68882f9966f8b91cb5876a240a10d1fb.ppt

- Количество слайдов: 49

Market Efficiency and Information Processing in Financial Markets Andrei Simonov Market Efficiency 1 3/16/2018

Market Efficiency and Information Processing in Financial Markets Andrei Simonov Market Efficiency 1 3/16/2018

Outline Efficient Markets Hypothesis l Predicting future returns from the past returns l – Value strategies – Momentum Strategies l Analysts & Information dissemination Market Efficiency 2 3/16/2018

Outline Efficient Markets Hypothesis l Predicting future returns from the past returns l – Value strategies – Momentum Strategies l Analysts & Information dissemination Market Efficiency 2 3/16/2018

Efficient Market Hypothesis (EMH) Do security prices reflect information ? l Why look at market efficiency l – Implications for business and corporate finance l Mitigation of agency problems: market sees through – Implications for investment l Impossibility to ”beat the market” Market Efficiency 3 3/16/2018

Efficient Market Hypothesis (EMH) Do security prices reflect information ? l Why look at market efficiency l – Implications for business and corporate finance l Mitigation of agency problems: market sees through – Implications for investment l Impossibility to ”beat the market” Market Efficiency 3 3/16/2018

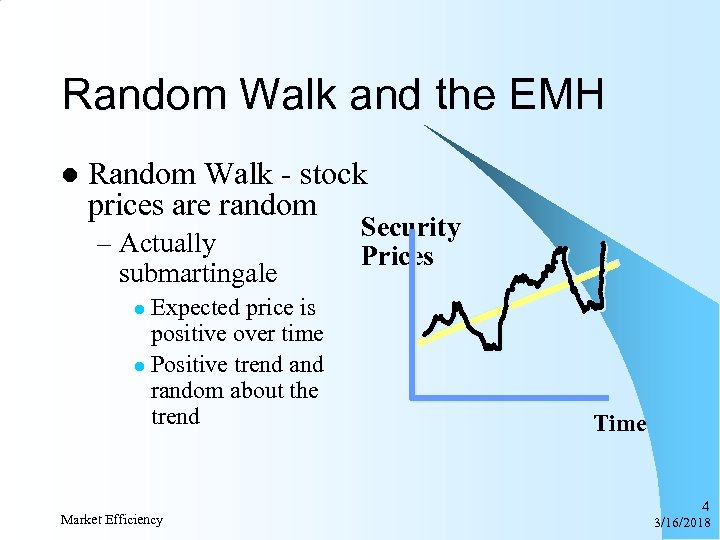

Random Walk and the EMH l Random Walk - stock prices are random – Actually submartingale Expected price is positive over time l Positive trend and random about the trend Security Prices l Market Efficiency Time 4 3/16/2018

Random Walk and the EMH l Random Walk - stock prices are random – Actually submartingale Expected price is positive over time l Positive trend and random about the trend Security Prices l Market Efficiency Time 4 3/16/2018

Random Price Changes Why are price changes random? l Prices react to information l Flow of information is random l Therefore, price changes are random Market Efficiency 5 3/16/2018

Random Price Changes Why are price changes random? l Prices react to information l Flow of information is random l Therefore, price changes are random Market Efficiency 5 3/16/2018

Market Efficiency 6 3/16/2018

Market Efficiency 6 3/16/2018

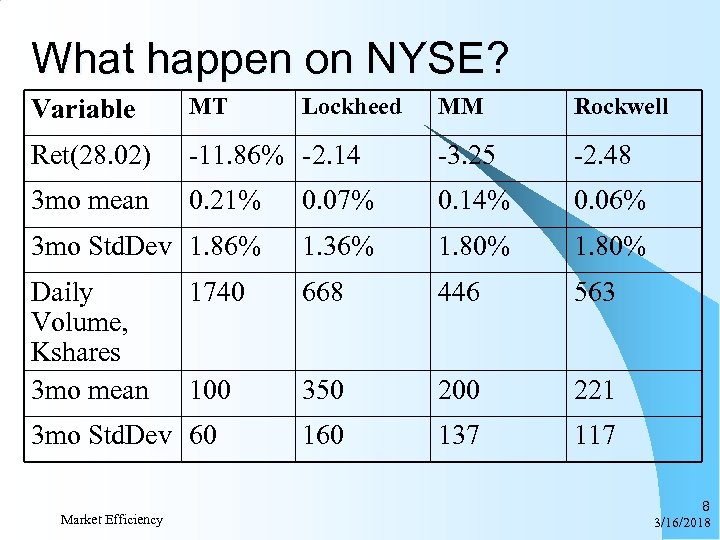

Case study: Challenger Disaster l l l Jan 28, 1986 at 11: 39 am Shuttle explodes on live TV Four companies involved: Rockwell, Martin Marietta, Morton Thiokol and Lockheed. Trading is suspended for 90 min, companies are in ”no comments” mode. Feb. 2 nd: first mention of faulty seals Feb. 5 th: First time MT is mentioned as prime suspect March 31 st: Problems with O-rings reported by Fortune. Market Efficiency 7 3/16/2018

Case study: Challenger Disaster l l l Jan 28, 1986 at 11: 39 am Shuttle explodes on live TV Four companies involved: Rockwell, Martin Marietta, Morton Thiokol and Lockheed. Trading is suspended for 90 min, companies are in ”no comments” mode. Feb. 2 nd: first mention of faulty seals Feb. 5 th: First time MT is mentioned as prime suspect March 31 st: Problems with O-rings reported by Fortune. Market Efficiency 7 3/16/2018

What happen on NYSE? Variable MT Ret(28. 02) 3 mo mean MM Rockwell -11. 86% -2. 14 -3. 25 -2. 48 0. 21% 0. 07% 0. 14% 0. 06% 3 mo Std. Dev 1. 86% 1. 36% 1. 80% Daily Volume, Kshares 3 mo mean 1740 668 446 563 100 350 200 221 160 137 117 3 mo Std. Dev 60 Market Efficiency Lockheed 8 3/16/2018

