14c4f61598073b3f4aced96b83e0d242.ppt

- Количество слайдов: 57

Market Actors & Behaviour by Erik. Ranheim@INTERTANKO. com Manager Research and Projects Copenhagen Business School Oslo 19 February 2008 ‘

Tanker industry Market Technology Finance Regulations

Focus on the tanker industry Tanker industry carries one of the worlds most strategic commodities from some of the politically most tense areas in the world. Oil can potentially cause serious pollution. After many years with negative or low profitability over the last years, the tanker industry has during this decade made extremely good profit and has even received attention in the world stock markets

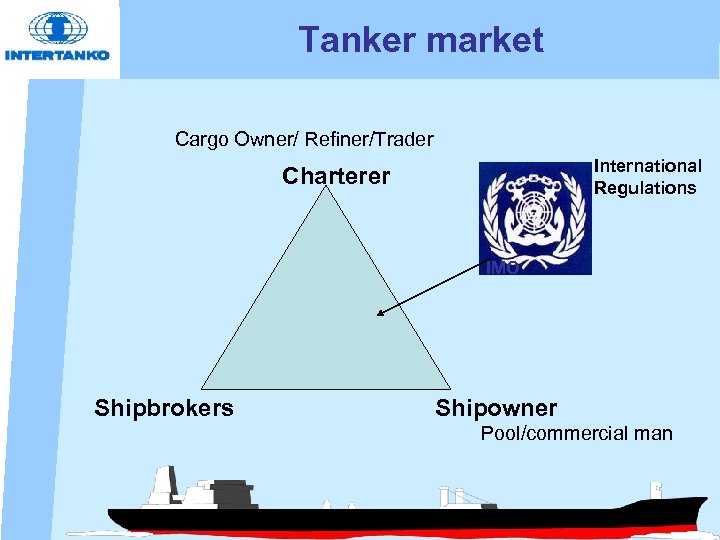

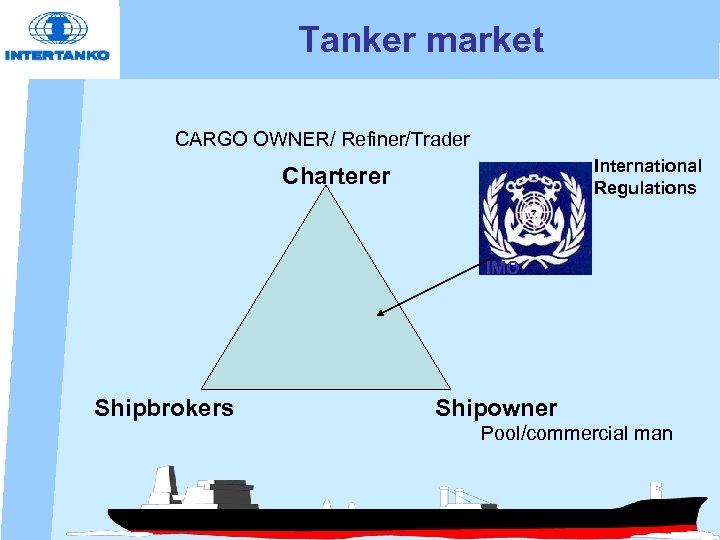

Tanker market Cargo Owner/ Refiner/Trader International Regulations Charterer IMO Shipbrokers Shipowner Pool/commercial man

IMO

What is IMO? • The International Maritime Organization (IMO) is the specialized agency of the United Nations (UN) concerned with Maritime Affairs located in London, England. • IMO (Formerly known as IMCO) was established under a 1948 United Nations convention that entered into force on 17 March 1958. • IMO currently has 168 member states, 2 associate members, 51 Inter-Governmental Organizations which have concluded agreements of cooperation, and 66 Non-Governmental Organizations in Consultative Status with IMO.

Why is there a need for IMO? • Shipping is international • Assets move between jurisdictions • Need for universally applied standards Without IMO trade would be restricted

What does IMO do? IMO’s main objective is to facilitate co-operation among governments on technical and legal matters affecting international shipping Work to achieve the highest level of international standards for maritime safety, maritime security and protection of the marine environment. This is accomplished through the development of international conventions, codes, and recommendations.

IMO has adopted 55 conventions & protocols, including: • Safety of Life at Sea (SOLAS) • Prevention of pollution from Ships (MARPOL) 6 Annexes • Preventing Collisions at Sea (COLREGS) • Loadlines • Standards of Training, Certification, & Watchstanding (STCW)

IMO Has Developed 25 Codes, Including: • Ship and Port Facility Security (ISPS) • Safety Management (ISM) • Standards for Training and Watchkeeping • Maritime Dangerous Goods (IMDG) • Construction and Equipment of Ships Carrying Dangerous Chemical in Bulk • Solid Bulk Cargoes • High Speed Craft • Construction and Equipment of Mobile Offshore Drilling Units

IMO has developed more than 700 recommendations & guidelines, including: l l l Safe access to and working in large tanks & large cargo holds Emergency towing requirements – tankers Medical first aid guide for use in accidents involving dangerous goods Safe use of pesticides in ships Packing Cargo in Freight Containers Provisions and Display of Manoeuvring Some guidelines/recommendations are required to be followed by charterers

IMO Facts • Annual Budget 24 m • Member States fund IMO budget through assessments based largely on size of fleet (% of world’s gross tonnage) • Secretariat – 320 Staff Members 50 Nationalities

