5b5d27f4ffdaa58c66f5206caaad1dfb.ppt

- Количество слайдов: 34

Managing Commodity Price and Supply Risk George A. Zsidisin, Ph. D. , C. P. M. Assistant Professor Michigan State University zsidisin@msu. edu © George A. Zsidisin, Ph. D. , 2005

Managing Commodity Price and Supply Risk George A. Zsidisin, Ph. D. , C. P. M. Assistant Professor Michigan State University zsidisin@msu. edu © George A. Zsidisin, Ph. D. , 2005

Agenda • What is supply risk? • Managing price volatility • Supply continuity planning • Summary

Agenda • What is supply risk? • Managing price volatility • Supply continuity planning • Summary

Definition of Supply Risk “The potential occurrence of an incident or failure to seize opportunities with inbound supply in which its outcomes result in a financial loss for the firm. ”

Definition of Supply Risk “The potential occurrence of an incident or failure to seize opportunities with inbound supply in which its outcomes result in a financial loss for the firm. ”

Supply Risk Sources • Suppliers • Market/Industry • Amplified by Item and Platform Characteristics

Supply Risk Sources • Suppliers • Market/Industry • Amplified by Item and Platform Characteristics

Risk Sources from Suppliers • Capacity constraints • Cost reduction capabilities • Cycle time • Disasters • Environmental performance • Financial health • Transportation systems

Risk Sources from Suppliers • Capacity constraints • Cost reduction capabilities • Cycle time • Disasters • Environmental performance • Financial health • Transportation systems

Risk Sources from Suppliers • Information system incompatibility • Inventory management • Legal liabilities • Management vision and stability • Product and process innovation • Quality problems • Shipment quantity inaccuracies • Volume and product mix requirements

Risk Sources from Suppliers • Information system incompatibility • Inventory management • Legal liabilities • Management vision and stability • Product and process innovation • Quality problems • Shipment quantity inaccuracies • Volume and product mix requirements

Risk Sources from Markets • Global sourcing • Market capacity constraints • Number of qualified suppliers • Geopolitical climate • Market price increases

Risk Sources from Markets • Global sourcing • Market capacity constraints • Number of qualified suppliers • Geopolitical climate • Market price increases

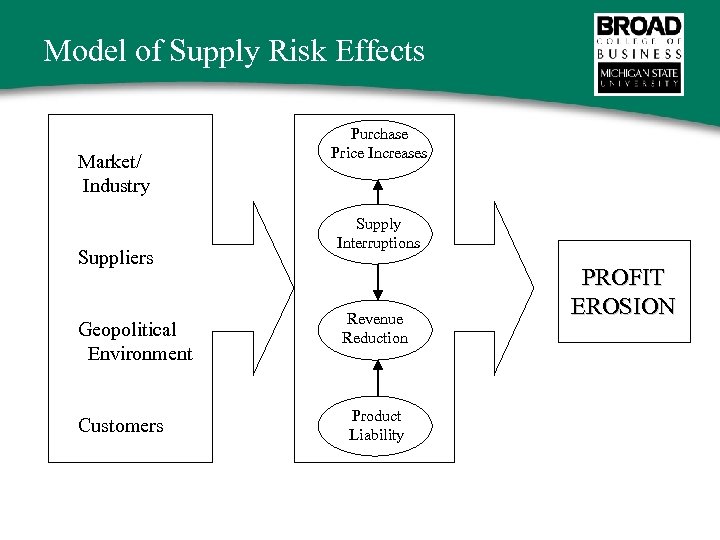

Model of Supply Risk Effects Market/ Industry Suppliers Geopolitical Environment Customers Purchase Price Increases Supply Interruptions Revenue Reduction Product Liability PROFIT EROSION

Model of Supply Risk Effects Market/ Industry Suppliers Geopolitical Environment Customers Purchase Price Increases Supply Interruptions Revenue Reduction Product Liability PROFIT EROSION

Managing Supply Risk • Commodity price volatility • Supply continuity planning

Managing Supply Risk • Commodity price volatility • Supply continuity planning

Commodity Prices are Volatile • Oil price volatility • Steel (>100% price increase from 12 -04 to today) • Import tariff removal • Industry consolidation • Production capacity reduction • Increase use in China • Food products • Florida hurricanes September 2004 • Tomato prices skyrocketed