What happen on NYSE? Variable MT Ret(28. 02) 3 mo mean MM Rockwell -11. 86% -2. 14 -3. 25 -2. 48 0. 21% 0. 07% 0. 14% 0. 06% 3 mo Std. Dev 1. 86% 1. 36% 1. 80% Daily Volume, Kshares 3 mo mean 1740 668 446 563 100 350 200 221 160 137 117 3 mo Std. Dev 60 Market Efficiency Lockheed 8 3/16/2018

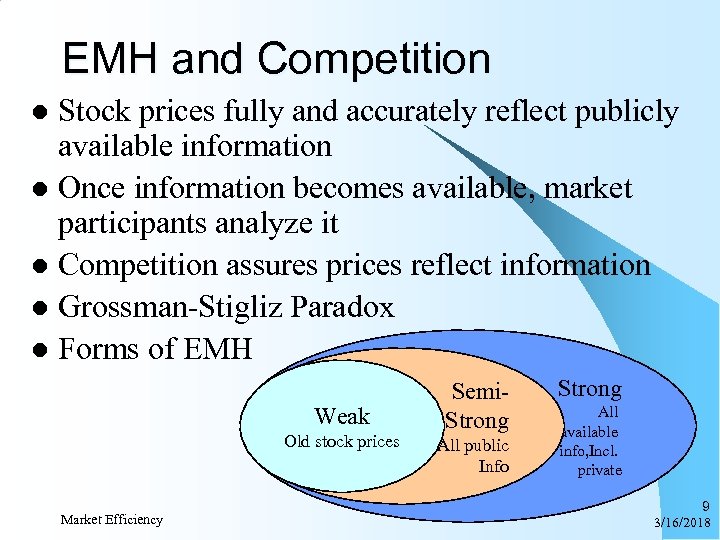

EMH and Competition Stock prices fully and accurately reflect publicly available information l Once information becomes available, market participants analyze it l Competition assures prices reflect information l Grossman-Stigliz Paradox l Forms of EMH l Weak Old stock prices Market Efficiency Semi. Strong All public Info Strong All available info, Incl. private 9 3/16/2018

EMH and Competition Stock prices fully and accurately reflect publicly available information l Once information becomes available, market participants analyze it l Competition assures prices reflect information l Grossman-Stigliz Paradox l Forms of EMH l Weak Old stock prices Market Efficiency Semi. Strong All public Info Strong All available info, Incl. private 9 3/16/2018

Econometric tool to study EMH Event study l Measure abnormal return l Problem: what is normal return? l Problem: How to measure event date? l Market Efficiency 10 3/16/2018

Econometric tool to study EMH Event study l Measure abnormal return l Problem: what is normal return? l Problem: How to measure event date? l Market Efficiency 10 3/16/2018

Example: Takeover premium before and after introduction of insider trading laws (Bris, 2000) Market Efficiency 11 3/16/2018

Example: Takeover premium before and after introduction of insider trading laws (Bris, 2000) Market Efficiency 11 3/16/2018

