aa498384aa985440b905542c145e9cf1.ppt

- Количество слайдов: 24

MARINE CLAIMS Presentation by

CLAIMS - DEFINITION A demand made on an insurer for performance of contractual obligation as per the policy issued by him. Only a fair & quick settlement of claim gives tangible shape to insurance contract desirable guiding principle of claims management is “Pay it, If we can! Repudiate it, If it is must!!”

Peculiarities of Marine Insurance Governed by the “Marine Insurance Act 1963” Assignability Customized for international use Principles of insurance- special applications Ø Legal duty to disclose Ø Implied warranties Ø Insurable interest Ø Inco Terms, Documents of Title Ø Valued policies /unvalued policies Ø Indemnity /subrogation / contribution Ø Sympathetic damage / sentimental damage

Claims Management Process Notification Review Pre Action Contacts for recoveries Response Settlements – standard, compromise, ex-gratia and rejections 6. Without precedence 7. Without prejudices 8. Recoveries 1. 2. 3. 4. 5.

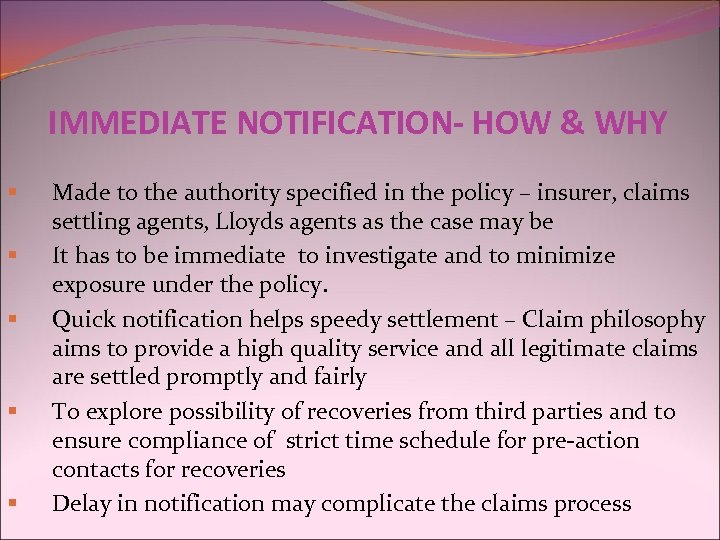

IMMEDIATE NOTIFICATION- HOW & WHY § § § Made to the authority specified in the policy – insurer, claims settling agents, Lloyds agents as the case may be It has to be immediate to investigate and to minimize exposure under the policy. Quick notification helps speedy settlement – Claim philosophy aims to provide a high quality service and all legitimate claims are settled promptly and fairly To explore possibility of recoveries from third parties and to ensure compliance of strict time schedule for pre-action contacts for recoveries Delay in notification may complicate the claims process

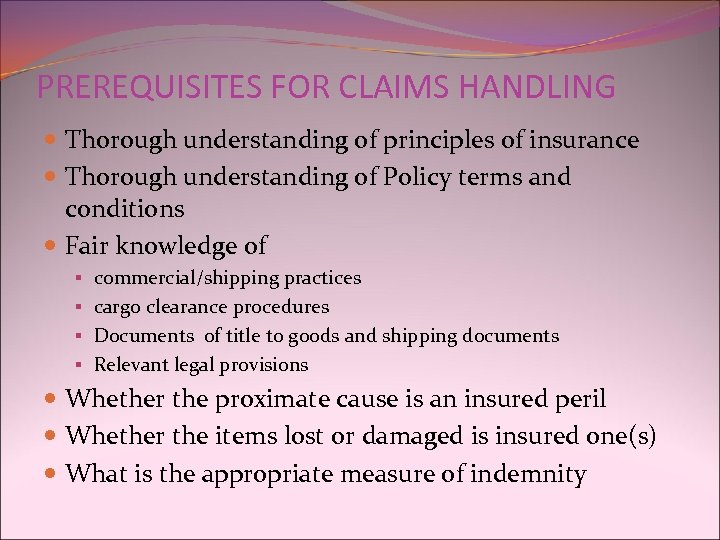

PREREQUISITES FOR CLAIMS HANDLING Thorough understanding of principles of insurance Thorough understanding of Policy terms and conditions Fair knowledge of § commercial/shipping practices § cargo clearance procedures § Documents of title to goods and shipping documents § Relevant legal provisions Whether the proximate cause is an insured peril Whether the items lost or damaged is insured one(s) What is the appropriate measure of indemnity

