b2a83d69e07e8554dd898fc782bfe3e3.ppt

- Количество слайдов: 11

Market Coupling on the German-Danish Interconnectors Interim Status of Temporary Suspension Enno Böttcher Northern Europe Electricity Regional Initiative 4 th Stakeholder Group Meeting 5 November 2008 København

Market Coupling on the German-Danish Interconnectors Interim Status of Temporary Suspension Enno Böttcher Northern Europe Electricity Regional Initiative 4 th Stakeholder Group Meeting 5 November 2008 København

AGENDA Top 1 – Background: Market coupling and scope of EMCC Top 2 – Challenges: Market coupling results Top 3 – Outlook: Status quo, actions and timeline 05. 11. 2008 2

AGENDA Top 1 – Background: Market coupling and scope of EMCC Top 2 – Challenges: Market coupling results Top 3 – Outlook: Status quo, actions and timeline 05. 11. 2008 2

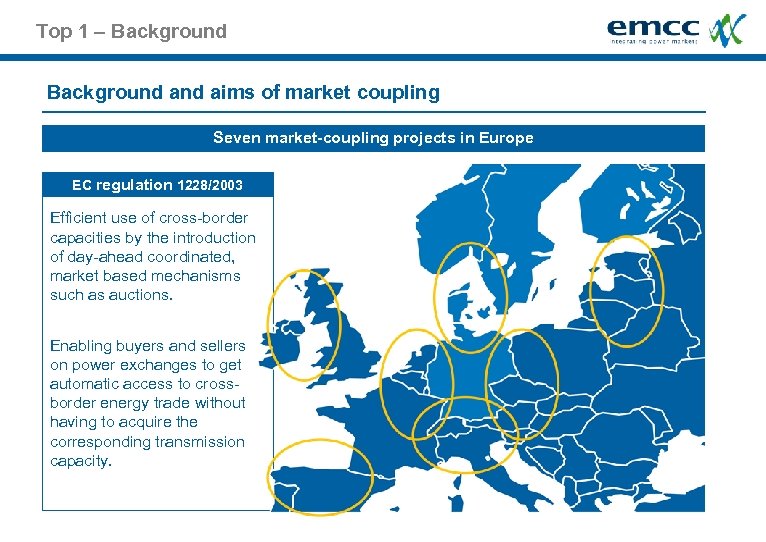

Top 1 – Background and aims of market coupling Seven market-coupling projects in Europe EC regulation 1228/2003 Efficient use of cross-border capacities by the introduction of day-ahead coordinated, market based mechanisms such as auctions. Enabling buyers and sellers on power exchanges to get automatic access to crossborder energy trade without having to acquire the corresponding transmission capacity. 05. 11. 2008 3

Top 1 – Background and aims of market coupling Seven market-coupling projects in Europe EC regulation 1228/2003 Efficient use of cross-border capacities by the introduction of day-ahead coordinated, market based mechanisms such as auctions. Enabling buyers and sellers on power exchanges to get automatic access to crossborder energy trade without having to acquire the corresponding transmission capacity. 05. 11. 2008 3

