e0cd5b927bdc8bf560d1aa8461c24452.ppt

- Количество слайдов: 35

“Managing a 340 B Pharmacy to Optimize Savings in Tough Economic Times” 13 th Annual Pharmacy Purchasing Network Conference Tuesday August 18, 2009 – 10: 50 am – 11: 50 am Las Vegas, Nevada Presented by: John Barnes

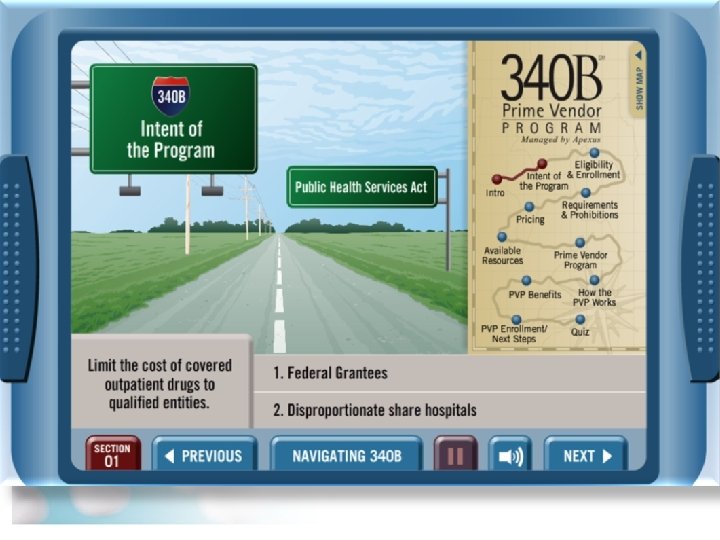

Overview/ Objectives • 340 B Drug Program refresher • Health Care Reform – Stimulus package – 340 B Health Care Reform Legislation • 340 B Program Improvement & Integrity Act • Patient definition • Contract Pharmacy • Apexus 340 B prime vendor program (PVP) – How pharmacy buyers access informational tools and resources for cost containment strategies – Steps pharmacy buyers take to optimize the PVP

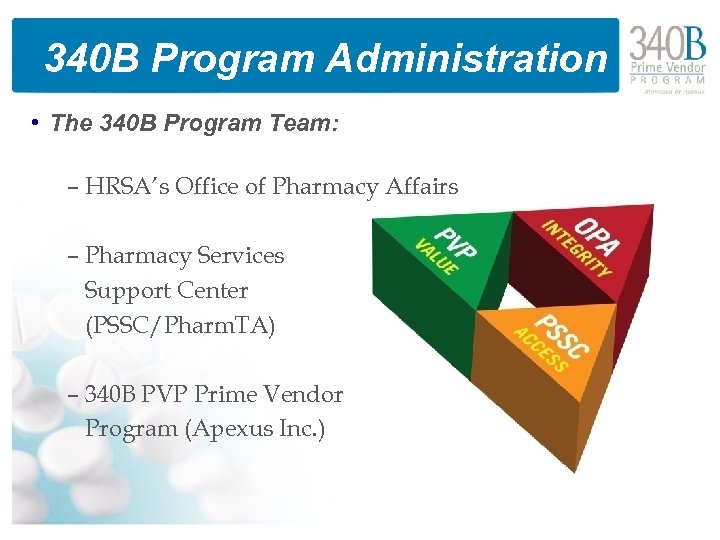

340 B Program Administration • The 340 B Program Team: – HRSA’s Office of Pharmacy Affairs – Pharmacy Services Support Center (PSSC/Pharm. TA) – 340 B PVP Prime Vendor Program (Apexus Inc. )

