1b89106d87510a97c4d683cdfc9472db.ppt

- Количество слайдов: 28

Managing Your Cash Take Charge of Your Finances Family Economics & Financial Education © Family Economics & Financial Education – Revised April 2008– Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

Managing Your Cash Take Charge of Your Finances Family Economics & Financial Education © Family Economics & Financial Education – Revised April 2008– Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

Managing Your Cash $ Lesson Objectives: § Explain the importance of cash management § Describe the five tools used for cash management § Categorize the characteristics of each cash management tool © Family Economics & Financial Education – Revised April 2008– Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

Managing Your Cash $ Lesson Objectives: § Explain the importance of cash management § Describe the five tools used for cash management § Categorize the characteristics of each cash management tool © Family Economics & Financial Education – Revised April 2008– Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 Did You Know? $ Small amounts saved and invested can easily grow into larger sums. § If a person saved a dollar each day by not having a candy bar or soda, they would save $365. 00 per year! § If the $365. 00 dollars was deposited into a certificate of deposit (CD) with 5. 0% interest, the money could grow to nearly $400. 00 in one year! © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 Did You Know? $ Small amounts saved and invested can easily grow into larger sums. § If a person saved a dollar each day by not having a candy bar or soda, they would save $365. 00 per year! § If the $365. 00 dollars was deposited into a certificate of deposit (CD) with 5. 0% interest, the money could grow to nearly $400. 00 in one year! © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 Cash Management $ The daily routine of handling money to take care of individual or family needs. © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 Cash Management $ The daily routine of handling money to take care of individual or family needs. © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 Cash Management Effective cash management includes having available money for: $ Living expenses; $ Emergencies; $ Savings; $ Investing. © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 Cash Management Effective cash management includes having available money for: $ Living expenses; $ Emergencies; $ Savings; $ Investing. © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 Cash Management Tool $ A financial account used to assist with daily cash management. $ Five types of cash management tools: § § § Checking Account; Savings Account; Money Market Deposit Account; Certificate of Deposit; Savings Bond. © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 Cash Management Tool $ A financial account used to assist with daily cash management. $ Five types of cash management tools: § § § Checking Account; Savings Account; Money Market Deposit Account; Certificate of Deposit; Savings Bond. © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 Checking Account $ Tool used to transfer funds deposited into an account to make a cash purchase. $ Checking accounts may be non-interest or interest earning. © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 Checking Account $ Tool used to transfer funds deposited into an account to make a cash purchase. $ Checking accounts may be non-interest or interest earning. © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 Checking Account continued $ Funds are easily accessed by: § § § Checks; Automated teller machines (ATMs); Debit cards; Telephone; Internet. $ Features may include: § Minimum balance requirements; § Charge transaction fees; § Limited number of checks written monthly. § Reduces the need to carry large amounts of cash. © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 Checking Account continued $ Funds are easily accessed by: § § § Checks; Automated teller machines (ATMs); Debit cards; Telephone; Internet. $ Features may include: § Minimum balance requirements; § Charge transaction fees; § Limited number of checks written monthly. § Reduces the need to carry large amounts of cash. © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

