66e90cd71c909eea1642f30094beb07e.ppt

- Количество слайдов: 54

MARKET An arrangement which allows buyers and sellers to exchange money and goods.

WHY DO MARKETS EXIST ? • We are not self-sufficient: (We specialize in what we do best. ) • We trade what we make for goods or services we need, or for money to buy goods and services we need. Markets facilitate specialization and exchange.

TWO TYPES OF MARKETS • INPUT (FACTOR) MARKETS -Firms pay resource owners (i. e. , owners of labor, raw material, land, machinery and buildings) -households-- for the right to use their resources; firm -- Resource-owner interaction • OUTPUT (PRODUCT) MARKETS -Consumers --households-- pay firms for consumer goods; consumer -- firm interaction

Two of Economy’s Primary Participants FIRMS HOUSEHOLDS

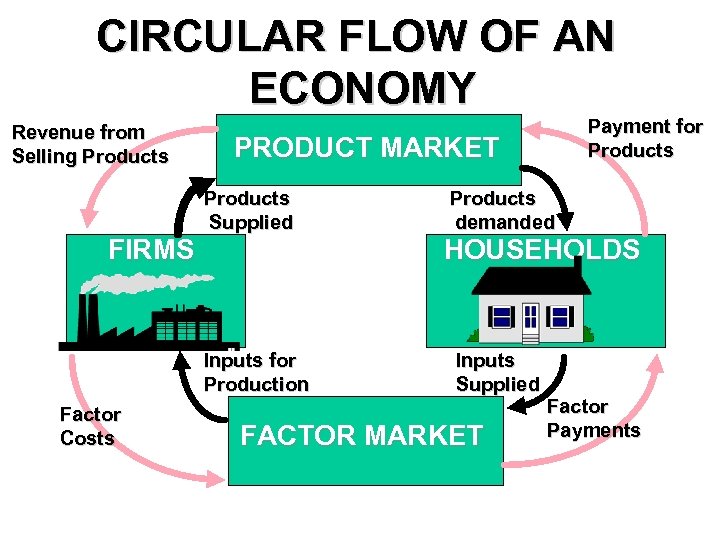

CIRCULAR FLOW OF AN ECONOMY Revenue from Selling Products PRODUCT MARKET Products Supplied FIRMS Products demanded HOUSEHOLDS Inputs for Production Factor Costs Payment for Products Inputs Supplied FACTOR MARKET Factor Payments

What Do Firms Do ? • Buy factors of production from households; • Transform factors of production into finished products and services; • Sell finished products and services to households.

Firms Buy Factors of Production • LABOR MARKET -- Hire workers and pay wages and salaries in exchange for work. • CAPITAL MARKET -- Households use savings to provide funds that firms use to buy machines, buildings and equipment. • NATURAL RESOURCES MARKET -- Households sell land, minerals, oil, etc. . to firms for use in production.

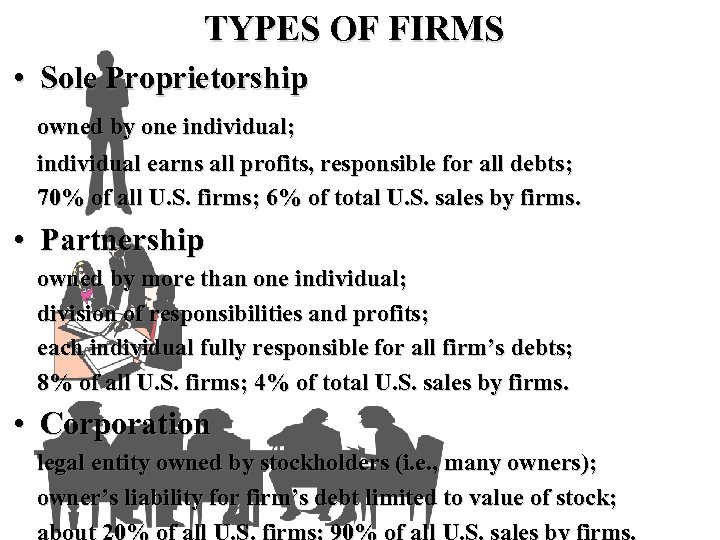

TYPES OF FIRMS • Sole Proprietorship owned by one individual; individual earns all profits, responsible for all debts; 70% of all U. S. firms; 6% of total U. S. sales by firms. • Partnership owned by more than one individual; division of responsibilities and profits; each individual fully responsible for all firm’s debts; 8% of all U. S. firms; 4% of total U. S. sales by firms. • Corporation legal entity owned by stockholders (i. e. , many owners); owner’s liability for firm’s debt limited to value of stock; about 20% of all U. S. firms; 90% of all U. S. sales by firms.