Commodity Prices are Volatile • Oil price volatility • Steel (>100% price increase from 12 -04 to today) • Import tariff removal • Industry consolidation • Production capacity reduction • Increase use in China • Food products • Florida hurricanes September 2004 • Tomato prices skyrocketed

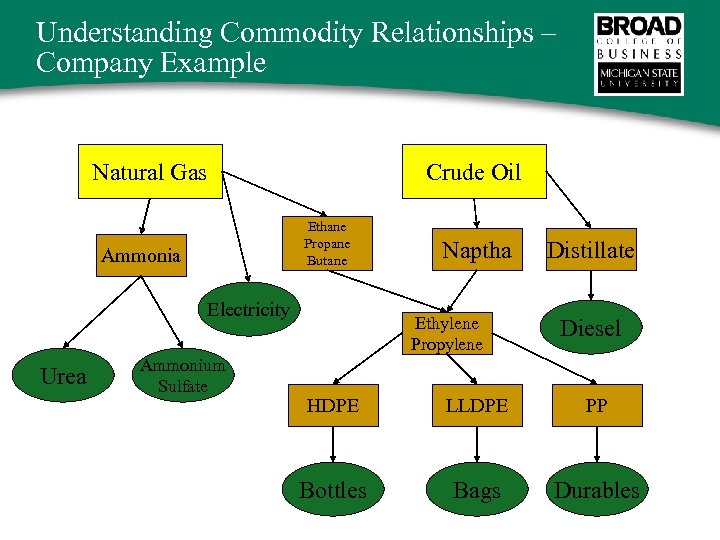

Understanding Commodity Relationships – Company Example Natural Gas Crude Oil Ethane Propane Butane Ammonia Electricity Urea Ammonium Sulfate Naptha Ethylene Propylene Distillate Diesel HDPE LLDPE PP Bottles Bags Durables

Understanding Commodity Relationships – Company Example Natural Gas Crude Oil Ethane Propane Butane Ammonia Electricity Urea Ammonium Sulfate Naptha Ethylene Propylene Distillate Diesel HDPE LLDPE PP Bottles Bags Durables

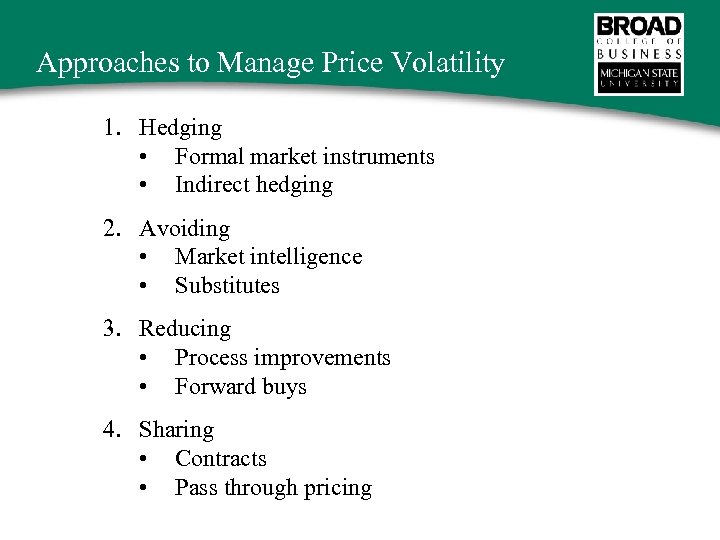

Approaches to Manage Price Volatility 1. Hedging • Formal market instruments • Indirect hedging 2. Avoiding • Market intelligence • Substitutes 3. Reducing • Process improvements • Forward buys 4. Sharing • Contracts • Pass through pricing

Approaches to Manage Price Volatility 1. Hedging • Formal market instruments • Indirect hedging 2. Avoiding • Market intelligence • Substitutes 3. Reducing • Process improvements • Forward buys 4. Sharing • Contracts • Pass through pricing