IMO Secretariat

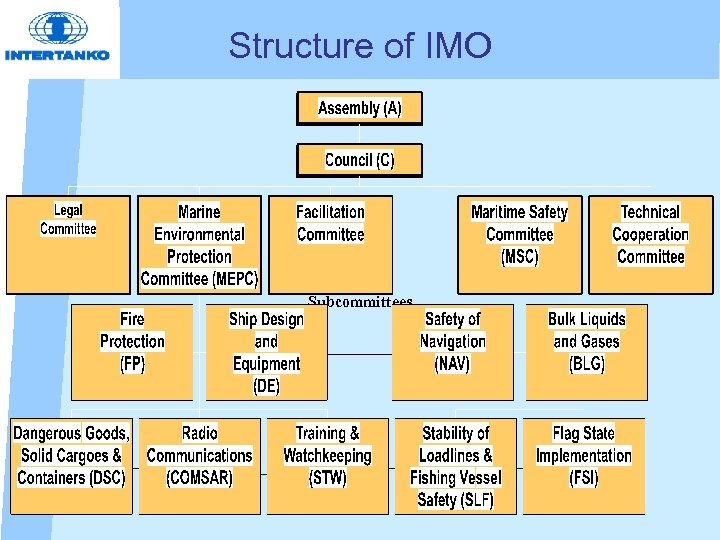

Structure of IMO Subcommittees

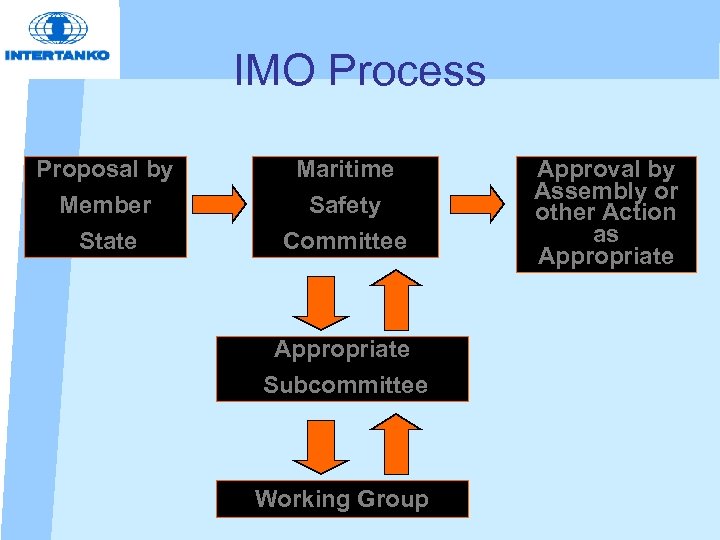

IMO Process Proposal by Maritime Member Safety State Committee Appropriate Subcommittee Working Group Approval by Assembly or other Action as Appropriate

Major Issues on IMO’s Agenda l Air Pollution from Ships l Role of the Human Element l Goal-based new ship construction standards l Maritime Security l Member State Assessment l Ballast Water Management l Recycling of Ships

New Approaches emerging at IMO? • Proactive vs. Reactive Goal Based Standards Maritime Security • Performance Based vs. Prescriptive Ballast Water Management

Delegations to IMO Meetings l l l Delegations consist of Government and/or Industry/Public Sector Advisors Decisions on who goes are made by the Head of the Delegation to each meeting Decisions are based upon specific issues to be discussed at each session Individuals are recommended based on a specific area of expertise or on organizational representation Expenses to attend IMO meetings are normally covered by the individual

IMO demographics have changed • Break up of USSR • Establishment of “Bloc” groups European Union GOLACC (Latin America) • Developing nations wanting a bigger say • Change in world’s fleet

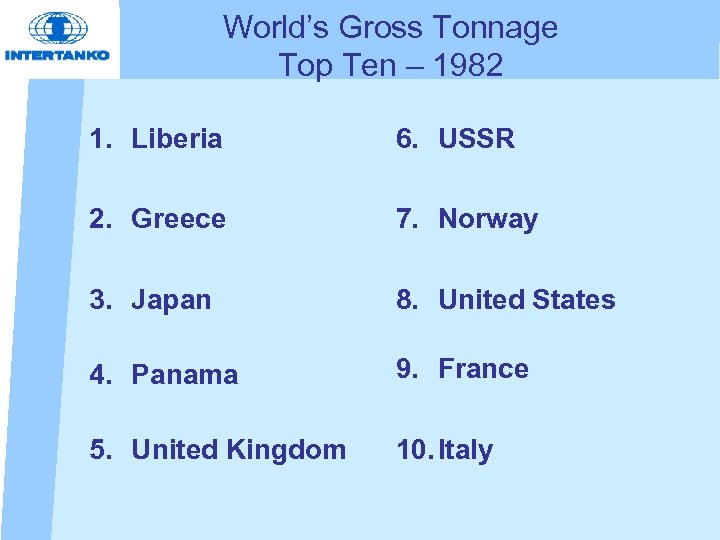

World’s Gross Tonnage Top Ten – 1982 1. Liberia 6. USSR 2. Greece 7. Norway 3. Japan 8. United States 4. Panama 9. France 5. United Kingdom 10. Italy

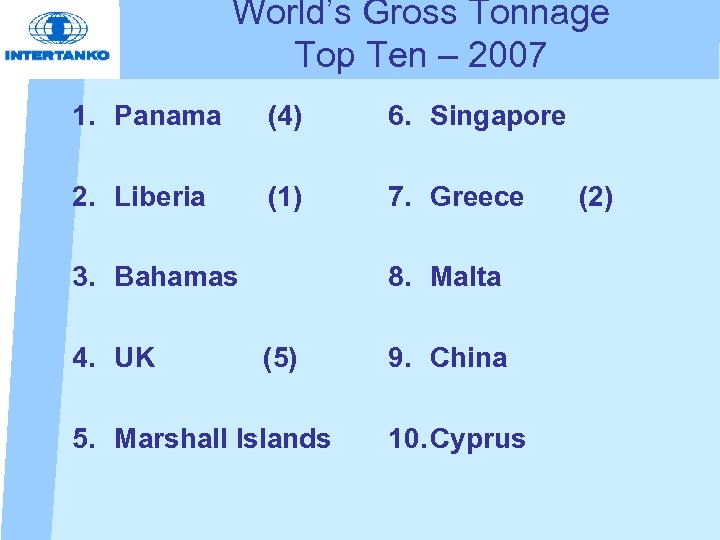

World’s Gross Tonnage Top Ten – 2007 1. Panama (4) 6. Singapore 2. Liberia (1) 7. Greece 3. Bahamas 4. UK 8. Malta (5) 5. Marshall Islands 9. China 10. Cyprus (2)

INTERTANKO’S ROLE As an NGO*, we represent tanker industry by: • • • Submitting proposals (w. /without co-sponsorship) Written comments on proposals Verbal comments at meetings Participating in working groups Lobbying for support on issues Demonstrating a proactive responsible role *None Government Organisation

Tanker market

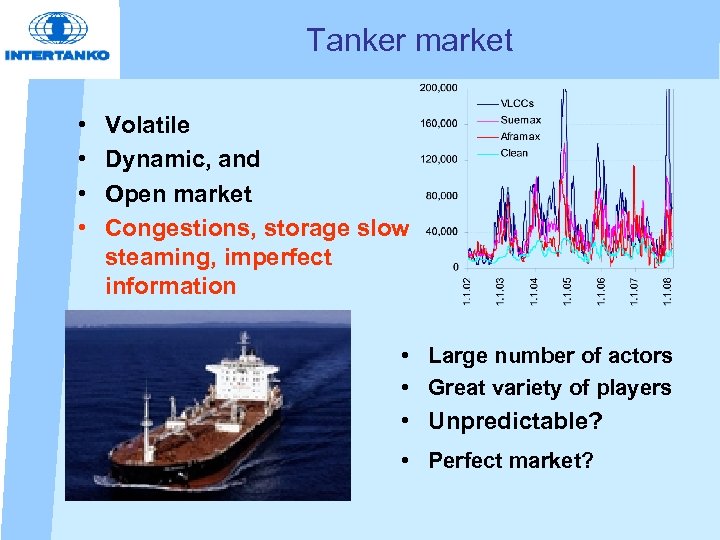

Tanker market • • Volatile Dynamic, and Open market Congestions, storage slow steaming, imperfect information • Large number of actors • Great variety of players • Unpredictable? • Perfect market?

