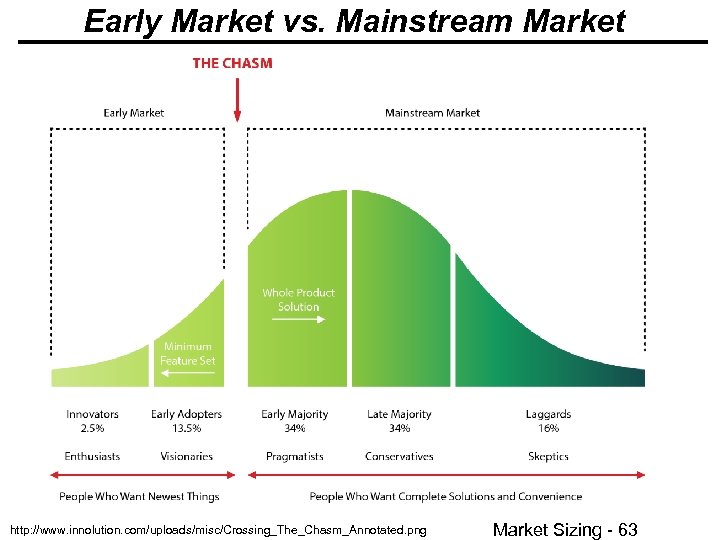

Early Market vs. Mainstream Market © Minder Chen, 1996 -2017 http: //www. innolution. com/uploads/misc/Crossing_The_Chasm_Annotated. png Market Sizing - 63

Early Market vs. Mainstream Market © Minder Chen, 1996 -2017 http: //www. innolution. com/uploads/misc/Crossing_The_Chasm_Annotated. png Market Sizing - 63

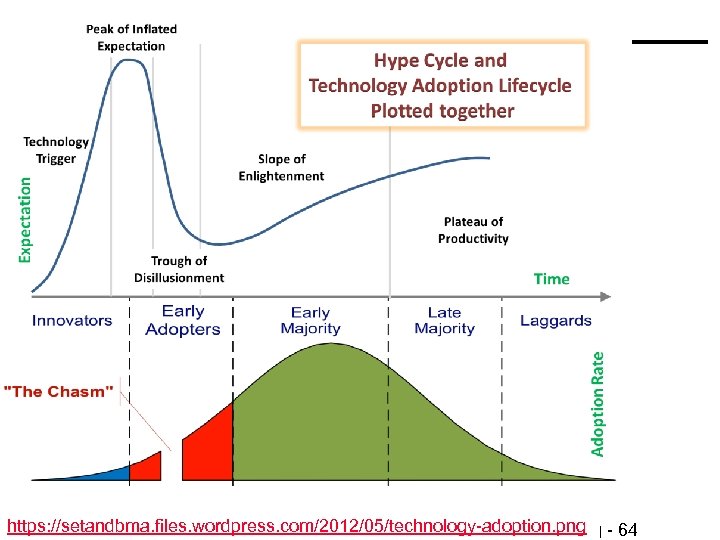

© Minder Chen, 1996 -2017 https: //setandbma. files. wordpress. com/2012/05/technology-adoption. png Market Sizing - 64

© Minder Chen, 1996 -2017 https: //setandbma. files. wordpress. com/2012/05/technology-adoption. png Market Sizing - 64