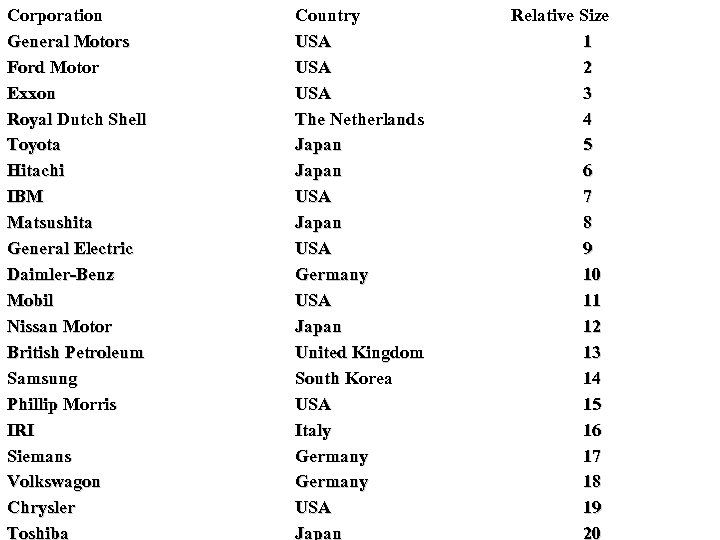

Corporation General Motors Ford Motor Exxon Royal Dutch Shell Toyota Hitachi IBM Matsushita General Electric Daimler-Benz Mobil Nissan Motor British Petroleum Samsung Phillip Morris IRI Siemans Volkswagon Chrysler Toshiba Country USA USA The Netherlands Japan USA Germany USA Japan United Kingdom South Korea USA Italy Germany USA Japan Relative Size 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20

CURRENCY MARKETS AND EXCHANGE RATES • Foreign Exchange Market -- Entity which provides for the exchange of one currency for another; • Exchange Rate -- Rate at which one currency can be exchanged for another.

SUPPLY AND DEMAND • • • Market interaction; Represents buyers and sellers in a particular market; Predicts equilibrium price and quantity in a particular market.

MARKET DEMAND How much of a particular product consumers are willing to buy during a particular time period.

MARKET DEMAND How much a Consumer Demands of a Product depends on: • • Price of the product being demanded; Consumer income; Price of related goods; The number of potential consumers (population); • Consumer taste and advertising; • Consumer expectations about future prices.

THE DEMAND CURVE • Shows how consumers exchange money for goods and services; • Shows relationship between price of a good and quantity consumers willing to buy during a specific time period; • Total amount demanded of a product is the sum of all consumers’ demand.

THE LAW OF DEMAND The lower the price, the larger the quantity demanded.

TWO DEMAND EFFECTS 1. Substitution Effect: The demand for one good normally purchased will increase if its price relative to the price of another good(s) decreases: more of the original good may be substituted at its new price. APPLES BANANAS Original Price $2/pound $0. 50/pound sacrifice 4 pounds bananas 1/4 pound apples New Price $0. 50/pound sacrifice 1 pound bananas 1 pound apples

TWO DEMAND EFFECTS 2. Income Effect A lower price for a product means that a given amount of money will buy more of all goods. Given: $5/week fruit budget; 1 pound of apples/week; APPLES OTHER FRUIT Original Price $2/pound ------Original spending $2 $3 New Price $0. 50/pound -----New spending $0. 50 $3 $1. 50 remains for purchase of any desired product. Price drop increases real income.

Change in Quantity Demanded • A change in the quantity resulting from a change in the price of a good; • Illustrated by movement along a demand curve.

