5cc9ea909546b84ebaa1c821c5adf9b1.ppt

- Количество слайдов: 39

Mapping the Israeli high tech industry Project: IFISE Work package 7 Arie Sadovski

Mapping the Israeli high tech industry Project: IFISE Work package 7 Arie Sadovski

Methodology • Database from a commercially available source • Eight hundreds companies were contacted in two cycles • Companies: estb. 1993 or later and hdqtrs in Israel • Received 143 qualified, filled-in questionnaires • Each company was contacted at least two times; in most cases three times: 1 st call to identify the founders, then interview via fax/email and followup

Methodology • Database from a commercially available source • Eight hundreds companies were contacted in two cycles • Companies: estb. 1993 or later and hdqtrs in Israel • Received 143 qualified, filled-in questionnaires • Each company was contacted at least two times; in most cases three times: 1 st call to identify the founders, then interview via fax/email and followup

The companies

The companies

Major industrial sectors • Communication (hardware) and electronic components • Software for internet • Software for other applications • Electronic medical instruments and devices • Software for telecommunication (ex internet) • Biotechnology (excluding pharmaceuticals) • Computer (hardware) semiconductor devices and electronic components • Optical instruments and materials (including optical communication items)

Major industrial sectors • Communication (hardware) and electronic components • Software for internet • Software for other applications • Electronic medical instruments and devices • Software for telecommunication (ex internet) • Biotechnology (excluding pharmaceuticals) • Computer (hardware) semiconductor devices and electronic components • Optical instruments and materials (including optical communication items)

Industrial sectors

Industrial sectors

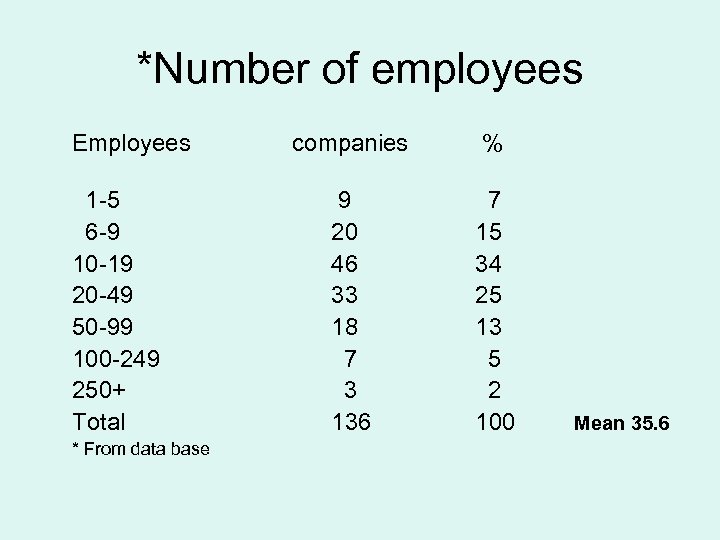

Number of employees • • The average number is 36 80% of the firms have < 50 15% of the companies have < 10 Mean employees' number having formal academic degrees is 23. 4 • on the average at least 65% of the employees have academic degrees

Number of employees • • The average number is 36 80% of the firms have < 50 15% of the companies have < 10 Mean employees' number having formal academic degrees is 23. 4 • on the average at least 65% of the employees have academic degrees

Companies’ age Age 1 year 2 -3 years 4 -5 years 6+ years Total resp Mean 3. 5 Companies # % 29 20 54 38 31 22 29 20 143 100

Companies’ age Age 1 year 2 -3 years 4 -5 years 6+ years Total resp Mean 3. 5 Companies # % 29 20 54 38 31 22 29 20 143 100

*Number of employees Employees 1 -5 6 -9 10 -19 20 -49 50 -99 100 -249 250+ Total * From data base companies % 9 20 46 33 18 7 3 136 7 15 34 25 13 5 2 100 Mean 35. 6

*Number of employees Employees 1 -5 6 -9 10 -19 20 -49 50 -99 100 -249 250+ Total * From data base companies % 9 20 46 33 18 7 3 136 7 15 34 25 13 5 2 100 Mean 35. 6

Product development phases # Research and development 21 Technological demonstration 6 Prototype 12 ß site 17 Initial sales 43 Sales 41 Total respondents % 15 4 9 12 31 29 140 100

Product development phases # Research and development 21 Technological demonstration 6 Prototype 12 ß site 17 Initial sales 43 Sales 41 Total respondents % 15 4 9 12 31 29 140 100