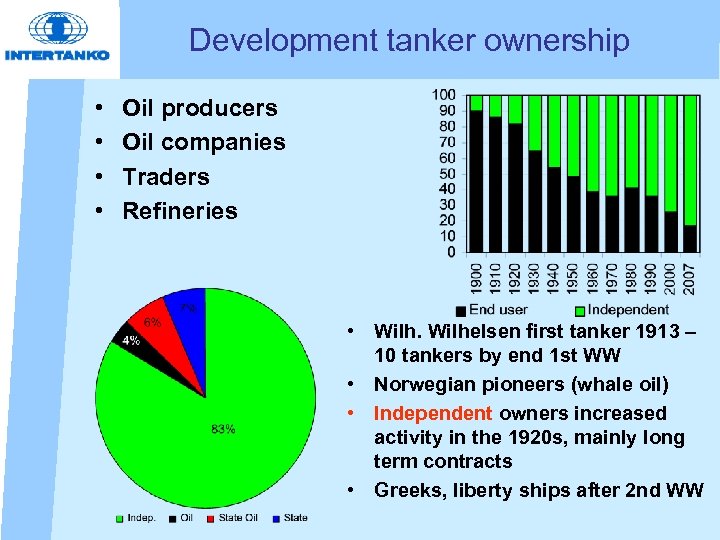

Development tanker ownership • • Oil producers Oil companies Traders Refineries • Wilhelsen first tanker 1913 – 10 tankers by end 1 st WW • Norwegian pioneers (whale oil) • Independent owners increased activity in the 1920 s, mainly long term contracts • Greeks, liberty ships after 2 nd WW

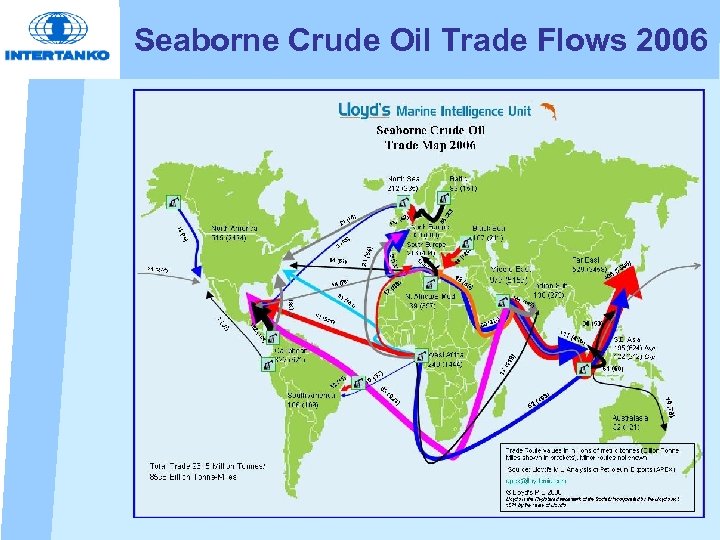

Seaborne Crude Oil Trade Flows 2006

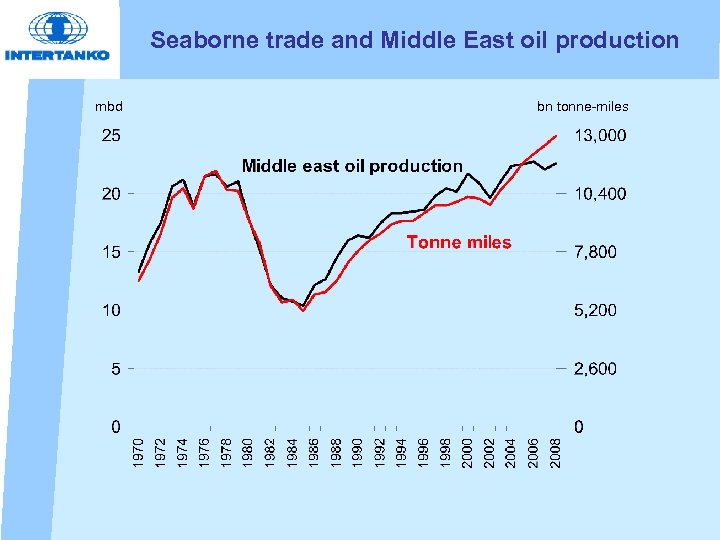

Seaborne trade and Middle East oil production mbd bn tonne-miles

Oil market

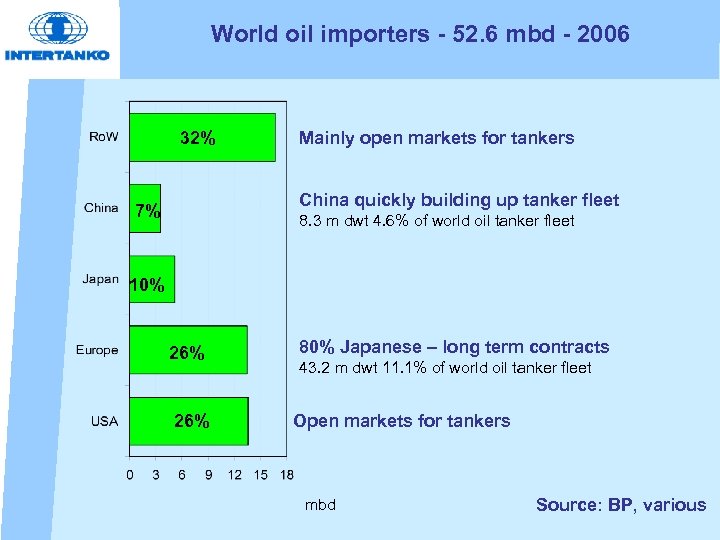

World oil importers - 52. 6 mbd - 2006 32% Mainly open markets for tankers China quickly building up tanker fleet 7% 8. 3 m dwt 4. 6% of world oil tanker fleet 10% 26% 80% Japanese – long term contracts 43. 2 m dwt 11. 1% of world oil tanker fleet Open markets for tankers mbd Source: BP, various