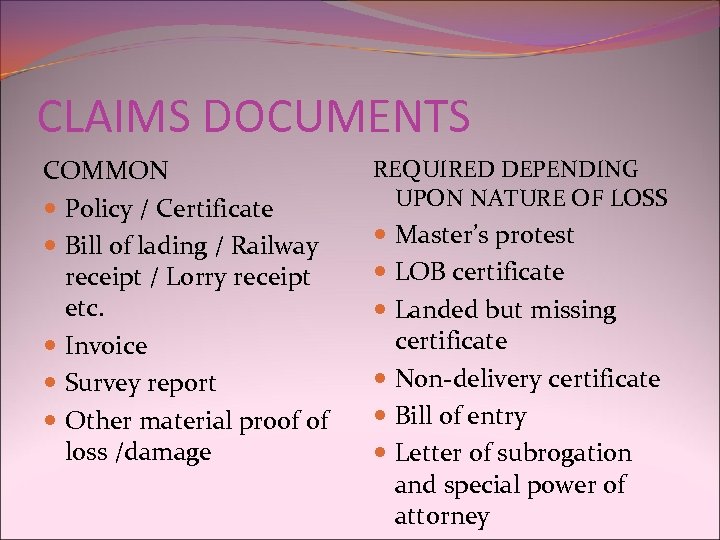

CLAIMS DOCUMENTS COMMON Policy / Certificate Bill of lading / Railway receipt / Lorry receipt etc. Invoice Survey report Other material proof of loss /damage REQUIRED DEPENDING UPON NATURE OF LOSS Master’s protest LOB certificate Landed but missing certificate Non-delivery certificate Bill of entry Letter of subrogation and special power of attorney

TYPES OF LOSSES Total Loss Ø Actual Total Loss Ø Constructive Total Loss Particular Average General Average Expenses Ø Sue and Labour Charges Ø Particular Charges Ø Salvage Charges Ø Extra Charges Liabilities

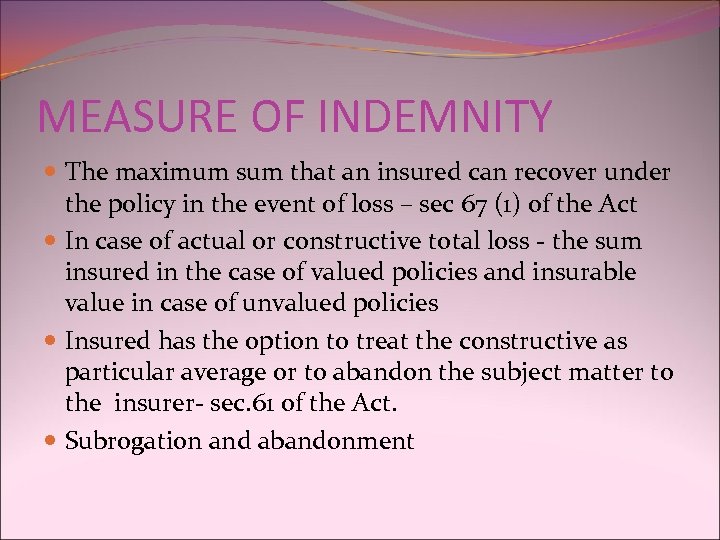

MEASURE OF INDEMNITY The maximum sum that an insured can recover under the policy in the event of loss – sec 67 (1) of the Act In case of actual or constructive total loss - the sum insured in the case of valued policies and insurable value in case of unvalued policies Insured has the option to treat the constructive as particular average or to abandon the subject matter to the insurer- sec. 61 of the Act. Subrogation and abandonment

MEASURE OF INDEMNITY – contd… Partial loss of cargo Sec 71(1)(3) of the Act Total loss of part of the cargo – insured value of each unit totally lost (units of equal value, different types in single sum insured) Damaged cargo and concept of net arrived sound value. The measure is the percentage (Depreciation) of the insured value by comparing the gross sound value with gross damaged value - Sec. 72(2) of the Act and Rule E 3 In case of disposal of damaged goods before duty is paid only the bonded price is to be compared For storage claim the quantity or the weights are compared

MEASURE OF INDEMNITY – contd… Trade losses (trade ullage) not covered – Sec 55 of the Actual shortage is to be calculated after adjustment of normal loss. Goods accidentally mixed and principle of common tenants Customary deductions (vary for each commodity) for water or impurities before loss adjustment. E 4 to E 6 Salvage loss – gross arrived sound value less sale proceeds after deducting expenses on sale