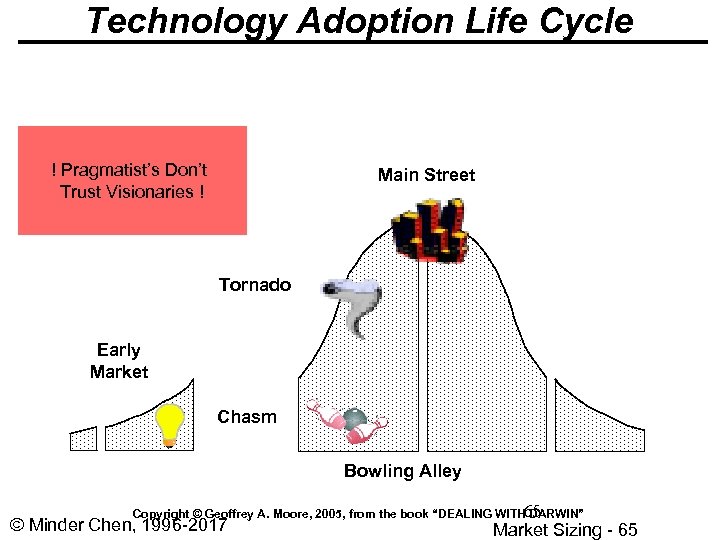

Technology Adoption Life Cycle ! Pragmatist’s Don’t Trust Visionaries ! Main Street Tornado Early Market Chasm Bowling Alley 65 Copyright © Geoffrey A. Moore, 2005, from the book “DEALING WITH DARWIN” © Minder Chen, 1996 -2017 Market Sizing - 65

Technology Adoption Life Cycle ! Pragmatist’s Don’t Trust Visionaries ! Main Street Tornado Early Market Chasm Bowling Alley 65 Copyright © Geoffrey A. Moore, 2005, from the book “DEALING WITH DARWIN” © Minder Chen, 1996 -2017 Market Sizing - 65

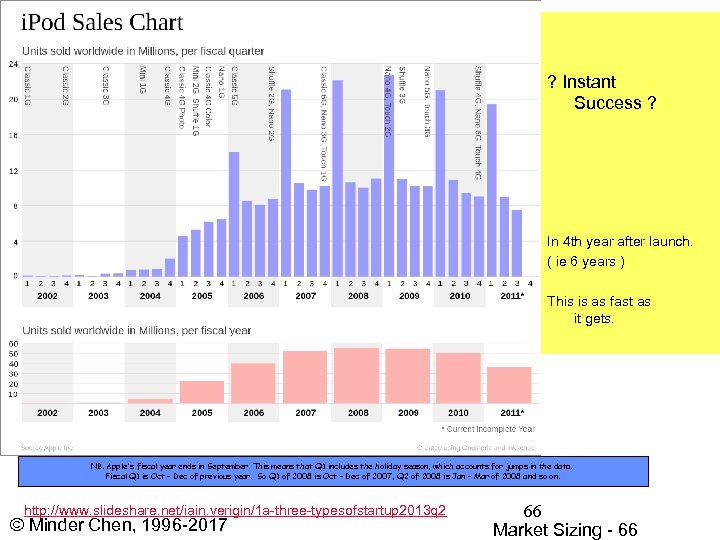

Update 2011 ? Instant Success ? In 4 th year after launch. ( ie 6 years ) This is as fast as it gets. NB. Apple's fiscal year ends in September. This means that Q 1 includes the holiday season, which accounts for jumps in the data. Fiscal Q 1 is Oct - Dec of previous year. So Q 1 of 2008 is Oct - Dec of 2007, Q 2 of 2008 is Jan - Mar of 2008 and so on. http: //www. slideshare. net/iain. verigin/1 a-three-typesofstartup 2013 q 2 © Minder Chen, 1996 -2017 66 Market Sizing - 66

Update 2011 ? Instant Success ? In 4 th year after launch. ( ie 6 years ) This is as fast as it gets. NB. Apple's fiscal year ends in September. This means that Q 1 includes the holiday season, which accounts for jumps in the data. Fiscal Q 1 is Oct - Dec of previous year. So Q 1 of 2008 is Oct - Dec of 2007, Q 2 of 2008 is Jan - Mar of 2008 and so on. http: //www. slideshare. net/iain. verigin/1 a-three-typesofstartup 2013 q 2 © Minder Chen, 1996 -2017 66 Market Sizing - 66