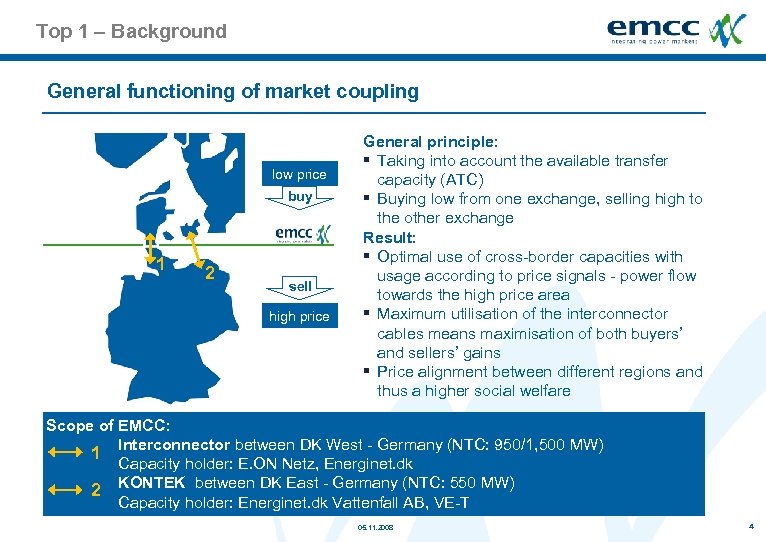

Top 1 – Background General functioning of market coupling low price buy 1 2 sell high price General principle: § Taking into account the available transfer capacity (ATC) § Buying low from one exchange, selling high to the other exchange Result: § Optimal use of cross-border capacities with usage according to price signals - power flow towards the high price area § Maximum utilisation of the interconnector cables means maximisation of both buyers’ and sellers’ gains § Price alignment between different regions and thus a higher social welfare Scope of EMCC: 1 Interconnector between DK West - Germany (NTC: 950/1, 500 MW) Capacity holder: E. ON Netz, Energinet. dk 2 KONTEK between DK East - Germany (NTC: 550 MW) Capacity holder: Energinet. dk Vattenfall AB, VE-T 05. 11. 2008 4

Top 1 – Background General functioning of market coupling low price buy 1 2 sell high price General principle: § Taking into account the available transfer capacity (ATC) § Buying low from one exchange, selling high to the other exchange Result: § Optimal use of cross-border capacities with usage according to price signals - power flow towards the high price area § Maximum utilisation of the interconnector cables means maximisation of both buyers’ and sellers’ gains § Price alignment between different regions and thus a higher social welfare Scope of EMCC: 1 Interconnector between DK West - Germany (NTC: 950/1, 500 MW) Capacity holder: E. ON Netz, Energinet. dk 2 KONTEK between DK East - Germany (NTC: 550 MW) Capacity holder: Energinet. dk Vattenfall AB, VE-T 05. 11. 2008 4

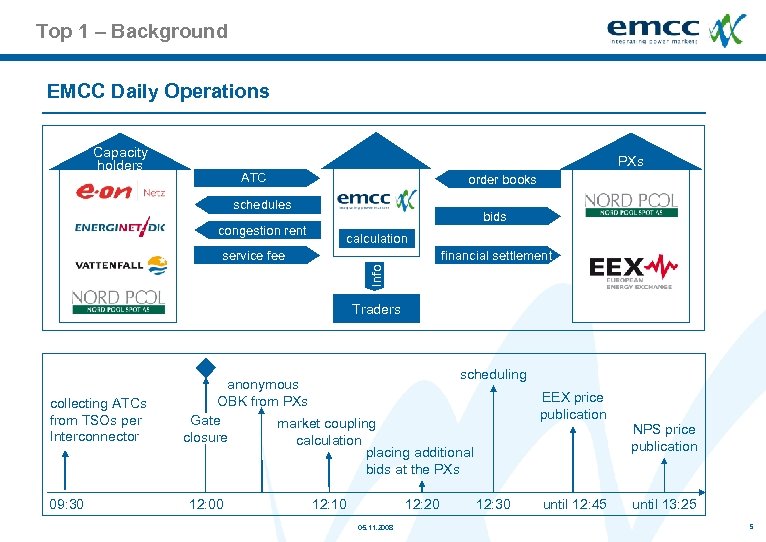

Top 1 – Background EMCC Daily Operations Capacity holders PXs ATC order books schedules congestion rent bids calculation financial settlement Info service fee Traders collecting ATCs from TSOs per Interconnector 09: 30 scheduling anonymous EEX price OBK from PXs publication Gate market coupling closure calculation placing additional bids at the PXs 12: 00 12: 10 12: 20 05. 11. 2008 12: 30 until 12: 45 NPS price publication until 13: 25 5

Top 1 – Background EMCC Daily Operations Capacity holders PXs ATC order books schedules congestion rent bids calculation financial settlement Info service fee Traders collecting ATCs from TSOs per Interconnector 09: 30 scheduling anonymous EEX price OBK from PXs publication Gate market coupling closure calculation placing additional bids at the PXs 12: 00 12: 10 12: 20 05. 11. 2008 12: 30 until 12: 45 NPS price publication until 13: 25 5

