0140b146dfddfc2bf460832c94646d67.ppt

- Количество слайдов: 29

Managing the Global Corporation Timothy Devinney Australian Graduate School of Management © Devinney, 2008

The Context and Complexity of Internationalization © Devinney, 2008

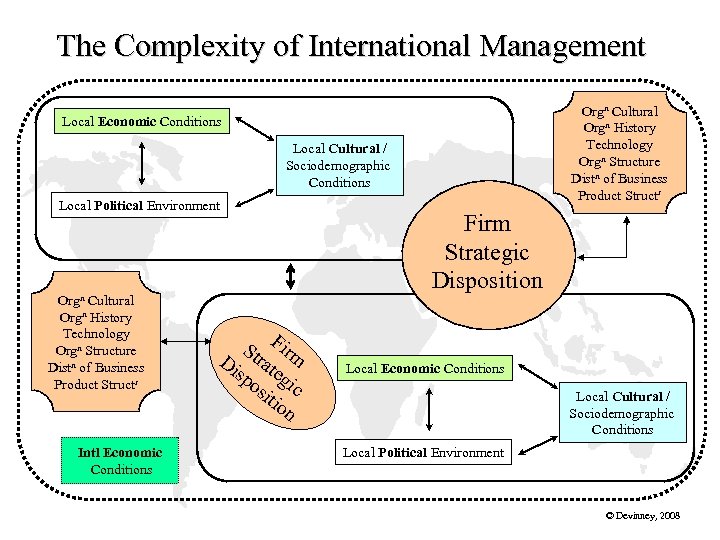

The Complexity of International Management Orgn Cultural Orgn History Technology Orgn Structure Distn of Business Product Structr Local Economic Conditions Local Cultural / Sociodemographic Conditions Local Political Environment Orgn Cultural Orgn History Technology Orgn Structure Distn of Business Product Structr Intl Economic Conditions St Firm Di rat sp eg os ic iti on Firm Strategic Disposition Local Economic Conditions Local Cultural / Sociodemographic Conditions Local Political Environment © Devinney, 2008

The International Mindset How does this complexity change your view Of the notion of ‘a’ strategy? Of the operational details of developing such a strategy? Of the operational details of implementing a strategy? © Devinney, 2008

Why Do Companies Invest ‘Overseas’? Seeking greater operational efficiency Communication with: Operations, customers, suppliers, competitors or R&D Proximity to: Operations, customers, suppliers, competitors or R&D Seeking new markets Proactive vs reactive Direct vs indirect Seeking new resources Physical vs intangible © Devinney, 2008

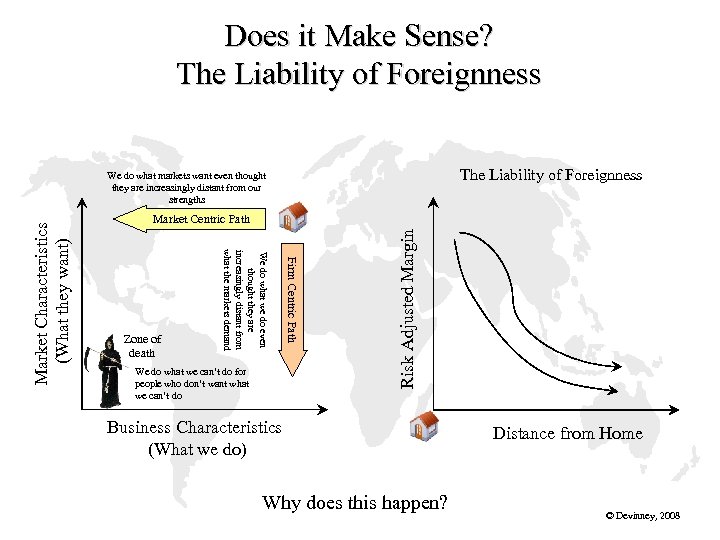

Does it Make Sense? The Liability of Foreignness Firm Centric Path Zone of death We do what we can’t do for people who don’t want what we can’t do Risk Adjusted Margin Market Centric Path We do what we do even thought they are increasingly distant from what the markets demand Market Characteristics (What they want) We do what markets want even thought they are increasingly distant from our strengths Business Characteristics (What we do) Why does this happen? Distance from Home © Devinney, 2008