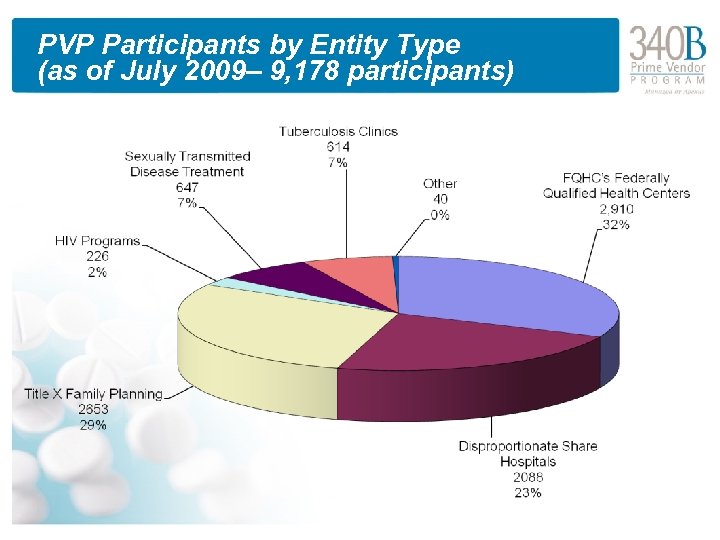

340 B Eligible Covered Entities 1) Disproportionate Share Hospitals (DSH) 2) HRSA Grantees: – – – – Federally Qualified Health Centers (FQHC) Hemophilia Treatment Centers Ryan White Programs (HIV programs) Sexually Transmitted Disease programs Tuberculosis Programs Title X Family Planning Clinics Urban 638 Tribal Programs

PVP Participants by Entity Type (as of July 2009– 9, 178 participants)

What Drugs Are Covered Under 340 B? Covered drugs: • Outpatient Prescription drugs • Over-the-counter drugs (accompanied by prescription) • Clinic administered drugs within eligible facilities Non-covered drugs: • Vaccines * • In-patient drugs *Aggressive discounts negotiated by the Prime Vendor Program for vaccines and other non-covered products

How 340 B Pricing Works • Statutory pricing calculation based on a formula reported by drug manufacturers to CMS The 340 B Price… – Reflects activity of retail pricing 6 months in past – Is the lower of Medicaid Best or AMP minus 15. 1% on brands • Formula: URA = the greater of AMP x 15. 1% or AMP – BP – For generics and prescribed OTC drugs, is AMP minus 11. 0% • Formula: URA = AMP x 11% – May contain additional discounts if price of drug has increased faster than the rate of inflation (CPI penalty)

How 340 B Pricing Works – Recalculates on a calendar quarter basis – Is considered confidential – Is a “Ceiling Price” and deeper discounts can be negotiated through the 340 B Prime Vendor program or independently

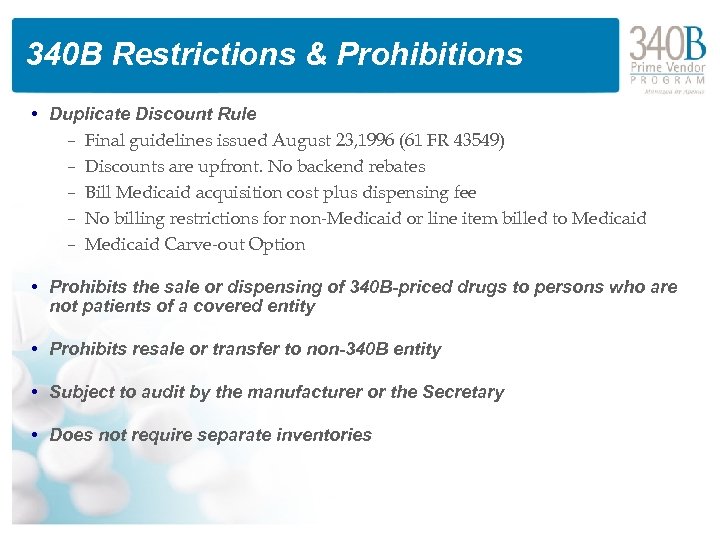

340 B Restrictions & Prohibitions • Duplicate Discount Rule – Final guidelines issued August 23, 1996 (61 FR 43549) – Discounts are upfront. No backend rebates – Bill Medicaid acquisition cost plus dispensing fee – No billing restrictions for non-Medicaid or line item billed to Medicaid – Medicaid Carve-out Option • Prohibits the sale or dispensing of 340 B-priced drugs to persons who are not patients of a covered entity • Prohibits resale or transfer to non-340 B entity • Subject to audit by the manufacturer or the Secretary • Does not require separate inventories