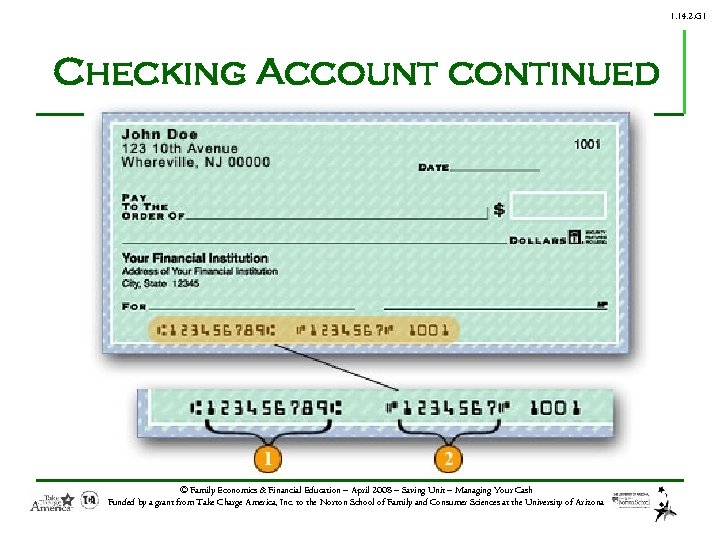

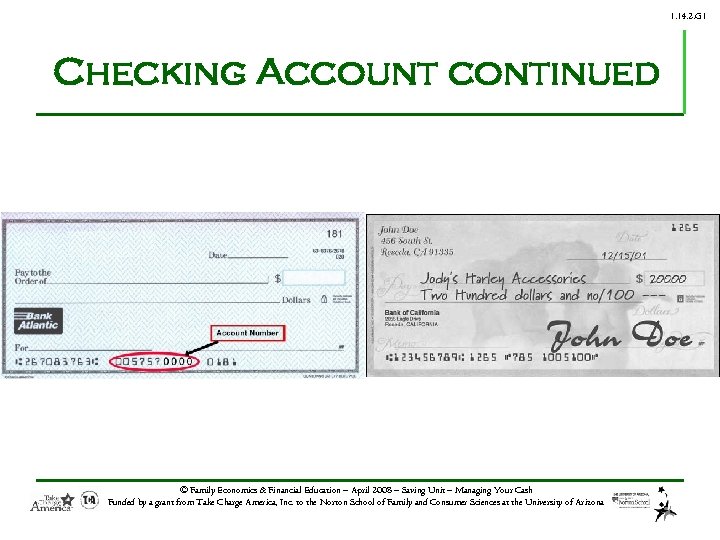

1. 14. 2. G 1 Checking Account continued © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 Checking Account continued © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 Checking Account continued © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 Checking Account continued © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 Savings Account $ Account to hold money not spent on consumption. $ Interest bearing. $ Have a lower interest rate than other cash management tools $ Money may be accessed or transferred between accounts through: § Automated teller machines; § Telephones; § Internet. © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 Savings Account $ Account to hold money not spent on consumption. $ Interest bearing. $ Have a lower interest rate than other cash management tools $ Money may be accessed or transferred between accounts through: § Automated teller machines; § Telephones; § Internet. © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 Savings Account continued $ Features may include: § § § Allows for frequent deposits or withdrawals; Easily accessible; Money storage for emergencies or daily living; Available at depository institutions; May require a minimum balance or have a limited number of withdrawals. © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 Savings Account continued $ Features may include: § § § Allows for frequent deposits or withdrawals; Easily accessible; Money storage for emergencies or daily living; Available at depository institutions; May require a minimum balance or have a limited number of withdrawals. © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 Money Market Deposit Account $ A government insured account offered at most depository institutions. § Have a minimum balance requirement with tiered interest rates. $ The amount of interest earned depends on the account balance. $ For example: a balance of $10, 000 will earn a higher interest rate than a balance of $2, 500. © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 Money Market Deposit Account $ A government insured account offered at most depository institutions. § Have a minimum balance requirement with tiered interest rates. $ The amount of interest earned depends on the account balance. $ For example: a balance of $10, 000 will earn a higher interest rate than a balance of $2, 500. © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 Money Market Deposit Account continued $ Accessibility is usually limited to three to six transactions each month; $ Features of may include: § Minimum amount required to open the account, often $1, 000; § If the average monthly balance falls below a specified amount, the entire account will earn a lower interest rate. © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 Money Market Deposit Account continued $ Accessibility is usually limited to three to six transactions each month; $ Features of may include: § Minimum amount required to open the account, often $1, 000; § If the average monthly balance falls below a specified amount, the entire account will earn a lower interest rate. © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 Certificate of Deposit (CD) $ Certificate of Deposit (CD) § An insured, interest earning savings instrument with restricted access to the funds. § Found in depository institutions accepting deposits for a certain length of time. § Interest rates vary depending upon specified time length. $ The longer the length, the higher the interest rate. © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 Certificate of Deposit (CD) $ Certificate of Deposit (CD) § An insured, interest earning savings instrument with restricted access to the funds. § Found in depository institutions accepting deposits for a certain length of time. § Interest rates vary depending upon specified time length. $ The longer the length, the higher the interest rate. © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 Certificate of Deposit continued $ Features may include: § Range from seven days to eight years in length; § Minimum deposits range from $100 -$100, 000; § If funds are withdrawn before the expiration date, penalties are assessed; § Low risk and no fees; © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 Certificate of Deposit continued $ Features may include: § Range from seven days to eight years in length; § Minimum deposits range from $100 -$100, 000; § If funds are withdrawn before the expiration date, penalties are assessed; § Low risk and no fees; © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 Savings Bond $ Discount bond purchased for 50% of the face value from the U. S. Government. $ Interest earned on a bond is tax exempt until redeemed. § No taxes are due on interest earned. § It will be tax exempt when redeemed if used for college expenses. © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 Savings Bond $ Discount bond purchased for 50% of the face value from the U. S. Government. $ Interest earned on a bond is tax exempt until redeemed. § No taxes are due on interest earned. § It will be tax exempt when redeemed if used for college expenses. © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 Savings Bond continued $ Access to funds is restricted $ Features of may include: § Many different types available; § Can be purchased for $25. 00 - $10, 000. 00; $ A $100. 00 bond would be purchased for $50. 00. When the bond matures to $100. 00, it can be redeemed. © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 Savings Bond continued $ Access to funds is restricted $ Features of may include: § Many different types available; § Can be purchased for $25. 00 - $10, 000. 00; $ A $100. 00 bond would be purchased for $50. 00. When the bond matures to $100. 00, it can be redeemed. © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

