53ed102edfde74bd4903e28d28e58bac.ppt

- Количество слайдов: 55

Managing Dairy Price Risk John J. Van. Sickle, Director International Agricultural Trade & Policy Center UF/IFAS 1

Managing Dairy Price Risk John J. Van. Sickle, Director International Agricultural Trade & Policy Center UF/IFAS 1

Important Clarification: • You do not have to alter any of your current marketing channels. • You will market actual milk production the way you normally do. • But, using futures contracts and/or put options, you can have a positive impact on the stability and level of income on your farm.

Important Clarification: • You do not have to alter any of your current marketing channels. • You will market actual milk production the way you normally do. • But, using futures contracts and/or put options, you can have a positive impact on the stability and level of income on your farm.

Outline I. III. IV. Dairy Price Risk Management Futures Markets Milk Put Options The Put Option Buying Strategy

Outline I. III. IV. Dairy Price Risk Management Futures Markets Milk Put Options The Put Option Buying Strategy

I. Dairy Price Risk Management. . . Essential for producers to remain competitive What it is Why it is needed 4

I. Dairy Price Risk Management. . . Essential for producers to remain competitive What it is Why it is needed 4

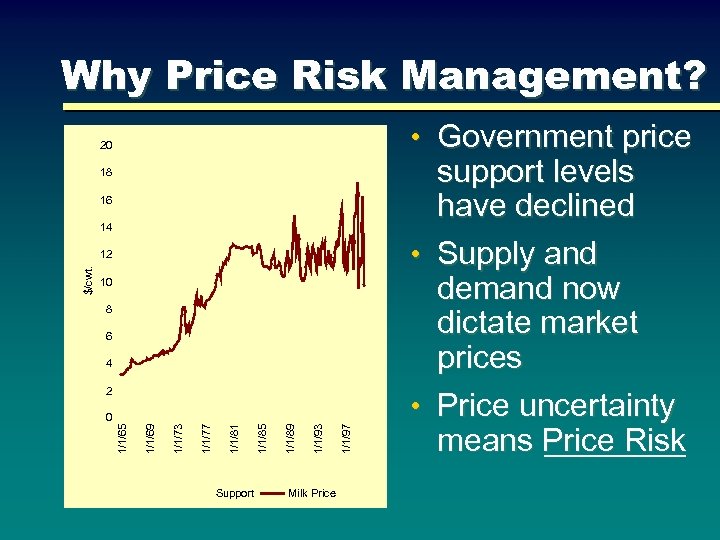

Why Price Risk Management? • Government price 20 18 16 14 10 8 6 4 2 Support Milk Price 1/1/97 1/1/93 1/1/89 1/1/85 1/1/81 1/1/77 1/1/73 1/1/69 0 1/1/65 $/cwt. 12 support levels have declined • Supply and demand now dictate market prices • Price uncertainty means Price Risk

Why Price Risk Management? • Government price 20 18 16 14 10 8 6 4 2 Support Milk Price 1/1/97 1/1/93 1/1/89 1/1/85 1/1/81 1/1/77 1/1/73 1/1/69 0 1/1/65 $/cwt. 12 support levels have declined • Supply and demand now dictate market prices • Price uncertainty means Price Risk

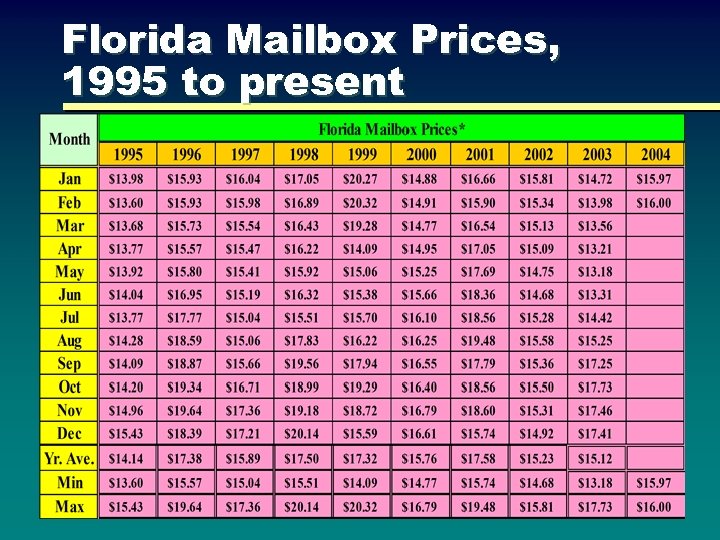

Florida Mailbox Prices, 1995 to present

Florida Mailbox Prices, 1995 to present

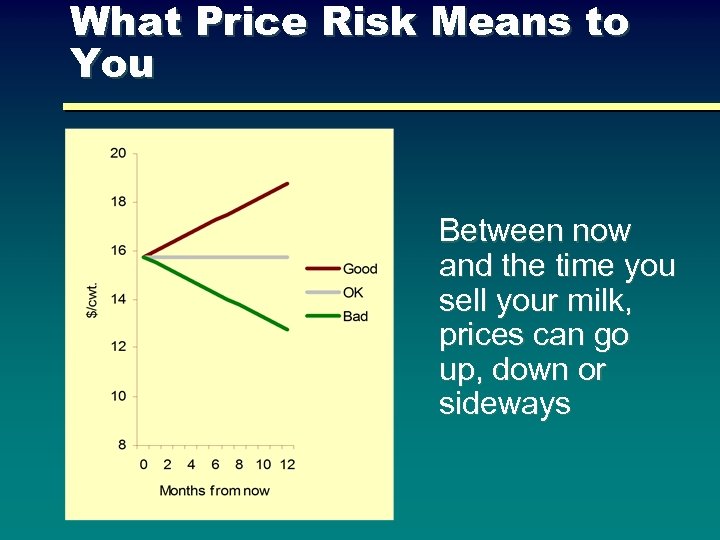

What Price Risk Means to You Between now and the time you sell your milk, prices can go up, down or sideways

What Price Risk Means to You Between now and the time you sell your milk, prices can go up, down or sideways

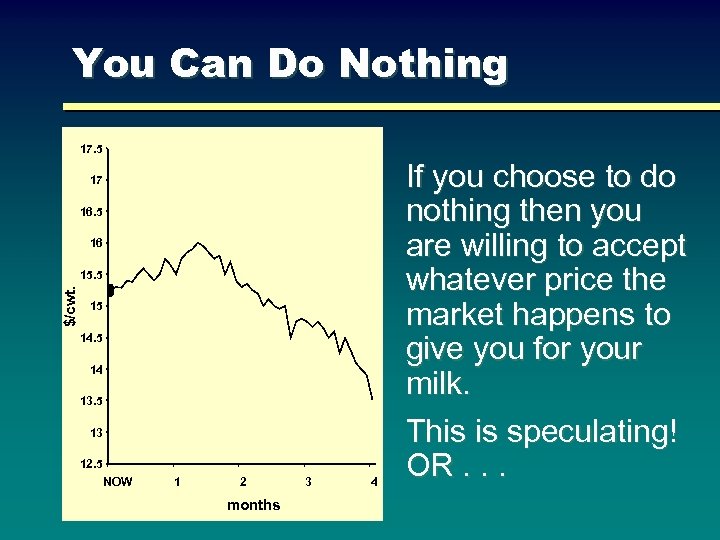

You Can Do Nothing 17. 5 17 16. 5 16 $/cwt. 15. 5 15 14 13. 5 13 12. 5 NOW 1 2 months 3 4 If you choose to do nothing then you are willing to accept whatever price the market happens to give you for your milk. This is speculating! OR. . .

You Can Do Nothing 17. 5 17 16. 5 16 $/cwt. 15. 5 15 14 13. 5 13 12. 5 NOW 1 2 months 3 4 If you choose to do nothing then you are willing to accept whatever price the market happens to give you for your milk. This is speculating! OR. . .

Or, You Can Take Action -by Using Risk Management: • Tools • Cash forward contracts • Futures contracts • Options on futures • Strategies • Selling cash forward • • • contracts Selling futures contracts Buying put options Combination strategies

Or, You Can Take Action -by Using Risk Management: • Tools • Cash forward contracts • Futures contracts • Options on futures • Strategies • Selling cash forward • • • contracts Selling futures contracts Buying put options Combination strategies

Summary: I. Dairy Price Risk Management • Price risk has increased in recent years. • It can have a major impact on the financial • • well-being of a dairy operations. Tools and strategies have been established to manage price risk. Trading futures contracts and put options are simple strategies that offer many risk-reducing advantages.