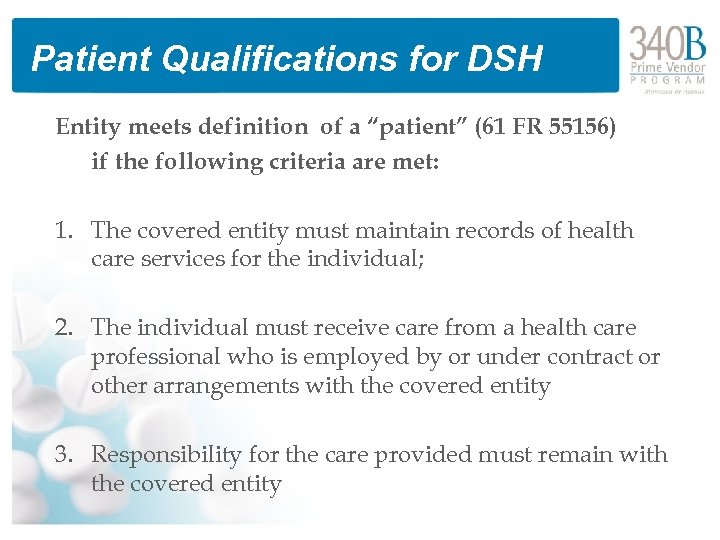

Patient Qualifications for DSH Entity meets definition of a “patient” (61 FR 55156) if the following criteria are met: 1. The covered entity must maintain records of health care services for the individual; 2. The individual must receive care from a health care professional who is employed by or under contract or other arrangements with the covered entity 3. Responsibility for the care provided must remain with the covered entity

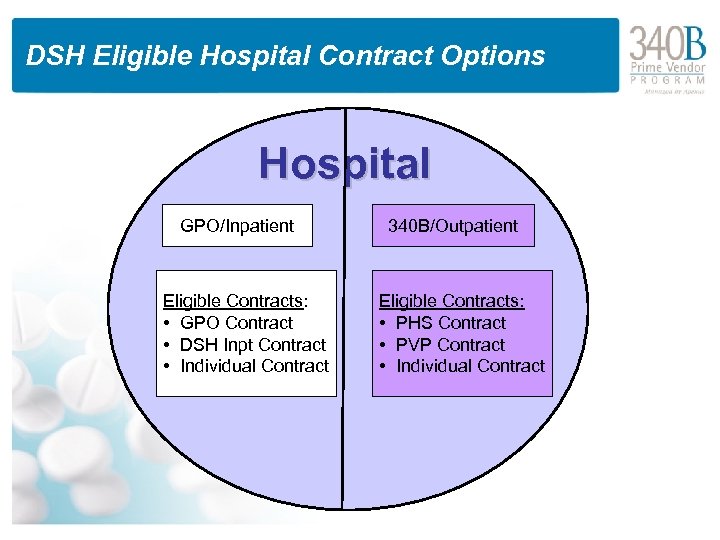

DSH Eligible Hospital Contract Options Hospital GPO/Inpatient Eligible Contracts: • GPO Contract • DSH Inpt Contract • Individual Contract 340 B/Outpatient Eligible Contracts: • PHS Contract • PVP Contract • Individual Contract