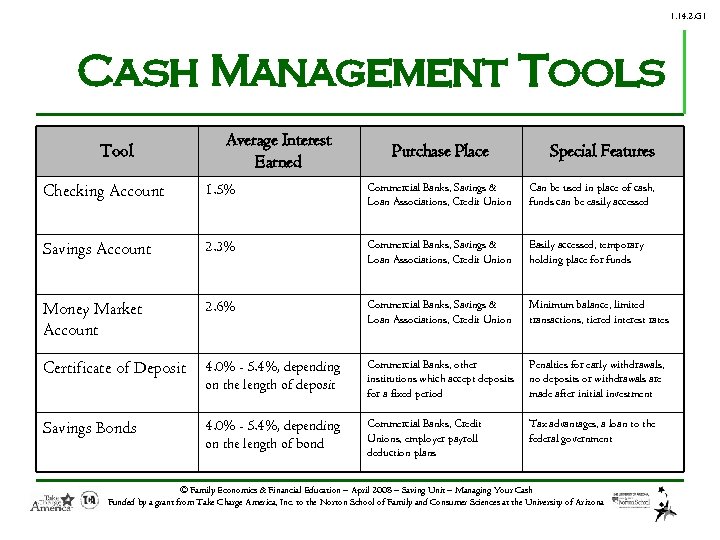

1. 14. 2. G 1 Cash Management Tools Tool Average Interest Earned Purchase Place Special Features Checking Account 1. 5% Commercial Banks, Savings & Loan Associations, Credit Union Can be used in place of cash, funds can be easily accessed Savings Account 2. 3% Commercial Banks, Savings & Loan Associations, Credit Union Easily accessed, temporary holding place for funds Money Market Account 2. 6% Commercial Banks, Savings & Loan Associations, Credit Union Minimum balance, limited transactions, tiered interest rates Certificate of Deposit 4. 0% - 5. 4%, depending on the length of deposit Commercial Banks, other institutions which accept deposits for a fixed period Penalties for early withdrawals, no deposits or withdrawals are made after initial investment Savings Bonds 4. 0% - 5. 4%, depending on the length of bond Commercial Banks, Credit Unions, employer payroll deduction plans Tax advantages, a loan to the federal government © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 Cash Management Tools Tool Average Interest Earned Purchase Place Special Features Checking Account 1. 5% Commercial Banks, Savings & Loan Associations, Credit Union Can be used in place of cash, funds can be easily accessed Savings Account 2. 3% Commercial Banks, Savings & Loan Associations, Credit Union Easily accessed, temporary holding place for funds Money Market Account 2. 6% Commercial Banks, Savings & Loan Associations, Credit Union Minimum balance, limited transactions, tiered interest rates Certificate of Deposit 4. 0% - 5. 4%, depending on the length of deposit Commercial Banks, other institutions which accept deposits for a fixed period Penalties for early withdrawals, no deposits or withdrawals are made after initial investment Savings Bonds 4. 0% - 5. 4%, depending on the length of bond Commercial Banks, Credit Unions, employer payroll deduction plans Tax advantages, a loan to the federal government © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

