27a94b04870b0ecafe319c600ec32948.ppt

- Количество слайдов: 19

Manuel Palacin (manuel. palacin@upf. edu) INTERNET INTERCONNECTION & NET NEUTRALITY 12 th November 2010

Manuel Palacin (manuel. palacin@upf. edu) INTERNET INTERCONNECTION & NET NEUTRALITY 12 th November 2010

Content Net Neutrality What is Net Neutrality? BEREC public consultation Search Neutrality Network Interconnection Definition Types Alternative Interconnections models BW Stock Market Scenarios Operators Action Plan Objective What is new in this approach Open questions

Content Net Neutrality What is Net Neutrality? BEREC public consultation Search Neutrality Network Interconnection Definition Types Alternative Interconnections models BW Stock Market Scenarios Operators Action Plan Objective What is new in this approach Open questions

What is Network Neutrality? ts s Network Neutrality is a principle that is based on the network access providers can not prioritize access of contents to users or companies over others The net neutrality does not prohibit the prioritization of flows according to the needs of users, but attempts to prevent access providers discriminate these flows based on content, origin or destination of traffic re te in f o t ic fl n o C i. e. If a network access provider reaches a financial agreement with Yahoo, it can prioritize this search over Google search. User access to Google website is not banned, but it will be so slower that the user could end up giving up and switching to another browser. 3

What is Network Neutrality? ts s Network Neutrality is a principle that is based on the network access providers can not prioritize access of contents to users or companies over others The net neutrality does not prohibit the prioritization of flows according to the needs of users, but attempts to prevent access providers discriminate these flows based on content, origin or destination of traffic re te in f o t ic fl n o C i. e. If a network access provider reaches a financial agreement with Yahoo, it can prioritize this search over Google search. User access to Google website is not banned, but it will be so slower that the user could end up giving up and switching to another browser. 3

BEREC Position BEREC (Body of European Regulators for Electronic Communications) BEREC responses (30 th Sept 2010) 14 questions http: //www. erg. eu. int/doc/berec/bor_10_42. pdf KEY problems that the resolution identifies if operators separate from neutrality principles: Discrimination and anticompetitive effects Long-term consequences in the Internet economy Problems in transparency and Qo. S 4

BEREC Position BEREC (Body of European Regulators for Electronic Communications) BEREC responses (30 th Sept 2010) 14 questions http: //www. erg. eu. int/doc/berec/bor_10_42. pdf KEY problems that the resolution identifies if operators separate from neutrality principles: Discrimination and anticompetitive effects Long-term consequences in the Internet economy Problems in transparency and Qo. S 4

Other Point: Search Neutrality Net Neutrality is in the air, but what happens with Searchers? Are neutral doing their searches or discriminate depending on their interests? Google was accused of modifying its Search Engine and Google. Add. Words to penalize some sites 5

Other Point: Search Neutrality Net Neutrality is in the air, but what happens with Searchers? Are neutral doing their searches or discriminate depending on their interests? Google was accused of modifying its Search Engine and Google. Add. Words to penalize some sites 5

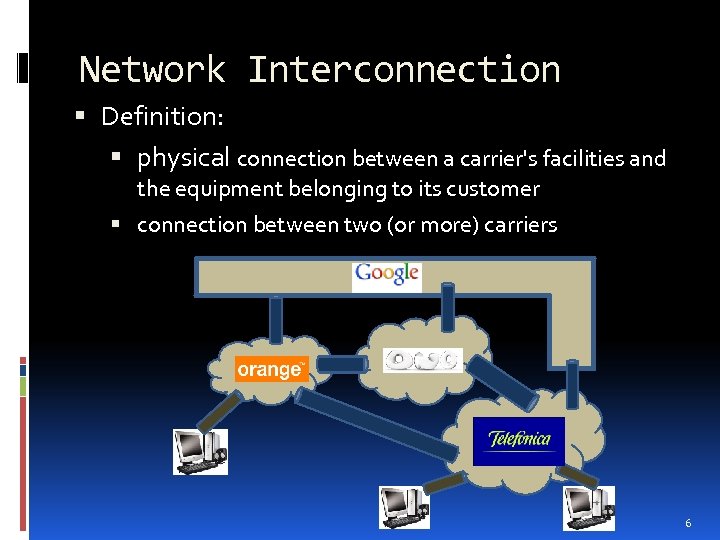

Network Interconnection Definition: physical connection between a carrier's facilities and the equipment belonging to its customer connection between two (or more) carriers 6