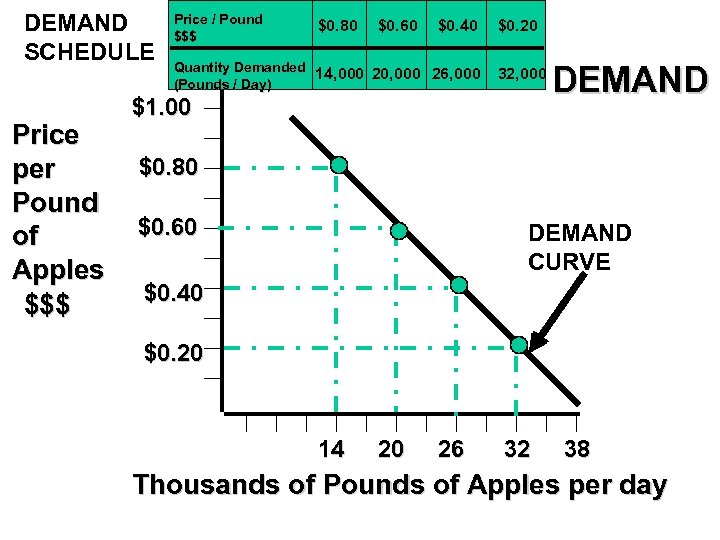

DEMAND SCHEDULE Price per Pound of Apples $$$ Price / Pound $$$ $0. 80 $0. 60 $0. 40 Quantity Demanded 14, 000 20, 000 26, 000 (Pounds / Day) $0. 20 32, 000 $1. 00 DEMAND $0. 80 $0. 60 DEMAND CURVE $0. 40 $0. 20 14 20 26 32 38 Thousands of Pounds of Apples per day

What Causes the Demand Curve to Shift (Change in Demand) A demand curve shifts as the relationship between product price and the quantity of the good demanded changes.

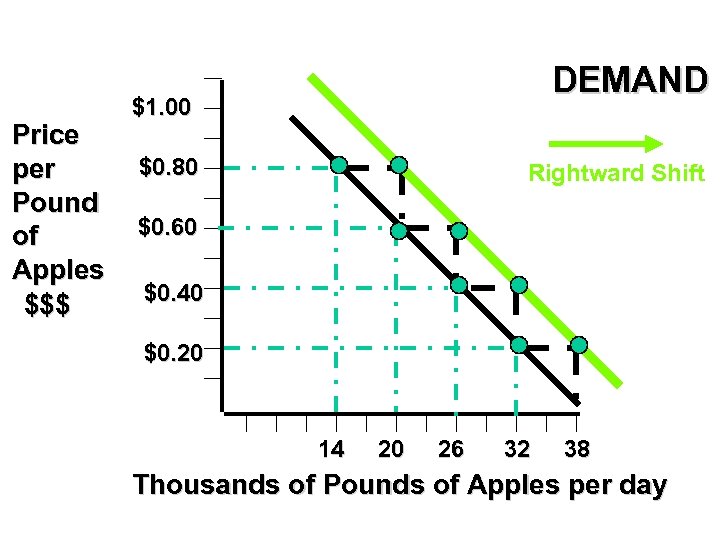

Demand Shift Causes • Change in income: income --Normal Good: An increase in income Good increases demand, shifting demand curve right; --Inferior Good: A decrease in income Good increases demand, shifting demand curve right;

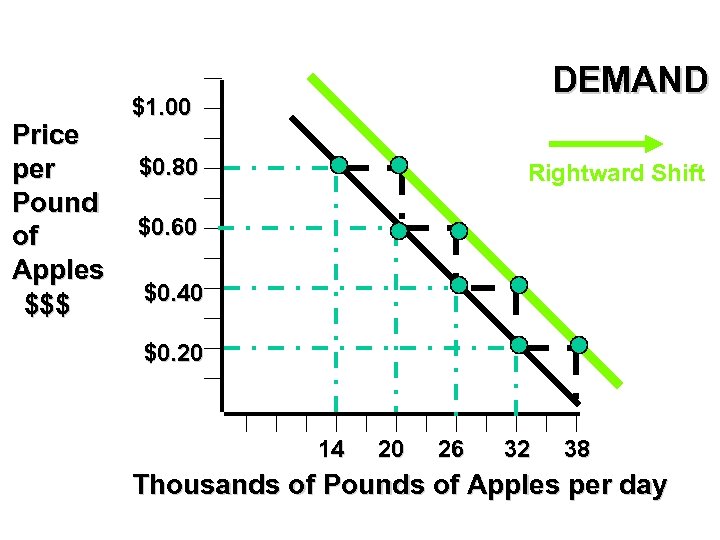

Price per Pound of Apples $$$ DEMAND $1. 00 $0. 80 Rightward Shift $0. 60 $0. 40 $0. 20 14 20 26 32 38 Thousands of Pounds of Apples per day

Demand Shift Causes • Change in income: income --Normal Good: A decrease in income Good decreases demand, shifting demand curve left; --Inferior Good: An increase in income Good decreases demand, shifting demand curve left;

