ccd14c144415e4126e8d9fd257a10e9b.ppt

- Количество слайдов: 114

Marke. Trak VI: Hearing Aid Industry Market Tracking Survey 1984 -2000 Sergei Kochkin, Ph. D. Knowles Electronics, Inc. February 27, 2002

Marke. Trak VI: Hearing Aid Industry Market Tracking Survey 1984 -2000 Sergei Kochkin, Ph. D. Knowles Electronics, Inc. February 27, 2002

Method • National family opinion panel – 80, 000 households • Balanced to key census variables – HIA survey in 1984 used NFO – All Marke. Trak surveys • Screening Question – Phase I (November 2000) – “Does anyone in your household have a hearing difficulty in one or both ears without the use of a hearing aid? ” – Physician screening for hearing loss during last physical within last six months. – Self, Spouse, Other, Child (Under age 18) – 15, 800 hearing-impaired individuals – 72% response rate

Method • National family opinion panel – 80, 000 households • Balanced to key census variables – HIA survey in 1984 used NFO – All Marke. Trak surveys • Screening Question – Phase I (November 2000) – “Does anyone in your household have a hearing difficulty in one or both ears without the use of a hearing aid? ” – Physician screening for hearing loss during last physical within last six months. – Self, Spouse, Other, Child (Under age 18) – 15, 800 hearing-impaired individuals – 72% response rate

Method • Hearing Aid Owner Survey - Phase II – Detailed questionnaire 3, 000 hearing aid owners based on Phase I response. – Response rate 87% • Topics: – – – – – Customer satisfaction (more than 50 areas) Hearing aid usage (e. g. hours worn) Use of ALDs First time user influences Brand selection Factors impacting choice of audiologist/dispenser Suggestions for improving hearing aids Perceived quality of life changes Use of computers in hearing healthcare

Method • Hearing Aid Owner Survey - Phase II – Detailed questionnaire 3, 000 hearing aid owners based on Phase I response. – Response rate 87% • Topics: – – – – – Customer satisfaction (more than 50 areas) Hearing aid usage (e. g. hours worn) Use of ALDs First time user influences Brand selection Factors impacting choice of audiologist/dispenser Suggestions for improving hearing aids Perceived quality of life changes Use of computers in hearing healthcare

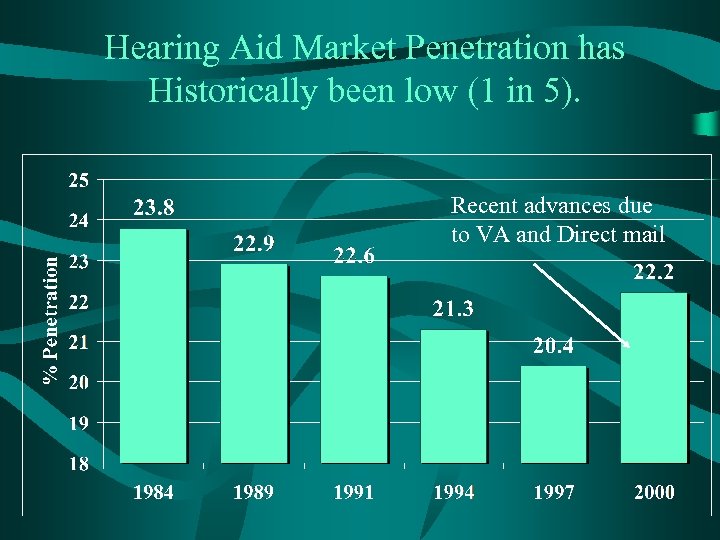

Hearing Aid Market Penetration has Historically been low (1 in 5). Recent advances due to VA and Direct mail

Hearing Aid Market Penetration has Historically been low (1 in 5). Recent advances due to VA and Direct mail

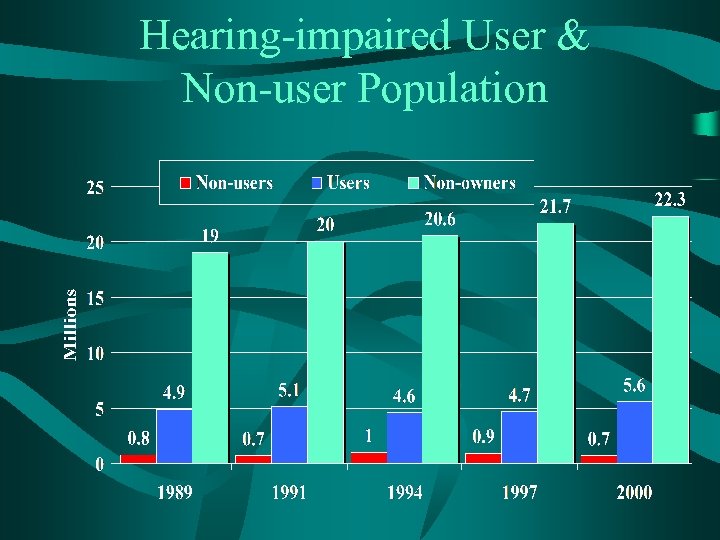

Hearing-impaired User & Non-user Population

Hearing-impaired User & Non-user Population

Hearing Loss Population by Age Group Owners versus Non-owners (2000)

Hearing Loss Population by Age Group Owners versus Non-owners (2000)

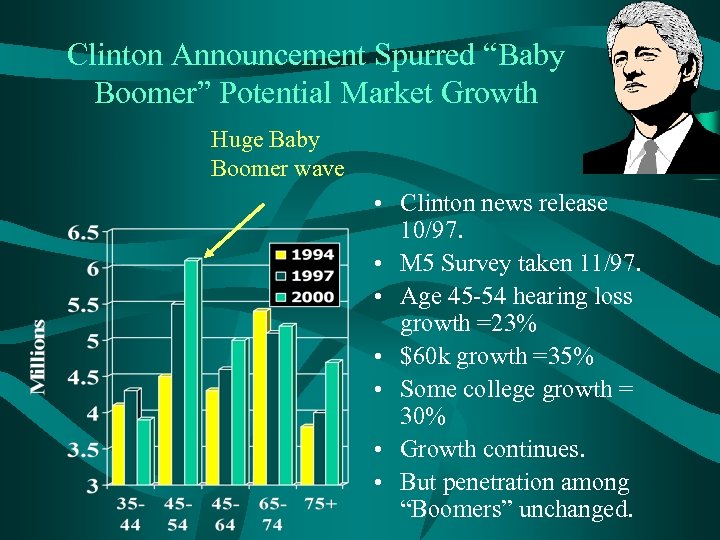

Clinton Announcement Spurred “Baby Boomer” Potential Market Growth Huge Baby Boomer wave • Clinton news release 10/97. • M 5 Survey taken 11/97. • Age 45 -54 hearing loss growth =23% • $60 k growth =35% • Some college growth = 30% • Growth continues. • But penetration among “Boomers” unchanged.

Clinton Announcement Spurred “Baby Boomer” Potential Market Growth Huge Baby Boomer wave • Clinton news release 10/97. • M 5 Survey taken 11/97. • Age 45 -54 hearing loss growth =23% • $60 k growth =35% • Some college growth = 30% • Growth continues. • But penetration among “Boomers” unchanged.

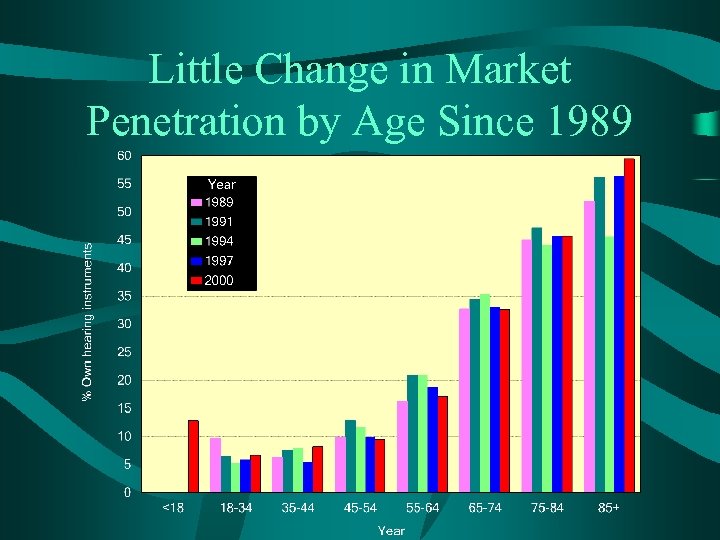

Little Change in Market Penetration by Age Since 1989

Little Change in Market Penetration by Age Since 1989

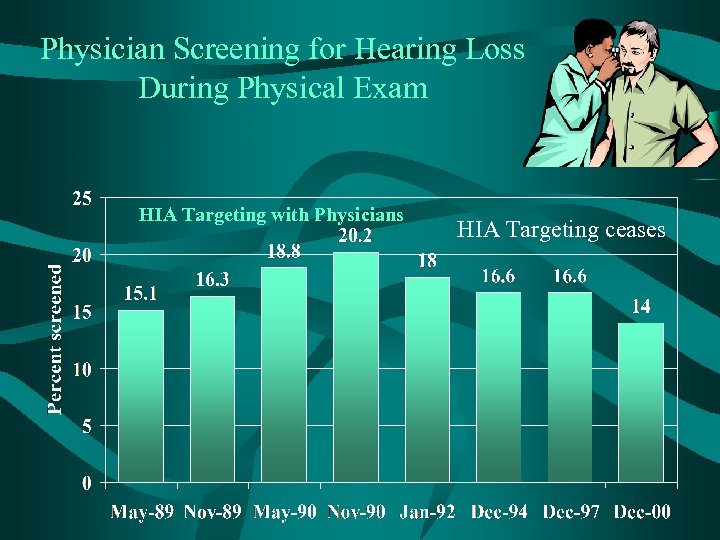

Physician Screening for Hearing Loss During Physical Exam HIA Targeting with Physicians HIA Targeting ceases

Physician Screening for Hearing Loss During Physical Exam HIA Targeting with Physicians HIA Targeting ceases

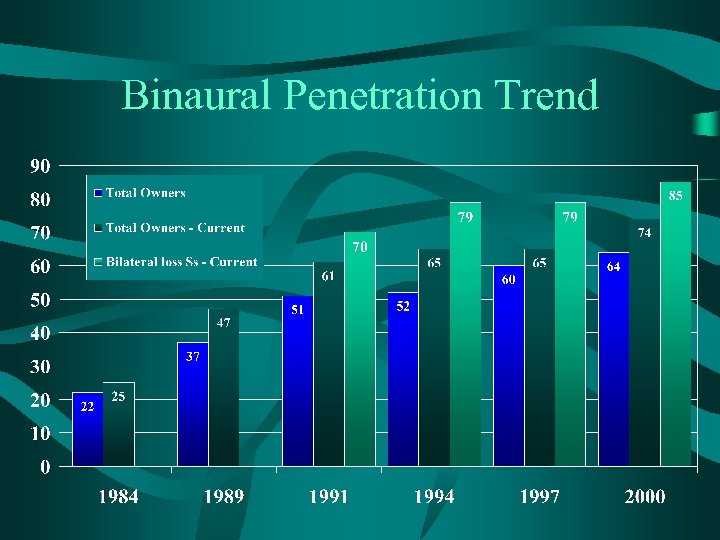

Binaural Penetration Trend

Binaural Penetration Trend

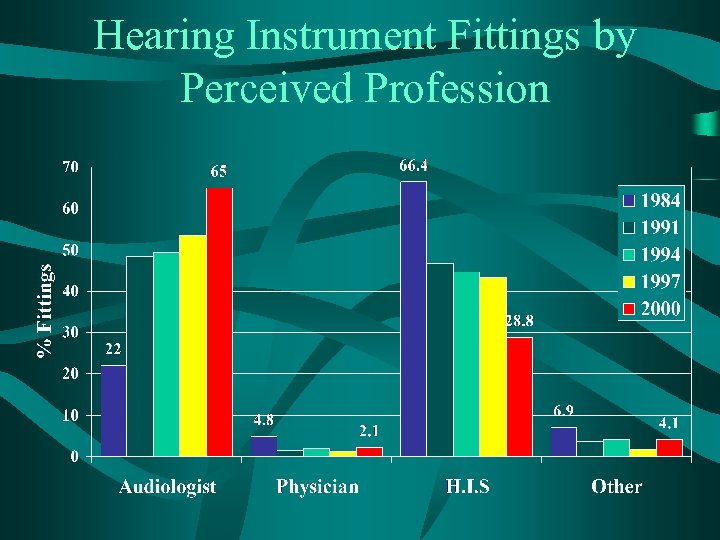

Hearing Instrument Fittings by Perceived Profession

Hearing Instrument Fittings by Perceived Profession

Hearing Instrument Fittings by Source of Distribution ØMail Order has grown 91% since 1997; 124, 000 hearing aid users. ØVA has grown 83% since 1997; 411, 000 hearing aid users.

Hearing Instrument Fittings by Source of Distribution ØMail Order has grown 91% since 1997; 124, 000 hearing aid users. ØVA has grown 83% since 1997; 411, 000 hearing aid users.

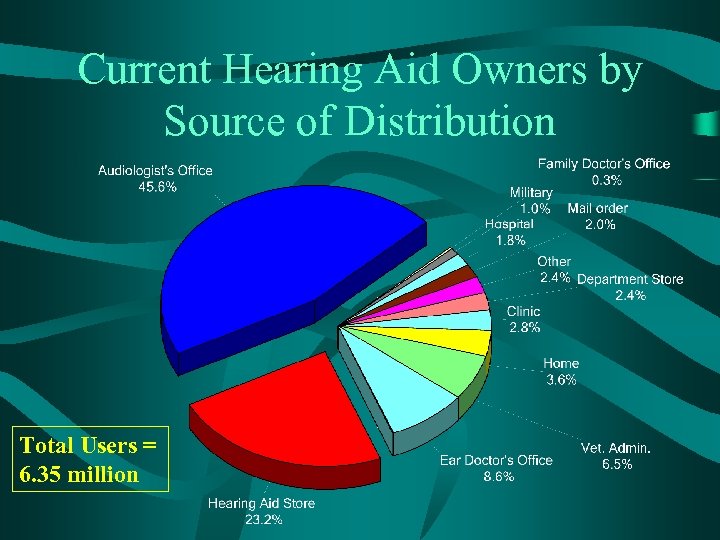

Current Hearing Aid Owners by Source of Distribution Total Users = 6. 35 million

Current Hearing Aid Owners by Source of Distribution Total Users = 6. 35 million

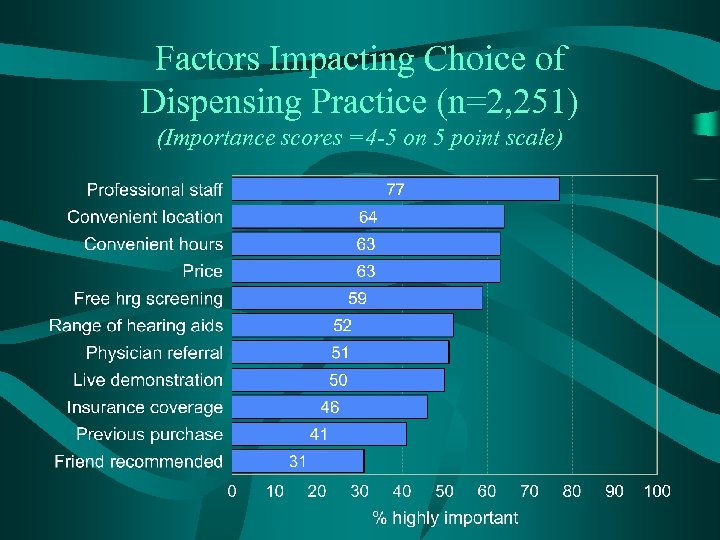

Factors Impacting Choice of Dispensing Practice (n=2, 251) (Importance scores =4 -5 on 5 point scale)

Factors Impacting Choice of Dispensing Practice (n=2, 251) (Importance scores =4 -5 on 5 point scale)

