7e2ab42138eaebc6bc2a1f9e0cfae8f4.ppt

- Количество слайдов: 22

MANAGING CONDUCT OF BUSINESS RISKS The Importance of Data in Assessing Culture ASTUTE FSB DAY 27 SEPTEMBER 2016 Presenter: Farzana Badat Head of Department: Insurance Compliance (Conduct of Business Supervision)

AGENDA 1. FROM TCF TO CONDUCT RISK Financial Services Board 2. DEFINING CULTURE 3. THE CURRENT DATA REALITY 4. CONCLUSION

Financial Services Board THE EVOLUTION FROM TCF TO CONDUCT RISK

THE LANGUAGE OF CONDUCT • OLD NEWS ü Just remembering the 6 TCF Outcomes? Financial Services Board • THE EVOLUTION ü • Move from talking about TCF outcomes to proactive management of market conduct / conduct of business risks BUT WHAT IS CONDUCT RISK MANAGEMENT? ü The operationalisation of TCF across all aspects of the business ü Embedding fair customer outcomes in all areas of the product lifecycle ü Including areas of the business that are outsourced

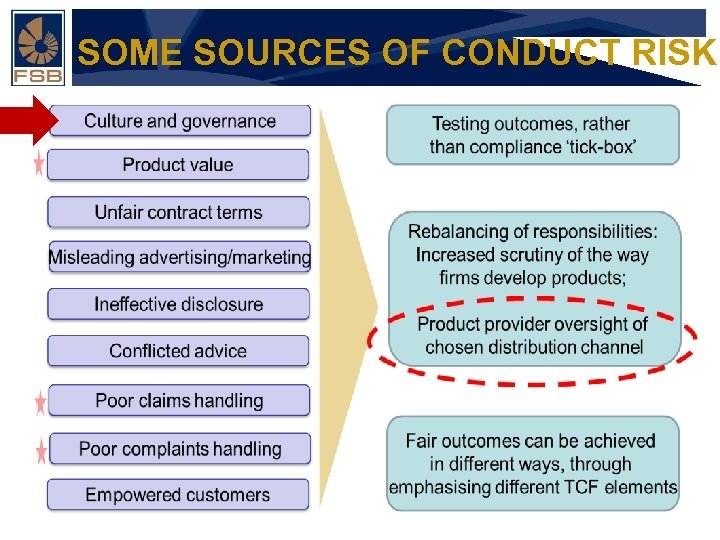

SOME SOURCES OF CONDUCT RISK Financial Services Board

Financial Services Board DEFINING “CULTURE” CAN YOU DEMONSTRATE CULTURE WITHOUT DATA?

DEFINING CULTURE • THE MYTH OF CULTURE ü Financial ü Services Board ü ü • “Culture can’t be defined!” “Culture? Hmm … that is such a soft, airy fairy concept!” “You cannot measure culture!” “Yes, we have a great culture. Here is our written policy to prove it!” THE REALITY OF CULTURE AND CONDUCT Our approach is joining the dots rather than assessing culture directly. This can be done through how a firm responds to regulatory issues; what customers are actually experiencing when they buy a product or service; how a firm designs products; the manner in which decisions are made or escalated; and even the remuneration structures. * *Clive Adamson, Director of Supervision, UK Financial Conduct Authority (FCA), November 2013 Culture remains a key driver of significant risks in every sector and the root cause of high-profile and significant failings. It impacts on individual behaviours which in turn affect day-to-day decisions and practices in the firms we regulate. Culture is therefore both a driver, and a potential mitigator, of conduct risk. ** ***UK Financial Conduct Authority (FCA), Business Plan 2016/12017

CULTURE - JOINING THE DOTS • ONGOING, PROACTIVE, DEMONSTRABLE MANAGEMENT OF CONDUCT RISK INDICATORS MANIFESTING IN: ü Continuous improvement in product design, service delivery, customer experience ü Fair pricing ü Appropriate products ü Clear and understandable disclosures ü Improved claims handling practices ü Reduction in persistent complaints ü Meaningful management information and reporting ü Enhanced governance and oversight of distribution channel ü Customer centric decision making Financial Services Board