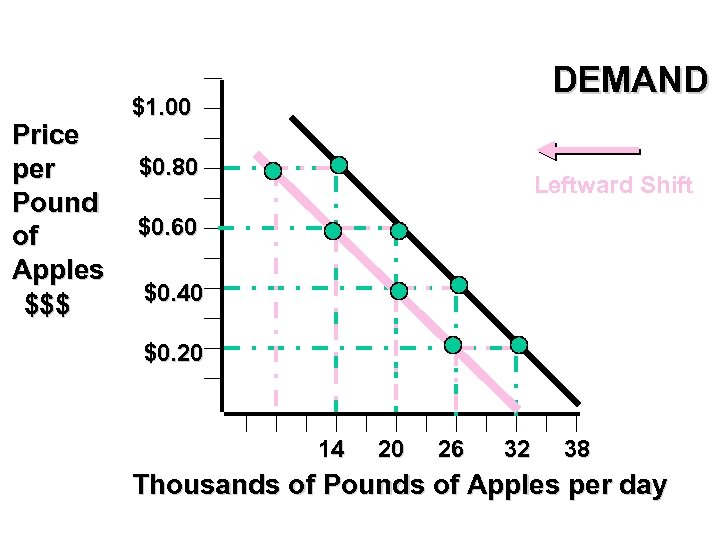

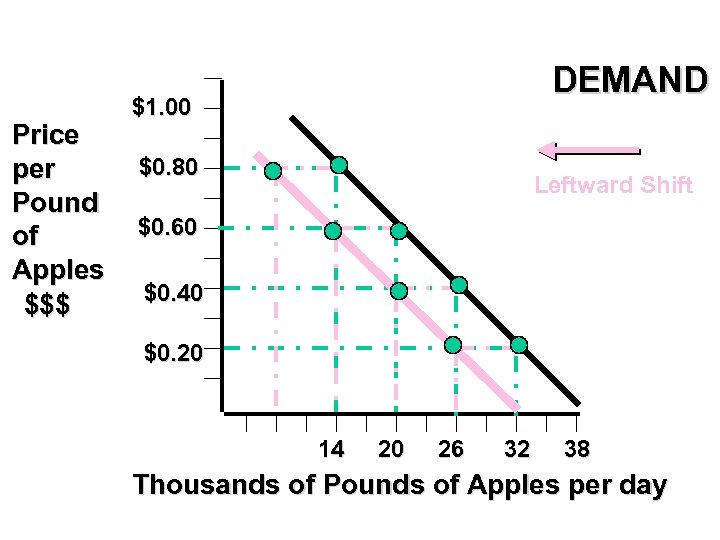

Price per Pound of Apples $$$ DEMAND $1. 00 $0. 80 Leftward Shift $0. 60 $0. 40 $0. 20 14 20 26 32 38 Thousands of Pounds of Apples per day

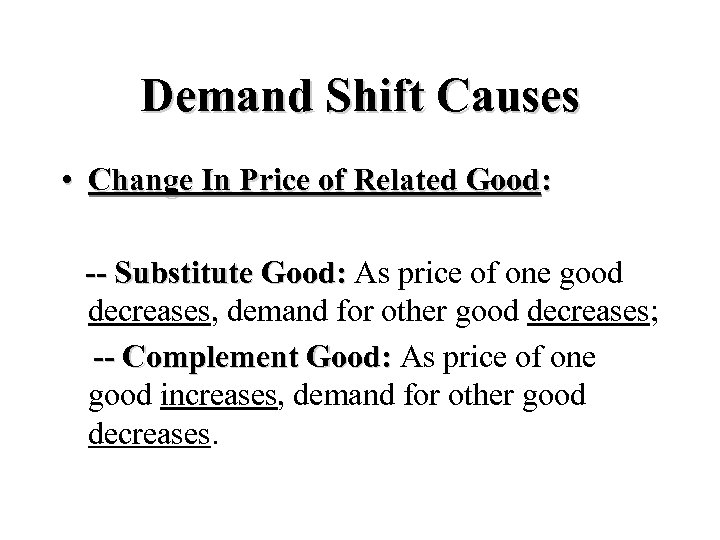

Demand Shift Causes • Change In Price of Related Good: -- Substitute Good: As price of one good increases, demand for other good increases; -- Complement Good: As price of one good decreases, demand for other good increases.

Price per Pound of Apples $$$ DEMAND $1. 00 $0. 80 Rightward Shift $0. 60 $0. 40 $0. 20 14 20 26 32 38 Thousands of Pounds of Apples per day

Demand Shift Causes • Change In Price of Related Good: -- Substitute Good: As price of one good decreases, demand for other good decreases; -- Complement Good: As price of one good increases, demand for other good decreases.