General Average A loss caused by or directly consequential on a general average act. The act include a GA sacrifice as well as a GA expenditure - Voluntarily and intentionally but reasonably made or incurred in time of peril for the common safety of the property imperiled in a maritime adventure

GA Sacrifices Damages to ship’s anchors and/or cables whilst attempting to refloat a stranded vessel Bulkhead broken to reach the seat of fire in the lower holds Sails and spares lost while forcing the vessel off the ground Burning of ships materials as fuel to reach nearest port of refuge in time of peril Jettisoning of cargo and freight lost on the same Damage to other cargo by water used for fire fighting

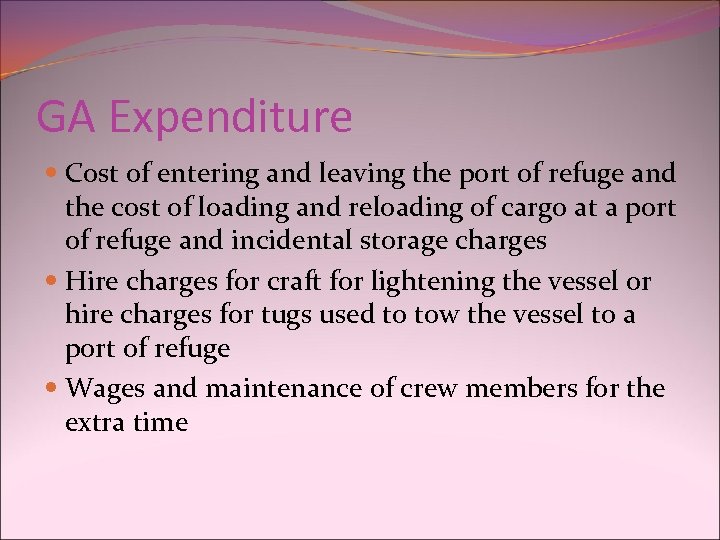

GA Expenditure Cost of entering and leaving the port of refuge and the cost of loading and reloading of cargo at a port of refuge and incidental storage charges Hire charges for craft for lightening the vessel or hire charges for tugs used to tow the vessel to a port of refuge Wages and maintenance of crew members for the extra time

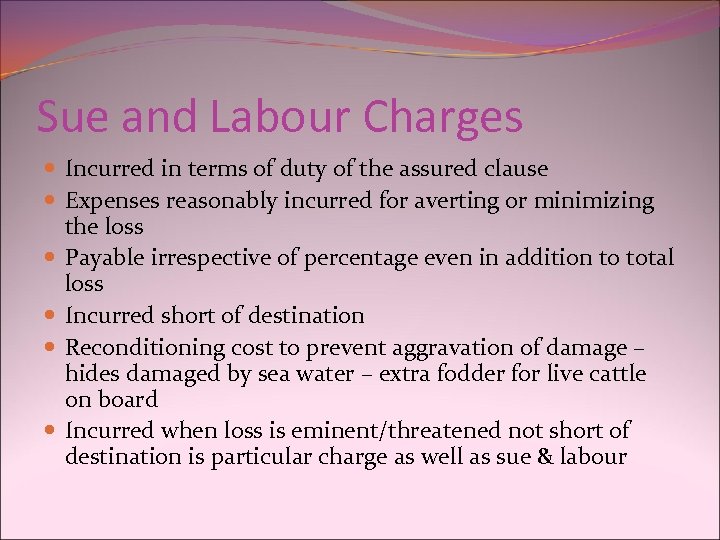

Sue and Labour Charges Incurred in terms of duty of the assured clause Expenses reasonably incurred for averting or minimizing the loss Payable irrespective of percentage even in addition to total loss Incurred short of destination Reconditioning cost to prevent aggravation of damage – hides damaged by sea water – extra fodder for live cattle on board Incurred when loss is eminent/threatened not short of destination is particular charge as well as sue & labour