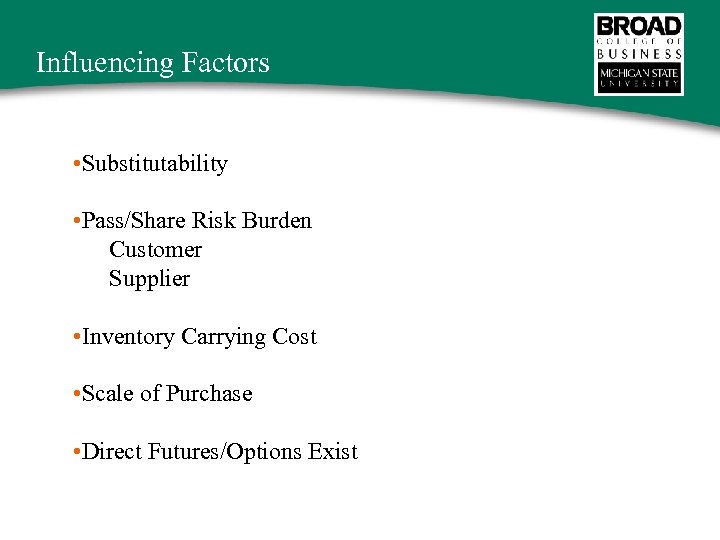

Influencing Factors • Substitutability • Pass/Share Risk Burden Customer Supplier • Inventory Carrying Cost • Scale of Purchase • Direct Futures/Options Exist

Influencing Factors • Substitutability • Pass/Share Risk Burden Customer Supplier • Inventory Carrying Cost • Scale of Purchase • Direct Futures/Options Exist

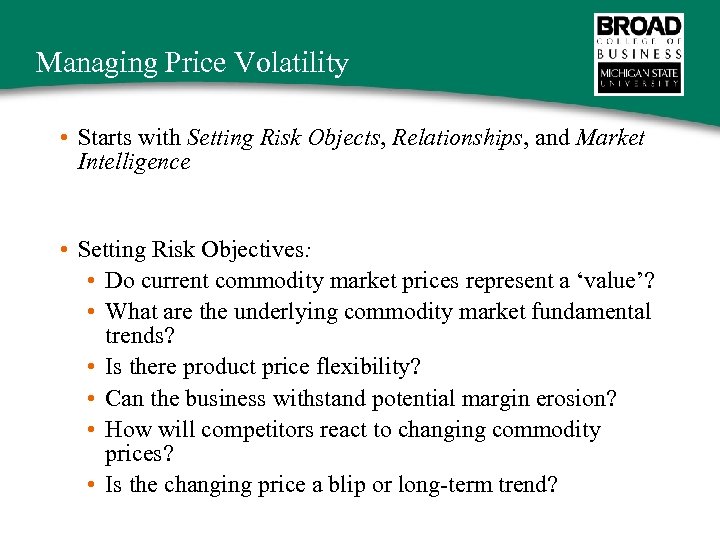

Managing Price Volatility • Starts with Setting Risk Objects, Relationships, and Market Intelligence • Setting Risk Objectives: • Do current commodity market prices represent a ‘value’? • What are the underlying commodity market fundamental trends? • Is there product price flexibility? • Can the business withstand potential margin erosion? • How will competitors react to changing commodity prices? • Is the changing price a blip or long-term trend?

Managing Price Volatility • Starts with Setting Risk Objects, Relationships, and Market Intelligence • Setting Risk Objectives: • Do current commodity market prices represent a ‘value’? • What are the underlying commodity market fundamental trends? • Is there product price flexibility? • Can the business withstand potential margin erosion? • How will competitors react to changing commodity prices? • Is the changing price a blip or long-term trend?