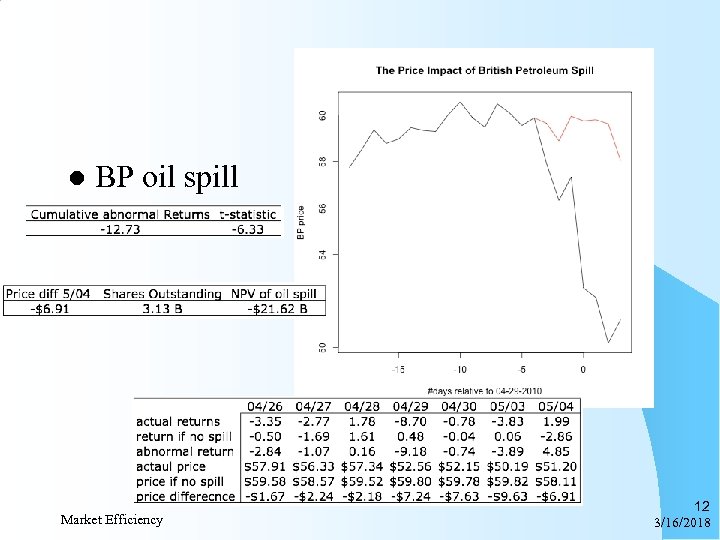

l BP oil spill Market Efficiency 12 3/16/2018

l BP oil spill Market Efficiency 12 3/16/2018

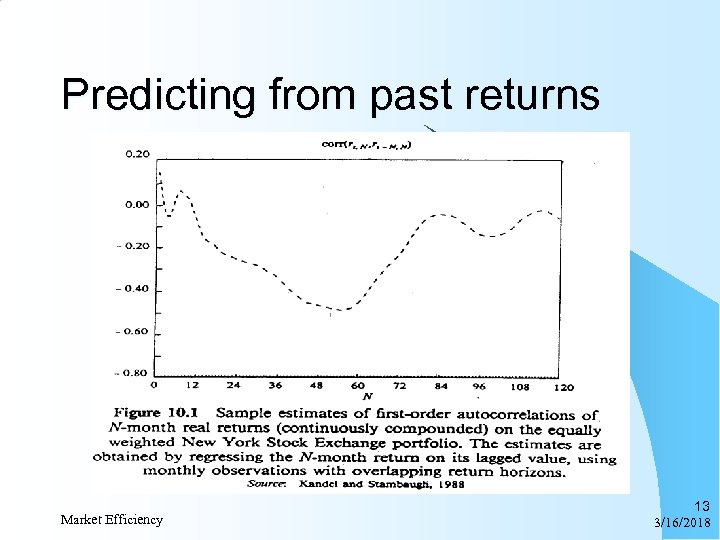

Predicting from past returns Market Efficiency 13 3/16/2018

Predicting from past returns Market Efficiency 13 3/16/2018

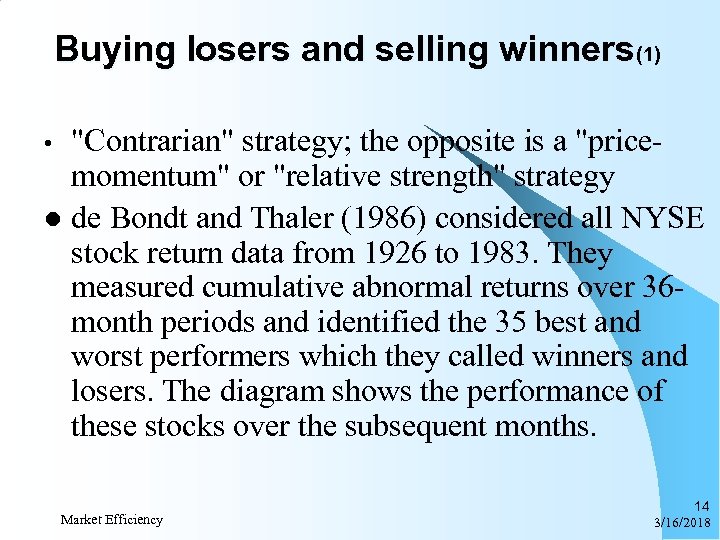

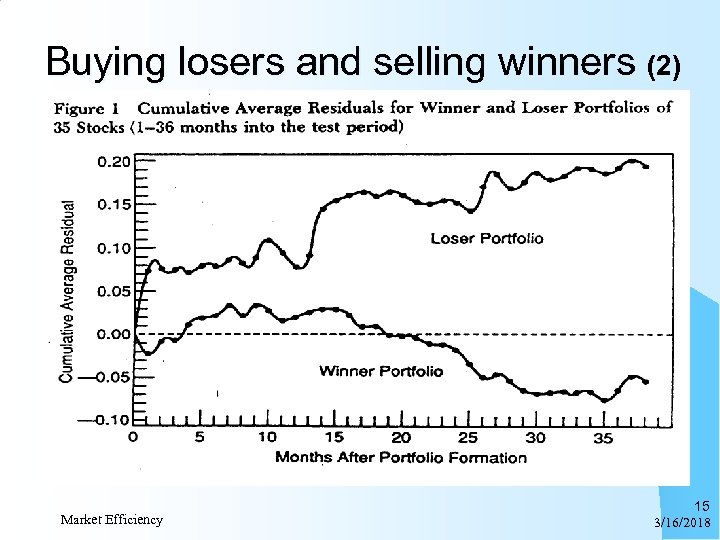

Buying losers and selling winners(1) "Contrarian" strategy; the opposite is a "pricemomentum" or "relative strength" strategy l de Bondt and Thaler (1986) considered all NYSE stock return data from 1926 to 1983. They measured cumulative abnormal returns over 36 month periods and identified the 35 best and worst performers which they called winners and losers. The diagram shows the performance of these stocks over the subsequent months. • Market Efficiency 14 3/16/2018

Buying losers and selling winners(1) "Contrarian" strategy; the opposite is a "pricemomentum" or "relative strength" strategy l de Bondt and Thaler (1986) considered all NYSE stock return data from 1926 to 1983. They measured cumulative abnormal returns over 36 month periods and identified the 35 best and worst performers which they called winners and losers. The diagram shows the performance of these stocks over the subsequent months. • Market Efficiency 14 3/16/2018

Buying losers and selling winners (2) Market Efficiency 15 3/16/2018

Buying losers and selling winners (2) Market Efficiency 15 3/16/2018

Buying winners and selling loosers l Short-run momentum effect: Select 6 mo past winners/loosers and create 0 -cost portfolio. Hold it for 3 -6 mo. – Industry effect (Grinblatt/Moskowitz) – essentially missed macroeconomic trend – Cross-sectional variability in stock returns (Caul& Condrad, but rejected by Grundy&Martin) Money are lost in 261 out of 828 mo. l Feasible only by institutions (high transaction cost) l Market Efficiency 16 3/16/2018

Buying winners and selling loosers l Short-run momentum effect: Select 6 mo past winners/loosers and create 0 -cost portfolio. Hold it for 3 -6 mo. – Industry effect (Grinblatt/Moskowitz) – essentially missed macroeconomic trend – Cross-sectional variability in stock returns (Caul& Condrad, but rejected by Grundy&Martin) Money are lost in 261 out of 828 mo. l Feasible only by institutions (high transaction cost) l Market Efficiency 16 3/16/2018

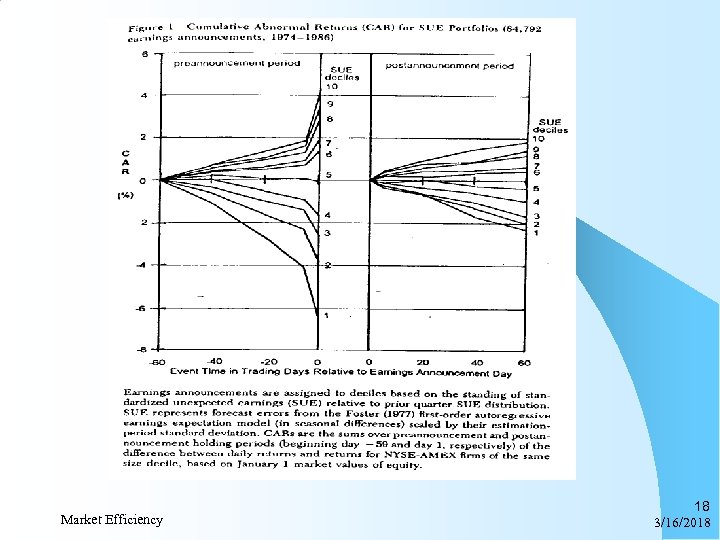

Earnings announcements Bernard and Thomas (1989) and many others before them document that, subsequent to the announcement of earnings, the stock price continues to drift up for "good news" firms and down for "bad news" firms [Price/earnings momentum]. l The enclosed figures are based on a sample of approximately 85, 000 observations for NYSE and AMEX stocks over the 1974 -1986 period. l Market Efficiency 17 3/16/2018