Summary: I. Dairy Price Risk Management • Price risk has increased in recent years. • It can have a major impact on the financial • • well-being of a dairy operations. Tools and strategies have been established to manage price risk. Trading futures contracts and put options are simple strategies that offer many risk-reducing advantages.

II. Futures Markets. . . A foundation for price risk management • Futures markets provide the primary method of price discovery for many commodities, including milk. They establish the foundation for many price risk management strategies, including the use of options

II. Futures Markets. . . A foundation for price risk management • Futures markets provide the primary method of price discovery for many commodities, including milk. They establish the foundation for many price risk management strategies, including the use of options

A Futures Contract is an agreement between: • A Buyer: Who promises to TAKE delivery of a specific quantity of a commodity on a specific future date at an agreed price or PAY THE CASH EQUIVALENT. • A Seller: Who promises to MAKE delivery of a specific quantity of a commodity on a specific future date at an agreed price or ACCEPT THE CASH EQUIVALENT.

A Futures Contract is an agreement between: • A Buyer: Who promises to TAKE delivery of a specific quantity of a commodity on a specific future date at an agreed price or PAY THE CASH EQUIVALENT. • A Seller: Who promises to MAKE delivery of a specific quantity of a commodity on a specific future date at an agreed price or ACCEPT THE CASH EQUIVALENT.

Features of Futures Contracts • All contracts for a specific • A buyer believes the price is too low or wishes to “hedge” commodity and month are against the possibility of an identical, except for the price. increase in price. • A contract is created in the • Through trading, risks are marketplace when a buyer transferred from hedgers to and a seller agree to a speculators. specific price. • Prices in the market move • News and information flow up or down seeking a to market players and balance between buyers impact opinions on prices. and sellers. • A seller believes the price is too high or wishes to “hedge” against the possibility of a drop in price.

Features of Futures Contracts • All contracts for a specific • A buyer believes the price is too low or wishes to “hedge” commodity and month are against the possibility of an identical, except for the price. increase in price. • A contract is created in the • Through trading, risks are marketplace when a buyer transferred from hedgers to and a seller agree to a speculators. specific price. • Prices in the market move • News and information flow up or down seeking a to market players and balance between buyers impact opinions on prices. and sellers. • A seller believes the price is too high or wishes to “hedge” against the possibility of a drop in price.

Commodity Exchanges • Are free and open marketplaces where • • • buyers and sellers meet to trade futures and options contracts Set and enforce trading rules Ensure the financial integrity of the marketplace Are regulated by the Commodity Futures Trading Commission (CFTC), an agency of the federal government

Commodity Exchanges • Are free and open marketplaces where • • • buyers and sellers meet to trade futures and options contracts Set and enforce trading rules Ensure the financial integrity of the marketplace Are regulated by the Commodity Futures Trading Commission (CFTC), an agency of the federal government

Who Trades on Commodity Exchanges? • Hedgers (Price Risk Managers) • Milk producers • Cooperatives • Food Manufacturers • Food Processors • Floor Traders • Floor brokers • Local Speculators • Speculators • Doctors • Lawyers • Anyone with money to risk for potential profits

Who Trades on Commodity Exchanges? • Hedgers (Price Risk Managers) • Milk producers • Cooperatives • Food Manufacturers • Food Processors • Floor Traders • Floor brokers • Local Speculators • Speculators • Doctors • Lawyers • Anyone with money to risk for potential profits

Milk Futures are Traded on The Chicago Mercantile Exchange • Milk 200, 000 lb. • Common features • Prices determined through open outcry. • Quoted in dollars/cwt. • Based on 3. 5% butterfat • Settlement in every calendar month • Expiration one day prior to USDA Class III announcement. • Cash-settled at expiration to announced Class III price (no need to worry about physical delivery) • Futures converge at expiration to announced Class III price

Milk Futures are Traded on The Chicago Mercantile Exchange • Milk 200, 000 lb. • Common features • Prices determined through open outcry. • Quoted in dollars/cwt. • Based on 3. 5% butterfat • Settlement in every calendar month • Expiration one day prior to USDA Class III announcement. • Cash-settled at expiration to announced Class III price (no need to worry about physical delivery) • Futures converge at expiration to announced Class III price

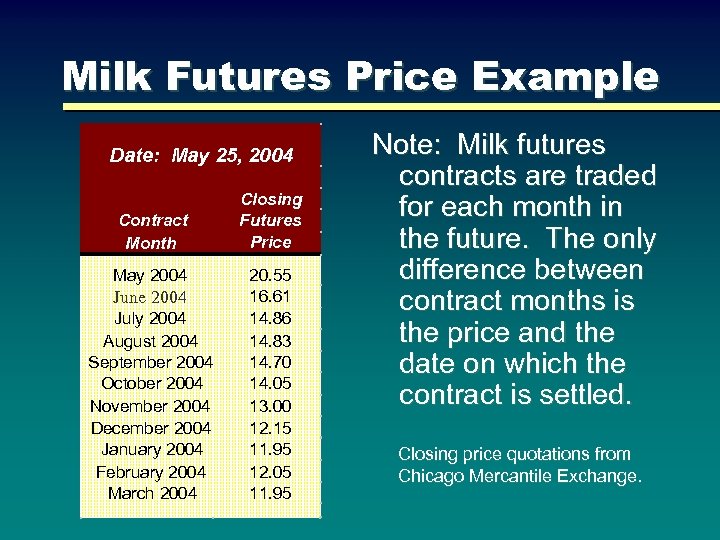

Milk Futures Price Example Date: May 25, 2004 Contract Month May 2004 June 2004 July 2004 August 2004 September 2004 October 2004 November 2004 December 2004 January 2004 February 2004 March 2004 Closing Futures Price 20. 55 16. 61 14. 86 14. 83 14. 70 14. 05 13. 00 12. 15 11. 95 12. 05 11. 95 Note: Milk futures contracts are traded for each month in the future. The only difference between contract months is the price and the date on which the contract is settled. Closing price quotations from Chicago Mercantile Exchange.

Milk Futures Price Example Date: May 25, 2004 Contract Month May 2004 June 2004 July 2004 August 2004 September 2004 October 2004 November 2004 December 2004 January 2004 February 2004 March 2004 Closing Futures Price 20. 55 16. 61 14. 86 14. 83 14. 70 14. 05 13. 00 12. 15 11. 95 12. 05 11. 95 Note: Milk futures contracts are traded for each month in the future. The only difference between contract months is the price and the date on which the contract is settled. Closing price quotations from Chicago Mercantile Exchange.

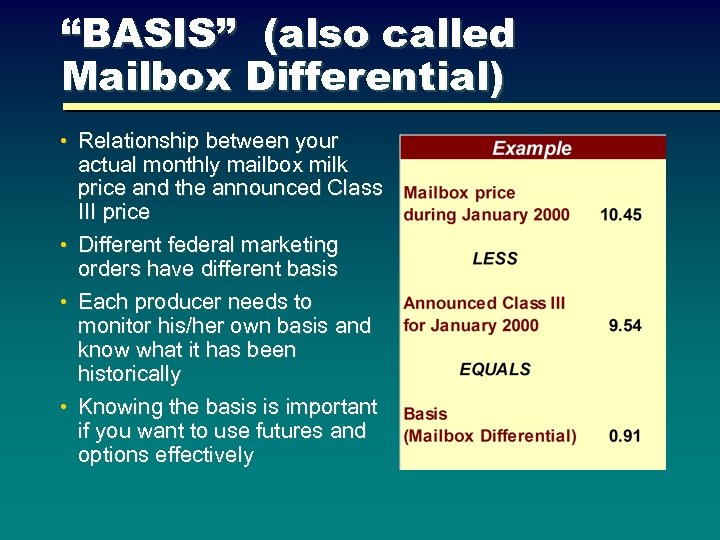

“BASIS” (also called Mailbox Differential) • Relationship between your actual monthly mailbox milk price and the announced Class III price • Different federal marketing orders have different basis • Each producer needs to monitor his/her own basis and know what it has been historically • Knowing the basis is important if you want to use futures and options effectively

“BASIS” (also called Mailbox Differential) • Relationship between your actual monthly mailbox milk price and the announced Class III price • Different federal marketing orders have different basis • Each producer needs to monitor his/her own basis and know what it has been historically • Knowing the basis is important if you want to use futures and options effectively