Gathering Market Intelligence – Web Sites • Global Business Reference: • Supplier Directories • Embassies and Consulates • HBS • Industry Links: • NAICS/SIC/UNSPSC • Sema. Tech • Raw Material Indexes • Economic Indicators: • Economist, WTO, World Bank • CIA Fact Book, OANDA Company Financial Research: • SEC Filings (Edgar online) • Fortune 500 Useful Links: • Globe Smart • Executive Planet Geography Specific: • Asia • Europe • Middle East • South America

Gathering Market Intelligence – Web Sites • Global Business Reference: • Supplier Directories • Embassies and Consulates • HBS • Industry Links: • NAICS/SIC/UNSPSC • Sema. Tech • Raw Material Indexes • Economic Indicators: • Economist, WTO, World Bank • CIA Fact Book, OANDA Company Financial Research: • SEC Filings (Edgar online) • Fortune 500 Useful Links: • Globe Smart • Executive Planet Geography Specific: • Asia • Europe • Middle East • South America

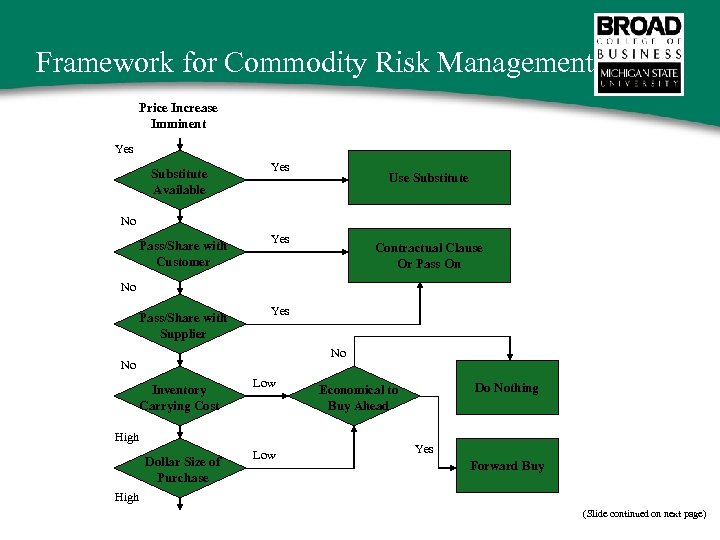

Framework for Commodity Risk Management Price Increase Imminent Yes Substitute Available Yes Use Substitute No Pass/Share with Customer Yes Contractual Clause Or Pass On No Pass/Share with Supplier Yes No No Inventory Carrying Cost Low High Dollar Size of Purchase Low Do Nothing Economical to Buy Ahead Yes Forward Buy High (Slide continued on next page)

Framework for Commodity Risk Management Price Increase Imminent Yes Substitute Available Yes Use Substitute No Pass/Share with Customer Yes Contractual Clause Or Pass On No Pass/Share with Supplier Yes No No Inventory Carrying Cost Low High Dollar Size of Purchase Low Do Nothing Economical to Buy Ahead Yes Forward Buy High (Slide continued on next page)

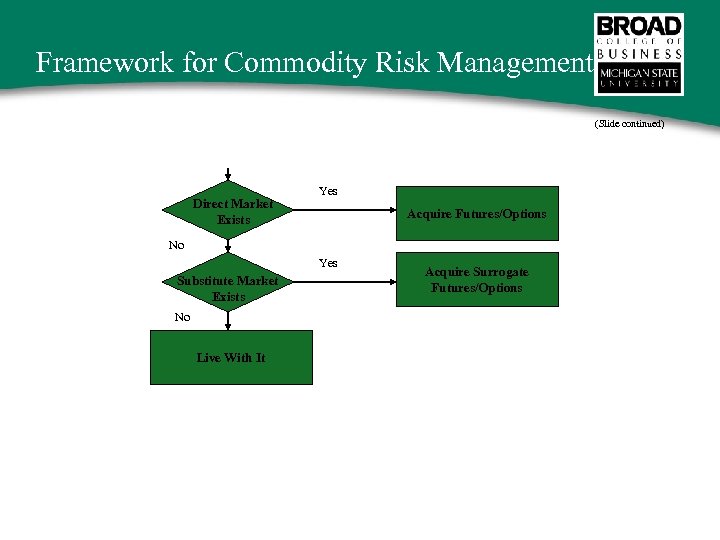

Framework for Commodity Risk Management (Slide continued) Direct Market Exists Yes Acquire Futures/Options No Yes Substitute Market Exists No Live With It Acquire Surrogate Futures/Options