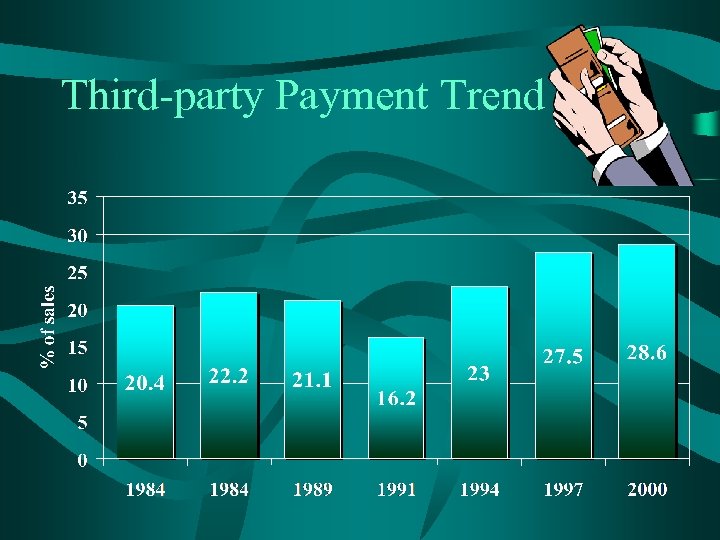

Third-party Payment Trend

Third-party Payment Trend

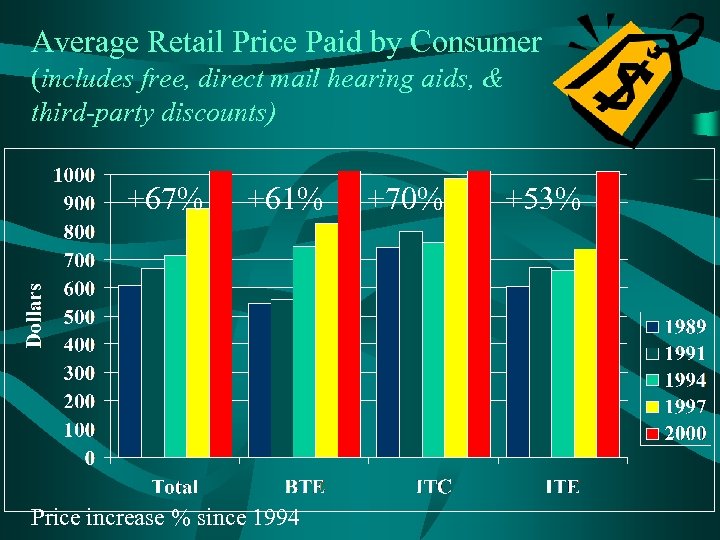

Average Retail Price Paid by Consumer (includes free, direct mail hearing aids, & third-party discounts) +67% +61% Price increase % since 1994 +70% +53%

Average Retail Price Paid by Consumer (includes free, direct mail hearing aids, & third-party discounts) +67% +61% Price increase % since 1994 +70% +53%

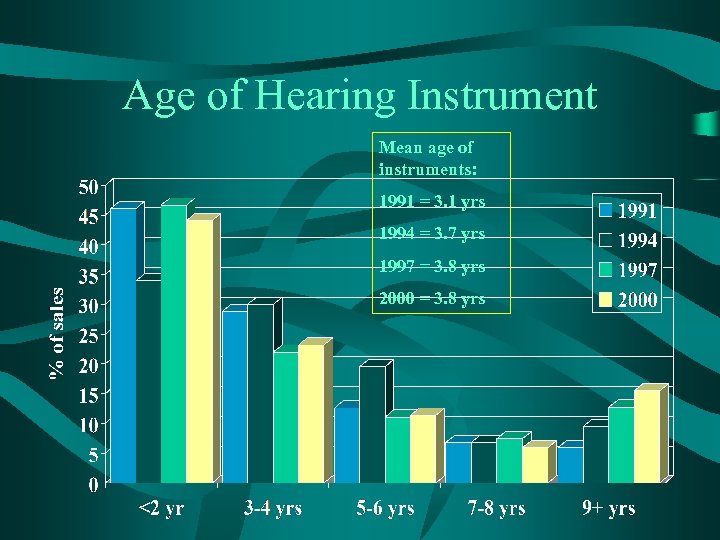

Age of Hearing Instrument Mean age of instruments: 1991 = 3. 1 yrs 1994 = 3. 7 yrs 1997 = 3. 8 yrs 2000 = 3. 8 yrs

Age of Hearing Instrument Mean age of instruments: 1991 = 3. 1 yrs 1994 = 3. 7 yrs 1997 = 3. 8 yrs 2000 = 3. 8 yrs

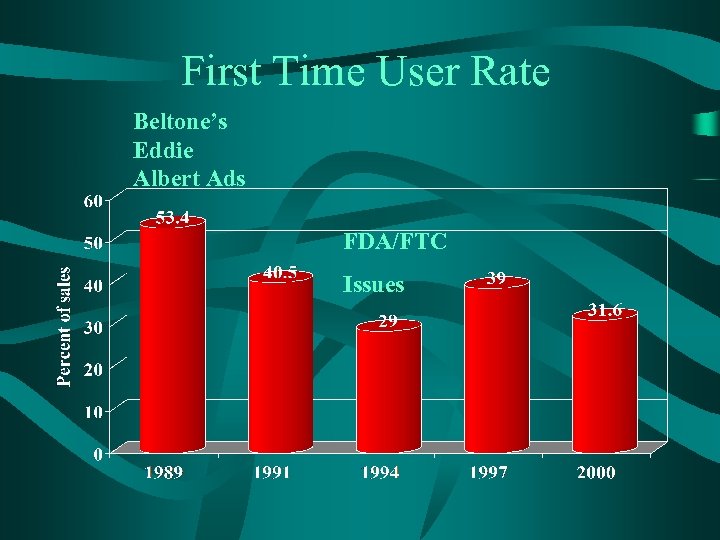

First Time User Rate Beltone’s Eddie Albert Ads FDA/FTC Issues

First Time User Rate Beltone’s Eddie Albert Ads FDA/FTC Issues

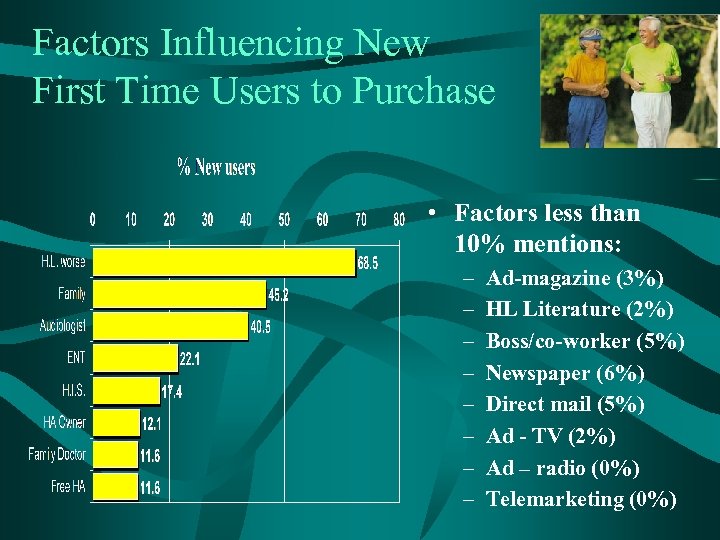

Factors Influencing New First Time Users to Purchase • Factors less than 10% mentions: – – – – Ad-magazine (3%) HL Literature (2%) Boss/co-worker (5%) Newspaper (6%) Direct mail (5%) Ad - TV (2%) Ad – radio (0%) Telemarketing (0%)

Factors Influencing New First Time Users to Purchase • Factors less than 10% mentions: – – – – Ad-magazine (3%) HL Literature (2%) Boss/co-worker (5%) Newspaper (6%) Direct mail (5%) Ad - TV (2%) Ad – radio (0%) Telemarketing (0%)

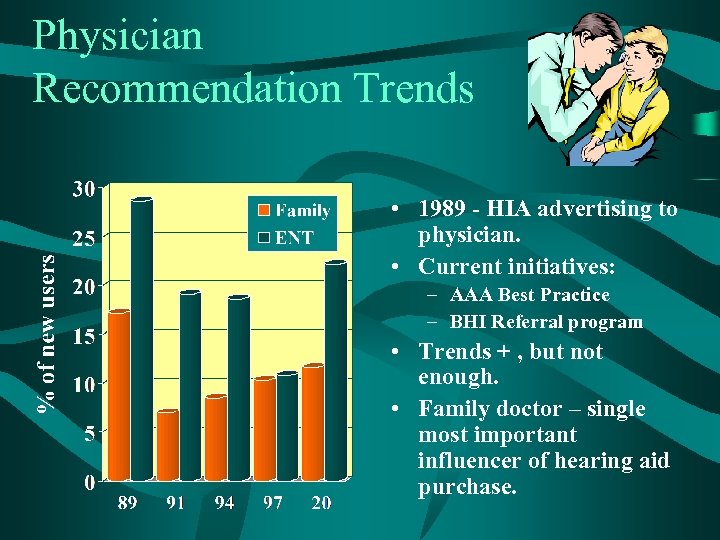

Physician Recommendation Trends • 1989 - HIA advertising to physician. • Current initiatives: – AAA Best Practice – BHI Referral program • Trends + , but not enough. • Family doctor – single most important influencer of hearing aid purchase.

Physician Recommendation Trends • 1989 - HIA advertising to physician. • Current initiatives: – AAA Best Practice – BHI Referral program • Trends + , but not enough. • Family doctor – single most important influencer of hearing aid purchase.

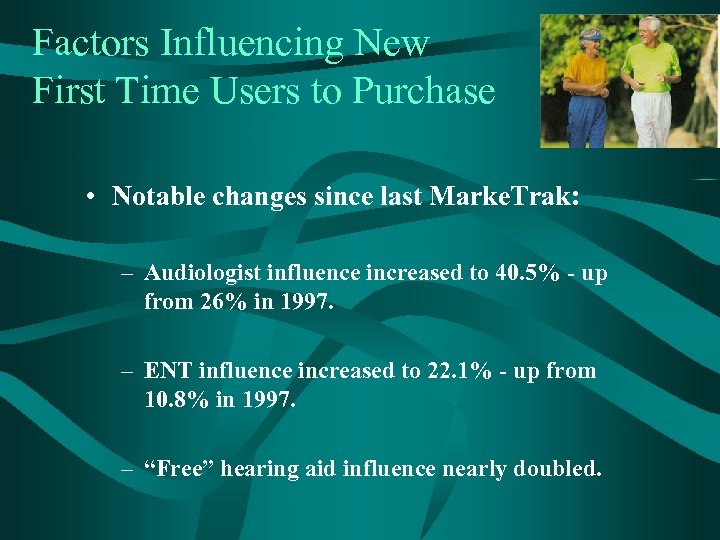

Factors Influencing New First Time Users to Purchase • Notable changes since last Marke. Trak: – Audiologist influence increased to 40. 5% - up from 26% in 1997. – ENT influence increased to 22. 1% - up from 10. 8% in 1997. – “Free” hearing aid influence nearly doubled.

Factors Influencing New First Time Users to Purchase • Notable changes since last Marke. Trak: – Audiologist influence increased to 40. 5% - up from 26% in 1997. – ENT influence increased to 22. 1% - up from 10. 8% in 1997. – “Free” hearing aid influence nearly doubled.

Factors Considered Helpful or Reliable When Choosing Brand of Hearing Aid (n=2, 273) (Helpfulness/reliability scores =4 -5 on 5 point scale)

Factors Considered Helpful or Reliable When Choosing Brand of Hearing Aid (n=2, 273) (Helpfulness/reliability scores =4 -5 on 5 point scale)

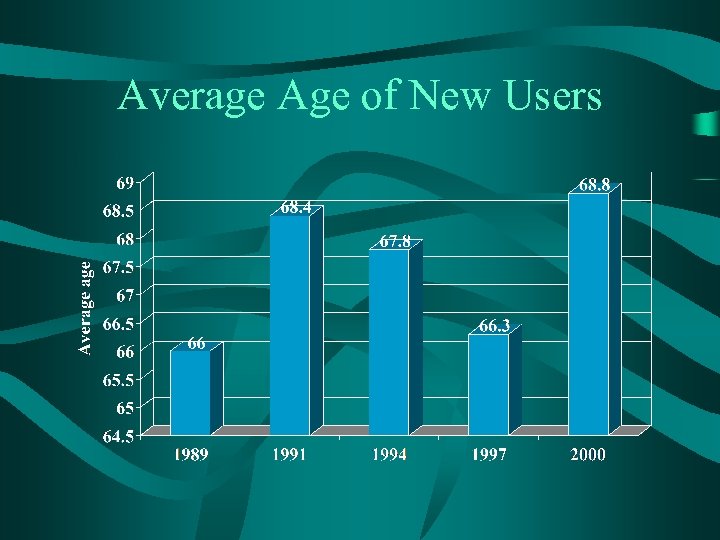

Average Age of New Users

Average Age of New Users

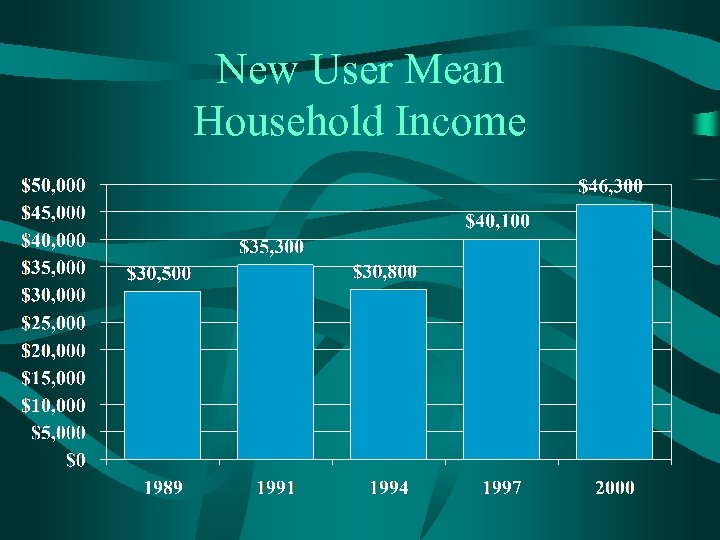

New User Mean Household Income

New User Mean Household Income

U. S. Customer Satisfaction Trends No significant differences (H. A. <5 years. )

U. S. Customer Satisfaction Trends No significant differences (H. A. <5 years. )

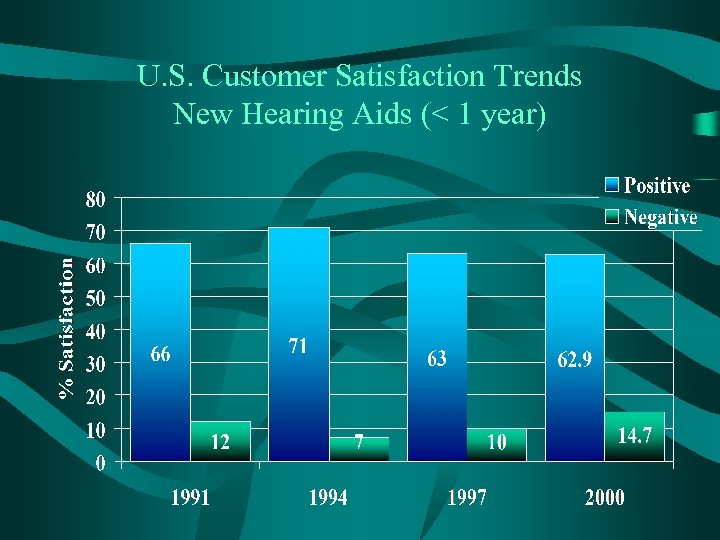

U. S. Customer Satisfaction Trends New Hearing Aids (< 1 year)

U. S. Customer Satisfaction Trends New Hearing Aids (< 1 year)

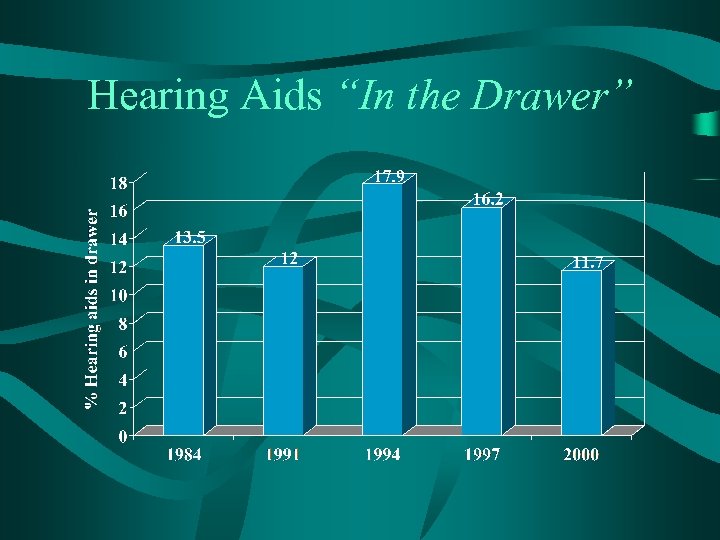

Hearing Aids “In the Drawer”

Hearing Aids “In the Drawer”

