cf5731949a9a17407cfd78018d7441eb.ppt

- Количество слайдов: 16

MARKET FAILURE 2: PUBLIC GOODS AND INFORMATION ECONOMICS BUS 111 MICROECONOMICS Lecture 9

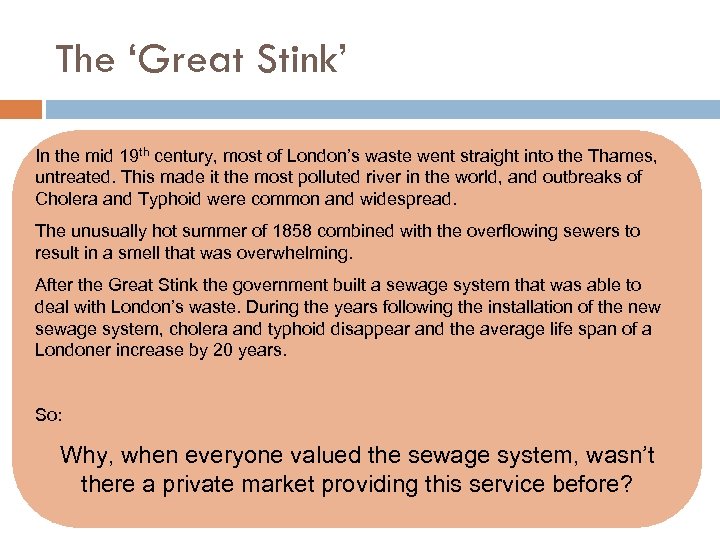

The ‘Great Stink’ In the mid 19 th century, most of London’s waste went straight into the Thames, untreated. This made it the most polluted river in the world, and outbreaks of Cholera and Typhoid were common and widespread. The unusually hot summer of 1858 combined with the overflowing sewers to result in a smell that was overwhelming. After the Great Stink the government built a sewage system that was able to deal with London’s waste. During the years following the installation of the new sewage system, cholera and typhoid disappear and the average life span of a Londoner increase by 20 years. So: Why, when everyone valued the sewage system, wasn’t there a private market providing this service before?

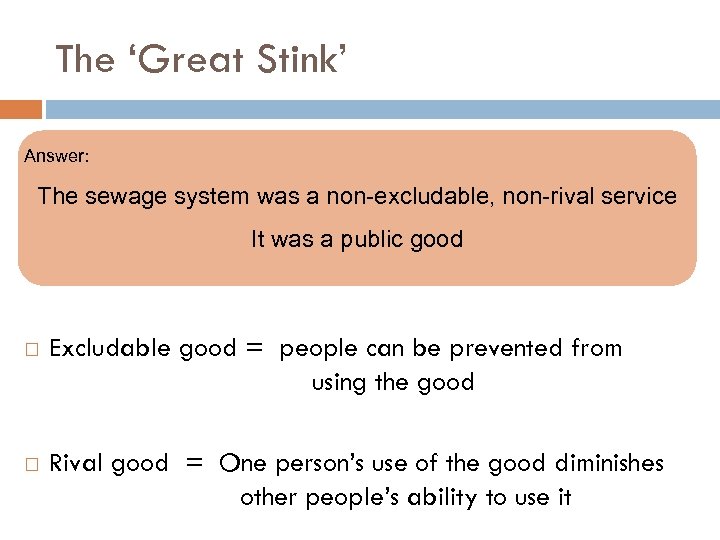

The ‘Great Stink’ Answer: The sewage system was a non-excludable, non-rival service It was a public good Excludable good = people can be prevented from using the good Rival good = One person’s use of the good diminishes other people’s ability to use it

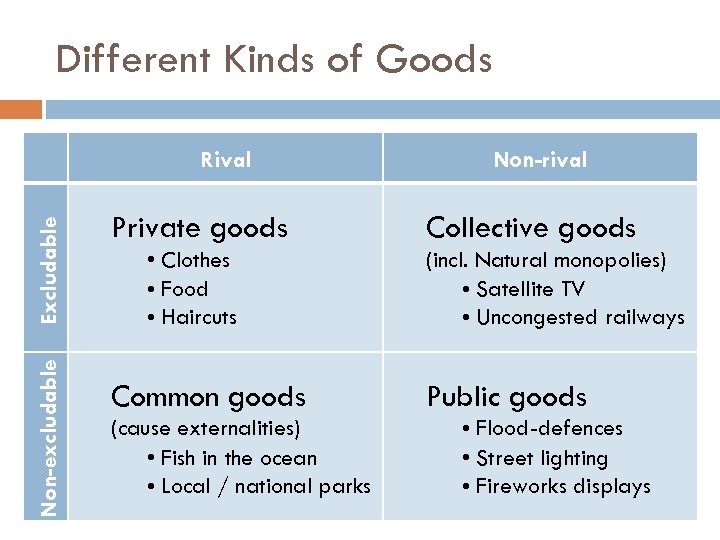

Different Kinds of Goods Non-excludable Excludable Rival Non Private goods • Clothes • Food • Haircuts Common goods (cause externalities) • Fish in the ocean • Local / national parks Non-rival Collective goods (incl. Natural monopolies) • Satellite TV • Uncongested railways Public goods • Flood-defences • Street lighting • Fireworks displays