Earnings announcements Bernard and Thomas (1989) and many others before them document that, subsequent to the announcement of earnings, the stock price continues to drift up for "good news" firms and down for "bad news" firms [Price/earnings momentum]. l The enclosed figures are based on a sample of approximately 85, 000 observations for NYSE and AMEX stocks over the 1974 -1986 period. l Market Efficiency 17 3/16/2018

Market Efficiency 18 3/16/2018

Market Efficiency 18 3/16/2018

Market Efficiency 19 3/16/2018

Market Efficiency 19 3/16/2018

Event driven investing l Extension of the same idea to other events: – Analysts’ forecasts and revisions – Share buy backs – Dividend continuations or not – Etc. . l In my opinion, most promising form of active (tactical) investing Market Efficiency 20 3/16/2018

Event driven investing l Extension of the same idea to other events: – Analysts’ forecasts and revisions – Share buy backs – Dividend continuations or not – Etc. . l In my opinion, most promising form of active (tactical) investing Market Efficiency 20 3/16/2018

Newsletters from Graham and Harvey, FAJ, Nov/Dec 97 l l As a group, newletters do not appear to possess any special information about the future direction of the market (see picture), Nevertheless, investment newsletters that are on a hot streak (have correctly anticipated the direction of the market in previous recommendations) may provide valuable information about future returns. Market Efficiency 21 3/16/2018

Newsletters from Graham and Harvey, FAJ, Nov/Dec 97 l l As a group, newletters do not appear to possess any special information about the future direction of the market (see picture), Nevertheless, investment newsletters that are on a hot streak (have correctly anticipated the direction of the market in previous recommendations) may provide valuable information about future returns. Market Efficiency 21 3/16/2018

Over the past decade, I have attempted to exploit many of the seemingly most promising ”inefficiences” by actually trading significant amount of money. . . Many of these effects are surprisingly strong in the reported empirical work, but I have never yet found one that worked in practice. Richard Roll Market Efficiency 22 3/16/2018

Over the past decade, I have attempted to exploit many of the seemingly most promising ”inefficiences” by actually trading significant amount of money. . . Many of these effects are surprisingly strong in the reported empirical work, but I have never yet found one that worked in practice. Richard Roll Market Efficiency 22 3/16/2018

How information is reflected in prices? l l l Via trading and price discovery Via public announcements Via investment research – Analyzing analysts’ “Task Accuracy” l just how good are analysts at what they do? l we’ll examine estimates and recommendations – Evaluating their Decision Making l are they better at some things than others? l why do they make the errors they make? – Debiasing and Using Analyst Information l we do get their info, how best can we use it? Market Efficiency 23 3/16/2018

How information is reflected in prices? l l l Via trading and price discovery Via public announcements Via investment research – Analyzing analysts’ “Task Accuracy” l just how good are analysts at what they do? l we’ll examine estimates and recommendations – Evaluating their Decision Making l are they better at some things than others? l why do they make the errors they make? – Debiasing and Using Analyst Information l we do get their info, how best can we use it? Market Efficiency 23 3/16/2018

What do (sell-side) security analysts do? l Tasks? – Estimate industry & company models & EPS – Recommend the best securities – Sell new securities to investors l Ultimate Goal? – Find the “right” price for MSFT or Amazon. com? Not a trivial task. . . l Incentives? – “On the folly of rewarding A, while hoping for B” Market Efficiency 24 3/16/2018

What do (sell-side) security analysts do? l Tasks? – Estimate industry & company models & EPS – Recommend the best securities – Sell new securities to investors l Ultimate Goal? – Find the “right” price for MSFT or Amazon. com? Not a trivial task. . . l Incentives? – “On the folly of rewarding A, while hoping for B” Market Efficiency 24 3/16/2018

Task #1: forecasting EPS l EPS: a virtual sub-industry in investing – IBES, First Call, others – A separate II All-American category: l l “EPS accuracy” How good are analysts at forecasting EPS? – An opinion: “somewhere between mediocre and bad” – Dreman and Berry (1995): l off by more than 10% over 55% of the time Market Efficiency 25 3/16/2018

Task #1: forecasting EPS l EPS: a virtual sub-industry in investing – IBES, First Call, others – A separate II All-American category: l l “EPS accuracy” How good are analysts at forecasting EPS? – An opinion: “somewhere between mediocre and bad” – Dreman and Berry (1995): l off by more than 10% over 55% of the time Market Efficiency 25 3/16/2018

Dreman and Berry, FAJ, ‘ 95 Market Efficiency 26 3/16/2018

Dreman and Berry, FAJ, ‘ 95 Market Efficiency 26 3/16/2018

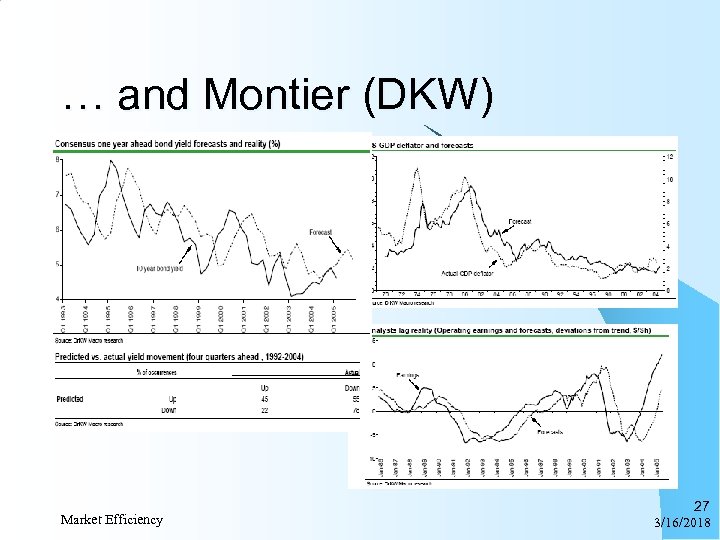

… and Montier (DKW) Market Efficiency 27 3/16/2018

… and Montier (DKW) Market Efficiency 27 3/16/2018

Task #1: forecasting EPS (cont. ) l Why “between mediocre and bad” ? – In spite of “help” from the companies – not yet adept at “Games Firms Play” l l l Incentives of firms “Earnings Manipulation to Exceed Thresholds” Why? – A discretionary component in EPS? – Listening too carefully to the firms? Or not carefully enough? – Missing the macro-economic trends! See Chopra (FAJ, Nov/Dec ‘ 98) Great article! Market Efficiency 28 3/16/2018

Task #1: forecasting EPS (cont. ) l Why “between mediocre and bad” ? – In spite of “help” from the companies – not yet adept at “Games Firms Play” l l l Incentives of firms “Earnings Manipulation to Exceed Thresholds” Why? – A discretionary component in EPS? – Listening too carefully to the firms? Or not carefully enough? – Missing the macro-economic trends! See Chopra (FAJ, Nov/Dec ‘ 98) Great article! Market Efficiency 28 3/16/2018

Task #2: recommending stocks l Predicting relative stock price performance is “hard” – Recommendations: a pure test of market “skill” – “Efficient markets” argues against success l The Catch 22 of market efficiency – The markets need information “snoopers” – Grossman and Stiglitz: An “equilibrium level of inefficiency” is needed in markets. The inefficiency is needed to pay the “snoopers”. Market Efficiency 29 3/16/2018

Task #2: recommending stocks l Predicting relative stock price performance is “hard” – Recommendations: a pure test of market “skill” – “Efficient markets” argues against success l The Catch 22 of market efficiency – The markets need information “snoopers” – Grossman and Stiglitz: An “equilibrium level of inefficiency” is needed in markets. The inefficiency is needed to pay the “snoopers”. Market Efficiency 29 3/16/2018

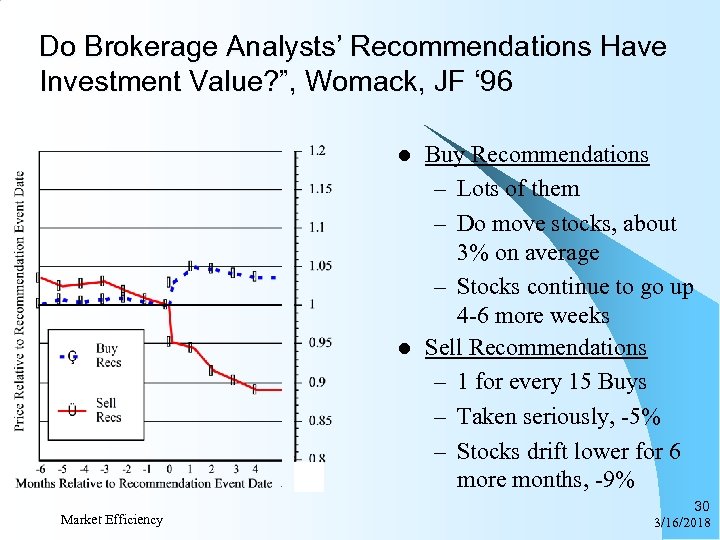

Do Brokerage Analysts’ Recommendations Have Investment Value? ”, Womack, JF ‘ 96 l l Market Efficiency Buy Recommendations – Lots of them – Do move stocks, about 3% on average – Stocks continue to go up 4 -6 more weeks Sell Recommendations – 1 for every 15 Buys – Taken seriously, -5% – Stocks drift lower for 6 more months, -9% 30 3/16/2018

Do Brokerage Analysts’ Recommendations Have Investment Value? ”, Womack, JF ‘ 96 l l Market Efficiency Buy Recommendations – Lots of them – Do move stocks, about 3% on average – Stocks continue to go up 4 -6 more weeks Sell Recommendations – 1 for every 15 Buys – Taken seriously, -5% – Stocks drift lower for 6 more months, -9% 30 3/16/2018

Do Brokerage Analysts’ Recommendations Have Investment Value? ”, Womack, JF ‘ 96 l Removals of Buy Recs – Analysts pick stocks that have recently outperformed by 5%ish – Stocks have negative abnormal returns for 3 -4 months after removal – Total underperformance of stocks after a “buy” removal: - 7% Market Efficiency 31 3/16/2018

Do Brokerage Analysts’ Recommendations Have Investment Value? ”, Womack, JF ‘ 96 l Removals of Buy Recs – Analysts pick stocks that have recently outperformed by 5%ish – Stocks have negative abnormal returns for 3 -4 months after removal – Total underperformance of stocks after a “buy” removal: - 7% Market Efficiency 31 3/16/2018

Brokerage Analysts’ Recommendations, Womack, JF ‘ 96 l Other conclusions – Smaller stocks respond more, and drift more after recommendations, too – Are the abnormal returns from “stock picking” or “market timing”? – Very substantial asymmetry between the value of 1) (the large amount of) positive new and 2) the small amount of negative news l When they say “sell” or “remove from buy”, watch out! Market Efficiency 32 3/16/2018