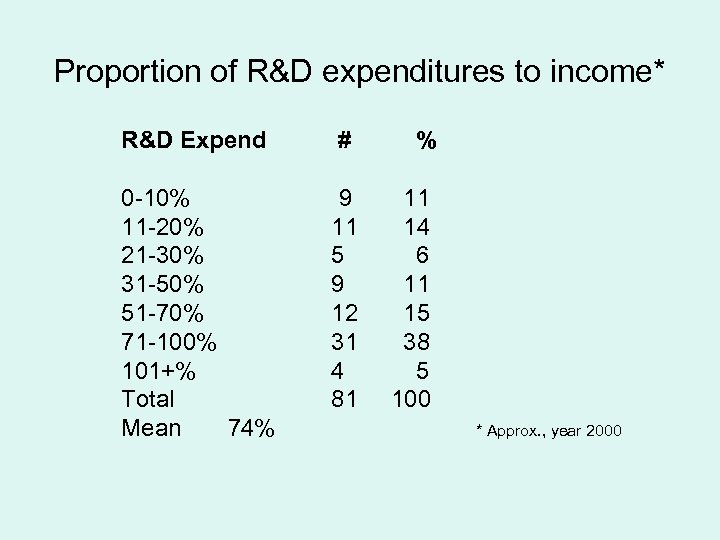

Proportion of R&D expenditures to income* R&D Expend # % 0 -10% 11 -20% 21 -30% 31 -50% 51 -70% 71 -100% 101+% Total Mean 74% 9 11 5 9 12 31 4 81 11 14 6 11 15 38 5 100 * Approx. , year 2000

Proportion of R&D expenditures to income* R&D Expend # % 0 -10% 11 -20% 21 -30% 31 -50% 51 -70% 71 -100% 101+% Total Mean 74% 9 11 5 9 12 31 4 81 11 14 6 11 15 38 5 100 * Approx. , year 2000

The founders

The founders

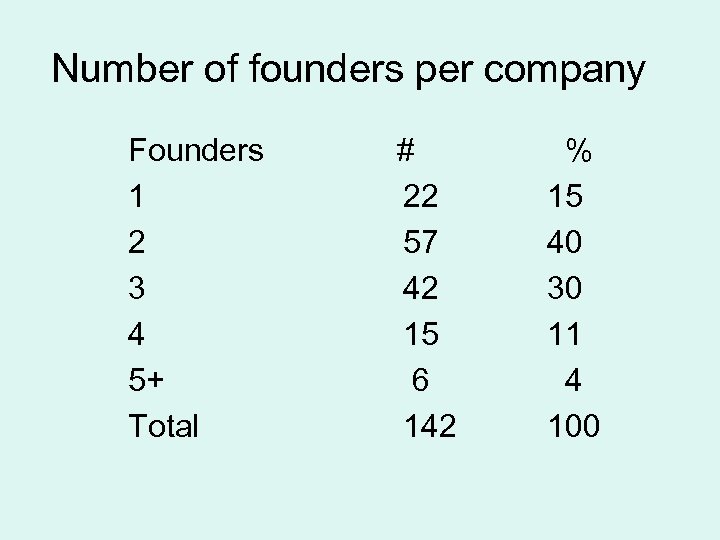

Number of founders per company Founders 1 2 3 4 5+ Total # 22 57 42 15 6 142 % 15 40 30 11 4 100

Number of founders per company Founders 1 2 3 4 5+ Total # 22 57 42 15 6 142 % 15 40 30 11 4 100

Founders’ formal schooling Non academic Vocational Engineers B. Sc. /B. A M. Sc. /M. A Ph. D. Military courses # 11 8 73 63 67 15 % 8 6 51 44 47 10

Founders’ formal schooling Non academic Vocational Engineers B. Sc. /B. A M. Sc. /M. A Ph. D. Military courses # 11 8 73 63 67 15 % 8 6 51 44 47 10

Founders’ professional training disciplines Engineering MBA Exact / Computer Science Management/Economic Life Science # 64 24 77 21 26 % 45 17 54 15 18

Founders’ professional training disciplines Engineering MBA Exact / Computer Science Management/Economic Life Science # 64 24 77 21 26 % 45 17 54 15 18