ASKING THE RIGHT QUESTIONS • EXAMPLES OF THINGS TO CONSIDER ACROSS THE CUSTOMER LIFECYLE: Financial Services Board ü What do “fair customer outcomes” mean in the context of the operating model and target market of the business? ü Does the chosen distribution model pose potential risks to fair customer outcomes? ü Is the ability to deliver fair customer outcomes a consideration during the development of products? ü What is the level of oversight over the product development and product launch processes? ü How do post-sales processes support the delivery of fair customer outcomes? (e. g. servicing, claims, complaints)? ü Do senior management and Board structures receive appropriate and accurate management information (MI) relating to the delivery of fair customer outcomes?

THE VALUE OF MEANINGFUL DATA • Meaningful regulatory and management reporting requires consolidation of accurate, quality and usable data from various distribution touch points Financial Services Board • Investing in more reliable, dependable, quality data helps to articulate conduct risks more precisely and makes compliance much easier to demonstrate • Having consistent access to the right data, in the desired format and at the right moment helps to generate new insights for better customer solutions and improved business efficiencies Reference: Data Points: HOW FINANCIAL SERVICES FIRMS USE TECHNOLOGY TO TURN DATA INTO ACTIONABLE INSIGHT Bloomberg for Enterprise

Financial Services Board THE CURRENT REALITY LET ME TELL YOU A STORY … OR TWO … OR THREE…

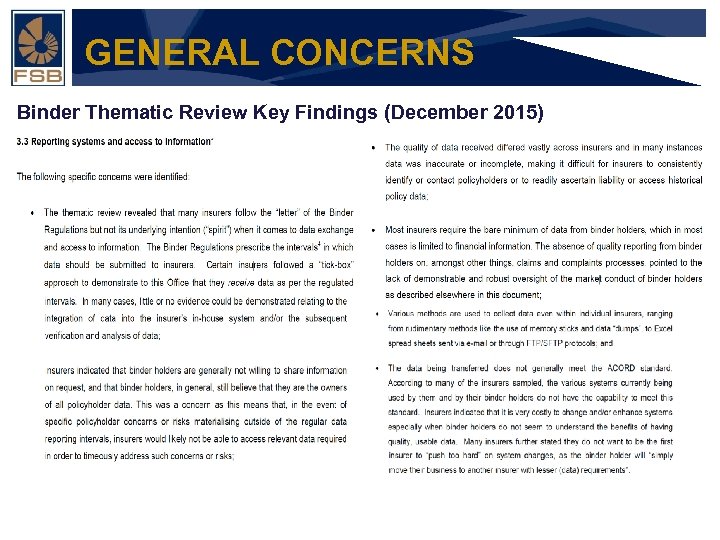

GENERAL CONCERNS Binder Thematic Review Key Findings (December 2015) Financial Services Board