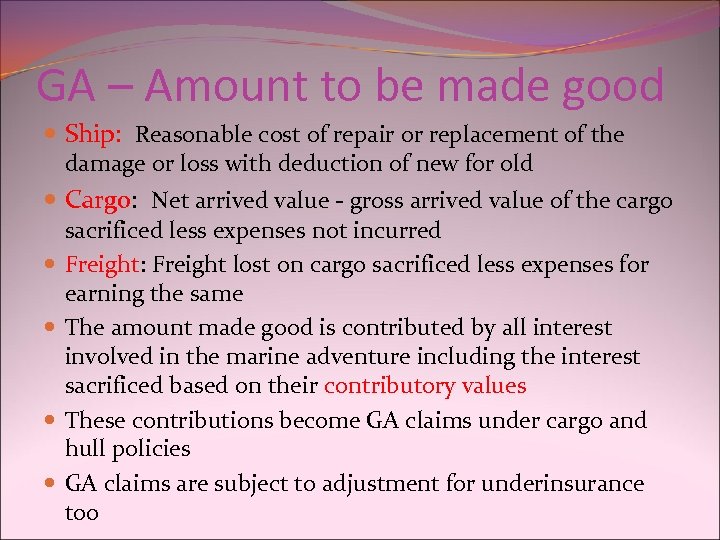

GA – Amount to be made good Ship: Reasonable cost of repair or replacement of the damage or loss with deduction of new for old Cargo: Net arrived value - gross arrived value of the cargo sacrificed less expenses not incurred Freight: Freight lost on cargo sacrificed less expenses for earning the same The amount made good is contributed by all interest involved in the marine adventure including the interest sacrificed based on their contributory values These contributions become GA claims under cargo and hull policies GA claims are subject to adjustment for underinsurance too

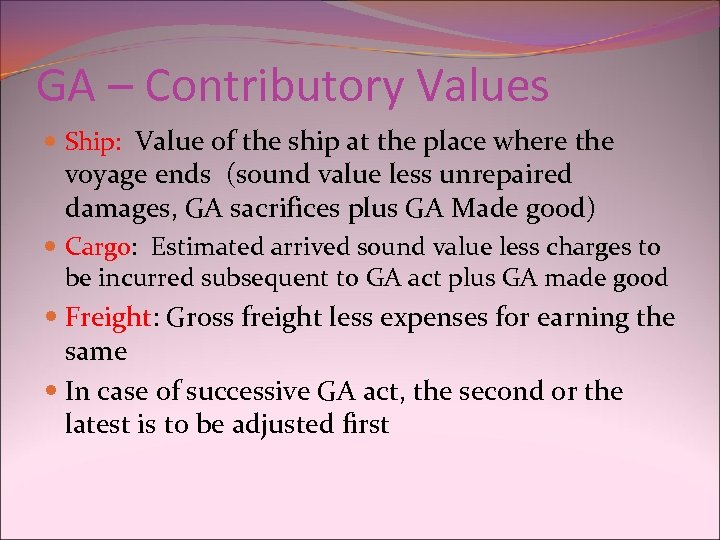

GA – Contributory Values Ship: Value of the ship at the place where the voyage ends (sound value less unrepaired damages, GA sacrifices plus GA Made good) Cargo: Estimated arrived sound value less charges to be incurred subsequent to GA act plus GA made good Freight: Gross freight less expenses for earning the same In case of successive GA act, the second or the latest is to be adjusted first

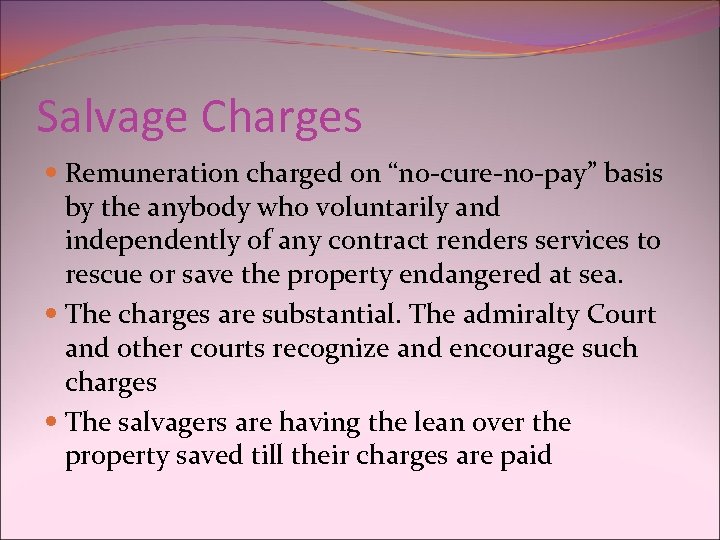

Salvage Charges Remuneration charged on “no-cure-no-pay” basis by the anybody who voluntarily and independently of any contract renders services to rescue or save the property endangered at sea. The charges are substantial. The admiralty Court and other courts recognize and encourage such charges The salvagers are having the lean over the property saved till their charges are paid