Price per Pound of Apples $$$ DEMAND $1. 00 $0. 80 Leftward Shift $0. 60 $0. 40 $0. 20 14 20 26 32 38 Thousands of Pounds of Apples per day

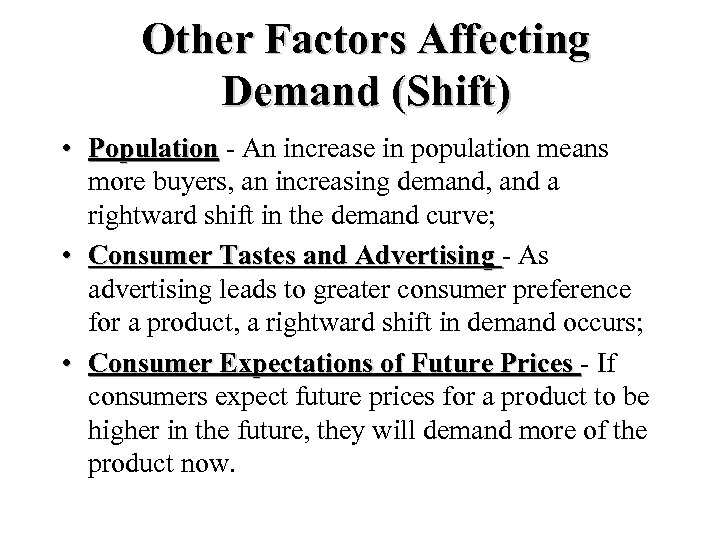

Other Factors Affecting Demand (Shift) • Population - An increase in population means more buyers, an increasing demand, and a rightward shift in the demand curve; • Consumer Tastes and Advertising - As advertising leads to greater consumer preference for a product, a rightward shift in demand occurs; • Consumer Expectations of Future Prices - If consumers expect future prices for a product to be higher in the future, they will demand more of the product now.

Individual Demand Curve Shows the relationship between the price of a good and the quantity that a single consumer is willing to buy (quantity demanded) during a particular time period.

Individual Demand Curve The result of a rational choice by the consumer, based on the associated benefits and costs of consuming a good.

Individual Demand Curve • • • Given a Budget ($30); Spend all budget on two goods: Hamburgers and tacos; Consumption of Hamburgers depends on: – price of burgers; – price of tacos; – income; – underlying tastes or preferences

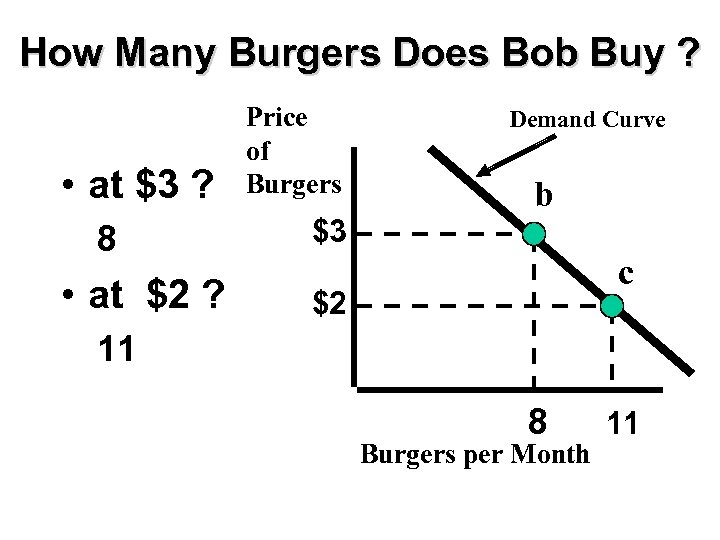

How Many Burgers Does Bob Buy ? • at $3 ? 8 • at $2 ? Price of Burgers $3 Demand Curve b c $2 11 8 Burgers per Month 11

The Principle of Opportunity Cost The Opportunity Cost: • Of something is what you sacrifice to get it; • Of hamburgers is number of tacos given up to get one hamburger. • Of 1 hamburger is 3 tacos, if hamburgers cost $3 and tacos cost $1. Consumption of the first through eighth hamburger provides greater pleasure than consumption of the first taco.

Substitution Effect Change in consumption resulting from change in price of one good relative to the prices of other goods. If price of hamburgers decreases ($2), while price of tacos remains constant, more hamburgers will be substituted for tacos. (Opportunity cost of hamburgers, in terms of tacos decreases).