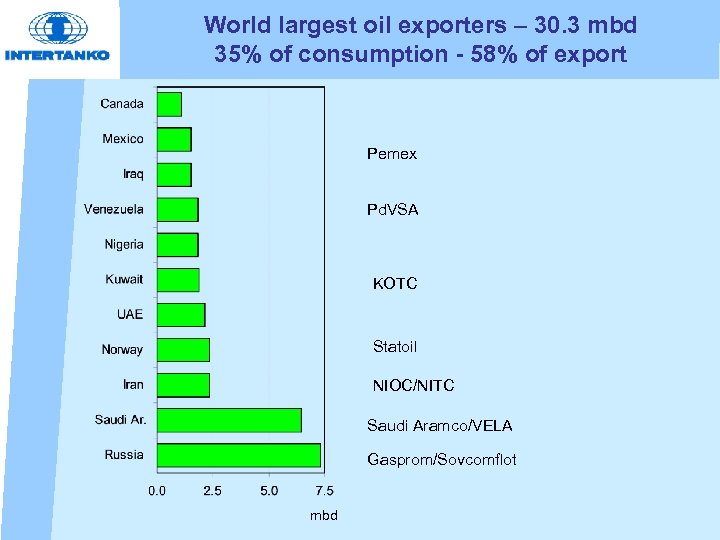

World largest oil exporters – 30. 3 mbd 35% of consumption - 58% of export Pemex Pd. VSA KOTC Statoil NIOC/NITC Saudi Aramco/VELA Gasprom/Sovcomflot mbd

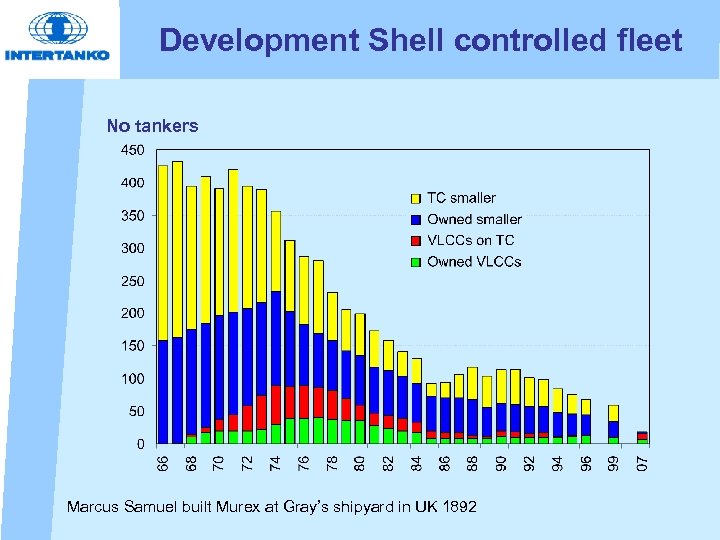

Development Shell controlled fleet No tankers Marcus Samuel built Murex at Gray’s shipyard in UK 1892

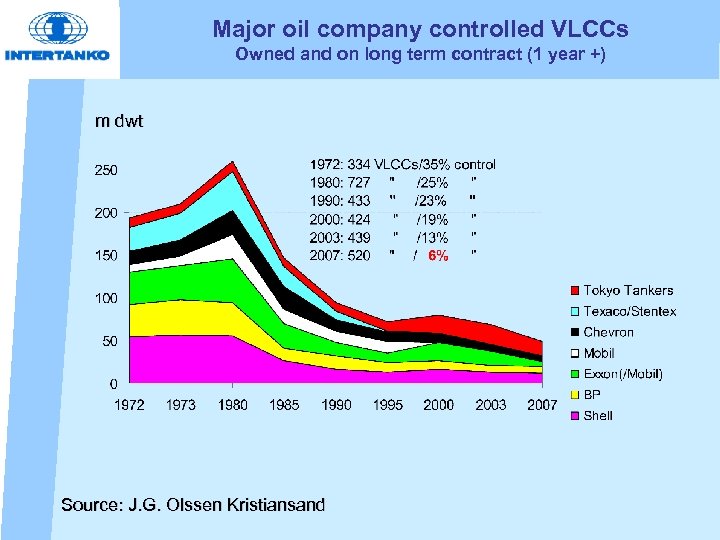

Major oil company controlled VLCCs Owned and on long term contract (1 year +) m dwt Source: J. G. Olssen Kristiansand

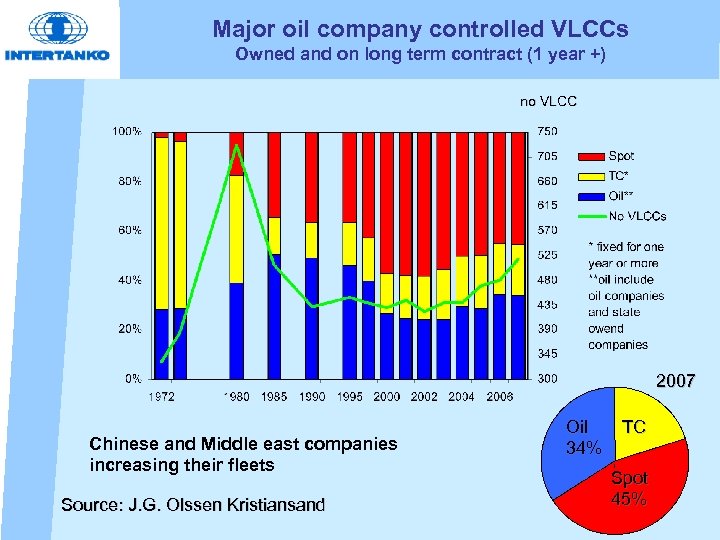

Major oil company controlled VLCCs Owned and on long term contract (1 year +) no VLCC 2007 Chinese and Middle east companies increasing their fleets Source: J. G. Olssen Kristiansand Oil 34% TC Spot 45%

Should oil companies own tankers • Vertical integration is most attractive when different types of market failure exist that threaten profitability. Bringing production inhouse allows a company to internalise and thereby overcome market failures. The strategy is not without its own costs in terms of efficiency and price. • Vertical integration is best where the activity in question is complex and hard to define under conventional legal contracts. • Vertical integration is attractive when outside suppliers are few and likely to behave opportunistic, exercise market power. When economics means business, Sultan Kermally