The Liability of Foreignness in Reality © Devinney, 2008

How Do You Go International? Export Make or buy? Fast or slow? Partner or no? …. . There is no “free lunch”: Each has a cost and benefit © Devinney, 2008

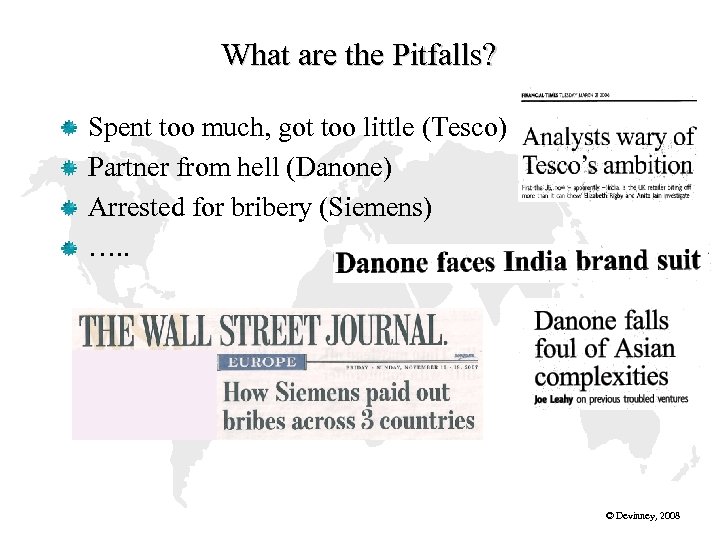

What are the Pitfalls? Spent too much, got too little (Tesco) Partner from hell (Danone) Arrested for bribery (Siemens) …. . © Devinney, 2008

Tim’s 3 -Steps to Success Internationalization Do “something” well Move that “something” from point A to point B Make money on that “something” at point B CEOs © Devinney, 2008

Applying The Rules (Globalizing Cement) Cemex built a dominant position in Mexico based on: Technological/Cost excellence Protection of IP Integration of capacity acquired via M&A It leveraged this position by purchasing marginal producers at scale Then utilized its M&A integration capabilities to transfer its technological and managerial systems © Devinney, 2008