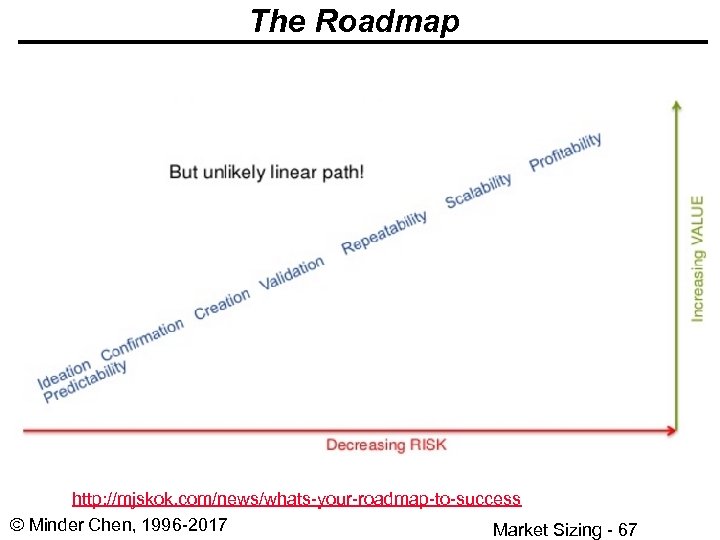

The Roadmap http: //mjskok. com/news/whats-your-roadmap-to-success © Minder Chen, 1996 -2017 Market Sizing - 67

The Roadmap http: //mjskok. com/news/whats-your-roadmap-to-success © Minder Chen, 1996 -2017 Market Sizing - 67

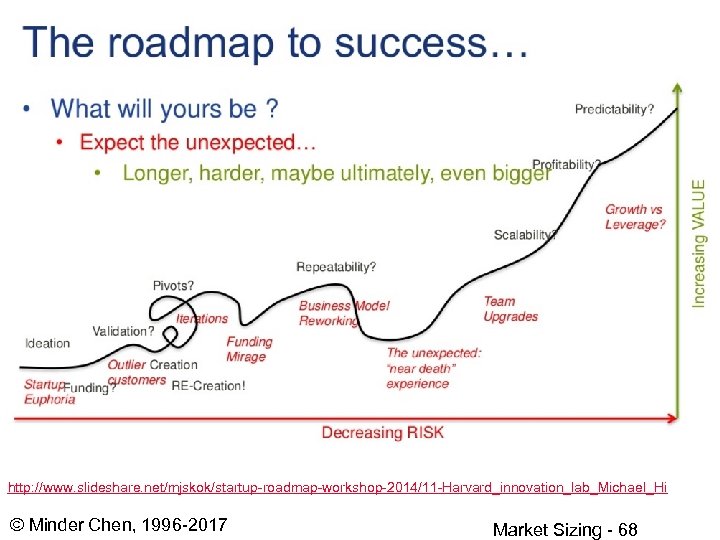

http: //www. slideshare. net/mjskok/startup-roadmap-workshop-2014/11 -Harvard_innovation_lab_Michael_Hi © Minder Chen, 1996 -2017 Market Sizing - 68

http: //www. slideshare. net/mjskok/startup-roadmap-workshop-2014/11 -Harvard_innovation_lab_Michael_Hi © Minder Chen, 1996 -2017 Market Sizing - 68