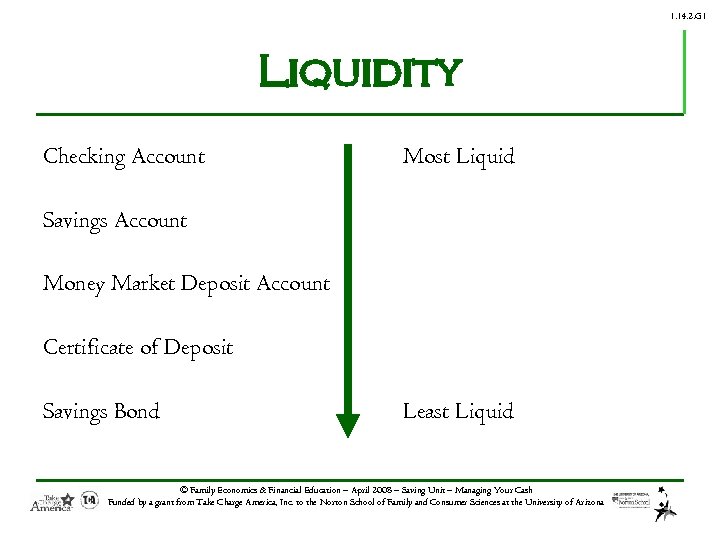

1. 14. 2. G 1 Liquidity § How quickly and easily an asset can be converted into cash. $ Investors should: § Invest in both liquid and non-liquid tools. § Liquid assets are important for emergencies when cash must be quickly accessed. $ Cash management tools are protected by the U. S. Government against loss. © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 Liquidity § How quickly and easily an asset can be converted into cash. $ Investors should: § Invest in both liquid and non-liquid tools. § Liquid assets are important for emergencies when cash must be quickly accessed. $ Cash management tools are protected by the U. S. Government against loss. © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 Liquidity Checking Account Most Liquid Savings Account Money Market Deposit Account Certificate of Deposit Savings Bond Least Liquid © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 Liquidity Checking Account Most Liquid Savings Account Money Market Deposit Account Certificate of Deposit Savings Bond Least Liquid © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 Low Risk These five cash management tools are low risk: § Insures the funds so the consumer does not lose money on the investment. § However, they have lower interest rates. $ Causes low returns © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 Low Risk These five cash management tools are low risk: § Insures the funds so the consumer does not lose money on the investment. § However, they have lower interest rates. $ Causes low returns © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

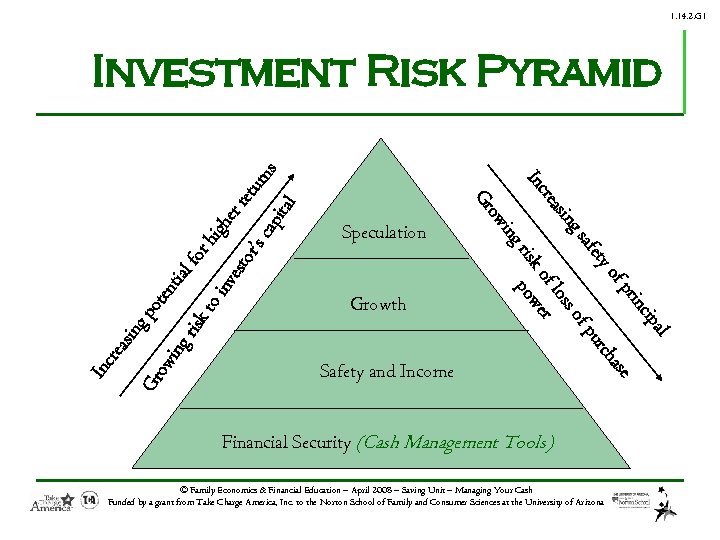

1. 14. 2. G 1 ’s c ap ita l etu rr tor hig he nv es for ow Gr Safety and Income se ha ing ris kt oi al nti ote gp sin l ipa inc pr urc cre a of fp In ety saf o ss f lo r k o owe p ris Growth ng ing ow Speculation asi Gr cre In rn s Investment Risk Pyramid Financial Security (Cash Management Tools) © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 ’s c ap ita l etu rr tor hig he nv es for ow Gr Safety and Income se ha ing ris kt oi al nti ote gp sin l ipa inc pr urc cre a of fp In ety saf o ss f lo r k o owe p ris Growth ng ing ow Speculation asi Gr cre In rn s Investment Risk Pyramid Financial Security (Cash Management Tools) © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 Summary $ Cash management is a daily routine of handling money to have enough funds for: § § Living expenses; Emergencies; Savings; Investing. © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 Summary $ Cash management is a daily routine of handling money to have enough funds for: § § Living expenses; Emergencies; Savings; Investing. © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 Summary $ Five types of cash management tools: § § § Checking account; Savings account; Money market deposit account; Certificate of deposit; Savings bond. © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 Summary $ Five types of cash management tools: § § § Checking account; Savings account; Money market deposit account; Certificate of deposit; Savings bond. © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 Managing Your Cash $ Lesson Objectives – Review § Explain the importance of cash management § Describe the five tools used for cash management § Categorize the characteristics of each cash management tool © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 Managing Your Cash $ Lesson Objectives – Review § Explain the importance of cash management § Describe the five tools used for cash management § Categorize the characteristics of each cash management tool © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 Managing Your Cash $ Assignments: § § Managing Your Cash 1. 14. 2. L 1 Note-taking guide Cash Management Tools worksheet 1. 14. 2. A 1 Managing Your Cash worksheet 1. 14. 2. A 2 Checking Account and Debit Card Simulation 2. 7. 3. B 1 © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1. 14. 2. G 1 Managing Your Cash $ Assignments: § § Managing Your Cash 1. 14. 2. L 1 Note-taking guide Cash Management Tools worksheet 1. 14. 2. A 1 Managing Your Cash worksheet 1. 14. 2. A 2 Checking Account and Debit Card Simulation 2. 7. 3. B 1 © Family Economics & Financial Education – April 2008 – Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

The End © Family Economics & Financial Education – Revised April 2008– Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

The End © Family Economics & Financial Education – Revised April 2008– Saving Unit – Managing Your Cash Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona