01f5d7b50bb3dc075ffb299355533423.ppt

- Количество слайдов: 76

Market Equilibrium and Product Price: Imperfect Competition Chapter 9

Discussion Topics üMarket structure characteristics üImperfect competition in selling üImperfect competition in buying üMarket structure in livestock industry üGovernmental regulatory measures

Market Structure Characteristics üNumber of firms and size distribution üProduct differentiation üBarriers to entry üPicture here tells a tale of two markets (no. 2 yellow corn vs. farm equipment) Pages 145 -146

Market Structure Characteristics § § Number of firms and size distribution Product differentiation Barriers to entry Existing economic environment (the conditions of supply and demand) Pages 145 -146

Four common barriers to entry include: • • Absolute unit-cost advantages Economies of scale Capital access and cost Preferential government policies

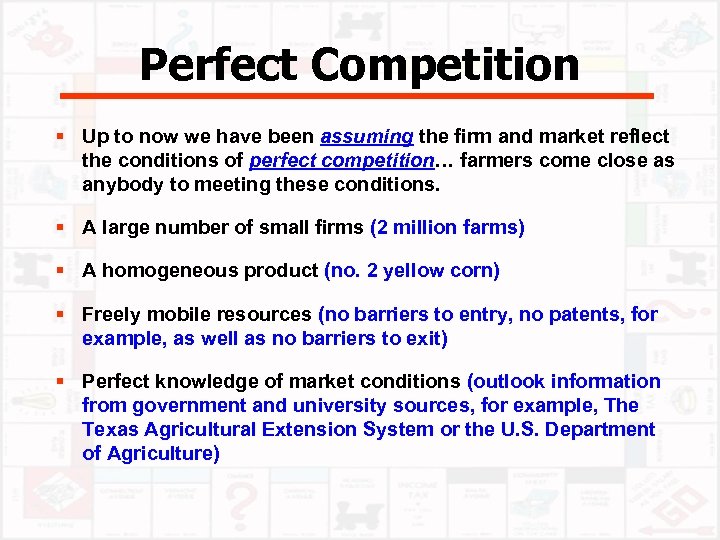

Perfect Competition § Up to now we have been assuming the firm and market reflect the conditions of perfect competition… farmers come close as anybody to meeting these conditions. § A large number of small firms (2 million farms) § A homogeneous product (no. 2 yellow corn) § Freely mobile resources (no barriers to entry, no patents, for example, as well as no barriers to exit) § Perfect knowledge of market conditions (outlook information from government and university sources, for example, The Texas Agricultural Extension System or the U. S. Department of Agriculture)

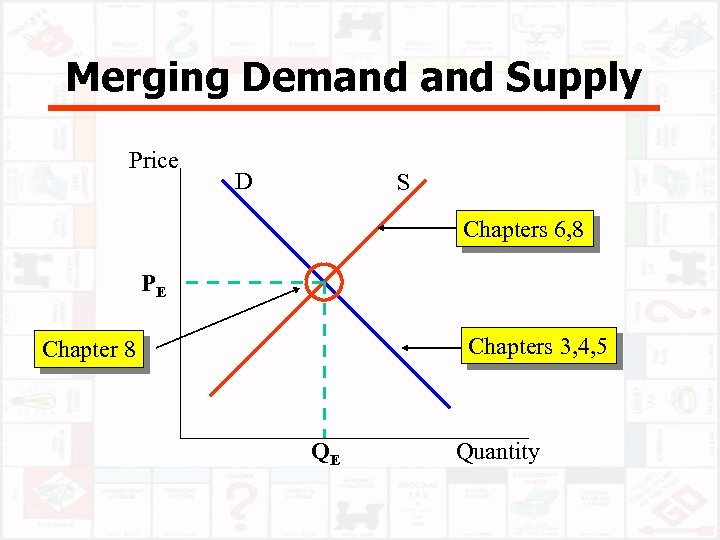

Merging Demand Supply Price D S Chapters 6, 8 PE Chapters 3, 4, 5 Chapter 8 QE Quantity

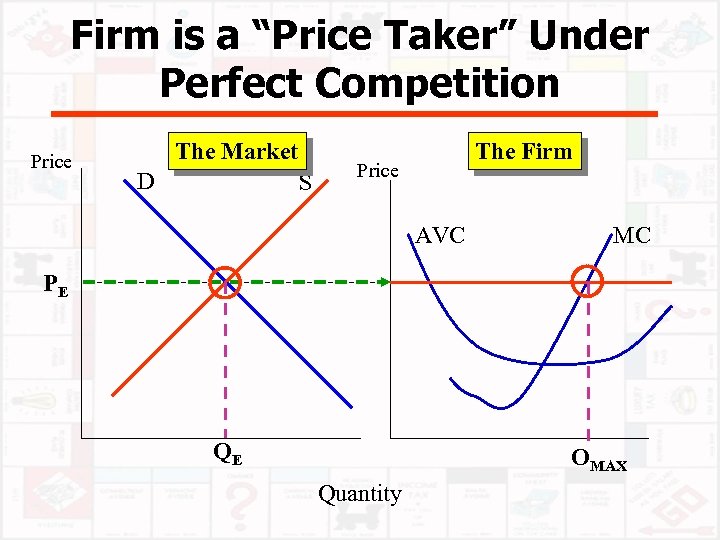

Firm is a “Price Taker” Under Perfect Competition Price The Market D S The Firm Price AVC MC PE QE OMAX Quantity

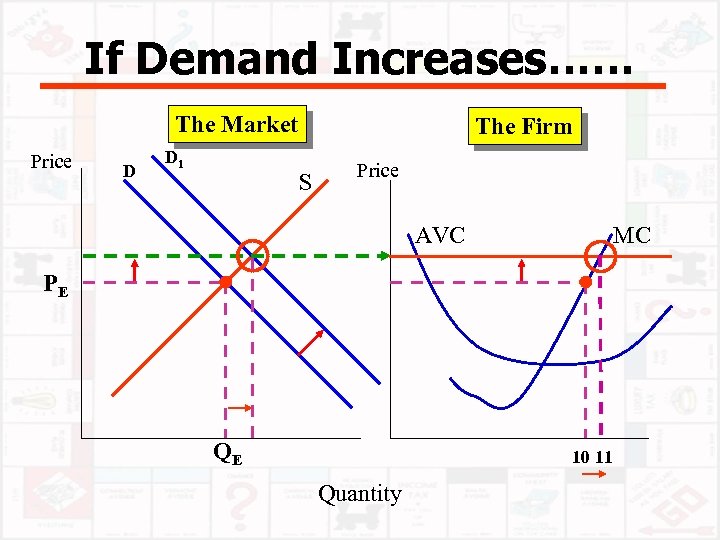

If Demand Increases…… The Market Price D D 1 The Firm S Price AVC MC PE QE 10 11 Quantity

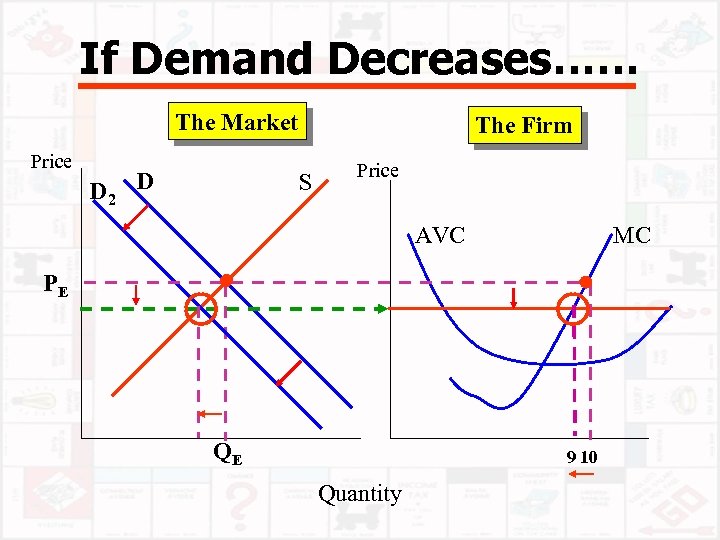

If Demand Decreases…… The Market Price D 2 D The Firm S Price AVC MC PE QE 9 10 Quantity

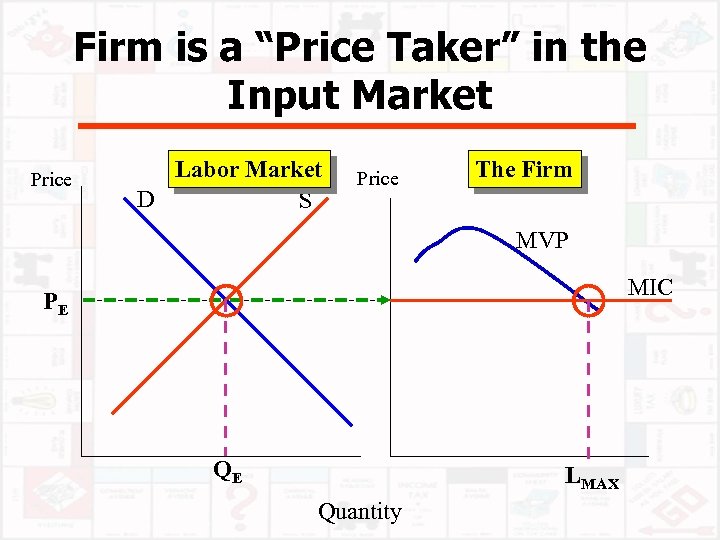

Firm is a “Price Taker” in the Input Market Price Labor Market D S Price The Firm MVP MIC PE QE LMAX Quantity

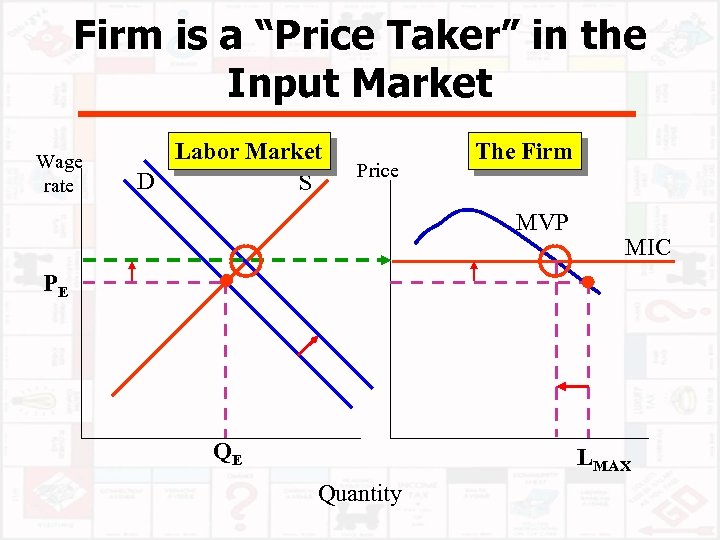

Firm is a “Price Taker” in the Input Market Wage rate Labor Market D S Price The Firm MVP MIC PE QE LMAX Quantity

Imperfect Competition in Selling

Imperfect Competition ü Many of the markets in which farmers buy inputs and sell their products however do not meet these conditions

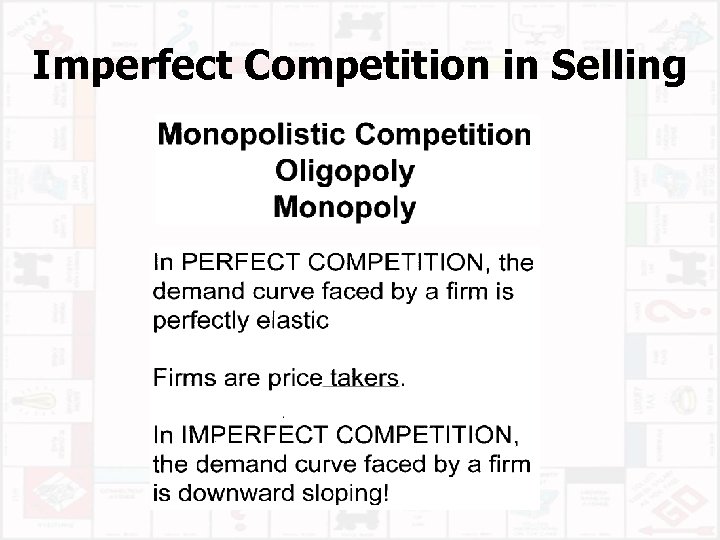

Imperfect Competition in Selling

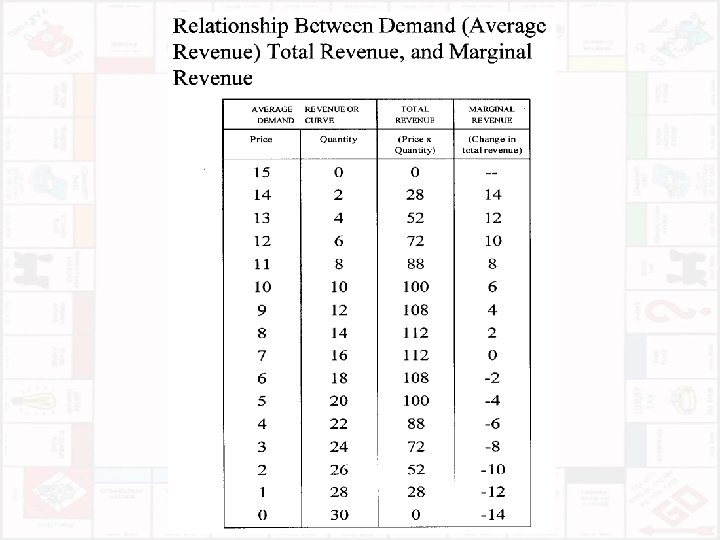

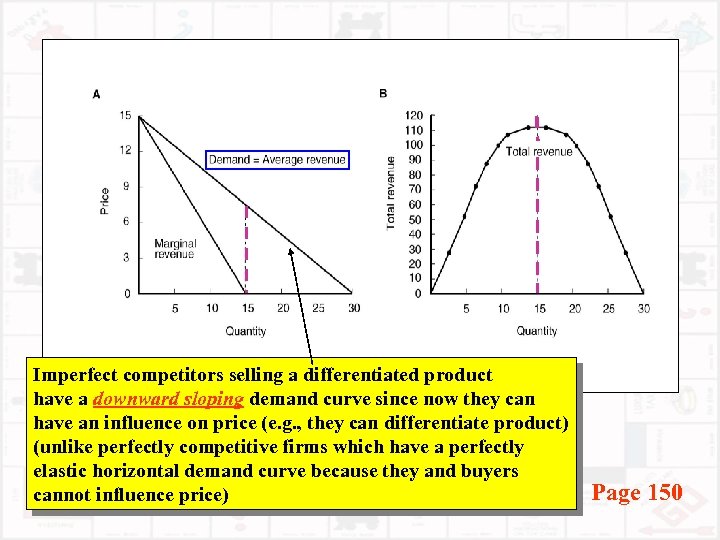

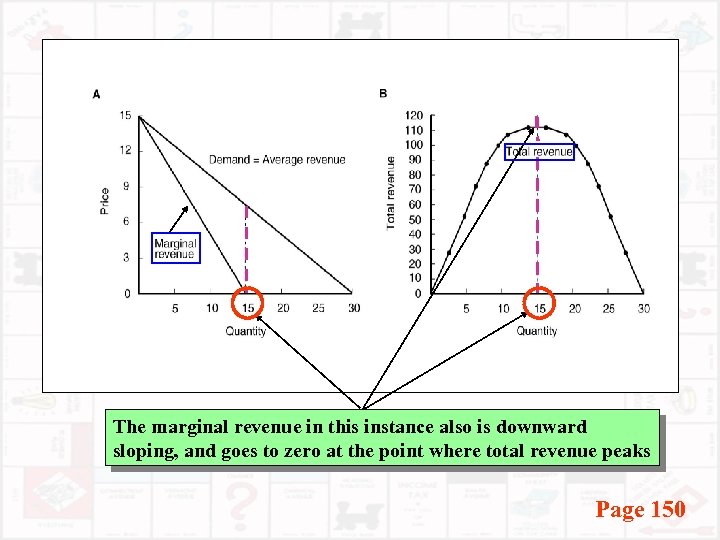

Imperfect competitors selling a differentiated product have a downward sloping demand curve since now they can have an influence on price (e. g. , they can differentiate product) (unlike perfectly competitive firms which have a perfectly elastic horizontal demand curve because they and buyers cannot influence price) Page 150

The marginal revenue in this instance also is downward sloping, and goes to zero at the point where total revenue peaks Page 150

Types of Imperfect Competitors on the Selling Side 1. Monopolistic competition 2. Oligopoly 3. Monopoly Let’s start here…

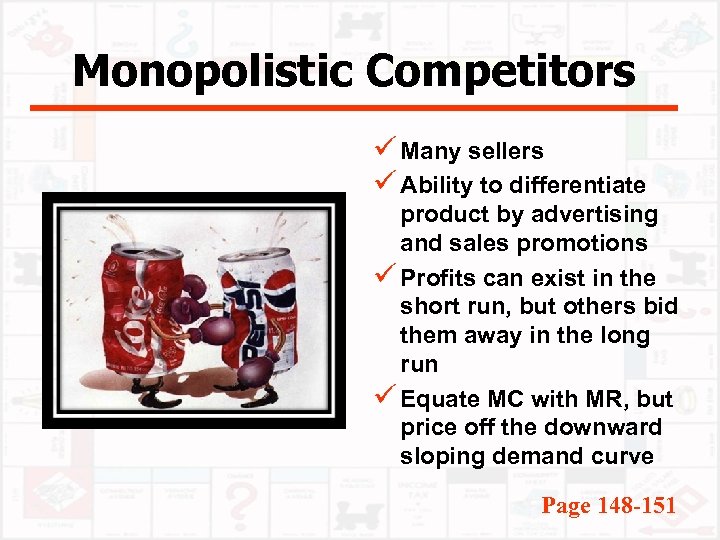

Monopolistic Competitors ü Many sellers ü Ability to differentiate product by advertising and sales promotions ü Profits can exist in the short run, but others bid them away in the long run ü Equate MC with MR, but price off the downward sloping demand curve Page 148 -151

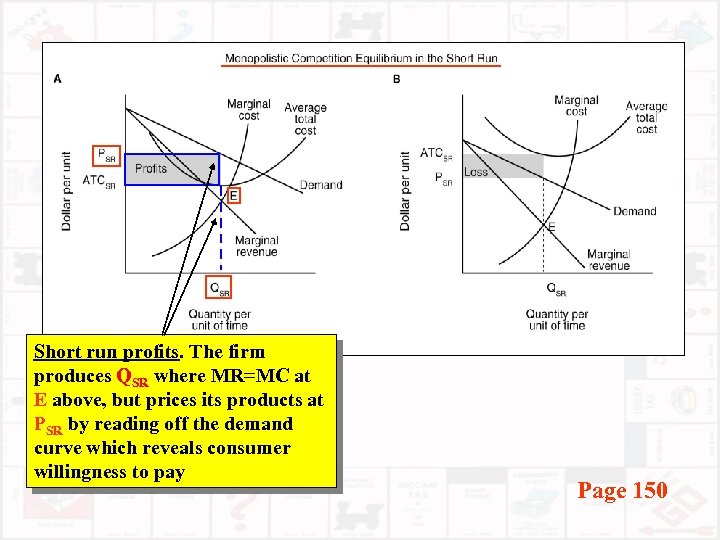

Short run profits. The firm produces QSR where MR=MC at E above, but prices its products at PSR by reading off the demand curve which reveals consumer willingness to pay Page 150

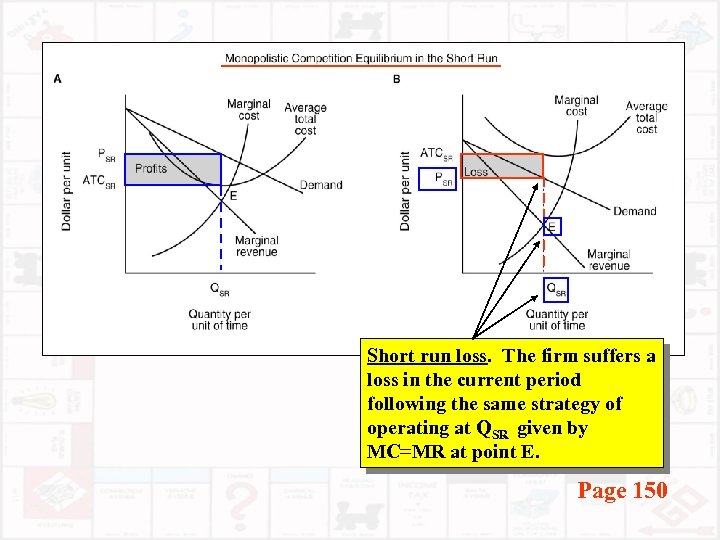

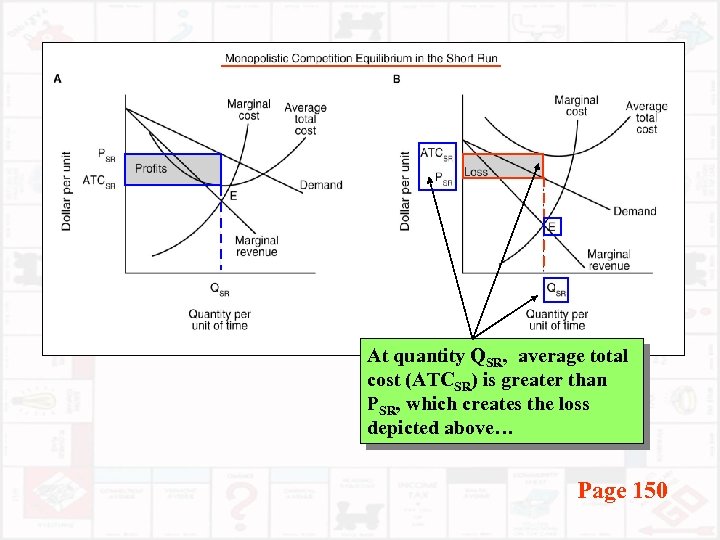

Short run loss. The firm suffers a loss in the current period following the same strategy of operating at QSR given by MC=MR at point E. Page 150

At quantity QSR, average total cost (ATCSR) is greater than PSR, which creates the loss depicted above… Page 150

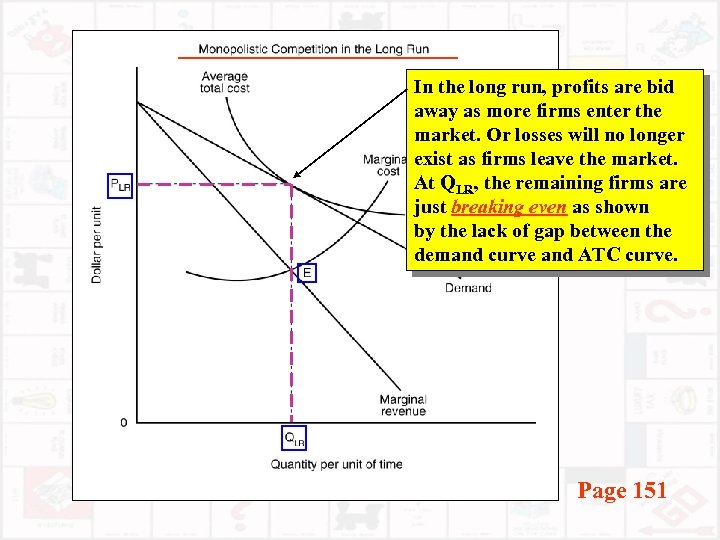

In the long run, profits are bid away as more firms enter the market. Or losses will no longer exist as firms leave the market. At QLR, the remaining firms are just breaking even as shown by the lack of gap between the demand curve and ATC curve. Page 151

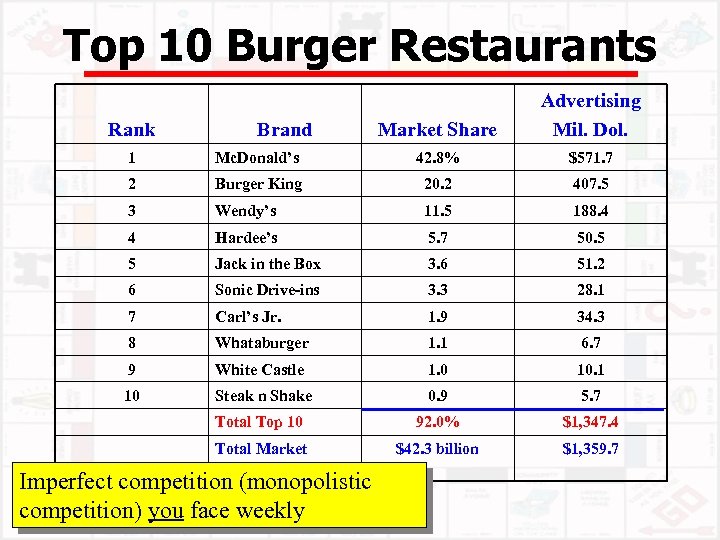

Top 10 Burger Restaurants Rank Brand Market Share Advertising Mil. Dol. 1 Mc. Donald’s 42. 8% $571. 7 2 Burger King 20. 2 407. 5 3 Wendy’s 11. 5 188. 4 4 Hardee’s 5. 7 50. 5 5 Jack in the Box 3. 6 51. 2 6 Sonic Drive-ins 3. 3 28. 1 7 Carl’s Jr. 1. 9 34. 3 8 Whataburger 1. 1 6. 7 9 White Castle 1. 0 10. 1 10 Steak n Shake 0. 9 5. 7 Total Top 10 92. 0% $1, 347. 4 Total Market $42. 3 billion $1, 359. 7 Imperfect competition (monopolistic competition) you face weekly

Oligopolies ü A few number of sellers, each of which is large enough to have influence on market volume and price ü Non-price competition between oligopolists ü Match price cuts but not price increases by fellow oligopolists ü Like monopolistic competitors, they have some ability to set market prices Pages 152 -155

Examples of Oligopolists Ø Farm machinery manufacturers Ø Domestic automobile industry Ø Domestic airline industry Ø Pesticide and fertilizer industry Products sold are largely identified or differentiated by company brand or name.

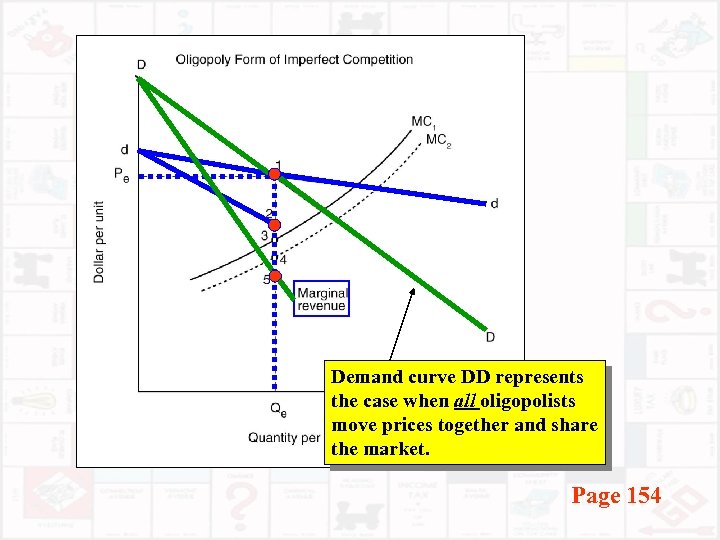

Demand curve DD represents the case when all oligopolists move prices together and share the market. Page 154

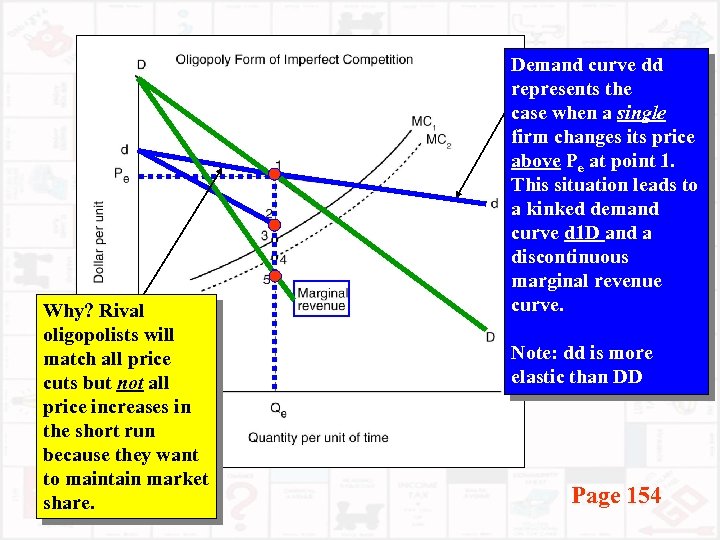

Why? Rival oligopolists will match all price cuts but not all price increases in the short run because they want to maintain market share. Demand curve dd represents the case when a single firm changes its price above Pe at point 1. This situation leads to a kinked demand curve d 1 D and a discontinuous marginal revenue curve. Note: dd is more elastic than DD Page 154

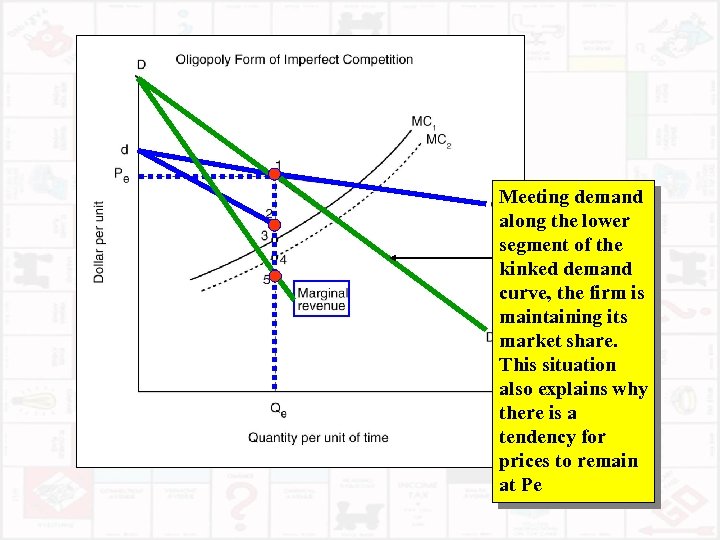

Meeting demand along the lower segment of the kinked demand curve, the firm is maintaining its market share. This situation also explains why there is a tendency for prices to remain at Pe Page 187

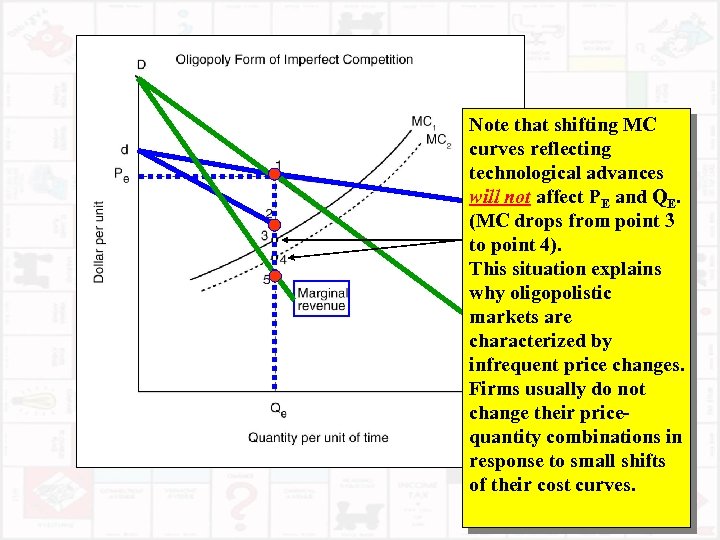

Note that shifting MC curves reflecting technological advances will not affect PE and QE. (MC drops from point 3 to point 4). This situation explains why oligopolistic markets are characterized by infrequent price changes. Firms usually do not change their pricequantity combinations in response to small shifts of their cost curves. Page 187

Monopoly (not the Parker Brothers Game) ü Only seller in the market ü Entry of other firms is restricted by patents, etc. ü They have absolute power over setting market price ü They produce a unique product ü They can make economic profits in the long run because they can set price without competition. Page 155 -158

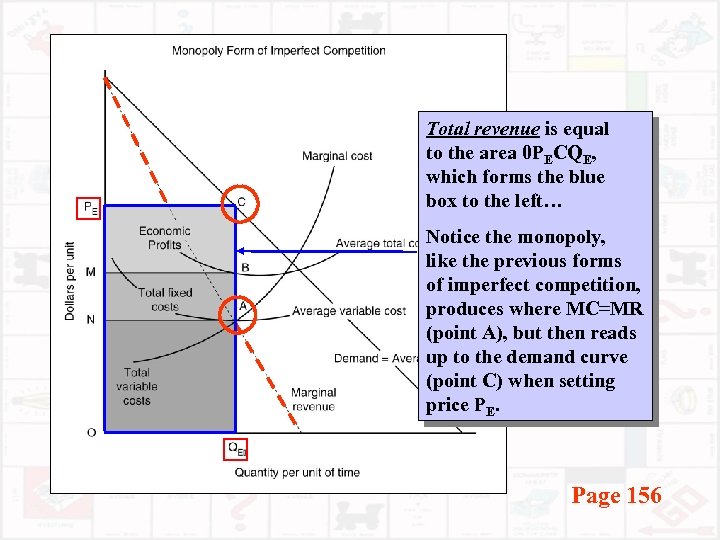

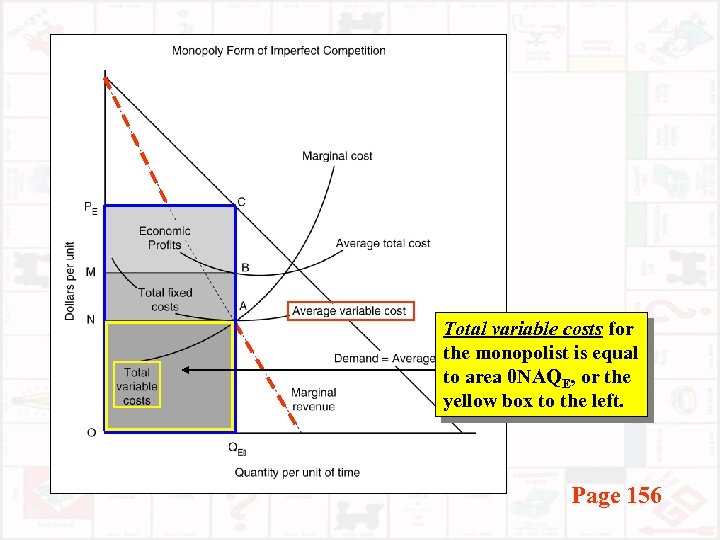

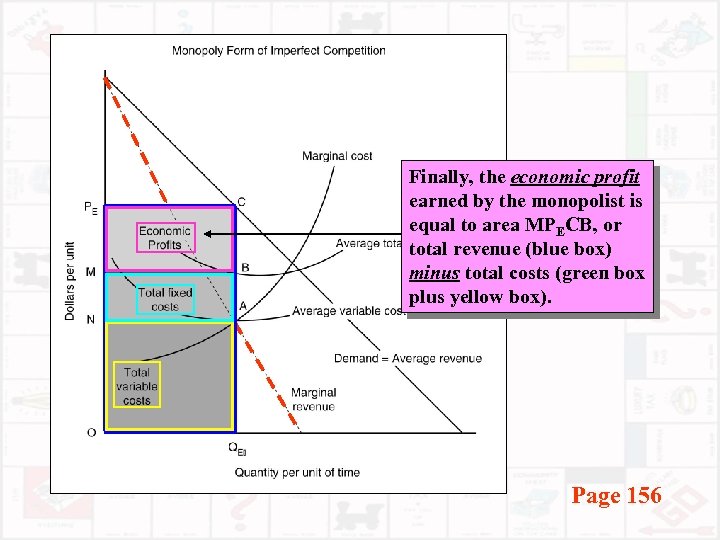

Total revenue is equal to the area 0 PECQE, which forms the blue box to the left… Notice the monopoly, like the previous forms of imperfect competition, produces where MC=MR (point A), but then reads up to the demand curve (point C) when setting price PE. Page 156

Total variable costs for the monopolist is equal to area 0 NAQE, or the yellow box to the left. Page 156

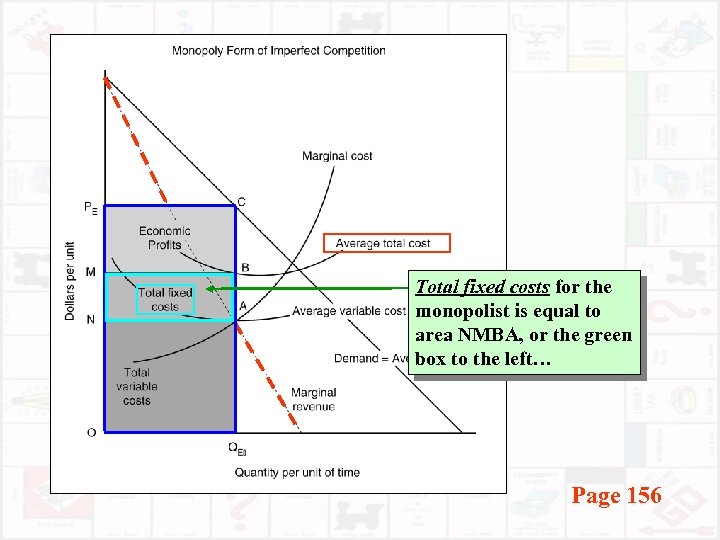

Total fixed costs for the monopolist is equal to area NMBA, or the green box to the left… Page 156

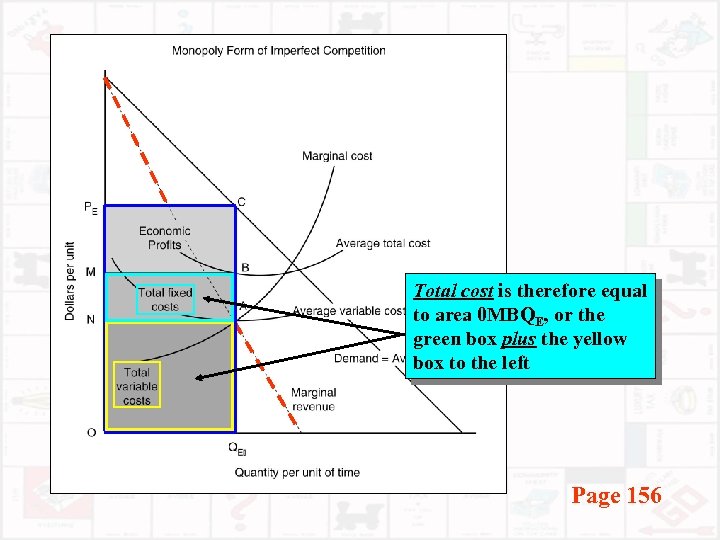

Total cost is therefore equal to area 0 MBQE, or the green box plus the yellow box to the left Page 156

Finally, the economic profit earned by the monopolist is equal to area MPECB, or total revenue (blue box) minus total costs (green box plus yellow box). Page 156

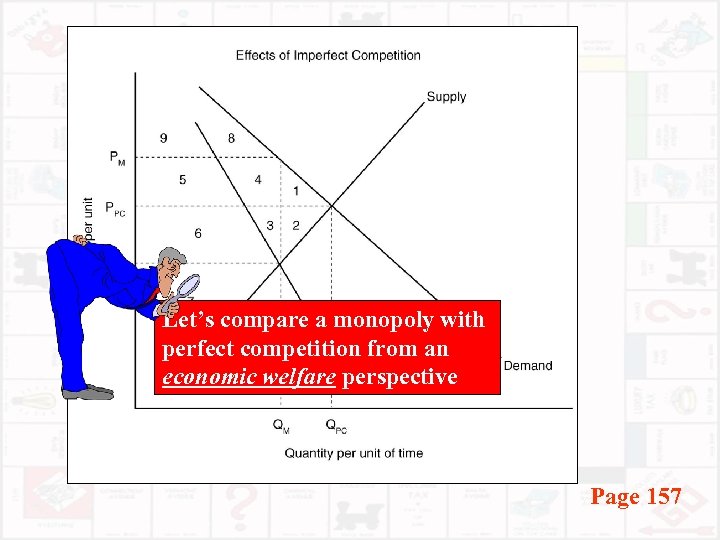

Let’s compare a monopoly with perfect competition from an economic welfare perspective Page 157

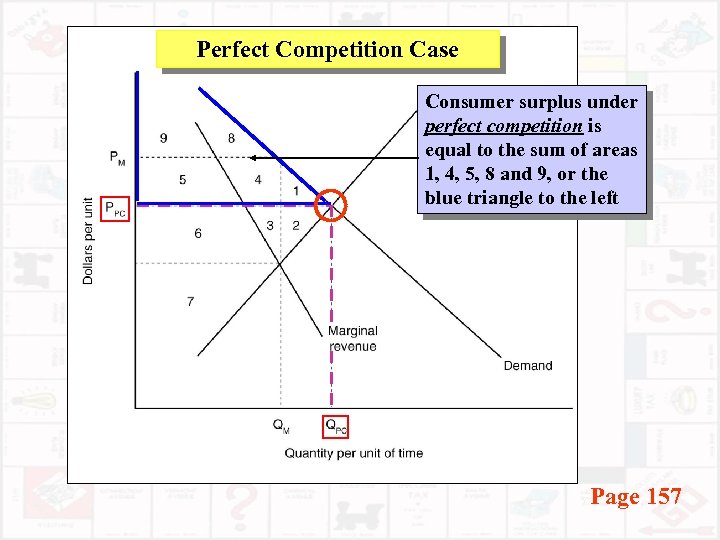

Perfect Competition Case Consumer surplus under perfect competition is equal to the sum of areas 1, 4, 5, 8 and 9, or the blue triangle to the left Page 157

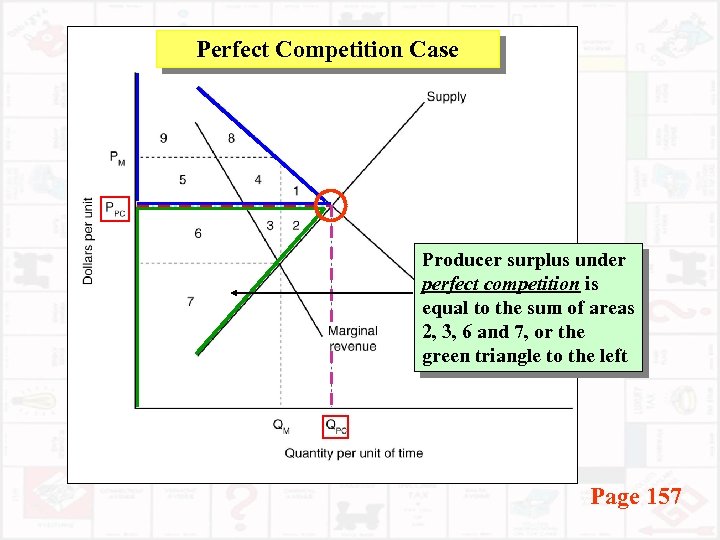

Perfect Competition Case Producer surplus under perfect competition is equal to the sum of areas 2, 3, 6 and 7, or the green triangle to the left Page 157

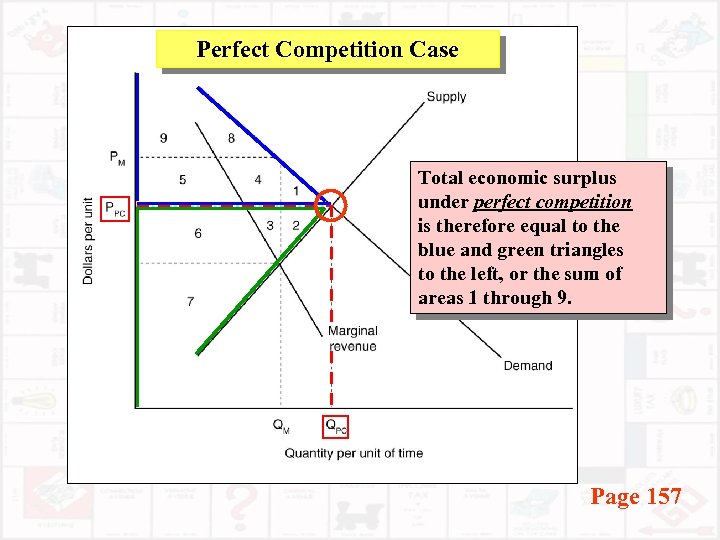

Perfect Competition Case Total economic surplus under perfect competition is therefore equal to the blue and green triangles to the left, or the sum of areas 1 through 9. Page 157

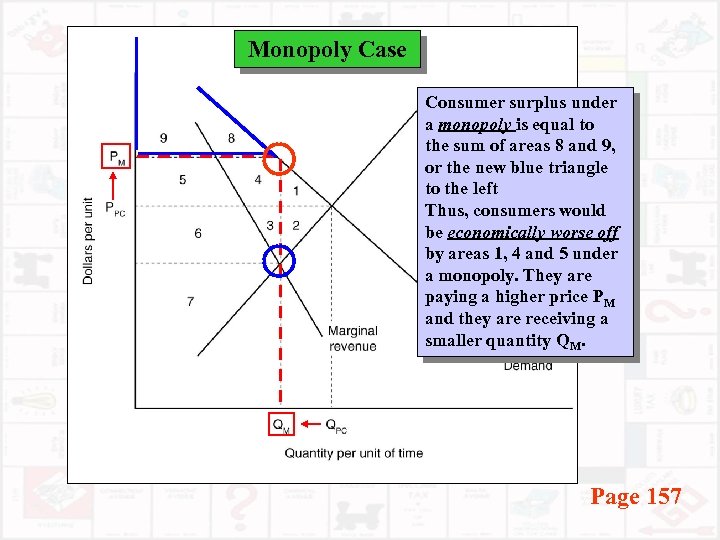

Monopoly Case Consumer surplus under a monopoly is equal to the sum of areas 8 and 9, or the new blue triangle to the left Thus, consumers would be economically worse off by areas 1, 4 and 5 under a monopoly. They are paying a higher price PM and they are receiving a smaller quantity QM. Page 157

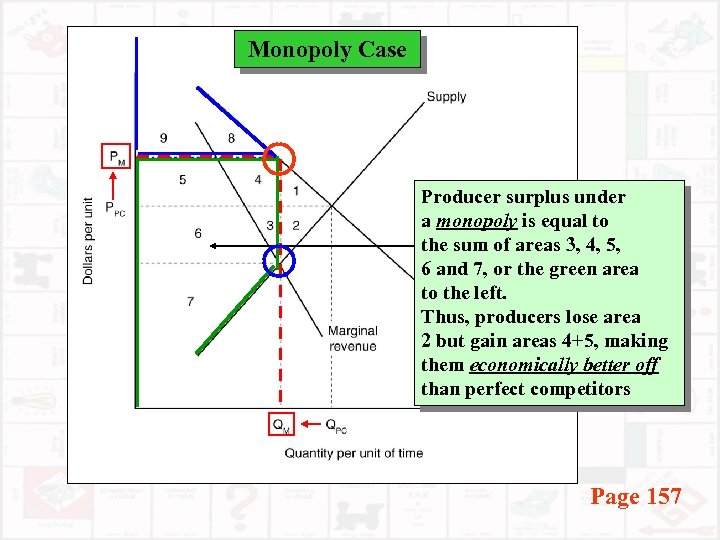

Monopoly Case Producer surplus under a monopoly is equal to the sum of areas 3, 4, 5, 6 and 7, or the green area to the left. Thus, producers lose area 2 but gain areas 4+5, making them economically better off than perfect competitors Page 157

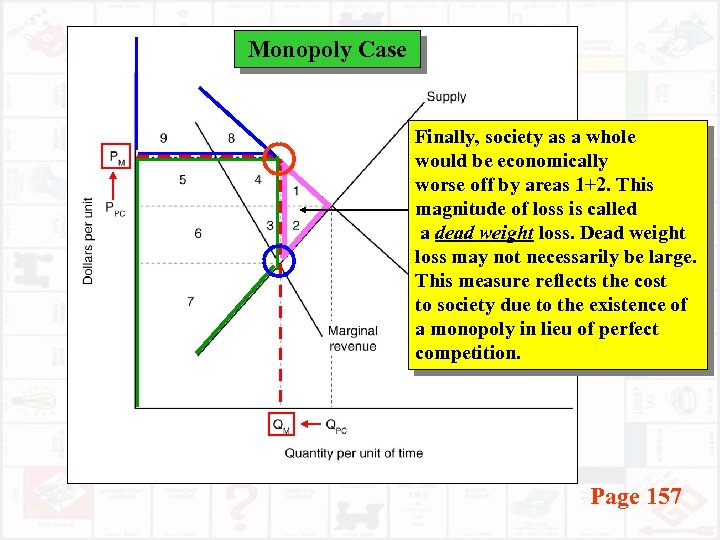

Monopoly Case Finally, society as a whole would be economically worse off by areas 1+2. This magnitude of loss is called a dead weight loss. Dead weight loss may not necessarily be large. This measure reflects the cost to society due to the existence of a monopoly in lieu of perfect competition. Page 157

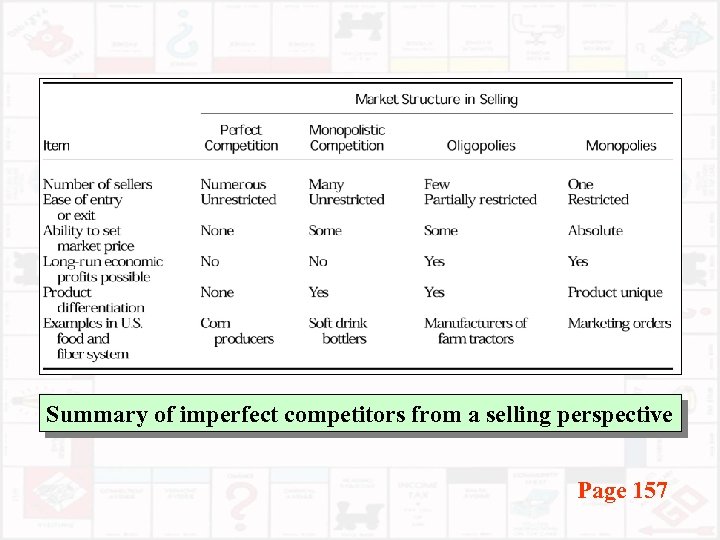

Summary of imperfect competitors from a selling perspective Page 157

Imperfect Competition in Buying

Types of Imperfect Competitors on the Buying Side 1. Monopsony 2. Monopsonistic competition 3. Oligopsony Let’s start here…

Monopsonies ü Single buyer in the market ü Focus is on the marginal input cost of purchasing an addition unit of resources ü Will equate MRP=MIC when making buying decisions ü As long as MRP>MIC, the monopsonist makes a profit Page 158 -160

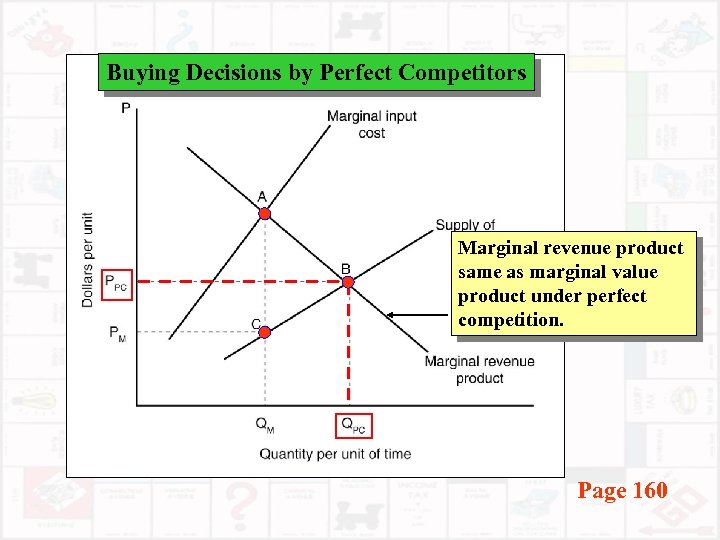

Buying Decisions by Perfect Competitors Marginal revenue product same as marginal value product under perfect competition. Page 160

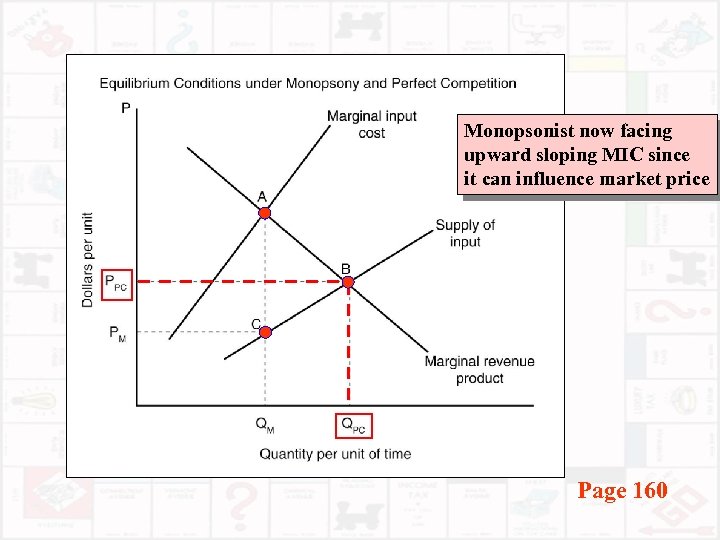

Monopsonist now facing upward sloping MIC since it can influence market price Page 160

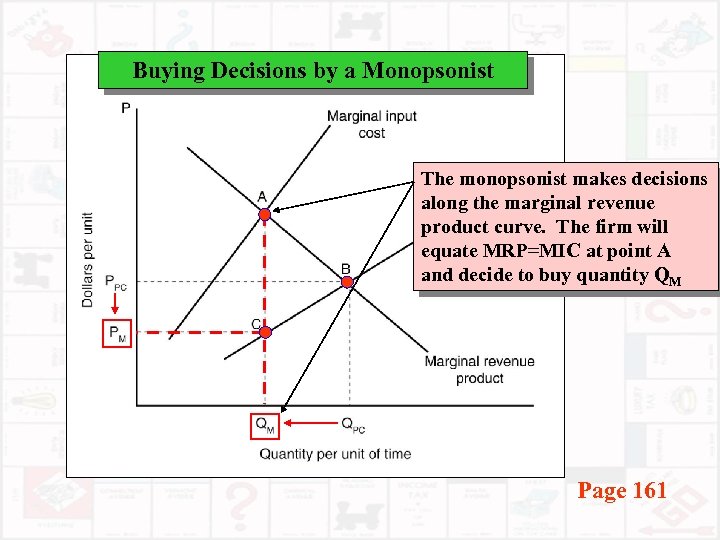

Buying Decisions by a Monopsonist The monopsonist makes decisions along the marginal revenue product curve. The firm will equate MRP=MIC at point A and decide to buy quantity QM Page 161

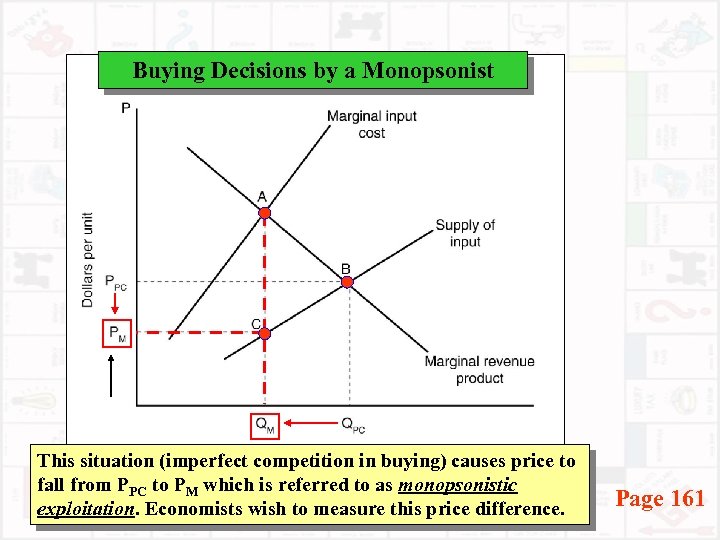

Buying Decisions by a Monopsonist This situation (imperfect competition in buying) causes price to fall from PPC to PM which is referred to as monopsonistic exploitation. Economists wish to measure this price difference. Page 161

Monopsonistic Competitors ü Many firms buying resources ü Ability to differentiate services to producers ü Differentiated services includes distribution convenience and location of facilities, willingness to provide credit or technical assistance ü P and Q determined same as monopsonist Page 161

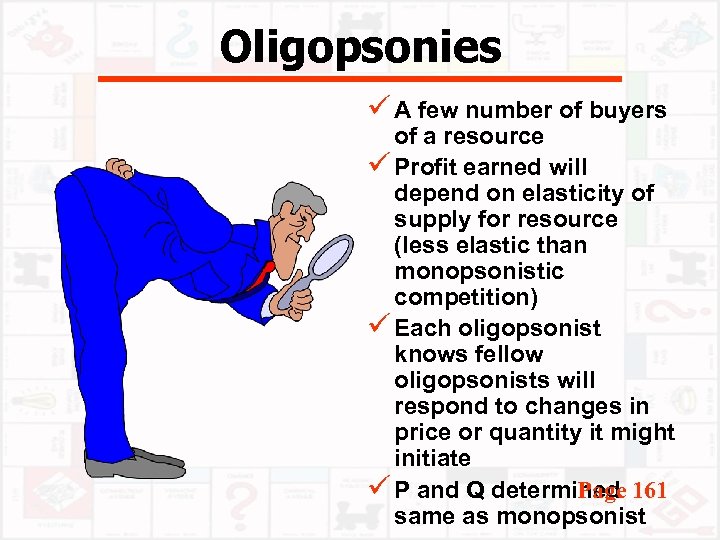

Oligopsonies ü A few number of buyers of a resource ü Profit earned will depend on elasticity of supply for resource (less elastic than monopsonistic competition) ü Each oligopsonist knows fellow oligopsonists will respond to changes in price or quantity it might initiate ü P and Q determined 161 Page same as monopsonist

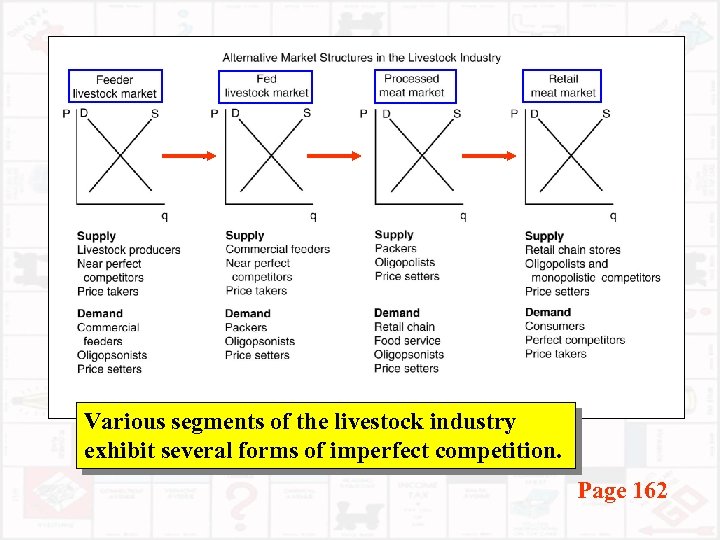

Various segments of the livestock industry exhibit several forms of imperfect competition. Page 162

Governmental Regulatory Measures Various approaches have been taken over time to counteract adverse effects of imperfect competition in the marketplace. These approaches historically include 1. Legislative acts passed by Congress, including various antitrust laws 2. Price ceilings 3. Lump-sum tax 4. Minimum prices or floors Pages 162 -166

#1: Legislative Acts Ø Sherman Anti-trust Act 1890 Ø Clayton Act 1914 Ø Packers and Stockyards Act 1921 Ø Capper-Volstead Act 1922 Ø Cooperative Marketing Act 1926 Ø Robinson-Patman Act 1936 Ø Agricultural Marketing Agreement Act 1937

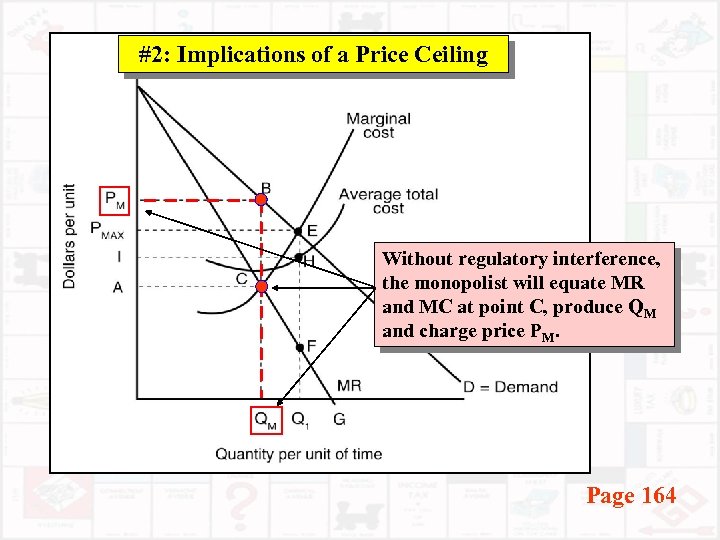

#2: Implications of a Price Ceiling Without regulatory interference, the monopolist will equate MR and MC at point C, produce QM and charge price PM. Page 164

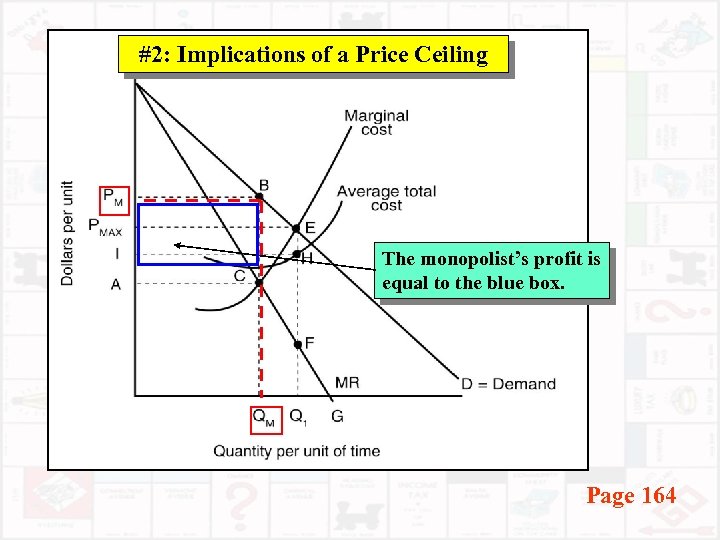

#2: Implications of a Price Ceiling The monopolist’s profit is equal to the blue box. Page 164

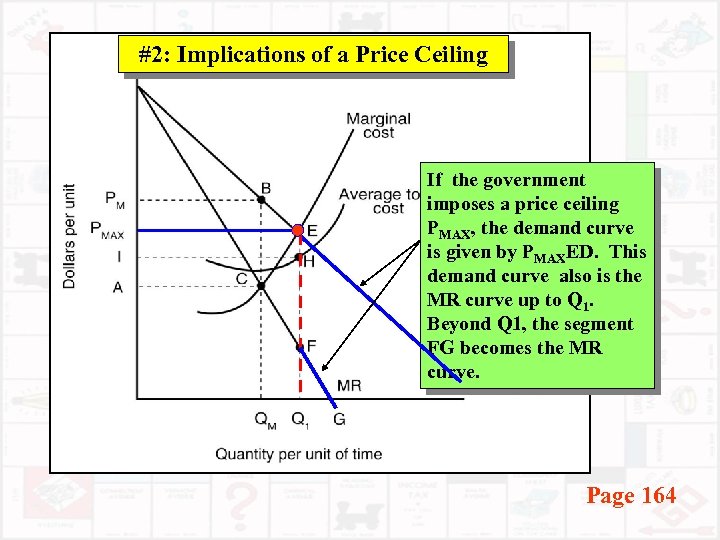

#2: Implications of a Price Ceiling If the government imposes a price ceiling PMAX, the demand curve is given by PMAXED. This demand curve also is the MR curve up to Q 1. Beyond Q 1, the segment FG becomes the MR curve. Page 164

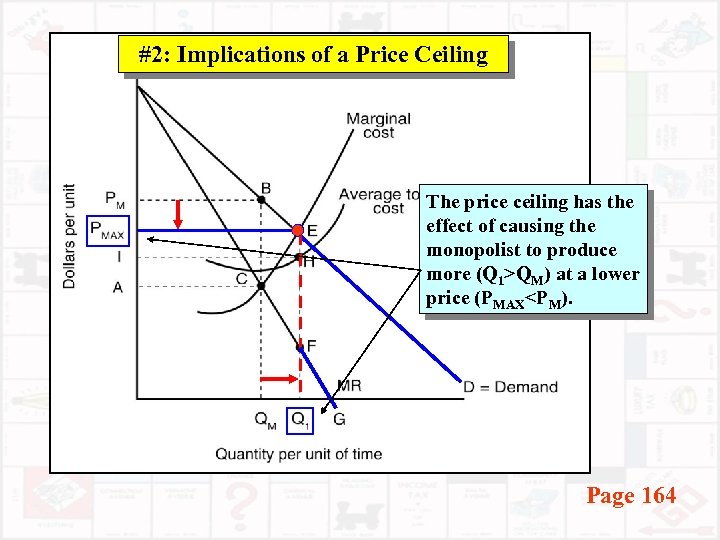

#2: Implications of a Price Ceiling The price ceiling has the effect of causing the monopolist to produce more (Q 1>QM) at a lower price (PMAX<PM). Page 164

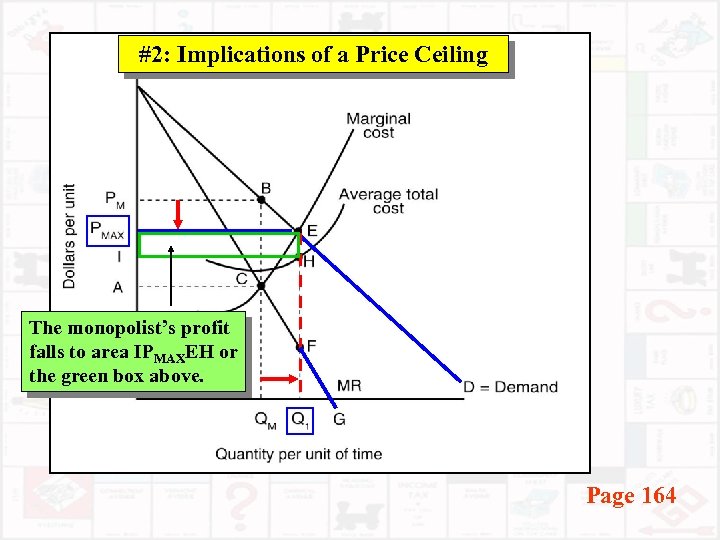

#2: Implications of a Price Ceiling The monopolist’s profit falls to area IPMAXEH or the green box above. Page 164

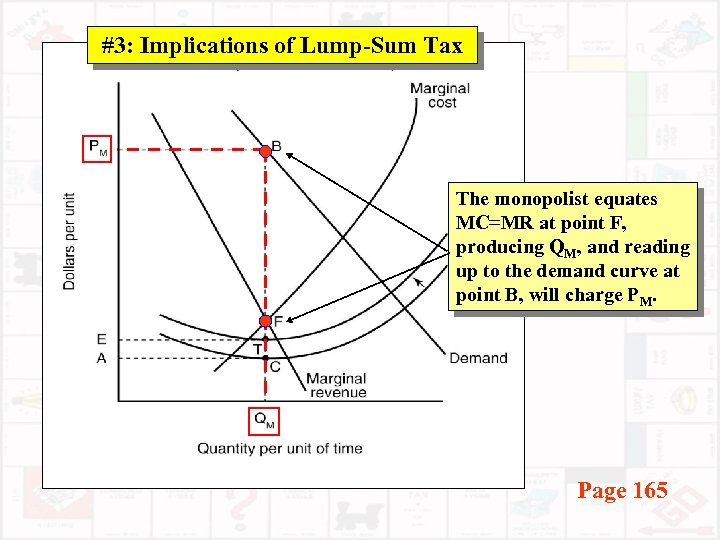

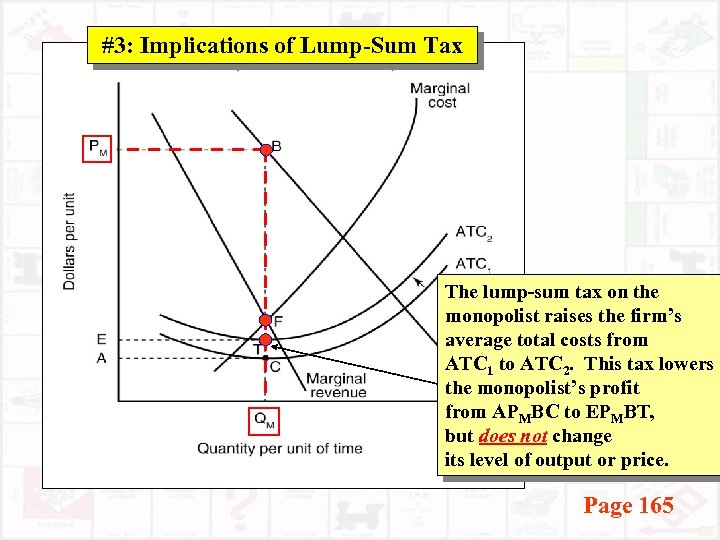

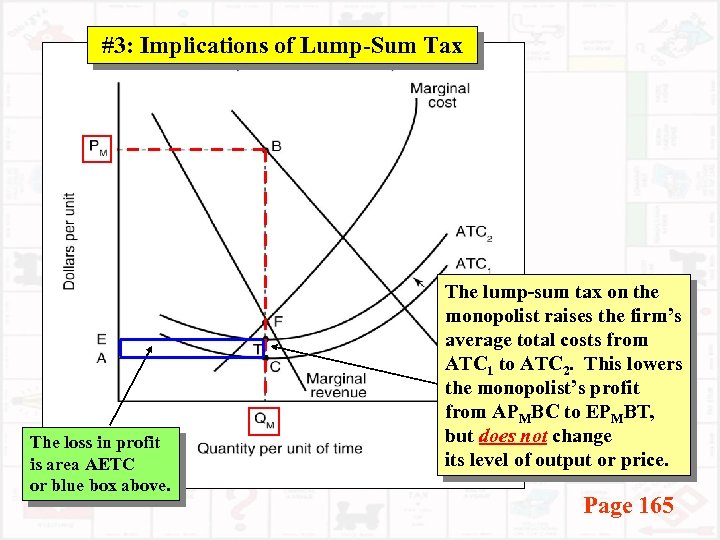

#3: Implications of Lump-Sum Tax The monopolist equates MC=MR at point F, producing QM, and reading up to the demand curve at point B, will charge PM. Page 165

#3: Implications of Lump-Sum Tax The lump-sum tax on the monopolist raises the firm’s average total costs from ATC 1 to ATC 2. This tax lowers the monopolist’s profit from APMBC to EPMBT, but does not change its level of output or price. Page 165

#3: Implications of Lump-Sum Tax The loss in profit is area AETC or blue box above. The lump-sum tax on the monopolist raises the firm’s average total costs from ATC 1 to ATC 2. This lowers the monopolist’s profit from APMBC to EPMBT, but does not change its level of output or price. Page 165

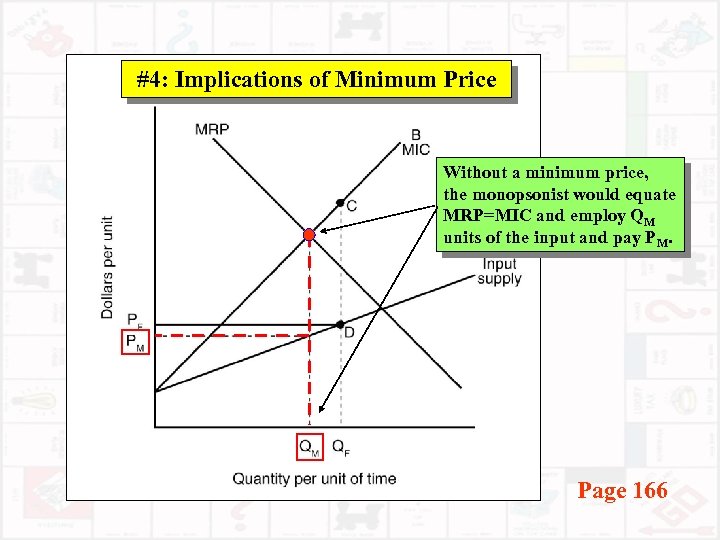

#4: Implications of Minimum Price Without a minimum price, the monopsonist would equate MRP=MIC and employ QM units of the input and pay PM. Page 166

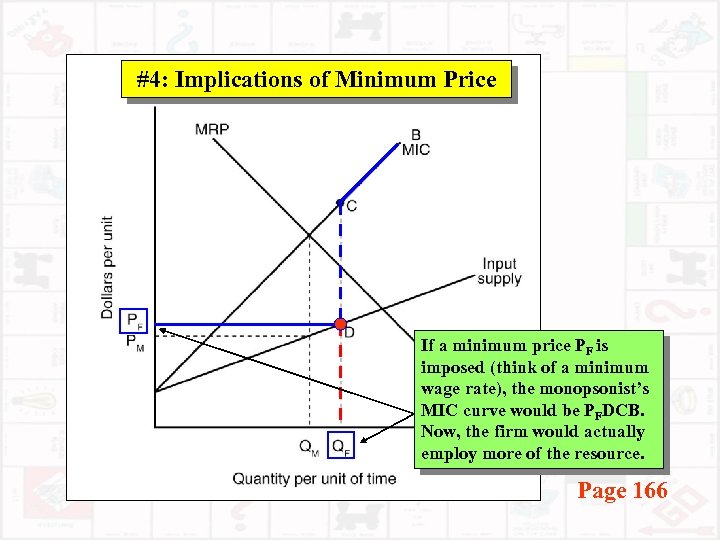

#4: Implications of Minimum Price If a minimum price PF is imposed (think of a minimum wage rate), the monopsonist’s MIC curve would be PFDCB. Now, the firm would actually employ more of the resource. Page 166

Summary ü Unlike perfect competition, imperfect competitors have ability to influence price. ü Monopolistic competitors try to differentiate their product. ü Monopolists are the only seller in their product market. Monopsonists are the only buyer. ü Oligopolies are a few number of sellers while oligopsonies are a few number of buyers. ü Know the economic welfare implications of imperfect competition at least on the selling side.

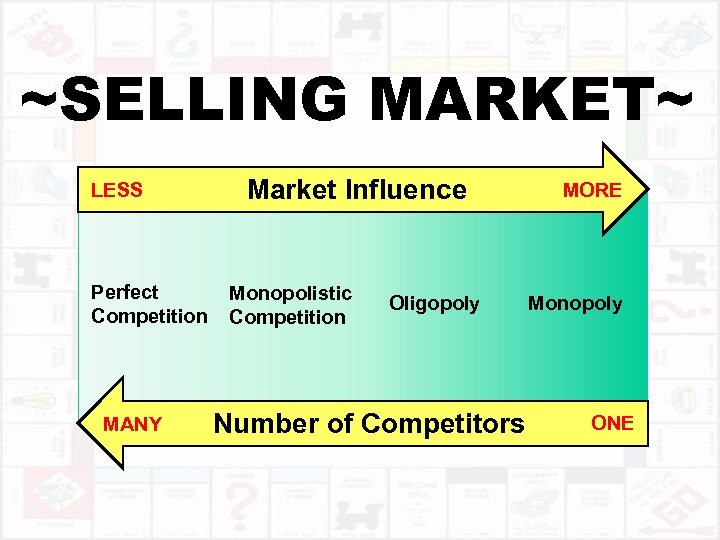

~SELLING MARKET~ LESS Perfect Competition MANY Market Influence Monopolistic Competition Oligopoly Number of Competitors MORE Monopoly ONE

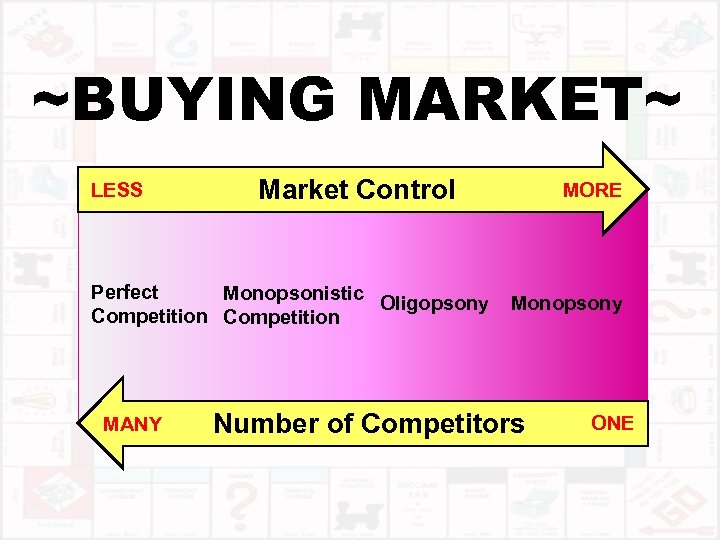

~BUYING MARKET~ LESS Market Control Perfect Monopsonistic Oligopsony Competition MANY MORE Monopsony Number of Competitors ONE

01f5d7b50bb3dc075ffb299355533423.ppt