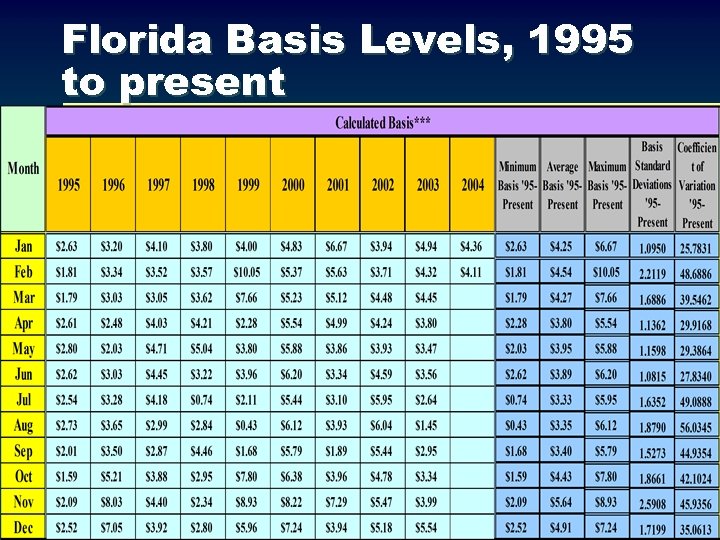

Florida Basis Levels, 1995 to present

Florida Basis Levels, 1995 to present

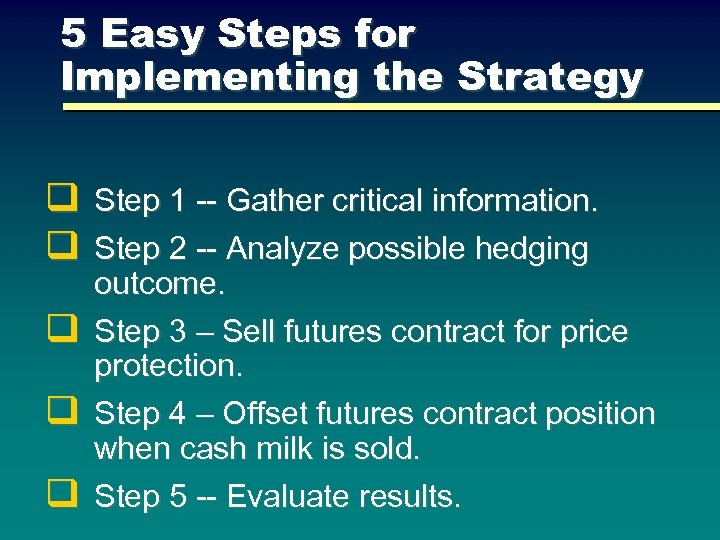

5 Easy Steps for Implementing the Strategy q q q Step 1 -- Gather critical information. Step 2 -- Analyze possible hedging outcome. Step 3 – Sell futures contract for price protection. Step 4 – Offset futures contract position when cash milk is sold. Step 5 -- Evaluate results.

5 Easy Steps for Implementing the Strategy q q q Step 1 -- Gather critical information. Step 2 -- Analyze possible hedging outcome. Step 3 – Sell futures contract for price protection. Step 4 – Offset futures contract position when cash milk is sold. Step 5 -- Evaluate results.

Example: Jittery Joe’s Dairy Farm • Date is May 25. • Joe is considering what to do to protect revenues for December milk production

Example: Jittery Joe’s Dairy Farm • Date is May 25. • Joe is considering what to do to protect revenues for December milk production

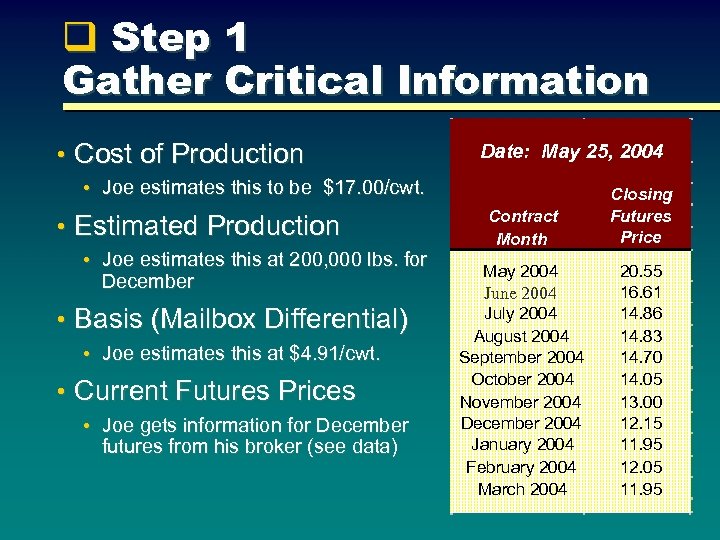

q Step 1 Gather Critical Information • Cost of Production Date: May 25, 2004 • Joe estimates this to be $17. 00/cwt. • Estimated Production • Joe estimates this at 200, 000 lbs. for December • Basis (Mailbox Differential) • Joe estimates this at $4. 91/cwt. • Current Futures Prices • Joe gets information for December futures from his broker (see data) Contract Month May 2004 June 2004 July 2004 August 2004 September 2004 October 2004 November 2004 December 2004 January 2004 February 2004 March 2004 Closing Futures Price 20. 55 16. 61 14. 86 14. 83 14. 70 14. 05 13. 00 12. 15 11. 95 12. 05 11. 95

q Step 1 Gather Critical Information • Cost of Production Date: May 25, 2004 • Joe estimates this to be $17. 00/cwt. • Estimated Production • Joe estimates this at 200, 000 lbs. for December • Basis (Mailbox Differential) • Joe estimates this at $4. 91/cwt. • Current Futures Prices • Joe gets information for December futures from his broker (see data) Contract Month May 2004 June 2004 July 2004 August 2004 September 2004 October 2004 November 2004 December 2004 January 2004 February 2004 March 2004 Closing Futures Price 20. 55 16. 61 14. 86 14. 83 14. 70 14. 05 13. 00 12. 15 11. 95 12. 05 11. 95

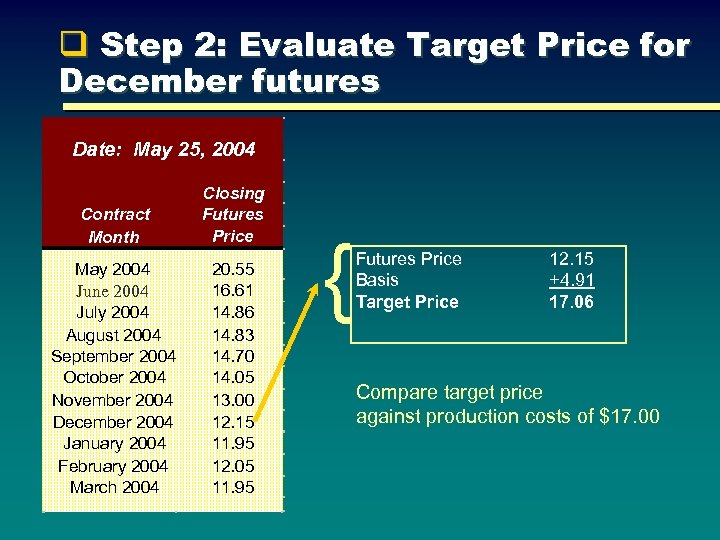

q Step 2: Evaluate Target Price for December futures Date: May 25, 2004 Contract Month May 2004 June 2004 July 2004 August 2004 September 2004 October 2004 November 2004 December 2004 January 2004 February 2004 March 2004 Closing Futures Price 20. 55 16. 61 14. 86 14. 83 14. 70 14. 05 13. 00 12. 15 11. 95 12. 05 11. 95 { Futures Price Basis Target Price 12. 15 +4. 91 17. 06 Compare target price against production costs of $17. 00

q Step 2: Evaluate Target Price for December futures Date: May 25, 2004 Contract Month May 2004 June 2004 July 2004 August 2004 September 2004 October 2004 November 2004 December 2004 January 2004 February 2004 March 2004 Closing Futures Price 20. 55 16. 61 14. 86 14. 83 14. 70 14. 05 13. 00 12. 15 11. 95 12. 05 11. 95 { Futures Price Basis Target Price 12. 15 +4. 91 17. 06 Compare target price against production costs of $17. 00

