f6e9ac9f085b1f7b1442d14dd03d9ec6.ppt

- Количество слайдов: 53

Market Manipulation in Wholesale Electricity Markets Presented to: NP Market Council Presented by: Shaun D. Ledgerwood, J. D. , Ph. D. 26 March, 2013 The views expressed in this presentation are strictly those of the presenter and do not necessarily state or reflect the views of. The Brattle Group, Inc. Copyright © 2013 The Brattle Group, Inc. www. brattle. com Antitrust/Competition Commercial Damages Environmental Litigation and Regulation Forensic Economics Intellectual Property International Arbitration International Trade Product Liability Regulatory Finance and Accounting Risk Management Securities Tax Utility Regulatory Policy and Ratemaking Valuation Electric Power Financial Institutions Natural Gas Petroleum Pharmaceuticals, Medical Devices, and Biotechnology Telecommunications and Media Transportation

Market Manipulation in Wholesale Electricity Markets Presented to: NP Market Council Presented by: Shaun D. Ledgerwood, J. D. , Ph. D. 26 March, 2013 The views expressed in this presentation are strictly those of the presenter and do not necessarily state or reflect the views of. The Brattle Group, Inc. Copyright © 2013 The Brattle Group, Inc. www. brattle. com Antitrust/Competition Commercial Damages Environmental Litigation and Regulation Forensic Economics Intellectual Property International Arbitration International Trade Product Liability Regulatory Finance and Accounting Risk Management Securities Tax Utility Regulatory Policy and Ratemaking Valuation Electric Power Financial Institutions Natural Gas Petroleum Pharmaceuticals, Medical Devices, and Biotechnology Telecommunications and Media Transportation

Agenda 1. Three triggers of market manipulation 2. A framework for the analysis of manipulation 3. The detection and analysis of manipulative activity 4. Punishments for market manipulation 5. Case studies 6. Additional reading 7. Biographical information 8. Company overview 2

Agenda 1. Three triggers of market manipulation 2. A framework for the analysis of manipulation 3. The detection and analysis of manipulative activity 4. Punishments for market manipulation 5. Case studies 6. Additional reading 7. Biographical information 8. Company overview 2

Agenda 1. Three triggers of market manipulation 2. A framework for the analysis of manipulation 3. The detection and analysis of manipulative activity 4. Punishments for market manipulation 5. Case studies 6. Additional reading 7. Biographical information 8. Company overview 3

Agenda 1. Three triggers of market manipulation 2. A framework for the analysis of manipulation 3. The detection and analysis of manipulative activity 4. Punishments for market manipulation 5. Case studies 6. Additional reading 7. Biographical information 8. Company overview 3

Market manipulation is a misunderstood phenomenon ♦ Many different categories of activity have been prosecuted as causing a manipulation: • • False reports made to an index or regulator Intentional omission of material facts Creation of an “artificial” price “Open market” manipulations, defined by category: ■ ■ ■ Wash trading “Banging the close” Pump and dump schemes ♦ Past enforcement outcomes in manipulation cases provide little common guidance, creating a perception that anti-manipulation enforcement follows an “I know it when I see it” approach ♦ Categorical definitions of manipulation raise more questions than answers (e. g. , how can “open market” trading ever be illegal in an otherwise “free” market? ) 4

Market manipulation is a misunderstood phenomenon ♦ Many different categories of activity have been prosecuted as causing a manipulation: • • False reports made to an index or regulator Intentional omission of material facts Creation of an “artificial” price “Open market” manipulations, defined by category: ■ ■ ■ Wash trading “Banging the close” Pump and dump schemes ♦ Past enforcement outcomes in manipulation cases provide little common guidance, creating a perception that anti-manipulation enforcement follows an “I know it when I see it” approach ♦ Categorical definitions of manipulation raise more questions than answers (e. g. , how can “open market” trading ever be illegal in an otherwise “free” market? ) 4

Major problem in separating manipulative cause and effect ♦ Major problem in separating manipulative cause and effect: • In “competitive” markets, traders are “price-takers” who react to market events, the result of which has little effect on the market • In reality, the requisite assumptions of competition are lacking, allowing traders to bias market outcomes (e. g. , a price) to benefit related positions that are valued by those outcomes ♦ Problem is exacerbated in wholesale electricity markets by the complex relationships between markets and products: • Physical systems built as natural monopolies, not for competition • Regulatory market design leaves gaps and seams issues • Interrelated physical markets (energy, ancillary services, capacity, fuels) must economically interact with each other and with financial markets (FTRs, options, derivatives) ♦ Given so many moving parts, separating and ordering “cause” and “effect” may seem challenging 5

Major problem in separating manipulative cause and effect ♦ Major problem in separating manipulative cause and effect: • In “competitive” markets, traders are “price-takers” who react to market events, the result of which has little effect on the market • In reality, the requisite assumptions of competition are lacking, allowing traders to bias market outcomes (e. g. , a price) to benefit related positions that are valued by those outcomes ♦ Problem is exacerbated in wholesale electricity markets by the complex relationships between markets and products: • Physical systems built as natural monopolies, not for competition • Regulatory market design leaves gaps and seams issues • Interrelated physical markets (energy, ancillary services, capacity, fuels) must economically interact with each other and with financial markets (FTRs, options, derivatives) ♦ Given so many moving parts, separating and ordering “cause” and “effect” may seem challenging 5

A better way to think about manipulation ♦ The difficulty of proving/disproving manipulation is often due to questionable cause and effect: • Willingly making uneconomic trades may be manipulative; But about half of all trades lose money in a fair market Concentrated trading to maximize price impact can be manipulative; ■ But “concentration” could be simply pouncing on an opportunity Leveraged positions may be designed to profit from such losses; ■ What looks like leverage is actually a hedge to other positions ■ • • ♦ Key element of a manipulation’s cause is that it exploits a market mechanism to achieve its effect ♦ Knowledge of the causes of manipulation provides clarity for compliance and certainty for enforcement ♦ Clarification of a manipulation standard would ideally relate manipulation analysis to analyses of fraud antitrust 6

A better way to think about manipulation ♦ The difficulty of proving/disproving manipulation is often due to questionable cause and effect: • Willingly making uneconomic trades may be manipulative; But about half of all trades lose money in a fair market Concentrated trading to maximize price impact can be manipulative; ■ But “concentration” could be simply pouncing on an opportunity Leveraged positions may be designed to profit from such losses; ■ What looks like leverage is actually a hedge to other positions ■ • • ♦ Key element of a manipulation’s cause is that it exploits a market mechanism to achieve its effect ♦ Knowledge of the causes of manipulation provides clarity for compliance and certainty for enforcement ♦ Clarification of a manipulation standard would ideally relate manipulation analysis to analyses of fraud antitrust 6

A framework to analyze price-based manipulation ♦ One way to explain the cause and effect of manipulation is to separate the analysis into a framework of three pieces: • A trigger – Acts intended to directionally bias a market outcome • A target – One or more position(s) that benefit from that bias • A nexus – A provable linkage between the trigger and target ♦ For example, triggers of a price-based manipulation are: • Outright fraud to misrepresent value to alter a price • Use of market power to alter a price • Transactions that intentionally lose money to alter a price ♦ This frameworks to analyze market manipulations for all three situations ♦ Outright fraud is relatively easy to prosecute: • Affirmative fraudulent acts draw swift prosecution • Omissions of material facts raise bigger questions: ■ Insider trading rules may overlap with manipulation (EU) 7

A framework to analyze price-based manipulation ♦ One way to explain the cause and effect of manipulation is to separate the analysis into a framework of three pieces: • A trigger – Acts intended to directionally bias a market outcome • A target – One or more position(s) that benefit from that bias • A nexus – A provable linkage between the trigger and target ♦ For example, triggers of a price-based manipulation are: • Outright fraud to misrepresent value to alter a price • Use of market power to alter a price • Transactions that intentionally lose money to alter a price ♦ This frameworks to analyze market manipulations for all three situations ♦ Outright fraud is relatively easy to prosecute: • Affirmative fraudulent acts draw swift prosecution • Omissions of material facts raise bigger questions: ■ Insider trading rules may overlap with manipulation (EU) 7

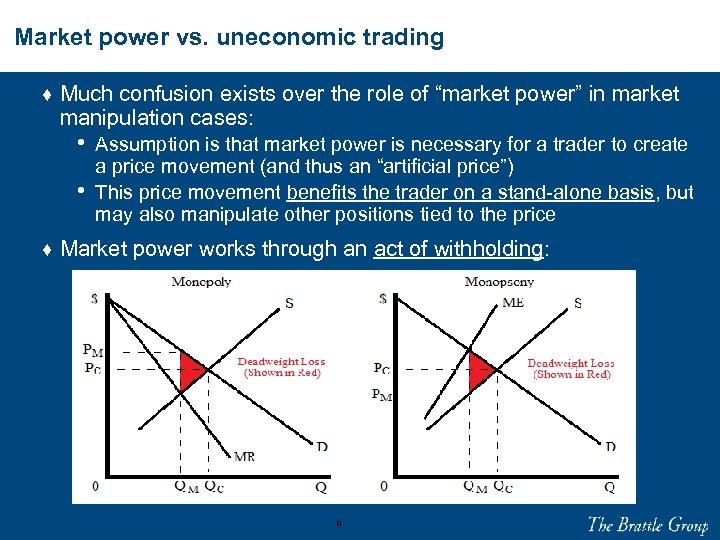

Market power vs. uneconomic trading ♦ Much confusion exists over the role of “market power” in market manipulation cases: • Assumption is that market power is necessary for a trader to create • a price movement (and thus an “artificial price”) This price movement benefits the trader on a stand-alone basis, but may also manipulate other positions tied to the price ♦ Market power works through an act of withholding: 8

Market power vs. uneconomic trading ♦ Much confusion exists over the role of “market power” in market manipulation cases: • Assumption is that market power is necessary for a trader to create • a price movement (and thus an “artificial price”) This price movement benefits the trader on a stand-alone basis, but may also manipulate other positions tied to the price ♦ Market power works through an act of withholding: 8

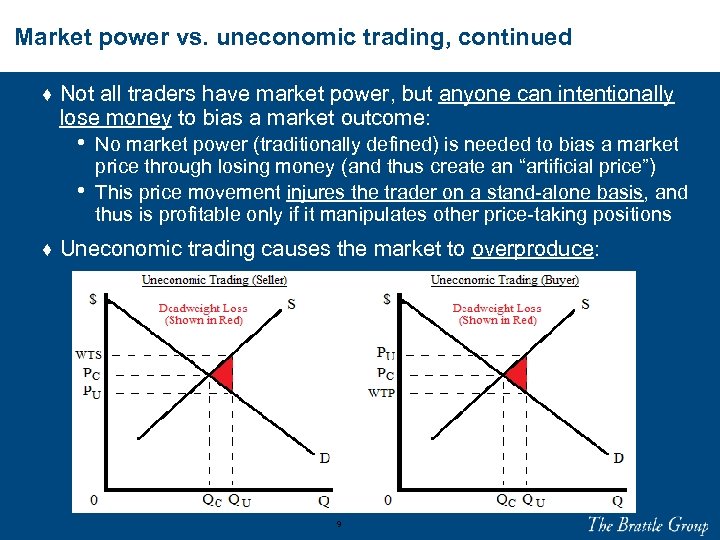

Market power vs. uneconomic trading, continued ♦ Not all traders have market power, but anyone can intentionally lose money to bias a market outcome: • No market power (traditionally defined) is needed to bias a market • price through losing money (and thus create an “artificial price”) This price movement injures the trader on a stand-alone basis, and thus is profitable only if it manipulates other price-taking positions ♦ Uneconomic trading causes the market to overproduce: 9

Market power vs. uneconomic trading, continued ♦ Not all traders have market power, but anyone can intentionally lose money to bias a market outcome: • No market power (traditionally defined) is needed to bias a market • price through losing money (and thus create an “artificial price”) This price movement injures the trader on a stand-alone basis, and thus is profitable only if it manipulates other price-taking positions ♦ Uneconomic trading causes the market to overproduce: 9