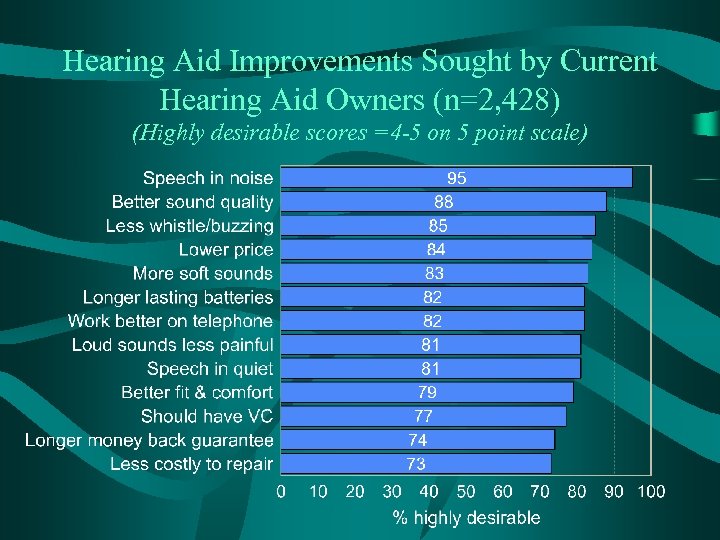

Hearing Aid Improvements Sought by Current Hearing Aid Owners (n=2, 428) (Highly desirable scores =4 -5 on 5 point scale)

Hearing Aid Improvements Sought by Current Hearing Aid Owners (n=2, 428) (Highly desirable scores =4 -5 on 5 point scale)

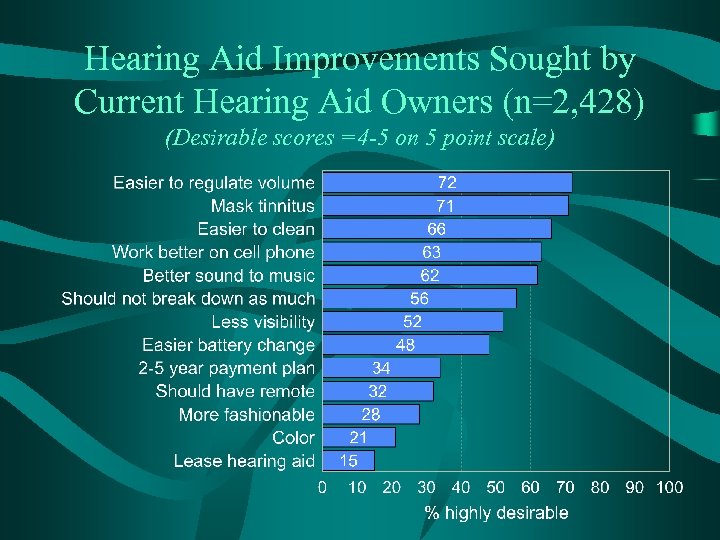

Hearing Aid Improvements Sought by Current Hearing Aid Owners (n=2, 428) (Desirable scores =4 -5 on 5 point scale)

Hearing Aid Improvements Sought by Current Hearing Aid Owners (n=2, 428) (Desirable scores =4 -5 on 5 point scale)

Non-owner Demography “The Opportunity”

Non-owner Demography “The Opportunity”

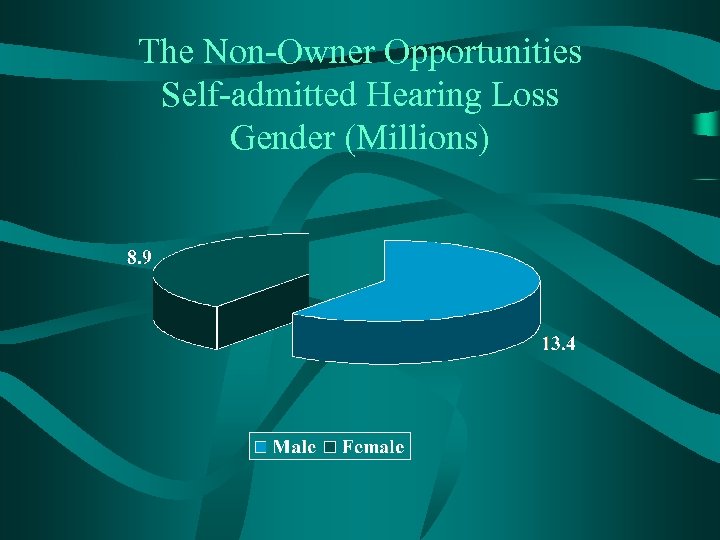

The Non-Owner Opportunities Self-admitted Hearing Loss Gender (Millions)

The Non-Owner Opportunities Self-admitted Hearing Loss Gender (Millions)

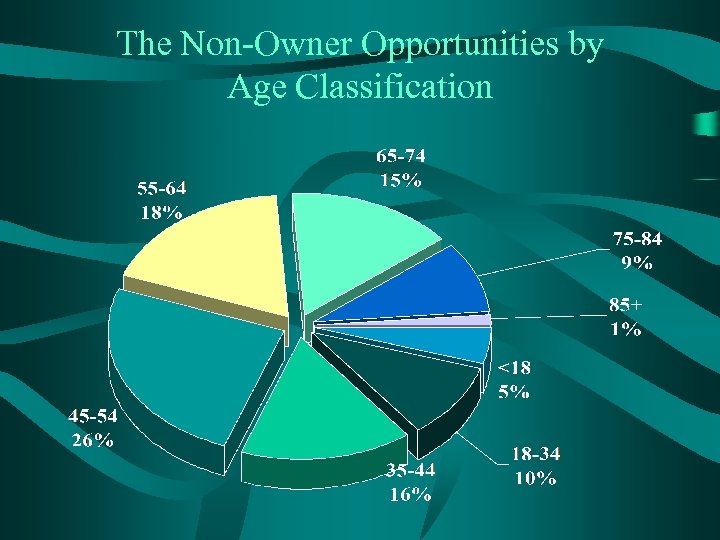

The Non-Owner Opportunities by Age Classification

The Non-Owner Opportunities by Age Classification

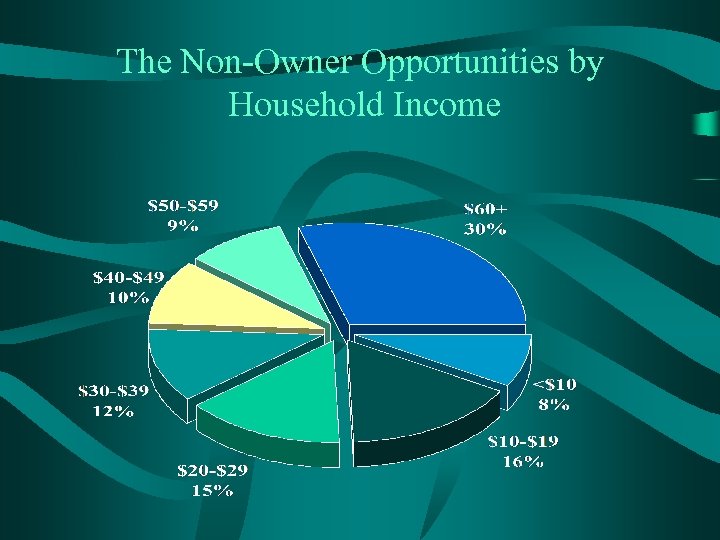

The Non-Owner Opportunities by Household Income

The Non-Owner Opportunities by Household Income

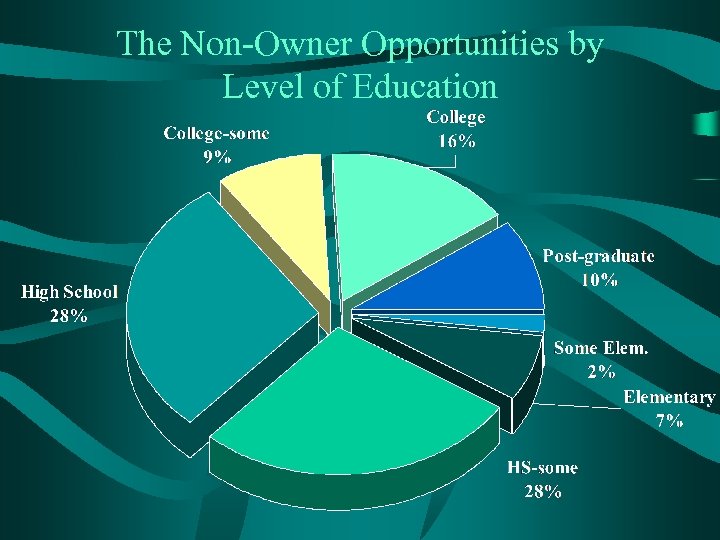

The Non-Owner Opportunities by Level of Education

The Non-Owner Opportunities by Level of Education

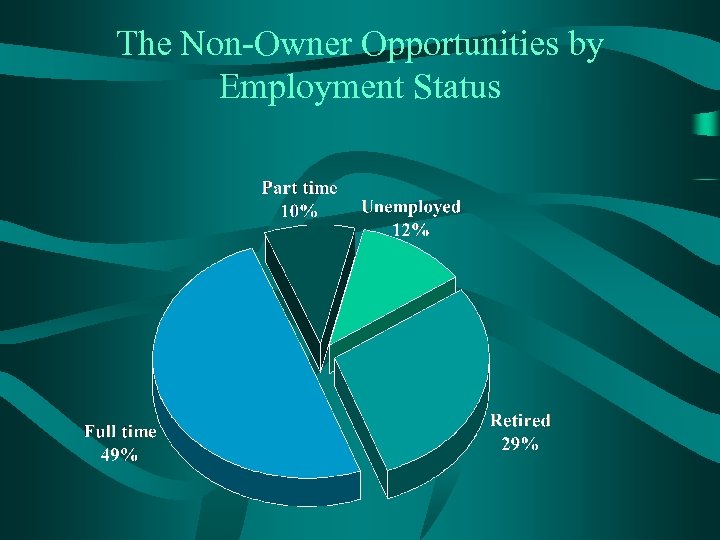

The Non-Owner Opportunities by Employment Status

The Non-Owner Opportunities by Employment Status

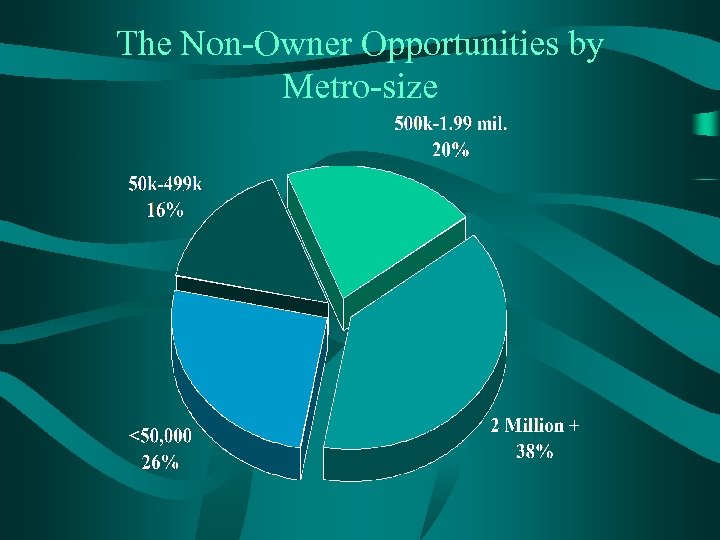

The Non-Owner Opportunities by Metro-size

The Non-Owner Opportunities by Metro-size

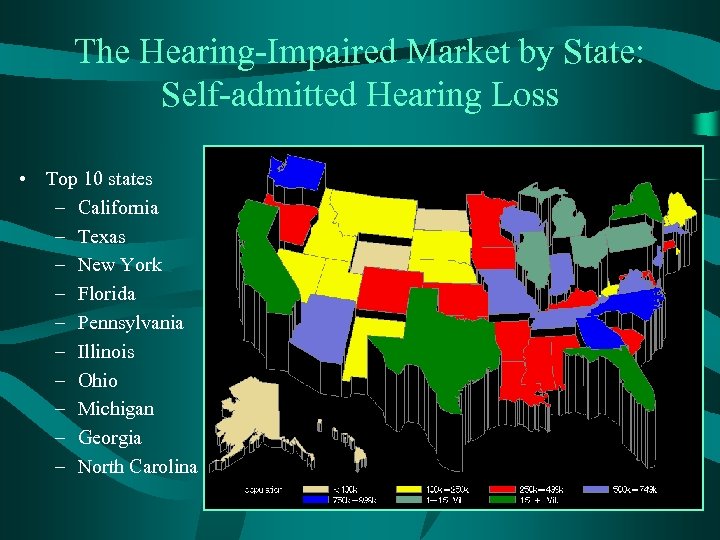

The Hearing-Impaired Market by State: Self-admitted Hearing Loss • Top 10 states – California – Texas – New York – Florida – Pennsylvania – Illinois – Ohio – Michigan – Georgia – North Carolina

The Hearing-Impaired Market by State: Self-admitted Hearing Loss • Top 10 states – California – Texas – New York – Florida – Pennsylvania – Illinois – Ohio – Michigan – Georgia – North Carolina

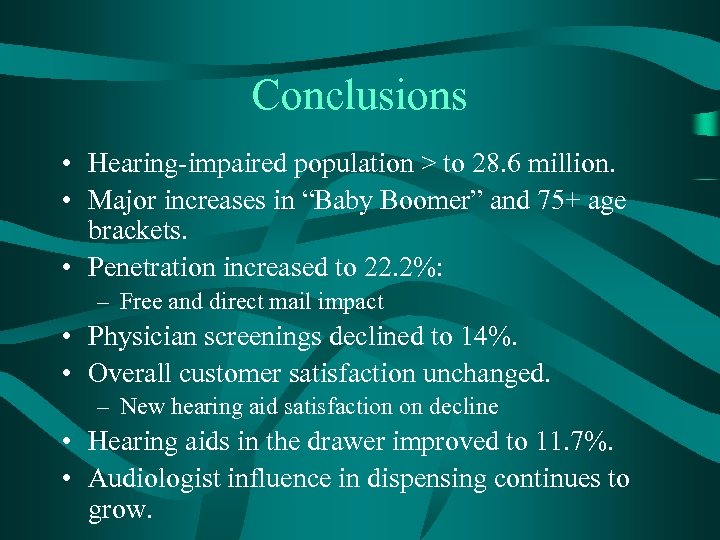

Conclusions • Hearing-impaired population > to 28. 6 million. • Major increases in “Baby Boomer” and 75+ age brackets. • Penetration increased to 22. 2%: – Free and direct mail impact • Physician screenings declined to 14%. • Overall customer satisfaction unchanged. – New hearing aid satisfaction on decline • Hearing aids in the drawer improved to 11. 7%. • Audiologist influence in dispensing continues to grow.

Conclusions • Hearing-impaired population > to 28. 6 million. • Major increases in “Baby Boomer” and 75+ age brackets. • Penetration increased to 22. 2%: – Free and direct mail impact • Physician screenings declined to 14%. • Overall customer satisfaction unchanged. – New hearing aid satisfaction on decline • Hearing aids in the drawer improved to 11. 7%. • Audiologist influence in dispensing continues to grow.

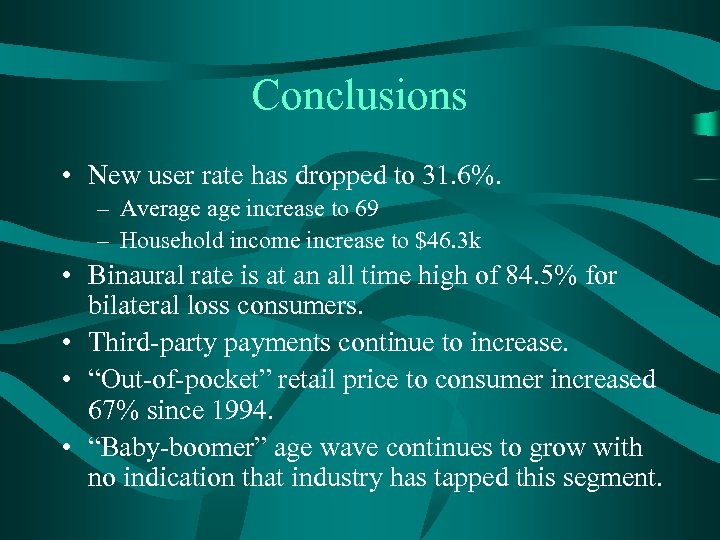

Conclusions • New user rate has dropped to 31. 6%. – Average increase to 69 – Household income increase to $46. 3 k • Binaural rate is at an all time high of 84. 5% for bilateral loss consumers. • Third-party payments continue to increase. • “Out-of-pocket” retail price to consumer increased 67% since 1994. • “Baby-boomer” age wave continues to grow with no indication that industry has tapped this segment.