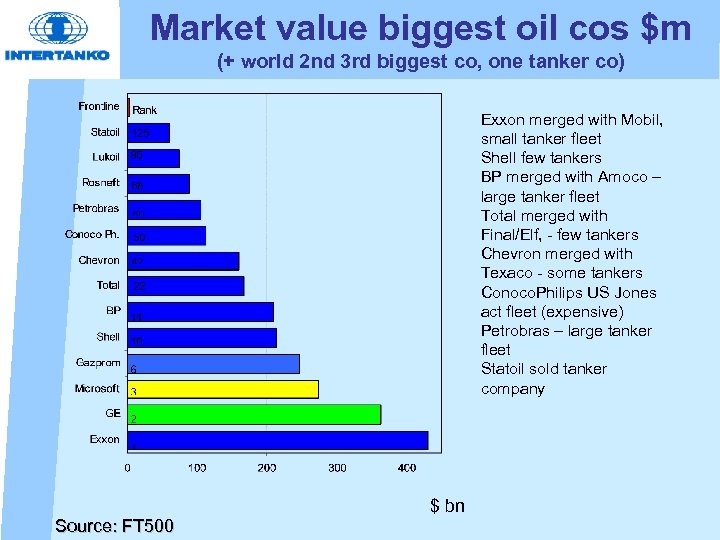

Market value biggest oil cos $m (+ world 2 nd 3 rd biggest co, one tanker co) Exxon merged with Mobil, small tanker fleet Shell few tankers BP merged with Amoco – large tanker fleet Total merged with Final/Elf, - few tankers Chevron merged with Texaco - some tankers Conoco. Philips US Jones act fleet (expensive) Petrobras – large tanker fleet Statoil sold tanker company Source: FT 500 $ bn

Why oil companies by each other • Horizontal integration merging of firms which are at the same level of production or are involved in similar processes • Horizontal integration competitive to achieve positioning of the firm vis-a-vis rivals. • Horizontal integration to achieve economics of scale. • Horizontal integration to acquire technology and knowledge When economics means business, Sultan Kermally

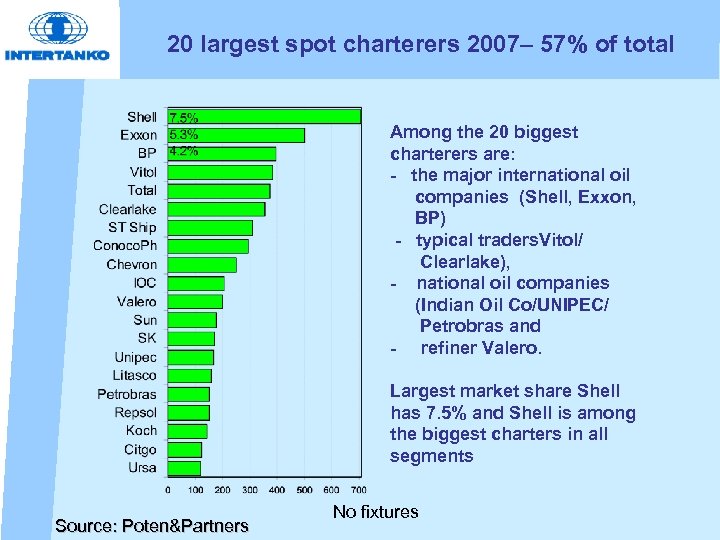

20 largest spot charterers 2007– 57% of total Among the 20 biggest charterers are: - the major international oil companies (Shell, Exxon, BP) - typical traders. Vitol/ Clearlake), - national oil companies (Indian Oil Co/UNIPEC/ Petrobras and - refiner Valero. Largest market share Shell has 7. 5% and Shell is among the biggest charters in all segments Source: Poten&Partners No fixtures

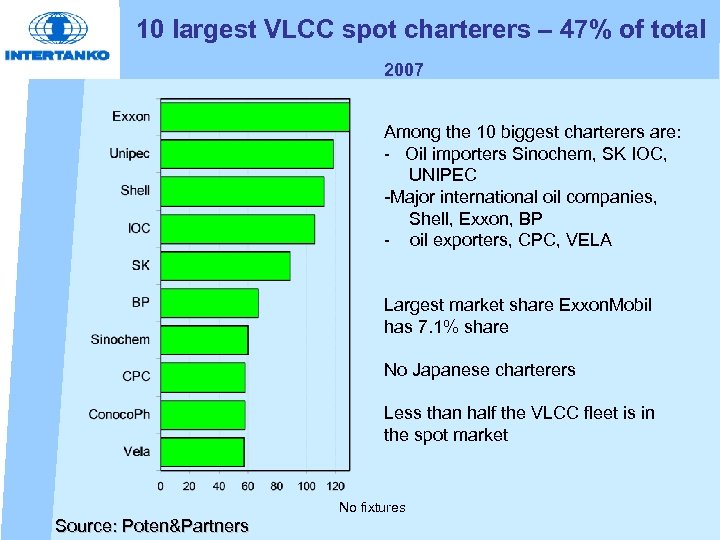

10 largest VLCC spot charterers – 47% of total 2007 Among the 10 biggest charterers are: - Oil importers Sinochem, SK IOC, UNIPEC -Major international oil companies, Shell, Exxon, BP - oil exporters, CPC, VELA Largest market share Exxon. Mobil has 7. 1% share No Japanese charterers Less than half the VLCC fleet is in the spot market No fixtures Source: Poten&Partners

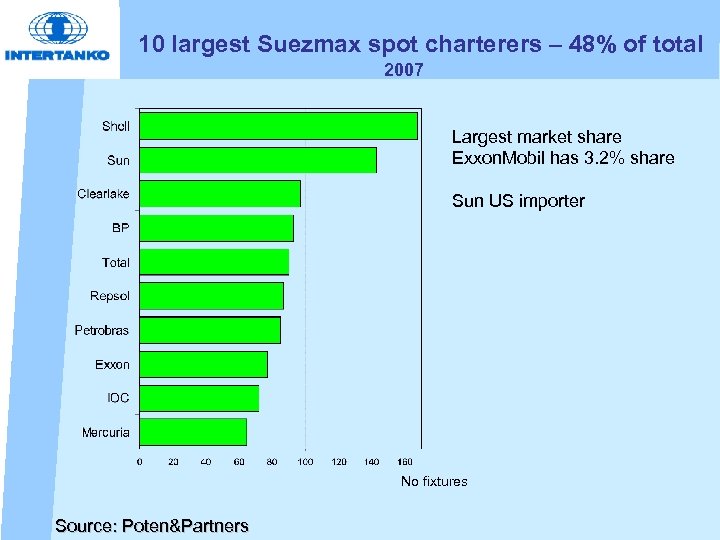

10 largest Suezmax spot charterers – 48% of total 2007 Largest market share Exxon. Mobil has 3. 2% share Sun US importer No fixtures Source: Poten&Partners