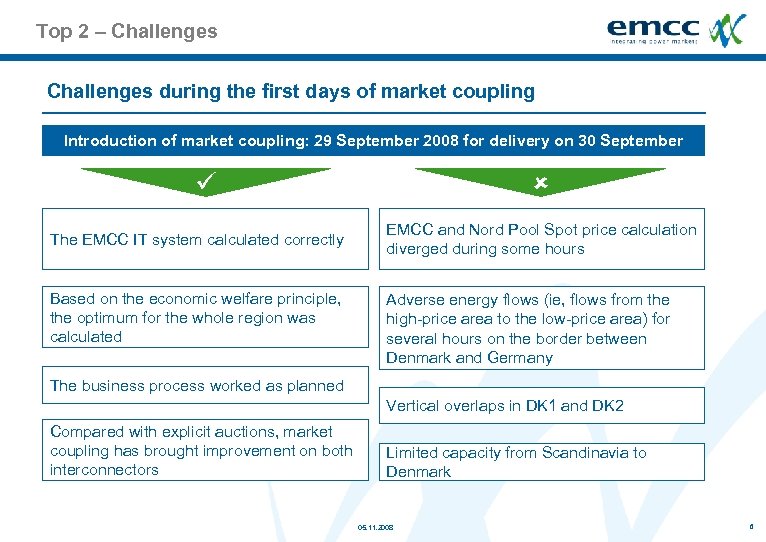

Top 2 – Challenges during the first days of market coupling Introduction of market coupling: 29 September 2008 for delivery on 30 September The EMCC IT system calculated correctly Based on the economic welfare principle, the optimum for the whole region was calculated EMCC and Nord Pool Spot price calculation diverged during some hours Adverse energy flows (ie, flows from the high-price area to the low-price area) for several hours on the border between Denmark and Germany The business process worked as planned Vertical overlaps in DK 1 and DK 2 Compared with explicit auctions, market coupling has brought improvement on both interconnectors Limited capacity from Scandinavia to Denmark 05. 11. 2008 6

Top 2 – Challenges during the first days of market coupling Introduction of market coupling: 29 September 2008 for delivery on 30 September The EMCC IT system calculated correctly Based on the economic welfare principle, the optimum for the whole region was calculated EMCC and Nord Pool Spot price calculation diverged during some hours Adverse energy flows (ie, flows from the high-price area to the low-price area) for several hours on the border between Denmark and Germany The business process worked as planned Vertical overlaps in DK 1 and DK 2 Compared with explicit auctions, market coupling has brought improvement on both interconnectors Limited capacity from Scandinavia to Denmark 05. 11. 2008 6

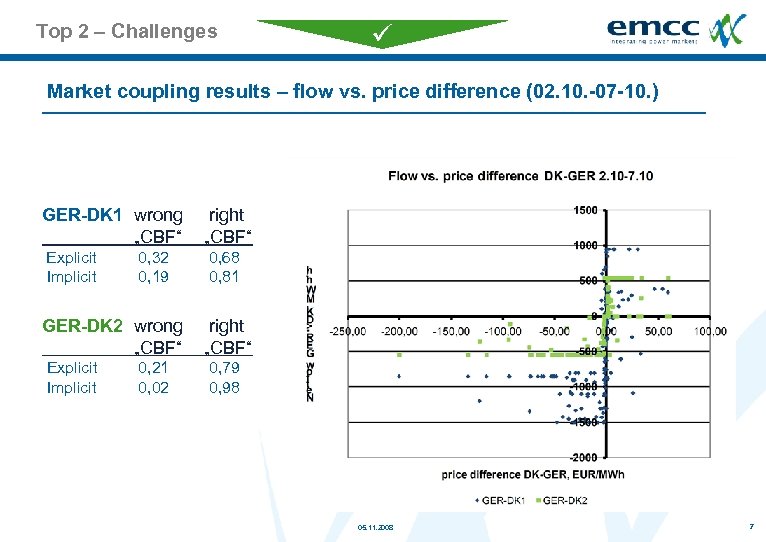

Top 2 – Challenges Market coupling results – flow vs. price difference (02. 10. -07 -10. ) GER-DK 1 wrong „CBF“ right „CBF“ Explicit 0, 68 0, 81 Implicit 0, 32 0, 19 GER-DK 2 wrong „CBF“ right „CBF“ Explicit Implicit 0, 79 0, 98 0, 21 0, 02 05. 11. 2008 7