Conclusions • New user rate has dropped to 31. 6%. – Average increase to 69 – Household income increase to $46. 3 k • Binaural rate is at an all time high of 84. 5% for bilateral loss consumers. • Third-party payments continue to increase. • “Out-of-pocket” retail price to consumer increased 67% since 1994. • “Baby-boomer” age wave continues to grow with no indication that industry has tapped this segment.

Conclusions • The top hearing aid improvements sought by current hearing aid owners: – – – Hearing in noise Better sound quality Less whistling & feedback Lower price More soft sounds • Least important improvements: – Leasing a hearing aid – Color of hearing aid – More fashionable hearing aids

Conclusions • The top hearing aid improvements sought by current hearing aid owners: – – – Hearing in noise Better sound quality Less whistling & feedback Lower price More soft sounds • Least important improvements: – Leasing a hearing aid – Color of hearing aid – More fashionable hearing aids

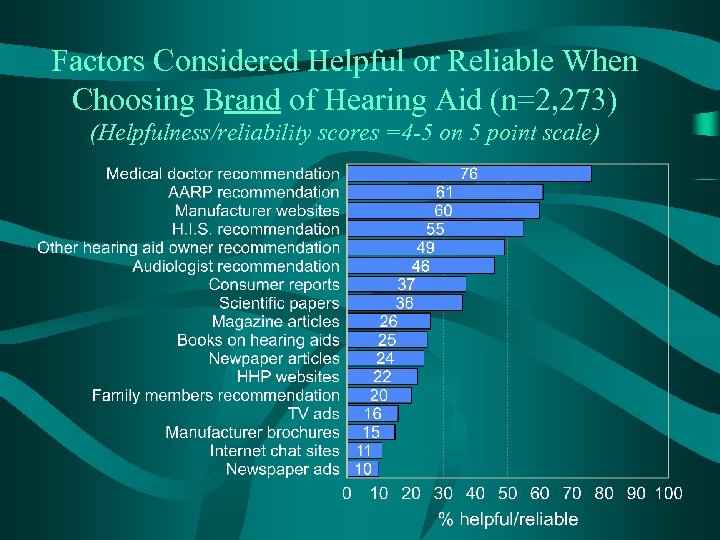

Conclusions • Top factors in choosing dispenser: – – Professionalism Convenient location Convenient hours Price • Top factors considered to be helpful and reliable when choosing a hearing aid brand: – – Medical doctor recommendation AARP recommendation Manufacturer website Hearing instrument specialist recommendation

Conclusions • Top factors in choosing dispenser: – – Professionalism Convenient location Convenient hours Price • Top factors considered to be helpful and reliable when choosing a hearing aid brand: – – Medical doctor recommendation AARP recommendation Manufacturer website Hearing instrument specialist recommendation

Key Findings from Knowles Market Development Studies

Key Findings from Knowles Market Development Studies

The Decision To Purchase a Hearing Aid is Very Complex and Little Understood

The Decision To Purchase a Hearing Aid is Very Complex and Little Understood

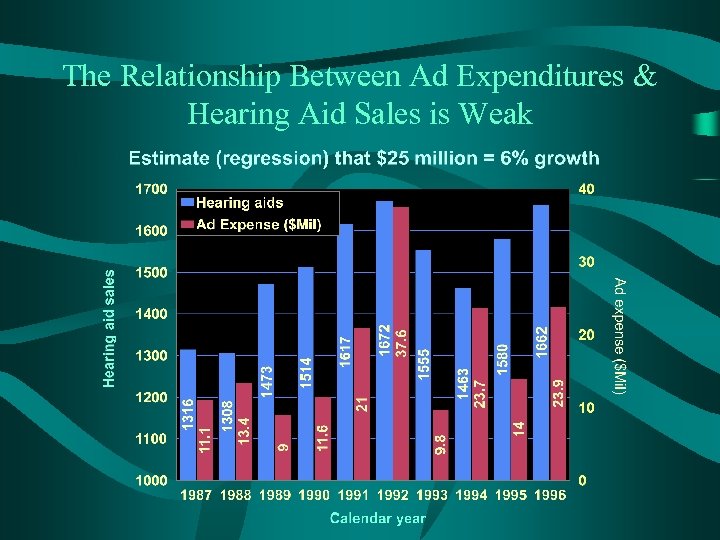

The Relationship Between Ad Expenditures & Hearing Aid Sales is Weak

The Relationship Between Ad Expenditures & Hearing Aid Sales is Weak

The Issue of Price & Value

The Issue of Price & Value

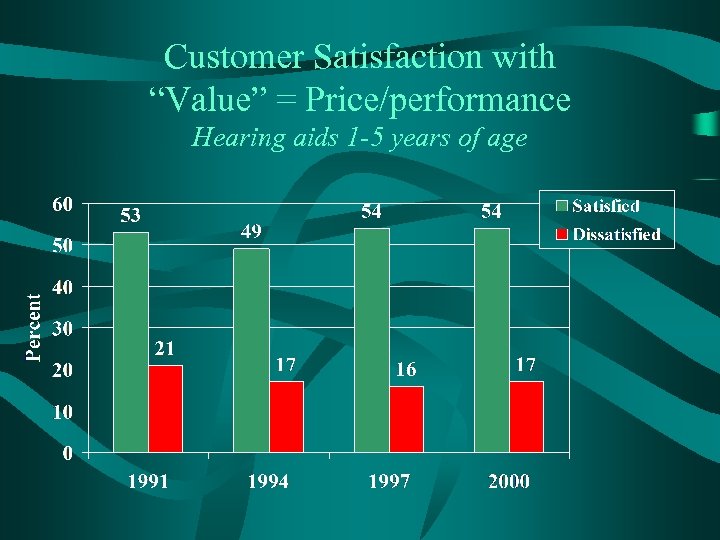

Customer Satisfaction with “Value” = Price/performance Hearing aids 1 -5 years of age

Customer Satisfaction with “Value” = Price/performance Hearing aids 1 -5 years of age

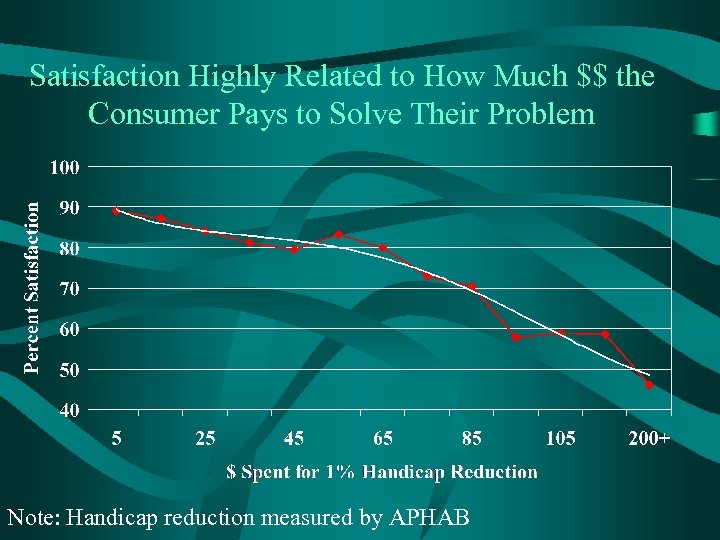

Satisfaction Highly Related to How Much $$ the Consumer Pays to Solve Their Problem Note: Handicap reduction measured by APHAB

Satisfaction Highly Related to How Much $$ the Consumer Pays to Solve Their Problem Note: Handicap reduction measured by APHAB

Hearing Aid Prices are Inelastic at Higher Prices & Highly Elastic at Low Prices Starter Hearing Aid Market

Hearing Aid Prices are Inelastic at Higher Prices & Highly Elastic at Low Prices Starter Hearing Aid Market

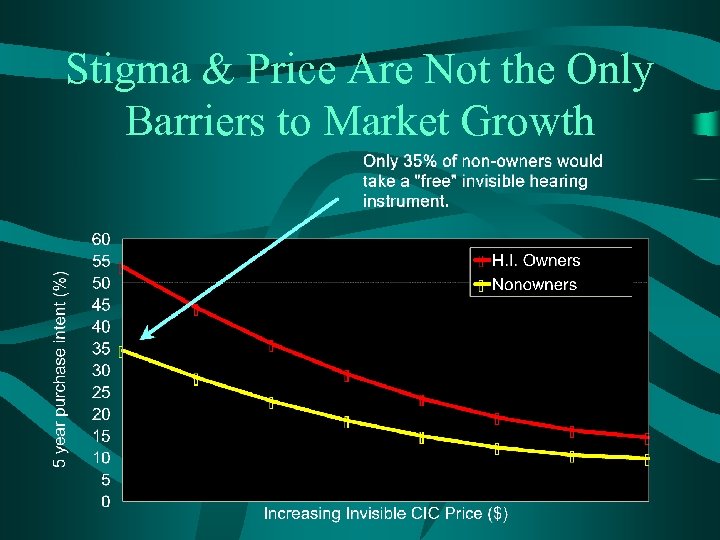

Stigma & Price Are Not the Only Barriers to Market Growth

Stigma & Price Are Not the Only Barriers to Market Growth

The Issue of Stigma

The Issue of Stigma

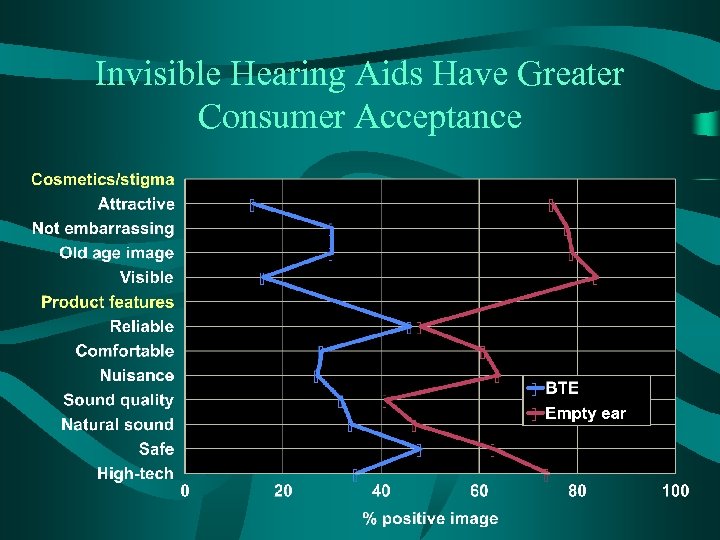

Invisible Hearing Aids Have Greater Consumer Acceptance

Invisible Hearing Aids Have Greater Consumer Acceptance

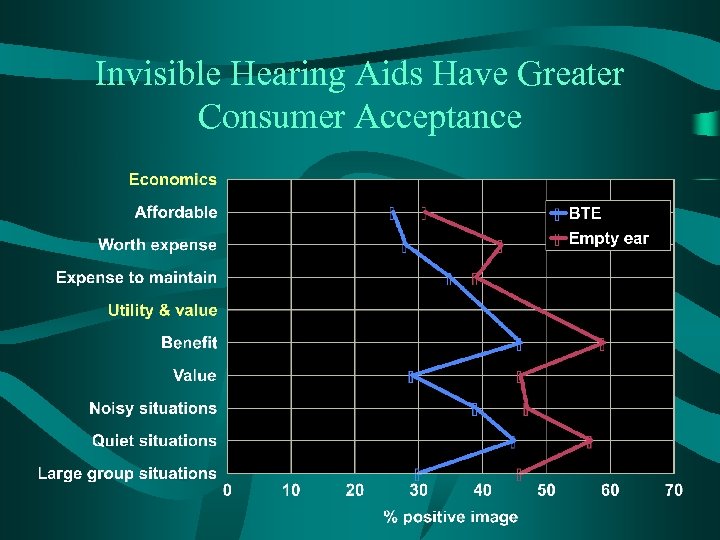

Invisible Hearing Aids Have Greater Consumer Acceptance

Invisible Hearing Aids Have Greater Consumer Acceptance

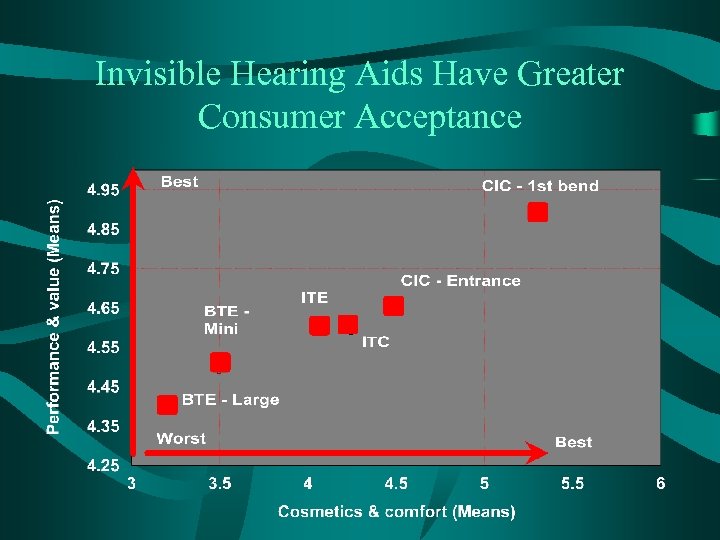

Invisible Hearing Aids Have Greater Consumer Acceptance

Invisible Hearing Aids Have Greater Consumer Acceptance

Can Positive Role Models Help Consumers Overcome Stigma? • Only Two examples I am aware of in our industry: – President Reagan – 1983 (associated with 20% growth) – Eddie Albert in Beltone commercials – 1989 • Apparent Clinton effect in Fall of 1997 – Probable impact on admission of hearing loss by male “baby -boomers” – No impact on sales to date

Can Positive Role Models Help Consumers Overcome Stigma? • Only Two examples I am aware of in our industry: – President Reagan – 1983 (associated with 20% growth) – Eddie Albert in Beltone commercials – 1989 • Apparent Clinton effect in Fall of 1997 – Probable impact on admission of hearing loss by male “baby -boomers” – No impact on sales to date

What is The Viable Market for Hearing Aids?

What is The Viable Market for Hearing Aids?

Market Penetration is Highly Related to Recognition of Hearing Loss Handicap

Market Penetration is Highly Related to Recognition of Hearing Loss Handicap

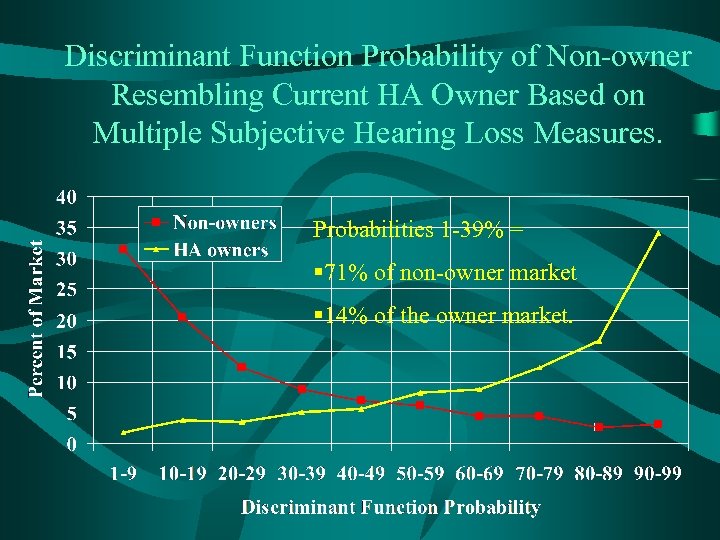

Discriminant Function Probability of Non-owner Resembling Current HA Owner Based on Multiple Subjective Hearing Loss Measures. Probabilities 1 -39% = § 71% of non-owner market § 14% of the owner market.

Discriminant Function Probability of Non-owner Resembling Current HA Owner Based on Multiple Subjective Hearing Loss Measures. Probabilities 1 -39% = § 71% of non-owner market § 14% of the owner market.

Four Methods of Measuring Viable US Hearing Aid Market • Based totally on hearing loss measures the additional possible market growth is: § § Gallaudet Scores (est. d. B Loss Better ear) = 125% Hearing Handicap Inventory (HHIE) = 154% APHAB = 127% Discriminant Function Modeling = 102% • Clear that the current market could easily double based totally on hearing handicap. • And, even more based on situational need.

Four Methods of Measuring Viable US Hearing Aid Market • Based totally on hearing loss measures the additional possible market growth is: § § Gallaudet Scores (est. d. B Loss Better ear) = 125% Hearing Handicap Inventory (HHIE) = 154% APHAB = 127% Discriminant Function Modeling = 102% • Clear that the current market could easily double based totally on hearing handicap. • And, even more based on situational need.

Why Buy Hearing Aids?

Why Buy Hearing Aids?