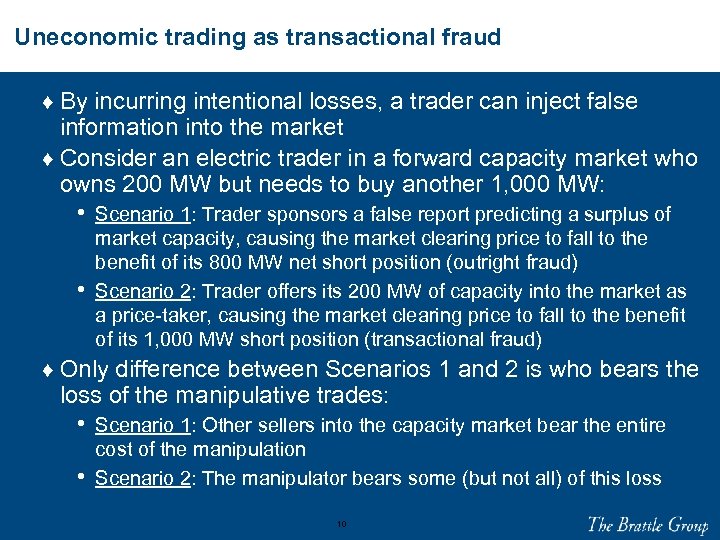

Uneconomic trading as transactional fraud ♦ By incurring intentional losses, a trader can inject false information into the market ♦ Consider an electric trader in a forward capacity market who owns 200 MW but needs to buy another 1, 000 MW: • Scenario 1: Trader sponsors a false report predicting a surplus of • market capacity, causing the market clearing price to fall to the benefit of its 800 MW net short position (outright fraud) Scenario 2: Trader offers its 200 MW of capacity into the market as a price-taker, causing the market clearing price to fall to the benefit of its 1, 000 MW short position (transactional fraud) ♦ Only difference between Scenarios 1 and 2 is who bears the loss of the manipulative trades: • Scenario 1: Other sellers into the capacity market bear the entire • cost of the manipulation Scenario 2: The manipulator bears some (but not all) of this loss 10

Uneconomic trading as transactional fraud ♦ By incurring intentional losses, a trader can inject false information into the market ♦ Consider an electric trader in a forward capacity market who owns 200 MW but needs to buy another 1, 000 MW: • Scenario 1: Trader sponsors a false report predicting a surplus of • market capacity, causing the market clearing price to fall to the benefit of its 800 MW net short position (outright fraud) Scenario 2: Trader offers its 200 MW of capacity into the market as a price-taker, causing the market clearing price to fall to the benefit of its 1, 000 MW short position (transactional fraud) ♦ Only difference between Scenarios 1 and 2 is who bears the loss of the manipulative trades: • Scenario 1: Other sellers into the capacity market bear the entire • cost of the manipulation Scenario 2: The manipulator bears some (but not all) of this loss 10

Agenda 1. Three triggers of market manipulation 2. A framework for the analysis of manipulation 3. The detection and analysis of manipulative activity 4. Punishments for market manipulation 5. Case studies 6. Additional reading 7. Biographical information 8. Company overview 11

Agenda 1. Three triggers of market manipulation 2. A framework for the analysis of manipulation 3. The detection and analysis of manipulative activity 4. Punishments for market manipulation 5. Case studies 6. Additional reading 7. Biographical information 8. Company overview 11

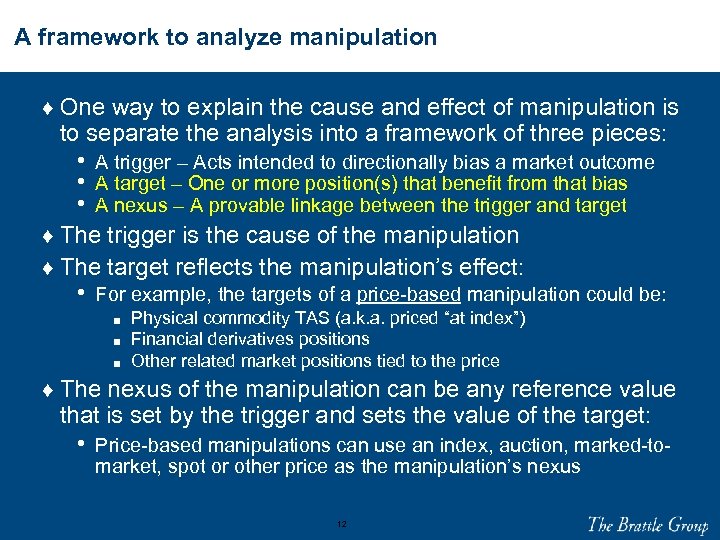

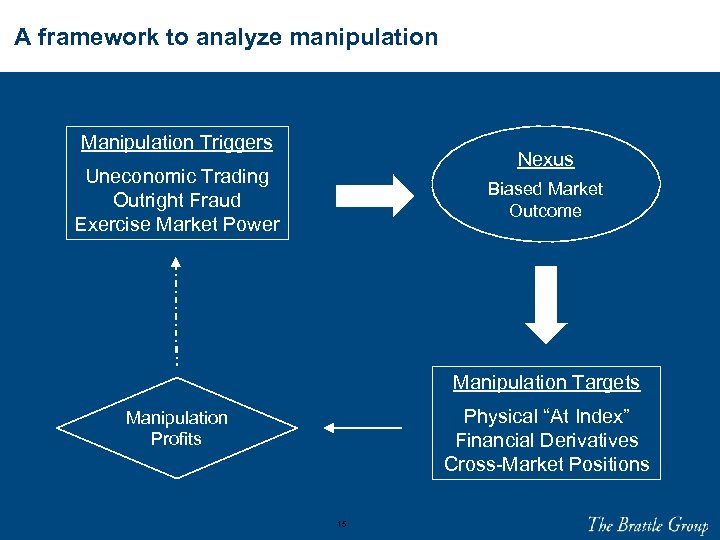

A framework to analyze manipulation ♦ One way to explain the cause and effect of manipulation is to separate the analysis into a framework of three pieces: • A trigger – Acts intended to directionally bias a market outcome • A target – One or more position(s) that benefit from that bias • A nexus – A provable linkage between the trigger and target ♦ The trigger is the cause of the manipulation ♦ The target reflects the manipulation’s effect: • For example, the targets of a price-based manipulation could be: ■ ■ ■ Physical commodity TAS (a. k. a. priced “at index”) Financial derivatives positions Other related market positions tied to the price ♦ The nexus of the manipulation can be any reference value that is set by the trigger and sets the value of the target: • Price-based manipulations can use an index, auction, marked-tomarket, spot or other price as the manipulation’s nexus 12

A framework to analyze manipulation ♦ One way to explain the cause and effect of manipulation is to separate the analysis into a framework of three pieces: • A trigger – Acts intended to directionally bias a market outcome • A target – One or more position(s) that benefit from that bias • A nexus – A provable linkage between the trigger and target ♦ The trigger is the cause of the manipulation ♦ The target reflects the manipulation’s effect: • For example, the targets of a price-based manipulation could be: ■ ■ ■ Physical commodity TAS (a. k. a. priced “at index”) Financial derivatives positions Other related market positions tied to the price ♦ The nexus of the manipulation can be any reference value that is set by the trigger and sets the value of the target: • Price-based manipulations can use an index, auction, marked-tomarket, spot or other price as the manipulation’s nexus 12

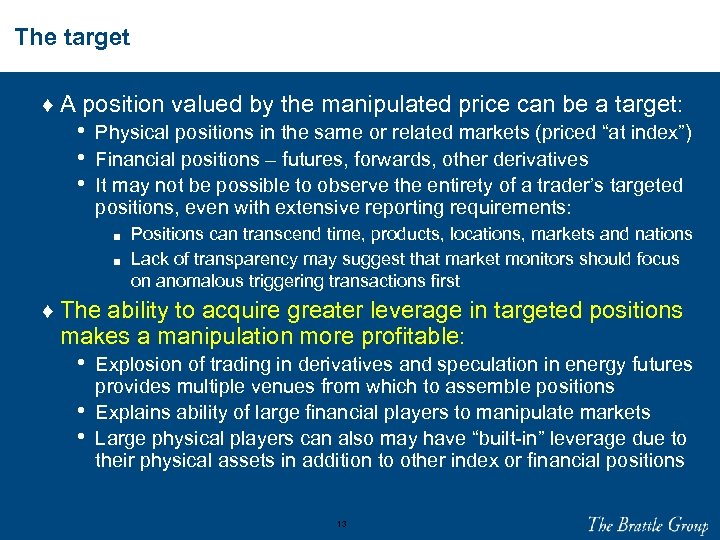

The target ♦ A position valued by the manipulated price can be a target: • Physical positions in the same or related markets (priced “at index”) • Financial positions – futures, forwards, other derivatives • It may not be possible to observe the entirety of a trader’s targeted positions, even with extensive reporting requirements: ■ ■ Positions can transcend time, products, locations, markets and nations Lack of transparency may suggest that market monitors should focus on anomalous triggering transactions first ♦ The ability to acquire greater leverage in targeted positions makes a manipulation more profitable: • Explosion of trading in derivatives and speculation in energy futures • • provides multiple venues from which to assemble positions Explains ability of large financial players to manipulate markets Large physical players can also may have “built-in” leverage due to their physical assets in addition to other index or financial positions 13

The target ♦ A position valued by the manipulated price can be a target: • Physical positions in the same or related markets (priced “at index”) • Financial positions – futures, forwards, other derivatives • It may not be possible to observe the entirety of a trader’s targeted positions, even with extensive reporting requirements: ■ ■ Positions can transcend time, products, locations, markets and nations Lack of transparency may suggest that market monitors should focus on anomalous triggering transactions first ♦ The ability to acquire greater leverage in targeted positions makes a manipulation more profitable: • Explosion of trading in derivatives and speculation in energy futures • • provides multiple venues from which to assemble positions Explains ability of large financial players to manipulate markets Large physical players can also may have “built-in” leverage due to their physical assets in addition to other index or financial positions 13

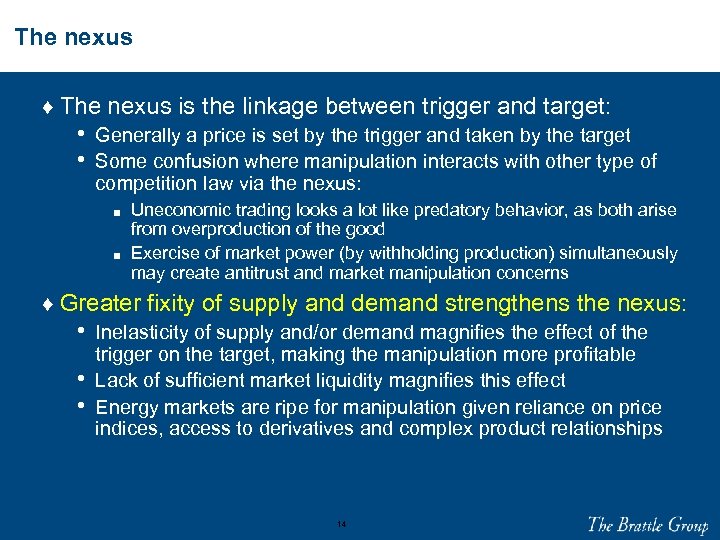

The nexus ♦ The nexus is the linkage between trigger and target: • Generally a price is set by the trigger and taken by the target • Some confusion where manipulation interacts with other type of competition law via the nexus: ■ ■ Uneconomic trading looks a lot like predatory behavior, as both arise from overproduction of the good Exercise of market power (by withholding production) simultaneously may create antitrust and market manipulation concerns ♦ Greater fixity of supply and demand strengthens the nexus: • Inelasticity of supply and/or demand magnifies the effect of the • • trigger on the target, making the manipulation more profitable Lack of sufficient market liquidity magnifies this effect Energy markets are ripe for manipulation given reliance on price indices, access to derivatives and complex product relationships 14