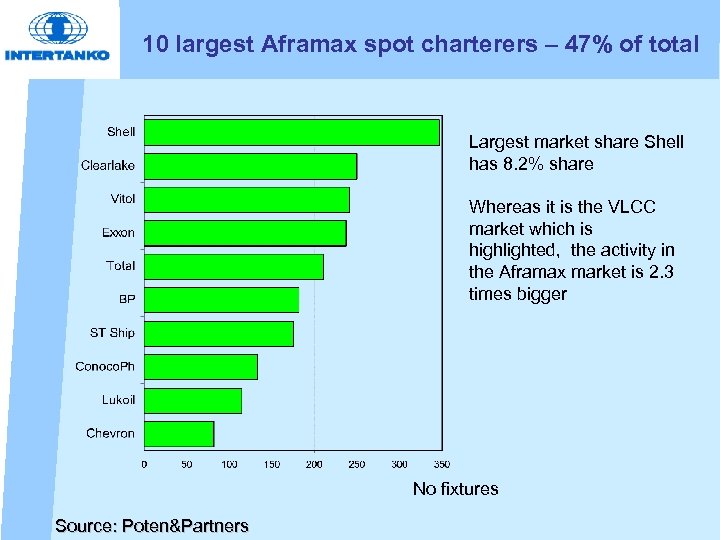

10 largest Aframax spot charterers – 47% of total Largest market share Shell has 8. 2% share Whereas it is the VLCC market which is highlighted, the activity in the Aframax market is 2. 3 times bigger No fixtures Source: Poten&Partners

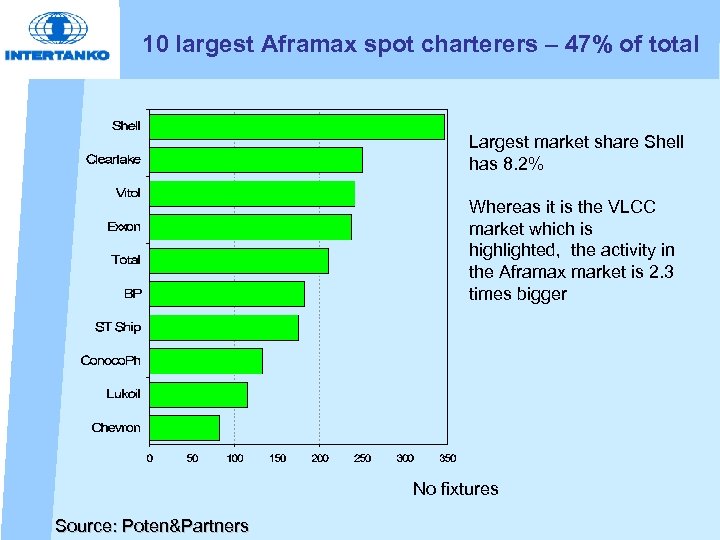

10 largest Aframax spot charterers – 47% of total Largest market share Shell has 8. 2% Whereas it is the VLCC market which is highlighted, the activity in the Aframax market is 2. 3 times bigger No fixtures Source: Poten&Partners

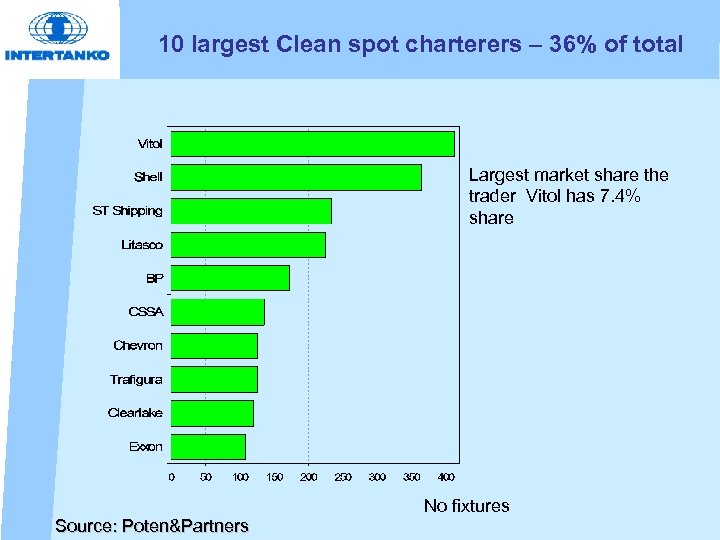

10 largest Clean spot charterers – 36% of total Largest market share the trader Vitol has 7. 4% share Source: Poten&Partners No fixtures

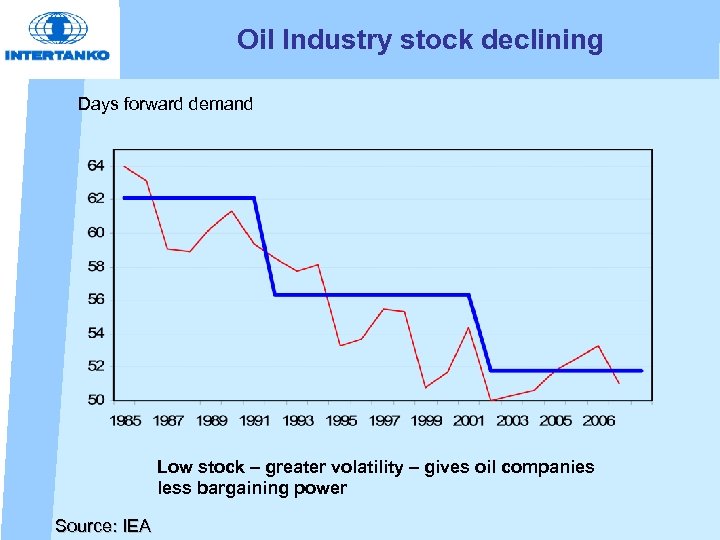

Oil Industry stock declining Days forward demand Low stock – greater volatility – gives oil companies less bargaining power Source: IEA