Attitudes Per Se are Important, But Relationship to Hearing Aid Purchase Intent is Perhaps More Important • Sample of 2, 753 non-owners • Measured their attitudes on 76 issues. • Measured their hearing aid purchase intent in the next five years. • Categorized them as a high or low purchase intenders. • Took ratio of high/low purchase intenders for each attitude item. • Ranked ratios • First – present their attitudes in key categories. – On following charts – view red (negative) as “barrier” to growth.

Attitudes Per Se are Important, But Relationship to Hearing Aid Purchase Intent is Perhaps More Important • Sample of 2, 753 non-owners • Measured their attitudes on 76 issues. • Measured their hearing aid purchase intent in the next five years. • Categorized them as a high or low purchase intenders. • Took ratio of high/low purchase intenders for each attitude item. • Ranked ratios • First – present their attitudes in key categories. – On following charts – view red (negative) as “barrier” to growth.

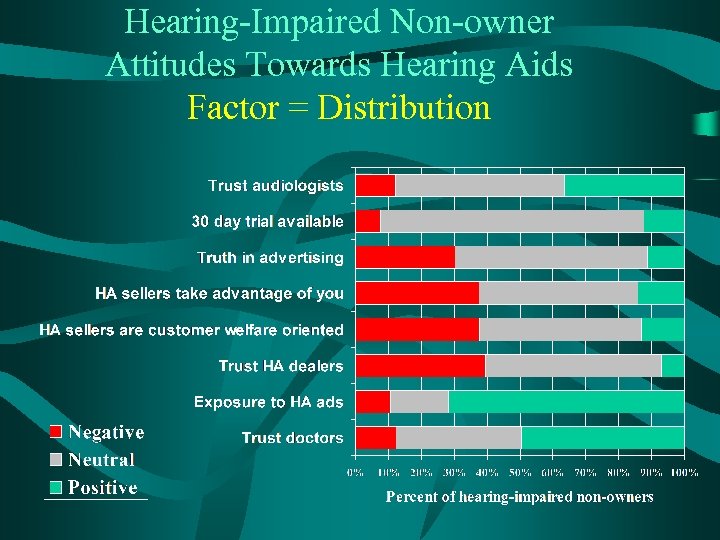

Hearing-Impaired Non-owner Attitudes Towards Hearing Aids Factor = Distribution

Hearing-Impaired Non-owner Attitudes Towards Hearing Aids Factor = Distribution

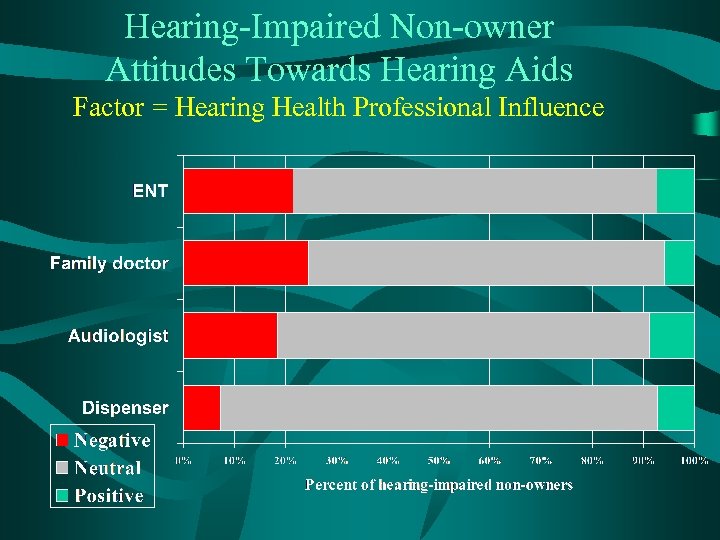

Hearing-Impaired Non-owner Attitudes Towards Hearing Aids Factor = Hearing Health Professional Influence

Hearing-Impaired Non-owner Attitudes Towards Hearing Aids Factor = Hearing Health Professional Influence

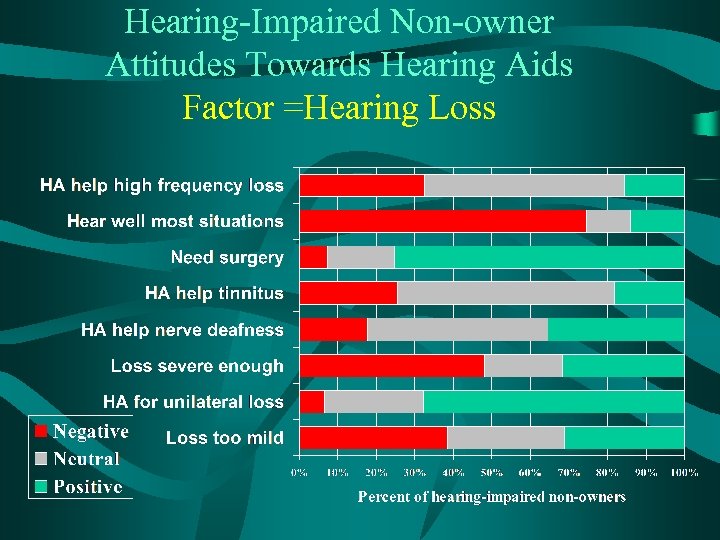

Hearing-Impaired Non-owner Attitudes Towards Hearing Aids Factor =Hearing Loss

Hearing-Impaired Non-owner Attitudes Towards Hearing Aids Factor =Hearing Loss

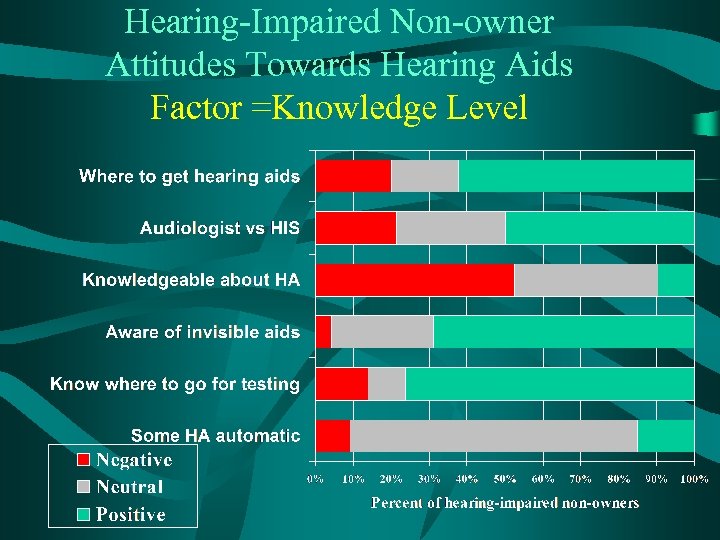

Hearing-Impaired Non-owner Attitudes Towards Hearing Aids Factor =Knowledge Level

Hearing-Impaired Non-owner Attitudes Towards Hearing Aids Factor =Knowledge Level

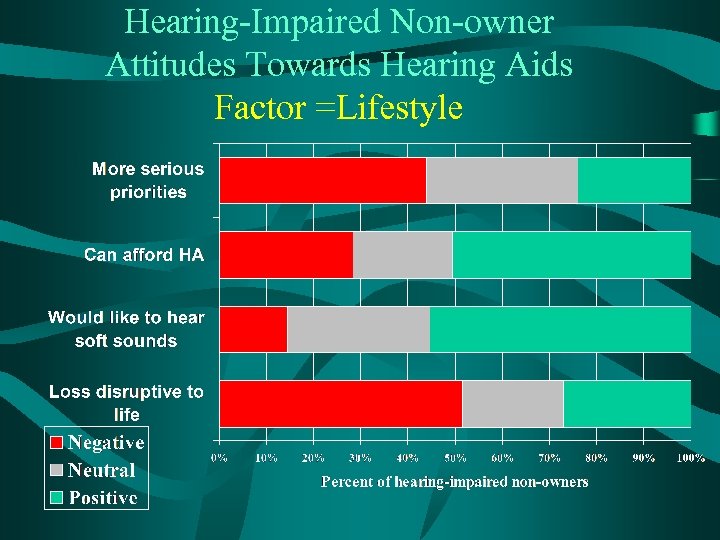

Hearing-Impaired Non-owner Attitudes Towards Hearing Aids Factor =Lifestyle

Hearing-Impaired Non-owner Attitudes Towards Hearing Aids Factor =Lifestyle

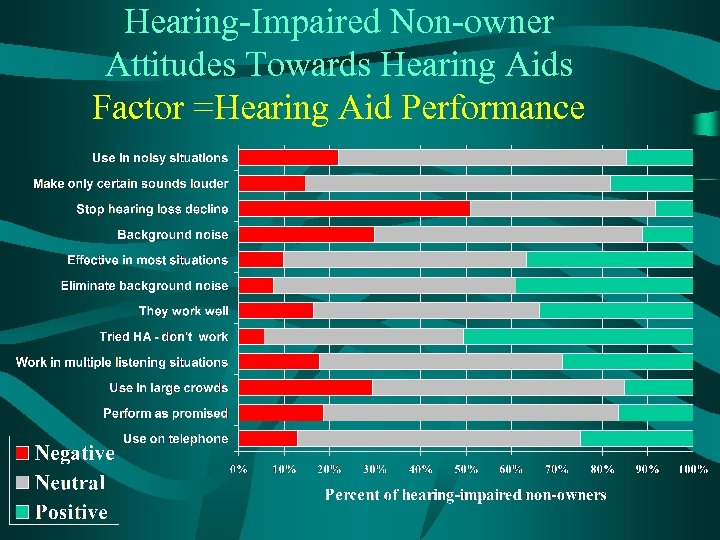

Hearing-Impaired Non-owner Attitudes Towards Hearing Aids Factor =Hearing Aid Performance

Hearing-Impaired Non-owner Attitudes Towards Hearing Aids Factor =Hearing Aid Performance

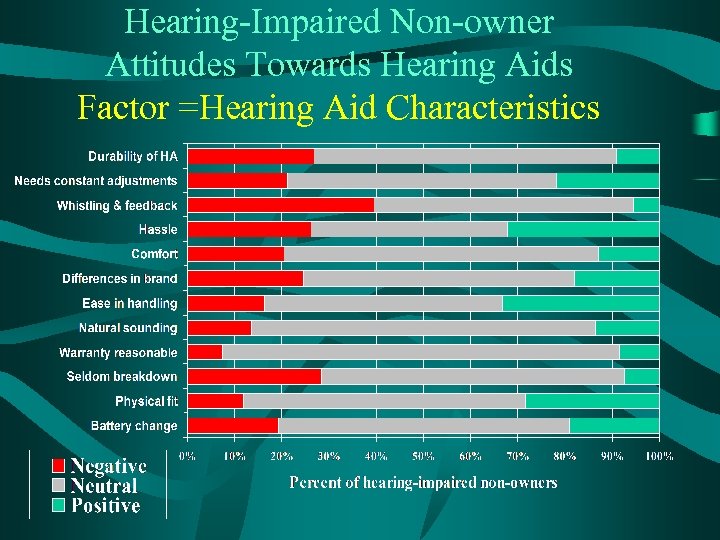

Hearing-Impaired Non-owner Attitudes Towards Hearing Aids Factor =Hearing Aid Characteristics

Hearing-Impaired Non-owner Attitudes Towards Hearing Aids Factor =Hearing Aid Characteristics

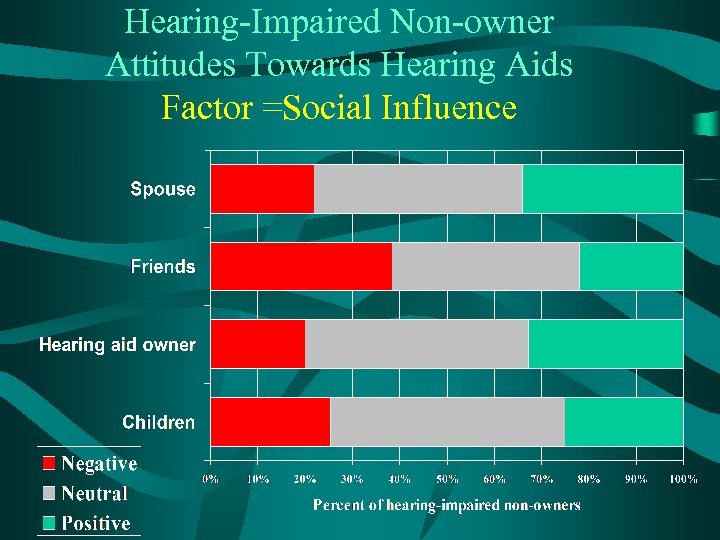

Hearing-Impaired Non-owner Attitudes Towards Hearing Aids Factor =Social Influence

Hearing-Impaired Non-owner Attitudes Towards Hearing Aids Factor =Social Influence

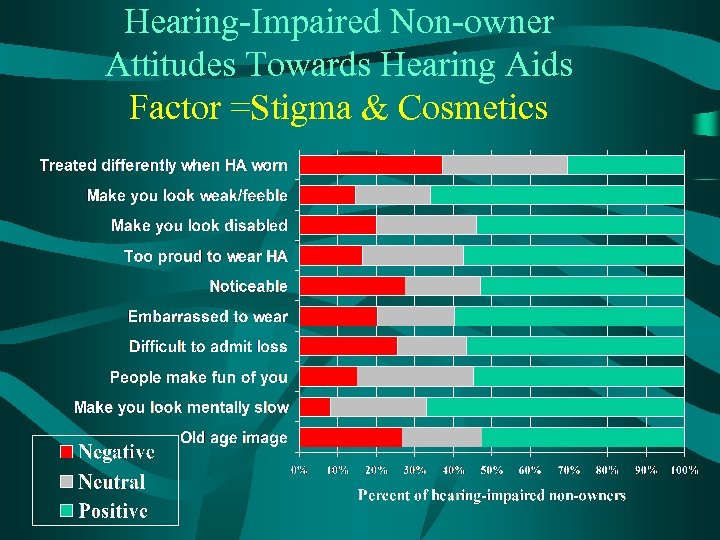

Hearing-Impaired Non-owner Attitudes Towards Hearing Aids Factor =Stigma & Cosmetics

Hearing-Impaired Non-owner Attitudes Towards Hearing Aids Factor =Stigma & Cosmetics

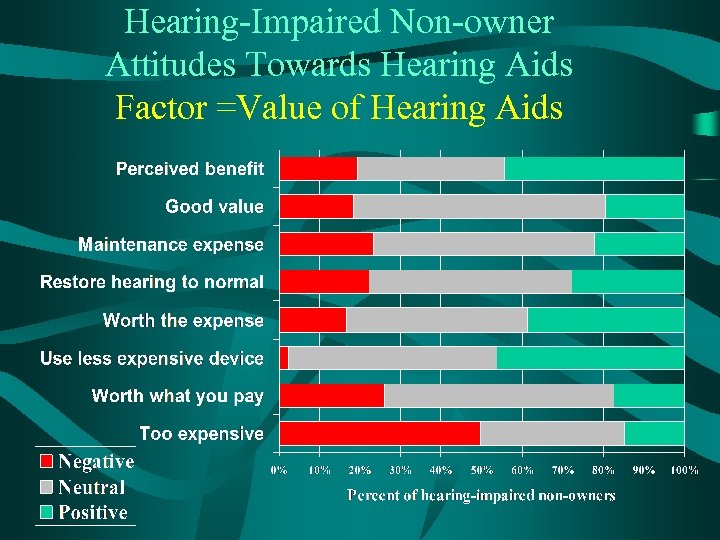

Hearing-Impaired Non-owner Attitudes Towards Hearing Aids Factor =Value of Hearing Aids

Hearing-Impaired Non-owner Attitudes Towards Hearing Aids Factor =Value of Hearing Aids

Top 12 Correlates of Hearing Aid Purchase Intent

Top 12 Correlates of Hearing Aid Purchase Intent

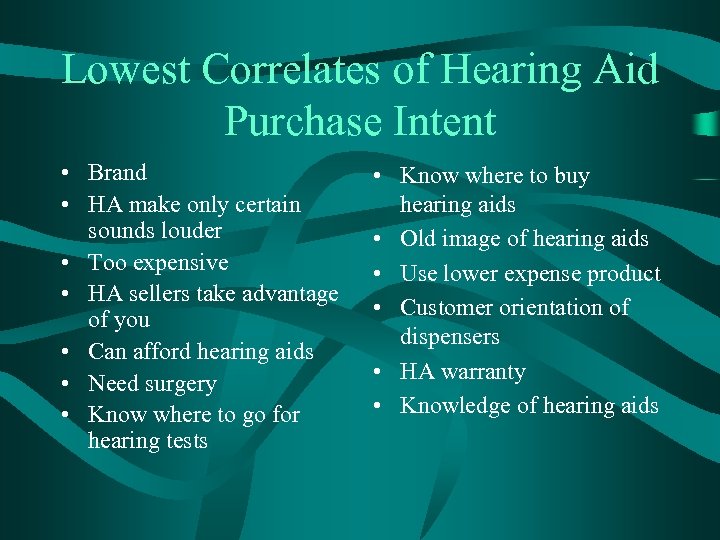

Lowest Correlates of Hearing Aid Purchase Intent • Brand • HA make only certain sounds louder • Too expensive • HA sellers take advantage of you • Can afford hearing aids • Need surgery • Know where to go for hearing tests • Know where to buy hearing aids • Old image of hearing aids • Use lower expense product • Customer orientation of dispensers • HA warranty • Knowledge of hearing aids

Lowest Correlates of Hearing Aid Purchase Intent • Brand • HA make only certain sounds louder • Too expensive • HA sellers take advantage of you • Can afford hearing aids • Need surgery • Know where to go for hearing tests • Know where to buy hearing aids • Old image of hearing aids • Use lower expense product • Customer orientation of dispensers • HA warranty • Knowledge of hearing aids

Optimizing Quality of Life Benefits for the Consumer of Hearing Aids

Optimizing Quality of Life Benefits for the Consumer of Hearing Aids

Summary of Quality of Life Benefits Associated with Hearing Aids (NCOA Study – January 2000 Hearing Review) • >Interpersonal relationships •

Summary of Quality of Life Benefits Associated with Hearing Aids (NCOA Study – January 2000 Hearing Review) • >Interpersonal relationships •

Leveraging the Quality of Life Findings • Best way to leverage is to assure that your clients have achieved significant benefit with their hearing aids. • Post-fitting benefit measurement and customer opinion surveys critical. • Minimize hearing aids in the drawer. • Use technology and processes which enhance customer satisfaction.