Framework for Commodity Risk Management (Slide continued) Direct Market Exists Yes Acquire Futures/Options No Yes Substitute Market Exists No Live With It Acquire Surrogate Futures/Options

Commodity Hedging Example

Commodity Hedging Example

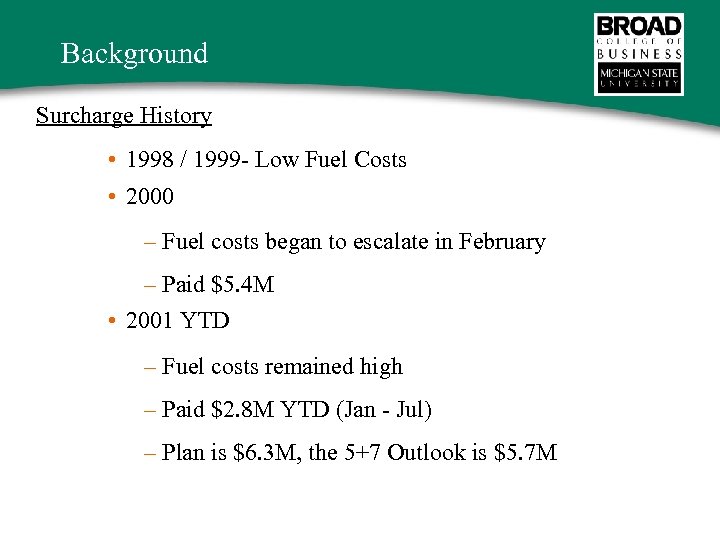

Background Surcharge History • 1998 / 1999 - Low Fuel Costs • 2000 – Fuel costs began to escalate in February – Paid $5. 4 M • 2001 YTD – Fuel costs remained high – Paid $2. 8 M YTD (Jan - Jul) – Plan is $6. 3 M, the 5+7 Outlook is $5. 7 M

Background Surcharge History • 1998 / 1999 - Low Fuel Costs • 2000 – Fuel costs began to escalate in February – Paid $5. 4 M • 2001 YTD – Fuel costs remained high – Paid $2. 8 M YTD (Jan - Jul) – Plan is $6. 3 M, the 5+7 Outlook is $5. 7 M

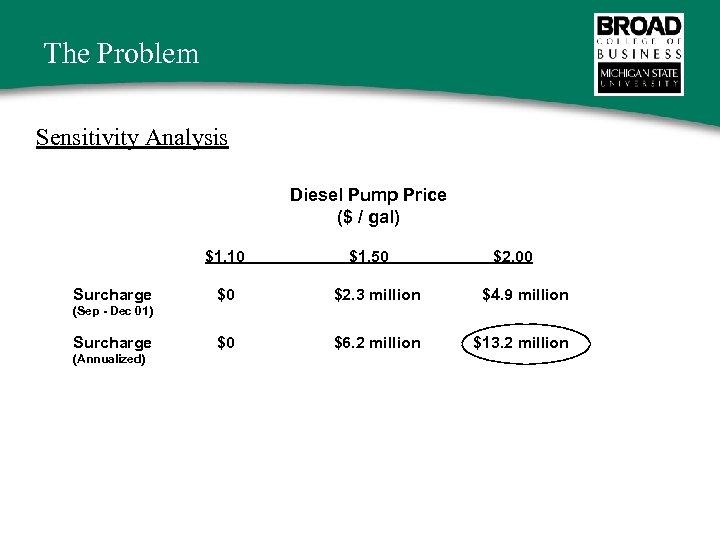

The Problem Sensitivity Analysis Diesel Pump Price ($ / gal) $1. 10 Surcharge $1. 50 $2. 00 $0 $2. 3 million $4. 9 million $0 $6. 2 million $13. 2 million (Sep - Dec 01) Surcharge (Annualized)

The Problem Sensitivity Analysis Diesel Pump Price ($ / gal) $1. 10 Surcharge $1. 50 $2. 00 $0 $2. 3 million $4. 9 million $0 $6. 2 million $13. 2 million (Sep - Dec 01) Surcharge (Annualized)