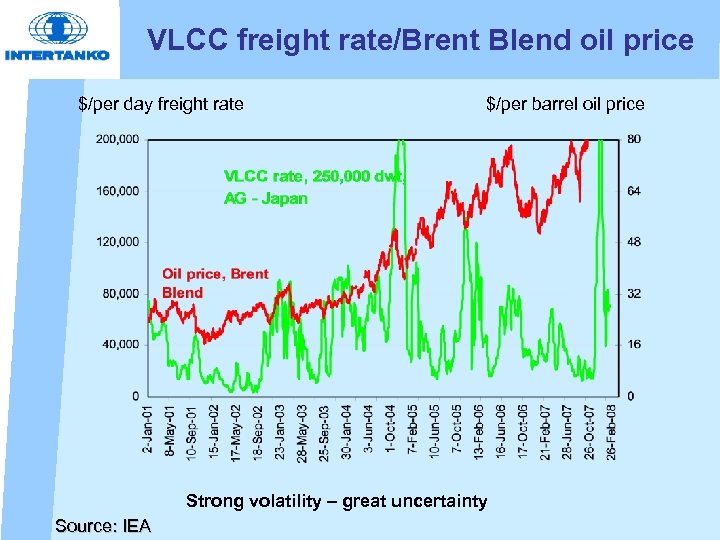

VLCC freight rate/Brent Blend oil price $/per day freight rate $/per barrel oil price Strong volatility – great uncertainty Source: IEA

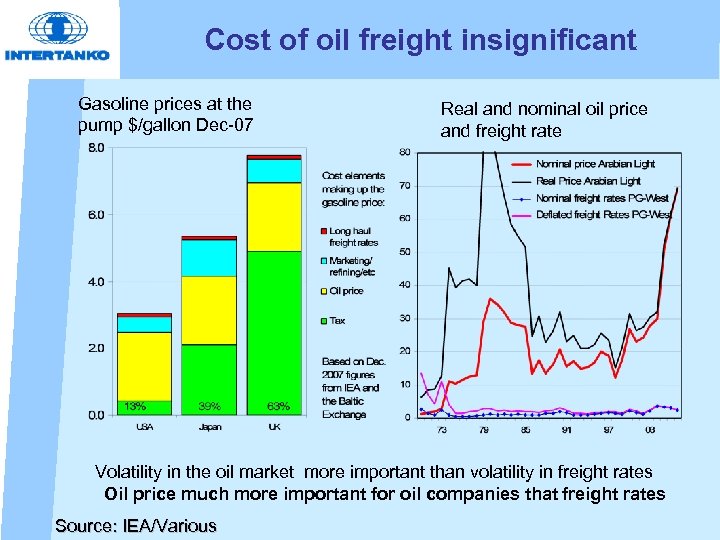

Cost of oil freight insignificant Gasoline prices at the pump $/gallon Dec-07 Real and nominal oil price and freight rate Volatility in the oil market more important than volatility in freight rates Oil price much more important for oil companies that freight rates Source: IEA/Various

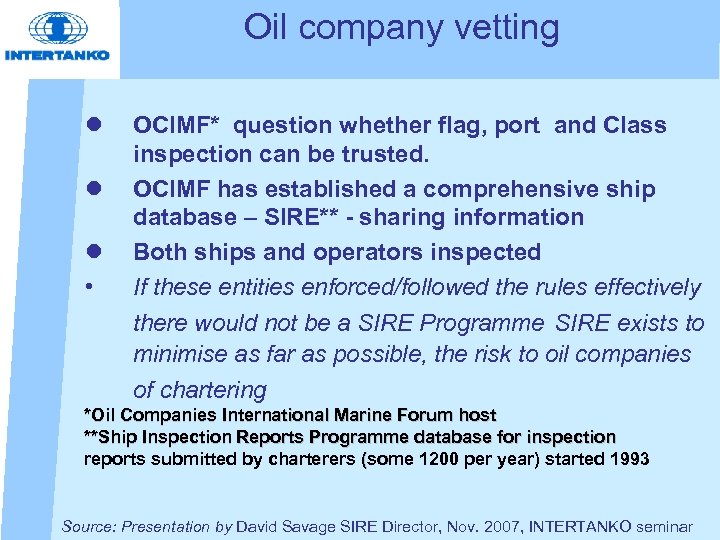

Oil company vetting l l l • OCIMF* question whether flag, port and Class inspection can be trusted. OCIMF has established a comprehensive ship database – SIRE** - sharing information Both ships and operators inspected If these entities enforced/followed the rules effectively there would not be a SIRE Programme SIRE exists to minimise as far as possible, the risk to oil companies of chartering *Oil Companies International Marine Forum host **Ship Inspection Reports Programme database for inspection reports submitted by charterers (some 1200 per year) started 1993 Source: Presentation by David Savage SIRE Director, Nov. 2007, INTERTANKO seminar

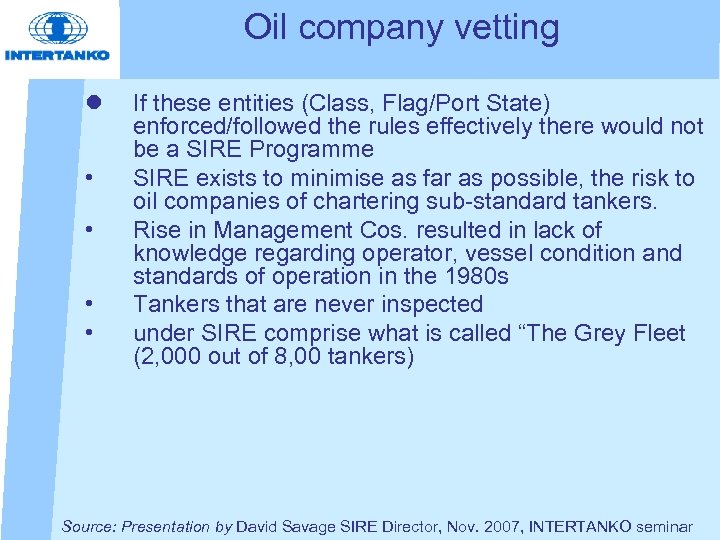

Oil company vetting l • • If these entities (Class, Flag/Port State) enforced/followed the rules effectively there would not be a SIRE Programme SIRE exists to minimise as far as possible, the risk to oil companies of chartering sub-standard tankers. Rise in Management Cos. resulted in lack of knowledge regarding operator, vessel condition and standards of operation in the 1980 s Tankers that are never inspected under SIRE comprise what is called “The Grey Fleet (2, 000 out of 8, 00 tankers) Source: Presentation by David Savage SIRE Director, Nov. 2007, INTERTANKO seminar