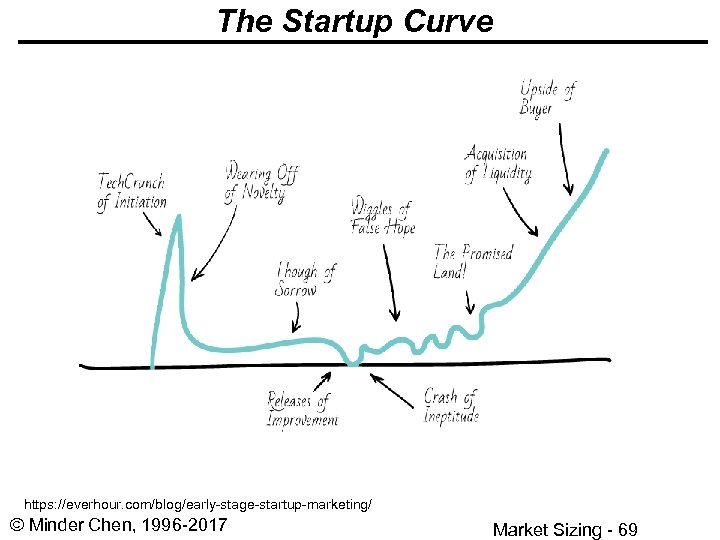

The Startup Curve https: //everhour. com/blog/early-stage-startup-marketing/ © Minder Chen, 1996 -2017 Market Sizing - 69

The Startup Curve https: //everhour. com/blog/early-stage-startup-marketing/ © Minder Chen, 1996 -2017 Market Sizing - 69

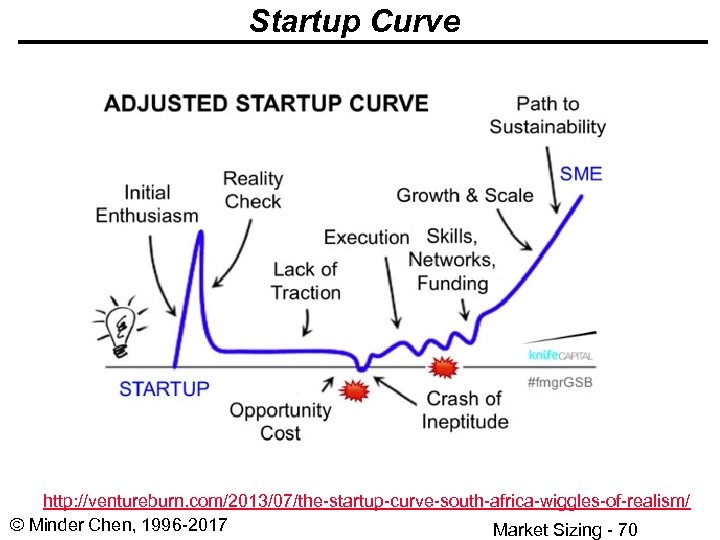

Startup Curve http: //ventureburn. com/2013/07/the-startup-curve-south-africa-wiggles-of-realism/ © Minder Chen, 1996 -2017 Market Sizing - 70

Startup Curve http: //ventureburn. com/2013/07/the-startup-curve-south-africa-wiggles-of-realism/ © Minder Chen, 1996 -2017 Market Sizing - 70

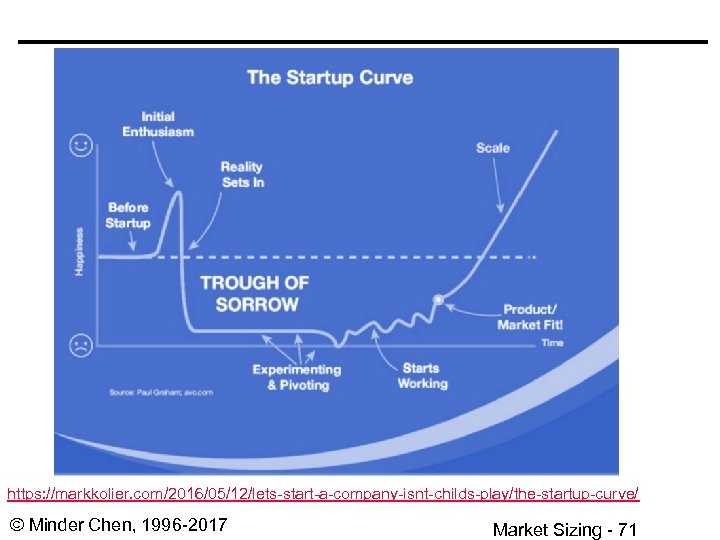

https: //markkolier. com/2016/05/12/lets-start-a-company-isnt-childs-play/the-startup-curve/ © Minder Chen, 1996 -2017 Market Sizing - 71

https: //markkolier. com/2016/05/12/lets-start-a-company-isnt-childs-play/the-startup-curve/ © Minder Chen, 1996 -2017 Market Sizing - 71