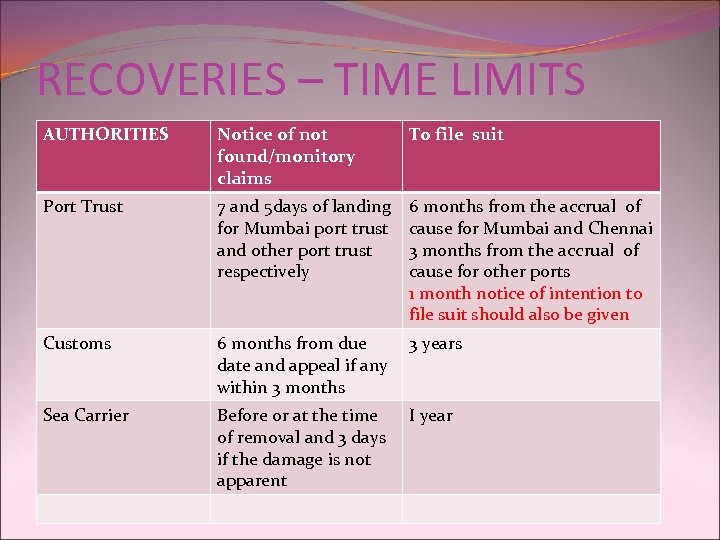

RECOVERIES – TIME LIMITS AUTHORITIES Notice of not found/monitory claims To file suit Port Trust 7 and 5 days of landing for Mumbai port trust and other port trust respectively 6 months from the accrual of cause for Mumbai and Chennai 3 months from the accrual of cause for other ports 1 month notice of intention to file suit should also be given Customs 6 months from due date and appeal if any within 3 months 3 years Sea Carrier Before or at the time of removal and 3 days if the damage is not apparent I year

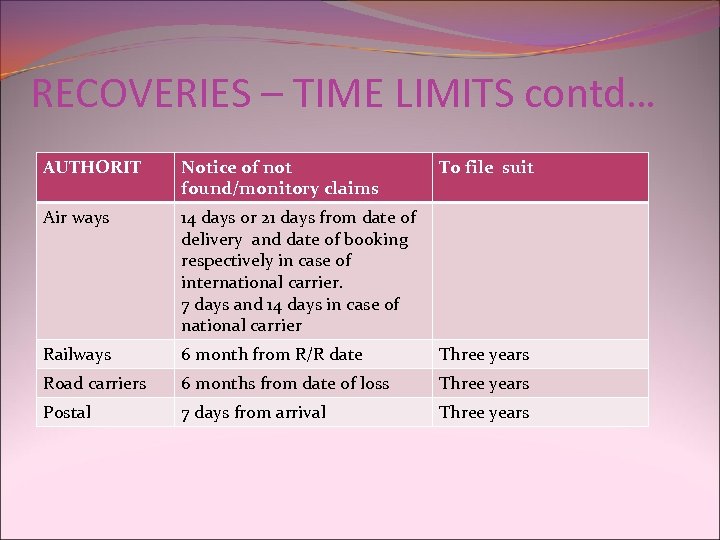

RECOVERIES – TIME LIMITS contd… AUTHORIT Notice of not found/monitory claims To file suit Air ways 14 days or 21 days from date of delivery and date of booking respectively in case of international carrier. 7 days and 14 days in case of national carrier Railways 6 month from R/R date Three years Road carriers 6 months from date of loss Three years Postal 7 days from arrival Three years