Thinking about an International Strategy © Devinney, 2008

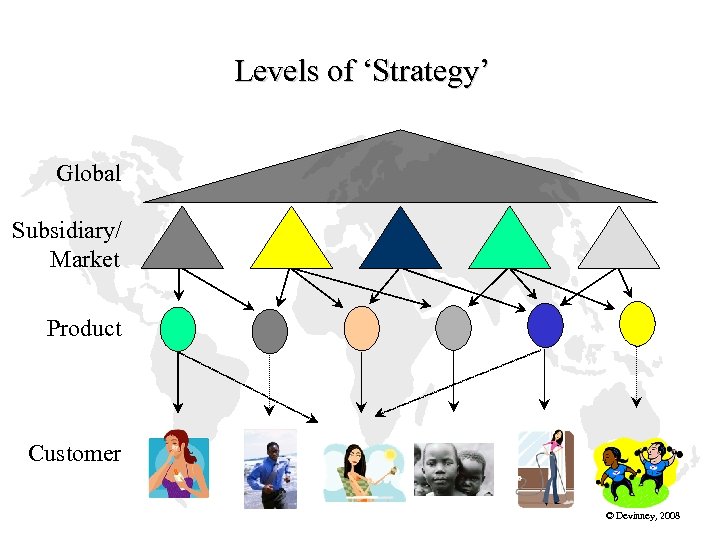

Levels of ‘Strategy’ Global Subsidiary/ Market Product Customer © Devinney, 2008

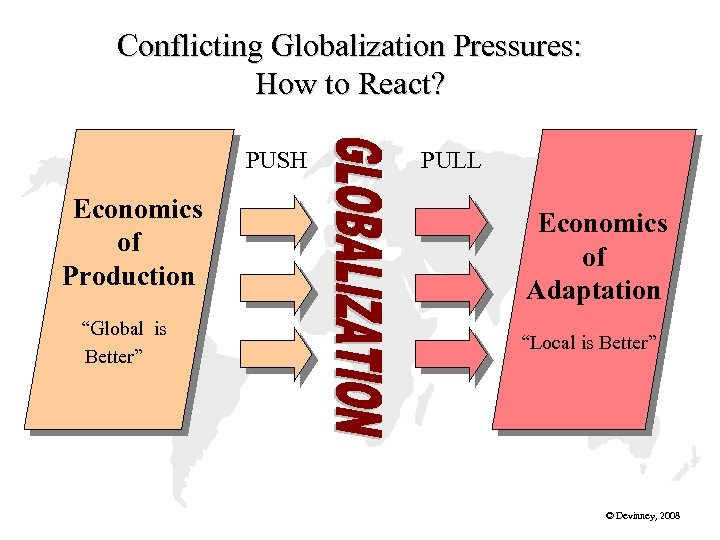

Conflicting Globalization Pressures: How to React? PUSH Economics of Production “Global is Better” PULL Economics of Adaptation “Local is Better” © Devinney, 2008

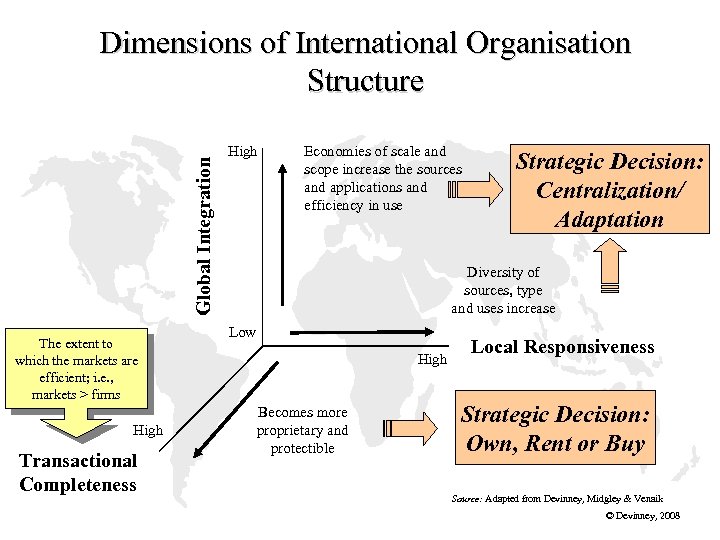

Global Integration Dimensions of International Organisation Structure The extent to which the markets are efficient; i. e. , markets > firms High Transactional Completeness High Economies of scale and scope increase the sources and applications and efficiency in use Strategic Decision: Centralization/ Adaptation Diversity of sources, type and uses increase Low High Becomes more proprietary and protectible Local Responsiveness Strategic Decision: Own, Rent or Buy Source: Adapted from Devinney, Midgley & Venaik © Devinney, 2008