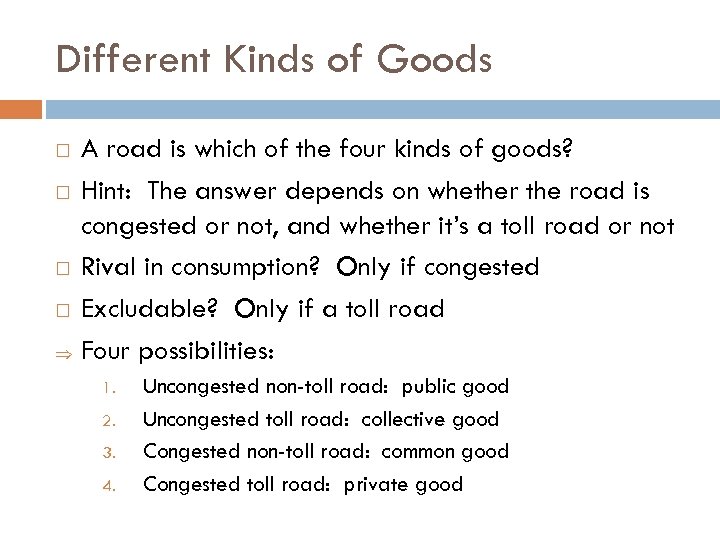

Different Kinds of Goods A road is which of the four kinds of goods? Hint: The answer depends on whether the road is congested or not, and whether it’s a toll road or not Rival in consumption? Only if congested Excludable? Only if a toll road Þ Four possibilities: 1. 2. 3. 4. Uncongested non-toll road: public good Uncongested toll road: collective good Congested non-toll road: common good Congested toll road: private good

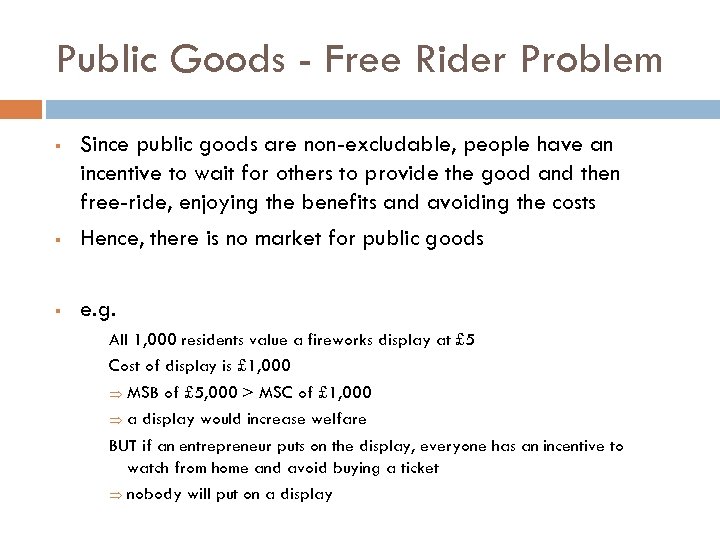

Public Goods - Free Rider Problem § Since public goods are non-excludable, people have an incentive to wait for others to provide the good and then free-ride, enjoying the benefits and avoiding the costs Hence, there is no market for public goods § e. g. § All 1, 000 residents value a fireworks display at £ 5 Cost of display is £ 1, 000 Þ MSB of £ 5, 000 > MSC of £ 1, 000 Þ a display would increase welfare BUT if an entrepreneur puts on the display, everyone has an incentive to watch from home and avoid buying a ticket Þ nobody will put on a display

Public Goods – Solutions Private provision § Funding by donation § Sale of by-products § Private contracting § Development of exclusion technologies Public provision § Fund by taxation • • How to tax least inefficiently Assessing the benefits of public goods

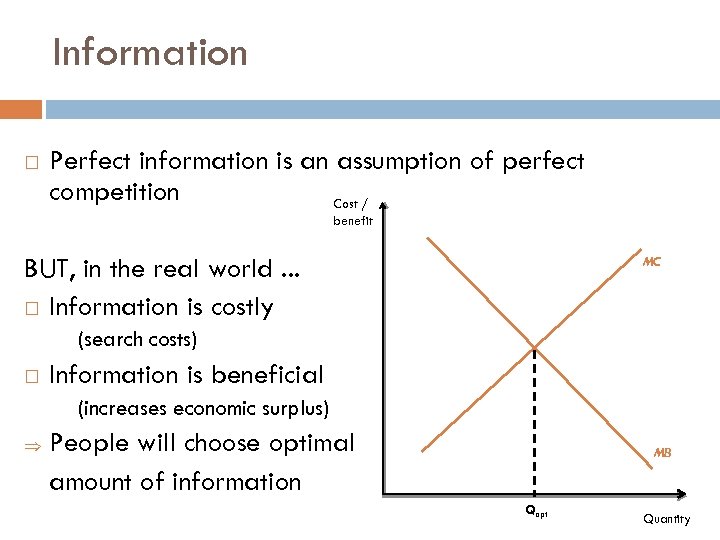

Information Perfect information is an assumption of perfect competition Cost / benefit BUT, in the real world. . . Information is costly MC (search costs) Information is beneficial (increases economic surplus) Þ People will choose optimal amount of information MB Qopt Quantity

