7c77cfba35e18f9f7eb3c5dc9bd7aac6.ppt

- Количество слайдов: 16

- March 18 - Inter-American Development Bank Private Sector Department Trade Finance Facilitation Program (TFFP)

TFFP – The Context During times of volatile international capital flows and/or temporary liquidity squeezes, international banks actively involved in trade finance: • Force up confirmation fees or loan margins • Reduce or cancel “bank limits” or • Reduce or cancel “country limits” Some examples: • Argentina 2001 – 2002 • Brazil 2002 – 2003 INTER-AMERICAN DEVELOPMENT BANK PRIVATE SECTOR DEPARTMENT March 18

TFFP – The Context (cont…) Without these limits • Local banks in IDB’s Borrowing Member Countries (BMCs) face difficulties providing trade finance to their exporters & importers, thus • Hindering their prospects for economic recovery & growth INTER-AMERICAN DEVELOPMENT BANK PRIVATE SECTOR DEPARTMENT March 18

TFFP – Purpose 1. Play an anti-cyclical role by providing liquidity to the international “trade finance system”, particularly during times of economic difficulties 2. Support and develop intra- and inter- regional trade 3. Help local banks in IDB BMCs establish track records with international banks INTER-AMERICAN DEVELOPMENT BANK PRIVATE SECTOR DEPARTMENT March 18

TFFP – Key Success Factors • Modeled based on the lessons learned from the successful implementation of the EBRD’s TFP • Consistent with the recently implemented TFP by the ADB As to: Leveling the playing field for international trade and global integration INTER-AMERICAN DEVELOPMENT BANK PRIVATE SECTOR DEPARTMENT March 18

TFFP – Key Success Factors (cont…) Use of an “open architecture” approach • Developing a complete network of local and international banks (“Issuing” and “Confirming” Banks, respectively) • Supporting all of IDB’s BMCs • Covering a substantial portion of the exposure on a comprehensive basis INTER-AMERICAN DEVELOPMENT BANK PRIVATE SECTOR DEPARTMENT March 18

TFFP – Key Success Factors (cont…) An efficient response to market needs • Run by a team of specialized trade finance professionals • Use of standardized “market-tested” documentation • Quick turnaround on individual transactions and use of SWIFT instructions INTER-AMERICAN DEVELOPMENT BANK PRIVATE SECTOR DEPARTMENT March 18

TFFP – Key Success Factors (cont…) Cost effective • Uncommitted Lines (I. e. no commitment fees) • Small enrollment & annual membership fees charged to Issuing Banks • Market-based guarantee fees commensurate with the level of IDB’s coverage on individual transactions INTER-AMERICAN DEVELOPMENT BANK PRIVATE SECTOR DEPARTMENT March 18

