dc3ed3e5809a390541fb51408d1d0e13.ppt

- Количество слайдов: 38

Market Mechanism Seminar, 31 May 2015 The Road of Carbon Emissions Trading from Pilots to a Nationwide Scheme in China Dr. Xianbing Liu Senior Policy Researcher/Task Manager Kansai Research Centre, IGES, Japan E-mail: liu@iges. or. jp

Market Mechanism Seminar, 31 May 2015 The Road of Carbon Emissions Trading from Pilots to a Nationwide Scheme in China Dr. Xianbing Liu Senior Policy Researcher/Task Manager Kansai Research Centre, IGES, Japan E-mail: liu@iges. or. jp

Market Mechanism Seminar, 31 May 2015 Structure of the presentation 2 Ø Ø Ø Background A brief overview of global carbon pricing progress GHG ETS pilots in China The progress to a nationwide scheme Perspective of Chinese businesses to ETS Summary of the presentation

Market Mechanism Seminar, 31 May 2015 Structure of the presentation 2 Ø Ø Ø Background A brief overview of global carbon pricing progress GHG ETS pilots in China The progress to a nationwide scheme Perspective of Chinese businesses to ETS Summary of the presentation

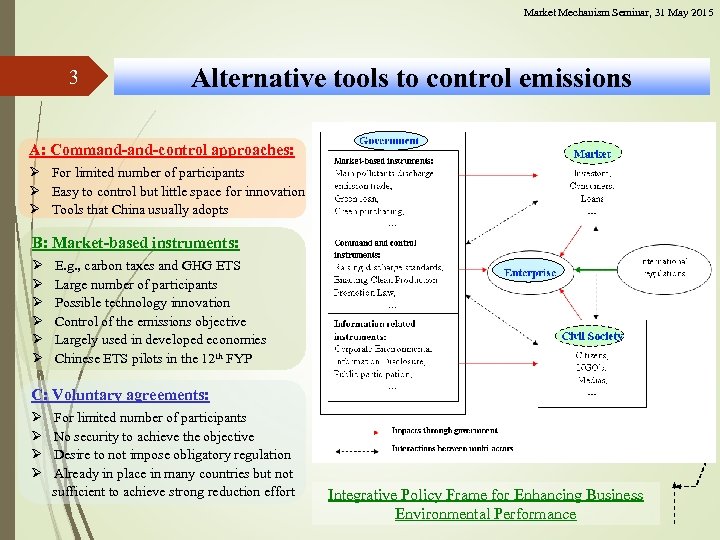

Market Mechanism Seminar, 31 May 2015 3 Alternative tools to control emissions A: Command-control approaches: Ø For limited number of participants Ø Easy to control but little space for innovation Ø Tools that China usually adopts B: Market-based instruments: Ø Ø Ø E. g. , carbon taxes and GHG ETS Large number of participants Possible technology innovation Control of the emissions objective Largely used in developed economies Chinese ETS pilots in the 12 th FYP C: Voluntary agreements: Ø Ø For limited number of participants No security to achieve the objective Desire to not impose obligatory regulation Already in place in many countries but not sufficient to achieve strong reduction effort Integrative Policy Frame for Enhancing Business Environmental Performance

Market Mechanism Seminar, 31 May 2015 3 Alternative tools to control emissions A: Command-control approaches: Ø For limited number of participants Ø Easy to control but little space for innovation Ø Tools that China usually adopts B: Market-based instruments: Ø Ø Ø E. g. , carbon taxes and GHG ETS Large number of participants Possible technology innovation Control of the emissions objective Largely used in developed economies Chinese ETS pilots in the 12 th FYP C: Voluntary agreements: Ø Ø For limited number of participants No security to achieve the objective Desire to not impose obligatory regulation Already in place in many countries but not sufficient to achieve strong reduction effort Integrative Policy Frame for Enhancing Business Environmental Performance

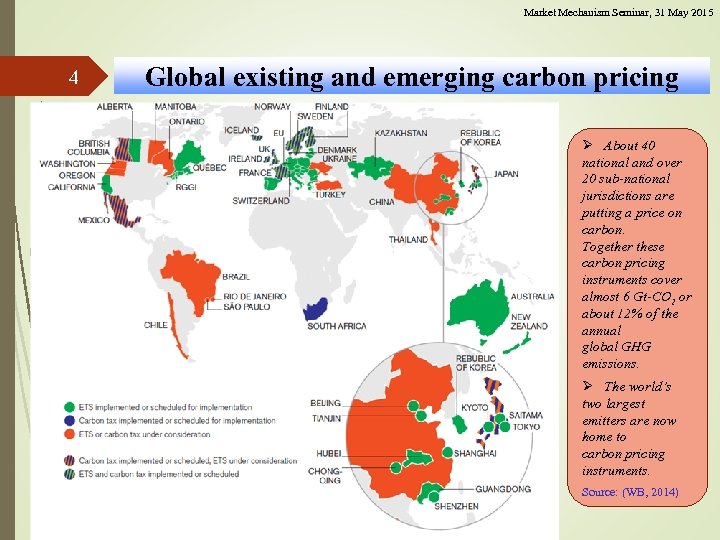

Market Mechanism Seminar, 31 May 2015 4 Global existing and emerging carbon pricing Ø About 40 national and over 20 sub-national jurisdictions are putting a price on carbon. Together these carbon pricing instruments cover almost 6 Gt-CO 2 or about 12% of the annual global GHG emissions. Ø The world’s two largest emitters are now home to carbon pricing instruments. Source: (WB, 2014)

Market Mechanism Seminar, 31 May 2015 4 Global existing and emerging carbon pricing Ø About 40 national and over 20 sub-national jurisdictions are putting a price on carbon. Together these carbon pricing instruments cover almost 6 Gt-CO 2 or about 12% of the annual global GHG emissions. Ø The world’s two largest emitters are now home to carbon pricing instruments. Source: (WB, 2014)

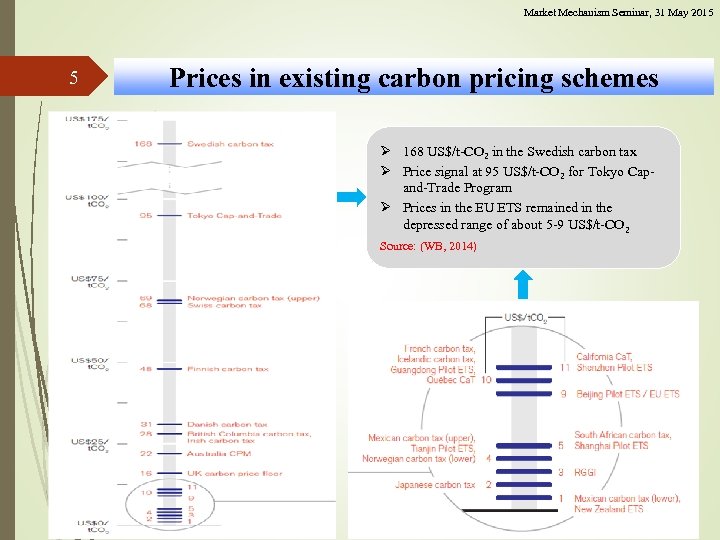

Market Mechanism Seminar, 31 May 2015 5 Prices in existing carbon pricing schemes Ø 168 US$/t-CO 2 in the Swedish carbon tax Ø Price signal at 95 US$/t-CO 2 for Tokyo Capand-Trade Program Ø Prices in the EU ETS remained in the depressed range of about 5 -9 US$/t-CO 2 Source: (WB, 2014)

Market Mechanism Seminar, 31 May 2015 5 Prices in existing carbon pricing schemes Ø 168 US$/t-CO 2 in the Swedish carbon tax Ø Price signal at 95 US$/t-CO 2 for Tokyo Capand-Trade Program Ø Prices in the EU ETS remained in the depressed range of about 5 -9 US$/t-CO 2 Source: (WB, 2014)

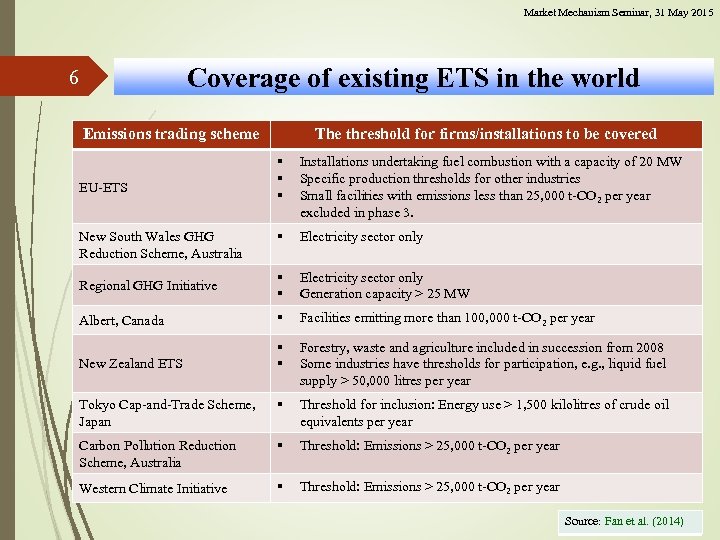

Market Mechanism Seminar, 31 May 2015 Coverage of existing ETS in the world 6 Emissions trading scheme The threshold for firms/installations to be covered § § § Installations undertaking fuel combustion with a capacity of 20 MW Specific production thresholds for other industries Small facilities with emissions less than 25, 000 t-CO 2 per year excluded in phase 3. § Electricity sector only Regional GHG Initiative § § Electricity sector only Generation capacity > 25 MW Albert, Canada § Facilities emitting more than 100, 000 t-CO 2 per year New Zealand ETS § § Forestry, waste and agriculture included in succession from 2008 Some industries have thresholds for participation, e. g. , liquid fuel supply > 50, 000 litres per year Tokyo Cap-and-Trade Scheme, Japan § Threshold for inclusion: Energy use > 1, 500 kilolitres of crude oil equivalents per year Carbon Pollution Reduction Scheme, Australia § Threshold: Emissions > 25, 000 t-CO 2 per year Western Climate Initiative § Threshold: Emissions > 25, 000 t-CO 2 per year EU-ETS New South Wales GHG Reduction Scheme, Australia Source: Fan et al. (2014)