Top 2 – Challenges Market coupling results – flow vs. price difference (02. 10. -07 -10. ) GER-DK 1 wrong „CBF“ right „CBF“ Explicit 0, 68 0, 81 Implicit 0, 32 0, 19 GER-DK 2 wrong „CBF“ right „CBF“ Explicit Implicit 0, 79 0, 98 0, 21 0, 02 05. 11. 2008 7

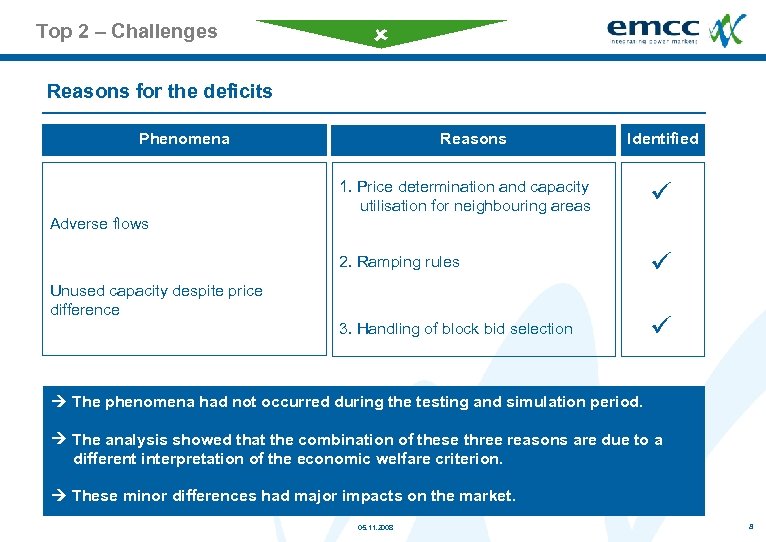

Top 2 – Challenges Reasons for the deficits Phenomena Reasons Identified 1. Price determination and capacity utilisation for neighbouring areas 2. Ramping rules 3. Handling of block bid selection Adverse flows Unused capacity despite price difference The phenomena had not occurred during the testing and simulation period. The analysis showed that the combination of these three reasons are due to a different interpretation of the economic welfare criterion. These minor differences had major impacts on the market. 05. 11. 2008 8

Top 2 – Challenges Reasons for the deficits Phenomena Reasons Identified 1. Price determination and capacity utilisation for neighbouring areas 2. Ramping rules 3. Handling of block bid selection Adverse flows Unused capacity despite price difference The phenomena had not occurred during the testing and simulation period. The analysis showed that the combination of these three reasons are due to a different interpretation of the economic welfare criterion. These minor differences had major impacts on the market. 05. 11. 2008 8

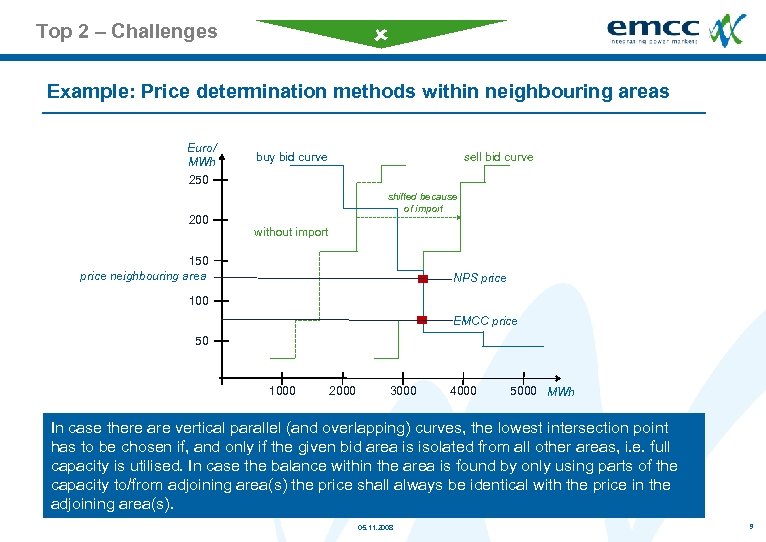

Top 2 – Challenges Example: Price determination methods within neighbouring areas Euro/ MWh 250 200 buy bid curve sell bid curve shifted because of import without import 150 price neighbouring area ▀ NPS price ▀ EMCC price 100 50 1000 2000 3000 4000 5000 MWh In case there are vertical parallel (and overlapping) curves, the lowest intersection point has to be chosen if, and only if the given bid area is isolated from all other areas, i. e. full capacity is utilised. In case the balance within the area is found by only using parts of the capacity to/from adjoining area(s) the price shall always be identical with the price in the adjoining area(s). 05. 11. 2008 9