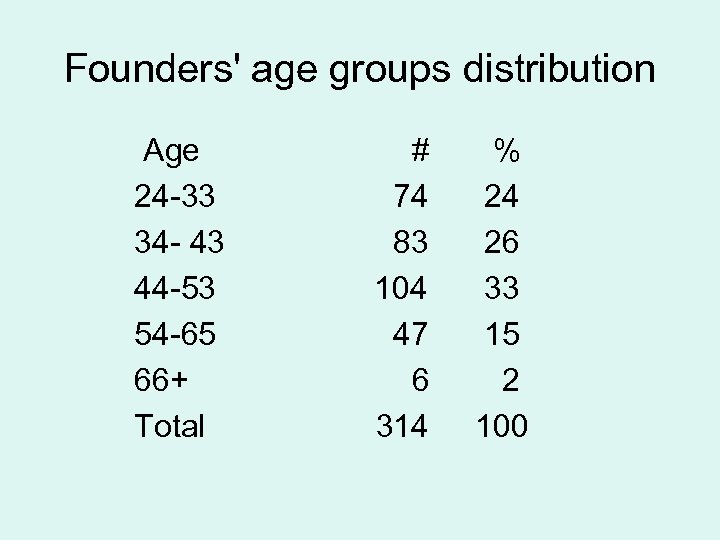

Founders' age groups distribution Age 24 -33 34 - 43 44 -53 54 -65 66+ Total # 74 83 104 47 6 314 % 24 26 33 15 2 100

Founders' age groups distribution Age 24 -33 34 - 43 44 -53 54 -65 66+ Total # 74 83 104 47 6 314 % 24 26 33 15 2 100

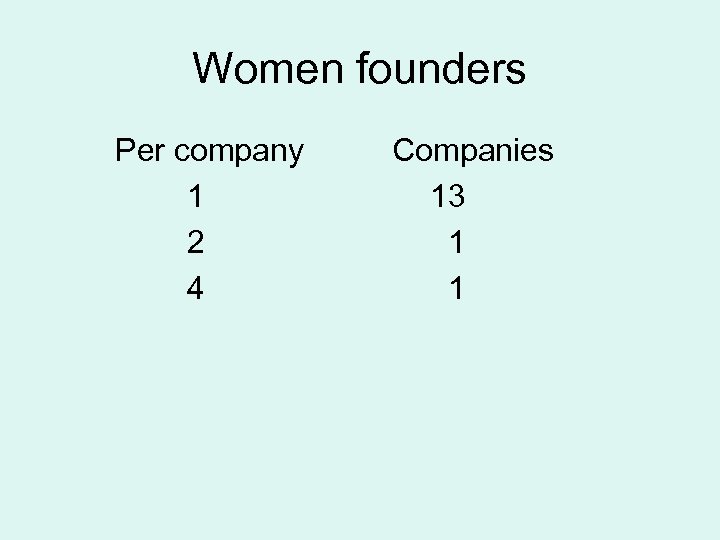

Women founders Per company 1 2 4 Companies 13 1 1

Women founders Per company 1 2 4 Companies 13 1 1

Changes in the founders' position Yes, all of them are still in the lead No, part of them are in the lead No, none of them are in the lead Total respondents # % 94 67 30 21 16 11 140 100

Changes in the founders' position Yes, all of them are still in the lead No, part of them are in the lead No, none of them are in the lead Total respondents # % 94 67 30 21 16 11 140 100

The entrepreneurial environment and background

The entrepreneurial environment and background

The geographical birth place of the new technology # Israel 128 Abroad 12 Both 2 Total respondents 142 % 90 8. 5 1. 4 100

The geographical birth place of the new technology # Israel 128 Abroad 12 Both 2 Total respondents 142 % 90 8. 5 1. 4 100

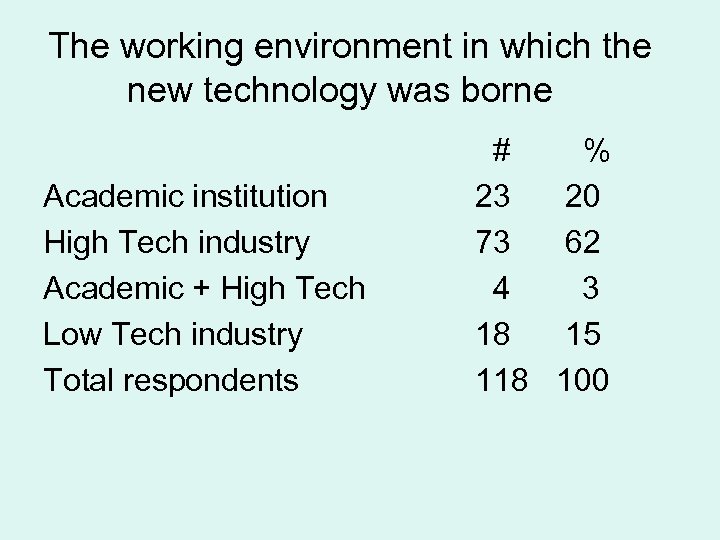

The working environment in which the new technology was borne Academic institution High Tech industry Academic + High Tech Low Tech industry Total respondents # % 23 20 73 62 4 3 18 15 118 100