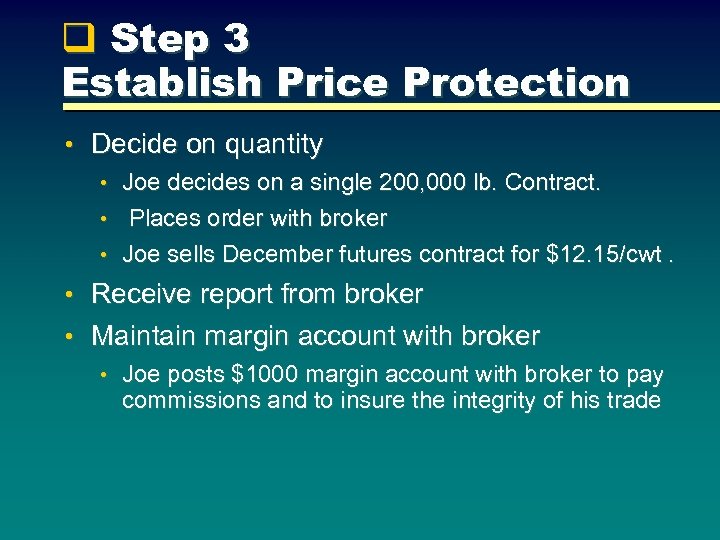

q Step 3 Establish Price Protection • Decide on quantity • Joe decides on a single 200, 000 lb. Contract. • Places order with broker • Joe sells December futures contract for $12. 15/cwt. • Receive report from broker • Maintain margin account with broker • Joe posts $1000 margin account with broker to pay commissions and to insure the integrity of his trade

q Step 3 Establish Price Protection • Decide on quantity • Joe decides on a single 200, 000 lb. Contract. • Places order with broker • Joe sells December futures contract for $12. 15/cwt. • Receive report from broker • Maintain margin account with broker • Joe posts $1000 margin account with broker to pay commissions and to insure the integrity of his trade

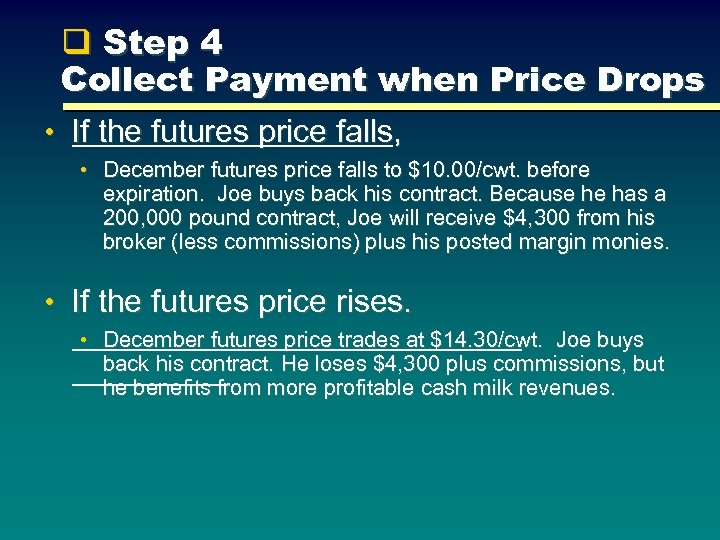

q Step 4 Collect Payment when Price Drops • If the futures price falls, • December futures price falls to $10. 00/cwt. before expiration. Joe buys back his contract. Because he has a 200, 000 pound contract, Joe will receive $4, 300 from his broker (less commissions) plus his posted margin monies. • If the futures price rises. • December futures price trades at $14. 30/cwt. Joe buys back his contract. He loses $4, 300 plus commissions, but he benefits from more profitable cash milk revenues.

q Step 4 Collect Payment when Price Drops • If the futures price falls, • December futures price falls to $10. 00/cwt. before expiration. Joe buys back his contract. Because he has a 200, 000 pound contract, Joe will receive $4, 300 from his broker (less commissions) plus his posted margin monies. • If the futures price rises. • December futures price trades at $14. 30/cwt. Joe buys back his contract. He loses $4, 300 plus commissions, but he benefits from more profitable cash milk revenues.

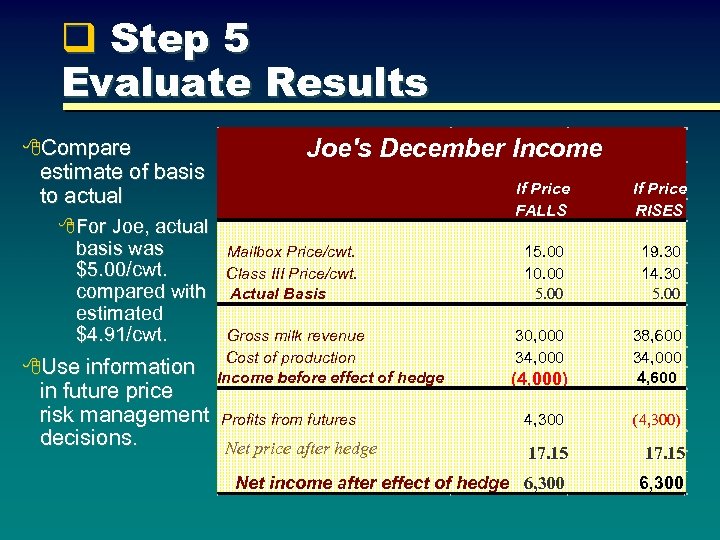

q Step 5 Evaluate Results 8 Compare estimate of basis to actual Joe's December Income If Price FALLS 8 For Joe, actual basis was $5. 00/cwt. compared with estimated $4. 91/cwt. 8 Use information Mailbox Price/cwt. Class III Price/cwt. Actual Basis Gross milk revenue Cost of production Income before effect of hedge in future price risk management Profits from futures decisions. Net price after hedge If Price RISES 15. 00 10. 00 5. 00 19. 30 14. 30 5. 00 30, 000 34, 000 (4, 000) 38, 600 34, 000 4, 600 4, 300 (4, 300) 17. 15 Net income after effect of hedge 6, 300

q Step 5 Evaluate Results 8 Compare estimate of basis to actual Joe's December Income If Price FALLS 8 For Joe, actual basis was $5. 00/cwt. compared with estimated $4. 91/cwt. 8 Use information Mailbox Price/cwt. Class III Price/cwt. Actual Basis Gross milk revenue Cost of production Income before effect of hedge in future price risk management Profits from futures decisions. Net price after hedge If Price RISES 15. 00 10. 00 5. 00 19. 30 14. 30 5. 00 30, 000 34, 000 (4, 000) 38, 600 34, 000 4, 600 4, 300 (4, 300) 17. 15 Net income after effect of hedge 6, 300

Summary: II. Futures Markets • Futures contracts make or take delivery (or the cash • • equivalent) for a commodity for some month in the future, Futures are traded on open, regulated exchanges, such as the CME, Different kinds of traders with different opinions and motivations trade futures, Milk futures are quoted by delivery month in $/cwt. , A knowledge of the BASIS (Mailbox Differential) is needed to use milk futures in effectively managing price risk.

Summary: II. Futures Markets • Futures contracts make or take delivery (or the cash • • equivalent) for a commodity for some month in the future, Futures are traded on open, regulated exchanges, such as the CME, Different kinds of traders with different opinions and motivations trade futures, Milk futures are quoted by delivery month in $/cwt. , A knowledge of the BASIS (Mailbox Differential) is needed to use milk futures in effectively managing price risk.

III. Milk Put Options . . . A tool producers can use to manage downside price risk

III. Milk Put Options . . . A tool producers can use to manage downside price risk

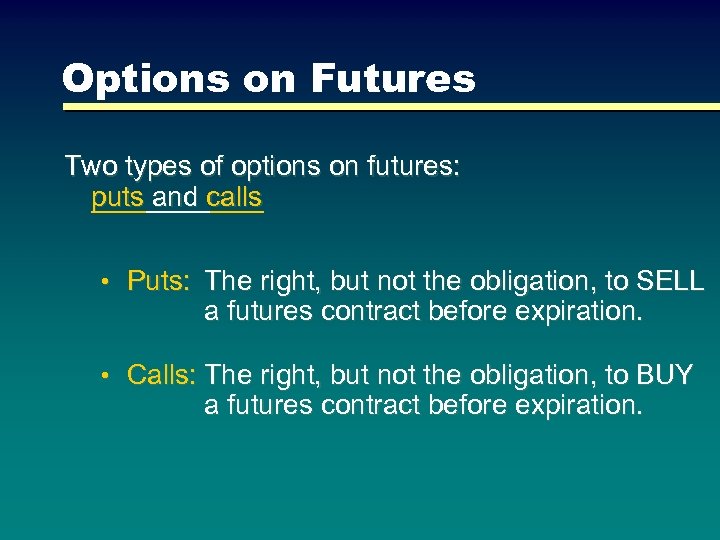

Options on Futures Two types of options on futures: puts and calls • Puts: The right, but not the obligation, to SELL a futures contract before expiration. • Calls: The right, but not the obligation, to BUY a futures contract before expiration.

Options on Futures Two types of options on futures: puts and calls • Puts: The right, but not the obligation, to SELL a futures contract before expiration. • Calls: The right, but not the obligation, to BUY a futures contract before expiration.

For Producers, a Put Option is Like an Insurance Policy Truck Insurance • You consider buying truck insurance to protect against the RISK that the truck will have an accident. • You decide on an appropriate DEDUCTIBLE. • You pay a PREMIUM for your insurance. Put Options • You consider buying a put to protect against the RISK that milk prices will fall. • You decide on an appropriate FLOOR PRICE. • You pay a PREMIUM for a put.

For Producers, a Put Option is Like an Insurance Policy Truck Insurance • You consider buying truck insurance to protect against the RISK that the truck will have an accident. • You decide on an appropriate DEDUCTIBLE. • You pay a PREMIUM for your insurance. Put Options • You consider buying a put to protect against the RISK that milk prices will fall. • You decide on an appropriate FLOOR PRICE. • You pay a PREMIUM for a put.

Insurance Comparison (Cont. ) Truck Insurance Put Option • In case of an accident, • In case of falling prices, you file a claim and collect an INDEMNITY the value of your put increases and you exercise or sell your put to collect this value from your broker as a GAIN.

Insurance Comparison (Cont. ) Truck Insurance Put Option • In case of an accident, • In case of falling prices, you file a claim and collect an INDEMNITY the value of your put increases and you exercise or sell your put to collect this value from your broker as a GAIN.

Insurance Comparison (Cont. ) Truck Insurance • You are pleased if you don’t have an accident and the period covered by your insurance expires without a claim. Put Option • You are pleased if prices don’t fall (remain stable or rise) and your put expires with no value.

Insurance Comparison (Cont. ) Truck Insurance • You are pleased if you don’t have an accident and the period covered by your insurance expires without a claim. Put Option • You are pleased if prices don’t fall (remain stable or rise) and your put expires with no value.

Features of Milk Options • Traded through open outcry along side futures contracts • Milk options expire on the same day as milk futures • CME milk put option contracts • 200, 000 lb.

Features of Milk Options • Traded through open outcry along side futures contracts • Milk options expire on the same day as milk futures • CME milk put option contracts • 200, 000 lb.

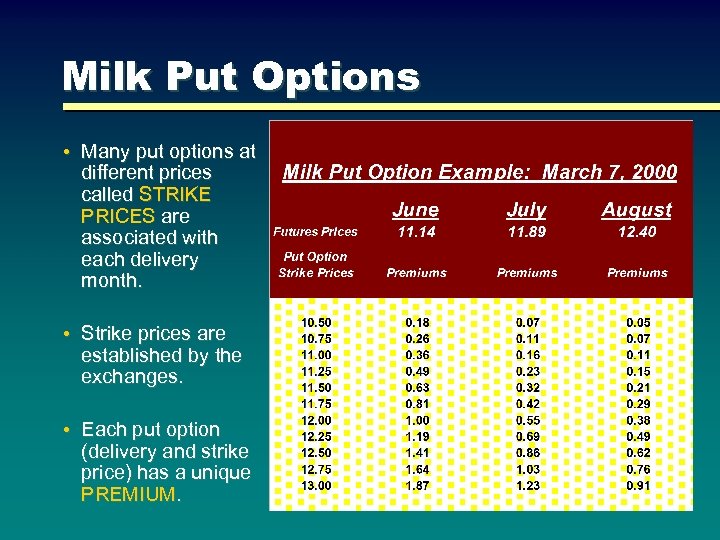

Milk Put Options • Many put options at different prices called STRIKE PRICES are associated with each delivery month. • Strike prices are established by the exchanges. • Each put option (delivery and strike price) has a unique PREMIUM.

Milk Put Options • Many put options at different prices called STRIKE PRICES are associated with each delivery month. • Strike prices are established by the exchanges. • Each put option (delivery and strike price) has a unique PREMIUM.

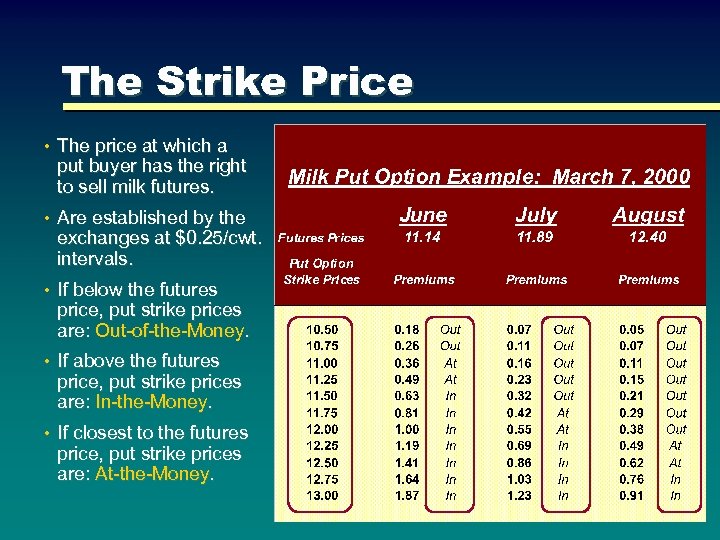

The Strike Price • The price at which a put buyer has the right to sell milk futures. • Are established by the exchanges at $0. 25/cwt. intervals. • If below the futures price, put strike prices are: Out-of-the-Money. • If above the futures price, put strike prices are: In-the-Money. • If closest to the futures price, put strike prices are: At-the-Money.

The Strike Price • The price at which a put buyer has the right to sell milk futures. • Are established by the exchanges at $0. 25/cwt. intervals. • If below the futures price, put strike prices are: Out-of-the-Money. • If above the futures price, put strike prices are: In-the-Money. • If closest to the futures price, put strike prices are: At-the-Money.

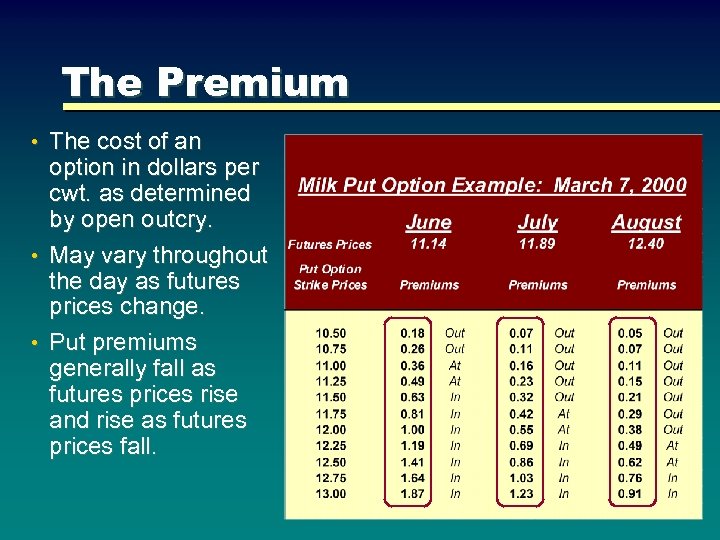

The Premium • The cost of an option in dollars per cwt. as determined by open outcry. • May vary throughout the day as futures prices change. • Put premiums generally fall as futures prices rise and rise as futures prices fall.

The Premium • The cost of an option in dollars per cwt. as determined by open outcry. • May vary throughout the day as futures prices change. • Put premiums generally fall as futures prices rise and rise as futures prices fall.