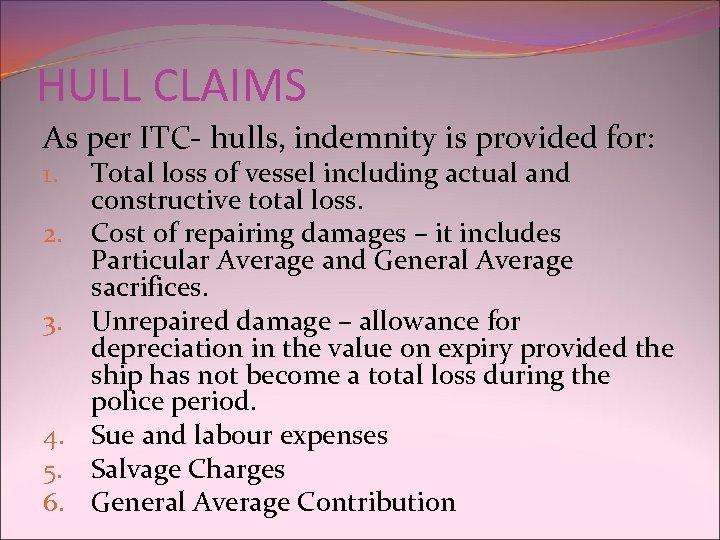

HULL CLAIMS As per ITC- hulls, indemnity is provided for: Total loss of vessel including actual and constructive total loss. 2. Cost of repairing damages – it includes Particular Average and General Average sacrifices. 3. Unrepaired damage – allowance for depreciation in the value on expiry provided the ship has not become a total loss during the police period. 4. Sue and labour expenses 5. Salvage Charges 6. General Average Contribution 1.

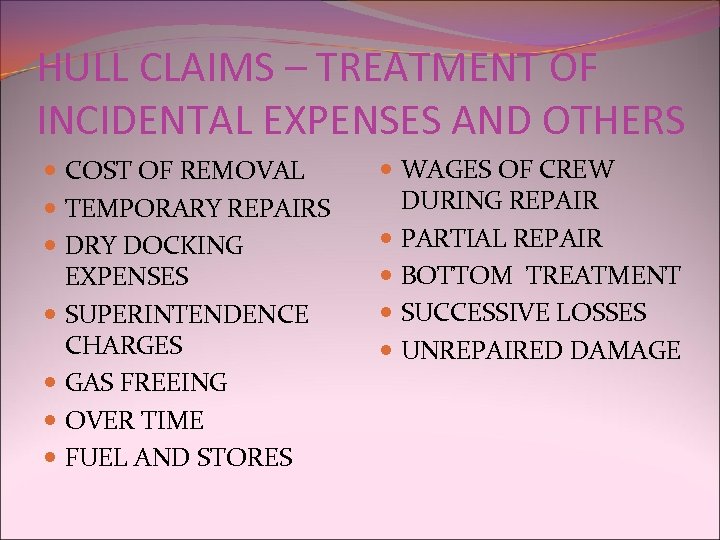

HULL CLAIMS – TREATMENT OF INCIDENTAL EXPENSES AND OTHERS COST OF REMOVAL TEMPORARY REPAIRS DRY DOCKING EXPENSES SUPERINTENDENCE CHARGES GAS FREEING OVER TIME FUEL AND STORES WAGES OF CREW DURING REPAIR PARTIAL REPAIR BOTTOM TREATMENT SUCCESSIVE LOSSES UNREPAIRED DAMAGE

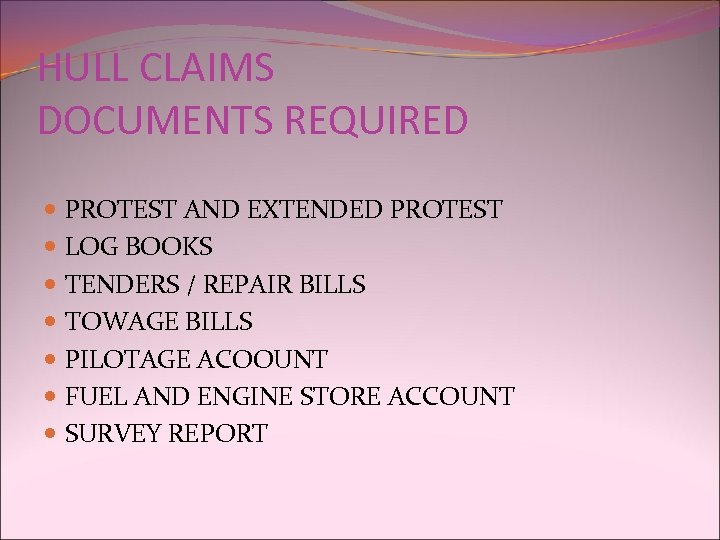

HULL CLAIMS DOCUMENTS REQUIRED PROTEST AND EXTENDED PROTEST LOG BOOKS TENDERS / REPAIR BILLS TOWAGE BILLS PILOTAGE ACOOUNT FUEL AND ENGINE STORE ACCOUNT SURVEY REPORT

aa498384aa985440b905542c145e9cf1.ppt