Market Mechanism Seminar, 31 May 2015 Coverage of existing ETS in the world 6 Emissions trading scheme The threshold for firms/installations to be covered § § § Installations undertaking fuel combustion with a capacity of 20 MW Specific production thresholds for other industries Small facilities with emissions less than 25, 000 t-CO 2 per year excluded in phase 3. § Electricity sector only Regional GHG Initiative § § Electricity sector only Generation capacity > 25 MW Albert, Canada § Facilities emitting more than 100, 000 t-CO 2 per year New Zealand ETS § § Forestry, waste and agriculture included in succession from 2008 Some industries have thresholds for participation, e. g. , liquid fuel supply > 50, 000 litres per year Tokyo Cap-and-Trade Scheme, Japan § Threshold for inclusion: Energy use > 1, 500 kilolitres of crude oil equivalents per year Carbon Pollution Reduction Scheme, Australia § Threshold: Emissions > 25, 000 t-CO 2 per year Western Climate Initiative § Threshold: Emissions > 25, 000 t-CO 2 per year EU-ETS New South Wales GHG Reduction Scheme, Australia Source: Fan et al. (2014)

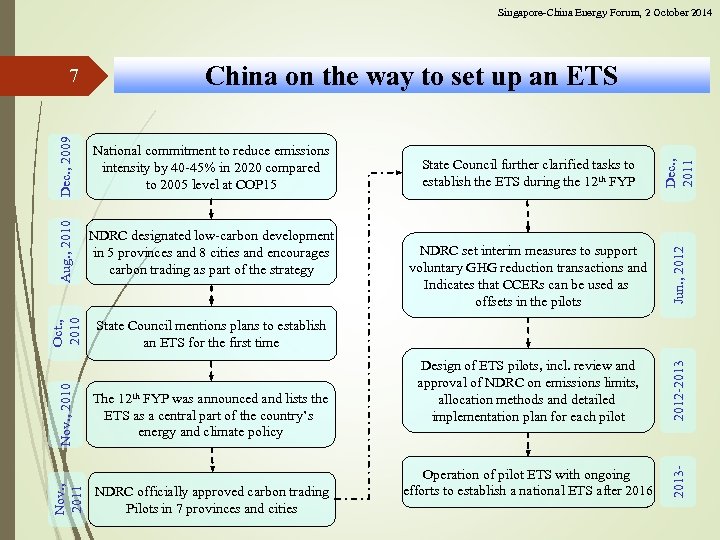

Singapore-China Energy Forum, 2 October 2014 NDRC officially approved carbon trading Pilots in 7 provinces and cities Jun. , 2012 Design of ETS pilots, incl. review and approval of NDRC on emissions limits, allocation methods and detailed implementation plan for each pilot 2012 -2013 Nov. , 2011 The 12 th FYP was announced and lists the ETS as a central part of the country’s energy and climate policy NDRC set interim measures to support voluntary GHG reduction transactions and Indicates that CCERs can be used as offsets in the pilots Dec. , 2011 State Council mentions plans to establish an ETS for the first time State Council further clarified tasks to establish the ETS during the 12 th FYP Operation of pilot ETS with ongoing efforts to establish a national ETS after 2016 2013 - Dec. , 2009 NDRC designated low-carbon development in 5 provinces and 8 cities and encourages carbon trading as part of the strategy Nov. , 2010 National commitment to reduce emissions intensity by 40 -45% in 2020 compared to 2005 level at COP 15 Aug. , 2010 China on the way to set up an ETS Oct. , 2010 7

Singapore-China Energy Forum, 2 October 2014 NDRC officially approved carbon trading Pilots in 7 provinces and cities Jun. , 2012 Design of ETS pilots, incl. review and approval of NDRC on emissions limits, allocation methods and detailed implementation plan for each pilot 2012 -2013 Nov. , 2011 The 12 th FYP was announced and lists the ETS as a central part of the country’s energy and climate policy NDRC set interim measures to support voluntary GHG reduction transactions and Indicates that CCERs can be used as offsets in the pilots Dec. , 2011 State Council mentions plans to establish an ETS for the first time State Council further clarified tasks to establish the ETS during the 12 th FYP Operation of pilot ETS with ongoing efforts to establish a national ETS after 2016 2013 - Dec. , 2009 NDRC designated low-carbon development in 5 provinces and 8 cities and encourages carbon trading as part of the strategy Nov. , 2010 National commitment to reduce emissions intensity by 40 -45% in 2020 compared to 2005 level at COP 15 Aug. , 2010 China on the way to set up an ETS Oct. , 2010 7

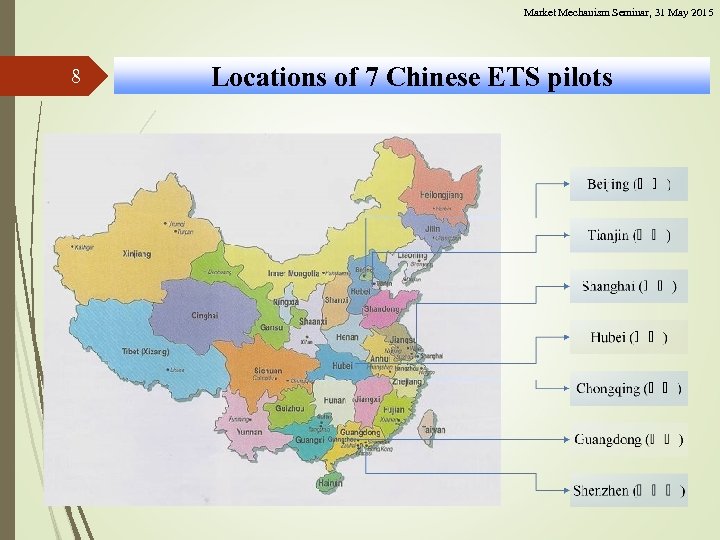

Market Mechanism Seminar, 31 May 2015 8 Locations of 7 Chinese ETS pilots

Market Mechanism Seminar, 31 May 2015 8 Locations of 7 Chinese ETS pilots

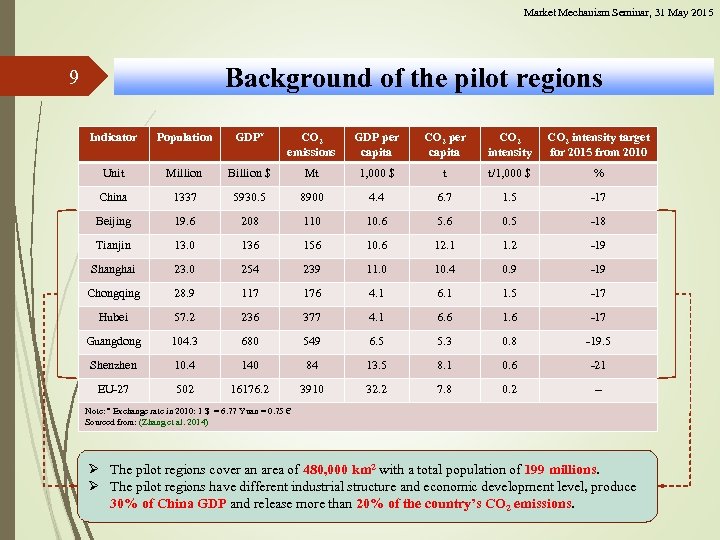

Market Mechanism Seminar, 31 May 2015 Background of the pilot regions 9 Indicator Population GDP* CO 2 emissions GDP per capita CO 2 intensity target for 2015 from 2010 Unit Million Billion $ Mt 1, 000 $ t t/1, 000 $ % China 1337 5930. 5 8900 4. 4 6. 7 1. 5 -17 Beijing 19. 6 208 110 10. 6 5. 6 0. 5 -18 Tianjin 13. 0 136 156 10. 6 12. 1 1. 2 -19 Shanghai 23. 0 254 239 11. 0 10. 4 0. 9 -19 Chongqing 28. 9 117 176 4. 1 6. 1 1. 5 -17 Hubei 57. 2 236 377 4. 1 6. 6 1. 6 -17 Guangdong 104. 3 680 549 6. 5 5. 3 0. 8 -19. 5 Shenzhen 10. 4 140 84 13. 5 8. 1 0. 6 -21 EU-27 502 16176. 2 3910 32. 2 7. 8 0. 2 -- Note: * Exchange rate in 2010: 1 $ = 6. 77 Yuan = 0. 75 € Sourced from: (Zhang et al. 2014) Ø The pilot regions cover an area of 480, 000 km 2 with a total population of 199 millions. Ø The pilot regions have different industrial structure and economic development level, produce 30% of China GDP and release more than 20% of the country’s CO 2 emissions.

Market Mechanism Seminar, 31 May 2015 Background of the pilot regions 9 Indicator Population GDP* CO 2 emissions GDP per capita CO 2 intensity target for 2015 from 2010 Unit Million Billion $ Mt 1, 000 $ t t/1, 000 $ % China 1337 5930. 5 8900 4. 4 6. 7 1. 5 -17 Beijing 19. 6 208 110 10. 6 5. 6 0. 5 -18 Tianjin 13. 0 136 156 10. 6 12. 1 1. 2 -19 Shanghai 23. 0 254 239 11. 0 10. 4 0. 9 -19 Chongqing 28. 9 117 176 4. 1 6. 1 1. 5 -17 Hubei 57. 2 236 377 4. 1 6. 6 1. 6 -17 Guangdong 104. 3 680 549 6. 5 5. 3 0. 8 -19. 5 Shenzhen 10. 4 140 84 13. 5 8. 1 0. 6 -21 EU-27 502 16176. 2 3910 32. 2 7. 8 0. 2 -- Note: * Exchange rate in 2010: 1 $ = 6. 77 Yuan = 0. 75 € Sourced from: (Zhang et al. 2014) Ø The pilot regions cover an area of 480, 000 km 2 with a total population of 199 millions. Ø The pilot regions have different industrial structure and economic development level, produce 30% of China GDP and release more than 20% of the country’s CO 2 emissions.