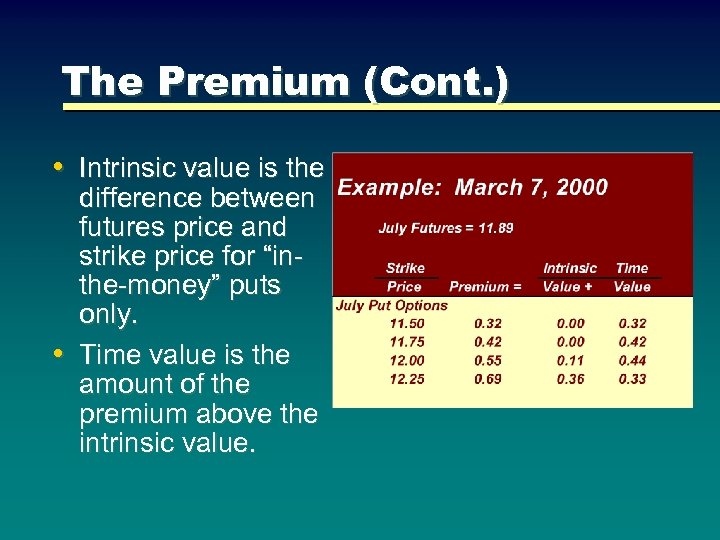

The Premium (Cont. ) • Intrinsic value is the difference between futures price and strike price for “inthe-money” puts only. • Time value is the amount of the premium above the intrinsic value.

The Premium (Cont. ) • Intrinsic value is the difference between futures price and strike price for “inthe-money” puts only. • Time value is the amount of the premium above the intrinsic value.

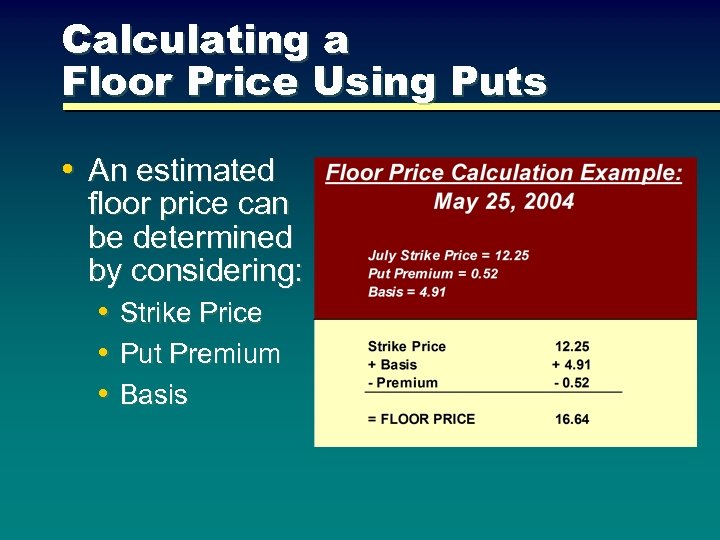

Calculating a Floor Price Using Puts • An estimated floor price can be determined by considering: • Strike Price • Put Premium • Basis

Calculating a Floor Price Using Puts • An estimated floor price can be determined by considering: • Strike Price • Put Premium • Basis

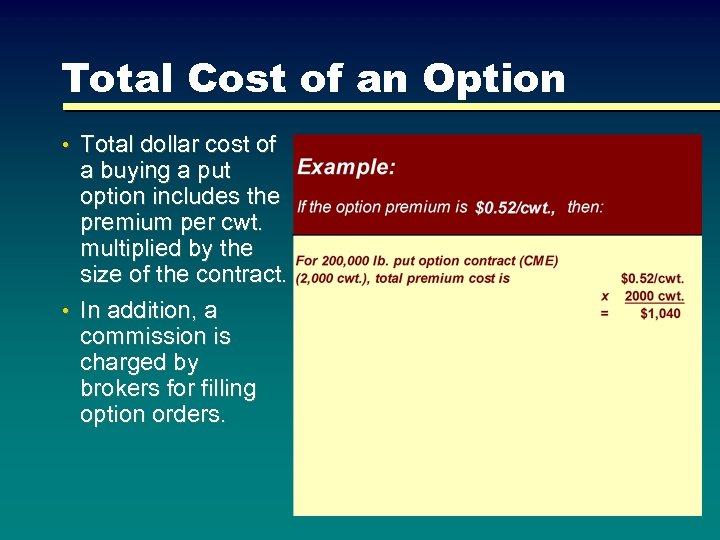

Total Cost of an Option • Total dollar cost of a buying a put option includes the premium per cwt. multiplied by the size of the contract. • In addition, a commission is charged by brokers for filling option orders.

Total Cost of an Option • Total dollar cost of a buying a put option includes the premium per cwt. multiplied by the size of the contract. • In addition, a commission is charged by brokers for filling option orders.

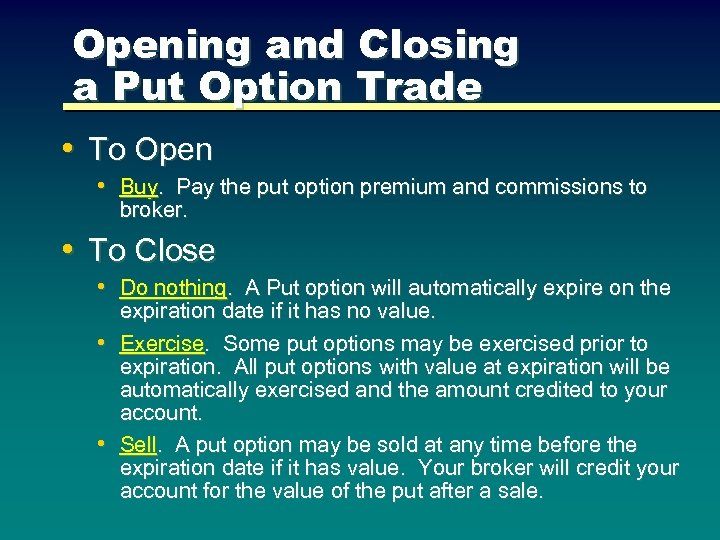

Opening and Closing a Put Option Trade • To Open • Buy. Pay the put option premium and commissions to broker. • To Close • Do nothing. A Put option will automatically expire on the expiration date if it has no value. • Exercise. Some put options may be exercised prior to expiration. All put options with value at expiration will be automatically exercised and the amount credited to your account. • Sell. A put option may be sold at any time before the expiration date if it has value. Your broker will credit your account for the value of the put after a sale.

Opening and Closing a Put Option Trade • To Open • Buy. Pay the put option premium and commissions to broker. • To Close • Do nothing. A Put option will automatically expire on the expiration date if it has no value. • Exercise. Some put options may be exercised prior to expiration. All put options with value at expiration will be automatically exercised and the amount credited to your account. • Sell. A put option may be sold at any time before the expiration date if it has value. Your broker will credit your account for the value of the put after a sale.

Summary: III. Milk Put Options • Two types of options -- puts and calls • Put options can be used as price insurance. • Put option quantities available on the CME are 200, 000 lbs. • The strike price is the futures price at which a put option may • • • be exercised. The premium is the value of the option determined in the market. Enter the market to set price protection by buying a put Exit the market by either • Doing nothing. • Exercising the put option. • Selling the put option.

Summary: III. Milk Put Options • Two types of options -- puts and calls • Put options can be used as price insurance. • Put option quantities available on the CME are 200, 000 lbs. • The strike price is the futures price at which a put option may • • • be exercised. The premium is the value of the option determined in the market. Enter the market to set price protection by buying a put Exit the market by either • Doing nothing. • Exercising the put option. • Selling the put option.

IV. The Put Option Buying Strategy. . . A simple method of insuring milk revenues

IV. The Put Option Buying Strategy. . . A simple method of insuring milk revenues

The Purpose of the Strategy To protect revenues of future milk production by establishing a floor price. When the market provides the opportunity, establish the floor price above break-even costs.

The Purpose of the Strategy To protect revenues of future milk production by establishing a floor price. When the market provides the opportunity, establish the floor price above break-even costs.

5 Easy Steps for Implementing the Strategy q q q Step 1 -- Gather critical information. Step 2 -- Analyze possible floor prices. Step 3 -- Establish price protection. Step 4 -- Collect a payment for price declines. Step 5 -- Evaluate results.

5 Easy Steps for Implementing the Strategy q q q Step 1 -- Gather critical information. Step 2 -- Analyze possible floor prices. Step 3 -- Establish price protection. Step 4 -- Collect a payment for price declines. Step 5 -- Evaluate results.

