ce113ebe06a5f7c982dc6276005b11da.ppt

- Количество слайдов: 16

Market Acceleration Center (MAC) Confidential

Quick Background • Who Are We? An organization of successful CEO's, Entrepreneurs and Thought Leaders who enjoy being involved with and building great companies. • What Do We Do? Holding company that starts, owns and manages a portfolio of Early Stage technology companies in proven markets with rapid growth potential Confidential

Board of Advisors Steven Cakebread Past President salesforce. com Dr. Robert Kaplan Harvard Business School (Balanced Score Card etc) Tim Mattox Worldwide Product Mgt Dell Greg Smith President Xerox Mortgage Svcs Confidential Joel Ronning, CEO Digital River Ron Verni Retired CEO Sage Software

Fellows Stephen Walden, Past Founding Team Prodigy & Bellsouth. net. Tom Lamb, Past CEO Agilex/Kelco/Huber. Dick Cook, Past CEO MAPICS. Michael Blake, Director of Valuations Habif, Arogeti & Wynne. Larry Smith, Retired General Counsel Home Depot. Michael Reene, Past Head of Strategy Choice. Point. Erik Sebusch, Investments Portfolio Mgr UPS. Jim Noble, CEO Noble Systems. Confidential

Executive Team Michael Price General Partner Floyd Hoffman Director of Corporate Dev. Bryna Larsen President, Loud. Job Nicole Lobisco Director of Marketing Svcs Dori Lindsey Director: MAC Donna Wise President, Survey. Executives Confidential John Sabol President, List. K Melinda Burns HR Services

Increasing Angel Returns Fundamentally Two Ways to Make More in Angel Investing: 1. Increase Odds of Each Company's Success. 2. Increase Odds of Owning Part of an Outlier. (through better funnel, picks, diversity). Confidential

What Got Our Attention? • Lost more startups from lack of market traction than all other risk factors combined. • Massive waste of capital when a product was viable but market traction wasn't reached. • Extreme variability in building an effective sales team for any given product. Confidential

Worth The Time? 1. Where Most of Us Invest Time Now: (Stats from Angel. Soft): • • • 1 in 100 companies formally requesting Angel funding secure it. 75% eliminated by initial screening process. 14% eliminated by live presentations and discussions. 10% eliminated by the due-diligence process. 1% secure Angel funding. • Historically 1 in 10 of these exit at a high multiple so: • 0. 1% truly succeed (1 in 1000 formally seeking capital). • Massive Amount of Angel Time Spent on Picking. Confidential

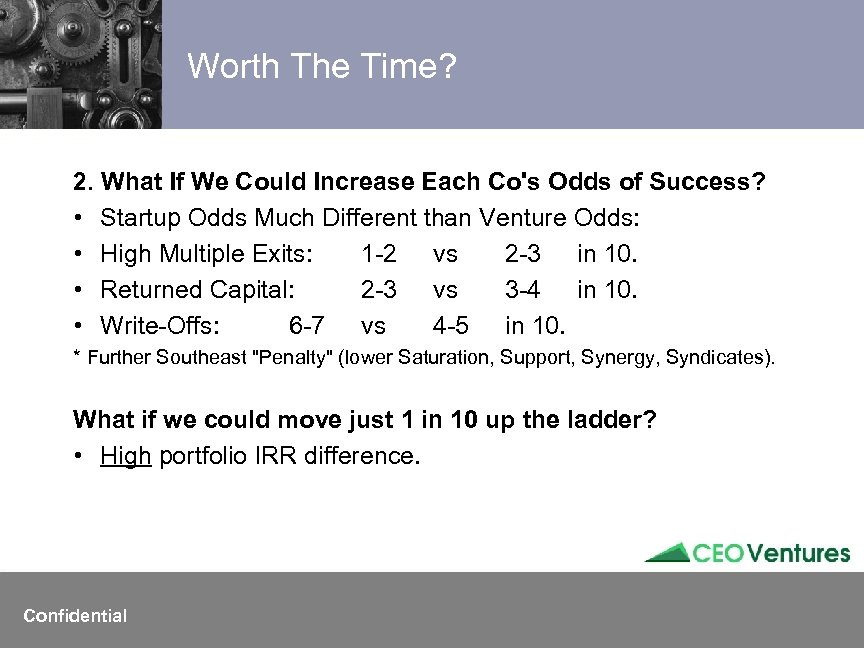

Worth The Time? 2. What If We Could Increase Each Co's Odds of Success? • Startup Odds Much Different than Venture Odds: • High Multiple Exits: 1 -2 vs 2 -3 in 10. • Returned Capital: 2 -3 vs 3 -4 in 10. • Write-Offs: 6 -7 vs 4 -5 in 10. * Further Southeast "Penalty" (lower Saturation, Support, Synergy, Syndicates). What if we could move just 1 in 10 up the ladder? • High portfolio IRR difference. Confidential