Tanker owners

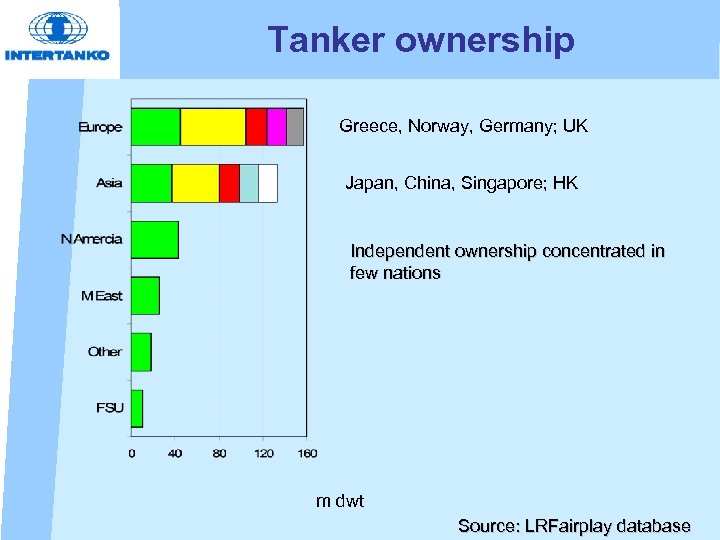

Tanker ownership Greece, Norway, Germany; UK Japan, China, Singapore; HK Independent ownership concentrated in few nations m dwt Source: LRFairplay database

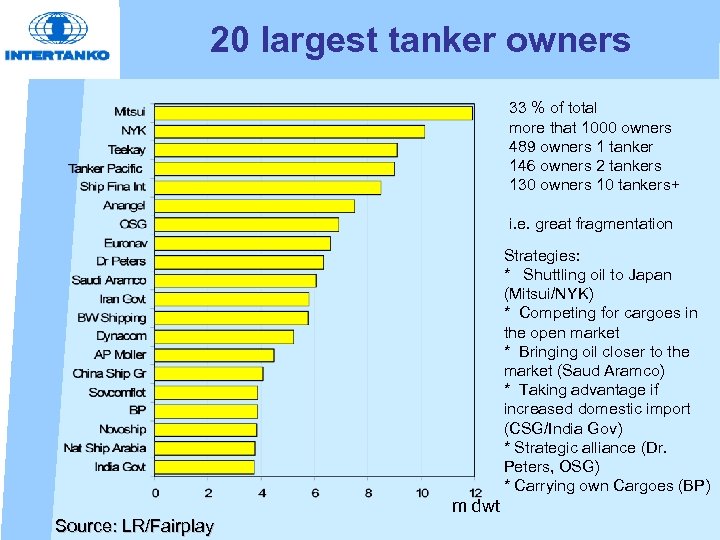

20 largest tanker owners 33 % of total more that 1000 owners 489 owners 1 tanker 146 owners 2 tankers 130 owners 10 tankers+ i. e. great fragmentation Strategies: * Shuttling oil to Japan (Mitsui/NYK) * Competing for cargoes in the open market * Bringing oil closer to the market (Saud Aramco) * Taking advantage if increased domestic import (CSG/India Gov) * Strategic alliance (Dr. Peters, OSG) * Carrying own Cargoes (BP) Source: LR/Fairplay m dwt

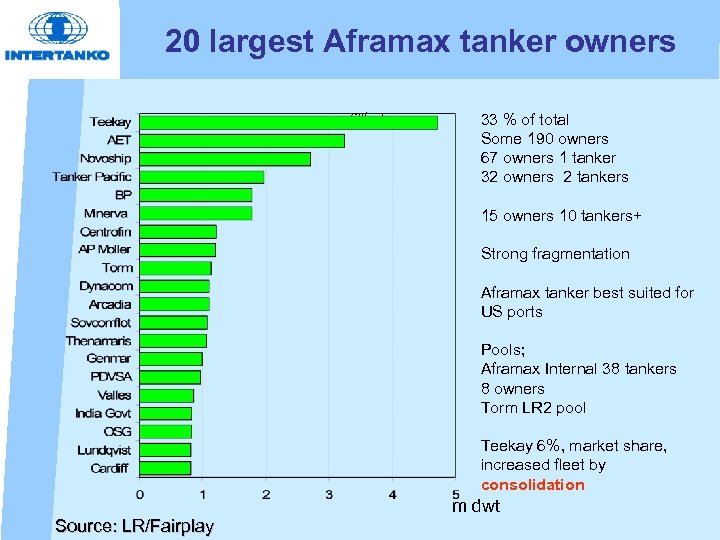

20 largest Aframax tanker owners 6% share 33 % of total Some 190 owners 67 owners 1 tanker 32 owners 2 tankers 15 owners 10 tankers+ Strong fragmentation Aframax tanker best suited for US ports Pools; Aframax Internal 38 tankers 8 owners Torm LR 2 pool Teekay 6%, market share, increased fleet by consolidation Source: LR/Fairplay m dwt

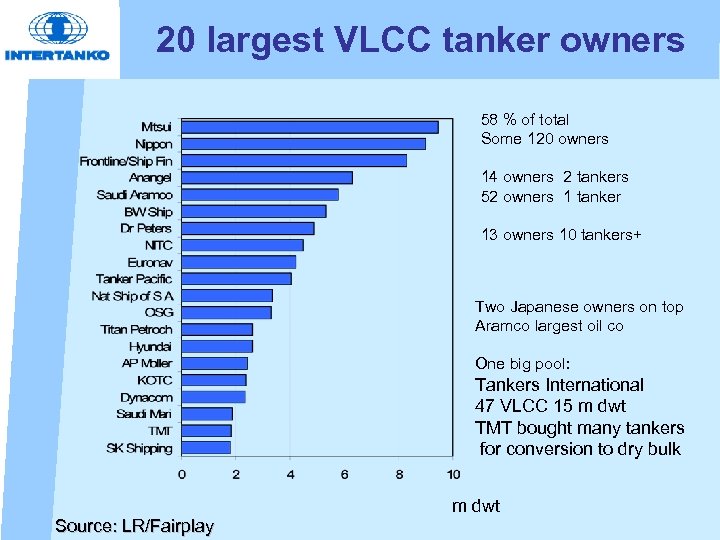

20 largest VLCC tanker owners 58 % of total Some 120 owners 14 owners 2 tankers 52 owners 1 tanker 13 owners 10 tankers+ Two Japanese owners on top Aramco largest oil co One big pool: Tankers International 47 VLCC 15 m dwt TMT bought many tankers for conversion to dry bulk Source: LR/Fairplay m dwt

End remarks • Close to a perfect market • A great deal of consolidation but still fragmented tankers ownership • National oil companies are becoming stronger • Many companies with different strategies makes the market dynamic

Tanker market CARGO OWNER/ Refiner/Trader International Regulations Charterer IMO Shipbrokers Shipowner Pool/commercial man

Tanker market players • • Oil producers (OPEC) Oil companies Traders Refineries • Tanker owners: – Independent – State owned – Oil companies Tanker ownership

Tanker market – unique? • Large number of shippers/charterers • Large number of receivers

14c4f61598073b3f4aced96b83e0d242.ppt