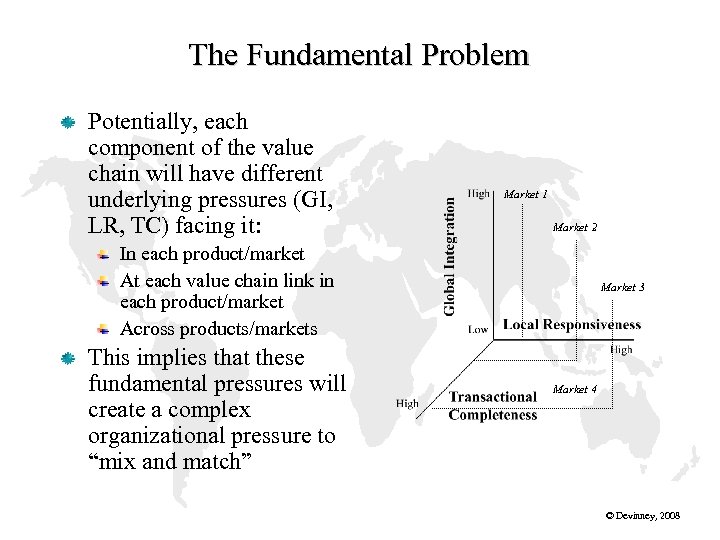

The Fundamental Problem Potentially, each component of the value chain will have different underlying pressures (GI, LR, TC) facing it: Market 1 Market 2 In each product/market At each value chain link in each product/market Across products/markets This implies that these fundamental pressures will create a complex organizational pressure to “mix and match” Market 3 Market 4 © Devinney, 2008

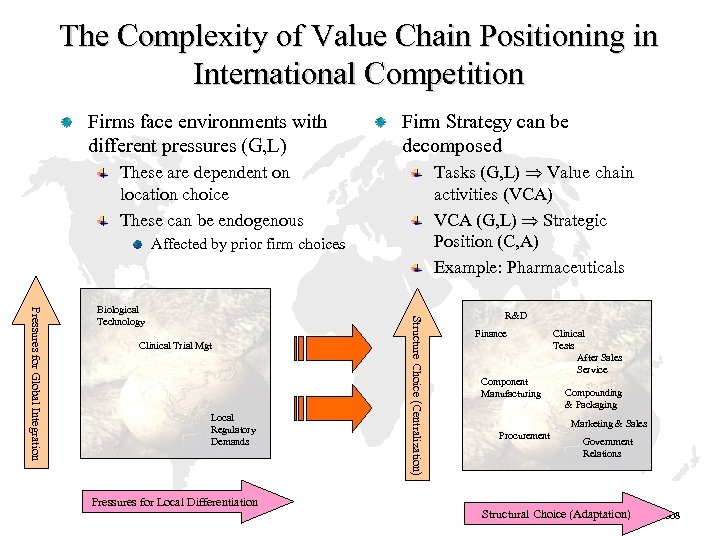

The Complexity of Value Chain Positioning in International Competition Firms face environments with different pressures (G, L) Firm Strategy can be decomposed These are dependent on location choice These can be endogenous Tasks (G, L) Value chain activities (VCA) VCA (G, L) Strategic Position (C, A) Example: Pharmaceuticals Affected by prior firm choices Clinical Trial Mgt Local Regulatory Demands Pressures for Local Differentiation Structure Choice (Centralization) Pressures for Global Integration Biological Technology R&D Finance Component Manufacturing Clinical Tests After Sales Service Compounding & Packaging Marketing & Sales Procurement Government Relations Structural Choice (Adaptation) © Devinney, 2008

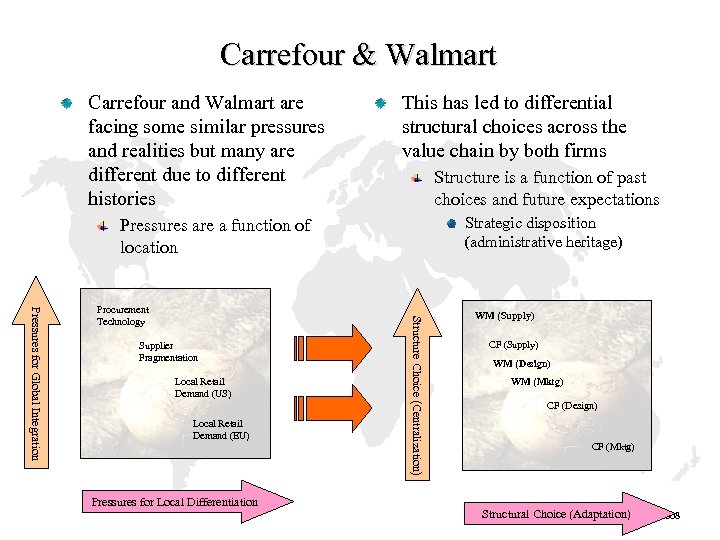

Carrefour & Walmart Carrefour and Walmart are facing some similar pressures and realities but many are different due to different histories This has led to differential structural choices across the value chain by both firms Structure is a function of past choices and future expectations Strategic disposition (administrative heritage) Pressures are a function of location Supplier Fragmentation Local Retail Demand (US) Local Retail Demand (EU) Pressures for Local Differentiation Structure Choice (Centralization) Pressures for Global Integration Procurement Technology WM (Supply) CF (Supply) WM (Design) WM (Mktg) CF (Design) CF (Mktg) Structural Choice (Adaptation) © Devinney, 2008