The nexus ♦ The nexus is the linkage between trigger and target: • Generally a price is set by the trigger and taken by the target • Some confusion where manipulation interacts with other type of competition law via the nexus: ■ ■ Uneconomic trading looks a lot like predatory behavior, as both arise from overproduction of the good Exercise of market power (by withholding production) simultaneously may create antitrust and market manipulation concerns ♦ Greater fixity of supply and demand strengthens the nexus: • Inelasticity of supply and/or demand magnifies the effect of the • • trigger on the target, making the manipulation more profitable Lack of sufficient market liquidity magnifies this effect Energy markets are ripe for manipulation given reliance on price indices, access to derivatives and complex product relationships 14

A framework to analyze manipulation Manipulation Triggers Nexus Uneconomic Trading Outright Fraud Exercise Market Power Biased Market Outcome Manipulation Targets Physical “At Index” Financial Derivatives Cross-Market Positions Manipulation Profits 15

A framework to analyze manipulation Manipulation Triggers Nexus Uneconomic Trading Outright Fraud Exercise Market Power Biased Market Outcome Manipulation Targets Physical “At Index” Financial Derivatives Cross-Market Positions Manipulation Profits 15

The framework supports U. S. anti-manipulation enforcement ♦ The FERC and CFTC’s recent anti-manipulation cases focused on the use of uneconomic behavior: • • Energy Transfer Partners (natural gas) Amaranth Advisors and Brian Hunter (natural gas) Constellation (electricity) Di. Placido (electricity) Optiver (oil) Deutsche Bank (electricity) ISO-NE DALRP cases (electric demand response) ♦ The DOJ’s recent Keyspan decision considered a case first brought before the FERC as a market manipulation (and awarded disgorgement as damages – a first for the DOJ) (electric capacity market) ♦ Litany of SEC and CFTC cases involving outright fraud (e. g. , “pump & dump” schemes, ponzi schemes) and uneconomic trading (e. g. , “marking the close, ” “framing the open”) ♦ The framework provides a common analytical construct across these cases, agencies, statutes, and (given new EU provisions) continents 16

The framework supports U. S. anti-manipulation enforcement ♦ The FERC and CFTC’s recent anti-manipulation cases focused on the use of uneconomic behavior: • • Energy Transfer Partners (natural gas) Amaranth Advisors and Brian Hunter (natural gas) Constellation (electricity) Di. Placido (electricity) Optiver (oil) Deutsche Bank (electricity) ISO-NE DALRP cases (electric demand response) ♦ The DOJ’s recent Keyspan decision considered a case first brought before the FERC as a market manipulation (and awarded disgorgement as damages – a first for the DOJ) (electric capacity market) ♦ Litany of SEC and CFTC cases involving outright fraud (e. g. , “pump & dump” schemes, ponzi schemes) and uneconomic trading (e. g. , “marking the close, ” “framing the open”) ♦ The framework provides a common analytical construct across these cases, agencies, statutes, and (given new EU provisions) continents 16

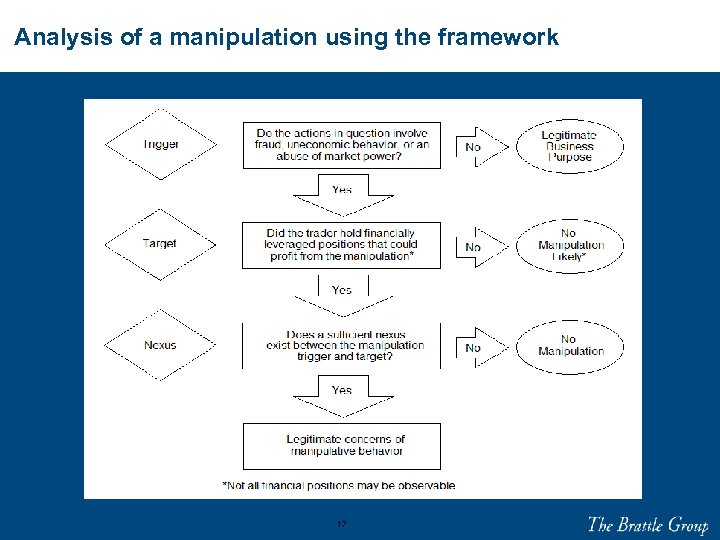

Analysis of a manipulation using the framework 17

Analysis of a manipulation using the framework 17

Agenda 1. Three triggers of market manipulation 2. A framework for the analysis of manipulation 3. The detection and analysis of manipulative activity 4. Punishments for market manipulation 5. Case studies 6. Additional reading 7. Biographical information 8. Company overview 18

Agenda 1. Three triggers of market manipulation 2. A framework for the analysis of manipulation 3. The detection and analysis of manipulative activity 4. Punishments for market manipulation 5. Case studies 6. Additional reading 7. Biographical information 8. Company overview 18

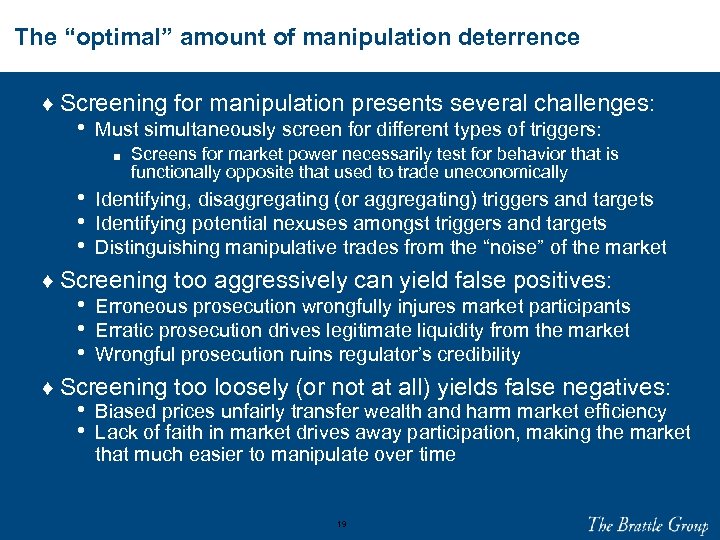

The “optimal” amount of manipulation deterrence ♦ Screening for manipulation presents several challenges: • Must simultaneously screen for different types of triggers: ■ Screens for market power necessarily test for behavior that is functionally opposite that used to trade uneconomically • Identifying, disaggregating (or aggregating) triggers and targets • Identifying potential nexuses amongst triggers and targets • Distinguishing manipulative trades from the “noise” of the market ♦ Screening too aggressively can yield false positives: • Erroneous prosecution wrongfully injures market participants • Erratic prosecution drives legitimate liquidity from the market • Wrongful prosecution ruins regulator’s credibility ♦ Screening too loosely (or not at all) yields false negatives: • Biased prices unfairly transfer wealth and harm market efficiency • Lack of faith in market drives away participation, making the market that much easier to manipulate over time 19

The “optimal” amount of manipulation deterrence ♦ Screening for manipulation presents several challenges: • Must simultaneously screen for different types of triggers: ■ Screens for market power necessarily test for behavior that is functionally opposite that used to trade uneconomically • Identifying, disaggregating (or aggregating) triggers and targets • Identifying potential nexuses amongst triggers and targets • Distinguishing manipulative trades from the “noise” of the market ♦ Screening too aggressively can yield false positives: • Erroneous prosecution wrongfully injures market participants • Erratic prosecution drives legitimate liquidity from the market • Wrongful prosecution ruins regulator’s credibility ♦ Screening too loosely (or not at all) yields false negatives: • Biased prices unfairly transfer wealth and harm market efficiency • Lack of faith in market drives away participation, making the market that much easier to manipulate over time 19

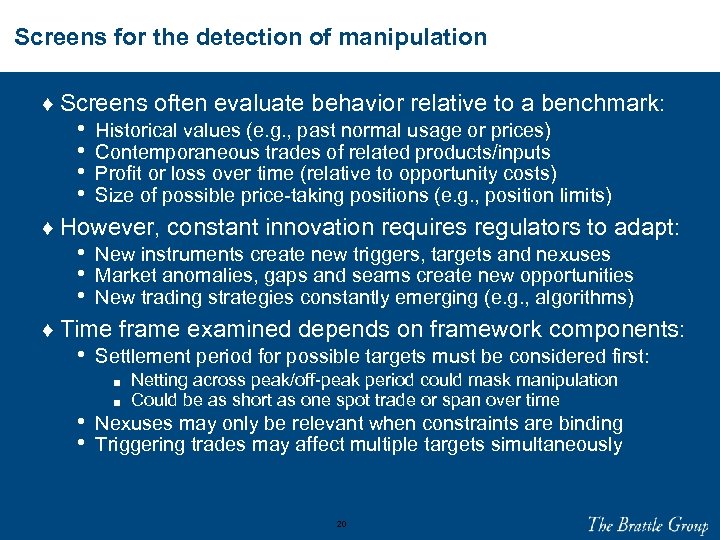

Screens for the detection of manipulation ♦ Screens often evaluate behavior relative to a benchmark: • Historical values (e. g. , past normal usage or prices) • Contemporaneous trades of related products/inputs • Profit or loss over time (relative to opportunity costs) • Size of possible price-taking positions (e. g. , position limits) ♦ However, constant innovation requires regulators to adapt: • New instruments create new triggers, targets and nexuses • Market anomalies, gaps and seams create new opportunities • New trading strategies constantly emerging (e. g. , algorithms) ♦ Time frame examined depends on framework components: • Settlement period for possible targets must be considered first: ■ ■ Netting across peak/off-peak period could mask manipulation Could be as short as one spot trade or span over time • Nexuses may only be relevant when constraints are binding • Triggering trades may affect multiple targets simultaneously 20

Screens for the detection of manipulation ♦ Screens often evaluate behavior relative to a benchmark: • Historical values (e. g. , past normal usage or prices) • Contemporaneous trades of related products/inputs • Profit or loss over time (relative to opportunity costs) • Size of possible price-taking positions (e. g. , position limits) ♦ However, constant innovation requires regulators to adapt: • New instruments create new triggers, targets and nexuses • Market anomalies, gaps and seams create new opportunities • New trading strategies constantly emerging (e. g. , algorithms) ♦ Time frame examined depends on framework components: • Settlement period for possible targets must be considered first: ■ ■ Netting across peak/off-peak period could mask manipulation Could be as short as one spot trade or span over time • Nexuses may only be relevant when constraints are binding • Triggering trades may affect multiple targets simultaneously 20

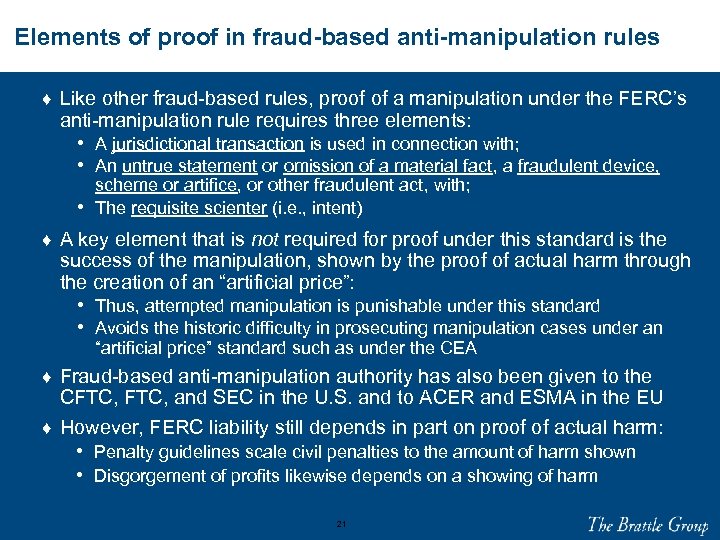

Elements of proof in fraud-based anti-manipulation rules ♦ Like other fraud-based rules, proof of a manipulation under the FERC’s anti-manipulation rule requires three elements: • A jurisdictional transaction is used in connection with; • An untrue statement or omission of a material fact, a fraudulent device, • scheme or artifice, or other fraudulent act, with; The requisite scienter (i. e. , intent) ♦ A key element that is not required for proof under this standard is the success of the manipulation, shown by the proof of actual harm through the creation of an “artificial price”: • Thus, attempted manipulation is punishable under this standard • Avoids the historic difficulty in prosecuting manipulation cases under an “artificial price” standard such as under the CEA ♦ Fraud-based anti-manipulation authority has also been given to the CFTC, and SEC in the U. S. and to ACER and ESMA in the EU ♦ However, FERC liability still depends in part on proof of actual harm: • Penalty guidelines scale civil penalties to the amount of harm shown • Disgorgement of profits likewise depends on a showing of harm 21