Leveraging the Quality of Life Findings • Best way to leverage is to assure that your clients have achieved significant benefit with their hearing aids. • Post-fitting benefit measurement and customer opinion surveys critical. • Minimize hearing aids in the drawer. • Use technology and processes which enhance customer satisfaction.

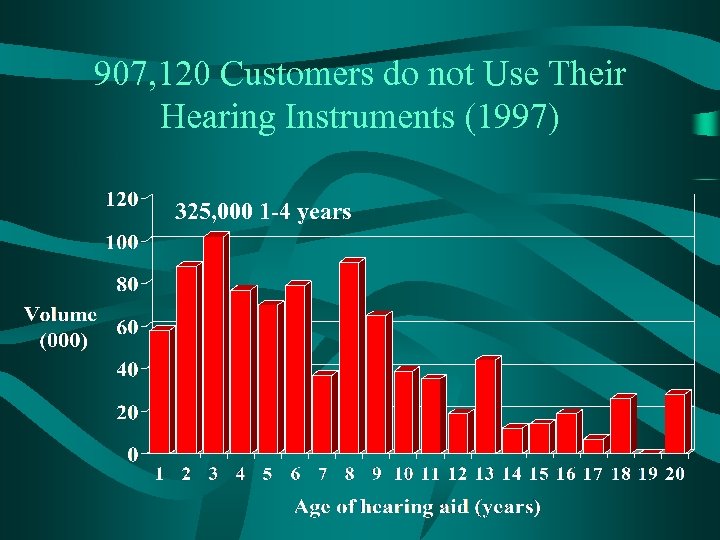

907, 120 Customers do not Use Their Hearing Instruments (1997) 325, 000 1 -4 years

907, 120 Customers do not Use Their Hearing Instruments (1997) 325, 000 1 -4 years

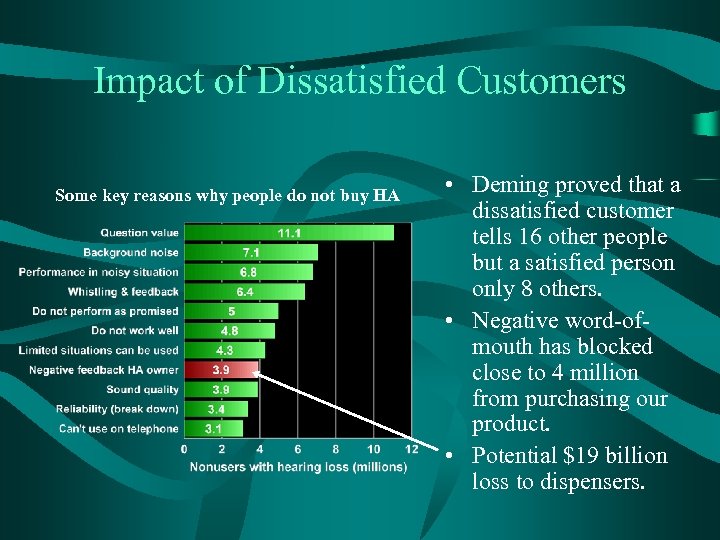

Impact of Dissatisfied Customers Some key reasons why people do not buy HA • Deming proved that a dissatisfied customer tells 16 other people but a satisfied person only 8 others. • Negative word-ofmouth has blocked close to 4 million from purchasing our product. • Potential $19 billion loss to dispensers.

Impact of Dissatisfied Customers Some key reasons why people do not buy HA • Deming proved that a dissatisfied customer tells 16 other people but a satisfied person only 8 others. • Negative word-ofmouth has blocked close to 4 million from purchasing our product. • Potential $19 billion loss to dispensers.

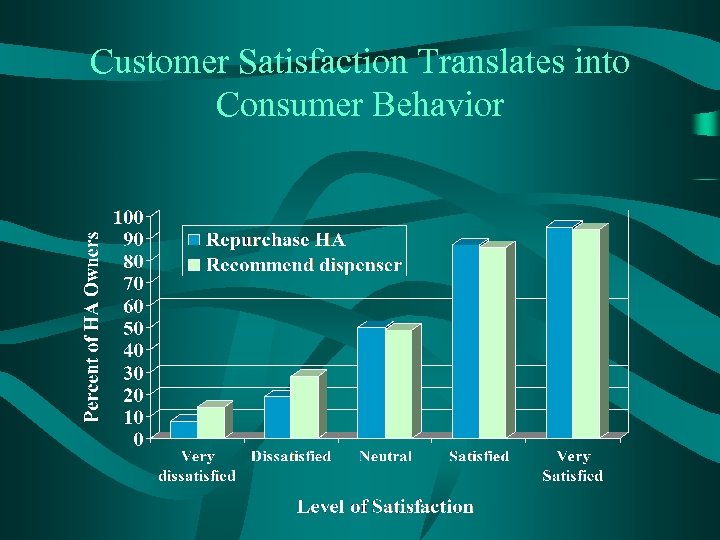

Customer Satisfaction Translates into Consumer Behavior

Customer Satisfaction Translates into Consumer Behavior

Reasons for Non-Use • #1. Poor benefit (30%) - 268, 507 “When ______sold me the H. A. , I was confident it would help me hear better. When I received it and wore it every day, it did not make my hearing any better. So, I don’t wear the HA and feel like I wasted my money. I tried to return it and the person did not seem to want to help me. I am quite dissatisfied with the whole experience. ”

Reasons for Non-Use • #1. Poor benefit (30%) - 268, 507 “When ______sold me the H. A. , I was confident it would help me hear better. When I received it and wore it every day, it did not make my hearing any better. So, I don’t wear the HA and feel like I wasted my money. I tried to return it and the person did not seem to want to help me. I am quite dissatisfied with the whole experience. ”

Reasons for Non-Use • #2. Background noise (25%) - 229, 383 I don’t wear my H. A. because I need it at a dance, restaurants, and large groups. All the H. A. does is increase all sound including background sounds. No help. ”

Reasons for Non-Use • #2. Background noise (25%) - 229, 383 I don’t wear my H. A. because I need it at a dance, restaurants, and large groups. All the H. A. does is increase all sound including background sounds. No help. ”

Reasons for Non-Use • #3. Fit & Comfort (19%) - 169, 431 “It’s hard to keep it in my ear. I travel for business a lot and can’t risk it falling out of my ear. ”

Reasons for Non-Use • #3. Fit & Comfort (19%) - 169, 431 “It’s hard to keep it in my ear. I travel for business a lot and can’t risk it falling out of my ear. ”

Reasons for Non-Use • #4. Negative side effects (11%) - 99, 048 “Ears that hurt, too much pressure in the ears, blisters in ears, rashes in ears, itching ears, dizzy, nervous, ears that sweat, builds up wax in inner ear, headache, hair gets caught in hearing aid, infections in ear, problems chewing or swallowing, plugs up ears”.

Reasons for Non-Use • #4. Negative side effects (11%) - 99, 048 “Ears that hurt, too much pressure in the ears, blisters in ears, rashes in ears, itching ears, dizzy, nervous, ears that sweat, builds up wax in inner ear, headache, hair gets caught in hearing aid, infections in ear, problems chewing or swallowing, plugs up ears”.

Reasons for Non-Use • #5. Price & cost (10%) - 93, 839 “My H. A. was never dependable. Taking it in for an adjustment was only a headache as it never performed very long. Had to be looked at again. The last time I had trouble, the office wanted to send it to _____ at $200 & just to check it, plus another $200 to repair it. ”

Reasons for Non-Use • #5. Price & cost (10%) - 93, 839 “My H. A. was never dependable. Taking it in for an adjustment was only a headache as it never performed very long. Had to be looked at again. The last time I had trouble, the office wanted to send it to _____ at $200 & just to check it, plus another $200 to repair it. ”

We must minimize hearing aids in the drawer • 907 k inactive hearing aid owners • Key reasons: – – – Poor benefit Background noise Fit and comfort Negative side effects Maintenance Cost/broken HA • Impossible for consumer to experience QOL changes if their hearing aid is in drawer. • Dispenser must find ways of optimizing the consumer’s experience

We must minimize hearing aids in the drawer • 907 k inactive hearing aid owners • Key reasons: – – – Poor benefit Background noise Fit and comfort Negative side effects Maintenance Cost/broken HA • Impossible for consumer to experience QOL changes if their hearing aid is in drawer. • Dispenser must find ways of optimizing the consumer’s experience

Dispenser does have control over hearing aids in the drawer • # 1. Poor benefit: ü Use programmable technology (analog or DSP) ü Pre-post benefit measurement ü Real ear measurement ü 90 day post fitting customer satisfaction survey. ü 100% money back guarantee ü Aural rehabilitation • Significant impact on hearing aid satisfaction. • Return rates been shown to be cut in half.

Dispenser does have control over hearing aids in the drawer • # 1. Poor benefit: ü Use programmable technology (analog or DSP) ü Pre-post benefit measurement ü Real ear measurement ü 90 day post fitting customer satisfaction survey. ü 100% money back guarantee ü Aural rehabilitation • Significant impact on hearing aid satisfaction. • Return rates been shown to be cut in half.

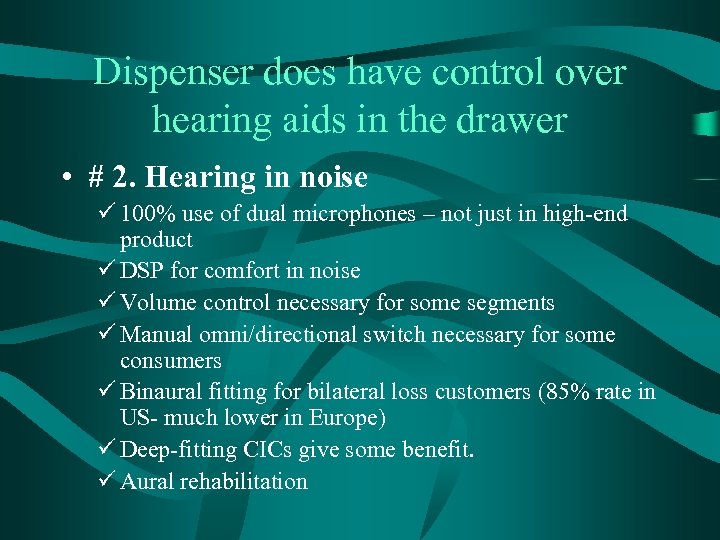

Dispenser does have control over hearing aids in the drawer • # 2. Hearing in noise ü 100% use of dual microphones – not just in high-end product ü DSP for comfort in noise ü Volume control necessary for some segments ü Manual omni/directional switch necessary for some consumers ü Binaural fitting for bilateral loss customers (85% rate in US- much lower in Europe) ü Deep-fitting CICs give some benefit. ü Aural rehabilitation

Dispenser does have control over hearing aids in the drawer • # 2. Hearing in noise ü 100% use of dual microphones – not just in high-end product ü DSP for comfort in noise ü Volume control necessary for some segments ü Manual omni/directional switch necessary for some consumers ü Binaural fitting for bilateral loss customers (85% rate in US- much lower in Europe) ü Deep-fitting CICs give some benefit. ü Aural rehabilitation

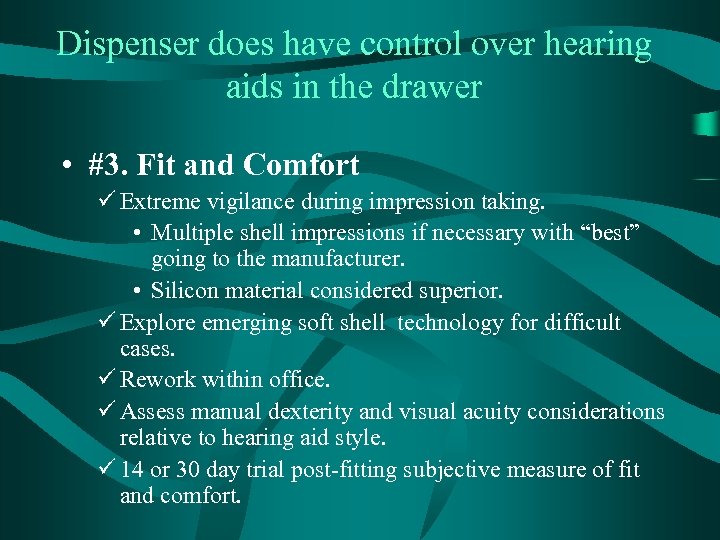

Dispenser does have control over hearing aids in the drawer • #3. Fit and Comfort ü Extreme vigilance during impression taking. • Multiple shell impressions if necessary with “best” going to the manufacturer. • Silicon material considered superior. ü Explore emerging soft shell technology for difficult cases. ü Rework within office. ü Assess manual dexterity and visual acuity considerations relative to hearing aid style. ü 14 or 30 day trial post-fitting subjective measure of fit and comfort.

Dispenser does have control over hearing aids in the drawer • #3. Fit and Comfort ü Extreme vigilance during impression taking. • Multiple shell impressions if necessary with “best” going to the manufacturer. • Silicon material considered superior. ü Explore emerging soft shell technology for difficult cases. ü Rework within office. ü Assess manual dexterity and visual acuity considerations relative to hearing aid style. ü 14 or 30 day trial post-fitting subjective measure of fit and comfort.

Improving Customer Satisfaction with Hearing Aids Recent Research

Improving Customer Satisfaction with Hearing Aids Recent Research

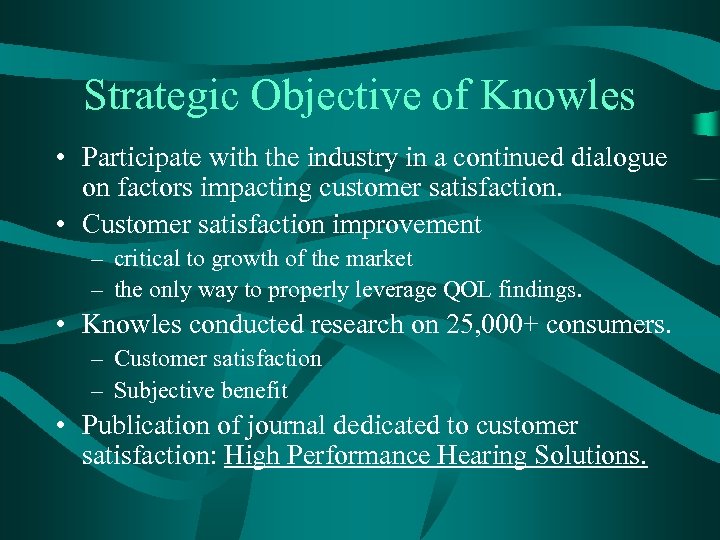

Strategic Objective of Knowles • Participate with the industry in a continued dialogue on factors impacting customer satisfaction. • Customer satisfaction improvement – critical to growth of the market – the only way to properly leverage QOL findings. • Knowles conducted research on 25, 000+ consumers. – Customer satisfaction – Subjective benefit • Publication of journal dedicated to customer satisfaction: High Performance Hearing Solutions.