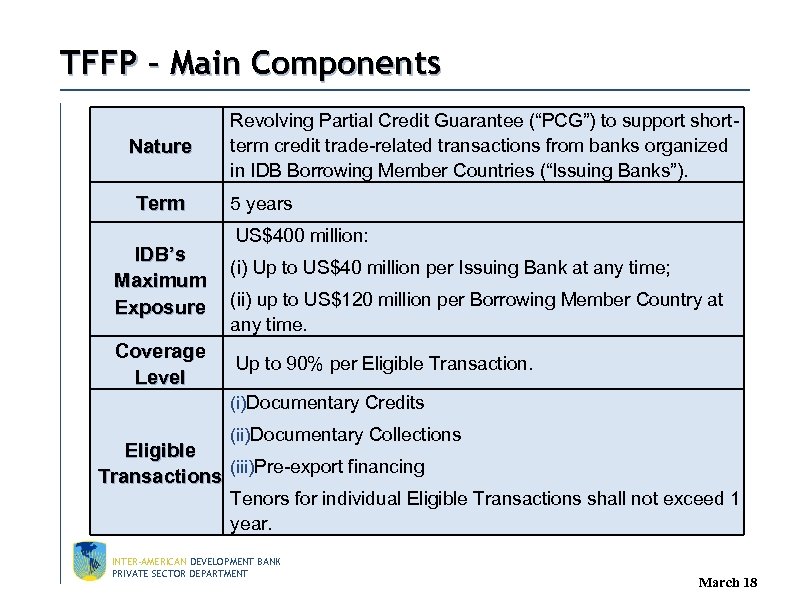

TFFP – Main Components Nature Term IDB’s Maximum Exposure Coverage Level Revolving Partial Credit Guarantee (“PCG”) to support shortterm credit trade-related transactions from banks organized in IDB Borrowing Member Countries (“Issuing Banks”). 5 years US$400 million: (i) Up to US$40 million per Issuing Bank at any time; (ii) up to US$120 million per Borrowing Member Country at any time. Up to 90% per Eligible Transaction. (i)Documentary Credits (ii)Documentary Collections Eligible (iii)Pre-export financing Transactions Tenors for individual Eligible Transactions shall not exceed 1 year. INTER-AMERICAN DEVELOPMENT BANK PRIVATE SECTOR DEPARTMENT March 18

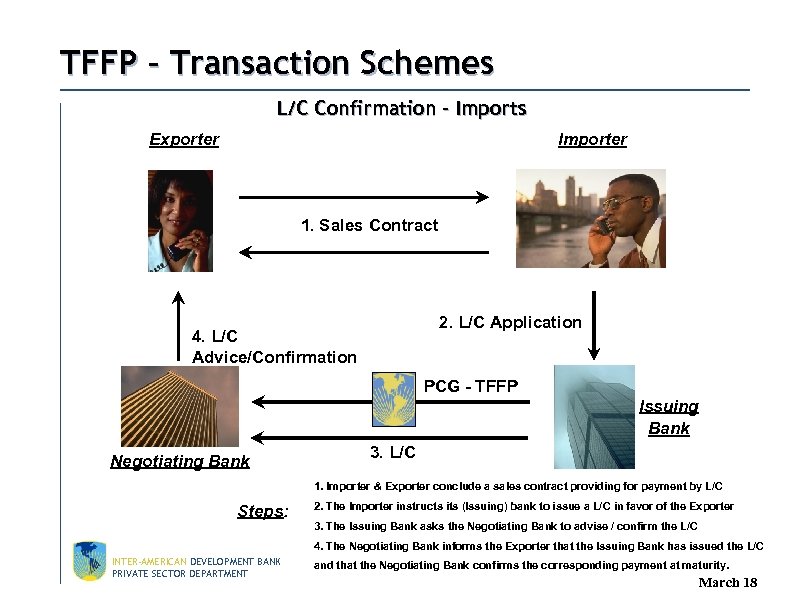

TFFP – Transaction Schemes L/C Confirmation – Imports Exporter Importer 1. Sales Contract 2. L/C Application 4. L/C Advice/Confirmation PCG - TFFP Issuing Bank Negotiating Bank 3. L/C 1. Importer & Exporter conclude a sales contract providing for payment by L/C Steps: 2. The Importer instructs its (Issuing) bank to issue a L/C in favor of the Exporter 3. The Issuing Bank asks the Negotiating Bank to advise / confirm the L/C 4. The Negotiating Bank informs the Exporter that the Issuing Bank has issued the L/C INTER-AMERICAN DEVELOPMENT BANK PRIVATE SECTOR DEPARTMENT and that the Negotiating Bank confirms the corresponding payment at maturity. March 18