How Do We Manage Startup Risk? 1. Diversification Risk (Pre-Investment). - Enough cos to have good odds of owning "Outliers". 2. Exit Risk (Pre-Investment). - Degree of interest by potential buyers pre-launch. - Right space to likely command a premium at exit time. 3. Market Risk (Pre-Investment). - Profitably reachable, would they consider you, enough of them, enough spend? 4. Development Risk (Pre-Investment). - What do they want? (not would they buy "This"), enough value/margin. - Core IT team, market-driven specs, cost advantage. 5. Sales Risk (Highest Impact on a Current Portfolio). - Can leaders crack the positioning nut then replicate w/reps. - Sales efficiency issues. Confidential

Where To Start on Sales Risk? We asked Those With Good Outcomes: • True Startup-To-Exits (ie. ISS, etc). • Frequent New/Scaling Products (ie. Sage, Infor, etc). • Rising Pre-Exits (ie. Hannon-Hill, Mansell, etc) Observation on Findings: • Shockingly Consistent. • Process driven, beyond a few rainmakers. • Great innovation among these processes. (ie. rapid defined advancement) • Findings handout. Confidential

What Are We Building? • Market Acceleration Center (MAC). • Ensures both Best Practices and Synergies. • NASCAR Pit Stop. • Dangers: Cos must "own" the process we help them fast track. • Litmus: Would exit buyer feel processes/control not owned. Confidential

Additional Unique Leverage. Lead Generation (via our List. K). • Deepest executive databases via web data mining. • Provides D&B, Hoovers, Info. USA, etc with emails etc. • Does lead generation for IBM, Oracle, AT&T Biz, etc. • All warm vs cold calls plus autodialing. Confidential

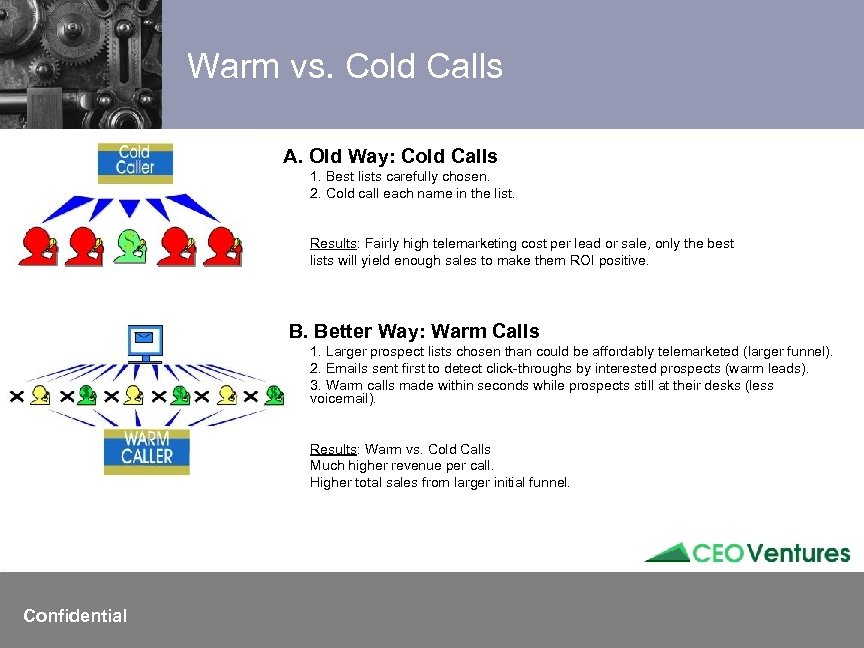

Warm vs. Cold Calls A. Old Way: Cold Calls 1. Best lists carefully chosen. 2. Cold call each name in the list. Results: Fairly high telemarketing cost per lead or sale, only the best lists will yield enough sales to make them ROI positive. B. Better Way: Warm Calls 1. Larger prospect lists chosen than could be affordably telemarketed (larger funnel). 2. Emails sent first to detect click-throughs by interested prospects (warm leads). 3. Warm calls made within seconds while prospects still at their desks (less voicemail). Results: Warm vs. Cold Calls Much higher revenue per call. Higher total sales from larger initial funnel. Confidential

Additional Power Tools. • Extreme Visibility (ie. Plug. Me. In. com). • Click-Through Rapid Live Connection. • Anonymous Visitor Identity/Alert Tech. • Instant Web Demo Tools. Confidential

Summary Before We Go Cut the Ribbon. • Rising Tide Lifts All Ships. • Success breeds success (ie. Security/Healthcare software etc). • We don’t have all the answers—like to share. • My contact: mprice @ ceoventures. com Confidential

ce113ebe06a5f7c982dc6276005b11da.ppt