Strategic Objective of Knowles • Participate with the industry in a continued dialogue on factors impacting customer satisfaction. • Customer satisfaction improvement – critical to growth of the market – the only way to properly leverage QOL findings. • Knowles conducted research on 25, 000+ consumers. – Customer satisfaction – Subjective benefit • Publication of journal dedicated to customer satisfaction: High Performance Hearing Solutions.

Previous Marke. Trak Customer Satisfaction Research • Advanced technology enhances customer satisfaction: – Programmable (digital or manual) – Multiple memories – Multiple channels – Multiple microphones – directional hearing instruments (strongest factor) – Non-linear signal processing (e. g. WDRC)

Previous Marke. Trak Customer Satisfaction Research • Advanced technology enhances customer satisfaction: – Programmable (digital or manual) – Multiple memories – Multiple channels – Multiple microphones – directional hearing instruments (strongest factor) – Non-linear signal processing (e. g. WDRC)

Previous Marke. Trak Customer Satisfaction Research • Other important factors – – Volume control (some segments) Telecoils Completely in the canal instruments (CIC) Binaural hearing aids • More recent research – Cerumen management systems (Sep. 2001 HR; Apr. 2002 HR) – Digital Hearing Aids (Nov. 2000 HR) 1. Now 40% of the market 2. Smaller clinical studies generally positive

Previous Marke. Trak Customer Satisfaction Research • Other important factors – – Volume control (some segments) Telecoils Completely in the canal instruments (CIC) Binaural hearing aids • More recent research – Cerumen management systems (Sep. 2001 HR; Apr. 2002 HR) – Digital Hearing Aids (Nov. 2000 HR) 1. Now 40% of the market 2. Smaller clinical studies generally positive

Recent Research with Micro. Waxbuster Demonstrates it Will Dramatically Reduce Hearing Aid Service Rates Micro. Waxbuster Cutaway CIC with Micro. Waxbuster installed

Recent Research with Micro. Waxbuster Demonstrates it Will Dramatically Reduce Hearing Aid Service Rates Micro. Waxbuster Cutaway CIC with Micro. Waxbuster installed

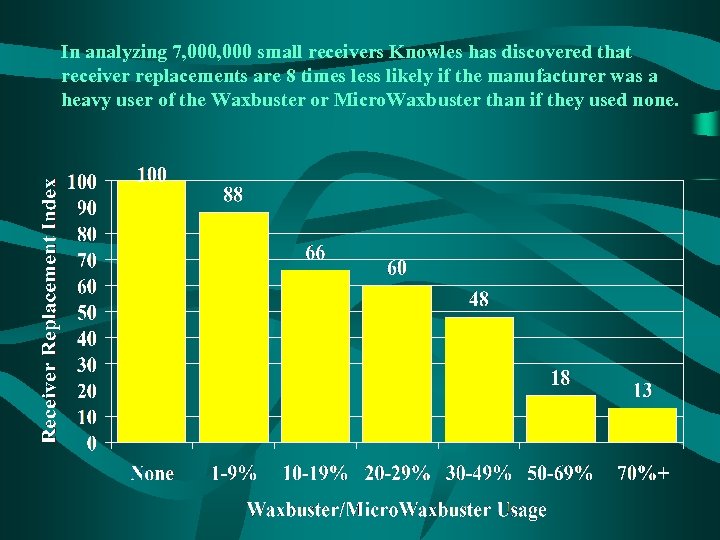

In analyzing 7, 000 small receivers Knowles has discovered that receiver replacements are 8 times less likely if the manufacturer was a heavy user of the Waxbuster or Micro. Waxbuster than if they used none.

In analyzing 7, 000 small receivers Knowles has discovered that receiver replacements are 8 times less likely if the manufacturer was a heavy user of the Waxbuster or Micro. Waxbuster than if they used none.

Study # 2 – 90, 000+ Consumers • Database query of one US manufacturer. • 24 month study across three styles of hearing instruments: CIC, ITE. • Consumers segmented: – Age of instrument – 1 -24 months – Micro. Waxbuster usage or None. • Tracked receiver replacements in corporate service files.

Study # 2 – 90, 000+ Consumers • Database query of one US manufacturer. • 24 month study across three styles of hearing instruments: CIC, ITE. • Consumers segmented: – Age of instrument – 1 -24 months – Micro. Waxbuster usage or None. • Tracked receiver replacements in corporate service files.

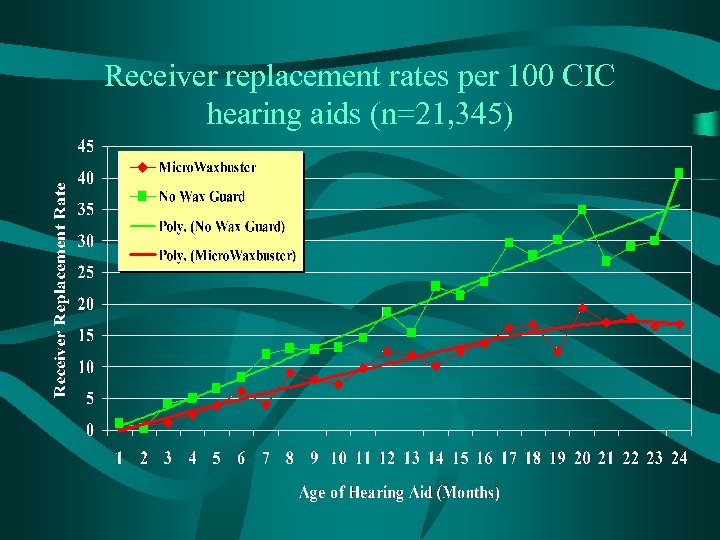

Receiver replacement rates per 100 CIC hearing aids (n=21, 345)

Receiver replacement rates per 100 CIC hearing aids (n=21, 345)

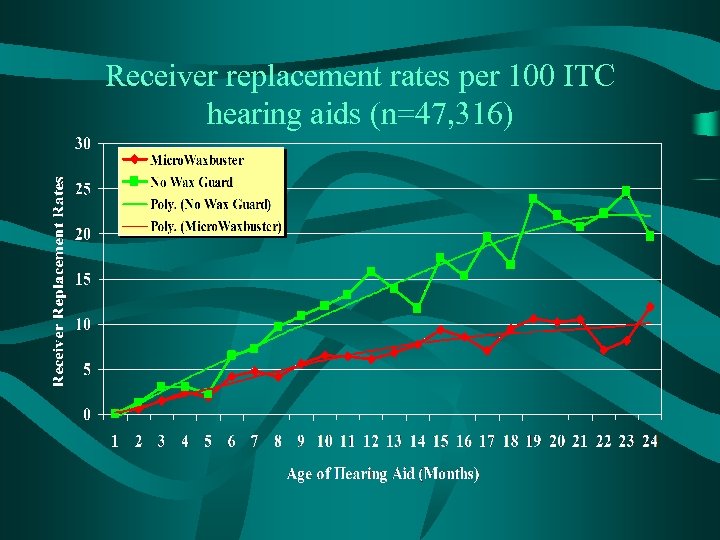

Receiver replacement rates per 100 ITC hearing aids (n=47, 316)

Receiver replacement rates per 100 ITC hearing aids (n=47, 316)

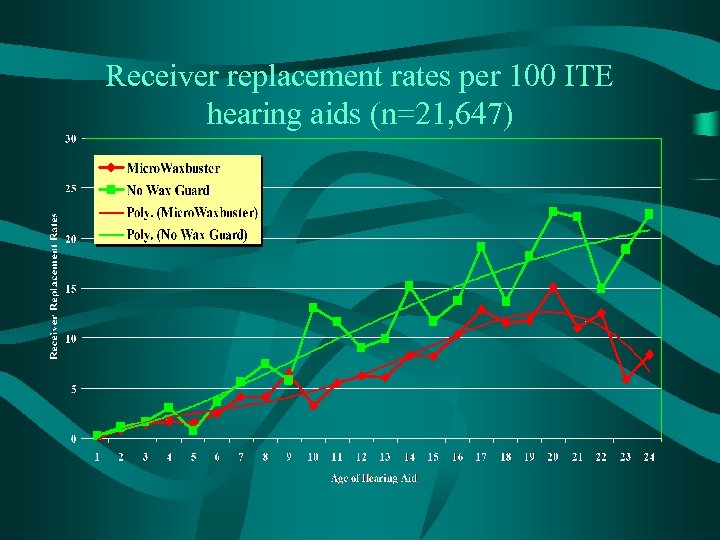

Receiver replacement rates per 100 ITE hearing aids (n=21, 647)

Receiver replacement rates per 100 ITE hearing aids (n=21, 647)

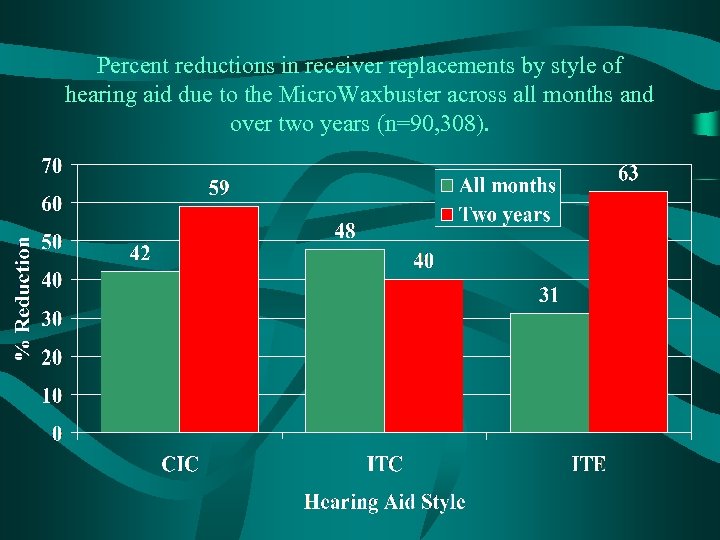

Percent reductions in receiver replacements by style of hearing aid due to the Micro. Waxbuster across all months and over two years (n=90, 308).

Percent reductions in receiver replacements by style of hearing aid due to the Micro. Waxbuster across all months and over two years (n=90, 308).

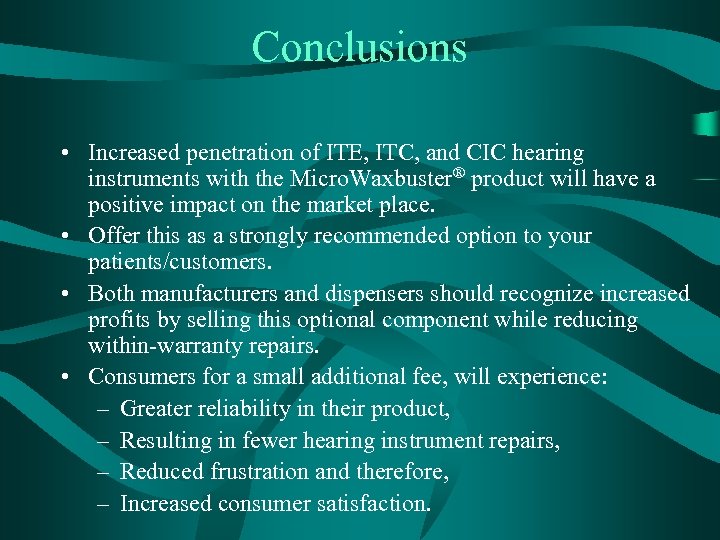

Conclusions • Increased penetration of ITE, ITC, and CIC hearing instruments with the Micro. Waxbuster® product will have a positive impact on the market place. • Offer this as a strongly recommended option to your patients/customers. • Both manufacturers and dispensers should recognize increased profits by selling this optional component while reducing within-warranty repairs. • Consumers for a small additional fee, will experience: – Greater reliability in their product, – Resulting in fewer hearing instrument repairs, – Reduced frustration and therefore, – Increased consumer satisfaction.

Conclusions • Increased penetration of ITE, ITC, and CIC hearing instruments with the Micro. Waxbuster® product will have a positive impact on the market place. • Offer this as a strongly recommended option to your patients/customers. • Both manufacturers and dispensers should recognize increased profits by selling this optional component while reducing within-warranty repairs. • Consumers for a small additional fee, will experience: – Greater reliability in their product, – Resulting in fewer hearing instrument repairs, – Reduced frustration and therefore, – Increased consumer satisfaction.

Digital Study November 2000 Hearing Review • Multiple manufacturer products were studied. • Results of first large-scale study on satisfaction with DSP hearing aids: – – – Single European based manufacturer 200 single mic (44% ITE / 56% ITC) 296 multiple mic (69% BTE / 31% ITE) Compared to 418 Marke. Trak (analog) norms Average of instruments 7 -8 months • Consumer completed Knowles Marke. Trak survey – 45 ratings of hearing aid and dispenser

Digital Study November 2000 Hearing Review • Multiple manufacturer products were studied. • Results of first large-scale study on satisfaction with DSP hearing aids: – – – Single European based manufacturer 200 single mic (44% ITE / 56% ITC) 296 multiple mic (69% BTE / 31% ITE) Compared to 418 Marke. Trak (analog) norms Average of instruments 7 -8 months • Consumer completed Knowles Marke. Trak survey – 45 ratings of hearing aid and dispenser

Top ten correlates of overall satisfaction (in rank order) 1. Perceived benefit 2. Sound clarity 3. Value (price/performance) 4. Reliability 5. Use in leisure activities 6. Natural sounding 7. Use in noisy situations 8. Use in large groups 9. Use in restaurants 10. Use outdoors

Top ten correlates of overall satisfaction (in rank order) 1. Perceived benefit 2. Sound clarity 3. Value (price/performance) 4. Reliability 5. Use in leisure activities 6. Natural sounding 7. Use in noisy situations 8. Use in large groups 9. Use in restaurants 10. Use outdoors

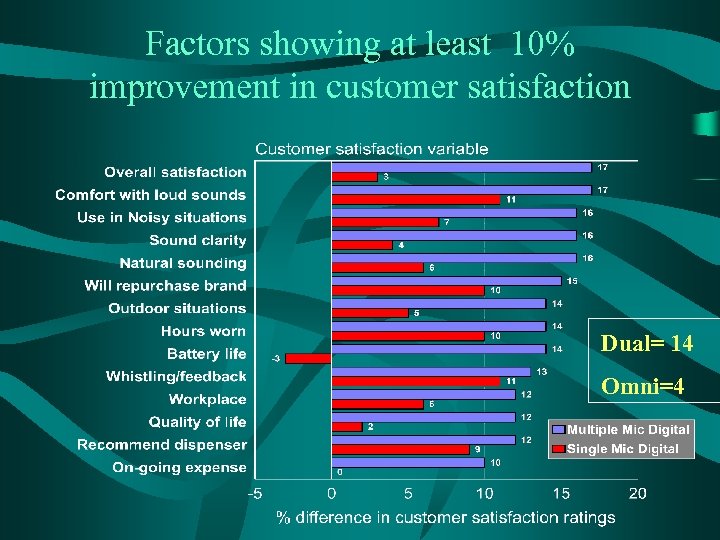

Factors showing at least 10% improvement in customer satisfaction Dual= 14 Omni=4

Factors showing at least 10% improvement in customer satisfaction Dual= 14 Omni=4

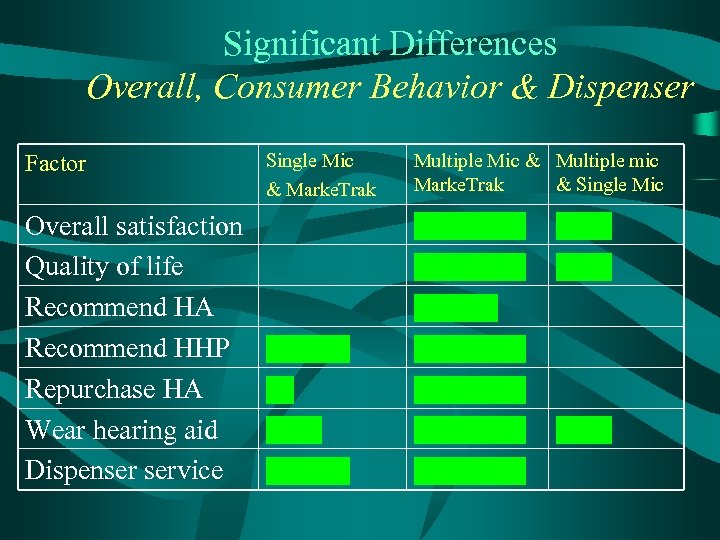

Significant Differences Overall, Consumer Behavior & Dispenser Factor Overall satisfaction Quality of life Recommend HA Recommend HHP Repurchase HA Wear hearing aid Dispenser service Single Mic & Marke. Trak Multiple Mic & Multiple mic Marke. Trak & Single Mic

Significant Differences Overall, Consumer Behavior & Dispenser Factor Overall satisfaction Quality of life Recommend HA Recommend HHP Repurchase HA Wear hearing aid Dispenser service Single Mic & Marke. Trak Multiple Mic & Multiple mic Marke. Trak & Single Mic

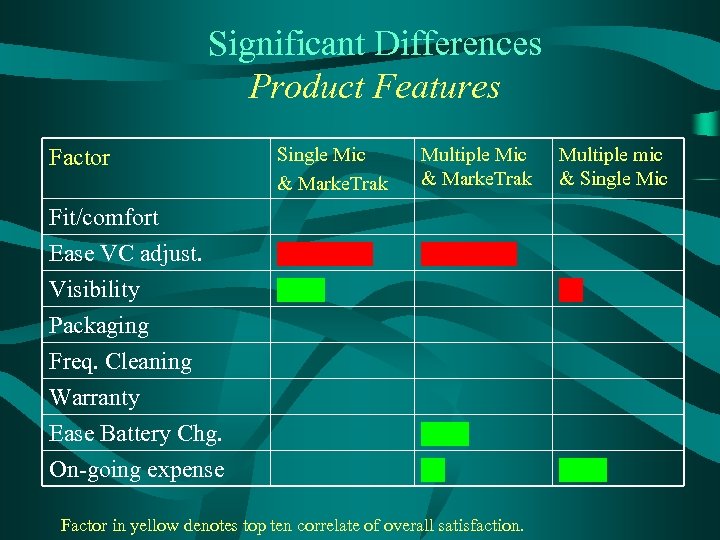

Significant Differences Product Features Factor Fit/comfort Ease VC adjust. Visibility Packaging Freq. Cleaning Warranty Ease Battery Chg. On-going expense Single Mic & Marke. Trak Multiple Mic & Marke. Trak Multiple mic & Single Mic Factor in yellow denotes top ten correlate of overall satisfaction.