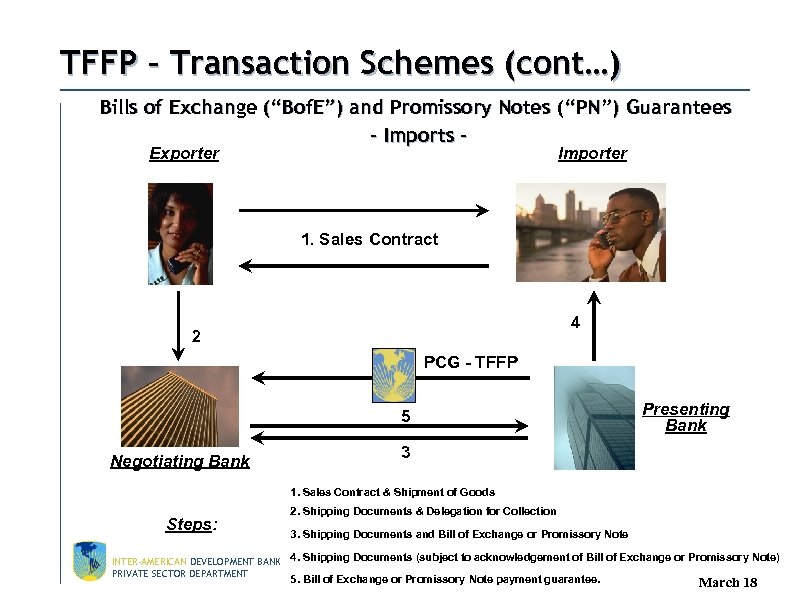

TFFP – Transaction Schemes (cont…) Bills of Exchange (“Bof. E”) and Promissory Notes (“PN”) Guarantees - Imports Exporter Importer 1. Sales Contract 4 2 PCG - TFFP 5 Negotiating Bank Presenting Bank 3 1. Sales Contract & Shipment of Goods Steps: 2. Shipping Documents & Delegation for Collection 3. Shipping Documents and Bill of Exchange or Promissory Note INTER-AMERICAN DEVELOPMENT BANK 4. Shipping Documents (subject to acknowledgement of Bill of Exchange or Promissory Note) PRIVATE SECTOR DEPARTMENT 5. Bill of Exchange or Promissory Note payment guarantee. March 18

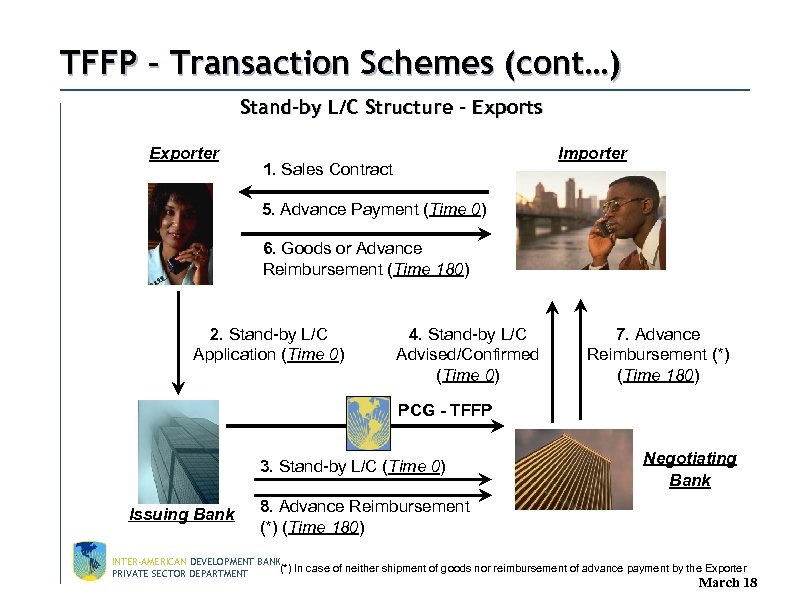

TFFP – Transaction Schemes (cont…) Stand-by L/C Structure – Exports Exporter Importer 1. Sales Contract 5. Advance Payment (Time 0) 6. Goods or Advance Reimbursement (Time 180) 2. Stand-by L/C Application (Time 0) 4. Stand-by L/C Advised/Confirmed (Time 0) 7. Advance Reimbursement (*) (Time 180) PCG - TFFP 3. Stand-by L/C (Time 0) Issuing Bank Negotiating Bank 8. Advance Reimbursement (*) (Time 180) INTER-AMERICAN DEVELOPMENT BANK (*) In case of neither shipment of goods nor reimbursement of advance payment by the Exporter PRIVATE SECTOR DEPARTMENT March 18