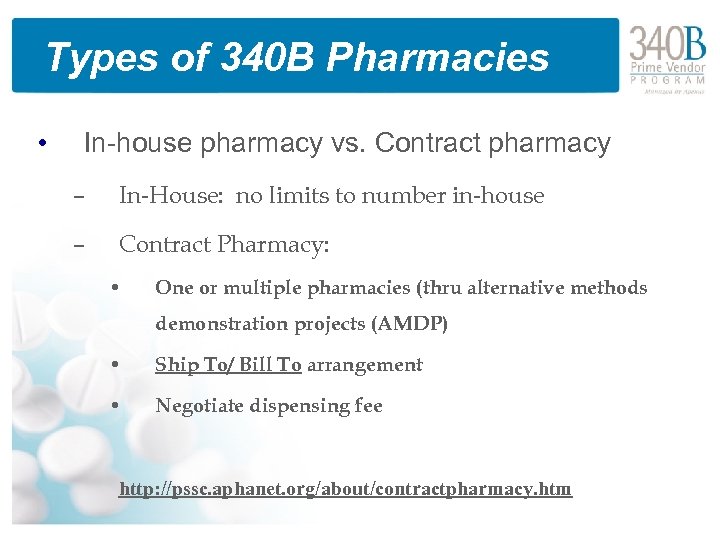

Types of 340 B Pharmacies • In-house pharmacy vs. Contract pharmacy – In-House: no limits to number in-house – Contract Pharmacy: • One or multiple pharmacies (thru alternative methods demonstration projects (AMDP) • Ship To/ Bill To arrangement • Negotiate dispensing fee http: //pssc. aphanet. org/about/contractpharmacy. htm

Health. Care Reform • President Obama’s healthcare plan has three broad objectives: 1. To reduce costs so that the system will “work for people and businesses – not just insurance companies” 2. To provide “affordable, accessible coverage options for all” 3. To promote prevention and strengthen public health

Stimulus Package: Money for 340 B Hospitals & Health Centers Federal stimulus legislation enacted in February 2009 provides: • $268. 8 M increase in Medicaid DSH payments in FY 2009 and 2010 – Biggest increases go to NY, CA, TX, NJ, PA, MO • Community health centers get $2 B in total funding – $500 M for increased demand in services – $1. 5 M for infrastructure improvements and new centers • Health Information Technology – Incentive payments to hospitals and providers participating in Medicare and Medicaid for adoption of electronic health records and e-prescribing, beginning in 2011

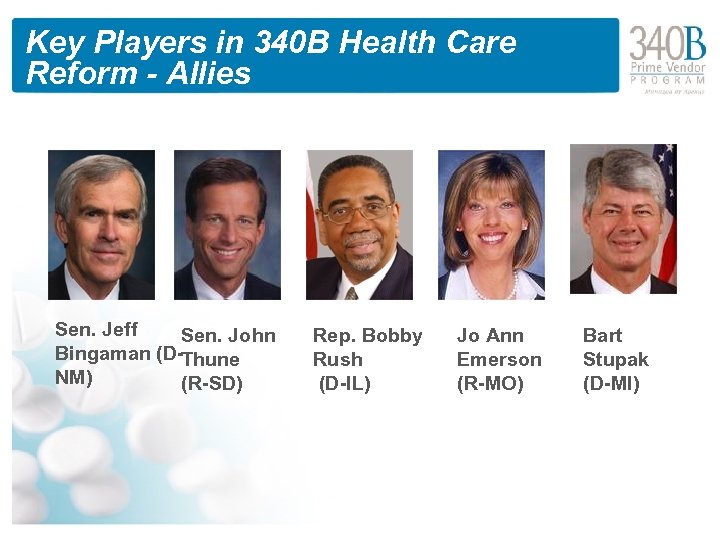

Key Players in 340 B Health Care Reform - Allies Sen. Jeff Sen. John Bingaman (D-Thune NM) (R-SD) Rep. Bobby Rush (D-IL) Jo Ann Emerson (R-MO) Bart Stupak (D-MI)

Features of House & Senate 340 B Legislation • Extends 340 B discounts to the inpatient setting • Expands list of covered entities eligible for 340 B discounts – Clarifies the status of children’s hospitals as 340 B covered entities – Adds potential new covered entities: • Critical access hospitals (CAHs) • Sole community hospitals (SCHs) • Rural referral centers (RRCs) • Medicare-dependent hospitals • Maternal & child health centers • Substance abuse and mental health centers

Features of House & Senate 340 B Legislation • Integrity Measures Recommended by OIG – Enhanced ceiling price transparency – Improved accuracy of data on OPA website – Expanded government oversight and enforcement authority over manufacturers and covered entities – Defined administrative procedures to address overcharges and pricing disputes • Expansion of Medicaid Rebate Program – Modifies AMP – increase Medicaid rebate from 15. 1% to 23% – Expands Medicaid Rebate Program to 6 million dual eligible's – Extends rebate program to Medicaid managed care plans