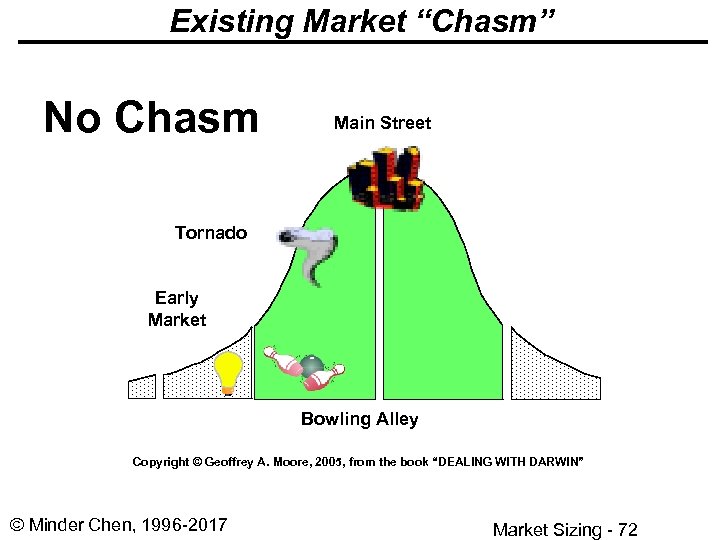

Existing Market “Chasm” No Chasm Main Street Tornado Early Market Bowling Alley Copyright © Geoffrey A. Moore, 2005, from the book “DEALING WITH DARWIN” © Minder Chen, 1996 -2017 Market Sizing - 72

Existing Market “Chasm” No Chasm Main Street Tornado Early Market Bowling Alley Copyright © Geoffrey A. Moore, 2005, from the book “DEALING WITH DARWIN” © Minder Chen, 1996 -2017 Market Sizing - 72

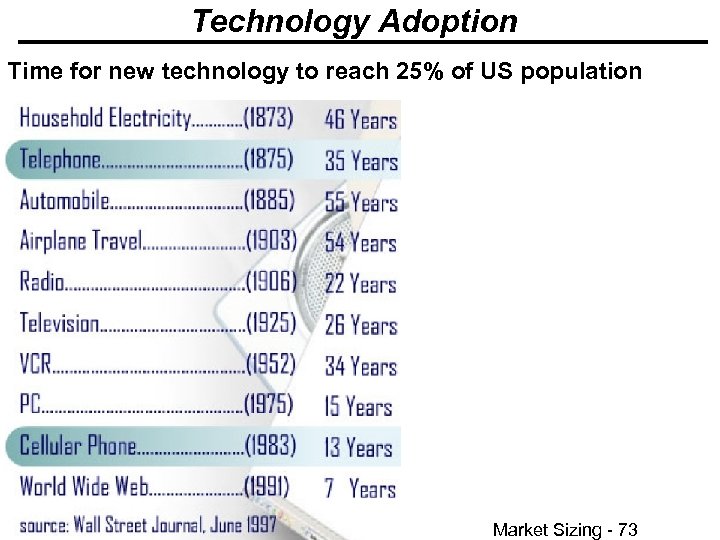

Technology Adoption Time for new technology to reach 25% of US population © Minder Chen, 1996 -2017 Market Sizing - 73

Technology Adoption Time for new technology to reach 25% of US population © Minder Chen, 1996 -2017 Market Sizing - 73