Network Interconnection Definition: physical connection between a carrier's facilities and the equipment belonging to its customer connection between two (or more) carriers 6

Interconnection Types Peering - Bill And Keep (BAK) Bilateral agreement signed by two operators or ISPs to exchange traffic for their customers in pure reciprocity Transit: An operator agrees to carry traffic from another operator to a third operator or interconnection point Calling Party Network Pays Calling operator (caller) pays the total cost of point-to-point connection. 7

Interconnection Types Peering - Bill And Keep (BAK) Bilateral agreement signed by two operators or ISPs to exchange traffic for their customers in pure reciprocity Transit: An operator agrees to carry traffic from another operator to a third operator or interconnection point Calling Party Network Pays Calling operator (caller) pays the total cost of point-to-point connection. 7

Exists any Interconnection Alternative? Maybe an interconnection stock market? Operators offer ALL or EXCEEDED BW from their networks with an associated Qo. S (LSA) Operators offer Dynamic BW Fares (LSA) in real time for LONG or SHORT periods (hours, days, exact date) The prices depend on the demand like in the stock market DYNAMIC Operators subscribe to LSAs with better conditions tradeoff(Less. Price-Best. Qo. S) in real time Requires a new model of acquisition of BW more flexible REAL TIME 8

Exists any Interconnection Alternative? Maybe an interconnection stock market? Operators offer ALL or EXCEEDED BW from their networks with an associated Qo. S (LSA) Operators offer Dynamic BW Fares (LSA) in real time for LONG or SHORT periods (hours, days, exact date) The prices depend on the demand like in the stock market DYNAMIC Operators subscribe to LSAs with better conditions tradeoff(Less. Price-Best. Qo. S) in real time Requires a new model of acquisition of BW more flexible REAL TIME 8

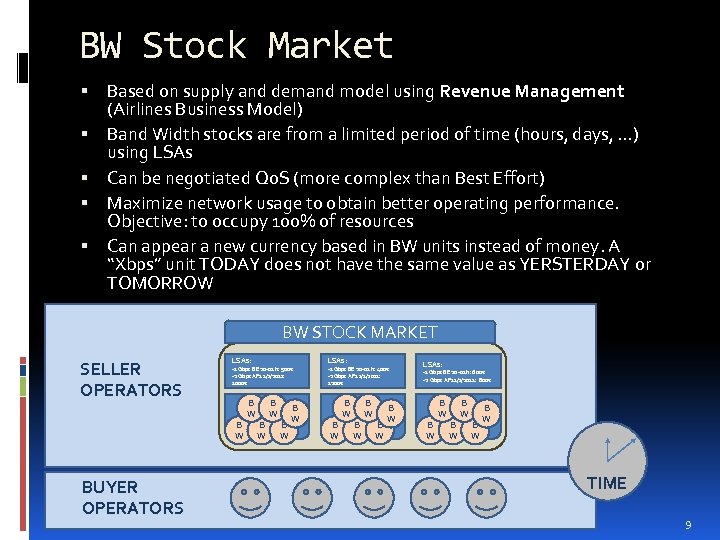

BW Stock Market Based on supply and demand model using Revenue Management (Airlines Business Model) Band Width stocks are from a limited period of time (hours, days, . . . ) using LSAs Can be negotiated Qo. S (more complex than Best Effort) Maximize network usage to obtain better operating performance. Objective: to occupy 100% of resources Can appear a new currency based in BW units instead of money. A “Xbps” unit TODAY does not have the same value as YERSTERDAY or TOMORROW BW STOCK MARKET SELLER OPERATORS LSAs: -1 Gbps BE 20 -01 h: 500€ -2 Gbps AF 1 1/1/2011: 1000€ B W BUYER OPERATORS B W B W LSAs: -1 Gbps BE 20 -01 h: 400€ -2 Gbps AF 1 1/1/2011: 1200€ B W B W B W LSAs: -1 Gbps BE 20 -01 h: 600€ -2 Gbps AF 1 1/1/2011: 800€ B W B W B W TIME 9

BW Stock Market Based on supply and demand model using Revenue Management (Airlines Business Model) Band Width stocks are from a limited period of time (hours, days, . . . ) using LSAs Can be negotiated Qo. S (more complex than Best Effort) Maximize network usage to obtain better operating performance. Objective: to occupy 100% of resources Can appear a new currency based in BW units instead of money. A “Xbps” unit TODAY does not have the same value as YERSTERDAY or TOMORROW BW STOCK MARKET SELLER OPERATORS LSAs: -1 Gbps BE 20 -01 h: 500€ -2 Gbps AF 1 1/1/2011: 1000€ B W BUYER OPERATORS B W B W LSAs: -1 Gbps BE 20 -01 h: 400€ -2 Gbps AF 1 1/1/2011: 1200€ B W B W B W LSAs: -1 Gbps BE 20 -01 h: 600€ -2 Gbps AF 1 1/1/2011: 800€ B W B W B W TIME 9

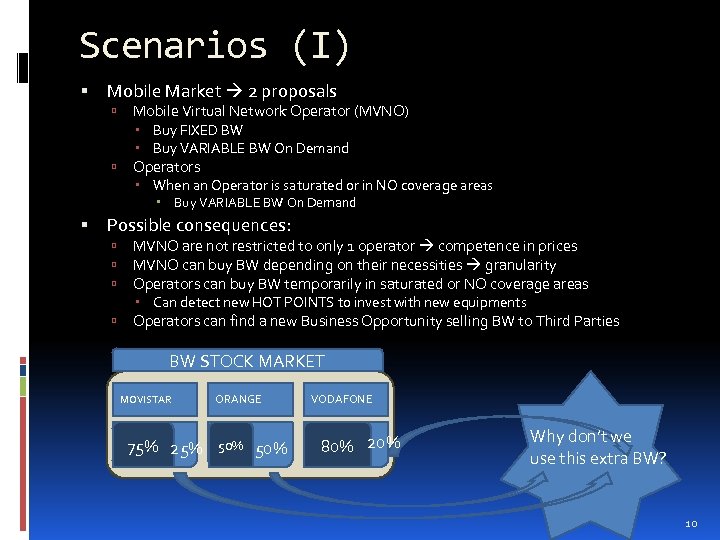

Scenarios (I) Mobile Market 2 proposals Mobile Virtual Network Operator (MVNO) Buy FIXED BW Buy VARIABLE BW On Demand Operators When an Operator is saturated or in NO coverage areas Buy VARIABLE BW On Demand Possible consequences: MVNO are not restricted to only 1 operator competence in prices MVNO can buy BW depending on their necessities granularity Operators can buy BW temporarily in saturated or NO coverage areas Can detect new HOT POINTS to invest with new equipments Operators can find a new Business Opportunity selling BW to Third Parties BW STOCK MARKET MOVISTAR 75% 25% ORANGE 50% VODAFONE 80% 20% Why don’t we use this extra BW? 10

Scenarios (I) Mobile Market 2 proposals Mobile Virtual Network Operator (MVNO) Buy FIXED BW Buy VARIABLE BW On Demand Operators When an Operator is saturated or in NO coverage areas Buy VARIABLE BW On Demand Possible consequences: MVNO are not restricted to only 1 operator competence in prices MVNO can buy BW depending on their necessities granularity Operators can buy BW temporarily in saturated or NO coverage areas Can detect new HOT POINTS to invest with new equipments Operators can find a new Business Opportunity selling BW to Third Parties BW STOCK MARKET MOVISTAR 75% 25% ORANGE 50% VODAFONE 80% 20% Why don’t we use this extra BW? 10