Example: Jittery Joe’s Dairy Farm • Date is May 25. • Joe is considering what to do to protect revenues for December milk production

Example: Jittery Joe’s Dairy Farm • Date is May 25. • Joe is considering what to do to protect revenues for December milk production

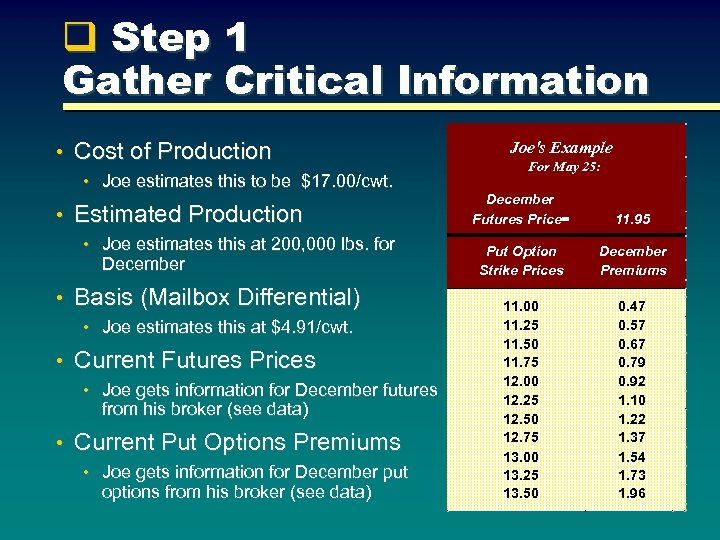

q Step 1 Gather Critical Information • Cost of Production • Joe estimates this to be $17. 00/cwt. • Estimated Production • Joe estimates this at 200, 000 lbs. for December • Basis (Mailbox Differential) • Joe estimates this at $4. 91/cwt. • Current Futures Prices • Joe gets information for December futures from his broker (see data) • Current Put Options Premiums • Joe gets information for December put options from his broker (see data) Joe's Example For May 25: December Futures Price= 11. 95 Put Option Strike Prices December Premiums 11. 00 11. 25 11. 50 11. 75 12. 00 12. 25 12. 50 12. 75 13. 00 13. 25 13. 50 0. 47 0. 57 0. 67 0. 79 0. 92 1. 10 1. 22 1. 37 1. 54 1. 73 1. 96

q Step 1 Gather Critical Information • Cost of Production • Joe estimates this to be $17. 00/cwt. • Estimated Production • Joe estimates this at 200, 000 lbs. for December • Basis (Mailbox Differential) • Joe estimates this at $4. 91/cwt. • Current Futures Prices • Joe gets information for December futures from his broker (see data) • Current Put Options Premiums • Joe gets information for December put options from his broker (see data) Joe's Example For May 25: December Futures Price= 11. 95 Put Option Strike Prices December Premiums 11. 00 11. 25 11. 50 11. 75 12. 00 12. 25 12. 50 12. 75 13. 00 13. 25 13. 50 0. 47 0. 57 0. 67 0. 79 0. 92 1. 10 1. 22 1. 37 1. 54 1. 73 1. 96

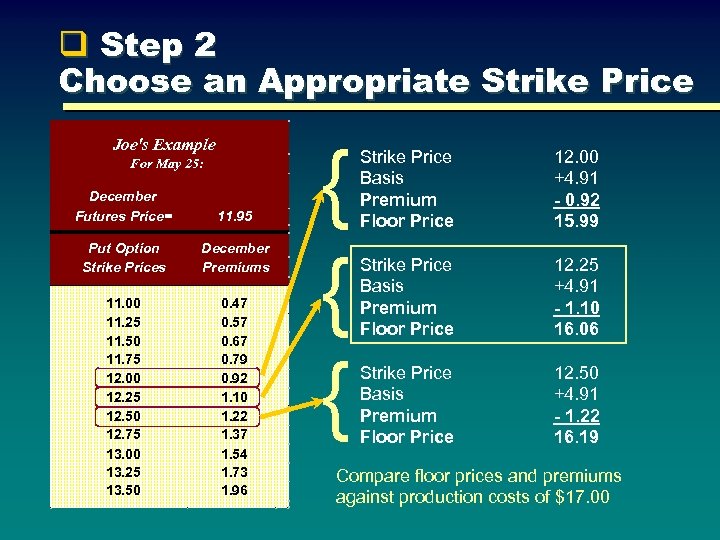

q Step 2 Choose an Appropriate Strike Price Joe's Example For May 25: December Futures Price= 11. 95 Put Option Strike Prices December Premiums 11. 00 11. 25 11. 50 11. 75 12. 00 12. 25 12. 50 12. 75 13. 00 13. 25 13. 50 0. 47 0. 57 0. 67 0. 79 0. 92 1. 10 1. 22 1. 37 1. 54 1. 73 1. 96 { { { Strike Price Basis Premium Floor Price 12. 00 +4. 91 - 0. 92 15. 99 Strike Price Basis Premium Floor Price 12. 25 +4. 91 - 1. 10 16. 06 Strike Price Basis Premium Floor Price 12. 50 +4. 91 - 1. 22 16. 19 Compare floor prices and premiums against production costs of $17. 00

q Step 2 Choose an Appropriate Strike Price Joe's Example For May 25: December Futures Price= 11. 95 Put Option Strike Prices December Premiums 11. 00 11. 25 11. 50 11. 75 12. 00 12. 25 12. 50 12. 75 13. 00 13. 25 13. 50 0. 47 0. 57 0. 67 0. 79 0. 92 1. 10 1. 22 1. 37 1. 54 1. 73 1. 96 { { { Strike Price Basis Premium Floor Price 12. 00 +4. 91 - 0. 92 15. 99 Strike Price Basis Premium Floor Price 12. 25 +4. 91 - 1. 10 16. 06 Strike Price Basis Premium Floor Price 12. 50 +4. 91 - 1. 22 16. 19 Compare floor prices and premiums against production costs of $17. 00

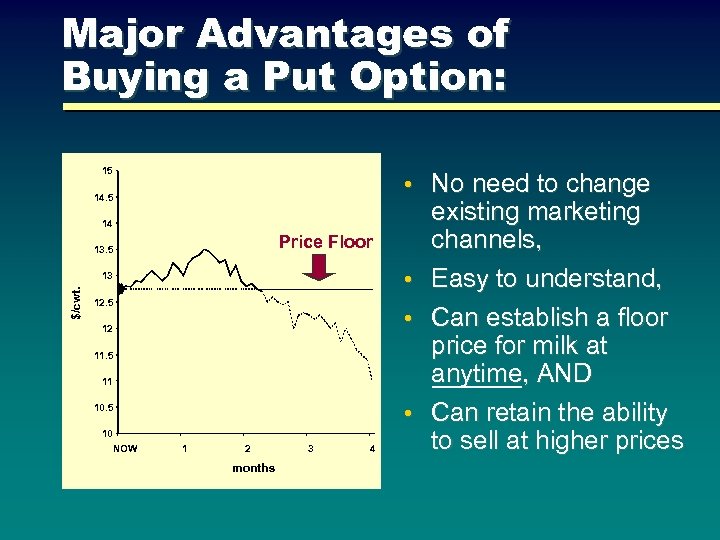

Major Advantages of Buying a Put Option: 15 • No need to change 14. 5 14 Price Floor 13. 5 • $/cwt. 13 12. 5 • 12 11. 5 11 • 10. 5 10 NOW 1 2 months 3 4 existing marketing channels, Easy to understand, Can establish a floor price for milk at anytime, AND Can retain the ability to sell at higher prices

Major Advantages of Buying a Put Option: 15 • No need to change 14. 5 14 Price Floor 13. 5 • $/cwt. 13 12. 5 • 12 11. 5 11 • 10. 5 10 NOW 1 2 months 3 4 existing marketing channels, Easy to understand, Can establish a floor price for milk at anytime, AND Can retain the ability to sell at higher prices