The working environment in which the new technology was borne Academic institution High Tech industry Academic + High Tech Low Tech industry Total respondents # % 23 20 73 62 4 3 18 15 118 100

Previous occupation of the founders # % Unemployed 2 1 Students 9 6 Academia, Research Institute 24 17 Industry 108 76 Total respondents 143 100

Previous occupation of the founders # % Unemployed 2 1 Students 9 6 Academia, Research Institute 24 17 Industry 108 76 Total respondents 143 100

Founders’ previous industrial positions # R&D % Manager 78 55 Staff 31 22 Production Manager Staff 10 1 7 1 Marketing /sales Manager Staff 33 6 23 4 Total responses 159

Founders’ previous industrial positions # R&D % Manager 78 55 Staff 31 22 Production Manager Staff 10 1 7 1 Marketing /sales Manager Staff 33 6 23 4 Total responses 159

Fund raising patterns

Fund raising patterns

Number of rounds used for fund raising Rounds 1 2 3 4 5 Respondents Companies 48 29 24 15 6 122 % 39 24 20 12 5 100

Number of rounds used for fund raising Rounds 1 2 3 4 5 Respondents Companies 48 29 24 15 6 122 % 39 24 20 12 5 100

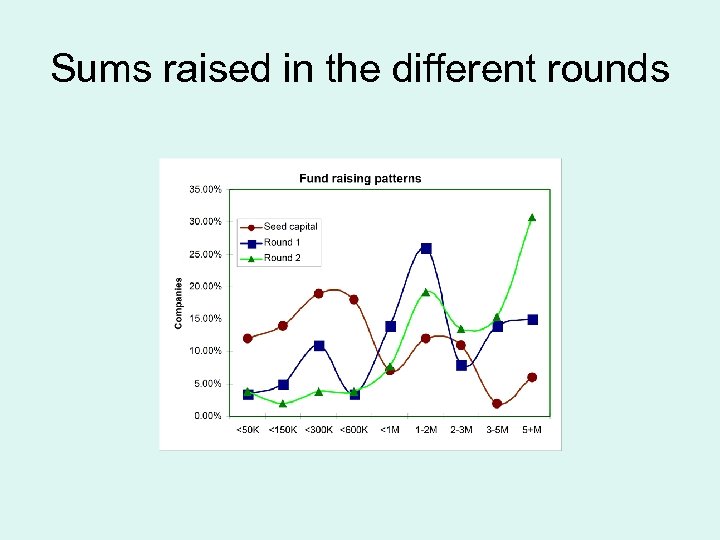

Sums raised in the different rounds Sums raised Seed <150 K 26 151 -600 K 37 2 -3 M 30 3+ 8 Total 100 1 st 8 14 48 29 100 2 nd 6 8 40 46 100

Sums raised in the different rounds Sums raised Seed <150 K 26 151 -600 K 37 2 -3 M 30 3+ 8 Total 100 1 st 8 14 48 29 100 2 nd 6 8 40 46 100