Elements of proof in fraud-based anti-manipulation rules ♦ Like other fraud-based rules, proof of a manipulation under the FERC’s anti-manipulation rule requires three elements: • A jurisdictional transaction is used in connection with; • An untrue statement or omission of a material fact, a fraudulent device, • scheme or artifice, or other fraudulent act, with; The requisite scienter (i. e. , intent) ♦ A key element that is not required for proof under this standard is the success of the manipulation, shown by the proof of actual harm through the creation of an “artificial price”: • Thus, attempted manipulation is punishable under this standard • Avoids the historic difficulty in prosecuting manipulation cases under an “artificial price” standard such as under the CEA ♦ Fraud-based anti-manipulation authority has also been given to the CFTC, and SEC in the U. S. and to ACER and ESMA in the EU ♦ However, FERC liability still depends in part on proof of actual harm: • Penalty guidelines scale civil penalties to the amount of harm shown • Disgorgement of profits likewise depends on a showing of harm 21

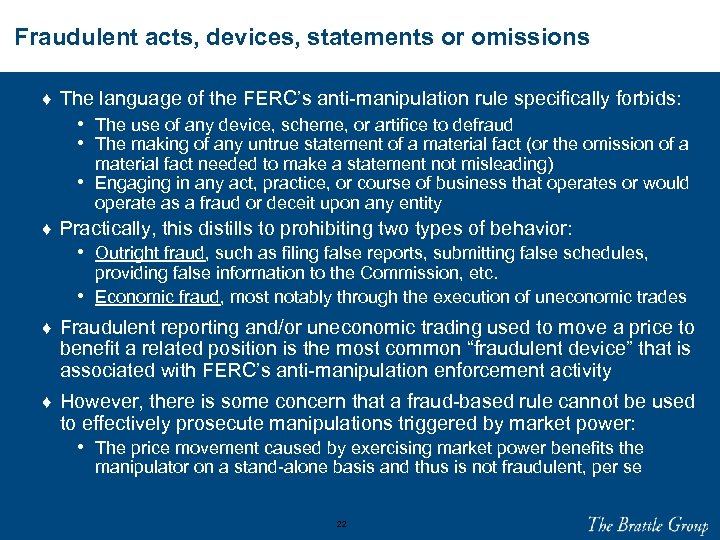

Fraudulent acts, devices, statements or omissions ♦ The language of the FERC’s anti-manipulation rule specifically forbids: • The use of any device, scheme, or artifice to defraud • The making of any untrue statement of a material fact (or the omission of a material fact needed to make a statement not misleading) • Engaging in any act, practice, or course of business that operates or would operate as a fraud or deceit upon any entity ♦ Practically, this distills to prohibiting two types of behavior: • Outright fraud, such as filing false reports, submitting false schedules, providing false information to the Commission, etc. • Economic fraud, most notably through the execution of uneconomic trades ♦ Fraudulent reporting and/or uneconomic trading used to move a price to benefit a related position is the most common “fraudulent device” that is associated with FERC’s anti-manipulation enforcement activity ♦ However, there is some concern that a fraud-based rule cannot be used to effectively prosecute manipulations triggered by market power: • The price movement caused by exercising market power benefits the manipulator on a stand-alone basis and thus is not fraudulent, per se 22

Fraudulent acts, devices, statements or omissions ♦ The language of the FERC’s anti-manipulation rule specifically forbids: • The use of any device, scheme, or artifice to defraud • The making of any untrue statement of a material fact (or the omission of a material fact needed to make a statement not misleading) • Engaging in any act, practice, or course of business that operates or would operate as a fraud or deceit upon any entity ♦ Practically, this distills to prohibiting two types of behavior: • Outright fraud, such as filing false reports, submitting false schedules, providing false information to the Commission, etc. • Economic fraud, most notably through the execution of uneconomic trades ♦ Fraudulent reporting and/or uneconomic trading used to move a price to benefit a related position is the most common “fraudulent device” that is associated with FERC’s anti-manipulation enforcement activity ♦ However, there is some concern that a fraud-based rule cannot be used to effectively prosecute manipulations triggered by market power: • The price movement caused by exercising market power benefits the manipulator on a stand-alone basis and thus is not fraudulent, per se 22

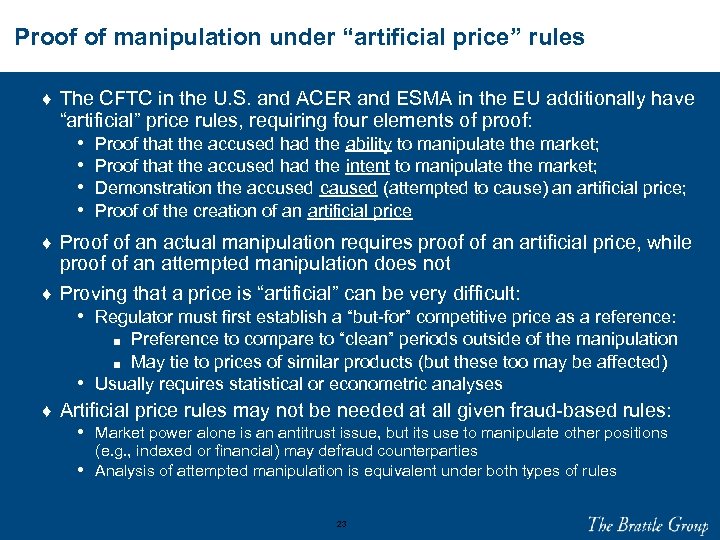

Proof of manipulation under “artificial price” rules ♦ The CFTC in the U. S. and ACER and ESMA in the EU additionally have “artificial” price rules, requiring four elements of proof: • • Proof that the accused had the ability to manipulate the market; Proof that the accused had the intent to manipulate the market; Demonstration the accused caused (attempted to cause) an artificial price; Proof of the creation of an artificial price ♦ Proof of an actual manipulation requires proof of an artificial price, while proof of an attempted manipulation does not ♦ Proving that a price is “artificial” can be very difficult: • Regulator must first establish a “but-for” competitive price as a reference: Preference to compare to “clean” periods outside of the manipulation ■ May tie to prices of similar products (but these too may be affected) Usually requires statistical or econometric analyses ■ • ♦ Artificial price rules may not be needed at all given fraud-based rules: • Market power alone is an antitrust issue, but its use to manipulate other positions • (e. g. , indexed or financial) may defraud counterparties Analysis of attempted manipulation is equivalent under both types of rules 23

Proof of manipulation under “artificial price” rules ♦ The CFTC in the U. S. and ACER and ESMA in the EU additionally have “artificial” price rules, requiring four elements of proof: • • Proof that the accused had the ability to manipulate the market; Proof that the accused had the intent to manipulate the market; Demonstration the accused caused (attempted to cause) an artificial price; Proof of the creation of an artificial price ♦ Proof of an actual manipulation requires proof of an artificial price, while proof of an attempted manipulation does not ♦ Proving that a price is “artificial” can be very difficult: • Regulator must first establish a “but-for” competitive price as a reference: Preference to compare to “clean” periods outside of the manipulation ■ May tie to prices of similar products (but these too may be affected) Usually requires statistical or econometric analyses ■ • ♦ Artificial price rules may not be needed at all given fraud-based rules: • Market power alone is an antitrust issue, but its use to manipulate other positions • (e. g. , indexed or financial) may defraud counterparties Analysis of attempted manipulation is equivalent under both types of rules 23

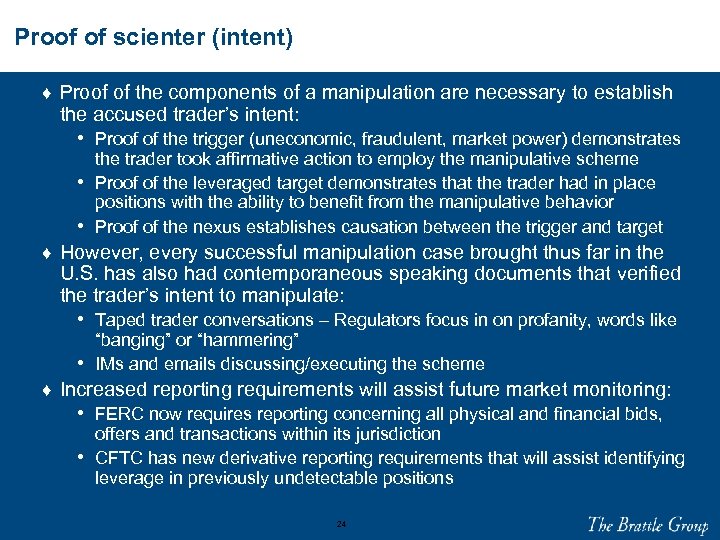

Proof of scienter (intent) ♦ Proof of the components of a manipulation are necessary to establish the accused trader’s intent: • Proof of the trigger (uneconomic, fraudulent, market power) demonstrates • • the trader took affirmative action to employ the manipulative scheme Proof of the leveraged target demonstrates that the trader had in place positions with the ability to benefit from the manipulative behavior Proof of the nexus establishes causation between the trigger and target ♦ However, every successful manipulation case brought thus far in the U. S. has also had contemporaneous speaking documents that verified the trader’s intent to manipulate: • Taped trader conversations – Regulators focus in on profanity, words like • “banging” or “hammering” IMs and emails discussing/executing the scheme ♦ Increased reporting requirements will assist future market monitoring: • FERC now requires reporting concerning all physical and financial bids, offers and transactions within its jurisdiction • CFTC has new derivative reporting requirements that will assist identifying leverage in previously undetectable positions 24

Proof of scienter (intent) ♦ Proof of the components of a manipulation are necessary to establish the accused trader’s intent: • Proof of the trigger (uneconomic, fraudulent, market power) demonstrates • • the trader took affirmative action to employ the manipulative scheme Proof of the leveraged target demonstrates that the trader had in place positions with the ability to benefit from the manipulative behavior Proof of the nexus establishes causation between the trigger and target ♦ However, every successful manipulation case brought thus far in the U. S. has also had contemporaneous speaking documents that verified the trader’s intent to manipulate: • Taped trader conversations – Regulators focus in on profanity, words like • “banging” or “hammering” IMs and emails discussing/executing the scheme ♦ Increased reporting requirements will assist future market monitoring: • FERC now requires reporting concerning all physical and financial bids, offers and transactions within its jurisdiction • CFTC has new derivative reporting requirements that will assist identifying leverage in previously undetectable positions 24

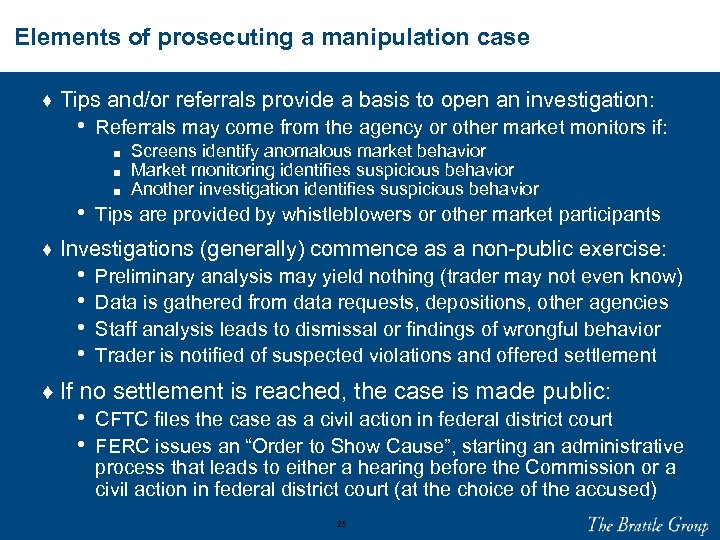

Elements of prosecuting a manipulation case ♦ Tips and/or referrals provide a basis to open an investigation: • Referrals may come from the agency or other market monitors if: ■ ■ ■ Screens identify anomalous market behavior Market monitoring identifies suspicious behavior Another investigation identifies suspicious behavior • Tips are provided by whistleblowers or other market participants ♦ Investigations (generally) commence as a non-public exercise: • Preliminary analysis may yield nothing (trader may not even know) • Data is gathered from data requests, depositions, other agencies • Staff analysis leads to dismissal or findings of wrongful behavior • Trader is notified of suspected violations and offered settlement ♦ If no settlement is reached, the case is made public: • CFTC files the case as a civil action in federal district court • FERC issues an “Order to Show Cause”, starting an administrative process that leads to either a hearing before the Commission or a civil action in federal district court (at the choice of the accused) 25

Elements of prosecuting a manipulation case ♦ Tips and/or referrals provide a basis to open an investigation: • Referrals may come from the agency or other market monitors if: ■ ■ ■ Screens identify anomalous market behavior Market monitoring identifies suspicious behavior Another investigation identifies suspicious behavior • Tips are provided by whistleblowers or other market participants ♦ Investigations (generally) commence as a non-public exercise: • Preliminary analysis may yield nothing (trader may not even know) • Data is gathered from data requests, depositions, other agencies • Staff analysis leads to dismissal or findings of wrongful behavior • Trader is notified of suspected violations and offered settlement ♦ If no settlement is reached, the case is made public: • CFTC files the case as a civil action in federal district court • FERC issues an “Order to Show Cause”, starting an administrative process that leads to either a hearing before the Commission or a civil action in federal district court (at the choice of the accused) 25

Agenda 1. Three triggers of market manipulation 2. A framework for the analysis of manipulation 3. The detection and analysis of manipulative activity 4. Punishments for market manipulation 5. Case studies 6. Additional reading 7. Biographical information 8. Company overview 26

Agenda 1. Three triggers of market manipulation 2. A framework for the analysis of manipulation 3. The detection and analysis of manipulative activity 4. Punishments for market manipulation 5. Case studies 6. Additional reading 7. Biographical information 8. Company overview 26

The penalties for market manipulation ♦ The potential liability for market manipulation is astounding: • $1 million per incident, per day in civil penalties (may rise to $10 million) • Disgorgement of profits • Possible additional civil liability (CFTC, SEC; not FERC) • Injunctions/removal of trading authority • Criminal liability (wire fraud, conspiracy) ♦ FERC’s Penalty Guidelines tie to several factors, including the level of managerial responsibility of the individuals implicated: • Individual traders are liable for fines and disgorgement, may be barred from • • future trading, and may face criminal charges Management liable for activities of traders if managers knew or should have known of the activity; involvement worsens civil penalties Firm ultimately liable for all activities of its employees; involvement by highlevel managers or executives merits severe penalties ♦ Other agencies may have overlapping authority: • FERC regulates the physical market, but CFTC regulates futures and derivatives • Department of Justice can prosecute market power abuses • Many EU regulators now have concurrent powers (e. g. , LIBOR manipulations) 27

The penalties for market manipulation ♦ The potential liability for market manipulation is astounding: • $1 million per incident, per day in civil penalties (may rise to $10 million) • Disgorgement of profits • Possible additional civil liability (CFTC, SEC; not FERC) • Injunctions/removal of trading authority • Criminal liability (wire fraud, conspiracy) ♦ FERC’s Penalty Guidelines tie to several factors, including the level of managerial responsibility of the individuals implicated: • Individual traders are liable for fines and disgorgement, may be barred from • • future trading, and may face criminal charges Management liable for activities of traders if managers knew or should have known of the activity; involvement worsens civil penalties Firm ultimately liable for all activities of its employees; involvement by highlevel managers or executives merits severe penalties ♦ Other agencies may have overlapping authority: • FERC regulates the physical market, but CFTC regulates futures and derivatives • Department of Justice can prosecute market power abuses • Many EU regulators now have concurrent powers (e. g. , LIBOR manipulations) 27

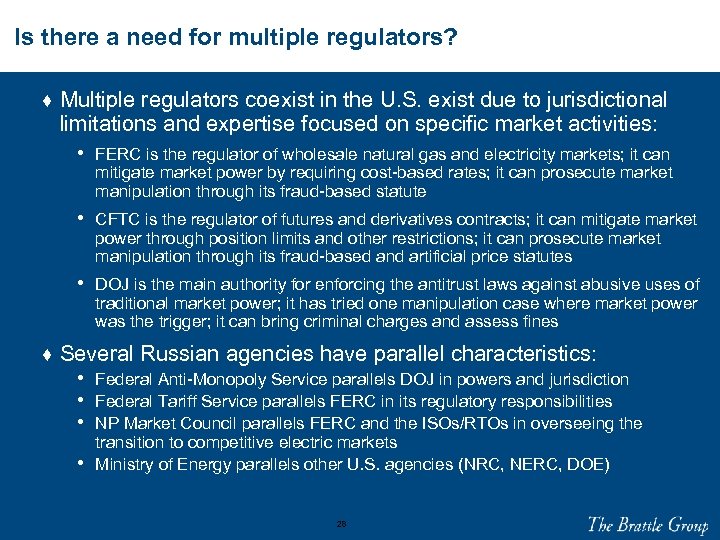

Is there a need for multiple regulators? ♦ Multiple regulators coexist in the U. S. exist due to jurisdictional limitations and expertise focused on specific market activities: • FERC is the regulator of wholesale natural gas and electricity markets; it can mitigate market power by requiring cost-based rates; it can prosecute market manipulation through its fraud-based statute • CFTC is the regulator of futures and derivatives contracts; it can mitigate market power through position limits and other restrictions; it can prosecute market manipulation through its fraud-based and artificial price statutes • DOJ is the main authority for enforcing the antitrust laws against abusive uses of traditional market power; it has tried one manipulation case where market power was the trigger; it can bring criminal charges and assess fines ♦ Several Russian agencies have parallel characteristics: • Federal Anti-Monopoly Service parallels DOJ in powers and jurisdiction • Federal Tariff Service parallels FERC in its regulatory responsibilities • NP Market Council parallels FERC and the ISOs/RTOs in overseeing the • transition to competitive electric markets Ministry of Energy parallels other U. S. agencies (NRC, NERC, DOE) 28

Is there a need for multiple regulators? ♦ Multiple regulators coexist in the U. S. exist due to jurisdictional limitations and expertise focused on specific market activities: • FERC is the regulator of wholesale natural gas and electricity markets; it can mitigate market power by requiring cost-based rates; it can prosecute market manipulation through its fraud-based statute • CFTC is the regulator of futures and derivatives contracts; it can mitigate market power through position limits and other restrictions; it can prosecute market manipulation through its fraud-based and artificial price statutes • DOJ is the main authority for enforcing the antitrust laws against abusive uses of traditional market power; it has tried one manipulation case where market power was the trigger; it can bring criminal charges and assess fines ♦ Several Russian agencies have parallel characteristics: • Federal Anti-Monopoly Service parallels DOJ in powers and jurisdiction • Federal Tariff Service parallels FERC in its regulatory responsibilities • NP Market Council parallels FERC and the ISOs/RTOs in overseeing the • transition to competitive electric markets Ministry of Energy parallels other U. S. agencies (NRC, NERC, DOE) 28

Is there a need for multiple regulators? (continued) ♦ There are significant advantages to decentralizing manipulation enforcement authority with respect to electric power: • Effectively detecting and deterring manipulative behavior in electricity markets requires a deep understanding of the technical dynamics of the industry, the design of the market, and the regulatory structures that remain • Regulators (and academics) who focus on traditional market power issues related to antitrust tend not to fully grasp the concept of uneconomic trading as a type of transactional fraud • Having multiple regulators with abutting jurisdictions allows for enforcement responsibilities to be spread across agencies’ resources and tailored (or limited) to match each agency’s jurisdictional powers ♦ There also some significant disadvantages: • Greater regulation incurs direct costs that must be borne by market participants • Real or perceived overlaps in jurisdiction may result in inefficiencies • Lack of cross-agency cooperation may complicate the effective enforcement of • anti-manipulation statutes Reporting to more regulators will increase the compliance burden on market participants 29

Is there a need for multiple regulators? (continued) ♦ There are significant advantages to decentralizing manipulation enforcement authority with respect to electric power: • Effectively detecting and deterring manipulative behavior in electricity markets requires a deep understanding of the technical dynamics of the industry, the design of the market, and the regulatory structures that remain • Regulators (and academics) who focus on traditional market power issues related to antitrust tend not to fully grasp the concept of uneconomic trading as a type of transactional fraud • Having multiple regulators with abutting jurisdictions allows for enforcement responsibilities to be spread across agencies’ resources and tailored (or limited) to match each agency’s jurisdictional powers ♦ There also some significant disadvantages: • Greater regulation incurs direct costs that must be borne by market participants • Real or perceived overlaps in jurisdiction may result in inefficiencies • Lack of cross-agency cooperation may complicate the effective enforcement of • anti-manipulation statutes Reporting to more regulators will increase the compliance burden on market participants 29

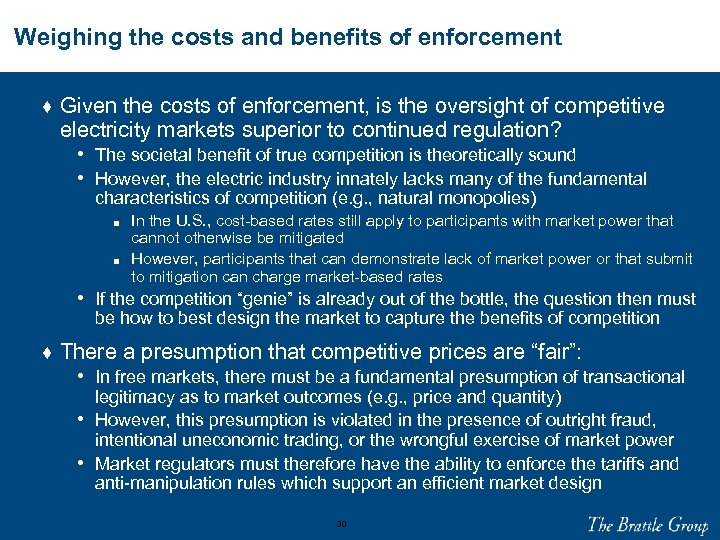

Weighing the costs and benefits of enforcement ♦ Given the costs of enforcement, is the oversight of competitive electricity markets superior to continued regulation? • The societal benefit of true competition is theoretically sound • However, the electric industry innately lacks many of the fundamental characteristics of competition (e. g. , natural monopolies) ■ ■ In the U. S. , cost-based rates still apply to participants with market power that cannot otherwise be mitigated However, participants that can demonstrate lack of market power or that submit to mitigation can charge market-based rates • If the competition “genie” is already out of the bottle, the question then must be how to best design the market to capture the benefits of competition ♦ There a presumption that competitive prices are “fair”: • In free markets, there must be a fundamental presumption of transactional • • legitimacy as to market outcomes (e. g. , price and quantity) However, this presumption is violated in the presence of outright fraud, intentional uneconomic trading, or the wrongful exercise of market power Market regulators must therefore have the ability to enforce the tariffs and anti-manipulation rules which support an efficient market design 30

Weighing the costs and benefits of enforcement ♦ Given the costs of enforcement, is the oversight of competitive electricity markets superior to continued regulation? • The societal benefit of true competition is theoretically sound • However, the electric industry innately lacks many of the fundamental characteristics of competition (e. g. , natural monopolies) ■ ■ In the U. S. , cost-based rates still apply to participants with market power that cannot otherwise be mitigated However, participants that can demonstrate lack of market power or that submit to mitigation can charge market-based rates • If the competition “genie” is already out of the bottle, the question then must be how to best design the market to capture the benefits of competition ♦ There a presumption that competitive prices are “fair”: • In free markets, there must be a fundamental presumption of transactional • • legitimacy as to market outcomes (e. g. , price and quantity) However, this presumption is violated in the presence of outright fraud, intentional uneconomic trading, or the wrongful exercise of market power Market regulators must therefore have the ability to enforce the tariffs and anti-manipulation rules which support an efficient market design 30

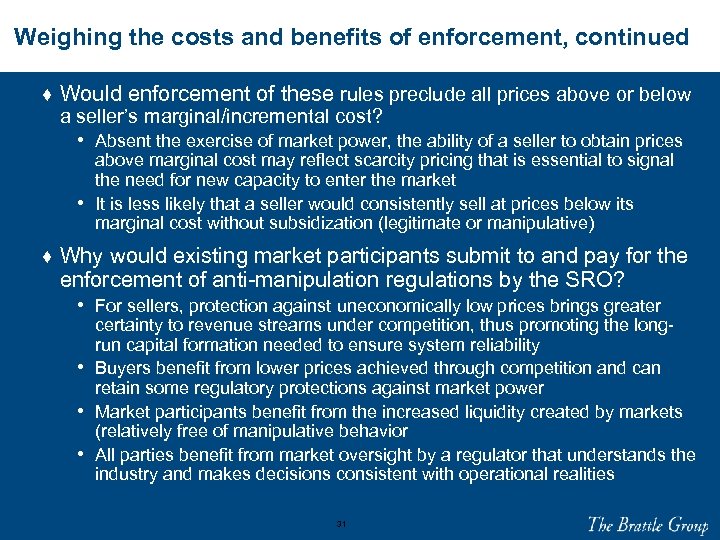

Weighing the costs and benefits of enforcement, continued ♦ Would enforcement of these rules preclude all prices above or below a seller’s marginal/incremental cost? • Absent the exercise of market power, the ability of a seller to obtain prices • above marginal cost may reflect scarcity pricing that is essential to signal the need for new capacity to enter the market It is less likely that a seller would consistently sell at prices below its marginal cost without subsidization (legitimate or manipulative) ♦ Why would existing market participants submit to and pay for the enforcement of anti-manipulation regulations by the SRO? • For sellers, protection against uneconomically low prices brings greater • • • certainty to revenue streams under competition, thus promoting the longrun capital formation needed to ensure system reliability Buyers benefit from lower prices achieved through competition and can retain some regulatory protections against market power Market participants benefit from the increased liquidity created by markets (relatively free of manipulative behavior All parties benefit from market oversight by a regulator that understands the industry and makes decisions consistent with operational realities 31

Weighing the costs and benefits of enforcement, continued ♦ Would enforcement of these rules preclude all prices above or below a seller’s marginal/incremental cost? • Absent the exercise of market power, the ability of a seller to obtain prices • above marginal cost may reflect scarcity pricing that is essential to signal the need for new capacity to enter the market It is less likely that a seller would consistently sell at prices below its marginal cost without subsidization (legitimate or manipulative) ♦ Why would existing market participants submit to and pay for the enforcement of anti-manipulation regulations by the SRO? • For sellers, protection against uneconomically low prices brings greater • • • certainty to revenue streams under competition, thus promoting the longrun capital formation needed to ensure system reliability Buyers benefit from lower prices achieved through competition and can retain some regulatory protections against market power Market participants benefit from the increased liquidity created by markets (relatively free of manipulative behavior All parties benefit from market oversight by a regulator that understands the industry and makes decisions consistent with operational realities 31

Agenda 1. Three triggers of market manipulation 2. A framework for the analysis of manipulation 3. The detection and analysis of manipulative activity 4. Punishments for market manipulation 5. Case studies 6. Additional reading 7. Biographical information 8. Company overview 32

Agenda 1. Three triggers of market manipulation 2. A framework for the analysis of manipulation 3. The detection and analysis of manipulative activity 4. Punishments for market manipulation 5. Case studies 6. Additional reading 7. Biographical information 8. Company overview 32

Alleged Manipulation of a Demand Response Program: Rumford Paper Company 33

Alleged Manipulation of a Demand Response Program: Rumford Paper Company 33

Rumford Paper Company: Background (as told by FERC) ♦ ISO-New England operated a “Day-Ahead Load Response Program” (DALRP): • Eligible load resources could enroll in the program • If accepted, the resource would need to set a “baseline”: ■ ■ ■ Baseline designed to establish a “normal” load against which demand response would be measured Initial baseline set as simple average of actual usage measured over a five workday period from 07: 00 -18: 00 Baseline would be adjusted by future actual usage, but not on days when the resource was used for demand response • Participant bids restricted to a minimum price of $50/MWh ♦ Rumford Paper Company (Rumford) enrolled in July 2007: • 95 MW load which ran flat 24 hours per day during the workweek • 110 MW on-site generator typically filled all of Rumford’s needs: ■ Plant was economic at power prices above $40/MWh 34

Rumford Paper Company: Background (as told by FERC) ♦ ISO-New England operated a “Day-Ahead Load Response Program” (DALRP): • Eligible load resources could enroll in the program • If accepted, the resource would need to set a “baseline”: ■ ■ ■ Baseline designed to establish a “normal” load against which demand response would be measured Initial baseline set as simple average of actual usage measured over a five workday period from 07: 00 -18: 00 Baseline would be adjusted by future actual usage, but not on days when the resource was used for demand response • Participant bids restricted to a minimum price of $50/MWh ♦ Rumford Paper Company (Rumford) enrolled in July 2007: • 95 MW load which ran flat 24 hours per day during the workweek • 110 MW on-site generator typically filled all of Rumford’s needs: ■ Plant was economic at power prices above $40/MWh 34

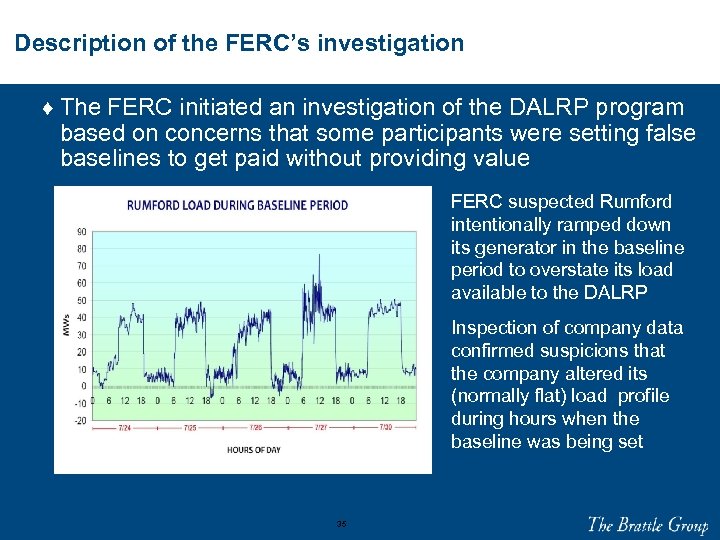

Description of the FERC’s investigation ♦ The FERC initiated an investigation of the DALRP program based on concerns that some participants were setting false baselines to get paid without providing value FERC suspected Rumford intentionally ramped down its generator in the baseline period to overstate its load available to the DALRP Inspection of company data confirmed suspicions that the company altered its (normally flat) load profile during hours when the baseline was being set 35

Description of the FERC’s investigation ♦ The FERC initiated an investigation of the DALRP program based on concerns that some participants were setting false baselines to get paid without providing value FERC suspected Rumford intentionally ramped down its generator in the baseline period to overstate its load available to the DALRP Inspection of company data confirmed suspicions that the company altered its (normally flat) load profile during hours when the baseline was being set 35

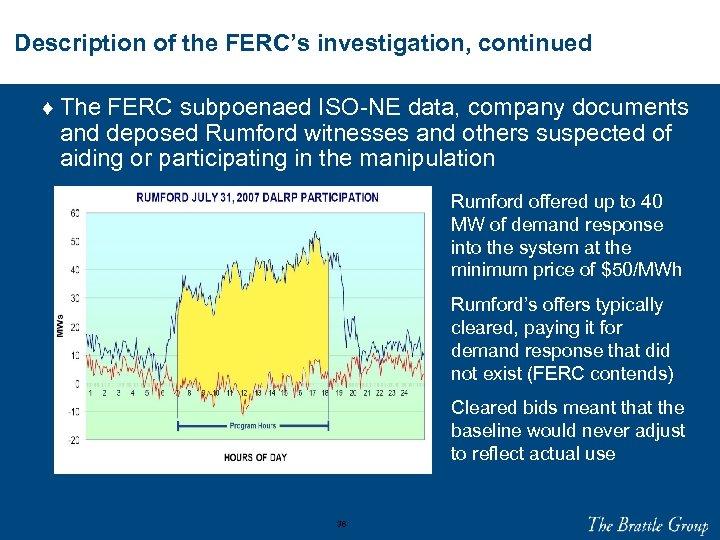

Description of the FERC’s investigation, continued ♦ The FERC subpoenaed ISO-NE data, company documents and deposed Rumford witnesses and others suspected of aiding or participating in the manipulation Rumford offered up to 40 MW of demand response into the system at the minimum price of $50/MWh Rumford’s offers typically cleared, paying it for demand response that did not exist (FERC contends) Cleared bids meant that the baseline would never adjust to reflect actual use 36

Description of the FERC’s investigation, continued ♦ The FERC subpoenaed ISO-NE data, company documents and deposed Rumford witnesses and others suspected of aiding or participating in the manipulation Rumford offered up to 40 MW of demand response into the system at the minimum price of $50/MWh Rumford’s offers typically cleared, paying it for demand response that did not exist (FERC contends) Cleared bids meant that the baseline would never adjust to reflect actual use 36

Examination of the FERC’s manipulation claim ♦ The activities in question were FERC-jurisdictional given the markets involved and Rumford’s market-based rate tariff ♦ Numerous documents came to light to objectively establish Rumford’s intent to execute the scheme ♦ Two types of manipulative triggers are raised in the allegation: • Rumford’s misreporting to the ISO was intentional outright fraud • Rumford’s choice to ramp down its generation during the baseline period was uneconomic: ■ Rumford paid $120, 000 for replacement power to continue operations, more than the ~$108, 000 cost it would have incurred from generating ♦ The manipulation’s target is payments from the DALRP ♦ The manipulation’s nexus is the exploited baseline process that rewards false bidding through the auction mechanism ♦ This case raises an interesting question as to whether the exploitation of “broken” market rules can be manipulative 37

Examination of the FERC’s manipulation claim ♦ The activities in question were FERC-jurisdictional given the markets involved and Rumford’s market-based rate tariff ♦ Numerous documents came to light to objectively establish Rumford’s intent to execute the scheme ♦ Two types of manipulative triggers are raised in the allegation: • Rumford’s misreporting to the ISO was intentional outright fraud • Rumford’s choice to ramp down its generation during the baseline period was uneconomic: ■ Rumford paid $120, 000 for replacement power to continue operations, more than the ~$108, 000 cost it would have incurred from generating ♦ The manipulation’s target is payments from the DALRP ♦ The manipulation’s nexus is the exploited baseline process that rewards false bidding through the auction mechanism ♦ This case raises an interesting question as to whether the exploitation of “broken” market rules can be manipulative 37

FERC’s penalty recommendations and Rumford’s defenses ♦ FERC is seeking $2, 836, 419, 08 in disgorgement and $13. 25 million in civil penalties, mainly because of senior manager involvement in the manipulation ♦ Rumford is defending the case by asserting that: • They did in fact increase available demand response to the region • FERC ignores evidence that the plant was economic most of the time, especially so during the baseline period when replacement power was purchased for $120, 000 ♦ FERC lists inconsistent perspectives on the use of economics in fraud cases in its Order to Show Cause: • Claims that “fraudulent intent is a fact-specific inquiry, not a matter • of general economic principles” The discussion continues to assert that Rumford’s transactions lacked economic value and that its choice to cut generation during the baseline period was uneconomic on a stand-alone basis 38

FERC’s penalty recommendations and Rumford’s defenses ♦ FERC is seeking $2, 836, 419, 08 in disgorgement and $13. 25 million in civil penalties, mainly because of senior manager involvement in the manipulation ♦ Rumford is defending the case by asserting that: • They did in fact increase available demand response to the region • FERC ignores evidence that the plant was economic most of the time, especially so during the baseline period when replacement power was purchased for $120, 000 ♦ FERC lists inconsistent perspectives on the use of economics in fraud cases in its Order to Show Cause: • Claims that “fraudulent intent is a fact-specific inquiry, not a matter • of general economic principles” The discussion continues to assert that Rumford’s transactions lacked economic value and that its choice to cut generation during the baseline period was uneconomic on a stand-alone basis 38

Alleged Manipulation of Congestion Revenue Rights: Deutsche Bank Energy Trading 39

Alleged Manipulation of Congestion Revenue Rights: Deutsche Bank Energy Trading 39

Background of the Deutsche Bank case ♦ DBET owned Congestion Revenue Rights (CRRs) at the Silver Peak intertie of the California ISO (CAISO): • CRRs are a type of financial swap issued by the CAISO designed to • • hedge against physical congestion costs on transmission lines The Silver Peak intertie is a 13 -17 MW transmission line DBET held ~50 MW of CRRs that were long to the price at Silver Peak (initial leverage of about 3: 1) ♦ On January 19, the CAISO derated Silver Peak, announcing that no imports would be allowed into California: • The congestion component of the power price at Silver Peak fell, • • causing DBET’s CRRs to lose money DBET immediately disputed this result with the CAISO, which explained the result as a “degenerate” price (see next slide) ISO defended its actions and the degenerate result under thenexisting market rules ♦ DBET reduced its CRR position, but continued to lose money on its remaining CRRs 40

Background of the Deutsche Bank case ♦ DBET owned Congestion Revenue Rights (CRRs) at the Silver Peak intertie of the California ISO (CAISO): • CRRs are a type of financial swap issued by the CAISO designed to • • hedge against physical congestion costs on transmission lines The Silver Peak intertie is a 13 -17 MW transmission line DBET held ~50 MW of CRRs that were long to the price at Silver Peak (initial leverage of about 3: 1) ♦ On January 19, the CAISO derated Silver Peak, announcing that no imports would be allowed into California: • The congestion component of the power price at Silver Peak fell, • • causing DBET’s CRRs to lose money DBET immediately disputed this result with the CAISO, which explained the result as a “degenerate” price (see next slide) ISO defended its actions and the degenerate result under thenexisting market rules ♦ DBET reduced its CRR position, but continued to lose money on its remaining CRRs 40

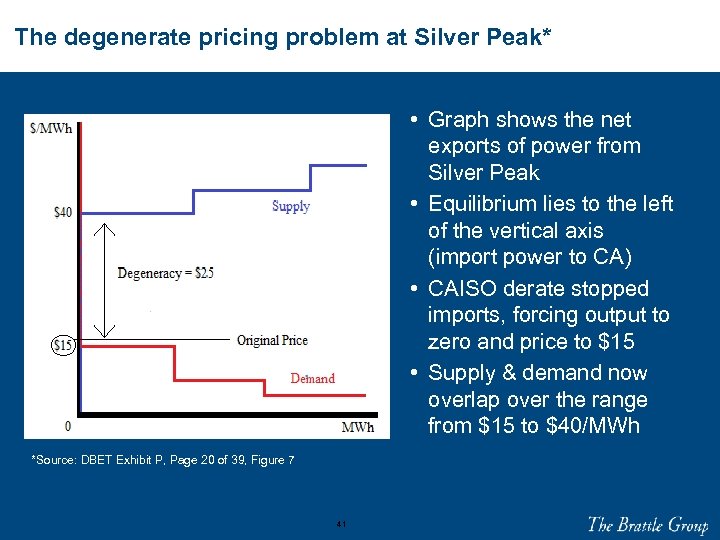

The degenerate pricing problem at Silver Peak* • Graph shows the net exports of power from Silver Peak • Equilibrium lies to the left of the vertical axis (import power to CA) • CAISO derate stopped imports, forcing output to zero and price to $15 • Supply & demand now overlap over the range from $15 to $40/MWh *Source: DBET Exhibit P, Page 20 of 39, Figure 7 41

The degenerate pricing problem at Silver Peak* • Graph shows the net exports of power from Silver Peak • Equilibrium lies to the left of the vertical axis (import power to CA) • CAISO derate stopped imports, forcing output to zero and price to $15 • Supply & demand now overlap over the range from $15 to $40/MWh *Source: DBET Exhibit P, Page 20 of 39, Figure 7 41

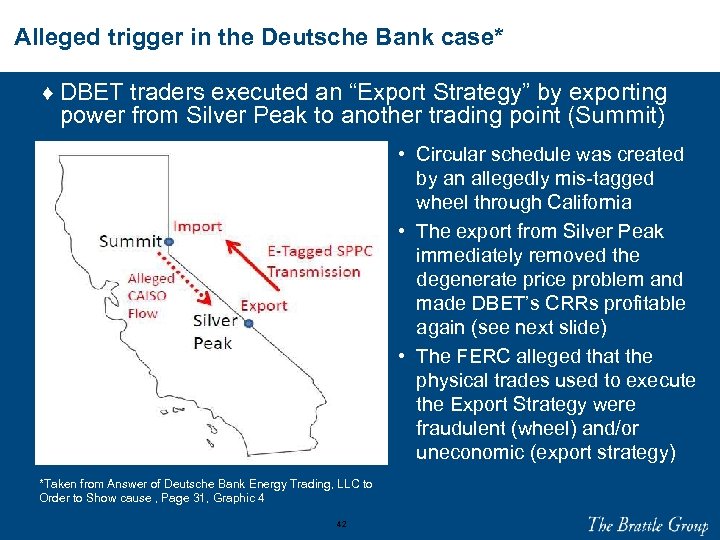

Alleged trigger in the Deutsche Bank case* ♦ DBET traders executed an “Export Strategy” by exporting power from Silver Peak to another trading point (Summit) • Circular schedule was created by an allegedly mis-tagged wheel through California • The export from Silver Peak immediately removed the degenerate price problem and made DBET’s CRRs profitable again (see next slide) • The FERC alleged that the physical trades used to execute the Export Strategy were fraudulent (wheel) and/or uneconomic (export strategy) *Taken from Answer of Deutsche Bank Energy Trading, LLC to Order to Show cause , Page 31, Graphic 4 42

Alleged trigger in the Deutsche Bank case* ♦ DBET traders executed an “Export Strategy” by exporting power from Silver Peak to another trading point (Summit) • Circular schedule was created by an allegedly mis-tagged wheel through California • The export from Silver Peak immediately removed the degenerate price problem and made DBET’s CRRs profitable again (see next slide) • The FERC alleged that the physical trades used to execute the Export Strategy were fraudulent (wheel) and/or uneconomic (export strategy) *Taken from Answer of Deutsche Bank Energy Trading, LLC to Order to Show cause , Page 31, Graphic 4 42

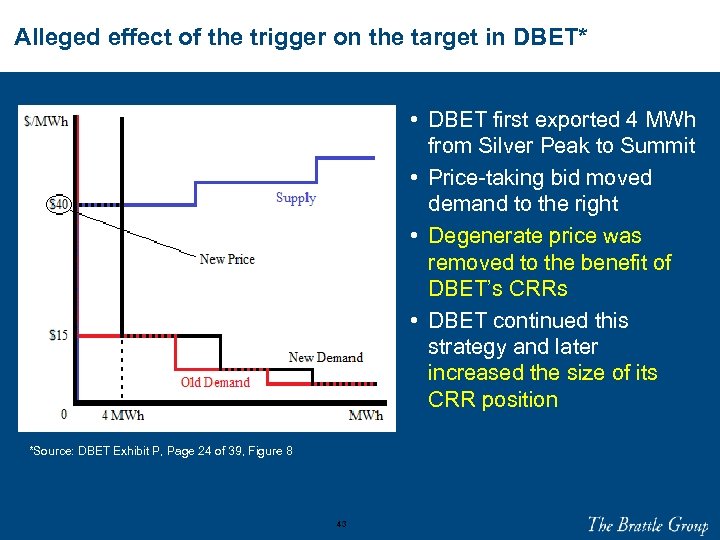

Alleged effect of the trigger on the target in DBET* • DBET first exported 4 MWh from Silver Peak to Summit • Price-taking bid moved demand to the right • Degenerate price was removed to the benefit of DBET’s CRRs • DBET continued this strategy and later increased the size of its CRR position *Source: DBET Exhibit P, Page 24 of 39, Figure 8 43

Alleged effect of the trigger on the target in DBET* • DBET first exported 4 MWh from Silver Peak to Summit • Price-taking bid moved demand to the right • Degenerate price was removed to the benefit of DBET’s CRRs • DBET continued this strategy and later increased the size of its CRR position *Source: DBET Exhibit P, Page 24 of 39, Figure 8 43

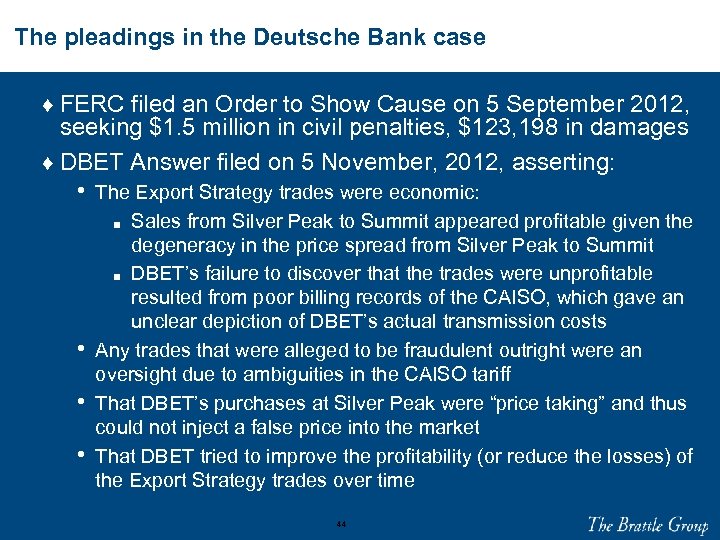

The pleadings in the Deutsche Bank case ♦ FERC filed an Order to Show Cause on 5 September 2012, seeking $1. 5 million in civil penalties, $123, 198 in damages ♦ DBET Answer filed on 5 November, 2012, asserting: • The Export Strategy trades were economic: Sales from Silver Peak to Summit appeared profitable given the degeneracy in the price spread from Silver Peak to Summit ■ DBET’s failure to discover that the trades were unprofitable resulted from poor billing records of the CAISO, which gave an unclear depiction of DBET’s actual transmission costs Any trades that were alleged to be fraudulent outright were an oversight due to ambiguities in the CAISO tariff That DBET’s purchases at Silver Peak were “price taking” and thus could not inject a false price into the market That DBET tried to improve the profitability (or reduce the losses) of the Export Strategy trades over time ■ • • • 44