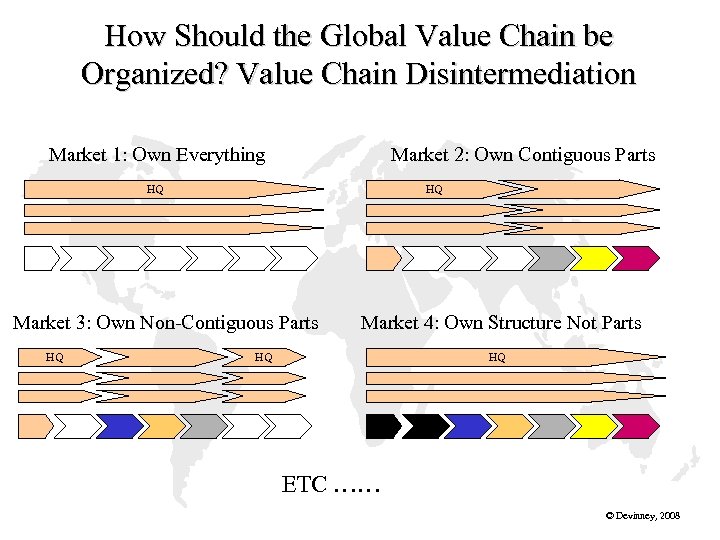

How Should the Global Value Chain be Organized? Value Chain Disintermediation Market 1: Own Everything Market 2: Own Contiguous Parts HQ HQ Market 3: Own Non-Contiguous Parts HQ Market 4: Own Structure Not Parts HQ HQ ETC …… © Devinney, 2008

The Key Organizational Question is How can competitiveness be enhanced by: Worldwide or regional integration of all scale-sensitivity activities? Decentralization of locally differentiated tasks with management accountability? Close coordination of local activities which have crossmarket implications? Simultaneously! Three rules should apply Centralize “scale-sensitive” activities whenever possible Centralize control over those activities which are the source of the firm’s competitive advantage, wherever located Set up as many cross-business or cross-country interactions as possible and feasible Trade off between simplicity and complexity © Devinney, 2008

Strategy/Management at the Subsidiary Level: Operationalization at the Market Level © Devinney, 2008

A Country Operation’s Strategic Role? Stand Alone Value Size of market and growth rate Competitive environment Price levels Favorable cost structure Tax rates Macroeconomic conditions Political risk Ë Strategic Market Value Ô Ô Ô Home market of global customers Home market of global competitors Significant market for global competitors Major source of industry innovation Home of most demanding customers Prestige value Synergy Value Shared activities with other businesses Shares upstream/downstream capacity (e. g. , raw material production, final assembly or distribution) Proximity to other markets © Devinney, 2008

