26ff74db3bb4e7a2c246e2bd58016214.ppt

- Количество слайдов: 24

Managing Your money BY DR. SUBHASH B BEHERE M. S. General Surgery & LLB MEDICOLEGAL SPECIALIST & ADVISOR & Student of science of investment [Has passed IRADA Exam For insurance NOT A SINGLE INSURANCE is registered] Disclaimer--- NOT A QUALIFIED INVESTMENT ADVISER knowledge– by attending lectures, reading, Google, & Huge Experience + own mistakes Listener – advised to gather information and take own decision,

Managing Your money

Managing Your money • To start investing one needs to have Savable – ( Surplus ) money i. e. the diff between what You earn - Your expense =saving. Earning---- business surplus( professional earning minus prof expense ) + Returns from investments -- A -- Your -- fixed expense- 1. Household Expenses 2. Insurance premiums- (only for illnesses i. e. medi-claims; Indemnity; accidents; vehicle and term LIC) 3. EMI on loan if any 4. Some corpus for recurrent expchange of CAR- maintenance of property, gifts to others , family tours every 1 or 2 yrs etc. Leaving behind your Long term savable money as LONG short – goal oriented & LONG -Long ( Retirement)

Managing Your money • I will indicate some signals • ROAD AND WEHICLE IS YOURS • Earlier You start Saving For Future bigger and better the final result—the magic of compounding

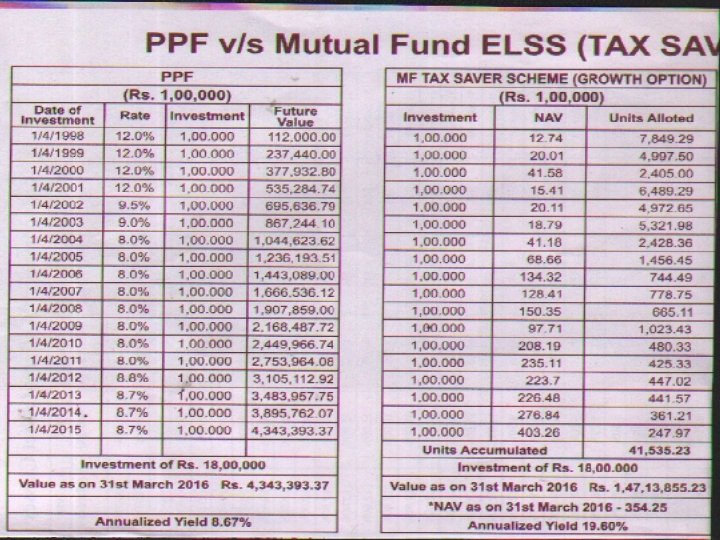

Managing Your money • PPF-- A Must. It is Fixed rate of return as per Govt declaration • Start early with Rs 1000/- per yr at least, even from internship • Withdrawal after 15 yrs – ( ie Lock in period initially) • Hence earlier you invest Maturity is earlier • Can be continued after 15 yrs in a block of 5 yrs • • Interest is Yearly credited in your ac and is TAX FREE • • Presently around 8 – 8. 5 %--Nomination available

Managing Your money-- PPF • Besides withdrawal is possible with certain riders After 15 yrs, if not continued by yearly installments, whole ac can be continued with yearly tax free interest. Major Benefit----- No court attachment Many more small points. NRI Cannot have ac. Needs to be closed after Maturity

Managing Your money • Insurance first--- Prof Indemnity is a must But It will be a part of business exp and is already subtracted as prof. exp • Mediclaim ---- Always Renew every Yr • Life Insurance --- only till you reach • reasonable saving. • Think of only term Insurance • NO OTHER COMBINATION • Renew in time • Car insurance, accident insurance etc as needed. • Social Security is a better life insurance for IMA Members—State & HQ + other associations if available— MUST Do—low premium

Managing Your money • • Other Investments Immovable--- Land , Plot , House, Flat etc Movable: Gold --- Ornament ( ancestral /or self made) Gold bonds Fixed return cash/cert investments/ Bank/ P. O Mutual Funds Equity i. e. shares