Brokerage Analysts’ Recommendations, Womack, JF ‘ 96 l Other conclusions – Smaller stocks respond more, and drift more after recommendations, too – Are the abnormal returns from “stock picking” or “market timing”? – Very substantial asymmetry between the value of 1) (the large amount of) positive new and 2) the small amount of negative news l When they say “sell” or “remove from buy”, watch out! Market Efficiency 32 3/16/2018

What are analysts good at? l A study of Womack: – Reasons analysts give for their recommendations – Then, categorizing them into four or five broad categories, then sub-categories – Two very common categories of reasons “its really cheap” by relative or historical valuation standards l “something new is or will happen”, news l Market Efficiency 33 3/16/2018

What are analysts good at? l A study of Womack: – Reasons analysts give for their recommendations – Then, categorizing them into four or five broad categories, then sub-categories – Two very common categories of reasons “its really cheap” by relative or historical valuation standards l “something new is or will happen”, news l Market Efficiency 33 3/16/2018

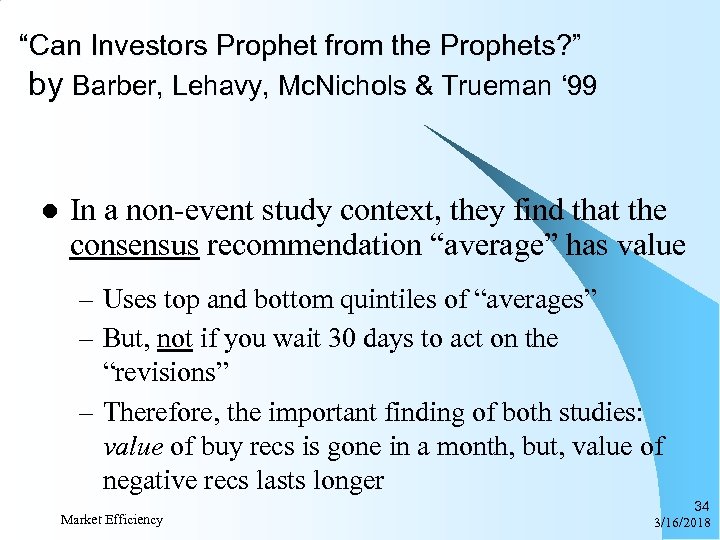

“Can Investors Prophet from the Prophets? ” by Barber, Lehavy, Mc. Nichols & Trueman ‘ 99 l In a non-event study context, they find that the consensus recommendation “average” has value – Uses top and bottom quintiles of “averages” – But, not if you wait 30 days to act on the “revisions” – Therefore, the important finding of both studies: value of buy recs is gone in a month, but, value of negative recs lasts longer Market Efficiency 34 3/16/2018

“Can Investors Prophet from the Prophets? ” by Barber, Lehavy, Mc. Nichols & Trueman ‘ 99 l In a non-event study context, they find that the consensus recommendation “average” has value – Uses top and bottom quintiles of “averages” – But, not if you wait 30 days to act on the “revisions” – Therefore, the important finding of both studies: value of buy recs is gone in a month, but, value of negative recs lasts longer Market Efficiency 34 3/16/2018

Task #3: Selling new securities l Underwriting transactions are highly profitable for firm and analyst – The changing role of security analysts in last decade: they’re now the main “pitch” people – Compensation to analyst for this is very big (double or triple the salary) l 2 nd year analyst at M. S offered $500 K vs. corporate finance at $250 K Market Efficiency 35 3/16/2018

Task #3: Selling new securities l Underwriting transactions are highly profitable for firm and analyst – The changing role of security analysts in last decade: they’re now the main “pitch” people – Compensation to analyst for this is very big (double or triple the salary) l 2 nd year analyst at M. S offered $500 K vs. corporate finance at $250 K Market Efficiency 35 3/16/2018

“Why do firms switch underwriters? ” Krigman, Shaw, and Womack ‘ 99 l Examined issuers switching to a new lead underwriter for second offering (30% of second-time issuers) – Conducted a survey of switching CFOs – Analyzed other empirical data for switchers vs. non-switchers l “Research coverage” and “influential analyst” were top reasons to switch – Along with “trade up” to higher reputation Market Efficiency 36 3/16/2018

“Why do firms switch underwriters? ” Krigman, Shaw, and Womack ‘ 99 l Examined issuers switching to a new lead underwriter for second offering (30% of second-time issuers) – Conducted a survey of switching CFOs – Analyzed other empirical data for switchers vs. non-switchers l “Research coverage” and “influential analyst” were top reasons to switch – Along with “trade up” to higher reputation Market Efficiency 36 3/16/2018