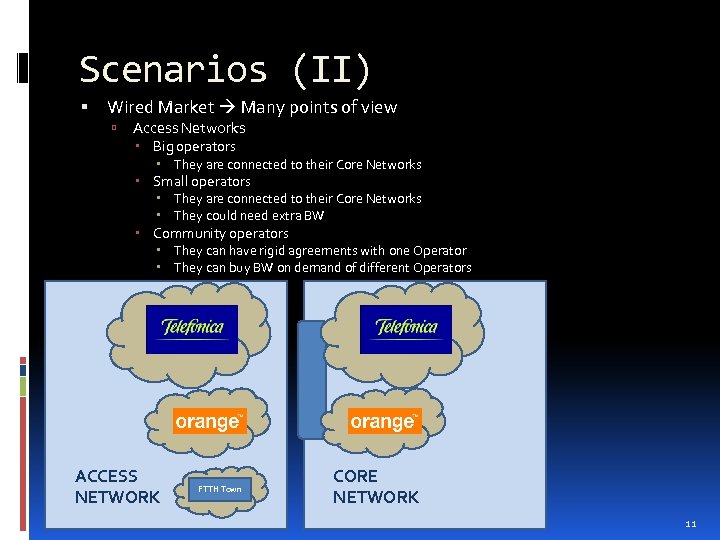

Scenarios (II) Wired Market Many points of view Access Networks Big operators They are connected to their Core Networks Small operators They are connected to their Core Networks They could need extra BW Community operators They can have rigid agreements with one Operator They can buy BW on demand of different Operators ACCESS NETWORK FTTH Town CORE NETWORK 11

Scenarios (II) Wired Market Many points of view Access Networks Big operators They are connected to their Core Networks Small operators They are connected to their Core Networks They could need extra BW Community operators They can have rigid agreements with one Operator They can buy BW on demand of different Operators ACCESS NETWORK FTTH Town CORE NETWORK 11

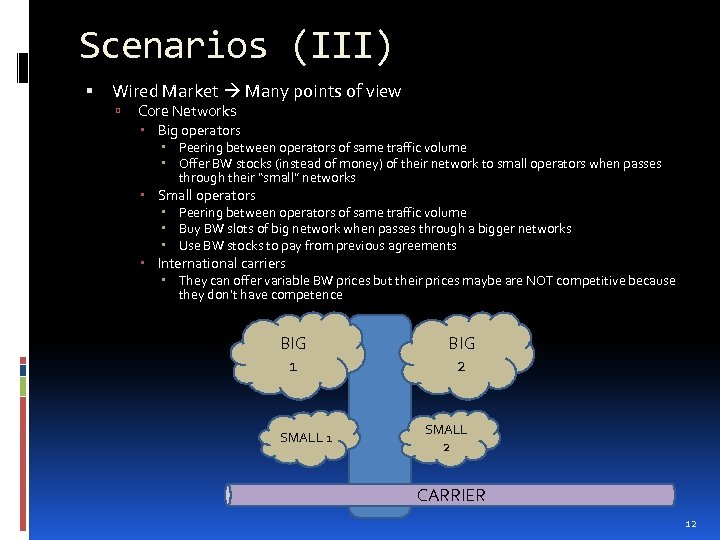

Scenarios (III) Wired Market Many points of view Core Networks Big operators Peering between operators of same traffic volume Offer BW stocks (instead of money) of their network to small operators when passes through their “small” networks Small operators Peering between operators of same traffic volume Buy BW slots of big network when passes through a bigger networks Use BW stocks to pay from previous agreements International carriers They can offer variable BW prices but their prices maybe are NOT competitive because they don’t have competence BIG 1 SMALL 1 BIG 2 SMALL 2 CARRIER 12

Scenarios (III) Wired Market Many points of view Core Networks Big operators Peering between operators of same traffic volume Offer BW stocks (instead of money) of their network to small operators when passes through their “small” networks Small operators Peering between operators of same traffic volume Buy BW slots of big network when passes through a bigger networks Use BW stocks to pay from previous agreements International carriers They can offer variable BW prices but their prices maybe are NOT competitive because they don’t have competence BIG 1 SMALL 1 BIG 2 SMALL 2 CARRIER 12