Top 2 – Challenges Example: Price determination methods within neighbouring areas Euro/ MWh 250 200 buy bid curve sell bid curve shifted because of import without import 150 price neighbouring area ▀ NPS price ▀ EMCC price 100 50 1000 2000 3000 4000 5000 MWh In case there are vertical parallel (and overlapping) curves, the lowest intersection point has to be chosen if, and only if the given bid area is isolated from all other areas, i. e. full capacity is utilised. In case the balance within the area is found by only using parts of the capacity to/from adjoining area(s) the price shall always be identical with the price in the adjoining area(s). 05. 11. 2008 9

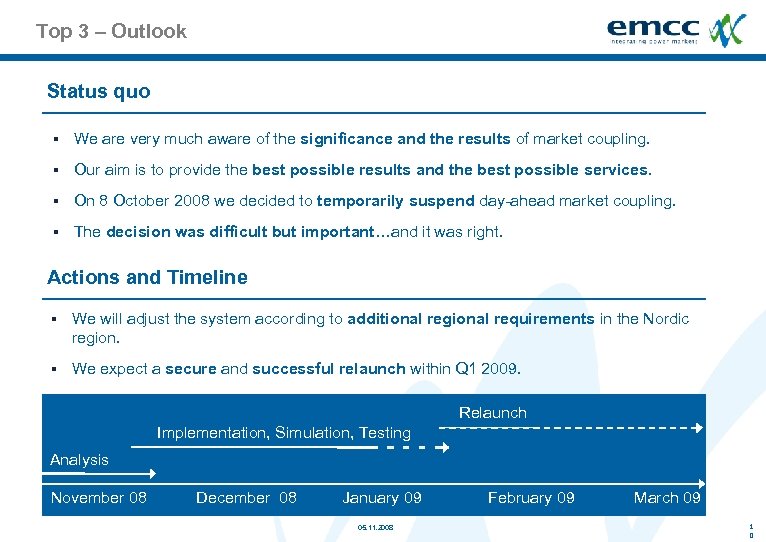

Top 3 – Outlook Status quo § We are very much aware of the significance and the results of market coupling. § Our aim is to provide the best possible results and the best possible services. § On 8 October 2008 we decided to temporarily suspend day-ahead market coupling. § The decision was difficult but important…and it was right. Actions and Timeline § We will adjust the system according to additional regional requirements in the Nordic region. § We expect a secure and successful relaunch within Q 1 2009. Relaunch Implementation, Simulation, Testing Analysis November 08 December 08 January 09 05. 11. 2008 February 09 March 09 1 0

Top 3 – Outlook Status quo § We are very much aware of the significance and the results of market coupling. § Our aim is to provide the best possible results and the best possible services. § On 8 October 2008 we decided to temporarily suspend day-ahead market coupling. § The decision was difficult but important…and it was right. Actions and Timeline § We will adjust the system according to additional regional requirements in the Nordic region. § We expect a secure and successful relaunch within Q 1 2009. Relaunch Implementation, Simulation, Testing Analysis November 08 December 08 January 09 05. 11. 2008 February 09 March 09 1 0

Contact Enno Böttcher European Market Coupling Company Gmb. H Hopfenmarkt 31 20457 Hamburg Germany Phone: +49 40 369 054 60 E-mail: office@marketcoupling. com Internet: www. marketcoupling. com 05. 11. 2008 1 1

Contact Enno Böttcher European Market Coupling Company Gmb. H Hopfenmarkt 31 20457 Hamburg Germany Phone: +49 40 369 054 60 E-mail: office@marketcoupling. com Internet: www. marketcoupling. com 05. 11. 2008 1 1