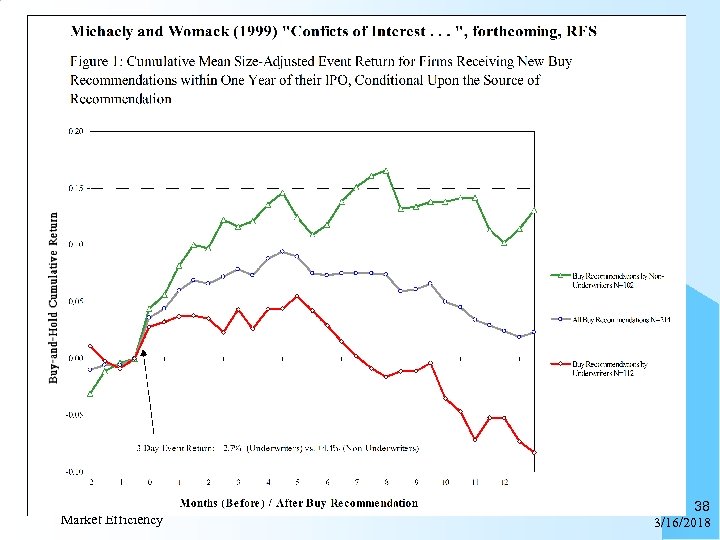

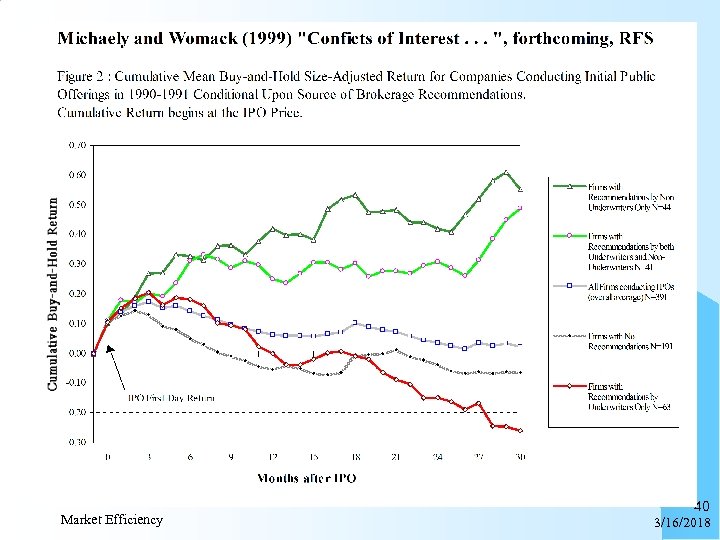

“Conflicts of Interest and the Credibility of Underwriter Analyst Recommendations”, Michaely and Womack, RFS ‘ 99 l Are analysts “truth telling” or “rent seeking”? – MW examine recommendations by the lead underwriter vs. all other analysts during the first year after the IPO l Their behavior is quite “suspicious” – underwriters’ recommendations are often called “booster shots” l are more likely to be made by underwriter when stock is doing poorly; not so for non-underwriters! Market Efficiency 37 3/16/2018

“Conflicts of Interest and the Credibility of Underwriter Analyst Recommendations”, Michaely and Womack, RFS ‘ 99 l Are analysts “truth telling” or “rent seeking”? – MW examine recommendations by the lead underwriter vs. all other analysts during the first year after the IPO l Their behavior is quite “suspicious” – underwriters’ recommendations are often called “booster shots” l are more likely to be made by underwriter when stock is doing poorly; not so for non-underwriters! Market Efficiency 37 3/16/2018

Market Efficiency 38 3/16/2018

Market Efficiency 38 3/16/2018

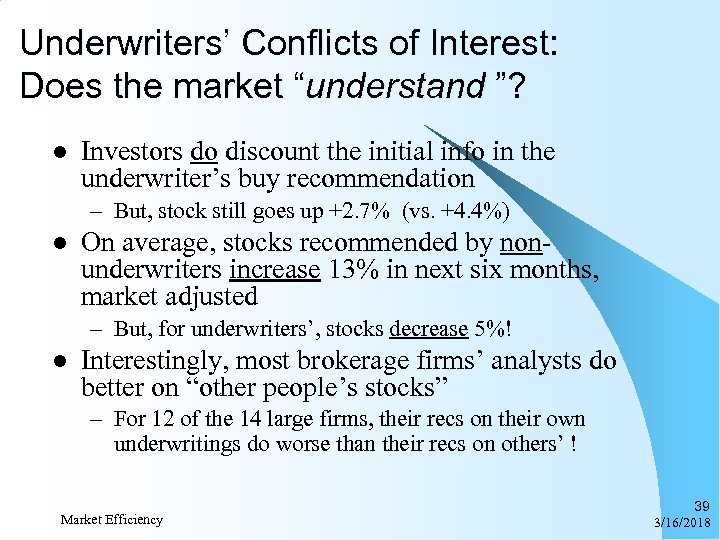

Underwriters’ Conflicts of Interest: Does the market “understand ”? l Investors do discount the initial info in the underwriter’s buy recommendation – But, stock still goes up +2. 7% (vs. +4. 4%) l On average, stocks recommended by nonunderwriters increase 13% in next six months, market adjusted – But, for underwriters’, stocks decrease 5%! l Interestingly, most brokerage firms’ analysts do better on “other people’s stocks” – For 12 of the 14 large firms, their recs on their own underwritings do worse than their recs on others’ ! Market Efficiency 39 3/16/2018

Underwriters’ Conflicts of Interest: Does the market “understand ”? l Investors do discount the initial info in the underwriter’s buy recommendation – But, stock still goes up +2. 7% (vs. +4. 4%) l On average, stocks recommended by nonunderwriters increase 13% in next six months, market adjusted – But, for underwriters’, stocks decrease 5%! l Interestingly, most brokerage firms’ analysts do better on “other people’s stocks” – For 12 of the 14 large firms, their recs on their own underwritings do worse than their recs on others’ ! Market Efficiency 39 3/16/2018

Market Efficiency 40 3/16/2018

Market Efficiency 40 3/16/2018

Scandals: l l Spinning: Allocating hot IPOs to the personal brokerage accounts of top executives in return for company business Global settlement bans spinning by major underwriters Laddering: Requiring the purchase of additional shares in the aftermarket in return for IPOs Analyst conflicts of interest: Giving “buy” recommendations in return for underwriting and M&A business Commission business in return for IPOs: Underwriters allocated IPOs primarily to investors that generated a lot of commissions on other trades Market Efficiency 41 3/16/2018

Scandals: l l Spinning: Allocating hot IPOs to the personal brokerage accounts of top executives in return for company business Global settlement bans spinning by major underwriters Laddering: Requiring the purchase of additional shares in the aftermarket in return for IPOs Analyst conflicts of interest: Giving “buy” recommendations in return for underwriting and M&A business Commission business in return for IPOs: Underwriters allocated IPOs primarily to investors that generated a lot of commissions on other trades Market Efficiency 41 3/16/2018