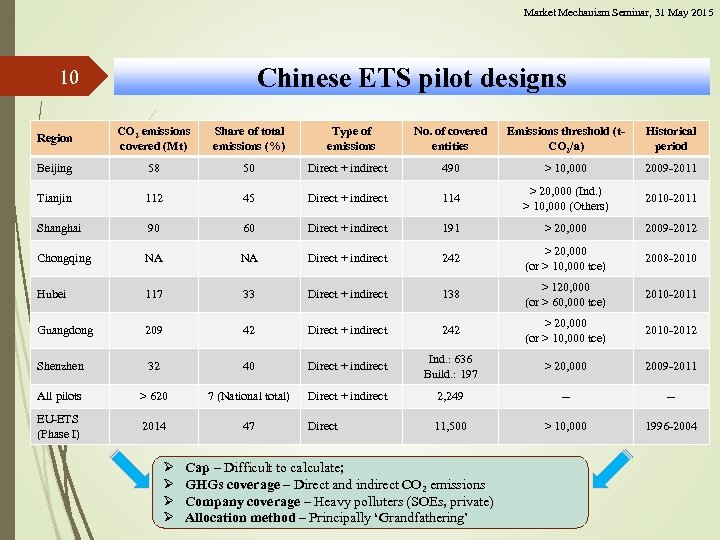

Market Mechanism Seminar, 31 May 2015 Chinese ETS pilot designs 10 Region CO 2 emissions covered (Mt) Share of total emissions (%) Beijing 58 50 Tianjin 112 Shanghai No. of covered entities Emissions threshold (t. CO 2/a) Historical period Direct + indirect 490 > 10, 000 2009 -2011 45 Direct + indirect 114 > 20, 000 (Ind. ) > 10, 000 (Others) 2010 -2011 90 60 Direct + indirect 191 > 20, 000 2009 -2012 Chongqing NA NA Direct + indirect 242 > 20, 000 (or > 10, 000 tce) 2008 -2010 Hubei 117 33 Direct + indirect 138 > 120, 000 (or > 60, 000 tce) 2010 -2011 Guangdong 209 42 Direct + indirect 242 > 20, 000 (or > 10, 000 tce) 2010 -2012 Shenzhen 32 40 Direct + indirect Ind. : 636 Build. : 197 > 20, 000 2009 -2011 All pilots > 620 7 (National total) Direct + indirect 2, 249 -- -- EU-ETS (Phase I) 2014 47 Direct 11, 500 > 10, 000 1996 -2004 Ø Ø Type of emissions Cap – Difficult to calculate; GHGs coverage – Direct and indirect CO 2 emissions Company coverage – Heavy polluters (SOEs, private) Allocation method – Principally ‘Grandfathering’

Market Mechanism Seminar, 31 May 2015 Chinese ETS pilot designs 10 Region CO 2 emissions covered (Mt) Share of total emissions (%) Beijing 58 50 Tianjin 112 Shanghai No. of covered entities Emissions threshold (t. CO 2/a) Historical period Direct + indirect 490 > 10, 000 2009 -2011 45 Direct + indirect 114 > 20, 000 (Ind. ) > 10, 000 (Others) 2010 -2011 90 60 Direct + indirect 191 > 20, 000 2009 -2012 Chongqing NA NA Direct + indirect 242 > 20, 000 (or > 10, 000 tce) 2008 -2010 Hubei 117 33 Direct + indirect 138 > 120, 000 (or > 60, 000 tce) 2010 -2011 Guangdong 209 42 Direct + indirect 242 > 20, 000 (or > 10, 000 tce) 2010 -2012 Shenzhen 32 40 Direct + indirect Ind. : 636 Build. : 197 > 20, 000 2009 -2011 All pilots > 620 7 (National total) Direct + indirect 2, 249 -- -- EU-ETS (Phase I) 2014 47 Direct 11, 500 > 10, 000 1996 -2004 Ø Ø Type of emissions Cap – Difficult to calculate; GHGs coverage – Direct and indirect CO 2 emissions Company coverage – Heavy polluters (SOEs, private) Allocation method – Principally ‘Grandfathering’

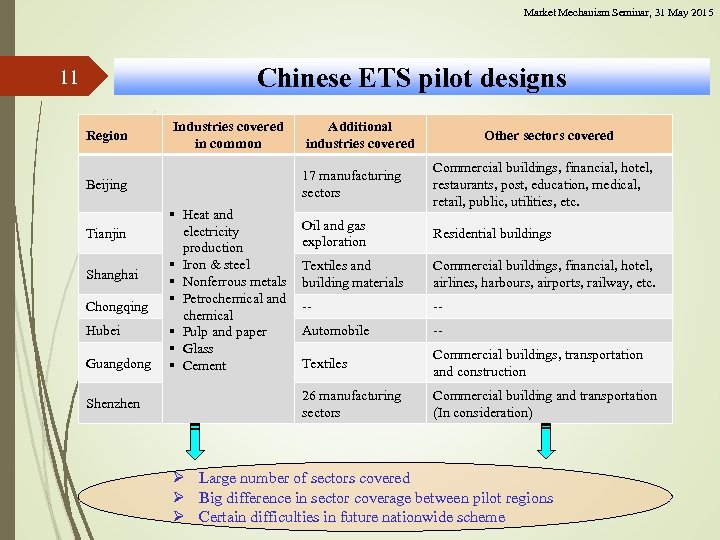

Market Mechanism Seminar, 31 May 2015 Chinese ETS pilot designs 11 Region Industries covered in common Shanghai Chongqing Hubei Guangdong Shenzhen Other sectors covered 17 manufacturing sectors § Heat and electricity production § Iron & steel § Nonferrous metals § Petrochemical and chemical § Pulp and paper § Glass § Cement Commercial buildings, financial, hotel, restaurants, post, education, medical, retail, public, utilities, etc. Oil and gas exploration Residential buildings Textiles and building materials Commercial buildings, financial, hotel, airlines, harbours, airports, railway, etc. -- -- Automobile -- Textiles Commercial buildings, transportation and construction 26 manufacturing sectors Beijing Tianjin Additional industries covered Commercial building and transportation (In consideration) Ø Large number of sectors covered Ø Big difference in sector coverage between pilot regions Ø Certain difficulties in future nationwide scheme

Market Mechanism Seminar, 31 May 2015 Chinese ETS pilot designs 11 Region Industries covered in common Shanghai Chongqing Hubei Guangdong Shenzhen Other sectors covered 17 manufacturing sectors § Heat and electricity production § Iron & steel § Nonferrous metals § Petrochemical and chemical § Pulp and paper § Glass § Cement Commercial buildings, financial, hotel, restaurants, post, education, medical, retail, public, utilities, etc. Oil and gas exploration Residential buildings Textiles and building materials Commercial buildings, financial, hotel, airlines, harbours, airports, railway, etc. -- -- Automobile -- Textiles Commercial buildings, transportation and construction 26 manufacturing sectors Beijing Tianjin Additional industries covered Commercial building and transportation (In consideration) Ø Large number of sectors covered Ø Big difference in sector coverage between pilot regions Ø Certain difficulties in future nationwide scheme

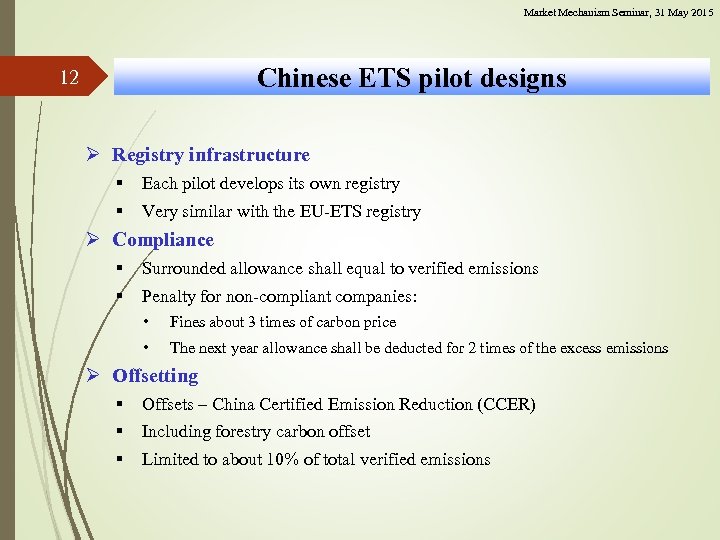

Market Mechanism Seminar, 31 May 2015 Chinese ETS pilot designs 12 Ø Registry infrastructure § § Each pilot develops its own registry Very similar with the EU-ETS registry Ø Compliance § § Surrounded allowance shall equal to verified emissions Penalty for non-compliant companies: • Fines about 3 times of carbon price • The next year allowance shall be deducted for 2 times of the excess emissions Ø Offsetting § § § Offsets – China Certified Emission Reduction (CCER) Including forestry carbon offset Limited to about 10% of total verified emissions

Market Mechanism Seminar, 31 May 2015 Chinese ETS pilot designs 12 Ø Registry infrastructure § § Each pilot develops its own registry Very similar with the EU-ETS registry Ø Compliance § § Surrounded allowance shall equal to verified emissions Penalty for non-compliant companies: • Fines about 3 times of carbon price • The next year allowance shall be deducted for 2 times of the excess emissions Ø Offsetting § § § Offsets – China Certified Emission Reduction (CCER) Including forestry carbon offset Limited to about 10% of total verified emissions

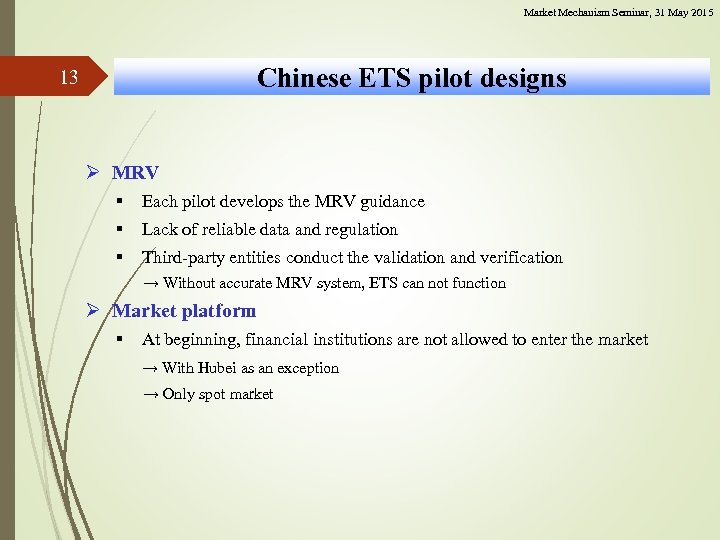

Market Mechanism Seminar, 31 May 2015 Chinese ETS pilot designs 13 Ø MRV § § § Each pilot develops the MRV guidance Lack of reliable data and regulation Third-party entities conduct the validation and verification → Without accurate MRV system, ETS can not function Ø Market platform § At beginning, financial institutions are not allowed to enter the market → With Hubei as an exception → Only spot market

Market Mechanism Seminar, 31 May 2015 Chinese ETS pilot designs 13 Ø MRV § § § Each pilot develops the MRV guidance Lack of reliable data and regulation Third-party entities conduct the validation and verification → Without accurate MRV system, ETS can not function Ø Market platform § At beginning, financial institutions are not allowed to enter the market → With Hubei as an exception → Only spot market

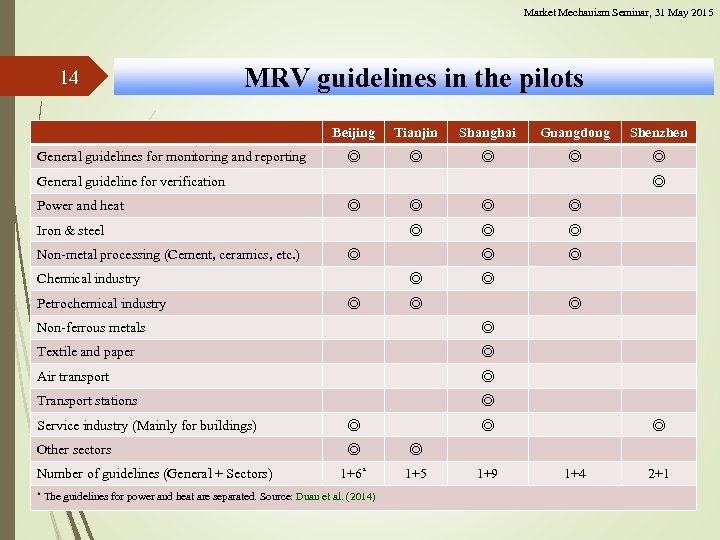

Market Mechanism Seminar, 31 May 2015 14 MRV guidelines in the pilots Beijing General guidelines for monitoring and reporting Tianjin Shanghai Guangdong Shenzhen ◎ ◎ ◎ General guideline for verification Power and heat ◎ ◎ Non-metal processing (Cement, ceramics, etc. ) ◎ ◎ ◎ Chemical industry Petrochemical industry ◎ ◎ Iron & steel ◎ ◎ ◎ Non-ferrous metals ◎ Textile and paper ◎ Air transport ◎ Transport stations ◎ Service industry (Mainly for buildings) ◎ Other sectors ◎ ◎ 1+6* 1+5 Number of guidelines (General + Sectors) * The guidelines for power and heat are separated. Source: Duan et al. (2014) ◎ 1+9 ◎ 1+4 2+1

Market Mechanism Seminar, 31 May 2015 14 MRV guidelines in the pilots Beijing General guidelines for monitoring and reporting Tianjin Shanghai Guangdong Shenzhen ◎ ◎ ◎ General guideline for verification Power and heat ◎ ◎ Non-metal processing (Cement, ceramics, etc. ) ◎ ◎ ◎ Chemical industry Petrochemical industry ◎ ◎ Iron & steel ◎ ◎ ◎ Non-ferrous metals ◎ Textile and paper ◎ Air transport ◎ Transport stations ◎ Service industry (Mainly for buildings) ◎ Other sectors ◎ ◎ 1+6* 1+5 Number of guidelines (General + Sectors) * The guidelines for power and heat are separated. Source: Duan et al. (2014) ◎ 1+9 ◎ 1+4 2+1

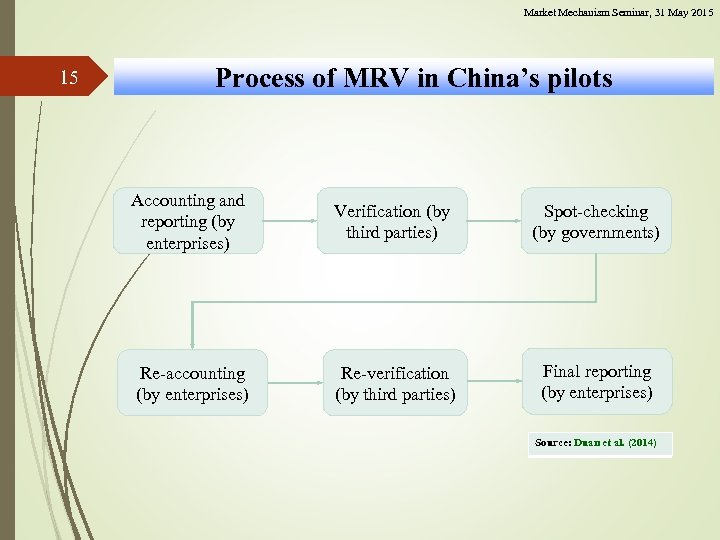

Market Mechanism Seminar, 31 May 2015 15 Process of MRV in China’s pilots Accounting and reporting (by enterprises) Verification (by third parties) Spot-checking (by governments) Re-accounting (by enterprises) Re-verification (by third parties) Final reporting (by enterprises) Source: Duan et al. (2014)

Market Mechanism Seminar, 31 May 2015 15 Process of MRV in China’s pilots Accounting and reporting (by enterprises) Verification (by third parties) Spot-checking (by governments) Re-accounting (by enterprises) Re-verification (by third parties) Final reporting (by enterprises) Source: Duan et al. (2014)

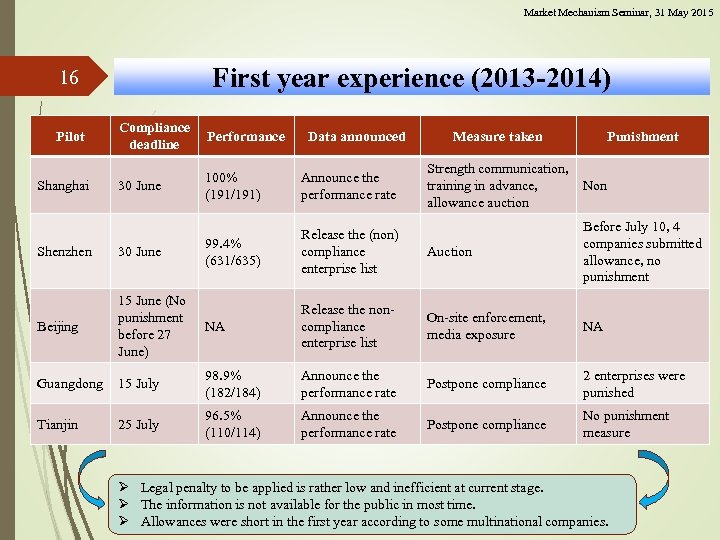

Market Mechanism Seminar, 31 May 2015 First year experience (2013 -2014) 16 Pilot Shanghai Compliance deadline Performance 30 June 100% (191/191) Announce the performance rate Data announced Measure taken Punishment Strength communication, training in advance, allowance auction Non 99. 4% (631/635) Release the (non) compliance enterprise list Auction Before July 10, 4 companies submitted allowance, no punishment On-site enforcement, media exposure NA Shenzhen 30 June Beijing 15 June (No punishment before 27 June) NA Release the noncompliance enterprise list Guangdong 15 July 98. 9% (182/184) Announce the performance rate Postpone compliance 2 enterprises were punished Tianjin 25 July 96. 5% (110/114) Announce the performance rate Postpone compliance No punishment measure Ø Legal penalty to be applied is rather low and inefficient at current stage. Ø The information is not available for the public in most time. Ø Allowances were short in the first year according to some multinational companies.

Market Mechanism Seminar, 31 May 2015 First year experience (2013 -2014) 16 Pilot Shanghai Compliance deadline Performance 30 June 100% (191/191) Announce the performance rate Data announced Measure taken Punishment Strength communication, training in advance, allowance auction Non 99. 4% (631/635) Release the (non) compliance enterprise list Auction Before July 10, 4 companies submitted allowance, no punishment On-site enforcement, media exposure NA Shenzhen 30 June Beijing 15 June (No punishment before 27 June) NA Release the noncompliance enterprise list Guangdong 15 July 98. 9% (182/184) Announce the performance rate Postpone compliance 2 enterprises were punished Tianjin 25 July 96. 5% (110/114) Announce the performance rate Postpone compliance No punishment measure Ø Legal penalty to be applied is rather low and inefficient at current stage. Ø The information is not available for the public in most time. Ø Allowances were short in the first year according to some multinational companies.