Income Effect Change in consumption resulting from an increase in consumer’s real income. Real income is measured in terms of the goods the money can buy.

Income Effect • At the original price ($3), Bob buys 8 burgers (cost = $24) and 6 tacos (cost = $6), for total cost of $30. • If the price of burgers drops, Bob’s purchasing power increases. • Given lower price, Bob can buy more burgers and tacos. • Since Bob’s $30 can buy more burgers and tacos when the price of burgers decreases, Bob’s real income increases.

Income Effect • Normal Goods - Most goods: New clothing, air transportation, and meats are examples. Consumption of normal goods increases as real consumer income increases.

Income Effect • Inferior Goods - Consumption of inferior goods decreases as real consumer income increases. Examples: Used clothing, potatoes, inter-city bus transportation.

The Market Demand Curve • Shows for each price, the quantity of a particular good demanded by all consumers. • It is the sum of quantities demanded by each consumer at a given price.

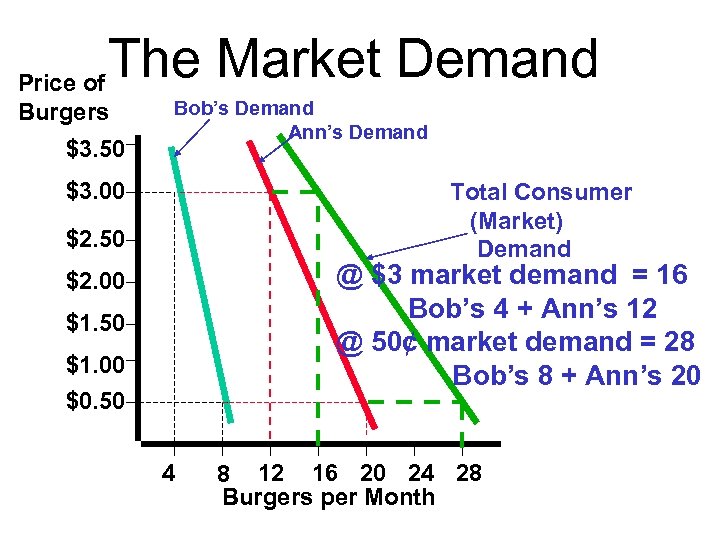

The Market Demand Price of Burgers $3. 50 Bob’s Demand Ann’s Demand $3. 00 Total Consumer (Market) Demand $2. 50 @ $3 market demand = 16 Bob’s 4 + Ann’s 12 @ 50¢ market demand = 28 Bob’s 8 + Ann’s 20 $2. 00 $1. 50 $1. 00 $0. 50 4 8 12 16 20 24 28 Burgers per Month

Market Demand Assumptions • All, except price of the good itself, are held constant: • Price of other goods, • Income, • Tastes, • Number of consumers.

UTILITY The benefit generated by consuming a good: the satisfaction or pleasure the consumer experiences when he or she consumes the good.

Marginal Utility The change in utility resulting from one additional unit of a good.

The Law of Diminishing Marginal Utility As consumption of a particular good increases, marginal utility decreases.

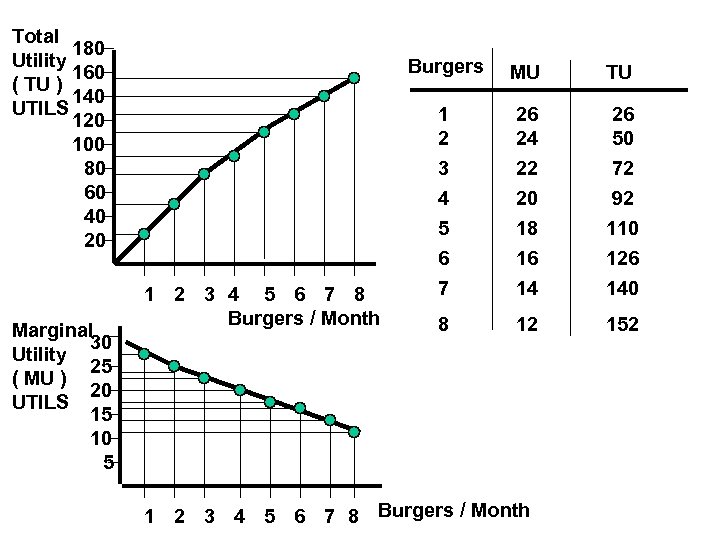

Total 180 Utility 160 ( TU ) 140 UTILS 120 100 80 60 40 20 Marginal 30 Utility 25 ( MU ) 20 UTILS 15 10 5 Burgers 1 2 3 4 5 6 7 8 Burgers / Month MU TU 1 2 3 4 5 6 7 26 24 22 20 18 16 14 26 50 72 92 110 126 140 8 12 152 1 2 3 4 5 6 7 8 Burgers / Month

The Marginal Principle Increase the level of an activity if its marginal benefit exceeds its marginal cost, but reduce the level if the marginal cost exceeds the marginal benefit. If possible, pick the level at which the marginal benefit equals marginal cost.