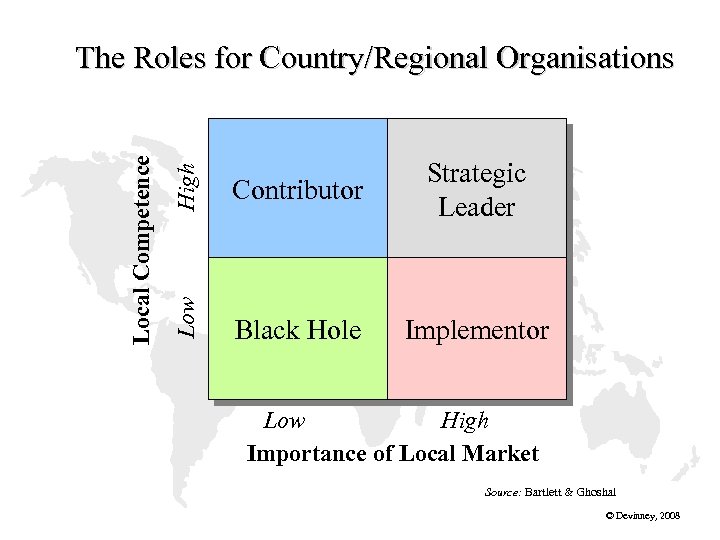

High Contributor Strategic Leader Low Local Competence The Roles for Country/Regional Organisations Black Hole Implementor Low High Importance of Local Market Source: Bartlett & Ghoshal © Devinney, 2008

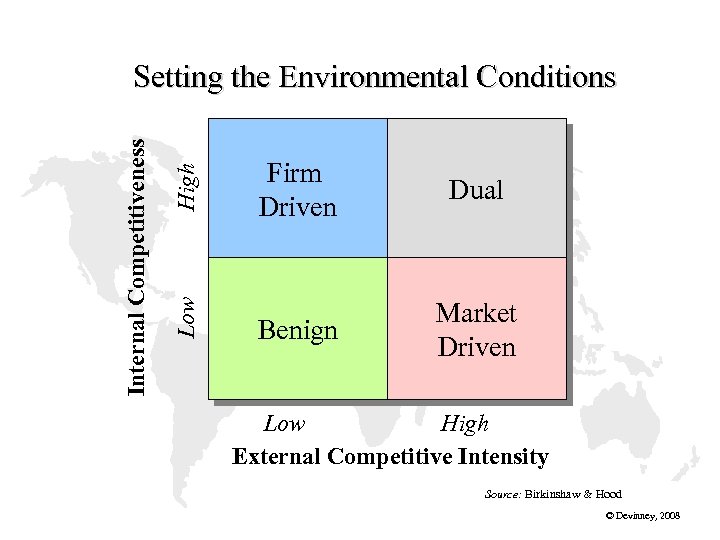

High Low Internal Competitiveness Setting the Environmental Conditions Firm Driven Dual Benign Market Driven Low High External Competitive Intensity Source: Birkinshaw & Hood © Devinney, 2008

A Few Final Words © Devinney, 2008

Is There a Thing Called International Strategy? The short answer is NO! Intl strategy is strategy in a more complex environment Rather on one set of economic environments you have many – Big implications for financing, marketing, accounting Rather than one set of cultural environments you have many – Big implications for marketing and human resources Rather than one set of political environments you have many – Big implications for all aspects of business subject to political risk Intl strategy is strategy with more complex managerial choices Organisational form is more complex and requires an interaction between more players both inside and outside the firm – Trade-offs between centralized and decentralized models of organizational design have never been solved – Alliances, licensing/franchising, FDI, exporting and a plethora of mixtures of this are always on the table © Devinney, 2008

Managerial Responses Essence of international operations is: The expansion of managerial control (expertise and knowledge) The simultaneous Exploitation of existing advantage Exploration for future advantage The development of distinctive MNE competences The ability to exploit internal and external networks System-wide optimization © Devinney, 2008

Managerial & Organizational Factors Leading to International Success The firm sees itself as a MNE led by a TMT that is comfortable on the world stage Develop integrated strategies that are costly and difficult to duplicate Understand that innovation is a global Operate as if the world was one market Have systems that keep them abreast of political/environment developments Are well managed—stick close to customers, run a lean organisation, and encourage autonomy and entrepreneurial activity MNEs must be able to accommodate their natural disadvantage, the cost of managing far flung operations © Devinney, 2008

How Do You Become a Successful MNC? Short answer is no one really knows how to do it. We do know, however, to what it is related: More successful MNCs have a greater percentage of intangible assets More successful MNCs establish a dominant organisational culture that allows it to be less effected organisationally More successful MNCs are better at disaggregating their value chains © Devinney, 2008

0140b146dfddfc2bf460832c94646d67.ppt