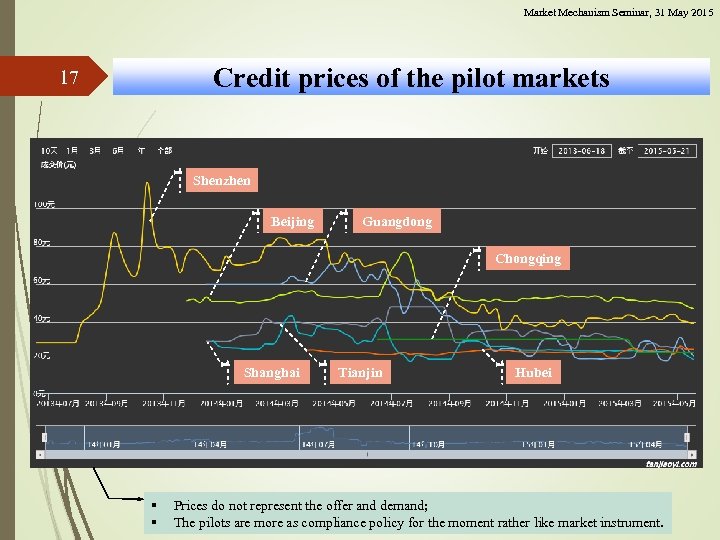

Market Mechanism Seminar, 31 May 2015 Credit prices of the pilot markets 17 Shenzhen Beijing Guangdong Chongqing Shanghai § § Tianjin Hubei Prices do not represent the offer and demand; The pilots are more as compliance policy for the moment rather like market instrument.

Market Mechanism Seminar, 31 May 2015 Credit prices of the pilot markets 17 Shenzhen Beijing Guangdong Chongqing Shanghai § § Tianjin Hubei Prices do not represent the offer and demand; The pilots are more as compliance policy for the moment rather like market instrument.

Market Mechanism Seminar, 31 May 2015 18 The market of Beijing pilot § § § Very low traded volume; Active trading around the compliance date; Carbon price is stable at around 50 Yuan/t-CO 2.

Market Mechanism Seminar, 31 May 2015 18 The market of Beijing pilot § § § Very low traded volume; Active trading around the compliance date; Carbon price is stable at around 50 Yuan/t-CO 2.

Market Mechanism Seminar, 31 May 2015 19 The market of Shanghai pilot Around 30 Yuan/t-CO 2

Market Mechanism Seminar, 31 May 2015 19 The market of Shanghai pilot Around 30 Yuan/t-CO 2

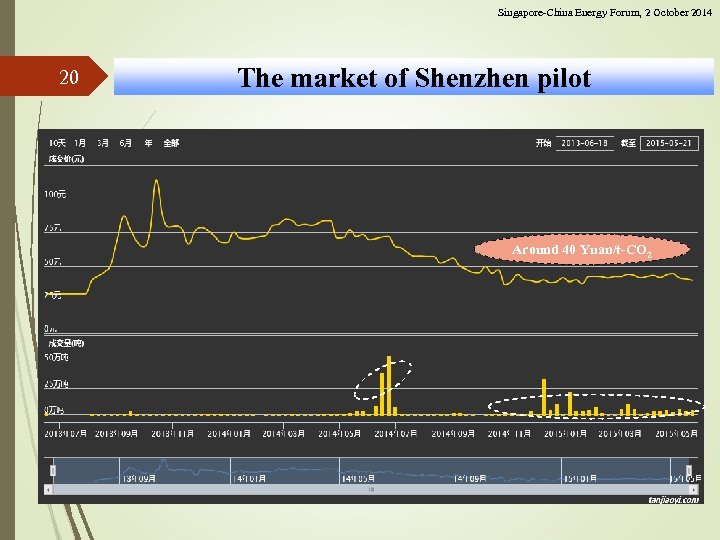

Singapore-China Energy Forum, 2 October 2014 20 The market of Shenzhen pilot Around 40 Yuan/t-CO 2

Singapore-China Energy Forum, 2 October 2014 20 The market of Shenzhen pilot Around 40 Yuan/t-CO 2

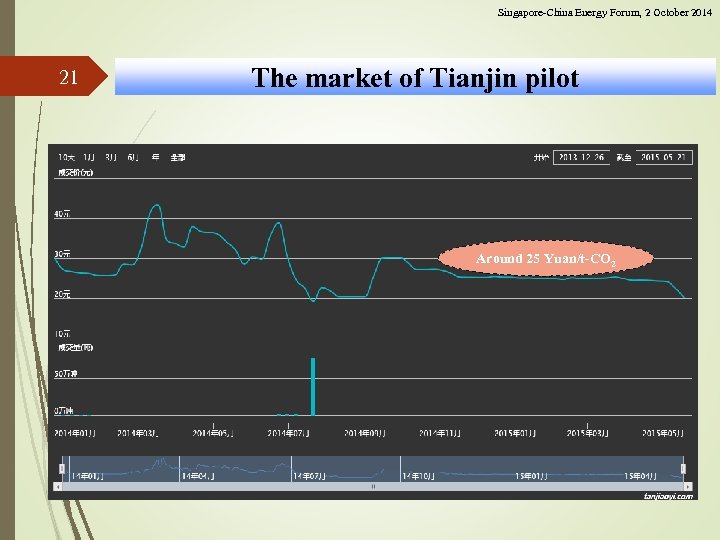

Singapore-China Energy Forum, 2 October 2014 21 The market of Tianjin pilot Around 25 Yuan/t-CO 2

Singapore-China Energy Forum, 2 October 2014 21 The market of Tianjin pilot Around 25 Yuan/t-CO 2

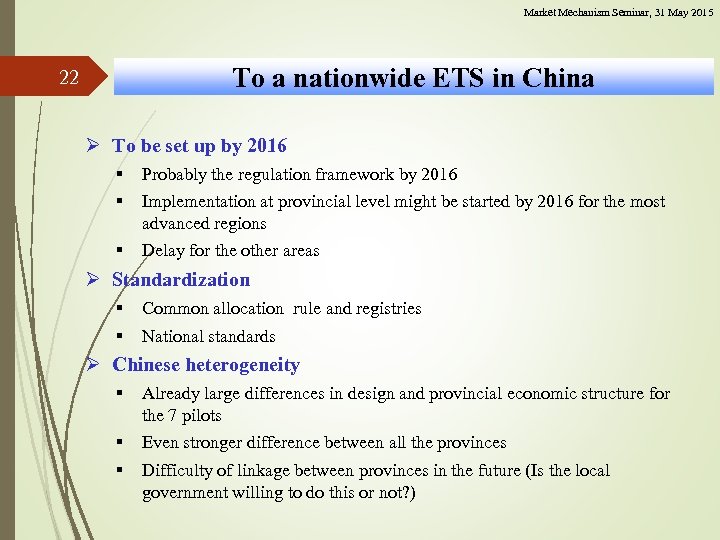

Market Mechanism Seminar, 31 May 2015 To a nationwide ETS in China 22 Ø To be set up by 2016 § § Probably the regulation framework by 2016 § Delay for the other areas Implementation at provincial level might be started by 2016 for the most advanced regions Ø Standardization § § Common allocation rule and registries National standards Ø Chinese heterogeneity § Already large differences in design and provincial economic structure for the 7 pilots § § Even stronger difference between all the provinces Difficulty of linkage between provinces in the future (Is the local government willing to do this or not? )

Market Mechanism Seminar, 31 May 2015 To a nationwide ETS in China 22 Ø To be set up by 2016 § § Probably the regulation framework by 2016 § Delay for the other areas Implementation at provincial level might be started by 2016 for the most advanced regions Ø Standardization § § Common allocation rule and registries National standards Ø Chinese heterogeneity § Already large differences in design and provincial economic structure for the 7 pilots § § Even stronger difference between all the provinces Difficulty of linkage between provinces in the future (Is the local government willing to do this or not? )

Market Mechanism Seminar, 31 May 2015 23 Interim management measures of carbon trading in China Ø Issued on December 10, 2014 by NDRC Ø Six chapters and supplementary (48 articles) § § § o General principles Allowance management Emissions trading Verification and quotas clearance Supervision management Liability Supplementary Ø Enacted since 30 days after the issuing date

Market Mechanism Seminar, 31 May 2015 23 Interim management measures of carbon trading in China Ø Issued on December 10, 2014 by NDRC Ø Six chapters and supplementary (48 articles) § § § o General principles Allowance management Emissions trading Verification and quotas clearance Supervision management Liability Supplementary Ø Enacted since 30 days after the issuing date

Market Mechanism Seminar, 31 May 2015 24 Interim management measures of carbon trading in China Ø Overall, general rules regulated with the details to be specified for operation Ø An example: emissions allowances allocation § Provincial authorities propose the key entities to be covered for NDRC approval (The thresholds? ) § Cap setting by NDRC in consideration of national target, provincial emissions amount, economic growth, energy structure and entities to be covered (Detailed emissions limits? ) § Mainly free allocation initially and introduce paid allocation in due time (Schedule and detailed ratios? ) § Certain amount of allowances reserved by NDRC for market stabilization and key construction projects, etc. (How much and how to use? )

Market Mechanism Seminar, 31 May 2015 24 Interim management measures of carbon trading in China Ø Overall, general rules regulated with the details to be specified for operation Ø An example: emissions allowances allocation § Provincial authorities propose the key entities to be covered for NDRC approval (The thresholds? ) § Cap setting by NDRC in consideration of national target, provincial emissions amount, economic growth, energy structure and entities to be covered (Detailed emissions limits? ) § Mainly free allocation initially and introduce paid allocation in due time (Schedule and detailed ratios? ) § Certain amount of allowances reserved by NDRC for market stabilization and key construction projects, etc. (How much and how to use? )

Market Mechanism Seminar, 31 May 2015 GHG accounting and reporting guidelines 25 Ø Two batches of guidelines (on trial) have been issued by NDRC Ø 1 st batch on October 15, 2013 § 10 sectors: Power generation; power grid; iron & steel; chemical; aluminium; magnesium smelting; plate glass; cement; ceramics; and, civil aviation Ø 2 nd batch on December 3, 2014 § 4 sectors: Petroleum and natural gas; petro-chemical; independent coking; and, coal production

Market Mechanism Seminar, 31 May 2015 GHG accounting and reporting guidelines 25 Ø Two batches of guidelines (on trial) have been issued by NDRC Ø 1 st batch on October 15, 2013 § 10 sectors: Power generation; power grid; iron & steel; chemical; aluminium; magnesium smelting; plate glass; cement; ceramics; and, civil aviation Ø 2 nd batch on December 3, 2014 § 4 sectors: Petroleum and natural gas; petro-chemical; independent coking; and, coal production

Market Mechanism Seminar, 31 May 2015 26 Major challenges Ø Idea problems: Balance in low carbon development and economic growth Ø Legislation problems: Delayed legislation Ø Absence of data and standard Ø Capacity building Ø Link of regional pilot ETS Ø State-owned enterprises to be involved in ETS Ø No financial institution involved in the carbon market (on the way to change)

Market Mechanism Seminar, 31 May 2015 26 Major challenges Ø Idea problems: Balance in low carbon development and economic growth Ø Legislation problems: Delayed legislation Ø Absence of data and standard Ø Capacity building Ø Link of regional pilot ETS Ø State-owned enterprises to be involved in ETS Ø No financial institution involved in the carbon market (on the way to change)

Market Mechanism Seminar, 31 May 2015 Major challenges 27 Ø Setting an ETS requires a long process over years (around 7 years for EU-ETS) § § 1998: Thoughts 2001: Proposition 2005: Start of trial phase What will happen after 2020? Ø Need a transparent, coherent and flexible legislation framework § § § Transparent: To assure reaching targets with equity among participants Coherent: To integrate other policy interventions Flexibility: To adjust and correct structural errors in time

Market Mechanism Seminar, 31 May 2015 Major challenges 27 Ø Setting an ETS requires a long process over years (around 7 years for EU-ETS) § § 1998: Thoughts 2001: Proposition 2005: Start of trial phase What will happen after 2020? Ø Need a transparent, coherent and flexible legislation framework § § § Transparent: To assure reaching targets with equity among participants Coherent: To integrate other policy interventions Flexibility: To adjust and correct structural errors in time

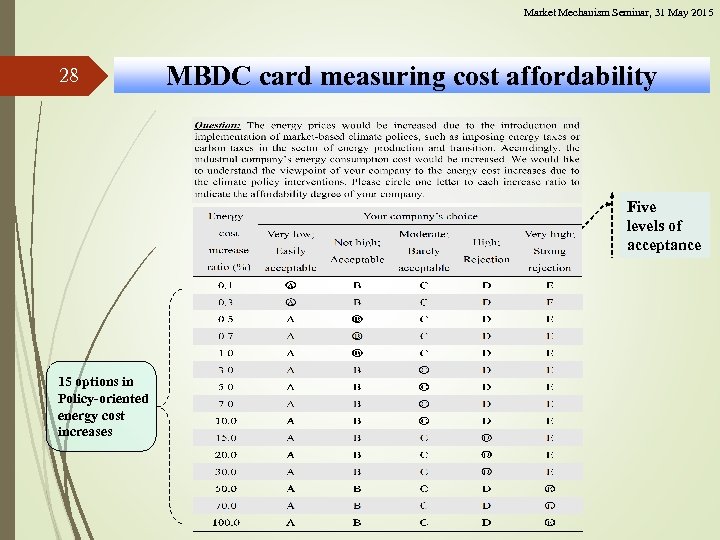

Market Mechanism Seminar, 31 May 2015 28 MBDC card measuring cost affordability Five levels of acceptance 15 options in Policy-oriented energy cost increases

Market Mechanism Seminar, 31 May 2015 28 MBDC card measuring cost affordability Five levels of acceptance 15 options in Policy-oriented energy cost increases

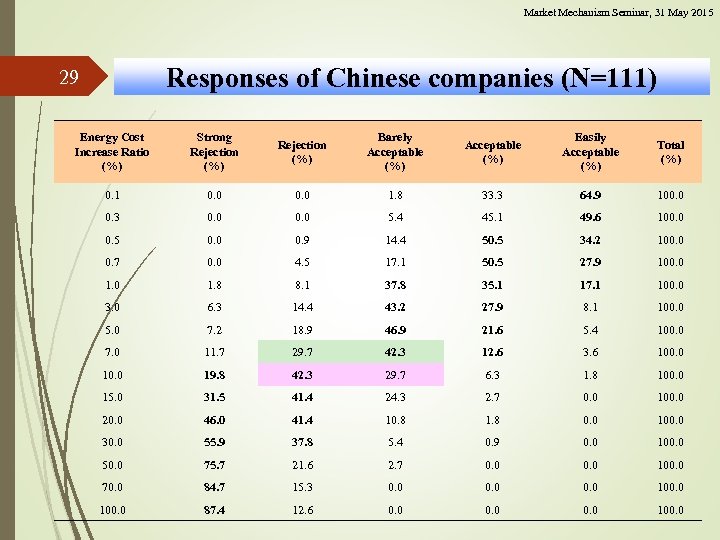

Market Mechanism Seminar, 31 May 2015 Responses of Chinese companies (N=111) 29 Energy Cost Increase Ratio (%) Strong Rejection (%) Barely Acceptable (%) Easily Acceptable (%) Total (%) 0. 1 0. 0 1. 8 33. 3 64. 9 100. 0 0. 3 0. 0 5. 4 45. 1 49. 6 100. 0 0. 5 0. 0 0. 9 14. 4 50. 5 34. 2 100. 0 0. 7 0. 0 4. 5 17. 1 50. 5 27. 9 100. 0 1. 8 8. 1 37. 8 35. 1 17. 1 100. 0 3. 0 6. 3 14. 4 43. 2 27. 9 8. 1 100. 0 5. 0 7. 2 18. 9 46. 9 21. 6 5. 4 100. 0 7. 0 11. 7 29. 7 42. 3 12. 6 3. 6 100. 0 19. 8 42. 3 29. 7 6. 3 1. 8 100. 0 15. 0 31. 5 41. 4 24. 3 2. 7 0. 0 100. 0 20. 0 46. 0 41. 4 10. 8 1. 8 0. 0 100. 0 30. 0 55. 9 37. 8 5. 4 0. 9 0. 0 100. 0 50. 0 75. 7 21. 6 2. 7 0. 0 100. 0 70. 0 84. 7 15. 3 0. 0 100. 0 87. 4 12. 6 0. 0 100. 0

Market Mechanism Seminar, 31 May 2015 Responses of Chinese companies (N=111) 29 Energy Cost Increase Ratio (%) Strong Rejection (%) Barely Acceptable (%) Easily Acceptable (%) Total (%) 0. 1 0. 0 1. 8 33. 3 64. 9 100. 0 0. 3 0. 0 5. 4 45. 1 49. 6 100. 0 0. 5 0. 0 0. 9 14. 4 50. 5 34. 2 100. 0 0. 7 0. 0 4. 5 17. 1 50. 5 27. 9 100. 0 1. 8 8. 1 37. 8 35. 1 17. 1 100. 0 3. 0 6. 3 14. 4 43. 2 27. 9 8. 1 100. 0 5. 0 7. 2 18. 9 46. 9 21. 6 5. 4 100. 0 7. 0 11. 7 29. 7 42. 3 12. 6 3. 6 100. 0 19. 8 42. 3 29. 7 6. 3 1. 8 100. 0 15. 0 31. 5 41. 4 24. 3 2. 7 0. 0 100. 0 20. 0 46. 0 41. 4 10. 8 1. 8 0. 0 100. 0 30. 0 55. 9 37. 8 5. 4 0. 9 0. 0 100. 0 50. 0 75. 7 21. 6 2. 7 0. 0 100. 0 70. 0 84. 7 15. 3 0. 0 100. 0 87. 4 12. 6 0. 0 100. 0

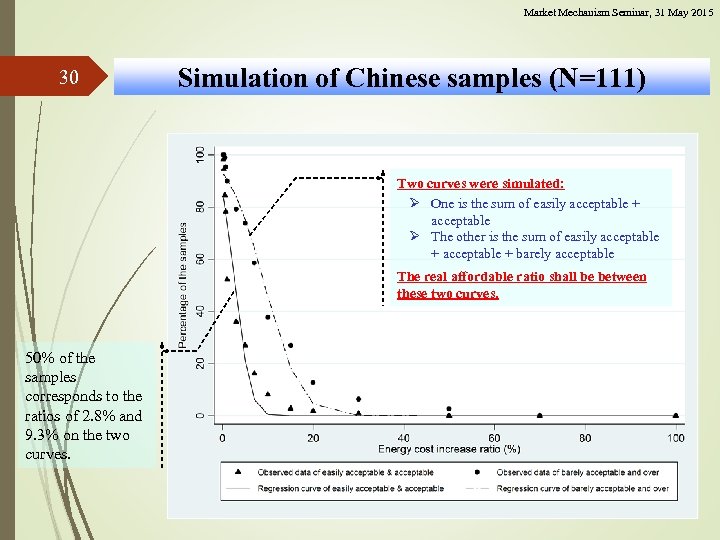

Market Mechanism Seminar, 31 May 2015 30 Simulation of Chinese samples (N=111) Two curves were simulated: Ø One is the sum of easily acceptable + acceptable Ø The other is the sum of easily acceptable + barely acceptable The real affordable ratio shall be between these two curves. 50% of the samples corresponds to the ratios of 2. 8% and 9. 3% on the two curves.

Market Mechanism Seminar, 31 May 2015 30 Simulation of Chinese samples (N=111) Two curves were simulated: Ø One is the sum of easily acceptable + acceptable Ø The other is the sum of easily acceptable + barely acceptable The real affordable ratio shall be between these two curves. 50% of the samples corresponds to the ratios of 2. 8% and 9. 3% on the two curves.

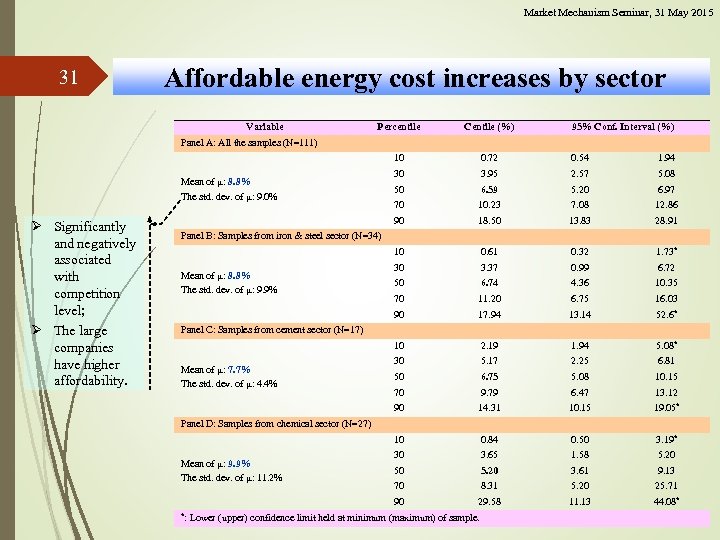

Market Mechanism Seminar, 31 May 2015 31 Affordable energy cost increases by sector Variable Percentile Centile (%) 95% Conf. Interval (%) 10 0. 72 0. 54 1. 94 30 3. 95 2. 57 5. 08 50 6. 59 5. 20 6. 97 70 10. 23 7. 08 12. 86 90 18. 50 13. 83 28. 91 10 0. 61 0. 32 1. 73* 30 3. 37 0. 99 6. 72 50 6. 74 4. 36 10. 35 70 11. 20 6. 75 16. 03 90 17. 94 13. 14 52. 6* 10 2. 19 1. 94 5. 08* 30 5. 17 2. 25 6. 81 50 6. 75 5. 08 10. 15 70 9. 79 6. 47 13. 12 90 14. 31 10. 15 19. 05* 10 0. 84 0. 50 3. 19* 30 3. 65 1. 58 5. 20 50 5. 20 3. 61 9. 13 70 8. 31 5. 20 25. 71 90 29. 58 11. 13 44. 08* Panel A: All the samples (N=111) Mean of μ: 8. 8% The std. dev. of μ: 9. 0% Ø Significantly and negatively associated with competition level; Ø The large companies have higher affordability. Panel B: Samples from iron & steel sector (N=34) Mean of μ: 8. 8% The std. dev. of μ: 9. 9% Panel C: Samples from cement sector (N=17) Mean of μ: 7. 7% The std. dev. of μ: 4. 4% Panel D: Samples from chemical sector (N=27) Mean of μ: 9. 9% The std. dev. of μ: 11. 2% *: Lower (upper) confidence limit held at minimum (maximum) of sample.

Market Mechanism Seminar, 31 May 2015 31 Affordable energy cost increases by sector Variable Percentile Centile (%) 95% Conf. Interval (%) 10 0. 72 0. 54 1. 94 30 3. 95 2. 57 5. 08 50 6. 59 5. 20 6. 97 70 10. 23 7. 08 12. 86 90 18. 50 13. 83 28. 91 10 0. 61 0. 32 1. 73* 30 3. 37 0. 99 6. 72 50 6. 74 4. 36 10. 35 70 11. 20 6. 75 16. 03 90 17. 94 13. 14 52. 6* 10 2. 19 1. 94 5. 08* 30 5. 17 2. 25 6. 81 50 6. 75 5. 08 10. 15 70 9. 79 6. 47 13. 12 90 14. 31 10. 15 19. 05* 10 0. 84 0. 50 3. 19* 30 3. 65 1. 58 5. 20 50 5. 20 3. 61 9. 13 70 8. 31 5. 20 25. 71 90 29. 58 11. 13 44. 08* Panel A: All the samples (N=111) Mean of μ: 8. 8% The std. dev. of μ: 9. 0% Ø Significantly and negatively associated with competition level; Ø The large companies have higher affordability. Panel B: Samples from iron & steel sector (N=34) Mean of μ: 8. 8% The std. dev. of μ: 9. 9% Panel C: Samples from cement sector (N=17) Mean of μ: 7. 7% The std. dev. of μ: 4. 4% Panel D: Samples from chemical sector (N=27) Mean of μ: 9. 9% The std. dev. of μ: 11. 2% *: Lower (upper) confidence limit held at minimum (maximum) of sample.

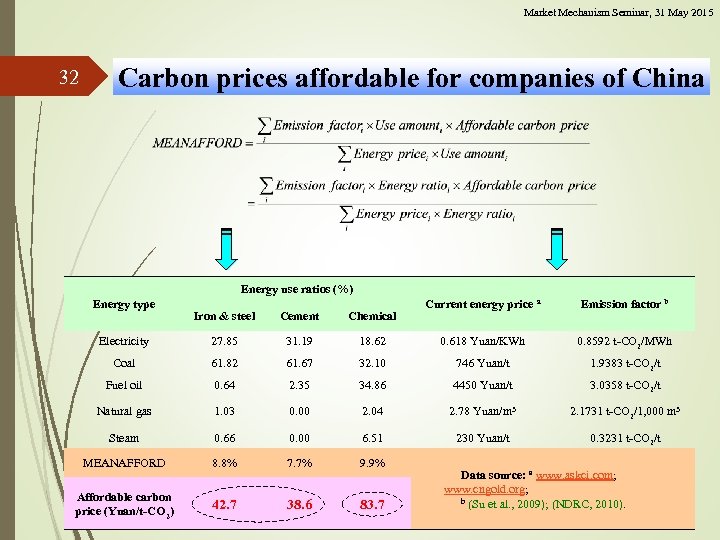

Market Mechanism Seminar, 31 May 2015 32 Carbon prices affordable for companies of China Energy use ratios (%) Energy type Current energy price a Emission factor b Iron & steel Cement Chemical Electricity 27. 85 31. 19 18. 62 0. 618 Yuan/KWh 0. 8592 t-CO 2/MWh Coal 61. 82 61. 67 32. 10 746 Yuan/t 1. 9383 t-CO 2/t Fuel oil 0. 64 2. 35 34. 86 4450 Yuan/t 3. 0358 t-CO 2/t Natural gas 1. 03 0. 00 2. 04 2. 78 Yuan/m 3 2. 1731 t-CO 2/1, 000 m 3 Steam 0. 66 0. 00 6. 51 230 Yuan/t 0. 3231 t-CO 2/t MEANAFFORD 8. 8% 7. 7% 9. 9% Affordable carbon price (Yuan/t-CO 2) 42. 7 38. 6 83. 7 Data source: a www. askci. com; www. cngold. org; b (Su et al. , 2009); (NDRC, 2010).

Market Mechanism Seminar, 31 May 2015 32 Carbon prices affordable for companies of China Energy use ratios (%) Energy type Current energy price a Emission factor b Iron & steel Cement Chemical Electricity 27. 85 31. 19 18. 62 0. 618 Yuan/KWh 0. 8592 t-CO 2/MWh Coal 61. 82 61. 67 32. 10 746 Yuan/t 1. 9383 t-CO 2/t Fuel oil 0. 64 2. 35 34. 86 4450 Yuan/t 3. 0358 t-CO 2/t Natural gas 1. 03 0. 00 2. 04 2. 78 Yuan/m 3 2. 1731 t-CO 2/1, 000 m 3 Steam 0. 66 0. 00 6. 51 230 Yuan/t 0. 3231 t-CO 2/t MEANAFFORD 8. 8% 7. 7% 9. 9% Affordable carbon price (Yuan/t-CO 2) 42. 7 38. 6 83. 7 Data source: a www. askci. com; www. cngold. org; b (Su et al. , 2009); (NDRC, 2010).

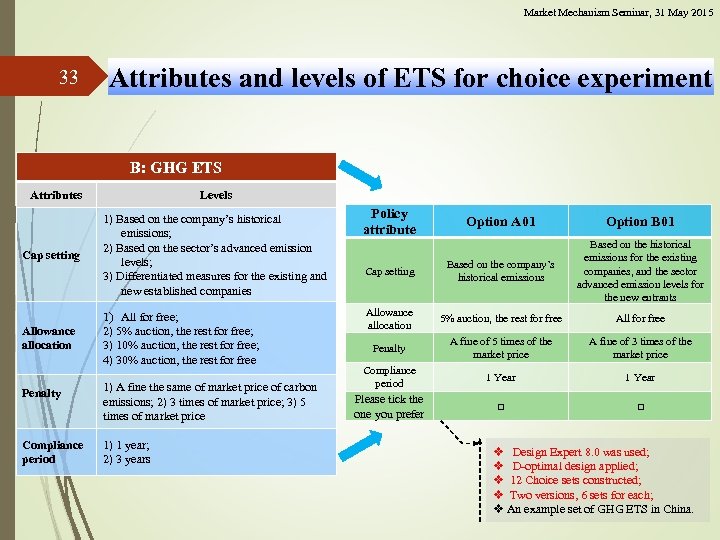

Market Mechanism Seminar, 31 May 2015 33 Attributes and levels of ETS for choice experiment B: GHG ETS Attributes Cap setting Allowance allocation Penalty Compliance period Levels 1) Based on the company’s historical emissions; 2) Based on the sector’s advanced emission levels; 3) Differentiated measures for the existing and new established companies 1) All for free; 2) 5% auction, the rest for free; 3) 10% auction, the rest for free; 4) 30% auction, the rest for free 1) A fine the same of market price of carbon emissions; 2) 3 times of market price; 3) 5 times of market price 1) 1 year; 2) 3 years Policy attribute Option A 01 Option B 01 Cap setting Based on the company’s historical emissions Based on the historical emissions for the existing companies, and the sector advanced emission levels for the new entrants Allowance allocation 5% auction, the rest for free All for free Penalty A fine of 5 times of the market price A fine of 3 times of the market price Compliance period 1 Year Please tick the one you prefer □ □ v Design Expert 8. 0 was used; v D-optimal design applied; v 12 Choice sets constructed; v Two versions, 6 sets for each; v An example set of GHG ETS in China.