Sums raised in the different rounds

Sums raised in the different rounds

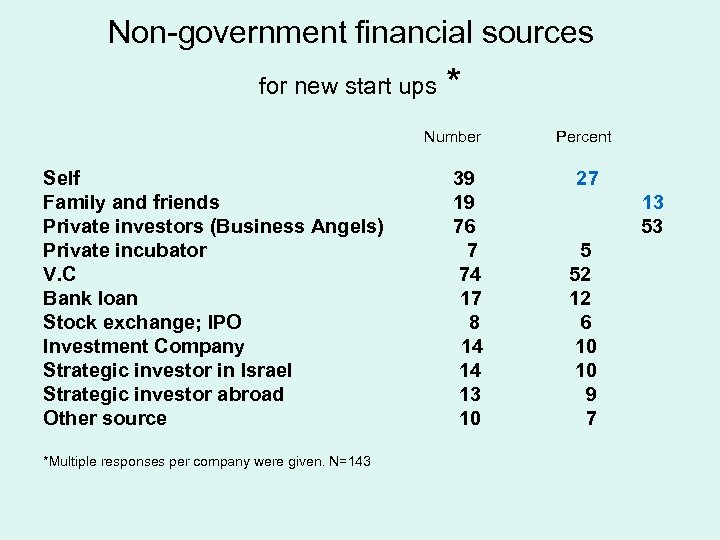

Non-government financial sources for new start ups * Number Self Family and friends Private investors (Business Angels) Private incubator V. C Bank loan Stock exchange; IPO Investment Company Strategic investor in Israel Strategic investor abroad Other source *Multiple responses per company were given. N=143 39 19 76 7 74 17 8 14 14 13 10 Percent 27 13 53 5 52 12 6 10 10 9 7

Non-government financial sources for new start ups * Number Self Family and friends Private investors (Business Angels) Private incubator V. C Bank loan Stock exchange; IPO Investment Company Strategic investor in Israel Strategic investor abroad Other source *Multiple responses per company were given. N=143 39 19 76 7 74 17 8 14 14 13 10 Percent 27 13 53 5 52 12 6 10 10 9 7

Non government financial sources

Non government financial sources

Yozma VC funds as a funding source Yozma VC funds Eurofund Medica Walden Gemini Nitzanim Apex Inventech Polaris Vertex Jerusalem Pacific Ventures Star *Multiple responses per company were given. N=27 Companies* Number Percent 4 1 4 3 1 3 4 9 2 0 4 15 11 4 11 15 33 7 0 15

Yozma VC funds as a funding source Yozma VC funds Eurofund Medica Walden Gemini Nitzanim Apex Inventech Polaris Vertex Jerusalem Pacific Ventures Star *Multiple responses per company were given. N=27 Companies* Number Percent 4 1 4 3 1 3 4 9 2 0 4 15 11 4 11 15 33 7 0 15

Government financial sources Companies* Number Percent Government Incubators 21 15 R&D grant – Regular 49 34 R&D grant - For start-up 5 3 R&D grant - “Magnet” 7 5 Bi-National programme – BIRDF 11 8 Bi-National programme – Other 1 1 Investment Center – Grant/capital equipment 11 8 Investment Center – Income tax benefits 21 15 *Multiple responses per company were given. N=143

Government financial sources Companies* Number Percent Government Incubators 21 15 R&D grant – Regular 49 34 R&D grant - For start-up 5 3 R&D grant - “Magnet” 7 5 Bi-National programme – BIRDF 11 8 Bi-National programme – Other 1 1 Investment Center – Grant/capital equipment 11 8 Investment Center – Income tax benefits 21 15 *Multiple responses per company were given. N=143

Incubators and Yozma programs affiliated companiescomparison of sales and growth - rates to the other respondents companies

Incubators and Yozma programs affiliated companiescomparison of sales and growth - rates to the other respondents companies

Difficulties encountered

Difficulties encountered

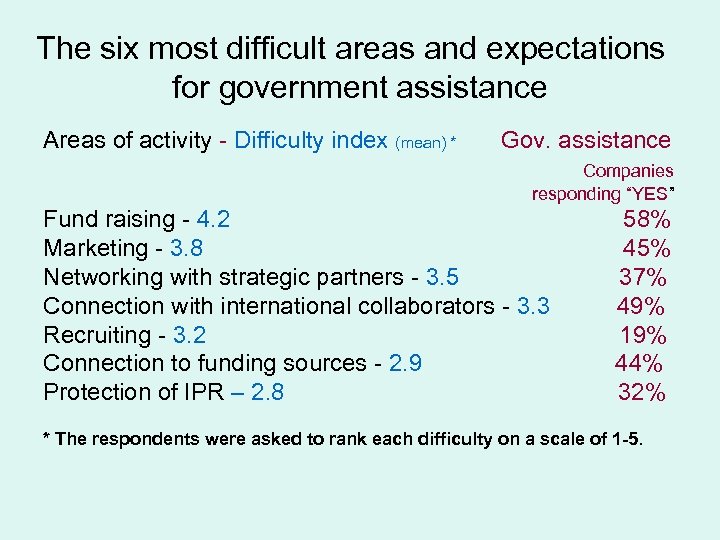

The six most difficult areas and expectations for government assistance Areas of activity - Difficulty index (mean) * Gov. assistance Companies responding “YES” Fund raising - 4. 2 Marketing - 3. 8 Networking with strategic partners - 3. 5 Connection with international collaborators - 3. 3 Recruiting - 3. 2 Connection to funding sources - 2. 9 Protection of IPR – 2. 8 58% 45% 37% 49% 19% 44% 32% * The respondents were asked to rank each difficulty on a scale of 1 -5.