Asymmetric Information Where buyers and sellers are not equally informed about the characteristics of products or services

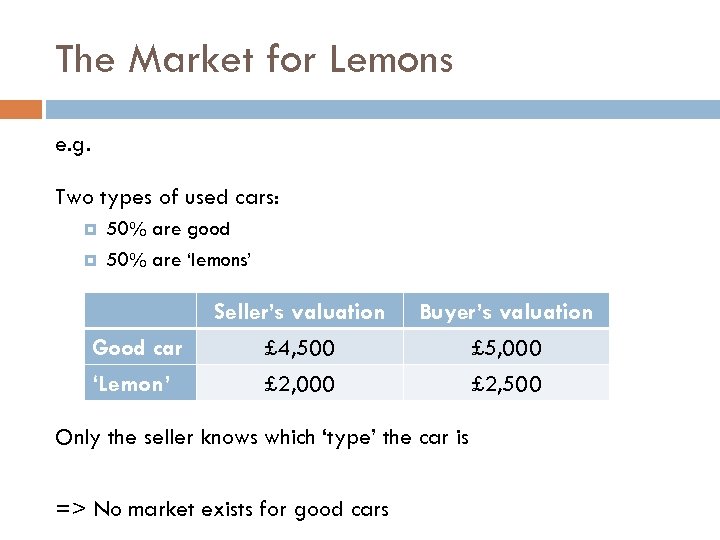

The Market for Lemons e. g. Two types of used cars: 50% are good 50% are ‘lemons’ Good car ‘Lemon’ Seller’s valuation £ 4, 500 £ 2, 000 Buyer’s valuation £ 5, 000 £ 2, 500 Only the seller knows which ‘type’ the car is => No market exists for good cars

Signaling Credibility problem – all sellers have incentive to signal highquality Þ A credible signal must be cheap for a high-quality seller BUT costly-to-fake for a low-quality seller e. g: warranties on used cars marble banking halls academic qualifications conspicuous consumption N. B. Signals may solve the problem of asymmetric information, but can be very costly

Adverse Selection e. g. Alun lives in Penmachno, a small village where he knows almost everyone. Bryn lives in Clapham, a busy area of south London where he knows less than 1% of the population. Both own exactly the same bike (£ 300 replacement cost) which they use to go to work, go to the pub etc. They often leave their bikes locked up on the street. Both see an advert for full bike theft insurance (£ 50 per year) Who is more likely to buy the insurance?

Moral Hazard e. g. Cerys and Delyth are going on holiday to Rome for the weekend. Cerys has taken out comprehensive travel insurance. Delyth decided it was too expensive to take out travel insurance. Who is more likely to walk around Rome with all their valuables in a handbag?

Adverse Selection Insurance is purchased disproportionately by people who’s innate characteristics make them inherently more risky. Because these people are more costly to insure, insurance companies have to raise their premiums. This further discourages low-risk individuals from buying insurance. Solutions to the problem – assess the characteristics of potential customers: qualifying criteria e. g. medical tests statistical discrimination e. g. postcode pricing

Moral Hazard Insured people tend to engage in more risky activities. These activities are costly to the insurance companies, who therefore have to charge higher premiums. Solutions to the problem – discourage or prevent people from engaging in such activities: required behaviour Incomplete insurance e. g. prescribed security e. g. charging an excess

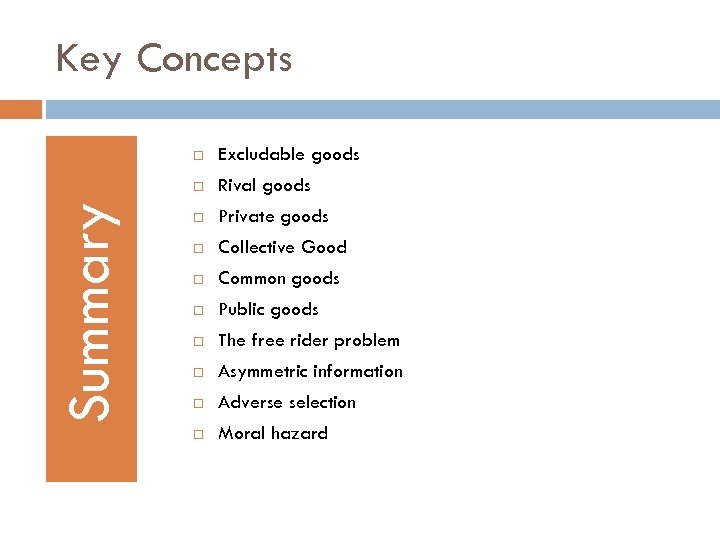

Key Concepts Excludable goods Summary Rival goods Private goods Collective Good Common goods Public goods The free rider problem Asymmetric information Adverse selection Moral hazard

cf5731949a9a17407cfd78018d7441eb.ppt