Market Mechanism Seminar, 31 May 2015 33 Attributes and levels of ETS for choice experiment B: GHG ETS Attributes Cap setting Allowance allocation Penalty Compliance period Levels 1) Based on the company’s historical emissions; 2) Based on the sector’s advanced emission levels; 3) Differentiated measures for the existing and new established companies 1) All for free; 2) 5% auction, the rest for free; 3) 10% auction, the rest for free; 4) 30% auction, the rest for free 1) A fine the same of market price of carbon emissions; 2) 3 times of market price; 3) 5 times of market price 1) 1 year; 2) 3 years Policy attribute Option A 01 Option B 01 Cap setting Based on the company’s historical emissions Based on the historical emissions for the existing companies, and the sector advanced emission levels for the new entrants Allowance allocation 5% auction, the rest for free All for free Penalty A fine of 5 times of the market price A fine of 3 times of the market price Compliance period 1 Year Please tick the one you prefer □ □ v Design Expert 8. 0 was used; v D-optimal design applied; v 12 Choice sets constructed; v Two versions, 6 sets for each; v An example set of GHG ETS in China.

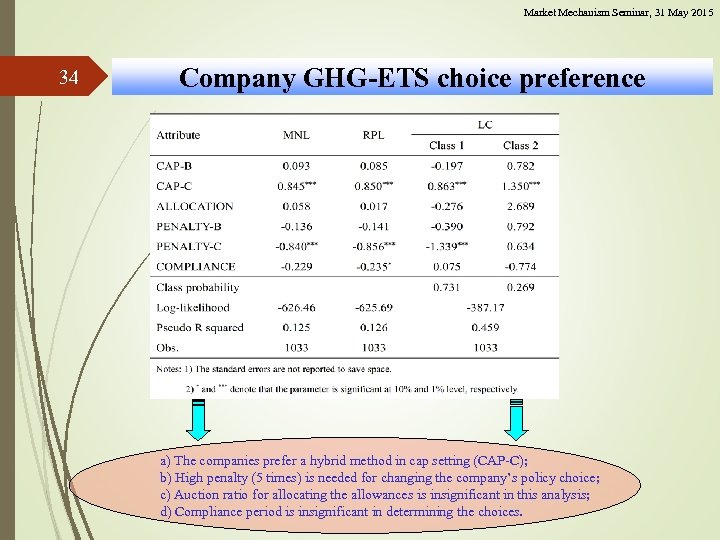

Market Mechanism Seminar, 31 May 2015 34 Company GHG-ETS choice preference a) The companies prefer a hybrid method in cap setting (CAP-C); b) High penalty (5 times) is needed for changing the company’s policy choice; c) Auction ratio for allocating the allowances is insignificant in this analysis; d) Compliance period is insignificant in determining the choices.

Market Mechanism Seminar, 31 May 2015 34 Company GHG-ETS choice preference a) The companies prefer a hybrid method in cap setting (CAP-C); b) High penalty (5 times) is needed for changing the company’s policy choice; c) Auction ratio for allocating the allowances is insignificant in this analysis; d) Compliance period is insignificant in determining the choices.

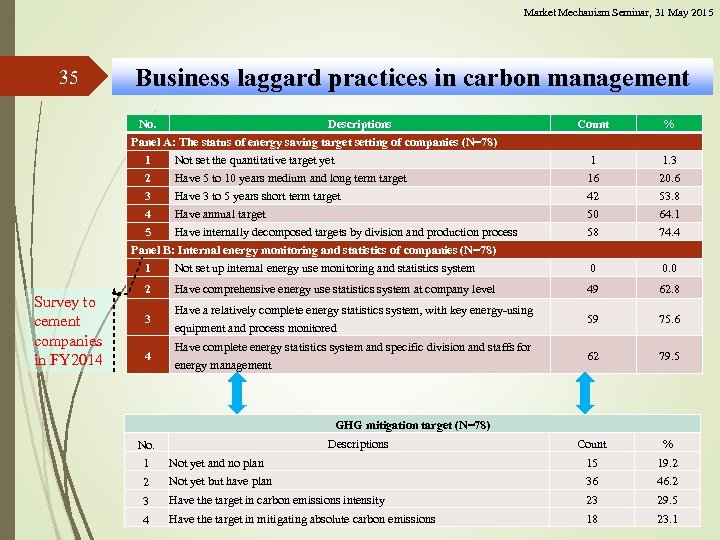

Market Mechanism Seminar, 31 May 2015 35 Business laggard practices in carbon management No. Descriptions Panel A: The status of energy saving target setting of companies (N=78) 1 Not set the quantitative target yet 2 Have 5 to 10 years medium and long term target 3 Have 3 to 5 years short term target 4 Have annual target 5 Have internally decomposed targets by division and production process Panel B: Internal energy monitoring and statistics of companies (N=78) 1 Not set up internal energy use monitoring and statistics system Survey to cement companies in FY 2014 Count % 1 16 42 50 58 1. 3 20. 6 53. 8 64. 1 74. 4 0 0. 0 2 Have comprehensive energy use statistics system at company level 49 62. 8 3 Have a relatively complete energy statistics system, with key energy-using equipment and process monitored 59 75. 6 4 Have complete energy statistics system and specific division and staffs for energy management 62 79. 5 Count % GHG mitigation target (N=78) Descriptions No. 1 Not yet and no plan 15 19. 2 2 Not yet but have plan 36 46. 2 3 Have the target in carbon emissions intensity 23 29. 5 4 Have the target in mitigating absolute carbon emissions 18 23. 1

Market Mechanism Seminar, 31 May 2015 35 Business laggard practices in carbon management No. Descriptions Panel A: The status of energy saving target setting of companies (N=78) 1 Not set the quantitative target yet 2 Have 5 to 10 years medium and long term target 3 Have 3 to 5 years short term target 4 Have annual target 5 Have internally decomposed targets by division and production process Panel B: Internal energy monitoring and statistics of companies (N=78) 1 Not set up internal energy use monitoring and statistics system Survey to cement companies in FY 2014 Count % 1 16 42 50 58 1. 3 20. 6 53. 8 64. 1 74. 4 0 0. 0 2 Have comprehensive energy use statistics system at company level 49 62. 8 3 Have a relatively complete energy statistics system, with key energy-using equipment and process monitored 59 75. 6 4 Have complete energy statistics system and specific division and staffs for energy management 62 79. 5 Count % GHG mitigation target (N=78) Descriptions No. 1 Not yet and no plan 15 19. 2 2 Not yet but have plan 36 46. 2 3 Have the target in carbon emissions intensity 23 29. 5 4 Have the target in mitigating absolute carbon emissions 18 23. 1

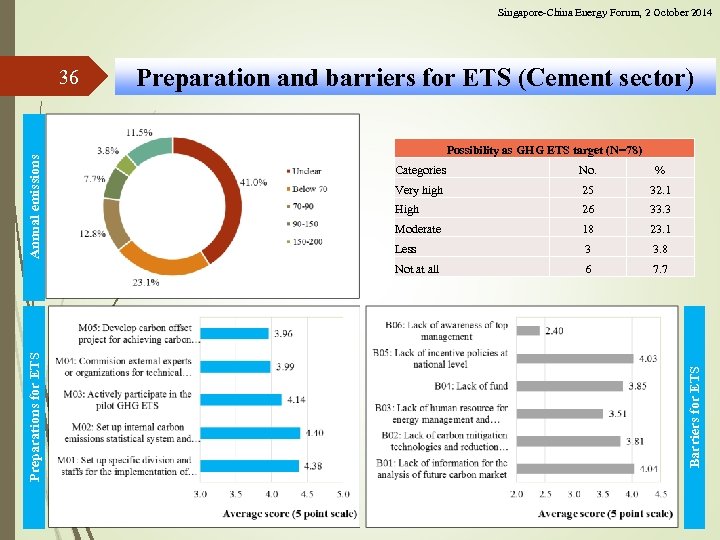

Singapore-China Energy Forum, 2 October 2014 Preparation and barriers for ETS (Cement sector) Possibility as GHG ETS target (N=78) No. % Very high 25 32. 1 High 26 33. 3 Moderate 18 23. 1 Less 3 3. 8 Not at all Preparations for ETS Categories 6 7. 7 Barriers for ETS Annual emissions 36

Singapore-China Energy Forum, 2 October 2014 Preparation and barriers for ETS (Cement sector) Possibility as GHG ETS target (N=78) No. % Very high 25 32. 1 High 26 33. 3 Moderate 18 23. 1 Less 3 3. 8 Not at all Preparations for ETS Categories 6 7. 7 Barriers for ETS Annual emissions 36

Market Mechanism Seminar, 31 May 2015 Summary of the presentation 37 n This presentation overviews the practices of China in ETS pilots and efforts for the establishment of a nationwide scheme; n Certain experience has been accumulated through the pilots and overall direction was clarified for an ETS at country level; n Many details to be specified for supporting the practical operation of the national ETS; n The business perspective was shared using the results from questionnaire surveys to Chinese companies; n The practices of Chinese businesses in carbon management are much laggard than the actions for energy saving; n Capacity building in MRV of carbon emissions at business level is highly necessary for smooth operation of ETS in China; n Nevertheless, giving modest carbon prices could be accepted by Chinese companies, even for those from energy-intensive sectors.

Market Mechanism Seminar, 31 May 2015 Summary of the presentation 37 n This presentation overviews the practices of China in ETS pilots and efforts for the establishment of a nationwide scheme; n Certain experience has been accumulated through the pilots and overall direction was clarified for an ETS at country level; n Many details to be specified for supporting the practical operation of the national ETS; n The business perspective was shared using the results from questionnaire surveys to Chinese companies; n The practices of Chinese businesses in carbon management are much laggard than the actions for energy saving; n Capacity building in MRV of carbon emissions at business level is highly necessary for smooth operation of ETS in China; n Nevertheless, giving modest carbon prices could be accepted by Chinese companies, even for those from energy-intensive sectors.

Market Mechanism Seminar, 31 May 2015 38 Thank you for your attention!

Market Mechanism Seminar, 31 May 2015 38 Thank you for your attention!