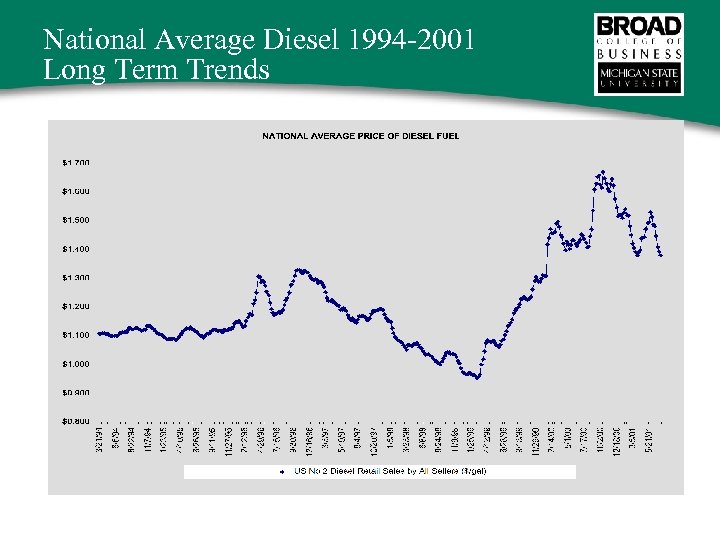

National Average Diesel 1994 -2001 Long Term Trends

National Average Diesel 1994 -2001 Long Term Trends

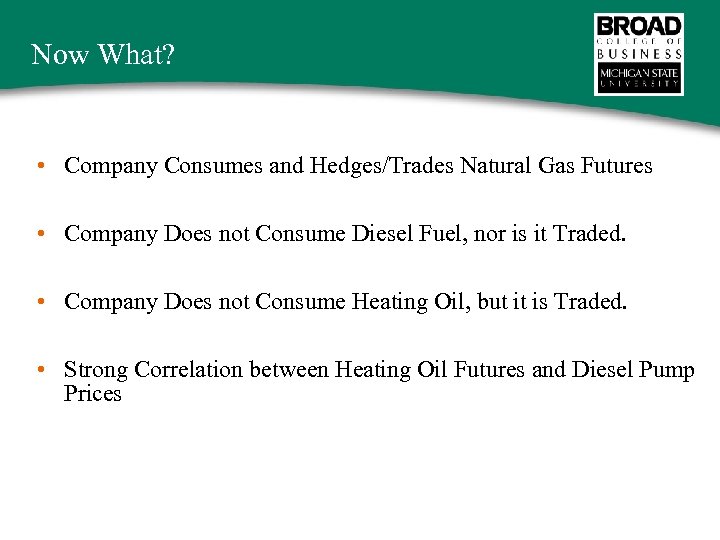

Now What? • Company Consumes and Hedges/Trades Natural Gas Futures • Company Does not Consume Diesel Fuel, nor is it Traded. • Company Does not Consume Heating Oil, but it is Traded. • Strong Correlation between Heating Oil Futures and Diesel Pump Prices

Now What? • Company Consumes and Hedges/Trades Natural Gas Futures • Company Does not Consume Diesel Fuel, nor is it Traded. • Company Does not Consume Heating Oil, but it is Traded. • Strong Correlation between Heating Oil Futures and Diesel Pump Prices