The pleadings in the Deutsche Bank case ♦ FERC filed an Order to Show Cause on 5 September 2012, seeking $1. 5 million in civil penalties, $123, 198 in damages ♦ DBET Answer filed on 5 November, 2012, asserting: • The Export Strategy trades were economic: Sales from Silver Peak to Summit appeared profitable given the degeneracy in the price spread from Silver Peak to Summit ■ DBET’s failure to discover that the trades were unprofitable resulted from poor billing records of the CAISO, which gave an unclear depiction of DBET’s actual transmission costs Any trades that were alleged to be fraudulent outright were an oversight due to ambiguities in the CAISO tariff That DBET’s purchases at Silver Peak were “price taking” and thus could not inject a false price into the market That DBET tried to improve the profitability (or reduce the losses) of the Export Strategy trades over time ■ • • • 44

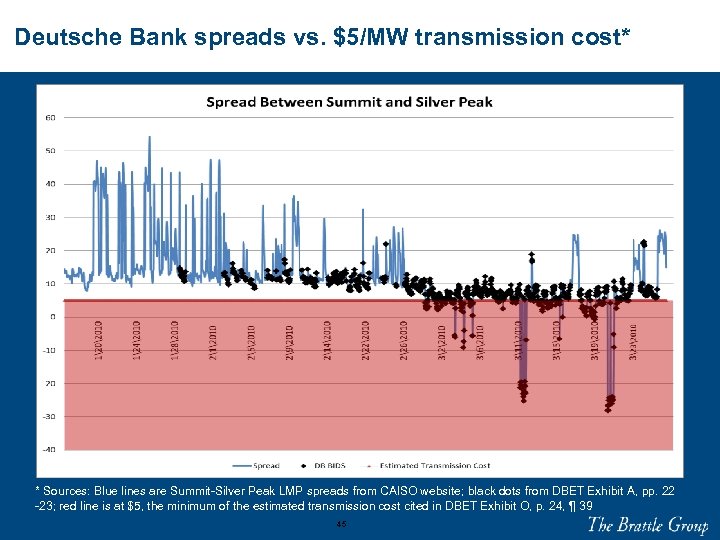

Deutsche Bank spreads vs. $5/MW transmission cost* * Sources: Blue lines are Summit-Silver Peak LMP spreads from CAISO website; black dots from DBET Exhibit A, pp. 22 -23; red line is at $5, the minimum of the estimated transmission cost cited in DBET Exhibit O, p. 24, ¶ 39 45

Deutsche Bank spreads vs. $5/MW transmission cost* * Sources: Blue lines are Summit-Silver Peak LMP spreads from CAISO website; black dots from DBET Exhibit A, pp. 22 -23; red line is at $5, the minimum of the estimated transmission cost cited in DBET Exhibit O, p. 24, ¶ 39 45

Takeaways from the Deutsche Bank settlement ♦ DBET settled for ~$50 K more than the FERC sought ♦ The DBET case contained the three framework elements: • Two types of price-making behavior allegedly used as the trigger: Outright fraud (false schedules submitted to CAISO); and ■ Uneconomic trading (intentional loss on physical power trades) CRRs used as the alleged manipulation target Nexus was the auction mechanism & resulting degenerate price ■ • • ♦ Key takeaways from DBET are: • “Price taking” trades can be used to bias (i. e. , “make”) a price • “Economic” trading may become “uneconomic” – pattern matters • “Tried to lose less” is not a defense • “Bad” market rules may not provide a defense • “Defending a losing position” is manipulation • Objective (stated) intent to move a price is an anathema! 46

Takeaways from the Deutsche Bank settlement ♦ DBET settled for ~$50 K more than the FERC sought ♦ The DBET case contained the three framework elements: • Two types of price-making behavior allegedly used as the trigger: Outright fraud (false schedules submitted to CAISO); and ■ Uneconomic trading (intentional loss on physical power trades) CRRs used as the alleged manipulation target Nexus was the auction mechanism & resulting degenerate price ■ • • ♦ Key takeaways from DBET are: • “Price taking” trades can be used to bias (i. e. , “make”) a price • “Economic” trading may become “uneconomic” – pattern matters • “Tried to lose less” is not a defense • “Bad” market rules may not provide a defense • “Defending a losing position” is manipulation • Objective (stated) intent to move a price is an anathema! 46

Agenda 1. Three triggers of market manipulation 2. A framework for the analysis of manipulation 3. The detection and analysis of manipulative activity 4. Punishments for market manipulation 5. Case studies 6. Additional reading 7. Biographical information 8. Company overview 47

Agenda 1. Three triggers of market manipulation 2. A framework for the analysis of manipulation 3. The detection and analysis of manipulative activity 4. Punishments for market manipulation 5. Case studies 6. Additional reading 7. Biographical information 8. Company overview 47

Additional reading ♦ “Using Virtual Bids to Manipulate the Value of Financial Transmission Rights. ” Available through the Harvard Electric Policy Group web site at http: //www. hks. harvard. edu/hepg/Papers/2012/Virtuals%20 and%20 FTR s%20 -%205 -3 -12. pdf ♦ “A Framework for Analyzing Market Manipulation. ” Review of Law & Economics. Volume 8, Issue 1, Pages 253– 295, ISSN (Online) 15555879, DOI: 10. 1515/1555 -5879. 1577, September 2012 ♦ “A Comparison of Anti-Manipulation Rules in U. S. and EU Electricity and Natural Gas Markets: A Proposal for a Common Standard. ” Energy Law Journal , Volume 33, p. 1 (April 2012) ♦ Other documents are available at Dr. Ledgerwood’s web site at http: //www. brattle. com/Experts/Expert. Detail. asp? Expert. ID=244 48

Additional reading ♦ “Using Virtual Bids to Manipulate the Value of Financial Transmission Rights. ” Available through the Harvard Electric Policy Group web site at http: //www. hks. harvard. edu/hepg/Papers/2012/Virtuals%20 and%20 FTR s%20 -%205 -3 -12. pdf ♦ “A Framework for Analyzing Market Manipulation. ” Review of Law & Economics. Volume 8, Issue 1, Pages 253– 295, ISSN (Online) 15555879, DOI: 10. 1515/1555 -5879. 1577, September 2012 ♦ “A Comparison of Anti-Manipulation Rules in U. S. and EU Electricity and Natural Gas Markets: A Proposal for a Common Standard. ” Energy Law Journal , Volume 33, p. 1 (April 2012) ♦ Other documents are available at Dr. Ledgerwood’s web site at http: //www. brattle. com/Experts/Expert. Detail. asp? Expert. ID=244 48

Agenda 1. Three triggers of market manipulation 2. A framework for the analysis of manipulation 3. The detection and analysis of manipulative activity 4. Punishments for market manipulation 5. Case studies 6. Additional reading 7. Biographical information 8. Company overview 49

Agenda 1. Three triggers of market manipulation 2. A framework for the analysis of manipulation 3. The detection and analysis of manipulative activity 4. Punishments for market manipulation 5. Case studies 6. Additional reading 7. Biographical information 8. Company overview 49

About The Brattle Group Insert corporate headshot here. Shaun D. Ledgerwood, J. D. , Ph. D. Senior Consultant Suite 1200, 1850 M Street NW Washington, DC 20036 Shaun. Ledgerwood@brattle. com 202. 419. 3375 (O), 405. 922. 2324 (C) Dr. Ledgerwood specializes in issues of market competitiveness with an emphasis on the economic analysis of market manipulation. He previously served as an economist and attorney for the FERC in its enforcement proceedings involving Energy Transfer Partners, L. P. and Amaranth Advisors, LLC. He has built upon these experiences to develop a framework for defining, detecting and analyzing manipulative behavior. He has worked as a professor, economic consultant, attorney, and market advisor to the regulated industries for over twenty years, focusing on issues including ratemaking, power supply, resource planning, and electric asset valuations. In his broader practice, he specializes on issues in the analysis of liability and damages for actions based in tort, contract or fraud. He has testified as an expert witness before state utility commissions and in federal court. 50

About The Brattle Group Insert corporate headshot here. Shaun D. Ledgerwood, J. D. , Ph. D. Senior Consultant Suite 1200, 1850 M Street NW Washington, DC 20036 Shaun. Ledgerwood@brattle. com 202. 419. 3375 (O), 405. 922. 2324 (C) Dr. Ledgerwood specializes in issues of market competitiveness with an emphasis on the economic analysis of market manipulation. He previously served as an economist and attorney for the FERC in its enforcement proceedings involving Energy Transfer Partners, L. P. and Amaranth Advisors, LLC. He has built upon these experiences to develop a framework for defining, detecting and analyzing manipulative behavior. He has worked as a professor, economic consultant, attorney, and market advisor to the regulated industries for over twenty years, focusing on issues including ratemaking, power supply, resource planning, and electric asset valuations. In his broader practice, he specializes on issues in the analysis of liability and damages for actions based in tort, contract or fraud. He has testified as an expert witness before state utility commissions and in federal court. 50

Agenda 1. Three triggers of market manipulation 2. A framework for the analysis of manipulation 3. The detection and analysis of manipulative activity 4. Punishments for market manipulation 5. Case studies 6. Additional reading 7. Biographical information 8. Company overview 51

Agenda 1. Three triggers of market manipulation 2. A framework for the analysis of manipulation 3. The detection and analysis of manipulative activity 4. Punishments for market manipulation 5. Case studies 6. Additional reading 7. Biographical information 8. Company overview 51

About The Brattle Group www. brattle. com North America Washington, DC +1. 202. 955. 5050 Cambridge, MA +1. 617. 864. 7900 San Francisco, CA +1. 415. 217. 1000 Europe London, England +44. 20. 7406. 7900 Madrid, Spain +34. 91. 418. 69. 70 52 Rome, Italy +39. 06. 48. 888. 10

About The Brattle Group www. brattle. com North America Washington, DC +1. 202. 955. 5050 Cambridge, MA +1. 617. 864. 7900 San Francisco, CA +1. 415. 217. 1000 Europe London, England +44. 20. 7406. 7900 Madrid, Spain +34. 91. 418. 69. 70 52 Rome, Italy +39. 06. 48. 888. 10

About The Brattle Group provides consulting and expert testimony in economics, finance, and regulation to corporations, law firms, and governments around the world. We combine in-depth industry experience and rigorous analyses to help clients answer complex economic and financial questions in litigation and regulation, develop strategies for changing markets, and make critical business decisions. Functional Practice Areas ♦ Antitrust/Competition ♦ Commercial Damages ♦ Environmental Litigation and Regulation ♦ Forensic Economics ♦ Intellectual Property ♦ International Arbitration ♦ International Trade ♦ Product Liability ♦ Regulatory Finance and Accounting ♦ Risk Management ♦ Securities ♦ Tax ♦ Utility Regulatory Policy and Ratemaking ♦ Valuation Industry Practice Areas ♦ Electric Power ♦ Financial Institutions ♦ Natural Gas ♦ Petroleum ♦ Pharmaceuticals, Medical Devices, and Biotechnology ♦ Telecommunications and Media ♦ Transportation 53

About The Brattle Group provides consulting and expert testimony in economics, finance, and regulation to corporations, law firms, and governments around the world. We combine in-depth industry experience and rigorous analyses to help clients answer complex economic and financial questions in litigation and regulation, develop strategies for changing markets, and make critical business decisions. Functional Practice Areas ♦ Antitrust/Competition ♦ Commercial Damages ♦ Environmental Litigation and Regulation ♦ Forensic Economics ♦ Intellectual Property ♦ International Arbitration ♦ International Trade ♦ Product Liability ♦ Regulatory Finance and Accounting ♦ Risk Management ♦ Securities ♦ Tax ♦ Utility Regulatory Policy and Ratemaking ♦ Valuation Industry Practice Areas ♦ Electric Power ♦ Financial Institutions ♦ Natural Gas ♦ Petroleum ♦ Pharmaceuticals, Medical Devices, and Biotechnology ♦ Telecommunications and Media ♦ Transportation 53