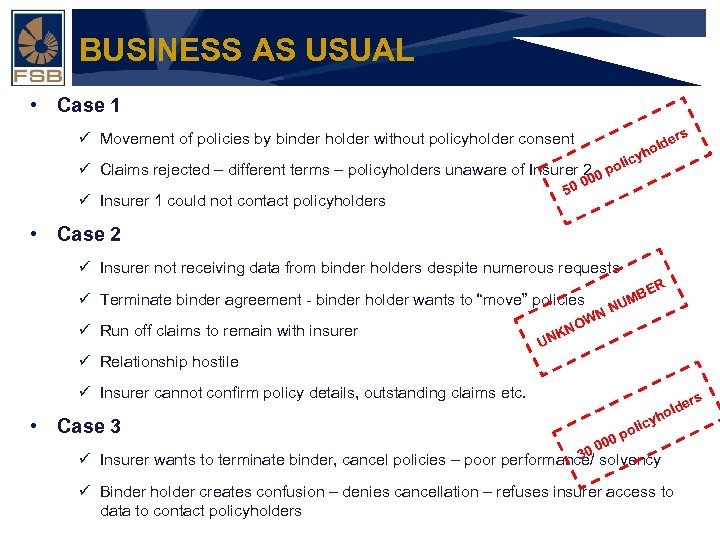

BUSINESS AS USUAL • Case 1 ü Movement of policies by binder holder without policyholder consent Financial Services Board ü Claims rejected – different terms – policyholders unaware of Insurer 2 0 50 ü Insurer 1 could not contact policyholders 00 e old rs cyh li po • Case 2 ü Insurer not receiving data from binder holders despite numerous requests ü Terminate binder agreement - binder holder wants to “move” policies ü Run off claims to remain with insurer UN E MB R U N WN O KN ü Relationship hostile ü Insurer cannot confirm policy details, outstanding claims etc. • Case 3 rs e old cyh li po 000 30 solvency ü Insurer wants to terminate binder, cancel policies – poor performance/ ü Binder holder creates confusion – denies cancellation – refuses insurer access to data to contact policyholders

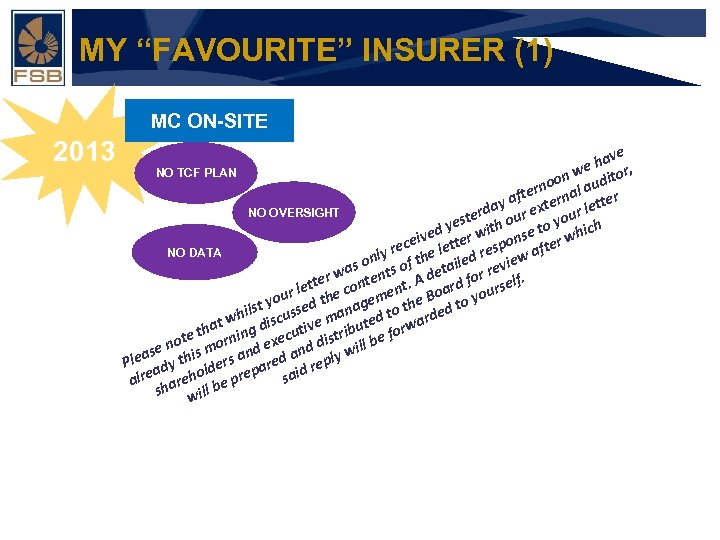

MY “FAVOURITE” INSURER (1) MC ON-SITE 2013 Financial Services Board e hav , r we NO TCF PLAN on udito no al a r afte tern etter ay x l NO OVERSIGHT terd our e your s ye to ith ich ived tter w ponse er wh ce NO DATA y re the le ed res ew aft nl as o nts of detail r revi w tter conte nt. A ard fo urself. e r le o you ed the agem the B d to yo t ss e to an hils t w g discu tive m buted rward a n i th o u ote morni d exec d distr ill be f n e n leas y this ers an red a reply w P ld ad pa said alre hareho be pre s will