Managing Your money For retirement How much Corpus ? ? As risk free and fixed return ? Transfer to LONG-Long = present monthly exp * 240/( 65 - Today’s age) *12 (at 45 yrs and retirement at 65 it is equal to monthly exp 65 -45=20*12= 240 ) if at 45 yrs and exp of 20000 required corpus- 20000* 240=48 lac + compounding effect think of 240 installments and not 48 lakhs 35 yrs ie 360 months 4800000/30*12= 13333/Inflation takes of its own care Rule of 72 -- 72/ no of yrs contemplated to double ur money= % of return per yr 72/12= 6%----- 72/9 yrs=8%

Managing Your money– SAVING- FDS-LAND- GOLDMFS- EQUITY --Rule of Four-4; 8; 12; 16 • Land --- agricultural. Non taxable. Rest – taxable– 54/E benefit up to 50 lakhs for long term capital gains • Large corpus needed • Legal complication- Defective Papers / ownership/double selling • Rules not investor friendly • Gross variation in Appreciation • Liquidity not easy • Part selling is difficult • Lucky ones -- huge benefit ; Tax -indexing

Managing Your money– LAND- GOLD-FD- MFS- EQUITY • Gold --- Ornament- may be Old – New Vale (pure metal wire, no making charges) • Gold bonds - Bank deposition • Presently rules are changing --- for sale purchase • Each has differant Plus and minuses • Theft- Making charges-Ghat • Small invest possible • Vey liquid to encash • Say NO to SILVER , Only take for utility things

Managing Your money– LAND- GOLD-FDS- MFS- Shares FDS--- Post office. National banks- Sahakari Banks. Company Deposits / debentures Long – or--short term Returns Taxable-Generally TDS Ease of withdrawal Make small investments which can be liquidated without much loss Instead of FDs, go for government company’s tax free bonds of long duration—prefer D’mat form And MF debt/liquid funds—yield better, long term capital gains advantage after 3 yrs

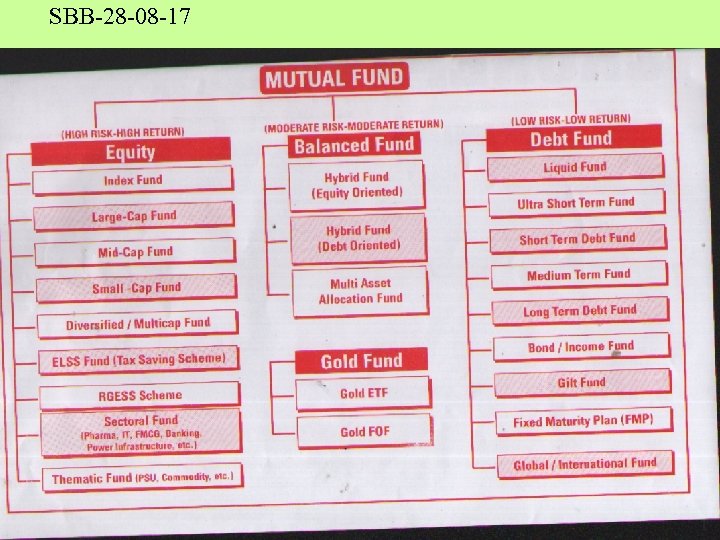

Managing Your money– • MFS---- Those who cannot devote time • Great flexibility and variety • Equity MF ; Balanced fund; Debt Fund • Sectoral fund e. g. banking fund, pharma fund • Tax saving ELLS (alternative to PPF) Returns variable Equity and Balanced funds tax free beyond 1 yr Go for Growth options for better returns Choose standard fund houses like HDFC, Birla, DSP, Principal, ICICI, SBI, FT etc DO NOT DEMATARALISE MF –opposite of shares

SBB-28 -08 -17

Managing Your money– LAND- GOLD-FDS- MFS- EQUITY • EQUITY • DO NOT keep in Physical form but in Dematerialized form • Always Keep jointly • Use few DPs • Long term gain-( i. e. after 1 yr) Tax NIL i. e. tax free • Short term gain---- Less than a Yr ) – 15 % tax • Understand concept of first – in – first out