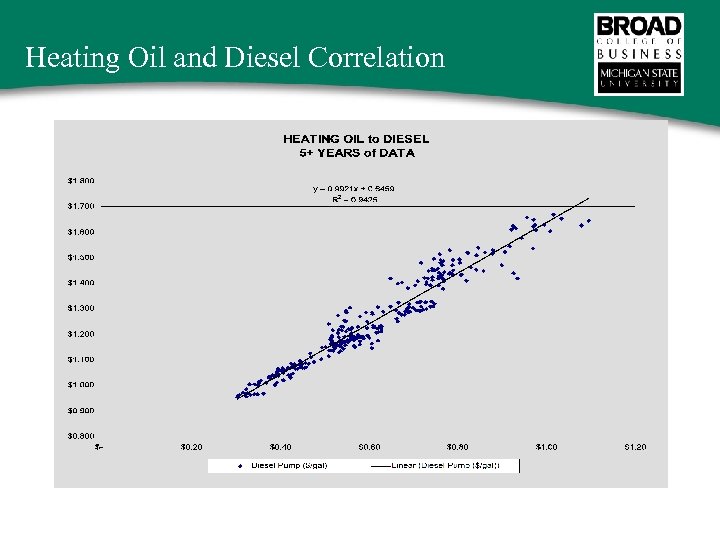

Heating Oil and Diesel Correlation

Heating Oil and Diesel Correlation

One Potential Solution • For surcharges – the company does consume diesel fuel (27 Million Gallons Annually) and therefore should participate in futures trading of heating oil. Correlation between Heating Oil Futures and Diesel Pump Prices • R 2 correlation coefficient = 0. 944 (very good) • 42, 000 gals = 1 Heating Oil Futures Contract • Would need 660 Heating Oil contracts to cover surcharges

One Potential Solution • For surcharges – the company does consume diesel fuel (27 Million Gallons Annually) and therefore should participate in futures trading of heating oil. Correlation between Heating Oil Futures and Diesel Pump Prices • R 2 correlation coefficient = 0. 944 (very good) • 42, 000 gals = 1 Heating Oil Futures Contract • Would need 660 Heating Oil contracts to cover surcharges

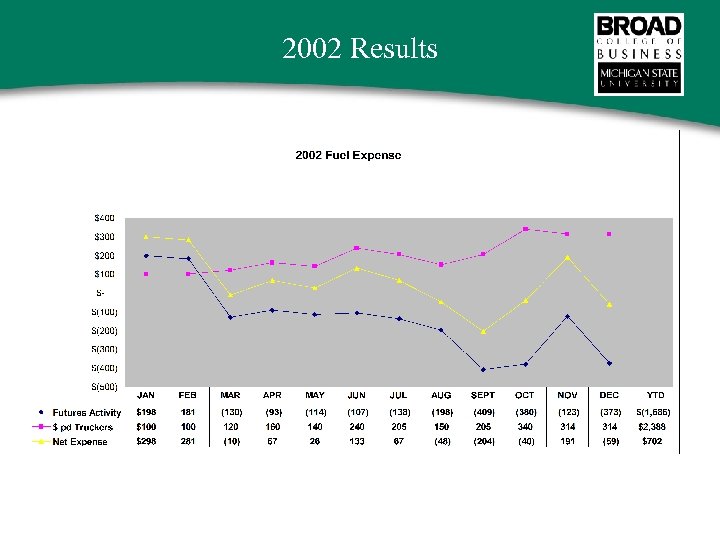

2002 Results

2002 Results

Fuel Hedging • New and Innovative Component of our Fuel Strategy in Cooperation w/Commodities. • Balance market exposures to diesel price fluctuations thru participation in heating oil futures. • “Locked-In” pricing on 27, 500, 000 gallons of fuel. • Paid Fuel in 2002 @ $1. 24 !!!!!!! • Market Returned Incremental $1. 7 M in 2002 !!

Fuel Hedging • New and Innovative Component of our Fuel Strategy in Cooperation w/Commodities. • Balance market exposures to diesel price fluctuations thru participation in heating oil futures. • “Locked-In” pricing on 27, 500, 000 gallons of fuel. • Paid Fuel in 2002 @ $1. 24 !!!!!!! • Market Returned Incremental $1. 7 M in 2002 !!

Supply Continuity Planning

Supply Continuity Planning

Definition of Business Continuity Planning • “The business management practices that provide the focus and guidance for the decisions and actions necessary for a business to prevent, mitigate, prepare for, respond to, resume, recover, restore, and transition from a disruptive (crisis) event in a manner consistent with its strategic objectives” (Shaw and Harrald, 2004; p. 3) • Supply Continuity planning (SCP) is an important facet of business continuity planning

Definition of Business Continuity Planning • “The business management practices that provide the focus and guidance for the decisions and actions necessary for a business to prevent, mitigate, prepare for, respond to, resume, recover, restore, and transition from a disruptive (crisis) event in a manner consistent with its strategic objectives” (Shaw and Harrald, 2004; p. 3) • Supply Continuity planning (SCP) is an important facet of business continuity planning