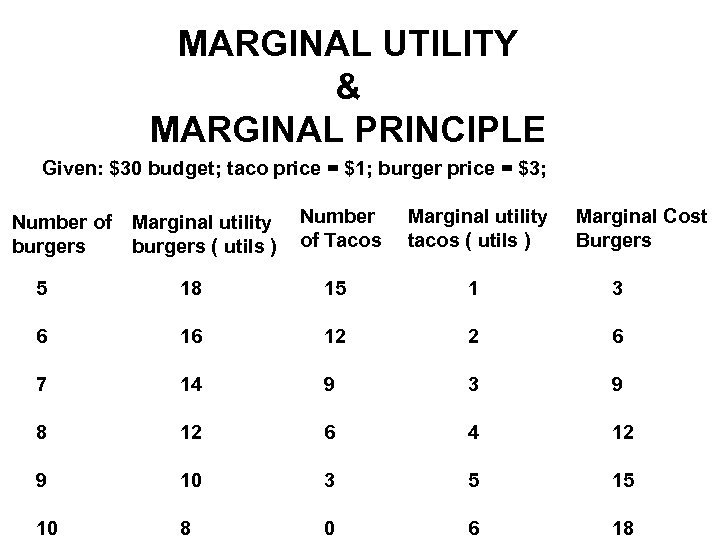

MARGINAL UTILITY & MARGINAL PRINCIPLE Given: $30 budget; taco price = $1; burger price = $3; Number of burgers Marginal utility burgers ( utils ) Number of Tacos Marginal utility tacos ( utils ) Marginal Cost Burgers 5 18 15 1 3 6 16 12 2 6 7 14 9 3 9 8 12 6 4 12 9 10 3 5 15 10 8 0 6 18

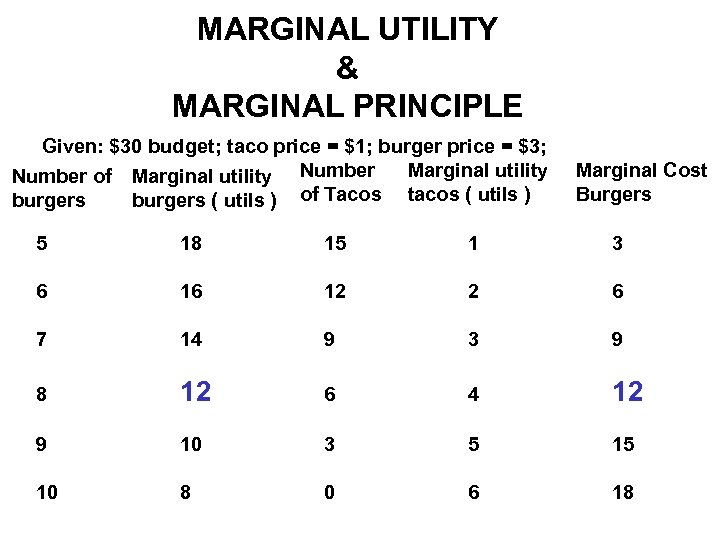

MARGINAL UTILITY & MARGINAL PRINCIPLE Given: $30 budget; taco price = $1; burger price = $3; Marginal utility Number of Marginal utility Number burgers ( utils ) of Tacos tacos ( utils ) Marginal Cost Burgers 5 18 15 1 3 6 16 12 2 6 7 14 9 3 9 8 12 6 4 12 9 10 3 5 15 10 8 0 6 18