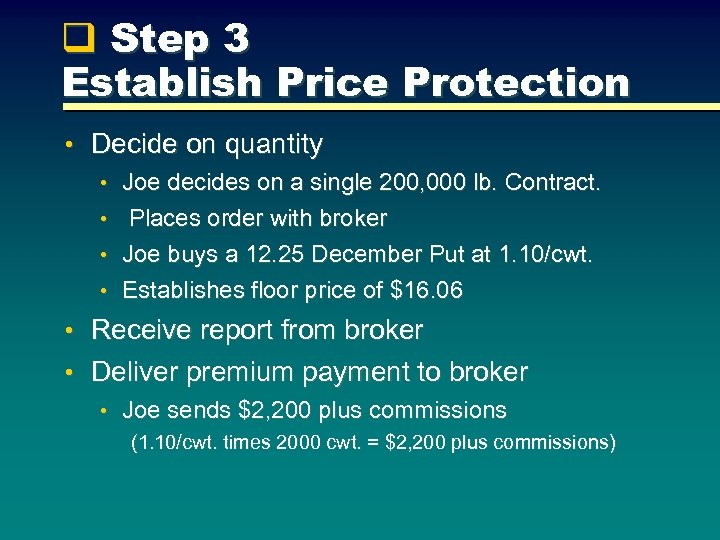

q Step 3 Establish Price Protection • Decide on quantity • Joe decides on a single 200, 000 lb. Contract. • Places order with broker • Joe buys a 12. 25 December Put at 1. 10/cwt. • Establishes floor price of $16. 06 • Receive report from broker • Deliver premium payment to broker • Joe sends $2, 200 plus commissions (1. 10/cwt. times 2000 cwt. = $2, 200 plus commissions)

q Step 3 Establish Price Protection • Decide on quantity • Joe decides on a single 200, 000 lb. Contract. • Places order with broker • Joe buys a 12. 25 December Put at 1. 10/cwt. • Establishes floor price of $16. 06 • Receive report from broker • Deliver premium payment to broker • Joe sends $2, 200 plus commissions (1. 10/cwt. times 2000 cwt. = $2, 200 plus commissions)

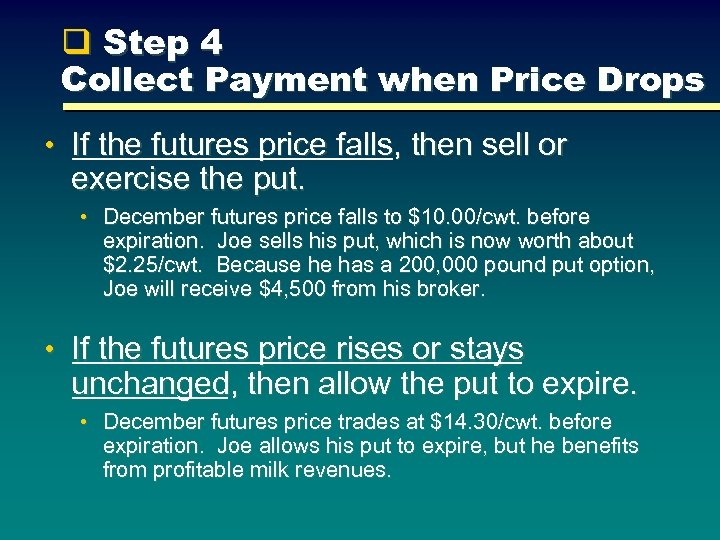

q Step 4 Collect Payment when Price Drops • If the futures price falls, then sell or exercise the put. • December futures price falls to $10. 00/cwt. before expiration. Joe sells his put, which is now worth about $2. 25/cwt. Because he has a 200, 000 pound put option, Joe will receive $4, 500 from his broker. • If the futures price rises or stays unchanged, then allow the put to expire. • December futures price trades at $14. 30/cwt. before expiration. Joe allows his put to expire, but he benefits from profitable milk revenues.

q Step 4 Collect Payment when Price Drops • If the futures price falls, then sell or exercise the put. • December futures price falls to $10. 00/cwt. before expiration. Joe sells his put, which is now worth about $2. 25/cwt. Because he has a 200, 000 pound put option, Joe will receive $4, 500 from his broker. • If the futures price rises or stays unchanged, then allow the put to expire. • December futures price trades at $14. 30/cwt. before expiration. Joe allows his put to expire, but he benefits from profitable milk revenues.

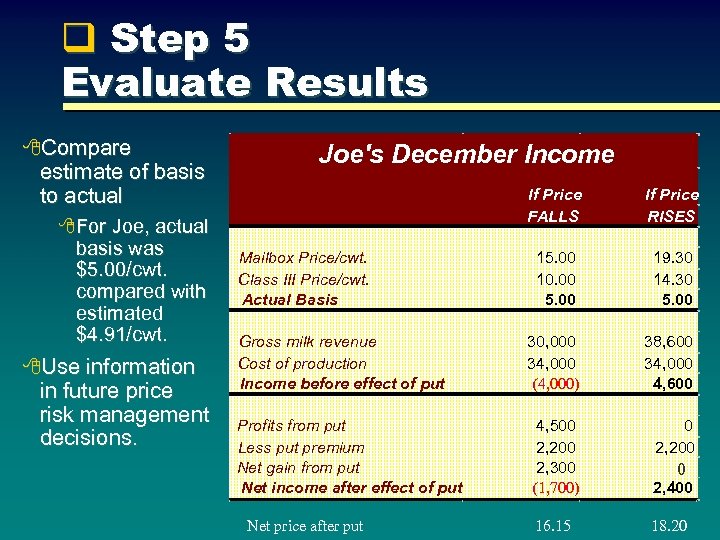

q Step 5 Evaluate Results 8 Compare estimate of basis to actual Joe's December Income If Price FALLS 8 For Joe, actual basis was $5. 00/cwt. compared with estimated $4. 91/cwt. 8 Use information in future price risk management decisions. Mailbox Price/cwt. Class III Price/cwt. Actual Basis Gross milk revenue Cost of production Income before effect of put Profits from put Less put premium Net gain from put Net income after effect of put Net price after put If Price RISES 15. 00 10. 00 5. 00 19. 30 14. 30 5. 00 30, 000 34, 000 (4, 000) 38, 600 34, 000 4, 600 4, 500 2, 200 2, 300 (1, 700) 0 2, 200 2, 400 16. 15 18. 20 0

q Step 5 Evaluate Results 8 Compare estimate of basis to actual Joe's December Income If Price FALLS 8 For Joe, actual basis was $5. 00/cwt. compared with estimated $4. 91/cwt. 8 Use information in future price risk management decisions. Mailbox Price/cwt. Class III Price/cwt. Actual Basis Gross milk revenue Cost of production Income before effect of put Profits from put Less put premium Net gain from put Net income after effect of put Net price after put If Price RISES 15. 00 10. 00 5. 00 19. 30 14. 30 5. 00 30, 000 34, 000 (4, 000) 38, 600 34, 000 4, 600 4, 500 2, 200 2, 300 (1, 700) 0 2, 200 2, 400 16. 15 18. 20 0

Summary: IV. The Put Option Buying Strategy q Step 1 -- Gather critical information. q Step 2 -- Analyze possible floor prices. q Step 3 -- Establish price protection. q Step 4 -- Collect payment for price declines. q Step 5 -- Evaluate results.

Summary: IV. The Put Option Buying Strategy q Step 1 -- Gather critical information. q Step 2 -- Analyze possible floor prices. q Step 3 -- Establish price protection. q Step 4 -- Collect payment for price declines. q Step 5 -- Evaluate results.

The Result: Jubilant Joe’s Dairy Farm Jittery Joe becomes Jubilant Joe! Why? . . . because he can MANAGE his price risk rather than leaving his business to chance.

The Result: Jubilant Joe’s Dairy Farm Jittery Joe becomes Jubilant Joe! Why? . . . because he can MANAGE his price risk rather than leaving his business to chance.

Summary: Managing Dairy Price Risk Using Milk Put Options I. Dairy Price Risk Management Essential for producers to remain competitive II. Futures Markets A foundation for price risk management III. Milk Put Options Tools producers can use to manage downside price risk IV. The Put Option Buying Strategy A simple method of insuring profit margins

Summary: Managing Dairy Price Risk Using Milk Put Options I. Dairy Price Risk Management Essential for producers to remain competitive II. Futures Markets A foundation for price risk management III. Milk Put Options Tools producers can use to manage downside price risk IV. The Put Option Buying Strategy A simple method of insuring profit margins

Managing Dairy Price Risk John J. Van. Sickle, Director International Agricultural Trade & Policy Center UF/IFAS 55

Managing Dairy Price Risk John J. Van. Sickle, Director International Agricultural Trade & Policy Center UF/IFAS 55