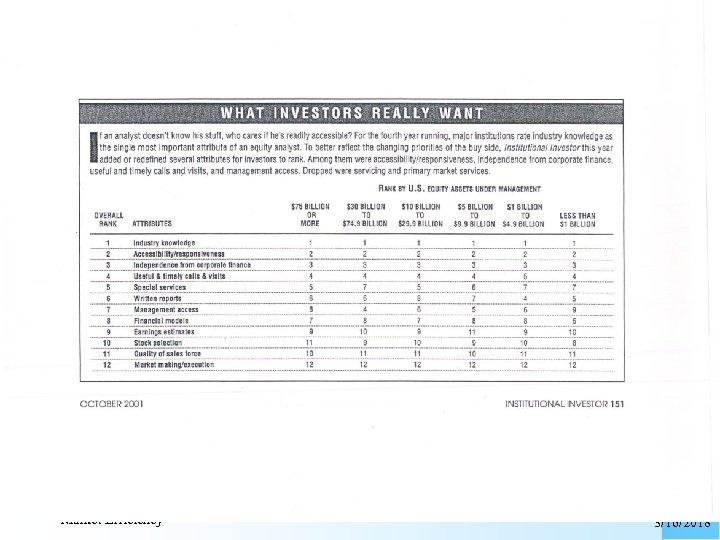

Market Efficiency 42 3/16/2018

Market Efficiency 42 3/16/2018

Conflicts of Interest Case: Lehman Brothers and Real. Networks Lehman co-managed SEO for Real. Networks in June 1999 and kept a strong buy on the stock until June 2001 07/11/2000 Stock drops from $52 to $38 in 10 days. Analyst issues report calming investors and reiterating the strong buy 07/18/2000 Stock bounces back. Analyst sends a message to one investor saying “RNWK has to be a short big time”. He explains its inconsistency regarding public reports: “We bank these guys” 07/19/2000 One day later, analyst issues report describing quarter results as “stellar” and reiterating strong buy Jan/2001 Stock is already at $9. Analyst explains privately to an investor that RNWK “is a short”, but does not change its strong buy rating 9 Source: Global Settlement Letter of AWC for Lehman Brothers Market Efficiency days (Jun/2000 -Jun/2001) 43 3/16/2018

Conflicts of Interest Case: Lehman Brothers and Real. Networks Lehman co-managed SEO for Real. Networks in June 1999 and kept a strong buy on the stock until June 2001 07/11/2000 Stock drops from $52 to $38 in 10 days. Analyst issues report calming investors and reiterating the strong buy 07/18/2000 Stock bounces back. Analyst sends a message to one investor saying “RNWK has to be a short big time”. He explains its inconsistency regarding public reports: “We bank these guys” 07/19/2000 One day later, analyst issues report describing quarter results as “stellar” and reiterating strong buy Jan/2001 Stock is already at $9. Analyst explains privately to an investor that RNWK “is a short”, but does not change its strong buy rating 9 Source: Global Settlement Letter of AWC for Lehman Brothers Market Efficiency days (Jun/2000 -Jun/2001) 43 3/16/2018

Where were regulators? Market Efficiency 44 3/16/2018

Where were regulators? Market Efficiency 44 3/16/2018

Survey of IPO Investors l “Do you think that investors expect reputable underwriters to take some account of true investment value in deciding the offering price in an IPO, rather than just the price the market will bear on the day of the offering? ” 84% agree Market Efficiency 45 3/16/2018

Survey of IPO Investors l “Do you think that investors expect reputable underwriters to take some account of true investment value in deciding the offering price in an IPO, rather than just the price the market will bear on the day of the offering? ” 84% agree Market Efficiency 45 3/16/2018

Survey of IPO Investors l Have you done any calculations of what the true fundamental value of a share in the company was, and compared the price of a share with this value? – 80% no. Market Efficiency 46 3/16/2018

Survey of IPO Investors l Have you done any calculations of what the true fundamental value of a share in the company was, and compared the price of a share with this value? – 80% no. Market Efficiency 46 3/16/2018

Is underwriter bias intentional? l Analysts are conflicted between two goals: their long-term reputation (“truth telling”) and profit generation for their firm – Survey results suggest “intentional” l Kahneman and Lovallo, MS, ‘ 93 – The “inside view” vs. “the outside view” a very important behavioral concept l The most important issue w. r. t. analysts l Market Efficiency 47 3/16/2018

Is underwriter bias intentional? l Analysts are conflicted between two goals: their long-term reputation (“truth telling”) and profit generation for their firm – Survey results suggest “intentional” l Kahneman and Lovallo, MS, ‘ 93 – The “inside view” vs. “the outside view” a very important behavioral concept l The most important issue w. r. t. analysts l Market Efficiency 47 3/16/2018

Other possible conflicts & problems Between sell-side and proprietary trading side l Analysts invests their own money l Other pressure from the management l Herding l – Follow the crowd – Career concern Market Efficiency 48 3/16/2018

Other possible conflicts & problems Between sell-side and proprietary trading side l Analysts invests their own money l Other pressure from the management l Herding l – Follow the crowd – Career concern Market Efficiency 48 3/16/2018

Using analyst information: conclusions l The “on average” value of analysts’ info is shortlived and only modestly positive – especially for the positive news l My rules-of-thumb: – When hearing a new recommendation: l l l “Is the analyst’s firm the investment banker? “What in this is out of consensus? ” “Is is a “news” or “valuation” story? – When hearing a negative report: “It’s probably true. ” Market Efficiency 49 3/16/2018

Using analyst information: conclusions l The “on average” value of analysts’ info is shortlived and only modestly positive – especially for the positive news l My rules-of-thumb: – When hearing a new recommendation: l l l “Is the analyst’s firm the investment banker? “What in this is out of consensus? ” “Is is a “news” or “valuation” story? – When hearing a negative report: “It’s probably true. ” Market Efficiency 49 3/16/2018