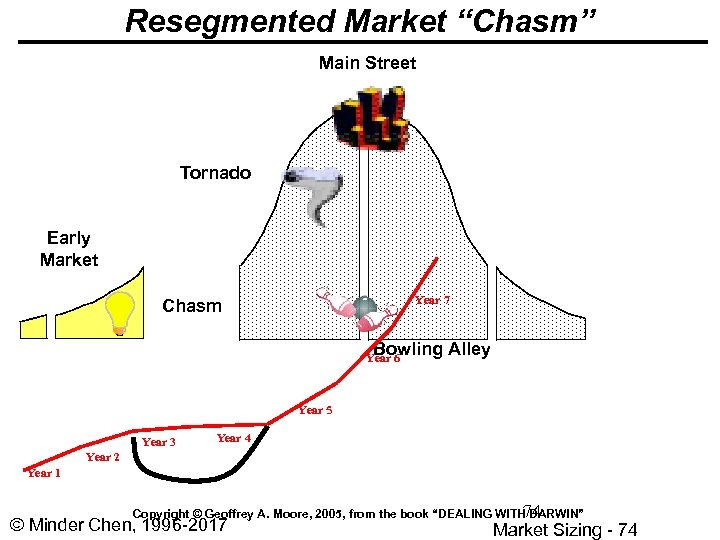

Resegmented Market “Chasm” Main Street Tornado Early Market Year 7 Chasm Bowling Alley Year 6 Year 5 Year 3 Year 4 Year 2 Year 1 74 Copyright © Geoffrey A. Moore, 2005, from the book “DEALING WITH DARWIN” © Minder Chen, 1996 -2017 Market Sizing - 74

Resegmented Market “Chasm” Main Street Tornado Early Market Year 7 Chasm Bowling Alley Year 6 Year 5 Year 3 Year 4 Year 2 Year 1 74 Copyright © Geoffrey A. Moore, 2005, from the book “DEALING WITH DARWIN” © Minder Chen, 1996 -2017 Market Sizing - 74

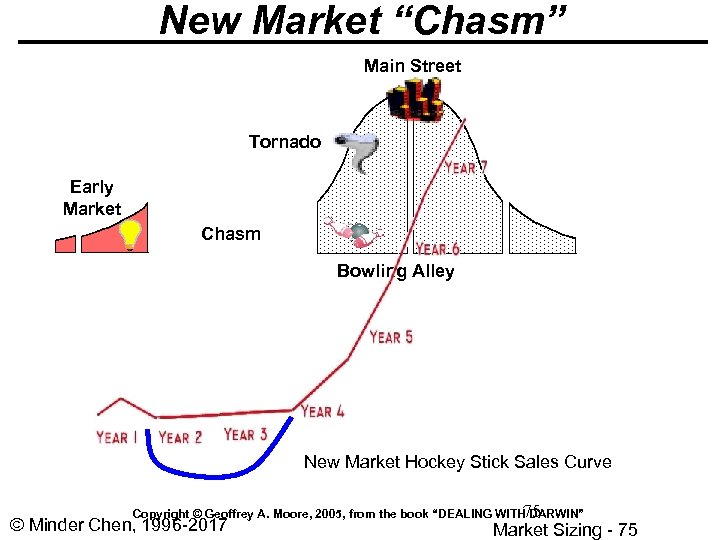

New Market “Chasm” Main Street Tornado Early Market Chasm Bowling Alley New Market Hockey Stick Sales Curve 75 Copyright © Geoffrey A. Moore, 2005, from the book “DEALING WITH DARWIN” © Minder Chen, 1996 -2017 Market Sizing - 75

New Market “Chasm” Main Street Tornado Early Market Chasm Bowling Alley New Market Hockey Stick Sales Curve 75 Copyright © Geoffrey A. Moore, 2005, from the book “DEALING WITH DARWIN” © Minder Chen, 1996 -2017 Market Sizing - 75