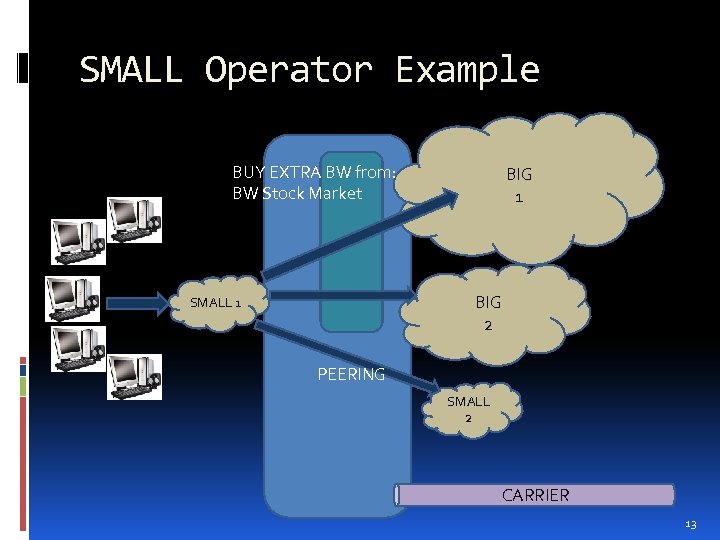

SMALL Operator Example BUY EXTRA BW from: BW Stock Market BIG 1 BIG 2 SMALL 1 PEERING SMALL 2 CARRIER 13

SMALL Operator Example BUY EXTRA BW from: BW Stock Market BIG 1 BIG 2 SMALL 1 PEERING SMALL 2 CARRIER 13

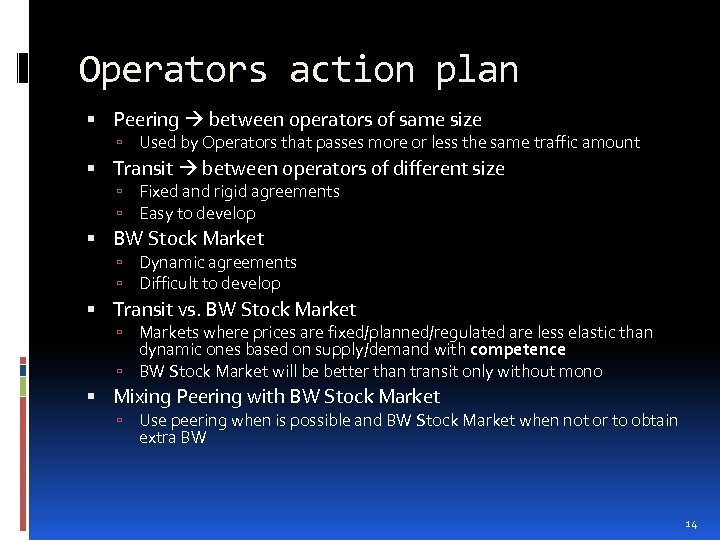

Operators action plan Peering between operators of same size Used by Operators that passes more or less the same traffic amount Transit between operators of different size Fixed and rigid agreements Easy to develop BW Stock Market Dynamic agreements Difficult to develop Transit vs. BW Stock Markets where prices are fixed/planned/regulated are less elastic than dynamic ones based on supply/demand with competence BW Stock Market will be better than transit only without mono Mixing Peering with BW Stock Market Use peering when is possible and BW Stock Market when not or to obtain extra BW 14

Operators action plan Peering between operators of same size Used by Operators that passes more or less the same traffic amount Transit between operators of different size Fixed and rigid agreements Easy to develop BW Stock Market Dynamic agreements Difficult to develop Transit vs. BW Stock Markets where prices are fixed/planned/regulated are less elastic than dynamic ones based on supply/demand with competence BW Stock Market will be better than transit only without mono Mixing Peering with BW Stock Market Use peering when is possible and BW Stock Market when not or to obtain extra BW 14