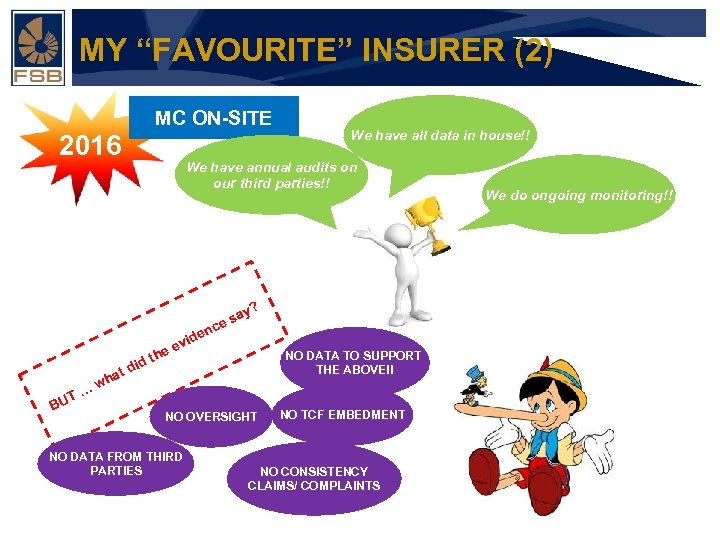

MY “FAVOURITE” INSURER (2) MC ON-SITE 2016 We have all data in house!! We have annual audits on our third parties!! Financial Services Board ? say e nc at T… BU wh did de evi e th NO DATA TO SUPPORT THE ABOVE!! NO OVERSIGHT NO DATA FROM THIRD PARTIES NO TCF EMBEDMENT NO CONSISTENCY CLAIMS/ COMPLAINTS We do ongoing monitoring!!

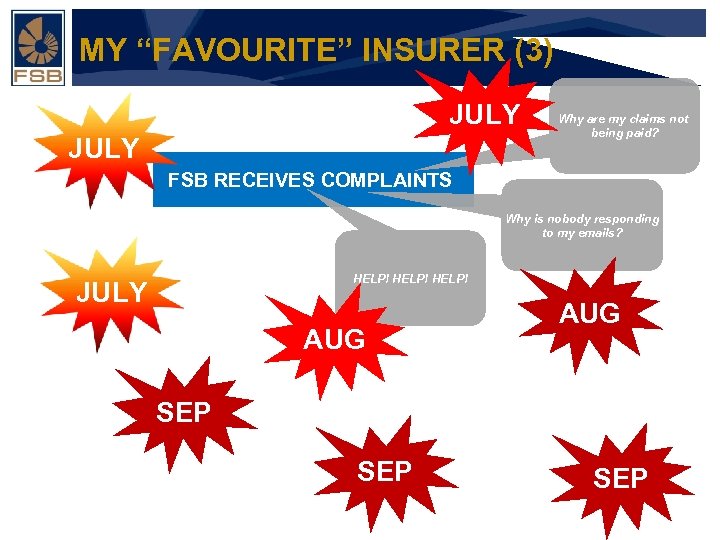

MY “FAVOURITE” INSURER (3) JULY Why are my claims not being paid? FSB RECEIVES COMPLAINTS Financial Services Board Why is nobody responding to my emails? HELP! JULY AUG SEP SEP

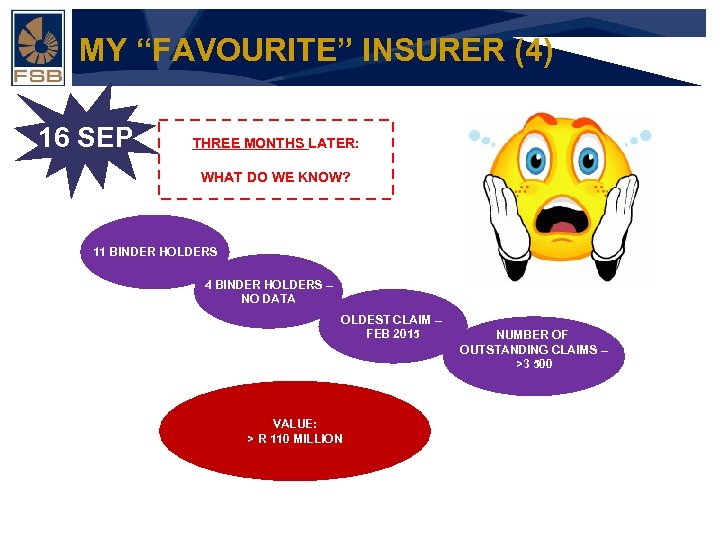

MY “FAVOURITE” INSURER (4) 16 SEP Financial Services Board THREE MONTHS LATER: WHAT DO WE KNOW? 11 BINDER HOLDERS 4 BINDER HOLDERS – NO DATA OLDEST CLAIM – FEB 2015 VALUE: > R 110 MILLION NUMBER OF OUTSTANDING CLAIMS – >3 500