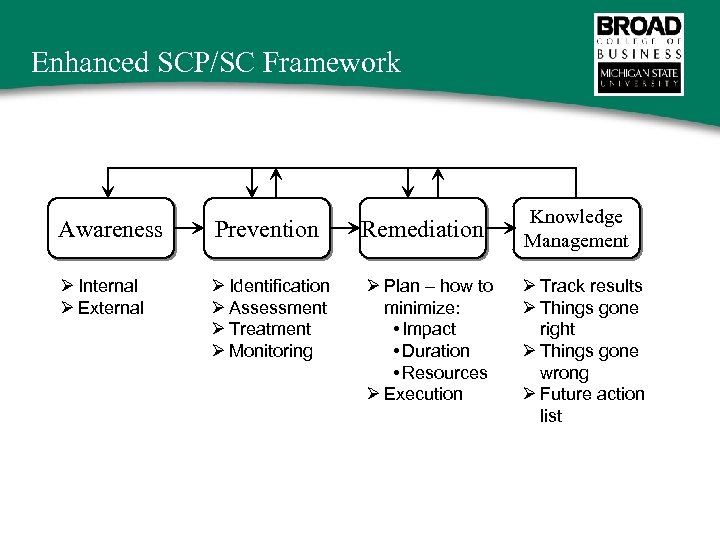

Enhanced SCP/SC Framework Awareness Prevention Remediation Ø Internal Ø External Ø Identification Ø Assessment Ø Treatment Ø Monitoring Ø Plan – how to minimize: • Impact • Duration • Resources Ø Execution Knowledge Management Ø Track results Ø Things gone right Ø Things gone wrong Ø Future action list

Enhanced SCP/SC Framework Awareness Prevention Remediation Ø Internal Ø External Ø Identification Ø Assessment Ø Treatment Ø Monitoring Ø Plan – how to minimize: • Impact • Duration • Resources Ø Execution Knowledge Management Ø Track results Ø Things gone right Ø Things gone wrong Ø Future action list

Elements of SCP Awareness • Recognition of exposure to risk within the supply chain • Awareness of • Probability • Impact • Recognition of effects of risk on: • Physical assets • Information • Awareness: • Internal • External

Elements of SCP Awareness • Recognition of exposure to risk within the supply chain • Awareness of • Probability • Impact • Recognition of effects of risk on: • Physical assets • Information • Awareness: • Internal • External

Elements of SCP Prevention • Goal • Reduce likelihood and/or impact of supply chain disruptions. • Key Processes: • Risk identification • Risk assessment • Risk treatment • Risk monitoring

Elements of SCP Prevention • Goal • Reduce likelihood and/or impact of supply chain disruptions. • Key Processes: • Risk identification • Risk assessment • Risk treatment • Risk monitoring

Elements of SCP Remediation • Goal: • Identify “a priori” procedures for managing the four stages of a disruption – Interruption, response, recovery, restoration of operations • Minimize adverse impact on: – Time – Cost • Determine most effective allocation of resources

Elements of SCP Remediation • Goal: • Identify “a priori” procedures for managing the four stages of a disruption – Interruption, response, recovery, restoration of operations • Minimize adverse impact on: – Time – Cost • Determine most effective allocation of resources

Elements of SCP Knowledge Management • Goal • Learn from experience – Things gone wrong – Things gone right – Results of remediation efforts • Modify current procedures and systems to reflect lessons learned. • A SCP “post mortem” • Formalized activity

Elements of SCP Knowledge Management • Goal • Learn from experience – Things gone wrong – Things gone right – Results of remediation efforts • Modify current procedures and systems to reflect lessons learned. • A SCP “post mortem” • Formalized activity

Summary for Managing Supply Risk • Supply risk differs by its sources and dimensions • Awareness and knowledge are the first steps • Commodity price management and supply continuity planning are two ways that organizations can manage supply risk QUESTIONS?

Summary for Managing Supply Risk • Supply risk differs by its sources and dimensions • Awareness and knowledge are the first steps • Commodity price management and supply continuity planning are two ways that organizations can manage supply risk QUESTIONS?