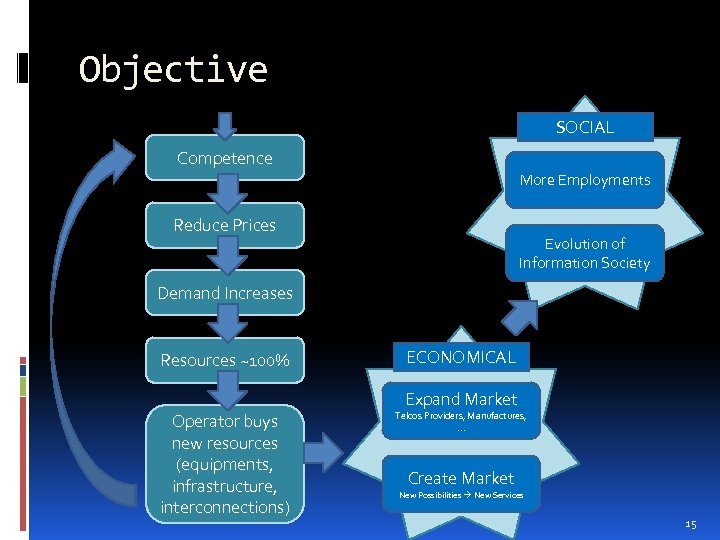

Objective SOCIAL Competence More Employments Reduce Prices Evolution of Information Society Demand Increases Resources ~100% ECONOMICAL Operator buys new resources (equipments, infrastructure, interconnections) Telcos Providers, Manufactures, . . . Expand Market Create Market New Possibilities New Services 15

Objective SOCIAL Competence More Employments Reduce Prices Evolution of Information Society Demand Increases Resources ~100% ECONOMICAL Operator buys new resources (equipments, infrastructure, interconnections) Telcos Providers, Manufactures, . . . Expand Market Create Market New Possibilities New Services 15

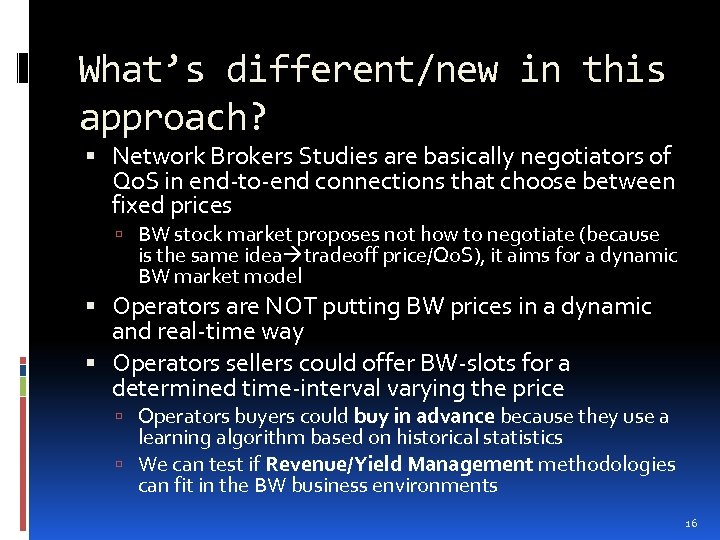

What’s different/new in this approach? Network Brokers Studies are basically negotiators of Qo. S in end-to-end connections that choose between fixed prices BW stock market proposes not how to negotiate (because is the same idea tradeoff price/Qo. S), it aims for a dynamic BW market model Operators are NOT putting BW prices in a dynamic and real-time way Operators sellers could offer BW-slots for a determined time-interval varying the price Operators buyers could buy in advance because they use a learning algorithm based on historical statistics We can test if Revenue/Yield Management methodologies can fit in the BW business environments 16

What’s different/new in this approach? Network Brokers Studies are basically negotiators of Qo. S in end-to-end connections that choose between fixed prices BW stock market proposes not how to negotiate (because is the same idea tradeoff price/Qo. S), it aims for a dynamic BW market model Operators are NOT putting BW prices in a dynamic and real-time way Operators sellers could offer BW-slots for a determined time-interval varying the price Operators buyers could buy in advance because they use a learning algorithm based on historical statistics We can test if Revenue/Yield Management methodologies can fit in the BW business environments 16