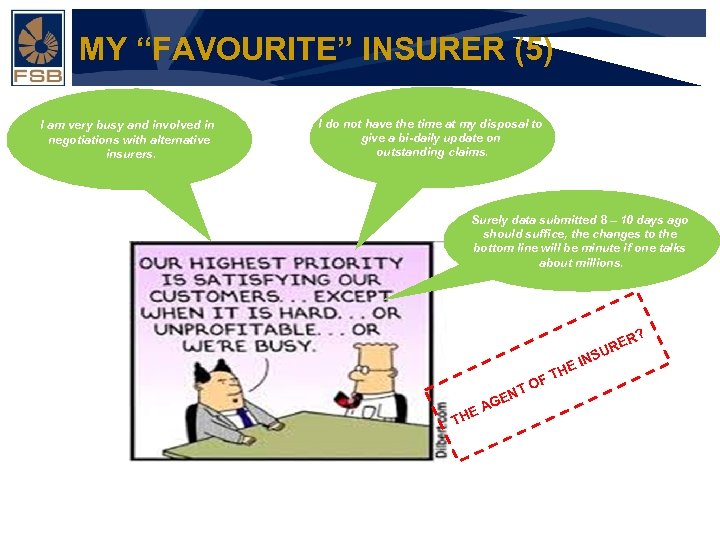

MY “FAVOURITE” INSURER (5) I am very busy and involved in negotiations with alternative insurers. I do not have the time at my disposal to give a bi-daily update on outstanding claims. Financial Services Board Surely data submitted 8 – 10 days ago should suffice, the changes to the bottom line will be minute if one talks about millions. HE T EA TH N GE T OF R? RE U INS

Financial Services Board CONCLUSION PREPARING FOR THE FUTURE

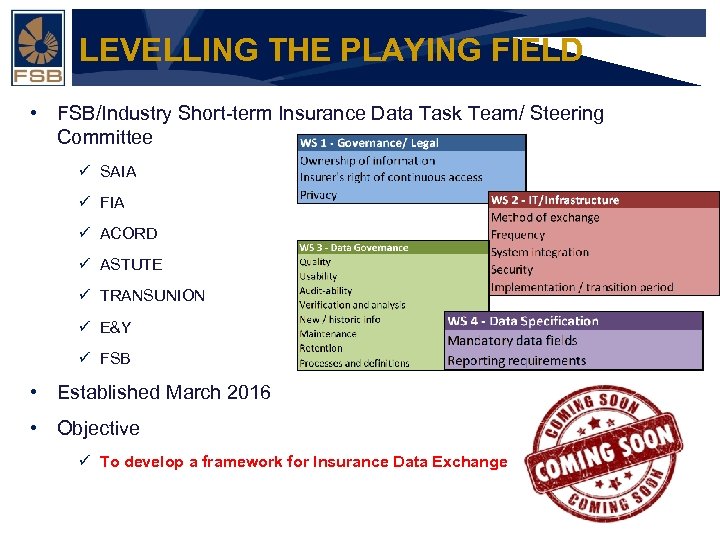

LEVELLING THE PLAYING FIELD • FSB/Industry Short-term Insurance Data Task Team/ Steering Committee Financial Services Board ü SAIA ü FIA ü ACORD ü ASTUTE ü TRANSUNION ü E&Y ü FSB • Established March 2016 • Objective ü To develop a framework for Insurance Data Exchange

THE NEW REALITY • NO outsourcing/ binders unless: ü Enhances operational efficiencies Financial ü Services Board ü Eliminates duplication of effort and costs Leads to proactive management of conduct of business risks and improved reporting (Regulatory CBRs & Internal MI) ü Ensures better customer experience • Efficiency is demonstrated by the capability of outsourced partners to integrate with the insurer’s system to enable continuous access to, and maintenance of, up to date, accurate, quality, usable, verifiable, secure and complete information • NO integration = Inefficiencies = Inability to proactively manage conduct risks = NO outsourcing =

THANK YOU

7e2ab42138eaebc6bc2a1f9e0cfae8f4.ppt