Managing Your money • EQUITY • Read capital Market- Dalal street- Money control. com • Stick to blue chips – large cap and selected mid caps • Large caps means (above 10000 cr ) and mid cap means 2. 5 to 10 000/- cr • To apply new issues needs time • Allotment in new issue is variable

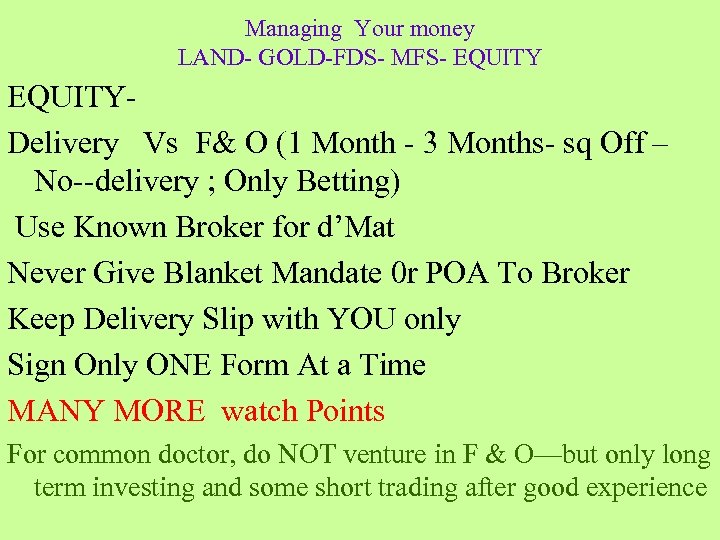

Managing Your money LAND- GOLD-FDS- MFS- EQUITYDelivery Vs F& O (1 Month - 3 Months- sq Off – No--delivery ; Only Betting) Use Known Broker for d’Mat Never Give Blanket Mandate 0 r POA To Broker Keep Delivery Slip with YOU only Sign Only ONE Form At a Time MANY MORE watch Points For common doctor, do NOT venture in F & O—but only long term investing and some short trading after good experience

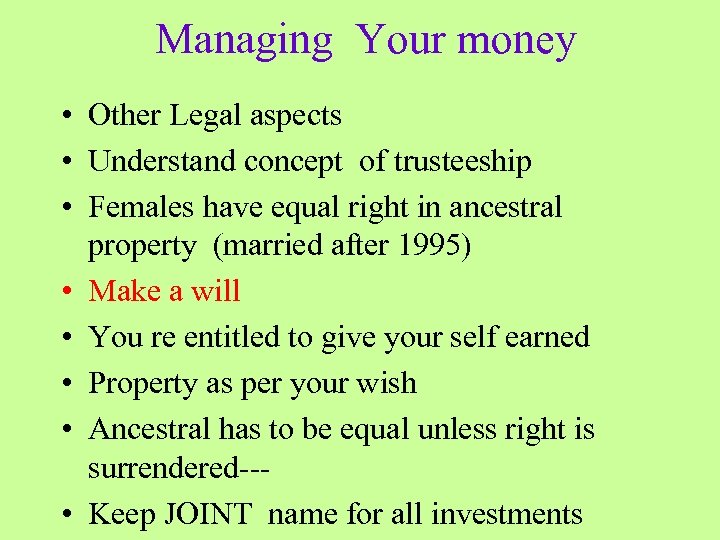

Managing Your money • Other Legal aspects • Understand concept of trusteeship • Females have equal right in ancestral property (married after 1995) • Make a will • You re entitled to give your self earned • Property as per your wish • Ancestral has to be equal unless right is surrendered-- • Keep JOINT name for all investments

Managing your money--HUF • Please create your HUF account along with PAN No. —if not already there. Separate AADHAR not required. By this, create a separate legal entity • Very easy create—ask your CA • So you can get 1. 5 lacs tax free per year under 80 cc —ELSS Mutual fund schemes—PPF not allowed for HUF. All MF schemes allowed. • Separate tax exemption limit of 2. 5 lacs like an individual. Any business allowed—not salaries • Can do share transactions, bank deposits etc • Can buy gold, land, flat or gift etc

SBB -28 -08 -2017 • WISH YOU • HAPPY RETIREMENT

Managing Your money– THANK YOU ALL

26ff74db3bb4e7a2c246e2bd58016214.ppt