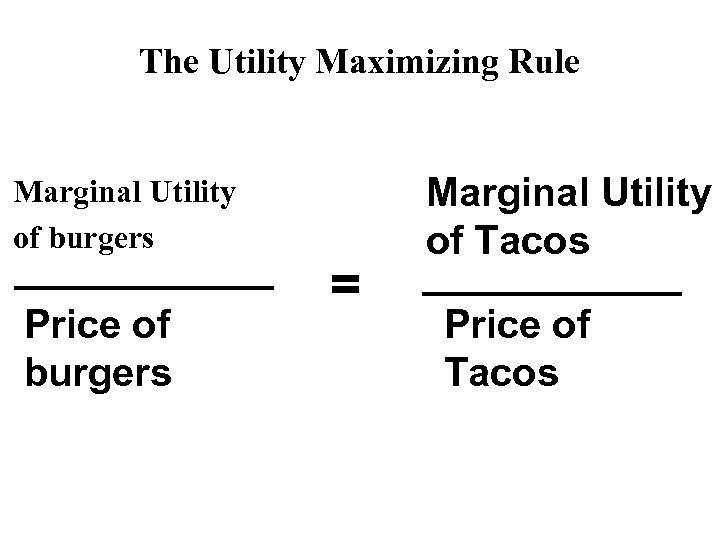

The Utility Maximizing Rule A consumer will maximize his/her utility by picking the affordable combination of consumer goods that makes the marginal utility per dollar spent on one good equal to that of a second good.

The Utility Maximizing Rule Marginal Utility of burgers Price of burgers = Marginal Utility of Tacos Price of Tacos

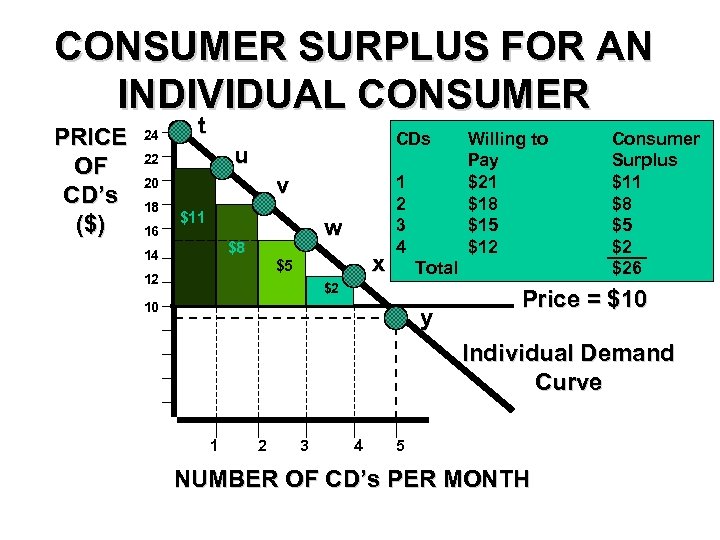

CONSUMER SURPLUS The difference between the maximum amount that a consumer is willing to pay for a good or service and the price he or she pays for the product.

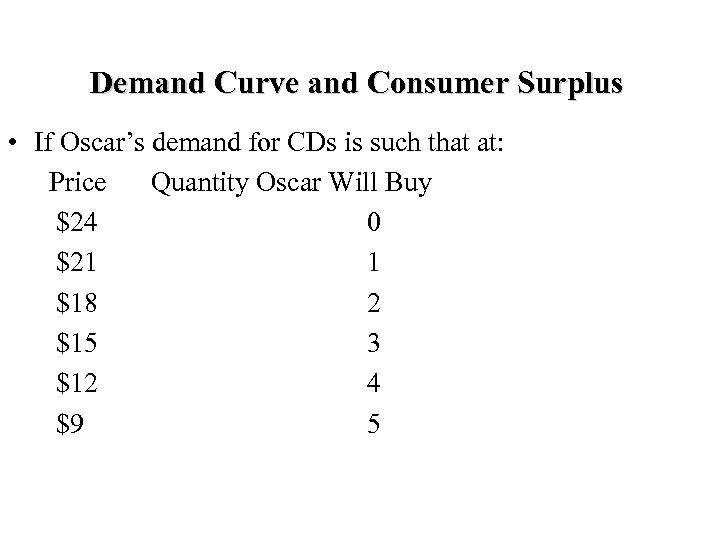

Demand Curve and Consumer Surplus • If Oscar’s demand for CDs is such that at: Price Quantity Oscar Will Buy $24 0 $21 1 $18 2 $15 3 $12 4 $9 5

CONSUMER SURPLUS FOR AN INDIVIDUAL CONSUMER PRICE OF CD’s ($) 24 t CDs u 22 v 20 18 16 $11 w $8 14 x $5 12 1 2 3 4 Willing to Pay $21 $18 $15 $12 Total $2 10 y Consumer Surplus $11 $8 $5 $2 $26 Price = $10 Individual Demand Curve 1 2 3 4 5 NUMBER OF CD’s PER MONTH

66e90cd71c909eea1642f30094beb07e.ppt