Open questions Is this model more effective in terms of competition than Peering or transit? In which situations (small/big operators)? Maybe can be used as a complement to these models for selling exceeded Band Width? It is needed more than 2 -3 interconnections points to avoid monopolies or oligopolies? Is it needed COMPETENCE to make run this model? It is a sustainable model in terms of maintenance? Will small operators, that cannot grow up, die? Will BW prices be reduced? Is this model creating more demand? Can interconnection agreements be done using an hypothetic BW currency? 17

Open questions Is this model more effective in terms of competition than Peering or transit? In which situations (small/big operators)? Maybe can be used as a complement to these models for selling exceeded Band Width? It is needed more than 2 -3 interconnections points to avoid monopolies or oligopolies? Is it needed COMPETENCE to make run this model? It is a sustainable model in terms of maintenance? Will small operators, that cannot grow up, die? Will BW prices be reduced? Is this model creating more demand? Can interconnection agreements be done using an hypothetic BW currency? 17

Bibliography DYNAMIC EFFECTS OF NETWORK NEUTRALITY. Johannes M. Bauer. Michigan State University. TPRC 2006 Draft Work Programme 2011 BEREC Board of Regulators. BEREC Response to the European Commission’s consultation on the open Internet and net neutrality in Europe. BEREC The Evolution of Internet Congestion. Steven Bauer, David Clark, William Lehr. Massachusetts Institute of Technology Internet Peering. Jean-Jacques Laffont, Scott Marcus, Patrick Rey, Jean Tirole. Source. The American Economic Review, Vol. 91, No. 2 Network Externalities, Competition, and Compatibility. Michael L. Katz; Carl Shapiro. The American Economic Review, Vol. 75, No. 3 Two Papers on Internet Connectivity and Quality. Roberto Roson. Dipartimento di Scienze Economiche, Università Ca’Foscari di Venezia Pricing and brokering services over interconnected IP networks. D. Di Sorte, G. Reali. Dipartimento di Ingegneria Elettronica e dell’Informazione (DIEI), University of Perugia Dynamic Price Competition with Fixed Capacities. Victor Martinez-de-Albeniz, Kalyan Talluriy. UPF and IESE Pricing, Provisioning and Peering: Dynamic Markets for Differentiated Internet Services and Implications for Network Interconnections. Nemo Semret, Raymond R. -F. Liao, Andrew T. Campbell, and Aurel A. Lazar, Fellow, IEEE 18

Bibliography DYNAMIC EFFECTS OF NETWORK NEUTRALITY. Johannes M. Bauer. Michigan State University. TPRC 2006 Draft Work Programme 2011 BEREC Board of Regulators. BEREC Response to the European Commission’s consultation on the open Internet and net neutrality in Europe. BEREC The Evolution of Internet Congestion. Steven Bauer, David Clark, William Lehr. Massachusetts Institute of Technology Internet Peering. Jean-Jacques Laffont, Scott Marcus, Patrick Rey, Jean Tirole. Source. The American Economic Review, Vol. 91, No. 2 Network Externalities, Competition, and Compatibility. Michael L. Katz; Carl Shapiro. The American Economic Review, Vol. 75, No. 3 Two Papers on Internet Connectivity and Quality. Roberto Roson. Dipartimento di Scienze Economiche, Università Ca’Foscari di Venezia Pricing and brokering services over interconnected IP networks. D. Di Sorte, G. Reali. Dipartimento di Ingegneria Elettronica e dell’Informazione (DIEI), University of Perugia Dynamic Price Competition with Fixed Capacities. Victor Martinez-de-Albeniz, Kalyan Talluriy. UPF and IESE Pricing, Provisioning and Peering: Dynamic Markets for Differentiated Internet Services and Implications for Network Interconnections. Nemo Semret, Raymond R. -F. Liao, Andrew T. Campbell, and Aurel A. Lazar, Fellow, IEEE 18

Thank you! Any question?

Thank you! Any question?