The six most difficult areas and expectations for government assistance Areas of activity - Difficulty index (mean) * Gov. assistance Companies responding “YES” Fund raising - 4. 2 Marketing - 3. 8 Networking with strategic partners - 3. 5 Connection with international collaborators - 3. 3 Recruiting - 3. 2 Connection to funding sources - 2. 9 Protection of IPR – 2. 8 58% 45% 37% 49% 19% 44% 32% * The respondents were asked to rank each difficulty on a scale of 1 -5.

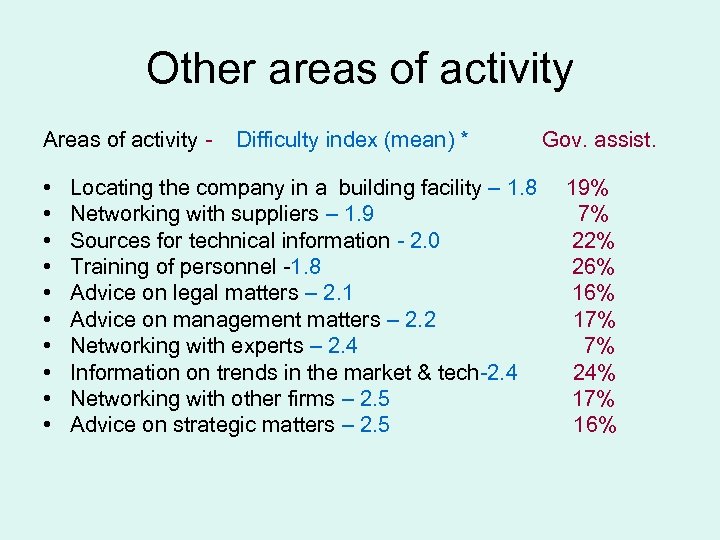

Other areas of activity Areas of activity - • • • Difficulty index (mean) * Locating the company in a building facility – 1. 8 Networking with suppliers – 1. 9 Sources for technical information - 2. 0 Training of personnel -1. 8 Advice on legal matters – 2. 1 Advice on management matters – 2. 2 Networking with experts – 2. 4 Information on trends in the market & tech-2. 4 Networking with other firms – 2. 5 Advice on strategic matters – 2. 5 Gov. assist. 19% 7% 22% 26% 17% 7% 24% 17% 16%

Other areas of activity Areas of activity - • • • Difficulty index (mean) * Locating the company in a building facility – 1. 8 Networking with suppliers – 1. 9 Sources for technical information - 2. 0 Training of personnel -1. 8 Advice on legal matters – 2. 1 Advice on management matters – 2. 2 Networking with experts – 2. 4 Information on trends in the market & tech-2. 4 Networking with other firms – 2. 5 Advice on strategic matters – 2. 5 Gov. assist. 19% 7% 22% 26% 17% 7% 24% 17% 16%

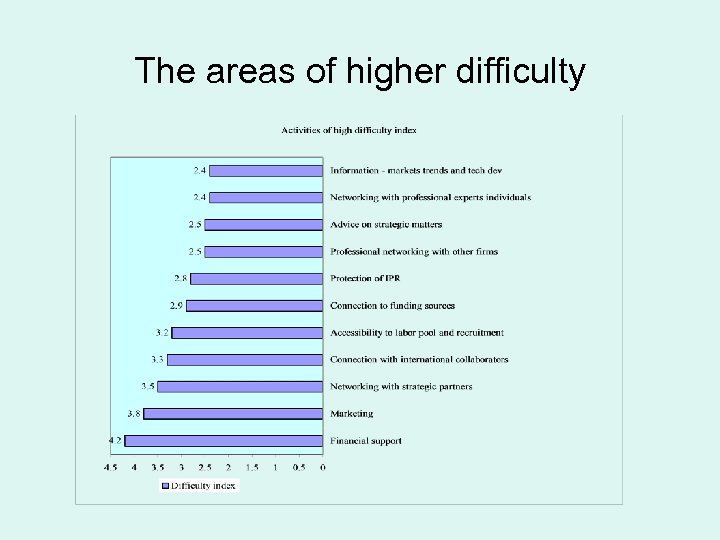

The areas of higher difficulty

The areas of higher difficulty

End

End