Significant Differences Product Features Factor Fit/comfort Ease VC adjust. Visibility Packaging Freq. Cleaning Warranty Ease Battery Chg. On-going expense Single Mic & Marke. Trak Multiple Mic & Marke. Trak Multiple mic & Single Mic Factor in yellow denotes top ten correlate of overall satisfaction.

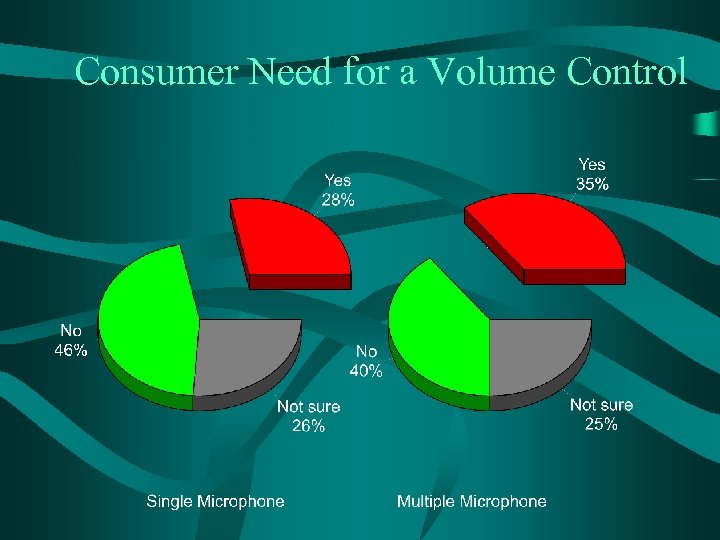

Consumer Need for a Volume Control

Consumer Need for a Volume Control

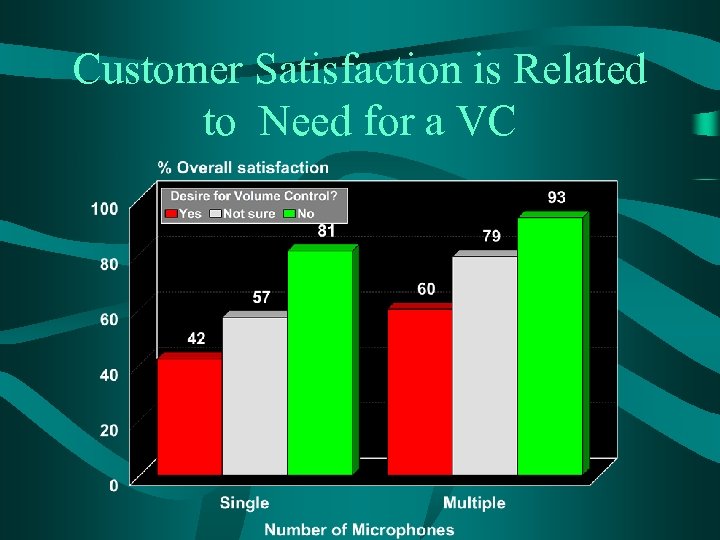

Customer Satisfaction is Related to Need for a VC

Customer Satisfaction is Related to Need for a VC

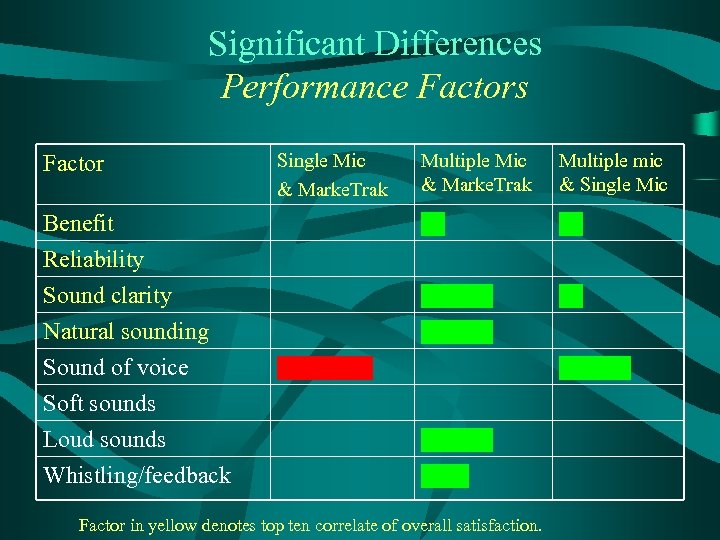

Significant Differences Performance Factors Multiple Mic & Marke. Trak Multiple mic & Single Mic Benefit Reliability Sound clarity Natural sounding Sound of voice Soft sounds Loud sounds Whistling/feedback Factor Single Mic & Marke. Trak Factor in yellow denotes top ten correlate of overall satisfaction.

Significant Differences Performance Factors Multiple Mic & Marke. Trak Multiple mic & Single Mic Benefit Reliability Sound clarity Natural sounding Sound of voice Soft sounds Loud sounds Whistling/feedback Factor Single Mic & Marke. Trak Factor in yellow denotes top ten correlate of overall satisfaction.

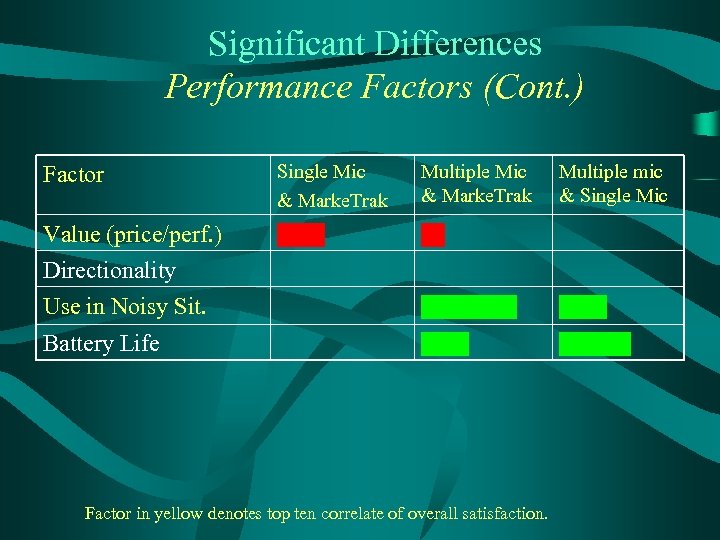

Significant Differences Performance Factors (Cont. ) Factor Single Mic & Marke. Trak Multiple Mic & Marke. Trak Value (price/perf. ) Directionality Multiple mic & Single Mic Use in Noisy Sit. Battery Life Factor in yellow denotes top ten correlate of overall satisfaction.

Significant Differences Performance Factors (Cont. ) Factor Single Mic & Marke. Trak Multiple Mic & Marke. Trak Value (price/perf. ) Directionality Multiple mic & Single Mic Use in Noisy Sit. Battery Life Factor in yellow denotes top ten correlate of overall satisfaction.

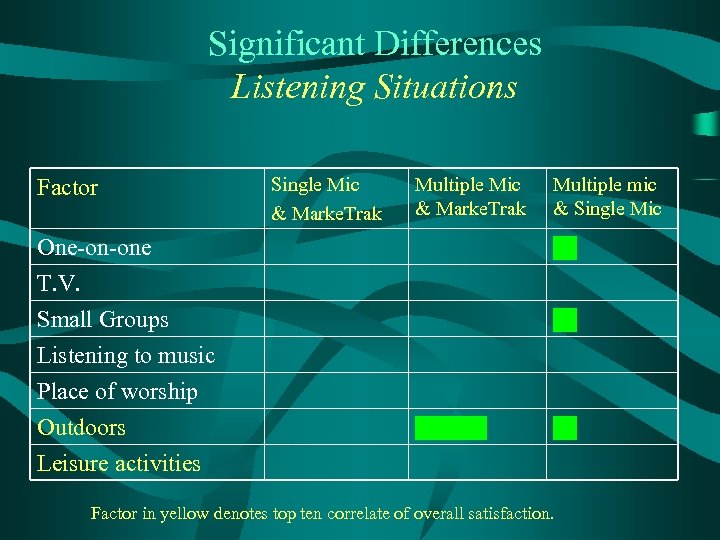

Significant Differences Listening Situations Factor Single Mic & Marke. Trak Multiple mic & Single Mic One-on-one T. V. Small Groups Listening to music Place of worship Outdoors Leisure activities Factor in yellow denotes top ten correlate of overall satisfaction.

Significant Differences Listening Situations Factor Single Mic & Marke. Trak Multiple mic & Single Mic One-on-one T. V. Small Groups Listening to music Place of worship Outdoors Leisure activities Factor in yellow denotes top ten correlate of overall satisfaction.

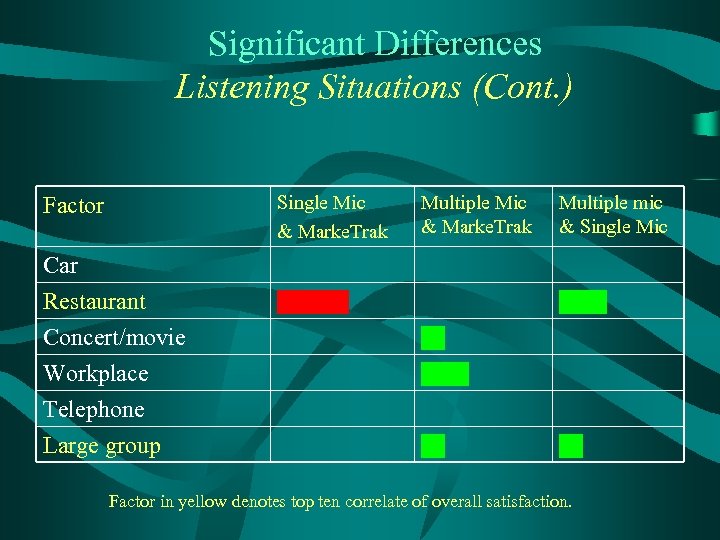

Significant Differences Listening Situations (Cont. ) Single Mic & Marke. Trak Factor Car Restaurant Concert/movie Workplace Telephone Large group Multiple Mic & Marke. Trak Multiple mic & Single Mic Factor in yellow denotes top ten correlate of overall satisfaction.

Significant Differences Listening Situations (Cont. ) Single Mic & Marke. Trak Factor Car Restaurant Concert/movie Workplace Telephone Large group Multiple Mic & Marke. Trak Multiple mic & Single Mic Factor in yellow denotes top ten correlate of overall satisfaction.

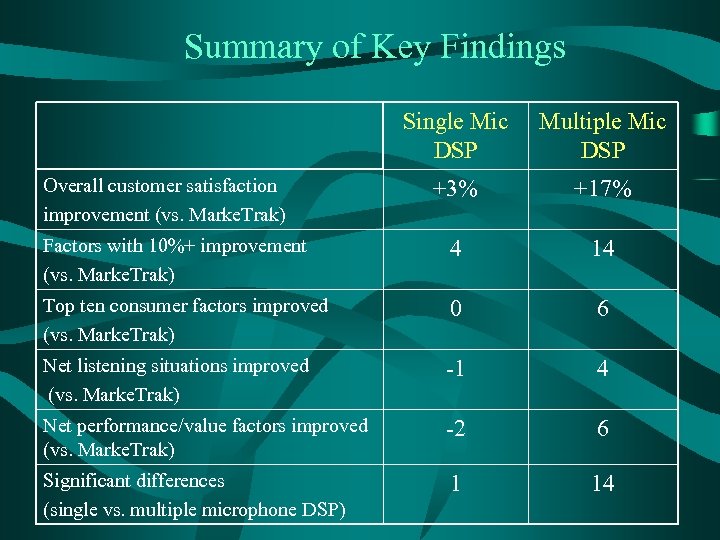

Summary of Key Findings Single Mic DSP Multiple Mic DSP +3% +17% Factors with 10%+ improvement (vs. Marke. Trak) 4 14 Top ten consumer factors improved (vs. Marke. Trak) 0 6 Net listening situations improved (vs. Marke. Trak) -1 4 Net performance/value factors improved (vs. Marke. Trak) -2 6 Significant differences (single vs. multiple microphone DSP) 1 14 Overall customer satisfaction improvement (vs. Marke. Trak)

Summary of Key Findings Single Mic DSP Multiple Mic DSP +3% +17% Factors with 10%+ improvement (vs. Marke. Trak) 4 14 Top ten consumer factors improved (vs. Marke. Trak) 0 6 Net listening situations improved (vs. Marke. Trak) -1 4 Net performance/value factors improved (vs. Marke. Trak) -2 6 Significant differences (single vs. multiple microphone DSP) 1 14 Overall customer satisfaction improvement (vs. Marke. Trak)

Conclusions • Performance in noise: – Key reason why hearing-impaired do not buy hearing aids (Marke. Trak). – #1 hearing aid improvement sought by hearing aid users (United States Marke. Trak study - 2001). – #1 hearing aid improvement sought by hearing aid users (German study - 1995). – #2 reason why 907, 000 of our customers place their hearing aids in the drawer (Marke. Trak).

Conclusions • Performance in noise: – Key reason why hearing-impaired do not buy hearing aids (Marke. Trak). – #1 hearing aid improvement sought by hearing aid users (United States Marke. Trak study - 2001). – #1 hearing aid improvement sought by hearing aid users (German study - 1995). – #2 reason why 907, 000 of our customers place their hearing aids in the drawer (Marke. Trak).

Conclusions • Consumer studies now demonstrate the superiority of multiple microphone hearing aids over omnidirectional only aids: – Kuk (Hearing Instruments, 1996) - analog – Kochkin (Hearing Review, 1996) - analog – Schuchman, Valente, Beck, Potts (HR, 1999) – analog (double blinded study) – Kochkin (Hearing Review, 2000)- digital • Consumer research supportive of dozens of small clinic/lab studies or theoretical papers.

Conclusions • Consumer studies now demonstrate the superiority of multiple microphone hearing aids over omnidirectional only aids: – Kuk (Hearing Instruments, 1996) - analog – Kochkin (Hearing Review, 1996) - analog – Schuchman, Valente, Beck, Potts (HR, 1999) – analog (double blinded study) – Kochkin (Hearing Review, 2000)- digital • Consumer research supportive of dozens of small clinic/lab studies or theoretical papers.

Recommendations • Fit all qualified candidates with directional hearing aids (BTE, Full concha, half shell). • Ask manufacturers to extend directional feature to lower priced product (not just high end programmable. ) • Completely automatic aids are tremendous feature for some, but not all, consumers: – Make sure your patient can live without VC or directional/omni-directional switch. – Lack of control could dramatically impact satisfaction. • Consider active wax protection system as standard feature on all In-the-ear instruments.

Recommendations • Fit all qualified candidates with directional hearing aids (BTE, Full concha, half shell). • Ask manufacturers to extend directional feature to lower priced product (not just high end programmable. ) • Completely automatic aids are tremendous feature for some, but not all, consumers: – Make sure your patient can live without VC or directional/omni-directional switch. – Lack of control could dramatically impact satisfaction. • Consider active wax protection system as standard feature on all In-the-ear instruments.