Federal Register Notice – Patient Definition (72 FR 1543) – Clarifies previous FR Notice of October 1996 – A clear and enforceable definition to help ensure against diversion and support 340 B program integrity – Hospitals, CHC’s, and other 340 B providers unhappy with proposal • Turns 3 step process into 8 step process • Could limit 340 B facilities’ ability to provide care – Status: comment period closed 03/13/07 – awaiting final publication

Federal Register Notice – Contract Pharmacy (72 FR 1540) – Updates previous FR Notice of August 1996 – Builds upon experience with Demonstration Projects – Incorporates multiple pharmacies as standard option – Network model arrangements would still requires Alternative Methods Demonstration Projects (AMDPs) approval – Status: comment period closed 03/13/07 – awaiting final publication

Apexus – HRSA’s 340 B Prime Vendor • Unique federal purchasing program (public-private partnership) • Voluntary program for suppliers and 340 b covered entities • Mission - To improve access to affordable medications for all 340 B covered entities by: – Lowering participants’ supply costs by expanding the current PVP portfolio of sub-340 B priced products – Providing covered entities with access to efficient drug distribution solutions to meet their patients’ needs – Providing access to other value added products and services meeting covered entities’ unique needs

Benefits of PVP to Covered Entities 1. No risk or cost to participate 2. No change of distributor required 3. Easy access to 340 B sub-ceiling pricing exclusive to participants 4. Longer term contracts 5. Monitoring of distributors to ensure appropriate charges for PVP contract items 6. Resources available on secure website – Pricing transparency: 340 B ceiling price verification & comprehensive subceiling catalog – Reports to help optimize spend

Benefits to Covered Entities – cont’d • E-mailed monthly to all participants – includes: – – – Special Announcements Contract Highlights Industry News FAQ’s Drug Shortages/Recalls Supplier Profile • Webinars – – CEO/CFO, – Buyers, FPC • Customized Surveys

Benefits to Covered Entities – cont’d

The Role of the Buyer/ Purchasing Agent • Buyer significantly impacts the budget • First to notice pricing fluctuations • Monitors wholesaler pricing • Validate wholesalers 340 B & PVP pricing • Contact wholesaler immediately with discrepancies • Utilize a formulary to contain costs • Choose the most cost effective selection • Read the Flash –– top 200 changes