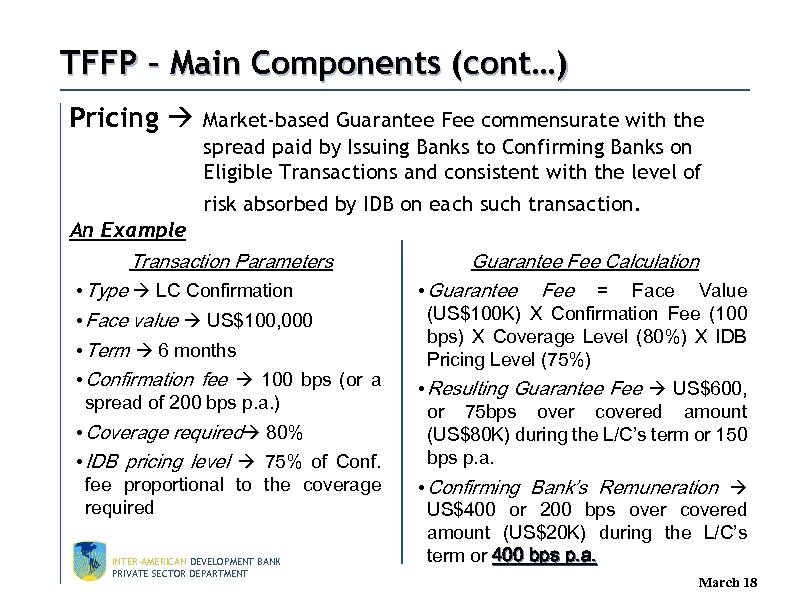

TFFP – Main Components (cont…) Pricing Market-based Guarantee Fee commensurate with the spread paid by Issuing Banks to Confirming Banks on Eligible Transactions and consistent with the level of risk absorbed by IDB on each such transaction. An Example Transaction Parameters • Type LC Confirmation • Face value US$100, 000 • Term 6 months • Confirmation fee 100 bps (or a spread of 200 bps p. a. ) • Coverage required 80% • IDB pricing level 75% of Conf. fee proportional to the coverage required INTER-AMERICAN DEVELOPMENT BANK PRIVATE SECTOR DEPARTMENT Guarantee Fee Calculation • Guarantee Fee = Face Value (US$100 K) X Confirmation Fee (100 bps) X Coverage Level (80%) X IDB Pricing Level (75%) • Resulting Guarantee Fee US$600, or 75 bps over covered amount (US$80 K) during the L/C’s term or 150 bps p. a. • Confirming Bank’s Remuneration US$400 or 200 bps over covered amount (US$20 K) during the L/C’s term or 400 bps p. a. March 18

TFFP – Main Components (cont…) Participants • Issuing Banks • Privately-owned and incorporated in IDB BMCs • Demonstrated track record in trade financing activities • Established relationships with international correspondent banks • Satisfactory credit worthiness based on the application of a standardized risk assessment methodology • The Issuing Bank would also be required to comply with Environmental, Social, Labor and Health & Safety (“H&S”) capabilities • Confirming Banks INTER-AMERICAN DEVELOPMENT BANK PRIVATE SECTOR DEPARTMENT March 18

TFFP – Application Process • Confirming or Issuing Bank contacts IDB • Transaction, tenor & pricing agreed between parties • SWIFT application sent to IDB • Normally 1 to 2 day processing by IDB • IDB sends SWIFT PCG (guarantee) to Confirming Bank INTER-AMERICAN DEVELOPMENT BANK PRIVATE SECTOR DEPARTMENT March 18

TFFP – Documentation • Confirming Bank Letter Agreement n includes general terms and conditions for all PCGs made from time to time • Issuing Bank Reimbursement Agreement n includes various undertakings and acknowledgements about IDB’s subrogation rights under a PCG INTER-AMERICAN DEVELOPMENT BANK PRIVATE SECTOR DEPARTMENT March 18

7c77cfba35e18f9f7eb3c5dc9bd7aac6.ppt