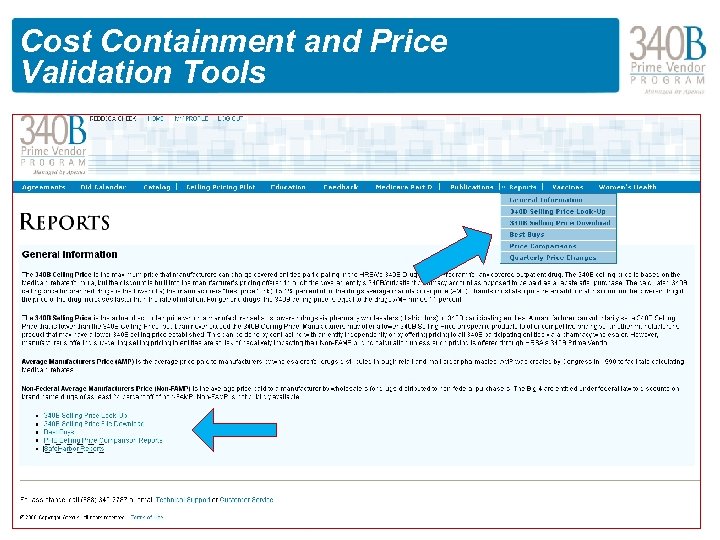

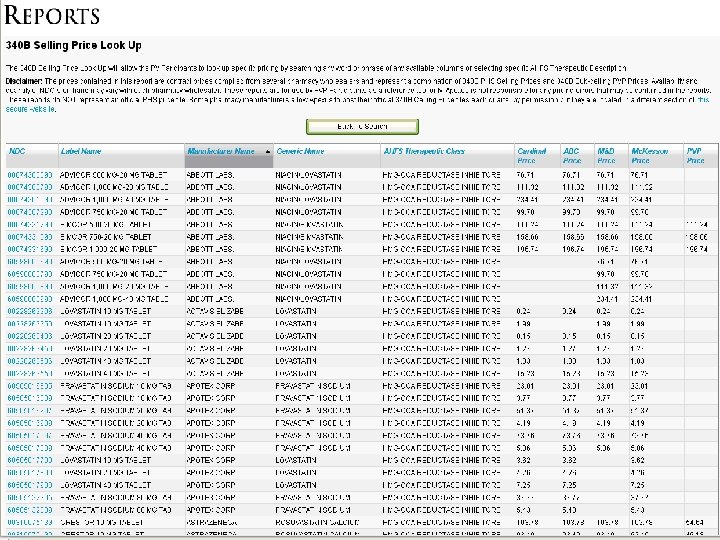

Cost Containment and Price Validation Tools

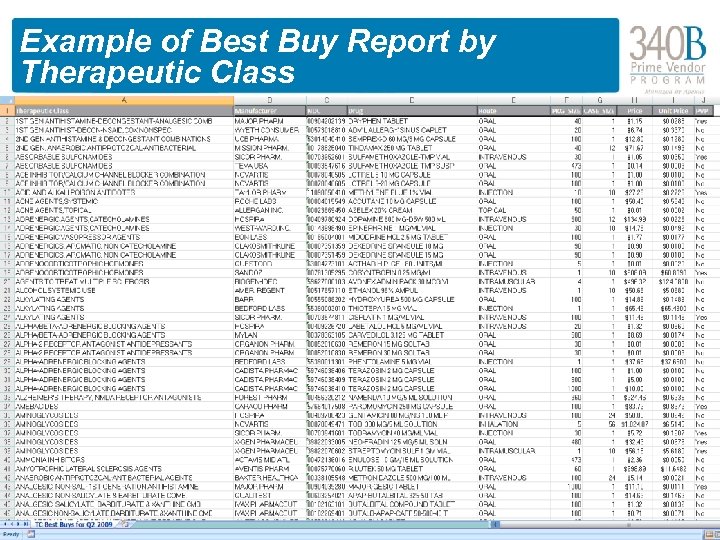

Example of Best Buy Report by Therapeutic Class

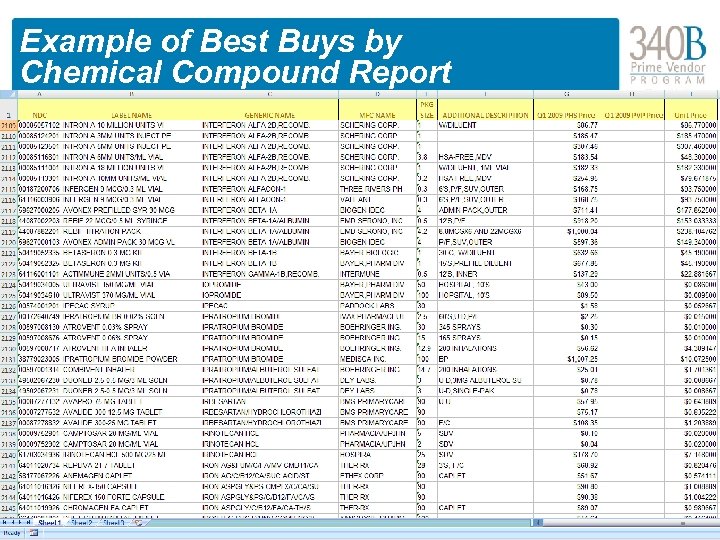

Example of Best Buys by Chemical Compound Report

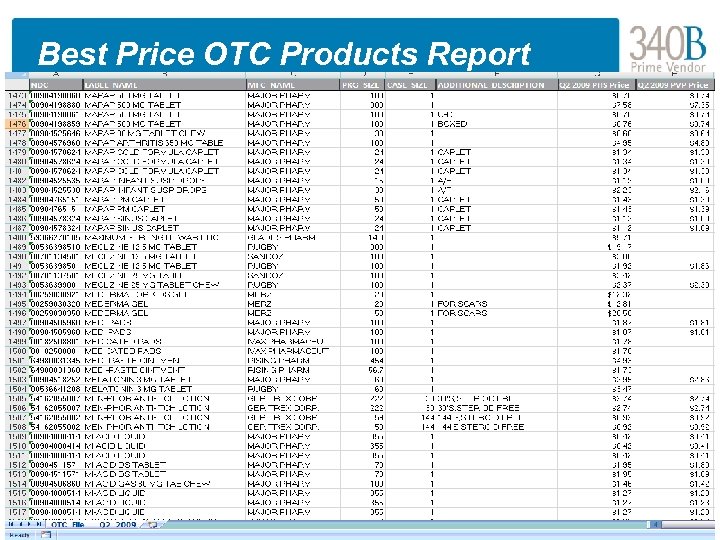

Best Price OTC Products Report

Summary of Cost Containment Reports • List of 20, 000 + NDC’s of 340 B selling prices for auditing wholesaler • Therapeutic Class Best Buy • Best Buy report by chemical compound • Best Price Over-the-Counter report

Other Value Added Products and Services for Participants • Pharmacy computer systems • 340 B virtual inventory tracking/split billing systems • Diabetic meters/strips • Biologicals/vaccines • Pharmacy technology / automation • Prescription vials, labels, printer cartridges • PBM services • Other

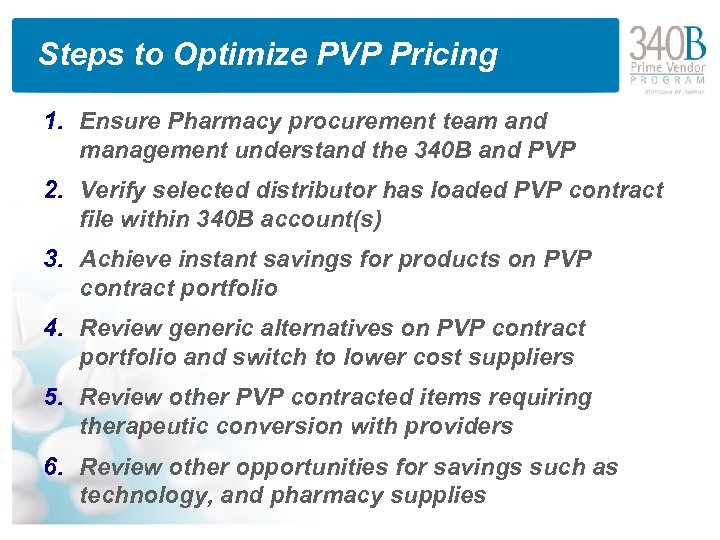

Steps to Optimize PVP Pricing 1. Ensure Pharmacy procurement team and management understand the 340 B and PVP 2. Verify selected distributor has loaded PVP contract file within 340 B account(s) 3. Achieve instant savings for products on PVP contract portfolio 4. Review generic alternatives on PVP contract portfolio and switch to lower cost suppliers 5. Review other PVP contracted items requiring therapeutic conversion with providers 6. Review other opportunities for savings such as technology, and pharmacy supplies

Contact Information Office of Pharmacy Affairs Phone: 301 -594 -4353 or 1 -800 -628 -6297 Email: opastaff@hrsa. gov Web: www. hrsa. gov/opa HRSA Pharmacy Services Support Center (APh. A) Phone: 1 -800 -628 -6297 Email: lscholz@aphanet. org Web: http: //pssc. aphanet. org Prime Vendor Program (Apexus) Phone: 1 -888 -340 -2787 Email: jbarnes@340 bpvp. com Web: http: //www. 340 bpvp. com

Discussion & Questions

e0cd5b927bdc8bf560d1aa8461c24452.ppt